A reader asked: I am thinking of filing for bankruptcy. Some of my debts go back quite few years. I tried a DMP and an IVA that failed. I’m behind on my household Bills too. I’m single mum and find hard to cope with all this stress. I finally plucked the courage to do the form. I have at least 13 creditors, some of these details I took off my IVA creditors list but some have passed the debts … [Read more...]

Getting out of debt

Practical articles about the different debt options, which might work for you and different ways of dealing with creditors

“What happens to a DRO if I move in with a new partner?”

A reader asked: I’m a single parent and have had about 10k of debts in a debt management plan for several years. I’m on low income and it looks like it will never end plus I have got some further debts. Now I’m considering a Debt Relief Order (DRO). But I met someone and I’m thinking about starting to live together. I don’t want to tell him about my debts and really want to sort this out … [Read more...]

Going bankrupt in England and Wales – a checklist

Most people find going bankrupt is stressful. Although afterwards it is usually much easier than you have expected, at the time there seems to be so much to get right. Here is a checklist, covering everything you need to do before submit your bankruptcy application. The good news is that this is now all much simpler than it used to be. A few years ago you had to go to court with three copies … [Read more...]

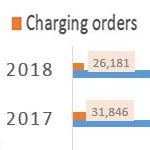

Are you worried about a charging order?

Can your house really be at risk if you get into difficulties repaying something like a credit card bill? You might think the answer is "no", but there are some very rare situations where this can happen. It helps to know the facts, so you can make good decisions about how to deal with your debts. To be able to sell your house a creditor has to: start by getting a County Court Judgment … [Read more...]

Which is better a DRO or an IVA? There is a very simple answer!

Everyone has heard of bankruptcy, but Debt Relief Orders (DROs) and Individual Voluntary Arrangements (IVAs) are less well known. Here is a comparison of IVAs and DROs, so you can see would be better for you. DROs and IVAs were the two most common types of personal insolvency in England and Wales in 2023. Some choices between debt solutions are genuinely hard. When I wrote about comparing … [Read more...]

“Debt collector can’t prove it’s my debt but wants payment”

A reader, Ms J, asked: I sent a Prove It! letter to a debt collector as I have no recollection of debt they say I owe. They replied saying that they cannot “provide specific details to your dispute” and we have marked your account as unenforceable meaning we will not pursue legal action and have informed our client to remove any reporting on your credit file. However the above account remains … [Read more...]

What happens in an IVA if I am made redundant?

Losing your job can be a big problem for your IVA unless you can get a new job quickly. Having redundancy pay can help through this period - but some of your redundancy pay may have to be paid into your IVA. Here I'll describe what the 2016 IVA protocol Individual Voluntary Arrangement says. Most IVAs have similar provisions for redundancy. It's a good idea to check your own IVA paperwork and, … [Read more...]

Recent payday loans make it hard to get a mortgage

Having a recent payday loan on your credit history can make it much harder for you to get a mortgage at a good rate - or even at all! If you have used payday loans, the rule of thumb for a mortgage application is to wait until at least 2 years have passed after your last payday loan was settled. Before coronavirus, the usual advice was to wait one year. But from 2020 many mortgage lenders … [Read more...]

“What will happen at my IVA annual review?”

A reader asked: I’m worried about my first IVA annual review. How much detail will they go into? I've found the year tough with a few car problems. I switched gas and electric to try to save money but it hasn't helped much. This is one of the many IVA issues where I have to start by saying that there is no definitive answer for everyone. It depends on the terms of your IVA, your IVA firm, your … [Read more...]

Is it a lot of work to run your own DMP ?

Most people use a firm to run their Debt Management Plan (DMP). In this case you make one monthly payment to the firm, who then divides it between your creditors. This is free if you go to StepChange, Payplan or CAP - other firms do exactly the same but charge you a fee each month. But you can do all this yourself, not using a DMP firm. The advantages of this are: you are in control; … [Read more...]

- « Previous Page

- 1

- …

- 11

- 12

- 13

- 14

- 15

- …

- 17

- Next Page »