Loans2Go offers what I have called the worst loans in Britain.

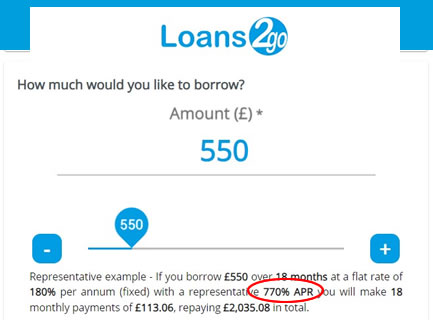

Since 2021 they have been charging 770% APR. See the representative example Loans2Go quotes on its website:

- £550 borrowed for 18 months is a monthly payment of £113

- this adds up to £2035, a bit less than four times what was borrowed.

Contents

MUCH cheaper to get a payday loan than a Loans2Go loan

Of course Loans2Go don’t point this out on their website, but check out these numbers!

With a payday loan for £550, the maximum interest that could legally be charged is £550 – the amount borrowed. So you would only have to repay £1,100 – the £550 borrowed plus the £550 interest. And the monthly repayments for a payday loan for 12 months can’t be more than £92.

So you would pay a payday lender £92 for 12 months

but Loans2Go is charging MORE PER MONTH (£113) for MUCH LONGER (18 months).

Loans2Go also used to offer logbook loans, but this article is just about their standard personal loans. If you had a logbook loan from them, use the template on this other page.

Is this legal?

The Financial Conduct Authority (FCA) calls payday loans “High Cost Short Term Credit”. Its definition of High Cost Short Term Credit is a loan over 100% in APR and of 12 months or less.

So the Loans2go loan is outside that definition because it is 18 months long. So it isn’t caught by the price cap rule.

Unfortunately, this means its loans have crept through a loophole and are legal. I think the FCA should close this loophole.

Many people are winning affordability complaints about Loans2Go loans

I think this is the worst loan in Britain.

A loan is unaffordable for you if the monthly repayments were so high you couldn’t afford to pay them without hardship, borrowing more or getting behind with important bills. This is a standard affordability complaint, used for many other sorts of loans. If you win this you will get a refund of all the interest.

Because Loans2Go loans are so expensive they are often unaffordable. Many people are winning Financial Ombudsman (FOS) complaints about these loans – here is just one example: Miss R’s personal loan provided by Loans 2 Go.

No-one who isn’t desperate would take one of these loans out, and the ombudsman says Loans2Go should make more detailed checks on affordability when it thinks the borrower may be in difficulty.

Several people have said they were not given the full details about the loan before the money was given to them. If this happened to you, say this in your complaint as well.

First complain to Loans2Go

It doesn’t matter if you have repaid the loan or you are still paying, you can still complain.

You have to complain to Loans2Go first, you can’t go directly to the Ombudsman.

Email customerservices@loans2go.co.uk and copy it to ps@loans2go.co.uk. Put AFFORDABILITY COMPLAINT as the title.

Use this template as a basis and make any changes so it reflects your case:

I am also complaining that the interest rate was grossly excessive. It is unfair to charge someone more per month over 18 months than they would have paid to a payday lender for a loan the same size over 12 months.

[only add this next sentence if the date of your loan was after the end of July 2023] This loan does not represent fair value and it is in breach of the FCA’s Consumer Duty.

[only add this if you were not told the loan terms] The loan was not adequately described to me before I was given the money. This is an unfair way to give high cost credit.

I am asking you to refund the interest and any charges I paid, plus statutory interest, and to delete any negative information from my credit record.

[delete if you have repaid the loan] I would also like an affordable repayment plan to be put in place if I still owe a balance after this refund.

I am also making a Subject Access Request (SAR) for all the personal information you hold about me including, but not limited to, my applications, all credit and other affordability checks, a statement of account for my borrowing, and a record of all phone calls.

Let me know in the comments below if you are making a complaint about a loan that started after the end of July 2023, as there are some new regulations about those.

Is an offer from L2G a good one?

If L2G has offered to wipe a small balance or take some money off what you owe, you have to decide whether this is a good enough offer to accept.

For example, they may offer 50% of the interest off “as a goodwill gesture”. Or to reduce your balance by 50%. These are often very poor offers, you could get a lot more by going to the Ombudsman.

Sometimes Loans2Go will increase an offer if you push them. Here is what one reader said:

They replied firstly with the offer to half what was left and agree a payment plan and I refused and they immediately came back and wiped the loan clean and removed it from my credit file.

It’s up to you what you think a good offer is. But you can’t change your mind later if you accept and then think you shouldn’t have.

So ask a question in the comments below if you aren’t sure.

Take a rejection or a poor offer to the Ombudsman

You can send your complaint to FOS if Loans2Go has rejected it or has made you a poor offer. This is easy, just use this simple FOS form which asks you what they need to know to set up your case.

Send your bank statements to the Ombudsman – 3 months before and 3 months after the date of the loan. These are the best evidence that the loan was unaffordable for you.

James says

Hi All

Thanks for all the comments above.

To explain my situation which is very similar, I took out a 1k loan from L2G on 25/07/2019 and now have to pay back £4,114 at £228.56 per month for 18 months! At the time i had 7 other payday loans as was struggling and cant afford to pay. Since then i have managed to pay £1414.36 after numerous calls explaining and making some payments every other month to try and clear. My last two payments I made were Aug and Sep 2020 for the full £228 and since then I haven’t been able to make payments and they haven’t contacted me at all or tried taking more payments which is strange so hopefully not going down the CCJ route now.

What is the best route to go down to get the remaining payments reduced or cleared as i have also just been made redundant at work?

I see there is a complaints template above in this thread so would it be best to start with that?

Thanks in advance

Sara (Debt Camel) says

Yes I suggest you send them a complaint using that template.

You could add to it that you have currently lost your job and are unable to make any payments at all towards the balance. Ask them not to add interest or charges. If they do and you win your complaint, they will all be removed anyway, but it’s best to explain your situation.

They should not go to court while you have a complaint in progress, with them or with the Financial Ombudsman. But look out for getting a Letter before Action/Claim, see https://debtcamel.co.uk/letter-before-claim-ccj/ as that is the precursor to going to court.

PS have you cancelled the direct debit to them, or the Continuous Payment Authority with your bank?

James says

Hi

Thanks for coming back to me so quickly, much appreciated.

Ok great i have just sent a complaint off to them with the above template and also added in the redundancy paragraph on why I havent been able to make payments since last payment in Sept 20. I haven’t received a Letter before Claim yet but will keep an eye out specifically for that and no I haven’t cancelled the CPA with the bank so will do that today also while complaint is being reviewed.

Is it best to wait for their response first and/or is it best to contact the FOS also?

Thanks for your help!

Sara (Debt Camel) says

You can’t go to FOS until either you have a rejection from L2G or it has been 8 weeks. Good luck!

N says

Can anyone help. I complained October 19 to l2g. Sent to fos a year ago. Adjudicator contacted me beginning of october to say hes the one looking at my case etc. Its been 13 weeks now and i still haven’t heard anything from adjudicator. Am still paying them £20 a month though in December for some reason they took the normal payment amount from my bank account without my permission as i told them i would pay manually. This company is by far the worst 😪. I have emailed adjudicator in December when they took the payment from me and theres just no reply. Its starting to get me down now

Sara (Debt Camel) says

have you cancelled the CPA to them with your bank?

have you repaid more than the amount you borrowed?

N says

When i asked for a payment plan they said they cancelled cpa. I have repayed almost 3 x amount borrwed.

Sara (Debt Camel) says

you need to tell your bank to cancel the CPA – never trust a bad credit lender!

If paying the £20 is hard, then the simple answer is to stop paying them anything. You will get more hassle but they shouldn’t go to court when you have a case at FOS – and if they do, FOS will prioritise your case.

N says

Ok i will contact bank today. Do you know how long adjudicator level takes? It seems to be taking a really long time is it due to the current situation with covid do you think?

Sara (Debt Camel) says

This seems a bit random. Covid has generally slowed things down, not necessarily at FOS itself, but a lot more lenders are being very slow in providing FOS with case files and answering adjudicator questions, so many cases take longer.

After 13 weeks I think you should ask the adjudicator if there is any more information you can provide, and if they say No, ask them what the hold up is.

Brett Dance says

Hi Sara,

I raised a affordability complaint with L2G – they have come back to me today saying that they do not uphold my complaint but are will to write off my interest up to 60%

Borrowed £407.65

paid back so far £372

Outstanding Balance £1490.72

willing to reduce by £761.65

Leaving £729 to pay

They say that this is their final response and i need to go to the FOS if i want to take it further – would it be best to accept the 60% reduction in interest or carry on with the complaint to the FOS ?

Thank you for your time

Brett

Sara (Debt Camel) says

If FOS looked at this case now and upheld it (which happens with a LOT of L2G cases!) then the balance would be reduced to about £35.

You could go back and offer a compromise that you will accept it if they reduce the balance to say £350? I don’t know if they will agree.

Brett Dance says

Thanks for the reply Sara, I have gone back with the counter offer and lets hope they agree. At least FOS would be able to see i have attempted to settle without the need of involving them first.

I’ll let you know what they say

Just in the meantime as they are wanting £94 a month and keep trying to take this and as its not direct debit – how do i stop them from taking this ?

Sara (Debt Camel) says

Tell your bank to cancel the CPA (Continuous Payment Authority) to them.

Brett Dance says

Hi Sara, so I sent them a reply rejecting the offer to reduce the interest by 60% and request a DSAR and also put my points across why i could not afford the loan etc. I put an offer on the table of bringing my balance down to £200 which they have accepted.

Yes if i had gone all the way to FOS it might be a case that it was written off but I had £1400 left to pay – so 4 x £50 a month to get this close is fantastic.

Thank you so much for creating all of this and how quickly you reply to everyone. I appreciate it

MAJ says

Hi, Using the template I have received a lovely email offering to reduce the amount owed as follows, I have omitted all the non essential details, should I accept do you think ? Dear, you wished to raise a complaint against Loans 2 Go Limited.

I understand you believe the FSLA should have never been granted, as should sufficient checks have been carried out, it would have been clear that you could not afford the loan You are also not happy about the interest applied.

Mentions not receiving bank details (after a 2 day period!!) I am unable to substantiate your claim that you

were not aware of the terms of the agreement. I have investigated your complaint and note it primarily has to do with your loan application and our decision to grant you the loan. Lonas2Go (!!??)makes use of information from (ONS) [as a responsible lender] Applicants that cannot meet should not succeed in securing a loan..as part of my investigation, I have investigated whether L2G carried out the checks detailed above.

However, I appreciate that your circumstances may have changed since taking out the borrowing, as a gesture of goodwill it has been agreed to write off 60% of the interest. Current balance outstanding: £2,382.72 Gesture of goodwill write off: £1,868.45 New amended balance to pay: £514.27

It is kindly requested of you to confirm by email within 7 days of the date of this letter

Yours sincerely,

Customer Satisfaction Manager

Sara (Debt Camel) says

how much did you borrow? how much have you paid them so far?

MAJ says

Hi Sarah

I borrowed £1000 in a fit of panic over another debt that I couldn’t pay off, thought this was the answer to my prayers, I paid off just over £1700 and pointed out that this amount was more than fair in the time I scrimped and borrowed to pay it off after realising the extortionate amount they charged but absolutely skinned myself doing it, I’ll be honest that I misread the payments section and thought there were that paying fortnightly would reduce the interest etc.. by making 18 payments (Months) when in fact it was 36 payments (Months) that’s when the scale of the loan hit me and the wording they had used had thrown me too.

Regarding affordability I cannot even get a £5 overdraft and my credit file although poor is getting better just through sheer persistence … these types of naughty front loaded loans don’t help.

Sara (Debt Camel) says

then I suggest you reply that you have already paid them more than you borrowed, if you take the case to the Ombudsman you will be likely to get all the interest refunded but in the interest of a speedy resolution you will be happy to settle if they agree to clear the remaining balance in full.

MAJ says

Many Thanks, I will post the outcome here, appreciate your time.

MAJ says

Wow, thanks for all your help, I sent off the following: Thankyou for your swift response and offer of a reduced payment.

I have sought further advice, it has been recommended that I do not accept the offer from Loans2Go as: “you have already paid them more than you borrowed, if you take the case to the Ombudsman you will be likely to get all the interest refunded”

In the interest of a speedy resolution I will be happy to settle if you agree to clear the remaining balance in full and look forward to your response.

I received this response today: I am sorry to learn that you are not happy with the outcome to your complaint which we believed to be fair and reasonable. In order to bring your complaint to a satisfactory closure it has been agreed to write off the outstanding balance and close your account as full and final settlement of the complaint, meaning that you would not be liable to make any further payments to Loans2Go. It is kindly requested of you to confirm by email within 7 days whether you are now satisfied with the resolution provided so that the necessary amendments can be made to your account.

Another victory thanks to your brilliant advice

Sara (Debt Camel) says

excellent!

Thomas says

Hi

I didn’t pay this months repayment as I’ve already paid well in excess of £1000 in interest and waiting for the ombudsman.

They have now said my arrears balance has increased.

Is this correct?

Thanks

Sara (Debt Camel) says

Every month you don’t pay, your arrears increase. This is nothing to worry about if you win Your complaint and have already paid more than you borrowed as all the interest and charges are removed.

Mr Daniel says

Hi Sara

I took out a 500 loan December 19 and was paying it fine up until I had to change jobs due to covid and now earn alot less. They have already defaulted my account and I haven’t paid them since September. I can’t have any more bad credit as my score is really low. I’ve paid back around 800 now (more than I borrowed) I’m not sure what to do as I cant afford 100 a month anymore and I’m sick that I even took it out in the first place. Same story online enquiry ( for a smaller loan) and before I knew the money was there. I cant have ccj or have another default.

Sara (Debt Camel) says

I suggest you send them a complaint using the template in the article above. And add a sentence saying you never applied for that much money and they never told you the total cost for you to agree, they just sent you the money which you think is unfair when they know they are dealing with people who may be desperate.

If the £100 is unaffordable, tell your bank to cancel the CPA (Continuous Payment Authority – it’s like a direct debit except you can’t cancel it yourself from your banking app you have to tell the bank to do it).

As there is already a default, stopping paying them will not harm your credit rating.

They may threaten court but they shouldn’t do this when you have a complaint open with them or with the Financial Ombudsman. And if you win the complaint the deaf should be removed as well as interest removed which should more than clear your balance so you should get a refund.

Martin says

Hi, I took out at a loan with Loans2go for £750 for 18months with £2250 the final amount to be paid. Not long after taking out the loan in Aug 2019 along with other debts it became unmanageable and after looking at the loans and this one in particular I felt that it was way to high of interest to be paying. I made a complaint to Loans2go but never got a response to my email so after around 7months I decided to make a complaint to the Financial Ombudsman (while paying Loans2go through Stepchange. After a couple of months of back and forth they presented a letter from Loans2go stating there final response however this had been sent in the post and I had moved house in the meantime so never received the letter. The Financial Ombudsman has come back and stated as my complaint to them is 6 months after the final response from Loans2go, that they can’t take my case any further. Is there anything I can do with this as Loans2go keep emailing and calling about payments (made £900 in payments so far) as I have now stopped them as I don’t agree with the extortionate interest rates. Thanks

Sara (Debt Camel) says

No. It is a great shame you did not follow this up sooner.

Gary says

Hi can I have some help please, I borrowed £1000 from loans2go on 8th October 2020, in total I would have to pay back £4400 odd, iv made about 3 payments of £228 and 1 payment of £250 so far as there was one month I couldn’t afford, my first payment I made was on 28th October 2020, I got other smaller debts that I’m trying to pay off but this loans2go is ridiculous I phoned up my bank to stop payments being made to them, I phoned loans2go and told them I can’t afford it but they still want me to pay, they sent me a letter the other day and says that I still owe about £3400, iv paid pretty much nearly £1000 what I borrowed so far in like 4 months, I didn’t expect to get the loan when I applied for it as I got bad credit and I already have 2 defaults on my credit report that I’m trying to fix, and I didn’t expect to pay this loan over 18 months I thought it was something like 3 years, I just want this gone now. (Any help will be very much appreciated)

Thomas says

Hi

Just thought I would update on my case with Loans 2 Go.

After chasing the ombudsman for numerous months they have finally made a decision that the loan was unaffordable and loans 2 go should refund me all interest paid.

They have given Loans 2 Go until 16th Feb to respond so lets hope they accept this decision and I can move on!

Stick in anyone waiting to hear back and I would say it’s worth while chasing up.

Thomas says

Update – Loans 2 Go don’t agree with the decision so goes to an ombudsman to make the final decision.

Has anyone got any ideas how many more months this drags on for?

Thanks

Sara (Debt Camel) says

it’s very unpredictable

Jordan says

How long has it taken from start to a decision from FOS being reached? Did you have to chase FOS? I’ve raised a complaint just wondering how long I can expect to wait, cheers

Thomas says

It was around 6 months from the complaint to getting an adjudicator to make a decision to which Loans 2 Go rejected.

Luckily I have only waited another 5 weeks or so for the ombudsman to make a final decision

Hopefully they will refund me soon

Thomas says

The ombudsman have said it will be many many months as they have a lot of high cost credit cases.

I can afford to pay them maybe £100pm while this is ongoing.

Do you think I should or just totally ignore them?

Sara (Debt Camel) says

Have you repaid them more than you borrowed so far? Do you have other problem debts?

Stu says

Hi Thomas. I had to wait about 13 months for an Ombudsman to look at my case. Just got a decision by email last wk upholding my complaint. Hopefully u aren’t waiting as long.

Thomas says

Thanks stu. Was that 13 months after the adjudicator or start to finish?

Loans 2 Go will probably be bust by then anyway.

Did you keep paying them?

Stu says

About 26 months in total! 13 months for adjudicator then another 13 months. Hopefully u won’t be that long. I had settled my loan due to a previous redress so wasn’t paying anything.

Thomas says

Another year wait then I suppose! The adjudicator has already said it will be many many months so just have to stick in.

Thanks for the info, much appreciated.

Stu says

6 days after the Ombudsman found in my favour with a final decision and Loans2go have paid up! Very surprising but happy it is done with. 26 months in total with the Ombudsman. Thanks Sara for this informative website! All claims now sorted barring the ones in Administration.

Candy says

Did they contact you by phone? The ombudsman has agreed with adjudicator and loans2 go have 4 weeks to pay up, it’s been 2 now and haven’t heard anything yet

A miller says

I’m the same I had my claim upheld 8 days ago but haven’t heard anything from loans to go how long did you both wait please

James says

Hi Sara (and others)

Are you aware of L2G making any refunds without having to raise them with the FO? They rejected my complaint, have now sent bank statements so they’re reinvestigating by the end of the week. From reading this it seems like they just reject every complaint.

Cheers

Sara (Debt Camel) says

they sometimes offer to knock off a bit of the interest.

Read back through the comments on this page and see what people are saying.

James says

Thanks I did which is what made me think they rarely accept responsibility. Just wondered whether I’d missed anything different.

Not got anything outstanding with them – purely going after historic interest, so guessing I’m probably going to the Ombudsman. Can’t understand it – thought these companies were charged £500 a pop if a case goes to the FO (does that include if it’s resolved at the adjudicator stage?) so surely makes sense to try and resolve them before that.

Ray says

I thought i was taking out a £250 loan”over 12 months. £10.13. Per week. I received the cash to my bank ins’tantly. Expecting. Them to take the agreed above amount each week. Instead they have been taking £13.13. Each week since. Feb 2020. Which i. Am led to beleive is a 18month plan with silly hnterest rates applied I have requested my Pre -contract. agreement. Because i would have never have knowingly agreed to this. No reply. . i. Opend an online account. All it tells me what i owe- what. Ive paid –

Sara (Debt Camel) says

I suggest you send them a complaint, saying the loan was never correctly described to you, was unaffordable as they did not do proper checks and had an extortionate interest rate. Ask for a copy of all your personal information including recordings of any phone calls (if you made any).

Karol says

Hello I Have same problem with loans2go. I took out a loan of £ 1000 I have a weekly payment of £ 52.74 which gives 4113.72 of the total loan payment. I have paid off 50 out of 78 installments so far, what do I have to do? wait until I pay off the entire loan, can I start doing something about it?

Sara (Debt Camel) says

no you can complain now. See the article above

Karol says

Complaint to ombudsman or try first to L2GO?

Sara (Debt Camel) says

you have to go to the lender first.

Ellis says

Hi

I also took out a loan with loans 2 go, of £890 ,I have paid 29 of 78, so in total pain back £1361, I looked to see when my last payment was due as I too thought it was 6 months, I am paying 1001% by the time I finish, I am going to write to them as you suggest, my question is. Should I now stop paying them as I paid back full amount and £471 in interest.

Sara (Debt Camel) says

can you afford the monthly payments and still pay your other bills, debts and living expenses? Or are you getting deeper into debt each month?

If you stop paying your credit record is harmed. But if you then win your complaint, any missed payments / defaults on your credit record are removed. And a LOT of people are winning these complaints.

Ellis says

No, I have had to borrow money from family to help pay othe debts ie poll tax and such

Sara (Debt Camel) says

Then I think you should stop paying. Don’t get into debt elsewhere to pay a debt you are disputing where you have already paid the amount borrowed.

if you have other debt problems as well, can I suggest talking to National Debtline on 0808 808 4000?

Dylan says

Hi all, I am starting a case against them too.. I borrowed £1500 of loans to go as I had just lost my job. the website was not clear and didn’t explain any details about how much this was eventually going to cost. I receive a call 10 mins after my application from an agent who stated that the interest was not showing on their website due to an error. she then just confirmed my details (identity) and didn’t explain anything? just hung up.

I am happy to pay off my loan but did not agree to this amount of interest.. I wouldn’t have agreed to this amount of interest!!! I have complained to them and will start my ombudsman after I get a reply and my Data request file. wish my luck

Chris Dixon says

Hi sara I’ve just recently won my complaint with the ombudsman that loans2go have accepted I’m now just waiting on them to send me an offer would it be possible to tell me how much I should be looking at getting back please

Loan 1: 400 paid back 1.417.28

Loan 2-5: 800 paid back 1856 each

Loan 6: 250 paid back 1019

Loan 7: 450 paid back 1.835.10

Loan 8: 650 still have an outstanding balance of 2084 on this one

Hopefully that makes sense to you

Thank you

Chris

Sara (Debt Camel) says

Have you made any payments to the last loan?

Chris says

From what I can see it looks like i paid 3 lots of £148 and 2 lots of £75 to them

Sara (Debt Camel) says

Adding that lot up, you borrowed a total of £4150 and have repaid £10433. So in all you have paid £6283 more than you borrowed. You should get that as a cash refund and your balance wiped. Also some 8% interest on top.

Elena says

I take a loan from they 1,500 and I mast pay back 4,423😡l don’t know the rate will be sow high 😡l try cancel after 5 minutes when I read the contract, l email them to cancel my request l don’t need a money..but to lait..they don’t answer to my request and send quickly money in my account 😡

Sara (Debt Camel) says

Send them a complaint as the article above says.

Naj says

How long does adjudicator take to reply. Mine contacted me in october. I ask every month if theres anything else needed and he says no and i appreciate you want us to look at the case i let you know when we are in a position to progress your case. Its starting to get me down now. I complained to the ombudsman over a year ago. Ive had other complaints resolved quicker than this but loans 2 go seems to be taking forever. I havent paid them this month as ive paid back what i owe and ive paid £620 interest . They still say i owe £340. On a £250 loan. I dont know what else to ask the adjudicator i feel like by the time he replies loans 2 go would have gone bust

Sara (Debt Camel) says

Phone them up and make a complaint about the length of time this is talking.

If making the payments is causing you hardship so you have to borrow elsewhere or get behind with bills, I suggest you stop paying. Any negative marks on your credit record will be remove4d if you win the complaint.

Thomas says

Hi Naj

It took me 7 months to get a decision from the adjudicator which Loans 2 Go rejected.

It’s now gone to an ombudsman’s to make the final decision which by the sounds of it will take another year.

The fact that this is acceptable and in the meantime the company more than likely goes bust is shocking in my opinion and not sure how it’s allowed.

Stick in though and hopefully they accept your complaint earlier.

Naj says

Thanks for the reply i have stopped paying now because its just ridiculous. I just got a feeling they will go bust before i get a decision. Its really getting me down. I was hopeful when adjudicator contacted me in october because usually i have an answer within a month from them but its just taking ages now. Good luck with yours too

Alison Ford says

Hi hoping someone can advise me,

I have an ongoing loan with l2go since 2017 I missed a payment when my dad died in 2018 and was harassed continuously they even sent a letter threatening to take my car and added extra charges to my account! Then a year later I broke my knee so I asked for the payments to be lowered whilst I recovered, they agreed but had weekly letters and calls about the arrears that were accumulating.

My loan was for £3500 paying back at almost £500 per month for 36 months and the total to pay back is £17500 I have just sent a letter to complain about the interest rates and I received back stating as a good will of gesture they will write off the last £1800 that is outstanding IF I do not take it to the ombudsman, so my question is do I accept this offer or do I take it further because they sound like they are fobbing me off? Is this interest rate acceptable? Thank you in advance!

Sara (Debt Camel) says

Do you know how much you have paid so far? It could be a lot more than 17500 minus the remaining 1800 if they have added a lot of extra charges and interest.

Alison Ford says

Hi, if I work it out from my statements they have charged me 2x £139 repo fees during the time which I was paying my loan but at a slightly reduced rate when I broke my knee, I have a payment due tomorrow if I include this payment I would have already paid pack a total of £16407.

thank you

Gary says

Loans2go doesn’t know the meaning of a goodwilll gesture, speaking from experience there completely uncaring towards customers complaints so for them to offer you that, to not involve the financial ombudsman tells me there worried about having to refund you all of your interest you’ve paid on your loan, I personally would complain £12000 + is a lot of money to be losing out on

Alison Ford says

Yes my thoughts exactly I even emailed them back so I could get them to confirm that the offer to close the account was only based on if I don’t take it further!my total in interest alone is just over £13000 I have tried to calculate the Apr and it just don’t match up to what I’m paying the only way I can get it close to the 17000 mark is if I devide my loan by 36 which is £97 of my loan per month then multiply the 388% on each month of that£97 surely they cant do this? Plus going through my statements they also added a 3rd repo fee which isn’t on the statement but going from what I have paid and what is outstanding there is a balance difference of another £139! I’ve decided to take this further and will email them declining the offer but should I state all the reasons above or just decline?tia

N says

Had a reply from adjudicator today not upholding my complaint. Im so angry i had so many other payday loans at the time i fell behind with priority bills. Ive asked him to send to ombusdman. Just because i had a £250 loan which was 57.14 a month for 18 months its affordable 😡. I hope someone sees sense because ive paid them back £900 so far and still owe £300.

Sara (Debt Camel) says

have you supplied FOS with your bank statements, credit record and details of the priority debts?

SHUTDOWN_LOANS2GO says

Hello. Just wanted to say a big THANK YOU to “Sara (Debt Camel)”, I borrowed 400£ in january 2020, had to pay back 1900£………………………, stopped paying in about september 2020, used the form above, they offered 50% interest cut so instead of paying 930£ back at that time i have to pay only 465£ which i decided to agree with it i really got no time to play with FOS etc. The only reason i commented is to make people to do something with it, STOP BLOODY PAYING IT!!!!! YOU CAN DO IT, again Thank you Sara, wish you everything best, and again people stop paying this **** THEY NEED TO SHUTDOWN

SHUTDOWN_LOANS2GO says

Forgot to add, Loans2go put a CCJ on my credit file which is gonna last for 6 years…………… im very angry about it….. Sara, do you think there is any possibility to make it gone after i accepted theirs 50% interest cut?

Kind Regards.

Sara (Debt Camel) says

No :(

You should have rejected their offer and gone to FOS – then if you had won the case they would have had to remove the CCJ.

Or you should have said you would only accept it if they remove the CCJ.

But now you have accepted it, they aren’t likely to agree to this.

SHUTDOWN_LOANS2GO says

Hello Sara. I didn’t realize i could do that…

Well, that’s sad but we learn on mistakes, but 6 years on credit file… it shouldn’t be that long, anyway Thanks Sara for help!

Kind Regards

Desperate_mug says

So glad I did a search on this company I have a loan with. I’ve had a lot of loans from expensive lenders but these guys really take the biscuit, hard to believe it’s legal (and I’m not sure it is if they are refunding people)

I was desperate at the time thinking I would be able to just pay it off in total so didn’t worry about the interest too much.

Currently in a position to sort out my finances and have been paying things off, most lenders are very costly but l2g stands out so much it’s ridiculous.

1500 loans over 24 months @ 250 a month

So 6k basically , 4x the loan amount.

I’ve paid 1500, there is 4500 left on the account but they have offered a settlement of 1900 , so that will be 3400 total.

Any idea if it’s be able to get this figured reduced at all ?

Sadly I think I’ve had and paid off loans with them in the past too, which I’ll have to look into..

Sara (Debt Camel) says

You need to find out if you have had loans from them in the past NOW. Look at your credit record? Your emails? Ask L2G for a list of all your loans, saying you want to consider the offer they have made you?

If you accept this offer now, you can’t go back and change your mind later because you had other loans.

They are anyway making you a poor offer. If you go to FOS and win, you would not have to pay any more as you have already repaid what you borrowed. You can accept it, reject it and go back to FOS or try to bargain – say you would accept it if they reduce the settlement amount to say £1000?

Desperate_mug says

Thanks for the quick reply.

I quickly checked my emails and found previous details, 3 loans including this current one.

1st I paid off in 4 days so not worried about that.

2nd was for 600 , and I ended up paying a total of 1400 after an early settlement @ 5 months.

More than happy to compile all this info and complain, I’ll start work on that next week as it seems there is a good chance of saving a lot of money and nothing to loose.

My only concern would be it dragging on for months while I’m still paying the tower of interest , if things didn’t turn out as planned I could be paying more then 3400 total for the current loan that I can get away with now.

Thanks again for writing this blog, you have really helped a lot of desperate people who have been taken advantage of save money or given them some hope they could do so ! – I wouldn’t have considered doing so without coming across your blog 😊

Desperate_mug says

I’ve had a reply already which was quick, disappointing though I’m afraid

However they did offer to reduce my interest, but the offer that they gave me was the same as the automated settlement figure in the account.

I paid the principle, 1500 back – they now want 1800 extra in interest claiming they are doing me a factor writing off 2400 from the original 4500 interest over the term.

Not really happy but not sure I can go to fos , they concluded ‘unable to

uphold any aspect of your complaint.’

Sara (Debt Camel) says

So you can go back to them and offer a compromise? Would you be happy if they reduc e your balance to say £500?

Or you can just send this straight to the Ombudsman – you could then possibly get ALL the interest removed.

The fact L2G says they don’t uphold any aspect of your complaint means they want you to give up. It does not mean you have a weak case!

Desperate_mug says

Hmm can’t reply to your last comment in this thread for some reason , but anyway yes I wrote straight back trying to negotiate , their response did say final response but the email said I could reply with questions for a time.

I would be happy with a decent reduction of account balance , sadly the figure they gave me is larger than than on my account currently as another payment was recently taken.

So far no confirmation my response was received.

P M says

I got a loan on a Saturday night at 6.00pm and it was in my account by 7pm same night 22_2_2020 no discussion what I had to pay back or how long it’s when I received a statement what I to pay and interest I could not belive this I am blacklisted and have very bad credit history and they stated the check this which I dont belive because it would have been declined. I written to then on this matter and they said it was affordable it’s not and the interest for 300 pounds loan turns out to be 1234.56 four times to what I borrowed surely this cant happen there a license to print money should be closed down its loan sharks yes I agree there customers service is very rude I paid back 137.00 and paid no more especially hold to ransom there must be some kind of protection against this

Thomas says

Hi

Does anyone have any experience recently of the number of months between the L2G rejecting the adjudicator decision and an ombudsman looking at the case?

The Financial Ombudsman just keep saying a few months but they don’t know how many are in front of my case.

How can things actually take 1-2 years!!!

Dvid says

Hi have been looking into my loans2go account and I am in arrears now. I took out 500 over a year ago but haven’t managed payments since September last year. I have agreed a payment plan with them but I can’t even manage it at the moment. It’s really unaffordable and they want just over £100 a month. I already have a default on my credit file but am feeling unsure. Is it possible to get them to reduce the interest?

Sara (Debt Camel) says

Read the article above – that looks at how to complain about this sort of loan. Loans2Go may offer to reduce the interest rate – but if you take your complaint to the Ombudsman, all the interest may be removed so you only have to repay what you borrowed AND the default will be removed from your credit record.

Do you have other problem debts as well?

dvid says

No although I do have a poor credit record from years ago. I could afford to pay them something a month but not the full amount. I have already paid back the borrowed amount plus interest. Should I just go for excessive interest rate as I earned more when I took out the loan. I now earn less and pay out more

Sara (Debt Camel) says

I suggest you go for both the excessive interest rate and affordability.

As they have already defaulted you AND you have already paid more than you borrowed, you should consider stopping paying them while the complaint goes through. Talk to National Debtline on 0808 808 4000 if you want to know more about the pros and cons of this.

dvid says

I am concerned that they would give me a ccj and I would lose the case with ombudsman. Is this a likely possibility?

Sara (Debt Camel) says

Loans 2Go are losing 60% of their cases at the Ombudsman! This is well worth a try.

If they go to court, you can ask the Ombudsman to give your case priority and ask the court to put your case on hold until the ombudsman has decided.

One sensible thing to do here is for you to try to save up the money you would have paid to Lons2Go – then if you lose the FOS case you have the money you can use to repay the loan and you won’t get a CCJ.

dvid says

Ok would it affect my case with the ombudsman that I have made temporary payment plans with them and missed the payments? I absolutely agree that they are an awful company and that they’re loans are unfair I just don’t want to affect my credit future as i have managed to stabilise my situation mainly but this loan is unmanageable

Sara (Debt Camel) says

would it affect my case with the ombudsman that I have made temporary payment plans with them and missed the payments?

no, that just shows you were in difficulty.

if the loan has been defaulted, then your credit record can only get worse with a CCJ. If you can’t manage the repayments, what other alternatives do you have apart from complaining?

dvid says

Yeah I guess your right. I’m just nervous as they’re quite aggressive with they’re tactics.

And I should add the interest rate was 1275 percent for my loan.

Dvid says

Hi just to check. If they go to court would the court definitely put the case on hold if the ombudsman is involved?

Sara (Debt Camel) says

yes you can ask for a “stay” while the FOS decision is given. Courts encourage alternative mediation options like FOS. Also FOS should give your case priority if there is a court case.

Dvid says

Could I also ask if you know why people are losing cases against them with the ombudsman?

Sara (Debt Camel) says

This is very much case by case.

So for example in one case, there had been 2 small loans of 300 and then 200 and then a third one of £500 and L2G offered to remove the interest from the outstanding loan – which the Ombudsman said was fair as the first two were small.

In another case the Ombusdsman asked to see bank statements which weren’t provided.

I can’t say your case will be upheld but it seems well worth trying – what do you have to lose?

Dvid says

Hi I’m trying to organize a reduced payment plan with them for now. They are asking for bank statements. Do I have to provide them with bank statements for this? When I’ve reorganized payments with anyone else they have worked with me and agreed without that

Sara (Debt Camel) says

you don’t have to, but then they don’t have to agree to accept reduced payments.

One easy option if you are making reduced payments to several creditors is a debt management plan through StepChange, see https://www.stepchange.org/how-we-help/debt-management-plan.aspx

There Stepchange work out the total you can afford and decide it up between the creditors so each gets their fair share. Loans2go are MUCH less likely to try argue with StepChange than with you. And it makes your life much easier, just having to make one payment a month. It’s a low stress way to wait while complaints go through.

Then if you win your complaint, the amount owing in your DMP drops and it will get paid faster.

Jordan says

Hi, I had a loan for £300 with monthly repayments of £68.57 for 18 months. I missed payments and eventually defaulted. I set up a smaller payment plan and repaid that a few months ago. I have raised an unaffordabilty claim however they dismissed it and I have now raised it with FOS. Could I raise another claim to them in regard to the ridiculous interest rates breaching rules? I’m reading FOS take months and it’s already been 1 month and I’ve heard nothing and want the default gone sooner rather than later! What would you recommend? Thankyou

Alison says

Update I have now sent my case to FOS I have 2 and a part payments left to pay to l2g which are purely arrears I have in total now paid them just over £16000 at this stage I feel like I have nothing to loose as I have already paid them so much its worth a try! Should i pay the last of arrears just incase? Or can I stop paying? Will this go against me? Thank you.

Sara (Debt Camel) says

Will this go against me?

FOS will decide your case based on whether the loan was affordable. It doesn’t make a difference if you still owe money or it has been repaid.

But this is a logbook loan? Do you still have the car? because you can’t stop paying a logbook loan with the risk they will repossess the car.

Alison says

Hi thank you, yes it’s a logbook loan and I still have the car. Will it effect the possible outcome of the interest to a normal loan with them or will it be treated the same way where interest is concerned?

Sara (Debt Camel) says

you need to keep paying it then, sorry, or the car can be repossessed. It’s not like a normal loan at all.

Alison says

Hi Sara, thank you

I thought I would so I will, after the final response letter I emailed back telling them I would be taking it to the fos and have but l2g have now emailed back saying they are willing to take a second look at my case? Do I respond and what? Or do I now leave it upto fos ? I honestly don’t believe it will make a difference also is the interest different on a logbook loan? Thank you

Sara (Debt Camel) says

I suggest you reply that your case will be going to FOS in a week if they have not cleared your balance and made a suitable offer of a cash refund.

Stacey says

Hi all, i am in hope of some advice.

I took a loan out for £600 around dec 2018. I made a few payments maybe a handful of £68. I received an email saying TOTAL OUTSTANDING BALANCE: £2147.62. This scared me and i thought i will never get away from this debt, therefore i didnt bother. Now im trying to better my credit score and this is showing a default. Is their any way i can ask them to reduce the interest etc. The oustanding balance was no where near affordable. I have had a ‘PRE-LITIGATION NOTICE’ i paniced and made another £68 payment. I then was in an unstable mind and didnt make any more payments. Should i leave it as is in hope i receive no further action. I have changed address a number of times since so my details are not up to date with them. I have no emails or letters of the agreement i took out just about 6 emails of payments and the notice. I would be happy to pay the 600 i borrowed but not £2147. 😪 or even more now no doubt. Many thanks in advance.

Sara (Debt Camel) says

It sounds as though the loan was unaffordable so you should put in a complaint as the above article says. Do include your bank statements for October & November 2018 as these will show how unaffordable the loan was.

Change this sentence “I am asking you to refund the interest and any charges I paid, plus statutory interest, and to delete any negative information from my credit record.” in the template to read:

“I am asking you to change the balance outstanding so I will only have to repay in total the £600 I borrowed and remove the negative information from my credit record.

I can afford to make monthly payments of £20 [or whatever] to pay off this balance.”

By making an offer of monthly payments, they may decide not to go to court. But also give them your new address. If you don’t, the court papers may be sent to your old address and you will get a CCJ.

stacey flynn says

hi Sara,

many thanks for your previous help. (thank you, thank you, thank you!!)

So, I have had a response from L2G team with an offer.

“as a gesture of goodwill it has been agreed to write off 50% of the interest

applied to the borrowing which equals £923.37 and amend your outstanding balance to £952.25.

Please find below a breakdown of the gesture of goodwill:

Current balance outstanding: £1,875.62

Gesture of goodwill write off: £923.37

New amended balance to pay: £952.25 ”

The original loan and status.

Principle: £600

Duration: 18 Months

Total Payable: £2,446.74

Total Paid: £571.12

Outstanding balance: £1,875.62

Status: Active

would you say this was a good outcome? personally i believe the loan is £28.88 short of being paid. im considering a £500 counter off with a cheeky question of removing the default from my credit file. does this seem reasonable ?

many thanks in advance,

Stacey.

Sara (Debt Camel) says

That sounds like a reasonable compromise – I don’t know if L2G will accept it but it is not a silly offer.

Stacey flynn says

Hi sara,

I have had a response from the l2g team as follows.

Thank you for your email.

I would like to confirm that we are happy to accept your offer of a one off £500 payment as full and final settlement of your account. However, unfortunately we are unable to remove any information recorded prior as we are obligated to provide the Credit Reference Agencies with accurate information. But, we can confirm that when your account has been closed, it will reported as settled on your Credit File.

I would like to thank you for taking the time to assist me and guiding me to getting this issue resolved.

I really hope you are well and many thanks once again.

Stacey.

Dvid says

This is my only debt which is an issue now. The problem is that I could afford it when I got paid more and weekly but now I get paid less and monthly. The interest rates mean that I’ve already paid back pretty much a grand from a 500 loan. They still want another 1000. I just want to agree something with them in the interim before I make a complaint

I’ve had to be helped with money from family and I’m worried this will go against me If they see that money has been in my account. But the only reason I’ve borrowed some and given some is because I’ve been struggling

Sara (Debt Camel) says

I really suggest you complain as soon as possible. It doesn’t help to try to do these things one after the other, it just slows things down.

If the loan was affordable at the start you may not win the complaint. But just get it under way and see!

Having to be helped by family should be clear on your bank statements and it helps your case, it doesn’t go against it.

Stacey says

Many thanks for your help. I will try this and will keep you updated of the process for anyone who may be in the same or similar situation.

Shane says

I took out a loan for £2000 in January of this year. I know it was my responsibility but I was deep in a gambling addiction and would have done anything for cash as I was vulnerable at the time. Sadly I lost the lot. However I feel this was irresponsible lending as I was already on a Debt Management Plan to do with other payday loan companies and my credit file is terrible. If L2G had of done more checks and looked my credit history and bank statements they would have seen my DMP and compulsive gambling and could have saved me a lot of hassle and heartbreak.

They wanted me to pay back £55.69 for 104 weeks (nearly £5800) which was completely unaffordable so I never made any payments. After 7 weeks I decided to ring them up and try to come to some sort of fair arrangement. They allowed me to pay £35 a week (to be reviewed) which I thought was manageable but there is no word of dropping the overall balance of £5800.

Ultimately I know I took out the loan and would be willing to pay it off with some interest included but the amount they are asking for is extortionate and I can’t help but feel they have taken advantage of my situation.

Any advice on how to move forward would be appreciated. Thanks

Sara (Debt Camel) says

Can you say how large the debts are in your DMP? And how much you are paying to the DMP?

Do you have other problem debts not included in your DMP?

Shane says

Yes the DMP is currently at £2000 and I am paying £58.50 a week and I’ve also been paying £44 a week to Provident.

Sara (Debt Camel) says

OK, well the article above looks at how to complain about the L2G loan. It is easier to win a complaint about affordability than just saying the interest rate is stupidly high.

Have you also sent an affordability complaint to Provident? Huge numbers of these Provident complaints are being upheld by the Ombudsman

Shane McGuigan says

Yes I have constructed a letter to them using your template and will wait to hear back. I will also take a look at provident too. Thanks

Shane says

So a follow up on my complaint to L2G, they have rejected my complaint and are unable to uphold any aspect of it.

However in an unexpected turn off events they have said the following:

“ However, at Loans2Go our main focus is to treat all of our customers fairly and sympathetically. Considering your gambling addiction and the ongoing pandemic I have decided as a gesture of good will to offer you to write off all interest on your account amounting to £3,791.76, meaning that you only would be liable to return the principal amount borrowed of £2,000……….. We are happy to assist you with a reduced payment plan so your loan can be cleared as soon as possible.”

This was a much better outcome than I expected. So thanks Sara for your article and guidance.

dvid says

How long did it take them to reply?

Shane says

I made the complaint on 10th March and they replied today (13th April)

Thomas says

I have now received a final decision from the Ombudsman about Loans 2 Go.

They have confirmed it was unaffordable and all interest should be refunded.

Does anyone have any experience of once the Ombudsman have confirmed this, the time it takes for Loans 2 Go to refund?

Candy says

I am also in the same position. I have accepted ombudsman’s offer and just waiting on Loans2go to provide the refund

Nicolette says

O my word! I also made a mistake thinking this guys is offering me 12.3% on a 24 months loan for £3000. I never got the “agreement” or signed it as it was between my spam. Today I thought, I must be nearly finish paying for this loan as I pay £114 per week since April… what a surprise. They advice me that the amount payable back is £11856 ????? This is more than 500% interest rate>? This is like money sharking??

I cannot afford to pay this amount, I only lend 3000 pound in September 2020 as I could not secure a tenancy on my name as I was just about to start at a new job after being a student… I am a single mum with 3 kids!

Sara (Debt Camel) says

read the article above and send in a complaint if you feel the loan was unaffordable.

Nicolette says

Yes I did thanks, I just send it to them. I hope they will respond still today. It is really a big stress point for me.

Sara (Debt Camel) says

OK if you can’t afford to carry on paying, do you have other problem debts as well? This may be the biggest but are there others?

Nicolette says

Yes my credit card about £500, and £300 at another place where I pay a x box off. This is not bothering me as I can afford it. I do not want my credit scoring to be affected by this stupid loan.

It is also not just the cannot afford to pay, it is the whole issue surrounding, lending £3000 and ending up with £11000…. I was under the impression I could pay it off in a few months with the weekly instalments. I applied the evening and it was paid out the next day. The guy who spoke with me was definitely not clear as he said to me it would not be a problem I can pay it off in a few months, I remember saying to him that I do not need to take it out over such a long period.

Sara (Debt Camel) says

So if the loan is unaffordable the what option do you have apart from not paying it – or offering a much reduced payment amount you can afford?

Borrowing more at high rates to pay this loan is a very bad idea. In this situation you may need to ignore the damage to your credit record and stop paying. If you win your complaint any negative information will be deleted from your credit record.

I understand your anger at the amount you have to repay and that it wasn’t properly explained. And you can raise this with FOS as being an unfair way to treat customers. But keep your eyes focussed on the fact that it is often sinmpler to win a complaint with affordability.

Paul says

Hi, I took a Loan out for £1,000 in 2019 at £225.56 a month for 18 months (£4114.08 in total).

At the time of taking out the loan I was in a financially bad situation with other lenders and I had turned to gambling. When payday would come knowing I was unable to pay all my creditors and bills I would gamble with the hope to win enough to pay everyone but this was not the case.

At the time of accepting the loan I felt like this was the only option as Loans2Go were the only people willing to offer me a loan and I was in a desperate situation.

During the term of the agreement I did not keep up with my payments and entered into multiple payment plans that were unaffordable as the customer service team wouldn’t accept anything less than 50% of original payment what resulted in 2/3 of the months I had paid I claimed a chargeback with my bank as I needed the money.

I am now in a position both mentally and financially to start paying the loan back but I feel the amount of interest is criminal!

The loan is now over the 18 months agreement and I am £3,262 in arrears having only paid £852 (less than the original borrowed amount)

Any advise would be greatly appreciated as until reading this thread I’ve thought there is no chance a complaint will be upheld with me gambling and my bank statements showing this

Sara (Debt Camel) says

Send in a complaint and attach your bank statements, they help your case.

What about your other creditors, were some of them also high interest?

Desperate_mug says

This sounds very much like my issue , I’ve paid a little more back on a larger loan (borrowed 1.5k which I have just about paid back)

My problems were gambling like yours, I’ve submitted a complaint based on the above and received a rapid response.

They asked me for bank statements but I chose not to send as I’m not sure they would help my case, I’m on a good wage so based on money in I should have been able to afford things results , but the state of my account was just terrible, hammered by loan repayments and gambling transactions as soon as I was paid ( trying to win to post summer stuff off) , so tbh I was too embarrassed to send these in especially if they just prove I was getting good money.

I focused on the fact their interest rate is ridiculous, and that they loaned to me when my rating was so incredibly poor with several outstanding loans.

They are investigating now, so I’ll wait and see where it goes – slightly lacking confidence as the response said they were putting a full hold on the account until investigation was done but today they have debited my account for the installment anyway ! Will be calling about that shortly.

Good luck Paul 👍

Sara (Debt Camel) says

Send those bank statements! Seriously, gambling problems showing helps your case.

And if you cant afford the payments, cancel the Direct Debit or Continuous Payment Authority with your bank.

Desperate_mug says

Thanks Sara – ok maybe I should just send them in then , I’ve not had another acknowledgement yet so I’ll just write a follow up with them attached, and swallow my pride 🙂

Tyler N says

Just a little contribution here .. I also had decent monthly income but the FOS will include it as part of your expenses if your gambling started BEFORE you had this loan.. Just have a look at your bank statements for the two months prior to your loan, if you had more going out than coming in (including the gambling) then this will strengthen your case for sure.

If this is the case, then make sure you also explain your reason for not including the spending in your monthly outgoings when you applied (embarrassment, didnt realise you should, etc).

Loans2go will reject your claim so be prepared for a wait for the FOS! But it will be worth the wait to have the balance nearly wiped and the loan off your credit history. If you have only paid £852, you will still need to the pay the remaining amount of £148 to fully repay the original balance even if you received the full refund.

There will no 8% interest paid if you still have an outstanding balance. But you’ll sleep a little easier with that interest gone!

Good luck Paul.

Unhappy says

Ombusdman didnt uphold my complaint with this company because it is one loan. I am absolutely appaled and i am not going to agree with it. I am going to ask loans 2 go if they will accept a reduced payment to close as i simply jist cant afford to pay them anymore. I am digusted. Waited almsot 2 years for them to reject it

Sara (Debt Camel) says

I’m sorry to hear that. I suppose the ombudsman thought a £250 loan was too small for L2G to have to make proper checks :(

What are the rest of your finances like?

Paul says

What route would you suggest going down with my complaint? High interest rate, unaffordable or both?

Im just a little lost when It comes to the what to say to L2G- do I tell them the payments weren’t affordable because of my gambling? like the above i feel embarrassed and with missing most payments and not keeping up with payment plans Ect I feel like my complaint will be laughed out the door

Especially when in reality if I wasn’t gambling I would have been able to make the monthly payments

Sara (Debt Camel) says

Unaffordable as the main complaint. You can add on that the interest rate is unfairly high but people seem to be winning on the affordability side much easier. Send your bank statements with your complaint to show your gambling and send the complaint to the Ombudsman if L2G don’t make you an OK offer.

Quinn says

Hi Sara, I took out a loan with loans2go about 3 years ago and saw on my dmp that im paying back £2600 on a £5/600. I was literally ringing them 6 times a day trying to get this money as I was desperate and had a drug problem and didn’t really understand how much I’d be paying back.I defaulted several times as I had to take out other loans to keep up but it still wasn’t enough. Do you think I have a case? I think by the fact I kept calling and kept trying to top up the loan in my desperate state should help my case? I’ve sent them the template email, so I wait for a response or can I also start with the ombudsman?

Thank you

Sara (Debt Camel) says

You can’t go to the Ombudsman until L2G have had 8 weeks to reply to your complaint. Have you sent copies of your bank statements to l2G? If not, send them now – they help your complaint.

What is the rest of your current financial situation like?

Edmund says

Hiya just asking for a bit of advice regarding L2G Personal Loans and the Consumer Credit Act’s right to withdrawal. I Took a £250 loan out today as I was referred to L2G through a short term loan comparison site where I was trying to borrow £250 for 3 months. My intention was going to pay it off at the end of the month when I get paid.

Now realised how naff this loan is. £58 for next 18 months – over £1000 for a £250 loan. I was still under the impression it was a 3 month loan! I understand that I have the right to withdrawal under 66a Consumer Credit Act 1974 but I have a few questions about the wording of the agreement – all too legalese for my brain.

“ (9)Where the debtor withdraws from an agreement under this section—

(a)the debtor must repay to the creditor any credit provided and the interest accrued on it (at the rate provided for under the agreement)”

From this I’m not quite sure what The rate in the agreement is. Or what counts as “interest accrued”.

From the agreement:

“ Interest is charged at a simple fixed interest rate of 207.6% per annum on the Amount of Credit for the Duration of the Agreement and is applied to the account, in full, at the commencement of this agreement. ”

(1/2)

Edmund says

as well as:

“ Right of Withdrawal Daily Interest: £1.42”

So basically I’m confused. From what I can tell, at the very commencement of the loan, L2G applies the full amount of interest – the full £770(roughly) in interest that I’m paying for the loan? So where the CCA refers to “any interest accrued”, it means that full £770? And by withdrawing from the loan agreement, I’ll have to pay back, the full £1000?

Or does it mean that if I were to trigger my right to withdrawal, then I would only pay back the £250 + £1.42 x every day after the commencement of the loan?

(2/2)

Tyler N says

Hello,

Right now its only going to cost you £250 + £1.42 (yesterday) + £1.42 (today) Get out of it before its too late!

It will be a £1000 if you dont tell them within first 14 days that you want to withdraw from the agreement.

Tell them today so they’ll give you a settlement figure then just pay it within the stated time.

Sara (Debt Camel) says

I agree with Tyler. And tell them IN WRITING YOU WANT TO CANCEL THE AGREEMENT and don’t spend the money. If they have told you the account you need to make repayments to, then immediately pay the money back plus two £1.42s.

Edmund says

Thanks Sara & Tyler.

Just got off the phone with L2G. I told them I want to exercise my right to withdrawal and the telephone operative tried talking me out of it and offering me an early settlement discount. I refused and insisted on exercising right to withdraw.

Unfortunately I can’t pay the full amount back today as I used some of the money to pay an unexpected yet urgent bill immediately after receiving the money yesterday.

Am going to pay back £250 + (£1.42 x 12) = £267.02 back in total on the 31st of this month. Not great, but definitely not a bad outcome considering some of the stories in these comments, and affordable at least. I just feel lucky that I was able to realise what a mistake I’d made so quickly before it was too late!

Despite how dodgy they clearly are, I’m hoping that they don’t have any more tricks up their sleeve and that I’m able to make the payment on 31st without a hitch.

I also informed them that I will be writing them a dated letter (with a receipt of postage) to indicate the triggering of my right to withdrawal and demanded email confirmation from them with the details of the withdrawal.

Thanks again

Sam says

Hi,

I got a loan of 3k in September 2020. My credit is so bad I am unable to get a basic overdraft.

L2G are now telling me I owe them over 11k. I have just emailed them to ask them to reduce the interest. I cant believe I was so stupid but did not understand the interest rate.

Sara (Debt Camel) says

Can you afford the repayments? Did you realise this loan was for 18 months?

What other problem debts do you have?

Sam says

I wrote to loans to go. I have just checked my credit report. It seems the whole debt has been removed ?!!!

Sara (Debt Camel) says

oh!

That may be good, but don’t get your hopes up yet.

Sam says

I am not sure why the whole debt would be removed though. It’s been marked as satisfied ?

Sara (Debt Camel) says

it could simply be an error.

dvid says

I am making a complaint to you about irresponsible lending. You should never have given me this unaffordable loan. If you had looked properly at my situation, you would have seen that I constantly live in my overdraft and struggled to pay rent. I had to rely on family handouts due to struggles with addiction and have struggled financially .My bad credit record should have alerted you to the fact I have had a lot of problems. If you had carried out the proper checks you would have known this loan was unaffordable.

I am also complaining that the interest rate was grossly excessive. It is unfair to charge someone more per month over 18 months than they would have paid to a payday lender for a loan the same size over 12 months. My repayments are £26.37 per week and over 52 weeks this works out to £1371.34 which far exceeds FCA guidance of a maximum of 100% interest over 12 months.

I am asking you to refund the interest and any charges I paid, plus statutory interest, and to delete any negative information from my credit record.

I am also making a Subject Access Request (SAR) for all the personal information you hold about me including, but not limited to, my applications, all credit and other affordability checks, a statement of account for my borrowing, and a record of all phone calls.

i am about to send this, do you think i should add anything?

Sara (Debt Camel) says

You can add more stuff about your bad credit record if you want. And o enclose your bank statements from 3 months before the loans.

dvid says

Ok I will mention that I have a ccj and multiple defaults. Is it best to send them bank statements or wait for them to ask?

Sara (Debt Camel) says

send them with your complaint. You are showing them the loan was unaffordanle. And showing you are well organised about the complaint.

Dvid says

Ok have sent it. Will keep everyone on here updated. Thanks for all the advice. Im not just making the complaint for myself because I guess every complaint that goes in will make a problem for them and I think this company are loan sharks who have tried to find a loophole in the law and prey on vulnerable people. It should be illegal

Dvid says

Do I have to wait for loans2go to respond to my complaint before going to the ombudsman?

Sara (Debt Camel) says

you have to allow them 8 weeks to reply.

Ellis says

I had a 850 loan out with them, kept up my payments for 6 months which were 49 pounds a week, I sent them the pro former that is on here complaining about the high charges and they said I had paid enough for them to right off 2200 that was remaining, a great result as that meant I any paid back 500 extra , very happy with out come

Tracey P says

Hi Sara – I wonder if you can offer some advice. This is not an affordability complaint but more of a contract/terms and conditions complaint.

I had a principle loan for £250 for urgent repairs on my car – I knew that I would only need this short term and wouldn’t require the loan for 18 months (the actual repayment for this full period was almost £1200). The wording of the contract stated ‘this loan can be settled at anytime with no fees and penalties’.

I thought I would need the loan for about 40 days but actually only needed it for 31 days in total. I had made a monthly payment of £57 in February and received the final settlement cost of £303 (I paid this as I wanted this massive loan off my credit file – it significantly dropped my score as they put the total loan cost on my file). This meant I paid £360.80 for a loan for 31 days. I calculate this at 44.32%, the contract monthly interest is 17.3%.

I have made a complaint direct to loans2go but so far they haven’t even acknowledged the complaint. I am assuming I will need to send to the financial ombudsman – do you think I have a case for the excess interest paid?

Weatherman says

Hi Tracey

If the contract let you repay at any point and just pay the interest incurred to date, then I agree with you that you have seemingly been charged more than you should have. I can’t see how that amount has been calculated. If you had the loan for 1 month, then the interest you paid should have been about 17%. Were you given any breakdown of how the final settlement cost was calculated?

You’ve done the right thing by complaining to Loans2Go to start with. If it’s been 8 weeks since you complained, you can take them to the Financial Ombudsman Service (if not, you’ll need to wait and see if they reply within 8 weeks of your complaint). Without seeing the contract itself I can’t be certain, of course – but it’s free to complaint to the FOS, so no harm in doing so. You won’t be in a worse situation if you do so.

Sara (Debt Camel) says

The settlement rules are set out in the Consumer Credit (Early Settlement) Regulations 2004

Basically If you have less than 12 months left on your plan, providers can charge up to 28 days’ interest. If you have more than a year to go, providers can add an extra 30 days or one calendar month.

Tracey P says

Hi Sara

These are the parts of the contract detailing early repayment.

Early Repayment Under s94 of the Consumer Credit Act 1974 you have the right to repay this agreement early in full. Payment can be made by debit card or cheque, payable to us, at the above address or by bank transfer to an account which you should contact us for details of. To repay all the credit early you must pay all amounts due to us under this agreement less any rebate of charges allowable by law. To repay part of the credit early you must pay some amount to us which is not yet due under the agreement within 28 days of your notice of intention to make early repayment. We shall reduce the amount payable by you as prescribed by law and by reducing the amount of each repayment still to be repaid. We will not seek to recover compensation under s95A of Consumer Credit Act 1974 should you make early repayment(s).

_________________________________________________

Would you expect the contract to clearly state that early repayment would include 28 days extra interest? the actual contract seems ambiguous to me – as the line the loan can be settled at anytime with no fees or penalties, suggests that it is reasonable to assume you only pay for interest up to the date payable?

Second point on this. The daily interest £ rate is £1.43. Even with the extra 28 days this would make my repayment

31+28 @£1.43 = £84.37 + £250 principle sum

Total = £334.37

Actual total paid = £360.84

Sara (Debt Camel) says

I suggest you talk to National Debtline on 0808 808 4000 about the details of this and how it applied to your situation.

Tracey P says

Hi Sara

Do National Debtline deal with contract issues? It’s not a debt case but an argument of contract interpretation

Sara (Debt Camel) says

This is an issue a debt adviser can help with.

sillysouth says

Does anyone know how long L2G are taking to action the ombudsmans final decision at all? I won and finalised my case thank god

Candy says

I also would like to know this. I’m currently on second week waiting since ombudsman has provided final award

Fiona says

Have you received any refund yet? I am in the same situation. Ombudsman disagreed with the adjudicator and has upheld my complaint. I sent back my acceptance of the final decision on the same day. Just wondering how long it usually takes to hear from Loans2go and receive the refund.

Candy says

Yes I received an email with the amount from Loans2go, I provided my bank details and the money was in there 3 days later. Whole process took 2 weeks. I got £4200, so great result thanks to sara.

Rebecca says

I received my final decision on the 29th, both accepted and received confirmation on the 30th from ombudsman. I rang them and they said it could take 4 weeks as mine was sold to a debt company. However got a email on the 1st with the amount and asking for my bank details. But still waiting for the payment due to the bank holiday. Ring them up if you still haven’t heard anything

Emma90 says

Hi I recently had a loan with loans2go and I am not able to repay the first payment I’ve gone for settlement amount but have not enough time to get £1218 to repay £1000 I have untill the 13th April to repay I’m struggling with this laon all my other credit commitments are absolutely fine and my credit rating has started to improve this loans2go have totally made me go back into depression again after all these years of getting to a good enough point and didn’t even explain the Apr outrageous I have to pay £228.56 @ month I only get paid £167.50 a week on Furlough and didn’t ask me for wage slips either very irresponsible I will copy and paste at the top and send them a complaint hopefully can get repays reduced before my first payment

Sara (Debt Camel) says

L2G are likely to make you a poor offer. It sounds as though you may have a good case to get all the interest removed if it goes to the Ombudsman, so it’s best to only make lower affordable payments. This means your credit rating is temporarily damaged but if you win your complaint all the negative marks are removed.