IVAs are now the most common form of personal insolvency in England. Clear Debt has recently stated: Individual Voluntary Arrangements) (IVAs) have become the procedure of choice for those people who have debts they can’t pay and a regular income to enable them to make contributions to their debts. But how often is the choice of an IVA based on accurate information about the alternatives and … [Read more...]

Debt news and policy

Debt Camel articles on what's changing - and what ought to change - in the world of personal debt in Britain.

If you are interested in a specific area, look at: High cost credit news & policy and Insolvency news & policy.

IVA early exit loans – Perinta/Creditfix and Sprout/Aperture

Early IVA exit loans from Perinta offered in 2016 to Creditfix customers Some people have been told they can end their IVA by taking an "early exit loan" from Perinta Finance Ltd, via a broker called Just Lending. Creditfix is sending these emails, but the loan may be available to people in IVAs with other firms. Pearse Flynn, the CEO of Creditfix, used to be a director of Perinta, but no longer … [Read more...]

Paying BadDebtor won’t help your credit record

A reader who had gone bankrupt recently was surprised to get a letter from "The Register of Bad Debtors". This offered to remove her name from their records if she pays them £49.95. She asked if BadDebtor can really do this? There are also reports that people with IVAs are receiving similar letters. In 2017 the Bad Debtor website was taken down. Before that, some people I had contacted - none … [Read more...]

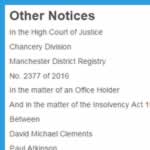

The 2016 IVA Protocol – what has changed?

In June the new 2016 IVA Protocol was published. It would have be helpful if the Standing Committee had issued a guide to the changes from the 2014 Protocol, but they haven't, so this article looks at the significant changes, ignoring routine updating (such as replacing OFT by FCA) and some which seem to me to be very minor. My thanks to Michelle Butler who wrote about the changes earlier this … [Read more...]

Wonga refunds – what happened before administration

This page covered the complaints and refunds process before Wonga went under on 30 August. Events in August 2018 August 4 - Wonga forced to ask investors for £10million in funding as the cost of affordability complaints increases. 26 August - news reports that Wonga was in trouble. Sky News reported that: Directors of the payday lender Wonga could appoint Grant Thornton as the … [Read more...]

Varden Nuttall – what happened

Varden Nuttall, a mid-size Individual Voluntary Arrangement (IVA) firm, was placed into administration on 24 March 2016. The administrators discovered that £9million was missing from the client account and evidence of fraudulent practices by Philip Nuttall, one of the insolvency practitioners and a director of Varden Nuttall Limited, In October 2018, Philip Nuttall was found to be in … [Read more...]

Why the FCA should ban the Compass debt advice model

In March 2016, the clients of Compass Debt Counsellors found out their debt management firm had gone into administration. Many people had thousands of pounds being held by Compass and may not get this money back. In This Compass points to Debt Misery, Legal Beagles points out: "This form of daylight robbery is hugely rewarding because no one ever seems to go to prison for such crime. If I … [Read more...]

IVAs – do you have to get a secured loan – a case story

A reader asked this in a comment, but it needs a whole article to tell the story properly: "We are currently 4.5 years into an IVA, we have got to raise £15,000 through remortgage. We have been told from the start to not worry as there is little to no chance of us being offered it, however we have been offered a £15,000 loan over 15 years and paying back £45,000. I can’t believe this is an … [Read more...]

Swift Sterling & Pounds Till Payday – refunds and complaints

Before December 2015 Swift Sterling, Pounds Till Payday and My Money Partner were trading names of Northway Financial Corporation Limited, a Maltese company. In 2016 these brand names were bought by a UK company called MMP which went into administration in December 2019. When were your loans? This affects who to complain to If your loans were before December 2015 Then you need to complain to … [Read more...]

Creditfix’s proposed PJG IVA variation (2014)

In October 2014, some people who had IVAs with PJG Recovery had their cases transferred to Creditfix. The people who have been transferred were told that nothing else would change in their IVA. Two months on in December 2014 however, they are being asked to agree to a variation in the terms of their IVA, including increasing the fees that Creditfix charge. Some people have expressed unhappiness … [Read more...]