If you are thinking of going bankrupt, there will probably be a lot of things that you want to ask.

This page looks at the nine most common questions people have about how bankruptcy will affect your life.

Contents

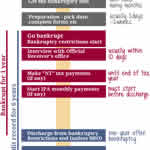

A brief overview of bankruptcy

You apply to go bankrupt online. The old days of having to go to court, before a judge, with masses of paperwork have ended.

Bankruptcy writes off almost all of your debts. It can give you a new beginning, a clean start in life.

When you go bankrupt, the Official Receiver (OR) will decide:

- if any of your assets will be sold. But most people do not lose any assets!

- if you have to make monthly payments for three years, called an Income Payments Agreement. But five out of six people do not have to make any monthly payments!

You will be discharged from bankruptcy after a year. After you are discharged you will find it harder and more expensive to get credit for the six years that bankruptcy shows on your credit record.

Everyone should get advice from a good free sector debt adviser before deciding to go bankrupt. No matter how obvious you think bankruptcy is, it is always worth 30 minutes of your time to talk to an expert as you may have better alternatives. Read A guide to bankruptcy which looks at these.

1. Will I be allowed to go bankrupt?

Yes! People often worry that they will be told they can’t go bankrupt as they will be told they just have to pay off their debts. This doesn’t happen.

When you make a bankruptcy application, this has to be approved by the Insolvency Service’s Adjudicator, who will look at various technical matters, including whether you are “insolvent”. The most common reason for an application to be rejected is that the person doesn’t normally live in this country.

If you have taken advice from a good free sector debt adviser and have been told that bankruptcy is a good option for you, then your bankruptcy is going to be approved.

2. What about my job?

There are some jobs which you cannot do as a bankrupt eg be an MP, be a company director. In some professions – solicitors, accountants, financial advisers – you may be prohibited by your professional body from practising until you are discahrged from bankruptcy after a year. It may be possible to find a similar role for which you do not technically need to have the relevant professional qualification.

If you are in the police, need a security check or you must inform your employer if you go bankrupt (this includes some jobs with banks), you might assume you will lose your job. However, the important thing for this sort of job is normally that they don’t like employing people with large financial problems because of concerns about fraud or blackmail. By going bankrupt you are getting rid of your debts and by telling your HR department you are eliminating the chance of blackmail.

So have a discussion with your HR department in confidence as it is possible that you will not lose your job. If you are a member of a Trade Union, they will have come across other people in this situation and know what happens in practice.

Lots of people worry unnecessarily about their job and bankruptcy. Unless you work in one of the areas mentioned above it is extremely unlikely that you will have any employment problems.

Ask yourself if you have ever been asked if you are bankrupt when applying for a job? If the answer is no, your employer probably doesn’t care.

Business Debtline can advise if bankruptcy is a good option for the self-employed and people with small limited companies.You are allowed to be self-employed as a bankrupt, but your existing business will be closed down and you will have to start to trade again. If you are a decorator and you just have the tools of your trade this won’t be a problem. If you employ other people and have a lease on a building, this gets more complex and you should take professional advice.

3. I’m renting – will bankruptcy affect this?

There may be a clause in your Tenancy Agreement which allows your landlord to end it if you are made bankrupt. If you live in council or housing association property, it is extremely unlikely that you will lose your home. If you are renting privately, your landlord is highly likely to want to keep you as a tenant – after all, if you have managed to keep paying the rent so far despite your other debts! It is a rare landlord who would prefer to get rid of a good tenant and have to look for a new one.

Renting somewhere new when you are bankrupt can be difficult because you will fail any credit check. But if your credit rating is already very poor, going bankrupt may not make much difference!

There are four ways around this sort of problem: find somewhere to rent privately, not through a letting agent, as landlords can apply common sense to your situation whereas letting agents normally have no discretion; get a guarantor; have a very large deposit; or delay your bankruptcy until after you have moved.

4. I’m buying – what happens to my mortgage and my house?

The Insolvency Service page Bankrupt’s Home covers many of the questions you may have about this.

Your mortgage and any secured loans are included in your bankruptcy. If you have handed back the keys to the lender or you have been evicted by the lender any shortfall after the property is sold will be a debt that is wiped out by your bankruptcy. This applies even if you pay the mortgage for a while and then hand back the keys.

But if you carry on paying your mortgage and secured loans your lenders will not repossess the property, so it may feel as though bankruptcy hasn’t affected your secured debts.

How much equity do you own?

If your house is worth more than the amount owed on any mortgage plus secured loan, then there is equity in the property and the OR will want to sell it.

When deciding how much equity you have, it can be reasonably argued to the OR that a lower value of the house should be agreed because of the need to sell the property relatively quickly and because lower sales costs are incurred (no estate agents or solicitors). Think of all the problems with your property – it needs a new roof, the boiler is 20 years old etc – as these can all reduce the amount of money needed to purchase your equity.

When you own the house jointly, the OR can still force a sale of the house, but your partner will be able to keep all their share of the equity. You can argue that your share of the equity is less than 50% if, say, your partner provided more than half of the deposit for the house, or if your partner has paid for large improvements such as installing central heating or building a conservatory.

If you have never owned any part of the property, the OR may still decide you have some beneficial interest in the property if you have contributed towards the deposit for the mortgage, if you have paid the mortgage or if you have paid for large improvements to the house. This is a complex area – discuss your situation with National Debtline if you think it might apply to you.

Ways to avoid losing your house

The OR has three years to decide what to do with your property. If there is no equity at the end of this time, the house will usually be returned to you.

You can avoid losing your home if a relative or friend can “buy” your equity from the Official Receiver:

- this could be your partner who owns the other half of the house if they are not going bankrupt;

- if there is no equity in the property a relative or friend can buy your interest for a nominal sum from the OR plus costs of a few hundred pounds.

If you cannot arrange for someone to buy your equity then you are going to lose your home:

- you should explore the alternatives of a DMP and an IVA in detail before deciding that bankruptcy is preferable.

- when your family are living with you, you are usually given 12 months before the sale to give time to make other living arrangements.

- if you have children or a disability, having your house sold by the OR will usually mean that your local council will be obliged to re-house you when you are made homeless.

- if you prefer to rent privately you will be allowed to save up a deposit for renting. Sometimes this could be done by stopping paying the mortgage.

There is no point in trying to transfer your half of the house to your partner (or anyone else) before you go bankrupt to avoid losing it. If your name is not on the deeds of your house so that you are not its legal owner, the OR may still decide that you have a beneficial interest in the property.

5. What about my car?

If you have a car, you may lose it unless it is essential. The simple case is where you have to have a car to get to work, perhaps there is no practical public transport or you have to travel for your job. You may also be able to have a car if it is essential for other reasons – health problems, school runs, caring responsibilities. You will need to explain why this is the cheapest or only practical alternative you have.

But if you drive a car that belongs to your partner or a relative, it is safe. This applies even if you are the registered keeper of the car. You may need to produce proof of who bought the car.

If a car is essential, you will be allowed to keep yours if it is worth less than about £4,000. Otherwise, it will probably be sold and you will be given £3,250 to purchase a cheaper car.

Cars on finance

The exception here is a car on finance. Here you do not own the car but it is more complicated and you should talk to a debt adviser. Some finance agreements have a clause which allows the lender to end the agreement if you go bankrupt or enter an IVA.

If you have HP which is just about to end, you may soon own the car. But early in finance or with PCP, most cars on finance will have negative equity, so the OR will not want to sell them.

Whether you are allowed to make the finance payments will depend on how large they are and whether you need the car for work.

6. What about all my other possessions?

You will lose any savings and investments (except your pension, see below) even if they are very small, such as £25 in premium bonds.

For possessions, you have to list your “assets” on your bankruptcy application if they are worth more than £500.

This £500 is their second-hand value, what you could sell them for, not what they originally cost. Even a new laptop or large fridge freezer is unlikely to be worth £500 second-hand!

It’s important to emphasise what doesn’t happen and what is not at risk:

- no-one will visit your house to make a list of stuff to be sold.

- the OR is not interested in the tools of your trade, your personal possessions, clothes or household goods unless they are of unusual value. Will I lose my lawnmower? looks in detail at this subject.

- your partner’s things and your children’s toys don’t have to be listed and are not at risk.

Your partner or a friend can offer to buy any items which the OR does claim, such as your car.

As a general rule, you should not give away or sell assets for less than they are worth before you go bankrupt. This doesn’t apply to normal presents, eg to children at Xmas.

The OR can go back and overturn transactions up to five years in the past. You may already have done this without any intention to defraud the OR. If this is the case, you should list the sale/gift on your bankruptcy application.

7. Will my pension be affected?

If you are already drawing money from your pension, then the income from this is included in the Income Payment Agreement calculations, see What happens after I go bankrupt?

If you are under 55 and not yet drawing money from your pension then it is not at risk except under extremely unusual circumstances eg you have made extremely large contributions to it which seem to have been funded by debts; a normal company pension will not be touched.

This is a bit more complicated if you are over 55 and have a defined contribution pension. Basically your pension will not be touched but if your pension pot is large you may be considered not to be insolvent, so you cannot go bankrupt, See this article on Pensions and Bankruptcy if this might affect you.

8. Who will know that I have gone bankrupt?

The OR will inform your creditors and, sometimes, your landlord about your bankruptcy.

Your employer is not informed of your bankruptcy. In theory, an employer could guess what has happened because your tax code will be changed to a nil code. But this isn’t likely – people’s tax codes change all the time and there are plenty of other reasons you may have a nil tax code apart from bankruptcy.

The Insolvency Register has the official list of names of people who have gone bankrupt, had a DRO or an IVA.

If you are at risk of violence, it is possible for your address not to be published – talk to a debt adviser about how to do this.

Bankruptcy Notices used to be printed in a local newspaper, but this is now very rare. It is usually only done if you are self-employed and the Official Receiver thinks you may have some local creditors. A small notice about your bankruptcy is placed in the London Gazette.

9. Can I get a mortgage afterwards?

It will be harder and you should assume that you will need a larger deposit than someone on the same income who has not been bankrupt. Read the page on Bankruptcy and your Credit Rating for a more detailed explanation. ]

The other insolvency options (IVAs and DROs) all have the same effect on your chance of getting a mortgage in future.

But also step back and ask yourself whether you have any chance of getting a mortgage if you don’t go bankrupt.

If you aren’t that young, or you don’t have a well-paid job and you live in an expensive part of the country, then owning your own house may just be a dream with no real chance of ever happening. Don’t let this sort of wishful thinking stop you taking the necessary measures to deal with your debts.

Help – a creditor is proposing to make me bankrupt

If one of your creditors is threatening to make you bankrupt, it may be a bluff to get you to pay them more money. It is very unusual to be made bankrupt for a normal credit card or loan type of debt. It happens more often for tax, including council tax, and commercial loans – did you guarantee a loan to your business?

But if you receive a Statutory Demand for any debt, this is not a bluff and you should take this very seriously as you need to settle the debt or get debt advice very fast to prevent yourself being made bankrupt. Phone National Debtline on 0808 808 4000.

If your assets are worth more than your debts, you should do everything you can to avoid being made bankrupt by a creditor.

Don’t think that bankruptcy can just be reversed later – although this can be possible it is likely to cost you tens of thousands of pounds in extra fees.

If you have a house with equity, then you could consider offering a charge over your house, but if you do this establish what (if any) interest will accrue and decide if you are happy with this.

What to do next

The next bankruptcy information page The process of going bankrupt looks at the timing of going bankrupt, the fees and completing the online bankruptcy application.

If you don’t like the sound of bankruptcy, see if you have a better alternative!

If you owe less than £50,000, are renting and have little spare income, a Debt Relief Order could be better for you – it has almost all the advantages of bankruptcy but there is no fee to pay!

Read about the Hard Choices – on those pages I compare the pros and cons of different options: DMP vs insolvency, IVA vs bankruptcy and Selling the house.

But if nothing else is looking better, sometimes you have to go for the least bad option, even if it’s not what you would have liked.

You should always take debt advice before going bankrupt – this is a big step and even if you think it is your only option, it is always worth half an hour of your time to talk to an expert about this.

Jane says

Hi Sara,

i wondered if you could answer this tricky problem. My late fathers estate is being repossessed and i was the administrator. This is due to losing a court case involving the property and land . i was paying the mortgage but as a result of losing the case, I had to declare bankruptcy. The OR has been dealing with it through insolvency but even though the bank know the situation, they are no repossessing it to get their money back. I had papers saying that it is going to court. Am i liable. my bankruptcy ends very soon and I would hate to have to be in this state again as I was just beginning to get on my feet. The mortgage is not in my name, I have never lived there and I could not do anything with the property as it a length court process after my father died. Do i need to attend court, they have mentioned witness statements and I feel like i have done all this and i have a young family. Will I be chased for this. i thought it was being dealt with through the insolvency agents. The firm the bank are using have said it is a separate matter. I am suffering with anxiety and I do not think I can go through this again. I have never lived there, its not my property but the judge awarded my the run down house and court costs of the same value plus the outstanding mortgage in my late fathers name. I cannot afford legal advice.

Sara (Debt Camel) says

I am sorry but you need legal advice. I can’t give you that. Have a look here and see if there is a low centre near you https://www.lawcentres.org.uk/i-am-looking-for-advice

Sandra says

Hiya, I have £16,000 debt. and due to a change in my circumstances I can’t pay it anymore, I’ve struggled on with it for a few years now but I’m going to have to finish work and take early retirement. Occupational health at work think this is best option too. My husband doesn’t have any debt. We have always had a joint bank account, do i just complete the stepchanges form in my name, put in my earnings and half the bills, or do both our details go on the form.

Thank you for your help

Sara (Debt Camel) says

Will you be getting an occupational pension? Do you know how much that will be a month and how does it compare to how much your husband gets a month in income?

Are you buying or renting?

R taylor says

Wife bought car; then refinanced with build society. Then lost job and has become very ill . I have paid payments and gave her money to try to start a business ( towards car) car has also been in and out of garage due to serious issues which can be proven. Insurance has always befn in my name. Didn’t change v5 as married and didn’t think about it. She is also disabled. Car value around 10k and live rurally. No transport options. They said they need to prove its not hers?!?? Help!!!! I’ve more than paid for it and it’s my way to get to work

Sara (Debt Camel) says

They said they need to prove its not hers

Who said this?

Andrew says

Dear Sara,

Hoping your can help?

I am looking at a financial compensation scheme claim against a mortgage broker company for advice in 2007 as now gone “bust”. However I was made bankrupt in Feb 2015. There was no equality so no action was taken against the property. Now Im looking to make a claim . . Would this go into the bankruptcy pot after all this time.

Thanks

Andrew

Sara (Debt Camel) says

yes this is very likely. the right to make a claim would have been an asset you possessed in 2015 when you went bankrupt, so that right is now owned by the OR.

Lisa Woods says

I have filed for Bankruptcy with debts over £39000.00. My mum owns our house and she brought our car which is registered in my name. Will I lose my car? I’m now dreading going forward but was advised to take this step.

Sara (Debt Camel) says

Your mum has always owned the house you are living in? Are you paying a market rent?

Did your mum buy your car in the first place? Or did you buy it and you have sold it to her?

Who did you take advice about bankruptcy from and did you mention the car to the adviser?

Amber says

Can you be made bankrupt without knowing? Say if an iva fails?

Sara (Debt Camel) says

Are you in an IVA at the moment or has one just failed? It’s VERY rare to be made bankrupt in this situation, can you say why you are worried and what has gone wrong?

Josh B says

Hi, I am currently bankrupt and 9 months prior to the bankruptcy I had sold some shares through a broker. The funds were then used to clear an overdraft as I was receiving letters and calls from the bank about the overdraft. The OR is now asking about these transactions and I was just wondering if this would be classed as an offence?

Sara (Debt Camel) says

At the time you sold the shares, was your financial position very bad?

Donna says

Hello

I going through a very messy divorce and my ex was unable to get credit so I obtained credit for him which he has not paid, the joint property is also in default also up for sale, mortgage company are looking for repossession. Although matrimonial debt he will not accept any responsibility for anything. Have a court date for financial hearing on 1st sept 22. I can’t pay all of these debts as I have a rented property and pay everything as well as joint council tax for the joint property which he has paid nothing for. I have no money to live on. Debt management charity step changes have advised bankruptcy would be my only option, although I don’t have the fee at the moment either. I have looked to see what debts can be included, all of mine seem to be covered I have a huge bill from my divorce solicitor which I am struggling to pay I have been allowed to pay by instalments however the costs are keep going up as my ex does not respond to anything, can these costs also be included in bankruptcy? As I would still be struggling to pay these, also because the mortgage is in joint names can I still apply for bankruptcy for this as he has paid nothing towards the debt. I would be grateful for any advise

Kind regards

Donna

Sara (Debt Camel) says

If StepChange have advised bankruptcy, this is very likely to be your best option. They know a lot more about your situation than I do… if you have any questions you can ask them about it.

I don’t see why the solicitor’s costs can’t be included, but realistically the solicitor is then likely to stop acting for you… I don’t know whether this matters to you as bankruptcy will be giving you your clean start?

You can apply for bankruptcy and that will remove your liability for the mortgage. It is up to your ex whether he then wants to look at clearing the debt or if he also wants to go bankrupt – it isn’t your problem.

re paying the bankruptcy fees, read https://debtcamel.co.uk/help-with-bankruptcy-fees/ which looks at your options.

Donna says

Hi I am a community nurse and have an nhs lease car which is needed for my job, if I apply for bankruptcy will I still be able to keep this car, if I terminated the lease early I have to pay up to £3000 for returning the car early, however I would not have the funds to pay for another car so I could not do my job. The car is not owned by me it’s owned by nhs lease. Also I am worried about my bank account I use monzo fir my wages and to pay my bills. I understand the account will be frozen will I still be able to use it one it’s unfrozen or will it be closed ?. Also how would I get my wages payed the following month if it’s frozen or closed ?. I read that it’s advised to take out of the account day to day living expenses once I’ve applied does that include all of my bills because I don’t have anything remaining once paid other than petrol or food no luxury items at all. I would be grateful for any advice

Sara (Debt Camel) says

The car shouldn’t be a problem – is it not an asset you own.

Can I ask what your total debts are?

Donna says

My total debts are around £40000 most are joint matrimonial debt, however we’re taken in my name as my soon to be ex husband could not get credit due to not keeping up his payments. Also have a property which is about to be repossessed anytime

Sara (Debt Camel) says

Then bankruptcy may well be your best option – but please take proper debt advice on this – it is worth your time to do this and it is also a chance for you to ask questions. I suggest you phone national Debtline on 0808 808 4000.

Have you moved out of the property? It is generally a better idea to sort out a new place to rent and move then go bankrupt if possible.

Monzo has a reputation for being bankruptcy friendly, but do you have an overdraft with them?

donna says

Hello

I don’t have an overdraft with monzo

I have had debt management advice from step changes debt management charity who have advised bankruptcy as my best option. I have also moved out of the house and I am in rented property. How much money are you allowed to take out if your bank account for bills and day to day living prior to filing. I only have enough to cover just that, thank you so much for all of your help it’s greatly appreciated

Kind regards Donna

Donna

Sara (Debt Camel) says

So bank accounts. These used to be a huge problem after bankruptcy but since 2016 they have not been.

The decision on whether to freeze or close your bank account is up to Monzo. I haven’t heard of them doing either if there is no overdraft, see https://debtcamel.co.uk/bank-accounts-after-bankruptcy/ but that is ancdotal and if they have changed their policy I may not heve heard.

If the account is frozen, you can ask the OR and he will write to Monzo and say the OR does not want the account to be frozen.

If the account is closed, then you simply open another account – see that link for a list of them.

If most of your bills come out in the week after you are paid, then you could time your bankruptcy for just after that and also make sure you have filled up the car and done a big shop. Then you shouldn’t need to take so much out in cash – not that the OR will care how much you take out in cash is it is needed for that month’s expenses, but it’s a hassle trying to pay some bills by cash.

This timing would give you time to open a new account and get you wages paid in there the next month. I doubt this will be necessary but if you are worrying then it is good to have a practical plan in case the worst happens. So make a decision now on what account you will open if you have to and make sure you have the necessary documentation.

Donna says

Hi Sara thank you so much for reply’s really helpful. I have been asked in a work savings direct fro my wages since Jan. I was saving the money not very much to help pay for Christmas, towards bankruptcy and pay for a fridge freezer which I haven’t got. The money is not available until end of November. If I go bankrupt before this is due would I be allowed to use the funds for what was intended. If I go bankrupt before end of nov I would have to stop paying essential bills to pay the cost ? I don’t know if your allowed to include Christmas and birthday as expenses as only asks for bills etc on the form

After I apply for bankruptcy if I am asked to work extra hours at work to support the team would this pay be automatically taken as not my contracted hours pay, just if needed. As don’t want to let the team down not been able to help but don’t want to get into trouble for earning more money on occasion

Kind regards

Donna

Sara (Debt Camel) says

I think you should talk to a debt adviser about all your questions. National Debtline on 0808 808 4000 are very good. These questions will be easier to answer if a debt adviser has gone through your income & expenditure and said if you are likely to have to pay an income payments agreement when you are bankrupt – that isn’t something that I can guess.

Getting an I&E worked out will also help in completing the bankruptcy application form, but yes you can include Xmas presents. See https://debtcamel.co.uk/8-sections-bankruptcy-application/

WS says

Hi

I live in a flat above my business its a bar , with a 10 year commercial lease in my name will

I have to hand this over ?

Sara (Debt Camel) says

I suggest you talk to Business Debtline about this and your whole situation. https://www.businessdebtline.org/

RM11 says

Can you still make affordability complaints if you go bankrupt? Thanks

Sara (Debt Camel) says

Yes but any refunds will go the Official Receiver not to you. Even for debts that had been repaid before your bankruptcy. So there is no point.

I think you have already won a lot of complaints. Are there many still to go? And do you still have a lot of debt and need to go bankrupt?

RM11 says

Not for me on this occasion. It’s for a member of my extended family I am trying to help.

From my experience, I imagine he would be able to claim a considerable sum back from high interest loans/finance but is in a hole too deep to continue the way he is.

Sara (Debt Camel) says

How large re his total debts?

RM11 says

30k+

Bailiff chasing stage. Self employed and work dried up. Behind on every bill imaginable.

Sara (Debt Camel) says

Then affordability complaints are unlikely to be a realistic alternative to bankruptcy… can you suggest they talk to Business Debtline https://www.businessdebtline.org/. Everyone should take advice before going bankrupt and this is especially important for the self employed. .

Anita says

Hi can my redundancy payment and pay in lieu of notice be taken by the official reciever

Sara (Debt Camel) says

see https://debtcamel.co.uk/or-redundancy-money/

John Ndets says

Can a bankruptcy that was discharged ten years ago affect my application for Biometric Residence Permit

Sara (Debt Camel) says

You don’t think you apply for a BRP itself, see https://www.gov.uk/biometric-residence-permits

Steven Drew says

I’m thinking about going bankrupt I owe around 14000 I have one credit card that is fully paid will I lose that card.

Sara (Debt Camel) says

This can be a bit random.

Have you taken advice on going bankrupt? – everyone should! Could you be eligible for a Debt Relief Order? Talk to your local Citizens Advice or phone National Debtline on 0808 808 4000.

Eleanor says

Hi,

I have just had to take another job due to my mental health. But because of this, i have taken an £8K pay cut. This means I’m struggling to pay my debt which I have built up from the age of 18 with having no financial support growing up and having to survive on credit cards to top up my salary. The debt is roughly around £20K now and I’m in a position where I cannot afford the £800 a month I’ve been paying out as after I pay it, I have to use my credit card to get the shopping. It’s a vicious cycle,

I’ve been speaking to family regarding this and I don’t know if I’m best to look into bankruptcy or A DRO, can someone advise please.

Sara (Debt Camel) says

This is going to depends on how much you have left after a realistic budget – if you are eligible for a DRO it is almost always better than bankruptcy. I think you should talk to National Debtline on 0808 808 4000. Or contact your local Citizens Advice.

John says

Hi.

I’m thinking of going bankrupt. I have just over 22k in debt and am struggling to pay everything having went to a much lower paid job. I have 2 questions

1. I took put a loan of 5k in May2024 and a fluid credit card which I balanced transferred 2.5k also in May. I was thinking by a company that i wouldn’t be allowed to go bankrupt as these applications were recently and is seen as fraud. Is that right?

The person told me that these 2 companies could reject the bankruptcy and still chase their money every after I’m discharged in 12months. Which to me, seems pointless going bankrupt.

2. I current rent a flat from a friend. He’s aware I’m going bankrupt and I’ve never issued any payments.

I was told by the person I spoke to about bankruptcy that the Insolvency Service’s Adjudicator, would go through bank statements to really look at what money is going out is that correct? On my bank statements for my rent to my friend. It just says RENT on it.

I’m worried that if I apply for it online, some of the creditors will accept and some won’t. Then I’ll end up failing the Insolvency Service’s Adjudicator’s questions on out goings afterwards.

Sara (Debt Camel) says

when did you more to a lower paying job? What did you use the 5k for?

John says

Hi Sara

So I move to the lower paid job in June of this year. But took the loans out back in April and May to help cover bills. I was out of work for 4months prior to that so needed them to cover rent and other house hold bills.

So would they accept bankruptcy with it being so soon and would they want to see my bank statements ?

Sara (Debt Camel) says

so what was your situation in April / May when you took the loan and the 0% balance transfer – were you in work? if you weren’t, what did you put down about your income?

John says

I wasn’t at the time. I knew I was starting work in June so I put down the wage I was going to be on at the time.

I was under the impression that at my new job there would be more opportunities to make more money, howvere there ate not.

I put my basic down wage down.

I think the other creditors I owe will accept it as I have been with them for years and have missed payments here and there. But I’m frightened that these 2 will not accept it and chase me again once the 12 months is up, which then makes it pointless to go through.

What do you think? Also, would they want to see bank statements ect for my income and outgoings?

Sara (Debt Camel) says

“I knew I was starting work in June so I put down the wage I was going to be on at the time.

I was under the impression that at my new job there would be more opportunities to make more money, howvere there are not.

I put my basic down wage down.”

That seems reasonable to me – you didn’t put a much inflated guess at what you may be able to get paid. I think a creditor would have difficulty in describing that as fraud.

Do you mean that on the income you put down in May, which has turned out to be correct, the loan isn’t affordable? And the minimum payment to Fluid isn’t affordable?

Who is the loan from? What other debts do you have?

Because a different approach would be to get a debt management plan now, talk to StepCahnge about a fee-free one, and at the same time look at affordability complaints against the loan and other old debts. See https://debtcamel.co.uk/tag/refunds/ for details about these complaints.

Winning complainst could reduce the debts to a manageable level. Your income could improve. And if things don’t look good in 6 months or a year revisit the idea of insolvency. Because at the moment you seem to have what could turn out to be a temporary problem. And you should not rush Into any form of insolvency (bankruptcy, DRO or IVA) if it isn’t necessary and if your situation could improve. In bankruptcy or an IVA you could find yourself paying much larger monthly payments that you expected if your situation does improve.

To answer a few point from your first post. Bankruptcy will not be rejected if you are unable to pay your debts as they fall due. The Offiicial Receiver’s office will want to see your bank statements after the bankruptcy is approved.

“I was told by the person I spoke to about bankruptcy”

who was this person?

john says

So yes i put down that my income (30k basic per year) was what i could afford. I was under the impression that there was an option to make up to 1k a month in bonus. but it turns out its just an annual bonus which could come out to 1k-2k per year before tax. I really like the job and is much better for my mental health compared to my previous role, so have no plans to leave. However it has left me on a tight budget going forward. The only thing i expect to change money wise in the next 5+ years is maybe a 3% pay increase which would work out at an extra £35+ per month after tax.

The loan is from a company called Reevo. this is what i owe:-

LOANS-Reevo 5k, (6.8k with interest) Oakbrook 2.7k (3.8k with interest)

CC- 118118 3.2k, Fluid 2.5k, Zable 2k, Elfin 2k, Zopa, 1.3k, Tesco, 1.3k, Onmo £450, Ocean £300

I have applied for a DMP through stepchange over the weekend. i can afford around £200 maybe £300 at a push per month for all debt. But it will take me around 10 years to have everything paid off in a DMP. a DRO wouldn’t work as i have more income left over to qualify.

So are you saying that the Offiicial Receiver will want to see bank statements if i go bankrupt? and that they would accept it even though the applications are recent?

I was thinking i could struggle on for 2-3 months paying what i can (not the full amounts) then apply for it. As my most recent creditors will then see that i am struggling and will more than likely accept bankruptcy

Sara (Debt Camel) says

I think a StepChange DMP looks like a sensible idea, don’t push to pay more than you can afford.

Combined with affordability complaints to try to reduce the balances owing and speed up the DMP. You seem to have a large collection of expensive lenders there…

Complaints against Reevo and Oakbrook – see https://debtcamel.co.uk/refunds-large-high-cost-loans/ for an article about loan complaints with a template

Complaints against the credit cards – see https://debtcamel.co.uk/refunds-catalogue-credit-card/.

After 6-12 months you will know how things are going and can make a decision on whether to go bankrupt. This seems to me to be a better, less stressful approach than your suggestion of muddling through.

Creditors don’t have to decide whether to accept or reject bankruptcy. It is very rare for a creditor to suggest that a debt was incurred through fraud.

“So are you saying that the Official Receiver will want to see bank statements if i go bankrupt?

yes. And they will set an income payments agreement that you will have to pay monthly for 3 years.

“and that they would accept it even though the applications are recent?”

It is VERY rare for a bankruptcy application to be refused, see https://debtcamel.co.uk/can-i-go-bankrupt/.

There is a chance you may get what is called “a Bankruptcy Restriction Order”, see https://debtcamel.co.uk/bankruptcy-restriction-order-bro/. There are no rules about this but it may well be that a BRO is less likely if you wait longer before going bankrupt.

Have you talked to StepChange about bankruptcy? Everyone needs full debt advice before considering this. Me answering some questions on the Internet is not debt advice!

john says

Would Reevo and Oakbrook do anything about the money i borrowed though? As i said i could afford it at the time, i guess they can only take my word for it. I guess Reevo should have seen that i currently had 15k of debt sitting on my credit file and asked whether i could afford that or not. What i wouldn’t want to do i go into a DMP for 6-12 months then bankrupt as thats an extra year of waiting on my credit file and more money paid out I am aware that i will be paying say £150-£200 for 3 years if i chose bankruptcy. I wasn’t aware that they would require bank statements. so they would want to see rent, council tax, gas/elec bills leaving my account. I thought it would just be me telling them what i am paying and maybe a payslip sent off.

i spoke to them last week and they said bankruptcy would be refused because the loan and credit card were taken out in april and may. they said i would need to wait 3-6 months before applying.

I would prefer to get bankruptcy asap. but i am concerned about the bank statements not show my rent as i just pay a friend for that. plus i was hoping to say that i paid around £260 in council tax when actually i only pay £230, just so that i could have money for savings. But i assume they will want to look at everything with a fine tooth comb for outgoing.

Sara (Debt Camel) says

Debt is only affordable if you can repay it and make all the other payments to your debts and pay bills and everyday living expenses without borrowing more. Reevo should absolutely have considered the 15k day of debt on your credit record…

If you win a complaint about a loan, then interest is removed so you only have to repay in total the amount you borrowed, so your balance drops. If you win a complaint about a credit card then interest you have paid is refunded, reducing your balance.

So StepChange is saying a DMP for 3-6 months then bankruptcy. I am saying a DMP for 6-12 months and try affordability complaints and see whether they significantly improve your situation.

I think you should just start down this track and then review it.