Have you had big overdraft problems for a long period?

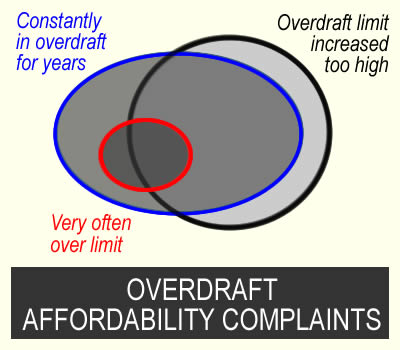

You can make an affordability complaint and ask for a refund of overdraft charges if:

- your overdraft limit was set too high at the start or increased to a level you are unable to clear; or

- your overdraft usage showed you were in long-term financial distress. For example, being in the overdraft all the time, or using an unauthorised overdraft a lot

- your overdraft was originally a student account with no charges, but now interest is being added and you are in the account all or almost all of every month.

This article shows how to make an affordability complaint to your bank, with a free template letter to use. If the bank doesn’t make a you a good offer, it is free to take your case to the Ombudsman.

These complaints do not hurt your credit record. And

Contents

Overdraft affordability complaints

Overdrafts are supposed to be for short-term borrowing

Overdrafts are intended to be used for short-term problems, not as long-term borrowing. A bank should review a customer’s repayment record and overdraft limit and if there are signs of financial difficulty, offer help.

One sign of financial difficulty is hardcore borrowing for a long period. The Lending Code defined hardcore borrowings as “the position where a customer’s current account overdraft remains persistently overdrawn for more than a month without returning to credit during that period”.

Some Ombudsman decisions

All cases are very individual. But these examples give you an indication of what the Ombudsman thinks is important.

In this NatWest decision, the Ombudsman decided:

NatWest did have an obligation to monitor Miss K’s use of her overdraft facility.

Any fair and reasonable monitoring of Miss K’s overdraft facility would have resulted in NatWest being aware Miss K was in financial difficulty … by October 2014 at the absolute latest. So NatWest ought to have exercised forbearance from this point onwards.

In this Santander case, the bank didn’t notice hardcore borrowing:

By this point, Miss C was hardcore borrowing. In other, words she hadn’t seen or maintained a credit balance for an extended period of time. Santander’s own literature suggests that overdrafts are for unforeseen emergency borrowing not prolonged day-to-day expenditure. So I think that Miss C’s overdraft usage should have prompted Santander to have realised that Miss C wasn’t using her overdraft as intended and shouldn’t have continued offering it on the same terms.

Decide which reasons apply to your overdraft complaint

In the overdraft all, or almost all, of the month for a long while

This is the most common reason for winning a complaint

Overdrafts are meant to be used when you have a short term problem. Using the overdraft a lot for a few months is fine. Or for a few days at the end of a month before you are paid.

Banks should review your overdraft annually. This is in most overdraft terms and conditions. And even if it isn’t, the Ombudsman says this is good industry practice.

So at one of these reviews, your bank should have seen if you were in difficulty with the overdraft. For example if you are in the overdraft for all (or almost all) of the month for a prolonged period. Or if you were often exceeding your arranged overdraft limit.

I would say over 18 months or 2 years is prolonged borrowing, not short term.

The bank set your limit too high

This may have been from the start when you were first given an overdraft. Or the initial low limit may have been fine, then the bank increased it to a level which it was impossible for you to repay.

If the bank saw signs of financial difficulty, it should not have increased your credit limit, even if you asked for it. And it should have considered offering your help instead (the regulator’s word is forbearance), for example by stopping charges.

But what is too high?

This depends on your income and expenses. An overdraft of £2,000 for someone whose income is £1,800 a month is a lot – but if you earn £5,000 a month, then a £2,000 overdraft may be reasonable.

Other points that help a complaint

You won’t win an affordability complaint by saying the charges were too high.

Instead, you say the bank should have known they were unaffordable for you because of all the financial problems it could see on your statements and your credit record.

Here is a checklist, do any apply to you?

- often having direct debits or standing orders not being paid;

- a lot of gambling showing on your statements;

- significantly increasing other debts with the same bank (you may also be able to complain about those loans or credit card);

- being recently rejected for a loan or a credit card by the bank;

- significantly increasing debts with other lenders showing on your credit record;

- a worsening credit record – maxed out credit cards, new missed payments, payment arrangements, defaults etc;

- using payday loans;

- mortgage arrears;

- a reduction in the income going into your account.

Free student overdrafts

You can only win a complaint about these after the bank has started charging you interest

Making your complaint

What you need at the start

You don’t need to know the dates your limit was increased before complaining, my template asks for them.

You don’t need to send statements to the bank with your complaint – the bank already has them!

You can’t go back and see exactly what your credit score was in say 2021 when the bank increased your limit. But your current credit record shows what was happening back six years, so download your credit report now and keep it. The sooner you get the report, the further back it goes. I suggest you get your free TransUnion statutory credit report.

Send a complaint by email

I don’t recommend phoning to start off a complaint. It’s too complicated and you will be talking to someone that doesn’t specialise in these complaints.

I think email is the simplest way to make these complaints. Here is my list of bank email addresses for complaints.

An alternative is to send a long message in the app. But if this means using a chat facility, it’s not usually a good idea, as you are again talking to someone who doesn’t understand what you are saying and tries to tell you what help is available with your overdraft – when all you want is to have your complaint considered.

A template you can adapt

In the template below, I’ve invented some examples and dates so you can see how a complaint email could read. The bits in italics should be changed or deleted to tell your story. Delete dates if you don’t know them. If a sentence doesn’t sound relevant, delete it.

I am making an affordability complaint about the overdraft on my current account number 98765432.

Your identity details (these are needed if you complain by email, not if you use secure message):

My name is xxxxx xxxxxxxx. My date of birth is dd/mm/yy. The email address I use/used for this account was myaddress@whatever.com.

Your home address (if you know the bank has your current address, ignore this):

My current address is xxxxxxxxxxxxxxxxxxxx. Please do not send any letters to older addresses you may have on your records.

If your overdraft was originally a student overdraft with no interest include this, otherwise delete it:

My account started as a student overdraft and no fees were charged. I am complaining about the period after, when you started to charge fees.

START BY SAYING they should have noticed your financial difficulty

Overdrafts are meant for short-term borrowing but you could see I was unable to clear the balance in a sustainable way. I was using the account for long term borrowing as I could not get out of this. The fees and charges you were adding were making my position worse.

I am complaining that [every year since [20xx] OR for many years] you have failed to notice my difficulty during the annual reviews of my overdraft. You should have offered forbearance eg by stopping interest and charges being added.

By 2017 I had been in my overdraft constantly for many months, not getting back into the black even when I was paid. This “hardcore borrowing” is a clear sign of financial difficulty. My income was only £1,850 a month – after I had paid bills, there was no way I could hope to clear an overdraft of £3500 in a reasonable length of time.

OR

By 2021, although my salary took my account briefly into credit, within a few days, I was back in the overdraft.

include any other points that show you were in difficulty

You should have seen that I was in financial difficulty because you rejected my loan application in 2021.

You should have noticed that the income going into my account decreased from 2020.

From 2020-22 there was a lot of gambling showing on my account.

In 2022 and 2023 there were a lot of rejected direct debits on my account.

… or anything else!

Say if the initial limit was too high or it was increased too high

You should never have given me an account with such a large overdraft. When I applied, you should have checked my credit record and income and seen I had recently missed payments to a credit card and had taken several payday loans.

OR

You should not have increased my overdraft limit. When you increased the limit, you should have seen that my debts to other lenders on my credit record had increased a lot

OR (for accounts that had been student accounts)

You should have seen after [2020] when you started charging interest that the limit was too high to be repayable on my income.

In your reply to this complaint, please tell me when any limit increases were and how much the limit went up.

END BY asking for a refund of charges and interest:

I would like you to refund all the interest and charges that were added to my account from 2016 when you increased my overdraft limit.

OR

I would like you to refund all the interest and charges that were added to my account from 2021 when you should have realised that my finances had got worse to the point that I was no longer able to clear the overdraft.

Please remove any late payment and default markers from my credit records.

Points to note

Student overdrafts

You won’t win a complaint about a student overdraft saying you were a student and it was unaffordable at that point.

But when the bank has started charging interest, it should start doing reviews and check if you are in difficulty. So from then on, you can win affordability complaints.

You can complain if the account is still being used or if it is closed

These complaints can be made if:

- you are still using the account or you have stopped using it and are paying it off;

- the account has been closed;

- the bank defaulted it and sold it to a debt collector (here you still complain to the bank, not the debt collector). If the debt collector has gone to court and got a CCJ, add a sentence to the template saying you want the CCJ removed as part of the settlement of your complaint.

But if you have had an IVA or bankruptcy after these problems, or if you are still in a DRO, then you shouldn’t complain – ask in the comments below for details.

Old accounts

Banks may say FOS won’t look at an old complaint, but this isn’t right. FOS will often look at a complaint if it has been open in the last six years. How far back FOS will go seems rather random, but it should be possible to go back at least 6 years.

Open and recently closed accounts aren’t a problem – the bank will still have your statements.

If your complaint is about an account that was closed more than 6 years ago, it’s going to be very hard to win.

Packaged bank accounts

These affordability complaints are not about the fees on packaged bank accounts. MSE has a page about packaged bank account charge complaints.

Personal accounts, not business accounts

The complaints covered here relate to personal accounts. For business accounts, talk to Business Debtline about your options.

The Bank replies

They want to phone me!

People are often scared if they get this message. But it may be good news! You can just ignore it or say you would like a reply in writing.

If you decide to take the call, it helps to be prepared:

- have a pen and paper handy so you can write down anything

- if they say they are partially upholding the complaint, ask them the date they are refunding the fees from, and how much. And say you would like to see this in writing before you decide whether to accept it.

- if they ask you questions that sound complicated or worrying, ask them to put the questions in writing as you find the phone difficult

- when they say they are rejecting the complaint, ask for this in writing, as you will be going to the Ombudsman.

Rejection/poor offer – go to the Ombudsman , it’s free

Banks reject many good complaints, hoping you will give up. So don’t! You know if the overdraft has caused you a lot of problems.

You can’t go straight to the Financial Ombudsman (FOS), you have to wait for the bank to reply, or for them to have not replied within 8 weeks.

Here are some things banks may say to try to put you off:

- you could have declined the increase to your overdraft limit – FOS probably won’t think that is a good reason

- you never let the bank know you were in difficulty – FOS probably won’t think that is a good reason

- your salary was enough to return you to credit each month – this is misleading if bills meant you soon went into the overdraft;

- FOS will not look into things that happened more than 6 years ago – if your account was still open in the last 6 years FOS may well look at it.

And the bank may offer to refund fees for the last 15 months say, even though your problems have been large for many years. Think twice about accepting a low offer – you won’t put this offer at risk by going to the Ombudsman.

If you are offered a refund for the last 6 years but not any further back, have a think if this is a good enough offer. It is unpredictable whether the ombudsman will be prepared to go back further than 6 years.

If you aren’t sure, post in the comments below.

To send the case to FOS, complete this online form:

- you can use what you put in your complaint to the bank;

- if the bank rejected your complaint or made a low offer, say why you think this is unfair;

- use normal English, not legal terms.

You don’t need to send your bank statements – the bank will send those to FOS. And you don’t need the policy documents for your bank account, the lender will supply those to FOS if they are needed.

Do these complaints work?

Yes! From 2024, some banks are making more offers directly.

A Guardian article featured a case where someone used the template letter here. Barclays denied it had done anything but made an £8,000 “goodwill” payment to the customer.

And if your bank rejects your case, people are winning cases at the ombudsman. FOS is a friendly service although it isn’t speedy. It isn’t faster to use a solicitor or a claims firm,

The comments below this article are from other people who have made this sort of complaint. That is a good place to ask for help if you aren’t sure what to do.

Refunds from unaffordable loans

L says

Hi. Can I still do affordability complaint for overdraft if I have savings with the same bank? Eg will they just say I should have cleared overdraft with savings therefore affordable? Savings are in joint account with my partner who doesn’t know about my financial

Problems so can’t withdraw it

Sara (Debt Camel) says

how large are these saving compared to the overdraft?

Bert says

Used the template and got £3.5k from Lloyds on an unaffordable overdraft that was over 10 years old. I had previously complained and they hadn’t upheld so went to the ombudsman. Took over 12 months to get a response from Lloyds but every couple of months the ombudsman contacted me to let me know they were still working on my case.

Really incredible grateful for the template, thank you so much

Harvey says

On the 15th of July I made a complaint to Barclays Bank regarding my overdraft, it is currently sitting at £3250, this has started at £300 over 10 years ago and raised to this amount over a 2 year period until it was increased via the app to £3250, I had been in my overdraft ever since, as it had been 10 years it was the norm for me, and the monthly charges became part of my out goings, Upon making the complaint I received a text from Barclays the next day saying it was being looked into and I should hear back no later than the 30th of July, the 30th of July rolled around and I had still heard nothing, the next day I got a letter saying they were still looking into it and I would hear back by the 19th of August, Fast forward to August the 14th I received a text saying it had been investigated and I would be receiving a letter shortly,

Today (August 18) I had still not received any kind of letter, so I decided to call them up and ask what the outcome was over the phone, The lady on the phone was really nice, however when reading the letter to me it was nothing but Barclays saying they didn’t uphold any point of my complaint and the reasons why they did not agree with me, HOWEVER Even though they did not agree with my complaint, they said they would like to offer me £5400 as a good will gesture, this will clear my overdraft, which they will remove, and leave me with about £2000 spare!

Great result, big thanks to Sara and Debt camel

LB says

We have had a £3k overdraft limit with Abbey/Santander ever since we opened the bank account with them in 2009. The limit has never been increased but over the last 10 years or so we have never been out of the overdraft and used up to the limit each month. As they have never increased the limit would this still give us grounds for a complaint?

Sara (Debt Camel) says

that sounds like a good complaint. You may only get a refund for the last 6 years, but this will often be a huge help

Maria says

I made a complaint with TSB after over 10 years of living in planned od and got £2600 back which is 5 years of charges. This paid off my debt fully and left me with £700 in credit. I still have a complaint open with the ombudsman due to how tsb handled the resolution but I already feel so relieved!

zoe says

Hi Maria,

My complaint is also with TSB – did you send from the email on here and if so how long did it take for them to come back to you?

Thanks

Joseph says

Hi Sara,

I submitted my complaint to Bank of Scotland 9 weeks ago using your template. After 8 weeks, they replied:

“We’re still looking into your complaint… you can now refer your case to the Financial Ombudsman Service… we’ll be back in touch by 12 September 2025 if we haven’t resolved it.”

Today, they sent me a message (on my payday) asking me to ring them back about my case.

I didn’t escalate immediately because I saw advice here suggesting waiting a month after the 8-week deadline for BOS/Lloyds/Halifax, due to backlogs.

Key details of my case:

• Persistent overdraft use since Apr 2023.

• Overdraft limit increases: £1,000 → £2,500 (Apr 2023 – May 2025).

• Reduced to £1,900 (Dec 2023)

• Held at £1,900 (through 2024 – Apr 2025)

• Increased to £2,500 (May 2025, current limit)

• Interest paid: Approx. £811.25 over the period.

• With statutory 8% interest: ~£870 total.

Even with a refund, I would still have around £1,630 overdraft debt remaining.

I need the bank to help me break this cycle — ideally by writing off part of the balance, freezing interest, or restructuring the overdraft into an affordable repayment plan.

• Should I call them back, or go straight to the Financial Ombudsman?

• What else should I ask for?

Sara (Debt Camel) says

Many people seem to be getting a quick response after talking to Lloyds/Halifax/Bank of s Outland on the phone.

You won’t get statutory interest added if the refund doesn’t clear the overdraft

You may need to move to a different bank account and set up a payment arrangement for the remaining overdraft balance.

Do you have any other debts you could also complain about?

Joseph says

I have a Lloyds Credit Card at 11.22%. Which is basically maxed out at £1200.

Monzo Overdraft at £350.

Paypal Credit maxed at £1700.

Sara (Debt Camel) says

It’s probably worth a complaint to Paypal – use my credit card complaint template for that.

But you should consider breaking the whole debt cycle by putting all of the debts into a debt management plan with Stepchange if you are unable to overpay any of them and stop using the cards/Paypal

Joseph says

Bank of Scotland came back to me with this summary:

They’re refunding me £330.32 (fees/interest) plus £50 compensation, which I’ll get on 29 Sept 2025.

They’re removing my overdraft facility on 29 Sept 2025, so after that date, I won’t be able to use an overdraft at all.

Any outstanding overdraft balance still has to be repaid.

If I don’t repay it by 29th September:

My account will fall into unarranged overdraft.

Payments may be declined.

Late payment markers will be added to my credit report.

The bank could eventually close my account and add a default (which stays on my file for 6 years).

Sara (Debt Camel) says

ok so as I said, “You may need to move to a different bank account and set up a payment arrangement for the remaining overdraft balance.”

Or put all the debts into a DMP with Stepchange

Joseph says

I know I am planning on doing exactly that. I put this here to find out your opinion, on if you think if its a fair deal or not?

Sara (Debt Camel) says

if you agree the start date is when you were in overdraft trouble, and they are refunding you all the interest from then, then yes its a fair offer. What else were you hoping for/

Jennifer says

I just wanted to say a huge thank you. I have now received a £2370 refund of fees from a Barclaycard credit card account where they continually raised my credit limit and a £3639 refund from TSB for a £2750 overdraft that I had been stuck in the bottom of for years, meaning my overdraft has been completely cleared and leaving me with nearly £900 paid into my account on top. Finding this website is the best thing I’ve ever done.

Lindsay says

Hey! Did you email TSB on the above address and how long did it take for them to respond to you? Even to confirm receipt of your complaint? :)

Jennifer says

Hi, yes I emailed TSB using the template and address on here and they took roughly a month to respond. I didn’t need to escalate it to the ombudsman as they immediately agreed to the complaint – they told me the date that the overdraft would be removed and the refund would be actioned and warned me it might not clear the overdraft but that they would be in touch with support if this was the case and thankfully the refund more than cleared it so that wasn’t a problem. It was a really smooth process actually and it was something I was worried about as it was a very large overdraft.

Jessica says

I am starting to draft an email to HSBC and wondered what to do in the case of a joint current account. Should we be making a joint claim and include both our contact details?

Sara (Debt Camel) says

I would just start by saying you are making this claim on behalf of your partner as well.

Lindsay says

Hey Sara!

I have an overdraft with TSB which is £3,010, which I’ve had since at least 2017, I did have it longer than that but I don’t remember the year and what the amount was initially. When I took this out my income was probably around £1000 monthly. I’ve literally never had my account be positive since as I now earn around £1700 per month. Even when I’m paid I’m still way into my overdraft. I used your template and emailed my complaint to TSB about this yesterday.

I also have an overdraft with Monzo, which I make fee payments for every month but am obviously never out of either. I have a £1000 capital one credit card which is maxed out that I only make minimum payments on. I also owe PayPal credit £1,900 and I am never out of this.

It’s manageable to a point I can make the monthly payments but I am never able to pay any of them off in full. But I do feel I have grounds to complain to all of them as all were given to me despite already having a £3,010 OD I couldn’t manage.

My worry is that TSB may close my account or say that the overdraft is being taken away and I need to pay up within a short space of time, same with PayPal. Should I wait until I deal with TSB first just in case? I don’t want to be in a situation where TSB, Monzo and PayPal want me to pay up immediately and I’m left with more debt and no money to live off.

What would you advise is best?

Sara (Debt Camel) says

You have no real hope of clearing the TSB overdraft though, have you?

This all feels too tight, with a lot of debts for your income.

I think the best answer may be to get a new bank with no overdraft and move all your income and household bills over to there. And talk to StepChange about a debt management plan for the overdrafts and the credit card. This will get interest frozen and let you make one smaller affordable payment a month. https://www.stepchange.org/

Then winning any affordability complaints will speed up the DMP and help clear your credit record sooner

Lindsay says

Hey Sara!

I just wanted to thank you, I have today received an email from TSB Customer relations following my complaint on 23rd August. They said that it was my choice to increase my overdraft over the years and I knew the terms and conditions of this, and that any interest and charges due to this were what I signed up for.

However, they said that they can clearly see that I have been struggling and my overdraft is always maxed, and I’m never not in a negative balance.

“I have therefore decided to remove your overdraft facility on 10 November and at the same time I’ll be arranging to refund your charges and interest applied to your account since August 2019. The refund totals £5210.96. This will be paid into your account ending ….

I will write to you again on 10 November to confirm this has been completed. As your account will go into credit, I will calculate 8% simple interest based on the charges and interest left once your overdraft has been cleared. This will be detailed in my letter I will be sending to you on 10 November.”

They said that any adverse credit records won’t be reversed as they feel it’s an accurate record of how I have used my account. Which I think is fair.

I just wanted to clarify if you know what the 8% interest is that they refer to when my account is credited? Does this mean I’m going to have to pay?

All in all I’m really happy with the outcome THANK YOU as without your template I wouldn’t ever have been able to do this.

Sara (Debt Camel) says

The 8% they refer to is an extra amount they will pay you (not charge you) on the amount your account goes back into credit. It can be hard to work out, but just see it as a nice little bit extra

Matthew says

I opened a student account in 2011 they gave me a £2000 overdraft, I then opened up two more student accounts with different banks, not once was I asked if I already had a student account I think the overdrafts were £2000 and £3000, as you can imagine I could never pay them off I understand it was my choice ultimately but this genuinely ruined 10 years of my life… when I eventually got employed I was in so much debt I had to get more loans out… eventually I joined step change and it is all paid off now but I just feel if I was told are you sure or if there’s further checks I could have stopped the snowball.. I know it’s a long time ago now but I only joined stepchange 5 years ago so a lot of the accounts in that time were just being paid off when possible… where should I start? Lloyds is the original one so don’t really wanna claim against them, but it was coop and rbs that let me open further accounts, then PayPal credit gave me like £3000 even though I was already in debt and very etc.. I’m not sure where to begin do I even have a claim? Thanks

Sara (Debt Camel) says

When did the DMP start?

James says

Hi, I owe around £10k on credit cards, I’ve emailed all of those and I’m awaiting a response.

I’ve emailed over 10 loan companies as I’ve also had reoccurring loans over the years too from 118, Admiral, Hastings, Castle Bank, Plata, Zopa, BetterBorrow, it is endless at least a 5 year debt cycle battle that I have been in, I came across this website and have instantly emailed them all demanding a refund of interest as all I’ve done is pay of loans with new loans all of which were high interest.

I’ve raised a complaint with Monzo I have a £2k overdraft which they gave me the day of applying for the account, I was already in financial hardship but they still gave me a £2k overdraft, since getting this it’s always been £2k overdrawn and the APR is almost 40% I believe, I think I’ve had the account around 3 years and I can’t pay it down, it’s impossible, I get charged around £60 a month, £60 x 36 months is £2,160.

I contacted them using the template and they replied “I understand you have requested a full refund of all interest and charges, as well as the removal of payment makers from your credit record. I can confirm with you that you have no missed/late payments as the moment as you do not have default in your account.

Sara (Debt Camel) says

This seems like a lot of debt. I suggest talking to StepChange age about a debt management plan (DMP) that will get new interest and charges stopped nd let you pay less each month

Then winning any affordability complaints will speed up the DMP and help clean your credit record sooner.

See https://www.stepchange.org/how-we-help/debt-management-plan.aspx

Sam says

I have a £2k overdraft with Santander which I’ve reached the limit of regularly since about 2020. It was a student overdraft initially and later started charging. I earn enough to get out of my overdraft but am back in it instantly as soon as rent is paid. I have had an email recently offering advice and wondered if I would still be able to make this affordability complaint, even though they had got in touch about my overdraft? They haven’t changed my limit or anything, only offered advice.

Sara (Debt Camel) says

yes you can still make this complaint now.

How large are the monthly charges in a typical month?

Sam says

Charges are around £45 per month

Sara (Debt Camel) says

so a refund for 4 years would clear the overdraft!

Jade says

Hi Sara,

I have submitted a complaint to the Ombudsman about my overdraft, for context, I was given this as a student overdraft in 2013 and have never been out of it. It changed to a normal account with overdraft in 2023. The Ombudsman have said they would only look at it from the point it became chargeable. They have come back and sided with Barclays because I got paid enough each month to clear it, when in reality, I would be in a positive balance for a day or two until my bills came out and then I would be straight back down to minus figures again. I raised concerns as well as some of my other ombudsman complaints have calculated I had enough disposable income when in reality, £1000 of my income was clearing the overdraft, just to use it again. The disposable income calculations for other complaints has never been more than £5/600 each month. It seems they didn’t take my constant overdraft use inro consideration. What concerns me the most though, is the investigator for the overdraft complaint said when it was a student account, ‘it was free money so it’s reasonable to make use of it’. While I agree in part, I don’t think constantly being in said overdraft for 99% of the time for the last 12 years is reasonable use. Do you have any advice please?

Sara (Debt Camel) says

The Ombudsman have said they would only look at it from the point it became chargeable.

this is correct. As a matter of practicality, there is no money to be refunded before that point either. There is no point in trying to argue about this.

So what is the decision about the last couple of years? how many days a month are you in the overdraft now?

Jade says

My balance becomes positive the day I get paid and then when all bills come out, I’m straight back into the overdraft and within a week, it’s maxed out again. The credit card complaints I’ve made have calculated that I had x amount disposable each month but in reality this is not truly disposable as it’s from my overdraft if that makes sense. Because I earned enough each month to clear the overdraft each month, they said that was affordable, regardless of me having to use it all again to pay my bills

Sara (Debt Camel) says

How large is the overdraft? what is your net pay each month? how large are your household bills? how large are your other minimum debt payments?

(Ignore the credit card complaints, they wont help you win this the overdraft one.)

Megan says

I submitted a complaint with Santander for a student overdraft opened in 2014 with charges from 2019 last month (at full £2k capacity every month since 2016 even with full time salary since 2018). I had a email to say they’ve received my complaint shortly after, and today I received the following.

Is this pretty standard? I’m hoping it means they believe my complaint has grounds and they’re looking into it more?

Thanks in advance!

“We recently wrote to you to let you know we’d received your complaint. Unfortunately it’s taking longer than we originally anticipated to investigate your issue(s).

We’re sorry for the delay and thank you for your patience.

Next steps

If for any reason we can’t complete our investigation and give you a resolution in the next 4 weeks, we’ll be in touch with you again to let you know.”

Sara (Debt Camel) says

Sorry, it is an automatic reply. No one has yet looked at your complaint.

Cara says

I have had a large (£3,300) overdraft with Natwest for many, many years (i left Uni nearly 30 years ago!). It started of as a student account overdraft and then got increased along the years. I did take a loan out with Natwest to clear the overdraft but then got back into it and had it pretty much maxxed out every month until recently when my-laws helped me out by paying it of. The problem I have is, I cannot remember when my overdraft limit got increased. I have always been on a low wage so never showed Natwest signs of me being able to afford to pay this amount of. Can I still email them and ask them to look at my claim even though I cannot remember specific details. Thank you

Sara (Debt Camel) says

yes you can, my template in the article above asks for the details of the limit increases.

In practice there will be very little evidence of charges for a long while ago. But even a 6 year refund would be really helpful, wouldn’t it?

Cara Daley says

Any refund would be amazing. Thank you, I’ll use your template and add in any extra information I remember.

Anne says

If I have multiple products (overdraft, credit card, loan etc) with the same bank, should I mention them all in one complaint or handle them separately? How would this work?

Sara (Debt Camel) says

I think separate complaints is easier, using my different templates.

but if you want you can make a single complaint with points from each of the templates.

Lyndsay says

In 2020 I was being charged £6 a month for my overdraft, plus interest. They refunded me £583.84 and stopped the £6 monthly charge. However, shortly after that the interest being charged went up significantly from £4-6 a month to £14-17 a month. Can I still request a refund if they’ve given me one previously?

Sara (Debt Camel) says

did you have a reply to your 2020 complaint saying they would stop charging you interest? Which bank is this?

Lyndsay Norton says

This is with Natwest. I honestly don’t even remember contacting them about a refund and can’t find any emails to or from them. I was just checking previous statements and saw the refund.

In my bank it shows as

Compensation – 248.09

Lending fees – 153.57

Interest – 182.18

Sara (Debt Camel) says

I suggest you make a complaint and see what they say. If they mention the previous complaint, ask for a copy of the decision

Liam says

I’ve been in my planned overdraft over ten years. Fees came in around 2017 with Lloyds and I had 5 defaults at the time. Thankfully all dropped off in 2023 and I’m still in my overdraft every month I accept I pay around £80 in fees a month and they also gave me a credit card which I maxed out. I have betting on my account but only small amounts. I’ve made a complaint I really hope Lloyds offer me some money to help get me out of this situation which seems impossible now. Do you think I’ve got a case? The overdraft sits at £2900 at the moment and I earn £3070 per month… I also used to go into my unplanned overdraft many times between 2017-2021 which caused me great stress as I was young and lived alone. I have two kids now and financially better but it’s still really hard to get out of it with more responsibility and a mortgage now. They also gave me a loan to consolidate my debt (for credit cards) and I had to lend from my mum to pay that off

For now I’ve tried to keep it simple and complained about the overdraft but if I’m successful in reclaiming fees I may complain about the loan affordability. Do you think I’ve got a case for the overdraft?

Sara (Debt Camel) says

Loan cases can be easier to win, especially if the loan started within the last 6 years. I suggest you compolain about this now, don’t delay.

i would hope you would get a refund of the last 6 years for the overdraft but these complaints can take a long time as many have to go to the ombududsman

Liam says

Thanks for that. Unfortunately at the time the loan came in I inherited a large sum of money but that had to be used to buy a house as we had a second child on the way. So I will probably have to leave that. Once spent I got the credit card to further help which is now maxed could I complain about that? Bearing in mind I’ve been overdrawn for years and years..

Really appreciate your responses

Sara (Debt Camel) says

yes you can also complain about the credit card

Liam says

Hello again, Lloyds responded to me on the 2nd September saying that they need more time and they will respond by 30th September. Should I wait to see their response or should I just go to the financial ombudsman. What would you recommend?

Sara (Debt Camel) says

has it been 8 weeks since you complained?

Liam says

Yes it has 2nd September was the 8 weeks and now they extended to the 30th.

Sara (Debt Camel) says

There is almost no chance of them responding by end September, so I suggest you send this to the Ombudsman now.

Liam says

Thank you for your help with this. I’ve submitted to the FOS is it up to 12 months to receive any final response? Do you have any idea what timeframes are like at the moment

Sara (Debt Camel) says

There is no “12 month limit” on FOS cases, but most are decided well within that. There are delays at the moment for some “over 6 years” cases, because of waiting for a court decision, but when that judgment comes, these cases should speed up.

Carly says

Thanks for the great guidance and advice here. I emailed HSBC as I’ve had a £2,000 overdraft since my student account in 2000. It was then changed to a standard current account. ‘I’ve reviewed your statements between 2019 and 2024, and I can see your salary was more than sufficient to cover the overdraft limit and once it credits your account, the account was always in credit. In fact, there were periods of time when the account remained in credit, and you didn’t use your overdraft facility. I note when you did use your overdraft facility there was non-essential spending on the account, which is not indicative of financial difficulties, and if this had been reduced, you could have considered reducing or repaying the overdraft. Whilst we haven’t made an error, I’ve reviewed the overdraft interest applied to your account between 2019-2024; this totals £950.00 (rounded up to nearest £10). As a gesture of goodwill, I can offer you a refund of 50% of the fees.’

Is this their way of fobbing me off, my bills took me into the overdraft, how can they know what is/isn’t non-essential spending? Should I go to the ombudsmen with this and if they agree with the bank, does that offer go away?

Thank you!

Sara (Debt Camel) says

£950 charges from 2019-2024 seems like a low amount, averaging less than £18 a month. What has happened to the account this year?

Carly says

I closed the account and switched to Lloyds TSB in November 2024. There was also a period in 2022 where I borrowed from my mortgage to repay it and other bills only to end up using it again.

Bc says

I’ve called Halifax again today as they said they haven’t looked at the complaint, the text message said they I could pass to the FOS or give them until 12 September, when I spoke to them today they said it’s still not been picked up by an account manager, do you think I should send to FOS now as they’ve already extended the date once. Thank you

Sara (Debt Camel) says

yes I think you should.

Zoe says

We probably complained at the same time. The date they gave me was 14th September and also said I could go to FOS now . I took mine to FOS and received a reference number from FOS last Monday. I initially complained to Halifax on 22nd June. I hear FOS can take a few months to allocate a case worker so I think the sooner you send it the better! Good luck.

Bc says

Thank you for your message, I’ve had a response from FOS with a reference number and they are contacting Halifax for a final response letter, today I received this text, we’re sorry we haven’t resolved your complaint. We’re doing everything we can to fix this. Your reference number. If you need to speak to us, please call 0800 096 7461. I’m not going to call them again as tomorrow is a further extension so I’ll just wait for FOS to assign it, good luck to you too.

Tim says

I’ve had an overdraft since 2019 starting with a £250 limit then slowly going up to £2000 which is my monthly salary. I borrowed money from a friend earlier this year to clear the overdraft. Can I still complain even though I know longer have an overdraft?

Thanks

Sara (Debt Camel) says

how long looking back have you been in the overdraft all or almost all of the month?

Tim says

Yes I was in it most of the months throughout the years

Sara (Debt Camel) says

You can complain even though the overdraft is now cleared.

Diane says

Hi, I’d be grateful for some advice if it’s worth trying an affordability complaint for my overdraft. I asked for the maximum amount on my overdraft £2100 in 2021 as I was moving house and had fees to pay. I also took out a loan with the same bank to pay the fees.

I managed to clear the overdraft shortly afterwards, but within months was back in it constantly. I’m normally in credit when I first get paid but within a couple of weeks I’m back in it and up to £1500. I’ve also run up my credit card (also with them) twice to £6000 and then transferred to 0% deals elsewhere.

Do I have a valid case as I requested the increase ?

Sara (Debt Camel) says

It makes no difference if you requested the increase or not, the bank has to make the same affordability checks.

What is a typical monthly charge by the bank?

Diane says

If I’m up to my limit of £2300, the charges are £28, but typically about £18

Sara (Debt Camel) says

These are pretty low charges. It suggests that your overdraft usage hasn’t been regular and heavy enough to have been such a problem that it should have alerted the bank. I would be surprised if you win this.

Have you had a look at making complaints about the credit cards?

Diane Eaton says

I regularly have letters from the bank about being in my OD, so they are rrying to be responsible too.

I haven’t made complaints about the cards. They’ve had high limits for a number of years and I manged to clear them 5 years ago due to an inheritance. I resisted using them for a couple of years. But since 2022 I have run them back up, transferred to a 0% deal, then run it up again. I’ve recently transferred that one over to a 0% deal too.

Natalie Cook says

Hi. I had an overdraft of £3500 with lloyds. I first requested the overdraft in 2017, I believe it was for £200 and by the end of it was up to £3500. I did request this but was young and didn’t realise the effects. My wage was £600-900 a month and I was constantly in my late overdraft. When I first got the overdraft the fees were about £30 a month. They then changed how they charged overdraft fees and it was 1p per £7 on the overdraft so this meant my fees were almost £5 a day. £150 a month. I could not cope with these charges and regularly had returned overdrafts. I asked for a loan of £3k to reduce it as loan repayments were lower than the charges but I was refused. It want till Covid in 2020 when they looked at responsible lending that they offered the loan. I’m finally back at £500 overdraft now which is manageable but it was crippling for me at the time. Is it worth sending off the form.

Sara (Debt Camel) says

was the 2020 loan affordable?

Natalie says

Not really. It was in peak Covid times. I was on furlough and on maternity leave so my income was low. I accepted the loan because the repayments were lower than what I was paying on the interest for the overdraft

Sara (Debt Camel) says

A complaint about the loan may be easier to win.

It’s not easy to go back more then 6 years for an overdraft

Lydia says

I had no idea something like this was possible! I wish I’d found this site years ago – the information on here is so helpful.

I got into significant debt which started when I was given an overdraft at age 18 in 2011 which I didn’t understand at all and then spiralled with my overdraft getting increased several times in the following years despite my obviously using credit cards and payday loans and being completely unable to keep up, ultimately culminating in over £20k of debt on an £18.5k salary and my entering into a Trust Deed (I’m in Scotland) in 2019 which (with a lot of hard work!) I completed in 2023.

My question is whether if I was to put in an affordability complaint now there’s even the slightest chance of it being upheld?

Is it supposed to be a correction of the Bank issuing an unaffordable overdraft, or to help to pay off and get out of a debt that the overdraft is currently contributing to?

Thanks so much :)

Sara (Debt Camel) says

This overdraft was cleared in the Trust Deed?

Lydia says

Yes! It was taken into account in the Trust Deed

Sara (Debt Camel) says

Then i think you will have a lot of problems winning this complaint as its so long ago AND even if you did any refund would just used to “clear” some of the debt to the bank that was wiped by the Trust Deed.

Complaints after (or in) IVAs and Trust Deeds are very rarely worth it.

Lydia says

Ah well, thanks so much for taking the time to reply :)

kathryn says

Just wanted to say thanks Sara for your help!

i submitted a complaint to Natwest regarding my £1600 overdraft, which was originally given as part of my student account, and have been paying charges from 2013 to around 3 months ago. Natwest did not uphold my complaint – so i escalated it to the ombudsman.

Today i have received an email from the investigator who has upheld my complaint, with fees, interest, charges and 8% interest to be refunded from March 2019 (6 years). The overdraft has already been paid off, so hoping the refund can pay my credit card balance which will help massively!

All in all it took 4 months from complaining to Natwest – to the investigators response today – i just hope that Natwest comply with the request.

Sophie says

Hi Kathryn,

Thanks for posting. Your situation sounds exactly like mine, so I’m going to send my email to Natwest today. I was wondering if you have received the payment successfully since you posted? Many thanks

Kathryn says

Hi Sophie!

No- just after I wrote this update my investigator emailed to say NatWest are not happy so it will be going to the ombudsman to make the final decision – I’ll keep you posted

Sophie says

Thanks for getting back to me. Sounds like we’re on the same track… NatWest didn’t hold up my complaint either, so I’ve passed it on to the Ombudsman. They’re just starting their investigation. Best of luck with the final decision!

Ryan says

My complaint is now 8 weeks old. Lloyds Bank have acknowledged receipt and that they are looking into it but have not yet sent me a final decision. A message received from Lloyds today says they are still looking into my complaint and apologised for it taking longer than it should have to resolve. As it’s been eight weeks since I lodged the complaint, Lloyds have advised that I can refer the case to the Financial Ombudsman Service. Whilst I don’t need to do this now, they have said they will be back in touch with me by 02 October 2025 if they still haven’t resolved my complaint. Should I wait or contact the Ombudsman now?

Sara (Debt Camel) says

I would send that to the ombudsman now because Lloyds don’t seem to be making as many good offers as they used to, so no point in waiting

JessB says

Hi. I sent my affordability complaint to the Santander email you provided on this page which is customerrelations@santanderconsumer.co.uk but they replied saying that particular email only deal with Vehicle finance. I did email back stating can you give me the email address for affordability complaints and she said she doesn’t have a direct email. Can you please help? I can’t seem to find any relevant emails for an affordability complaint anywhere online. Thankyou

Sara (Debt Camel) says

You would prefer to send an email not phone I assume?

Sara (Debt Camel) says

Try consumerservice@santander.co.uk– Santander have changed the address on the regulator’s register

Kim says

Following Sara’s template letter for overdraft affordability, I complained to Barclays regarding an overdraft which started as a student overdraft dating back to 2002. Barclays rejected my complaint and would not look back beyond the previous six years – however they have offered me a goodwill gesture of £4600 for charges and fees added since 2019.

I am absolutely thrilled as this will pay off a huge chunk of my debt.

Zoe says

Hi Sara,

I have messaged a few times now and I just want to again thank you so much for your responses and help.

Unfortunately the FO got back to me today and sided with bamboo loans. I borrowed £2,000 even though 2 weeks prior I borrowed £3,000 from another company. My bank statements show gambling transactions, lots of other credit card and shopping account transactions however they did not ask for these when I applied. They said based on what I told them I had enough disposable income at the time.

I can decline the decision is it worth me doing this and providing statements etc or because they’ve taken my word for it it’s not worth it now?

Sara (Debt Camel) says

Send in those bank statements now!

If your borrowing had been increasing or was high for your income, say Bamboo should have seen this and made more detailed attempts to verify your expenses, when they would have seen the gambling.

Zoe says

Thank you for getting back to me I am gathering all the information now. My statements were very bad at the time. Because I didn’t state to them all of my expenses at the time they are using that in their favour. Here is a section from the final response email;

The relevant legislation, specifically Chapter 5 of the FCA’s CONC sourcebook, states that a business may,

depending on the circumstances, include some or all of the following when making its assessment of

creditworthiness:

(a) Its record of previous dealings [with the customer],

(b) Evidence of income,

(c) Evidence of expenditure,

(d) A credit score,

(e) A credit reference agency report, and

(f) Information provided by the customer.

In this instance, Bamboo considered d), e) and f) when making our assessment for your loan. We also

made a statistical determination of additional living expenses using ONS data, which, as mentioned above,

has been confirmed by the FCA as an appropriate basis for determining an applicant’s living expenses.

Sara (Debt Camel) says

Your credit report showed a lot of debt?

Did Bamboo ask about your expenses in detail?

Zoe says

I have since looked back at my credit report and it shows a lot of debt!

I think when I applied they simply asked for income and expenditure and I didn’t go into depth of what I spent out. They didn’t even ask for proof of income. No statements. P60s nothing.

I have declined the FO decision and currently uploading statements and screenshots of my credit file at the time of approval

Sara (Debt Camel) says

You need to argue that your were not asked for detailed expenses and a lender should attempt to verify them. And that the amount oif your other debts should mean the verification was more thorough

Mark says

I always struggled in my overdraft for years after my first born arrived in 2018. My partner had to give up working meaning we lost her income at a time when we needed it the most. We slipped into the overdraft and couldn’t get out because of the banks need to charge us high interest payments. I never thought I could ask for help with my overdraft. My bank did offer a small refund but I knew I could get more. I used the template provided and drafted up my own version of a letter to hsbc. This then led me to be in touch with an ombudsman to which they believed I was owed compensation. In the end I got £466 and 12 months 0% interest on my overdraft. I could not have managed that without the help from debt camel. Forever grateful. 🙏

Jamie-Lee says

Hi. I recently tried to contact Santander using the email in the list you have, however they have responded saying that email only deals with vehicle finance. I’ve been unable to find the right email. Do you know where to find it please?

Sara (Debt Camel) says

They seem to have switched this response on yesterday.

There is of course no reason why they can’t just forward your complaint to the department dealing with affordability complaints.

I suggest first you send the regulator (the FCA) an email about this and copy it to Santander, hopefully they will hate this.

—————————–

Email to consumer.queries@fca.org.uk

Cc the email to consumerservice@santander.co.uk santanderregulatoryliaison@santander.co.uk

Subject: Santander (firm 2294747) is making it hard to complain

I want to report Santander for not providing a simple way for customers and ex customers to make a complaint. The DISP rule 1.3.2 says that firms should “allow complaints to be made by any reasonable means”, but Santander will not provide an email address for this.

It also does not provide an address for a letter of complaint with a FREEPOST address.

Their website says https://www.santander.co.uk/select/support/complaints people should phone, but this isn’t appropriate for complex complaints and it also doesn’t recognise the needs of customers who are nervous or anxious about using the phone. Any ex customers are also unable to message in the app.

This appears to be an attempt to put people off complaining. I know the FCA doesn’t look into individual complaints, so I will be writing to Santander but I thought the FCA’s supervision section should be aware of the poor way Santander are treating vulnerable customers.

————————————————————

If you can access the app, one person yesterday managed to get a complaint put through by webchat.

Otherwise you have to write to Complaints, Santander UK plc, Sunderland, SR43 4GD. Make sure you give your name, home address, email address Santander knows you by, date of birth.

Tierney says

Hi – I sent an affordability complaint to Santander over a student account RE interest they have been charging since. I sent it by email 11/12 weeks ago and they haven’t replied other than an email 2 weeks after the complaint to say they were busy but would get back to me. Any advice on how to proceed with this?

Sara (Debt Camel) says

I would give them a few more weeks as they seem to be making reasonable offers in some cases.

Becky says

Hi,

I complained to Halifax on 18/5/2025 about my overdraft they said they will respond in 8 weeks. Then I got a message saying it’s taking longer than expected they will respond by 10 Aug. On 8 Aug they messaged saying they still haven’t resolved the complaint they’re doing everything they can. Still no update since I contacted them last week and they said no update no it will be by this date or anything . Is this the usual timescale?

Sara (Debt Camel) says

they seem to have a large backlog. And as they also seem to be making fewer good offers, I suggest you should now send this case to the ombudsman. Link to the FOS online page to do this.

Halifax will still look at your case when it gets to the top of their pile. If they make you a good offfer then, you just tell FOS that you want to accept it

Jadie says

Hi FOS have asked me these questions, how should I reply?

When did you realise that the credit provided by TSB bank was unaffordable? (Please provide a date in DD/MM/YY format and an explanation as to how you realised the credit was unaffordable)

When did you realise that TSB Bank may have been responsible for the difficulties you were facing? (Please provide a date in DD/MM/YY format and an explanation as to how you realised that TSB Bank could be at fault)

Many thanks

Sara (Debt Camel) says

can you tell me a bit about the overdraft eg when did it start? was it a student overdraft at the beginning? did they increase the limit? have you always had problems with it? have your other debts been increasing? how was covid for you? how many days a month roughly are you in it now?

Charlotte says

Hi sara,

I sent an affordability complaint on the 14th of june to Natwest. The last email they sent, which was on the 8th of August mentioned their still working on the case. Do I continue to wait or do I go to the financial Ombudsman?

Im not sure what to do.

Sara (Debt Camel) says

send this to the Ombudsman now. So far as i can tell, Natwest reject well over 95% of overdraft complaints, far more than any other bank

Charlotte says

do i send the same letter i sent to Natwest to the FOS? And do I have to inform Natwest I’m going straight to the FOS? Sorry for the questions…

Sara (Debt Camel) says

use the FOS online case reporting form – link in the article above.

No you don’t have to tell Natwest – FOS will tell them

Charlotte says

Thank you, Sara. I have sent the complaint to the Ombudsman.

This morning, however, Natwest contacted me to discuss my complaint, and I requested that they call me back at a later time.

I am uncertain whether I should engage with them or inform them that I have already submitted the complaint.

Sara (Debt Camel) says

it’s fine to tell them you have sent the complaint to the ombudsman.

if they start asking questions and you are unsure what to say, ask them to put them in writing as you find it hard to think on the phone.

Jess says

Hi, I made an affordability complaint to HSBC this week on a joint account with a £2500 overdraft which was put up from £2000 in February 2020 despite it being used frequently. Since then it has been used frequently and constantly in at least the last two years. Interest for the last year was £644 and over the whole period is closed to £1,500. I heard back with an acknowledgement of receipt within 24 hours and yesterday had an email from a complaints worker saying she is investigating and is there a good time for her to call me. I am a bit anxious about taking a call but is this standard? I don’t want to be put on the spot and if more information is needed I would need time to find it anyway. Just wondered if this is common for them to phone?

Sara (Debt Camel) says

some banks do this. If you are being asked anything you are unsure what to say, as them to pout the questions in writing as you find phone calls hard

Alex says

Hello!

I raised a complaint with Halifax back in May regarding my overdraft – likewise to others I imagine have had letters and texts to extend the response time. I hadn’t heard from them for a while so decided to call, the agent was lovely and explained it hasn’t been allocated as of yet but they have a large backlog.

I know I am within my right to escalate to FOS given the 8 weeks have passed, do you think I should await Halifax FR or just go to the FOS now?

Many thanks for all the advice!

Sara (Debt Camel) says

I would send this to FOS now. This delay is unacceptable and also they don’t seem to be making so many good offers, so go to FOS now

Melissa says

I am in the same boat with Halifax and complaint started in May , the first extension I decided to give them the 4 weeks and since then I’ve had a bereavement and just not been on the ball. I will be going to the FOS now as it’s been 17 weeks for me. Good luck.

Jeff Kitten says

Hello,

Lloyds bank (on behalf of halifax) have finally responded with the below questions

Bank statements if your primary bank account was not held with us at the time, we will need bank statements showing all income and expenditure for the three months prior to the account opening and any credit limit increases. Your account was opened in March 2022, and your limit was increased in September 2022. These statements must show all income and expenditure, as they are essential for us to assess your financial position at the time of lending.

Your permission to view bank statements if these are held within Lloyds Banking Group.

Your account of events from the time the lending was provided. This will help us understand why you’re raising the complaint now. For example, has there been a change in your circumstances, such as employment, health, or financial vulnerability.

Has anyone else had this?

I had a very small overdraft with them about 15 years ago which has increased to £700 now. I’ve never managed to get myself out of it and they approved a credit card for £1,500 last year which I am also never out of of

Sara (Debt Camel) says

This is a standard reply from them. Tell them they have your permission to look at your bank statements with Lloyds ban group

Do you also use another bank account?

Jeff says

Yes I do have other banks but don’t use them. They’re for use when abroad

Stacy says

Hi Sara,

Thanks for this advice and template! I’m looking into an affordability complaint with Santander, but I was wondering if its worth it as I have paid off and closed my over draft twice but then almost immediately reopened it (within a few weeks), I have also been unemployed and on Universal Credit during times my overdraft was maxxed out.

If I go ahead with an affordability complaint,it it worth mentioning the severe anxiety I suffered due to this? I was signed off work for months and can provide proof of that if for some reason they should require it.

Thank you very much!

Sara (Debt Camel) says

How large is the overdraft?

Do you have other debts at the moment?

Stacy says

Hi Sara,

The overdraft is £1000, reduced from 2000 after a student overdraft.

I have an ‘unofficial’ loan from a friend – which was used to pay off a credit card and my overdraft around 2 years ago, but I then had to reopen the overdraft maybe 3 weeks later and have pretty consistently stayed in it since.

Thank you!!

Sara (Debt Camel) says

I think you should make a complaint.

Mentioning severe anxiety doesnt mean they are more likely to uphold your complaint 9unless they already know about you mental health problems?) but they should take this into account going forward if you are in need of further help.

Ashley says

Hi, I made an affordability complaint to Bank of Scotland for an arranged overdraft that I have had since 2018. After 9 weeks I referred the complaint to the FOS as I hadn’t received a response. My case is open with the ombudsman but I have since received a final response from Bank of Scotland advising they will uphold the complaint in part and are only considering the last three years but have offered a refund of £800 and are removing my overdraft facility which will then put me into an unarranged overdraft as the refund amount isn’t enough to clear the overdraft. I’m aware I have to make arrangements to pay the balance but I have advised the FOS that I disagree with the banks final response and want them to continue with the investigation as I believe that last 6 years should be looked at.

My question in regards to this is, do the bank proceed with what they have advised (refunding the money and removing my overdraft) whilst the complaint is still under investigation with the ombudsman or is there no action taken until the ombudsman has reached a final conclusion?

Thanks

Sara (Debt Camel) says

Banks normally refund you what they have said in this situation but it’s not guaranteed.

Are you going to change banks?

Ashley says

Thanks for the response.

Ideally I don’t want to switch banks. I have spoken with the financial assistance team and they advised that all they can offer right now is to default close the account and can’t offer a reasonable repayment plan but they did say to call back once the overdraft is removed and they can re look at the options, if any, at that point.

I wasn’t sure if the bank won’t remove my overdraft facility until the FOS finished their investigation but from what you are saying that more than likely will still happen?

Thanks

Sara (Debt Camel) says

I can’t guarantee what a bank will do…

I think you should get another bank account up and running now and switch your income nd bill payments to that. You don’t know if ny DDs could be rejected, and TSB are being so unhelpful about this sort of thing. Not necessarily bad, but not explaining in detail now so you can mke an informed choice. So better safe than sorry

David gobey says

I did a irresponsible lending letter to Santander in Feb 2025 ,i opened acc in 2005 but cudnt remember when overdraft started but at the end point it was £2750 and I was only earning £1850 max each month never being out of it ever . They paid me £1700 in interest etc back from 2021-2024 , it stated that if I was unhappy then I cud go to ombudsman ,so I did ,last month they sent me the usual questions ie. When did u know you were struggling etc etc

But today they sent me a email saying

Santander has provided evidence of an overdraft limit of £650 being in place as of October/November 2010, however, the information available doesn’t confirm when the overdraft initially commenced.

Therefore, please can you confirm:

Whether you have any information relating to an overdraft limit being in place prior to October/November 2010 – if so, please provide evidence of this.

In your opinion do u think they are looking to try and get a refund from this date ? I said I wasn’t sure when the overdraft started .

He then sent this reply

Your complaint about Santander UK Plc

Thank you for the confirmation. I shall provide a further update in due course once I’ve received some further information from Santander.

Kind regards

So do u think I have a chance of going further back than 2019

Sara (Debt Camel) says

Sorry I really can’t guess.

Magda says

Hi!! I’ve had a 123 account with Santander when I was a student, since 2014. Straight away when going to uni they offered me a £950 overdraft at the time whilst I didn’t have any sort of income but nobody carried out any checks. I could increase it over the years on the app but luckily never did it for more than 950. After I graduated in 2017 the account has changed to a normal account and was charging me fees, at that point I was working and only earning about £1100 maximum some months around £850 so after paying bills I was back in overdraft within days and would remain in it throughout the month. Since about 2019 I stopped using the account as it was taking up my salary and changed into another bank but was only transferring in the interest amount every month up until now which is £31 a month around (2200 in fees as of 2025). I’ve never had any communication from Santander to say we are reviewing your account limit or checking whether this overdraft was ever affordable for me (unlike Barclays which do this check on me annually). Only in 2025 a decade later I got an email to say you need to act now as in November we will be removing your overdraft as it is not designed for long term borrowing and you need to make sure its paid off or the account will default, and arrangement to pay will go on your credit file which I want to avoid. Do you think it’s worth putting a complaint about this Santander?

Thanks,

M

Sara (Debt Camel) says

Well you may as well make a complaint!

The fact they never checked you could afford the student overdraft is irrelevant – no one can as a student. What matters is that from the point of charging you interest after 2017, they didnt make annual checks that the overdraft was affordable.

Do you have other debts as well?

Magda says

I do have a credit card which is not with Santander, but now having to pay 950 before november will mean i can put less towards the credit card….

thank you,

M

Adam says

I have logged a complaint to the financial ombudsman as Lloyds failed to respond to me. I have been in an overdraft since 2014 and at the time had two defaults, pay day loans, and small amounts gambling. I have never been out of it up to now and only just realised it was unfair they even let me have one. I was extremely depressed during that very dark time.

I received some inheritance in 2023 which helped me buy my family home and in fairness I could have paid off my Overdraft but did the house up as we had baby 2 on the way. I am happier now and earn more but my overdraft is £2910 and my wage is £3,140 per month.

I also noticed Lloyds sent me digital letters instead of paper (maybe i chose that years ago) but there are some generic letters about ‘how much my overdraft is costing me’ and contains a number to call to see if they can help. my argument is this isnt meaningful support and surely they should have put a stop to my persistent overdraft use years ago.

a few questions if you dont mind answering.

1. is this going to impact my claim?

2. would the date of awareness rule come in to play and could I say at least refund for 6 years up to the date of my inheritance if they use that against me?

3. Will this be rejected because I had those letters? i never even saw them until i realised this was an unfair situation that i hadnt noticed.

Sara (Debt Camel) says

It’s hard to say how much not clearing the overdraft with your inheritance will affect the claim.

The 6 year rule starts from the current date, there is no reason why it should start from some arbitrary older date

Generic letters often don’t make much difference to c omplaint.

Jess Hallett says

Hi, I have just heard back from HSBC rejecting my claim for an unaffordable overdraft. The reasons given are around responsible lending saying they followed what they should and there was nothing on my record to indicate the overdraft shouldn’t be increased and was in line with the turnover of the account. My complaint was on the unaffordable interest and not being able to get out of the overdraft (£650 in fees last year alone). They say they made me aware I was in the overdraft by sending alerts (I was aware but stuck!)

Should I go straight to the ombudsman now? Is there anything in particular I should be saying to refute their argument that essentially I knew what I was getting in to?

Sara (Debt Camel) says

how many days of the month are you in the overdraft typically?

Jess says

Usually only out of it once a month for 24-48 hours after I get paid.

Sara (Debt Camel) says

yes I think this should go to the ombudsman.

It should have been clear that you couldnt get out of it

Jess says

Thank you. I have completed the form, fingers crossed.

Bee says

I have a 2k overdraft which I have been living in for many years.

I also have my mortgage with the same bank. Can I still ask my bank for a refund of charges? Or will this affect my mortgage etc?

Sara (Debt Camel) says

This will not affect your mortgage at all. Lots of people have done this, no problems with the mortgage

Jo says

Hi we have an ongoing complaint against the natwest re a long term overdraft use and charges. The ombudsman investigator has twice now set out his reccomendations as to what the natwest should do to rectify this in our favour ie refund all charges from 2018 amongst other things to put it Right. The natwest don’t agree and have twice disagreed with the investigator who has twice reviewed the case and given the same recommendations after the natwest sending “new” information. Its now gone to the ombudsman to settle the matter. Does this look positive for us or will the Ombudsman disagree with the investigator. This has been going on since January 2024. The investigator has been updating us and says that it will take time as they are changing how they look at these cases and it may affect our case.

Sara (Debt Camel) says

The reason the investigator has said this may take some time is that there have recently (july) been a legal challenge to FOS from some lender about some over 6 years cases. The judgment hasn’t yet been published. If FOS wins (and it has a record of winning most of this sort of challenge) then the cases may all settle quickly – although there is the possibility of the case going to appeal. If FOS loses, it may need to rethink its approach.

joanne cosgrove says

Have you heard anything update on the legal challenge that could affect my claim at all Sarah? My original complaint to the natwest was January 2024 and then about 8 weeks later we contacted the ombudsman. Im.payimg nearly 200 pounds charges put of my 464 pension its hard. I co tacted stepchange but they say although they can help I would have a default against my name. I feel this is unfair as I’ve been paying overedraft charges well over 15 years on this account ? Thanks for the advice previously.

Sara (Debt Camel) says

The judgment in the legal cases haven’t yet been published.

Does your credit score matter if you are retired?

Gemma says

I used the template to complain to Barclays. Just had a call today that they are not accepting the complaint and no goodwill gesture offered. I have said I will take it to the ombudsman, is there anything else I can do? My husband couldn’t work due to being in hospital in March and we were in the overdraft ever since. I have had to clear it using a credit card. They had charged me every month for the overdraft – I thought I would get something back!

Sara (Debt Camel) says

Overdrafts are meant for temporary problems. If you didn’t have difficulty with the overdraft before March, then this is a short term problem. These affordability complaints are for when you have had a long term problem, sorry.

Paige says

Hi, I put in an affordability complaint with Santander yesterday. Have been in my overdraft for YEARS after having the student overdraft and then never being able to get out of it for any significant periods of time.

Today I received an email that I had a new document on my account to read and it is a letter from Santander saying that I need to take action regarding my overdraft usage. It is dated 10th September so one day before I put in my affordability complaint but I only received notification of it today – one day after my affordability complaint. It’s shocking that they haven’t sent this to me with the ‘options’ they have outlined before now in the years I have had an overdeaft and very clearly been struggling to get out of it.

Could this mean they won’t accept my affordability complaint as they have written to me the day before? Is there a chance this has been done dishonourably in order for them to refute my claim?

Sara (Debt Camel) says

No they can’t argue that.

what are the options they have outlined?

magda says

Hi Paige,