Contents

Quick overview

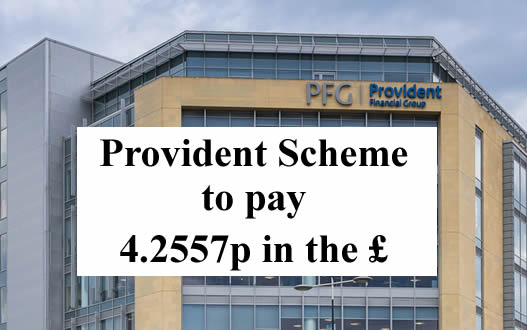

Provident’s Scheme of Arrangement is now in the final stages.

The Scheme was proposed because Provident could not afford to carry on paying full refunds to customers winning affordability complaints. The Financial Ombudsman was upholding 75% of complaints against Provident.

The FCA, Provident’s regulator, said it did not approve of the Scheme. But as Provident has stopped providing doorstep loans, the FCA did not object to the Scheme in court.

It started officially on 5 August 2021 after it was approved in court. The deadline for claims was the end of February 2022.

Provident has assessed claims and informed customers of their decision. The large majority of appeals have been held.

Provident is making payments to bank accounts or sending cheques:

- it is paying 4.2557p in the £;

- so if your redress was £1,000, you will receive about £42;

- a final letter will be uploaded to your portal account setting out the payment;

- the first bank payments will be arriving in accounts on Tuesday 5 July.

Here is confirmation from one reader (see the comments below for others):

FUNDS PENDING!!!

Hi all, I’m new to this to thread but just thought I would give an update.

I have a Monzo account, it is showing my Bacs credit as going into my account on Monday, for most people with standard accounts this means you will be be paid Tuesday

I can also confirm it is 4.2557% as stated.

Glad it’s eventually been sorted.

But no-one should assume they will get their payment next week.

They may be going out in batches. And in any mass payment, some of them fail. Do not plan your July finances on the assumption that you will get paid early in the month.

Which loans were covered by the Scheme?

More than 4 million people were given a loan by Provident that comes under the Scheme.

These loans were given between 6 April 2007 and 17 December 2020.

The loans came from four different brands:

- Provident – often called “doorstep loans” or “home credit”;

- Satsuma payday loans;

- Greenwood – another doorstep loan brand that hasn’t been used since 2014;

- Glo – a very small guarantor loan brand.

If you have an affordability complaint about Vanquis or Moneybarn, these complaints are NOT included in the Scheme. You can still make a normal affordability complaint and get a full refund.

The definition of “unaffordable”

A loan is only “affordable” if you could repay it on time and still be able to pay your other debts, bills and living expenses.

You may have paid the loan on time, but it may still have been unaffordable.

If paying Provident left you so short of money you had to borrow more or you got behind with bills then it was “unaffordable”.

If you had several loans without a break between them, then Provident should have realised you were trapped in a cycle of borrowing and that these expensive loans were not affordable. Even a single loan can be unaffordable if it is large.

Provident pays out on old uncashed cheques

In 2018-20 Provident frequently made very poor offers to people that complained, sending a cheque. They frequently used to offer to refund just a few loans, often not the largest or the most recent. For example, in one case with a large number of loans, Provident upheld a loan for £1,000 but decided the next loan for £2,500 was affordable.

Many thousands of people didn’t cash these and instead sent their complaint to the Ombudsman, where they often got ten times as much! who had made affordability complaints.

When the Scheme was announced, people tried to cash the cheques but some cheques were too old to be bankable. Until now Provident has refused to send out a new cheque. In February 2022, at last Provident relented and refunded this money and people can also make a claim to the Scheme for the extra they should have had.

How much will you be paid?

The next stage is for Provident to divide up the £50 million in the Scheme between the people who have had their complaints upheld.

Customers who made a claim have been told which loans have been upheld and what the total redress for these loans is. You will be paid a percentage of this redress number, not all of it.

When the Scheme was voted on, many people thought they were being told that the payout would be 10%, or 10p in the £. I said at the time that that looked unlikely and it could only have been based on an unusually low number of people making a claim.

For several months Provident quoted a range, saying:

Based on the claims that we have received to date, we estimate that the pence in the pound rate of compensation to be paid to each customer will be between 4-6p.

Now it is known that Provident will only be paying 4.2557p in the £.

A final letter will be added to your portal account setting out what you will be paid.

Credit records will be cleaned

In other schemes and Administrations, some people say getting rid of a default was the most important result for them. Not the small cash refund!

For upheld loans, any defaults or missed payments will be removed from your credit record.

This clean up will be done at the end, when they can do everyone’s together. This is very annoying if you want to make a mortgage application, but there is nothing you can do to speed it up.

If your credit record is not cleaned in this process, there will probably be no-one to complain to about this. But there is process for resolving this sort of problem, see Correct credit records by “suppressing” them if the lender has disappeared.

Current loans

Loans that were sold to a debt collector

If your loan was sold to a debt collector, Provident is trying to get this settled. This seems to be taking some time, for example with Lowell saying they haven’t been given the right information from Provident. Several people are complaining about these in the comments below.

Loans that hadn’t been sold were written off in December 2021

In December Provident announced that it was no longer collecting any payments for existing loans:

There is nothing you need to do. You can stop making payments on your outstanding loans owed to PPC and if your payments are taken by the Continuous Payment Authority (CPA), we will stop these for you. Any payments made after 31st December 2021 will be paid back to you.

If you’re in arrears or didn’t pay your loan within the time we agreed when you got your loan, we’ll update your file with our Credit Reference Agency to show the balance as zero and partially settled.

Your credit record is being changed to show that the loan is partially settled or partially satisfied.

If you are a Provident or Satsuma customer, you should have been told about this by email or letter.

That is a pathetic payout

Provident is a successful company with the profitable Vanquis and Moneybarn brands which are still in business. It is a disgrace that the regulator has allowed them to structure their business in a way that has permitted Provident to abandon all its doorstep lending customers and not pay them their proper redress.

If you are feeling mad that Provident has got away with paying you so little, this is the time to look at whether you can make other affordability complaints, not just for loans but for other types of credit.

I have a separate page for each sort, as they need slightly different template letters to complain:

- refunds for large loans, including Moneybarn and other car finance;

- refunds from catalogues and credit cards such as Vanquis;

- refunds from overdrafts

- refunds from Lending Stream, Safetynet Credit and other payday lenders.

Adreva says

Well the unaffordable loans 4/5 Provident loans I had have been removed from credit files.

Last one showing a default registered in Sept 2021. 3+ years after last payment.

Provident won’t change the date so will try escalation to Ombudsman.

Thanks Sara for the help through what has been a shameful shambolic scheme. I still can’t understand the rationale behind decisions and as for the independent appeals process.

Ultimately I’m going to be worse off as the £30 pittance of compensation is vastly outwayed by the default meaning the Provident loan will be on my credit record for a decade.

Sara (Debt Camel) says

Provident won’t change the date

Have they given a reason or are they just ignoring this?

I don’t think FOS will look at this issue because of the Scheme.

One thing you can do in a couple of months is contact the CRAs and say the default date on this debt is wrong and Provident will not answer your questions about it and ask the CRA to “suppress” the debt because it is incorrect. See https://debtcamel.co.uk/correct-credit-records-lender-administration/. But it is too early do this at the moment.

adreva says

They’re sort of ignoring it , complained Apr 2021 about no default added then default added in Sept 2021 Provident saying they dealt with the complaint previously in Apr 2021 which is pretty amazing as the complaint is about the incorrect date for a default which wasn’t added for another 5 months.

And now no response ….

I will try to supress but im concerned that the debt is registered as with Provident and they may respond

Sara (Debt Camel) says

That is why you need to wait another couple of months – Provident are trying to close this down. I doubt they will be paying people to respond to these quesries in a few months time.

Adreva says

Thanks Sarah will try that

Julie says

I still haven’t had my money paid into my account. They are saying that my account was linked to another customers and that it has to be re assessed. Is anyone else having this issue?

Michelle Robinson says

I was told the office will still be open till end of august for all who went with the adjudicate

Kirsty Fletcher says

I still haven’t even had an offer keep getting told they are looking into it and still no response and the office is now closed

Mrs Barbara says

I wrote to provident asking for. MyYself and partners PPi and told they stopped paying it .I took very ill through Covid I had to.move to a smaller housewith walk in shower So I didn’t revieve.y letters As tley went to our old adress

Sara (Debt Camel) says

I am sorry to hear this but it i9s now too late to make a claim to Provident.

Lucy says

just realised I should have posted here instead of someones comment.

I contacted Lowell today both the automated service and customer service confirmed that my account for Lowell has been closed it was closed on 22nd July.

I enquired about the refund and they said they are sending out letters this month regarding refunds if this helps. They said if you haven’t recieved a letter by end of August then to ring them back.

Christine says

At last had a response of lowell solicitors my account has been put on hold and under investigation while they look at all the evidence I’ve sent them from provident, this had to be done through lowell as the solicitors department ( put in a complaint about there attitude regarding the issue) were just not interested will wait and see result, which says can take up too 8 weeks to investigate!!!

Sara (Debt Camel) says

at last!

Stuart Ridley says

I am the same ….still have not received my compensation payment…….the office is closed…..how do we contact you now ?

Mark says

Hi Sara,

I had an account with Provident which had already defaulted. It wasnt deemed unaffordable lending but they closed the account and notified the credit reference agencies that it was “Closed – Partial Settlement” with a zero balance.

The Experian credit record is still showing this as Default and not a closed account which is negatively impacting my credit score. The other Reference agencies have it as a closed account and my scores are good.

Will Provident been clearing all defaults or only those who won the unaffordable lending claim?

Thanks

Sara (Debt Camel) says

Only the loans upheld as unaffordable.

But in a couple of months you can ask Experian to “suppress” this record, see https://debtcamel.co.uk/correct-credit-records-lender-administration/

merveille says

i havnt recieved anothing at all from them, i have been told that the money was going to be senf through on the 31 july due to some delays all now nohting which is ashame. i have sent soo many emails , now i dont know what to do

Louise says

Hi!

I was wondering if anyone else has had a similar experience to me? I had multiple loans with Provident including a glo loan. This was not included on the first calculation so I appealed the decision and it was upheld by the adjudicator. They’ve since sent me a further calculation with the glo loan on it hut the compensation value as being zero. I’m not sure what else I can do now? Any help would be appreciated!

Sara (Debt Camel) says

if you think the glo loan was unaffordable you can ask for that to go to the adjudicator too.

Louise says

Hi Sara,

It already has and yjey upheld it. I just don’t understand why the compensation value is £0 on thr coaimd calculation!

Sara (Debt Camel) says

how large was the loan? How much have you paid to it so far?

Lynnsey says

I just received an email saying that I have a secure message in the portal. But I can’t access the portal. I never have been able to

Joe says

Me too but the loan amount total is totally different from the 1st redress email they sent me and there are home credit loans on there when I only ever used satsuma!!!! It’s over £3000 more!!!! But still reads I’m owed nil amount as owed more than my redress claim????? So confused!

Stacy says

I’m the same I can’t log in to my account either?

Sarah says

I’m in the same situation

Christine says

I’ve have had one to but it’s totally different to 1st one with outstanding balances increased from my 1st portal letter what’s they doing? 1st outstanding balance was £1300 now it’s £6100!!!

Christine says

Just read through it again and compared to 1st redress letter and loans deemed affordable had NO outstanding balances on but on one received today they now have outstanding balances I’m SO confused!!

Faye says

Hi I’ve just had a letter in my portal with outstanding balance of 3000, but like others first one had a nil balance 🤷🏼♀️

Rebecca Rogers says

Still waiting for replacement cheque was told Wes sent 3 weeks ago appalled to be in this situation

Kim Northcott says

I was told on 29th July a replacement cheque was being sent 16th August still waiting! Getting very annoyed now!

Kim Northcott says

I still waiting for my cheque from provident, first cheque they sent to my old address (even though they had my new one ) on the very last day 29th July was told they would send me another one! To date 13/08/2022 still no cheque! Will be very surprised to actually receive it

pamela says

rec a email telling me they a message in portal cant get into it try sending a email to them email closed now so dont know how to go about it

Toni says

I just wondered if anyone has had any refund from lowell yet?

Christine says

Unfortunately not I check my online account everyday but still just says on going complaint so they not even acknowledged the debt being unaffordable yet!!!

Ashlee says

I’ve received a letter today saying I’m entitled to a £350 refund from overpayment. Its the first thing I’ve received from lowell acknowledging the scheme and refund. I called them and I should have my refund in my bank over next few weeks

Toni says

I got the same letter, rung them and got through straight away, gave them bank details and was told 7 to 10 working days x

Ashlee says

I got told the refund needs to be approved so allow a week for that then 2 weeks for it to clear into my bank 🤯 I do hope it’s sooner. They tried their hardest to get me to take it off my other debt but after the way they treated me they can have their 50 a month and stick it. I’m gonna spend it on whatever I like and enjoy it :)

Luke says

Hi, I’m stuck as well had a email saying I need to go to portal as there’s a message for me, but I can not get in. If I email them I just get one saying it’s now closed.

Thank you for any help

Mary leek says

I have try e/mail provident put no reply made my claim back 2019 / still no refund there it was to be paid by July.

DL says

Does anybody still have missed payments etc on upheld Provident loans showing with credit reference agencies?

I’ve raised this with Experian and Transunion but all I get is the standard text about ‘we can only change things if the creditor tells us’. I’ve told them they’ve gone under and that the administration put it in writing that these missed payments would be removed (I even attached the docs) but I’m still getting the same dross from CRAs.

Is there a precedent to resolve this? My credit profile(s) now clearly contradict Providents decision. I emailed cheque replacement address but nothing from that either.

Sara (Debt Camel) says

In a couple of months you can ask the CRAs to suppress the credit records, see https://debtcamel.co.uk/correct-credit-records-lender-administration/

Margaret says

I had 17 loans with provident i have had no refund off them

Ashlee says

Anyone else get a letter from lowell regarding the overpayment? I am now expecting a refund from them of £350 which I’d written off personally as I was happy with just a 0 balance. If not I imagine they’re coming soon! Just a little late but better late than never as they say

Joe says

Are these letters coming from Lowell direct or lowell solicitors? As lowell solicitors not even acknowledged the loan they bought was unaffordable yet even though everything I received from provident has been sent to them regarding the loan they bought just put my account under investigation.

Ashlee says

My accounts were with lowell and the letters came from lowell also. Sorry can’t help you much

Nicola Giles says

Still waiting for my replacement cheque in my correct current name . Been over 4 weeks now .

Kim Northcott says

Iam waiting for my replacement cheque, I emailed provident received a reply saying they have sent out the last of the cheques!, if I haven’t received it then I’ve to email my details and they will send a replacement cheque! I googled to find how to contact them.

Christine says

Well just had an email from Lowell solicitor saying my complaint regarding provident account with them is still being investigated so still no joy!!!

Ashlee says

I got my refund off lowell in the bank this morning, happy spending to me!

Christine says

Wish lowell solicitors side was the same it’s been going on for months now!!!

Ummar Patel says

My debt was sold to Cabot still not heard anything from them any one else with similar situations.

debbi says

hi,

I chased up my dmp with cabot and they advised me that my account had been selected as part of the provident close down scheme, meaning the account was in the process of being closed down and the balance will be written off.

they said i could go ahead and cancel my dmp payments to them and any payments made in the meantime would be refunded but as yet they didnt know if the refunds would come from them or provident.

they said my account along with some other provide accounts were being held and no outbound calls or contact would go out to us during this time.

Jade says

Anyone still waiting for a cheque/ payment?

They sent me a £3 cheque at the start of the month which I have not cashed as my claim was upheld by the adjudicator. The revised compensation cheque has still not arrived…

Any suggestions on what to do?

Anne Hammond says

Haven’t heard anything since applied back to when I first got e.mail is this still going to pay out ?

Sara (Debt Camel) says

did you get an email saying your complaint was upheld?

Anne Hammond says

Hear absolutely nothing since first applied I joined provident when I was in my thirty’s now I am a pensioner and getting no where

Sue worsley says

Hi Sara can I still put a claim in with mossleys

Sara (Debt Camel) says

should that have said Morses?

Anne Hammond says

When is all this going to get sorted been over two years now actually thinking that isn’t going to happen my son was paid out near.y two years ago

Adreva says

Well an unexpected surprise today Provident have changed the date of default from Sept 2021 back to Oct 2018 it’s still not great but better then nothing

Christine says

Well heard back from lowell solicitors they have refused to uphold my complaint against them for my provident account they purchased and was deemed unaffordable by provident, they have taken my account off hold and again demanding payment!!! What can I do next??

Sara (Debt Camel) says

read this https://debtcamel.co.uk/no-set-off-scheme-administration-debt-sold/ and then send Lowell a written complaint.

Christine says

Hi Sara I’ve read that but my head baffled by it who do I complain to? It’s ridiculous the loan was deemed unaffordable but they still demanding payments from me and as it’s a ccj they are using bailiffs& warrant of execution to scare me even more to continue to pay it!!

Sara (Debt Camel) says

you complain to Lowell Solicitors. And if they won’t sort it, you send the complaint to the Ombudsman.

I think in most previous cases the creditor backed down or offered an acceptable compromise.

Christine says

Is there a template letter anywhere I could use to send them?

Sara (Debt Camel) says

No but the section Complain to PRAC in that article says what to say in your email.

Instead of PRAC you are complaining to Lowell Solicitors. Instead of ICL you say Provident. Add a sentence asking for the CCJ to be set aside as the loan was mis-sold.

Christine says

Hi Sara I did what you said regarding sending an official complaint to lowell solicitors heard nothing back from them but when logged onto there online accounts noticed my account had been sent back to lowell direct, contacted lowell over this thinking I was getting some where, only to be told they had no information at all from lowell solicitors regarding my complaint ( excuse different department) or that the loan they bought had been deemed unaffordable by provident and they requested all the info I had ( sent to lowell solicitors) needed to be sent to them to be investigated what the hell is going on it’s months later and no further forward with this!!! They just dragging there feet.

Tracy says

Can you tell me why I’ve had a email from provident scheme today I can’t get on it and also can I apply for a refund as it was sold to lowell they payed off over 7000 they said but it was all deemed unaffordable I haven’t had one penny back

Sara (Debt Camel) says

what did the email say?

who paid off 7000?

do you still owe lowell any money?

Toni says

Lowell did that with most accounts, you wont get the money they just put whatever you had left to pay to 0. If they paid off a 7000 debt that’s a win for you, I had 1700 paid off and debt cleared

Tracy says

Lowell payed it off provident said

Sara (Debt Camel) says

Or Provident paid off Lowell?

Christine says

Well heard off lowell regarding my Un affordability claim quick response but unfortunately NOT in my favour

1st they said the agreement numbers on the paperwork I sent them from provident did not match anything they have on file, as well as Lowell’s own reference number lowell solicitors gave me the original agreement number from provident which is DEFINITELY on the paper work.

2nd they said amounts of loans nothing matches what they have on record unfortunately I can’t do much about that as don’t know how much loan was when lowell bought it,

They then said the loan they bought must not of been part of the unaffordability claim even though the reference number is there in black and white and paperwork says more than once “ lowell have agreed to clear balance and refund any payments made since august 2021, they are saying they have nothing on record from provident confirming this loan was unaffordable, so this loan still stands and Is still legally collectable from them and the ccj they acquired will stand.

I don’t know what to do and this is now effecting my mental health and effecting me sleeping ect it’s all backward n forwards and getting NO where!!! I have the proof but they having nothing of it.

What else can I do!!!

Sara (Debt Camel) says

send your complaint about Lowell (not Provident) to the Financial Ombudsman. Use this form https://help.financial-ombudsman.org.uk/help

Debbi says

I have had confirmation today that Cabot are clearing my balance owed which is part of a DMP with step change, they are clearing £1,800 debt and refunding nearly £700 in payments made since last Aug, the refund is being send to Stepchange, fortunately this was the only debt i had left on my DMP so i have emailed StepChange and advised them to send the refund to my bank account. So as i only got a refund from provident of £96 I’m happy that the £1,800 has been cleared off and I get a refund of £700.

Cabot have been more than helpful in correspondence over this.

Sara (Debt Camel) says

good to know!

Charlie says

although i had multiple loans previously, with one outstanding at the time of their announcement they were paying people back., which was with stepchange. i got rejected when i put a claim in. i have appealed it all and they still rejected me. thought it was abit unfair and didn’t make sense to me

Christine says

Hope lowell follow suit as they having NONE of it even with sending them all documents from provident so off to financial ombudsman they have gone!!!

Anne Hammond says

I am not surprised at all haven’t heard a thing from them most of us still waiting haven’t got a chance seeing any money back I was a customer of provident back in the 80s to 90s still not even acknowledged anything so wish you good luck,

Jade says

Can anyone help?

Who do I contact now… my claim was upheld by the adjurdicator through the appeals process, but Provident have yet to have paid out, nor has my credit history been removed/ altered. I’m at a dead end as there is no means to contact and have heard nothing from the ‘replacement cheque’ email address they have provided. Any help would be greatly appreciated… TIA

Joe says

I’m having an issue as well with a debt collector my upheld loan was sold too refusing to clear it, and every number I’ve called ( no longer operates) and every email I’ve sent just been returned ( with the message all communication now closed)!!!!

Sara (Debt Camel) says

which debt collector?

Joe says

Lowell financial Been horrendous sent them copies of everything I received from provident confirming the loan they bought was classed as unaffordable, and emails from provident saying lowell would close account ect… but still refusing to clear loan and refund overpayments and still demanding re payments as saying they have heard nothing from provident about my account and until they do account is still live. Them don’t know what to do next regarding it.

Sara (Debt Camel) says

Send them a complaint in writing by email to support@lowellgroup.co.uk with COMPLAINT as the title. Attach all the evidence again. If they reject the complaint, come back here.

Joe says

Thank you will do that and let you know how I get on this whole situation lowell situation has been a NIGHTMARE

Margaret says

I have not received refund of provident I am waiting for my refund

Joe says

After weeks n weeks on waiting this is what lowell have said to my un affordability claim regarding the loan they bought from provident

After looking into this, I confirm that unfortunately this is not the case. The account we hold is still valid and owed and the County Court Judgement will remain for 6 years.

Theis is because the loans now owned by Lowell relate to historic agreements where repayments were not maintained during the term of the agreement. They were sold by Provident to us and the repayment terms have been revised to reflect current affordability. The only debt written off was by Provident owned loans and they made their customers aware that any purchased debt would still be owed.

I was NEVER informed by provident this loan was still payable to lowell even though it was deemed unaffordable m,

Sara (Debt Camel) says

read this https://debtcamel.co.uk/no-set-off-scheme-administration-debt-sold/. It’s a bit complaicated but take it slowly.

Then send Lowell a complaint as that article says.

Joe says

Thanks Sara, but after hitting a brick wall down every avenue with lowell over this for months that’s the route I finally used in hope 🙏🙏🙏 after reading comments and advise on here, but they are still not accepting that my loan was part of the scheme of arrangement and deemed unaffordable so off we go to the financial ombudsman.

Ashlee says

Mine got sorted in the end but I was such a pain in their backsides and I think that’s the only reason it did get sorted. I sent them copies of everything, highlighted the wording from provident saying lowell had agreed. Persevere and hopefully ombudsman sorts it for you, please let us know how you get in. I’ve been to ombudsman for a different company and once it was with them the company couldn’t do enough for me, I do hope it’s same for you

Joe says

Thank you hope so don’t know what other evidence lowell need it was there in black and white for them but they point blank refused to accept it, sent my complaint to the financial ombudsman now so fingers crossed will keep you posted.

Joe says

Hi heard from Lowell today, strange when I informed them I’d sent my case to the financial ombudsman!! got half of what I wanted they have agreed to close the account refund any payments made since last august but the CCJ will stay on my credit file for the full 6 years NO amendment will be made to my credit file, they have said it’s a gesture of good will hope the financial ombudsman will help remove this.

Ashlee says

That’s a start! Hopefully financial ombudsman will get it removed for you but glad lowell have finally backed down. If they can wipe some that were included in the scheme and amend credit files why not others? That was my argument with them and they wiped it eventually then I got a letter about credit file afterwards but I was happy with it just being wiped if I’m honest

Joe says

Did Lowell remove yours without the aid of the financial ombudsman? I agree I know it’s more complicated to remove but why some and not others? Provident told me all negative information would be removed from my credit report, as the CCJ still has 3 years left I would of been happy if they had just said we will close account and set aside CCJ hope financial ombudsman will vote in my favour.

Ashlee says

Yeah they did although I threatened it in my very first phonecall (and spoke to ombudsman after that call and they told me what to say) and every correspondence after that. I emailed them daily for about 2 weeks 🙈 they probably done it to shut me up hahaha yeah they told me something like “each account involved is truly unique and the actions are unique” or some tripe like that, I just asked how when all letters are saying the same and again sent them a copy of the letter from provident and email from provident and that was the last I sent them, after that they closed the account and later came the refund and credit file

Cassie says

Hi I have just been made aware that provident have closed down. I currently have two outstanding debts with lowell.

How would I go about getting money back from Lowell as the scheme has now closed ?

Sara (Debt Camel) says

you didn’t make a claim to the Provident scheme?

Shaun stringer says

Hi All.

An update ftom my side, ive not recently had any communication from Lowell or the Solicitors, yet had a payment called Refund in my bank from Lowell. This amount is the amount i have paid since August 2021 until i stopped when i emailed with proof that the loan was deemed unaffordable.

Still awaiting a letter or email regarding the outcome from their own investigation.

So this surly is good positive news for all that this nightmare is coming to an end??

Ashlee says

Oh that definitely sounds good news maybe with the postal strikes the letter is delayed? I’d maybe pop them another email asking if the refund is signatory of the end of it all. Then if they say yes you’ve got it in writing just incase the letter doesn’t turn up (if they’ve sent one)

Chris says

Hi Shaun did you have a ccj attached to the account with you mentioning lowell solicitors?? They have done the same my end as a gesture of goodwill they say, but my ccj will not be removed from my credit file , trying to get the financial ombudsman to help but that’s been a nightmare as they saying they can’t help with the account being with the solicitors side of lowell but once I put in my complaint the account was handed back to lowell direct and then had nothing to do with the solicitors so still trying.

Brooks says

Just FYI, I think you can start to send in suppression requests to the CRA’s now without Provident responding. Experian and TransUnion have both removed their record and subsequent default from my file now

George Bradshaw says

what did you say to them?

PW says

I had my claim accepted but haven’t had a payment. And now I can’t log into the portal. Any suggestions?

Brooks says

Disaster, somebody at Provident is looking at the suppression requests. TransUnion have added the suppressed record back onto my credit report after receiving an update from Provident.

I’ve since tried to email Provident to get some (any!) more information to see if there is anything I can do, but they have not responded to me.

Sara (Debt Camel) says

But Provident told you they would remove the record. So this should be simple to get sorted.

Mrs Angela butcher says

I was told would be in bank then told a check had nothing emails returned no known address

Christine Weatherburn Kizzyo says

I finally won my argument with lowell regarding my provident debt they held after a lot of effort and months of trying from myself they agreed they would also remove the ccj attached to the account they said I would hear in 6/8 weeks regarding its removal they sent the info to the courts in November ( still showing on credit file) as yet I have heard Nothing and it’s now 9 weeks how long should I wait before recontacting Lowell over it?

Sara (Debt Camel) says

Well done. I suggest you should ask them at the end of January.

Christine Weatherburn Kizzyo says

Hi contacted lowell as still no removal of the ccj from my credit report or any confirmation from either lowell or the courts this has yet happened, lowel said they have done as much as they can and it’s in the hand of the courts and out of there hands and they can’t case this up was told six to 8 weeks it’s now been 16! Any advice??

Sara (Debt Camel) says

are lowell saying that they have submitted a set aside request? If so, ask for a copy of this.

Christine Weatherburn Kizzyo says

That’s what lowell are saying will ring them tomorrow and request a copy of it

Will keep you informed.

Andy says

Has anyone had lantern harassing them over these loans as I have? What should I do as the loans presumably are written off?

Sara (Debt Camel) says

The remaining loans were sold in Dec 2021.

But this doesn’t include loans that had been sold before that date – when did Lantern buy yours?

Christine Weatherburn Kizzyo says

s per our recent letter dated 8 November 2022, I can confirm the associated CCJ for your former Provident account has been raised to the court for requested set aside. As I’m sure you can appreciate, the Judge holds discretion as to whether this application is successful or not and whilst we do not anticipate there to be any issues, we need to make you aware of this.

Unfortunately, we are unable to provide any timescales for court to deal with our application and although a usual estimation would be around 6 to 8 weeks, this can increase dependant on court volumes. The outcome of this will be notified to you in due course under separate cover.

That what I was advised in November I have now emailed lowell asking for a copy of the letter they issued to the court regarding having the ccj set aside.

Christine Weatherburn Kizzyo says

Have phoned lowell on a number of occasions but they are yet too send me a copy of the request to set aside the ccj they keep putting me off saying it has been sent to the relevant team for investigation and I must wait 6/8 weeks for a response or after the will pass you to the relevant team I get cut off , stuck at what to do now!!

Sara (Debt Camel) says

I suggest you send Lowell a formal complaint. Email will do. Say you understand court timescales are not undeer Lowell’s control but this seems to be taking a LOT longer than expected. Say you would like to be assured of what Lowell put in the set aside application and you have asked for a copy several times but this has not been provided.

Christine Weatherburn Kizzyo says

Tried all that Sara but they are NOT responding to my emails, so have tried again today by phone after 20 mins of customer service advisor telling me the ccj would not be removed as was unpaid he then read my notes!! said he would have to speak to a senior member of the team and guess what IWAS CUT OFF getting very frustrated now.

Sara (Debt Camel) says

So you have sent them a formal complaint? What date?

Christine Weatherburn Kizzyo says

5 of March I sent the email it went through as got the usual automated response, as had no reply from them I started phoning them.

Sara (Debt Camel) says

well it can go to the Financial Ombudsman after 8 weeks

Christine Weatherburn Kizzyo says

Hi Sara I’ve eventually heard Back from Lowell regarding my official complaint regarding them removing the ccj from my credit report

This is what they said

I have liaised with Overdales, and an application to Set Aside the judgment has been filed with the Court, however we are still awaiting on a hearing date. Although an application has not yet been determined by the Court, we shall contact you once it has.

Surly this can’t still be how things stand when I was told in November it would take 6/8 weeks!!

Ive been waiting daily for a letter from the courts saying the ccj has been removed and it still hasn’t even got that far!!

Where do I go next??

Sara (Debt Camel) says

have you asked for a copy of the application?

Christine Weatherburn Kizzyo says

This was my complaint email

I have emailed and phoned you on a number of occasions regarding the removal of the ccj attached to the provident account you owned.

It has now been many months since this was referred to the courts to be set aside by yourselves and unfortunately this is still on my credit file, and I have heard nothing more regarding its removal since your last email in November,

Every time I phone yourselves I’m told the customer service advisor will need to speak to a different member of the team and I am cut off this has happened on at least 5 occasions.

I understand court timescales are not under Lowell’s control but this seems to be taking a lot longer than expected.

I would like to be assured of what lowell have put in the set aside application as I have asked for a copy many times but this has not been provided.

I await your response

Sara (Debt Camel) says

I suggest you reply that unless they provide you with a copy of the set aside application, you will be sending this to the Financial Ombudsman by the end of next week

Christine Weatherburn Kizzyo says

Thanks Sara will give them the eight weeks AGAIN.

Christine Weatherburn Kizzyo says

Hi Sara received a letter from Lowell yesterday saying they are looking into my complaint and I must give them the 8 weeks to investigate,

they still haven’t sent me a copy of the set aside ccj information they sent to the courts I requested!

Christine Weatherburn Kizzyo says

Hi Sara this is what I have received from Lowell regarding a copy of my set aside application

In relation to receiving the Set Aside request, this is something we are unable to provide to you as it is included within a bulk Set Aside application.

Sara (Debt Camel) says

unfortunately that is not a bad explanation.

Christine says

Hi Sara does it usually take this long to have a ccj set aside?

I have still heard nothing regarding its removal and we are now getting on for a year!!!

Sara (Debt Camel) says

I don’t know. You need to ask people that see a lot more of these cases than me. I suggest you phone National Debtline on 0808 808 4000 and/or post on the Legal Beagles court forum https://legalbeagles.info/forums/forum/legal-forums/court-claims-and-issues/received-a-court-claim

venita maclean says

I’v only now seen this site. My 78 mum took out loans with company. So provident went bust? I wish I know about putting in a claim.

Sara (Debt Camel) says

I am sorry but the time for making a claim has long passed.

Paul says

Hi, I had an email from provident back in September 2021, I put my claim in on the same day, but to date I still haven’t received any contact regarding my claim or any payment. What are my options now?

Sara (Debt Camel) says

It is a great pity that you did not chase this up sooner.

There may be nothing you can do now – it isn’t even clear if your claim went in properly.

You can email joe.sweeney@vanquisbankinggroup.com and ask.

Christine Weatherburn Kizzyo says

Hi Sara as of todays date

Lowell still haven’t set aside the ccj that was attached to my provident account, as I’d heard nothing from them I contacted them yet again too be told they had an appointment with the courts on the 2nd of September and I would hear in due course,

I emailed them a few days ago to see as to what was happening to be told they were waiting for the courts decision on the situation.

This I don’t understand I thought it would be cut & dry, the ccj (set a side) has now been going on for a year and I’m no further forward it’s still showing on my credit report I’ve left a post on the legal beagle site as you advised but have had no response to my query.

Sara (Debt Camel) says

Ok this is getting ridiculous. Tell them you are sensing a complaint to the Ombudsman if this isnt resolved in by the end of next week and will be asking for compensation for the delay.

Christine Weatherburn Kizzyo says

Hi Sara I’ve tried the financial ombudsman and received this reply

A ccj was obtained by the courts, which was issued in August 2019 and a court deemed the balance as owing and payable.

• When we consider complaints, we have to handle the complaint in line with the DISP rules set by the regulator, The Financial Conduct Authority. This explains we can review a complaint that meets what is deemed a regulated activity, which I have pasted below:

(1) regulated activities (the definition of a regulated activity does not include pursuing a debt determined as owing by a court order, such as a CCJ).’

• So our service is unable to consider what’s already been reviewed by the courts if a debt balance has been deemed repayable, as they are the higher authority. Any dispute about a CCJ or court order would have to be discussed with the courts directly or seek independent legal advice, as this isn’t something our service has the power to look into. • So I wouldn’t be able to comment on whether the B have done anything wrong in relation to the debt owed or the issue. This is because I think this complaint is outside of our services jurisdiction and not one we can assess unfortunately.

This is the opinion of Investigator

Sara (Debt Camel) says

when was that?

Christine Weatherburn Kizzyo says

Was July this year.

Sara (Debt Camel) says

did you ask for the reply to be looked at by an investigator? because you are NOT complaining about the CCJ, you are complaining about Lowell’s failure to remove the CCJ, promptly, which they have agreed to do.