Have you had big overdraft problems for a long period?

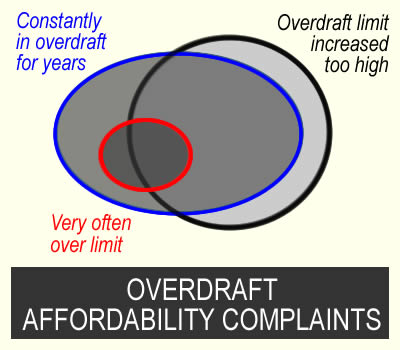

You can make an affordability complaint and ask for a refund of overdraft charges if:

- your overdraft limit was set too high at the start or increased to a level you are unable to clear; or

- your overdraft usage showed you were in long-term financial distress. For example, being in the overdraft all the time, or using an unauthorised overdraft a lot

- your overdraft was originally a student account with no charges, but now interest is being added and you are in the account all or almost all of every month.

This article shows how to make an affordability complaint to your bank, with a free template letter to use. If the bank doesn’t make a you a good offer, it is free to take your case to the Ombudsman.

These complaints do not hurt your credit record. And

Contents

Overdraft affordability complaints

Overdrafts are supposed to be for short-term borrowing

Overdrafts are intended to be used for short-term problems, not as long-term borrowing. A bank should review a customer’s repayment record and overdraft limit and if there are signs of financial difficulty, offer help.

One sign of financial difficulty is hardcore borrowing for a long period. The Lending Code defined hardcore borrowings as “the position where a customer’s current account overdraft remains persistently overdrawn for more than a month without returning to credit during that period”.

Some Ombudsman decisions

All cases are very individual. But these examples give you an indication of what the Ombudsman thinks is important.

In this NatWest decision, the Ombudsman decided:

NatWest did have an obligation to monitor Miss K’s use of her overdraft facility.

Any fair and reasonable monitoring of Miss K’s overdraft facility would have resulted in NatWest being aware Miss K was in financial difficulty … by October 2014 at the absolute latest. So NatWest ought to have exercised forbearance from this point onwards.

In this Santander case, the bank didn’t notice hardcore borrowing:

By this point, Miss C was hardcore borrowing. In other, words she hadn’t seen or maintained a credit balance for an extended period of time. Santander’s own literature suggests that overdrafts are for unforeseen emergency borrowing not prolonged day-to-day expenditure. So I think that Miss C’s overdraft usage should have prompted Santander to have realised that Miss C wasn’t using her overdraft as intended and shouldn’t have continued offering it on the same terms.

Decide which reasons apply to your overdraft complaint

In the overdraft all, or almost all, of the month for a long while

This is the most common reason for winning a complaint

Overdrafts are meant to be used when you have a short term problem. Using the overdraft a lot for a few months is fine. Or for a few days at the end of a month before you are paid.

Banks should review your overdraft annually. This is in most overdraft terms and conditions. And even if it isn’t, the Ombudsman says this is good industry practice.

So at one of these reviews, your bank should have seen if you were in difficulty with the overdraft. For example if you are in the overdraft for all (or almost all) of the month for a prolonged period. Or if you were often exceeding your arranged overdraft limit.

I would say over 18 months or 2 years is prolonged borrowing, not short term.

The bank set your limit too high

This may have been from the start when you were first given an overdraft. Or the initial low limit may have been fine, then the bank increased it to a level which it was impossible for you to repay.

If the bank saw signs of financial difficulty, it should not have increased your credit limit, even if you asked for it. And it should have considered offering your help instead (the regulator’s word is forbearance), for example by stopping charges.

But what is too high?

This depends on your income and expenses. An overdraft of £2,000 for someone whose income is £1,800 a month is a lot – but if you earn £5,000 a month, then a £2,000 overdraft may be reasonable.

Other points that help a complaint

You won’t win an affordability complaint by saying the charges were too high.

Instead, you say the bank should have known they were unaffordable for you because of all the financial problems it could see on your statements and your credit record.

Here is a checklist, do any apply to you?

- often having direct debits or standing orders not being paid;

- a lot of gambling showing on your statements;

- significantly increasing other debts with the same bank (you may also be able to complain about those loans or credit card);

- being recently rejected for a loan or a credit card by the bank;

- significantly increasing debts with other lenders showing on your credit record;

- a worsening credit record – maxed out credit cards, new missed payments, payment arrangements, defaults etc;

- using payday loans;

- mortgage arrears;

- a reduction in the income going into your account.

Free student overdrafts

You can only win a complaint about these after the bank has started charging you interest

Making your complaint

What you need at the start

You don’t need to know the dates your limit was increased before complaining, my template asks for them.

You don’t need to send statements to the bank with your complaint – the bank already has them!

You can’t go back and see exactly what your credit score was in say 2021 when the bank increased your limit. But your current credit record shows what was happening back six years, so download your credit report now and keep it. The sooner you get the report, the further back it goes. I suggest you get your free TransUnion statutory credit report.

Send a complaint by email

I don’t recommend phoning to start off a complaint. It’s too complicated and you will be talking to someone that doesn’t specialise in these complaints.

I think email is the simplest way to make these complaints. Here is my list of bank email addresses for complaints.

An alternative is to send a long message in the app. But if this means using a chat facility, it’s not usually a good idea, as you are again talking to someone who doesn’t understand what you are saying and tries to tell you what help is available with your overdraft – when all you want is to have your complaint considered.

A template you can adapt

In the template below, I’ve invented some examples and dates so you can see how a complaint email could read. The bits in italics should be changed or deleted to tell your story. Delete dates if you don’t know them. If a sentence doesn’t sound relevant, delete it.

I am making an affordability complaint about the overdraft on my current account number 98765432.

Your identity details (these are needed if you complain by email, not if you use secure message):

My name is xxxxx xxxxxxxx. My date of birth is dd/mm/yy. The email address I use/used for this account was myaddress@whatever.com.

Your home address (if you know the bank has your current address, ignore this):

My current address is xxxxxxxxxxxxxxxxxxxx. Please do not send any letters to older addresses you may have on your records.

If your overdraft was originally a student overdraft with no interest include this, otherwise delete it:

My account started as a student overdraft and no fees were charged. I am complaining about the period after, when you started to charge fees.

START BY SAYING they should have noticed your financial difficulty

Overdrafts are meant for short-term borrowing but you could see I was unable to clear the balance in a sustainable way. I was using the account for long term borrowing as I could not get out of this. The fees and charges you were adding were making my position worse.

I am complaining that [every year since [20xx] OR for many years] you have failed to notice my difficulty during the annual reviews of my overdraft. You should have offered forbearance eg by stopping interest and charges being added.

By 2017 I had been in my overdraft constantly for many months, not getting back into the black even when I was paid. This “hardcore borrowing” is a clear sign of financial difficulty. My income was only £1,850 a month – after I had paid bills, there was no way I could hope to clear an overdraft of £3500 in a reasonable length of time.

OR

By 2021, although my salary took my account briefly into credit, within a few days, I was back in the overdraft.

include any other points that show you were in difficulty

You should have seen that I was in financial difficulty because you rejected my loan application in 2021.

You should have noticed that the income going into my account decreased from 2020.

From 2020-22 there was a lot of gambling showing on my account.

In 2022 and 2023 there were a lot of rejected direct debits on my account.

… or anything else!

Say if the initial limit was too high or it was increased too high

You should never have given me an account with such a large overdraft. When I applied, you should have checked my credit record and income and seen I had recently missed payments to a credit card and had taken several payday loans.

OR

You should not have increased my overdraft limit. When you increased the limit, you should have seen that my debts to other lenders on my credit record had increased a lot

OR (for accounts that had been student accounts)

You should have seen after [2020] when you started charging interest that the limit was too high to be repayable on my income.

In your reply to this complaint, please tell me when any limit increases were and how much the limit went up.

END BY asking for a refund of charges and interest:

I would like you to refund all the interest and charges that were added to my account from 2016 when you increased my overdraft limit.

OR

I would like you to refund all the interest and charges that were added to my account from 2021 when you should have realised that my finances had got worse to the point that I was no longer able to clear the overdraft.

Please remove any late payment and default markers from my credit records.

Points to note

Student overdrafts

You won’t win a complaint about a student overdraft saying you were a student and it was unaffordable at that point.

But when the bank has started charging interest, it should start doing reviews and check if you are in difficulty. So from then on, you can win affordability complaints.

You can complain if the account is still being used or if it is closed

These complaints can be made if:

- you are still using the account or you have stopped using it and are paying it off;

- the account has been closed;

- the bank defaulted it and sold it to a debt collector (here you still complain to the bank, not the debt collector). If the debt collector has gone to court and got a CCJ, add a sentence to the template saying you want the CCJ removed as part of the settlement of your complaint.

But if you have had an IVA or bankruptcy after these problems, or if you are still in a DRO, then you shouldn’t complain – ask in the comments below for details.

Old accounts

Banks may say FOS won’t look at an old complaint, but this isn’t right. FOS will often look at a complaint if it has been open in the last six years. How far back FOS will go seems rather random, but it should be possible to go back at least 6 years.

Open and recently closed accounts aren’t a problem – the bank will still have your statements.

If your complaint is about an account that was closed more than 6 years ago, it’s going to be very hard to win.

Packaged bank accounts

These affordability complaints are not about the fees on packaged bank accounts. MSE has a page about packaged bank account charge complaints.

Personal accounts, not business accounts

The complaints covered here relate to personal accounts. For business accounts, talk to Business Debtline about your options.

The Bank replies

They want to phone me!

People are often scared if they get this message. But it may be good news! You can just ignore it or say you would like a reply in writing.

If you decide to take the call, it helps to be prepared:

- have a pen and paper handy so you can write down anything

- if they say they are partially upholding the complaint, ask them the date they are refunding the fees from, and how much. And say you would like to see this in writing before you decide whether to accept it.

- if they ask you questions that sound complicated or worrying, ask them to put the questions in writing as you find the phone difficult

- when they say they are rejecting the complaint, ask for this in writing, as you will be going to the Ombudsman.

Rejection/poor offer – go to the Ombudsman , it’s free

Banks reject many good complaints, hoping you will give up. So don’t! You know if the overdraft has caused you a lot of problems.

You can’t go straight to the Financial Ombudsman (FOS), you have to wait for the bank to reply, or for them to have not replied within 8 weeks.

Here are some things banks may say to try to put you off:

- you could have declined the increase to your overdraft limit – FOS probably won’t think that is a good reason

- you never let the bank know you were in difficulty – FOS probably won’t think that is a good reason

- your salary was enough to return you to credit each month – this is misleading if bills meant you soon went into the overdraft;

- FOS will not look into things that happened more than 6 years ago – if your account was still open in the last 6 years FOS may well look at it.

And the bank may offer to refund fees for the last 15 months say, even though your problems have been large for many years. Think twice about accepting a low offer – you won’t put this offer at risk by going to the Ombudsman.

If you are offered a refund for the last 6 years but not any further back, have a think if this is a good enough offer. It is unpredictable whether the ombudsman will be prepared to go back further than 6 years.

If you aren’t sure, post in the comments below.

To send the case to FOS, complete this online form:

- you can use what you put in your complaint to the bank;

- if the bank rejected your complaint or made a low offer, say why you think this is unfair;

- use normal English, not legal terms.

You don’t need to send your bank statements – the bank will send those to FOS. And you don’t need the policy documents for your bank account, the lender will supply those to FOS if they are needed.

Do these complaints work?

Yes! From 2024, some banks are making more offers directly.

A Guardian article featured a case where someone used the template letter here. Barclays denied it had done anything but made an £8,000 “goodwill” payment to the customer.

And if your bank rejects your case, people are winning cases at the ombudsman. FOS is a friendly service although it isn’t speedy. It isn’t faster to use a solicitor or a claims firm,

The comments below this article are from other people who have made this sort of complaint. That is a good place to ask for help if you aren’t sure what to do.

Refunds from unaffordable loans

JJ says

Hi Sara,

Hope you’re well! My investigator has determined that NatWest were indeed at fault, but in the settlement nothing is mentioned of a refund but rather having my entire overdraft balance (£7500) written off, should i question it or let it be? id estimate my total interest payments have amounted to around £7000 so this would be considered a good outcome, just unusual? Really appreciate all the help you provide here.

Thankyou!

Sara (Debt Camel) says

It does sound unusual but if you think it’s a good result I suggest you say that is fine!

Fingers crossed that NatWest accept it.

JR says

Hi Everyone

Just wanted to say a massive thank you to Sara, I’ve won my complaint against Santander for a unaffordable overdraft – I just wondered if anyone else was in the same boat with them and how long they usually take to pay out! I’ve not even had a statement to confirm how much they are going to refund so I can check it! I know they have 4 weeks to issue the money, however does anyone else have experience of how long they take?? It’s been 2 weeks and all I have is radio silence

Thanks :-)

KB says

Hi JR

Amazing news!

I hope you don’t mind me asking, How long did it take them to look at this?

I raised mine on the 4th October and it’s been 8 weeks and they’ve responded to advise it’s taking longer and that I can wait for them to complete review or escalate to the FOS.

Wondered how you’ve gotten on as I’m unsure what to do. For reference I spoke to them Monday and they said the complaint hadn’t even been looked at.

Thanks in advance

Tracy says

Hi Sarah you helped me massively previously with advice relating to payday loans. I didn’t realise you can make complaints about overdrafts! I started work in 2001 and opened a Santander current account, within a very short space of time I was given a £5000 overdraft. I can’t recall my salary at the time but I do remember it wasn’t huge, I had 3 dependent children and worked part time. I used the overdraft every month, my salary would never clear it. On 5 January 2018 my house sale completed and for the first time since it was provided, I cleared my overdraft. In fact on the day the funds hit my account I had 15p of the 5k overdraft left! I’ve not used it since, it’s still there. Would I be able to complain at this stage or is this too long ago. Years and years of interest were being paid. The bank would have seen huge amounts spent on gambling and payday loans. Many thanks tracy

Sara (Debt Camel) says

You can complain, but it may be very hard to win this one. It’s comparatively easy to go back 6 years, so normally worth doing just for that, with any over six years as a bonus. But yea you cleared the balance about 6 years ago, none of this is easy. Normally it may be possible to go back more than 6 years but these case all have to go to the Ombudsman and FIS may say you should have known you could make a claim earlier because of the payday loan refunds.

Tracy says

Thank you Sarah, thinking back I was on child tax credit etc as I could only work part time. I was made redundant in Dec 2013, that cleared the OD but it was back in force in 2014, and I only cleared it when I sold my home. I have seen some other comments where FOS is saying payday loan refunds would have prompted unaffordability claim, however as others have said, I had no idea that an OD would fall into that category. It’s all such horrendous memories in a massively abusive marriage, with a partner that literally sold household equipment like TVs and Vacuum cleaners to fund his habits and regularly stole money that I earned. I did eventually escape the marriage but not the stalking and violence that continued for many years after. He passed away last year, I’m pretty sure I have PSTD, as I still have lucid dreams and think I see him in the street sometimes then remind myself it’s over. Thank you for your help and guidance. Tracy

Tracy says

Hi Sara quick update re overdraft complaint to Santander. They didn’t have an outcome at the 8 week stage so I referred it to the FOS. Once FOS contacted them they agreed that they had not reviewed the OD as they should have, but have randomly only offered a refund of interest/charges for 2015-2016, they state that they only chose this year because that’s when their fees increased. I contacted Santander and have asked for all statements since I opened the account in 2001. They are sending them by post. I contacted my investigator to advise and he said it didn’t matter because the FOS will only ever look at complaints within the last 6 years? I’m certain I’ve read some outcomes where because of hardcore long term borrowing the ombudsman has made a decision to go back further? I’ve also added a question on credit card page I could really do with some advise about. Thank you

Sara (Debt Camel) says

is the account still open? if not, when was it closed?

Tracy says

Yes it’s still open

Sara (Debt Camel) says

“he said it didn’t matter because the FOS will only ever look at complaints within the last 6 years?”

Well that isn’t correct – FOS can decide to look at older cases if you have only recently found out that you had a cause to complain.

I suggest you go back to the investigator and argue this

Tracy says

Thank you Sara, I’m just waiting for all the paper statements to come in from Santander. As soon as the FOS contacted them they made the offer of the refund just for 2015-2016, he has asked them why that particular year only and they responded as in first message above. He said if Santander refuse to let the FOS investigate further back there’s litttle they can do? I’ll keep you updated.

Sara (Debt Camel) says

You need to say that under the 3 year rule FOS can go back further.

Tracy says

That’s really helpful, I’ll mention the 3 year rule. I’d be staggered if they thought giving someone earning around £700 a month could ever get out of being 5k overdrawn for close to 20 years possible. Without a single review by the bank ever Thanks again

Sara (Debt Camel) says

The point to emphasise is that until recently you did not blame Sanatader, you thought it was your own fault for using the overdraft too much. And it wasn’t until you found out last year through social media that Santader should have been making annual reviews that realised they couldn’t have done this so you had a reason to complain.

Tracy says

Perfect thank you

JJ says

Are banks usually insentivised to accept claims? like are there repercussions if they go to the ombudsman? Both my cases with natwest (overdraft and loan) were accepted and refunds in both cases have been suggested, but Natwest is yet to respond to either of them.

Sara (Debt Camel) says

There are no direct incentives except that adjudicator decisons are not published but ombudsman decisions are. However FOS will get fed up if a lender is routinely rejecting adjudicator decisions and the bank will be called in for meetings.

JJ says

The £2000 refund for the loan was sent to them on Friday and was already accepted yesterday which was good news, unfortunately the overdraft refund is coming up to the two week cut off, fingers crossed!

Lukas says

Monzo Bank, all accounts closed.

I had an email from them that they are closing all my accounts: main account overdraft by 1750, Flex maxed up to 3500, and loan 7000.

They were giving me this money and increased nonstop, and all the money went to gambling or transferred to my other account and used for gambling again.

They borrowed over 12K without any checks, closed all accounts and asked me to pay everything. If not, they will default all accounts on the credit report. If you try to call them, they will never answer; if you email them, they will replay the automatic message after two weeks.

After they closed my account, I sent payment ( that I took from my other credit card) for an overdraft to pay in full and close the account.

By accident, I put a reference that is connected to the loan and all the money I sent they put towards my loan.

Please see the respond from them:

We’ve had a look into your payment from the 3rd of October, and can see the payment was sent with the reference ‘LN’ as the incorrect payment reference was used the payment was put towards your loan. Unfortunately, we’re unable to move this from the loan to the overdraft.

Please advise what to do – I already complained that all this money needed more responsive lending, and I shouldn’t get it without checking my situation.

Sara (Debt Camel) says

Have you opened a new bank account and switched to using that?

Lukas says

Hi Sara,

Monzo closed all my bank accounts in October without any notice and sent me an email that I needed to pay the outstanding balance via a different bank account by transfer. I have Barclay’s, so I’m making payments from there to Monzo ( they have a Barclays bank account ). I maintain all my payments on time, so I’m sending them payments. You can see above I just put in a different reference number, and now they don’t want to settle my account. Please note that payment to them is to same bank account.

I don’t know what to do – I already complained that they let me borrow almost 12K without any checks, but I don’t want to have any default made by them.

It is impossible to speak to them; I can’t access the app or online.

I’m not sure all this process is a bit weird.

Sara (Debt Camel) says

I think you need to talk this through with a debt adviser. You could go to your local Citizens Advice or phone National Debtline on 0808 808 4000.

James says

Hi Sara

Following a complaint to Halifax I received a partial refund of around £1500 dating back 6 years (thank you for the advice on this page!), they did this without giving me a decision to accept or reject but just paid me the money and removed my overdraft. However, they refused to go back further than the 6 years rule despite my complaint going back to 2012.

I took this to the Financial Ombudsman Service but the investigator has agreed with Halifax and won’t go back further than 6 years. I am escalating this to the Ombudsman, as I had mental problems at the time with a significant gambling addiction. The investigator has asked me whether I want the Ombudsman to investigate the past 6 years Halifax has already refunded. My question is; could the Ombudsman find in Halifax’s favour and I be in a situation where I would have to repay Halifax this money already refunded if I allowed this all to be looked at?

Sara (Debt Camel) says

I have never known that happen with a serious refund – FOS tends to assume that is correct and just look at whether more should have been refunded.

Siobhan says

Update from. After submitting a new complaint as advised by adjudicator, the new adjudicator has found in favour of NatWest. Not overly sure how because NatWest themselves have said they could see I was in financial trouble two months after taking out overdraft.

Have requested final decision by ombudsman but also putting in a complaint about the adjudicator for their vile attitude when I queried why they had said that because I had a rent payment going out of my bank that I clearly had money.

It’s not a huge overdraft and is in my dmp so not a big deal.

Sara (Debt Camel) says

have you made affordability complaints about other debts in your DMP?

Siobhan says

I’ve done some of them. Vanquis was paid off out of refund. NatWest and PayPal the fos have rejected. I don’t think I’ll get anything for payday loans and catalogues because I was paying them off fine until everyday loans gave me a loan and the repayments on that caused the biggest issue. Everyday loans have rejected my claim.

Am going to ask the like of Lowell etc to provide credit agreements because some of the catalogues are quite old

Thomas says

Hi Sara, thank you for all your help.

Natwest rejected my unaffordable overdraft complaint (been in it for 20 yars (£5k) and 2 loan complaints (£20k and £11k) lots of gambling on account for circa 10 years. Always at limit and bounced payments, unpaid DD’s, Charges, but gave me £600 compensation. 450 for a few months interest and 150 as they sent me the wrong persons rejection letter! I went to the ombudsman and they are looking into. Natwest said it is too far back and older than 6 years. Can you please remind me of the wording or case study where I only just found out in June this year regarding the Guardian story and wasn’t aware I could complain please?

Its been with them 2 months and they said Natwest have lost the 2 loan agreements. Natwest have also emailed me to say they have lost them both which is convenient and annoying! Any help would be appreciated please. Thank you!

Sara (Debt Camel) says

In this situation FOS usually asks you some questions about when you realised NatWest was at fault – have they done this?

How long ago were these loans?

Thomas says

Hi – yes they asked and I said I only just recently saw the article. They have messaged a few times when I have asked for an update saying just waiting for Natwest to agree we can look into re the over 6 years from complaining which I found odd as I have already explained it.

Loans were in Feb 2019 (£20k) when still £5k overdrawn and another 7k barclays credit card and £12k lloyds credit card. I then cleared these balances (and over £10k gambling over 6 years ) and other loan was May 2022 £11k which I cleared the £5300 overdraft and a £2k Monzo overdraft. They have confirmed they are also looking into the loans but may not be able to look into the overdraft. Thanks

Thomas says

Hi Sara – Ombudsman got back to me on the 7th December to say they think I am allowed to complain about the overdraft complaint as I was unaware until I saw the Guardian article. They also said Natwest had advised the Ombudsman they had written to me since July 20 and I complained in June 2023 so this is also within 3 years. They have asked the complaint to be looked into going back to 2002 when the first overdraft was drafted and to reply by the 21st December. They said it was clear I was trapped in my overdraft and showed hardcore borrowing as well as large amounts of consistent gambling. My financial difficulty should have been identified and dealt with appropriately. If no reply an ombudsman will look at the complaint again and make a decision – so great news! Thank you…

DD says

My complaint with Halifax was submitted on the 20/10 but I’ve heard nothing back yet or even had an auto response from the mailbox. Sent to onlinecomplaints@lloydsbank.co.uk – is it worth emailing them again or waiting until 15/12 whereby they will have had the 8 weeks? I’ve seen some posts on here say that money has been refunded into accounts without any correspondence being relayed so perhaps that’s Halifax’s approach? Unless they disagree then I should presumably receive a final response

Sara (Debt Camel) says

I suggest you phone them up and ask them to confirm they have your complaint.

DD says

Hi,

Rang as you suggested Sara, they advised they hadn’t received my email so not sure if the above email address is now obsolete. They gave me this email address customerservicesglasgow@lloydsbanking.com

I’ve since emailed that address with my original email attached asking them to review the complaint and whether they can honour my original email from 19/10 instead of now having 8 weeks.

Sara (Debt Camel) says

the email address on my list is the one on the FCA register. You should point that out to them and say they should correct it if it is wrong.

KB says

I’m just wondering if you could advise here.

I raised an affordability complaint with Santander on the 4th October. The first email I had regarding the complaint was 4 weeks ago advising it’s taking them longer than usual to review the complaint and to expect to hear from them within 4 weeks. I decided to give them a call Monday. I was advised the complaint hadn’t been looked at & had no notes on there however I would receive communication from them shortly.

I have had an email today advising the below (also appears to be a generic email response)

“As you know we’re looking into your complaint, and it has been 8 weeks since you first contacted us.

We’re sorry our response is taking longer than we expected…”

My complaint was a little more difficult due to having overdraft consolidated in a loan. In 2020 I asked for forbearance with the interest due to multiple debts I wasn’t managing, they declined the request to freeze the interest and advised me at that time to consider a debt consolidation loan with them. I’ wasn’t aware of this therefore hadn’t considered it previously. I immediately applied and was accepted. I continue to pay a monthly sum just shy of £300 with 13 months remaining of this. This cleared overdraft debt along with 4 other creditors, due to having multiple lenders with multiple interest rates I felt to manage this debt this route was my best & final option as I was on the brink mentally.

KB says

I appreciate my complaint is slightly more complex as I have requested interest rates to be refunded along with 8% interest however I had also requested they consider partial refund of the loan as £2000 of the debt is consolidated within what I pay towards the loan and continue to pay currently.

I am very unsure on how to proceed whether I give them more time or simply to escalate as they have reached the window in which the bank should provide a final response.

I understand they need to thoroughly investigate but due to the generic responses to date along with the operator advising 2 days ago it wasn’t looked at my feeling is that they may provide a response to say they do not uphold the complaint, then at that stage which could be however many weeks later, I would need to escalate to FOS.

It may be worth mentioning, my partner who banks elsewhere raised an affordability complaint a week after mine and was refunded all interest charges and the 8% only 2 days after the complaint was raised.

Sara (Debt Camel) says

That is a generic reply . I suggest you send your complaint to the Ombudsman now.

” I had also requested they consider partial refund of the loan as £2000 of the debt is consolidated within what I pay towards the loan and continue to pay currently.” so this would be a refund of the overdraft before 2020?

In that case you need to be clear to FOS that you are making two complaints – about the overdraft befor 2020 being unaffordable and the consolidation from 2020 being unaffordable.

EP says

Hello Sara

I made a compliant to the FOS after receiving no response from NatWest after filing my complaint with via their online complaint form in September.

I have received a response from the FOS stating that NatWest have no record of my complaint being made and that I would have to resubmit to them directly and wait until I receive a final response before they can intervene.

I explained that when I submitted my complaint online it did go through successfully so NatWest should have received it and I was not at fault if they claim to have not received it.

I don’t want to resubmit my complaint online , wait another 8 weeks and then be told they haven’t received it again.

What do you suggest is the best method to proceed?

Sara (Debt Camel) says

You filled in their form? Or sent an email?

EP says

I filled in their online complaint form, apparently this is their preferred method. The form was definitely submitted as a message popped up on screen. I didn’t take a screenshot as I thought they would send an acknowledgment email with my complaint reference which never arrived. I did keep copies of my actual complaint which I sent to FOS but after NatWest said they hadn’t received them I am now being asked to resubmit them wait another 8 weeks.

Sara (Debt Camel) says

This is why I suggest sending complaints by email. As by email you have record of what you sent and when. I am sorry but you now need to send the complaint again as there is no proof of what you sent before.

EP says

Thanks Sara

EP says

I just wanted to add although NatWest claims to have never received my complaints I have just noticed they sent me a letter in November, 2 months after my complaint, stating they would not be sending me a new credit card when my current one expired due to concerns with my usage. My usage has been the same ever since I was issued with it 6 years ago, it cannot be a coincidence that they have just now sent me this letter. In any event, I have resent my complaints this time by email.

Douglas says

Opened Santander 123 student account in 2016, came with a £2000 overdraft. I had no full time employment and my student loan only covered my rent. In the last year of 3 years university worked part time earned maximum of £1200 a month. Left university and my income remained at £950 (£1200 with overtime). Since then my income went up to £1750 in 2021, before rising to around £2200 now. Been at the maximum £2000 for majority of the accounts use, no regular income being deposited, only loans that have taken the account out of negative credit for a total of 27 days spread across 2 separate occasions. I also have another overdraft am still paying debt consolidation loans with Halifax.

Wrote to Santander to refund charges dating back to when interest began to apply to my overdraft in 2021 using template letter, I was rarely in credit, was often in unarranged overdraft due to interest fees (but no charges related due to unarranged overdraft use) and had taken out other loans to attempt to consolidate and pay off the debt.

They rejected overdraft increase requests but I have no record of when I applied. Santander complaints handler called me today and said they may be able to look at refunding some of the charges but due to terms and conditions it’s unlikely they’ll refund the full amount, I asked for all my options to be sent in writing. Should I persist with my original request? Could you provide insight on my chances and what action/compromises to take.

Sara (Debt Camel) says

So you complained quite recently?

And Santander haven’t yet responded to your complaint in writing?

Douglas says

Complained yesterday and no response in writing yet. The complaint handler today seemed to be trying to dissuade me from perusing a refund and instead choose repayment options because the terms and conditions of the account mean it’s only possible that a few of the £1333 in charges to be refunded.

Sara (Debt Camel) says

I suggest you tell Santander you would like a response to your complaint.

Do you have an immediate problem, unable to make debt repayments this month?

Douglas says

I’ve asked for a written response with all available options to resolution. I can make debt repayments to Halifax and the Santander monthly interest charge but I’m left with nothing after bills unless I do overtime and will usually hit my overdraft limit each month.

Sara (Debt Camel) says

I think this all looks too close. These complaints may need to go to the Ombudsman which will take months. I think you should ask Halifax and santader for payments arrangements and to freeze interest and charges.

This will harm your credit record, but the negative markers will be removed if you win the complaint.

This will NOT affect your complaints.

Douglas says

Thanks Sara – I agree that given the potential timescale other action should be taken. Should I also launch a complaint with Halifax at the same time and are there any repercussions for challenging two banks at once? I’m not sure if I’m just being too doubtful myself or the banks influence on my thoughts, but still partially unsure if I meet the criteria for refund despite being in total of £5000 worth of overdraft related debt for years and earning max £2200.

Sara (Debt Camel) says

Should I also launch a complaint with Halifax at the same time

Yes – you are overthinking this.

and are there any repercussions for challenging two banks at once?

no.

Douglas says

Santander rejected complaint, usual reasons as listed in your related article. Referred to FOS, investigator has now relayed Santander have made an offer to refund charges 02/23 -11/23, on the basis they “had been monitoring your account and had sent correspondence relating to overdraft repeat use between 02/22 and 02/23 in the form of emails and SMS reminders asking you to contact them if you were in financial difficulty.” Investigator believes only refunding from 02/23 rather than 07/21 is fair – “the account doesn’t appear to be your main account as I couldn’t see any essential bill payments going out from it or your salary coming into it, however you were paying credits into the account and making transfers out of it whilst remaining in overdraft. Remaining in an overdraft on its own is not enough to say someone is in financial difficulty unless there are other concerning factors showing on the account i.e returned direct debits for essential bills, or other activity which indicates the overdraft was not sustainable and I didn’t see anything like that on your account.”

Only financial support correspondence that I have are unarranged overdraft notifications, overdraft alternative emails (ie suggesting other overdrafts or credit products), and Covid related support circulars. Unarranged overdraft notifications frequently say if the unarranged overdraft is paid “there’s no need to get in touch”. Misled me to believe that if I continued to pay the unarranged overdraft interest when notified, there would be no need to “get in touch” with Santander.

The overdraft charges started in 2021, but the overdraft became unaffordable long before then.

During 2019 – 2021, the account was a 1|2|3 Graduate account that “must be used as your main current account and your salary must be paid into it”. The overdraft consistently remained overdrawn often close to the limit, throughout the 1|2|3| Graduate account’s existence. My salary was never being paid into it. There are also direct debit payment rejections and frequent unarranged overdraft notifications since 2019 onwards.

I contacted Santander Financial Support about the account usage around October 2019 and they suggested that moving an amount of money, not specifically my salary, between my Halifax and Santander account would resolve the outstanding account dormancy issues. There was no assessment of income, budget planner or affordability.

Could you advise how to respond to investigator?

Sara (Debt Camel) says

how many rejected direct debits were there and in which years?

Douglas says

I have two Payment(s) refused due to lack of funds emails in August 2020, and have monthly emails/texts since July 2020 telling me I have exceeded my overdaft limit and further payments will be refused.

Sara (Debt Camel) says

Then I suggest you go back to the investigator and say this sounds like evidence of financial difficulty to you.

Point out that the unarranged overdraft notifications frequently said there was no need to get in touch in the account was brought under the limit, but getting them every month should have a been a clear sign of problems if they had reviewed your account. So you think they should not have started to charge interest in 2021 and interest should be refunded from that point.

Jon says

Well after waiting for my second complaint i thought i would give an update!

Overdraft complaint picked up by investigator 13/06/2023 and was rejected, so i asked for ombudsman to review and again ‘ as there were no exceptional reasons’ he too also rejected the complaint on the 6 year rule.

The loan complaint was picked up on 15/06/2023 but then didn’t hear anything until 11/10/2023 from a new investigator saying the previous one had left so she was now dealing with it. I had a decision on 3/11/2023 saying again the 6 year rule so again i asked for and ombudsman to review this and got a provisional decision on the 30/11/2023 saying that they could !! I now have to wait until the 14th December to see if Barclays come back with sny further information. I have to say that i had to read the decision about 4 times to understand that it was in my favour! Will let you know the outcome!!

Sam says

Hi Jon,

Sounds quite promising for the loan complaint so good luck with that. Do you mind if I ask if there were any exceptional circumstances as to them going beyond the 6 years? I have been rejected with a car finance complaint based on it being over 6 years.

Thanks in advance

Thomas says

Hi Sara… thanks to you I heard today Natwest have deducted all my interest on my 20k loan. FOS found that they never did a credit search and I had gambled and lost 1200 a month before they approved my £20k loan. Natwest contested twice. Went to ombudsman and I have had all the interest (£10k) taken off the balance. It means I owe 1800 left on the capital repayment ofn20k left but they have spread this over the term of repayments… means my 316 monthly repayment has dropped to 50 and all interest on the loan taken off. This has helped me and my family so so much. I salute you! 🫡 have a great weekend Sara as I can now start saving and am 265 pounds better of lf a month. I would have been paying 316 for the next 4 years… my overdraft complaint is still with the ombudsman but have a strong feeling I will get 8k back in interest and bank charges back. Thanks Sara!!

Sara (Debt Camel) says

very good news for you.

Jon heard says

Well the ombudsman came back on Thursday to say that my case can be investigated. Does this mean a new aujudicator will look at it or the one that originally decided that it was out of time?(6 year rule). Will it now take another few months or will it now be quicker? Jon

Sara (Debt Camel) says

Out of time decisions are often handled by different adjudicators. So you may get a new one. This should b3 quicker to be picked up as the lender will Zlready have supplied their case file.

Jon heard says

Well i have just had an email from the fos and its the same aujudicator that is going to look at it!( funny as she was the one that rejected the complaint due to timescales) and she is currently awaiting information from Barclays and will let us know in due course. Not really sure how i feel about this to be honest!

Stewart Duncan says

Hello there,

I’m just wondering if the emails posted are confirmed as useable. I’ve written to the TSB one posted, and although it’s not hit the 8 week mark, I’ve asked for a confirmation that they have received my complaint, and as yet have not had a reply. Is this a common ploy.

Sara (Debt Camel) says

Phone them up and ask. C

Jess says

Hi Sara, I have received a response from tsb regarding my overdraft complaint and loan, the response disputes the loans offered to me they have also said that they will agree to refund overdraft charges since June 2022 and are closing my overdraft account and there financial services department will be in contact to arrange a payment plan is this normal practice. I sent my complaint to the FOS yesterday as they had 8 weeks to respond

Sara (Debt Camel) says

Not common at all.

How long have you had the overdraft problem?

How large is the remaining balance?

Jess says

I found this response odd that they are closing my overdraft and referring me to their financial services department to agree a payment plan, I’m not happy. Will this affect my credit rating?

I’ve been in an overdraft for over 10 years balance £3000

Sara (Debt Camel) says

Did they say why they had only refunded charges from 2022? Did they agree it was unaffordable?

Are you in the overdraft most or all of the month?

Jess says

They said they only refunded since 2022 as they feel they only made a few mistakes. But I feel I have a decent case with the ombudsman hence why they are quickly closing the overdraft account and making a partial refund.

But will referring my overdraft to their financial services affect my credit rating as I’m hoping to get a mortgage next year

Sara (Debt Camel) says

You can tell the team that it should not harm your credit rating as you were given an unaffordable limit.One option is to switch to a different bank and repay more than the fees are to the account each month.

Realistically you need to clear this overdraft fast anyway – applying for a Mortgage with large overdraft usage is not a good idea whatever your credit record is like. Are you saving a deposit at the moment?

Jess says

I see I assume that the overdraft account being moved to financial services mean I won’t be charged interest and it will give the opportunity to pay off the outstanding balance once I’m refunded from June 2022 for fees etc

Sara (Debt Camel) says

I have no idea – this isn’t normal!

Refund from Jun 22 – how much will this reduce the balance?

Jess says

The refund will be approximately £1000

Darren says

Hi Sara

I have had a HSBC account for years with a £450 overdraft that I managed well but in 2020 it went up to £1000 to 2000 to 2500 then stayed at £3000 till I managed to clear it September this year with a vanquis claim I had won.

My question is can I make a claim to HSBC even if I asked for the increases I kept asking as I was getting more in to debt when my wages went in this never cleared the 3k overdraft so was in the red for months. If I can make a claim unsure how to put it to them. Can you help

Sara (Debt Camel) says

Yes you can make a claim. There is a template letter in the article above – add a few sentences to describe what happened. Eg saying the limit of £1000 was manageable but not the increases.

The fact you asked for the increases isn’t relevant – HSBC should still have made proper checks that the higher limit would be affordable eg that your income coming in would allow you to clear it in a sustainable fashion – which if the limit was larger than your income you obviously couldn’t.

Darren says

Hi Sara

I have put in a email complaint with hsbc and today I have received a text to say they are going to call me shortly, my question is is this normal? I don’t mind talking to them but I am unsure what more I can say apart from what’s in my email. Any ideas?

Sara (Debt Camel) says

Hard to guess.

My advice is to have a pen and paper handy. If they offer you something, say you want to read the response in writing before deciding whether to accept it or go to the Ombudsman.

If it isn’t the answer to your complaint but they want you to make some sort of arrangement to repay the overdraft, say you want to see their response to your complaint first.

If they want to ask you questions, ask them to put them in writing.

Darren says

Hi Sara

Ok thank you it won’t be asking me to pay overdraft as I have cleared that now with a over claim I won from vanquis I will ask them to put everything in writing

Sara (Debt Camel) says

Just to be clear for anyone else reading this – they wouldn’t normally ask you to clear it, but they may offer help if it currently is unaffordable.

If you didnt say in your complaint that you cleared the overdraft with another affordability refund, tell them on the phone.-

Darren says

Hi Sara

Just had the call

They have said they have done nothing wrong as they checked my score and deemed it affordable, they have also said they did not have to look in to my high limit. They would only do that if I contacted them to say I was struggling, do you think it’s worth sending to the ombudsman? They are going to send me a email regarding this

Sara (Debt Camel) says

so tell me about the overdraft. Before you cleared it, roughly how many days a month were you in it? how long has this been going on for? what was a typical balance at the end of the month before you got paid? and what roughly do you get paid?

also do you owe HSBC any other debts – loans, credit card,….

Darren says

I had a £3000 overdraft for a approximately two years when my wages went in most months it didn’t clear the overdraft but sometimes it would give me £200 or £300 credit for about a day or so then the bills will put me back in to it, I had a small loan with them that I also paid off with my successful vanquis claim. So I now owe nothing to them and have approximately 2.5k balance in my account. I don’t want to be greedy but if it was not for the vanquis claim I won I would now be in the red with them and still struggling

Also typical month I would be -£2700 roughly and wages would be £2283 so mostly never cleared the overdraft

Sara (Debt Camel) says

then definitely send this to the Ombudsman.

HSBC who carried on charging you high overdraft fees when they should have seen you were in difficulty is the greedy one here, not you.

DD says

Halifax called me for my claim but wanted to know more information such as mobile phone number etc. they’ve said they have a backlog with complaints and the 8 weeks is up on Friday. They’ve said they will call or write to me but won’t email as they say it’s not a secure way to communicate my details…..my claim sounds similar to Darren’s above with often still being in the overdraft (3.4k) even after being paid. This happened from 2017 until at least June 2021 when Halifax finally reduced my overdraft limit to 1k. Wording they used was “from time to time we review overdrafts” I think it should have been annually and it’s clear that had the checked more often they would have seen the multiple issues with my account. I’m hoping the response is clear and obvious from Halifax and they refund all interest and charges from 2017

EP says

Hello Sara

What would be the best way to respond to my bank saying they did make attempts to help me reduce my overdraft by writing to me. All I ever received was generic emails saying I should try and reduce my overdraft. I have never been in the position to reduce my overdraft one of the reasons being I have been charged £100 per month in overdraft fees for the last 10 years. I never had any one contact me on a personal basis to discuss my particular situation.

Sara (Debt Camel) says

Don’t bother – they won’t change their mind or even think about what you say. Send the complaint to the Financial Ombudsman.

Thomas says

Hi Sara – Ombudsman got back to me on the 7th December to say they think I am allowed to complain about the overdraft complaint as I was unaware until I saw the Guardian article. They also said Natwest had advised the Ombudsman they had written to me since July 20 and I complained in June 2023 so this is also within 3 years. They have asked the complaint to be looked into going back to 2002 when the first overdraft was drafted and to reply by the 21st December. They said it was clear I was trapped in my overdraft and showed hardcore borrowing as well as large amounts of consistent gambling. My financial difficulty should have been identified and dealt with appropriately.

Ombudsman has said Natwest has come back and said they disagree with the outcome as they feel the complaint was made out of time and it will now go to the Ombudsman. I have said I only complained when I saw the article in the guardian. Is there anything else I can say or any precedent case law i can add please?

Sara (Debt Camel) says

You can refer to this FOS decision https://www.financial-ombudsman.org.uk/files/290226/DRN5869499.pdf. FOS doesnt operate by a precedent – but you can reasonably ask what is different in your case that would mean that Natwest did not have to monitor/review your overdraft

You can also point out that your major gambling problem constituted an addiction so it was harder for you to step back and take an overall view of your finances.

DD says

Got a call from Halifax today with good news. They said their annual review in March 2018 should have identified I was in financial difficulty and gotten in touch to support me. They’ve refunded me 4.5k and removed my overdraft facility. They also added the 8% but I can’t work out the 8% figure they got to. They’ve said it’s £695 and the charges and fees equated to £3813 so not sure where the £695 comes from?

Sara (Debt Camel) says

They only have to start adding 8% tax at the point where your overdraft would have moved into credit if they hadn’t deducted interest and charges. What was your balance before this refund?

DD says

The balance of my current account before they added the refund? It was -£830. I just assumed they add 8% of the refund amount? I assume they’ve worked it out right I just don’t want to be in the position where they’ve miscalculated and I end up having to return some of the refund! Thank you again Sara for your advice and this website. It’s genuinely life changing and helps me and my family out so much.

Sara (Debt Camel) says

ah you thought it was a fixed 8% of the refund and were concerned it was too large… I thought you were worried it was too small!

It is 8% per year on the refund – but the trucky bit is know when it started… it doesn’t sound very wrong to me.

Also they have probably taken tax off? You may be able to reclain up to £200 of the tax deduction back from HMRC, see https://debtcamel.co.uk/ppi-payday-refund-get-back-tax/

DD says

Yes I thought it was fixed on the refund amount. Good to know it’s likely right based on each year. I’ll also look at the reclaim as part of the tax deduction. I’ve not had the letter breaking down the refund so not sure yet whether they’ve take tax off. Presume in most cases they do so I’d be right to seek some back from HMRC

EP says

Hello Sara

The FOS have been in touch and have asked the below questions, I was wondering how you felt it was best to answer them.

When you realised the overdraft was causing you a loss or financial difficulty?

What prompted you to make a complaint recently?

When you realised NatWest’s actions (or its failure to act) might have caused the loss?

Are there any exceptional circumstances I need to be aware of, which may have stopped you from complaining sooner?

I had a severe gambling addiction throughout the period and only realised I could make a claim after reading the article in the guardian this year.

Natwest are challenging the claim as they say the overdraft was given to me over 6 years ago. I have been in fully daily use of my overdraft since it was given to me till this current day.

Sara (Debt Camel) says

I have had a look back at your previous comments – you could reply something like this: [but make sure it is really accurate for you!]

When you realised the overdraft was causing you a loss or financial difficulty?

I have know my finances were in mess for many years. I didn’t focus on my overdraft specifically as causing my difficulty as my gambling addiction dominated everything and that felt like the cause of my problems.

What prompted you to make a complaint recently?

I saw an article about overdraft affordability in the Guardian earlier this year. Until I read that, I had no idea that a bank should have reviewed overdraft usage.

When you realised NatWest’s actions (or its failure to act) might have caused the loss?

When I read that Guardian article. It was immediately clear to me for the first time that Natwest cannot have made the proper – or indeed any – checks on my overdraft. They had sent me some generic communications but there was nothing in those to suggest that Natwest had realised that my prolonged, constant overdraft usage was inconsistent with overdrafts being used for short-term problems.

Are there any exceptional circumstances I need to be aware of, which may have stopped you from complaining sooner?

I feel my gambling addiction was a mental health problem that made it impossible for me to step back and appreciate what a mess my finances were. It always felt as though if I could just get through to the next month things may improve.

EP says

Thanks Sara, very helpful.

Wishing you and your family a merry Xmas.

GL says

Hi Sara,

Hope you’re well!

I put in an overdraft complaint with NatWest on the 30th November 2023. I have had confirmation that it has been received but no firm response yet.

I just wanted to get your opinion. I’ve been in a permanent over draft of £3000 increasing to £4000 since 2017 and even before. Wages going into that account is the same as the overdraft and with the fees added I haven’t been able to decrease it. I’ve had no contact from NatWest with regards to decreasing apart from the automated emails over the last year. Do you think think I have a good case to be refunded the interest and charges?

Thanks!

G

Sara (Debt Camel) says

I’ve been in a permanent over draft

you mean every day of the month?

increasing to £4000 since 2017

when was the increase?

GL says

Hi! Yea everyday of the month. The increase to £4000 was in July 2019.

Thanks

Sara (Debt Camel) says

OK, I think you have what sounds like a very strong case to be refunded all the interest from July 19 – not only should they not have increased your limit at that poiunt, but they should have seen you were in difficulty and stopped adding interest andd fees for the old limit.

And a pretty good case for saying the refund should go back further.

GL says

Thanks Sara! I used the the email template you supplied on this page so fingers crossed! ☺️

Sally says

Hi Sara

Please can you advise whether overdraft complaints need to be for a personal account, or whether a business could complain?

I have a very small limited company. I opened a business account with cash plus and they immediately gave me an overdraft facility. My own personal finances were in a mess (lots of credit cards with late payment charges, over the limit charges etc) – I was unable to get any credit personally.

At the point of giving me the initial overdraft, the business had no financial history as it had only just been incorporated.

I needed to open a business account for my limited company as I was contracting at the time and this is how my employer wanted to pay me.

I only worked for my company for 6 months before moving jobs where I no longer needed the limited company.

The account is overdrawn and has been for a long time now. Long after I invoiced anyone, and therefore long after the account had received any moneys in, the bank increased the overdraft. I used this to help settle some tax bills and have been paying through the nose on interest ever since.

I would argue that both the initial overdraft and the increase were unaffordable, but I’m not sure if this is possible since it wasn’t a personal account…

Thanks,

Sally

Sara (Debt Camel) says

I suggest you talk to Business Debtline on 0800 197 6026 about this and about your options. See https://businessdebtline.org/

JE says

So today I got a response from the investigator who has asked natwest to refund me all fees and interest from 2020.

Can’t believe it.

So fingers crossed from a fast response from NatWest. I had originally asked from 2018 but the investigator thinks the bank were still acting reasonably at that point. I’m quite happy with the compromise I think depending on what the outcome is regarding money to come back to me. Still in shock.

Rachel Peters says

I had simpler good news before Christmas. Just for your information, I’ve been waiting for 3 weeks and no news from NatWest yet.

JE says

NatWest have been given until the 16th January to respond.

JE says

Had notification from the investigator today that natwest accept her recommendations! Now just need the magic figure! Hoping it clears the overdraft. If not will certainly go a long way to help!

Thomas says

Hi Sara, thank you so much for all your help. Investigator said my overdraft can be looked at as within 3 years and also I complained when I read the guardian article. natwest have disagreed so going to an Ombudsman and may be 6 months. But my loan complaint I won and Natwest have agreed – mainly die to large gambling losses the month I took out the loan. £20k loan – £10k interest. I have worked out I paid back £18,100 – Natwest have 4 weeks to get back to me. So will I just owe the remaining £1900 – ombudsman said they have to take off all the interest but I could be in a credit balance (can’t work out how though as surely i still owe the £1900) wither way great result as it has saved me so much money! Thanks again!

JessyJ says

So I posted a few months ago, TSB have refunded me charges from June 2022 although I have had an overdraft for over 10 years. TSB have removed my overdraft facility and now I have to set up a payment plan to pay off the remaining amount of the overdraft. I have offered a monthly sum which was the interest amount I was paying on the £2880 overdraft, my balance is now £2000. I have already put in a complaint the ombudsman and I currently awaiting to hear further from them. My question is would being on a payment plan affect my credit rating as I am hoping to get this overdraft cleared in a year alongside other debts which I have

Sara (Debt Camel) says

TSB should allow you to set up a payment plan wiout it affecting your credit record – can you pay a reasonable amount to it? How large are your other debts?

JessyJ says

I have been advised by TSB this morning that clearing the overdraft will incur further interest and costs so basically its putting me in a worse position than I was already in – to anyone on here making a complaint I would advise them not to do so as its going to make your situation worse

Sara (Debt Camel) says

tell the Ombudsman what is happening. And go back to TSB and say that is unreasonable as they have recognised that the overdraft limit was unaffordably high so they should not be adding more interest. And if you are paying what their charges would have been, there is no possible reason for this to harm your credit record.

How large are your other debts? Have TSB responded to the complaint about the loans? It would have been almost impossible to get a mortgage with a 3k overdraft you were permanently in… this process may be annoyingly long but it offers a real hope of improving your situation.

Jessj says

Yes agreed.

I’ve been on the phone to tan most of today so stressful I have agreed with the repayment plan plus interest for now but have also advised the ombudsman of what they have done.

TSB advised me on my last call today that they have made a further offer to ombudsman to refund more overdraft charges from 2019 so happy days as this should be another £1500 due to be refunded in a few months and as for the loans that complaint is ongoing going to get back all my money so I can have a fresh start end of the year

Other debts are only £1600 they will be cleared on the next 7 months

Basharath says

I have had a overdraft loan with Natwest bank for 32 year until there closed my account 2 years ago without giving me a reason. 95 i was in my overdraft. Can i claim as i was on benefits.

Sara (Debt Camel) says

95 i was in my overdraft

Is 95 a typo for something? How many days a month were you in the overdraft?

Lol says

Hello all,

I have a current account with Barclays that between approx 2005 (possibly earlier) and 2015 was from 2k increasing up to 5k overdrawn continually on 3-3k monthly salary. Lots of credit rejections and payday loans from around 2010. I actually went in and tried to get a loan to pay off the overdraft in 2009 and they knocked me back for bad credit. I got made redundant in 2015 and as soon as they realised the wages had stopped they demanded repayment. They made so much cash out of me… account is still active, finish paying off the overdraft next month.

Does anyone think I have the basis of a claim or is it too long ago? Also, how does anyone complain to Barclays? It’s almost like they’re trying to avoid being contacted.

Thank you 😊

Sara (Debt Camel) says

Have they carried on charging interest after 2015?

Rachel Peters says

Hi Sara,

Firstly, a huge thank you! Before Christmas, my investigate found that Natwest were at fault. It took exactly 4 weeks but Natwest have credited my account and we are overdraft free for the first time in years! Thank you! Although I’ve received the payment, I haven’t had anything from Natwest detailing the breakdown of the compensation. Would you expect something in writing which outlines the calculation of the payment?

I also wanted to ask your advice about Bank Charges. We have had a Black Account with Natwest which cost £31 per month. We clearly couldn’t afford this. Should this form part of the compensation? Thank you again for all your advice. For anyone reading this – with Sara’s help – it was so easy and really worth it. Thank you again.

Sara (Debt Camel) says

What was the decision about refunds from the investigator?

Has the refund left you in credit?

Rachel Peters says

Yes, our overdraft has been cleared and the account is now in credit. The investigator said Natwest Should:

‘Re-work X and X’s current overdraft balance so that all interest, fees and charges applied from the last six years onwards are removed. NatWest (if any) can minus any refunds (from this figure) it has already made over the same

period. NatWest will have to resolve the case in the most applicable of the below, as at this stage it’s not clear if there will be a remaining balance or not:

If an outstanding balance remains on the overdraft once these adjustments have

been made NatWest should contact X and X to arrange a suitable repayment plan for this. If it considers it appropriate to record negative information on X and X’s credit file, it should backdate this to six years ago.

If the effect of removing all interest, fees and charges results in there no longer being an outstanding balance, then any extra should be treated as overpayments and returned to X and X’s, along with 8% simple interest on the overpayments from the date they were made (if they were) until the date of settlement. If no outstanding balance remains after all adjustments have been made,

then Business should remove any adverse information from X and X credit file.

Thank you so much for your help.

Sara (Debt Camel) says

” all interest, fees and charges applied from the last six years onwards are removed. ”

that includes any monthly charges for the account

Rachel Peters says

Sara, I wrote to Natwest to check that the charges for our Natwest Black account (£31 per month) had been refunded. This is the reply:

Please be advised that this complaint reference XXXXXXXXX related to the charges and interest incurred as a result of us previously agreeing an overdraft facility on this account – not the packaged account fees. Please be advised that if you feel that the packaged

account was mis sold, then you need to please raise this complaint separately so that it can be investigated and a response letter issued to you.

New compliant? Or back to my investigator? I find it unbelievable that we have been overdrawn for so long and they have been charging us for the account. Thank you in advance for your advice.

Sara (Debt Camel) says

I suggest you go back to the investigator and ask about this. Point out the decision said “all charges”.

Kevin Winterbone says

My bank rejected my affordability complaint – I had a 3.5k overdraft for over 10 years so I referred it to the FSO. Had a text the other day sayin my overdraft credit limit had expired and I needed to get the account in credit. Needless to say I was beside myself but when I called it turned out they had refunded all the interest for the past 6 years which wiped out the overdraft and left a bi over. Still waiting on notification from the FSO though. I’d recommend the form letter above and stick at it – it works!

John says

Hi Sara,

I had a letter off my bank offering £429 refund but that was only dating back 2 years. I contacted the ombudsman and had first contact today wanting questions answered.

1. When did you become aware your overdraft was causing you financial difficulties?

2. When did you become aware the difficulties, you were experiencing may have been because of Lloyd’s decision to increase your overdraft in 2012?

3. What made you aware Lloyds may have done something wrong?

4. Did anything else prevent you from complaining about your overdraft limit increase in 2012 before 2023?

Could you advise on any of these to reply with… I’ve never been out of my overdraft since it was opened 2013

Sara (Debt Camel) says

So you have basically just lived with this issue? Do you have other problem debts or have you had since 2012? Have you had any other credit from Lloyds? Did this start as a student overdraft?

John says

I’ve had a gambling addiction the whole time I had this overdraft and borrowing throughout the time as well a lot of payday loans etc. bank offering £449 refund but that’s for the last two years

Sara (Debt Camel) says

So something along the lines of:

1 I have been in financial difficulty continuously since 2012, because I had gambling addiction. But I regarded this as my fault. It didnt occur to me that Lloyds was making these difficulties worse by continuing to allow me to have the overdraft and by charging me – at the time it just felt that I needed the overdraft and so it was useful

2&3 when I heard [early in 2023? was this when you read am article in the Guardian? or saw something on social; media? say how you found out] that a bank should have made sure that an overdraft could be sustainably repaid and should have reviewed its usage annually. It should have been clear to Lloyds, see the gambling on my account, that I would not have been able to cope with the increased credit limit. And they cannot have been reviewing my overdraft usage annually.

4. Gambling is an addiction that makes it hard to step back and take sensible money decisions.s. If I had managed to stop gambling years ago I may have been able to see my finances in a different light. But that is hypothetical. I didnt realise Lloyds had done anything wrong and I didnt have enough knowledge to ask the sort of questions or complain that would have brought to light Lloyds failures.

aaron says

hi

you mention “But if you have had an IVA or bankruptcy after these problems, or if you are still in a DRO, then you shouldn’t complain – ask in the comments below for details.:

I am just applying or an IVA, should/can I still make a complaint for my Santander overdraft?

Sara (Debt Camel) says

so first of all, would you like to make sure that an IVA is a good idea for you? IVAs are good for only a tiny number of people at the moment and they are being missold to tens of thousands because they generate very large fees.

Read https://debtcamel.co.uk/debt-options/iva/ and ask any questions below that. If an IVA does seem to be a good idea for you, we can talk there about the overdraft complaint

Rachel Peters says

Hi Sara,

I contacted my investigator about the bank charges on my Natwest Black account (£31 per month) and that these should be refunded as part of “all charges” in the compensation. They have said:

“In regards to the account fee chargeable on this account, this was not included in this complaint as the complaint was regarding irresponsible lending and overdraft charges, not the mis-selling of the account type you had, this would fall under packaged account complaints.”

Any advice? How do I make the new claim about the type of account I had? Clearly, NatWest should not have been charging me every month when they could see that I was in so much debt. I’m just appalled that banks think they can get away with this type of stuff. Do you think I would have a claim for being missold the package? Should they have reviewed the package when they knew we were is difficulty ?

Sara (Debt Camel) says

MSE has a page with reasons why a packaged bank account may have been missold at the start: https://www.moneysavingexpert.com/reclaim/reclaim-packaged-bank-accounts/#checklist.

If any of those reason apply to you, mention that in the complaint.

What was the reason that the investigator gave for deciding there should be a refund on your overdraft? Did they say that NatWest should have reviewed the overdraft or something similar?

Rachel Peters says

Yes, the FOS said ‘I appreciate that NatWest sent several letters between 2020 and 2023 to X and X regarding financial difficulties and asking whether they need support. However, typically this isn’t enough to say that NatWest did nothing wrong. Typically, an overdraft is subject to review on a yearly basis, and we would expect NatWest to have completed said reviews from account opening.’

Thank you so much for your help – I will put in another complaint.

Sara (Debt Camel) says

I suggest you add to your new complaint that in your previous complaint FOS found that NatWest should have completed reviews of your account and you feel that a review would have highlighted that the account fee appeared to be unaffordable and NatWest should have checked that the package continued to be suitable for me. As they didn’t, this has caused me financial difficulty and I junk these fees should be refunded.

Steve says

Hi, my bank was definitely irresponsibly lending me an overdraft for a number of years (constantly in unplanned overdraft, payday loans etc) but I’ve since cleared this when I got a better paid job, does that make me ineligible to apply for this?

Sara (Debt Camel) says

How long ago was the problem period?

Steve says

It was particularly bad from around 2011-2018, then a bit more stable. I only cleared the overdraft completely in the last year or two, between 2018 and then I was probably in and out of it every month.

Sara (Debt Camel) says

ok, so your situation improving doesnt not change the fact that the bank was irresponsible in its decsions before, so you can complain.

Complaints made within 6 years of problems are easier to resolve, but the ombudsman can agree to going further back so this is worth a try.

Laura says

Hi Sara,