Loans2Go offers what I have called the worst loans in Britain.

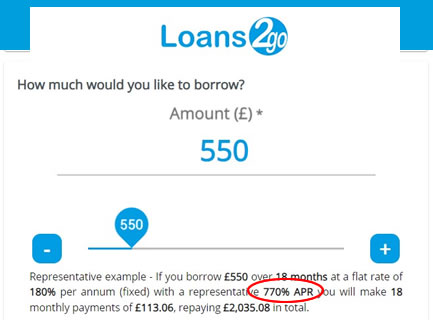

Since 2021 they have been charging 770% APR. See the representative example Loans2Go quotes on its website:

- £550 borrowed for 18 months is a monthly payment of £113

- this adds up to £2035, a bit less than four times what was borrowed.

Contents

MUCH cheaper to get a payday loan than a Loans2Go loan

Of course Loans2Go don’t point this out on their website, but check out these numbers!

With a payday loan for £550, the maximum interest that could legally be charged is £550 – the amount borrowed. So you would only have to repay £1,100 – the £550 borrowed plus the £550 interest. And the monthly repayments for a payday loan for 12 months can’t be more than £92.

So you would pay a payday lender £92 for 12 months

but Loans2Go is charging MORE PER MONTH (£113) for MUCH LONGER (18 months).

Loans2Go also used to offer logbook loans, but this article is just about their standard personal loans. If you had a logbook loan from them, use the template on this other page.

Is this legal?

The Financial Conduct Authority (FCA) calls payday loans “High Cost Short Term Credit”. Its definition of High Cost Short Term Credit is a loan over 100% in APR and of 12 months or less.

So the Loans2go loan is outside that definition because it is 18 months long. So it isn’t caught by the price cap rule.

Unfortunately, this means its loans have crept through a loophole and are legal. I think the FCA should close this loophole.

Many people are winning affordability complaints about Loans2Go loans

I think this is the worst loan in Britain.

A loan is unaffordable for you if the monthly repayments were so high you couldn’t afford to pay them without hardship, borrowing more or getting behind with important bills. This is a standard affordability complaint, used for many other sorts of loans. If you win this you will get a refund of all the interest.

Because Loans2Go loans are so expensive they are often unaffordable. Many people are winning Financial Ombudsman (FOS) complaints about these loans – here is just one example: Miss R’s personal loan provided by Loans 2 Go.

No-one who isn’t desperate would take one of these loans out, and the ombudsman says Loans2Go should make more detailed checks on affordability when it thinks the borrower may be in difficulty.

Several people have said they were not given the full details about the loan before the money was given to them. If this happened to you, say this in your complaint as well.

First complain to Loans2Go

It doesn’t matter if you have repaid the loan or you are still paying, you can still complain.

You have to complain to Loans2Go first, you can’t go directly to the Ombudsman.

Email customerservices@loans2go.co.uk and copy it to ps@loans2go.co.uk. Put AFFORDABILITY COMPLAINT as the title.

Use this template as a basis and make any changes so it reflects your case:

I am also complaining that the interest rate was grossly excessive. It is unfair to charge someone more per month over 18 months than they would have paid to a payday lender for a loan the same size over 12 months.

[only add this next sentence if the date of your loan was after the end of July 2023] This loan does not represent fair value and it is in breach of the FCA’s Consumer Duty.

[only add this if you were not told the loan terms] The loan was not adequately described to me before I was given the money. This is an unfair way to give high cost credit.

I am asking you to refund the interest and any charges I paid, plus statutory interest, and to delete any negative information from my credit record.

[delete if you have repaid the loan] I would also like an affordable repayment plan to be put in place if I still owe a balance after this refund.

I am also making a Subject Access Request (SAR) for all the personal information you hold about me including, but not limited to, my applications, all credit and other affordability checks, a statement of account for my borrowing, and a record of all phone calls.

Let me know in the comments below if you are making a complaint about a loan that started after the end of July 2023, as there are some new regulations about those.

Is an offer from L2G a good one?

If L2G has offered to wipe a small balance or take some money off what you owe, you have to decide whether this is a good enough offer to accept.

For example, they may offer 50% of the interest off “as a goodwill gesture”. Or to reduce your balance by 50%. These are often very poor offers, you could get a lot more by going to the Ombudsman.

Sometimes Loans2Go will increase an offer if you push them. Here is what one reader said:

They replied firstly with the offer to half what was left and agree a payment plan and I refused and they immediately came back and wiped the loan clean and removed it from my credit file.

It’s up to you what you think a good offer is. But you can’t change your mind later if you accept and then think you shouldn’t have.

So ask a question in the comments below if you aren’t sure.

Take a rejection or a poor offer to the Ombudsman

You can send your complaint to FOS if Loans2Go has rejected it or has made you a poor offer. This is easy, just use this simple FOS form which asks you what they need to know to set up your case.

Send your bank statements to the Ombudsman – 3 months before and 3 months after the date of the loan. These are the best evidence that the loan was unaffordable for you.

Andy says

Hello,

Not yet? I wanted some feedback from the site, not sure if its valid case. I was thinking of asking for bank statements , I have some details from my credit file but not all.

Thanks

Sara (Debt Camel) says

I suggest you send in the complaint now and then get together all the details you may need. Take a copy of your credit record in a form you will be able to forward to the Ombudsman – the statutory reports are often the easiest. And get your bank statements – these will really help your case.

Peter fraser says

Hi I have an on going claim with loans2go I complained to them I received a final response from them. And was shocked with the response claiming I had a gambling problem iv not ever gambled. I have since proved there was no credit checks done. Its with the ombudsman. The final date has passed and no response from either of them. I had a loan of 400 paying back 1800. The other was 200 paying back 980. Dose anyone no how long it takes to sort out throu the ombudsman?

Sara (Debt Camel) says

So they did send a “final response” but it was simply wrong. Have you told the Ombudsman this?

Are you making payments to these loans at the moment?

Peter Fraser says

The final response was completely wrong. Yes I am still paying them. Yes I sent a copy of it to the ombudsman.

Adam says

Sara,

I sent Loans 2 go asking to remove an old loan that I withdrew from, off my credit file. They came back saying

“ As you withdrew from the loan, this should not have any effect on your credit file.

However if this affected your credit file, could you please provide us with proof of this? We will then amend your credit file accordingly.”

Is there anything I can say to them to get it removed? As you know from previous posts of mine I’m only doing this to have as little old loans as possible come mortgage time

Sara (Debt Camel) says

Well you can send them a copy of your credit record and say your complaint goes to the Ombudsman if they don’t remove it… that may work. But you are unlikely to win an ombudsman complaint on this, so they may refuse.

Dvid says

Hi Sara. I have received my response from l2go. Would you be happy to read it and tell me what you think if I post it? It’s quite long

Sara (Debt Camel) says

could you just summarise the interesting bits? not general stuff, but bits directly relevant to your case.

dvid says

Loan: 41674902 Agreement date: 21/12/2019

Principle: £500

Duration: 18 Months

Total Payable: £2,056.86

Total Paid: £960.21

Outstanding balance: £1,096.65

Status: Active

I note that you declared your monthly income as £1,600, we verified that you received a minimum

of £950.31 monthly via an online income verification tool. You declared your monthly expenditure

and credit commitments to total £2.00, however, following an extensive review of your

application, in addition to your credit file, we calculated them to total £675.93. We also then added

a buffer of 10% to your verified expenditure to account for any fluctuations in your monthly

income or expenditure, even after which, your contractual loan repayment of £114.27 would have

still been affordable.

However, based on the additional information which you have provided and in order to assist you

as best as we can, as a gesture of goodwill it has been agreed to write off 40% of the interest

Current balance outstanding: £1,096.65

Gesture of goodwill write off: £622.74

New amended balance to pay: £473.91

i think this is all the interesting bits you might like to look at

Sara (Debt Camel) says

“we calculated them to total £675.93”

Do you think that is an accurate summary of your monthly expenditure?

did you send L2G your bank statements with your complaint?

dvid says

No it’s not. I sent them statements and they show that I think. I’m not sure what online calculation tool they used. Also they say they did an equifax credit check which shows a ccj but this doesn’t come up when I check through clear score. It’s only on experian and transunion which I think is odd

Sara (Debt Camel) says

Then reply to them that your bank statements which you have sent them show your expenditure was much higher than that and you will be sending the complaint to the ombudsman if they do not clear your balance (if you think that is fair? if you want a refund of the interest you have already paid there is no point in arguing with L2G you may as well send the case straight to FOS).

dvid says

Have done. Does anyone know if they will respond if you come back with another offer after they have sent a final response? I have asked them to get back to me within 7 days

NC says

Hi sara I’m just looking your opinion really.

I have been in debt with several payday loans and had taken out a loan with loans2go of £900 in desperation to clear my other debts and hopefully have a smaller amount off my wage per month.

I’m on my 14th of 18 payments of £205.

I didn’t take in to consideration the amount of interest I would be paying to l2go which is nearly £2800.00

I’m now on a dmp to try and clear everything off in one payment, my monthly payments are £412 per month and my biggest chunk of that goes towards l2go.

I have about 3 months left of my dmp, however i have been struggling at the end of every month to make ends meet

Would it be reasonable for me to complain to them?

Sara (Debt Camel) says

yes if you think the repayments were unaffordable – which if they were a big cause of you ending up in a DMP they probably were.

NJ says

I’ve just had a final response from L2GO after sending my affordability complaint..

They have offered to wipe off the £825 outstanding balance and close the loan.

They explained at the time I agreed and signed to the loan that they could see I had enough money for the 18 monthly payments of £205

However at the time of taking the loan out I had already been paying towards other payday loans, was in my overdraft and had a terrible credit score.

After taking out l2go loan of £900 i eventually found myself borrowing again to try and pay off my debts.

I’m not sure of l2go final offer is reasonable and if i should respond asking for a better final offer?

I’ve already paid off the £900 plus about £1970 in interest.

Sara (Debt Camel) says

If the loan was unaffordable and you win the case at FOS, you would get the balance wiped plus a refund of the interest you have paid so far. So it’s not a great offer. But it’s not a terrible one.

It’s up to you

– you can accept and be glad this loan is out of the way

– or go back and try to negotiate for more by offering a compromise – perhaps £500 refund? not the lot, that’s not a compromise

– or send the case to the Ombudsman and try to get the lot back.

Nj says

I’d prefer to negotiate for a refund too, however I’m not sure how I would ask for a compromise.

I’ve already expressed how I thought their interest rate was too high and to much interest was being paid, but their response was basically “you agreed to the terms”

Sara (Debt Camel) says

You can say you don’t think their offer is good enough, you are happy to compromise for a sppedy resolution rather than send this to FOS, so you would be prepared to accept a refund of £X, which is a lot less than you would get from FOS. I have no idea if they will agree, and it isn’t certain you would win the Ombudsman case.

Jodie says

Could someone help on how long it takes for them to transfer the money to my account? I won my claim through resolver and this was the reply off loans 2 go. I received this Wednesday and immediately replied back with acceptance and bank details as requested.

Following the acceptance of the offer, I can confirm the total redress amount due to you is £1,104.10.

Please let us know if you agree with the amount and provide us your bank details for us to make the funds available to you as soon as possible

Julie says

Hello,

I’m looking for the same answer if anyone can help.

L2G agreed with the Adjudicator last Tuesday and the adjudicator said that they have 4weeks to pay. Do they normally take the full 4weeks? Are they supposed to send me an email with the amount of redress?

Many Thanks

Julie says

Hello Jodie.

Sorry to ask but have you received your refund yet? Just trying to work out how long they normally take to pay.

Many Thanks

Paul says

Hi Sara,

I’ve got a response from L2g today they are not upholding my complaint but are willing to refund 100% of interest. although I was wishing for the default to be removed from my credit file I feel for this to be resolved in 4 weeks and not have to wait for FOS its too good to turn down.

do you know if there is anything they can do to sort my credit file/ is it worth asking?

In the circumstances and after consideration of all the evidence available to me, I am unable to

uphold any aspect of your complaint. However, based on what you have advised about your

current financial circumstances, I believe that it is important we offer some assistance. As a gesture

of goodwill and testament to Loans2Go Limited’s continued commitment to treating its customer’s

fairly, I am offering to write off all the interest on your active Loan Agreement. I am offering this

in full and final settlement of your complaint. I can also confirm that we will be happy to put you

in an affordable repayment arrangement to pay off what would be left outstanding of your balance

if at all you need this.

Sara (Debt Camel) says

So from your previous post you have paid £852 and you borrowed £1000? Can you confirm that they are planning to reduce your balance to £148?

(It is ALWAYS worth double checking this and that a lender isn’t planning on just removing the remaining interest in the balance, not taking account of the interest you have already paid.)

If that is right then it is indeed a good offer. My guess is your credit rating is pretty rubbish anyway or you would never have fallen into their clutches, so you may decide you would just like this settled quickly without the stress and delay of going to FOS.

Paul says

Yes, They are refunding 100% of interest (£3,114.08) and I just need to pay back the remaining of what I borrowed. I was sure if It was worth pushing my luck asking if they were able to update my credit file.

Sara (Debt Camel) says

Good.

It’s up to you. It can’t be 100% guaranteed FOS would say refund the interest (though the odds are very good!). And it would be good to get this settled quickly without any more hassle.

Nicola says

Hi sara i have had a loan for 250 pounds plus i had a top up for 250 pounds i have made an affordability complaint as well as paying the loan off which i loaned off a friend however the early settlement figure i was given has been paid however all it has done is go on to added extra payment.

I have sent an email to say i have paid the early settlement which said was due by the 7th june. however have not heard anything back.

Charlotte says

Hi Sara

I complained to Loans to go about the affordability and interest rate of my loan. They said they won’t uphold my complaint but have offered to clear the reasoning balance and close my loan.

I took out a of £300 loan 9months ago and have paid back £617 in total so far. I have not missed any payments. They amount they are clearing is £617. If I accept should this have any negative affect on my credit score? I’m hoping not as I have not missed a payment.

Thanks

Charlotte

Sara (Debt Camel) says

you need to say that you will accept that if they mark the debt as settled, not defaulted or partially settled.

Charlotte says

Thank you. I will reply with that

Julie says

Hi my mum took out £1500 yesterday which was the 04/05/21. I’ve just looked at the interest and it’s a shocking £2894. My mum is 69 and didn’t look at the interest and she’s on a pension is there anything I can do

Sara (Debt Camel) says

Tell her to repay the £1500 now?

Can she afford the monthly repayments?

Why did she need the loan, what other financial problems does she have?

Steven says

I have made a affordability complaint yesterday 05/05/21 via email to Loans2go how long does it normally take for them to respond. This site has been really helpful.

Charlotte says

I emailed my complaint on 4th April and they replied on 30th April. I responded to that email on the same day and not had a response as yet

Steven says

Just had a reply from them today. That was quick.

Alan says

I had 6 loans from loans2go in a 13 month period, I sent an affordability complaint last month, they got back to me last week rejecting my claim, I appealed to them proof of my bank accounts/income that the loans were never affordable and shouldnt have been given them, they have just replied to me saying they still believe my loans were affordable and thus not upholding my complaint, they have though offered me a gesture of goodwill refund of £150, the total interest I paid on all loans combined is roughly £590 so this isn’t really a great offer, why would they offer me this if they are adamant they were right to loan me the money? Are they just bluffing and trying to get me to settle for cheap as they know I have a strong case if I go to the ombudsman?

Sara (Debt Camel) says

the total interest I paid on all loans combined is roughly £590

That sounds very little. Are you sure it is right?

Did you repay all the loans after just a week or two?

Alan says

Hi, yeh it’s correct, for all of the loans I settled early to save on interest, they initially used this to reject my claim, I was however using money from other loan companies to repay the L2G loans as their interest rate is through the roof

Alan says

I have just replied to their offer of £150 with a counter offer of £450, don’t know how successful this will be but I’ll report back with the outcome when they respond

Sara (Debt Camel) says

I was going to suggest a counteroffer. You would be unlikely to get all the interest back from a FOS case.

Alan says

hi, it looks like ive come to an agreement with loans2go. They have offered to repay me 50% (£295) of the interest I paid for the 6 loans total upon me emailing the financial ombudsman to withdraw my complaint. I have done so and waiting for loans2go to send me the funds. I think I might have received more if I waited for the ombudsman to get involved but from reading other peoples posts about their cases not being taken up for months up months I think taking this offer was the best course of action. Also the chance of them going into administration before the ombudsman makes a ruling also contributed to my decision.

Julie says

Hello everyone.

How long does L2G take to pay after you have given them your bank details?

Many Thanks

Amiller says

Hello did u end up getting paid and can I ask if u won ur case through FOS

dvid says

Hi shall I copy my original complaint email to loans 2 go along with my bank statements in the initial complaint with the ombudsman?

Sara (Debt Camel) says

You can do, or you can just summarise it? It is a good idea to send your bank statements. And to attache the reply from L2G

Kirsty says

Hi can this same template be used for the logbook loans?

Sara (Debt Camel) says

better to use the one over on this other page: https://debtcamel.co.uk/refunds-large-high-cost-loans/

Kirsty says

Thank you,

Could I just ask if I need to send bank statements with the complaint if I sent them at the time the decision was made? I have sent the initial complaint email and they have responded saying the are investigating my complaint and “if I intend to rely on any information that was not provided to us when the loan application was made (eg medical reports, bank statements) please send them to us immediately as it may assist the investigator in fully assessing your case and reaching the right outcome”

Also I had numerous loan top ups with the going back to 2015 I put all the reference numbers in the initial email, will they look at all accounts or just the most recent one- all are payed off and nothing owed.

Thank you

Sara (Debt Camel) says

what bank statements did you provide when you applied for the loan?

Kirsty says

Hi,

I provided the last 3 months prior to the application, they called me earlier to say they have bank statements for all loans but not for the loan that was given in 2018 – could I use that as a factor ie they provided me with a loan without requesting bank statements?

Sara (Debt Camel) says

if the bank statements would have shown you could not afford the loan, yes.

Adam says

Hi Sara,

Just a couple of questions some advice again. My Loans2go is still waiting on adjudicator, only received email from FOS today that they would assign one ASAP but wait times on website are 5 months. I’m wondering if I went to Loans2go and told them that I will withdraw my complaint if they accept what I originally borrowed in full and remove the loan completely from credit file, how likely are they to accept this?

Will it go against me at all if they don’t agree and it goes ahead to FOS?

Sara (Debt Camel) says

I will withdraw my complaint if they accept what I originally borrowed in full and remove the loan completely from credit file,

Was that what your original complaint asked for? Did you have previous loans? Were you hoping for a cash refund and bnow you are just saying you want the balance cleared?

how likely are they to accept this?

I don’t know.

Will it go against me at all if they don’t agree and it goes ahead to FOS?

No. If uou make this offer, say it is in the interest of getting a speedy resolution that you are suggesting this compromise.

Adam says

The original complaint was for a full refund but I still owe money towards what I originally borrowed. Now I just want to pay them the rest of what I owe from what I originally borrowed and remove the loan from credit file. I had this loan with them and a previous loan which I withdrew from within 2 days but it’s also on my credit file.

Jess says

I got a loan for £900 my credit rating was shocking, I sent no proof of income to them and they didn’t state the interest rates until after they issued the loan. Anyway it’s gone to a CCJ as of 17-05-21 I agreed I owed the money and let it go way to far but I hid from the debt and I panicked when I received the court letter. Is there anything I can do about it now or have I blown it.

Steve says

I have just had a reply from Loans2go regarding my complaint. They are not upholding my complaint, but are willing to write off existing balance of £1408. I originally borrowed £500 and made 5 payments. Many thanks to this site and Sara without it I would not have got this result.

dvid says

Hi I have submitted my complaint to the ombudsman and loans2go have just sent me an email saying that my account is now off hold after being deferred due to covid-19. Even though they defaulted me during the first lockdown. They are asking me to call them. Should I ask them to put my account on hold until the ombudsman case is over. Can they take me to court?

Sara (Debt Camel) says

They shouldn’t start a court case when you have an open complaint with the Ombudsman.

If they do, FOS will usually give your case priority. And court cases can take a VERY long while to go through if you defend them as the courts are backed up because of covid-19,

dvid says

Ok thanks. Can I ask if you know how many cases are getting there interest reduced due to the interest being substantially repaid over 12 months? I think this is the most likely win for me rather than getting a refund

dvid says

I have paid 960 back from a 500 loan already.

Sara (Debt Camel) says

At the Ombudsman how far you are through the loan is unlikely to make a difference to the their decision about whether the loan was affordable for you.

dvid says

What I meant was if the fo decide the loan was affordable are they still upholding complaints based on the interest rates being higher than the payday loan ruling?

Sara (Debt Camel) says

I haven’t seen one upheld on that basis – they are normally won on simple affordability

dvid says

Ok thank you. Hopefully my affordability complaint will win I was just wondering about how many people are getting interest reduced based on the really high interest rates

Kirsty says

Hi sara,

I put a complaint into loans 2 go a couple of weeks ago regarding 5 loans (each were renewed) they have got back to me today to say that they will not uphold my claim as all checks showed that they were affordable, and that they require customers to be honest in there income and expenditure. They have said as a good will gesture for being an outstanding customer they have offered me a refund of £300!

All together I payed £4858 in interest should I go back with a counter offer or go to the FOS?

Thanks

Sara (Debt Camel) says

What sort of counter offer do you think would be a fair compromise?

Kirsty says

Hi,

I’m not sure maybe £1000? If I went back with a counter offer and they rejected that would I then have to take it to the FOS?

Thank you

Sara (Debt Camel) says

I think that sounds like a very low amount. If you are happy with that, they may well agree.

(If you were going to say you wanted £4000 I was going to say just go straight to FOS.)

Kirsty says

Hi,

I didn’t have a set amount I wasn’t to sure, is it worth going back to them with a counter offer of the larger amount or is it best to go to the FOS?

Thank you

Sara (Debt Camel) says

If you would be happy with a lower amount it is worth offering it. But if you want the most you can get then you may as well go straight to FOS now.

I think £1000 sounds very low when you have paid that much interest. But it’s up to you what amount now you would feel happy with.

Kirsty says

Hi,

Thank you I will go to the FOS. Hopefully they go in my favour

Thanks

Steve says

Just had confirmation from Loans2go my balance of £1408 has been cleared and my credit report will be marked as settled. Put a complaint in 3 weeks ago it’s now settled and I’m happy with the result. Thanks to debtcamel .

Florian says

Hello ,do they started a CCJ against you and what happened?

Kieran says

I took a logbook loan out in November 2018 for £1350

The repayments was £186 a month for 36 months total amount payable £6700 so that alone is over £5000 interest I’ve just sent a complaint to them at the time I needed the money but with really bad credit this was my only option and have regretted it since I really hope I can get something back

Tina says

Hi Sara,

Thanks for all of your help!

I took out a loan with L2G for £250 and I still currently owe over £900. I am with Stepchange and pay them monthly and this is one of the loans that is on my plan.

I want to raise a complaint with L2G but before doing so would it be likely that they will just clear some/all of the debt that I still owe? Also another thing that has always stuck with me is that when I took out the loan I incorrectly entered my date of birth by mistake and they also had this on my account. Surely if proper checks were done then my loan application would have been declined due to details not matching? Is it worth bringing this up or not?

Thanks in advance.

Sara (Debt Camel) says

Definitely complain. That could get a large amount removed from your DMP, possibly even some cash back.

You can mention the date of birth but it isn’t that important.

Craig says

If you have been stuck with these crooks go the ombudsman.

Now, I am going to suggest that you all do this because I am pretty sure anyone desperate enough to use this company will have some defaults or CCJ’s on their credit reports.

The financial ombudsman ruled that they shouldn’t have given me the loan and loans2go should have done more research into my financial situation as it was clear from what they could see on my credit report that I was struggling financially.

The ombudsman ruled that I only need to pay back the money I borrowed with no interest and loans2go have to remove any negative remarks from my credit file.

So please, if you have used this company, please get in touch with the ombudsman as this crooked outfit is so very close to getting shut down so play your part in hammering the final nails into their coffin.

It feels so good to finally get one up on these crooks.

Dvid says

I wholeheartedly agree. My complaint is in it’s initial stages with the ombudsman and will hopefully get the same outcome as yours. Can I ask why you think they are close to being shut down? ( I’m just interested as being part of bringing them down was a big reason for me to complain) I genuinely think this company are as bad if not worse than Wonga and all those payday loan companies that went bust

Sara (Debt Camel) says

I too think they are worse. Not just because of the horrendous interest rate but because so many people have reported being given the loan before the terms were explained.

I would love to think they are close to closing but I have no particular reason to think that is the case.

For anyone worried about their complaint if they do go into administration, the claim can then be made to the Administrators who normally tryouts follow roughly what the Ombudsman would decide. There is no reason to accept a poor reduction in your balance because of these worries as you have the right to have the balance reduced in administration.

Keisha Palmer says

I hope they go into administration because the FO says I must pay back over £3000 for a £700 loan even though I cry to Loan2Go on the phone that I cannot afford to pay the loan l. I did not understand the interest. I need advice what I can do. Because I cannot move forward with my life.

Sara (Debt Camel) says

was this a decision from an adjudicator or an Ombudsman?

what are the rest of your finances like at the moment?

Katie says

Hi,

What did you have to send to the FOS? With the complaint?

Thanks

Adam says

Hello again,

I can report back a good result (for my situation anyway) after some emails back and forth with Loans 2 go they agreed to remove all interest and remove this loan and a previous loan from my credit file. I then paid the loan in full of what was remaining as my financial situation is much better now and allowed me to do so. This was a great outcome for me as didn’t have to wait for FOS but I also wasn’t getting a refund.

Thanks Sara again for what you do and this fantastic website!

Adam says

Hi Sara

I’ve had this generic response back from Money boat when I emailed them the template letter from your site.

I am concerned about the fraud claim, is this something I should be worried about.

I think at the time of applications I was in severe debt and would have been making many applications perhaps without reading all the small print,as maybe I should have.

Can you advise how I should proceed?

Adam says

Sorry here is the actual email response from them

In the event of an affordability/irresponsible lending complaint, could you please provide us with copies of your bank statements applicable at the time of your applications, so that we may carry out a full and comprehensive review of your complaint.

Should it transpire that information provided by you at the time of application was false or misleading, we may register this attempt to gain redress falsely as a first party fraud with CIFAS the fraud prevention agency. To learn more about fraud and understand your rights please visit cifas.org.uk. Any fraud marker may affect your ability to obtain credit with banks and other lenders in the future.

Sara (Debt Camel) says

Moneyboat says that to everyone! They seem like threats designed to make you give up but are in practice just bluffs – no-one here has reported any problems if they have taken a Moneyboat complaint to the Financial Ombudsman.

Adam says

Thanks Sara

Did feel like a bluff but wanted to confirm.

I will continue to pursue.

Adam says

Hi

I’ve put in a complaint against Loans to go,and they are responding that firstly my email is not registered with them and now that my address is not known either.

This is lies on both parts,as I made the applications with both of these.

Response below:

Please be advised, the address you provided does not match the address we have on the account for you. We kindly ask that you provide us the registered address on the account.

Has anyone had a similar response from Loans to Go,and how did you get around it?

I can see why they are doing it,because the loans date back a number of years,and they are perhaps trying to deny all knowledge of the loans.

Not sure how to fight them,when they are saying they have no record of my details.

Any advise would be warmly received

Sara (Debt Camel) says

How long ago were these loans? Do you have any records of them – emails, bank statements?

LULU says

Hi , Just thought I would give some hope to those who have had L2G reject their complaint , I made a complaint in 2019 following 4 loans with them starting in 2015 , my complaint was rejected and went to the adjudicator who also rejected it , I asked that it be looked at by the ombudsman who upheld all 4 complaints !! I am currently waiting for a settlement figure now that is likely to be around £6000 so just wanted to say DONT GIVE UP !!! These people are sharks and need to be stopped!!

Isabel says

Hi everyone. I made a complaint to loans2go by using your template and explaining that the loans were unaffordable, correct checks weren’t carried out and the interest rate was extortionate. I quoted the rules regarding 0.8% maximum per day etc. They came back and said that there was nothing wrong with the loans. I replied saying that the result was I had to borrow from other loan companies to try to get out of the high interest which resulted in a cycle of pay day loans and eventually a dmp. They then replied saying there was still nothing from with the loans but would offer me a ‘good will gesture’ of £250. The interest i have paid across 3 loans is £1500+. I have gone back and offered 50% of total interest to settle it and otherwise i’ll take the complaint to the FOS. Do you think this is realistic? Thanks for all the info so far, this website it hugely helpful!

Sara (Debt Camel) says

if you are happy to settle for 50% of the interest then that sounds an ok compromise.

If they say No, send it to the Ombudsman where you may get it all back!

Gary says

I would personally go for 100% interest refund, just won a case myself and there’s nothing better than knowing they have to refund you all your interest back, along with l2g paying the the ombudsman £500+ in case fees. Sweet sweet victory

lukem says

hi – my loan was for £1399 and my repayments will total £5520 – is this even legal?! was in a bad place when i accepted it and had to pay 24 payments of £230. I have since had to go into a DMP. just wondering if i will need to pay it back fully or if they’d accept to reduce the amount

Sara (Debt Camel) says

Unfortunately it is legal – because the loan is for 18 months, the payday loan rules which would restrict the interest do not apply.

But send them an affordability complaint! See the article above for how to do this. If you were in a bad place, they should probably never have given you this loan at all – as the loan was so large they should have been extra careful.

Ask them to remove ALL the interest – just taking off a few hundred isn’t good enough. If they refuse, send the complaint to the ombudsman.

Can I ask you how large the total of your debts in your DMP is? And how much you are paying a month?

Lukem says

Thanks sara. The loan is over 24 months if that helps at all. And yes got myself in a severe situation, Covid hit and I used to have commission that was actually more than my salary but that changed abruptly!

I have a DMP with step change which is £300 a month over 5 years I think – across 4 lenders. A couple of them are threatening with defaults in which I didn’t think would even be a possibility if I had set up a DMP, stepchange nor the lenders told me this could happen which isn’t ideal!

Sara (Debt Camel) says

Defaults are best in this situation – they mean the credit record will disappear 6 years after the default date. If your credit record only shows payments arrangements, they stay on for 6 years after the debt is settled…

If you win the L2G complaint at the ombudsman. they will have to remove all negative marks from your credit record :)

Who are the other 3 lenders?

Lukem says

I’m just worried as I already have a default (bank overdraft) so don’t want 3 or 4 defaults! Other lenders are Bamboo who haven’t been helpful at all, AA loans and Lendable. Basically for myself in a right mess and wish I came across you before. I am now in a better financial situation (I work in events so extra money coming in) but just anxious about the whole situation really

Sara (Debt Camel) says

With one default, a few more doesn’t make that much difference :(

Have you cleared the bank overdraft? Otherwise that should be added to your DMP too. You don’t have any credit cards?

Look at affordability complaints against Bamboo, AA and Lendable – see https://debtcamel.co.uk/refunds-large-high-cost-loans/ for a template for those complaints. Every bit you can get the current balances reduced will speed up your DMP! Also winning these complaints is the best way to improve your credit record.

Lukemc says

Hi Sara yes have the overdraft on the DMP, and I do have a credit card but that isn’t included. Will certainly look at affordability complaints thank you!

Sara (Debt Camel) says

why isnt the credit card included? that would get the interest frozen on that. When you are in a mess like this, it is better to put everything in. As soon as the debts are gone you will be able to start rebuilding your credit rating. I suggest you call your DMP firm and ask them to include it.

Paula says

Hello

I sent a complaint to loans2go using your templates and have received this response this morning

Principle loan £500 for 18 months 01/11/2018

Total payable £2039.04

Total paid £1226.40

Outstanding £ 812.64

Goodwill gesture write off the outstanding balance of £812.64

I was wondering if you could advise if this is a good offer or worth taking to the FSO?

Thanks

Sara (Debt Camel) says

So you have already paid 1226-500 = 726 in interest. If you send the case to the Ombudsman, that is what you might get repaid (plus a small amount of 8% interest, but that will not be large).

It is up to you if you are happy with this as an offer. It obviously isn’t great but neither is it terrible. If you had paid £1300 in interest and they were onlt offering to wipe the remaining balance of £200 then that would be dreadful.

One thing you could try is to say you would be happy to compromise if they will refund you £226, which will mean you have paid the same interest as you would have on a payday loan.

But if you want the full £726 back you will have to send it to the Ombudsman.

Paula says

That’s great thanks for the advice. I will try for the £226 but if not successful will be happy for the remaining balance just to be cleared and my credit file update.

Paula says

Just to let you know. I received an email this morning offering to clear the balance of my outstanding loan and refund me the £226. Thank you so much for all your advice and help.

Lukemc says

I have just received the following from loans 2 go. Initial amount £1399, total repayments due £5520, total paid £2070……

‘ Good afternoon Luke

I understand from the content of your email that you believe the interest on our loan is high.

Regarding the interest applied to your account, we can confirm the interest charged is in line with the contractual terms and conditions. We clearly advertise them on our websites, and we provided you with a copy of the Pre-contract credit information, Fixed Sum Loan agreement, and terms and conditions of the agreement before signing the loan. The key financial information contains, among other pertinent information, the total amount payable, interest rate and the duration of your loan agreement. It was required of you to read, agree, and sign these documents before being provided with the funds.

We would also inform you that the interest is frontloaded, which means that all the interest which will become payable over the term of a loan is added at the beginning of the loan term.Also, please note that Loans 2 Go is fully regulated as well as authorised by the Financial Conduct Authority (FCA)

Sara (Debt Camel) says

Did your complaint say the loan was unaffordable?

Lukemc says

I initially said it was just way too much email but have followed up with a reply using the template that others have used, stating it was unaffordable and they’d know that if they did their job properly! Awaiting a reply, i have already paid about £600 + the initial loan amount so they have already made a good profit on me

Sara (Debt Camel) says

Suggest you reply that you await a response to your affordability complaint made on dd/mm.

kate says

loans2go have sent my debt to a debt collector, can i still complain/get my interest taken off. original loan was 700 but with interest debt collector is requesting I repay 3200 (bw legal services)

Sara (Debt Camel) says

yes, your complaint goes to L2G.

Have you repaid more than the 700 borrowed so far?

Have you made a payment arrangement with BW legal?

What is the rest of your finacial position like?

Lauren says

Not sure if anyone could help, but I had a final demand letter from loans2go, which I offered to clear my arrears and re-start the monthly contacted payments from next month which they agreed to. I paid £172 to clear the arrears of £171.42. They then took another £171.42 from my bank the same day which was not agreed. Is there anything I can do about this? All they said was to make a complaint which will obviously not go no where.

Sara (Debt Camel) says

Was this taken by direct debit?

Are these loan payments affordable? That means can you pay them and also be able to pay your other debts, bills and normal lining costs? If not, read the article above and make an affordability complaint as a very large number of these are being won and that would not just reduce/clear your balance but also clean up your credit record.

Lauren says

It wasnt a direct debit. In the emails, they asked how I’d like to get my account up to date either via their online portal or send it to them using their bank details. I said I’d use the portal to pay, so there was no where in the email that i said they could take it out of my bank.

I am in a position where I can afford to pay them back. I’m at the start of sorting my finances out to get back on track.

Sara (Debt Camel) says

are you aware you have ever given L2G a continuous payment authority over your debit card?

the online portant. did it say how much you were going to pay ? or did it just ask for your bank details?

re affordability – it doesn’t matter if the loan is affordable NOW what matters is your situation when you applied for the loan. Only the very desperate normally end up with a L2G loan…

Lauren says

I did have a CPA set up to begin with, but only for the amount of £57.14 per month, not £171.42. On the portal, i put in how much I was going to pay. So my total arrears were £171.42, I paid £172 to get it up to date and apparently I’m still in arrears of 0.58p. This is on my requested statement after my payment.

I’ll definitely have a look into the affordability side of things.

Sara (Debt Camel) says

did you cancel the CPA with your bank? If not, you should do this immediately. Tell L2G you will pay them in future by bank transfer.

You should put in an immediate complaint to L2G that they took 2 payments when you had only authorised one.

Luke says

Hi, I have had a ‘final response letter’ from loans to go which looks like it may have come from the financial ombudsman (that’s how it’s signed off). Even though I have never contacted the FO. They said because it was affordable to me at the time I have no grounds to complain, and they claim that the interest rate is legal, initial amount was £1399 and total including interest is £5520 – do I have any grounds for complaints about the interest? I have already paid £2070.

Sara (Debt Camel) says

It is best to stick with “not affordable” as your main complaint as it is massively easier to win. You can say the interest rate is too high, but although FOS sometimes mentions this I don’t remember seeing a case won purely on the interest rate basis.

Would you be happy if they wrote off your debt? L2G will often compromise by doing this if you say otherwise the complaint goes to FOS.

Emma says

Help

I have just been offered £250 on the below loans. Bascially they saying due to my salary i could afford the loans, at the time we had so many payday loans to pay off each one and then apply for antoher loan to pay of the next. i never declared the loans on by expenditure when applying for loans, i was worried we wouldnt be able to live through the month (bad i know) Glad to say we have finally paid them all off now . Is this offer acceptable.

Principle: £300.00

Duration: 18 Months

Total Payable: £1,234.26

Total Paid: £725.44

Outstanding balance: £00.00

Status: CompletedPrinciple: £426.88

Duration: 18 Months

Total Payable: £1,756.26

Total Paid: £1,561.12

Outstanding balance: £00.00

Status: Completed

Sara (Debt Camel) says

this is two loans? the first one for 300 and then one for 426? Did you repay them both early?

Emma says

Ok , Just checked the first one i did pay early as i borrowed the money off my mum to pay off , the second one i had one month left on the loan which was due to come out on the 25/6/21 , i asked for a settlement figure and they said that i had no more payments to make.

Your agreement 45294720 – Private and confidential

collections@loans2go.co.uk

Thu 24/06/2021 12:20

To: You

Dear Sir/Madam

Our reference: 45294720

Dear Mrs Seville,

Agreement: 45294720

Thank you for contacting us today.

I can confirm your loan is settled and closed.

Sara (Debt Camel) says

so you seem to have paid £425 interest on the first loan.

On the second loan you seem to have paid 836 in interest.

So an offer of £250 isn’t good.

At this point you can either go back to them and offer a compromise – “I am prepared to accept a refund of £600 in the interest of resolving this speedily. Itherwise I will send my complaint to the Ombmudsman where I expect I will be awareded a larger refund.”

or you can just send the case to the Ombudsman.

What would you be happy with?

Adam says

Hi Sara,

I have been in recent dialogue with Loans to go.

I’ve requested data for all loans taken out and it’s transpired that interest paid between 2016-2018 totals £2190.

I have admitted previously to L2G that I had a gambling issue,so I’m concerned this may impact how I am treated with regards compensation.

They have offered a £500 refund,is this acceptable or should I take to the ombudsman?

I do have some debts at the moment so the £500 would be very helpful,but it would be upsetting if I am accepting a low offer if I could realistically expect to receive the full £2190 back.

Also I wandered what the time frame is for cases to go to FOS and a result being given?

Many thanks

Sara (Debt Camel) says

How many loans did you have? Were these logbook loans secured on your car or unsecured loans?

How much interest did you pay on the loans in order, eg 650, 1050, 490.

Gambling helps a complaint because if a lender should have looked more closely at affordability for you then they would have seen the gambling and not lent.

What is acceptable us up to you. But L2G may be prepared to offer more, which us why it’s helpful to know what interest you paid on each loan.

Also at FOS there would be 8% per annum interest added, so that would be another 25% at least. So even if FOS didn’t uphold all the loans, they could add up to a lot more than £500.

Adam says

Hi Sara,

There were 7 Loans in total, between April 2016 and Jan 2018.

The total amount in interest paid was £2800.

Some loans were paid off early (within a month) where I would have either lent from somewhere else to pay or perhaps gambled and won.

But other loans ran for months.

I had one £800 loan for 6 months that I ended up paying £820 in interest on.

I’ve seen a few posts on here saying 50% of total interest paid is a fair offer,and to remove any negative marks from credit file.

So I’m wandering whether to pitch that?

Having waited so long for the money shop response,not sure I have the energy for a year long wait for FoS to deal with the case,if it would take that long.

Sara (Debt Camel) says

Did you have any negative marks on your credit record for missed payments for these L2G loans? If you did you definitely want the, removed. And if they were early in your 7 loans, you can argue you should have a full refund of all the interest you paid on the later loans. But if you only missed a payment on laon 6, this isn’t an argument you want to make.

It’s up to you if you think 50% is fair. You would probably get a lot more than that if you took the case to FOS but it takes time.

Adam says

Hi Sara,

I paid off all loans bar the final one,which defaulted and was sold to Prac legal.

Who I then settled with for around £500.

So the final loan has left a mark on credit file.

So I was worried I wouldn’t qualify for all interest back as I paid 6 of the 7 loans off and significantly earlier than the full term of the loan.

I thought they would say for that reason they are affordable.

I have asked for a final settlement of 50% of interest paid and removal of any negative marks on credit file.

Do you feel that would be settling too low then?

I’m assuming £500 is very low,they are still refusing to admit it was unaffordable lending,they are citing this as a goodwill gesture.

Sara (Debt Camel) says

I thought they would say for that reason they are affordable.

No, they can’t argue that, not with 7 loans.

The total amount in interest paid was £2800.

did this include the payment you made to PRAC?

and removal of any negative marks on credit file.

you need to check they will ensure that PRAC also delete the default from the credit record they issued.

It is very personal choice how much you value money and closure now against the chance of more money later.

Adam says

Hi sara,

So apparently Prac have the default settled on file,but can I request that is completely removed and the default taken off my file then?

Yeah total interest is £2800 inclusive of payment to Prac legal of around £500.

I think I will accept half of that for closure as I find the whole process and back and forth of emails quite stressful.

Do you have any guidance on how long cases take to be reviewed from FOS?

Would it likely be at least 6 months?

Thanks

Sara (Debt Camel) says

you should definitely say you want L2G and PRAC defaults deleted.

FOS cases it is very hard to tell, sorry. You couldn’t be sure it would be under 6 months.

adam says

Hi Sara,

Thank you, i have requested 50% of interest paid and deafult removed.

I will be happy with that as an outcome if it is accepted.

I also thought i would mention i secured £860 back from H&T through use of the template letters on your site, so thank you so much for this service you provide and the ongoing support

Having that framework to work from and the answers to respond back has been invaluable, you are providing a fantastic service!!

Jess says

Hello. I made a loans2go complaint on 14th July. They have got back to me today rejecting the complaint but offering me25% reduction on the interest of the loan. The loan was £250 I’ve paid £342.84. I don’t really know what to respond this, any advice? I don’t want that offer but don’t no if it’s worth taking to FOS. They said my monthly outgoings were 950 from equites so they added 10% and my income was 1330. So it was affordable. I did have various payday loans at times which I sent them screenshots of.

Sara (Debt Camel) says

so what is your balance and what are they proposing to reduce it to?

Jess says

It says on the calculation.

Amount of credit – 250

Total amount payable – 1028.52

Total amount paid – 342.84

Current balance – 685.68

Proposed new balance – 491.05

Sara (Debt Camel) says

So you have already repaid more than you borrowed. If you win a complaint at FOS, you would get a cash refund of about £92 and the loan cleared.

They have said the loan was affordable – that doesn’t mean they are right! They are losing a LOT of FOS cases.

One thing you could do is go back and say their offer isn’t acceptable but you are happy to compromise. If they reduce your balance to £158 then you will repay the same amount of interest you would have paid on a payday loan – say you think that’s fair and if they agree you won’t go to FOS.

Helen says

Hello – just got an email from Loans 2 Go after I used your letter template and they are offering to effectively write of the balance of my account which is currently £285.70. I have paid back £724.82 already (on a £250 loan)

Is this a good offer? I have 7 days from yesterday (30/7) to respond.

Sara (Debt Camel) says

It’s up to you if you thank that is fair.

If you win the case at the Ombudsman the balance would be written off and you would get a refund of c 475.

you could go back and say you are happy to compromise to get a quick settlement if they will clear the balance and pay you £225 – that will mean you have paid the same amount of interest that you would have done on a payday loan.

Helen says

Thank you very much, Sarah. This website is brilliant.

I think I will give that a go and see what they say.

Do I need to use a formal template to respond to them with, or can I just use wording in your response?

Sara (Debt Camel) says

Just put it into your own language.

Maggie says

Hi Sara

I took out a loan with loans2go a year ago for £2000 and only after the loan was issued they told me my repayments altogether would be over £7500!! It was initially for 18months and in an email it was changed to 24 months. I already took out the loan as I was in desperate need but this is becoming ridiculous and so far I have paid over £5500 and my settlement figure is still £1800. This is beyond affordable and I feel so scammed and conned out of money. I had a poor credit and I don’t think they should have even provided me with this loan! Please can you let me know what I can do and whether it’s worth reporting to the FOS?

Many thanks

Sara (Debt Camel) says

I think you should make an affordability complaint and also complain that the loan was not properly explained to you before you took it out. There is a template in the article above – change that so it covers what happened to you.

If they make you a poor offer, come back and ask here before accepting it? Sometimes they can be persuaded to increase offers.

If the rest of your financial situation is bad, I suggest you also talk to National Debtline on 0808 808 4000. This is in addition to complaing to Loans2Go

Maggie says

Thanks for your help Sarah. Loans 2 go have agreed to wipe out the remaining balance of my debt. I have agreed to this as it’s causing me a lot of stress and to be honest it is a good outcome for me.

I understand that I could have taken this further and tried to get some compensation but I’d rather just leave this behind me now and not have anymore to do with this company again. Thank you for your help as I wouldn’t have been able to wipe out my debt if it wasn’t for this site! Thanks again!

Sara (Debt Camel) says

A good result is one that works for you! Well done.

Richard says

Hi Sara,

I have contacted loans2go with the template above, I have had 3 loans £500,£500,£1000, first loan was 2018 and the last 2020.

Over the course of these loans I have paid them back £4989.

Loans2go have replied and said they are not upholding my complaint but will reduce the interest on my loan by 35%.

This leaves me with current balance of £3086 reduction of £1383 so they say my balance is £1703 left to pay them.

I feel this is a really bad offer as I have already paid almost £5k to them.

How do I proceed from here.

Regards

Richard

Sara (Debt Camel) says

can you say what you repaid to loans 1 and 2 individually? And how much you have paid so far to the current loan?

what were the “gaps” between these loans – the time from repaying loan 1 to taking loan 2? from repaying loan 2 to taking loan 3?

Richard says

Loan 1 was taken on 01/12/18 for £500 amount to repay was £2039.04 I paid a total of £1358 and then got a £500 top up to this loan and it says interest waiver of £485.

Loan 2 was taken 11/12/19 for £500 top up to repay £2854.44 I paid a total of £1427.

Interest waiver £339.02

Loan 3 was taken on the 8/9/20 and was £1000 top up to repay £5291.76 I have so far paid a total of £2204.

Many thanks

Richard

Sara (Debt Camel) says

ok so the loans were continues and the second two were refinancing, so the loans were getting bigger.

In this situation I would be astonished if the third loan was not upheld by the Ombudsman – you have aklready repaid more to L2G for the third loan than you borrowed so the balance would be wiped – that suggests that is the minimum you should settle for.

It is likely the second loan would be upheld too. Possibly even the first. In whuch case you would be refunded 3k in cash and the balance wiped

If you want all three fully refunded you will have to send the complaint to FOS.

But L2G are sometimes open to negotiation. So you could go back to them and say their offer is not acceptable as youthe Ombudsman would be likely to uphold 2 or even all 3 of your loans. However in the interest of speedy resolution you would be prepared to accept a settlement where your balance is cleared and you are refunded £x in cash.

It’s up to you what you think x should be – less than the 3k you might get from FOS. Say £1000?

Not going to FOS will save L2G a £650 FOS fee, they have to pay that even if they win the complaint. But they already know that so there is no need to point it out to them. But it is another reason why they should accept a reasonable compromise.

Richard says

Thank you for the advice, I will reply to them now and update you with how I get on.

Kind regards

Richard

Richard says

Hi Sara,

L2g have got back to me and have said that they have reviewed my complaint again and are unable to agree with my assertion that the loans were irresponsible lent and they won’t except the offer I have made.

They have now offed to reduce the interest on the loan to 50% which still means that I would owe them £1,110.49.

I really don’t know what to do next as I a nervous about filling out lots of forms for fos and it dragging on for a long time.

I really want this wretched company off my back as I am getting calls daily saying I have defaulted on the last payment because they did not take the payment when they were supposed to due to me dealing with the complaints department.

Any further advice you can give would be wonderful.

Many thanks

Richard

Sara (Debt Camel) says

Well they aren’t really offering much, are they? you won’t be getting rid of them, you will still have to pay them more than a thousand pounds. Sorry but FOS looks the obvious step. You could simply reply that that in that case you are going to FOS and see if they get back to you very quickly with another inmprovement?

You are VERY likely to have that last loan upheld at FOS so it would be wiped and you would get a bit of cash back. getting that loan cleared looks to me to the minimum accaptable offer and even that isn’t good.

There aren’t a lot of forms to fill in at FOS, nothing to be nervous about. There is a simple online complaint form (https://help.financial-ombudsman.org.uk/help) that asks you for all the details FOS needs – these aren’t difficult questions but there are things like what your date of birth is and is this a joint loan – easy for you to answer and it helps FOS set up the query correctly in their system.

if the re[payments are currently unaffordable you can also tell L2G you can onbly afford 3x a month and remove their direct debit or continuous payment authority with your bank so they can’t take more.

Richard says

Hi Sara,

thank you so much for the advice, I never seem to get any luck with these kind of situations.

I am going to reply to them asking for the remainder of what I owe to be cleared and hopefully can leave it at that and be rid of them.

If they don’t take this offer I will go to the fos.

Would it be better to continue to pay them in the mean time at hopefully a reduced rate?

And do you know how long it normally will take going to the fos?

many thanks again.

Richard

Sara (Debt Camel) says

FOS cases seem to be going through a bit faster recently but it’s hard to say.

Louise says

I took out a loan for £300 in 2020.

During that time I was in a spiral of payday loans and was not paying them back.

I did not pay any of this loan back and have recently cleared all my debt with this one outstanding. I contacted them to offer to pay the £300 explaining how much stress I was under at the time etc.

They came back to me and said due to the status of my account I would have to pay the full outstanding balance of £1234.

I really thought they would have been willing to meet me even half way.

I have now sent them an affordability claim as I feel it was VERY clear from my credit report at the time that I could not afford that loan.

Should I have done this first? And will this affect my claim?

I am willing to pay back what I borrowed but just hope they are a little more lenient with this claim than they were with a settlement offer :/

Can you tell me how quick they usually are with a reply?

Thank you

Sara (Debt Camel) says

Should I have done this first? And will this affect my claim?

No, you have now made a complaint and they have to consider it. Have you also sent them your bank statements for the three months before your loan application?

louise says

I haven’t but will get them and forward them on.

They haven’t emailed an acknowledgment yet so will get that done asap.

Fingers crossed. They seem to be the only company that have been a nightmare, most are happy to accept i am keen to get the account closed.

Sara (Debt Camel) says

I would be surprised if they accept an offer of 300 – you could try offering to repay 600, on the grounds that is the interest that would have been added if you had taken a payday loan.

Tom Saunders says

Good Afternoon,

Loans to go have come back to me with regarding my complaint of the original loan totalling 2k for a 500 loan and at the end of there never ending letter agreed to accept just the original loan amount .

I think they want me to have a answer in 7 days .

The only problem I have is I don’t have that full amount and I guess they would want it in one payment, any suggestions would be appreciated.

Sara (Debt Camel) says

go back and say you will be able to pay it at a rate of £x per month, which is all that is affordable for you. Chack this will not be recorded on your credit record as a payment arrangement.

Tom Saunders says

Ok Thank-You Sara,

What would payment arrangement mean?

Sara (Debt Camel) says

a payment arrangement is an arrangement with a creditor to pay less than the contractual amount. This harms your credit score. But as L2G have agreed the loan in unaffordable all negative marks should be removed and no new ones should be added.

Tom Saunders says

Thanks Sara,

I emailed them this morning to confirm if they would remove all negative information of my credit files and not to add any more and also to see if they would agree to a affordable repayment plan, Just waiting on a reply and if this is the agreed then I will be tackling my worse debt and chipping at the smaller ones and a few negative Mark’s to drop of I’m on my way hopefully to improving my credit..

Daniel says

Hello Loans2go have responded with this after using your template is the offer any good?

Agreement date: 27/11/2019

Principle:£250

Duration:18 months

Total Payable:£1028.82

Total Paid:£543.84

Outstanding balance:£0

Status:Completed

Agreement date: 20/062020

Principle:£398.14

Duration:18 months

Total Payable:£1638.00

Total Paid:£865.93

Outstanding balance:£0

Status:Completed

Agreement date: 12/01/2021

Principle:£506.93

Duration:18 months

Total Payable:£2085.72

Total Paid:£802.20

Outstanding balance:£1283.52

Status:Active

Offer: write off 50% of the Interest Current balance outstanding: £1,283.52 Gesture of goodwill write off: £789.39 Balance after accepting the offer: £494.13

Sara (Debt Camel) says

So on those figures you paid £93 in interest on the first loan. ££468 interest on the second loan and have repaid the the amount borrowed on the last loan and an extra £295 in interest so far … and if you now pay another £494 as they are suggesting, that would be £aboout £790 in interest on the last loan.

It’s up to you if you think that sounds fair…

But at the Ombudsman you would be VERY likey to get the last loan upheld, which would wipe the balance and have you refunded ££295. And you may also get the second loan upheld as well. That doesn’t sound good to me!

L2G will often agree to a compromise. So what should you suggest? You could suggest that you would accept just the last loan being refunded, even though FOS may uphold the second loan too. I think as a minimum you should ask for the balance to be cleared.

Daniel says

I’ll email back and ask for the last loan to be refunded and see where that gets me thanks

Sara (Debt Camel) says

Remember the lender gets charged a fee if you send a case to FOS – so they want to reach an acceptable solution too.

BillyBobby says

I filed an affordability complaint with L2G and they came back with a low offer which I accepted at the time as I needed the money.

Could I make a new complaint about the excessive interest and still have a chance with FOS ? Thanks

Sara (Debt Camel) says

no, sorry you should not have accepted that low offer.

BillyBobby says

but the complaint would be about interest rate not, affordability? Given precedent outcome from FOS don’t I have a chance at all?

Sara (Debt Camel) says

I really don’t think so – it would be seen as trying to make a very similar complaint again because you regretted accepting the first offer. Also I don’t remember seeing one of these interest rate complaints succeeding unless there is also some affordability component or the elnder was aware that you werein finaical difficulty.

Chris McDonald says

Hi,

Just wanted to query and see how long it has taken other people to get the final response back from L2G?

I put my complaint in 2 weeks ago and it was acknowledged about 10 days ago, I’m not expecting to have a response back for a little while yet, but just wanted to see what the average wait time for everyone on here has been.

P.S. Thank you Sara for all the information on this page, as well as your others, I will be following through with your advice on all the previous lenders that I have used.

kelly says

Hi Chris

I put in my complaint to l2g on 16th august, had a reply today saying they do not uphold my complaint but as gesture of goodwill offer 50% reduction on interest. I have responded that I don’t not find their offer acceptable

Danny says

Hi Sara I have had 3 or 4 loans with this company for over 1000 each time whilst also juggling other loans sometimes paying upwards of 900 a month due to having a severe gambling addiction (that I did not declare for fear of being rejected) I copied your template exactly and sent it to them and have yet to see a reply from 2 days ago.. do I have a leg to stand on or should I just accept what they offer? I currently have a loan I’ve paid 236 to 4 times and the loan i took out was 1000 with total amount payable over 3600.. I’m hoping they either drop the interest or return some from previous loans to help pay it off.. do you think they’ll offer me a payment?

Sara (Debt Camel) says

If you complained only a few days ago it will be a while before you hear back. 4 £1000 loans sounds like a lot to me. L2G often make a poor offer but can be persuaded to improve it – so come back here and check before accepting it?

Daniel Mcdonald says

Hi the loans werent all at the same time but I merely paid off one from money I’d lent from my mum or won gambling and once i started losing again I’d take another after being refused at multiple other loan companies and knew they wouldn’t reject me.. is it bad to know their efforts to search are so poor that I can guarantee they would pay out! I currently have a loan running my complaint wont cause them to raise my interest would it? Thanks for the reply

Sara (Debt Camel) says

no they can’t increase your interest!

Kate says

Hi I have just had my loans 2 go agree the ombudsman decision, I had 2 loans with them 300 pound and 250 pound, I took out 300 in 2018 and paid then In full of 1223 by 2020, madness

I then took another and I hVe outstanding balance of 200 to pay but in full 1026 was paid, fos Hve said to refund interest and charges etc and 8% but I’m clueless to what thus us,any advice?

Sorry to bother you appreciate it x

Sara (Debt Camel) says

Well done on winning the decision!

For the first loan you borrowed 300 and repaid 1223- that is £923 in interest to be refunded.

For the second one, if you have paid £1026 and you borrowed 250, then you have already paid £776 in interest. This will be refunded and the balance cleared.

So you will get back 923+776=£1699. The 8% is complicated to work out but it won’t be a lot as the loans are so recent – perhaps £120.

edna says

Hi Sarah

I used ur template to make a complain here us what they are offering me

Credit: £2,350.00

Total Amount Payable: £11,656.00

Total Amount Paid: £2,230.40

Current Balance: £9,743.60

Proposed Write Off Amount: £3,722.40 (40 % of Total Interest) Proposed New Balance: £6,021.20

We are offering the 40 % reduction of the interest on your loan, in full

I have replied them stating the loan remains an affordable and no credit check was carried out as i had a ccj the loan was borrowed.

Sara (Debt Camel) says

I am assuming this is your first loan from them.

Obviously that isn’t a good offer!

They will sometimes negotiate…

if you want the full amount you could get from FOS, that would be to remove the interest so you have about £120 to repay. In that case there is no point in negotiating and you should send your complaint to FOS ASAP.

But if you want to try to get a better deal, you could say what you thing would be an acceptable solution. it depends on you what you think that is. Would you be happy if your balance was reduced to £4000, £3000, £2000? £3000 would mean you pay more interest that you would on a payday loan.

If you need your balance reduced AND for them to accept lower monthly payments that are affordable, then say how much you can afford to repay.

Eg something like “That isn’t an acceptable offer as you should have realised the loan was unaffordable and not given it to me. In the interest of a speedy settlement I am prepared to accept a reduction of my balance to £X and an agreement that I can repay this at £Y a month with no negative marks being added to my credit record. If you do not agree I will be sending my complaint to the Ombudsman.”

Is this a logbook loan secured on your car? If it is, you have to keep paying while a FOS complaint goes through.

If it is a normal unsecured loan, if the repayments are unaffordable then it would be good if you can pay off the rest of the amount you borrowed – about £120. Then you could decide to stop paying while the rest of your complaint goes to FOS – that can take many months to go through so you need to get into a safe financial place. Stopping paying will affect your credit record but if you will the FOS complaint all negative marks will be removed.

edna says

Hi Sarah

It was a log book car , they took my car as i could nolonger afford to pay , when they gave me the loan i had a ccj.

Sara (Debt Camel) says

When did you take this loan?

When did they repossess the car? How much was it worth? how much have they sold it for?

what are the rest of your finances like – what other debts do you owe?

edna says

Agreement date: 19/03/2015

Agreement date: 12/12/2015

Principle: Duration: Total Payable: Total Paid: Status:

£1,800.00 36 months £8,280.00 £3,480.00 Completed

Loan two: T

Principle: Duration: Total Payable: Total Paid: Status:

£2,350.00

36 months £11,656.00 £2,230.40 Pre-

customers fairly, we are offering to reduce the interest on your active Loan Agreement by 40 %.

Amount of Credit: £2,350.00

Total Amount Payable: £11,656.00

Total Amount Paid: £2,230.40

Current Balance: £9,743.60

Proposed Write Off Amount: £3,722.40 (40 % of Total Interest) Proposed New Balance: £6,021.20

We are offering the 40 % reduction of the interest on your loan,

They sold my car for £1.600. On 07/07/2016 15:29 14/

My car was worth £3000 at the time

Sara (Debt Camel) says

😢

And the rest of your finances? Is this your only debt at the monent?

Edna says

This is the only big one at the momemt some of them are managable , not these crazy intresrs when i took it out my mum was unwell later on died.

Sara (Debt Camel) says

Then your options are:

1) to send this complaint to the Financial Ombudsman complaining that they never checked the loan was affordable and they sold you car for a lot less than its value

2) to first talk to a good debt adviser such as National Debtline on 0808 808 4000 about your whole situation and see if you have any better options that will cover all of your debts, such as a debt management plan (then you could also send this complaint to FOS) or a Debt Releief order (which would wipe out all your debts and mean you didn’t need to send this one to FOS).

Edna says

Thanks Sarah i will let you know of the outcome. I refused the 40 % offer i have emailed them still waiting for their response

Should i go ahead and send the complaint to FOS?

Sara (Debt Camel) says

did you propose a compromise to them or just reject the offer?

edna says

Hi Sarah

I proposed to pay off the balance of £120 and i am still waiting to hear from them

Sara (Debt Camel) says