The FCA has published its Portfolio Strategy Letter to firms providing high cost lending. This was sent on 6 March to firms that provide: guarantor loans (eg Amigo) payday loans high-cost unsecured subprime loans home-collected credit (eg Provident) logbook loans pawn-broking rent-to-own (eg Brighthouse). This letter doesn’t cover overdrafts, subprime credit cards or … [Read more...]

High cost credit news and policy

January 2019 – Wageday Advance proposes cutting the refunds it pays

Wageday Advance asks the FCA for a Scheme of Arrangement On 31 January 2019, Curo, the American parent of payday lender Wageday Advance (WDA) announced it is in talks with the FCA about a Scheme of Arrangement (SOA) for its redress liabilities in the UK. See Curo's statement in its end-of-year results. These liabilities are the payday loan refunds that WDA is having to pay to current and … [Read more...]

Is your refund from Vanquis right? It’s probably too small!

Have you had an email or a letter from Vanquis saying it is refunding you some money? In late 2018 tens of thousands of people are getting these refunds. Nice? Yes, but it may be too low... Some people are being given tens of pounds when I think they should get hundreds. And people getting hundreds should be getting thousands! There were no details of the refund in the email or letter … [Read more...]

FCA will cap BrightHouse prices and interest from April 2019

The Financial Conduct Authority (FCA) is capping the cost of buying from BrightHouse, PerfectHome and other pay weekly shops from April 2019. This is very good news. It is not just a cap on the interest, where the FCA has imposed the same 100% cap that currently applies to payday lending. The FCA is also proposing controls over the prices of the goods the shops are allowed to charge. … [Read more...]

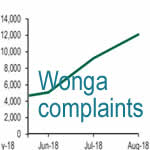

How the Wonga administrators will handle refunds – the Proposals

The Wonga Administrators sent a letter in late October to some of Wonga's creditors with their proposals to handle the administration. These include: background on the events before administration; how to decide the payday loan affordability complaints that have already been sent to Wonga; and how to encourage other customers to submit a complaint. These Proposals were agreed by a … [Read more...]

Dear Payday Lender CEO – should you start a redress program?

On October 15, the FCA sent a Dear CEO letter entitled Affordability of High Cost Short Term (HCST) loans to payday lenders. This letter tells the lenders to review their affordability assessments. There are some very clear points about what the FCA expects a payday lender to do if it is not making good affordability assessments now or hasn't done in the past. "Chains of loans" over an … [Read more...]

2018 – Ombudsman decides it can look at payday loans over 6 years old

The Financial Ombudsman (FOS) has published in September 2018 two Decisions involving payday loans over six years old: Mr H has complained about fifty-four payday loans Lender C lent to him between March 2010 and September 2014. Mrs W’s complaint is about nine short-term loans from Lender D between November 2009 and July 2012. In both cases FOS has decided that its rules do allow it to … [Read more...]

Lessons to be learned from Wonga – 6 policy challenges

It's now a few weeks since Wonga went into administration. This seems like a good point to ask some difficult questions about the lessons from Wonga and what should be done to reduce consumer harm in future. Much of the media coverage has gone as follows: Wonga was the worst - then the FCA fined them and made them write off debts in 2014 and introduced good payday loan regulation in 2015. … [Read more...]

Vanquis ROP refunds – they look too low – what is happening?

People are starting to get refunds from Vanquis for the extra interest they paid if they had the Repayment Option Plan (ROP). That's the good news. But the refunds are being paid very slowly. In June, Vanquis gave up its three-month target and said it hoped to refund people with open accounts by the end of the summer. UPDATE That didn't go well. In October people were then being told … [Read more...]

FCA high cost credit review – great headlines, not so much action

The FCA published two High Cost Credit Review consultation papers published yesterday: rent-to-own, home-collected credit, catalogue credit and store cards, and alternatives to high-cost credit; overdrafts. Although these got some great headlines - the word crackdown appeared frequently - I think it is fair to say that most debt policy campaigners have been disappointed by the proposals … [Read more...]

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- Next Page »