Contents

Quick overview

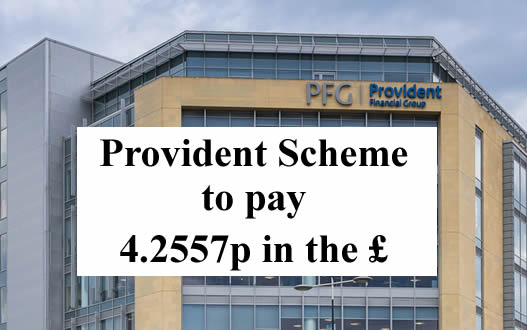

Provident’s Scheme of Arrangement is now in the final stages.

The Scheme was proposed because Provident could not afford to carry on paying full refunds to customers winning affordability complaints. The Financial Ombudsman was upholding 75% of complaints against Provident.

The FCA, Provident’s regulator, said it did not approve of the Scheme. But as Provident has stopped providing doorstep loans, the FCA did not object to the Scheme in court.

It started officially on 5 August 2021 after it was approved in court. The deadline for claims was the end of February 2022.

Provident has assessed claims and informed customers of their decision. The large majority of appeals have been held.

Provident is making payments to bank accounts or sending cheques:

- it is paying 4.2557p in the £;

- so if your redress was £1,000, you will receive about £42;

- a final letter will be uploaded to your portal account setting out the payment;

- the first bank payments will be arriving in accounts on Tuesday 5 July.

Here is confirmation from one reader (see the comments below for others):

FUNDS PENDING!!!

Hi all, I’m new to this to thread but just thought I would give an update.

I have a Monzo account, it is showing my Bacs credit as going into my account on Monday, for most people with standard accounts this means you will be be paid Tuesday

I can also confirm it is 4.2557% as stated.

Glad it’s eventually been sorted.

But no-one should assume they will get their payment next week.

They may be going out in batches. And in any mass payment, some of them fail. Do not plan your July finances on the assumption that you will get paid early in the month.

Which loans were covered by the Scheme?

More than 4 million people were given a loan by Provident that comes under the Scheme.

These loans were given between 6 April 2007 and 17 December 2020.

The loans came from four different brands:

- Provident – often called “doorstep loans” or “home credit”;

- Satsuma payday loans;

- Greenwood – another doorstep loan brand that hasn’t been used since 2014;

- Glo – a very small guarantor loan brand.

If you have an affordability complaint about Vanquis or Moneybarn, these complaints are NOT included in the Scheme. You can still make a normal affordability complaint and get a full refund.

The definition of “unaffordable”

A loan is only “affordable” if you could repay it on time and still be able to pay your other debts, bills and living expenses.

You may have paid the loan on time, but it may still have been unaffordable.

If paying Provident left you so short of money you had to borrow more or you got behind with bills then it was “unaffordable”.

If you had several loans without a break between them, then Provident should have realised you were trapped in a cycle of borrowing and that these expensive loans were not affordable. Even a single loan can be unaffordable if it is large.

Provident pays out on old uncashed cheques

In 2018-20 Provident frequently made very poor offers to people that complained, sending a cheque. They frequently used to offer to refund just a few loans, often not the largest or the most recent. For example, in one case with a large number of loans, Provident upheld a loan for £1,000 but decided the next loan for £2,500 was affordable.

Many thousands of people didn’t cash these and instead sent their complaint to the Ombudsman, where they often got ten times as much! who had made affordability complaints.

When the Scheme was announced, people tried to cash the cheques but some cheques were too old to be bankable. Until now Provident has refused to send out a new cheque. In February 2022, at last Provident relented and refunded this money and people can also make a claim to the Scheme for the extra they should have had.

How much will you be paid?

The next stage is for Provident to divide up the £50 million in the Scheme between the people who have had their complaints upheld.

Customers who made a claim have been told which loans have been upheld and what the total redress for these loans is. You will be paid a percentage of this redress number, not all of it.

When the Scheme was voted on, many people thought they were being told that the payout would be 10%, or 10p in the £. I said at the time that that looked unlikely and it could only have been based on an unusually low number of people making a claim.

For several months Provident quoted a range, saying:

Based on the claims that we have received to date, we estimate that the pence in the pound rate of compensation to be paid to each customer will be between 4-6p.

Now it is known that Provident will only be paying 4.2557p in the £.

A final letter will be added to your portal account setting out what you will be paid.

Credit records will be cleaned

In other schemes and Administrations, some people say getting rid of a default was the most important result for them. Not the small cash refund!

For upheld loans, any defaults or missed payments will be removed from your credit record.

This clean up will be done at the end, when they can do everyone’s together. This is very annoying if you want to make a mortgage application, but there is nothing you can do to speed it up.

If your credit record is not cleaned in this process, there will probably be no-one to complain to about this. But there is process for resolving this sort of problem, see Correct credit records by “suppressing” them if the lender has disappeared.

Current loans

Loans that were sold to a debt collector

If your loan was sold to a debt collector, Provident is trying to get this settled. This seems to be taking some time, for example with Lowell saying they haven’t been given the right information from Provident. Several people are complaining about these in the comments below.

Loans that hadn’t been sold were written off in December 2021

In December Provident announced that it was no longer collecting any payments for existing loans:

There is nothing you need to do. You can stop making payments on your outstanding loans owed to PPC and if your payments are taken by the Continuous Payment Authority (CPA), we will stop these for you. Any payments made after 31st December 2021 will be paid back to you.

If you’re in arrears or didn’t pay your loan within the time we agreed when you got your loan, we’ll update your file with our Credit Reference Agency to show the balance as zero and partially settled.

Your credit record is being changed to show that the loan is partially settled or partially satisfied.

If you are a Provident or Satsuma customer, you should have been told about this by email or letter.

That is a pathetic payout

Provident is a successful company with the profitable Vanquis and Moneybarn brands which are still in business. It is a disgrace that the regulator has allowed them to structure their business in a way that has permitted Provident to abandon all its doorstep lending customers and not pay them their proper redress.

If you are feeling mad that Provident has got away with paying you so little, this is the time to look at whether you can make other affordability complaints, not just for loans but for other types of credit.

I have a separate page for each sort, as they need slightly different template letters to complain:

- refunds for large loans, including Moneybarn and other car finance;

- refunds from catalogues and credit cards such as Vanquis;

- refunds from overdrafts.

Sarah H says

Hi Sara,

I had put an affordability claim into provident and then to FOS, these were put on hold due to the court case. Do I need to re send my claim or should it already be in the process with them.

Sara (Debt Camel) says

It should already be in the process.

But I suggest you register with the portal and see what that says. If there is no ign that there is a claim from you, I suggest you send one in – better safe than sorry!

Mari Joyce says

I am trying to register on the portal but it is asking for an ID. I do not have one. Can someone please help me.

Sara (Debt Camel) says

phone Provident up and ask for one. Explain you never received a letter or email and make sure they have your correct addresses for both.

Daniel Mcdonald says

If they emailed you it’s in the top right hand corner of the email

sunflower12 says

If you previously registered you should have an email with a scheme id number in your email. If not I would contact provident about it.

Sar says

Hi Sara I took a satsuma loan back in December 2018 long story short I am in a DMP now and have just yesterday made a affordability complaint to satsuma directly Will they look into this or do I need to still make a claim through the portal? I have got a account set up through the claim portal already as I was sent a invitation to vote on the scheme but I think that was just for the provident loans that I took out? How can I get the satsuma loan added to my account

Sara (Debt Camel) says

I can’t tell if you have 1 or 2 accounts with them.

If there is only one account, then having voted on the Provident Scheme should also cover the Satsuma loan.

BUt if there are two, you need to get a claim made to the Scheme about the satsuma loan AND make sure this is considered together with your Provident loans. See the section in the article on “Do you have two accounts?”

Sar says

I don’t know if I have 1 or 2 accounts with them I made a complaint to them back in the beginning of 2018 for the provident loans won this at the FOS received money in 2018 but then I took a satsuma loan of them which I never complained about but I haven’t moved addresses or changed emails or anything

Sara (Debt Camel) says

I think you need to ask them.

Val says

Hi

Same with me an I asked an had reply that satsumas an provident just one claim on portal covers all

Sarah T says

Hiya.

I took out a Satsuma loan in May 2018 and already had a DMP but they gave me a loan anyway. I made a complaint shortly after as the payments were unaffordable and had it added to my DMP. They refused to do anything including removing the 100% added interest charge. I heard about this scheme and all I want is for the interest to be removed as this will mean I will be debt free a year earlier. They’ve since refused again and advised me to go through the scheme. They are horrible to deal with and I’m really hoping now that the balance is written off as almost all of it is their shocking interest!

Sarah

J Lloyd says

If a complaint was made to Provident in March do I still have to make another claim?

Sara (Debt Camel) says

If your complaint was made before 15 March, it should already be in the system – but as I said to Sarah H above, I suggest you set up a portal account and check this.

If your complaint was made on or after 15 March, you need to submit a claim to the Scheme.

Dominik says

:( Not what I have expected

Sara (Debt Camel) says

Not what I hoped for, but after the FCA decided not to appear in court, I am unsurprised.

Chris Clipstone says

Your message is very helpful, clear and easy to understand. Thank you Chris

Tracy says

I have a few loans over them years from provident and loans at home I have moved a few times don’t have the loan letters will they still be able to fund me through records

Sara (Debt Camel) says

Yes they should. Contact them on the phone number and give your name, date of birth and old addresses.

re Loans At Home – they aren’t in a Scheme so you can send them a normal complaint, see https://debtcamel.co.uk/refund-doorstep-loans/ for a template. Again give all your details so they can identify you.

SatsumaCustomer says

There’s a section on claim form that says “Recorded defaults on customer’s credit file (optional)4

This means that the Customer has failed to pay back a loan given by another lender, and does not mean that the Customer has missed payments on that loan.

Has the Customer ever had a genuine recorded default on their credit file because they failed to pay back a loan taken out from any lender (other than Provident, Glo, Satsuma or Greenwood)?”

Whilst not a loan a credit card went into default whilst I had this loan as I couldn’t afford repayment

Would this count towards this information & if so how do I add proof as it asks once you select yes.

Sara (Debt Camel) says

yes a default about a credit card is something they should be taking into account. Or on a gas bill or a catalugue or a mortgage … ANY default on your credit record matters.

And late payments matter too!

When you say yes, what does it ask for next?

SatsumaCustomer says

“Please provide details of all of your defaults between 2007 – 2020”

But there is no text box or options to add anything.

Could I seek anything.woth the credit card company if my claim is successful, to remove the default – it was fully paid 3mths after default date.

Sara (Debt Camel) says

oh! That’s not good :(

the credit card default – who was the lender? how long ago was this? Do you think they increased your credit limit too high?

SatsumaCustomer says

CapOne

Jan last year default added

3mts later I paid off.the satsuma and Capone card

Sara (Debt Camel) says

You can only get the Cap One default removed if you have a reason to complain about it. See https://debtcamel.co.uk/refunds-catalogue-credit-card/ and the main reason to complain is if a lender increased yopur credit limit too high.

n ballard says

what would happen if your default is older then 6 years how do you prove it mine was in 2010 and you no longer bank with the bank your on a losser there so how can it be fair

Sara (Debt Camel) says

You may have some information about this somewhere?

how many loans did you have from Provident?

n ballard says

i have nothing to back this up had a few over the years

Sara (Debt Camel) says

It is still worth making a complaint. If you had enough loans you may well still get arefund. the extra evidence is more important if you only had a few loans.

n ballard says

thanks, made a claim but not getting my hope’s up as it’s over 6 years and no proof they got intouch with me

Jess says

Do i need to do this myself or can i use one of these claims companies do it for me?

Sara (Debt Camel) says

Definitely do it yourself.

All you have to do is enter a claim on the Provident page. First set up a portal account

If you get a claims company to do it, they will ask you for all the details then they will type them in. And charge you 30 or 40% of the refund for doing that. They won’t speed things up. They won’t negotiate for you – because there is no negotiation to be done. They are just parasites on this process so don’t use them.

Denise says

Hello there,

I had this article arrive on my phones newsfeed a few moments ago…I hope that you don’t mind me posting it on here?

https://www.bbc.co.uk/news/business-58089605.amp?fbclid=IwAR3WNjzS9H9UBlzw463eSx269_dCAKXgNoMo1w2OBwz1Qm11KkgIzeMbZnY

It is from the BBC and it is about Provident.

Thank you

Darina Nedeva says

Hi Sara I have a loan with Provident it’s 1000 and I paid 1400 and they still required to pay 590 more basically I’m on 50pound arrangements now cause I can’t afford monthly payments but it harms my credit record so do I still need to pay to Provident? (I’ve already submit my claim) thank you

Sara (Debt Camel) says

Was this your first loan from them?

Are the £50 repayments affordable or causing you difficulty?

Darina says

I’m on universal credit basically it’s not affordable but I had to accept this offer I had no other choice.

It’s my second loan, first was 300

Sara (Debt Camel) says

oh £50 is a lot too much probably if you are on UC.

You do have another option – you can stop paying until they have considered your complaint. Or you can insist that the payments are reduced to a more affordable £5 a month. This damages your credit record, but you already have a payment arrangement harming that.

Can I ask if you have other debts you have payment arrangements with? Or are you behind with any bills?

Vansqeestomer says

Cheeky, because Vanquis (owned by Provident) is still happily ripping customers with 39.9% on the card balances. Why only 50mln in the pot, then? More of those usury businesses bust is just a veey good news.

Andy says

Hi

Can you help me as I got confused reading the provident post regarding which template to use and in the past 12 years I have used a lot of morses and shopacheck doorstep loans and provident and satsuma loans. All are now paid but it’s taken a lot of juggling and sorting some weeks I missed and it was never any issues to borrow more to pay Peter to pay Paul scenarios, I do have one Amigo loan left and I am paying this still and I have a claim in place then I am debt free and in a better position and place nowadays and it’s been a huge battle but I have got there.

My question is can I claim even if it small amounts as every bit helps going forward and which template fits which loan type but I don’t have anything in the way of account numbers or even the weekly little books they used to update and sign each weekwill this be an issue?

Like I say I did far to much borrowing whilst I thought I was doing the right thing as I was on my own after a break up and divorce was happening and my head was not in a good place never once did morses or shopacheck ask for any payslips etc etc.

Thank you

Andy Avery says

Thank very much for the links I will start straight away.

As for the the Amigo stop paying thing it makes great reading and a lot of sense to do so and I will be £208 per month better off also that over the term time left will be a lot more than I get back.

I have had a none existing credit score for last 10 years but it’s now back to 550 not the best score but it means the world to me to get it there and in three agencies so I just didn’t want to go way back down the tree or scare my guarantor Daughter into thinking she will be affected or pestered to pay ? Not an easy decision to make either way

Sara (Debt Camel) says

the Amigo decision is difficult. You know the facts.

Andy Avery says

I have done the provident portal and logged a claim to the scheme and there are some opinional drop down box’s to tick yes or no and fill in details of CCJs and loans refused because of credit file but as they where optional will that matter if I left them blank,if the want to dig into my credit file they can ?

Sara (Debt Camel) says

If you know the details, why not give them?

Provident will still consider your complaint in the Scheme if you don’t, but this extra information could be helpful if it isn’t in their records for some reason. If they look at your current credit record it only goes back 6 years.

Darina says

I’m on time with bills I have arrangement for vanquis cc £1.. and aqua cc, capital cc and barclays cc all I’m paying on time.. I cleared my amigo loan just today.. only I have satsuma as loan

Sara (Debt Camel) says

So you are paying the full amounts to aqua, Capital one and Barclaycard?

Darina says

I’ve got direct debits as £30 each I can’t pay whole amount.

BTW I complaint to satsuma last year they didn’t accept I sent to FOS they didn’t accept my complaint too cause I was working full time and they didn’t find its unaffordable I used to earn £25k per year I had £750 rent, £100 bills £600 amigo etc according to this situation they said I can afford to pay but I use my 4k overdraft they didn’t care now I fed up to pay them especially satsuma.. amigo already done

Sara (Debt Camel) says

I think those payments too sound too high. It’s very easy to agree one repayment which sounds ok but the total of them all is too much. I suggest you talk to StepcChange about a DMP https://www.stepchange.org/how-we-help/debt-management-plan.aspx for all your debts, the cards, the satsuma loans and the overdraft.

You can do this as well as pursue your Satsuma claim – winning that will speed up your MP.

Darina says

Thank you Sara I’ll try that

All the best

Frank says

Hi,

I have 2 paid off provident loans showing on my credit report from 2018 (no defaults or missed payments). I’m more concerned about cleaning up my credit report, would these be deleted if these were proven to be mis-sold?

Thanks!

Sara (Debt Camel) says

I don’t know. Normally in this sort of situation if you ask the lender they will just say they will remove negative information. But in practice it is much simpler for the lender to delete the entire record, so this is often what happens.

Mark says

Hi I have a debt with provident I’m just wondering about this payment a refund how do I get one I am in debt with him for about £120

Sara (Debt Camel) says

Is this your first loan from Provident/Satsuma? If not, how many did you have before this?

Ann says

We had several loans in these years and still owe money do we need to apply

Sara (Debt Camel) says

Hi Ann,

You have to make a claim if you think the loans were unaffordable and you would like a refund.

An unaffordable loan is one that left you so short of money you had to borrow more – perhaps by getting another loans from provident, perhaps from another lender or bindirectly by you getting behind with bills or going deeper into your overdraft or using catalogues/credit cards more.

Basically if you know the loans were difficult to manage I suggest you make a claim.

Do you have an email or a letter about the Scheme which has your Scheme ID on it?

If you and your partner both took loans, you have to apply seperateley.

Kelly McCandless says

When provident announced this scheme my claim had been at ombudsman for 12 months and I was just about to receive their desision when it came to an abrupt halt. I contacted ombudsman yesterday to see if they would pick up where they left off and they told me know provident would be in touch. I have signed into the portal and they are telling me I have to start a claim. Surely not? I dont think I have any fight left in me to start this whole process again. So frustrated.

Sara (Debt Camel) says

The Provident flowchart says that a claim where you rejected a provident decision and sent it to FOS will automatically be registered as a Claim.

If the Portal is telling you you have to register a claim, I am guessing that this may change when they add the FOS cases to the system. You could wait a couple of weeks and see if this happens? Or to be on the safe side it might just be easier to start a claim yourself?

Just checking – you banked that large cheque I hope so you are just arguing about extra 5k?

Kelly McCandless says

Ok thanks Sara, I will leave it a week or so and see if it pops up. The frustrating part is if I need to log another, it will be about 2 and a half years wasted. Yes that cheque ( that was a claim I did for my sister) did you in the bank and she was able to reclaim over £700 from the tax man. That was a close one, to think another day or so that cheque might not have been worth the paper it was written on.

Robin says

My name robin iv had 3or 4 loan s from provident from 2007 that were unaffordable I didn’t get a letter with a I’d number I’m behind on my repayment and they handed to Capquest is anything I can do still iv payed over what I borrowed and I still ow 2200

Sara (Debt Camel) says

Hi Robin,

so that last loan was LARGE. Even if you didn’t have other loans just before it, you may win an affordability claim about this.

You need to phone Provident up and ask for your SchemeID. Check they have your correct house address and email address. You may have been sent an email but it disappeared into into your spam/junk folder and you never saw it.

In addition to this, what is the rest of your financial situation like at the moment? Do you have other problem debts? Are you behind with any bills?

Robin says

Robin put in my claim but not sure what to do bout the rest of my loan it s been handed to a debt collection agency I’ can’t really afford pay it should I wait and see what provent day

Sara (Debt Camel) says

you could be waiting 6-9 months for an answer from Provident!

If you can’t afford to pay it, tell them you need a lower payment. Most people on Universal Credit can’t afford more than £5 a month – do you have other problem debts? Are you behind with any bills?

Robin says

No just bout covering my bills IV had to use my full overdraft when I got my loan I was working then after bout year I had to give up work as had get kidney transplant just was wondering if I keep paying this other companie if my loan was. Not affordable can provdent still pay me my interest as it’s not with them

Sara (Debt Camel) says

how much are you paying a month?

Robin says

I’m not working I’m on universal credit and iv had to get two loans of them so money is tight should I pay they still pay the the rest of loan I got 2500 with interest it was just over 5000 iv paid 2800 over the last three years

Andy Avery says

Okay I will try dig out some info for the portal, it was way back nearly ten yrs ago so I might struggle with the ccjs but I know who refused me in the past so I could put that if nought else.

I take it then when Provident look at the portal they look at the previous loans etc and with Satsuma and do their workings out who gets what when they eventually get round to it.

I wish it was as easy as the doorstep template then you can add words coz the portal is just name and address and scheme ID basically

Sara (Debt Camel) says

I think the idea is people aren’t put off by having to write anything.

In practice my guess is they will hope to get the large majority of cases decided automatically by computer and only look at a small number by human. I will be encouraging people who have a case rejected, or on;y accepted for a small number of loans, to put in an appeal and you may be able to make extra points then.

Robin says

Robin it should be 220 a month but the deat collection agency drop it to 20 a month so you think I should keep paying it back and ask them to drop it a bit

Sara (Debt Camel) says

if you can afford £20 a month then there is no harm in carrying on. If you can’t, and it is making it harder to afford your bills and living expenses, then ask to reduce it.

It doesn’t matter this is being paid to a debt collector, it will all be taken into account as though you were paying it to Provident.

Robin says

Ok thanks for your help

Andrew says

My brother who has severe mental health problems as well as other conditions had several loans with provident going back many years. His only income was JSA and when I discovered he had loans and couldn’t afford to pay back provident added extra interest charges. I complained to provident possibly in 2015 about giving my brother credit to a very vulnerable person and they dismissed my complaint . I ended up paying off the loan myself in one lump sum to get rid of them.

My brother then got hold of another provident loan months later and told him not to pay a single penny back. They seem to have given up pestering him now for repayments.

Recently provident have been in touch regarding the court case.

My question is … is it worth putting a complaint claim in. And if he won any compensation would provident not keep the award and set it against the last loan that has not been repayed?

Sara (Debt Camel) says

If he gets compensation it will be offset against the remaining loan. But the problem is that Provident will likely be selling the outstanding loan book, so although they haven’t been bothering your brother, it’s possible the new debt collector will.

The loan is old but may not yet be statute barred, see https://debtcamel.co.uk/statute-barred-debt/. If you can find out the date of the loan and if your brother ever made any payments to this, you could talk to National Debtline on 0808 808 4000 about this.

This isn’t an easy decision to make.

Andrew says

Thank you. Very clear and good advice.

My gut feeling was to ignore the compensation claim form and not to “reset the clock” regarding last loan.

Thanks once again.

Valbell says

Have done the portal an voted the provident loans

Also have satsuma outstanding

Wrote an asked if both included got generic email back told me to vote an do portal

Tried to do another portal for satsuma Wong do that as wants claim number

Wrote again to three email addresses just get generic email back

Tried ringing an I just get make a claim re portal so none the wiser reply

In portal doesn’t say amount of loads total either yet so I can’t tell if both satsuma an provident on one portal

Any ideas ? Has anyone had to lodge separate claims ?

Aaron says

Hi, I have been helping a family member who over the years has paid over £20,000 to provident in unaffordable loans, which included them recommending her to get more loans from them to pay off the previous. The family member still has around £5,000 in active loans. How does the scheme affect these active loans, will the family member still be able to get the interest removed and just pay off what was lent?

Sara (Debt Camel) says

They need to submit a complaint as the article above says.

That sounds like a lot of lending over a long period and so it is likely to be a very strong complaint. If the calculated redress for their case is over £5000 (or whatever the remaining balance is) then that will be written off – for large cases the calculated redress can be very large!

If only the active loans are upheld (which sounds to me to be unlikely) then the interest would be removed and they would just have to repay in total what they borrowed.

Can they afford the current repaymentss?

Lucas says

Any news on quick quid refunds??

Joyce says

As I accidentally deleted the email that provident sent me weeks ago I can not set up a portal as I had no ID to insert. I am after rinsing provident to request this ID number and was told that my details were submitted and that there was nothing further needed. This is worrying me Sarah as I won’t be able to see developments and progress without having a portal. Surely she should have told me my ID number. She only asked for name, address, and DOB

Sara (Debt Camel) says

yes, I think you should ring them up again and say you want to be able to login to the portal, so ask what your ID number is.

Joyce says

Thanks Sarah, portal now successfully set up

Denise Holland says

i would like compensation as i cant afford loans

Sara (Debt Camel) says

Hi Denise,

you need to send a claim to the Scheme. The article above explains how to do this.

Do you have a current loan from them?

Kelly McCandless says

Hi Sara, just an update, I got an email from ombudsman today (see below part of it) haven’t logged in yet to see if it has been logged but as you said at the start, the ombudsman is passing on the information.

Will keep you updated

Thanks

What does this mean for my complaint?

Consumers are now able to make a claim for redress directly through the Scheme. So we won’t consider your complaint further.

We will forward your details to Provident and you will be automatically included in the Scheme process. Provident will inform you if your complaint has been accepted in the Scheme and what compensation you are entitled to.

Sara (Debt Camel) says

It means that your complaint has now been replaced by a claim in the Scheme.

Lesley Donoghue says

How do I create an account to apply for refund as its asking for a number and I don’t have one

Sara (Debt Camel) says

See article above – you need to phone them up and ask for the number.

Lesley says

Ty hunni I’ve had numerous loans off provident over the years, I’m payin one off now that I’ve paid the amount I borrowed but owe a grand in interest xx

Sarah Louise Tansley says

Hi Lesley,

I’m almost in the same situation as you. Paid what I actually borrowed so only the interest left. I hope they hurry up and finalise everything because I have a feeling that I’ll be out of pocket somehow if I keep paying as I just want the loan written off, but then I don’t want to not pay as it will affect my credit score which I’ve been working so hard at trying to build up. Fingers crossed 🤞🏻

Mary says

Hi, some weeks ago I received notifications on web from claims 4U in relation to provident refund. I completed the form on pandoc. No update since.

Anyone else done this?

Is my claim legitimately filed?

Don’t have a number to use Portal?

Sara (Debt Camel) says

I don’t know, you need to ask Provident.

This was NOT a good idea. If your claim has been filed, the claims firm will take a lit of your refund for doing nothing except complete a simple form that you could have done yourself.

Anyone else should avoid these parasites. The respectable end of the claims management companies is not going after this business.

Paul says

I put in a complaint to the FOS about several loans with Satsuma/Provident that I believe were unaffordable. The FOS has informed me to access the SOA which I have registered for and provided all details.

I’ve worked hard with help from this site to dramatically clean up my credit file. Lots of previous payday loans have gone. From having many over a period of 2011-2019, only 8/9 are left showing on my report.

Will the fact that my credit file is cleaner now than it was when I took out the loans be a stumbling block in this claim please? I don’t know how I will be able to prove it. Thanks

Sara (Debt Camel) says

Do you not have an old copy of your credit report?

Paul says

I don’t think so no. Do you think that could be a problem?

Sara (Debt Camel) says

well it makes life easier if you do.

But you can just send Provident your current credit record plus a list of all the loans that that have been deleted.

Ian hodgson says

ScHEME I.D xxxxxxxxxx want to know if I’m due any thing I have other Debt’s

Sara (Debt Camel) says

This is NOT the right place to make a claim to the Provident Scheme. read the article above and it tells you how to send a claim in using your Scheme ID 9which i have xxxx’d out)

Do you still owe Provident any money? If you do, how many previous loans did you have from them roughly?

Do you have other problem debts at the moment – can you say something about those?

RICHARD says

Many thanks for your clear concise advice Sara.

I made myself Bankrupt in 2009, and had it discharged in 2010 but it stayed on my Credit File for 6 years (2015).

From 2012 I suffered from extremely poor health both physical and mentally (I have severe depression/anxiety and PTSD. The only people I could borrow from were Wonga, Satsuma and Provident. I had multiple loans with Satsuma and Provident at the same time, it was a nightmare. After repayment I continued getting loans eg. using one to pay off another, I felt unable to seek help due to my poor MH.

I did get back money from Wonga when they went into Administration it was about £600 but better than nothing.

I have opened a Portal account and will be submitting copies of my Bankruptcy & Discharge letters, also a detailed letter of all of my health issues and how they affect me (she does 12 page ones for the DWP for me, it’s like a template she updates every couple of years when the DWP come knocking. Also my new MH Social Worker is writing a letter for me, I sent here a link to here.

Do you think this is good supporting evidence ?

Thanks,

Richard

Sara (Debt Camel) says

I think that sort of evidence is exactly what should be considered in the Scheme. But if you borrowed a lot from them then by itself that is also probably a good case!

unfortunately you are not going to get a good % back. Do you still owe Provident or Satsuma any money at the moment?

Richard says

Hi Sara,

I’d be happy with 0.5% back just as an acceptance that they were in the wrong. I have about £250 outstanding over 2 loans which I repay at just under £50 a week so not far to go, I’d rather pay them off than stop and possibly get a negative on my credit file. which would take time to remove, however,

I am a week in arrears but sod them, their rep I spoke to at Head Office said no problems if I am late. Believe it or not I have a good credit rating now..

When I went bankrupt in 2009 the court wrote off about £2,500 in Provident debt. My credit cards and loans were over £55,000 at the time so that was a huge weight lifted off me, but I had to borrow £450 at the time to pay court fees, lol.

Thanks for the clarification over my supporting letters I’ve uploaded the GP one and my bankruptcy certs.

PS. Thank you for editing out my surname.

Kerry says

I made a compliant to Provident r.e unaffordable lending. I was lucky enough to have my claim dealt with by the provident manager and he made an offer and I accepted. I received my payment last year. I have since received a letter from them to submit a claim through the portal ? I’m confused can I still do this as I thought this had been settled. Thanks

Sara (Debt Camel) says

yes you can. Often Provident made VERY poor offers – that may not have been the case for you but it was for many.

If you make a claim now, they will calculate a refund amount, then subtract what you were given before. Then you will be paid a small percentage of the extra amount.

Kerry says

Will do – thanks Sara

hugo says

has anyone had any luck communicating with provident? I have tried all day and i cannot get through and i cant even register online as it says it cannot find me…

Richard says

Hugo, I pay my loans by phone, not the automated system, and the women on 2 occasions have checked my “Scheme account, ” and made updates for me with no issues.

0800 218 2803

Best of luck.

Richard says

Hugo,

Here’s their email as well, they seem to respond in about 48 hours.

soa@provident.co.uk

Richard says

I forgot to add Sara that I also had a Vanquis credit card just after my Bankruptcy with a £1200 limit, which I reached a couple of years later. I repaid about £100 for about 6 months then had a chat with them as I was struggling. They froze the account and card, I haggled a lower interest rate, about 5% – down from almost 40%, but they wouldn’t go lower. I repaid at £50 pcm until it was paid off. Does this count towards this scheme as well please ?

Thanks and stay safe 🙏

Sara (Debt Camel) says

No, Vanquis isn’t covered, nor is Moneybarn. It’s just Provident, Greenwood, Glo and Satsuma loans.

Richard says

Thanks Sara.

I guess it would at least go to prove that they were giving me one or two unaffordable loans from Provi plus say 2 from Satsuma on top of the Vanquis debt. They were also offering me more loans or refinancing.

Now the only people I borrow money from in an emergency (eg. Broken washing machine/fridge freezer) is the DWP Social Fund, as I’m in the Support group of ESA & PIP I can get a budgeting loan of up to £348,

usually repayable at around £22 per week.

You can apply online, get a quick decision, reply by text, then the money goes to your account about a week later. You are meant to disclose any debt for affordability check.

https://www.gov.uk/budgeting-help-benefits/how-to-apply

Sara (Debt Camel) says

yes, for people on benefits those budgeting loans are a great help.

Chris says

Hi Sara

Can you raise a dispute through Experian to remove the loans from your credit search if you have joined the scheme?

Sara (Debt Camel) says

No – Experian will just ask Provident who will say that they haven’t yet determined your claim. You need to wait until the Scheme has determined the loans were unaffordable. Even then, they may just remove negative marks… although it is more likely they will delete the records as it’s simpler for them.

Lorraine says

Does anyone know if a Vanquis card comes under the scheme.

Andi says

No.

Only Provident, Greenwood and Satsuma.

For Vanquis do the following:

Apply for SAR (subject access request)

Look through Transaction list they send through.

Record in a excel all ROP (Repayment Option Plan) fees and Charges (Overlimit / Late payment)

Vanquis will try to say you can not claim ROP as the time frame for PPI has passed, however Vanquis are fully aware that ROP was never marketed as PPI

Also obtain copies of your credit reports and compare the amount of Credit companies you were using at the time of opening the Vanquis card as you may be able to also submit a claim for irresponsible lending.

Sara (Debt Camel) says

Also read https://debtcamel.co.uk/refunds-catalogue-credit-card/ which looks at how to make an affordability complaint if Vanquis increased your credit limit to high a level.

Carly says

Hi there i have received a letter regarding the claim scheme but it is in my married name, i had quite a few big loans with provident in my maiden name. How will this work? (ive sent this again without my surname) thanks

Sara (Debt Camel) says

You need to contact Provident and ask if the loans in your maiden name are showing under your married name. If they aren’t then there are two accounts and you want them both assessed together as a single account, not seperately.

Robert says

Hi, I recieved a letter today regarding claiming against loans I’ve recieved in the past from provident/satsuma etc. I think I had a few with satsuma and atleast 1 with provident when about 8-10 years ago when I first turned 18 but I’m a bit anxious about making a claim. I’ve just recently got my credit score clean with various debts from other lenders dropping off my file and was wondering if I made a claim to see if I was entitled to anything would this in anyway harm my credit file again?

Sara (Debt Camel) says

No it won’t. the only thing that can harm your credit score is if you do not make the repayments to credit you currently have. These old loans are presumably either already repaid or you have already defaulted on them… here nothing you can do will make your credit record worse.

If you win ca claim, your credit record may improve, as Provident would have to remove any negative marks from loans that were unaffordable.

J Scott says

I had a few loans with provident at the same time, as a result I couldn’t pay them, my electric bills weren’t paid, even water and other bills, eventually provident sent the debt to a collection agency, as it is I cannot locate the provident old paperwork just the debt agency I pay for the balance of over 6k, I haven’t been sent any paperwork to make a claim nor have I been sent any information on this from. Provident. I’m annoyed I’ve been effectively cut off and left out. I pay £5 a week to a debt agency and its just goign to take forever at the rate I’m doing. Any help you can offer is great, I can’t register on the portal as I don’t have a reference and I’ve got no emails or letters with anything on what can I do.

Sara (Debt Camel) says

Phone them up and ask for your Scheme id.

angela twist says

Both me and my husband had provident loans for years we couldn’t afford to pay in the end and they went to debt collection agencies. Now the last email i have is from wescot where i offered them £5 a month for my provident debt that was in 2008. I have just phoned provident to ask for a scheme id and she said she cant find anything for me and my husband at all and she refused to give us a scheme id. Apparently she cant find any of our details either by name, dob or postcode on their systems so we are not entitled to claim according to her. What should we do.

Sara (Debt Camel) says

Were all your debts before 2008?

Bonnie says

I have submitted my claim into the portal, they have a section asking for details on defaults but all you can do is add a date (year) in and cannot record any additional information.

I am just hoping that they will delete all entries from the credit reports.

Will they only start reviewing this in Feb 2022 after the portal closes?

Sara (Debt Camel) says

I don’t know, I hope they will start earlier.

Jack says

Hi Sarah,

I had two loans in short succession with Satsuma in Jan and March of 2019. I had other multiple payday loans going. Eventually, I couldn’t cope and I entered into a DMP a few months later.

The loans with Satsuma were about £600 combined. The repayments for them were about £65 a month combined, but of course I had other loans I was repaying.

What chance do I have to make a claim for unaffordable lending? What sort of evidence might prove helpful?

Sara (Debt Camel) says

I can’t guess what the chance is, but it is pretty easy to make a claim, so why not?

The evidence that may help is your credit record at that time, if you don’t have an old report, take one now. Also your bank statements from 3 months before and 3 months after each loan application. Again get these now, don’t wait to be asked for them.

If your claim is rejected, make an appeal and attach the bank statements.

Jack says

Somewhat related…

When I defaulted, the bank sold that debt to a third party. However, I now have two defaults on my credit file. This had happened twice, so it doubled the default number.

Is this normal, and does it affect my credit rating further than had they remained a single default?

Sara (Debt Camel) says

This is normal, but only one is counted in the credit scoring system.

If you make a claim and the debt that was sold is decided to be unaffordable, this will be bought back from the debt collector and both defaults removed.

Theresa says

Hi I have borrowed from provident for over 20 years and have paid thousands back to them and I’ve made a claim as the agent did not check my situation so I was in dire straights for years and as being a young mum at the time and a single one at that my agents always offered me more. With bro g skint I obviously took them though I struggled for years. I was paying my last loan back at 400 a month and that was tough though I got took into hospital due to covid and the agent never came back. I also never put a complaint in ever so will that affect my claim or will they have all my info? It’s all confusing to me tbh

Sara (Debt Camel) says

Repaying all the loans won’t harm your claim. If you borrowed continuously for a long while that is normally a sign that the loans were unaffordable so this is a good claim.

Provident should have a list of all your loans.

eck loran says

do you think you could apply to provident for a Equitable Set Off

Sara (Debt Camel) says

You have a current loan and you have made a claim to Provident?

eck loran says

yes sara still owe 1200 my claim was delayed 5 times before scheme came into force

Sara (Debt Camel) says

are you making payments at the moment?

eck loran says

stop them 2 months ago but now getting pestered with company capquest fishing for my details so if i could get a Equitable Set Off this could stop this as my claim is for major loans about £20.000 over the years and was delayed for 56 days 5 times as they said they where finalizing the claim but where just delaying till the scheme came into force

Sara (Debt Camel) says

So this Equitable Set Off is mainly important for Amigo customers as it stops the guarantor being asked to pay, which isnt relevant for Provident.

Just tell Capquest that you have made a claim that you think will result in you being owed a cash refund after your balance has been cleared and you won’t be making any payments to wards this until your claim is settled.

Mark says

Hi,

If you already have a default on your credit file, do we have to wait until the outcome of the claims or can we ask provident to temporarily take them off pending outcome?

Thanks

Mark

Sara (Debt Camel) says

they won’t do anything until the claim is resolved.

Faz says

Hi Sara

Satsuma has not recorded one of my loans as defaulted since 2016 despite me not paying anything towards it.

I had submitted a claim to FOS which got sent back as Provident entered the scheme which I have registered for.

I am fully expecting the scheme to remove this loan as unaffordable however may end up still owing some amount. I asked provident if they could accept a settlement now and remove the missed payments since they had not recorded a default yet. They have come back saying wait for the scheme however they have said due to a systematic issue a default was never applied which they can do now if I request. Do you think this will work out better as currently on my credit profile it seems like I am missing payments every month whereas if I take the hit on the default they will have to record an older date for it and hopefully that will make my credit profile look better?? Or can they actually now not record the default as ita been so long and its their own fault for not recording it. Any advice appreciated

Sara (Debt Camel) says

It sounds best if they add a default backing it – which they can do. And you wait for the outcome to your scheme claim before settling it. So what provident has suggested.

If they add a default in 2016, it will drop off your credit record in 2022. And if your claim is upheld, it will be removed at that point.

Adreva says

Same here, loans from 2017 with no default never got told about the systematic issue and provident refuse to back date or apply a default. I’ve complained to the ombudsman onnuust the default issue and I’m waiting to hear back.

David says

Same here missed payments showing for 45 consecutive months now starting from 2017. I’ve applied to dispute the recording of the missed payments via credit reference agencies. Should I contact Provident and ask them to apply a backdated default to 2017 as an old default will have less impact? I’m guessing either way hopefully any entries will be removed next year once the scheme is finished?

Sara (Debt Camel) says

Older defaults do have slightly less impact on your score, but I doubt Provident will look at this – their aim is to get claims decided. If your claim is upheld, the default will be deleted.

Janine says

Hi

When will we know if we a eligible for a refund and will we be notified or do we have to chase them

Many thanks

Sara (Debt Camel) says

You should be notified when your claim has been assessed. You will then be able to appeal it if you don’t think the decision is right.

In the recent Money Shop scheme a significant number of people got extra loans included as unaffordable when they appealed. So don’t assume this will be hopeless.

I don’t know if you will be notified by email – no one has yet had their claim assessed and been told so far as I know.

You could log in to your account and see what that says – it might be a good idea to get into the habit of doing this every month. And come back to this page every month and see if there are any reports of people getting decisions.

Darren Mallinson says

I’ve had my claim via the claim portal returned to me, as I indicated I had defaults and CCJs at the time I took out loans. They are wanting evidence of this.

They are asking for dates and amounts of the CCJs and defaults. I can only access these details on my credit record up to 6 years ago, but they are asking for information from 2007 onwards (which is when I originally took out some of these loans).

Firstly, can they reasonably expect me to have records going back this far? I would suggest that it is reasonable for me to have access to records that a credit reference agency has under 6 years, but anything older than that I would consider an unreasonable expectation. I responded a number of weeks ago querying this and suggesting it was an unreasonable request but unsurprisingly they’ve ignored it.

Secondly, I think this is nothing more than an exercise to put barriers up hoping to stall the process and hope customers give up a claim.

Are there any methods whereby I can get details of CCJs and/or defaults extending back to 2007? I did think of possibly sending a DSAR in, but to who – the credit agencies are unlikely to have data this old.

Sara (Debt Camel) says

Did you borrow continuously for years? How long?

Do you have any evidence of CCJ, – old letters, emails whatever?

Wayne says

Hi. I have tried multiple times to access the link to the Provident claims portal, and each one comes back with the same message that the portal is not working? Is there any other way to log a claim?

Sara (Debt Camel) says

Have you phoned them up? Provident on 0800 056 8936.

Gordon KENT says

This is what Provy are asking for , by the vary nature of any failings in character we tend to keep it hidden away , i.e. Gambling, alcoholism etc so its hard to supply proof , any advice ? Claim has been re-opened with the following message: Good Morning,

This claim is awaiting to be progressed. In order for us to progress this claim, we require the medical evidence you have selected to provide.

Medical evidence should include the following:

• Name of health condition or impairment

• Date of diagnosis

• How the diagnosis will impact the Customer managing their account/finances

• Length of time the practitioner expects the condition or impairment to last (prognosis)

The evidence may include (in applicable circumstances):

• Possibility of relapse e.g. is a mental health episode likely to reoccur based on the customer’s condition? If so, is this likely to impact the Customer again in the future?

• Side effect of medication

• Arrangements for on-going support / current support network

Evidence must be signed by the medical professional and:

• Dated stamped

• On letterheaded paper representing the organisation the medical professional works for

• The most recent evidence that the Customer can get

Other forms of medical evidence may also be accepted. If you are unsure, please call us on 0800 056 8936.

If you have clicked this box by mistake and do not wish to provide any medical evidence towards with you claim, then please uncheck this box.

Thanks G.K.

Sara (Debt Camel) says

Did you borrow from Provident for a prolonged period continuously?

Gordon KENT says

Hi Sara , thank you for your reply , there was in fact 2 loans from Satsuma , if I am remembering correctly both in 2017, Jan the 1st one , then another in Aug , they never asked for bank statements which would of highlighted a excessive spending on a Gambling website. Which I didn’t recognize as a problem then , so wouldn’t seek medical advice and thus did not seek support , I am self healed since then . Thanks

Sara (Debt Camel) says

OK, so how large were the Satsuma loans?

Gordon KENT says

Hi , Amounts possibly , £1400 then further subsequent loan £ 1000 ?. Thanks

Sara (Debt Camel) says

ok so you don’t have any evidence of mental health problems. That is understandable, but equally it is understandable that provident want some proof of this, not just your assertion.

However those are very large payday loans! Would your credit record have shown recently increasing debt levels? Any missed payments? You can argue that these should have cause Satsuma to either decline the loan or look in more detail at your situation, when asking for your bank statements would have shown a gambling problem.

If provident reject your claim, then appeal this.

Gordon KENT says

Thank you Sara you have summed it up very well and I will do as you have suggested and yes if bank statements had been asked for at the time they would of seen a pattern of online debits to a large Gambling Organization , , hopefully I will be successful in my claim , and will appeal as you have suggested . Thanks Again

jacqueline says

Hi my name is jacqueline, i have had a lot of provident loans, i still have my loan books since 2013 and a statement from march 2016 where my balance stood at£8113, i was unable to repay the loans due to my financial issues. I would like to put in a claim but am unsure how to find and access the portal

Sara (Debt Camel) says

the link to the portal is in the article above. If you are having problems, phone Provident on 0800 056 8936.

Andrew says

Morning,

Do we know when the Provident loan will be taken off our credit files? Will this be in February ?

Am going through mortgage options and this is the only one holding me back.

Thanks

Sara (Debt Camel) says

you have made a claim to the Scheme? I presume you have not yet heard if the claim has been upheld and for which loans?

Andrew says

I have made a claim but not yet heard anything about the outcome. I presumed that would be in February.

Sara (Debt Camel) says

February is the last date for submitting claims. I don’t know when Provident will start telling people the decision on their claim, and then people will be able to appeal that.

It is possible Provident could remove negative markers (or delete loans, we don’t know which they will do) as soon as they assess a case but it is more likely they will batch them up and do them in one or two hits. Those would be likely to be 3-6 months later than February – that is my guess. I could be wrong!

Gordon KENT says

Yep 3 -6 months seems a fair assessment as we all know all credits take a lot longer than any debits do to accounts from any Organization

Joshua says

Received letter from Provident today. Scheme not yet assessed but to stop paying all loans and balance cleared.

Really feel sorry for anyone whose been actually paying.

Currently will only mark credit file as partially settled.

Will they be taken off altogether if claim is successful?

Sara (Debt Camel) says

I think it will probably be deleted if that loan is upheld. But that isn’t clear.