Have you had big overdraft problems for a long period?

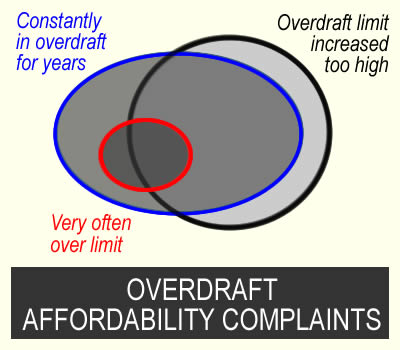

You can make an affordability complaint and ask for a refund of overdraft charges if:

- your overdraft limit was set too high at the start or increased to a level you are unable to clear; or

- your overdraft usage showed you were in long-term financial distress. For example, being in the overdraft all the time, or using an unauthorised overdraft a lot

- your overdraft was originally a student account with no charges, but now interest is being added and you are in the account all or almost all of every month.

This article shows how to make an affordability complaint to your bank, with a free template letter to use. If the bank doesn’t make a you a good offer, it is free to take your case to the Ombudsman.

These complaints do not hurt your credit record. And

Contents

Overdraft affordability complaints

Overdrafts are supposed to be for short-term borrowing

Overdrafts are intended to be used for short-term problems, not as long-term borrowing. A bank should review a customer’s repayment record and overdraft limit and if there are signs of financial difficulty, offer help.

One sign of financial difficulty is hardcore borrowing for a long period. The Lending Code defined hardcore borrowings as “the position where a customer’s current account overdraft remains persistently overdrawn for more than a month without returning to credit during that period”.

Some Ombudsman decisions

All cases are very individual. But these examples give you an indication of what the Ombudsman thinks is important.

In this NatWest decision, the Ombudsman decided:

NatWest did have an obligation to monitor Miss K’s use of her overdraft facility.

Any fair and reasonable monitoring of Miss K’s overdraft facility would have resulted in NatWest being aware Miss K was in financial difficulty … by October 2014 at the absolute latest. So NatWest ought to have exercised forbearance from this point onwards.

In this Santander case, the bank didn’t notice hardcore borrowing:

By this point, Miss C was hardcore borrowing. In other, words she hadn’t seen or maintained a credit balance for an extended period of time. Santander’s own literature suggests that overdrafts are for unforeseen emergency borrowing not prolonged day-to-day expenditure. So I think that Miss C’s overdraft usage should have prompted Santander to have realised that Miss C wasn’t using her overdraft as intended and shouldn’t have continued offering it on the same terms.

Decide which reasons apply to your overdraft complaint

In the overdraft all, or almost all, of the month for a long while

This is the most common reason for winning a complaint

Overdrafts are meant to be used when you have a short term problem. Using the overdraft a lot for a few months is fine. Or for a few days at the end of a month before you are paid.

Banks should review your overdraft annually. This is in most overdraft terms and conditions. And even if it isn’t, the Ombudsman says this is good industry practice.

So at one of these reviews, your bank should have seen if you were in difficulty with the overdraft. For example if you are in the overdraft for all (or almost all) of the month for a prolonged period. Or if you were often exceeding your arranged overdraft limit.

I would say over 18 months or 2 years is prolonged borrowing, not short term.

The bank set your limit too high

This may have been from the start when you were first given an overdraft. Or the initial low limit may have been fine, then the bank increased it to a level which it was impossible for you to repay.

If the bank saw signs of financial difficulty, it should not have increased your credit limit, even if you asked for it. And it should have considered offering your help instead (the regulator’s word is forbearance), for example by stopping charges.

But what is too high?

This depends on your income and expenses. An overdraft of £2,000 for someone whose income is £1,800 a month is a lot – but if you earn £5,000 a month, then a £2,000 overdraft may be reasonable.

Other points that help a complaint

You won’t win an affordability complaint by saying the charges were too high.

Instead, you say the bank should have known they were unaffordable for you because of all the financial problems it could see on your statements and your credit record.

Here is a checklist, do any apply to you?

- often having direct debits or standing orders not being paid;

- a lot of gambling showing on your statements;

- significantly increasing other debts with the same bank (you may also be able to complain about those loans or credit card);

- being recently rejected for a loan or a credit card by the bank;

- significantly increasing debts with other lenders showing on your credit record;

- a worsening credit record – maxed out credit cards, new missed payments, payment arrangements, defaults etc;

- using payday loans;

- mortgage arrears;

- a reduction in the income going into your account.

Free student overdrafts

You can only win a complaint about these after the bank has started charging you interest

Making your complaint

What you need at the start

You don’t need to know the dates your limit was increased before complaining, my template asks for them.

You don’t need to send statements to the bank with your complaint – the bank already has them!

You can’t go back and see exactly what your credit score was in say 2021 when the bank increased your limit. But your current credit record shows what was happening back six years, so download your credit report now and keep it. The sooner you get the report, the further back it goes. I suggest you get your free TransUnion statutory credit report.

Send a complaint by email

I don’t recommend phoning to start off a complaint. It’s too complicated and you will be talking to someone that doesn’t specialise in these complaints.

I think email is the simplest way to make these complaints. Here is my list of bank email addresses for complaints.

An alternative is to send a long message in the app. But if this means using a chat facility, it’s not usually a good idea, as you are again talking to someone who doesn’t understand what you are saying and tries to tell you what help is available with your overdraft – when all you want is to have your complaint considered.

A template you can adapt

In the template below, I’ve invented some examples and dates so you can see how a complaint email could read. The bits in italics should be changed or deleted to tell your story. Delete dates if you don’t know them. If a sentence doesn’t sound relevant, delete it.

I am making an affordability complaint about the overdraft on my current account number 98765432.

Your identity details (these are needed if you complain by email, not if you use secure message):

My name is xxxxx xxxxxxxx. My date of birth is dd/mm/yy. The email address I use/used for this account was myaddress@whatever.com.

Your home address (if you know the bank has your current address, ignore this):

My current address is xxxxxxxxxxxxxxxxxxxx. Please do not send any letters to older addresses you may have on your records.

If your overdraft was originally a student overdraft with no interest include this, otherwise delete it:

My account started as a student overdraft and no fees were charged. I am complaining about the period after, when you started to charge fees.

START BY SAYING they should have noticed your financial difficulty

Overdrafts are meant for short-term borrowing but you could see I was unable to clear the balance in a sustainable way. I was using the account for long term borrowing as I could not get out of this. The fees and charges you were adding were making my position worse.

I am complaining that [every year since [20xx] OR for many years] you have failed to notice my difficulty during the annual reviews of my overdraft. You should have offered forbearance eg by stopping interest and charges being added.

By 2017 I had been in my overdraft constantly for many months, not getting back into the black even when I was paid. This “hardcore borrowing” is a clear sign of financial difficulty. My income was only £1,850 a month – after I had paid bills, there was no way I could hope to clear an overdraft of £3500 in a reasonable length of time.

OR

By 2021, although my salary took my account briefly into credit, within a few days, I was back in the overdraft.

include any other points that show you were in difficulty

You should have seen that I was in financial difficulty because you rejected my loan application in 2021.

You should have noticed that the income going into my account decreased from 2020.

From 2020-22 there was a lot of gambling showing on my account.

In 2022 and 2023 there were a lot of rejected direct debits on my account.

… or anything else!

Say if the initial limit was too high or it was increased too high

You should never have given me an account with such a large overdraft. When I applied, you should have checked my credit record and income and seen I had recently missed payments to a credit card and had taken several payday loans.

OR

You should not have increased my overdraft limit. When you increased the limit, you should have seen that my debts to other lenders on my credit record had increased a lot

OR (for accounts that had been student accounts)

You should have seen after [2020] when you started charging interest that the limit was too high to be repayable on my income.

In your reply to this complaint, please tell me when any limit increases were and how much the limit went up.

END BY asking for a refund of charges and interest:

I would like you to refund all the interest and charges that were added to my account from 2016 when you increased my overdraft limit.

OR

I would like you to refund all the interest and charges that were added to my account from 2021 when you should have realised that my finances had got worse to the point that I was no longer able to clear the overdraft.

Please remove any late payment and default markers from my credit records.

Points to note

Student overdrafts

You won’t win a complaint about a student overdraft saying you were a student and it was unaffordable at that point.

But when the bank has started charging interest, it should start doing reviews and check if you are in difficulty. So from then on, you can win affordability complaints.

You can complain if the account is still being used or if it is closed

These complaints can be made if:

- you are still using the account or you have stopped using it and are paying it off;

- the account has been closed;

- the bank defaulted it and sold it to a debt collector (here you still complain to the bank, not the debt collector). If the debt collector has gone to court and got a CCJ, add a sentence to the template saying you want the CCJ removed as part of the settlement of your complaint.

But if you have had an IVA or bankruptcy after these problems, or if you are still in a DRO, then you shouldn’t complain – ask in the comments below for details.

Old accounts

Banks may say FOS won’t look at an old complaint, but this isn’t right. FOS will often look at a complaint if it has been open in the last six years. How far back FOS will go seems rather random, but it should be possible to go back at least 6 years.

Open and recently closed accounts aren’t a problem – the bank will still have your statements.

If your complaint is about an account that was closed more than 6 years ago, it’s going to be very hard to win.

Packaged bank accounts

These affordability complaints are not about the fees on packaged bank accounts. MSE has a page about packaged bank account charge complaints.

Personal accounts, not business accounts

The complaints covered here relate to personal accounts. For business accounts, talk to Business Debtline about your options.

The Bank replies

They want to phone me!

People are often scared if they get this message. But it may be good news! You can just ignore it or say you would like a reply in writing.

If you decide to take the call, it helps to be prepared:

- have a pen and paper handy so you can write down anything

- if they say they are partially upholding the complaint, ask them the date they are refunding the fees from, and how much. And say you would like to see this in writing before you decide whether to accept it.

- if they ask you questions that sound complicated or worrying, ask them to put the questions in writing as you find the phone difficult

- when they say they are rejecting the complaint, ask for this in writing, as you will be going to the Ombudsman.

Rejection/poor offer – go to the Ombudsman , it’s free

Banks reject many good complaints, hoping you will give up. So don’t! You know if the overdraft has caused you a lot of problems.

You can’t go straight to the Financial Ombudsman (FOS), you have to wait for the bank to reply, or for them to have not replied within 8 weeks.

Here are some things banks may say to try to put you off:

- you could have declined the increase to your overdraft limit – FOS probably won’t think that is a good reason

- you never let the bank know you were in difficulty – FOS probably won’t think that is a good reason

- your salary was enough to return you to credit each month – this is misleading if bills meant you soon went into the overdraft;

- FOS will not look into things that happened more than 6 years ago – if your account was still open in the last 6 years FOS may well look at it.

And the bank may offer to refund fees for the last 15 months say, even though your problems have been large for many years. Think twice about accepting a low offer – you won’t put this offer at risk by going to the Ombudsman.

If you are offered a refund for the last 6 years but not any further back, have a think if this is a good enough offer. It is unpredictable whether the ombudsman will be prepared to go back further than 6 years.

If you aren’t sure, post in the comments below.

To send the case to FOS, complete this online form:

- you can use what you put in your complaint to the bank;

- if the bank rejected your complaint or made a low offer, say why you think this is unfair;

- use normal English, not legal terms.

You don’t need to send your bank statements – the bank will send those to FOS. And you don’t need the policy documents for your bank account, the lender will supply those to FOS if they are needed.

Do these complaints work?

Yes! From 2024, some banks are making more offers directly.

A Guardian article featured a case where someone used the template letter here. Barclays denied it had done anything but made an £8,000 “goodwill” payment to the customer.

And if your bank rejects your case, people are winning cases at the ombudsman. FOS is a friendly service although it isn’t speedy. It isn’t faster to use a solicitor or a claims firm,

The comments below this article are from other people who have made this sort of complaint. That is a good place to ask for help if you aren’t sure what to do.

Refunds from unaffordable loans

Sam says

Hi, thank you for all of this info, I am planning to email my bank this week. I’ve had a £2000 overdraft for 15 years since I was a student and am always overdrawn even after I’m paid (other than for a couple of years in 2015/16 when I was usually in credit). Interest is £45ish a month. I have a credit card with them and they’ve also loaned me £7k in this time too, thankfully I paid that off on schedule.

I would like to ask if I should mention in my complaint the two occasions I’ve been into my local branch in the past 6 yrs to very informally ask for advice on paying it off only to be not given any advice at all and essentially told they don’t know (I asked about balance transfer credit cards).

Wondering if this may help or hinder the complaint! Many thanks for your time, Sam

Sara (Debt Camel) says

When were the loans?

The credit card, do you mainly pay the minimum, have they ever increased the credit limit?

Sam says

Thanks for replying so quickly. The loan was end of 2018. The credit card I’ve had for at least 10 years I think, not sure when exactly. They have increased it without me asking several times and the limit is now approx 7k (I believe it was about £3.5k when I applied). I used to pay the balance every month but now I pay as much as I can afford each month – always over the minimum amount at least but never back anywhere near back to zero. Thanks

Sam says

Just wanted to come back to let you know TSB have now replied (it took 4 weeks, quicker than I expected) to say they’re closing my overdraft in a months time and will pay back any charges since 2020 on that date. If I’m still in the negative at that point they will set up a repayment plan. I don’t suppose you know if ‘all charges’ means the monthly interest I’ve been paying? If so fingers crossed it should clear the overdraft completely.

Thanks again for all the info you’ve given that allowed me to contact them in the first place.

Sara (Debt Camel) says

yes “any charges” will include the interest!

Sam says

Excellent, that should get me back past zero then! Thanks again

Harris says

Hi Sara I hope your well

I opened a normal current account with HSBC when I was first in uni. It had no agreed overdraft and in a period where I made silly decisions across a period of a few days I used the card to deposit on Betfair multiple times in those few days and put myself in a overdraft of £800. After not being able to pay it off monthly as I was not in work and a full time student after 2 years HSBC closed my account and sold it to a debt collection agency who harassed me for over 2 years to collect it. I paid a small amount of it off. Am I eligible to do this check as the transactions on betfair happened in a short space of time and even when my balance was 0 HSBC allowed to me to go in an unwarranted overdraft. Now these past 4 years have caused my credit score to be so low it was a struggle to open a bank account elsewhere, get a phone etc?

Sara (Debt Camel) says

Is this debt now settled or are you making monthly payments?

Harris says

To made a few payments to hsbc and then I was in a bad financial situation and couldn’t afford to for around a year upon which they sold it to a debt collection agency and they took around half of it

Sara (Debt Camel) says

Well you can try. But if the transactions were just in a few days, I think you are likely to struggle, especially if they were small.

If you have other debts, it would be a good idea to talk to a debt adviser about your options, eg StepChange

Ellie says

Hello Sarah,

I submitted a refund request for Halifax start of Jan, I’ve received a text to say

we’re writing to let you know we’re still looking into your complaint. We know this has taken longer than you expected and we’re sorry about that.

They have given me a reference number and said if I don’t here back by the 11th March to contact Ombudsman, do I wait it out or contact ombudsman straight away?

Sara (Debt Camel) says

Well it’s only a couple more weeks. It’s up to you.

Fran says

Hi Sara

I made a complaint to PayPal last year about increasing my credit limit by a large amount a few times between 2018-2019 at the time I had multiple other credit cards and a large loan too. My other complaints to Lloyds held up and they paid back interest but PayPal rejected my complaint so I referred it to the ombudsman and after 3 months of waiting Iv just heard back saying they can’t investigate my complaint as PayPal agreed to my credit facility and increases to my credit limit from its office in Luxembourg – in other words, outside of the United Kingdom. They said their powers do not extend to complaints about business conducted in the United Kingdom on a services basis from an establishment outside the United Kingdom. Is there anything more I can do here?

Sara (Debt Camel) says

No I am sorry, the Ombudsman can only look at lending by Paypal when they became FCA regulated after Brexit.

Fran says

That’s a shame, I wasn’t aware of that when I sent it to the ombudsman so that’s good to know. The investigator said that PayPal has provided rights to refer the complaint to this service in addition to those of the Luxembourg alternative dispute resolution authority, the CSSF. And that I may still be able to contact the CSSF about my complaint. Do you think this is worth a try?

Sara (Debt Camel) says

I think some people have tried this but they have never reported back on what happened

Claire says

Hi

I took my overdraft complaint to the ombudsman and they have came back with the following questions –

When did I realise these were unaffordable

At what point did I consider TSB may atleast be partly to blame

Why didnt I complain sooner

I didnt know i could complain and assumed it was my own fault i also had reduced income after Maternity leave but that didnt change anything and i was just permanently in my overdraft for years.

Could you help with how best to word the response please?

Thank you

Sara (Debt Camel) says

did you have other debts eg loans and credit cards? how long ago was your maternity leave?

Claire says

Just car finance I think.

First Mat leave was 2009 and the second 2015 both was still fully in overdrafs

The overdrafts only cleared in 2020-21 by then i had mucg more debt

Thanks

Claire

Catrin says

Hello Sara,

I’ve had my Barclays overdraft 20 years this August. Madness. It started off as a student account with a £200 limit, which I regularly increased in my first year until it got to £1600. Eventually after graduating, this moved to a different type of account. I had many struggles financially during my uni years (paid a lot of overdraft charges etc) and I have pretty much been in this overdraft ever since. I regularly receive email telling me I’m using it regularly, but have never been contacted about paying it off or reducing it. I also had a credit card with Barclaycard which I’ve made a complaint about and am awaiting the outcome. Do you think I have any chance of them refunding my interest? Which is what I’ll ask them for. I’ve held off doing it at the same time as the card as I’m worried about them just demanding I pay the overdraft back – which I wouldn’t be able to do straight away!

Sara (Debt Camel) says

Do you have any other debts? What is your credit score like?

Catrin says

I do! I didn’t want to cram too much into my first comment as it was a lot (I’ve also commented about a Barclaycard on the Credit Card posts). I just looked at my credit score – I’m quite astonished it’s 921 on ClearScore. I currently have 3 credit cards with high balances almost maxed out, but am finally in a good place with paying them down to hopefully clear them all in the next two years. There was a period of time where I was in a payday loan cycle, had the Barclaycard maxed out (It is now on a paydown plan with 6 months to go), while living on the limit of my overdraft.

Thank you.

Sara (Debt Camel) says

So this is well worth making a complaint about.. You may not get a refund for many years ago, these are unpredictable, but even the last 6 years will be useful,

Any refund will much reduce or even clear the overdraft. Barclays don’t tend to automatically remove the overdraft when you complain, but if they did with very good credit score and an improving situation you can probably get a 0% money transfer card and use that to clear the overdraft. See https://www.moneysavingexpert.com/credit-cards/money-transfers/

Catrin says

Thanks Sara! Really appreciate you taking the time to respond!

Vicky says

Hi Sara,

I have had an overdraft with Natwest since 2010 as a student. It changed after I graduated and overdraft fees added. I’ve pretty much been at the top end of this overdraft ever since. Clearing it maybe for 1 week each month with my wage and then ending back at the top of it. They email me every so often about using my overdraft all the time and to contact them for ways to help I.e. budgeting etc. But never contact me to arrange ways to help directly with the constant overdraft usage.

I have loans, credit cards etc. That they will be able to see payments coming out for and this has been the case for years. The loans and credit cards are not with the bank. On some occasions several years ago the overdraft fees actually caused me to go over my agreed limit (I can’t remember when but I know it happened). Do you think I have cause to complain?

Sara (Debt Camel) says

yes but you may have an easier affordability complaint against any recent loans or credit limit increases on credit cards

NZ says

Hi Sara,

After following, I decided to put a complaint in to NatWest, I initially had an overdraft of £200 and I couldn’t remember how I ended up with an overdraft of £1,800 but that is what it has been for around 18 years!

NatWest said, ‘After reviewing our records it appears that the arranged overdraft facility of £1,800.00 was centrally reviewed and increased by us and placed on your account. I am aware that you would have been sent a letter at the time asking you contact us if you wished to opt out of the centralised overdraft increase’

Does this mean they increased it without asking me?

The past 3 years I have had a new job which has only just enabled me to match £1800 in the account, but then due to bills and debts etc I have to go back into the over draft, last year alone I was charged £500 for being in the overdraft, before this new job I never earned more than £1800, meaning I could never pay it back, even now I am only just matching it.

They have said that they have tried to get in touch with me numerous times regarding my overdraft and listed some dates and said I’ve never replied, I can truly say I recall one phone call where they mentioned about paying it back but I didn’t know how when I was continuously in it.

Should I take this further or not, thanks so much

Sara (Debt Camel) says

Yes you should go to the Ombudsman.

You would have been told about limit increases so you could have said No, but you many not have read the notifications and this doesn’t excuse NatWest from making proper checks.

NZ says

Thank you so much

Lyndsey says

Hi,

I recently came across the complaint information on social media, and came across your source today regarding the complaint for refund of interest on an overdraft and thought I would ask for advice/clarification before sending my complaint, as I’m unsure and had never heard of this before.

I’ve been in and out of overdrafts for years (With TSB) as I’m very poor with my finances. I got out of an £800 OD years ago, but ended up going into a £1400 one in 2021, which I’ve been in ever since, the lowest I got it down to was £1200 (this was start-mid last year) but then got approved to up it again October 2025 to £1700 and now £1750, which I’m not sure how when my wages after tax are £1500-£1600. They also approved a student overdraft of £500 which is still sitting there since 2019 not paid back (I stress about this regularly but I’m unable to pay back as I’ve been in and out of jobs yearly since I was a teenager.

After providing this information, do you think the complaint I give will have a high chance doing well, given that the overdrafts are my requests, even though I know I probably shouldn’t have requested such high ones :(?

Apologies for the lengthy post.

Thank you in advance, LC.

Sara (Debt Camel) says

A bank should make checks that a limit is affordable even if you ask for it to be increased.

Yes I think this looks like a good complaint, send it in

Do you have other debts as well? Often an overdraft is a sign of bigger debt problems.

Michael Mackinnon says

NZ & Sara in fact everybody who has written here thank you so much your knowledge expertise and information of your experiences are invaluable please keep us posted on how you get on . I have just come across this page and have found it to be so helpful I am putting in a complaint with NatWest next week my overdraft is £3500 has been for years and multiple times I’ve gone overdrawn because of the interest and charges !!! if they deny my complaint I will definetly go to the ombudsman please everyone keep this page updated and keep fighting the good fight thank you I will definetly keep you posted and let you know how I get on to thanks again

Natalie says

Hi Sara my old overdraft I’ve had since 2008 seems to be getting investigated. Its been with the ombudsman over a year now. They have asked me for my statements between 2008 – 2010 which is when my overdraft went from 100 – 1200, its still at 1200 to this day. NatWest would only given them my statements from 2010 onwards. Luckily asked for my bank statements from 2007 onwards which NW provided so I have my statements when the OD and increases were applied. I was wondering if the banks are able to be purposely obstructive with these claims as they have clearly lied saying they don’t have the statements when they do as they provided them to me? Thanks for everything you do!

Sara (Debt Camel) says

Interesting idea…

Natalie says

Hi Sara, the investigator has finally looked at my complaint after 12 months has has determined NW acted unfairly from 2012 however feels they shouldn’t refund me from 2012 as I delayed complaining and didn’t do anything about it until 2024. (even though I didn’t know I could complain). case law has been quoted of SMITH V RBS 2023 re unfairness of complaining after 6 yrs. She’s asked them to provide interest etc from Jan 2018 if they don’t agree will go to an Ombudsman for final decision. Just wondering if you think that’s a good outcome or not? I’m grateful that they have agreed they acted unfairly, but I disagree with their conclusion as I genuinely didn’t know I could complain until last year so how would I of complained sooner?

Sara (Debt Camel) says

How large will that refund be?

your choices are

1) to say yes, that’s fine

2) No I want this to go to an Ombudsman, or

3) In the interest of a speedy settlement I will accept that decision, but if Natwest reject so it has to go to the Ombudsman I will also object as I think it’s unreasonable to expect me to have complained about something I had no knowledge of and which was not common knowledge

Natalie says

Hi Sara.

Ive worked out some of the charges and it will pay back the OD and ill have a little left over, not much though.

If I reject the decision and it goes to the Ombudsman I assume that will run the risk of the Ombudsman saying NW did nothing wrong?

Am I correct in thinking there is a big backlog of cases being reviewed by the the Ombudsman. As Ive waited 12 months to get to this point part of me thinks to just go with the Investigators decision to get it over with, but the other part of me thinks I might aswell let it go to the Ombudsman as I’ve waited this long. I do still have to keep paying interest on the OD in the meantime though which is frustrating. Thanks for everything you do.

Sara (Debt Camel) says

In theory the ombudsman can decide anything. In practice they typically agree with the investigator

I understand wanting to get it all over with and get on with your life. But if it has to go to the Ombudsman because NW reject it, you may as well push for a refund for further back?

Natalie says

Hi Sara. further to my earlier posts Natwest have rejected the investigators decision to refund me from 2018 and have requested the Ombudsman review the complaint.

Reasons are:-

1. The complaint is relating to a lending decision more than 6 years prior to the date of the complaint so Im out of time.

2. They also feel its unreasonable for me to be refunded from 2018 as them paying me indicates they shouldn’t have borrowed any credit to me at all and it would mean I’ve had received an interest free lending from 2018 to date (Ive had the overdraft since 2008) and this puts me at an unfair advantage compared to other customers who have paid interest for that period and they dont think its fair?

The investigator has said if I want the ombudsman to go further than 2018 i must provide further evidence or representations? I’m not sure what else I can provide?

Just wondering if that is a typical response from Natwest. I was hoping they would just agree so we can get it over with but clearly not.

Sara (Debt Camel) says

Natest is being difficult about many cases over 6 years. It is a common ombudsman decision for overdrafts that you should get a refund for the last 6 years.

Has your situation been uniformly bad between 2007 and now? Are there any points in that time when it got noticeably worse which you think natwest should have noticed?

Did you have any other borrowing from natwest (loans, cards) in this time? or were you ever declined for any?

Natalie says

Hi Sara. Thanks for responding. Yes have I lived in the overdraft ever since I had it. In the investigators response they did see that in 2011 I started using payday lending services to make ends meet and used Wonga 14 times from June 2011 to May 2012 using and the overdrawn balance to make ends meet, pay utility bills etc, my income was never enough to bring it into credit. The investigators response they don’t feel there was any issues with the Overdraft initially however I applied again in 2011 for an overdraft increase which was denied and on that basis my account should have been reviewed a year later in 2012 when I was taking out the payday loans which is why they said they think NW acted unfairly from 2012 however only suggested they refund me from 2018, 6 years prior to the complaint. I apparently spoke with their Debt Management Team at NW in Oct 2012 which was unrelated to the overdraft they think its unfair to expect NW to remedy the unfairness going back to March 2012 and that I should have brought it to NW attention about it being unfair sooner. Im not sure what else I can do or say to make them consider the complaint from 2012 I’ve already said i think its unreasonable for then to expect me to complain about something I had no knowledge of until last year.

Sara (Debt Camel) says

I am sorry I missed seeing your reply.

So they will only refund you for the last 6 years?

Maid says

Santander just removed my overdraft facility after being in a payment plan. I called to setup a payment plan because I was stuck in the interest and never paying it off. The only reason plan they could after was to stop the overdraft which would impact my credit file and then repay. I unfortunately missed one payment so they withdrew the rest of the overdraft leaving my account seriously minus.

I have contacted santander on 2/3 occasions over the years as I was stuck in the overdraft and the fees were £50 per month at least I was living in my overdraft.

I have now just put a complaint in using your template. I really hope for a positive outcome.

AA says

Hi Sara,

I was just wondering if you or anyone has ever had to wait longer then 8 weeks for the final letter response?

In my case/complaint, the 8 weeks were up to day and I got a text saying they apologise for it taking longer then expected and it said I now go to the Ombudsman, but it also says I don’t need to do this yet and I am still awaiting the final letter. It also gives a deadline date 31st March which essentially extends the whole process I assume. This is a bit disheartening as I just want the final letter, even if it’s a no, i want this off my mind. Not have to hope and wait another month with the possibility it could all be for nothing.

It also a bit vague really, because now I don’t know whether to wait another month or just send it to the Ombudsman?

Sara (Debt Camel) says

Some people get these from banks, it seems to be random, it doesn’t mean your case is m,ore likely to be accepted or declined.

But if you get a No, you should really consider taking this to the Ombudsman and asking them to decide. At the moment banks are rejecting far too many good complaints, fobbing people off with replies that make it sound as though there is no hope…

Catrin says

Who was it with? I have one with Barclays where they keep extending their response!

Emily says

Sara I would just like to say a huge thank you, I sent my email of complaint to TSB in the middle of January, I’ve had a £3000 over draft with them for it must be ten years at this point and felt there was no way to ever pay this back. Well with you amazing advice I’ve literally just been paid back £4500 in interest and overdraft fees, £3000 of course being used to clear and remove my overdraft. I honestly can’t thank you enough for your advice and help. I would encourage anybody to please send the email with Sara’s draft above. I’m no sitting with a positive current account for the first time in ten years. Thank you Sara!!!

Tim says

Firstly, I’d like to say a massive thank you. I emailed your template (although slightly edited) to my bank regarding my overdraft from my Lloyds and Halifax bank accounts, 2 weeks ago today. I received the usual email stating that they’d got my email and would be in touch. I’ve just had a notification saying that a payment was recieved into my account (Halifax) which is the exact amount of the overdraft. I’ve had no other emails or phone calls from my bank, so unsure as to whether I’d also get my fee’s back or whether my overdraft from another account (Lloyds) has been cleared too (I dont have access to the other account and not even sure if that account is still open). Is it worth waiting to see?. It’s only been 2 weeks, so we’re still not near the 8 week mark yet…or should I go to the ombudsman now?

Thank you, Tim.

Sara (Debt Camel) says

Can you log into the other account?

Tim says

No. I managed to find the details in an old email, but it just says error when trying to log in so I’m guessing that account is closed. It looks like they’ve cleared the overdraft for the Halifax account though. At the risk of sounding greedy, do you think they may also refund the fees as requested in the email? As mentioned in my orignal comment, I havent had any contact from Halifax as yet.

Sara (Debt Camel) says

I think you should get a response in writing to your complaints about both the lloyds and Hilfax overdrafts. If you haven’t hear anything by next week, phone them up and ask

Tim says

Hi Sara. So it’s been 3 months now. I contacted the Ombudsman at 2 months as suggested and they simply said my bank has said they were working on my complaint, but it’s delayed (the bank also messaged saying so). I feel like Im being lead on at this point as even the Ombudsman arent pushing for a result?

Sara (Debt Camel) says

So it’s good you have gone to the ombudsman. They will be waiting for the bank’s decision at the moment. the bank will still be working on this, they haveb’t stopped.

Tim says

So just an update on the off-chance anyone else is having the same issue as me. I phoned the bank today, they said it still hadnt been assigned but I should be near the top of the list since it’s now been 3 months since I sent the original complaint. I’m hoping they’ll get back to me soon and I dont need to get the Ombudsman involved (if I still can by the time they get back to me).

Sara (Debt Camel) says

The Ombudsman has your case?

Tim says

Yes. It took them over 8 weeks to even get back to me, so I referred it to them. Hopefully the bank resolves the issue before the time is up and I dont need the Ombudsman to do their bit, all we can do is see what happens.

Tim says

So it’s 4 months since I submitted my complaint and still nothing. I’ve phoned Lloyds 4 or 5 times now and each time they simply say it hasnt been assigned yet. Seems a lot of people are making complaints. I’m not going to hold my breath on this one. The Ombudsman arent interested until Lloyds have made a decision, if they ever do.

Sara (Debt Camel) says

Lloyds will make a decision. Going to the Ombudsman doesn’t change this.

The Ombudsman can’t do much without getting the case file from the lender, it doesn’t make sense for them to try to start work now, especially as answering FOS questions would distract from getting you a response.

Do you have other debts you could make affordability complaints about? It is a big mistake to try to do these one at a time as you can’t guess which will be easy, which have to go to the ombudsman etc

Tim says

The only ones Ive got are with Lloyds and Halifax and I have both complaints with them. The huge backlog of complaints just shows how bad they are. Hopefully something happens before the end of the year lol.

Khadija says

I won my affordability complaint with nationwide, took about 5 weeks. Didn’t need to go through the ombudsman, so they’ve cleared the balance which was £3885 and they’ve refunded me £1132 in fees and interest that I paid over the past 18 months. If I hadn’t come across your page this never would have happened, thank you so much!

Ellie says

I made my complaint on the 11th Jan to Halifax, received the generic text receipt to say they’ve received it looking into it and my reference number, received another text 2 weeks ago apologising for the delay but I should receive a response by the 11th March, I decided to call and ask for an update, apparently my complaint hasn’t been handed over to a complaints manager to be processed so it hasn’t even been looked at yet, off the ombudsman I go as it’s not going to get handed over and resolved within 5 days as it’s still sat in backlog pile, feeling slightly deflated🥺

Jasmine says

Hi Ellie, have you received a response from Halifax yet? I’m in a similar position currently!

Amy says

I’m in the same position , logged my complaint 16th January and was told I would hear by 13th March. Then I got a text saying it’s taking longer than expected , it will now be looked into by 10th April. I rang them and was told exactly the same , that my case hasn’t even been assigned to a complaints manager yet! It is very frustrating x

Jasmine says

Mine was logged the 14th of January and still nothing from them 😔 seems to be taking forever!

Jane says

Hi just wanted to thank you

I used your affordability template to contact Lloyds bank about my overdraft

I have heard today that my complaint has been upheld and they will be refunding all the interest I have paid which will pay off my overdraft with some left over to go towards my debt

The whole process was quite straightforward although it took 3 months to resolve Lloyds did however give me a further £50 as compensation

I did have several conversations with a very nice guy from Lloyds I was worried about talking to them but he was very understanding and helpful and I always spoke to the same person

I will be overdraft free for the first time in 20 years

Thank you 🙏 I would never have thought of this had I not come across your account

For anyone thinking of doing it don’t hesitate you have nothing to lose

Sam says

Hi Sarah, I just wanted to leave a comment here after following this advice having seen it on your Instagram page. I had an overdraft of £1200 with HSBC, I was in persistent debt with this account using the maximum amount every month. I wrote to them with an irresponsible lending complaint. Within 10 days they called me to say they didn’t seem my overdraft unaffordable and felt their reviews and affordability checks were reasonable. However they could see I was struggling with debt and managing my finances. They offered to put me in contact with the ‘Financial hardship team’ who called me the next day. After speaking to this team and explaining my financial situation, they offered to wipe my entire overdraft and also a loan of £3000 that I had with them. I couldn’t believe how kind and supportive they were.

Sara (Debt Camel) says

Good result!

David says

I haven’t been lucky with Natwest. They rejected my complaint for the account originally was a student account in 2013 when an overdraft facility was open and converted into a normal account thereafter. But then they increased the overdraft a coupe of times since, because they say I asked it for. They claim everything they did, the assessment, the criteria was spot on. Maybe this doesn’t apply to student accounts? I am not sure.

Sara (Debt Camel) says

It’s not a question of “luck”, it’s that banks routinely reject complaints about old account and you have to send these to the Ombudsman to get them properly looked at.

A lot of complaints are won about overdrafts that started off as student accounts. You won’t win one by saying that the bank shouldn’t have set the overdraft limit so high at the start, but once they are later charging interest, you argue that from that point they should have seen that the overdraft limit was unaffordable

David says

Thanks. I am going to send it the Ombudsman as you suggested. Thanks for caring

RC says

Ive put in an affordability complaint to halifax about an £10k overdraft that was passed to third party in 2021. Halifax have had the complaint for now 11 weeks and today i was told it was with a review team, when i asked for further information they were unable to provide to me. I have already contacted ombudsman about it, as last week i was told that Halifax only just assigned a advisor to it after the ombudsman contacted them. Has anyone else has a similar experience? Im wondering if they will close the complaint as non upheld and have no urgency to review my complaint.

Sara (Debt Camel) says

Halifax seems behind on some cases – not all, some go through earlier than 8 weeks.

They will still come up with a proper response

Ellie says

Hello- I’m in the exact same position with Halifax, my 8 weeks is up tomorrow, I rang Halifax on Friday for an update and my case hadn’t even been passed over to an advisor it was still sat in a backlog, received a text this morning to say it’s delayed and taking longer than expected and that I should hear something by the 11th of April, I’ve reported to ombudsman but haven’t heard from them yet, if you don’t mind me asking what response did you get from the ombudsman?

Rc says

Ive not had anything back yet other than they have started the investigation so far

Rc says

Ive had a call from Halifax yesterday and today regarding my complaint. Todays call was to ask if they pay me funds where would I want them to pay the money. They haven’t confirmed they are paying anything to me, but sounds positive after the long wait.

Amy says

Hi do you mind me asking if you’ve heard anything back yet? I’m in the same position they passed the 8 weeks on 13th March and said they will be in touch by 10th April. I spoke with them yesterday to ask if this will be resolved by then and the advisor didn’t know 🙄so I’m not feeling to hopefully!

Pete says

I first posted on this forum in October 2024, explaining that I had been maxed out on a £15k overdraft with my bank since 2018. To keep it brief, I’ve been paying around £300–£400 a month in interest for the past six years. I raised a complaint with my bank, but they rejected it, so I escalated it to the FOS.

Today, the investigator upheld my complaint and ruled that the bank should refund all interest, fees, and charges from the point when my overdraft was increased to £15k. If the bank accepts these findings and doesn’t challenge them with any missing information, my overdraft will be completely cleared, plus I’ll receive roughly £6k. On top of that, they’ll have to pay 8% simple interest on the refunded amount (though I’m not sure how much that will total).

I can’t thank you enough, Sara—I never thought I’d escape this cycle of debt. Without this site, I wouldn’t have even known I could complain. I truly appreciate all your help along the way!

Sally says

Hi. Not sure if I would be a candidate for a refund on my overdraft. I have had an overdraft with Santander of £4000 for many years. I use it almost every day of the month and end up paying about £80 to £90 a month in charges. I used to pay just £5 a month to use the facility but when the banks increased their interest to 39 percent off it went up to this amount. There is no way I can pay it off immediately now it would take me years and they now keep writing to me saying that unless I make arrangements to reduce they can reduce or take away my overdraft which is causing me

Sara (Debt Camel) says

do you have other problem debts as well?

It sounds as though you should make a complaint to Santander, because you are about to lose this account anyway. A refund of a few years would nearly clear the overdraft.

You should also consider opening a new bank account now with a different bank and moving you wages and direct debits over to there.

Sally says

At the moment they only mention if I don’t start reducing my overdraft by 50 a month they could look at reducing my overdraft to taking it away altogether. Is it likely they are talking about closing my account altogether then as they don’t say that? Just got the letter and I was planning on paying it all off early October when I cash in my pension so was just trying to get to October before I have to worry about it. The was going to put in my complaint at that point

Sally says

I have just opened a current account with Barclays just in case. I worry that if I complain now to Santander they will close my account and then I am not in a position to pay the overdraft. Am I better waiting to see if and when they contact me in the next 6 months to either reduce or take away my overdraft at which point in 6 months I will be in a position to pay it. If they stop it now I have no way of paying it back immediately

Sara (Debt Camel) says

I can’t predict what they will do, sorry. Does your credit score matter to you?

Sarah says

Hi, this page has been such a game changer. I’ve put in two complaints, one to HSBC and one to Monzo. My question about the Monzo account is that I was in an overdraft from 2021 and every month I was in a minus balance ever since I had my increase request approved. I’ve never come out of the minus balance although I have received payments that could’ve taken me out of the balance, but I had to pay for things like rent, council tax, covering other debts like my credit card etc. so I worry they’ll argue that I had money that could’ve taken me out of my overdraft. Another thing, I minimised my overdraft and then went back to the original amount a while later because I fell on hard times. I applied for it and they approved, then I applied for a higher amount and they approved again. Do you think they’ll have a problem with this and reject my complaint?

Sara (Debt Camel) says

I had to pay for things like rent, council tax, covering other debts like my credit card etc. so I worry they’ll argue that I had money that could’ve taken me out of my overdraft.

That wont be a problem. You were paying for essentials. If all the money had gone on holidays and designer clothes, that may be different, but everyday spending isn’t.

It doesn’t matter if you asked for a higher limit, the lender has to make the same affordability check

AW says

TSB upheld my affordability complaint on my overdraft that I’ve had since (2014 student days!!!) and refunded all interest / charges from Jan 2020. Limit was £2,740 and they refunded £3,815.85 leaving a total of £980.53 (after tax exc). I’m thrilled and honestly can’t thank you enough!!! They’ve also removed the Overdraft limit at my request. Xx

DC says

Hello there,

I have been in and out of overdraft for twenty odd years. Late last year I started paying back agreed amount on this and other debts through a Debt Management Plan with Step Change. The other debts are loans from same bank as current account with overdraft, credit card from same bank and one other.

I wondered if, considering the above payment plan with StepChange, I should make the complaint or will it jeopardise the plan in place?

Many thanks in advance!

Sara (Debt Camel) says

Making these complaints doesn’t jeopardise a DMP – they are a great way to speed up a DMP! And they may even result in yiour credit record being clean a bit earlier.

I suggest you also make complaints about the loans and both credit cards.

AL says

Hi there,

I had an overdraft with TSB for £4,500 when I was 19 and only earning around £1,200 a month. I ended up in an IVA in 2019 and I have now paid it off. The account is showing as in default and the balance is still -£4,062. Would I be able to raise a complaint? Thank you.

Sara (Debt Camel) says

was this overdraft included in your IVA?

what default date shows on your credit record for this debt?

AL says

Hi, yes the overdraft was included in my IVA. The default date is showing as 29th January 2020, my IVA was arranged 21st November 2019. Thank you

Sara (Debt Camel) says

Winning an affordability complaint won’t help, as any refund will just be used to clear the amount of the overdraft that was legally written off at the end of the OVA.

But the default date is wrong, it should be the start of the IVA. See https://debtcamel.co.uk/repair-credit-record-iva/ for how to get that corrected.

Ella says

Hello- I’ve received a text from Halifax that they would like to call me today, I’m a tad worried about speaking on the phone with them, anyone else had this and could tell me what to expect?

Sara (Debt Camel) says

Banks sometimes do this. It’s not good or bad news, it seems random.

if they start asking questions and you aren’t 100% sure what to say, just say you aren’t good on the phone and can they ask in writing.

Same if they make you an offer – unless your are sure it’s great, ask them to put it in writing so you can think about it.

But if the idea makes you very anxious just say you would rather not talk on the phone as it makes you anxious

Ella says

Hi Sarah,

Thanks for your reply,

I’ve had the phonecall and I’m feeling really upset,

In my complaint email I highlighted my difficulties started December 2023, the complaints manager said they would upheld my complaint from August 2024 and refund the interest charges of £400 which would come off the overdraft total, current overdraft is £2100, she also said in 30 days she would close the overdraft leaving me with an un-arranged overdraft of £1700

I’m unable to pay off this £1700 unarranged overdraft, I asked what to do if I don’t accept this offer, she said it’s not a case of accepting it or not the overdraft would be closed regardless so I still have to pay it in 30 days, then she said she would also give me an £80 goodwill for my stress which has just been paid into my account, I don’t want to accept this offer, please help me what do I do now?

Sara (Debt Camel) says

You say your difficulty started in Dec 2023. what happened then? were you using the overdraft a lot before then?

Do you have another bank account you can use?

Ella says

Hi Sarah,

Thank you for your response, yes my difficulty started in 2023, I had just started using my overdraft but was maxed out on it, no I don’t have another account to use, do I take this to the ombudsman?

Sara (Debt Camel) says

Then you may not get much more if you go to the ombudsman – you have to argue that it should have been clear before they gave you the overdraft that it would have been unaffordable.

I suggest you get another bank account now, move your pay and bills payments over to that, leaving the halifax overdraft as a debt to be repaid – ask the hlifax for a payment arrangement for it.

Do you have other problem debts as well?

CS says

I have made a complaint with Halifax and today they’ve sent me my final letter saying they aren’t upholding my complaint. They’ve said I made applications for loan/credit card and overdrafts saying my income was ‘X’ and my bills were’X’, but I’ve been in 3 overdrafts for years totalling £2500, they increased them, gave me a loan for £5k and a credit card for £1500 during the same time period, despite refusals for loans etc in this time due to my credit rating. God knows how much interest I’ve paid. I’m going to the ombudsman but I’m wondering if it’s even worth it? Would really value your advise!

Sara (Debt Camel) says

You have had 3 overdrafts from the Halifax?

Roughly how many days a month are you in each of these? How long has it been like this?

CS says

It’s been like this for several years. When I had one I would pay it off on pay day in full, gradually throughout the month it would dwindle back to maxed out. With the 3, the credit card and loan I’m constantly maxed out on all 3 and can’t make a dent in them. It’s been like that for about 3/4 years now.

I’m fully in my overdrafts 75 percent of the month I’d say now

Sara (Debt Camel) says

I think this sounds worth taking to the ombudsman!

L says

So grateful to have come across your page Sara.

Just recently heard back from Halifax after about 6 weeks of waiting and they’ve upheld my irresponsible lending complaint. Was a little apprehensive at first about making the complaint due to problematic gambling but they’ve since come back and refunded interest across multiple lending streams.

If in doubt but feel you’ve got a good case then please I urge you to use Sara’s templates and get those complaints in.

Thank you so much Sara for all the work you’re doing, it’s truly amazing!

Elizabeth says

Hello,

I’ve put a complaint in with my bank and they have now come back saying that I as I got added onto the account with an overdraft on 2013 that I can’t put a complaint in.

Is this correct?

Where do I go from here?

My husband would only refer it to me as he’s got anxiety and adhd.

Any help is appreciated!

Sara (Debt Camel) says

which bank is this? how many days of the month are you in the overdraft?

Elizabeth says

It’s with NatWest Bank.

I’m in my overdraft everyday. In fact I’ve not been out of it for many years. We are really struggling with debt and can’t get out of it due to fees upon fees.

Sara (Debt Camel) says

Send this straight to the Ombudsman. You may not be able to get a refund back to 2013 but even the last six years would be a help..

What other debts do you have? Any others with NatWest? And loans taken out in the last 6 years, still going or settled, may have been unaffordable. Any credit cards that have increased your limits in the last 6 years?

And if you are struggling a lot, talk to StepChange about a debt management plan, where all new interest on cards and overdrafts is stopped. Affordability complaints can take a long time as many have to go to the Ombudsman, so a DMP gets you into a safe, stress free space while they go through. Winning any then really speeds up your DMP. And helps clean up your credit record.

See https://www.stepchange.org/how-we-help/debt-management-plan.aspx

Jen says

Hi Sara

Iv been waiting for the financial ombudsman to get back to me about a complaint for the last 3 months and I finally got a reply, they are asking me quite specific questions that I’m not sure how to answer with specific dates. Such as –

When specifically, did you realise you had cause to complain? (Please note this is different to when you realised you could complain).

When did you become aware that this account was causing you to struggle financially, and what month and year did you realise this?

What or who did you blame for any difficulty you may have had repaying and why? What month and year did you realise this?

My complaint was for a credit card and increases from 2016 – 2018 which was over 6 years ago so got rejected straight away from the bank and they said I should have know I could of complained when I went onto a DMP in 2021 over 3 years ago so they rejected it. Any advice on how to answer these questions? Thanks

Sara (Debt Camel) says

you has other debts as well as this in the DMP? Large ones?

Jen says

Yes I did, 4 credit cards and 1 large loan, I won complaints for most of these direct with other lender in December as it was all mostly with 1 bank. I just finished paying off my DMP last month (I used redundancy pay I had).

Ag says

I have an account at Barclays bank since 2011. On October 2018 i have asked to increase my overdraft from £2700 to £5000. I was moving so needed money for deposit etc. before my previous landlord returned my deposit. My monthly take home pay was around £2200 at that time. Then a lot things happened : covid, i got pregnant, my husband lost his job, so we ended up in a position we are now. even after the payday the account is still in minus and my overdraft fees come to around £100 per month. We have a few other debts, which we are half a way paying back, never missed any payments. I have received letters from Barclays many times saying i can get in touch if struggling, but i never did as i felt ashamed. Would you advise to contact the bank and talk or would it be better to try my luck with affordability complaint? Thanks

Sara (Debt Camel) says

Then a lot things happened : covid, I got pregnant, my husband lost his job, so we ended up in a position we are now

So things were OK until 2020?

Ag says

I would’t say so. We lived in South, the area was quite expensive, so we decided to move up North hoping to save on rent and commute. When i look back into my statements I did use overdraft before as well. Between jul 2016-jun 2017 i’ve paid £100 overdraft fees, between jul 2017- jun 2018 i paid £500 in overdraft fees ( been overdrawn most of the days) and they’ve agreed almost to double my overdraft limit on October 2018. Thank you

Sara (Debt Camel) says

So this sounds as though you have old bank statements – that’s a help.

I think you have a good case here that they shouldn’t have increased your credit limit in Oct 2018 as you were already struggling.

Do you have a separate bank account? Because when you have such a large overdraft, often the only practical option is to move to a different bank and then try to repay the overdraft like any other debt. Winning an affordability complaint should reduce this, but it’s hard to say how much

Ag says

Thank you for your reply.

I have Monzo bank account on my name too. It is being used as “joint account” atm. Almost all direct debits come from this account and my husband sends money in so we budget into pots etc, organise all the family spending.

All the spare money go into Barclays to reduce overdraft, but we are not getting anywhere atm as fees are like £100 a month.

I am not working atm too ( had to leave my job after maternity leave as I could’t work around my husband hours, but planning to be back working from September as little one will go to nursery, so our income will increase.

How do i move to different bank with such a big overdraft? Monzo has got only £200 overdraft. I have never tried to increase it, but don’t think they would atm.

I am worried to send a complaint. What happens if complaint gets declined? Will Barclays close my overdraft and ask to repay it back in short time period?

Thank you very much for your advice

Sara (Debt Camel) says

So I think this sounds like a good complaint but I am not sure how much you may get back so you may well be left with an overdraft. This isnt a reason not to fo it, you can’t carry on living like this, it’s miserable and you can never get out of it.

The reason I asked about a different bank account was to suggest that if you are worried about what Barclays will do, you could get your wages paid into a different account. Are you paying any important bills from the Barclays account or are they all from Monzo? Is Barclays just your spending account as popped to family amending eg groceries which is from Monzo?

You won’t need an overdraft on another account, you just leave the barclays overdaft behind as a debt. Winning a complaint then reduces that debt a lot and the monthly charges so it’s easier to clear.

Sara (Debt Camel) says

so typical answers are as follows, but make sure they are accurate for you!

When specifically, did you realise you had cause to complain? (Please note this is different to when you realised you could complain).

I only found out that lenders had to ensure that credit cards, loans etc were affordable for the customer last year in [month – presumably this was just before you actually made the first complaint?]. It was at that point that I realised some of my lenders cannot have done this so I had a reason to complain.

When did you become aware that this account was causing you to struggle financially, and what month and year did you realise this?

My finances were difficult for many years, starting in about [when? some date before 2016?] and my debts were increasing mostly after that. Apart from this credit card debt, I had a loan and several other cards which went into my DMP. So I was always trying to get through to the next month, looking for any 0% transfers, try to cut expenses, looking for a new card, or thinking about consolidating. This credit card debt was just a part of this picture but not one I focused on in particular.

What or who did you blame for any difficulty you may have had repaying and why? What month and year did you realise this?

I thought I had been really bad at managing money and I regretted the amount I spend earlier that led to more and more debt. This led to me taking debt advise in 2021 and starting a DMP. The debt advice never suggested that my lenders were in any way to blame, the debt was treated as my problem to repay and the lenders would be asked to freeze interest. So although in 2021 things had come to a head and I was trying to be responsible about repaying the debts, I was still blaming myself for the difficulty not the lenders for lending more that was manageable.

Amanda says

Hi Sara

I made a complaint to Santander on the 3rd February 2025 regarding my £1600 overdraft I’ve been continuously in for many years now.

I had no clue that this was an option until I came across your instagram account in January 2025. I was unsure as to whether I should make the complaint but with the feedback I kept seeing from others and then the templates you have created, made it so simple to do so I went ahead.

Today, 6 weeks since I sent the email my complaint has been upheld and the £1600 overdraft has been refunded back to me in full and removed from my account.

I am extremely grateful to you for your work you do and all the help you’ve given me.

Emma says

Hi Amanda,

Did Santander come back with any further questions before refunding the overdraft? Also did they try to call you. I put in my complaint today via email and they’ve emailed me back saying not to send personal details via email and that they’ve logged it and to expect a call but I really don’t want to speak to them on the phone as it makes me really anxious.

I just wanted to know what to expect in the next few weeks from them.

Harriet says

Hi Sara,

HSBC increased my overdraft in 2019 to £4000 and for the past few years I have not been able to get out of it. Before increasing it was already maxed out at £1500. I raised an affordability complaint as at the time my monthly income was around £1700 so don’t think this should have been allowed. They have rejected my claim and said they did not act out of the guidelines. I don’t really understand how the bank think I am comfortably get out of the overdraft with the fees coming to around £110 per month. I filled in income and expenditure which leaves only around £100 per month! Do you think its worth going to the ombudsman?

Sara (Debt Camel) says

Are you in the overdraft most or all days of the month?

Do you have other debts as well?

Rc says

Following on from my complaint to Halifax, they have paid me £20k back today! Thank you Sara for this helpful website and advice, as I never would have thought I would be in a position to complain!

Sara (Debt Camel) says

That’s massive! Was it just for an overdraft or loans and credit cards as well? Going back how far?

Rc says

It was a £10k overdraft from 2016 until now, it had been passed to a third party and i now can repay the outstanding in full and save the rest , Im so grateful for you setting up this site, it has made a huge difference to my circumstances. Thank you again

Carolann Nolan says

Hi I hope you don’t mind me asking but how long did they take to reply to your complaint? I have an affordability complaint in with Halifax/Bank of Scotland for a 20year overdraft and credit card. They have until 25th March to reply so I was just wondering how long yours had taken.

Rc says

It hit 3months this week, i spoke with a advisor last week asking for information around my circumstances with the overdraft who said that they were prioritising my complaint due to length of time for them to look at it.

Eddy P says

Hi,

I made an affordability complaint for my overdraft, and the bank have replied back to the FOS stating that student loans I received would have been enough to cover the overdraft.

From my understanding student loans are not classified as income and we have to pay back and is to help with costs whilst at University.

Is this correct.

Thanks

Sara (Debt Camel) says

How long ago did you stop being a student? when did the bank start charging you interest?

Eddy P says

Hi,

It’s been over 12 years. My bank account was a normal current account by the time I started my second degree and I was being charged in 2013.

Sara (Debt Camel) says

And this account is still open? is the overdraft still a problem?

Eddy P says

Hi,

Closed account last year and on a repayment plan to pay off the overdraft.

Sara (Debt Camel) says

ok so this problem was continuing in the last 6 years. I suggest you tell the ombudsman that you aren’t just complaining that the limit was too high originally, but that the bank should have seen it was unmanageable high in the reviews that should have done of the account.

Stewart says

Hello Sara.

Received a fairly positive response, in my favour, from the investigator, but TSB haven’t agreed with their findings and have just been sent the following, from the ombudsman, today. Is this a common thing?

Our service has received judicial review claims which challenge the way we approach complaints where section 140A is relevant law. Whilst the complaints are not identical to yours, the approach we’ve taken to complaints about unfair relationships is being challenged in the courts, and the outcome of those court proceedings may have the potential to impact the way that we consider your complaint. As a result, I’m afraid we won’t be issuing a decision on your complaint whilst the matter is being considered more widely.

Stewart Duncan says

Hi Sara

Have you heard of this before, and do you have any knowledge which could help?

Sara (Debt Camel) says

The JR cases were heard last week. It may take a few months for the judgment to be published, then it is always possible that one of the lenders (NatWest, Santander, Barclays and Vanquis) or the Ombudsman may decide to appeal. Things may take a while yet, this is not under the ombudsman’s control

Marianne says

Hi,

I have complained to Lloyds bank about my overdraft interest fees and I haven’t had a reply within 8 weeks. How do I forward this on with the ombudsmen?

Thank you

Sara (Debt Camel) says

Une the FOS online form, there is a link in the article above these comments.

lloyds/Halifax do seem behind at the moment and a lot of people are getting told they will get a reply by dd/mm/yy but they now have the right to go to the ombudsman.

Have they told you this? If they haven’t, have you had any acknowlegement at all from yhem about your complaint? If you haven’t, you need to phone them up to check they actually have the complaint.

If they have asked you to wait a few more weeks, it’s hard to know what to suggest. They are sometimes making very good offers but sometimes a very good case gets a rejection.

In theory if you go to the Ombudsman now you get “further ahead in the queue” to get your case picked up. But the Ombudsman won’t do anything until Lloyds have responded to your complaint. Is your situation really difficult at the moment?

Marianne says

This is what I received…

Dear Miss Buckingham, we’re still looking into your complaint. We know it’s taken us longer than it should have to resolve this and we’re sorry for the delay. Because it’s been eight weeks since you told us about your issue, you can refer your case to the Financial Ombudsman Service. You don’t need to do this now as you’ll still have time after you receive our final response. You can find more details at https://www.financial-ombudsman.org.uk/businesses/resolving-complaint/ordering-leaflet/leaflet. Your reference number is NC12304473. If you need to speak to us, please call 0800 096 1279. We’ll be back in touch by 20 April 2025 if we still haven’t resolved your complaint.

I think I’m going to wait and see if they do reply in the next couple of weeks.

Jade says

Hi,

I am in the same position as you with Halifax, that they have extended their reply date. May I ask if you’ve had any other communication since the 8 week deadline? Have you referred your case to the FOS?

Thanks!

K says

Hi recently used the template letter to send to the bank they have gave me a £2000 overdraft which they are saying I could afford but they should have been doing a human check and have agreed to being irresponsible for this due to having a lot of gambling transactions, they have offered £1100 of fees back however they are only Calculating this back to 22 because they said prior to then my over draft was only £700 but from then I increased these over the years to 2024, do you think its still worth go to the ombudsman to look further back ? As there was still a considerable amount of gambling prior to this ?

Sara (Debt Camel) says

So before 2022, how many days a month were you using the overdraft typically?

K says

Just about everyday because my wages didn’t pay it off

Sara (Debt Camel) says

So when the overdraft was only 700, your wages less why bills that came out immediately, were less than 700?

K says

Yes so I was mabye only getting a wage of £400/500

Sara (Debt Camel) says

So it sounds as though going to the ombudsman may be worthwhile as even though pre 2022 the overdraft was “only” 700. it was still unaffordable.

Stan says

Good afternoon

Is it possible and are there any templates or methods to request refunds from book markers online for failings in social responsibility?

Many thanks

Sara (Debt Camel) says

For gambling? Not that I know of, sorry

Shaun says

Hello, firstly thanks for all the information on your website, it’s helped me so much!

I have complained to Royal Bank of Scotland and Monzo re overdrafts. Both have rejected. FOS have replied to me regarding my RBS with a series of questions, do you have any advice on how these should be answered?

– When did you first know you had suffered a loss resulting from the lending?

– When did you first realise RBS was at least partly to blame for that loss?

– What was it that made you aware of this?

– If there were any specific reasons why you weren’t able to raise this complaint sooner? Please provide details.

They are also looking for bank statements and credit reports from before the bank can supply. In all honestly, I had no idea I could complain until I came across your Instagram so I’ve no idea how to respond. Thank you!

– Are there any exceptional circumstances that prevented you from bringing the complaint earlier? If so, what were they and how did it prevent you from complaining?

Sara (Debt Camel) says

If you can give me some details about the history of the RBS overdraft (when did it begin, when did it get very difficult, has the limit ever been increased, how many days a month are you in it and has it been like that a long while, have you had a lot of other debts etc) and how you found this page (saw claims company advet, told by friend, seen on Tiktok, there are no wrong answers!) I can make some suggestions.

Have the problems continued for the last 6 years? If there are no statements before then, then it will be very hard to win back a long way. But even a 6 years refund could be good?

Shaun says

Hi Sara,

Thanks for getting back to me!

It was a student overdraft, around 2014. It was continually increased (at my request). I can’t remember what year it stopped becoming student and started charging but well over six years. It’s been £2250 for around 8 years. It’s been maxed out that whole time till around 7 months ago (as soon as I was paid, it basically covered the overdraft so it wouldn’t have been used for 1 or 2 days in the month, if that).

Other debts – Monzo overdraft which I’m also hoping to complain to them about (Monzo haven’t accepted any responsibility). 2 credit cards (totalling under £5k), car finance, PayPal credit and possibly a store card (I think it was the same time!).