In a Debt Relief Order (DRO):

In a Debt Relief Order (DRO):

- you don’t have to make any monthly payments at all;

- your creditors can’t ask you to pay them, take you to court or send bailiffs;

- at the end of a year, the debts in your DRO are wiped out.

If you meet the DRO criteria, it is often your best debt option, unless you expect your situation to improve a lot very soon.

DROs were introduced in 2008. In the first ten years, a quarter of a million DROs were set up. In 2023, DRO numbers increased with the costs of living crisis – now more than 2,500 people a month choose a DRO.

This article looks at the important things you need to know about DROs:

- are you are likely to meet the DRO criteria;

- is this is the best option for your financial problems;

- what can happen during a DRO and after it ends.

Contents

Are you eligible for a DRO?

The main criteria

Unlike most of the other debt solutions, you have to be able to meet all of the rules to get a DRO, there isn’t any “wriggle room”. The most important ones are:

- your total debts have to be under £50,000 You can’t decide to leave a debt out to get under this limit;

- you can’t own a house or have a mortgage. This applies even if you only own part of the house, you don’t live in it, the property is in another country, you can’t sell it, or it has negative equity;

- the second-hand value of your assets must be less than £2,000. That doesn’t sound much, but ordinary household objects and clothes etc are not counted at all. There is also an additional allowance for a car, see below. The second-hand value is what you could sell it for, eg on eBay. Few people have a problem with this £2,000 limit;

- you can’t own a car or motorbike worth more than £4,000 You may be able to have a car on finance – read Can I have a car on finance in a DRO for details;

- you must have less than £75 a month spare income after paying all your normal bills and expenses. See below for more about this.

- you can’t have had a DRO within the last 6 years.

The £75 “spare income” test

The hardest rule for most people to understand is that you can’t have a DRO if you have “more than £75 a month spare income“:

- this is the amount of money you have left over after paying your bills and other everyday expenses;

- it doesn’t take into account the payments you are currently making to your debts, because those payments stop in a DRO.

The level of spare income will be assessed by the debt advisor who sets up your DRO. You aren’t expected to live on a very tight budget. You can have some money for Xmas, replacing household goods, kids costs etc

I have come across people who have had an IVA payment of over £150 proposed who would have been easily “under £75” on the DRO criteria.

You don’t need to worry that disability benefits such as DLA or PIP will mean that you have too large an income for a DRO. When you have a disability-related benefit, you are allowed to offset that income with a line called “adult disability expenses.”

Some people who have been struggling with debt repayments find the expenditure allowances surprisingly generous. This may be the first time in a long while that you have any money to spend on clothes.

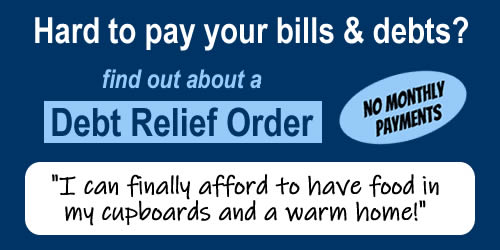

The quote in the picture at the top of this article from a reader sums this up:

“I can finally afford to have food in my cupboards and a warm home.”

Other technical criteria

Apart from these main rules, some other reasons could stop you from getting a DRO. These are much less common – your DRO adviser will check if any are a problem for you.

A few debts can’t be included

A DRO will clear most kinds of debt, not just money you have borrowed such as credit cards, but also council tax and energy arrears, tax debts and benefit overpayments.

Three that cannot be included in a DRO are:

- student debts;

- magistrate’s court fines, including TV license fines (but fixed penalty charges such as parking fines and the London Congestion Charge can be included); and

- debts incurred through fraud.

See this National Debtline factsheet for a complete list of debts that are included and excluded.

The DRO total debt limit is only for included debts – so if you have a large student loan debt that is ignored in checking if you are under the limit.

What about my partner?

You won’t be refused a DRO because you live with someone who has assets or a good income.

If you and your partner both have debts and want a DRO then you each have to apply for one – there isn’t any such thing as a joint DRO.

If you have a DRO and your partner doesn’t, then they will become fully responsible for any previously joint debts that you had together. This applies to things like council tax arrears and a joint bank loan.

What happens during the year a DRO takes?

“The DRO year”

In a DRO, your debts are cleared after a “moratorium period” of 12 months.

During this year your creditors are not allowed to ask you to pay the debt or take you to court.

No monthly payments during the DRO year

A DRO is designed for people with little or no spare income, so you don’t have to make any monthly payments.

From 6 April 2024, the £90 fee to set up a DRO has been scrapped.

This is a major advantage over an IVA, where you have to make payments for five or six years usually. And over a DMP, which could last a long time if you can only make low payments.

If something changes during the year

Once a DRO has been set up, you will find the DRO very low-key. No one from the Insolvency Service checks what you spend money on or asks for your bank statements,

But if you have a change of circumstances during the year (pay rise? inherit money?) you have to inform the Insolvency Service.

If you no longer meet the DRO criteria, your DRO may be cancelled. This is pretty rare, because often if your income goes up, your benefits are reduced.

Some detailed articles:

- what happens to my DRO if my pay increases or I get a lump sum of money?

- inheriting money in a DRO

- do not take money out of your pension during the DRO year

- how a DRO affects refund claims – it’s best not to try to make affordability or other refund claims while you are in a DRO. Wait until the year has ended and then think about them.

A DRO harms your credit score

A DRO is a form of insolvency and has the same bad effect on your credit rating as bankruptcy or an IVA. See how does insolvency affect my credit record? for details.

The DRO marker stays on your credit record for 6 years.

A DRO won’t affect the credit score of anyone else in your house unless you have joint financial products, such as a joint bank account.

At the end of the DRO year

At the end of the DRO year, there is no check that you still meet the requirements. Your DRO simply ends and your debts are written off, see What happens at the end of a DRO?

After the DRO year has ended, you can start to “repair” your credit record. It only gets better slowly until the DRO and the debts in the DRO drop off your credit record.

Who does a DRO suit?

A DRO is frequently the best option with a low income or where much of your income comes from benefits.

This includes:

- where you have caring responsibilities;

- pensioners;

- people with long-term health conditions;

- when you have high childcare costs.

When you only have a short-term money problem, a DRO is unlikely to be your best option. It gets rid of your debts after a year, but it will have a very bad effect on your credit file for six years from when it begins. This downside is well worth it if you have a larger debt problem, but not for a short-term difficulty. Here look at a temporary token payment plan.

If you qualify for a DRO, it is always a better option than an IVA. In a DRO you don’t have to make any monthly repayments and it is very rare for a DRO to fail, but more than a third of IVAs fail, leaving you back with your debts.

DROs affect your credit record for 6 years in the same way that IVAs and bankruptcy do. This can make it harder or impossible to take out new credit at a reasonable interest rate and harder to get a new private tenancy – but if you have large debt problems you may well have a poor credit record anyway.

It is unusual for a DRO to cause any problems with your employment – talk to your adviser if you are worried about this.

How to set up a DRO

Who to talk to

Contact Citizens Advice. They can also help if you have problems with priority debts such as rent arrears.

If you would prefer to do this on the phone, contact National Debtline. Or Business Debtline if you are self-employed.

After the debt adviser decides that you are eligible for a DRO they will talk you through the details. You are often sent an application pack to complete.

Setting up your application

Your adviser does all the necessary checks before submitting your application. This can take two or three months sometimes. Your adviser may set up a Breathing Space for you during this time so you don’t get hassle from creditors.

I’ve looked at some common questions about DRO applications here: DRO application FAQs. But talk to your adviser about anything you are uncertain about or would like confirmed.

This includes:

- anything you have on Hire Purchase or any unusual debts ;

- if you are owed money by someone. Or you expect to get money in the next year, possibly from benefits backdating;

- what happens to bills such as council tax and utilities if you have a partner.

It’s important that all your debts are listed on a DRO as you cannot add another one later. Let your adviser know if you are worried you may owe council tax for previous year, owe HMRC and tax credits ocerpayment, oew the DWP any benefit overpayments, may have parking tickets you haven’t kept track of.

Approving your application

As the adviser makes all the detailed checks, the process of approval is very fast once your application is submitted to the Insolvency Service:

- there is no court hearing;

- no-one visits your house;

- DRO applications are usually approved within 2 working days of being submitted;

- more than 98% of DRO applications are approved.

When your DRO application is approved, the Official Receiver send you a letter called the Debtor’s Notice. Keep this letter safe even when your DRO has finished – it is a simple proof that a debt has been included in your DRO.

Kerri says

I had a dro six years ago and have fallen into debt with my local authority, am I able to apply for another dro?

Sara (Debt Camel) says

You cannot have a another DRO within 6 years of your previous one. I suggest you talk to StepChange about whether a DRO is a good option for you now, or whether there are any other alternatives.

Sam says

Did you manage to get another one?

Sara (Debt Camel) says

you have replied to a very old comment – Kerri is unlikely to see your question. But this is not a matter of doubt – if your DRO was more than 6 ago and you meet the other criteria for a DRO now, you can have a second DRO,

Dan says

Hi. I am just undergoing the wait for the official DRO interview via the CAB. My question is what,during the year the DRO is active,does the OR actively do to monitor your income or is it all reliant on the honesty of the individual to submit any changes ?

Sara (Debt Camel) says

There isn’t any “active monitoring”, no one checks your bank statements or tax records each month or even at the nod of the year. The incentive to report (apart from the fact that you are legally obliged to!) is that the Official Receiver has discretion and is more likely to be sympathetic to your case if you do report promptly.

For income it isn’t just the extra income you may get that matters, you may also have extra expenses or reduced benefits. If you are unsure during the year, talk to the adviser that is setting up your DRO.

Dan says

Thanks for your prompt reply.The reason I asked is I am not keen on my employers knowing my situation and if the OR was in contact with them for check ups during the period of the DRO.In that event I may have been better of telling my employer ,but you have put my mind at ease.

Regards

Salman says

Hi

I am in the process of applying for the DRO which hopefully should get accepted but I might be in a position to get a new job that before tax raises my income by £3000 per year. How badly would this effect my DRO if I had one in place. I figured if I do get lucky and get the job pretty much all of my additional income may go to the creditors so financially I still wont have any improvement?

Sara (Debt Camel) says

Hi Salman, you need to do some maths. Your gross income may be going up, but how much will your take home pay (after tax, NI and any pension contribution) change? Then are you claiming any benefits such as tax credits, housing benefit or universal credit – if you are then these are likely to be reduced if you income goes up. Also will you have any higher costs, such as a more expensive commute to work?

I suggest talking to the debt adviser who is setting up your DRO to see if taking this job would mean your DRO is cancelled. You need to know that now – then you can take a proper decision about what to do.

Naomi says

Hi

I am just enquiring if any body has ever had a Debt relief order and had to send in there financial statements such as bank slips etc during their 12 month period or at the end?

Sara (Debt Camel) says

No you don’t routinely have to supply information during or at the end of a DRO.

Of course if you think your income might increase a lot, then you shouldn’t start a DRO. But if you are just worried about how intrusive this process is – well it isn’t.

Jessie says

Hello, I have a friend who is just about to start the process of getting a DRO, She has been off sick for over a year and has been so poorly she physically hasn’t been able to start the process sooner. Is it possible to have the moratorium period (12 months) written off as in could the debt be written off immediately if she provides the consistent sick notes she has from her doctors that covers that 12 months as proof ? Thank you in advance for any help

Sara (Debt Camel) says

No, there is no way the year moratorium can be speeded up or treated as having already happened.

If she is concerned that during the next year she may be back to earning a good wage and may have a DRO revoked, then she needs to discuss this with a debt adviser. It may be better to wait until she gets back to work to see what her finances are like then. Or bankruptcy may be a better option now. Or she could decide to postpone starting work until the DRO year is up.

But if in the next year she isn’t likely to get back to work, or her job will probably be poorly paid leaving her with little spare income then just getting on with the DRO now is probably best.

Lots of alternatives, she needs to to discuss these with a debt adviser who can set up a DRO if needed.

Nicola says

I am in the process of applying for a DRO, as a student what do I include in the DRO, as I have a maintenance loan, which is classed as income, but also have have a grant, are grants included as part of income as I have used the full amount to work out my income?

Sara (Debt Camel) says

Yes I think they are – but check with the adviser who is setting up your DRO.

Anna says

Hi!I’ve been single parent for 6 years and went trough few debts total 10K which I tried to re-pay by the debts management plan.I’m on low income and it looks like will never end plus I went on futher debts because I was re-paying old ones.Now I’m considering DRO as I met someone and I’m thinking about start to live together so I will be in partnership.I don’t want to tell him about my debts and really want to sort this out myself.From the other side I worry that If I will start to live with him during the period of 12 months my DRO will be revoked.I know that he also pays some debts back as we both coming out from divorces.Will my debts become his debts If we decide to be proper partners?I work part-time and have 6 year old son.He earns more but also pays his debts and child maintanance.Do I need to wait with partnership until the period ends?

Sara (Debt Camel) says

Your debts will never become his debts – not even if you get married!

But your situation may change a lot if your start to live together. Somethings will be cheaper, but you may also get less benefits. I think you need to take debt advice about your options now and how they may change when you are living together. Good places to get advice here: https://debtcamel.co.uk/more-information/

I also think you should both have an open discussion about money. He has debts himself – he isn’t likely to faint with horror because you have! You aren’t telling him because you want him to help with your debt, but because you want to be honest about your situation. It would be good if he can do the same with you.

Ian says

Hi there I’m struggling pretty hard with debt. I’m in about 11k maybe more and it’s driven me to the point of being suicidal. I earn 18k pa would this affect my application for a DRO and how would it work regarding renting again as I’m currently homeless. Debt repayments left me without food in September any help would be greatly appreciated.

Sara (Debt Camel) says

Hi Ian, there is no “upper limit” on your income that bars you from a DRO. But the important thing at the moment is not your debts but your housing situation. Once your housing is sorted, then a debt adviser can see whether a DRO or some other option is best for you.

Can you get to your local Citizens Advice and ask them for help? They can explain what to say to your creditors to give you a breathing space whilst your homelessness is sorted. And they may also have good suggestions about housing as they know the local area.

Kay says

Hi I currently work full time earning a good salary. My husband is a stay at home dad to our 9 month old daughter. Last year he was taken to court by dwp for an overpayment of benefits but was found not guilty to it being fraudulent. They also advised they are not able to come after me for the debt. It’s around £14k overpayment but he doesn’t receive any benefits or income at all. Would he be able to apply for a DRO to have this debt written off. He will not have any change of circumstances until my daughter is 3 and then possibly go back to work.

Sara (Debt Camel) says

Hi Kay, I am going to say possibly… sorry but he really needs to talk to a debt adviser that can look at the details on this benefit overpayment and the rest of his situation. A DRO is definitely worth looking into as an option.

cherry says

i have a huge overpayment in tax credits plus other debts total amounting to £17000. they currently take the overpayment of tax credits back by reducing my tax credits payment by 100% which means myself and my 4 children receive nothing now until late next year. this has only started in the last 2 weeks and im frantic. if i take out a dro will tax credits overpayment be included (there was no fraud i just didnt earn enough being self-employed to qualify for wtc apparently and can i make a new tax credits claim after the dro and expect to receive full child tax credits?

Sara (Debt Camel) says

Yes tax credits are included in a DRO. But the first thing to do is to ask for the tax credits recovery rate to be changed as this is causing you hardship – call HMRC tomorrow and ask for this, they will probably send you a firm to complete. Then go to your local Citizens Advice and ask for their help with this and also with your full debt situation and whether you will qualify for a DRO.

Rebecca says

Hi, I’m 28 and I seem to have aquired a lot of debt :( my current job barley covers everything including the debts. I have just enough to pay it all but nothing really over once everything including rent, food, work travel etc is paid. Soon my boyfriend and I will be moving which means I won’t have a job until I find one and it might not pay as much as I get now which is 1210. I don’t want my boyfriend to see how irresponsible I’ve been, I’m so ashamed. I had the debts before we were together but they’ve got bigger and bigger. My mum has mental health issues, and has been sectioned once. I admit I’ve comfort bought in the past because of it although I obviously can’t lay the blame on this entirely. Can I get a dro? Please help :( I’m feeling like I just want to end it all, I’m just caught in this cycle of the debts never seeming to go down :(

Sara (Debt Camel) says

Hi Rebecca,

I think it would help you to talk to a debt adviser who can look at your position. If you aren’t eligible for a DRO now (and you may not be if you can just about pay all the debts at the moment) then you probably would be when you move if you aren’t working or earn less. I suggest you call National Debtline on 0808 808 4000.

However, I know you don’t want to hear this, but you really do need to talk to your partner. You have had problems in the past, but the responsible thing to do now is to tell him about them and how you are proposing to tackle them – you aren’t expecting him to pay your debts, you are getting a plan that will work (hence talking to a debt adviser) but he does need to know. The longer this goes on, the harder it is to have this conversation and the more upset he will be. It’s not really possible to hide a large debt problem from your partner.

Ryan says

Hi, I was about to apply for a DRO and I told the agency who I am applying with my partners income is £600 a month. This is worked out averagely over the year. I have no income. When I got the application pack through the post the agency would like copies of the last 2 payslips from my partner which actually show she earned £730 for each month. I am confused on how to feel the budget sheet because the amount she earns a month is between £500-£700 and like I said the average is around £600.

If I was going to complete the budget sheet with the income £730 monthly for the whole year then surely tax credits, housing and council tax benefit would all be reduced. At the end of the year her earnings always work out to be £7500.

Also I’m not sure why my partners income is included because the debts are all in my name and was before I met her. I individually have no income but between us if we did have any spare income how can you say to someone your working and any spare money you earn has to pay the debts I accumulated 10 years ago?

Sara (Debt Camel) says

Hi Ryan, firstly don’t worry, this isn’t going to be a problem for you getting a DRO. There are questions about your partners income because household costs have to be split fairly. Imagine you were earning 15k a year and so did your partner – in that case you could only claim for half the rent, utilities etc. As you don’t have an income, this isn’t going to matter!

But it’s good to get the forms completed correctly as it saves having to answer questions later. So talk to the agency who is setting up your DRO about what you should do.

Gary says

Hi,

I am considering a debt relief order but i have a concern my children (my boy is 3 my girl is 2) have savings in premium bonds £1300 between them would this affect my application?

Thanks

Sara (Debt Camel) says

Assuming you havent just bought them for your kids, I wouldn’t expect this to be a problem. But mention it to the adviser that is setting up your application.

Alexande says

How often official receiver contact with the person that has got a dro during the period? My dro nearly will be finished and my situtation hasnt changed but noone on dro office contact me that how is going or requesting any letter.

Sara (Debt Camel) says

This is normal – there isn’t usually any contact at all. It is your job to tell the OR if something has changed.

You may find this article helpful: https://debtcamel.co.uk/end-dro/.

Peter says

hi there so I am eu citizen working in uk 10 years recently due bad luck i accumulate dept about 8k and lost good pay job since then i cant find decent pay job and work at retail ,i own on few rents and slowly paying off,i like to apply for dro and then go back to europe cause on minimal wage i am rally straggling and i have family at home who can help me not to become homeless or hungry every end of the month question is how would it work if i leave after dro to live in another eu country? many thx

Sara (Debt Camel) says

So far as I know there is no reason why you have to stay in the UK during the DRO moratorium year. You will need to report changes in your circumstances to the DRO Unit during the year. These would include not having to pay rent say if you moved in with a relative abroad. If you then got a job, your net income may be over the DRO level. I suggest you discuss these possible situations with a detb adviser who could set up a DRO for you.

Melanie says

Hi I’m applying for a dro. It says you can’t have assets over 1000 which I don’t but my partners car is worth more than 1000 will this affect my dro application?

Sara (Debt Camel) says

No, not if it is in his name.

Janet Milliken says

Hi I’m paying £267 into a DMP but I’m struggling with the payment as I’m disabled and due to worsening mobility need to get taxis everywhere (including work). I also have mental health problems. I can claim a lot of the taxis fares back through ATW but tend not to as I can’t face the extensive form filling. My question is if I apply for a DRO (I’m eligible if the taxi fares are part of my expenditure ) will they expect me to claim them back & therefore deem me ineligible?

Sara (Debt Camel) says

Sorry, quite a few questions.

Are you getting PIP? What rate?

Have you asked if ATW will pay for some help for you to complete the taxi reclaim forms because of your mental health issues?

Who is your DMP with?

How large are the debts in the DMP?

Janet Milliken says

Hi Sara

I don’t get PIP (turned down)

I could get help with forms but the main problem is having to pay up front for taxis and then claim back at end of month

My DMP is with Payplan

The debt total is £10000

Sara (Debt Camel) says

OK, I think you should discuss this with Payplan as you haven’t been able to claim all your taxis back and you are in hardship because you have to pay the taxis first then don’t get refunded until the next month. Ask if you can not make this months DMP payments as a result.

I think you do need to ask for help with the forms. Once you are asking for a refund for every taxi, after a couple of months it will all be OK as every month you will get a full refund of the previous month which will let you pay that months taxis.

If you think your mobility problems have got worse, I suggest reapplying for PIP.

Hannah R says

Hi i have been unable to find this answer anywhere I have 8 defualts from 2016 and one from early 2018 , I have applied for dro with stepchange and I have to now just pay the fee , my question is will all of those defualts now change dates from 2016 to 2018 or will they drop of in 2022 instead of 2026 , I know it’s only two years but hoping to move out in to rented accommodation and not sure what my best option is before I move out . Hope you can help thanks

Sara (Debt Camel) says

The default dates will remain what they currently are, new defaults will be added to any debts which aren’t currently defaulted.

Having a DRO on your credit record will make it considerably harder to rent, the defaults are less important. But if you aren’t renting now and you have less than £50 a month spare income, how are you going to manage to pay rent? Are you expecting your finances to improve a lot?

Jimmy says

Hi,

I was approved for a debt relief order last month, which was a great relief. My debts almost touched the 20k mark and my disposable income was at minus £79 per month.

Came home today and I have a letter from HMRC saying they owe me £1300 in a tax refund for tax year April 17 – April 18.

I know that I need to contact the insolvency service DRO office to tell them, do you think my DRO would be revoked because of this?

Also if I don’t tell them how can they find out?

Thanks in advance

J

Sara (Debt Camel) says

Read https://debtcamel.co.uk/dro-income-up/ which looks at this situation. £1300 is in the “discretionary” region – you should tell them promptly about this extra money as that is the best chance of them deciding not to end your DRO.

Wendy says

Hi Sara would I be able to put in complaints about unaffordable lending to companies such as shop direct and next if I have recently had a debt relief order put in place or would that be a bad idea? Thanks . Wendy

Sara (Debt Camel) says

It’s a very bad idea – a big refund could get your DRO cancelled… Same applies to PPI and payday loan refunds. See https://debtcamel.co.uk/dro-income-up/.

Wendy says

Okay thanks Sara for your advise. Wendy

Wayne says

Hi

Is it possible for you to give me some advice regarding my partners , she is about to enter into a DRO , at present she lives on her own with her 16 year old son , however I would like her to move in with me , will this affect her DRO , also what affect will this be on me .

Thank you in advance

Sara (Debt Camel) says

Affect on her DRO – Most single parents will have been on benefits. These will then change, possibly a lot, when she moves in with you (NB telling HMRC, the DWP and the local council that she has moved and has a partner is top priority after the move otherwise she will be over paid benefits and end up with them to repay.) On the other hand, her living costs will have dropped. She should make a fair contribution to your rent and utilities, not live with you “for free” It’s also reasonable that she should pay the expenses for her son – clothes, clubs, pocket money etc.

So this is very much case by case, but for many people there will be no change to their spare income, still having less than £50 a month, so the DRO will be unaffected.

She should talk to the adviser who is setting up the DRO about this as they will know the details of her case. In a few cases there can be other affects because she is moving, not getting a partner eg on on the repayment of any rent arrears she has.

There will be no effect on you if you avoid having any joint account, loan or mortgage with her for the next 6 years while the DRO shows on her credit record. Otherwise your credit score will be badly impacted by a link.

Claire says

Hi I have debt of £18000 I have been making token payments of £1 a month since 2014. They are showing as closed accounts on my credit file but no default date because I have been paying them regularly. There is no chance il ever be able to pay them back so would I be better off going for a DRO so at least they will fall off my account after 6 years?

Also if I do all the debt is in my name but do I they take my partners income into account for the DRO? Thanks in advance

Sara (Debt Camel) says

This sounds like a situation where a DRO may be your best option.

It is possible you could get default dates added (see https://debtcamel.co.uk/debt-default-date/) so they would drop off in 2010 or 2021. But you would still owe the money.

A quick check to see if there are other possibilities – what sort of debts are these? Who were the original creditors and have they all been sold to debt collectors?

Your partner’s income matters only because they should be paying their fair share of your household costs. If you both earned the same, it wouldn’t be fair for you to pay all the rent, council tax and bills.

Jackie says

Hi, I have been advised that a DRO with only affect my partners credit rating on a joint account If the account is overdrawn. Is this correct? Will it affect his rating if its one we both use, no overdraft?

The adviser also said that a mail order is still allowed as long as it doesn’t exceed a certain. Amount? I currently have £45 on a catalogue that’s not mine, but was used by a friend who wishes to pay (I’ve not yet fully applied for a DRO).

Can this mail order account whilst the DRO is in place? For minimal things? I don’t want credit but it doesn’t allow you to pay as you buy.

Sara (Debt Camel) says

“I have been advised that a DRO with only affect my partners credit rating on a joint account If the account is overdrawn. Is this correct? Will it affect his rating if its one we both use, no overdraft?” I don’t think that is right. A joint account creates a financial association, not the overdraft. One of you should get their name taken off this joint account.

The catalogue. If you paid it off as soon as you bought something, that would not be credit. You couldn’t buy anything on a buy now pay later deal. In general this is a very expensive way to buy things, so it may be best to give up the habit?

Jackie says

Thank you. That was my understanding regarding the account.

As for the catalogue. I only the facility that you get virtually everything from it. But yes you’re right.

Will it affect my application for a DRO the fact that it has £45 waiting to be paid/or be cleared by then?

Sara (Debt Camel) says

Other £45 has to be paid by the time your application is submitted OR it has to be listed as a debt on your application, in which case it can’t be paid afterwards.

Jackie says

Hi can you answer something for me please.

Can a debt relief order affect my current tenancy? I’m in social housing, no rent debts and I’ve never missed a payment. I can’t see anything in the tenancy agreement and wondering as I’ve been a tenant for 4years, unless they’re looking, would they know?

I understand only banks would be informed?

Many thanks

Jackie

Sara (Debt Camel) says

If you have no rent arrears there will no impact on your tenancy. Even if the social landlord knew, why would they case?

(There is only one minor exception, which is that it could affect your ability to buy under the Right To Buy. But if you qualify for a DRO it is highly unlikely you would be able to get a mortgage offer anyway.)

Jackie says

Thank you for answering that. Exactly as you said, as I qualify for a DRO it would affect my right to buy, I did consider this but my chances are shot anyway.

Do many succeed in years to come however? I’m not the breadwinner in my family, therefore in the future would only look to be a second name? I understand it takes time to rebuild but is this actually impossible or do you know of success rates here… People rebuilding? Or do we stay this way for life

I’m grateful for your advice.

Sara (Debt Camel) says

oh yes, people do get mortgages after 6 years when a DRO (or bankruptcy or an IVA, they are all the same for your chance of getting a mortgage in future) drops off your credit file.

You may be asked on a mortgage application if you have ever been insolvent (which is what a DRO is) and you have to say yes, but go through a broker and there will be high street lenders that won’t care about your ancient credit problems and will offer you a mortgage at a good rate.

A DRO gives you a clean start.

Jackie says

Thank you. This is very much appreciated. I’ve been in turmoil as to what to do. However the final straw was getting a CCJ, then I was told I had little chance of building up credit ratings anyway. So that I understand. Apparently the impact of the DRO is not much more than that if CCJ? My reason for going for DRO.

What I wasn’t sure of was the full long term impact of a DRO, it sounds so final. I thought no one would look twice in the long term (even though I’m standing no chance currently as I can’t get in top of things)

My intermediary has advised lots but I forget to question things like this. I have a phone contract too, Been with o2 for 20yrs, never missed a payment. I’m hoping they don’t revoke my contract but they stand not to get their money on handset so hopefully not. They’ve always honoured my updrade yet other networks wouldn’t entertain me. Might not with DRO showing on my credit file at time of contract renewal I daresay

Sara (Debt Camel) says

An unpaid CCJ on your credit record makes it VERY hard to get any credit.

re your mobile contract. You do need to talk to your DRO adviser about this. If they think you will have problems, you can get a SIM card then just pay monthly for that. But most people don’t find mobile contracts after a DRO are a problem.

Jacqueline May says

Hi i want to apply for a dro there all in my name does my partner income count towards a dro

Sara (Debt Camel) says

Your partner’s income only matters as they will be expected to pay a fair share of the household costs. So if you both have the same income, you would each be expected to pay half of the rent, council tax, bills. See https://debtcamel.co.uk/dro-applications-faqs/ for other questions you may have about the application.

The adviser that sets up a DRO will explain everything in detail. It’s good to make a list of questions to ask – there is no such thing as a silly question!

Michelle says

A relative on ESA has recently agreed an iva based on being told ccj for an old debt would disqualify her has she been mis advised and is it too late for her to apply for a DRO

Also when applying is there a difference between husband and partner.

Thanks

Sara (Debt Camel) says

She was told she couldn’t have a DRO because she had a CCJ? Or was this because the CCJ amount would have taken here over the 20,000 limit? How old was this CCJ?

Debbie says

Hi,

I’m after a bit if advice about a dro please. I do fit the criteria, live in rented property, have no assets, no car, on benefits.

I owe approximately £14,000 spread over 3 credit cards. I would say 90% of this debt is due to gambling. I had my light bulb moment six months ago and hung my head in shame at the amount of debt I had through gambling! No credit card has been used since. I’m just finding it so hard to even make the minimum payment every month, I haven’t missed any payments yet because my family have been helping me out each month.

My questions are,

Will I be able go get a dro because of the gambling.

Can the credit company object to the dro and could it be revoked.

If I got a restriction order say for 4 years would the debt still be written off after 12 months or would I have to wait until the 4 years was up.

Thanks for any assistance you can give me.

Debbie.

Sara (Debt Camel) says

Well done for getting through 6 months free of gambling. This is a good point to sort out your debts – you can’t carry on with your family having to help you.

Yes, you can get a DRO if you fit the criteria – gambling will not prevent this.

No, a credit card company can not object on the grounds that you had been gambling. And your DRO cannot be revoked because of gambling.

Your debts are still written off at the end of the 12 months even if you get a restriction order. There is an exception if a debt was obtained by fraud, but this doesn’t normally happen because of gambling even if you applied for credit and your application wasn’t accurate.

Debbie says

Sara, thank you so very much for your quick reply.

You have certainly put my mind at rest. I’ve had nightmares of being led to the gallows or flogged in public, my imagination has been running riot!

It is now time to sort my life out and get back on track, the first step to that is sorting these debts out. I will be getting in touch with CAB on Monday to get an appointment and start the ball rolling.

Once again Sara many thanks.

Debbie xx

Martin says

Hi Sara,

First of all, thank you so much for all the time and effort you put into this website. It’s an invaluable resource, and you should be very proud!

I have a quick question about what happens after a DRO has been granted.

What happens if creditors included in the DRO continue to add interest and charges during the moratorium period? At the end of the moratorium period, do you still owe the difference between the debt figure listed on the DRO application and the balance at the end of the 12-month period?

Also, if interest and charges added during the moratorium period cause the total value of your debt to breach the £20,000 limit, does this mean that the DRO will be revoked, or is it just important that your debts are below £20,000 at the time of application?

Thank you,

Martin

Sara (Debt Camel) says

A DRO freezes your debts. All that matters is that you are below the £20,000 when you apply. At the end of the year your debts are then written off.

embob says

hi any advice please i have a debt management plan with a stepchange and have over 2 years left but have more debt that i am paying as well and feel that a debt relief order is my alternative.i no its my own fault and want to put my life on the upward turn now.i have read all your information on the dro and fit all the criteria.would it be ok to cancel the dmp and go for a dro or is it not that straightforward

Sara (Debt Camel) says

That may be a very sensible decision for you. You don’t actually have to formally cancel a DMP, just stop paying the DMP and stop paying the newer debts as well for a few months.

I suggest you talk to StepChange as they can talk about your options and set up a DRO if that is right for you.

embob says

thanks for your help. will i have to tell my bank or open a new bank account ? i do not have any debt with my bank

Debbie says

Hi again,

Just a couple of more questions if you dont mind.

Would it matter that I haven’t missed any payments, as I said my family have been paying the minimum payments on the cards for me.

I have noticed that in bankruptcy they mention life insurance policies, is it the same with a dro, my husband has got an over 50s life insurance plan in his name, its only £10 a month and comes out of my bank, would that be affected or am I just over thinking things too much.

Thanks

Debbie.

Sara (Debt Camel) says

No it won’t matter if you haven’t missed payments.

(What can sometimes matter is if for a while you have been paying some debts but not others – that is called “preference”. But if all the creditors have been paid or all not paid or all in a DMP, or all getting the same token payment, then they are being treated fairly.)

Life insurance can be a problem in two ways. First some insurance policies have a value they could be cashed in for – I don’t think your husband’s will have! Second the OR may not treat the payment as an allowable expense. This only matters if it will push your surplus income over the £50 a month level. Your debt advisor can say if this looks likely to be an issue for you.

Is there any reason why your husband can’t start paying for this?

Debbie says

Thanks Sara,

Yes the insurance policy has no cash in value, if I stopped paying it that would be the end of the policy, it only pays out on death. He took one out for me and I took one out for him, we pay each others, not sure now why we done it that way! I suppose I could swap the payment to his account.

Thanks once again Sara.

Debbie.

Cheryl Howe says

From what you advise, it seems that I would qualify for DRO. However, some of the debt I owe is to my dad and I would obviously like to pay this. Can I do this and, if so, can payments I make him come off my disposable income?

Thank you

Sara (Debt Camel) says

Your debt to your dad would be included in your DRO and wiped out. Of course you could still pay him some money later if you wanted. But those payments would not be regarded as payments that would reduce your disposable income. I think you should discuss your full situation with a debt adviser.

James says

Hi,

Regarding the 50 pounds limit, does that include what is left after debt repayments? Thanks.

Sara (Debt Camel) says

A budgeting loan is a debt that cannot be included in a DRO.

You need to talk to your DRO adviser about what happens when the loan is paid off. If your budget would be “negative” before thus happens, it nay nit bea problem.

Karen says

Hi Sara,

I started an iva with credit fix 3 years ago. I have had occasional struggles with the monthly repayments.

I had £6000 debt (catalogues) I live in rented accommodation, am single and my only income is benefits, including DLA. I had never heard of DRO until I found your website today. Can I cancel my iva and apply for DRO or is it not possible?

Many thanks.

Sara (Debt Camel) says

What is your monthly IVA payment?

And how many months payments have you made?

( these may sound irrelevant but actually could affect your options…)

Kelly R says

Hi my partner is currently going through applying for a dro. He owns a car worth under a £1000 But I don’t my car is worth more will that matter? When I rang step change we decided to do a household income form because he doesn’t work at the moment because of mental health problems. I gave all the details asked and was were lower the £50 a month but i only mentioned his car. I’m now worried that it will affect the dro. All the debts are his not mine.

Sara (Debt Camel) says

A car owned by you will not affect his DRO. Even if he is the only person that drives it, it could still belong to you!

Have a look at the form you completed. Did it ask for details of any car he owns? or any cars in the household?

Kelly Taylor says

We are awaiting the forms from step change…I am sure they just asked if it was him that just owed a car. That was my next question actually if I own the car and he insures the car (cheaper as I am a new driver) Thank you for you help. So nervous doing all this.

Kimberley says

Im with new partner and he has a new home will that infect him?

Sara (Debt Camel) says

It shouldn’t do. Read https://debtcamel.co.uk/what-happens-to-a-dro-if-i-move-in-with-a-new-partner/ and talk to a debt adviser about this.

embob says

hi some advice please. i am in my final stages of applying for a dro.i noticed that some of the amount owed on my balances is slightly lower will this matter or will i have to get these changed

Sara (Debt Camel) says

So the amounts on your application are too large. Or too small?

embob2 says

hi they are smaller than on my dro application form for a couple of my debts

Sara (Debt Camel) says

In that case i don’t think it is significant, but tell the adviser setting up your DRO.

embob says

many thanks for your help.just 1 more question i am in the process of saving enough money to finally pay my £90 for my dro.a few weeks ago i received a refund from a payday refund would the official receiver see this as a problem in my dro

Sara (Debt Camel) says

how large was the refund? what have you done with the money? and do you have any more complaints underway?

embob says

it was about £150 and iv saved it for my dro

.and no i have no more refunds

embob2 says

many thanks for all your help.my dro form has bern submitted and fingers crossed will be ok and can sort out my life

Sara (Debt Camel) says

best of luck – most people say it was the best move they ever made.

Ann says

Hi there and thank you so much for this question/answer section on your website. May I enquire whether it would be alright to contact my credit card debt companies and offer a monthly token payment until my DRO via Stepchange has been arranged and hopefully granted by The Insolvency Service? I have missed the last 3 payments with one of the three credit cards and very worried. Thanking you in advance.

Sara (Debt Camel) says

It’s good to treat all your creditors in the same way while you are applying for a DRO. that could be making no payments, or sending them all a token payment.

I wouldn’t really worry about having missed some payments if you are getting a DRO, all they will do for a while is send you cross letters and the odd text or call. If you talk to StepChange they will be able to put your mind at rest or suggest what to do. Good luck!

Ann says

Thank you so much Sara, really appreciate your advice.

Joshua North says

Hi,

I just got a 6k council tax debt (long story ) but i have credit cards maxed out 10k and about 2k other debts (some of these debts would go of file before a dro )the council want payments of £300 a month ,thing is after all basic bills ,rent ,child maintance ,im left with around £380 a month to myself for food petrol , other bits , would a dro be ok for council tax

Sara (Debt Camel) says

A DRO can include council tax debt. You need to talk to an adviser that can set up DROs about whether you meet the DRO requirements – if you can it may be a very good option for you.

Joshua North says

thank you i will do that i cant survive on 80 a month or pay council and ignore others catch 22

carl says

Hi Sara

My debts are at 19500 but one debt goes of my credit record july 2020 ,though they are not chasing for me it as lowells entered wrong default date ,i had the letter of them but cant find it was 2years ago , i also have 1 debt 6900 though they will amend to 6400 in september , could the lowells debt be left out of a dro ?and am i right in thinking if you apply and your debts are under 20k at the time its ok ? At my whits end with worry

Thank you

Sara (Debt Camel) says

No you can’t leave the Lowell debt out of the DRO. And you shouldn’t want to. Lowell may find the default date error and still pursue you for the money and you could get a CCJ, or if the money would have taken you over the 20k your DRO would be cancelled.

You need to talk to a debt adviser asap about your options.

Kimberley says

Hi my name is kim i live with my new panter snd i have debits i have dla but i dont think ill be getting it any more all the debts are in my name not my partners im a bit worried will the dto take his assets and will infect my uc i only get 360 on u uc and i dont know ive im getting my dla any more as ive had my report back and it dont look gd i dont want them take my panters stuff as hes not on the debts its not far on him

Sara (Debt Camel) says

Hi Kim,

nothing ever gets taken in a DRO, not even your stuff. Anything your partner has, including savings, will be safe.

I think you should talk to someone about a DRO now. It may be a very good move for you even if your DLA continues.

I also think you should get some help with your DLA – have you had a letter saying they are moving you over to PIP? Or have you had an assessment saying you don’t have enough points? Whatever the problem, your local Citizens Advice can help you with the next step, including an appeal. And they can also check to see if a DRO will work well for you.

Miss A says

Hi,

I just came across this article. I have a few questions on DRO. I have a hire purchase car, a car is a must for me and my job which requires a lot of home visits and I don’t have disposable income to purchase a cheap car. Would DRO possibly consider leaving the car. The value of the car is approximately £5000 now but by the time I finish clearing off the finance it will be £1000. Does DRO affect future mortgage plans? I think this is the best option for me compared to an IVA. Pls let me know.

Sara (Debt Camel) says

You can have a car in a DRO, but sometimes the car firm will repossess it. But they may also do this in an IVA!

When does the car finance end?

From your previous comment, at the moment you have too much spare income for a DRO but that may be different in a few months.

DROs, bankruptcy and an IVA are all forms of Insolvency and they all have much the same effect o the chance of you getting a mortgage in future. The main difference is that with a DRO and bankruptcy you can start saving a deposit sooner and so will have a larger one than you would after paying a lot more money into an IVA! See https://debtcamel.co.uk/bankruptcy-iva-dro-credit-rating/ for details.

Miss S A says

I have another five years before the car finance ends. I have 100 left over after paying for everything but even that 100 goes in food and nappies. So before my next Salary technically I have nothing left hence why haven’t been able to pay anything towards my debts. I was given the option of an IVA but I’m too scared to go for it in case I can’t commit to payments regularly hence why apprehensive. I need my car as I said for work but if the firm will repossess it I feel stuck I suppose.

Sara (Debt Camel) says

“I have 100 left over after paying for everything” is that after you have made the current repayments to your other debts and the car finance? How large is your monthly car finance payment?

Miss S A says

Maybe if I explained a bit better. My current maternity Pay 1600 this figure will be dropping in a month or 2 months. I return to work either January or March 2020 depending if I extend my 9 months. My actual salary is 1800. However I plan to drop my hours to 3 days a week. I get tax credits 33 a week and 137 for child benefit.

My rent is 226.92 per week. Monthly I pay after HB help £719. I pay car finance 237. Car insurance 103. Council tax £73. I pay professional council £9 a month and another £34 to stay registered to practice. I pay 49 in electric and gas. I pay 30 to water bill per month. I pay 8 Netflix. 38 to tv license. Mobile broadband all inclusive 88 there no tv channels. I pay 60 for my sons club. I pay 50 for his monthly rehab for hand disability. I pay 14 a week for formula. 22 a week in nappies. Since it’s a newborn and changing quickly I could easily spend 20 a month in clothes for him. 20 for my other son for clothing monthly. Food and cleaning about 260 a month. So i don’t see how I can clear of my debts too.

Here I haven’t even added things which life may require such as clothing for me, hair cut, toiletries. Furniture and stuff for newborn. It’s all necessaries above. So I’m not sure if I actually qualify. My biggest fear is my car. I can’t do without one. My sons school is far. His rehab clinic are far. Food shopping. One hand I wanna clear my debts and deal with all the calls and letter other I’m confused.

Sara (Debt Camel) says

On those figures you can’t possibly afford an IVA, you need to rule that out as it would fail after a 3-12 months of massive stress and worry.

I suggest you talk to your local Citizens Advice about benefits and how they will change when your maternity pay ends. And whether you could get any additional benefits if our son is disabled.

Citizens Advice can also look at a DRO for you.

You may need a car, I don’t know, it depends if there is any public transport. But the car you have is absurdly expensive. You will be paying well over £400 a month when you add in petrol and servicing. I can’t say if you would lose the car in a DRO, but that doesn’t make any difference to a decision between a DRO and an IVA because you can not afford an IVA. Full stop.

Miss S A says

Thank Yes I agree. I’ve offered IVA multiple times. This time round they just keep calling me and telling me that it’s the best way for me to move forward because I have 174 remaining after my necessary spending which I still can’t work out where is, given that I’ve told him my mat pay is due to change and my plan to reduce my hours and future child care costs. Yes my car is the most expensive thing at hand and cause I’m stuck in a contract I didn’t know what to do but let’s see. I’ll get in touch with citizen. Just one last question each time I google citizen in my area for DRO or finance nothing comes up. Isn’t there one inn newham?

Mrs B says

Hi

My partner is currently looking at getting a dro. What we are confused about is what they will look into of mine. I have some debts but they’re totally manageable and I’m in control of them. He earns much more than me, yet we are well below the £50 excess. A dro isn’t an option for me but is the best thing for my partner. What info will they want about me? Will they need to know universal credit payments, child benefit, maintenance payments I receive etc? Also all of these will reduce a lot soon due to my child leaving education. I also have a very small wage. Which of these will they look at and will they need to look at my bills too or will they tell me I’m not allowed to pay them? A dro is not an option for me, but I’m concerned about how my partner’s will Affect me, even though I know it’s the best thing for him.

Finally, my car is still financed, but the finance is in his name. How will this affect things?

Thanks, I really appreciate any advice you can give

Sara (Debt Camel) says

“Also all of these will reduce a lot soon due to my child leaving education. I also have a very small wage. ” in that case you to may need to look at a debt solution soon?

What info is needed about a partner depends a bit on the adviser setting up the DRO. But typically they want to know your income so household expenses can be fairly allocated. So if you earned the same, that would be 50/30. As he earns more, he would normally be expected to pay more of the expenses – so it’s in your interest to co-operate and show how little you do earn.

If the car finance is in his name, it may be that the car finance company will cancel this and repossess the car if he opts for a DRO, IVA or bankruptcy. even if you are still making the payments.

Michael smith says

I want to apply for a debt relief order but I worked out my Esa a month and I think I have 167 a month left but I’ve not worked out my bills properly could I still qualify just thought I’d ask thanks

Sara (Debt Camel) says

If your only income is ESA you are very unlikely to have much spare income a month and you are going to qualify for a DRO, assuming your meet the other criteria. Phone National Debtline on 0808 808 4000 and they can help you.

Derek says

Hi Sara,

I’ve just come to the end of a token payment DMP and I’m about to apply for a DRO. I haven’t yet spoken to the DRO specialist unit at Step Change, so I was wondering if you could explain how rent arrears with your current landlord are treated.

Are you allowed to exclude them from a DRO?

If not, are you allowed to continue to pay them out of your budget surplus?

I’m with a housing association that does it’s best to help tenants so no fear of eviction, but obviously they’ll need the full rent.

Thanks,

Derek

Sara (Debt Camel) says

No, you can’t exclude rent arrears.

Yes, you will be allowed to continue to repay them out of your budget surplus.

Where you have rent arrears to a local council or Housing Association, I suggest you talk to your local Citizens Advice, as they may know how the housing association treats tenants in a DRO.

Derek says

Hi Sara, thanks for your response.

Is there any risk I’m not aware of if I ask the housing association? They asked when I signed the tenancy agreement eight months ago if I was in debt and I told them I was on a DMP (they didn’t ask for any figures and seemed satisfied that the debt is being managed). The amount owed is only about £150 because housing benefit is paid in arrears so there’s always the option of delaying a DRO until I’ve cleared the rent arrears.

The reason I’m really in a hurry is that in a month’s time I’ll get a summoning for a council tax bill (for a former property) and have £45 court costs added to the debt. As I’m writing this I just thought of another question, if I may. Would the council tax bill be included in the DRO or does a court summoning have any impact?

Sara (Debt Camel) says

£150 arrears isn’t going to be a problem. You don’t have “real“ rent arrears at all, you have a timing difference between benefit payments and rent being charged.

I suggest you talk to StepChange now, and unless they say you need to, don’t bother to talk to your Housing Association.

But the council tax bill will always be included in your DRO even if it has gone through getting a liability order in court. It’s good to get a move on with the DRO application though as it takes a couple of months usually and you don’t want the hassle of dealing with bailiffs for the council tax (tip – never open the door to a council tax bailiff!)

Derek says

Thanks for the advice Sara. I’ve been informed by the council that after they receive a liability order I can contact them within 7 or 14 days to agree a payment plan. It’s only a few weeks council tax but I understand the bailiffs (crazy in this day and age!) are only called for if you still can’t pay or agree on a payment plan. The amount they would be allowed to take from your benefit of wages is quite small, starting at 3% if you receive at least £75 a week.

Ryan says

I currently have an amigo guarantor loan which I am finding extremely difficult to keep up with the payments. (I am a carer and my only income is from benefits) currently the payments are being collected from the guarantor, obviously I am unhappy about this. Before this happened I had contacted amigo and asked them for a DMP, i was willing to pay more interest in exchange for reducing the monthly payments by half. However, Amigo refused this and insisted on collecting from my guarantor instead. So that’s why I have landed on the DRO page. I am considering applying for a DRO but because I have a vehicle (worth less than £1000) one thing I am concerned about is that I rely on being able to pay for my insurance on a monthly credit basis, and I understand that a DRO on my file would affect my credit score negatively, so my question is would the DRO on my file prevent or make it difficult for me to obtain car insurance on pay monthly credit basis in the future?

Sara (Debt Camel) says

First let’s think about guarantor loans and DROs. Yes you can include your guarantor loan in the DRO. If you do the liability to pay remains with the guarantor, your DRO doesn’t change that. You may not care? But if you do, then the guarantor needs to be removed from the loan…

This can be done in several ways.

Possibly the simplest is for you to complain to Amigo that the loan was unaffordable and they should have realised that before they gave you the loan if they had looked closely at your credit record, income and bank statements. There is a template letter you can use here: https://debtcamel.co.uk/how-to-complain-guarantor-loan/. If you win this complaint, the interest will be removed from the loan and your guarantor will be released from it and you will be able to make a more affordable payment arrangement. A VERY large number of these complaints are currently being won, obviously I can’t guarantee your will be but this isn’t some outside chance that won’t often work.

Would this be enough to change your whole situation? Or would you still need a DRO because of your other debts?

Some other questions. This may sound irrelevant but the answers to them may affect whether you have any better options…

Are you on good terms with your guarantor?

How well off is your guarantor, is paying this loan a struggle?

Was this your first loan from Amigo?

Do you have other high cost credit eg payday loans?

Bumblebee says

Hi

I’m considering a DRO. I do have rent arrears and am a council tenant. There are no plans re seeking possession etc as there is a repayment plan in place. I know it will affect me re Right to Buy, but will a DRO potentially leave me homeless?

Sara (Debt Camel) says

The best place for you to get advice on this is your local Citizens Advice as they will be aware of what your local council does in DRO/rent arrear situations. Often there isn’t a problem but you need to be sure what will happen to you.

... says

Would you say it’s better going for a dro as I have s CCJ or my record from October last year which is now satisfacted anyway even if my overall debt is not that much

Sara (Debt Camel) says

No! If you have already paid the CCJs and you don’t have much other debt, why would you want a DRO?

Roxanne says

Hi I’m looking at trying to get some answers. First of all I have a debt of about £18000. Do you include on going payment you already have like I have a loan I am paying £60 a week for which takes me under the £50 disposable income, but if they don’t include that debt then I have over £50. Also could I put new debt in or is it just old ones? So I’m assuming they would accept me at first then at the end I will have more so they won’t clear my debt? I’m so confused about all this.

Sara (Debt Camel) says

All your debts at the time of the DRO application go in. Not just old ones.

The “£50 a month” calculation is done assuming you don’t pay anything to your debts. But the expenses you are allowed may be more generous than you think… I suggest you talk to National Sebtline on 0808 808 4000 about whether a DRO is suitable for you and if not what your other possible debt solutions are.

Clive Mahoney says

Hi if someone as been approved for DRO

Will the people monitoring check persons bank each month?

And are thay told of any tax refunds by Tax people?

Sara (Debt Camel) says

Your bank account isn’t monitored. But you have to notify the Official Receiver of any windfall you receive such as a tax rebate. This isn’t a problem if it is less than £1000, if it is more your DRO may be ended. If you are expecting a large refund, it’s probably better to postpone starting your DRO until afterwards.

K says

Recently moved in with my partner and considering getting a DRO

He earns a good wage and owns his house and his car. I have nothing, no job, no car or house. Do they take his earnings and possessions into consideration when I apply ? I have been told baliffs will be visiting due to old council tax Bill’s (it was being paid out my benefits but since moving in I’m not eligible) will this all be included? Thank you

Sara (Debt Camel) says

You should be OK for a DRO. His possessions are not yours. And the fact you have only just moved in emphasises the fact you have no claim on his house.

Yes old council tax bills can be included in a DRO.

I suggest you talk to a Debt Adviser and get the DRO process started.

Before a DRO is set up, it’s important that you don’t let any bailiff into the house – see https://debtcamel.co.uk/bailiffs-dont-open-door/

Derek says

Hi Sara. I hold health power of attorney over my mother, not financial. Does health PoA also have to be removed before applying for a DRO?

Liam says

Hello,

When the creditor recieves the creditor notice informing them that a DRO has been granted – do they recieve details of the budget and income expenditure and assets and all the ins and out of the situation etc or just a notice to say a DRO has been granted ?

Sara (Debt Camel) says

They receive a copy of the debt relief order, this lists the debts included in the DRO. It doesn’t give detail your I&E.

Adrian says

Hi, I have about 15000 in dept, towards which I pay a fixed amount monthly trough a dmp.

I have a ‘help to buy ISA’, where I occasionally put money, not to buy a house as in the current situation I won’t be able to. It is mainly due to its high-interest rate and tax-free. The savings I have there are over £1000

I am considering starting a DRO as my work situation will not improve for the next years, as I am starting a uni course and will only be working part-time.

I am trying to understand what will happen to my savings? For me, it’s important to pay the monthly dro but also feel financially secure by knowing I have few savings if something goes wrong such as medical issues or loss of job.

Sara (Debt Camel) says

How large are your savings?

What sort of debts do you have?

Matt says

Hi, I owe £7500 to my bank NatWest for a loan and also £2500 overdraft to NatWest plus just received a Virgin £3500 bill from many years ago. Big surprise. I’ve had a DRO about 15 years ago.

I’m disabled as of 4 years ago, now have multiple autoimmune disorders. All the money I receive is from benefits. PIP, ESA, Housing Benefit and Severe Disability Premium.

I am struggling now but I do have more than £50 left each month. Will I qualify for a DRO?

Thanks

Sara (Debt Camel) says

I am sorry to hear about your health problems. Yes, you should qualify for a DRO as all the costs associated with your disability are taken into consideration. Talk to a debt adviser and they will go through everything in detail with you.