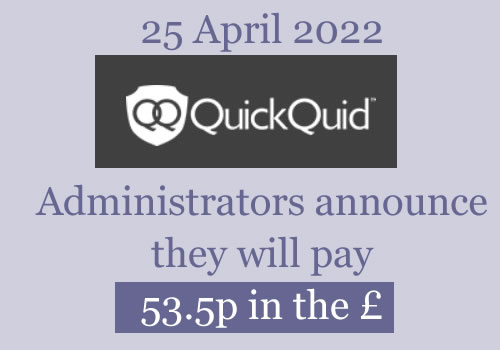

Payments – UPDATE – 25 April 2022

Administrators have started sending emails to everyone with an upheld claim telling them what they will be paid.

“The Joint Administrators are now in a position to declare a first and final dividend of 53.5p in the £”

The average claim value is c £1,700. Someone with that claim value will get a payout of about £910.

The payout details are given in the email:

- This will be paid over the next two weeks.

- If the administrators couldn’t validate your banking details, it will be sent by cheque. I don’t know how the administrators will “validate” your details.

- If you used a claims company, the money will be paid to them.

- Most people are not having any deduction for tax paid to HMRC, so there is no need to reclaim anything.

Credit records

The administrators may decide to :

– remove any negative marks on your credit record

– delete all loans that were upheld

– delete all your loans.

I don’t know what they have chosen to do – if people can check and report in the comments when they see a change, that would be great.

How much your credit score will change will depend on whether there were any negative marks. If you want to get a mortgage, you would like as many payday loans gone as possible, even if they were repaid on time and not hurting your credit score.

In a few months when the administrators no longer talk to the CRAs you can ask for any remaining loans to be “suppressed” so other lenders can’t see them. See https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do that now.

QuickQuid went into administration in October 2019

CashEuroNet (CEU), which owns the QuickQuid, Pounds To Pocket and On Stride brands, stopped giving loans and went into administration on 25 October 2019.

I will be talking about QuickQuid (QQ) rather than CashEuroNet as it is the more familiar name. Everything here also applies to loans from Cashruronet’s other brands, Pounds To Pocket and On Stride.

Grant Thornton were appointed as Administrators. They set up a page about Redress Complaints – this is their term for people who have asked for a refund because they were given unaffordable loans.

Background to the QuickQuid Administration

QuickQuid was one of the “Big Three” payday lenders in Britain, starting out in 2007.

After Wonga and the Money Shop Group had all stopped lending and gone bust over the last fifteen months, QuickQuid was left as the largest UK payday lender.

QuickQuid had well over a million customers. When it went into administration there were c. 500,000 customers with outstanding loans.

Many of these customers had prolonged borrowing from QQ. They either rolling loans over or repaid one loan but were left so short of money that they had to borrow again.

These customers have good reasons to win an affordability complaint and get a refund of the interest they paid.

Affordability complaints started on a small scale in 2015 and increased in the next few years.

In 2018, complaints going to the Financial Ombudsman (FOS) jumped with the involvement of Claims Companies and QuickQuid became the most complained about firm to FOS, excluding PPI complaints.

For a long time QQ refused to refund interest on any loans taken more than 6 years before or where the loans were given in 2015 or afterwards. This resulted in a huge backlog of claims at the Financial Ombudsman, where QQ had made very poor offers to customers and then rejected an adjudicator decision.

In late July 2019, QQ agreed to accept several thousand FOS complaints it had previously rejected.

By accepting the FOS decisions on loans over 6 years, long chains of borrowing, and loans taken after 2015, the scale of QQ’s likely future liability for refunds will have become clear to the company.

After failing to persuade the FCA that a Scheme of Arrangement was appropriate, Enova, CEU’s large and profitable US parent, decided to close the UK business, blaming the UK regulatory environment.

How could the regulators let this happen?

This is an excellent question… Stella Creasy, MP called for an inquiry into the FCA over Wonga and QuickQuid.

What has happened in the administration

Customers with a valid claim for a refund are “unsecured creditors”. This includes:

- any refunds that were in progress after an amount was agreed or a Final Decision from a FOS Ombudsman (FOS);

- complaints that were underway at QQ or FOS when QQ went under;

- any new complaints sent to the Administrators.

All complaints at FOS legally had to stop and were been passed back to the Administrators. It isn’t possible to send any new complaints to FOS.

It is now too late to submit a Claim for unaffordable lending. The last date was 14 February 2021.

The administrators have given the following statistics about claims:

- 169,000 customers made claims for unaffordable lending;

- 78,000 claims were upheld by the administrators;

- the upheld claims had a total value of £136million, so an average of about £1,700 per claim.

Still owe a balance on a QuickQuid or On Stride loan?

More than 300,000 of the current loans were sold to Lantern in summer 2021. You should have been informed if your loan was sold.

The administrators have now stopped collecting any money from the remaining unsold loans.

This page is no longer updated

Comments have been turned off. If you have a query, please post it on the Refunds from loans page.

Joe says

So Quick Quid (Cash Euro Net) just called from a number in Hololulu, US. I didn’t answer due to it being an international number. They left a voicemail asking me to call them back on an 0800 number, which is the QQ collections contact number, which I did.

Advisor told me they are having trouble verifying my bank account for my claim so they are asking me to send a bank statement showing the last 30 days of transactions – they stressed that it has to show the past 30 days of transactions as well as sort code and account number.

I am dubious about sending this as I am not sure they need this to verify my bank account?

QQ previously set up a Direct Debit on my updated bank details, which I gave to them when I made a claim as I had old details registered with them but did not agree to a DD being set up? So I assume they had already verified my new bank details when I claimed?

ROBERT says

Can you not input your Bank details on the Portal?

Joe says

I did input my new bank details when I claimed but they said they weren’t verified at the time…. I called and gave them the details, they said they were verified at the time – this was months ago. As I said they must have verified them as they set up a DD using these updated bank details which they should not have done.

ROBERT says

Hi Joe, Thank you for your reply. Not sure of your personal situation, but a brief summary. Do you owe any monies? Having supplied your Bank details did they attempt a withdrawal without your consent? If so you can cancel this DD through you Bank account. A happy new year to you.

Joe says

Cheers – I have been paying QQ through a DMP for ages, so do still owe money.

The DD has already been cancelled – they set the DD back up when I updated my new bank details after putting my claim in, which they shouldn’t have done as I had not been paying through a DD for a while.

They didn’t take any money fortunately but did set the DD up without my approval, despite any previous DDs on my old bank account being cancelled a long time ago.

Main concern is them now saying my bank details can’t be verified unless I send a bank statement despite them already being verified as they set a DD up

On it….

Carla says

They are asking for a copy of my bank statement too. Did you provide yours?

Joe says

No, I didn’t yet provide a bank statement as they told me they needed it to verify my bank details but told somebody else on here that they wanted their bank statement to verify employment????

I am still unsure, I emailed QQ outlining that they’d previously verified my new bank details and got this response from them;

“ Due to us being unable to verify your bank details we are requiring a bank statement dated within the last 60 days and must show a full 30 days of transaction history in order to verify the details that you have provided. Without this information we are unable to proceed with your claim review. Please note the bank statement information will solely be used to verify your bank details.”

So, I am still unsure? Not sure if anyone can provide advice/Sara?

Danni says

Hi Sara,

I’ve written a couple of times regarding a previous refund, and whether customers were eligible to apply again so the loans that were not previously considered (dating back past 6 years) can be considered.

I am at the end of ny tether as I have been unable to get a response and it is obvious my emails must be getting ignored also. I emailed Christine Laverty as advised and still nothing. Is there anyone actually trying to help customers as I haven’t received even acknowledgement of my emails since I made my first telephone contact in the 1st September 2020.

Thank you in advance.

Sara (Debt Camel) says

how long ago did you email Chris Laverty?

Danni says

It was on the 23rd November.

Danni says

Hi Sara,

Is that a normal timeframe for response considering there’s one more month for people to submit a claim?

Thanks

Sara (Debt Camel) says

sorry I didn’t see your previous reply.

No that isn’t acceptable.

I suggest you send her another email and say if you do not get a reply within the next two weeks you will be sending a formal complaint to the IPA (that is her regulator).

Angie C says

I too have had a call from QQ asking me to email my last months bank statement showing employment details. Have queried this with them and keep getting a generic reply that it is required to proceed with claim. Unsure what to do.

Joe says

They told me they wanted my statmement to verify my bank details not my employment details? Regardless, I am sending a statement but editing all my financial transactions out before sending, so all they can see is my name, address and bank details…

Dan says

Has anyone’s loans been removed yet from your credit file?

Dave R says

I haven’t but I only had my decision on 22nd December. The email said it would take “many months”, I emailed them and queried this and asked if there was any way we could get it removed asap and they said:

“Thank you for contacting CashEuroNet UK, LLC. In regards to your query, we understand your concerns and do a[ologise for the delay. We are working to get all credit files updated as soon as possible. Unfortunately, it’s a process and all credit file updates are completed in sequence. Please continue to monitor your email for updates. “

Lauren says

Yes mine were removed

Amy says

Hi, I wonder if you can help me with some advice. I have a loan with QQ which I took out two years ago (whilst in a lot of debt). I haven’t paid them back and have been hesitant due to the administration. I can’t afford to pay it in one lump. I think it’s about £600. Can I call them and ask if we can come up with a settlement? I have tried to claim against them but they replied to say that its been rejected. Thanks

Sara (Debt Camel) says

do you want to offer a partial settlement now? or an affordable monthly payment?

what is the rest of your debt situation like? If there are any debts you are paying interest on, they are your top priority as no more interest can be added to this QQ debt. It may be better to carry on trying to clear other debts and wait until QQ contacts you?

Also with Wonga, the administrators offered everyone a chance to settle the outstanding debts for 20% and have the debt removed from their credit record. This was much later in the administration than QQ are yet at. It may or may not happen with QQ, but it could be useful if it did!

S says

Hello, i had three missed calls from QQ today. I called back and they asked me to email over a recent bank statement to verify my details in regards to the claim process. Anyone else had the same? Thanks S

S says

Hi all. I contacted them back with my bank statement as proof of my bank account etc. They have now emailed me total redress amount but obviously maybe less than total shown and its due to be paid on the 14th March.

Has anyone’ else been sent this?

Thanks S

Sianyyyy says

Still no reply regarding my appeal have sent countless emails, not sure what to do to escalate?

Sara (Debt Camel) says

I suggest you email Christine Laverty – details here https://www.insolvencydirect.bis.gov.uk/fip1/Home/IP/9121

Chantal Smith says

Does anyone know how long they are supposed to take with your appeal? Has anyone had a response to their appeal yet?

Pete says

I appealed mine at the end of Nov and heard back just after Christmas however they’ve made a error on the figures and trying to get this sorted now is becoming a pain as others have said they don’t respond or send generic templates I emailed someone at gtuk and have been told to allow 2weeks

Adam says

I just wondered if anyone else having the issue of not being able to submit a claim had been resolved. I was told on November 7th that it had been past to the administration management for resolution and still haven’t heard a thing I have emailed Chris laverty today so hopefully have an update soon, was told by a representative on the claim line that there were quite a few people affected.

Pete says

Not had any emails after the error on my claim assessment but just had a notification to say my credit report had changed and can now see they have updated my balance on my credit report and on the website £3559 with redress of £3495 owe then just £64 now

Also had my adjudicator uphold 2 further loans from avant so that balance will also be cleared and some cash my way but waiting on final figures

Once again thanks for all you do Sara

Louis says

Has anyone received a response after sending their bank statements in for verification? I submitted mine and covered up the transactions along with some payee names which were friends and received a response advising they cannot accept an altered bank statement… My name, address and banking details were all still visible however so slightly alarming as to why they need to see the other info… Could anyone advise on this or confirm legitimacy of this process? Thanks in advance!

Paul says

Hi I’m just wondering if anybody can help. I’ve had my complaint upheld by QuickQuid, which is great. The refund total is over £3000. But it states in the acceptance email that the money I will receive will be significantly less than the full amount as they need to wait until every bodies claims have been assessed to see what money is left over to be shared amongst everyone. Does anybody know roughly what the percentage of the payouts will be. As I’ve asked them via email but they can’t give me any estimates. I’m just wondering if I should be expecting 50%, or 25% of my full claim balance. Or if it will be even lower than that, which will be very disappointing. Thanks in advance for any advice given.

Sara (Debt Camel) says

it is likely to be a lot less than 25%, probably less than 10%

Chantal Smith says

It’s extremely likely to be less than 10%, roughly about 2-4% based on other payouts like Wonga and Wageday Advance.

Chantal Smith says

They will write off any outstanding balance due at that time.

Louise says

Hi Sara, I had my complaint agreed last year just before QQ went into liquidation and I was offered over £3000.

I know I will get significantly less than this but I don’t know how to find out how to claim for whatever I am owed.

Can anyone advise me.

A company called fast track was doing it for me but have stopped now that I won’t get anywhere near the amount agreed.

Thanks in advance

Louise

Sara (Debt Camel) says

Submit a claim on the claims portal

Nathan says

Just to give others some hope who are also appealing. I raised my appeal at the end of November last year and it has finally been reviewed and accepted today. I only have one payment left but its still nice to get it offset.

Sianyyyy says

What reasons did u appeal under? Still waiting on mine so fingers crossed!

Nathan says

I appealed on the basis that at the time I already had around 10 payday loans so to give me another £1,000 was unaffordable. I sent them everything they asked for and lucky for me it got accepted.

Michael says

Hi Sara,

My pounds to pocket loan was sold to Lantern. I received an update in December from the administrators to say they’re contacting Lantern for further information. Will the fact that my loan was sold to a debt collection agency affect the chances of my loan being removed from my credit file if my claim is accepted? Thanks

Sara (Debt Camel) says

I’m not sure what the administrators are doing here – I think they were taking legal advice about the treatment of loans that have been sold

Hmcat says

I have several emails from them the portal would not accept sort code called the number sent through process told submitted.. then received emailsaying claim it submitted called again told submitteddecision circa 120 days..two months later email saying my claim is not submitted and running out of time wed to call or etc REALLY fishy

George says

Hello

I was asked to provide a bank satement, firstly i sent a bank account that a have with Monese, which had no transactions ( i told them that i am unemployed so no salary transactions). I was asked to provide a bank statement with some recent transactions. I did a formal transaction in this account (a top up) and sent it again and it was again rejected. I currently live abroad and have no other active account in UK, except from this one, do you know if i can send a bank statement from foreign account? Will it be accepted? Will the fact that i live abroad have any impact to my claim (non eligibility, etc)? I had some loans with QQ while i was working in UK a couple of years ago. How should i act?

Thanks

Sara (Debt Camel) says

There is no reason why you cannot make a Claim from Abroad.

You need to ask customer services why they have rejected this account.

Claude says

Is there an anticipated payment date for QQ? Even a rough estimate?

Sara (Debt Camel) says

No date has been mentioned by the administrators.

The final date for claims is mid Feb. Then the claims have to be decided and the customers informed. Then time has to be allowed for people to appeal and to process those appeals. That would suggest possibly June-August for a distribution?

Unless there is some other matter that will take longer to resolve – – it isn’t clear they have resolved how to treat loans which have been sold to debt collectors. or whether there will be a sale of the remaining loan book.

Dave R says

Has anybody with a successful claim had their credit file updated yet? I know they are working through these in batches at the moment.

Pete says

I appealed mine towards the end of Nov and had it upheld just before Christmas the balance on transunion is showing as updated around 2weeks ago

John says

I was notified on the 22nd Dec that my outstanding loan (£800) with them was to be wiped and removed from credit file, since then the balance for this account on my credit file has been updated and reduced to £0 and “satisfied” however the accoun still appears in my “closed accounts” also I still have the entries of missed payments for the last 12 months or so listed on my credit file, from what I read in the email that I was sent these should be removed entirely from the file but so far hasnt happened, am I correct in thinking the missed payments will be deleted? cheers

Alex says

May be your other loans was accepted,but not this one were you had outstanding balance. It means they will wipe you balance, but not delete file with this loan, because other loans were accepted. If this loan was accepted they must remove loan from your file as well

Hmcat says

I submitted bank statements with my live UK account they declined want employment and visible transactions no legal right to decline submission because they are dataharvesting? I have raised things with ICO but goodness knows when they will respond like others emailed Chris lavery a rep responded saying passed to complaints.This is appalling

Sean Cotter says

I had the same issue in the end I send them the first page of my bankstatement then came back yesterday they need 30 days of transaction to validate my bank what a load of rubish

Sp

John R says

Hi guys,

I too submitted a complaint about 1 week before QQ went into administration and one of the guys working there was looking into my complaint. The last email I received was at the start of December 2019 to say they will be back in touch within 8 weeks. It’s now 13 months later and I’ve heard absolutely nothing and they have since went into liquidation.

Is there anything I can do as they were investigating prior to liquidation?

Thanks!

John

Sara (Debt Camel) says

Have you sent in a Claim on their portal? The deadline for doing this is mid February

Simon H says

Hi, I had some very old loans with QQ (probably dating back to 2011 to 2014), which I took out on a recurring basis, to pay my mortgage and bills but then I’d be paying up to £250 in interest but then repay it in full, then take out another loan again. This went on for a number of months. Eventually I managed to pay it off and stopped taking out new loans, but during that 3 year period I was in an absolute spiral of debt and had the interest not been so high would have been more affordable. I didnt miss a payment and it never appeared as a negative on mu credit record, but I was in a complete mess financially. Given the time which has elapsed since then, and the fact I keep getting emails from Euronet to apply, do you think I have a claim?

Sara (Debt Camel) says

if you had several loans I suggest you send in a Claim.

John R says

The claims portal isn’t recognising my details or the customer and loan ID – I think this may be due to the loans being between 2009 and 2012? I was a student at the time and earning approx £400 a month from a part time job yet they were giving me £700 loans towards the end!

Sara (Debt Camel) says

phone the CashEuroNet Customer Support Team at 0800 016 3250

claire says

so glad i found this forum, i have had another email saying to log my claim HOWEVER on page 3 it asks for sort code and bank details why on earth do i need to provide these , sorry that sounds a stupid question but im very suspicious about handing out details in case they wish to take payment ( i have stopped paying mine for 2 years ) its still on my credit file as delinquent and im aware i need to open a case for unaffordable lending as had 4 loans and several with other companies as well who i have opened complaints with

Dan says

The bank details are for any payment. It’s legit.

ROBERT says

If as I hope you expect a payment…where do you think they will send the monies too…we all have had to go this long and laborious process. Bank Account & Sort Code is easy…no one is taking unless you authorize …they simply want to give if you are owed.

Joe says

To be honest, when I provided them with my bank details (the ones they previously held for me were a few years out of date), they set up a direct debit using my new bank details and when I called them regarding it, claimed it was done in error – not sure how when usually for a company to set up a direct debit, it requires the customer to agree to it.

A number of months since this, they have asked me to provide a full bank statement, which needs to show a full 30 day transaction history and needs to be no more than 60 days old. This is, according to their request, to confirm that the account is active.

I have not yet sent a full bank statement as I am not sure why they are collecting all of my date when they seemingly already verified my account when they falsely set up a direct debit without my agreement.

Louise says

I can’t even access my customer and loan ID.

I wouldn’t know where to look as I’ve never had paperwork. QQ doesn’t exist anymore and even though they agreed last June that I would be refunded, I’ve heard absolutely nothing.

Sara (Debt Camel) says

phone the CashEuroNet Customer Support Team at 0800 016 3250

Holly says

I thought it was suppose to be 0.3/0.4p per £? would mean you would get around £900 -£1000.

dave says

if you mean 3-4p per pound (3-4%) that would be £90-120

0.3 or 0.4 % would be that divided by ten, obviously

£900-1000 would be 30-33.5 ish %

Jimmy says

Hi,

I’ve had a pounds to pocket loan in June 2018, think I made 1 or 2 payments as I had been gambling and got alot of loans for this. I had lost my job before I got it and could never afford it. I have now been trying to sort my debts and get back on track. It defaulted in December 2018. I’ve seen it is now on stride it is with and I’m not sure if I need to put in a complaint or just contact them and arrange making some sort of payment plan or getting a partial settlement if possible. Thanks

Sara (Debt Camel) says

If you want to make a complaint you need to do this NOW – the deadline is mid February, after this you won’t be allowed to make a Claim.

If you win the Claim, interest is removed and so is the negative information on your credit record.

Jimmy says

Okay I would be safer doing this. I will make it now. Thank you for your fast reply

Becky says

I appealed my decision on 16th December and still haven’t heard anything . There email said a response would be provided within 22 days but nothing. I’ve sent emails chasing it twice but had nothing back at all. Has anyone had anything about an appeal they’ve submitted?

chrissy says

I’ve just phoned them (using number above) and apparently due to the amount of appeals they are now saying 8 weeks. When I asked if that was 8 weeks from appeal she told me they changed the advice at the end of December so it could be 8 weeks from then! I guess we just keep waiting while they plough through it all.

swati soin says

Thank you for contacting QuickQuid. We received your email.

In regards to your query, for customers whose unaffordability claim has been fully or partially accepted, their credit files will be updated in due course. Please note that, due to the volume of claims, this could take a number of months. We expect that to be between 6-7 months after 14/02/2021. We ask you to monitor your email for any updates.

Yours sincerely,

Dave R says

6-7 months from February is absolutely outrageous. Has me stuck with a default which they have agreed to remove when upholding my complaint. That’s such a long period of time to have it stuck on the record.

Chantal Smith says

I got told within 28 days and submitted mine end of December so it is time for me to start chasing now. It could be that so many have appealed they cannot meet their deadlines. I’ll let you know if I hear anything back about my appeal or chase emails.

Hm says

So quickquid aka eurocashnet Chris lavery have generic reply they need valid bank statement .The complaints team sent robo answer saying need 60 days worth of statements with visible transactions so they may pay back If due but may take 30 days to verify.Some people may assume due back payment due to terminology this is not what they are saying. They do not need current banking to gain employment household expenditure et Al to make a decision on the information they based decision on years ago.This is disgusting data harvesting and unorthodox .An excuse not to look at claims and or data harvesting .Valid bank details should be accepted my current income expenses are non of theirbees wax and why so h bent on having people’s employment details et Al Not on Ico not responded .. seems like it’s tough QQ can manipulate

Joe says

To update you all, I reluctantly sent my bank statement to casheuro net UK but blanked out the financial details (left the dates in and obviously bank details and name and address) but didn’t see why they needed to know what my money is spent on, but the dates were clear.

This is the reply I got, but wanted to check if this is accurate – as I already claimed through the portal, but this seems to suggest my claim will only be dealt with from this point onwards after sending my statement? Haven’t other people had their outcome emails already?

Please note, it may take up to 120 days for your claim to be processed and assessed. Once processed, you will receive an assessment outcome by email, which will detail the outcome of your claim in the administration.

As a reminder, should any of your details change in the future, please contact us as soon as possible. Alternatively, your details can be updated through the Online Claims Portal

M says

If it’s true that the administrators are dealing with a lot of appeals – I hope people have a good cause for an appeal and not simply doing it to remove the loans off their credit record, because let’s face it, we won’t be getting much of a payout. The more appeals, the longer it will take and cost for the people with legitimate claims and marks to be removed from their file.

Sara (Debt Camel) says

Oh this is going to take many months yet. The claims portal hasn’t closed.

And people are going to get a really low payout, extra appeals won’t make much difference.

People have every right to make an appeal even if all they are fussed about is getting a default removed – for some people that can make it much easier to get a mortgage.

mark h says

Hi,

I have had loans from Quick Quid, Wonga and Pounds to Pocket but they are all paid off.

I submitted a claim but have had emails from CashEuroNet asking for my bank details.

I`m very reluctant to email them my bank details but was wondering if anyone else had and what the outcome was please?

Thanks,

Mark.

Thomas says

Hello,

I put in my claim through their panel months ago for my onstride loan that I’m still paying, in fact I hit the 120 day maximum time for a decision they quoted me in the email after I made the claim yesterday, yet I’ve still not heard a single thing from the administrators. What are my next steps?

Sara (Debt Camel) says

have you asked them? CashEuroNet Customer Support Team at 0800 016 3250.

Are the repayments affordable at the moment?

Jane Y says

Hi

Just had an email from CashEuro net saying

Due to an internal error the Final Response Letter sent to me had an incorrect outstanding balance..

I had an offset amount of £1104.99 which was the balance on my debt plan. This was cleared off and my credit file shows this.

Has anyone else had this today?

Jane Y

Jane Y says

Hi Sara

Have you heard that anyone else has had an email saying that there had been an internal error on their FRL from Cash Euronet. I had mine in November where my balance was cleared and due a redress. Yesterday got this email to say that there was an incorrect outstanding balance. My outstanding balance was 0 after all the redress figures taken into account. Nit sure how this can be. The amount of set off was the outstanding balance due to them. This was also cleared off my credit file. They said I should get another FRL within 7 days.

I’m slightly confused as to what’s going on. Can they reissue and change their final responses like this?

Thanks

Jane

Sara (Debt Camel) says

I don’t remember anyone else saying this. you can look back through the comments on this page to see.

Shorif says

Thank you for your patience whilst we looked into this matter.

Your case has been discussed with the Administration team, and your earlier loans will now also be considered.

A revised claims assessment email will be sent to you with the outcome of your claim.

However due to the added complexities of your case, this may take a couple of weeks.

However, please be assured that your claim will be considered in full.

Kind Regards

Muhunthan

This great news it took awhile to get hold of them

Chantal Smith says

That’s great. I’m chasing mine up now today as I still haven’t heard anything back from them and it has been over 21 days. I hope to hear from them soon with a positive result like you.

Val says

2019 they agreed write off £996 plus £2505 redress owed

I was overjoyed

Two days later they went into administration so was angry as no mention in redress letter

Gutted

Having waited via wonga over a year I gave up as new it was a looser

Last Friday was pondering so rang them

Nice guy found claim apologies an said he will take this up an they had wrote off the debt but redress not paid an was agreed way before administration an I should’ve had in within couple days

Was bad timing he said an I should not be penalised for that

Said he will update me in five days as it’s obvious fallen down the crack between agreeing an administration

I must say he sounded very helpful an was quite appalled this had happened

No doubt redress will now be much lower but hey hoe like many others it’s a waiting game again an I don’t hold much hope on getting an update within the said five days

I’ll call them after that

He did repeat call being recorded

I also recorded

Will update this if I do get any response

Sianyyyy says

Hi Sara just had my appeal decision only partially upheld the same decision as my original outcome. No real reason given as to why no change. But I feel that my pattern of borrowing followed the criteria they provided of repeat borrowing please advise if I am wrong:

loan(s) from your credit file as part of your accepted redress claim.

Loan ID Start Date

Loan Amount Paid Interest And Fees Accepted/Rejected

491640

2009-07-22

£100.00

£162.00

Rejected

784847

2010-01-07

£150.00

£193.11

Rejected

1119629

2010-06-30

£150.00

£65.62

Rejected

1338431

2010-08-31

£400.00

£472.60

Accepted

9742261

2015-07-24

£400.00

£126.19

Rejected

10318664

2016-01-22

£300.00

£229.07

Rejected

11563716

2017-01-31

£950.00

£337.42

Rejected

1258615

2017-05-10

£2600.00

£2018.13

Rejected

11990775

2017-05-31

£950.00

£609.95

Rejected

I can appreciate the initial loans in 2009 with quickquid and 2015/2016 with pounds to pocket shouldn’t be included but the loans taken out within 6months should be included.

I have to them to ask for a detailed explanation as to why those have been rejected but just feel a bit lost now as I am worried the outstanding loan I have will now fall in to default As I haven’t paid due to waiting for the outcome of this!

Sara (Debt Camel) says

A detailed explanation would be a help.

Sianyyyy says

Would it be worth looking at seeking legal advice? I have cc’d in Chris Laverty and Lucy Freeman from grant Thornton in my reply also.

Sara (Debt Camel) says

If there is a Law Centre near you (https://www.lawcentres.org.uk/about-law-centres/law-centres-on-google-maps/geographically) that could be free.

As you are likely to only get a small amount of any redress back, you may be reluctant to pay for any legal advice.

Jane Y says

I have had a look but the email only came yday. I wasnt if it was really from them.

Can companies send revised final offers once one has been sent already?

Sara (Debt Camel) says

You can phone up to check.

I don’t remember this happening, but in general someone is often allowed to correct an error.

Swati says

Hello Sara,

Is it possible to get the credit file updated soon as i have no outstanding but has a default where they have partially accepted the claim in the Month of December but now they are replying with a message that it might take 5 to 6 months after February to update the file accordingly and i have a remortgage pending in the month of April and i am not able to get offers because of this default happened in the year 2018.

Thank you for contacting QuickQuid. We received your email.

In regards to your query, for customers whose unaffordability claim has been fully or partially accepted, their credit files will be updated in due course. Please note that, due to the volume of claims, this could take a number of months. We expect that to be between 6-7 months after 14/02/2021. We ask you to monitor your email for any updates.

Thank you for contacting QuickQuid. We received your email. We understand your concern. However, we cannot escalate for your credit file to be updated as soon as possible. All customers whose claim has been fully or partially accepted, their credit files will be updated in due course. Please note that, due to the volume of claims, this could take several months. We advise you to monitor your email for any updates about credit file updates as part of the claim decision.

Sara (Debt Camel) says

I think it is going to be hard to get QuickQuid to speed up.

You can simply stay with your current mortgage on their SVR for a few months until this is actually resolved.

Another option if to complaint to the credit reference agencies that the administrators accept the default should be removed but they are not doing this so your credit record is inaccurate. The CRAs will then ask QQ qho will either not respond at all or will say they will be sorting the credit records later. The CRA will then probably say you have to wait. You could then go to the Financial Ombudsman with a complaint about the credit reference agencies but it will take a while to be picked up by FOS who may say the CRAs are not being unreasonable in saying this is too soon. Even if this route did work it would take a long while…

Dave R says

Hi Swati,

I have the same issue regarding a default removed by QQ as my claim was fully upheld. They definitely won’t budge if you ask them directly – have tried several times.

I’ve got it with Experian as a dispute and they are looking into it, should hear back tomorrow. I’ll let you know how it goes but I strongly suspect that QQ will say that they will delete it eventually and Experian will refuse to. I think Transunion already rejected the dispute as well.

swati says

Hello Dave,

Already have a reply from Experian, they are unable to help and waiting from QQ to update the file accordingly and QQ team is not taking it seriously for vulnerable people like me. Though i have no payment outstanding and i am not very keen on receiving few hundred ££ as compensation, all i need is to be updated as earliest. They promised in the month of December several months however now they updated the statement 6 to 7 months after 2 week of February. I have attached even my medical condition report that i am partially blind now from last 2 years and this remortgage need to be sorted but i think they have standard answer for all.

Jay says

I submitted my claim 126 days ago and counting, has anyone else had to wait past the time limit QQ state? Not sure what to do next other than keep calling, they said they’ve escalated but who knows what that means…!

Ellie says

Yes – I’m now at 120 days and had no response, despite winning a FOS case (FOS found in my favour, they made an offer based on FOS recommendations, I accepted and then they went into administration before paying… just galling). Haven’t had any joy calling them either.

Sianyyyy says

Guys, persevere with any appeals you have. I have just had an email today advising they are upholding the last 2 loans which were P2P £950 and Onstride £2600. I could actually cry tears of joy as this puts an end to nearly 2 years of stress over my finances. I don’t even care about the amount I’m getting back I am just happy to be rid of these loans! Thank you Sara for all your advice and this website I would still be drowning in debt if it wasn’t for you!

Sara (Debt Camel) says

Excellent.

Becky says

Great news. I’m still chasing my appeal keep sending emails but getting no response at all. When did you first submit appeal?

Sianyyyy says

First submitted end of November then got an email mid Jan as it was a “complex case” (I had too separate claims one for QQ and the other for P2P/Onstride). They initially just sent back the original claim acceptance, and I challenged why the loans weren’t included. The guy who came back to me was really helpful. CC in Chris laverty and Lucy Freeman in all emails. And if you think somethings not right challenge it. I sent over all bank statements and it came out my last loan with P2P and my large loan with Onstride taken a month later should have been included.

Dave R says

So interestingly, Experian emailed this morning to say they hadn’t received a reply from QQ but would “Supress” the record from my credit record so it wouldn’t show to me or future lenders until QQ offered a response. However, few hours later, Experian got in touch again to say that QQ:/CashEuro had confirmed it should be removed and have requested for the loan to be deleted completely. Takes a few days apparently so hopefully it does actually get taken off!

Transunion have written to me to say they will be suppressing the data as they have not heard back from QQ either – so hoping they are told

To remove it as well!

swati soin says

4th February 2021

Our ref: SH1

Thank you for your email. I can confirm that the Casheuronet account would only be updated or removed from your Experian credit report if Casheuronet contact us directly to confirm this change. As we have received no contact from Casheuronet, the defaulted account has remained on your Experian credit report.

Please can you confirm if you want me to contact Casheuronet to query the defaulted account and if so then please can you confirm if you have any correspondence from Casheuronet to confirm they would delete the defaulted account from your credit report – if you do then please provide this to me as I will provide this to Casheuronet when I query the account with them.

Kind regards

Senior Customer Relations Case Manager

Experian

Dave R says

So the QuickQuid loan and default have been removed from my Experian report and my score has rocketed up from poor to excellent which was lovely to wake up to. I know the score doesn’t really mean anything but it felt amazing nonetheless. Thank you Sara for all your help.

Annoyingly, they seem to have told Transunion that no changes need to be made because the account “is in the process of a claims submission”. Not sure if Transunion reached out to the wrong team or something. I’ve replied to Transunion with a copy of my claims acceptance email and also with a copy of my email from Experian where they quote CashEuroNet giving permission to delete the account from my record. I’ve also emailed CashEuroNet and attached my Experian letter and have requested them to update Transunion as well. Do you think this will work and get them to get ride from Transunion also?

Thierry says

Hey Dave,

I’ll be keen to know to whom email address (Experian) you sent your email to get your default removed. What information did you include in your email to them?

I’ll use the same process, hoping to get the same results. :-)

Regards,

Shorif says

Thank you sara 💓

Chantal Smith says

I appealed and have chased it twice now and heard nothing. Has anyone else been able to get a response to their appeal by another means as their emails have been ignored? Thanks.

Thomas says

I stopped paying while waiting for the DMP to kick in as it was too difficult to afford the payments in the meantime and they sent me a default email. They’re finally replying to me now, but I don’t know what to do.

They say they sent me an email on December 25th and my claim was denied and said it may have been sent to my spam folder, I check my email and spam daily and received nothing regarding my claim. They asked for the details of the DMP and said they’d “take it into consideration” regarding the default so I gave them the reference number, company (Stepchange) etc.

I’ve also asked them to start an appeal as when I took out my onstride loan, I was over my head in debt, working an extremely low pay job on a zero hours contract and had to borrow more money every month just to survive, all my credit cards were maxed out to around £6-7000 and I had a Bamboo loan at £550 a month I struggled to afford the repayments on. I’m sure even a quick glance at my credit file would have shown how desperate I was with everything maxed, a default within 3 months, and low income, yet onstride gave me a £1500 loan. I’m wondering if considering that if it’s likely I’ll win the appeal or if they’ll likely remove the default they’ve just given me as I wait for the DMP to kick in or whether I’m likely to be stuck with it?

Thanks,

Thomas.

Mr and Mrs C says

Is anyone else getting the same message when they try to log the claim, this has been going on since November and each time we call QQ they say try again tomorrow. We are running out of time to log the claim and getting no where with customer services.

“Apologies, we have experienced a processing error which means that we have been unable to process your claim at this time. Please come back again tomorrow to re-try your claim submission, or contact a member of the customer support team on 0800 0163 250 for assistance”

Sara (Debt Camel) says

What do customer Services say?

Mr and mrs c says

They just tell us to keep trying again the next day

Lee Taylor says

My details were not accepted in the claims portal and I have rang the CashEuroNet Customer Support Team who claimed it was an IT Technical Issue that they can’t provide a concrete ETA for fixing. I’ve chased a few times now, I’m becoming suspicious now that they’re stalling. What would your next cause of action be to ensure I’m protected?

Sara (Debt Camel) says

You need to ask Customer Support to email you confirmation that you have tried to input a claim and you will be allowed to submit this even if it is after the deadline allowed.

Lee Taylor says

Okay will do, thank you for the response

Jimmy says

Has anyone had to appeal a decision. I really don’t know where I stand with my claim. It says it has been rejected in full and to appeal within 21 days. I got the loan out at a very bad period in my life. I had been gambling very badly and gotten other loans and spent them all on gambling. Its all on my bank statements. I had told them I was working but had actually recently lost my job when I got the loan so not sure exactly how to go about my appeal. I am sure they shouldn’t have given me the loan and if I had it removed from my credit file with no interest it would be great but do you think I would have that chance?

Thanks

Oliver says

I have had a response to my appeal asking for PayPal statements to show that the loans were used for online gambling (excessive amount of gambling)

What do you think the chances are of getting an outstanding loan wiped off due to Gambling?

I know if successful you do get repayments made under the repayment plan post the claim being submitted refunded.

The appeal was raised over 2 months ago.

Sara (Debt Camel) says

I don’t know. Have you already paid more towards the debt than you borrowed?

Oliver says

Yes & paid interest and then went into repayment plan

The whole loan (and previous ones to the big one) was used for gambling.

All my bank statements show PayPal entries.

They then asked for the detail behind the PayPal payments

When I sent over 5 years worth they all had online gambling e.g Ladbroke, platojo etc

They never asked what the loans were for when they were taken and never asked for bank statements at the outset.

Customer services / underwriter did say to me that if they saw that amount of PayPal when the loan was issued they would have declined.

I just wish they upheld my claim at the outset rather than going through the appeal.

I have sent over so much evidence

They did say that if successful then all repayments made since the portal was live would be refunded in “full” in addition to any redress

Sara (Debt Camel) says

ok, if you have repaid more than you borrowed, it is possible the remaining balance could be wiped.

Jimmy says

What exactly did you say in your appeal? Are there and draft emails to go off?

Thanks

Oliver says

I just stated that there was excessive amount of gambling as that was one of the reasons for the appeal as set out by the administrator when I had a rejection of the original claim

I know underwriters take a serious view of gambling when issuing loans.

Jimmy says

Okay thanks for the reply. And did you state anything about what you wanted from the appeal or just why you were appealing? I have all my statements showing I had been getting loans to gamble it all. I had been gambling 1000s a week on an income of 3/400 a week.

Oliver says

Interest refunded plus any payments made towards the loan since I submitted the claim. All payments are returned as standard if the claim is successful