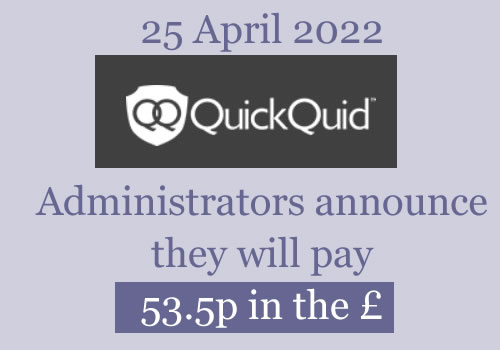

Payments – UPDATE – 25 April 2022

Administrators have started sending emails to everyone with an upheld claim telling them what they will be paid.

“The Joint Administrators are now in a position to declare a first and final dividend of 53.5p in the £”

The average claim value is c £1,700. Someone with that claim value will get a payout of about £910.

The payout details are given in the email:

- This will be paid over the next two weeks.

- If the administrators couldn’t validate your banking details, it will be sent by cheque. I don’t know how the administrators will “validate” your details.

- If you used a claims company, the money will be paid to them.

- Most people are not having any deduction for tax paid to HMRC, so there is no need to reclaim anything.

Credit records

The administrators may decide to :

– remove any negative marks on your credit record

– delete all loans that were upheld

– delete all your loans.

I don’t know what they have chosen to do – if people can check and report in the comments when they see a change, that would be great.

How much your credit score will change will depend on whether there were any negative marks. If you want to get a mortgage, you would like as many payday loans gone as possible, even if they were repaid on time and not hurting your credit score.

In a few months when the administrators no longer talk to the CRAs you can ask for any remaining loans to be “suppressed” so other lenders can’t see them. See https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do that now.

QuickQuid went into administration in October 2019

CashEuroNet (CEU), which owns the QuickQuid, Pounds To Pocket and On Stride brands, stopped giving loans and went into administration on 25 October 2019.

I will be talking about QuickQuid (QQ) rather than CashEuroNet as it is the more familiar name. Everything here also applies to loans from Cashruronet’s other brands, Pounds To Pocket and On Stride.

Grant Thornton were appointed as Administrators. They set up a page about Redress Complaints – this is their term for people who have asked for a refund because they were given unaffordable loans.

Background to the QuickQuid Administration

QuickQuid was one of the “Big Three” payday lenders in Britain, starting out in 2007.

After Wonga and the Money Shop Group had all stopped lending and gone bust over the last fifteen months, QuickQuid was left as the largest UK payday lender.

QuickQuid had well over a million customers. When it went into administration there were c. 500,000 customers with outstanding loans.

Many of these customers had prolonged borrowing from QQ. They either rolling loans over or repaid one loan but were left so short of money that they had to borrow again.

These customers have good reasons to win an affordability complaint and get a refund of the interest they paid.

Affordability complaints started on a small scale in 2015 and increased in the next few years.

In 2018, complaints going to the Financial Ombudsman (FOS) jumped with the involvement of Claims Companies and QuickQuid became the most complained about firm to FOS, excluding PPI complaints.

For a long time QQ refused to refund interest on any loans taken more than 6 years before or where the loans were given in 2015 or afterwards. This resulted in a huge backlog of claims at the Financial Ombudsman, where QQ had made very poor offers to customers and then rejected an adjudicator decision.

In late July 2019, QQ agreed to accept several thousand FOS complaints it had previously rejected.

By accepting the FOS decisions on loans over 6 years, long chains of borrowing, and loans taken after 2015, the scale of QQ’s likely future liability for refunds will have become clear to the company.

After failing to persuade the FCA that a Scheme of Arrangement was appropriate, Enova, CEU’s large and profitable US parent, decided to close the UK business, blaming the UK regulatory environment.

How could the regulators let this happen?

This is an excellent question… Stella Creasy, MP called for an inquiry into the FCA over Wonga and QuickQuid.

What has happened in the administration

Customers with a valid claim for a refund are “unsecured creditors”. This includes:

- any refunds that were in progress after an amount was agreed or a Final Decision from a FOS Ombudsman (FOS);

- complaints that were underway at QQ or FOS when QQ went under;

- any new complaints sent to the Administrators.

All complaints at FOS legally had to stop and were been passed back to the Administrators. It isn’t possible to send any new complaints to FOS.

It is now too late to submit a Claim for unaffordable lending. The last date was 14 February 2021.

The administrators have given the following statistics about claims:

- 169,000 customers made claims for unaffordable lending;

- 78,000 claims were upheld by the administrators;

- the upheld claims had a total value of £136million, so an average of about £1,700 per claim.

Still owe a balance on a QuickQuid or On Stride loan?

More than 300,000 of the current loans were sold to Lantern in summer 2021. You should have been informed if your loan was sold.

The administrators have now stopped collecting any money from the remaining unsold loans.

This page is kept updated

The comments below this article are a good place to ask any questions. And you may be able to see where someone else has already found out the answer.

Dave R says

Hi Sara,

Im in discussions with CashEuroNet/QQ about removing a loan and default from my Transunion credit report (Experian have removed already).

They’ve said “In regards to your concern, please send in your Transunion credit report. Once received, we will escalate the matter.

If you have any further questions, please feel free to ask.”

Should I send this through to them? Not sure why they need to have it?

Sara (Debt Camel) says

I have NO IDEA why they have asked for this, but it’s often simpler to do what they have asked than to try to query why…

Dave R says

Annoyingly Transunion are suddenly not letting me into the free online report. I’ll query it and let them know I’ve re-raised the dispute and that they need to agree to remove the data this time as they did with Experian.

“Sorry, we haven’t been able to verify and validate your identity and can’t provide your credit report.

Unfortunately we’ve not been able to automatically verify and validate your identity. As your credit report contains such personal and important financial information we need to make sure that we only make it available to the right person.”

I’m not sure if I’ve checked it too many times over the last month or so, as have been checking it a lot to see if things have been removed.

Aaron says

Customer Support Team at 0800 016 3250.

Some of the rudest, most useless people I have ever dealt with!

If you feel like someone is wasting your time put down the phone and try again. It cycles through – I eventually spoke to a guy named Robert who was helpful. They’re inundated with emails sounds like they won’t be getting through them anytime soon.

Tony says

I was unable to submit a claim through the online portal, I contacted Quick Quid on the 25/01/21 and was told that the case had been escalated and that it would be sorted within 48 hours, on the 01/02/21 the problem wasn’t resolved so I called again and was told it had been escalated again. 10/02/21 still not resolved so I called again, they said they would escalate it again but instead I requested a manager call back and raised a complaint, 2 minutes later the contact centre operator called me back asking if I still wanted to go ahead with the complaint and the manager call back as the problem had miraculously been fixed and I could submit my claim

Lee Taylor says

I’ve had a similar problem and asked them to email me to get it into writing:

“Thank you for contacting CashEuroNet UK, LLC

In response to your query, we would like to confirm you are eligible to file a complaint with the joint administrators. However, there is a technical issue on our end which has prevented the capability. We have escalated your account as of 21/01/21 for resolution. Once resolved your complaint can be submitted. We apologise for any inconvenience we have caused.

If you have any further queries, please call 0800 016 3250.

For and on behalf of CashEuroNet UK, LLC

The Joint Administrators”

Might try a more aggressive tactic like you Tony because I’m concerned that they’re up to something…

SK says

Reading about all these “technical issues” makes me wonder whether the online portal has been set up, operated and maintained by (or with the help of) Enova, the parent company. They take a huge chunk for service level agreement fees…

Wouldn’t be surprised if the dirty tactics are still going on strong in the background…

Jay says

Hi Sarah

I have only just been advised of a redress of £5400. What roughly can be expected as the “much lower amount” if you are aware of a rough percentage and how long should / can this take ?

Thanks

Oliver says

About £230

Wonga was 4.3p in the pound

tim says

expect to get maybe 2-3% of that max, probs wont get paid for another 3-4 months, rough estimate I was told by quickquid

Oliver says

Onstride told me today that administrators have said 7 months from the 14th February when the portal closes.

Lisa Smith says

When my claim was upheld by 90%

This was the criteria in my email and I dont see how they are not upholding this

What was the assessment criteria?

Your loans have been assessed against a number of affordability criteria:

Loan value as a proportion of income

If a loan’s value was greater than 30% of your income at the time that you took out the loan, your claim for that loan has been accepted.

Time in loan or number of loans

Subject to the type of loan borrowed from CashEuroNet, if you were a repeat borrower of CashEuroNet loans for a significant number of loans or period of time (without a break from CashEuroNet of at least 6 months) your claim for all loans beyond the number or period of time threshold have been accepted.

Additional affordability factors

In addition to the above, if there was any evidence that the loan(s) were unaffordable, e.g. payments in arrears or a record of you contacting CashEuroNet and reporting hardship, your claim for all loans after this point (without a gap of at least 6 months) have been accepted.

Please note that any loans that have been previously compensated have not been re-assessed by the Joint Administrators.

Sara (Debt Camel) says

When my claim was upheld by 90%

What does this mean?

Lisa Smith says

When they agreed to pay 90% of my claim

9/10 loans were accepted

Sara (Debt Camel) says

ok so are you saying they should have upheld your other loan?

Or were you talking to Sianyyyy and saying hers should have been upheld?

Daryl says

I have a query. I have been advised of an accepted claim value of £2,024.39, comprising of £1,465.27 interest and fees on loans, with an additional £559.12 of compensatory interest.

There is also a separate note for a refund of £520.01 for overpayment on a loan.

When I queried this with QQ, they advised that refunds are paid in full but would have to wait until the claims were closed.

If it is going to be paid in full, is there a reason why I would have to wait until the portal is closed?

Sara (Debt Camel) says

I don’t think it’s a legal reason but administrators do have to try to minimise their costs or there will be less money to pay out. So I am not surprised if they want to batch them up and pay them all at once rather than do it individually.

They aren’t doing this to make more interest on the money.

Daryl says

Thank you, I was just concerned because I didn’t really understand it and was worried that their “reluctance” to not pay it straight away might be so they could turn around and reduce it’s value?

Sara (Debt Camel) says

I haven’t heard of anyone having a problem with this. You have stopped paying them now I hope?

Daryl says

I had settled all my loans previously.

Under review they advised the redress and separate refund based on overpayment of a previous loan.

Oliver says

Following a successful appeal I have been told to wait for a follow up email for the claim value.

As my loan is in arrears I am hoping this will clear the outstanding balance

Does anyone know how long it takes to get the claim values following the outcome of an appeal?

Kel says

When did you put your appeal in? And If you don’t mind me asking, what was the reason you appealed? I submitted mine on the 7th December

Oliver says

My appeal has been upheld but now I have to wait for the figures for the final settlement amount.

Excessive amounts of gambling

Appeal submitted 1st December

Chantal says

I am still waiting a response to my appeal. I’ve contacted them a few times to chase but now being ignored. Receiving automated emails from them saying they have received it and that’s all. Any one else feel they are being ignored?

And when did you put yours in? I put mine in on the 28th of December.

Oliver says

Appeal submitted 1st December. Decision this week Monday 8th February

Chantal Smith says

I finally got a reply. They are still looking in to it, due to the very high numbers of claims and appeals. Guess just got to be patient now. At least I finally had a response.

Dave S says

Happy and sad at the same time. Happy that i should be receiving and unexpected cash injection and that my financial status is a million times better off now than it was when i took out the payday loans, but gutted that the full redress amount was almost £25k and i’ll be receiving just 4.3 % off that

Sara (Debt Camel) says

25k. That’s why you were in such dire straits for so long :(

bob says

4.3% is optimistic, the final % will be lower almost certainly

Andy says

Hi don’t know if I’m in right place. I was in a payment plan with uncle buck loans and they have sent me a email of default or forbearance and say my account is now closed. I managed to log on to account and it stated my debt was sold but I’ve been trying all week to get through to them to see who has bought debt to no avail. I now try and log on and I think the site is no longer in use as I keep getting a cloudfront error. Does anyone know anything about this?.

Sara (Debt Camel) says

It sounds as though they maybe writing off the loan and not selling it?

Lisa Rutter says

Hi, I submitted a redress claim but haven’t heard if mine is successful or not yet. Can you advise when I should hear please?

Dave R says

Hi Lisa,

I believe the response is normally 120 days from the day you submitted the claim. Did you submit before the deadline which I think was yesterday? Their acknowledgement of your claim should state the 120 day decision timeline. My decision came at 95 days.

Jay says

I’m at day 138 with still no response to my claim. I’ve escalated three times but to no avail, I wonder if Sara has any suggestions as to an appropriate next step at this point, please?

E says

I didn’t receive a response from them to my submission in October and after 120 days I called the helpline. They claimed to have sent a response in December but I had no record of it (either in emails or in junk folder) so they resent. Not sure whether it’s widespread but worth calling

Oliver says

Has anyone had an actual refund yet of any overpayments to the loan.

I was told these will be received much quicker that the divedent payment which is due in 7 months

Alex says

Still waiting email about it this over payment as well

Daryl Rogerson says

I e-mailed a few days ago asking them this question, still no response.

Oliver says

They cleared the actual loan within 5 mins of the calculation which is great; just thought they would have processed the overpayment at the same time as it is a “full” refund and not divided up once all claims are received.

Sara (Debt Camel) says

the administrators probably want to batch up payments made to reduce the administration costs.

they are NOT doing this to make money from the extra interest they get – there isn’t any.

Oliver says

I’ve received the email with all the figures. Loan is now closed due to the refund but there is an overpayment of £50 per month since the portal was open. Logged the complaint back in August so £350. As there is no share of the dividend and full value refund I thought it would be quicker. They cleared the loan within minutes after receiving the refund amount. Can’t see how it takes 7 months for an overpayment.

Lisa Smith says

Received an email from quickquid today stating:

Our records indicate that you have an accepted claim and have received an assessment outcome with the breakdown of your claim value in the administration of CashEuroNet UK, LLC (in Administration).

As part of your claim submission, you provided us with your current details, including your current bank account details.

As previously explained, in the event that a dividend is payable, the bank details that you have provided will be used to pay your dividend.

What if my details have changed?

Customers with an accepted claim in the administration can change their contact and payment details up until 14 March 2021 by accessing the Online Claims Portal . You will need to follow the same authentication steps that you took when you entered your claim.

As stated above, all details must be updated through the Online Claims Portal by 14 March 2021. No changes can be made after this date.

Does anyone know the estimated value of return for these loans ?

Emma Sharpe says

I’ve had the same e-Mail today. I was confused by the wording. It seemed to suggest I’d already been informed that my claim was successful and had a breakdown of figures and values which I haven’t. Maybe I misunderstood?

Lisa Smith says

You should of had a breakdown. But depends when you submitted. My breakdown of money owed to me was confirmed back in November probably a week after those emails they sent by accident. Search your junk mail just in case. The email with the claim assessed came from Quickquid. All other emails came from CashEuronet UK

Oliver says

Thanks.

I won my appeal and confirmed the breakdown Monday this week.

Loan in arrears cleared immediately and have £350 owed in full due to overpayments since the portal opened,

Seems to be about 3 months then since the figures were confirmed to you receiving the refund. I presume this was the overpayment you received back as they have yet to confirm the dividend part of the refund?

Hopefully it will be quicker now that the portal is closed for new claims

Steph Critchlow says

I had this today so checked bank details were correct.

Just had a notification From my bank I’ve had 2 payments with the reference redress payment and another with remediation?!

Is this my payout??

No clue where it’s from otherwise!

Lisa Smith says

Thats really good. How much percentage of your redress amount would you say they paid – less than 5% ? Roughly

Steph Critchlow says

My claim value was £470.30 the 2 payments I’ve received total £222.14.

I’m not sure if it is the refund, just on hold to my bank to see if they can tell me the senders details.

Seems too high to be the refund.

Oliver says

Could be the overpayment part if that was due.

That is refunded in full.

Most had this figure in the table – last figure in the list.

All payments to the loan since the portal was opened are refunded in full of the claim is successful

These refunds are paid quicker than the dividend part.

Waiting for my overpayment refund!!

Jane Y says

Hi Steph did you find out what this was for? I had the same email yday and am due a refund but as yet no cash received

Thanks

Jane Y

Chantal Smith says

It is likely to be somewhere between 3 and 4.5% only.

Oliver says

I would like to know when they are making full refund values for overpayments.

No dividend share as it is a full refund

Daryl says

I queried them about it a few days ago. This is the response:

————————————

Thank you for contacting CashEuroNet UK, LLC. We appreciate your patience during this time, in response to your query, once your refund for the amount of £520.01 has been process our joint adminstators will be providing a confirmation email. Unfortunately there is no direct timeframe that can be provided at this time. Please continue to montior your emails for future updates.

————————————

As someone said above, they have commitments to keep costs down, so will no doubt try and make as few batch payments as possible with this is mind.

Oliver says

Thanks.

I have had inconsistent messages.

The claims handler said 3 months

One person in customer services said anywhere up to 7 months

And someone else said much quicker than that couple of days as there is no dividend of value to work out as it is a full refund,

I would have thought when they cleared my loan down to zero they would have processed any overpayment at the same time as BACS or faster payments have min cost to the business (5p) for a faster payment at a cost to the business.

They cleared my loan in 5 mins of receiving the outcome which at least is good.

Oliver says

It’s likely to do with an overpayment refund

What was the time difference from getting the outcome email with the figures to getting the email and payout about bank account?

Jane Y says

Hi

I had this email today as well. I’m due a refund for overpayment but as yet not received anything.

Did your payment go through a long time after receiving the email?

Oliver says

When did you get the outcome to your claim with all the figures. I’m seeing a trend of about 3 months between the outcome to the claim to getting the email about the confirmation of bank account etc

Was yours much quicker than 3 months?

Jane Y says

Hi

I originally received outcome email late November.

I then received another one start of this month with same details. Then today received the next email as mentioned earlier. My query was that I have not had any payments received as someone else was saying that they had. I too am due a refund for overpayments

Matt says

Hi , just wondering if there is any news on what the

administrators are going to do with the business?

Do you think they will let the business go into liquidation.

And if you have had a claim rejected, if they go for liquidation will the credit reference agency have to remove all loans ?

Thanks

Matt

Sara (Debt Camel) says

It’s definitely heading for liquidation.

It is possible the remaining loans could be sold to a debt collector but they may not be.

CRAs don’t remove all loans when a creditor disappears. But if you then want to get your record corrected, the CRA can’t get this confirmed by the creditor so you can can ask the CRA to “suppress” the record so other people can’t see it.

Kel says

Hi Sara, what would happen if they didn’t sell the loans and went into liquidation. Would they still expect to recoup the remaining loans?

Sara (Debt Camel) says

What happened with Wonga – the administrators either couldn’t sell the loans or were offered a such a low price that they choose not to. Instead they offered everyone a chance to settle at 20% of the balance and have the loan deleted from your credit record. And after that then they stopped taking any more payments.

QQ may not be the same of course.

Once a company is liquidated it can’t continue to take loan repayments because there is no one there, no bank accounts etc.

Kel says

That gives me some hope if my appeal is denied. I’m paying £200 a month at the minute (70 for arrears whilst I was on my dmp and my contractual amount). I’ve already paid my loan amount back 3.5k and another 3.5k to go :(

Sara (Debt Camel) says

this is the reason it may be less likely to happen with Q than with Wonga – most Wonga balances were smaller and many had defaulted a long while before so are a lot less easy to sell.

JP says

Hi,

I’m still waiting on a reply from the administrators in regards to my appeal, however i was wondering if my claim was upheld will i be refunded in full for all payments made during administration? My loan finished in Sept 20 but had continued paying throughout administration.

Thanks

Sara (Debt Camel) says

mmm probably. You do have to replay the capital but at a guess you would already have repaid that before the administration started.

JP says

Yeah i’d already paid the capital back give or take a £100. So would it be from Oct 19? Or when the portal opened in Aug 20? Fingers crossed it comes back in my favour. Thanks.

Oliver says

Any overpayments made to the loan since the portal opened are refunded in full

Waiting for mine following my successful appeal

JP says

Good news, hopefully mine will be the same

Kel says

Sara, do you think my grounds for appealing is legitimate, I’m still waiting to hear back. I chased them yesterday and apparently it will be another ten days. My complaint is that when I tried to get loan back in 2017 I didn’t realise I already tried to get a loan with them in the past. It had my old employer details, income and expenditure but wouldn’t let me change it before clicking proceed. I didn’t get an automatic response, someone called asked for my payslip, so I sent it in but was sure i wouldn’t get the loan as it was a different company and lower amount. The next day I was approved. 7’months later i went onto a DMP. When I contacted onestride, they couldn’t find my account with my postcode, old or new. Turns out they had my old employers postcode? And … my loan doesn’t appear anywhere on my credit file and I’ve still got over 3k left to pay….

Sara (Debt Camel) says

Are you saying they rejected your claim as they couldn’t find an account for with a loan?

Kel says

They didn’t say why they rejected my claim. I only had one loan of 3.5k with onstride. The total value including interest is over 7k. I’m still actively paying the loan.

I’m guessing I didn’t meet the criteria?

Sara (Debt Camel) says

so was the loan unaffordable? If it wasn’t, appeal and send your bank statements to prove the loan was unaffordable. People seem to be winning some appeals when they didn’t meet the “criteria” used.

Kel says

I believe it was and I ended up on a dmp a few months later. Also I stated they didn’t carry out the proper checks, for example my old employers details were saved on my account when I applied for the loan. When I sent in my payslip from my new employer it wasn’t questioned. I’ve provided all the info in my appeal and I’m just waiting for a response now. It’s been over 2 months.

Kel says

So I’ve had a reply from in regards to my appeal. They have accepted it and have said I will receive a new claim value email in the next 7 days. What happens with the interest? Will it all be removed and any remaining balance from my original loan amount left to pay? (If any)

Sara (Debt Camel) says

Good – people do seem to be winning some of these appeals.

The balance should be adjusted so that you only have to pay in total what you borrowed. Do you know what you have paid in total to the loan so far – ignore if this is “interest” or “principle”, just the total of your cash payments.

Kel says

Hi Sara, yes, I’ve paid around £3600, my loan was £3500 so technically I shouldn’t have anything left to pay. They recognised they had not completed the appropriate checks on my income and expenditure at the time of funding.

Sara (Debt Camel) says

In that case the balance should be cleared and the excess should be refunded to you in full. These were payments made during the administration that should not have been made so you get a full refund, this doesn’t go through the pro-rating process where people only get percentage of their refund back.

Kel says

That’s great. I have another payment due on Friday and I’m concerned that my revised claim value won’t arrive by then. Should I pay it in case they try and issue a default? I’ve tried my hardest to clear up my credit rating so not sure what to do in this situation. I doubt they’ll place a hold on my account.

Sara (Debt Camel) says

Can you make the payment easily?

I think there is little chance they will sort out your claim so fast to be able to stop taking the Friday payment. Yiou need to acty fast to be able to cancel it from your end.

They can’t issue a default until you have missed several months, but they could add a missed payment to your credit record. But in administration this often doesnt seem to happen. If it did, they would have to remove it as you have won your claim.

Kel says

I could make the payment, i just don’t want to be waiting x amount of months for the refund of the overpayment. My bank issued a new debit card last week as there was an issue with my other one so they don’t have any details to take a payment. I’ll wait until Thursday, if I haven’t heard anything else about my claim value I’ll call them to make a payment.

Oliver says

I hear it is up to 3 months for the overpayment refunds.

Seems from comments that people are now getting refunds now from resolved claims back in November. Only the overpayment part

I so hope it is sooner as waiting for mine from my resolution of last week.

The dividend share is taking 7months from when the portal was closed

Kel says

Oliver, how long did it take for you to receive your new claim value from when you got the accepted claim email?

Oliver says

Exactly 7 days.

Loan was cleared immediately from the interest refund – £1050 in arrears. Got the calculation email and then 5 mins later email to confirm loan was closed.

Waiting for my £350 refund from 7 payments since the portal opened £50 a month from a repayment plan. Been a week since loan was cleared

I’m hearing mixed messages on the overpayment refund. Some saying days, weeks and now up to 3

Months. Certainly treated differently to the % / dividend refund which takes 7 months. Expecting £10 refund lol

Jane Y says

Hi both

I received an email back in Nov 2020 accepting claim and quiting a refund for overpayments. I then received the same email in Feb this year. I am still waiting for the overpayment refund.

Jane

Kel says

I won’t have much of a refund but I’m not really bothered, as long as my account will be closed I’m happy. Be glad to finally put this to bed and not have to deal with them anymore. Fingers crossed your refund comes through fairly soon

Chantal Smith says

I have had a response to my appeal.

My claim was upheld by the financial ombudsman before they went in to administration. But I wasn’t paid and the claim wasn’t settled. I then applied through the portal, to be rejected. I appealed and they are now asking for information ie bank statements that I won’t be able to obtain as it is now more than 6 years old. When I first complained it was about 4 years old. It took over two years to be dealt with and I obtained everything I was asked for at the time. Don’t know what to do now. I did keep my emails from the complaint being upheld. Does anyone think I should send these in to them seeing as I now cannot obtain different bank statements that they are asking me for?

Sara (Debt Camel) says

did you get bank statements for FOS?

Chantal Smith says

Yes I did and I sent all these to the administrators but they are asking me for more now that it will be impossible to provide?

Sara (Debt Camel) says

so how many did you send and how many are they asking for? can you something about how many loans you had over what period?

Chantal Smith says

I had a total of 15 loans over two years. I have sent them statements to cover all the period of borrowing, except for 30 days before the borrowing started, which wasn’t requested at the time and I could have gotten this then but now it is over 6 years old the banks no longer have the records. The borrowing was from 2011- 2012 and I started the complaint in 2016. This was then held up with the Ombudsman waiting to see if Cash Euronet would look at it because of the age. They finally agreed to look at it and agreed with the ombudsman decision a short while before they then went in to administration.

I then raised it through the portal and appealed and sent them all the statements that I had originally sent to the ombudsman. They are now asking me to send them a bank statement which is dated 30 days before the borrowing which I don’t have and it will be impossible to get. I’m now at a loss and very infuriated because my complaint was previously upheld on the information that I had already provided.

Sara (Debt Camel) says

Then reply that you can no longer get that statement, point out if FOS or CEN had originally asked for it you could have done, but say that you do not mind if you don’t get a Refund for the first loan.

Dave R says

QQ accounts and a default now all removed from both Experian and Transunion. Both achieved via raising disputes and attaching my claims outcome email which states the accounts would be removed. Don’t wait months and months for Quickquid to eventually make the changes folks, get your disputes in.

So happy these are gone. Thanks so much Sara and this wonderful community for all your help and advice.

alan says

nice one, Ive raised manual disputes with both for the same thing, did it around 12 days ago, can I ask how long it took for you to get the info removed from having initially emailed the dispute?

Dave R says

Hi Alan,

Experian wrote to me on the 28th day to say they were deleting it all. It was off my credit file there the next morning.

Transunion took about 6 weeks from initial dispute. They actually initially rejected the dispute because curiously CashEuro/QQ replied to them to say that my case was ongoing still and no update was needed – which is false. I provided Transunion with my

email from my Experian and asked them to re-dispute the issue. I then emailed email addresses for both Cash Euro and QQ and asked for them to remove the data/agree to the dispute this time. I provided them with the Experian letter and my final response letter from them. They oddly asked for my Transunion report (sent them the credit karma version) and upon receiving that said they would escalate the issue. 1 week later they emailed me to say they had requested the information be deleted and Transunion emailed on the same day to say that the re-dispute was upheld.

Thierry says

Hey Dave,

Well done on removing QQ from your credit report. You mentioned Experian and Transunion. But what about Equifax?

Dave R says

Hi Thierry, QQ haven’t appeared on my Equifax report at any point. Not sure if they report to them? Are they on your Equifax report as well?

If they are, I’d contact Equifax and do exactly the same thing. Send them your final response letter where they have stated they will remove the loans as evidence for your dispute.

J. Ball says

Hi I contacted them early last year and was told I would get a reply by September, I haven’t had anything and I can’t find the original email they sent me?

Sara (Debt Camel) says

You need to talk to customer Services urgently to find out what is happening.

Hmcat says

If you thought you had claim submitted but then were asked for bank details etc contact them asap after fruitless emails to lavery etc once ICO included they admitted my claim wasn’t submitted due to requests for employment details etc on bank statements I maintain data harvesting not required for historic decision and if making payment then ask for details .. finally got a response claim apparently submitted before deadline did not have to provide all bank statements with employment household transactions .. but how many claims not submitted due stupid caveat or attempts at setting up DD on bank accounts as veiled validation? heads up this is a huge can of worms they refused submissions INCORRECTLY.. or a cynic might say delay delay delay…

Jay says

I’m at day 145 with no outcome to my claim. I’ve emailed Christine Laverty with no reply, countless escalations with no updates, I’m at a loss now. Do you have any ideas as to what I should do now, Sara? Or has anyone else had a similar issue? When I just called, the first question was ‘are you calling to update bank details or to submit an appeal?’ Which leads me to believe that the scheme has moved into a new phase and I’m concerned my claim has slipped through the cracks.

Sara (Debt Camel) says

Email her again with the word COMPLAINT as the subject.

J says

Hi does anyone have an email address? I’ve been emailing onstride since last year and no response!

Julie says

Can anyone confirm whether the overpayment amount is separate from the other figures and whether this should be paid in full?

Jemma Ball says

Yes in may last year and I have an acknowledgment email from cash euro net but they don’t seem to reply to my emails

Sara (Debt Camel) says

have you phoned them up?

Oliver says

I’m in the same position regarding overpayments (full refund)

Anyone had theirs yet since having the calculations come through. How long did you have to wait.

Appreciate that the dividend/ share will take longer but keen to get overpayment back

I had an overpayment with another lender in administration and received it back within 48 hours by faster payment.

Still waiting a week since the email confirming the amount.

Julie says

I emailed them asking when the funds will be paid and they said anytime up until September

Rebecca says

I too have finally had my appeal upheld but have been told it will be a few weeks before my assessment is calculated due to the complexities of my case. I’m aware that my outstanding balance with onstride that I’ve been paying monthly will be fully cleared but I’ve got a payment that is scheduled to be taken Friday, do you know if I cancel the card whether the payment can still be taken?

Jo says

Hi,

Just need a little advice?

I have an live on stride account on my credit file. I took the loan out in 2017 under Pounds to Pocket , however straight after I was unable to make any payments. I have not be chased for the debt since 2017.

I’m sorting out my adverse credit and notice today that the company is under administration? Is it worth clearing the debt ? Can I reach a settle with the administrator? Any other relevant advice?

Many thanks

Sara (Debt Camel) says

oh dear. The time to make an affordability complaint to the administrators passed a few weeks ago.

is this loan defaulted on your credit record?

We don’t know what will happen to these debts. With Wonga, the administrators wrote to everyone and offered them the chance to settle at 20% of the debt balance, but that was a bit later on, near the end of the administration.

The Wonga loans were never sold. In some other administrations loans have been sold to a debt collector and you can then offer the debt collector a settlement.

J says

I’ve just had notification that after a loan for £700 the total repayable was over £6000! Surely they would have to consider such a claim or write off the balance owed

Sara (Debt Camel) says

how old was that loan?

J says

It was from 2013!

Sara (Debt Camel) says

ok, you need to wait and find out what happens to your claim.

paul says

Hi submitted my affordability complaint via the portal end of august but haven’t heard anything since. Is anyone else still waiting after this time? Thanks

QQdef says

I had one loan with QQ which was assessed and fully accepted. The email said that the loans will be removed from my credit file but I notice that this month they now have a balance of 0 and are showing as settled.

I’ve emailed experian who say that the loan will stay on my credit file for 6 years from default. But I thought missold loans are supposed to be removed from my credit :/

Oliver says

Clearing the balance to zero and settled is the easy part. They will take up to a couple of months to clear from your record as a default. I’m in the same position. I have sent my confirmation email to agencies to see if they will remove manually.

Tom says

Just had message from Experian, I raised a manual dispute with them to have my quickquid default and missed payments removed from my credit file, today’s message is as follows, pretty disappointing

“I am writing about the recent query we raised with CASHEURONETUK, LLC, about the accuracy of data recorded on your report. As we haven’t received a response from them within 28 days of you raising the matter with us, we have suppressed this information from your report.

This means that, even though we still have a record of that information – it won’t be seen by lenders if you make credit applications, and won’t be seen by you if you obtain a copy of your report. You may see a change to your Experian Credit Rating once this information has been suppressed.

When we do receive an update from CASHEURONETUK, LLC one of the following things will happen:

1. If they confirm that the information is accurate, we’ll stop suppressing it, so it will appear on your report again.

2. If they tell us that the information can be changed, we’ll make the change and the information will then appear on your report again.

3. If they say the information can be deleted, we’ll permanently delete the information from your report.

We will let you know once we receive their reply.

Kind regards,

Experian Ltd”

Mr and Mrs C says

Finally!

The Joint Administrators have assessed your claim and can confirm that it has been partially accepted. Your assessed redress claim amount is explained in the table below, with your claim amount detailed at the “Accepted claim value” row of the table. A breakdown of your loan history with CashEuroNet UK, LLC is also provided at the end of this email.

Debbie says

Hi Sarah

I recieved an email from Casheuronet in Dec20 saying they needed more time to look at my claim due to my loans being with a third party (lantern) which I am still paying. I rang today for progress and got told they are still waiting for the statements from lantern and I could speed my redress claim up if I got a copy of them and sent them by emai. I have asked Lantern for a copy of these. My question is if my redress is worth more than what I owe on the debt is Lantern liable to refund me the difference or do I just get the percentage the administrators are giving from casheuronet

Many thanks

Sara (Debt Camel) says

I don’t think there is much chance Lantern will refund you any cash.

Debbie says

Just another quick question. Do I keep on paying my monthly payment to Lantern or do I ask them to put it on hold while my redress is looked at. I only owe £320 now.

Many thanks

Sara (Debt Camel) says

If you think you have a strong complaint to QQ then it’s best to stop paying. If you can put this money aside so if things go wrong and you still owe Lantern the money, you have it waiting?

Charlotte says

I am in the same position. A quick quid loan was sold to third party debt company. I haven’t made any payments to them as I wanted to see the outcome of my claim. If my claim is upheld will this debt no longer need paid or that it has been sold to them do I need to pay it? I’ll start a payment plan with them if I need to, but I don’t want to pay if it is classed as unaffordable in my assessment

Debbie says

Charlotte I have just rang Lantern who are my debt recovery firm. I’ve been advised that I should have stopped paying OR they should have stopped taking my payments when they were told of my complaint for redress. They have now stopped my payments and told me that if I have overpaid them because they didn’t stop my payments I will be refunded. So hopefully if my redress is in my favour they will be owing me some money back.

Charlotte says

Thanks for the information Debbie. I won’t set up a PP until I know the outcome of my claim

J says

Hi Are grant Thornton dealing with all payday lenders ie lantern, Quickquid etc?

Thanks

Sara (Debt Camel) says

When a lender goes bust, a firm of insolvency practitioners is appointed. GT were appointed for Wonga and QuickQuid. Other firms have handled different lenders.

Lantern is not a payday lender and they are not in administration, they are only mentioned here as they are a debt collector that has bought some payday loans.

Lynne says

Basically I’ve got until 14th March to change my details on the online portal but it won’t let me log in. Not even with previous emails and postcodes! Argh this is incredibly frustrating.

Lynne says

I’ve spoken to them and they can’t locate my account based on the info I’d given them despite the fact I’ve only had two different addresses and two different email addresses grrrr.

It was obvious she could see my loans as well because she suggested I look up my credit report to get the loan reference off that, then she said oh but you won’t be able to as they’re from so long ago!

J says

I didn’t have mine- when I went on the portal it couldn’t find my details so I ended up emailing instead

J says

Hi can I ask what the process was for you to get money back?

I took a loan out for £700 total repayable was £6800 and I am being chased for a balance of £1021.

I have an email from Cashruronet who say that my complaint is being looked at and can take up to 120 days from submission date.

Thanks

Lynne says

I did email them but it was kind of an automated response telling me to ring them if it was about a claim. Thing is she said she didn’t need all the correct details to verify me over the phone, just either postcode, email or mobile, but whatever I gave her she still she said it wasn’t right. I know where I’ve lived!

Sara (Debt Camel) says

you have no option but to persevere with this. Otherwise you aren’t going to get paid.

J says

Yes I haven’t assumed- they asked for up to date contact details once they confirm they had received my complaint and it was being dealt with

Lynne says

Did they take long to get back to you once you’d emailed? Appreciate I only sent them the message yesterday but I’m conscious that the deadline for updating/changing contact and bank details is 14th March so the clock is ticking. As she couldn’t log into my account over the phone I put everything down in an email so was kinda hoping they could use what I’d said on there to get into my loan history.

Sally says

Hi Sara ,

I had previously submitted my

Claim to casheuronet , which they rejected in November 2020,

I emailed back the same day with an appeal to reconsider and sent in my bank statements and credit report , I have recieved an email today that my claim has been assessed and fully accepted . I just have a question as to what I would get after the settlement (I still owe quickquid)

Here are the figures they sent me .

TOTAL INTEREST AND FEES ON LOANS -£704.40

TOTAL COMPENSATORY INTEREST – £69.39

LESS SETOFF. -£600.00

REVISED INTEREST AND FEES ON LOANS- £104.40

REVISED COMPENSATORY INTEREST. -£69.39

ACCEPTED CLAIM VALUE. -£173.79

COMPENSATORY INTEREST SETTELED BY WAY OF SETOFF. -£0.00

REMAINING LOAN BALANCE DUE. -£0.00

REFUND FOR OVERPAYMENT ON CASHEURONET UK LLC LOAN. -£132.07

Thanks for your help in advance

Sara (Debt Camel) says

They don’t make it easy, do they!

I think they are saying they are wiping out the £600 you owe them – that is the set off part.

That leaves a refund due to you of 173.79 – but you will only get a small percentage of that.

However you have paid them £132.07 so far in loan payments in the administration which they are refunding in full because the loan was unaffordable. So you will get this money back. probably separately from the small amount of the refund you will get back.

If you are still paying them then stop at once!

J says

Hi,

No almost immediately- I’ve was back and forth with them this morning.

Do you have the correct email?

Oliver says

Anyone received their overpayment refunds yet or are they waiting until after the 14th March the deadline to update bank details?

Julie says

I’m still waiting for mine too. Will be interested to know whether anyone has received this as yet

Lynne says

They still haven’t answered my email and I said it was urgent due to the deadline looming to update banking and contact details grrr.

Graham says

Hi,

I had a few payday loans in the past with Wonga, Quickquid & Piggy Bank. I understand claims processes have closed, my question is, can I write to anyone to try and get some of them removed from my Credit file due to unaffordability?

I received emails from Wonga / their administrators last year regarding the administration process but be great if you could advise who to contact to try and get some removed from my Credit report. Thanks

Sara (Debt Camel) says

This is a general problem, not confined to affordability issues. Some of the possible reasons for an incorrect credit record include:

– that the debt was settled, perhaps partially, but still shows as open.

– that the lender had agreed to delete the credit record or to remove the default but didn’t before administration.

– identity theft – you never took that debt out in the first place

– the default date was wrong because you hadn’t made any payments for more than 6 months before that

– a default should have been added a long while ago but the debt has been left showing missed payments or payment arrangement and so will not drop off

– that a missed payment or default was the fault of the lender who never took payments under a direct debit or continuous payment authority so you thought the debt had been settled and you were never asked to pay the balance.

So someone may feel that their credit reporting is wrong for some reason but the lender is either in administration and the administrators are not responding to requests to correct the credit record or the lender has been liquidated and there is no-one to respond at all.

In this situation you can ask the credit reference agencies (Experian, Equifax and TransUnion – check all three to see which your debts show on) to correct your credit record as it is wrong and the incorrect reporting is against the data protection rules.

The CRA will then ask the lender. If they are in administration it is likely the administrators will not reply. If the lender is liquidated there is no-one to ask. You may then be told by the CRA the change can’t be made as the lender has not agreed.

You should then ask for the credit record to be “suppressed” as it is inaccurate. If the CRA refuses, you should send the CRA a formal complaint. If this is rejected you should send the complaint against the CRA – not the original lender – to the Financial Ombudsman.

If you have evidence to support what you are saying, it would be good to send that to the CRA and onto the Ombudsman if necessary. For example you may have reported identity theft to Action Fraud and have been given a crime reference number. You may have the email from the lender accepting your partial settlement offer and your bank statements may show it was paid. You may have the email from the lender agreeing to delete the record or remove the default. But sometimes there may be little or no evidence or it may be complicated and here it isn’t clear how much time the CRAs will put into investigating these complaints.

graham says

Hi Sarah,

Thanks very much for such a detailed reply, very much appreciated. I wish I’d found this website before the closing date for claims to Piggybank!

There were no frauds, missed patents or defaults, just quite a few payday loans, in succession. From reading your site, it looks like I may have had a good chance to claim against unaffordability reasons. I’m not too fussed about getting any money back but getting the entries on the credit report removed would be ideal, as I’d been planning on applying for a mortgage this summer (last payday loan paid off July 2019).

I’ve checked all three CRAs through CheckMyFile, looks like entries only show on Transunion report. Do you think it’s worth contacting each lender (Wonga, Piggybank &Quickquid) before the CRA?

Thanks again for you assistance,

Graham

Sara (Debt Camel) says

There is no-one to contact for Wonga anymore, the company is liquidated.

I think it is worth emailing QQ and Piggybank. Say you understand you have missed the cut off to submit a Claim for a refund, but you only want the loans deleted from your credit record as they are unaffordable.

If you haven’t had a reply in a few weeks, you can then tell TransUnion this.

Graham says

Thanks very much Sarah.

I’ve contacted QQ & Piggybank requesting credit record removals. QQ replied today stating the portal had closed (I don’t think they read the email fully, as I stated I was only requesting credit record removal). They’ve replied saying they’ve submitted my credit report dispute, which is subject to eligibility & approval. Fingers crossed.

I’ve also contacted Transunion and raised disputes about a few Wonga loans and one Payday Express one.

Thanks very much again for your enormous help.

Gary says

I need some advice, Administrators rejected my claim on 9 of 10 loans so I appealed and won appeal, I know that I will hardly get any money but I have an Onstride loan which is part of appeal I won and I still owe on it as I refused to pay them, I have a default on my credit file from it. Am I right in thinking they will offset what I owe on that and default should be removed, I ‘m a bit confused

Thanks in Advance :)

Sara (Debt Camel) says

That sounds right

Gary says

Nice one, thanks Sara

Not even bothered about the money side just want the default gone

Sara (Debt Camel) says

I am not saying this will work. It is a more difficult case to argue that the loans should be deleted as they were unaffordable. But you can try.

Gary says

Ok, I’ll give it a shot anyway

Thanks

Gary says

I have received my settlement email from CashEuroNet

It includes the offset to clear the money that was outstanding to Onstride and I have confirmation email that that is now settled in full.

It states on my email the following

Will my credit file be updated?

All loans that have been accepted as part of your claim value will be removed from your credit file. Please note that, due to the volume of claims, this could take a number of months.

So I have emailed them back to see if that includes the default being removed

Might get a few quid back as my accepted claim value is £1227

Sara (Debt Camel) says

It says the loan will be removed. A default is attached to a loan record so it will go too :)

Lynne says

This is incredibly frustrating there’s just a few days left now to update banking details etc and they’re just not responding to my messages. I hate the way these companies harass you when it’s you owing them but ignore you when it’s the other way around.

Lynne Gilchrist says

I just emailed support@quickquid address and got an automated response that they will get back to me in 24 hours, which is more than I got from the claims address! Has anyone else found this to be the case?

George says

Hello

I am awaiting a decision regarding mine having sent my claim on 11/10/2020. I spoke to them today and they advised that because my debt was sold in 2018, they will take an extra 90 days to speak to the DCA. I have a CCJ on that particular QQ account. If my complaint is upheld, what would happen to the CCJ on my credit file?

Thanks!

Lynne says

I’ve spoken with the claims team again and despite giving them my customer ID number now (which I didn’t have last week) they still can’t get into my account! So he’s told me to email quickquid identity theft email address! I can see this claim going nowhere quite frankly.

Dave Wilson says

When can we expect quick quid to pay?

Lynne says

Don’t ask me Dave. They can’t even find my account and I borrowed £1000’s over the years!!