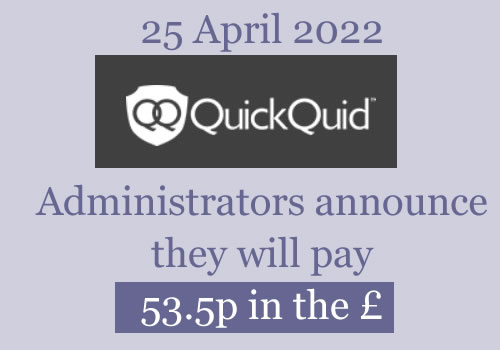

Payments – UPDATE – 25 April 2022

Administrators have started sending emails to everyone with an upheld claim telling them what they will be paid.

“The Joint Administrators are now in a position to declare a first and final dividend of 53.5p in the £”

The average claim value is c £1,700. Someone with that claim value will get a payout of about £910.

The payout details are given in the email:

- This will be paid over the next two weeks.

- If the administrators couldn’t validate your banking details, it will be sent by cheque. I don’t know how the administrators will “validate” your details.

- If you used a claims company, the money will be paid to them.

- Most people are not having any deduction for tax paid to HMRC, so there is no need to reclaim anything.

Credit records

The administrators may decide to :

– remove any negative marks on your credit record

– delete all loans that were upheld

– delete all your loans.

I don’t know what they have chosen to do – if people can check and report in the comments when they see a change, that would be great.

How much your credit score will change will depend on whether there were any negative marks. If you want to get a mortgage, you would like as many payday loans gone as possible, even if they were repaid on time and not hurting your credit score.

In a few months when the administrators no longer talk to the CRAs you can ask for any remaining loans to be “suppressed” so other lenders can’t see them. See https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do that now.

QuickQuid went into administration in October 2019

CashEuroNet (CEU), which owns the QuickQuid, Pounds To Pocket and On Stride brands, stopped giving loans and went into administration on 25 October 2019.

I will be talking about QuickQuid (QQ) rather than CashEuroNet as it is the more familiar name. Everything here also applies to loans from Cashruronet’s other brands, Pounds To Pocket and On Stride.

Grant Thornton were appointed as Administrators. They set up a page about Redress Complaints – this is their term for people who have asked for a refund because they were given unaffordable loans.

Background to the QuickQuid Administration

QuickQuid was one of the “Big Three” payday lenders in Britain, starting out in 2007.

After Wonga and the Money Shop Group had all stopped lending and gone bust over the last fifteen months, QuickQuid was left as the largest UK payday lender.

QuickQuid had well over a million customers. When it went into administration there were c. 500,000 customers with outstanding loans.

Many of these customers had prolonged borrowing from QQ. They either rolling loans over or repaid one loan but were left so short of money that they had to borrow again.

These customers have good reasons to win an affordability complaint and get a refund of the interest they paid.

Affordability complaints started on a small scale in 2015 and increased in the next few years.

In 2018, complaints going to the Financial Ombudsman (FOS) jumped with the involvement of Claims Companies and QuickQuid became the most complained about firm to FOS, excluding PPI complaints.

For a long time QQ refused to refund interest on any loans taken more than 6 years before or where the loans were given in 2015 or afterwards. This resulted in a huge backlog of claims at the Financial Ombudsman, where QQ had made very poor offers to customers and then rejected an adjudicator decision.

In late July 2019, QQ agreed to accept several thousand FOS complaints it had previously rejected.

By accepting the FOS decisions on loans over 6 years, long chains of borrowing, and loans taken after 2015, the scale of QQ’s likely future liability for refunds will have become clear to the company.

After failing to persuade the FCA that a Scheme of Arrangement was appropriate, Enova, CEU’s large and profitable US parent, decided to close the UK business, blaming the UK regulatory environment.

How could the regulators let this happen?

This is an excellent question… Stella Creasy, MP called for an inquiry into the FCA over Wonga and QuickQuid.

What has happened in the administration

Customers with a valid claim for a refund are “unsecured creditors”. This includes:

- any refunds that were in progress after an amount was agreed or a Final Decision from a FOS Ombudsman (FOS);

- complaints that were underway at QQ or FOS when QQ went under;

- any new complaints sent to the Administrators.

All complaints at FOS legally had to stop and were been passed back to the Administrators. It isn’t possible to send any new complaints to FOS.

It is now too late to submit a Claim for unaffordable lending. The last date was 14 February 2021.

The administrators have given the following statistics about claims:

- 169,000 customers made claims for unaffordable lending;

- 78,000 claims were upheld by the administrators;

- the upheld claims had a total value of £136million, so an average of about £1,700 per claim.

Still owe a balance on a QuickQuid or On Stride loan?

More than 300,000 of the current loans were sold to Lantern in summer 2021. You should have been informed if your loan was sold.

The administrators have now stopped collecting any money from the remaining unsold loans.

This page is kept updated

The comments below this article are a good place to ask any questions. And you may be able to see where someone else has already found out the answer.

Robert James says

I understand there’s £90 million in the pot (money recovered , etc) and there are 169072 claimants.

To prevent further money loses to the administrators as they are incompetent, this money should be split evenly between all claimants now and paid in this month of November. It’s be around £530 per claimant. That’ll be better than 2-3 % for many of us if this drags on and theadministrators & parent company steal more money.

Sara (Debt Camel) says

this money should be split evenly between all claimants now

Unfortunately, that would be in breach of insolvency law. It isn’t going to happen and there is no point in hoping for it.

Owed 14.5k says

Thankfully this is would be illegal. Maybe for you thats a good outcome but considering i’m owed 14.5k this would be a joke.

Gary says

Unfortunately though, you’d be unlikely to get more than a few hundred quid back so it’s best to manage your expectations for this.

Robert James says

I’m owed £5134 , so it would be what I would get at 10 % .

Noel mccready says

Wonga was around 2per cent maybe 3 so I would base our claims on that same administration seem to be doing them all. Never believe anything until its in our bank acvounts

Sara (Debt Camel) says

Wonga was 4.3%

That doesn’t mean QQ will be about that level though.

Robert James says

Yes Wonga was 4.3 % because I had that. Also wonga had 400,000 claimants with a £24 million pot.

So with £90 million in the pot and only 169072 claimants, there are under half the number of claimants with four times the pot, if we don’t get 20 % to 33 % there’s a fiddle going on somewhere. Perhaps that’s why they are taking so long , the parent company doesn’t want give that sort of money to us. It stinks of corruption.

I would say the averaged percentage would be 25 % .

Sara (Debt Camel) says

if we don’t get 20 % to 33 % there’s a fiddle going on somewhere.

these comparisons mean very little.

the parent company doesn’t want give that sort of money to us

The parent company has no say in what happens.

owed 14.5k says

@Sara this is why when we get the final figure we look at the %. We then ask under freedom of information act the amount the company had to pay in Sep of 2021 and get the value each person would have got and then ask for details of the final in 2022 in march when they pay.

If in march 2022 the % we get is less than it would have been in sep 2021 then this is reason for court action against the company for mishandling of the account.

Sara (Debt Camel) says

Can you explain how you would start the court action, which court and which law it is in breach of? You can’t just say something is unfair.

Gary says

No chance will we be getting 20-33%. That’s completely false hope. It’s already been widely accepted it’s going to be 2-5%.

Roland says

The progress report released by the administrator today suggests 30p – 50p in the £ for Unsecure Creditors, so perhaps there is hope

Noel mccready says

Think it will be another year at least

Robert Liddell says

No by law they have to make payments by March 2022 !

Noel mccready says

We will see not be depending on it

Noel mccready says

Read different accounts of rate and dates as I said believe it when it’s in your bank accounts

Noel mccready says

Hope some of u are right with the rest.

Too much delay. Would not surprise me if they try for a further one.

Alex says

Hello. May be some one heard something about overpayment payments,when they will be paid? It is really big joke,even this money are not paid.

Gary Armstrong says

I received an email this week from grant Thornton saying the joint administration are on course to pay out the overpayments in November, I won’t hold my breath as this saga is just going on and on a total shambles

Marm says

Can you copy and paste the email you received?

Robert James says

Why just overpayments. Why not all payments including creditors redresses. Surely, if they know how much overpayments are they should then know what I a creditor am going to get.

Also, we all should be getting an email with this week being the third week of the month. ‘With the third week being reached, doth thou take thy holy email and throw at thy creditors, who being owed in thy sight shall be redressed’–misquoted Monty Python( Holy Grail). (Sry, being silly I apologise)

Sara (Debt Camel) says

Why just overpayments. Why not all payments including creditors redresses. Surely, if they know how much overpayments are they should then know what I a creditor am going to get.

because overpayments are ring fenced and repaid in full. It doesn’t matter how much money they is left to distribute between unsecured creditors, these are two completely separate streams of payments.

Noel mccready says

Think of all the interest that are making on the 90m

Sara (Debt Camel) says

I have seen the accusation that administrators delay things to gain interest on the money on several previous administrations.

This is all nonsense. Very little interest is earned and it doesn’t go to the administrators anyway.

Customers are getting a very bad deal here but that is the fault of the FCA that

A) allowed these afford loans to be given

B) failed to insist the lenders kept adequate capital to pay complain and

C) failed to provide a safety net for customers claims when a lender went under. If a PPI firm went bust, customer who won complaints had them paid in full from the FSCS scheme – it was the FCA that decided not to extended this scheme to cover lending.

This is not the administrators fault.

Noel mccresdy says

It goes to QQ

Sara (Debt Camel) says

It goes into a bank account which is where the refunds will be paid from, the administrators do not benefit from any interest that is earnied.

Alan says

But there staff and directors will be earning nicely out of this for as long as they are legally able.

B says

Hi there, how do I go about making an affordability complaint for loans taken from On Stride, or have I completely missed the deadline? I’m not interested in having any financial reimbursement, but it is having an impact on my credit file and if possible I’d like to have this removed/suppressed.

I also wondered if you can ask CRAs to suppress or remove files for more than one company post administration or if this ultimately damages the over all validity of one and so you should just pick the one that would be best removed? Hope this makes sense. Thanks for your advice.

For anyone wondering, I successfully had Sunny loans removed from Equifax and Experian. I am about to write to Transunison as I got a bit lost in their online reporting system.

Sara (Debt Camel) says

You have missed the deadline to complain. the administrators won’t be interested in an argument that says you only want your credit record corrected – they couldn’t do that without looking at your case and they are not going to do something they don’t have to do.

At the moment it is too early to ask the CRAs to suppress this Onstride record. You need to wait for a few months after the administrators have distributed payments.

I don’t see there is a problem in asking the CRAs to correct the records for more than one creditor. Each record correction has to be argued on its merits.

Noel mccready says

Well the 3rd week ofnov is upon us and surprise surprise no news. Looks like its on to March.

Keely says

Has anyone had a look through the review that come out today?

What does this even mean so many figures and % listed.

Does that mean we won’t get a payout until March 22 now then?

Ian h says

Hiya

Have put a very rough calculation at foot of this thread. It’s all a bit up in the air but basically look at the amount you had in your email of redress amount, multiply it by 0.3 and you have – roughly – the amount due. But you may pay tax on some of it (the interest bit).

Martin says

I made an enquiry about NOID payments about 2 weeks ago in which I received a reply stating that these payments are anticipated to be made by the end of November. But as per usual radio silence… Nothing.. The silence is deafening. It has been so disgraceful how this whole saga has been handled. Just pay the people their NOIDs and surely that will be half the battle!

Branka says

New progress report has been uploaded, for the period up to November 2021. According to the report, the redress payments should be made by March 2022.

owed 14k says

Where is this report? I never got an email and I cannot see it on the website.

KarenH says

Hi Branka

Great news! Where can we see the report please? Nothing on their site as yet

Sara (Debt Camel) says

The latest report is not yet on the website nor at Companies House. My thanks to the helpful person who has sent me a copy!

The administrators say the payout is likely to be between 30p and 50p in the £. So considerably better than Wonga and many other administrations.

The payout is likely to be in March 2022. The delay is partly due to the need to get tax clearance which may not come before Feb 2022.

My comment – 30p-50p is a very wide spread. Reading between the lines, it sounds as though the administrators are disputing a bill from Enova, the US parent company, for £71m for services prior to administration. If less is paid to Enova then the payout may be towards the upper end of the 30-50p.

owed14k says

How can the parent company do that as that is against UK laws. They put the company into administration. They cannot then say ok if administrators manage to get money back we can claim all of that. This is outragous.

owed 14k says

In short the reason this is not allowed is this.

I own a company. A

I start company B as a plc company.

I run up debts on company B.

I then raise an invoice to company B stating it owes x for services.

I then put company B into liquidation.

The result is I do not need to pay back all debitors.

Any funds received from liquidators I can then claim back due to invoice I put in prior to going into liquidation,

WOW they really are trying to rob people.

Sara (Debt Camel) says

That seems rather confused.

The administrators need to decide on the claim from Enova relaying to the previously issued invoice. At the moment we don’t know if it is valid or not.

Sara (Debt Camel) says

I think they would only get the 30p-50p in the pound back on whatever the value of the claim is determined to me – this isn’t secured lending.

Gary says

I just looked back through my emails and can see my accepted claim value was £3,729 which is the amount after the uphold outcome at FOS. So would I likely get 30-50% of this amount? Thanks

Sara (Debt Camel) says

yes I think that is what they are now saying.

Gary says

This is fantastic news and wholly unexpected given we thought it would be a tenth of this level. Surely a fantastic result for so many that have been wronged. Very happy for all involved.

Martin says

Any news on the NOID payments? Are they still on course for November?

Sara (Debt Camel) says

The report says they should be paid by the end of November.

Laura says

:) woohooo just a shame after Xmas lol would be awesome to have got beforehand

Robert James says

Well, you could always get a payday loan to tide you over xmas.

Another example of tax policies, etc penalising the poor whereas the filthy rich get away with it.

Gary says

How do we access the claims portal to know what the accepted value of the claim was? Mine was already agreed by an ombudsman and not an adjudicator. Hopefully this will be the amount they use. Not sure how to check this?

Sara (Debt Camel) says

You had a Final Decision from an Ombudsman at FOS before the administration? Did you submit a claim or were you told you didn’t need to?

Gary says

Quickquid offered me £3,550 after an ombudsman upheld my complaint. I was a couple days away from receiving this payment before the administration was announced. I submitted a claim via the portal and can’t recall now if I was asked to. Would I receive a percentage of that full amount then? I’ve sent an email to them to confirm what’s going to happen.

Robert James says

Well, if the minimum amount is 30 % why don’t they pay that now and give us the remaining later when the theft has been resolved and the parent company is sent back to America bruise and battered. This is Britain we don’t subscribe to the American way of screwing people over. and we will fight their exploitative ways.

Sara (Debt Camel) says

They can’t pay until they have clearance from HMRC which they are hoping to get in February going by the length of time it typically takes for this.

Sara (Debt Camel) says

Also making payouts is an expensive process – they have said they will only make one payment to minimise the costs.

Robert James says

Oh well, a nice tidy sum of money, but unfortunately delayed by the tax people again. Typical how taxation always penalises the poor as opposed to the big mega-corporations where taxation issues are easily brush aside. BTW how much tax will we pay , is it 8%?

Sara (Debt Camel) says

I don’t know what the tax arrangement will be.

If you had received the amount from the lender, not in administration, then the “refund of interest” is not taxable – it is your own money you are getting back – but the extra 8% element is taxable as savings so 20% basic rate tax is deducted from that. which you could then in most cases reclaim up to £200 of from HMRC.

In previous administrations I have seen, the administrators reached some agreement with HMRC that no tax would be payable by the person getting the payment. I don’t know if this was because the payouts were so tiny in many cases, in which case this may not apply in this case, of if HMRC took a pragmatic view that the cost of it giving small refunds to tens of thousands of people would be larger than the tax take.

So we will have to wait and see.

Mark says

It is Britain that screwed you over with their light regulation…

Steven Lawless says

I’d be amazed if we got 30-50p in the pound I would of expected3-4p won’t believe it till a divedened is uploaded

Sara (Debt Camel) says

There is no reason why the dividend should be the same for Wonga and QuickQuid. it would be a coincidence if it was.

As always keeping your expectations low and then getting a nice surprise is a good idea.

Adam says

I submitted a claim in Oct 2020 and the joint administrators accepted all by loans with a payout value of £5,694. So will i get 30%-50% off this amount? And is the payout Nov or Mar?

Sara (Debt Camel) says

At the moment the administrators are saying between 30 and 50% will be paid out. That isn’t guaranteed but I think they have given a pretty wide range to be confident the actual pay out will be within it.

That is 30-50% OF the amount, not OFF the amount.

They are hoping to pay in March, this is dependent on them resolving a number of loose ends and the one they mention with a timescale is getting clearance from HMRC. They know how long these applications to HMRC normally take to get resolved and they are hoping this will be in February. See my comment below about how they may just tell people in March what they will get and the payout may be a few weeks later.

Mark says

Whether its March or next week for payout, this is fantastic news given the 4p in the £ from other lenders.

A guaranteed minimum of 30p in the £ in the context of previous administrations has certainly put a smile on my face.

Sara (Debt Camel) says

re the timing of the payout:

With the Wonga distribution, the administrators paid out several weeks after saying what the amount paid would be – which they call “declaring the divident”. I can’t tell if they expect the declare the dividend in March or actually make the payments in March.

People would be wise to not plan on getting this money by the end of March – I really hope you will get it but don’t build detailed plans around it!

Melissa says

Hi Sara. Firstly thank you for such a wonderful website.

With the recent claim news, can I clarify with you the amounts? My claim was assessed and £9,377 was upheld. Does this mean I can expect between £2800 and £4600 next year?

Sara (Debt Camel) says

That is what the administrators are saying!

Do not bank on this arriving by the end of March. Things can go wrong. And I am not sure if they mean they will tell everyone how much in March and then take another few weeks to pay it.

There may be some tax deduction on the 8% element – that isn’t clear. If there is you can reclaim some of it from HMRC.

Melissa says

Thank you. How would I claim the tax back? I want every penny I can!

Sara (Debt Camel) says

If there is any tax deducted – and there may well not be – this is how to reclaim some or all of it: https://debtcamel.co.uk/ppi-payday-refund-get-back-tax/

Edward says

I wish people would stop saying it costs so much money sending payments: working in the corporate banking industry it costs pennies not pounds to send BACS files via their online banking. Yes it costs on average £5 per payment for faster payments however I’m sure people won’t mind waiting 3 working days for a BACS payment. Most have been waiting all year a couple of more days won’t hurt just to get their NOID payments.

Sara (Debt Camel) says

It isn’t just the banking cost, it is the systems costs and the amount of staff time to cope with queries and resolve problems.

Kel says

When I emailed the administrators regarding the Post noid payments back at the end of October they said they were intending to issue payments in around 8-12 weeks so I think we’ll be lucky to get them before Christmas. She said they had to recheck the refunds

ann stanley says

Could you please tell me the email address ?

Kel says

casheuronetuk@uk.gt.com

Chris says

Hi

Please see below

interest and fees on loans £4,030.44

Total compensatory interest £902.72

Less set off £733.78

Revised interest and fees on loans £3,296.66

Revised compensatory interest £902.72

Accepted claim value £4,199.38

Compensatory interest settled by way

of set off £0.00

Remaining loan balance potentially due

to CashEuroNet UK, LLC £0.00

Refund for overpayment on

CashEuroNet UK, LLC loan £94.08

I received this off the administrator over 12 months ago. Does this mean I will get a percentage of the £4199.38 accepted claim value?

Sara (Debt Camel) says

Yes I think so.

Also I think you should be repaid the Refund for overpayment on CashEuroNet UK, LLC loan £94.08 in full.

Chris says

Thank you, and 5 stars for your site excellent communication 👍

John says

I’d prefer it to say “will pay 30p to 50p in the £..

Only when “will” replaces “may” will we know it will be at least 30p in the £.

Edward says

Are we sure that this is not a miss type and it is 3 to 5% 😂

john says

the administrators have untill march 22 to make payments including redress payments , issued by a court of law,did you not read the last update sara

Sara (Debt Camel) says

yes, but in the case of wonga some of these statements seemed in the end to just refer to declaring what the dividend was, and it was paid a few weeks later… so I am just saying the money is only in your bank when it actually arrives…

Martin says

Do you have a link to the report? I’ve not received an email or find it on website

Jason says

Seems to me, that if the payout is going to be up to 50p in the pound, that quick quid could have been refinanced easily by the parent company, but the decided it would be financially beneficial for them to wind up the company rather than pay 100 per cent compensation for missold loans..

SK says

I think you are spot on, here is a reminder what David Fisher, CEO of Enova said about “pushing” CashEuroNet into administration:

“Over the past several months, we worked with our U.K. regulator to agree upon a sustainable solution to the elevated complaints to the U.K. Financial Ombudsman, which would enable us to continue providing access to credit for hardworking Britons,” said Fisher. “While we are disappointed that we could not ultimately find a path forward, the decision to exit the U.K. market is the right one for Enova and our shareholders. Looking ahead, we believe that our diversified product offerings provide meaningful growth as we allocate our resources where we see the greatest opportunities.”

And this statement on their website https://www.enova.com/company/ always makes me laugh…

“We Are All About Responsible Lending

Enova is a member of leading financial services trade associations in two countries, and we offer financing in a total of four. That means dealing with a whole lot of different lending laws! But we always work hard to ensure we comply with all applicable lending laws and regulations in each country.”

Linda says

Getting worried that this 30p in the £ us a hoax…lol

Noel mccready says

Believe it when it’s on your bank account and the cheque has cleared

Ian H says

Ok this may not be overly helpful and the November report is not yet available but a few points.

1) if HMRC does not have an outstanding bill in respect of withholding tax from redress prior to GTs appointment then the value of unsecured and trade debts is around £208 million. That assumes Enova is paid in full.

2) as of the last report assets stood at £68.2 million

3) assuming GT fees are largely linear they will be due around £5 million for the year April 2021 to March 2022.

That means, broad calculation and assuming there are no surprises lurking for other debtors and assuming the collections since May 2021 are zero and no value of sale for other assets around £63.2 million for distribution. That equates to 30.4 per cent.

Take off Enova as a whole (unlikely I would guess at around 50 per cent but that’s just me) would be 46.5 p er cent.

There will be ups and downs but should be relatively insignificant to be honest. So on a projection from May that shows where the 30 per cent comes from.

Sara please delete this if it creates false hope but that’s a really quick easy summary of the numbers as they stood

Sara (Debt Camel) says

I think it’s better to wait and read the report!

Ian h says

Don’t disagree but for those saying is it a typo…

Melissa says

Hi Ian. So what are you suggesting the final payout amount will be? Pence to the pound.

Ian h says

As Sara says best wait for the report. It is speculative an so much depends on the Enova piece. All I wanted to do was show the percentage doesn’t look wildly out. I’m working on 25 pence in the pound in my head but my top end guess is 35. I suspect the Enova piece is probably fairly cast iron. But as Sara says this is speculative, all we can show is that the estimate of 30 – 50 seems realistic on the headlines

philip nightingale says

I have a claim same as yourselves and I can’t log into my email account anymore ! Any ideas who I can contact so any correspondence can go to my new email address ?

Cheers

Phil

Sara (Debt Camel) says

phone the CashEuroNet Customer Support Team at 0800 016 3250.

Stephen B says

Hi Sara

Love the content you provide its been very helpful to me. You state that final claim amounts wont be decided until march 2022 but the administrators are saying the are confident of pay the dividend as soon as possible and that it must be paid by March 2022. Therefore the claims could be paid anytime between now and then? Am i right in saying that?

Sara (Debt Camel) says

The administrators require clearance from HMTC before declaring the dividend amount – see section 3.5 in the report. They are hoping to get it in February but it may be March.

Ian h says

Well the report is up and i think it makes rather positive reading. In particular the sale of the loan book for £17 million is surprising, although I feel for the people who continue to be chased so it’s very much a bitter pill in lots of ways.

There would seem to be no corporation tax liabilities, subject to HMRC confirmation of course, which is positive too.

So apart from Enova, and I assume the SLA costs will have the costs of services to date taken off, there would seem to be just GT fees and other disbursements to go.

As an update to yesterday and again only a rough guide the amount available for distribution would seem to be around £78 million, have allowed for £2 million of other stuff, any liabilities and things in the woodwork.

Enova would seem to be an unsecured creditor so the total creditor amount seems to be around £200 million, assuming that Enovas costs so far are deducted and the whole amount of the remaining SLA is due.

That suggests, and only suggests but is not unreasonable, something right in the middle of the 30-50p range.

Again as Sara says so often don’t go spending it yet and the final figures may be a bit higher or lower but overall I see nothing that means at least 30p us achievable.

After my Wonga 4.2p this is really pleasing and I hope gives people some significant redress for the grief caused.

Pip says

Thanks Ian, my maths comes out similar to yours (37.6p) when making reasonable assumptions about future operating costs/final realisations.

No clear what could happen to get the figure any higher than than.

However, all in all, most will be very happy with the outcome.

Ian h says

Well the main differential will be Enova and how much of the SLA is enforceable. My only thought, but haven’t read it clearly, is whether it is deemed to be for services not yet provided. Arguably you can’t have a debt for something that never took place but so much depends on fine print Pip. It is though a sizeable sum and around 50 per cent of the unsecured creditor amount. I’d say it is a bonus if it comes down and nobody should think more than the 30 – 35p range to allow for every contingency

Tommy h says

Will the claims company I used still want there share?!!!

Sara (Debt Camel) says

I think most of them will, but you need to ask the claims company.

Martin says

Mine gave my case up due to it likely that I would not receive much.

probably kicking themselves now as it’s likely to be between 5k (30p) and 8.5k (50p)

Ashley Clark says

If your account has been sold to Lantern, will that be cleared or will it still be chased. I got a CCJ and will this be wiped?

Sara (Debt Camel) says

The administrators have not been clear on this.

Did they decide that the loan that was sold to Lantern was unaffordable?

Ashley Clark says

Yes my account is on hold with Moritary Law and they are just waiting for Lantern to get back to them. My claim was £586

James says

Did you ask them was the CCJ being removed or what? I had an affordability claim accepted where i asked for the default to be removed from my file but its still there and i haven’t heard anything else back since the email about my claim being accepted on 21/4/21.

Having reviewed the additional evidence received from you, we are writing to confirm that we have investigated your claim and our findings are set out in more detail below.

Based on said evidence which reflects your income and expenditure at the time of funding, the Joint Administrators have accepted your appeal.

A revised claim assessment email will be sent to you outlining further details of your revised accepted claim value.

That was in the email and still no reply, should i reply to that email?

Sara (Debt Camel) says

So you need to ask the administrators what is happening with your refund and can it clear the Lantern debt. If they say No, not by them, you will be paid 30-50% of it and it’s up to you what to do with it, you could offer that as a settlement to Lantern. If Lantern refuse, you may be able to make a claim against them for Equitable set off… but let’s wait and see what happens before going into that?

It is VERY unlikely the CCJ will be removed.

You may however be able to apply to the court for the CCJ to be “set aside”. This costs £275 but if you are on benefits or a low income this could be free. Or it may be possible to get Lantern to agree to it being done “by consent” which would be £100.

I suggest you wait at the moment and see what is happening to the debts, then think about the CCJ afterwards.

Ashley Clark says

That’s the strange thing as the administrators said the CCJ should be removed

it was in a email. it said

Thank you for contacting CashEuroNet UK, LLC.

Our records indicate that your claim was accepted. As stated in your final assessment letter, all loans that have been accepted as part of your claim value will be updated accordingly on your credit file. Which would mean there is no longer a CCJ on the loan. Please note that due to volume of claims, updating your credit file could take a number of months.

This was sent to me on the 11/08/2021

Sara (Debt Camel) says

oh! Right, you need to contact Lantern and tell them that.

Ashley Clark says

i did but they said i needed to go to Moritary Law and then they said they are waiting for Lantern to tell them what to do.

Sara (Debt Camel) says

Are you making any payments to them? If not, you may as well sit back and wait.

Ashley Clark says

Im paying £15 a month at present with £317 left to pay and i have already paid £468

Sara (Debt Camel) says

how much has your claim been assessed at?

Ashley Clark says

Claim was about £567 lantern debt was £804.28. i have paid £487.24.

Deb says

I was doing the same but my account was put on hold when I rang lantern last year. Original debt was over a thousand pounds even though the debt sold was only £700 and I have £322 left to pay.

Deb says

Sorry £700 loan taken then when welting lantern was over a thousand. I’m wondering what happens with this and whether I’ve paid to much in interest as it was stated as being unaffordable when the claim was accessed.

Dave says

Hi,

I had a claim accepted at just over £7000, I haven’t paid much notice to it as I was expecting to see a few hundred of it at most. However, seeing the 30-50p I has got me interested again.

I have been through my old emails from casheuronet regarding the claim, I have found the email that contained the pdf attachment to show my claim and the pdf doesn’t work anymore, it comes up with a message from a company called zen desk. Has anyone else had this issue . I would like to see my claim again just to refresh my memory.

Rebecca says

I’ve also got the same issue. I’ve emailed them asking if I can have a copy of my claim assessment again but not received a response. Like you didn’t pay much attention at the time as thought would only get a few hundred max

Neil says

Similar here. I called them earlier as I haven’t received any emails since I got an accepted claim value years ago. Called them earlier they were able to locate my details using my email, dob and phone number. The numbers in the thread….

Edward says

Pleased to see the one liner in the report saying that overpayment refunds will me made at the end of November

Mark says

I emailed them on Sunday asking for the to confirm my redress figure… They responded on Monday afternoon with the figure.

Neal says

Hi,

Not sure if anything can be done with this but I had a pounds to pocket loan, complained about unaffordability Feb 2020, like many other loans I had at the time. A lot have been upheld. But I never heard anything back from P2P, onstride, whatever theyre called. I forgot all about it, heard nothing about them going bust, had no correspondence until Lantern contacted me this august saying they had bought the debt. Can I do anything or will anyone hear my complaint? Lantern are saying they’ve done nothing wrong and can’t speak about what P2P did or didn’t do.

Sara (Debt Camel) says

So you sent in a claim?

Neal says

I did in Feb 20. They didn’t reply or acknowledge it. I didn’t realise as I’d sent out so many.

Sara (Debt Camel) says

You can ask Customer Support on 0800 016 3250 what has happened. But it is now too late to do anything if your claim was not properly submitted or if it was rejected.

Neal says

Thanks Sara, they just ignored it I think. Too late, never mind

Steve says

My accepted claim amount is for £8,499. Seeing the news that I may receive 30-50% of this has got me excited. How likely is it to be within this range? Surely the administrators wouldn’t have said this if they weren’t very confident that this will be the case. I don’t want to take too much notice at the moment because the disappointment will be massive if it’s significantly lower however any feedback from someone more knowledgeable would be appreciated. Thanks.

Sara (Debt Camel) says

They must be pretty confident.

Ian h says

See above. As Sara says they need to be fairly confident and all the numbers show that it’s a very strong possibility.

Steve says

Thanks. I’m guessing it’s likely to be nearer the 30%.

Liz says

Can anyone tell me where to go or complain to as Quick Quid told me that they have no paperwork on my Loans and according to them I never had any loans, yet I know full well that I had numerous loans between 2007 – 2011 but being that long ago I no longer have any proof.

What can I do?

Sara (Debt Camel) says

I am sorry but with loans that old QuickQuid may have deleted the information. And even if you could find any evidence yourself, this is now far too late to try to do anything – the deadline for claims was in February.

Martin says

To be honest I find the claims line to be useless. It seems that you are put through to American call handlers and anytime I have rang with a query they only give the same generic responses and are no help at all. I asked about NOID payments and was only quoted that the administration payouts will be made in March. All I want to know is

If its the end of November can I have a specific day?

I don’t want to get my hopes up only to be shot down… I am hoping at least they will let people know one way or the other. They don’t respond to emails and some better clarification would be most helpful

Sara (Debt Camel) says

You are NOT going to be told a specific day. Don’t plan on it being there until it has hit your account.

I know this is frustrating but having seen a lot of people in similar situations that is the best advice I can give.

The administrators job is to distribute the money fairly at the least possible cost. You may think providing a simple but helpful communications service is part of this, but it isn’t.

Julie says

Hi. I emailed them earlier asking for an update and they said they have until March 2022 to pay including the overpayment. There was no mention of them paying the overpayments by the end of November as I have read on previous threads

Sara (Debt Camel) says

Section 4.3 of the report (link in the article above) says the administrators estimate the overpayments will be refunded by the end of November.

Daryl says

Weirdly if you try and search on the PDF it only searches the latter half of the document.

However, the information is on Page 9 of the report.

Julie says

Worryingly they didn’t put a year next to November so who knows whether they even mean this year

Ish says

It could be November 2022

Sara (Debt Camel) says

what could?

Ish says

Sorry meant to say the payout.

Sara (Debt Camel) says

That isnt what the administrators are saying

Linda says

Don’t know why you print those childish comments about it being November 2022..

Sue says

I have not received any confirmation of any redress amounts – not heard anything since March 2021 when they asked me to confirm my address. Should I contact them?

Sara (Debt Camel) says

yes.

Sue says

Does anyone have a contact e mail address? No reply from the e mail address I have. Thanks

James says

My claim is £23k, so was expecting a grand at best. The prospect of £7.5k at worst is a welcome bonus

Shorif says

Wow 23k and there i was thinking 10k borrowing was bad.

Noel McCready says

Mines 13k but I will believe it when the money is in the bank

James says

I know I was bad then, I don’t know how I survived, debt free now paid it all back, wasn’t easy, and caused by my own stupidity.

Kev says

You are not the only one. It was so easy to fall into

Psul says

How do we contact them, I’ve lost my email with my details on how much my claim was worth.

Could somebody please supply the contact number?

EJ says

I am confused now, are we due to receive our redress amount back in November or in March?

Sara (Debt Camel) says

it is now expected to be in March.

Danny carmody says

looks like march, on the emails l have seen, plus all the message seen on this site

Edward says

However overpayments are anticipated by end of November; Tuesday. Heres to hoping 🤞

Gloria says

Does the interest payment change with the length of time we have had to wait?

Sara (Debt Camel) says

No. Because there isn’t enough money to distribute. If you say everyone would get another 8% as they have had to wait another year, there would still be the same amount, so the distribution would be a lower percentage of the larger amount.

MR says

30p in the £ is a great result. After the wonga % I felt like giving up completely. I’m so glad I continued with my complaint through the administration process of QQ because at one time I thought there was no point.

Oliver says

Last day of November – no overpayment refund

Am I surprised!!!

Martin says

What a surprise. End of November and no hint of Noid payments… Why bring out a report this day week ago anticipating Noid payments to be made at the end of November when in reality its not going to happen. Yes I and others shouldn’t get our hopes up.. But the fact of the matter is these payments are ring fenced they are meant to be refunded fully and its just unnecessary delays holding the whole thing up. This money has been held for over a year now and it can’t all come down to costs of the administration. Some of us are still struggling in debt and with covid and Christmas coming up it would be nice if these payments go through when they say they are going to make them

Gary says

So it’s the 30th of November and overpayments should have been made but surprise surprise no money in my account , already looking like they are fobbing us off already total joke

Kel says

I emailed the administrators back at the end of October and they said the post noid payments were targeted to be paid in 8 to 12 weeks – 8 weeks would be just before Christmas, I highly doubt this will be the case.

Alex says

Administrators Novembers report is much more important that email in October you received. How guys wrote it was uploaded 2 weeks ago. If they would not sure about November why not write November/December. Just mocking people. Some people in really bad financial situation…

Kel says

The report was probably written before she replied to me but whatever people want to believe. I’m just telling folks what I was told. I’m waiting for my refund as well…. I would have preferred November!

Kel says

> On 25 Oct 2021, at 16:33, CashEuroNet wrote:

>

> Commercial in confidence

>

> Dear Kelly,

>

> Thank you for your email.

>

> The overpayments required further review by the Joint Administrators and are targetted to be paid in the next eight to twelve weeks.

>

> Thank you for your continued patience

>

>

> Kind regards

>

> Lucy

> For the Joint Administrators

>

> Lucy CM Freeman

> Associate Director, Advisory

> Grant Thornton UK LLP

Elle says

This is so frustrating, ive accepted we are going to get very little to what we are owed and this was a big claim for me. But what bothers me most is how they have decided hardly any of my loans were unaffordable, and I can’t challenge that decision – yet FOS have agreed all of my loans were unaffordable in every other case when all my loans were taken in the same period I’ve been successful in every single claim so this one would have been no different. I just wanted these off my credit record for a mortgage. Is there no way we can challenge that aspect?

Sara (Debt Camel) says

did you appeal their decision?

Elle says

I’ve just checked must have got mixed up with sunny – quid quid did not agree that ANY of my 15 loans were unaffordable – taken out in very quick succession and all other affordability complaints in this period have even upheld by FOS. How is this ok?! Only way to appeal was to take it to court it said in my email.

Sara (Debt Camel) says

I don’t understand the decision but you should have been given a time to appeal. After that, the only way is by court.

If you wait until the second half of next year, the administrators will probably have stopped communicating with the credit reference agencies. At that point you can ask the CRAs to “suppress” the loan records, see https://debtcamel.co.uk/correct-credit-records-lender-administration/

Neil says

Sorry Sara,

does that mean I can ask the CRAs to suppress all of my loans from companies that have gone bust (thinking Wonga primarily) even the ones that were not deemed unaffordable? I am also trying to get a mortgage and thinking that removing as many payday loans as possible even in the distant past may help. Thanks.

Sara (Debt Camel) says

Well you do need a reason why the records should not be there… you may have further evidence why the loans were unaffordable, or some of the dates may be wrong, or you may have been misled by a Wonga article saying that taking loans would help your credit record, but now they feel this is misleading as they create problems for some lending.

Neil says

Thanks for the info

Denise says

Good morning.

I just received this as a news feed on my phone.

https://www.mirror.co.uk/money/customers-payday-lender-quickquid-up-25572705.amp?fbclid=IwAR2UBYlcb7qE_JoYh2VT3luUfwVktEaMoGJGpC-zmBnd9CN2pobKxXsoeoM

I do hope that it’s alright to post this?

Regards

Denise

Sara (Debt Camel) says

thanks, I hadn’t seen that article.

Denise says

It is my pleasure…

David says

Hi, I forgot to make a claim on time. I took several Quick Quid loans between 2017-2019. I managed to repay them all by borrowing from family. Is it still possible to claim? If so how can I do it?

Sara (Debt Camel) says

No I am sorry but this is way too late.

Mike says

Still no update for QuickQuid over payments – had this reply today.

Not completely sure why we we’re told end of November is this was never going to be the case?

Thank you for contacting CashEuroNet UK, LLC

In regards to your query, we do apologise there is no update to advise in regard to earlier over payment payouts going out at this time. Please continue to monitor your email as you will receive cliam updates as they become available. We appreiciate your patience.

Alex says

Email them about redress % and they will reply where you got info about 30-50% . Ha ha ha. Report write people from the street. Ha ha.