UPDATE: 27 February 2018 – Victory! Vanquis is made by the FCA, its regulator, to offer refunds of the additional interest charged to all cardholders who have had ROP.

UPFATE: 2 August 2018 – Well only a partial victory :( The refunds Vanquis is actually paying out are a lot smaller than they should be. Read Why the ROP refunds are too small and how to complain.

I am leaving this old article here as a lot of readers commented on it.

Vanquis Bank’s Repayment Option Plan (ROP) for its credit cards is being investigated by the regulator, the Financial Conduct Authority (FCA). This was announced by Provident, who own Vanquis, on 22nd August 2017.

This article looks at whether you should cancel this ROP if you are still paying for it and complain and ask for a refund of ROP. The details of one refund are shown – you may get a large amount back because you also get a refund of all the interest that was charged on your ROP fees.

Many readers have got hundreds or even thousands back, see all the comments below.

What is the ROP and why is the FCA looking at it?

Vanquis’s ROP is a bit like insurance, offering some features that could help if you have difficulty with repayments to the credit card.

The main feature is an “account freeze” if you get into financial difficulty: no payments needed, no interest being added and your credit record is protected. You can’t just ask for a freeze, you have to supply evidence eg that you have lost your job, send an income and expenditure sheet etc

There are also some other short-term options if you miss a payment or want to miss a month’s payment, but the ROP would be a VERY expensive way to get these minor benefits. The “no impact on your credit rating” feature may sound nice, but it’s not worth much unless your credit rating was actually good. People with a credit rating worth protecting don’t usually have a Vanquis card at all!

The cost – £1.29 per £100 outstanding – may not sound high. But that monthly charge adds up to a lot over the year.

The ROP charge is also treated as a purchase on your Vanquis card, so unless you repay the whole balance every month, the next month you will be paying interest on the previous months ROP charges.

If you only repay the minimum amount and you are having ROP charge added, your balance is hardly going to drop at all.

What are the FCA concerns likely to be?

The Provident announcement said:

The FCA indicated that it has concerns about the ROP product and is investigating the period from 1 April 2014 to 19 April 2016. Vanquis Bank agreed with the FCA to enter into a voluntary requirement to suspend all new sales of the ROP in April 2016 and to conduct a customer contact exercise, which has now been completed.

That’s the only public information – the rest of this is my speculation.

The FCA’s main objection is probably the fact that Vanquis are charging for this account freeze, which is something they should be offering to all customers in difficulty without any charge. FCA rules (CONC 7.3.4) say:

A firm must treat customers in default or in arrears difficulties with forbearance and due consideration.

“Forbearance” in this sort of situation often involves freezing interest. So the FCA rule means that all customers may have their interest frozen when they are in difficulties.

If Vanquis didn’t explain this to customers when it was selling them the ROP, this may well have been misleading and the product may have been mis-sold.

Why only from 2014 to 2016?

The FCA’s investigation starts from 2014, when the FCA took over regulating this sort of debt.

But the previous regulator, the OFT, had very similar wording. It described failing to treat borrowers in default or arrears difficulties with forbearance as an unsatisfactory business procedure, and said creditors should consider reducing or stopping interest and charges when a borrower evidences that he is in financial difficulty.

So although the FCA isn’t looking at older cases, this suggests that the customers who paid for the ROP before 2014 were not fairly treated either so they too can complain.

How much could a refund be?

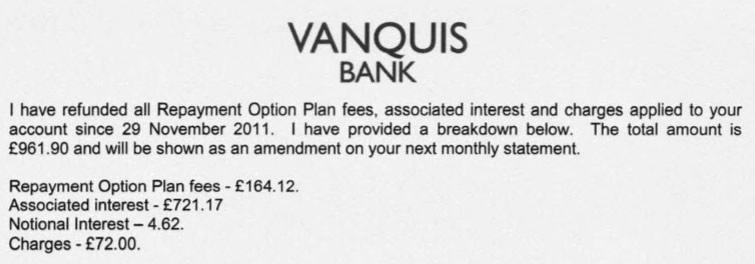

One Debt Camel reader, Mr N, complained to Vanquis about the ROP earlier this year. This is the refund he was given:

He only had the ROP for a short period in 2011/12 so the ROP fees weren’t high. But look at the extra interest that was refunded – £720 – wow!

This is high because Mr N didn’t repay his card balance in full every month. Paying for the ROP meant he was paying less off the balance on the card. He was effectively paying 39% interest on his ROP payments for nearly 5 years and that is what he is being compensated for.

How did Mr N get that refund from Vanquis?

Mr N complained that he felt he had been pressured into signing up to the ROP which wasn’t right for him. Vanquis listened to the phone call from 2011 when he signed up to the ROP to check that certain points had been properly explained to him. The investigator concluded:

although you did accept the repayment option Plan as a feature of your account, I do not feel all these points were satisfied when discussing the plan with you.

What should you do now?

Cancel the ROP?

It’s always hard to suggest that people should cancel insurance, however ridiculously over-priced it is. You might cancel the ROP and then lose your job next month… But the regulator’s rules mean that if you do get into difficulty, you can ask Vanquis to freeze interest on your account, see What to do if you can’t pay a bill this month.

You have to think about the cost of the ROP. Not the headline £1.29 a month per £100 charge… look at what the true cost to Mr N was for his ROP product. Paying ROP makes it much harder to get your Vanquis balance to drop as so much of your monthly payment is eaten up by the ROP charge, so you are actually more likely to end up in financial difficulty!

There may be hundreds of thousands of people who still have ROP on their Vanquis cards. I think they should all be seriously considering cancelling it!

Complain about it? (this was written before the FCA’s decision in February 2018)

If you took out the ROP after April 2014, your case will be among those being looked at by the FCA. You could decide to wait and see if you get awarded any automatic compensation. But if you have financial problems at the moment, you may want to ask for a refund now as there is no indication how long the FCA investigation may take.

People who were sold the ROP before April 2014 are unlikely to be included in any redress scheme the FCA proposes. But they can still get refunds if they ask for them. So complain to Vanquis now and asking for a refund of the ROP fees plus the associated interest you paid on the card.

You can complain if you are still paying the ROP or if you cancelled it. It doesn’t matter if you still have the Vanquis card and owe a balance, or you have closed the card. You can also complain if you are currently in debt management.

Don’t complain if:

- you have gone bankrupt after you got the Vanquis card (the refund would go to the Official Receiver)

- you are currently in an IVA (the refund would go to your IVA firm);

- you are currently in a DRO (your DRO could be cancelled if you get a refund).

October 2017 update – some of the first complaints upheld

About 8 weeks since the first complaints went in based on this article we have the first few results:

- people have been offered refunds of £418, just under 3k, £1600, £507, £285 (that was only for 6 months ROP) and £531;

- most are happy with the offered refund but one is going to the Ombudsman as the numbers don’t reflect what he thinks he paid;

- people who applied for the card more than 6 years ago have had their complaints rejected – some of these are going to the Ombudsman;

- 3 people who took out the ROP in the last 6 years have had their complaint rejected.

Obviously there could have been a lot more decisions – I am just going on what has been reported in the comments below this article.

November 2017 update – more complaints upheld

Increasing numbers of results reported:

- refunds offered of £448, £321, £508, £1,255, £1,286, “full refund”, £4,279.

- 4 people who took out the card within the last 6 years have had their complaint rejected, 1 person asked for a copy of his phone call and was sent one that clearly showed he had rejected the ROP – he has sent the case to the Ombudsman.

- 2 people who opened accounts more than 6 years ago have had their complaint rejected.

- Vanquis have missed the 8 week deadline in a few cases.

December 2017 onwards

Lots more people have been getting refunds, too many for me to keep track of. See the comments below for recent examples.

A few interesting cases:

- one reader has her complain accepted because Vanquis couldn’t find the call recording;

- one reader has had a decision from an adjudicator at the Financial Ombudsman that the FO can look at cases where the account was opened over 6 years ago. Good news – although it could still be challenged by Vanquis.

Pear says

Hi Sara, I sent my complaint last week regarding ROP from pre 2014, I also complained that they have not updated my credit file even though the card was settled in full in 2013 as a result it shows on my credit report as an active card. I will keep you updated.

Ross says

Hi Sara,

As you’re aware, I have submitted my complaint for a closed account for a refund of the ROP. I believe mine to have been a lot more than Mr N’s, so I am sure that Vanquis are going to reject it as, if the interest Mr N received is anything to go by, mine could be extremely large. Just one question though, if I may? Although the account was closed within the last 6 years, what about any ROP payments that may have been made before the 6+ years (such as ones made in 2010 for instance?). Would these be classed as not being able to be investigated, should it go to the FOS, along the lines of the way QQ and Wonga are being with payday loan complaints? I know that this isn’t necessarily relating to PPI claims, as some of these are for many years ago, but Vanquis have argued that the ROP is not PPI. This is what I’ve seen online, not what they’ve said to me personally, as I’m still waiting for my final response. As promised, I will keep you, and the site, updated on how I get on.

Sara (Debt Camel) says

T’m not sure that the 6 year rule should be an issue at all for these complaints at all. With a payday loan, the problem is their very short duration, so if you borrowed and repaid in 2010, that was closed more than 6 years ago. Here your Vanquis card has been open continuously for a long period, including within the 6 year time.

As a matter of practicality, if you only get a refund for the last 6 years, this should still be pretty big!

I suggest not mentioning any comparison with PPI in a complaint. There is no point in trying to argue this with Vanquis, just stick to the real problem – that you were paying for the possibility of an account freeze which you should not have been charged for and that it wasn’t clearly explained to you how much the cost of the ROP would be because of the additional interest that resulted.

Vijay says

I put in my complaint on the 15 August, received a letter in the post from Vanquis and was told they have 57 days to look into it. I’ll keep the forum posted on what they decide. Thank you for this great and timely post Sara!

Sara (Debt Camel) says

57 days – well the Ombudsman says 8 weeks, which would be 56 days, but no point in arguing about that :)

Alex says

Ive just checked my vanquis statement and Ive been payong ROP, no idea for how long as the online statements only go back 6 months.

I got into a bit of a mess with vanquis this year, missed a couple of payments and ended up going quite a bit over my limit. My limit is 3.5k and I was at nearly 4.2k. I contacted them and after a bit of back and forth they offered me a 3 month payment plan but they didnt freeze the interest, they lowered it to 1.99% a month. My payment plan with them has finished and im still just under £100 over my limit and they wont help me as they say I can afford to pay my monthly payments despite for the next couple of months I will always just be one bad month away from exceeding my limit (in fees ect i dont use the card).

Ive had my card since 2012ish started on 250 and its gone up to 3.5k. Ive no idea how long the ROP has been on it and I dont remember agreeing to it.

Do you think Ive any chance of reclaiming anything? The ROP over the last 6 months varies from £48-£56 I cringe at the thought of how much Ive potentially paid and that extra charge is obviously not helpfull when Im trying to stay ontop of the monthly payments

Sara (Debt Camel) says

For a start, I suggest you cancel the ROP straight away. It hasn’t helped when you have had problems this year, has it! Not paying £50 a month for this will mean that your balance at last starts dropping.

Yes I think you should complain and ask for a refund of the fees you have paid (it doesn’t matter that you don’t know how much this is) plus the associated interest you have paid.

Did they mention the ROP to you when you contacted them earlier this year? If they didn’t and you didn’t remember what it was so you didn’t ask about it, you can also add a sentence to your complaint saying that they should have pointed out you had this “cover” and not charged interest.

If they did mention the ROP but said you couldn’t claim on it, I would be interested to know why?

Alex says

Hi, thanks for the reply.

Ive checked over emails and there is no mention of the ROP from either side. When I was in contact with them I did ask them to freeze the interest for a few months to allow me to get back on top of things (no mention of the ROP) but all o was offered was 1.99% for three months.

Ill email them now to cancel the ROP. Would it be the same email address listed above? Or their resolve email address?

Should I wait for it to be cancelled before I email them requesting they repay the fees ext?

Isabelle Marchant says

Thank you for the interesting news about Vanquis. It came just when I was looking for solutions to stop using this credit card which I have been holding since 2005. My credit scoring has improved since, but I have not yet managed to pay it off. I rarely use it nowadays and everytime I do, I am appalled by the huge interest rates. Hearing that they have been issued with a profit warning is a bit worrying I must say.

I did pay the ROP from 2005 till 2011. It seems that I would not be part of the FCA investigation. Being self-employed, I thought the ROP could be useful. Unfortunately when I needed a ‘repayment holiday’ in November 2011, I was told that as I am self-employed, they could not proceed and self-employed people did not fall under the scheme! However when they offered me to subscribe to the ROP, I had clearly stated my work status as ‘self employed’. I could not make any claim under the PPI claims since the ROP was not considered as a PPI.

I am going to follow your advice and ask for a refund directly to Vanquis and see what happens.

Isabelle

Sara (Debt Camel) says

Interesting – that is very PPI-like, not making clear the conditions when you sign up for something…

That is well worth putting in a complaint about. It may be rejected as the sale was so long ago, but it’s worth a try.

If your credit score has improved, any chance of getting a better balance transfer card to pay off the balance? If no, then the best thing is if you can start making fiexed payments to it each month which are more than the current minimum. See https://debtcamel.co.uk/fix-credit-cards-payments/

Isabelle Marchant says

Hi Sara,

Thank you for the advice. Apparently it is very difficult to switch credit cards with Vanquis but I keep on investigating. I do try to make higher payments than the minimum. Their fees are crazy really! I just checked my annual statement. I spent £837 in purchases and got charges £960 in interest payments!! My best option is to try to pay off as much as possible and stop using it.

Just sent the email to Vanquis. We’ll see whether they reply and take it further.

Sara (Debt Camel) says

Definitely the best option to stop using the card. Making a fixed payment each month and then paying any extra you can is the best way forward. Good luck with the complaint!

Chris says

Hi Sara, is it still worth complaining and trying to get a refund if the freeze account option was used for around a year?

thanks.

Sara (Debt Camel) says

Oh I think so – after all, they would probably have frozen interest if you hadn’t had the ROP… worth a try!

Acee says

Where do you find if you had ROP? I’ve been on my statement but can’t see it.

keith says

Hi Acee look at statements in the description bits in that u will see repayment option plan and a charge each month.

Acee says

Hi thanks Keith looks like I don’t have the ROP shame :-(

I’ve looked at the benefits on the ROP and things like payment holiday and account freeze I was offered and I get texts when overlimit etc so I was sure I had it. Have to have a better look after work.

keith says

hi acee yer have a good look, the statements will have the description bit with all payments you have made and any bills outgoings you have used on card, then will have end of the description bit there will be cash interest added then purchase interest added then any overlimit charges added then any late payment fees added then repayment option plan charges added hope that helps ya

Phil says

Hi guys,

I have a vanquis card currently maxed out on my limit of £1,000 (A limit I did not ask for). My card was increased from £250 to £1,000 a couple years ago and being in a difficult situation and needing the extra cash, I happily accepted this. I am now stuck in a cycle of paying my interest off each month at roughly £80, whilst being unable to pay off any of the balance. I have explained to vanquis multiple times over the various phone calls chasing my interest payments that I am struggling to make these payments, and a few times the have been quite helpful and offered to pay half if I can pay the other 50%.

I have checked my statement and see nothing in regards to having an ROP on my account so pretty sure none of the above applied to me, but is anyone able to provide help of how I can get out of this cycle before it gets worse? If it helps, I’m pretty sure I was already experiencing financial difficulty at the time of my limit being increased by 300%…

Sara (Debt Camel) says

Do you have other debts as well?

Phil says

I have a few others such as a littlewoods account and another debt with EE, but nothing too horrific. Trying to resolve my debts before they get to the point I can no longer manage, as currently me and my partner are living payday to payday.

Sara (Debt Camel) says

One route you could try is to make an “affordability complaint” saying that Vanquis should not have increased your credit limit. See https://debtcamel.co.uk/vanquis-rop-refund/. You could also try this with Littlewoods if they also increased your credit limit?

BUT you can’t rely on these complaints working – they aren’t quick (many months as they will probably have to go to the Ombudsman) and the success rate is less than 50%.

I think you should talk your situation through with a debt adviser now. It may be that the adviser says the repayments are just manageable to you need to persevere. But it may be that the adviser says they aren’t surprised you are struggling and that a debt management plan, where the lenders freeze interest, is a good idea. It’s worth doing this now, rather than staggering on. I suggest talking to National Debtline 0808 808 4000.

You can still make the affordability complaints if you are in debt management, so you don’t have to choose between these two routes.

Alex says

I emailed the above address yesterday regarding the ROP, I added in that when I contacted them due to financial problems my account wasnt frozen and all I was offered was a 3 month 1.99% plan despite clearly being charged for ROP.

This is the reply I got, just wondering if this is the standard reply as it says nothing about them having 8 weeks to look into it ect.

Thank you for your e-mail.

I have logged your complaint under reference *** ******

We are sorry you have had to make a complaint. Your complaint has now been logged for further investigation and we will contact you in due course. If you would like to give us any additional information regarding your complaint, please do not hesitate to get in touch. You can either respond to this e-mail or call us on 0345 6122 602* between 9:00am and 5:30pm Monday to Friday.

Thank you for your patience whilst we look into your complaint.

Ross says

Hi Alex,

I sent a complaint, via email, and had the same response. However, today, I have received a postal confirmation of my complaint and this gives all of the necessary information about going to the FOS after 8 weeks or a final response etc… keep us updated on your progress please, as I will be so as to assist others who may be considering complaining ???

Isabelle Marchant says

I got the same reply too within one day of sending my complaint.

I’ll keep you posted on any outcome.

Linda says

Hi I had a Vanquis credit card but fell into arrears, the default payment charges and interest racked up really high and it was passed to a debt collector. I’m now in DMP now and paying the balance off that way. I’m unsure if I had ROC but I usually opted for insurance in cards. How can I find this out for certain as although I have the account number I have no access to statements?

Sara (Debt Camel) says

I suggest you just send them a complaint saying you had it and asking for a refund of the fees – see what they reply.

Have you made PPI complaints about your other cards? This can be a great way of clearing debts which are in a DMP, see https://debtcamel.co.uk/reclaim-ppi-dmp/.

Linda says

I’m in the middle of a PPI complaint for a Lloyds credit card. Lloyds disagreed with my complaint and it’s currently in the the hands of the FO I had the letter from them last week so quite a new claim. I’ll try a complaint with Vanquis also and see what happens and maybe see if I can finish me some old statements. Thavks Sarah

Adam says

Hi Sara

I currently have a credit limit of £2000 with Vanquis and for the last few months I’ve been around £90 over my limit, each time paying £12 fee. I’ve been paying the ROP since I got the card but my concern is that if I complain about the ROP, can they pass the current debt to a debt management company or anything like that?

Thanks

Sara (Debt Camel) says

If you are making the minimum payments on the card, then it can’t be sent to a debt collector and can’t harm your credit record.

I suggest you first consider cancelling the ROP – that will save you a significant amount of money each month which can then reduce your balance. Then put in a complaint about the ROP as this article suggests. Any refund could pay a lot off your balance.

Xenedra says

I have also applied for this to be refunded. My limit with Vanquis is £4500!!! and I definitely had the RPO as I remember cancelling it in about January this year. Had the card since 2011. The debt is in a DMP now so hoping if nothing else they might agree to reduce my outstanding balance with the at least with any refund!

Will keep up to date.

Bev says

I had card frozen when on maternity leave twice through ROP on my card. You think I could still complain???

Bev says

Just sent complaint anyway. No harm in trying :)

GMA says

Forgot to mention when I had cancelled my ROP I was offered a 3K loan! Never took them up on it!

Pear says

Not yet but I got a letter saying they would be posting a cheque for £100 because for the last 3 years they have been reporting my card as active to equifax.

Luchelle says

So I made my complaint for ROP using the above template explaining that I also want a refund of all ROP and interest I paid to them. They sent me a first letter acknowledging my complaint and said they will look into it , I have since then received a second letter advising me that they have cancelled my ROP and if I have any concerns about the plan or the way it was offered to me then to give them a call.. what do I do next ? Because I’ve already sent me initial complaint to them telling them that I wasn’t happy with it and that I want a refund. Do I go to FOS? Or do I send in my complaint again?

FourMenHadADream says

Luchelle, I received the same letter today. I called them and was told that my complaint is still being investigated.

Sara (Debt Camel) says

I suggest you call them and point out that you have already complained about the product and asked for refund. If they want to know why, say you have just found out the regulator says that Vanquis would have to consider freezing interest if you were in financial difficulty, this wasn’t properly explained when you took the ROP out and if it had been you would not have agreed to pay for the ROP. (NB obviously only say that if it is true in your case!)

Jon says

I rang up and logged a complaint directly with Vanquis last week about an old account that ROP, I called them yesterday and there was an update on the system which stated I never even had it and complaint has been closed. I full well know I had it the only problem is I moved address and cannot find any paperwork, I’m going to call them back to request further information about this.

Jon says

Update: My complaint has been re-opened after the wrong account been looked into, my older account opened in 2013 is the one that had ROP therefore an adviser is now looking at that account.

Will provide an update on the outcome.

Ross says

Hi Jon,

Your post has persuaded me to contact Vanquis for an update. I had confirmation of my complaint, via email, 3 weeks ago. Even though I know they have 8 weeks, I was shocked to find that YOU had to contact them, to be told that your complaint had been closed without anyone from Vanquis contacting YOU to advise of this. My ROP is from an old, closed account and I am 100% certain that I had it, as I remember seeing it on my statement and calling to cancel it, when the whole PPI situation started to blow up (I cancelled PPI on all of my other cards at the same time). I’ll keep you updated.

Jon says

Hi Ross,

Well I decided to contact them after a week due because when I initially logged the complaint I was told that I would receive an email confirmation within 5 days, this never happened, therefore proceeded to chase them only to be told it was closed (reasons above).

What did make me laugh when I rang the complaints team the advisor I spoke to was adamant I had it as my account was opened in 2013 and it was highly likely I had ROP, but then after reading the notes from the previous advisor he started back tracking on what he was saying, although at the end of the conversation it was clear the checked the wrong account so I’m positive it will be resolved.

Fingers crossed we get somewhere!

Ross says

I’ve just had a response, rather efficiently actually, advising that my complaint is being picked up by an customer relations advisor shortly. At least they didn’t tell me the complaint had been closed! I’m also complaining about increases they made to my account credit limit, without my consent. They increased it right up to the top limit, of £3000, and I was paying £150 a month and shaving only pennies off the balance. Along with the ROP, I probably wasn’t even achieving that! Will keep you updated.

Jon says

That’s good to hear!

I’m intrigued about the other part of your complaint, it sounds very similar to my situation 2 years ago when my credit limit increased to the max and was basically paying very little back, Vanquis didn’t seem to look at my situation and just wanted more money from me. Can something be done about that?

Ross says

Hi Jon,

If you only ever made minimum payments, missed payments and went overlinir, it’s definitely questionable as to whether your limits should have been increased. You can definitely make a comlaiht regards to this if you feel you have a case?

Jon says

Hi Ross,

I see, thanks for this information I will need to check over it all and see if I can make a complaint on those grounds.

Vijay says

Just to update: I took out a Vanquis card on 17 Dec 2007 and it defaulted in October 2009, my account was under “final demand” and that I owed £92.00 but I was still paying ROP. In fact, I was paying ROP when my account was suspended and in arrears. So they kept charging me the ROP until 7 July 2010.

I received an answer from Vanquis today: “The FOS cannot consider complaints about something that happened more than 6 years ago or later. and more than 3 years after you realised (or should have realised) there was a reason to complain.”

Then said that the ROP was added during a call when I opened my account but “On this occasion, I have been unable to listen to the call where you opted in as the call took place more than 6 years ago and the calls are removed from our system after 6 years”.

For these reasons, I am unable to uphold your complaint.

I am pretty surprised: I didn’t know or understand what ROP was, they continued to have me pay for something when my account was blocked and in arrears and in collections, and despite them having no evidence to support themselves, they say they are no upholding my complaint. What do you think? Straight to the bin or straight to the FOS? Thanks for the advice.

Sara (Debt Camel) says

When your account went into arrears, presumably this was because you were in financial trouble? Did you ever ask Vanquis to freeze the account because that was a feature of the ROP? Did Vanquis ever mention the ROP to you? Or were you really unaware of what the ROP was?

Vijay says

Yes, I was in financial trouble with dozens of payday loans/ defaults/bank overdraft defaults, etc. I never asked Vanquis to freeze the account and had no idea that was a feature of the ROP and they never mentioned ROP to me or explained it. I truly had no idea what it was and definitely never used it. I only noticed it because of this website and I thought it was PPI, looked at an old statement or two and saw ROP on there and then investigated what it really meant.

Vijay says

Today I filed a complaint with the Ombudsman relating to this Vanquis ROP (more than 6 years ago) and I’ll keep the forum posted on developments.

BrizoH71 says

I got the same response to my complaint… I had ROP between 2009 and 2011 if memory serves, but later fell into problems and entered an arrangement that saw me pay reduced amount each month from 2013 which I had to restructure in 2014.

They can’t listen to my sales call as they seemingly only hold 6 years’ worth of call recordings and mine has been deleted.

When I first got into trouble, Vanquis reduced my interest to 1.99%, but they then froze interest altogether after the restructured arrangement was agreed. Vanquis’ agreement to do so without ROP in mind shows that I was previously paying for a product that I didn’t require.

Sara (Debt Camel) says

These older cases could be difficult. you could let it drop or send the case to the Financial Ombudsman. If you do take the case to the Ombudsman then you need to argue that you cancelled the ROP when you realised it was costing such a lot, but at that point you didn’t realise that the firm should not have been charging for offering forbearance, because it should have done that for free.

Carol says

Hi Sara – I have put in a ROP complaint – I have been paying this since 2011. Vanquis have acknowledged and I am awaiting their reply.

In the meantime, I am still paying the premium as I am almost up to my limit but as in the probation period of a new job am concerned as it is not yet secure, I may ultimately need to utilise one of the ROP options, to prevent any effect on my credit file (I work in the financial sector and it is increasingly important not to have any markers etc) so this seems the only way around it.

My questions are – If I have put in a complaint can I still use the facilities of that product or will that affect the complaint/outcome. Also, for anyone working in the financial sector who is struggling with debt, are there any options to make an arrangement without it being recorded on your credit file as by doing so, you could loose your job/be unable to apply for another.

Thank you.

Bev says

I received this reply about 5 days after complaint

Thank you for your e-mail.

I have logged your complaint under reference CAT @@##.

We are sorry you have had to make a complaint. Your complaint has now been logged for further investigation and we will contact you in due course. If you would like to give us any additional information regarding your complaint, please do not hesitate to get in touch. You can either respond to this e-mail or call us on 0345 6122 602* between 9:00am and 5:30pm Monday to Friday.

Thank you for your patience whilst we look into your complaint.

Do I give it the usual 8 weeks to wait for a reply?

Ross says

Hi Bev,

Yes, it’s the usual 8 weeks if you don’t receive a final response. My complaint will be at week 4, this week, so either they’re gathering all of the evidence to reject my complaint, or they’ve had an influx of complaints about the ROP product. I’m not going to overthink which one it could be, as I’ll just await their response and take it from there. Will keep you updated on my progress.

Pear says

Everyone beware, I rang vanquis today and enquired about my ROP claim and was told a letter was sent dated 30th August saying that because it was more than 6 years ago they would not uphold my complaint. I never received this letter but I received one dated 29th August saying my complaint was being investigated. Sara do you think I have a chance under the 6+3 ruling as it was taken out in 2009 or will the say I would have known about PPI complaints and therefore should have complained sooner?

Sara (Debt Camel) says

The “6+3” is NOT a general ruling. You can try to argue you had no idea you could complain about this but it will be hard. How long did you have the product?

Pear says

I am honestly not sure how long i had it, I remember cancelling it when I got in financial difficulty and realised it did nothing. I will send it to ombudsman to see what happens. They had been reporting the card as active to equifax for 3 years after it was settled and when I complained they sent a cheque for 100 quid which I haven’t cashed yet, can I tell them I am not happy with this and ask for more?

Spiralling Debt says

What would the time frame be used to work out the interest accrued? (59.9% APR)

So far I have £200 of ROP, £500 of Overlimit Charges & about £300 of late & unpaid item charges for the period ROP was active.

My Vanquis card is still running since Aug 2010, but ROP was cancelled in Sep 2015 – however I have only made minimum payments never have cleared the balance of the card.

Spiralling Debt says

Oh and I do have a copy of EVERYTHING (SAR’d them) which included my phone call that accepted the ROP – I was asked, I said I would like to have the information sent to me, nothing was read out, they asked again – I said go on then —— apparently “Go On Then” can be deemed as being uncertain + the fact I asked for the paper work & nothing read should be in my favour :)

Sara (Debt Camel) says

These are the first complaints going in – there really isn’t any experience to go on until a few have been seen through to a conclusion. You don’t need to specify any numbers, I suggest you just use the template letter in the article.

Jon says

I received a final response back today regarding my complaint, I’m pretty pleased that I’m going to be receiving £285.35 via cheque, all from a 20 minute call to them.

Thanks to this site it really has helped and I hope everyone else manages to get their refunds.

Ross says

Hi Jon,

Firstly, well done on achieving your refund. May I please ask what your time frame was for your complaint? I’m approaching week 4 this week, since my complaint was acknowledged. Also, was the £285.35 just a refund of your ROP premiums, or the premiums + interest. Mr N, as Sara pointed out, received a very substantial refund, when the associated interest was taken in to account. May be worth double checking this before you go ahead and accept?

Jon says

Hi Ross,

Thanks.

The time frame I was given was 14 days, the email came through after 6 days.

The breakdown of the following refund was:

Repayment Option Plan fees – £152.96 Associated interest – £78.57

Charges – £12.00

Notional Interest at 8%*- £52.27

Withheld Tax Amount – £10.45

I know I only had it for about 6 months, my complaint was for those 6 months, which is great as I wasn’t expecting this much.

Adam says

Did you ring to complain rather than sending an email then Jon?

Jon says

Yes Adam I called up on 0330 099 3303, they sorted it out with pretty limited information.

Paul says

I am trying to help my Brazilian born cleaner. Back in 2014 one of her clients stopped paying her and although she kept working for him, expecting a lump sum payment, he kept avoiding and prevaricating. She needed the work, hence carried on working for him, eventually he offered to clear the back pay at £135 per month. At this point after 3 years it had reached nearly £10,000!

The point of this post is that to cover the shortfall and do a return visit or two to family in Brazil for weddings and funerals she borrowed money on a couple of cards and has been struggling to pay them off since. One of them is a Vanquis with ROP.

Earlier this year I helped negotiate and draw up a repayment plan for the client.

However, today she asked me what the ROP was on the credit card she is desperately trying to pay off (now the repayments are coming through – belatedly and with no compensatory interest) and I did a quick bit of research and called Vanquis on her behalf. When I explained that she could have frozen the interest for this issue it was news to her. Further though, when I spoke to Vanquis there was no question of backdating the freeze AND the evidence required to start the freeze would have needed to have been an accountant’s letter or similar. These are things that in her position she was never going to have access to , hence for a self employed person like herself this ROP was always going to be ineffective/inappropriate.

Sara (Debt Camel) says

Do you know when she got the card? You say you helped to negotiate a repayment plan – on the Vanquis card? How much was offered to the card each month? Did you ask for interest to be frozen? Did Vanquis never mention the ROP?

The back pay – if her previous employer has any assets, it may be a good idea to consider suing him unless he can increase the monthly payments significantly.

Isabelle Marchant says

I was self employed when they sold me the ROP and they knew it clearly. Then in November 2011 I needed a repayment holiday and they refused on the grounds I was self-employed! I never knew 1/ that the ROP did not apply to self-employed people (otherwise why would I have accepted?) and 2/ that we could freeze the payments without the ROP.

I have filed my complaint on 29/08 and received the standard answer with a filing number. I sure will follow up thoroughly on this as I feel I have been doubly betrayed. Besides my credit limit with them went up to £3500 without any notification. Right now I am repaying as much as I can on this card and will stop it if I manage to repay the balance totally.

Even if I stopped the ROP back in 2011, if the answer from them is negative, I will send it forward to the Ombudsman as we are talking about a high amount of interest paid at a time when my limit was £2500.

Regardless of whether the FCA is investigating as of 2014, to me this is a form of PPI even though when I did try to claim compensation under PPI, I was told that Vanquis did not do PPI!! They just call it ROP…

I hope your Brazilian friend does get compensated.

Spiralling Debt says

So I’ve just informed Vanquis that I’m in receipt of benefits & need some help with freezing interest and charges.

I get this back from them:

Thank you for your recent email. We are unable to freeze the interest and charges on your account as you do not have the Optional feature on your account called the Repayment Option Plan. This is no longer being offered to customers.

So they are unable to help because I haven’t got a product that the FCA are investigating & will not assist me despite the FCA rules? (rules (CONC 7.3.4) say:

A firm must treat customers in default or in arrears difficulties with forbearance and due consideration.)

They are shooting themselves in the foot here.

Sara (Debt Camel) says

Have you supplied them with an income & expenditure statement? You can complete the online budget here https://tools.nationaldebtline.org/yourbudget/ and at the end it gives a PDF you can send to your creditors.

If you have a lot of creditors, it may be better to use the CABMoney software, from Citizens Advice but you can use it yourself directly, not going through CAB. See https://debtcamel.co.uk/more-than-1000-people-using-cabmoneys-free-dmp-facility/. This can automatically import addresses for your creditors and generate letters to them and lets you keep track of the replies.

Alternatively contact StepChange and ask them to set up a DMP for you.

Spiralling Debt says

Nope not done an income / expenditure – I refuse to as they use this to get the “most” money you can afford out of them.

The only people to legally request an income / expenditure form is the Courts.

I offered them £5pcm, if they refuse they get nothing from me.

I did not have to make an offer either – rules on benefits state that it’s for living costs & helping back to work – loans, cards, catalogues are not deemed as essential & a person can not be forced into using benefit unless deemed bungee court (had this year’s ago with a PDL – stopped them chasing me till I was back in work)

Think they should see my complaint regarding the ROP sale (which has now been logged) and see that a refund greatly exceeds balance.

Sara (Debt Camel) says

It is (of course) up to you if you want to do that. However the FCA rules about exercising forbearance would only be where a customer has provided evidence of their financial difficulty.

The I&E template I linked to uses the “Standard Financial Statement” – that is the currently acceptable format and if that shows you can only afford an offer of £5 a month, then they should not pressure you to pay more than that.

You are correct that only a court can make you supply an I&E – but they are under no obligation to freeze interest if you don’t. It’s up to you…

You statement that benefits aren’t meant for paying debts is a common myth I am afraid and it really doesn’t help you get your debts sorted as easily as possible. If your are on benefits, your I&E statement will show that you don’t have enough spare income.

L says

I recently paid off my Vanquis account and phoned to cancel my ROP, however noticed after two months there was still a payment of £6.95 being take from my account. I contacted them to discuss this and it turns out this is something called Value Saver. I have no recollection of ever signing up to this but it appears to have been added to my account July 2015. I have lodged a complaint and asked them to confirm how and when I agreed to this. Anyway google searching information regarding Value Saver bought me here and I am glad it did!

I have just hit ‘send’ on my ‘ROP Complaint’ e-mail after reading the above. I took this out in March 2014 and still have the letter confirming this. I remember the sales pitch when I took it out and I was in a panic thinking ‘what if i did lose my job’ and at no point was it explained to me that they had the option to freeze interest rates anyway should my circumstances change.

I’ll let you know how I get on with both complaints…

Sara (Debt Camel) says

Please do – I haven’t come across this “value saver” before and would like to know more.

Spiralling Debt says

It’s another Vanquis Scam.

They would ring about 6mths after start of the card and offer a unique saving scheme,where you’d get money off vouchers, discounts etc – kind of like quidco but with a hell of a charge.

They’d get you by saying if you sign up for the months trial we will send £xx fuel/shopping voucher to be used with in the first month.

To cancel the only way is to log into the account and cancel – but it takes 30days for the letter to come through.

The other bit was cashing in the vouchers would trigger the start of the paid saving scheme.

Ross says

I, vaguely, remember this. I was cold called, by Vanquis, offering the product on a 30 day trial. They sent out a ‘welcome’ pack, which had totally useless vouchers in it. Some of the deals, I recall, were just downright bizarre? I called to cancel and the advisor was very pushy, trying to persuade me to keep the product because of the ‘great deals & savings, I would make’. Unfortunately, for him, when I stand my ground, I stand my ground and when I asked to be put through to a manager, he promptly cancelled the product. I believe they charged a monthly membership fee, to your card, but remember that this is a ‘purchase’ and, as well as paying the monthly charge, you’ll also be paying interest on this ‘charge’ if your balance is not paid off at the end of each month. I would avoid at all costs!

L says

Only response from Vanquis I have received so far is an acknowledgement of complaints.

I am 99% certain that I did not agree to signing up to ‘Value Saver’ from Vanquis. I am very cautious when signing up to anything that costs me money. Given the fact I had no idea what it was and after it was explained to me it was for vouchers and discounts surely something would have come back to me. I know if i was aware that i was spending £6.95 for it every month I would have made damn sure I was getting my moneys worth.

I searched my e-mail inbox for any evidence of me signing up to it and all I had was an email in 2014 inviting me to join and then a year later is when the reminder e-mails started flowing in reminding me to save with ‘Value Saver’. No notification of sign up, no validation of account sign up link, no ‘welcome’ e-mail – nothing!

When I explained to Vanquis I wanted it cancelled immediately I was advised I had to contact Value Saver direct via e-mail (apparently they don’t have a telephone number). I find it laughable they can’t cancel given the fact they were the ones who added it to my account!

I’ll keep you guys posted…

L says

Received a letter today advising my complaint for “value saver” has been received and is being investigated.

L says

Still no further update on this. However my Mum (who didn’t believe she opted in for ROP) received a letter yesterday from Vanquis giving her a break-down of what she has paid over the last 12 months (or from whenever she took out ROP). So it seems everyone is receiving this standard letter along with a leaflet giving further information on ROP even if they haven’t already submitted a complaint. She has no recollection of taking this out and she only made me aware today so unable to call them and ask a few questions as their customer service office doesn’t appear to be open on a Sunday.

The reason this came to light today as she was telling me she is struggling with her repayments. Her monthly repayments are just covering the interest. So I have a question – do I get my mum to phone and explain that she is experiencing financial difficulty and see how they can help. Or do I get her to use ROP and ask for her interest to be frozen for two years? If I go with the 2nd option I assume I risk being able to put in any future claim for the mis-selling of ROP?

Any guidance would be appreciated. Thank you.

Sara (Debt Camel) says

The ROP isn’t just something you can ask to use… lots of people get turned down if they ask to have interest frozen.

If she does use it, then she probably won’t be able to make a mis-selling complaint.

If this is her only problem debt, I suggest she phones up and cancels the ROP, then puts in a complaint about it as the article above says. She can say that she didn’t realise she had it.

CAncelling the ROP will reduce her monthly payments. If she can now afford those, good. It would be even better if she can afford to pay some more as then her balance will start to drop. But if she can’t afford this – perhaps she has other debts as well? – then she should probably take debt advice. StepChange are a good place for her to talk to: https://www.stepchange.org/. This may result in the interest being frozen on Vanquis and her other debts as well!

Going through StepChange will not hurt the complaint she is making.

L says

3 days to go until I am at the 56 day mark. I phoned Vanquis today to ask if I will be receiving a response this week to both of my complaints (ROP and ValueSaver). The lady I spoke to was rather abrupt and just kept repeating that they had 3 days to reach a resolution. She also advised they have “lumped” both complaints together.

Kk says

I sent through a complaint about PPI first about 2 weeks ago and just received letter cancelling my ROP. I didn’t even know anything about this.

So I googled it and found all these helpful details. I have emailed with the template you guys have added and they responded saying they have added this to my complaint.

So fingers crossed.

Richard Coltrane says

Shouldn’t they be struck off from the Credit Reference Agencies? Their membership is, I assume, conditional on providing the CRA’s with accurate information to ensure other lenders can make ‘informed choices’. This scheme seems to be the paying of money to the Vanquis

who then agree not to report the arrears to the CRA’s?

The FCA may wish to investigate that as well.

Spiralling Debt says

Nope. Not yet.

They are following guidelines correctly, only until FCA say they are in the wrong then they are put at risk of there credit licence just like Wonga, CFO etc on payday loans – they are then given a period of time to rectify this. If they fail then the licence gets removed and so should any CRA reporting.

At the moment they are in their right to report as we’ve all borrowed under the terms of the credit agreement which is what’s reported on (ROP has separate T&C + in some cases a separate credit agreement)

The best thing to do is contact the three CRA and lodge a complain / notice of correction. Quickest and easiest way is through the free services:

Noddle (Call Credit)

Money Saving Expert Credit Club (Experian)

Clear Score (Exquifax)

There’s also a new one from Totally Money (Experian) has a little bit more information than Credit Club & better complaint logging.

Noddle are a swine to complain about as its drop down selections.

Pick closes to your complaint and when you get the email responses you can send more info.

Steven says

Not sure I understand the logic of your advice?

Don’t complain if: you have gone bankrupt after you got the Vanquis card (the refund would go to the Official Receiver); you are currently in an IVA (the refund would go to your IVA firm);

Surely you SHOULD complain in order that your creditors (to who you owe money) get an increased dividend?

Sara (Debt Camel) says

Well it’s up to you if you want to be bothered with doing this when you won’t get any financial benefit yourself from it. For bankruptcy in particular, your creditors are unlikely to see a penny as the Official Receiver’s fees have to be paid first.

Chris says

Complaint sent.

i had a card for many years but i think the time to complain has been missed as this was quite a few years ago but worth a try I suppose

Chris says

Hi, just recieved a letter from Vanquis. They have confirmed that I took the ROP out on the 30/04/2012 after a phone call but feel not all the point discussed where satisfied. They have decieded to upheld my complaint and offered me the following:

ROP fees – £334.99

Associated interest – £145.64

Charges – £24

Notional interest at 8% – £33.99

Withheld Tax amount – £6.79

Total – £531.83

I believe this to be a lot lower then what I paid out in total considering my balance was over 2k for maybe 2 years, does this sound correct to anybody else?

Sara (Debt Camel) says

Assuming they are correct about the ROP fee amount, the associated interest that looks wrong AND the 8% interest.

Do you know over what period you paid the ROP? Was your account still open after this, if so until what date? Did your balance ever fall below 334 during this time?

Chris says

I had the ROP from 30/04/2012 until the account was closed in June this year. For a year I used the freeze service which comes with the ROP so it looks like this has been taken off but that would still be around 4 years of paying this service with a balance of £370-£2250. Is the 8% interest over the whole 4 years or should that be 8% each year I had the service? Also what kind of associated interest should I be looking at?

I’m not sure if Vanquis are just offering me this to try and resolve the case hoping I would accept anything but to me that seems a lot lower then I was expecting, also this case is with an adjudicator from the FOS so should I contact them to let them know of this offer?

thanks.

Sara (Debt Camel) says

“I had the ROP from 30/04/2012 until the account was closed in June this year. For a year I used the freeze service which comes with the ROP so it looks like this has been taken off but that would still be around 4 years of paying this service with a balance of £370-£2250”

In that case I think the ROP fees also looks on the low side.

The “associated interest” is the extra interest you have been charged by Vanquis because of the ROP payments. Say you had paid £50 to your card, £15 (say, I just made that number up) would have paid the ROP if the ROP hadn’t been there your balance would have dropped by £15 more. So the next month you were charged Vanquis’s horrible interest rate on that £15. And the month after etc unless your balance got to below the total of the ROP you had paid… So this should be the really large figure.

I’m not quite sure why they would add 8% on top, but if they do, it is 8% per year, not on the overall amount.

I suggest you reply thanking them for their offer but asking for the details of how the figures were worked out as think you paid more ROP than their figure, and the associated interest looks a lot too low given the interest you were incurring on your Vanquis balance which was too high because of the ROP.

Sara (Debt Camel) says

re the FOS, I suggest you tell the FOS that Vanquis have offered a refund but you think they haven’t calculated the figures correctly and you will get back to them when Vanquis have given you more details.

Adam says

Hi Chris

How long did it take Vanquis to respond with this offer following your original complaint?

Thanks

Chris says

My initial complaint was around June, they took around 6 weeks to respond and upheld my complaint which I then took to the FOS. This is the first time they have offered me anything.

Spiralling Debt says

That’s well off.

Your associated interest is less than 20% I doubt the Apr was ever this..

It may be worth while paying £10 for a SAR & send along with the reply stating your require your sar as information appears to be incorrect.

Without statements you can not really see what you’ve paid – especially that they are workin out the interest before charges where as the interest on vanquish cards is for the balance as a whole.

Unsure about the 8% as I’ve had a settlement with the FOS and a pdl company where they have told the company to apply 8% on the whole balance in relation to settlement and then 8% per year from Open to close of account on interest & charges.

FOS state: “we suggest 8% interest to be added it is from the date the payment was originally made (for the interest and charges) to the date it is refunded.”

Alex says

I sent my complaint email in August, received a letter this week saying they are looking into it and thanks for being patient ect.

Ive just logged into my vanquis account and the ROP has dissapeared from my old statements. Should I be concerned? Seems a bit iffy to me.

Spiralling Debt says

Send a SAR request straight away.

If they have removed entries from previous documents then this is an act of fraud.

Every penny must be accounted for.

The SAR will also help you to work out fees / charges and interest amounts should you progress further with FOS (there are refund calculations spreadsheets that you load this info into)

Ross says

I’ve just received my final response from Vanquis. In it, they state that I paid the ROP from July 2008 to October 2011. They state that the call where I would’ve been opted in to the plan was in July 2008 and, therefore, they are not able to listen to the call, as they erase these after 6 years. They are further stating that they’re doubtful the Ombudsman would look at the case, as it’s more than 6 years or more than 3 years since I should’ve realised I could complain. However, if the ROP ended in October 2011, then I would say that I have until October 2017 to complain to the FOS, would you agree Sara?

Spiralling Debt says

Should have realised?

Nope you only realised when FCA started to look into it…

Depending on the outcome of FCA, I don’t think age would have anything, so submit to FOS.

In your complaint you can state that they’ve told you not to go to the FOS – this is extremely frowned upon by them ?

FourMenHadADream says

You should go back to them. The initial call may have more than six years ago, however, Sara or anyone else correct me if I’m wrong, when i worked in financial services under DPA we had to keep all records for six years after the relationship ended. So that would be six years from when you closed your account.

Happy to be corrected if I’m wrong.

Sara (Debt Camel) says

Well there are two things here. The first is whether the initial sales call was poor – without the recording that is going to be impossible to prove. But the second is whether this a fundamentally unfair add on to your credit card, because you were being charged a lot for something (forbearance) that the lender was obliged to offer for free if you were in difficulty. That wasn’t just one problem at the start, it carried on through the whole contract. Presumably you cancelled it in Oct 2011 because you thought it was very expensive – but at that stage you didn’t realise you had no need to pay for it at all, so you are complaining as soon as you became aware of this.

Ross says

Thanks Sara,

I did cancel the plan in October 2011, as it seemed pointless (and very expensive!) to me. They have totally ignored several important points I have put forward. For instance, if I was sick, my company sickness scheme pays me 6 months full and 6 months half pay, so I would’ve been able to keep up with repayments. It was doubtful that I would lose my job, as I have held my job for years in double figures and work in a very stable industry (railway). I’m not surprised at it’s contents. A lot of ‘You would’ and ‘You should’. Isn’t hindsight a wonderful thing?

Spiralling Debt says

Just been speaking to a relative, they submitted a complaint back in June to also be told the call had been deleted.

So she ended up submitting a SAR request, and yesterday it finally came back. Everything has been included: agreement, copies of statements, manual intervention notes, call transcripts from day one to current, a CD with 23 calls on including the welcome call about ROP and the last call that said the welcome call had been deleted.

I’m beginning to wonder if the “deleted call as its over 6yrs” is just an easy way to wipe it under the carpet.

For the sake if £10, I think the Subject Access Requests will be worth their weight in gold against Vanquish.

Sara (Debt Camel) says

Interesting… though people do need to be aware before they pay £10 for a SAR that FOS cases where you signed up over 6 years ago may be much more difficult, and likely to be impossible if the ROP was cancelled over 6 years ago.

Ross says

My ROP was cancelled in October 2011, so I think I’m within the 6 year period, just!

Paul says

I assumed the ROP’s interest freeze is very different from an interest freeze when you’re in default. One is reported as a default to credit agencies and affects your credit rating and ability to get new debt elsewhere while the other protects your credit rating (under certain unexpected events’) and gives added flexibility for payment holidays, 2 year account freeze and more – this sounds like a valuable feature

Sara (Debt Camel) says

Most people with a Vanquis card don’t have a credit score worth paying to protect!

Also few people will only have a Vanquis card, so if you are going to default on other debts, it will make virtually no difference to your credit score if you default or not on Vanquis.

Then there is the question about how much this “valuable feature” is worth… it’s not just the tens of pounds you are charged each month. It’s the fact that you are borrowing this money from Vanquis at their normal horrible card rate that makes this incredibly expensive.

There is a complete imbalance between what Vanquis knew and what a customer knew here:

– Vanquis knew that it would generate huge amounts of money for them (over 30% of their profits come from this product).

– Many customers had no idea how much apparently small sounding amounts would add up to over years.

– Or that they may have interest frozen if they get into difficulties even if they didn’t pay for the ROP. If Vanquis had told people this during the sales call, they would have been in a position to make a properly informed choice.

Also the savvy people who are really only using the card to credit build would have been using it for small amounts and clearing the full balance every month – they had no need of this protection at all.

Alex says

Thats assuming they will actually freeze your account when in financial difficulty. I know from my own personal experience my account wasnt frozen when I was in financial difficulties, I also know of another who got into financial difficulties and their account was not frozen despite paying for ROP.

Hers is mind boggling, a stay at home parent thats had her card about 4 years with a small limit of £250 shes paid ROP and when she contacted them to tell them shes experiencing financial difficulties and specifically asked would they freeze her account for a few months so she could get back on top of things and she even mentioned ROP that she was paying every month, the reply she got was no you cant use the freeze account option because youre on benefits. She is not on benefits. Her circumstances have not changed since she got the card so why was she sold ROP when shes not allowed use the main feature?!

Sara (Debt Camel) says

Why was she sold the ROP… Because it was a money making scheme for Vanquis not any form of genuine protection?

But that is indeed a horrible case – can you suggest she puts in a complaint about the ROP?

Alex says

She intends to put in a complaint, shes already cancelled the ROP.

Ross says

Sara,

Just out of curiosity, IF the FCA deem the product to have been not fit for purpose, what implications would this have for people who have had ROP from the outset? Would they be forced in to a redress programme do you think?

Sara (Debt Camel) says

I would assume there would some form of redress program, but there isn’t much point in me speculating about who may be included or what the redress would be.

Ross says

Fair comment and I know we can’t speculate. Personally, I feel the FCA will find the product to be not fit for purpose, based on the fact that they were/are asking people to cough up for forbearance they should be providing anyway. I’m also alarmed to see that people who HAVE paid in to it have not been offered its features? Very naughty!

pauline says

Hi all,

I have only today contacted Vanquis to find out if I was paying PPI on my account. Is ROP the same as PPI?

I applied for my Vanquis credit card in February 2014, but in July 2015 entered into a DMP with Vanquis being one of my creditors included in this. Looking at my statement, it looks as if all interest charges have been frozen whilst payments are being made via Step Change DMP. Is ROP something I should consider complaining about?

Thanks

Sara (Debt Camel) says

When Vanquis reply to your question about PPI, I suggest you follow up with asking if you had ROP? If you did, then as the above article suggests, it may be a good idea to complain.

Pauline says

Thanks Sara. I always wonder if being on a DMP hinders getting any compensation at all. Worth asking about I guess.

Thanks

Sara (Debt Camel) says

No it shouldn’t. In fact it shows you are in financial trouble!

FourMenHadADream says

Vanquis have until 24 October to issue a final response. Today I received a letter from Vanquis with the following –

We are writing to remind you that you had previously opted in ROP. You opted out of the Plan on 01/09/2017.

While you were opted in to ROP it appeared on your statement each month as a purchase transaction. In the last twelve months (or since you opted in to the Plan if less than 12 months ago) you were charged £263.50, plus any interest rate at your purchase rate of 39.94%.

This letter is not a bill so you do not need to make any additional payments.

Since you opted out of the plan on 01/09/2017, you have not incurred any ROP charges to your account. If you have any questions please call on……… letter ends.

Why are Vanquis sending out this letter? They have previously sent me a letter after I sent my complaint, advising the ROP had been cancelled.

GMA says

I have recieved the same letter today

john craig says

Hi Sara

I recently received a similar letter having cancelled my ROP in Jan of this year and i have a complaint in regarding the sale of ROP to me,have you any thoughts on what Vanquis may be up to here, given and i suspect a lot of people have received similar letters.

Spiralling Debt says

These letter are just tactics to get you to call in, and then they try to baffle you with their technical jargon.

Email them asking what the letter relates to as it doesn’t relate to any answers of your complaint.

Other things to put in to back up your complaint is to quote other sections from CONC – it’s a really interesting read (not just for vanquis debts)

In particular take a look at ruling 7.3.9

“A firm must not operate a policy of refusing to negotiate with a customer who is developing a repayment planicon.”

Vanquish will still say you require ROP but that is deemed as a refusal and also contravenes the FCA rulings.

Just google CONC handbook section 7.

GMA says

Hi, I emailed regarding this letter and have had a response an hour later

Dear Mrs ***

Thank you for your email.

The letter dated 4 October was to advise that we are still investigating your complaint an assure you that we are still looking in to this for you.

So hopefully they still are

Alex says

I wonder should I be concerned then that I havent received a letter ?.

Did your letter tell you how much youve paid for ROP for the whole time you had it?

Its 6 weeks today since I sent my complaint so they only have two weeks left.

GMA says

It only said the last 12 months but have had it since 2015

C says

Hi Sara – I have a complaint in which has been acknowledged. I have not cancelled the product (I am going to) however, this month I find myself short of funds to make the minimum payment. If I use the “holiday” option will it affect my ongoing complaint please?

Sara (Debt Camel) says

yes it probably will! you can’t just use one of its features when you are saying that you should not have been sold it! It’s up to you what you want to do – carry on with complaint and cancel the ROP OR not make a payment this month and have a larger debt next month.

Spiralling Debt says

As long as you haven’t had any late payment charges added in the past 6mths I would skip the payment.

That way if you do get charged the late payment fee you have proof that the policy is useless as its meant to allow you to skip a payment without the late payment fee.

Check the terms of ROP and you will see it’s stated in there.

It’s one of my points in my complaint :)

Sara (Debt Camel) says

no really that is not a good idea, What if they don’t charge a late payment fee and then point out she has benefited from the ROP? She will have saved a very small late payment fee but potentially ruined a claim that could be worth a lot of money.

S says

I’ve just sent my complaint email off today. I cancelled my ROP a couple of years ago but genuinely don’t ever recall agreeing to it when I took out the card.

I’m not overly hopeful as successful stories with this type of complaint against Vanquis are thin on the ground but nothing ventured and all that.

Sara (Debt Camel) says

the first complaints about this only went in at the end of August, so it’s not surprising that there haven’t been any success stories yet!

UPDATE – by 21st October, 5 readers had reported refunds.

Alex says

I too received a letter today telling me how much ROP ive paid in the last 12 months. Ive just emailed asking why they sent the letter and why it only states how much was paid in the last 12 months.

They only have 8 days left before Ive hit 8 weeks since I sent my original complaint.

Alex says

The reply I got to my email said that these letters are sent to anyone that has raised a complaint regarding ROP. I did ask why it only stated how much was paid in the last 12 months but it wasnt answered.

Spiralling Debt says

I’m actually (expecting) looking forward to my complaint being rejected.

Reason is over the last two weeks I’ve had emails from their support staff telling me that I need ROP on my account for the account to be frozen as I’m now in financial difficulty (tut tut tut – against FCA rules) and then I’ve had another conversation where they,duets financial difficulties have frozen my account and refunded fees & charges from the date I informed them of said difficulties.

This proves that the ROP is worthless and Vanquis haven’t idea what on earth they are doing (except fleecing)

Quick question – added interest, that should be the Card interest rate or is it the stat 8%?

Alex says

When I was in financial difficulties they wouldnt freeze my account despite having ROP. All they gave me was a lowered interest rate for 3 months. So ROP really is worthless. Im hoping we all get some very nice refunds.

Sara (Debt Camel) says

If you didn’t clear the balance on your card, then it is the card interest rate that is relevant.

Ross says

I think the FOS must be snowed under, as it’s taken 2 and a half weeks for my complaint to be acknowledged by them (they’ve sent an email, today, confirming they’re looking in to my complaint. In their response, Vanquis have failed to address any of the points I put forward. Firstly, they said that they sent letters, prior to granting credit limit increases which may be the case now but I know categorically it wasn’t back then. I also asked why the ROP wasn’t suited to my needs, based on the benefits I receive from my employment (for instance, if I was to be off on long term sick leave, I get 6 months full and then 6 months half pay). Based on this, I believe the whole policy was a complete white elephant and total waste of money. To actually read some comments on here, about the ROP not even being put in to action for what it was (allegedly) designed for is mind boggling to say the least?

L Hancock says

We got the letter saying we had the cover on my husbands account (which we have since paid off and closed). We phoned Vanquis saying we didn’t realise we had it and could we have a refund. We were told they would log it as a complaint and get back to use.

Letter has come today saying complaint upheld and cheque for £507 on its way!!

Anyone that had this I would definitely try. According to the letter they found a call from Feb 15 when we were apparently sold the cover, they said that upon listening to the call the agent did not cover everything they should have and have therefore upheld the complaint!

———————————-

Some details The breakdown is as follows

Repayment Option Plan fee’s £ 313.38

Associated Interest £127.80

Charges £48.00

Notional Interest at 8% £22.54

Withheld tax amount £4.50

We had ROP from Feb 2015 to when we paid the card off in May this year so just over 2 years. Started off in Feb 15 with a credit limit of £450 and after about a year it increased to £1500. We paid minimum payment each month, sometimes £10/£20 extra when we could

Alex says

How long did it take from the complaint being raised to vanquis giving you their decision?

L Hancock says

About 2 weeks. Received the notification letter saying that we had it on that account so phoned the same day and just said didn’t realise we had it so could we get the money back. They just said they would log as a complaint that it was mid sold and they would be in touch. Got the decision letter today. We weren’t even asked to put anything in writing. The wording in the decision letter is exactly same as the Mr N case above

Alex says

I wonder then are they dealing with telephone complaints first ?.

It will be 8 weeks next tuesday since I sent in my complaint.

L Hancock says

Did you complain following receipt of the letter informing you that you had it or did you hear about the investigation and decide to do it?

I know that the poeple who received the letter are the ones whose cases are part of the FSA enquiry so I wonder if that is why they dealt with it swiftly?

Alex says

No, I sent my complaint after I read the article on this site about it.

Chris says

Don’t expect the payment any time soon, I had same letter dated 21/09/2017 and still waiting. Can see them leaving it the full 30 days.

Reen says

Brilliant site and has given me the incentive to follow up on Vanquis. I originally complained about ROP back in 2013 after my balance never going down and was subsequently told they had listened to my call from July 2011 and had agreed to it. I cancelled my ROP and dd and missed payments.

I then had a letter from impact saying to call who then offered a partial settlement and agreed on a payment plan but due to job changes and then 3 months later losing the job (wrong company for me!) I never paid anything but charges still went on including interest amounted to around 700 pound and statements saying I had to pay 1500 now (limit was 3k) I panicked and never contacted them. If I recall I didn’t receive anything afterwards as far as I know. I had moved back to the north of England by then.

From July last year I had a letter at my new place it had been transferred 3700 at this time to a collector. I was unemployed and ignored the letters plus due to ill health never even replied to a ccj so now owe 4200!

I have just had a quick look on paperwork, yes I did keep all and even scraps of paper re phonecalls and saw my notes from applying and also a remark about trying to cancel ROP and told i couldn’t cancel. Where do I stand with this, would I have a chance of getting 700 interest/cgarges back at all and obviously try for ROP refunded too? Any advice would be appreciated very much.

I am also going for pdl refunds when I get my head around all this!

Sara (Debt Camel) says

Hi Irene,

yes put in a complaint asking for a refund of the ROP charges.

I’m not clear when Vanquis were aware that you were struggling. Was this when you called to cancel the ROP? had you missed payments by this point? If so, they should have asked about your situation then and frozen charges.

Or when you had “a call from impact” – I don’t know who this is, was it an internal department in Vanquis or a debt collector? I think they should have frozen interest then.

So in addition to your complaint about the ROP, you have another complaint that Vanquis knew you were in trouble but they continued to add interest. Ask for a refund of this interest as well. NB you need to be very clear that these are two different complaints. Literally call them COMPLAINT ONE and COMPLAINT TWO in your letter.

The added interest complaint is made more difficult by the fact there already is a CCJ, but it’s worth a try!

BrizoH71 says

‘Impact’ is Vanquis’ own in-house debt collector.

Reen says