UPDATE: 27 February 2018 – Victory! Vanquis is made by the FCA, its regulator, to offer refunds of the additional interest charged to all cardholders who have had ROP.

UPFATE: 2 August 2018 – Well only a partial victory :( The refunds Vanquis is actually paying out are a lot smaller than they should be. Read Why the ROP refunds are too small and how to complain.

I am leaving this old article here as a lot of readers commented on it.

Vanquis Bank’s Repayment Option Plan (ROP) for its credit cards is being investigated by the regulator, the Financial Conduct Authority (FCA). This was announced by Provident, who own Vanquis, on 22nd August 2017.

This article looks at whether you should cancel this ROP if you are still paying for it and complain and ask for a refund of ROP. The details of one refund are shown – you may get a large amount back because you also get a refund of all the interest that was charged on your ROP fees.

Many readers have got hundreds or even thousands back, see all the comments below.

What is the ROP and why is the FCA looking at it?

Vanquis’s ROP is a bit like insurance, offering some features that could help if you have difficulty with repayments to the credit card.

The main feature is an “account freeze” if you get into financial difficulty: no payments needed, no interest being added and your credit record is protected. You can’t just ask for a freeze, you have to supply evidence eg that you have lost your job, send an income and expenditure sheet etc

There are also some other short-term options if you miss a payment or want to miss a month’s payment, but the ROP would be a VERY expensive way to get these minor benefits. The “no impact on your credit rating” feature may sound nice, but it’s not worth much unless your credit rating was actually good. People with a credit rating worth protecting don’t usually have a Vanquis card at all!

The cost – £1.29 per £100 outstanding – may not sound high. But that monthly charge adds up to a lot over the year.

The ROP charge is also treated as a purchase on your Vanquis card, so unless you repay the whole balance every month, the next month you will be paying interest on the previous months ROP charges.

If you only repay the minimum amount and you are having ROP charge added, your balance is hardly going to drop at all.

What are the FCA concerns likely to be?

The Provident announcement said:

The FCA indicated that it has concerns about the ROP product and is investigating the period from 1 April 2014 to 19 April 2016. Vanquis Bank agreed with the FCA to enter into a voluntary requirement to suspend all new sales of the ROP in April 2016 and to conduct a customer contact exercise, which has now been completed.

That’s the only public information – the rest of this is my speculation.

The FCA’s main objection is probably the fact that Vanquis are charging for this account freeze, which is something they should be offering to all customers in difficulty without any charge. FCA rules (CONC 7.3.4) say:

A firm must treat customers in default or in arrears difficulties with forbearance and due consideration.

“Forbearance” in this sort of situation often involves freezing interest. So the FCA rule means that all customers may have their interest frozen when they are in difficulties.

If Vanquis didn’t explain this to customers when it was selling them the ROP, this may well have been misleading and the product may have been mis-sold.

Why only from 2014 to 2016?

The FCA’s investigation starts from 2014, when the FCA took over regulating this sort of debt.

But the previous regulator, the OFT, had very similar wording. It described failing to treat borrowers in default or arrears difficulties with forbearance as an unsatisfactory business procedure, and said creditors should consider reducing or stopping interest and charges when a borrower evidences that he is in financial difficulty.

So although the FCA isn’t looking at older cases, this suggests that the customers who paid for the ROP before 2014 were not fairly treated either so they too can complain.

How much could a refund be?

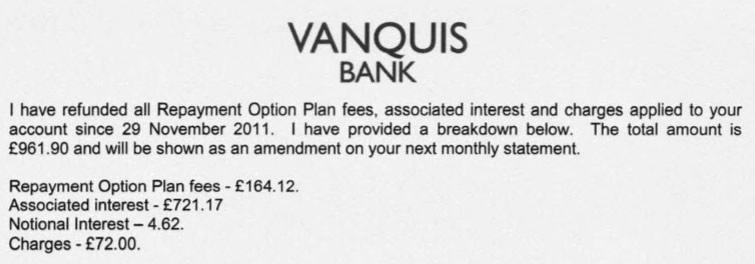

One Debt Camel reader, Mr N, complained to Vanquis about the ROP earlier this year. This is the refund he was given:

He only had the ROP for a short period in 2011/12 so the ROP fees weren’t high. But look at the extra interest that was refunded – £720 – wow!

This is high because Mr N didn’t repay his card balance in full every month. Paying for the ROP meant he was paying less off the balance on the card. He was effectively paying 39% interest on his ROP payments for nearly 5 years and that is what he is being compensated for.

How did Mr N get that refund from Vanquis?

Mr N complained that he felt he had been pressured into signing up to the ROP which wasn’t right for him. Vanquis listened to the phone call from 2011 when he signed up to the ROP to check that certain points had been properly explained to him. The investigator concluded:

although you did accept the repayment option Plan as a feature of your account, I do not feel all these points were satisfied when discussing the plan with you.

What should you do now?

Cancel the ROP?

It’s always hard to suggest that people should cancel insurance, however ridiculously over-priced it is. You might cancel the ROP and then lose your job next month… But the regulator’s rules mean that if you do get into difficulty, you can ask Vanquis to freeze interest on your account, see What to do if you can’t pay a bill this month.

You have to think about the cost of the ROP. Not the headline £1.29 a month per £100 charge… look at what the true cost to Mr N was for his ROP product. Paying ROP makes it much harder to get your Vanquis balance to drop as so much of your monthly payment is eaten up by the ROP charge, so you are actually more likely to end up in financial difficulty!

There may be hundreds of thousands of people who still have ROP on their Vanquis cards. I think they should all be seriously considering cancelling it!

Complain about it? (this was written before the FCA’s decision in February 2018)

If you took out the ROP after April 2014, your case will be among those being looked at by the FCA. You could decide to wait and see if you get awarded any automatic compensation. But if you have financial problems at the moment, you may want to ask for a refund now as there is no indication how long the FCA investigation may take.

People who were sold the ROP before April 2014 are unlikely to be included in any redress scheme the FCA proposes. But they can still get refunds if they ask for them. So complain to Vanquis now and asking for a refund of the ROP fees plus the associated interest you paid on the card.

You can complain if you are still paying the ROP or if you cancelled it. It doesn’t matter if you still have the Vanquis card and owe a balance, or you have closed the card. You can also complain if you are currently in debt management.

Don’t complain if:

- you have gone bankrupt after you got the Vanquis card (the refund would go to the Official Receiver)

- you are currently in an IVA (the refund would go to your IVA firm);

- you are currently in a DRO (your DRO could be cancelled if you get a refund).

October 2017 update – some of the first complaints upheld

About 8 weeks since the first complaints went in based on this article we have the first few results:

- people have been offered refunds of £418, just under 3k, £1600, £507, £285 (that was only for 6 months ROP) and £531;

- most are happy with the offered refund but one is going to the Ombudsman as the numbers don’t reflect what he thinks he paid;

- people who applied for the card more than 6 years ago have had their complaints rejected – some of these are going to the Ombudsman;

- 3 people who took out the ROP in the last 6 years have had their complaint rejected.

Obviously there could have been a lot more decisions – I am just going on what has been reported in the comments below this article.

November 2017 update – more complaints upheld

Increasing numbers of results reported:

- refunds offered of £448, £321, £508, £1,255, £1,286, “full refund”, £4,279.

- 4 people who took out the card within the last 6 years have had their complaint rejected, 1 person asked for a copy of his phone call and was sent one that clearly showed he had rejected the ROP – he has sent the case to the Ombudsman.

- 2 people who opened accounts more than 6 years ago have had their complaint rejected.

- Vanquis have missed the 8 week deadline in a few cases.

December 2017 onwards

Lots more people have been getting refunds, too many for me to keep track of. See the comments below for recent examples.

A few interesting cases:

- one reader has her complain accepted because Vanquis couldn’t find the call recording;

- one reader has had a decision from an adjudicator at the Financial Ombudsman that the FO can look at cases where the account was opened over 6 years ago. Good news – although it could still be challenged by Vanquis.

john styles says

I received a letter. I have already complained about ROP.

‘We are writing to remind you that you have previously opted in to Repayment Option Plan. Repayment Option Plan appears on your statement each month as a purchase transaction. In the last twelve months (or since you opted in to the Plan) you have been charged £59.24 plus any interest at your purchase rate of 00.0%.

I paid more than 59.25 in rop and my purchase rate was 39% not 0%

vanquis dont do purchase rate at 0%

Sara (Debt Camel) says

I suggest you email them saying that you have complained to them on DD/MM/YY, you don’t understand why they have sent you a letter talking about the ROP you paid in the last year, as you complaint is about all thr ROP paid, and they gave anyway got the facts in the letter wrong as you paid more ROP than that in the last year and your interest rate is 39%.

john styles says

yeah I rang up and spoke to the guy yesterday but as the department was closed he said he get some to ring me on Monday as he could not understand why my rate was saying 0% either

gillian says

hi sara i have just read your page on repayment option plan with vanquish and checked my card and logged into my account online for the first time i see that i am paying nearly 20 pound a month for this so i called and cancelled it i have had the card since about 2010 just wondering could i claim some of this back as i have had bad credit since the start and they have increased my limit a few times even though i often made or missed payments even if i cant thank you you have saved me 20 pound a month anyway after also letting me know i could reclaim nearly 13000 pound on my payday loans i can honestly say you have made my life a lot easier i now do not have to worry about having no money left after being paid thank you again for your advice it is a god send

Sara (Debt Camel) says

You have two possible complaints here against Vanquis. Forst that they mis-sold your the ROP – it sounds as though you weren’t even aware of it… The article above looks at how to complain about this. This may not be easy as you opened the account more than 6 years ago, but it’s worth trying!

Second that Vanquis increased your credit limit even though they should have been able to see that you were already in difficulty. See https://debtcamel.co.uk/refunds-catalogue-credit-card/ for more about this.

You can complaint about both. Just be clear if they are offering £x to settle one complaint, that this doesn’t affect your other complaint.

Phil says

Hi here is some of the letter from Vanquis:

Our Findings

I have carefully considered the circumstances regarding this complaint and reviewed the necessary information calls to form my opinion

You were offered the ROP during a call which took place on 16 April 2015. When reviewing this call I have looked to ensure the following points are met. You understood the Plan .The script was followed. All additional information relating to the Plan was correct and not misleading. The pricing was clear and given corectly. You accepted the Plan as a feature of your account.There was no pressure on you to accept the Plan. Having now listened to the call, I am satisfed that the ROP information was given correctly and that you understood the Plan, You expressly agreed to have the Plan as a feature of your account. During the call, the agent made clear that the ROP was an optional feature. The agent also clearly explained the cost of the Repayment Option Plan, stating that “lts just £1.29 for every £100 of the outstanding balance on your statement each month. So if you had £100 balance

on your statement it would cost £1,29 each month. And if you have say £50 balance outstanding it would cost you just £0.65 for that month, After also being provided with details of the features of the product, you opted into the ROP, saying “yes go on then. The agent then reiterated that you had opted into the Plan and that it could be cancelled at any time.

Spiralling Debt says

lts just £1.29 for every £100 — shot themselves in the foot there – they didnt mention that you’d accrue interest on top of that as it’s deemed as a purchased.

“yes go on then” is a phrase that one may use when they are asked a question and dont want to answer it

“Pressure to accept the plan” – the product was sold when all you wanted to do was activate the card, it made you feel like if you didnt accept it, they would not activate the card.

Details of the feature BUT did they say that they would consider forbearance without the requirement for ROP?

Sara (Debt Camel) says

I agree with SPLITTY that “Its just £1.29 for every £100 of the outstanding balance on your statement each month. So if you had £100 balance on your statement it would cost £1,29 each month.” didn’t explain to you that you would then be paying interest on that amount. It was described as though it wasn’t much, but it adds up very quickly once interest is added.

Do you think you were pressured to accept? There is no need to exaggerate in these complaints – keep them factual.

Also I agree with SPLITTY that it is important that they never told you that if you didn’t accept the ROP, they would still consider freezing interest if you were in financial difficulty. because this was never explained to you, you were left with the impression you were buying a valuable feature, whereas actually you could have had the ROP’s main benefit without paying for it at all :(

Phil says

Yes defiantly felt pressured because I know they made previous calls to me to try and sell it. I have requested they send me the recording. The letter is two and a half pages long. Also they keep increasing my limit, am currently up to 4k which I have never asked for any increase. Would it be ok to post more of the letter?

FourMenHadADream says

Hi Sara, my complaint was also rejected. I received the letter last week however I’ve been abroad and I’m now just getting the change to go through it. I’m looking for some assistance on whether it’s worthwhile going to FOS. I complained to Vanquis using the template on the article above. The letter does go in to quite a lot of detail and I’ve posted their findings below as I’m sure a lot of site users will receive an identical rejection. Any help is really appreciated.

Having now listened to the call, I am satisfied that the ROP information was given correctly and that you understood the Plan, you expressly agreed to have the Plan as a feature of your account.

During the call, the agent made clear that the ROP was an optional feature. The agent also clearly explained the cost of the Repayment Option Plan, stating that “lt’s just £1.29 for every £100 of the outstanding balance on your statement each month. So if you had £100 balance on your statement it would cost £1,29 each month. After also being provided with details of the features of the product, you opted into the ROP, saying “yeah I’ll go for that, yeah”. The agent then reiterated that you had opted into the Plan and that it could be cancelled at any time.

We do not consider it to be necessary or appropriate to discuss with you what forbearance options might be available in advance of difficulties occurring. To discuss these options may incorrectly suggest that it was permissible to get in to arrears or otherwise breach your terms and conditions or that there would be no consequences if you did not repay your borrowing.

In line with ROP terms and conditions you have the right to a guaranteed account freeze on interest and repayments for up to 24 months, which is not available under standard forbearance. The ROP also covers a wider range of circumstances under which an account freeze can be activated, for example, attending Jury Service. A further important distinction is that Account Freeze under ROP results in your credit report being up to date whereas under standard forbearance we are obliged under the terms and conditions of the credit bureaux to report your arrears or defaults. The ROP therefore offers a real added benefit in terms of avoiding negative credit reporting.

As such, we do not think that there was any reason for you to think that the ROP would be treated differently to other card transactions for interest purposes. In the regular account statements sent to you the Plan has been itemised alongside all other purchase transactions. There is no requirement to breakdown that interest figure for each separate purchase, but in line with industry standard practice, it was shown as an aggregate amount.

The other issue raised in your complaint involves one of the features of the ROP, the Account Freeze, which provides customers who experience one of a set of “Difficult Financial Circumstances” with the option to freeze all interest and the ROP charges on the account for up to 24 months, during this time we will report the account as being up to date the credit reference agencies. You have suggested we would always consider freezing an account if you got in to financial difficulty. We do offer a number of forbearance options to customers in financial difficulty which complies with regulatory guidance to consider the type of forbearance that may be appropriate in the circumstances. However, it is not correct to say that vanquish is obliged to freeze accounts in the same way that the ROP provides for.

The ROP also provides other types of value above standard forbearance. In particular, it offered peace of mind and certainty about what would happen in the event that you got into financial difficulty, it allowed you to retain your card, and it ensured that you did not have to seek lending from any other, potentially higher interest, sources. Other features of ROP, such as payment holiday, are also available irrespective of whether there are any financial difficulty.

Sorry for the long pos

Phil says

Very similar to mine

Sara (Debt Camel) says

1) No one would pay the ROP fees (if they realised what the extra interest would add up to ) just for being able to take the odd month break in payments! The main thing being offered was the 2 year payments freeze.

2) “We do not consider it to be necessary or appropriate to discuss with you what forbearance options might be available in advance of difficulties occurring. ” by not doing this they made the ROP look like an important protection, when you could have got the biggest benefit without paying for it.

3) the “reporting as up to date with credit reference agency” may have sounded nice but for the vast majority of Vanquis users it is worthless. Most users already have a poor credit record, there is nothing to protect, And they also have other sorts of borrowing as well and if they are in difficulties they will be getting missed payments and defaults added there. keeping your Vanquis reporting clean in this situation really doesn’t help you at all.

Sara (Debt Camel) says

I think this is worth taking to the FOS. You were charged a VERY large amount of money for a facility with VERY little added benefit. The price quoted may have seemed low but the fact this is then treated as a purchase so you would be paying interest on it (and indeed more ROP the next month on the accumulated ROP) meant the actual cost was very high. And the main benefit – a 2 year interest freeze – was something you could have had for free if you were in difficulty, but this was never explained to you.

Spiralling Debt says

“Sara (Debt Camel) says

yes. not sure what you are arguing here?”

Arguing? asking a question where the answer points out the fact that the card, by there own admission (and Providents) (advertising) is a credit builder/repair card – meaning they already know full well there clients have poor credit ratings else they’d go elsewhere for better rates.

That in it’s self is something that must be highlighted in any response to Vanquis (or to the FOS) against the “reporting to credit agencies”

Sara (Debt Camel) says

the word “arguing” wasn’t meant to be negative – we are all discussing the arguments Vanquis has used, whether they are fair and what reasonable arguments customers may have to put to the FOS.

I am a great believer in keeping this simple in FOS complaints. It’s best to argue why YOU think you were missold something that appeared cheaper and more useful than it was. If your credit record was a pile of poo, you can mention this and say you had no need of the “credit record protection” benefit as there was nothing to protect.

But I see no point in making more complicated arguments about who Vanquis was marketing to and on what basis. Concentrate on how the card affected you because that is what the ombudsman will be interested in.

Spiralling Debt says

“We do not consider it to be necessary or appropriate to discuss with you what forbearance options might be available in advance of difficulties occurring” but instead we decided to talk you into purchasing a product knowing full well that there is no charge for forbearance.

“In line with ROP terms and conditions you have the right to a guaranteed account freeze on interest and repayments for up to 24 months, which is not available under standard forbearance.” nope standard forbearance is for the life of the product – if you’ve ended up losing a job due to ill health and then end up calming benefits for the rest of your life then the plan you enter into under forbearance lasts as long as your making the payments/circumstances change.

“The ROP therefore offers a real added benefit in terms of avoiding negative credit reporting” – check credit reports and see if you got flagged for missing payments and also if you had any charges applied to your account within the period of ROP as there is something in there that states no charges for a month every 3mths…

“We do not consider it to be necessary or appropriate to discuss with you what forbearance options might be available in advance of difficulties occurring” – they dont even do that after you’ve purchased – I’ve found out recently whilst trying to get assistance they just referred to the ROP as being the only way – very naughty…

FourMenHadADream says

Thanks for the comments guys I’ll forward it on to FOS

Wiggles says

Just had a letter through from Vanquis, they have upheld my complaint for the ROP. I took a card out on the 12th august 2011 and they have said that even though all points on there check list was met when listening to the call they feel not all of them were satisfied when discussing the plan,

£418.28 to be refunded by check and I will call them to get a certificate for the tax so i can claim that back at the end of this tax year

Win Win

£115.15 ROP fees

£231.13 Associated Interest

£24.00 Charges

£60.02 Notional Interest @ 8%

-£12.00 Tax Withheld

The ROP was taken out on the 12th Aug 2011 and i only ever had a £150 limit on it

Wiggles says

Got the cheque yesterday and paid it in today

Ross says

What I’m finding confusing is this; Vanquis state that they stuck to a set script on the sale of ROP, meaning that everyone must have been told the same when taking it out. Based on this, how can they uphold some complaints, but not others? Is it because some would be more costly to uphold and they’re choosing to uphold ones where the cost is minimal or is it to show the FOS/FCA that they’re being sympathetic (in certain cases, that is?).

Sara (Debt Camel) says

There isn’t much point in speculating about this. But even if there was a script it may not have been stuck to.

FourMenHadADream says

That would make sense with my case as I had calculated circa £900 in ROP alone however it’s difficult to speculate.

Adam says

Received my letter from Vanquis yesterday and they have upheld my complaint. They are refunding me £448.09 which will be shown on my next statement. Breakdown of refund below

Repayment Option Plan Fees – £300.08

Associated Interest – £75.89

Charges – £72.00

Notional Interest at 8% – £0.15

Withheld Tax Amount – £0.03

I’ve had ROP since Nov 2015 but didn’t use the card much until late 2016 when the balance quickly got up to £2000.

Thanks for your help Sara.

Burchell says

I have just had the same rejection letter, taken over six years ago and 3 years to complain, I had this cover on my account for over 5 years cannot remember credit limit, I have since called them as I thought as long as it was active within 6 years ago and to also advise that I did try to reclaim a few years back through a third party but was sent a letter to advise that I did not have any cover on my account but now I have a letter from them to prove that I did. I have been advised this information will be passed to the investigating officer and I will be contacted within 14 days but I am thinking they will still try to get out of paying somehow as I should imagine that having it for over 5 years would add up to a decent refund

Spiralling Debt says

The following is the agent on the ROP sale (Oct 2010) – Took Less than 2mins to go through all the details and my acceptance – she was very quick talker.

Agent:

“I would like to take this opportunity to tell you about our Repayment Option Plan.

This is an Optional feature that provides piece of mind in the event of financial difficulty, and might benefit you in the current economic climate.

If you do have the ROP the first thing it will allow you to do is freeze your account upto 2yrs

That would be if you were to experience financial difficulty such as becoming unemployed, sick disabled or an accident which effects ability to make your payments or you have to stay in hospital due to a medical condition

As well as this you can miss your monthly payment once every 6 mths any time you like, providing you have had your account for 6mths and it is in order.

Its ideal if your are having an expensive month for family birthdays or christmas for example.

Please be aware that interest continues to accrue on your account during this period.

All it costs is £1 and 29p for every £100 of your outstanding balance each month. If no balance on statement you are not charged anything but fully covered. So a £100 balance just costs £1.29

There is a full list of circumstances under which you can freeze your account. Which I can read to you now or in the confirmation letter if you would rather wait and read myself.”

Spiralling Debt says

The call confirmed that APR = 59.9%, Purchase = 47.89% & Variable Cash 53.95%

Notice no reference to any other part of the ROP (Lifeline/Payment Holiday) sold everything as part of the Payment Freeze – stated that it would only cost £1.29 per £100 no mention of purchase interest being applied – and I have only just noticed that it is not a true freeze of the account as “You will still accrue interest during this period”

Sara (Debt Camel) says

very interesting. I didn’t know that – I thought it was a true freeze on interest. That is even worse, because it means anyone asking for the 2 year ROP freeze is actually worse off than if they had simply said they were in financial difficulty and asked for interest to be frozen.

Matthew Davies says

Hi I found this page by luck earlier when I searched on Google to see what the repayment option plan was on my statement every month, I am relativley uneducated when it comes to credit cards etc and I thought the repayment option plan was something I had to pay every month, there’s approx £500 of rop fees in past 2 years. I’ve followed your advice and will update when I get a reply.. don’t want too get too exited but I really have no memory of anyone offering it to me as an option so prepared to fight it!!

Matthew Davies says

Had an apology email today for the delay in replying and my claim has been sent to the relevant department. They got until the 3rd of Jan now so ill just wait and see..

Matthew Davies says

It’s 55 days today and the suspense was killing me so I just called them, my complaint has been upheld and they put a letter in the post today, they are refunding £649. Until the letter arrives I don’t know the full breakdown but I did expect a little more so I’ll post the breakdown when it arrives to get your opinion.. either way it’s win win so I’m happy but if I’m owed more I’m happy to push on for it.. Thanks for your help

Matt

Darren says

This is my reply to my email asking to cancel the ROP and get a refund of all payments made. Should i ring them up now???

Dear DARREN Repayment Option Plan We are writing to remind you that you have previously opted in to Repayment Option Plan. Repayment Option Plan appears on your statement each month as a purchase transaction. In the last twelve months (or since you opted in to the Plan) you have been charged £389.03, plus any interest at your purchase rate of 39.94%. Based on your current balance of £383.02 and if you made only the minimum payments the cost for Repayment Option Plan including interest for the next 12 months would be £68.09. The Product Guide that appears below sets out the 5 features and ‘useful things you should know’ about each feature, including illustrative pricing and how to opt out:

Important things you should know

This is not a bill so you do not need to make any additional payments. If you are making payments through a payment arrangement this letter will not affect your arrangement and you will not be charged for the Repayment Option Plan for the duration of the arrangement.

Darren says

Just got off the phone to Vanquis ROP is cancelled and my claim of mis selling as gone to customer relations. The guy said could take up to 56 days but did I want a personal loan. PMSL

Jane G says

Just to let you know that I logged into my Vanquis account this morning to check my balance (because I was about to go ‘special’ shopping), to find a £603 credit to the account. Clearly they’ve paid out what looks like a full refund. I really couldn’t say because I’ve never been able to get a full record of what I paid. I could only estimate using calculations based on the few statements I can access, and I’d only estimated just over £300, so this was a bonus.

I actually emailed them yesterday because I hadn’t heard from them and the eight weeks is up and I was about to go to the ombudsman. I still haven’t received any notification or acknowledgement but they often seem to prefer to write rather than email.

I wouldn’t have had the guts or the determination to make the complaint before reading this website – so glad I did. I’ve also made some claims to payday lenders which are still going through but have already started to be successful. And because it was all so easy I even managed to claim back £15 that I’d been diddled out of by a company called CreditPerfect – they tricked me into signing up for a paid credit report service disguised as a loan broker/application. They weren’t going to refund me (“not our policy – never!”) so I complained to the ombudsman and now they’ve emailed to say the money will be back in my account within a few days. Result!!

So thank you very much, Sara. I’m recommending this site to everyone I know who has/has had debt issues.

gillian says

hi sara i have just gone through all my cedit card statements from last 6 yeas i had capital one luma vanquish marbels and found i was paying up to 72 pound a month in repayent potection over all these cards didnt even realise i had it thanks to your site now all paid off with payday intrest refund would it be worth asking fo refund of this as i didnt realise the true cost of this plus i didnt even know what it included eg it says it would only pay ten percent pe month of balance if you were to claim for 12 months if you lose your job not much good if you unemployed for more than that also the freeze intest bit did not realise they would prop do that anyway i often missed payments on these cards or went over limit when intrest and chargers were added so even more chargers added if you understand what i mean ty

Sara (Debt Camel) says

Vanquis – if you were paying for ROP definitely put in a complaint that you were mis-sold it. The fact you were in a payment plan and didn’t know about the ROP is good evidence!

For Capital One, Luma, Marbles, I think you may have been paying some form of PPI? If you were definitely put in a PPI complaint. MSE has a great page on how to do this: https://www.moneysavingexpert.com/reclaim/ppi-loan-insurance.

Now the cards are all paid off, any refunds come straight to you.

Spiralling Debt says

Sweet :) just logged into account to pay my agreed £5 pcm payment arrangement to see the balance (£288) now shows Zero with loads credits applied – will have to take a further look into what they are.

So I rang the customer support team and they said from the notes the complaint was upheld on Friday and the sum awarded is £1286.69.

He couldn’t give me a breakdown but a letter had been sent out with the full details.

(He then asked would I be interested in a loan lol)

I think the figure is about right but will have to wait for the breakdown.

Spiralling Debt says

Statement entries read:

12 Nov PRINCIPAL DEBIT ADJ £21.37

12 Nov PRINCIPAL CREDIT ADJ + £21.37

12 Nov PRINCIPAL DEBIT ADJ £104.86

12 Nov PRINCIPAL CREDIT ADJ + £68.86

12 Nov PRINCIPAL CREDIT ADJ + £12.00

12 Nov PRINCIPAL CREDIT ADJ + £24.00

10 Nov EXGRATIA PAYMENT + £288.81

Unsure why they’d credit the account only to reverse it.

Natalia says

I had a balance transfer on my card around 6 months ago so this card is at £0 but I just keep it incase of an emergency. I’ve had it since September 2012 and I took out ROP upon application not realising i would be charged interest on every month, also I was not told about forbeance… if I complain about this will they close my card down?

I’ve had balances up to £3500 from 2012-2017 and even called up around 2 years ago to have ROP remover when I paid the balance at the time in full was told I was best to keep it as my balance was £0…

Shall I go ahead and complain? I don’t want them to close my card, also will I be paid by cheque if accepted? Thanks!

Sara (Debt Camel) says

They won’t close the account if you complain.

If you don’t have a balance on your card, they will probably pay you by cheque, but that’s a guess. I suppose they could credit your card.

Natalia says

Thanks Sara, weirdly today I received the standard letter they’ve been sending to everyone reminding them about ROP and how much I paid this year. At a guess I think I’ll be owed around £1000. Email sent, let’s hope I get somewhere! Keep you updated

Adam says

Hi Sara

I recently received a refund from Vanquis for my ROP which reduced by balance from just short of £2000 to £1550. I had been around or over the credit limit of £2000 for the best part of 6 months. The week after I received the refund on the ROP, I received an email saying my credit limit was being increased from £2000 to £3000. I find this ridiculous as it’s clear that I was struggling financially.

Any recommendation?

Thanks

Adam

Sara (Debt Camel) says

I suppose a stupid computer system may have thought that you had just paid off some money!

What they have done doesn’t actually break any rules at the moment. The regulator is thinking of introducing an “opt in” system for credit card limits but at the moment it is “opt out”. You can contact Vanquis and tell them you don’t want the increase.

Spiralling Debt says

No letter as yet but I’ve just spoken to them and the break down is as follows:

ROP Fees: £182.46

Interest: £547.50

Charges: £432.00

Interest (8%): £155.91

Tax Withheld: -£31.18

Total Refund: £1286.89

Less Card Pmt: £288.81 (clears balance and they have confirmed they will also close the account)

Total to be refunded by cheque: £987.88 which will be with me within 28 days (MERRY CHRISTMAS :))

The ROP & Charges are about right to what I have from my SAR (dated 2015) but I am unsure on the interest part – it seems as if it’s just calculated on the ROP, where interest is applied to balance which includes charges?

I know I also have incurred charges after the cancellation period. I think I might have to spend a £10 and get an updated SAR & keep the complaint open a little longer…

Sara (Debt Camel) says

Thinking about this, even if you did pay the default charges immediately, there is a good argument that if the charges hadn’t been there you would have been able to pay more off the balance…

I suggest you ask Vanquis why the interest paid on the Charges was at 8% not the credit card rate of interest. I don’t think getting an SAR is going to help you here, you just need an answer to this questions before you decide what to do next.

Spiralling Debt says

I have the Agreement from a previous SAR and it states

“3.9 – We will only charge simple interest on Default Charges. We will not charge any interest on a Default Charge for 28 days starting from the date that we give you notice that the Default Charge has been charged to your Account.”

“3.14 Where you are not repaying the whole of the outstanding balance on your Account, your repayments to us will be credited to your Account in the following order: 3.14.1 Balance Transfer and Promotional Rate Transactions; 3.14.2 Interest/minimum finance charge, fees and/or Default Charges; 3.14.3 Purchase Transactions; 3.14.4 Cheque Transactions; 3.14.5 Cash Transactions”

By that I’m thinking that no interest has been applied to the Charges or the default charge interest has been repaid. and that the Interest at 8% is the Statutory interest applied?

Chris Jubert says

I sent my complaint about ROP on October the 24th, and I’ve had two letters communicating that first of all, my complaint has been received, and secondly, they’ve stopped my ROP altogether. Fingers crossed that cancelling the ROP is an admission that it was mis-sold in the first place! I will update as soon as I receive anything else.

Natalia says

Hi Chris, this is where I’m at now too! Just received the second letter to say ROP has been cancelled without me asking for it to be! Fingers crossed,

Keep us updated!

Chris Jubert says

Hey Natalia,

So I finally received my letter from Vanquis, but unfortunately, they aren’t going to uphold my complaint. They believe that ROP was well explained to me on the phone, and that by agreeing to it, they can’t uphold my complaint as “I am (they are) satisfied that the plan was correctly applied and charged to your account upon your consent.”

I guess the next stage is the financial ombudsman, but I’m really not sure how successful I’ll be, as I always felt as though I was chancing my arm here anyway!

Sara (Debt Camel) says

You can still win the complaint if it “was well explained to you” because what they will NOT have said on the phone is that if you are in financial trouble they will consider freezing interest anyway, regardless of whether you pay for the ROP or not. If they had said that to you, you would probably have decided not to pay for the ROP!

So send the case to the ombudsman and also ask Vanquis for a copy of the telephone call, but don’t delay sending the case to the ombudsman while waiting for a copy of the call as it can be a very long while.

Clevercookie says

Hi Everyone,

I have as of today gone thought 40 days of waiting, I was wondering if anyone had heard from Vanquis before the allocated 56 days, I had my card from around 2012/13 and ended up with a limit of 2500 by the time I closed it mid last year

Waiting to hear the outcome…..

GMA says

Hi, they took the full 56 days to reply, they do respond quite quickly when I have queried but they just say that they have 56 days so no point really, just be patient. Have had my card since 2015, credit limit is now £3’500, never missed a payment or gone over the limit, cancelled my ROP in September and got turned down the refund 56 days later. I have requested a copy of ‘the call’ where they sold me it, that was 13 days ago, chased yesterday and was told by reply that it can take 14 days to get it copied onto cd and then it would be posted out by recorded delivery.

Abdulai says

Hi, I had Vanquis card and for 6 months I kept the payments in order and then I lost my job and they ask me for proof of it but at that moment I was going thru such a terrible time as a father that couldn’t provide I failed to send them the proof that they wanted so they kept add on interest every month,so that was having such big impact in my credit score so I decided to come to an partial agreement and paid them 436.67 in September 15, can I ask for refund as I wasn’t aware of top?

Sara (Debt Camel) says

You paid them 436 in settlement of a larger debt? How much larger?

Kk says

Got email from F.O 3 days ago saying they will contact me within 4 weeks on how they can help me . I have requested a recording of my call also . Vanquis finally sent me a list of payments I made to them over last 18 months. Totally £101.00 but no mention of interest etc . Just plainly rejected my claim . Let’s hope for progress with FO

Ross says

Just received an email, from an investigator at the FOS, advising that she cannot agree with my complaint about the credit limit increases and has sided with Vanquis. However, she has made no reference to my complaint about the ROP product, so I have just emailed back, asking for clarification on what’s happening with the ROP element of the complaint. I’m hoping that this part of the complaint is still being looked at, although I am concerned that the response to the credit limit complaint response doesn’t mention anything about the ROP complaint as in ‘However, your ROP element is still being looked in to’. I shall await a response back from the investigator and let you know.

Anna says

Just leaving an update. I have email Vanquis complaining of ROP on 25th October. On 4th November I received a letter stating that they’re upholding my complaint. they refunded interest and charges applied to my account since February 2011.

Repayment Option Plan fees £94.49

Associated interest- £79.48

charges- £144.00

Notional interest at 8% – £3.87

My account has been closed years ago so they said they would send a cheque for £321.07 within 28 working days. The cheque arrived yesterday. Very quick process for me.

Donna says

Hi Anna

Did you use the above template or what did you say in your email?

Anna says

Hi sorry for late reply. I used the template without basically any details. Just basic stuff. Date on my letter confirming refund for 28 th November .

Alfie says

I am looking for some advice.

I have come across an old statement from Vanquis that says that I have a repayment option plan. I took out the card in 2009. I defaulted on this account in 2015. The whole time I had the ROP and this never came into action. I have been paying a sum every month since to a debt collection agency. Do you think I would be able to claim back the ROP?

Sara (Debt Camel) says

I think you have a good complaint that they should have told you that you had the ROP when you defaulted as you may have been able to claim. Ask for a refund of the ROP you paid.

Alfie says

Well the complaint has gone, let see what happens

Beaconsman says

Good Morning all, I have been following this thread and on 15th Nov 2017, wrote to Vanquis for reclaiming of the ROP charges. Account was in default but partially settled according to experian and noddle. Wrote to ? also asking for the original default entry to be removed as it is imo, false and inaccurate. Had the standard 56 days letter reply form vanquis dated 15th Nov 2017 so my date is 9th January 2018. Total charges apprise (ROP) approx £170. Separate letter sent regarding the default charges. See how we go. Account started in 2012 ish, have an SAR from ? and full statements from vanquis so I can easily tot up the charges,,,

Spiralling Debt says

Don’t forget the default charge interest fee. 96p per charge.

Phil says

We’ll that’s bizarre, Vanquis have sent me the recording of a call were I have rejected the ROP. They asked me twice if I want it and then ask what’s the reason to me not wanting it, this is when I have a balance of zero and have just activated the card. Also, they dont even mention that i would be paying interest on the ROP. They stated in my rejection letter that I said “oh go on then” ??? Confusing

Sara (Debt Camel) says

Confusing? That sounds like an excellent case for a refund to me! I suggest you call Vanquis up and point this out and say the case is going to the Ombudsman unless they make you a good offer within a week and you will be asking for additional compensation from the Ombudsman as their reply to your complaint was very inaccurate.

Obviously everyone who had their complaint rejected has to ask for a recording!

GMA says

I had a call on Friday as their 14 days was up to provide it (her words) she said they had been inundated and that she would personally chase today (Monday 20/11/2017) and that she would also send me the password to get in to the recording.

Phil says

They sent me two discs one I couldn’t get into, the other was the recording of when I activated my card but still trying to sell me the ROP.

Phil says

Hi Sara, sent an email to Vanquis last Monday an they have not replied. So all details have been sent to the Financial Obudsman and I’m seeking additional compensation for there inaccurate response. I’m surprised they never responded to my email considering they have messed up.

Eve says

Hi Phil

I’ve just received my calls on disk and because the file is encrypted it is asking for a passcode. I don’t have a passcode and there is no code in the letter that came with it. Did you have to phone Vanquis and request a code? I’m unable to listen to the calls until I can get into the file unfortunately.

Phil says

Hi Eve, it was a while when I last listened to the calls and I have sent them all to the ombudsman but I do remember you need windows media for a start then the passcode which is normally your complaint number. You have to choose a drive were you would like to store it which normally is your c drive.

Clevercookie says

Hi I called Vanquish today and they said I have 6 days left, I asked them if they had any news and said they would email the resolver now and I should know within the next few days…has anyone else had this? He didn’t tell me either way if it had been upheld or not just said due to ROP workings it takes a while. Feeling like it might get rejected but fingers crossed. Will update soon!

Ross says

Disappointing news from me. The FOS have been in contact, to advise that they CAN’T investigate my complaint, as I first took out the ROP in 2008 and that it doesn’t fit in with the 6+3 year rule. I thought I would’ve been OK, as the account was closed in October 2011, but it turns out it’s when you FIRST take out the product that matters and not when it ended. I suppose Vanquis knew this would be the case and the fact that they rejected my complaint, knowing it would fall foul of the timescales. Ah well, you win some, you lose some. It was worth a try I suppose?

Alfie says

I have just sent a complaint to Vanquis I took mine out in Aug 2009, hopefully I will just fit the 6+3 fingers crossed!

Sara (Debt Camel) says

This is probably a misunderstanding of the “6+3” rule – I don’t like that term, it’s misleading.

I think Ross is being told that he took the product more than 6 years ago and that’s what counts.

Brizoh71 says

I’ve just gone back to FOS for the same; Vanquis rejected my complaint and stated the 6+3 rule.

I took my Vanquis card out in October 2008; but I complained to Vanquis in September this year, so I just fall inside the 6+3 threshold. As Provident only released that FCA were investigating ROP I had no previous reason to suspect that I might have a claim before then as it isn’t a PPI policy.

Fingers crossed.

Sara (Debt Camel) says

Sorry i wasn’t clear. the reason i don’t like the term 6 + 3 is that you can’t add 6 and 3 together and think you have to complain in 9 years. They are two different tests. The standard test is 6 years. If you are outside that, then you have to argue that you are an exception and that you are complaining within 3 years of knowing that you could complain… this could be if the original problem was in 2007, that wouldn’t matter if the ombudsman agreed you should be treated as an exception.

The bad news is that exceptions are incredibly rare, apart from payday loans. You can argue for why you should be an exception and that you had no idea you could complain until a few months ago, but I don’t want to give you the impression this will be simple. And there is no point in saying you come in under 6+3=9 years as that test simply doesn’t exist.

L says

I have not yet received a response from Vanquis regarding my complaint and the 56 days was up on Saturday 18th of November. I will be forwarding my complaint to FOS.

However, I made a complaint on behalf of my mother on the 23rd of October regarding ROP and today she received a letter confirming the complaint is being upheld.

ROP fees – £508.00

Associated Interest – £530.59

Charges – £12.00

Notional Interest at 8% – £51.41

Withheld Tax Amount -£10.28

Total Refund: £1,091.72

I am so pleased I stumbled upon this page. Thank you so much Sara, this refund will help my Mum massively.

Spiralling Debt says

Vanquis has stated that they are not at able to issue a full breakdown of how the refund figures are calculated until they are double checked by the team that issued them, the time frame that they have for this is an additional 18 days (vanquis version of 2 weeks) from the point of request.

Where charges have been refunded it does not include the Default Charge Interest Fee of 96p per charge & it’s additional interest – this appears on your statement as either Default Charge Interest Fee OR Billed Financial Charge.

Conic says

Hi debtcamel,

I took out a vanquis visa in late 2008. And ROP was sold to me, without being explained clearly to me.

I experienced difficulties in 2013 and defaulted on the account (total £3060). I am now paying it back to a collection agency.

I never claimed any ROP as I didn’t understand what it was for.

Total ROP paid by myself was £861

I have written to vanquis asking for a refund, although I notice all claims before 2011 are being rejected.

Any advice?

Thanks

Sara (Debt Camel) says

I think the fact they knew you were in difficulty but never suggested that the ROP could help makes this a complaint that is worth pursuing to the Ombudsman if Vanquis reject it. It’s not just that they misssold it over 6 years ago, within 6 years they did not treat you fairly by letting you know about the ROP.

Conic says

Thanks for your response Sara. I shall post the reply from vanquis to the forum

Valentina davies says

I have just e-mailed vanquis using the template provided.

I got the card in 2015, I remember applying online so not sure if I spoke to them on the phone..it was a very low point in my life at the time so everything is just a blur..

PhilD says

I emailed Vanquis on the 10th November, at the moment i’ve not had a response to my email, is it worth calling them ? I took out the card in 2012, I am self employed so seems the ROP was not suitable for me anyhow, is that correct ? thanks

PhilD says

Had a letter today saying my complaint has been registered for investigation, this was dated 16th Nov so I will phone on Monday for update

Darren says

Got exact same myself today letter dated as 15th Nov and they have 56 days to respond. But will try to sort it sooner.

Mohammed says

I have had a Vanquis card since about 2012 and took out ROP not long after getting the card. I remember the phone call I took where they explained what ROP is and sold it to me. I actually took the time to ask lots of questions but still decided to go with it.

I tried my luck after reading this forum but wasn’t very hopeful based on the conversation I remember having. I called them last week Monday for an update as they were due to reach their 56 day limit on the Friday just gone. I completely forgot about it (until just now) and decided to login in to my online account and I have received an exgratia payment £1,255.42 which I’m delighted with. I’d have liked a bit more but haven’t we all. My balance has usually been between £2-3k, although I was able to clear it a few times. I look forward to receiving details of the full breakdown.

I have actually taken advantage of some of the benefits of the ROP too so all in all, it’s been a good result for me. Now time to clear the rest of my balance (fingers crossed) and throw away the card for good!

Thank you Sara for all your advice :)

Angela Bohea says

I emailed Vanquis on 9th November about ROP paid and have had no acknowledgement at all – has anyone else had this problem?

Dean Unsworth says

I emailed on 14th November and have rung twice, was told a letter was sent out to me on 20th which I’ve still not received

Sara (Debt Camel) says

If it hasn’t turned up by Monday, ask them to send /email you another one.

Waytogowoman says

Hi I also sent my email on the 14th November and was wondering when I’d hear from them. I received an email this morning apologising for the delay and that I am now into the 14th day of my investigation period and they have 56 days in total to respond fully.I also received my letter this morning. You should hear something soon…

Angela Bohea says

I have had an email today saying they have received my complaint however, looking at the posts I don’t think I will have any luck as mine dates back to 2008. I was self employed at the time – will this make any difference as I don’t think the policy applied to self employed people? I did write to them in 2012 when I was applying for PPI refunds and they sent the standard ‘this is rop not ppi’ letter

Sara (Debt Camel) says

Do you remember if their reply to your “PPI refund” told you that you could take your complaint to the Financial Ombudsman?

Angela says

Hi Sara, I cannot remember although I may have the letter somewhere. Would it make a difference?

Sara (Debt Camel) says

If they didn’t tell you had the right to go to the FOS, you could ask the FOS to look at that complaint now, even though more than 6 months has passed. If they did tell you, then I suspect the FOS will now not look at a complaint.

Also if Vanquis just rejected your PPI complaint on the grounds ROP was not PPI, you could argue that they misled you and should have considered your underlying issue which was that ROP was missold. It will help if you can find that letter!

The Winklepicker says

Following a letter I received from Vanquis in October 2017 about the ROP I had paid in the last year (didn’t even know this was optional) I cancelled my ROP by telephone yesterday afternoon and have emailed my refund request this evening using your template.

I have had my card since mid 2015 with a current balance of £3k. My ROP has been around £40 a month so not a small amount!

Having read all the threads above, I am keeping my fingers crossed for a full refund!

I applied for my card online and then had to ring to active it. It seems to be at this point the ROP has been added but I genuinely cant recall agreeing to it.

Will keep you informed.

Many thanks for your valued advice.

Waytogowoman says

Hi I sent Vanquis an email on the 14th of November and hadn’t received an acknowledgement by the 22nd so emailed asking them to confirm receipt of email. No response. So rang them later in the afternoon and spoke to an advisor who said they received my email on the 19th (?) and had sent a letter on the 20th. She told me my ROP had been cancelled, even though I hadn’t requested it be cancelled – was primarily asking for an investigation and a potential refund. I haven’t received a letter yet (25th) but was wondering if anyone else had their ROP cancelled and then to have their comp!aint upheld? Seems to be little consistency between those whose complaints are upheld and those who are being rejected.

Thanks for all the info and posts – is very helpful to read the experiences of others.

Pete says

I got my Vanquis card around 2014/2015, and have been in the ROP since that point. I now have a balance of £3500 and have been around that since the start of this year. I have been paying around £45 a month+ for this service and didn’t really know the extent of these payments until I received the email from them a few weeks ago. I have since rung and cancelled the plan, but have now written an email complain. Not sure when I will received a reply but keeping my fingers crossed. Been trying to get my balance reduced for what seems like forever and the ROP has done the opposite of what it was meant to do, and hasn’t helped at all. Keeping my fingers crossed and has helped to read the experiences of others.

Sara (Debt Camel) says

“the ROP has done the opposite of what it was meant to do, and hasn’t helped at all” … that says it all.

The fact you tried to ask for the account freeze and was rejected should help your case if you were given a misleading description of the ROP at the beginning. eg if it sounded easy to ask for the freeze if you were in difficulty and you weren’t told that you had to send in proof that you had lost your job.

Also were you told you could cancel the ROP when they said you couldn’t claim? Some people haven’t realised that they could and Vanquis don’t seem to point this out to people :(

Pete says

I don’t remember being told I could cancel the ROP when I rang up to ask about the account freeze. I will send them a follow up email now to add to the one I’ve already sent.

Waytogowoman says

Hi Yes …I know how you feel. I wrote this in my complaint:

‘However, it seems to me now, that the very product which was designed to ‘insure’ against unforeseen financial difficulties is also the very thing causing the greatest financial and emotional distress……I feel as if I am fighting a losing battle’

In other words, I can’t chip away at the balance each month because ‘minimum payment + interest+ ROP + interest….’ ..eternal cycle.

Vanquis informed me during my follow-up call wrt email complaint that they had cancelled the ROP automatically

Pete says

I also forgot to mention, last year, I rang up to ask about using one of the “benefits” and wanted t freeze my account. I told the person on the phone that I was struggling to pay the money back and asked about the account freeze. I was told I would be unable to use that service unless I had lost my job etc, so they ended up doing nothing and I continued struggling and paying the fee’s. Will this help my case?

Spiralling Debt says

Yes. Because one of the options available is a payment holiday. You should have been offered that instead, until you could get proof of financial hardship (which does not necessarily mean losing a job – see their t&c’s)

Spiralling Debt says

Cheque received today. Cheque dated 12/11/2017.

I’ve been speaking to them relating to the information on charges & they are forwarding all statements for my account.

Think I might see if I can go after All Charges on account as some months I received £48 charges due to it being a 5wk month.

Alfie says

I wondering if anyone can help. I have logged a complaint with vanquis regarding ROP. I currently pay Robinson Way as I could not keep up with repayments and the ROP was no help! Today Robinson Way have told me that my account is on hold for 30 days as requested by vanquis while they investigate. Is is this normal practice?

Sara (Debt Camel) says

if a debt is in dispute you shouldn’t be taken to court over it. Sometimes people carry on with arrangements to pay, sometimes not.

Lenny says

I took the card out in 2012 and only cancelled my ROP June 2017, I have had no outstanding balance since May 2017, I still have the card. I complained 52 days ago and today received a letter saying they were upholding my complaint, even though I agreed to having ROP the advice was not accurate, clear and explained In full.

Full refund of all my ROP payments and associated interests has been given.

Many thanks for all the advice on here, much appreciated.

Darren says

I’ve more or less told them the same thing in my phone call to them a fortnight ago and have had for similar amount of time as you. Hope I get same result.

Matthew says

Hi all

Received a letter today stating my complaint is upheld! They listened to the ROP call from June 2012 and agreed that it was mis-sold to me. I had used a template from this website (many thanks).

They have offered me £4272.69 (cheque as the account was closed a few months ago thanks to a windfall)

Breakdown as follows:

ROP fees £1821.24

Associated Interest £2175.70

Charges £180.00

Notional Interest at 8% £119.69

Withheld tax amount £23.93

I had the card for about 5 years, building up to a £3500 limit. The ROP fees sound correct but I have no idea how the interest is calculated.

I have no plans to ever have a credit card again. To everyone else – don’t give up, and thanks for the information sharing.

K says

Hi, my complaint is nearly up. 54 days in and heard nothing. Just checked my account online and still the same. I am assuming it has been rejected and I will receive a rejection letter either tomorrow or Tuesday. Has anyone been lucky and had their complaint upheld right at the last minute?

K says

Day 55 and still waiting. What do I do if it goes over 56 days?

Deano says

Hi, My complaint reached 55 days literally yesterday, so I rang vanquis directly and they advised they wouldn’t let it run past the 56day deadline, the next day I received an email they had upheld my complaint,completely wiped the balance of around £330 owing on the card and have sent a cheque of £40 out in the post.

Give them a call 0345 612 2602

Thanks to Sara an the help on this site iv reclaimed from various lenders, just awaiting the Wonga + 6 one now

Darren says

Was this product also sold around 2005-2007?

About 4 years ago I performed multiple PPI claims to everyone who I’d borrowed from who had sold me insurance. Vanquis were one of these, but quickly responded that their product wasn’t PPI so therefore my complaint wasn’t valid. However, the description sounds very similar.

I’m conscious of the fact that they gave me a final response back then, however it would appear that their response was misleading – it’s a product that was mis-sold yet they refused to consider it under the same rules. I’m also aware it’s well over 6 years old, but when the PPI complaints were made I was able to successfully claim from RBS and Barclays for loans/credit cards from the early 1990s so I’m willing to push this if necessary.

Looks like I’m going to have to go up in the loft to find these statements again.

KT says

55 days today, I rang them and said it should be resolved by tomorrow and I will get a letter next week?

K says

57 days for me. I rang yesterday and was told my complaint had been upheld but were unable to give me any details. I was just told I would receive a letter. Just checked my account online and no changes!? Confused.

amanda says

hello could anyone help me. I got my card about 3 years ago and I didnt really know what this rop was for. I am now finding it harder to of my balance of each month. it’s not even making it go down with interest altogether is like 80 and wondered if i could get a refund of my rop. I’ve always wondered wot it was. please could anyone help me. thank you amanda

Sara (Debt Camel) says

If you don’t know what it is, the chances are it wasn’t explained properly to you when you took it out! It is very expensive and pretty useless, it’s benefit is letting you have a freeze ion interest payments if you get sick or lose your job… but actually you can get a freeze on interest if you are in big financial trouble anyway even if you don’t pay for this ROP.

So read the article above and send them a complaint about it, asking for a refund. Also tell them to cancel it, that will save you a lot every month.

Paul King says

Hi,

I came accorss this feed and checked my statement and saw ROP, I called them to ask what it was and they kindly explained it to me. I have obvisouly cancelled it because I wouldnt have agreed to pay for something that effectively does nothing! They told me I opened my account in Feb 2008 and I have said to them I would liek to complain as I dont feel that I would have agreed to this as it is not insurance. They cancelled it as of today, can I claim back a refund of the last 8/9 years plus interest?

Sara (Debt Camel) says

Unfortunately they will probably reject your complaint as you opened the account over 6 years ago.

Have you ever had any problems paying them that they were aware of? Spoken to them about late or missed payments?

David Varley says

I e-mailed Vanquis on 3 November advising them that I felt that I’d been mis-sold ROP (as per the template e-mail on here) and asking that the ROP be cancelled with immediate effect.

I received my latest statement this morning and ROP was still being charged, so telephoned Customer Services. They have now cancelled the ROP but said that there was no sign that they’d received my e-mail of 3 November.

I told them that I stll wanted to persue a claim for ROP being mis-sold and they have said that they’ll look into it.

Am I right in thinking that the 56 days for them to respond starts on the date I first e-mailed them regardless of whether they’ve received it or not?

Thanks,

David

Sara (Debt Camel) says

yes that is right.

Katie says

Hi Sara,

Do you think these figures look right?

I had the card from oct 2012

ROP Fees 176.54

Asscociated intrest: 155.47

Charges – 60.00

norional intrest 8% 64.71

Total back was £443.78

Claim made 56 days today!

Sara (Debt Camel) says

The ROP fees look pretty low … if you have been paying ROP for 5 years, that’s less than £3 a month… Were you sent a letter recently saying how much ROP you had paid in the last year?

John says

Hi, first of all thank you for this website. After stumbling upon this site it has helped me with a couple of complaints I didn’t even know I could make. Your time and efforts a greatly appreciated!

My Vanquis complaint has been rejected as it was taken out over 6 years ago (12/2010) so I’ve taken it to the FOS saying that seeing as it wasn’t announced until 08/2017 there’s no way I’d have known it was mis-sold to make a complaint within the allowed 6years, so hopefully they can investigate further.

However on the rejection letter from Vanquis, it says they sent out a booklet explaining my right to cancel at any time and that it was always shown on my statements as a purchase. Is that standard on all the rejection letters or do you think that’ll be their excuse to get out of it?

It was definitely mis-sold as I remember feeling pressured into taking out the ROP and they definitely didn’t tell me I’d be paying interest on it…

Sara (Debt Camel) says

My guess is they have a standard letter they send out to everyone who took the ROP out more than 6 years ago.

darren says

hi

i sent a letter complaining about my rop on 14th nov, said id like to cancel and requsted a full refund, i recieved a letter today saying the rop has been cancelled, but nothing else…

it did say if i had anymore questions to call!! what is my next move plz, thanks…..

Sara (Debt Camel) says

It’s unlikely that they think this is the answer to your complaint, they are probably still looking at it, but to be sure you could call them and check this.

darren says

thx…. will give them a call, someone told me to ask for the transcript of our call as i cant remember agreeing to this, is this a good idea, or just let them do the investigation?

Sara (Debt Camel) says

I would just let them investigate, and if they don’t give you a refund ask for the transcript at that point.

Jen Cordiner says

I had the same response from vanquis and heard no further. I just want to thank this website. I used the template letter and today logged in to vanquis to see that I have been awarded £1811.53 exgratia payment on my account. Please give it a go because I had no idea I had been refunded. And it seems it works!

gemma says

Hi

Thanks for the information on this page, very helpful. Ive had 2 accounts with Vanquis both with ROP. Ive used Resolver to submit my complaint using the template. Ive also managed to provide details from noddle of the account. I did use the account freeze last year. But it has been on my account since 2012. My first account was around 2006/7/8 so not holding my breath for that one. I work in PPi complaints myself for a high street banking group and we send letter templates out so that will be why peoples letters will be the same as i dont think they will often free style write a letter. (it would need singing off etc) We uphold complaints that go way back further than the 6 years so not sure why they cant either.

Jen Cordiner says

I just want to thank this website. I used the template letter and today logged in to vanquis to see that I have been awarded £1811.53 exgratia payment on my account. Please give it a go because I had no idea I had been refunded. And it seems it works!

amanda says

hello how do i go about cancelling my rop because I’ve been paying it on top of my interest and my account dont seem to be going down at all? thank you

Sara (Debt Camel) says

Phone them up and say you want to cancel it! BUT also read the article above and think about asking for a refund – not only is it very expensive – as you have found out it makes it a lot harder to get your card balance to fall if you are paying this – but it is also unnecessary as Vanquis would have had to look at freezing your interest if you got into financial problems anyway. SO it wasn’t worth paying for at all for most people.

john says

Yay thanks. So much for this page i won my complaint got. 320 refund. As i had paid card in full that 320 might be only little but still 320quid nice before Xmas thanks for all the info

Andy Isaacs says

Thank you for this article!

I received a response on the 22 November wherein they said I was getting nearly £3k refunded.

My balance has been cleared, the account closed and the remaining amount has been sent in a cheque – although I have yet to receive this. They said 28 days but I was hoping it might arrive sooner.

Steve says

Many thanks to this website. Checked my account today and found large refund after 56 days . I used the template letter on this site. Many thanks again .

Simon says

Guys, I recently received over £2500 from Vanquis after complaining that I was miss sold ROP. It took around 5 weeks from the initial complaint to the time they refunded me.

Richard says

Hi Simon,

any indication of what your card balance was over the period you complained about so as to deduce the sort of amounts of ROP you were trying to reclaim? also how long was the claim for?

Simon says

Hi Richard,

I had the card around 5 years and was often close to my 3k limit if that helps. I found on my Experian credit report it showed me my exact balance per month since I had the card so Ibwas able to calculate how much they owed me. I was actually with a few pounds. ????????

Wes says

Hey,

Just an update on Vanquis ROP complaint.

I complained around the 11th October. Received the standard letter saying they had 56 days to investigate and was taking longer than usual.

8 weeks was up on the 5th December – hadn’t heard by the 8/9th so gavethem a call.

Turns out I’m being refunded a total of £1400 or there about. I’ve still not received confirmation of this through the post, think things are delayed with the snow/weather so not jumping for joy to quick, but just wanted to say thanks Sara!

Hadn’t even realised that i had ROP on my Vanquis card so quite a nice shock!

Darren says

Received a letter from Vanquis today saying that they were still investigating my complaint dated Nov 9th and that they wanted to remind me that they had 56 days to come back with an answer. If they were going to take longer than 56 days they will contact me with further instructions of what I should do???? Any ideas what they mean????

Sara (Debt Camel) says

Their “instructions” are likely to be “Sorry but we are still looking into your complaint, you have the right to take your complaint to the ombudsman now if you wish.”

I think that is a standard letter, I wouldn’t try to read anything more into it.

Keith says

I can only advise to stick with it and take note of all the excellent advice being shared on here. I eventually got a refund of well over £4000.

Jane says

They didn’t uphold complaint and sent out a letter Thursday which haven’t received yet. So when I get letter, hello ombudsman. I am not happy at all as I know this was mis sold. They’ve lost customer as I am going to pay this off and cancel card.

Sara (Debt Camel) says

Did they give a reason – possibly this will be in the letter. Have you asked for a transcript of the phone call?

It should be possible to win this complaint at the Ombudsman whatever was said in the call, because you would not have been told that Vanquis will consider freezing interest for any customer who is in financial difficulty… and if you had been told that you probably wouldn’t have decided to take the ROP.

But it’s worth asking for the transcript because one person was sent a transcript which showed that he had said he didn’t want the ROP! So their response to his complaint was just wrong. So I suggest putting in a complaint to the Ombudsman saying that ROP was missold and asking for the transcript at the same time. If the transcript turns up anything useful, you can then add that to your Ombudsman complaint.

Jane says

When they sold it to me, they never told me that they would only consider freezing it. They never told me that I would need to put in evidence every three months to be able to freeze card. I am on disability and they knew that and sold it to me but the insurance is only really useful if you become disabled. I’ll call once I get letter to ask for transcript. Never gave reason over phone for it being turned down just that I knew everything when they sold it. When they sell it, they make it sound like it gives you all the control over card. It doesn’t!