If you receive a Claim Form from a County Court through the post you need to respond rapidly.

Ignoring court papers is a bad idea, even if you think the debt is too old or you are worried you can’t pay the money.

- If you agree you owe the money you will get a County Court Judgment (CCJ) but if you complete the Claim Form papers properly you will be able to make monthly payments and won’t get visits from bailiffs.

- If you don’t agree you owe the money, you need to defend the Claim.

Contents

Check this really is a court form

Some debt collectors send letters designed to make you think you are being taken to court when you aren’t! If you get one of these, read Threats of CCJs and bailiffs – are debt collectors bluffing?

If you get a letter headed something like Letter Before Claim or Letter Before Action, a court case has not yet been started. But don’t ignore this – it is much easier to dispute a debt at this stage than fight a court case in a month or two. So read this: How to reply to a Letter before Claim.

A real N1 Court Form may be on white paper or on blue and white paper. It will have something like this at the top:

There should be a court name, a court stamp and a claim number.

If you aren’t sure, you can phone the court to check or phone National Debtline on 0808 808 4000 and ask them.

In the same pack, you also get other blank forms: N1 – Claim form; N9 – Response pack; N9A – Admission (specified amount); N9B – Defence and counterclaim.

Check you are named as the Defendant on the form. If your name is slightly wrong (a typo? your maiden name?) you should treat this as though it is correctly addressed to you.

But if it’s obviously meant for someone else, read this about debt letters for other people coming to your house.

Don’t panic!

This article looks at your options. for what to do, now you know the form is real.

But first, don’t panic! Some worries you may have:

- you can’t be sent to prison for not paying the utility bills, loans, credit cards and other debts that lead to this type of court action.

- if the court decides you owe the money, you will get a County Court Judgment (CCJ) – this isn’t a criminal conviction.

- if you get a CCJ, you can get an affordable monthly payment agreed. You won’t have to pay it all at once if you can’t afford to.

- you won’t get bailiffs coming round to your house unless you try to ignore these papers and then ignore the CCJ.

If the court is the Civil National Business Centre in Northampton, you will not have to go to Northampton. If there has to be a court hearing, you can ask for this to be in your local County Court.

Reasons to dispute the debt – READ THIS

You may not know that you have a reason you can defend this case and not get a CCJ. So read this even if you know you owe the money.

It’s not your debt!

Often you know immediately which debt the form is referring to.

But sometimes a debt may have been assigned to someone else – this is legal jargon for selling your debt. The new owner of the debt is entitled to sue you for the money – you don’t have to have agreed to the debt being sold.

If you don’t recognise the debt at all, call up the claimant and ask about it.

If you are called Jane Baker, the debt may belong to a different Jane Baker. Or this could be identity theft – someone pretended to be you.

You may feel nervous about being pressurised to agree to something, but make it clear you just want to know more details of the debt, then end the call when you get them.

After talking to the creditor, if you still don’t think the debt is yours, you must reply to the Claim, see How to dispute the Debt below.

If you ignore the Claim because the debt isn’t yours, you will get a CCJ automatically because you didn’t repond to the forms.

The only exception here is if you have convinced the creditor that the debt isn’t yours. Here you want the creditor to tell you in writing that they are going to stop the court case and withdraw the Claim. If they say this on the phone, that’s not good enough, ask them to put it in writing.

If you aren’t sure what to do, telephone National Debtline on 0808 808 4000.

You recognise the debt – but is the amount right?

The debt may have been yours, but the amount may be wrong:

- perhaps you paid some money recently which hasn’t been taken into account;

- you may have already paid the debt off – possibly several years ago, possibly to a different debt collector;

- you may have had a partial settlement, also called a full and final settlement, accepted.

- the amount may be right, but there is some reason why the claimant owes you money. This means that you have a counterclaim against the claimant, which can be decided by the court at the same time as the claim against you.

Other reasons to defend the case and not get a CCJ

It’s not just whether you owe this money, what is important here is if the creditor can win the case.

There is a lot of legal protection for consumers, especially for old debts.

Here are some reasons you may be able to defend the case:

- for credit cards (including store cards and catalogues) and loans (including HP and payday loans) the creditor has to be able to produce a copy of the written agreement for the debt. See National Debtline’s Getting information about a debt for details. That tells you how to ask for this information and you should do this asap, BUT ALSO reply to the Claim within the short time limit, see How to dispute the debt below for details;

- the money was for some goods or services where there was something wrong and it’s not right that you should pay;

- you have gone bankrupt and the debt should have been wiped out by that, or the debt was included in a DRO or an IVA;

- the debt is statute-barred so the claimant can’t go to court about it because it is so old, see Questions about Statute-Barred Debt for more information;

How to dispute the debt

What to put on a defence form

If you don’t recognise the debt or you don’t agree you owe the money or you have a counterclaim, or you have some other possible defence you must complete the Defence Form (N9B) and say why you are disputing the debt.

The words you use matter here. Although it may be possible to add other reasons later in your defence, it is simpler to try to list all the possible reasons you have now. Don’t just put what you think is your “best reason”, if there are several reasons to defend the case, list them all.

National Debtline has a good factsheet on Disputing a debt. Read that, but unless you are very confident, I suggest that you call National Debtline on 0808 808 4000 and ask for help. You can also post about your case on the Legal Beagles forum.

Reply within the tight time limit

You need to send the Defence Form back within 14 days. Send the paper form to the court, and send it recorded delivery and keep a copy. Or, if the claim was made using an online service, you can respond online.

If you would like more time to sort this out you should complete and send back the Acknowledgement of Service form ( N9CPC) within the 14 days. You then have 28 days from when you received the forms to return the Defence Form.

It is essential you put in your defence within the given time. If you don’t reply in time you get a CCJ “in default” – because the rules assume that if you don’t reply you are agreeing you owe the money.

So don’t assume you will win the case because the debt isn’t yours or it’s very old. If you don’t reply in time, using the court forms and defend the case, there will never be a court case and no judge will even look at it – you are going to get a CCJ.

And things won’t wait if you have talked to the creditor on the phone or written to them… For example you may have asked the creditor for the CCA agreement and they haven’t replied. You still have to use the forms to reply in time to the court and defend the case.

What to do if you agree you should pay the money

If you can pay it all now – you won’t get a CCJ on your credit record

If you can pay the full amount, then you should complete the Admission Form (N9A) but you don’t need to give details about your income and expenses. You should fill in:

- the box that says How much of the claim do you admit

- Section 1 Personal details

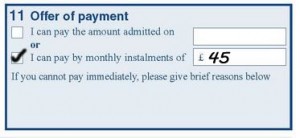

- the box that says Section 11 Offer of Payment

- Section 12 Declaration – sign and date this

You should send the paper form back to the Address for sending documents on the N1 Claim form. Send this recorded delivery and keep a copy of what you send.

If you do this, you will not get a CCJ on your credit record.

NB This is not a reason to pay up and keep quiet if you have good grounds for disputing the debt. If you defend the case and lose, you still have the option of paying the money in full within a month and the CCJ will then be removed from your record.

Offer to pay in monthly installments

Here you need to complete the Admission Form (N9A):

- the box that says How much of the claim do you admit,

- Section 1 Personal details

- Section 2,3,4,5 about your family and financial situation

- Section 6,7,8,9,10 about your income, expenditure and other debts (make sure that all your incomes and expenses are quoted as per month so that you can add them up)

- the box that says Section 11 Offer of Payment

- Section 12 Declaration – sign and date this.

For more information see How much should I offer to a CCJ? and talk to National Debtline if you are unsure what to offer or what what to put on the form.

It is common for courts to accept your offer of payment, especially if you have taken advice about how much to offer and how to complete the form.

If the creditor accepts your offer, you will get a notice that you have a CCJ and should make the monthly payment that you have proposed.

If the creditor refuses your offer, it gets sent to the court to determine how much you should pay. This is usually done without a hearing. Talk to National Debtline if you are uncertain what is happening or what you should do, or if a repayment is set that you can’t afford.

Do you have other debts?

If you have been avoiding tackling a larger debt situation, getting these court papers is a warning that you need a rethink.

Try to list all your debts and have a first stab at doing a budget, then ring National Debtline on 0808 808 4000. They can help with what to put on the court forms. But just as importantly, they can talk about your bigger debt picture and what your options are.

What happens next if I do get a CCJ?

I’ve done another article on this, see link below. For now the important thing is to complete and return the forms correctly, as this will minimise your problems later on.

stuart says

so if i defend the claim say i dont owe it what proof does the claiments solicitor send to the court what if i just send claim back to the court and say its not me then what the court cant pass judgement without my admission of libilaty or my signeture or date of birth in case its somebody with the same name has me just because the debts been assigned it doesnt mean i owe it

Debt Camel says

hi Stuart, I’m simplifying here, but if you deny you owe the debt, the claimant will have to produce the documentation you signed.

I’m not clear if you know you do owe the money, but would like to be “difficult”, or if you genuinely don’t know what the debt is. If you really have no idea what the debt is, then call up the claimant and ask for details.

If you want to defend the claim on the grounds that you are not the debtor, it is statute-barred, you have cleared the debt in full, the amount claimed is wrong or for any other reason, then I suggest you telephone National Debtline, as they are very good at helping with CCJ-related enquiries.

stuar says

what documents does the claiment ie debt collector have to provide the court to prove that i owe the debt and can i ask the claiment to supply me all documents relating to there claim ie deeds of assignments and novation and credit aggrement

Debt Camel says

You can put in a CCA request for a copy of your credit agreement – sample letter here from National Debtline https://www.nationaldebtline.org/EW/factsheets/Pages/getting-information/credit-agreement-advice.aspx. I recommend that anyone having problems with a CCJ talks to National Debtline about their case. You can also ask for a copy of the Notice of Assignment to the debt collector. You don’t have a right to see the commercial documents relating to the sale of your debt, eg at what price the debt was sold.

stuart says

ok thats right ive been to a litigation solicitor he told me just ask for a copy of the credit aggrement if they cant provide it they cant inforce the debt in a court

Clive says

I have received a ccj saying claim form at the top. In the letter it states I owe money to Lloyds bank on calling them they said I had no account with them and that I never have.

The account number relates to a different bank ie Halifax which I did have account with. Can I deny the claim against me as it’s the wrong bank named as it clearly states I owe to Lloyds bank?

Sara (Debt Camel) says

Hi Clive, Lloyds now own Halifax – I don’t think you will get far trying to defend this claim – at best you may buy a small bit of time whilst they reissue the Claim Form. I think you should concentrate on the debt to the Halifax – do you owe the amount alleged? etc. Follow the steps in the above article and call National Debtline if you need assistance or want to check something.

amy says

I’ve just received a claim form from the county court business centre Northampton about a debt of £181 for lloyds. I don’t have any information on this debt so I was going to request the credit agreement, how would I do this and what do I need to do with the claim form from the court if I’m requesting the credit agreement?

Sara (Debt Camel) says

Hi Amy – you need to defend the claim. I always suggest people contact National Debtline about how to do this: https://www.nationaldebtline.org/EW/Pages/default.aspx

Suz says

myself and my partner receive joint esa, its my partners esa claim, what amount would i put in for income half, or the amount they actually allow for a partner?

Sara (Debt Camel) says

Hi Suz, the simple approach is put in half the income and also half of all the relevant household expenses. Do think about discussing the offer you should put on the form with National Debtline.

Sonja says

I have received a county court claim form, they are taking me to court for £664 which I’m not in a position to pay in full I’ve filled out form n9a with all my income and outgoings and would be happy to send my bank statement to the court for them to see that I only have £20 left over after paying all my bills , if the court agree my offer of payment of £20 as I can start paying straight away will I still get a judgement against me by not being able to pay the full amount in full of the £664 they asked from me ? As I worried as my Mortgage finishes next April and I would need to re mortgage and if I were to get a judgment against me this would stop me from re mortgaging can you advise me will I get a judgement even though court were to agree my offer of payment of £20 a month ?

Sara (DebtCamel) says

Hi Sonja, you could talk to the creditor and ask if they will accept £20 and withdraw the court claim. But if they go ahead and you get a CCJ, the court may set your payments at £20 a month but the CCJ will still exist. If you could pay it in full within 30 days it would be deleted. Otherwise it will be on your credit file and will make it much harder for you to remortgage at a good rate next year. (I am sending you an email about another matter.)

Sabrina says

I have received a county court claim form, and I am currently unemployed so unable to make payment to my creditors. I have responded to the courts. I wanted to know if this will this blacklist my parents house although I do not own it or pay for the mortgage? Or prevent them from taking out a another mortgage?

Sara (Debt Camel) says

Hi Sabrina, if you get a CCJ it will not affect anyone unless you have a financial link with them such as a joint account, joint debt or they have guaranteed your loan. Just living with someone is not a financial link,

lee kirkman says

Hi could anyone tell me the correct answer to this question if a debt is sold can the new owner instigate county court proceedings when there is no credit agreement between them or yourself.

thanks

Sara (Debt Camel) says

Hi Lee, the answer is Yes, the new owner can start court proceedings. the new owner now has all the same rights that the original owner had – see https://debtcamel.co.uk/sold-to-dca/ for more details.

jagsy says

hi my daughter has received a blue claims form from the courts, the claimant is Lowell`s

this is for £463 which they are saying she alledgely owes, my daughter told me she knows nothing of this account, ive looked on her credit records and the start date of the account is 2010

in 2010 my daughter would have only been 15 years old, is it true that you cannot be taken to court for a credit agreement if your under 18 years old and if so can I point this out on the defence in the blue claims form, if I did this do you think a judge would dismiss this claim?

Sara (Debt Camel) says

Hi jagsy, it sounds as though the debt collector has got the wrong person :) At an earlier stage I would have suggested sending a Prove it! letter but now it’s urgent to return the defence forms. Your daughter’s age should certainly be mentioned. I suggest you / she call National Debtline on 0808 808 4000 and they will talk through the case in detail, including exactly what to write on the form.

Shab says

Hi i have received a claim form. I wanted to know if the solicitor can withdraw the claim from the court if I agree to pay the monthly payment?

Sara (Debt Camel) says

Hi Shab,

yes, the claim can be withdrawn. Most solicitors would prefer to proceed with the claim at this stage though, in case you don’t keep up with the payments. If you have a job which would be adversely affected by a CCJ, one alternative is a “Tomlin” or “Consent” Order, see https://moneyaware.co.uk/2012/04/clear-debt/

Shab says

Thanks for your reply…. No i dnt do any kind of job i m a house wife with 2 kids How can i convence the solicitor that i will keep up with the monthly payment n ask him to withdraw the claim form court…. I call the solicitor n they are giving me 30% of on my debt but still its too much gor me to pay or from where can i get some credit to pay them off my bank account was also closed… I really need help…..

Sara (Debt Camel) says

You can make monthly payments to a CCJ, you don’t have to pay it in full. I think getting someone to help you look at your full situation would be useful. I suggest calling National Debtline on 0808 808 4000 or going to your local Citizens Advice.

Andy says

I have received a county court letter asking me for £1300 for a debt that had been sold on from a payday loan company. The DMC are asking for this amount yet the original debt from the payday loan company was £550. Any advice as I need to contest how much interest they can bang onto the original £550 as this seems extortionate, and not in keeping with the new Government rules for payday loans. I was taking out PDL to pay off other PDL, you know how it goes. The PDL company never asked for affordability checks and just gave me the money, which I could never afford to pay back. It’s my stupid fault. Would you suggest a full and final offer, even if they have requested a CCJ?

Sara (Debt Camel) says

hi Andy, actually it’s not “your stupid fault” – it is the lender’s fault that you defaulted as you should never have been given this loan. You MAY be able to claim some compensation – see https://debtcamel.co.uk/more-payday-refunds/ for how to do this.

But although I really suggest you should try this, it doesn’t answer your urgent problem about how to reply to this claim form – can I suggest you call National Debtline on 0808 808 4000 tomorrow and discuss your possible actions?

Leanne says

Hi

Yesterday I received a judgement for claimant regarding debt. I never received any claim forms before this only a letter from the claimant and one letter from the solicitor which was back at the beginning of September. I like an idiot didn’t do anything with these as I was under the impression the debt was statue barred. Anyway I am just not sure what to do as I didn’t get the correct paper work from the court before this ccj letter. Also it’s already been put on my credit file and if I was to pay it off in full would it enable to be taken off.

Sara (Debt Camel) says

Hi Leanne, I’ve written another article on what to do if you get a CCJ – https://debtcamel.co.uk/help-ccj/. Basically if you pay it in full in 30 days it will disappear from your credit record. I suggest you call National Debtline on 0808 808 4000 and talk this through with them as it costs £155 to get a CCJ set aside and so you need to be very sure that the debt really is statute barred.

sal says

An on line claim has been made against me and the claimant has confused the wordings of claimant and respondent and refers to me as the claimant – can I make use of this technicality in any way. I was not happy with the service i received from a surveyor. thanks

Sara (Debt Camel) says

Hi Sal, it’s usually pretty easy for this sort of minor error to be corrected. For advice on what your defence should be, I suggest calling National Debtline as this article says.

Richard says

Hi I have received what appears to be a claim form from the county court, from reading posts I expected it to be blue but it is white and the crest isn’t quite right, slightly blurry is it a tactic debt collectors use to fake papers?

Sara (Debt Camel) says

Hi Richard, if you are in doubt, call the court up and ask them! it’s probably OK, but best be sure.

James says

Hi, I have received a county court business centre claim.

I have defended this claim since July 2007. Over 8 years. Today I have received this letter giving warning of a ccj. Is it too late to apply for statute-barred..?

Thanks

james

Sara (Debt Camel) says

Hi James, you don’t “apply” for statute barred before a CCJ, you have to enter statute barred as your defence on the court papers and do this within the time limits, which can be tight. I suggest calling National Debtline who will be able to talk to you about how to reply to this claim. If you ignore it, you will get a CCJ even if your debt is statute barred.

Richard says

Hello there I got court forms through about a debt Lowell say I owe, I sent them and their solicitor a statute barred letter, I got this response,

We have received your letter dated first December 2105 (yes they did put that date in) in relation to the claim against you in this letter you state that you believe the debt is statute barred as the last time you made payment in relation to the debt was over six years ago our records show that although you did last make payment on 15 June 2009 The default date for the account was 31 August 2012 the time to bring a claim against you for this debt is six years from the default date and therefore our clients are well within their legal rights to issue this claim please can you formally respond.

I am defending this claim as I think it is statute barred, they written the date of payment which is over 6 years ago, I thought it was the last action on the account that makes it statute barred? what I would like to know is what do you think my chances are in court? Am I on the right track and do you have to go court or is it done in the post etc. Thank you for your help this site is so informative!

Sara (Debt Camel) says

Hi Richard, a few creditors seem to be trying this line at the moment, suggesting that the default date is the starting date for the 6 year “statute barred” clock. This is just wrong as you say, but I suggest talking to National Debtline and talk to them about this problem – it won’t be the first time they have come across it – and what you should put on the forms.

Sometimes this can be resolved by completing the forms – you can use MCOL (https://www.moneyclaim.gov.uk/web/mcol/welcome) to do this or send the forms by post. Sometimes it goes to court, here the case will be transferred to your local County Coout. If this happens you should always go – often “the other side” doesn’t bother to turn up – he who turns up tends to win!

Good luck!

EDIT – in January 2019 the legal position got more complicated when the Appeal Court decided that for some credit debts (loans and credit cards) the creditor had 6 years from the date of a Default Notice to start action. See https://debtcamel.co.uk/statute-barred-debt/ for details and talk to National Debtline on 0808 808 4000 if you think this may affect you.

sean says

hi I have a capitol one debt which has been sold to Cabbots , it defaulted in 2011 , now I’ve never made a payment since before then but they are saying that the last payment was the default date which is obviously wrong or it wouldn’t of defaulted at that time, I have now got court letters, if I get a ccj will the 6 years start again, thankyou.

Sara (Debt Camel) says

Hi Sean, if you get a CCJ, this will then stay on your credit record for another 6 years.

I think Cabots may be suggesting that the “statute barred” time limit starts from the default date. This is wrong (see https://debtcamel.co.uk/statute-barred-debt/) but several creditors seem to be trying this one on at the moment, see the previous comment above! If this is what is happening, you need to try to find when you did last make a payments and talk to National Debtline about how you can defend this CCJ.

EDIT – in January 2019 the legal position got more complicated when an Appeal Court judgment said that for some credit debts (loans and credit cards) the creditor had 6 years from the date of a Default Notice to start action. See https://debtcamel.co.uk/statute-barred-debt/ for details and talk to National Debtline on 0808 808 4000 if you think this may affect you.

Joanne says

Hi, I revived what looks like a claim form from the county court business centre today, the claim is for a mobile contact I had for 13days in 2013, the form is not filled out in my full name half my last name is missing , can some one tell me if this is relevant? The debt started at £900 for data I’d used for the 13days I had the phone Iv never payed anything on the debt as I all ways disputed the cost of the data & returned the phone in the grace period, now it’s at £2422.75

Sara (Debt Camel) says

Hi Joanne, mobile phone companies can be very difficult to deal with. I suggest you call National Debtline about how to defend this claim as just challenging them on the wrong name isn’t going to get very far as they will just correct it.

Sue says

Lowell trying to take me to court years old debt sent cca request and proof of signed agreement. There solicitor wrote back getting docs from Capitol one, and state payment made to scotcall 2012reg Capitol one. I paid them a different debt and only payment to Lowell was vanquis card need help as know there lying who payments were for. And will it come to my word against there’s. And will Capitol on have docs proof after all this time?

Sara (Debt Camel) says

So you are saying the Capital One debt should be statute barred? You could ask Lowell for a statement of your account for the Vanquis card and for the Capital One account. Will they be able to produce the CCA docs – possibly, you shouldn’t assume that they can’t. This doesn’t sound like a simple CCJ to defend, I suggest you phone National Debtline as it’s important your defence goes in on time even if they say it will take longer to find the docs.

Sarah says

Hi. I have received a small claims court letter from Cabot acting for capital one, dated 12 Feb. They say I owe £389.87 raised to £474.87 with costs. I know I do owe this as I have been burying my head in the sand a lot to be honest. Would I be able to make an offer to them to pay a lump sum as a full and final offer to get this paid off? would I phone them to make this offer or write it on the court form

Sara (Debt Camel) says

Yes you can make an offer at this point but this needs to be asap. Make it direct to Cabot by phone, but if they agree you want it in writing that they are accepting your offer in full and final settlement, that they will not continue with the claim and that they will not sell the remaining debt on to a third party. Then you pay them and enter a defence to the claim saying it has been paid and attach the email from Cabot confirming this.

It will help to get an offer accepted if you send an I&E showing you can only pay a small monthly amount. But at this point they are unlikely to take a low offer.

donna says

I recently received a Claim Form from Lowell Portfolio, it had a crest on it, and a claim number and a circle within which says “”the county court””. But the form has no actual court stamp or signature of a judge as I would have expected and it is not a blue form (it looks like a black and white photocopy). What do these official forms look like, as I do not know if it is a bluff or a scam or genuine? Also, as the time for response has expired, I received another letter saying in default which also looked like a black and white photocopy. What is the likelihood that I would get a charging order on my house as an outright owner (unemployed) for a debt of £898 that I do not acknowledge? Thanks.

Sara (Debt Camel) says

Hi Donna – the “in default” sounds as though the CCJ has been issued because you didn’t defend the claim. You need urgent advice on what your options are – phone National Debtline on 0808 808 4000 and they can talk you through them.

Donna says

UPDATE: I challenged Lowell Portfolio in court, got the CCJ overturned (set aside) and ended up winning my case. They had no proof of any debt when I challenged them to provide the proof. It therefore got thrown out of court. No more Debt Collectors for me. I found out that if you stand your ground and put the burden of proof back on them, they rarely have a leg to stand on. :-)

Chris says

Hi

I was with a debt management company called first step finance, who went bust along with a sum of money I had paid 18 months ago. This was devastating at the time, however I started again with step change and have been in a debt management plan since which has gone well so far. However today I received a county court form for a debt that has not been included in my plan. The original debt management firm first step had challenged the creditor who had been unable to provide any of the documatation in relation to the original credit agreement. In fact what they did provide wasn’t even my hand writing. So had written to them stating the debt was unenforceable and even sending a harassment notice.

This debt it appears has been sold on to a collection firm who are now talking the action against me . I only found out by chance today because all the paperwork had gone to my previous address.

I guess I could challenge the debt but I don’t have the knowledge or the money to pay for legal help and won’t qualify for any legal aid, but my preferred option would be to make a payment arrangement through my current dmp

Can this still be done at this stage ,I have a few days left to respond to the court documents. I desperately don’t want a CCJ as I want to get a mortgage this year and was on track to do so. Is it possible to make arrangement with the debt collecton solicitors I don’t want to call them myself as I don’t want to admit any liability. The debt is almost £9000 Thanks

Sara (Debt Camel) says

Hi Chris, phone National Debtline tomorrow morning asap 0808 808 4000. You don’t need to pay for a solicitor – and no-one gets legal aid for this time of case. But National Debtline will be able to talk to you about how to respond to this Claim. If the creditor cannot produce the correct CCA documentation, this debt is may not be enforceable in court.

Donna says

You need to fight it! If they cannot prove it then you should not pay, because if the original creditor starts demanding payment and has the documentation to prove the debt, you will have to pay the same debt twice! Contact the CAB.

Chris says

Hi further to my post earlier in the week I have been busy, however I have been given conflicting advice.

First I phoned national debt helpline, they suggested as the debt is pre 2007 I can fight it as the creditor only has a reconstituted credit agreement and this is not enforceable. They suggested several legal websites to assist with leagal advice. However after a few enquirers I spoke to my house insurance provider NFU who seen to think I’m covered for this kind of legal dispute. I spoke to one of their solicitors they are going to look into it as to whether I can claim and fight this.

I then called step change as I have a debt management plan with them and they said I should contact the creditor and try to make an arrangement to pay, because I have made a payment in the last four years ( I only defaulted three years ago) this I taken as admission of the debt. But I already have an income expenditure list with them it won’t cost me any more they even said it could become a priority debt at the expense of the others , they also said the creditor may suggest a Tomlin order. But I am wary of speaking to them.

I am happy to pay this as I intend to make full and final offers to all my creditors in the next twelve months. I would like to just add it to my debt plan but getting a CCJ will ruin not only my plans but could put my Job at risk

My over ridding priority is not getting a CCJ , should I ring them and try to negotiate or fight it.

Its a big worry now any suggestions appreciated.

Chris

Sara (Debt Camel) says

It’s a tough decision, knowing you probably have a good case, as National Debtline have said but being reluctant to take any risk. I can’t say what you should do. Talking to your insurer’s solicitor may clarify things for you.

A couple of things to add to your thought process:

– a Tomlin order is a good way around the CCJ problem, talk to National Debtline about this

– another good way if you have the money to repay the debt in full at the moment is to fight it and then if you lose pay it withing 30 days – in that case it disappears completely.

lucy says

Hi I’ve recently received a claim form (claimant being Lowell solicitors limited) relating to a debt (it says) with Lloyd banking group.

The amount is for £2646.78.

I believe this is actually an overdraft of £2000.00 Halifax allowed me to have on my account in 2010. At the time I was claiming benefits for me and 5 of my children and had been in the same financial situation for a year’s, I was gobsmacked that Halifax had allowed me to have so much, but over the next 2/3 years I was paying bank charges between £30-£55 every month, I knew I was never gonna be able to just put 2000.00 bank into my account so realising I would paying these charges forever I decided to open a new bank account elsewhere and turned my back on Halifax. I know now this wasn’t the right thing to do but I felt trapped as i couldnt afford the huge monthly bank charges.

Now I’m worried, I’m gonna end up with people knocking on me door demanding money that I simply haven’t got!

Sara (Debt Camel) says

You won’t get people knocking on your door if you make an offer to repay the debt which you can afford and make the payments each month. Call National Debtline 0808 808 4000 and they can talk you through what offer to make and how to complete the court forms. You might also talk to them about whether all the overdraft charges were fair or not, but at the moment completing the court forms has to be your priority.

stephen says

Hi, I have received a so called claim form from county court business centre… firstly is this letter genuine very poor quality and its grey and white looks like a photo copy? The stamp also just states THE COUNTY COURT

2….. I am aware of the debt it is for parking in a hotel carpark now I know that these parking people are always trying it on and have read and heard a lot saying just to ignore them. The debt is now at 225 which is ridiculous.

Obviously my main concern is having a bad credit. … but on the other hand don’t wanna pay some one who is trying their luck?

Sara (Debt Camel) says

Hi Stephen, you can call the helpline on 0300 123 1056 and check the claim number with them to see if it is genuine.

If it is, I suggest you call National Debtline 0808 808 4000 and discuss with them whether you have any defence to the claim.

stephen says

Ok I will do that… is this letter a court order? Or will this matter go to.court if I ignore it? Thanks

Sara (Debt Camel) says

If it is a genuine claim form and you ignore it, the claimant will win the case “in default” without it going to court. It will only go to court if you submit a defence.

Stephen says

Ok thanks for your help, appreciate it, I will be checking its genuine

hara says

i am about to get a ccj, i get dla for myself & my son do i have to inc both of them on the forms – i’m no good at explaining what i spend my money on ( i’m autistic ) & haven’t got time to get help as i haven’t been opening my post till now .. is there anyway to stop a ccj if it’s at court in the next few days without paying the full amount .. ? i suffer from depression , mental health & lots of other medical conditions . thank you if you can help xx ps i have other creditors i owe …

Sara (Debt Camel) says

Hi hara, I suggest you call National Debtline 0808 808 4000, they can help you sort out monthly offers to the CCJ and any other debts and what to put on the court forms. Good Luck!

Peppa says

I have received a Claim Form, which I would like to dispute the full amount claimed filling the N9B. As I am not solicitor, just would like to make sure to write the correct word that I do not agree with the claim in the Section 3. Defence. Is there any special technical word for that?

Also can I attached documentation as proof with the N9B?

Many thanks

Sara (Debt Camel) says

Hi Peppa, it’s good to check these things. I suggest you call National Debtline 0808 808 4000, they can talk about your defence and the forms.

Michelle evans says

Good morning you’re help would be greatly appreciated it concerns what income and expenditure you should include when offering a scheduled repayment. I’m currently in receipt of esa and dla child benefit and child tax credits (in joint names) I also have 13yr old son who receives dla do I include everything I receive including my son’s money and do I include any money my partner receives and finally how do I breakdown expenditure as it is mainly in my partners name. Thankyou Michelle.

Sara (Debt Camel) says

Hi Michelle, by coincidence I have just written an article about this! See https://debtcamel.co.uk/ccj-monthly-payment-form/

Tara says

I have received a court claim form initiated by Lowell Portfolio Ltd who bought my debenhams store credit card debt from New Day/ Debenhams. I have offered a minimal payment but they have not cooperated, and are now using the county court to claim payment.

I know that Debenhams miss-sold ppi to me, am I entitled to claim ppi, and can I use the court’s counter claim to claim the ppi owed to me at this stage?

Sara (Debt Camel) says

I suggest you talk to National Debtline 0808 808 4000 about how to respond to this claim form – it’s important you reply quickly as there are strict time limits.

I don’t think you can use PPI as a counterclaim, but you could put in a PPI complaint right away – then if you get any money back you may be able to use that to settle the debt. Don’t use a Claims firm – you need as much money back from this as possible! Contact number for New Day storecard PPI reclaims is 0330 3333 079.

Gordon says

23/3/15 my partner was dealing with “The Claims Guys”. They asked if there was anyone else living there, she gave them my name. 25/3/15 I received a claims pack ref: 10027674, 26/3/15 I received another pack containing a Letter of Authority ref: 10033583. None of these were completed, signed or returned. (I still have both) I have never received anything seen from TCG, then out of the blue I got a claim form from the County Court Business Centre 1/7/16 for £667.49. The initial fee for work carried out – All fees attributable to reclaiming monies.

[edited]

Sara (Debt Camel) says

Hi Gordon, that was a long and interesting post about the way this firm appear to be pursuing you for work they never did which you never authorised them to do. Unfortunately I can’t give you advice on how to complete these court forms. An excellent place for advice would be National Debtline 0808 808 4000 – lines open until 8pm.

Defending a court case can involve a surprising number of stages over a long period. If you would like general support through this process, you might consider posting on this forum: https://legalbeagles.info/forums/

Jodi says

Hello Sara

I wrote to you some time ago regarding a Claim that was made against me. I hope what I am about to write, will help the many people who are being pursued for money.

The creditor had sent me an invoice which showed he had almost doubled the amount of hours actually worked. I had already paid half of what I believed I owed, and then sent him the second half with the invoice. He refused my cheque and said that he wanted all of the money. I refused to pay. He took out a claim against me and then returned my cheque. At the hearing the Judge looked at my Defence and believed what I had said that he had not worked the number of hours he was claiming for the work done. He had to accept a lesser amount than I had originally tried to pay him, plus I paid the Application fee. He ended up £47 worse off than if he had accepted the cheque instead of returning it!

He had to provide proof that he worked the hours. But he did not have any proof. I had not signed any time sheets etc. He could not produce any evidence whatsoever, whereas I had proof from other people who were in attendance at my house at the same time as he was. I was informed by the Judge that even though I still owed him some money, I would not have a CCJ against my name, especially in light that I knew I still owed him some money, but not all that he was claiming. I had not defaulted on the amount.

The Judge also said that it is up to any Claimant to provide proof of work done, not up to the Defendant to provide proof of work completed, or not. But I always think it is a good thing to provide as much proof as possible. I did.

A CCJ will not be put against someone’s name if it is shown they are willing to co-operate. There is none against my name.

I hope this helps anyone who is concerned.

Tim says

Can the courts take money from my pip

Sara (Debt Camel) says

Hi Tim, that is a bit of a general question. If you are trying to fill out the Income & Expenditure details on a court form, because a creditor is taking you to court for a CCJ, then this article may help https://debtcamel.co.uk/ccj-monthly-payment-form/.

if your question refers to some different court process, I suggest you call National Debtline 0808 808 4000 who can talk you though what you need to do and what is likely to happen.

Chris says

I was recently issued with a claim via the County Court Business Centre. I was acting as Power of Attorney while selling my mother’s house who has dementia and the claimant is after me for misrepresentation relating to some building works which I had no knowledge of. The claim form has my name on it and I have been advised that any judgement, if it gets that far and is not sorted out beforehand, will be against my mother’s estate and not mine, Should my mother’s name have been on the claim form and if any award is made against my mother’s estate, should it be my mother’s personal details which include bank account and savings that go down on the form ?

Sara (Debt Camel) says

Hi Chris, there is no point in me making a guess about this, you need to be able to talk to someone about the details. I suggest you first speak to National Debtline 0808 808 4000, hopefully after that things will seem clearer to you but it may still be advisable to get a solicitor if the money involved is significant.

Chris says

Thanks a lot Sara. Appreciate your response.

Jo says

Hello Chris

Do you have legal cover, or does your mother have legal cover, with the house insurance? I am with Admiral and I have legal cover up to £100,000. It’s worth having a look.

melanie says

Hi,

i had a car accident which my insurers decided was my fault. 2 years later i receive a “claim form” saying that the other party wants money for loss of earnings. This case was already settled by my insurers.

Do i have to pay?

Please help me.

Melanie.

Sara (Debt Camel) says

You need to talk to your insurance company urgently. First because it is obviously linked to the insurance claim which has been settled and second because you may have legal cover with your insurance. If that doesn’t help speedily, phone National Debtline. Make sure you reply tithe Claim form within the tight time limit.

Jo says

This sounds very suspicious. Loss of earnings would have been taken into account when the claimant first filed the claim against your insurance company who would have paid up. I agree with Sara you need to get in touch with your insurance company as a priority and send them a copy of the claim form. In the meantime, don’t do anything else as the claim form could be a fraud.

Jo says

– Sorry I apologise as I may have misunderstood. If the claim form is from the County Court then you do need to respond within the time specified, but ensure that the form is the real thing as some of the ones that appear to be from Northampton are fake. If the ‘claim’ form has come in any other format and not from the Court, then proceed as suggested before.

Sara says

Hi

I have received a white claim form from the county court business center my question is if I full out the N94 admission form to make monthly instalment on this debt will it put a ccj on my credit file

Sara (Debt Camel) says

Yes it will. Do you have any reason to defend the case?

Kaye says

Does a County Court Claim form come on white paper that looks photocopied?

Sara (Debt Camel) says

Sometimes. There should be a stamp from the court, the court’s full name and a Claim Number. If you don’t think this is really from a court, talk to National Debtline on 0808 808 4000

Victoria says

Hi, i was wondering could i do the 3 letter process on a debt i have already agreed to pay monthly? I recieved a county court claim form and panicked so put amout on and sent it back but i had already issued the “1st letter” of the process? Many thanks!

Sara (Debt Camel) says

The 3 letter process is a legal nonsense. If you agree you owe the debt, then you have done the right thing by responding to the claim form with an offer.

Victoria says

Thank you!

Soaps says

I had an old debt in relation to a professional studies loan which I have been chased for years – it has been assigned twice and recently, as I have been trying to improve my credit score I contacted the debt collectors to make an offer of payment via the website. I had a letter a month or so later saying that they accepted my offer and my first payment would be 28th August and enclosed an income and expenditure form which I thought I had completed online. I didn’t return it. I thought everything was sorted. Earlier this month I received a claim form from a firm of solicitors I had never heard of applying for a CCJ dated 30th September. They have said it relates to an overdrawn account which is incorrect and when I contacted the debt collectors they said that I should’ve received a letter from the solicitors but they couldn’t tell me when just that it would have been posted 2nd class but I have not received. Can I defend on this basis?

Sara (Debt Camel) says

I suggest you talk to National Debtline 0808 808 4000 urgently about possible defences as you have very little time. I don’t know how old the loan is, but it may be worth asking them to produce the CCA agreement for the debt, National Debtline can explain how to do this and the implications if they can’t.

Emma says

Hi there

I received a claim form from the county court business centre. This is for an unpaid mobile phone contract. This is the first piece of correspondence I have had regarding this (although the claim form stated they have made numerous attempts to contact me).

I contacted the mobile phone company as I currently have a contract with them at the moment. They managed to find this old contract and said it was taken out July 2010 and first defaulted 2ndo September 2010 and no payments or contact been made since then. Am I right in thinking that this debt would be statute barred? If so how do I go about filling in this claim form and what do I do in terms of credit file?

Many thanks

Sara (Debt Camel) says

Hi Emma – ring National Debtline 0808 808 4000 and discuss this. The first thing is do you agree you owe the debt? Then whether it is statute barred. Then how to complete the defence form. Good luck!

If you defend the Claim and win, it won’t appear on your credit file. if you lose, then the CCJ will appear but will be deleted if you pay the debt within 30 days.

Kerri says

Hi, do I have to send the Ackowledgement of Service form as well as the N9B defence form? And is it the Court I need to send it to?

Sara (Debt Camel) says

Hi Kerri, I suggest you talk to National Debtline asap about your defence and completing the forms: 0808 808 4000.

Lisa says

Hi Kerri, you have to send the Acknowledgement of Service form back as well as the N9B if you are defending the claim detailing your defence, if you do it chronologically will be really helpful to the person who will revised your case (if it’s necessary add copies of documents you can rely on).

Last September I had a claim from a former accountant and won the case without opening our mouth just with the Defence form and evidence such as emails, letters…

kevin says

hi i have sat court forms so i rang a help line i think my debt is statous barred as i havent payed any thing for about 7 or 8 yrs i have sent them the statous barred form and im jobless since jan 2010 i dont know what to put on my court formas i dont get any money my patner pays for every thing so what do i do and do i wait for a responce from lowell solicters sorry about the grammer

Sara (Debt Camel) says

Hi Kevin, have you talked to National Debtline 0808 808 4000? There is no need to apologise for your grammar, but it may help if you tell National Debtline that you aren’t at all confident with with writing and you need help on what to put on the court forms for a statute barred defence.

kevin says

not yet but i defo in the morning thank you

Mario says

Hi Sara

I have filed a defence stating claimant has not proved the debt is mine despite my requests for disclosure. Claimant solicitors who issued the claim stayed the claim after i filed the defence but have now shown copies of my bank statements at the time showing that i borrowed money from a payday company. Is a copy of a bank statement sufficient proof that i owe the debt as i have asked claimants for full disclosure, signed credit agreements etc? Could i also claim costs from the claimant or his solicitors for corresponding perusing papers checking the law etc as they only produced the bank statement after they started the claim in court and after i filed the defence despite my requests for disclosure in the last 3 years?

Many thanks

Sara (Debt Camel) says

Hi Mario, you need urget advice about your particular case which I cannot give, I suggest you call national debtline on 0808 808 4000 and talk about your options.

sharon says

Hi

I have received a money claim online from my previous employer-long story and have already defended (and part won) their last claim. Seems they are out to be a nuisance to me. Anyway their latest claim form N1 did not have any supporting evidence with it. As I have a limited time to send in my defence, this was done on what I can only “assume” they are claiming and I made a point in my defence highlighting this. Do they now have the opportunity to send in documents retrospectively as that seems unfair due to my defence paperwork already being submitted!

Many thanks

Sara (Debt Camel) says

Hi Sharon,

I suggest you talk to National Debtline 0808 808 4000 about your case.

Jo says

Hi – re the documents. Provided these are submitted within the dates given on the form, they can send them in. If they submitted outside of the date, they have to make a special application to submit further documentation, but you have to be notified of this and can object. It is up to the Judge to accept or decline these documents. If they are late by a day or two, sometimes the documents are accepted. It’s all up to the Judge’s discretion.

Robyn says

Hi, need some advice! Managed to lose the forms that they send through! What do I do now?

Any advice welcome x

Sara (Debt Camel) says

If you have just lost the Response Pack but still have the Claim Form, you can download the relevant form (Acknowledgement of Service if you want more time to reply, N9A if you admit the claim, N9B if you want to defend the claim), see the links in these pages https://www.gov.uk/respond-to-court-claim-for-money/overview, or use the Money Claim Online service see https://www.moneyclaim.gov.uk/web/mcol/welcome.

If you agree you owe the money and can pay it in full, you don’t need to fill in the forms. You should contact the creditor or their solicitors and arrange to pay it. If this is done before a CCJ is issued or within 30 days afterwards, the CCJ will not appear on your credit record.

If you agree you owe the money but need to pay it in monthly instalments, there is no need to worry. If you don’t fill in the forms you will get a judgment “in default” because you didn’t, but you can then ask for a “redetermination” to pay monthly, if this is done in 14 days there is no charge. See https://debtcamel.co.uk/help-ccj/ for more details.

So the only case where you have to act quickly is if you want to defend the case. In this case, call the Court asap and ask for a copy of the form. If the debt is a normal credit card or loan, the court is almost certainly the Northampton County Court Business Centre, contact details https://www.gov.uk/courts-tribunals/northampton-county-court-business-centre. Any problems with this, or to talk through how to defend your case, call National Debtline

Karen says

Hi I agreed to be a guarentor for a colleague of mine not knowing at the time my ex partner had taken out several large loans in my name which has left me in a position of having to go on a debt management plan as I can’t prove I didn’t take them out. As soon as I found out I informed Amigo loans of the situation and I am now on a debt management plan through stepchange and as the other person has defaulted I am paying an amount to them monthly. I have now been advised that they are now going to court to get a ccj against us both what I would like to know is what my rights are in regards to this as I have not benefited from the loan.

Sara (Debt Camel) says

When you agred to be a guarantor, were these other large loans showing on your credit record, even though you were not aware of them?

Karen says

No unfortunately not they were taken out in the following month.

Sara (Debt Camel) says

Bother – if the loans had already been showing there would have been a case for challenging the Amigo loan as it was unaffordable. I suggest you talk to National Debtline 0808 808 4000 about whether you have any defence to a CCJ claim.

Karen says

Thank you I will do that

Nev Benqasim says

Hello

I was wondering if you could help me in writing a defence or look a one for a county court claim.

I’m am intending to defend this claim on the ground that:

I was under age 16 at the time (23 now) and unable to understand the implication of the agreement.

Due to learning difficulty’s I did not have the mental incapability to understand what I was agreeing to.

This debt is Statute barred as last communication and payment were made is early 2010.

This was an internet contract.

Due to the fact that it is 8 years later and I have been given no acknowledgement, I do not have any written evidence myself other than then my age and learning difficulty proof due to the length of time passed.

Thank you

Sara (Debt Camel) says

If you were under 16 at the time the debt was taken out this should be a simple defence – this should be your primary argument as it is easy to prove! Talk to National Debtline on 0808 808 4000 about how to reply to the court forms.

Elie says

Hello,

I received claim form, and the claimant state they i had an agreement with opus (which i do not know them). I checked on my credit file and there is no such defaulted account. However I had previous credit expert report and it show the amount claimed and i did dispute it back in august 2016 and they removed it from my file. You can see that the amount was defaulted 30/09/2010. I would like to defend the claim, as i do not want any CCJ. In my defence i will ask them to provide copy of the agreement, but shall i mention that the amount is statute barred, as it is more than 6 years since is defaulted?

Thank you

Sara (Debt Camel) says

Hi Elie, I suggest you talk to National Debtline 0808 808 4000 asap about your options about how to defend this Claim.

Vicky says

Hi, my mum is being ordered to court due to a finance agreement with Santander not being resolved. Her only income is benefits, high rate DLA, state pension and pension credit. Will the court order her to use her benefits to pay the creditors? She is unable to speak for herself due to a stroke so I am really concerned about this. I suffer with depression and anxiety and am finding it really difficult. Any help would be really great. Thanks

Sara (Debt Camel) says

Hi Vicky, that sounds very difficult for your mum. Can I ask a few questions?

By “being ordered to court” do you mean a solicitor is threatening court action? Or has she received a Claim Form? Although it’s possible to be “ordered to court” it’s very unusual and I am hoping it hasn’t happened to her.

Also, does she have other debts as well? Is she renting or does she own her house?

Vicky says

Hi, thank you for your reply. She has to attend county court for questioning over her finances and means of repaying the debt. The letter is titled ‘order to attend court for questioning’ and was hand delivered to her at her home. She is renting a housing association house and has other small debts such as catalogues and overdraft with the bank.

Sara (Debt Camel) says

Here is some information about this https://www.citizensadvice.org.uk/debt-and-money/action-your-creditor-can-take/how-a-creditor-can-get-information-about-your-finances/.

Is your mum physically able to attend court? It’s important she goes if she can and takes any letters confirming the benefits she is getting, her pensions and bank statements.

Could you call National Debtline 0808 808 4000 tomorrow on her behalf? I’m suggesting this because you say she has trouble speaking. If you could make the call with her there, it would help. They can talk through her whole situation – this Santander debt, her other debts, this court hearing and her options. I don’t know how much her debts add up to, but it’s possible something like a Debt Relief Order could help her, see https://debtcamel.co.uk/debt-options/dro/. National Debtline could explain about this and set one up for her if one is suitable.

Vicky says

Thank you, I will certainly do that. The only way she can attend court is if I am with her but I have a holiday booked for the week of the date. I have tried contacting the court to see if I can change the date but am unable to get hold of anyone.

I have just looked at DRO and it will not be suitable as the debt is more than £20k. I have looked into bankruptcy and think this is an option

Sara (Debt Camel) says

Talk to National Debtline about the problem with the court date.

Lots of info here about bankruptcy: https://debtcamel.co.uk/debt-options/guide-to-bankruptcy/. National Debtline can advise her on that, but living on benefits in a Housing Association property it may well be a good idea for her.

It’s lucky you are there to help her.

Vicky says

Thank you so much for your help. I really appreciate it.

Suzie says

Hi there could someone help me ….

If there was a hfc agreement made in 2007 and last payment was 2008 but default notice wasn’t till Dec 2011 can they still try to reclaim the debt or can I go for statue barred?!

Thanks

Sara (Debt Camel) says

Have you had a Claim Form or recent contact with them or a debt collector? And what sort of debt is this – a loan? an overdraft?

Suzie says

No I’ve received a court letter only to which I have put on there I know nothing about the debt which is true I have no idea what the debt is over when I rung company bwlaw they said it was a credit agreement with PC world from my memory I’ve never bought anything on hp from them !

Sara (Debt Camel) says

So you have three possible reasons to defend the debt:

– the simple “it’s not mine” where your witness statement can say that you have no recollection of ever buying anything on HP from Currys

– you can ask them to produce a Consumer Credit Act agreement for the account, if they can’t the debt is unenforceable

– and statute barring.

In defending cases it is usually best to include all reasons. For you it is essential that you request the CCA agreement and enter a full defence. Contact National Debtline about this tomorrow, this is urgent. I cannot give you advice on handling a court case, they are the experts in this.

Suzie says

Will try the above thank you very much

Suzie says

Hi there me again

I’ve now received a form of mediation from the court …. I guess the defence I sent in with regards to knowing nothing about the debt was ignored …. so now I have to pay the debt off?! I have no choice ?! Or can I still write in and ask for statue barred as debt is over nearly over 6years old (dec this year and it will be)

Thanks

Suzie

Sara (Debt Camel) says

Is this what you have received? https://formfinder.hmctsformfinder.justice.gov.uk/n180-eng.pdf

Suzie says

Yes that’s the form I’ve received

Sara (Debt Camel) says

You haven’t lost this case, it hasn’t been heard yet! You definitely don’t need to pay the debt because from what you said you may have a good case that it is statute barred.

Getting that form means the court has received your defence – it is asking questions so the court knows how you want your case to go. You can say:

– whether you want to opt for mediation (section A)

– give some more contact details (section B)

– say if you want it to be heard as a Small Claim (section C)

– give more information about what you want to happen at the hearing eg where your local court is. The claim will usually have come from Northampton and you probably don’t want to have to go there! (Section D).

Previously I suggested you contact National Debtline – can I ask if you did this?

Suzie says

No not as yet that was my next move tomorrow to call them ….

BW legal have written their form (same as above) to the court I have a copy of it …. they agree to small claims mediation service … do I need to fill out the form and do the same? And I need to find the nearest court to myself I guess?

Sara (Debt Camel) says

You have to call them tomorrow. I don’t know what you put on your defence. I don’t know if you have asked for a CCA agreement. From what you said before there were three possible things to put on your defence, if you didn’t put ALL of those down, you need to talk to National Debtline urgently about getting your defence amended… I can’t give you advice on what you should do.

Suzie says

No I didn’t put all three down I only put the one down that I didn’t know of the debt itself I had no idea about it was the only thing I said … so I couldn’t write on a separate piece of paper now with this form and send to the court?

Sara (Debt Camel) says

Phone National Debtline. Sorry, it’s what I said to do before and it’s what you must do now.

Suzie says

Will call them tomorrow thanks very much for all the help so far you have been so very helpful to me

PAUL says

hi, i have just been served with a claim form issued from northampton… i have had this before last year for a different matter and won against lowells… so i know the procedure… What i would like to know is.. is the DCA obliged to include the alleged default date of when i am alleged to have defaulted with original creditor, in the particulars of claim? they have not and i am including this in my defence… will also be asking for deeds of assignment and cca…any help appreciated..Also what is the best template to use in requesting cca and deeds? so many on the net floating around.

Sara (Debt Camel) says

Template for CCA request here: https://www.nationaldebtline.org/EW/factsheets/Pages/getting-information/credit-agreement-advice.aspx and even if you think you know the procedure, I do suggest talking to National Debtline before submitting a defence. They can talk about whether you should have received a Default Notice before the claim was started.

Losing Hope says

Hi There,

I have just received a Claim Form for a business loan from HSBC back on 2001 for $9000 including court fees, it’s now with a legal company 3rd party I’m guessing.

This debt isn’t on my credit file, I have great credit right now and I’m stressing out how this is going to adversely affect my career. I’m suffering from depression and suicidal thoughts.

I don’t have a job currently and feel sooo ashamed of this and now it’s come back to haunt me.

Do they have a right to put a CCJ on a loan so old, is there anything I can do to stop the ccj?

Or having it on my credit file with it being since 2001?

Any advice appreciated

Thank you

Sara (Debt Camel) says

You need to call National Debtline urgently 0808 808 4000 or use their web chat. This debt may be so old it is statute barred, that would be a good defence to this claim, National Debtline can talk to you about what you have to do to defend it.

Carl says

Hi

I have received a claim form from the county court business centre. The letter is on white paper and the writing in black. On the top of the letter it has CLAIM FORM and the official stamp looks fuzzy and not clear as if it’s photo copied or scanned. To the right it has the circle stamp with the crown and THE COUNTY COURT below it which again looks scanned or photo copied. I have read that these companies send out bogus copies to try and scare you into paying the debt. The debt is definitely over 5yrs without payments being sent, possibly over 6 years. I have read that the original letters would be sent in blue and white papers. So I am asking really if this is a copied letter by the debt collector trying to pressure me into paying. The old debt was for a credit card and has been passed on. I have not made contact with anybody for definitely over 5 years. I am not registered to vote at this address where I live. Hope this information helps and you can give me some advice if this is an original document or not.

Many thanks

Carl.

Sara (Debt Camel) says

Did you receive N1 – Claim form; N9 – Response pack; N9A – Admission (specified amount); N9B – Defence and counterclaim all in the same pack? You can contact the court to check the Claim Number is correct.

Assuming this is a valid claim form you do need to respond promptly to defend the case. You need to find out if possible if you have made a payment in the last 6 years – if you haven’t you can defend on the grounds that it is statute barred. Depending on what type of debt this is, it may be a good idea to ask for the Consumer credit Act agreement for the debt. National Debtline can explain when and how to do this: 0808 808 4000.

Carl says

Hi Sara

And thank you for the quick reply. Yes the forms are numbered as

N1SDT

N9SDT

N9A

N9B

Yes I’ve just called the court and it is an original claim.

The claim is for a Barclaycard that I stopped paying and using around 5/6 years ago. I am not 100% sure if it has gone over the 6 years to be honest.

So do I telephone the debt number you have given and would they be able to trace when the last payment was made? And to my understanding it has to be 6 years or over to make it statue barred? What if it is a few months off it actually being 6 years as I think it is not that far off if not already. Sorry for so many questions, I am just a bit worried.

Thanks

Carl

Sara (Debt Camel) says

National Debtline can’t trace when the last payment to the debt was. You can ask the creditor to give you a Statement of Account that will say where they think the last payment is. But it’s also a good idea to get your back bank statements to make sure.

If it is just under the 6 year period, then statute barred isn’t a possible defence.

National Debtline can explain about completing the court forms and the timescales. And help you look at the full picture – do you have other problem debts etc.

The Legal Beagles forum is also good for help with defending court cases.

John says

Hello

I have a question regarding a claim form, I have just received one, it has the symbol you showed at the begining of this article and the stamp aswell but both are printed on the paper, the stamp is not original, can this form be a genuine one or is fake?

Thank you!

Kind regards!

Sara (Debt Camel) says

If it came with Other forms (N9 – Response pack; N9A – Admission (specified amount); N9B – Defence and counterclaim.) it is unlikely to be fake. If you would like to be sure, phone the Court up on Monday and ask them.

Carl says

Hi

I phoned the number and it is a genuine claim. So I have wrote to the claimant asking requesting the cca with the postal order of £1. So I am awaiting their reply. I received their letter on 28th august, I replied on the 7th September. I’ve not heard anything yet. I hope I’ve done it the right way?..

Sara (Debt Camel) says

You need to urgently put in a defence to the Claim. Contact National Debtline on 0808 808 4000. or try their webchat. if you don’t you will lose this case “in default”

Carl says

Hi

I’ve spoke to the debt line online and they told me to register online to acknowledge the debt. I registered and it says online that a claim was made against me on the 21/8. A judgement has been made 18/9.

What does this mean and would you know what situation I am in now?

Thanks

Sara (Debt Camel) says

It means you have a CCJ :( You need to talk to National Debtline again asap to see if there is anything you can do.

Steve says

Received a claim form today over money owed for work carried out. Already paid additional £700 for works carried out, but expected to pay another £1480. This work was never quoted, just a bill sent out. Disputed this for months.

Where do I stand?

Sara (Debt Camel) says

Hi Steve, I suggest you go to your local Citizens Advice to get some help with this. Take details of the work done, photographs etc. You may need to get some quotes from other firms as to the value of what has been done.

You should have been sent an ‘acknowledgement of service’ form with the Claim Form. Tick the box to say you wish to defend all of the claim. Send the form back to the court within 14 days. This gives you another 14 days after that to complete your defence form and return it to the court.

Rachel says

I have received a claim form today for a credit card debt which I think may be statute barred. If I acknowledge the claim to give me extra time to find out when the last payment was made, will I then be able to admit the claim and offer monthly payments if it isn’t statute barred? Or will acknowledging the claim mean I have to defend it or pay in full?

Sara (Debt Camel) says

The Acknowledgement of Service, just extends the 14 days to 28 days. You can still choose to pay in full, offer a monthly payment or dispute the debt.

I do suggest talking to National Debtline if you are unsure about whether it is statute barred OR what to offer as a monthly payment.

Kerry says

ive filed my defence 4 days after the 28 day time scale. Will i get a ccj by default or will the court still consider my defence?

Sara (Debt Camel) says

I suggest you talk to National Debtline 0808 808 4000 about your situation.

Kerry says

Thanks I will do that tomorrow. Ive filed my defence because i have asked lowell for more information on the dbt which they havent sent through. There last letter was they have put the acount on hold until they have the info from the lender. Then i received the claim form. I asked for time to prepare my defence then stupidly forgot until i was tidying the desk tonight.

My question is does a judge automatically file a ccj on the 29th day?

Thank you for taking time to answer on a sunday night

Adam says

I received a claim pack from Mortimer Clarke, on behalf of Cabot on the 6th Feb. Total including fees is £389.04. I have paid them £350 of this and not yet filled in the claim pack, having been told this would be put on hold as I have paid this as long I pay the rest (£39.04) by 1st March. I received a phone today from them, long shot of this is, they will still take a judgement out for me but this won’t appear so long as the rest is paid in 28 days?? Why would they suddenly change their minds?? Totally confused by this business!! And if I have paid money already then how can they put in a judgement for the full amount??

Sara (Debt Camel) says

I don’t know why they changed their mind. But it doesn’t matter that the judgment is for the full amount, the fact that you have paid part means you only have to pay the rest.

Stay on top of this – pay the money by March 1st. I suggest you should check your credit record once a month for the next few months to make sure a CCJ doesn’t appear and then stay there!