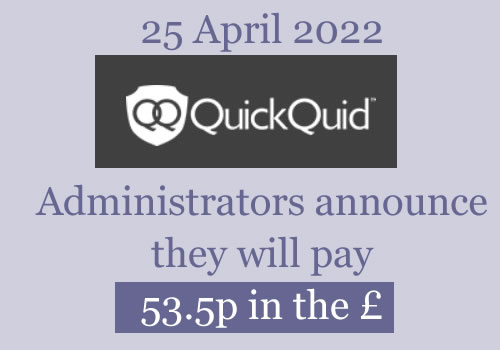

Payments – UPDATE – 25 April 2022

Administrators have started sending emails to everyone with an upheld claim telling them what they will be paid.

“The Joint Administrators are now in a position to declare a first and final dividend of 53.5p in the £”

The average claim value is c £1,700. Someone with that claim value will get a payout of about £910.

The payout details are given in the email:

- This will be paid over the next two weeks.

- If the administrators couldn’t validate your banking details, it will be sent by cheque. I don’t know how the administrators will “validate” your details.

- If you used a claims company, the money will be paid to them.

- Most people are not having any deduction for tax paid to HMRC, so there is no need to reclaim anything.

Credit records

The administrators may decide to :

– remove any negative marks on your credit record

– delete all loans that were upheld

– delete all your loans.

I don’t know what they have chosen to do – if people can check and report in the comments when they see a change, that would be great.

How much your credit score will change will depend on whether there were any negative marks. If you want to get a mortgage, you would like as many payday loans gone as possible, even if they were repaid on time and not hurting your credit score.

In a few months when the administrators no longer talk to the CRAs you can ask for any remaining loans to be “suppressed” so other lenders can’t see them. See https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do that now.

QuickQuid went into administration in October 2019

CashEuroNet (CEU), which owns the QuickQuid, Pounds To Pocket and On Stride brands, stopped giving loans and went into administration on 25 October 2019.

I will be talking about QuickQuid (QQ) rather than CashEuroNet as it is the more familiar name. Everything here also applies to loans from Cashruronet’s other brands, Pounds To Pocket and On Stride.

Grant Thornton were appointed as Administrators. They set up a page about Redress Complaints – this is their term for people who have asked for a refund because they were given unaffordable loans.

Background to the QuickQuid Administration

QuickQuid was one of the “Big Three” payday lenders in Britain, starting out in 2007.

After Wonga and the Money Shop Group had all stopped lending and gone bust over the last fifteen months, QuickQuid was left as the largest UK payday lender.

QuickQuid had well over a million customers. When it went into administration there were c. 500,000 customers with outstanding loans.

Many of these customers had prolonged borrowing from QQ. They either rolling loans over or repaid one loan but were left so short of money that they had to borrow again.

These customers have good reasons to win an affordability complaint and get a refund of the interest they paid.

Affordability complaints started on a small scale in 2015 and increased in the next few years.

In 2018, complaints going to the Financial Ombudsman (FOS) jumped with the involvement of Claims Companies and QuickQuid became the most complained about firm to FOS, excluding PPI complaints.

For a long time QQ refused to refund interest on any loans taken more than 6 years before or where the loans were given in 2015 or afterwards. This resulted in a huge backlog of claims at the Financial Ombudsman, where QQ had made very poor offers to customers and then rejected an adjudicator decision.

In late July 2019, QQ agreed to accept several thousand FOS complaints it had previously rejected.

By accepting the FOS decisions on loans over 6 years, long chains of borrowing, and loans taken after 2015, the scale of QQ’s likely future liability for refunds will have become clear to the company.

After failing to persuade the FCA that a Scheme of Arrangement was appropriate, Enova, CEU’s large and profitable US parent, decided to close the UK business, blaming the UK regulatory environment.

How could the regulators let this happen?

This is an excellent question… Stella Creasy, MP called for an inquiry into the FCA over Wonga and QuickQuid.

What has happened in the administration

Customers with a valid claim for a refund are “unsecured creditors”. This includes:

- any refunds that were in progress after an amount was agreed or a Final Decision from a FOS Ombudsman (FOS);

- complaints that were underway at QQ or FOS when QQ went under;

- any new complaints sent to the Administrators.

All complaints at FOS legally had to stop and were been passed back to the Administrators. It isn’t possible to send any new complaints to FOS.

It is now too late to submit a Claim for unaffordable lending. The last date was 14 February 2021.

The administrators have given the following statistics about claims:

- 169,000 customers made claims for unaffordable lending;

- 78,000 claims were upheld by the administrators;

- the upheld claims had a total value of £136million, so an average of about £1,700 per claim.

Still owe a balance on a QuickQuid or On Stride loan?

More than 300,000 of the current loans were sold to Lantern in summer 2021. You should have been informed if your loan was sold.

The administrators have now stopped collecting any money from the remaining unsold loans.

This page is no longer updated

Comments have been turned off. If you have a query, please post it on the Refunds from loans page.

Hollie Lawrence says

Hello.

I have an outstanding loan with QQ of about £1,400 .. i think. However i received an email this morning from them saying my loan had been paid in full. I havent paid it! I was paying £1 a month back and had a lot to pay off! I have logged on yo my account and the loan has gone and showing 0 ?

Sara (Debt Camel) says

did you put in a claim to the administrators?

Graeme says

Keep an eye out for your claim decision email, I got this through before that one, too.

Rosie says

I’ve not received anythjng yet and I done mine in August. Do you think there just doing so many a day?

Chantal says

Probably. I also did mine in August and I am still waiting for the outcome.

Darren says

Just received email.they agree loans totalling £2800 were sold incorrectly .

Payment should be made March 2021

I’m expecting a paltry 4p in the pound

Timbo says

I know it’s a finger in the job but any idea what percentage we are likely to get from QQ? Is 5% aiming to high? Does anyone know what percentage Wonga and wageday advance customers got? Thanks

Lloyd says

I got 5.8p to the £1 from wageday advance. So I was told £15. Ended up with around 50p! My redress claim is £1100 from quick quid so maybe £50-100. Better than nothing perhaps.

Graeme says

Wonga was 4.3p to the pound, and moneyshop are projecting between 3 and 4p to the pound.

Sam Phoebe Gravener says

I got about £600 back from Wonga. Think I had about £1800 in loans but that’s a very rough memory guess lol

Janie says

Hi I had about 7500 redress from wonga and got 290£

My letter from quick quid states £5600 so I’m expecting not much maybe just over 100£

My advice is to expect VERY VERY LOW.

Chantal Smith says

Maybe about 50 to 60 quid per 1200 quid.

Well with Wonga I got 47.60 from 1120 and wageday advance paid me 67.72 from 1278.

Marie Darling says

Hi again I went on the quick quid portal to update my bank details but after entering new details and hitting the update button the page just goes blank I’ve tried a few times but still the same outcome I haven’t received any emails confirming the update is anyone else experiencing this or any advice welcome thanks Marie

Chantal Smith says

So tonight I have received my email from the administrator about my claim and they have confirmed it is partially accepted. I had 4 loans in total and 2 have been accepted and two have been rejected. The two that have been rejected are the two I paid the most in fees and interest for. The two that have been rejected thru have listed one as I didn’t pay any fees or interest on. Surely that can’t be true as you pay interest and or fees on any loan, especially payday loans when they were allowed?

My accepted claim value is only £121. 67. Is it worth it if the payment will be significantly smaller than this? Your thoughts people.

Chantal Smith says

So at 4% I predict I will get roughly 4.84 back. Is it worth the wait and their time and effort?

Sara (Debt Camel) says

well you don’t have to do anything. And the administrators are legally obliged to assess claims.

Chantal Smith says

This is true Sara. Yes. I don’t have to do anything so anything is better than nothing I guess.

Graeme says

Any loans deemed unaffordable will be expunged from your credit record, as well. It’s not just about the payout.

Michael says

Even if they were referred to a debt collection agency?

Sara (Debt Camel) says

IF QQ deletes the loan you can ask any debt purchaser to do the same.

Charlotte says

Do this mean we shouldn’t pay it? I’m being chased by a debt company over a QQ loan, but they hve said my loans were unaffordable

Sara (Debt Camel) says

It means you have a case to make a complaint to the debt collector who now owns the debt saying that the QQ administrators have accepted the loan was unaffordable, so you should not have to pay the interest on this debt. How much did you borrow? How much have you paid so far to this debt, to QQ at the start and then later to a debt purchaser?

Charlotte says

Now then! I don’t know the ins and outs. I will look into it and speak to them to take the interest off before I start a payment plan.

Thank you

Andy says

I have received an email from CashEuroNet to advise me they have partially accepted my claim. They have rejected my claim for my most recent loan in 2018 that was on a reduced payment plan but they reported as 6 payments down for the duration of the plan. I have disputed this with them already and sent them my statutory credit report (thank you for that advise with another query from me this week), with an explanation that I was at my limit on two credit cards, at my overdraft limit and in default on multiple accounts at the time. Two of the defaults have dropped off now but interestingly were both with them! I’m rambling but my question is that as this is the ‘final response’ from the administrator, is there anything I can do if they reject my appeal? I am not concerned about the minimal refund I will get, I just want to clean up my credit file.

Thank you.

Sara (Debt Camel) says

If you have made an appeal and it is rejected, your only further option is going to court. Impractical for most people.

Andy says

Hi Sara

Hopefully my appeal is upheld as I believe I’ve provided compelling evidence that the loan shouldn’t have been given. But if not, is there any info about how I do this and how much it costs, I’ll then evaluate whether it’s a viable option for me.

Thanks for your help as always

Sara (Debt Camel) says

So far as I know you would have to take action against the administrators personally (not Grant Thornton) under the Insolvency Act 1986. Schedule B1 covers the conduct of an administration. You have to be very clear which part of the Insolvency Act you think the Administrator is in breach of. I think action has to be taken in the Business & Property Courts which are part of the High Court, not a local County Court.

I think anyone thinking of doing this should get advice from a solicitor first.

Chloe says

This morning I have received my email from the administrators regarding my claim, the accepted value of my claim is £2500. Guessing I could end up with 5% of this? It says it can be appealed if I believe there are extenuating circumstances, what would count as extenuating circumstances? At this late stage in the game is it ever possible to receive the total value of the assessed claim.

Graeme says

No, thanks to the administration nobody can get the full amount. All you can appeal is any loans that they didn’t deem unaffordable.

Chantal Smith says

Yes that’s very true Graham, although these loans are already excluded from my credit record now as they were in 2011 and 2012.

Graeme says

Look on the bright side. You’ll still be able to buy a few freddos with that.

Holly says

Good morning all and Sara , little confused with my email it has been partially upheld but I am shocked my largest loans when I was in the most trouble have been rejected – could anyone help with what this means please

Guide

Total interest and fees on loans £283.20 1

Total compensatory interest £71.50 2

Less set off £354.70 3

Revised interest and fees on loans £0.00

Revised compensatory interest £0.00

Accepted claim value £0.00 4

Compensatory interest settled by way of set off £71.50 5

Remaining loan balance potentially due to CashEuroNet UK, LLC £690.24 6

Refund for overpayment on CashEuroNet UK, LLC loan £0.00

Then the accepted rejected part is

2588425 2011-07-04 £100.00 £73.25 Rejected

10088693 2015-11-07 £100.00 £32.80 Rejected

10813617 2016-06-25 £600.00 £283.20 Accepted

11257588 2016-10-31 £1,018.99 £1,167.14 Rejected

13209433 2018-04-23 £1,201.24 £544.45 Rejected

Josh says

Total interest and fees on loans £215.63

Total compensatory interest £198.99

Accepted claim value £414.62

Refund for overpayment on CashEuroNet UK, LLC loan £0.00

I recieved an email from Casheuronet today. Why Refund of overpayment is Zero?

Graeme says

Because you didn’t continue paying after they went into administration or pay more than you were due to, I think. That’s the impression I got from what they meant by “overpayment”.

DEAN MCMINN says

I have the same email different values.

from mine I am expecting this means they admit you and myself overpaid but nothing is getting refunded.

either that or because they don’t have the agreed percentage to go back to ppl this is noted at 0.00?

Graeme says

I think it’s just a generic template as some people have overpaid (ie paid more than was expected of them or continued paying post administration). You’ll still get a percentage of the claim value as a payout, as well.

(I’ve been through this with Wonga).

Jane Y says

Hi Sara

My email from Casheuronet stated below.

Total interest and fees on loans £5,004.65 1

Total compensatory interest £2,177.65 2

Less set off £1,104.99 3

Revised interest and fees on loans £3,899.66

Revised compensatory interest £2,177.65

Accepted claim value £6,077.31 4

Compensatory interest settled by way of set off £0.00 5

Remaining loan balance potentially due to CashEuroNet UK, LLC £0.00 6

Refund for overpayment on CashEuroNet UK, LLC loan £70.10

Poks like they have cleared my outstanding loan as an offset amount and also a refund of £70.10 for overpayment.

I have advised my Debt Management company to remove from my plan as per the offset. Do you know if the refund will be a separate payment to the redress amount?

Thanks

Jane

Sara (Debt Camel) says

yes the refund seems to be coming as a separate payment.

Jane Y says

Hi

I have not heard anything more on the over payment of 70.10. Has anyone heard anything on these separate payments?

Jane

Miss Bonjour says

Hi

I have an accepted claim value for £1,000.

If % so low I am not bothered but will be happy for any money back, my issue is that my partner also applied has received no email and he has got defaults from quickquid due to affordability.

If he has claimed can these be miraculously taken off/squashed?

Please advise

Sara (Debt Camel) says

the defaults will be removed for any loans which are decided to be unaffordable

Christine says

Just interested when people submitted their claims. I submitted mine on 5th August and heard nothing so far

Lyndsey says

I submitted my claim on the 14th August. Aside from the bogus emails received early November I’ve not heard a thing. I’ve sent an email today to Claims@casheuronetuk.co.uk asking for an update as I am now outside of the 120 day assessment period window

Lyndsey says

To follow up on this they responded this morning with a copy of the original email they sent to me on 25/11/2020 (I can’t find the original but it may have fallen into my junk folder and been deleted)

Hope this helps if you’re still awaiting a response

Dave R says

1st October and have heard back this morning. Just over 80+ days. Surprised as was expecting to be chasing them after 120 days!

Malcolm says

Is it realistic to think the refund percentage will be 4%?

Rebecca says

My claim was submitted on the 6th august and I’ve still not had a response. I’ve got my next onstride payment due on Monday was hoping for a response by then as I can’t really afford to continue making payments but have only done so to protect my credit score.

Sara (Debt Camel) says

how many loans dod you have from them?

Rebecca says

Only this one from onstride which was £3000 but I had multiple loans with QuickQuid in 2013. I can’t remember exactly how many but it was over a period of at least 12 months

Sara (Debt Camel) says

I don’t know how they are assessing very large single loans.

Are you having covid related financial problems?

Rebecca says

No but have been on maternity and sick pay for last 18 months

Alexxx says

I took only one loan from CashEuroNet 1400£ for 16 month and it was upheld. Rebecca bear in mind that if you loan will be upheld all installments you paid since August will be refunded back 1£ to 1£ if you paid all amount what you borrowed without interests until August

KRC says

I’ve had an email saying none of my claims have been accepted. One loan was for £1050 and I was earning £1500 at the time, so we’ll above the 30% affordability threshold they mention in the email.

I’ve emailed back with my payslips from the time to appeal but just wondering if anyone has had any success in appealing things like this?

Josh says

I have the same issue. I emaild my pay slips but they asking my historic bank statements and other supporting evidence which I don’t have. I have no idea what to do. There is no way I can go back 10 years bank statements.

KRC says

That’s what I was worried about, I only have the payslips by fluke.

Robert says

You can ask your Bank. I retrieved 8 years of Statements from Natwest. Just putting it out there for all of you.

Louise says

The administrators have rejected my claims despite my FOS adjudicator partially upholding my complaint.

Is it common for administrators to overlook adjudicator’s decisions? I’m appealing but worried about my chances

Sara (Debt Camel) says

There isn’t really a “common” here – we are just seeing the first decisions come through.

Rebecca says

Hi Sara,

Thank you for informing us all on this matter.

I have an outstanding debt with QQ of £806.50 left, the loan was not affordable and they did not explain to me how financially I could afford the loan at the time. I was also suffering with severe mental health issues at the time which is part of the reason I ended up in this mess.

Should I write to them with the template or put in a claim to CashEuroNet?

Sara (Debt Camel) says

put in a claim using the claims portal – this is the only way to send in a complaint at the moment.

Dave L says

I’m rapidly starting to lose my patience with Grant Thornton and Chris Laverty again . Another rejection email despite my last loan being £1500 with over £1600 paid in interest, this is 60% of my take home pay so well above the 30% required for it to be unaffordable under their own policy. Chris Laverty and Grant Thornton are clearly just incompetent.

Caroline says

I have received a rejection email today. How can I be sure this is not another email sent out in error, or is this genuine?

Sara (Debt Camel) says

Last time when these were sent in error I had dozens of people commenting here about them – this doesn’t seem to be happening at the moment. How many loans did you have from them over what period?

Caroline Earle says

Hi Sara

I had four loans in total: 2 x 2012; 1 x 2013 and 1 x 2018.

I will assume, therefore, that I am not entitled to any compensation.

Thanks for your help.

Caroline

Sara (Debt Camel) says

unless the loans were large, that may be right.

H says

Hi,

I was rejected in August 2019 by quickquid. I had 15 loans month after month. Against each of my rejected loan no reasons were given in my final response.

I feel like they just rejected me to buy themselve more time. If they would of partially accepted me like the administrators have then I would of received by payout mid September before they went into admin.

Today I’ve received my accepted claim amount of £5k from the administrators and I know I’m going to end up with 5p in the pound which will be £250.

My question is, can I do anything about this? Is there anybody that I can go to?

How are they able to get away with this.

Any help will be appreciated, thanks

Sara (Debt Camel) says

Is there anybody that I can go to?

See my reply here: https://debtcamel.co.uk/quickquid-casheuronet-administration/comment-page-7/#comment-397538

Fuming 2020 says

I started receiving email demanding money last year from Quickquid for a loan I defaulted on in 2011. I’ve recieved a partically accepted claims email this week but the ID numbers and amounts don’t match those on the demand emails from QQ last year. They have stated that even with the compansation due to me I still owe £76.38 and have added it back onto my credit file I noticed on Friday, so in less that a week of me receiving the email. Surely they can’t do this? The credit file states that the loan is from 2011 and that I have missed 2 payments already. Not had this issue with Wonga or others and have appealed this today with the Joint Adminstrators demanding that it also be removed from my credit file. Has anyone else had this? Where can I take this if they ignore like before?

I’m not bothered about the money, as there are people who need it far more than me. I’ll far more bothered about the credit report issue as I’ve worked hard to clear my debts over the years since 2011 to get myself in a better position. I completely forgot about this one until the emails started last year but am starting to feel like it was a mistake not just ignoring them.

Sara (Debt Camel) says

So it sounds as though they have not included the last defaulted loan in the ones they have upheld. Is that possible, or do the loan details not make any sense at all?

You have two problems. First that they are asking you for money. Second that the debt is on your credit record.

An appeal that succeeded in getting the last loan included would resolve both problems.

The money issue can also be tackled by pointing out the debt is statute barred.

the credit record issue can also be solved by pointing out that there should have been a default added back in 2011/12. If you think there was a default and the debt dropped off 6 years later, point this out.

If you had ignored the email the debt would probably have reappeared anyway.

Lauren says

Hi Sarah, I received a rejection note from Grant and Thornton but none of the rejections make sense.

I had 6 concurrent loans over a 18 month period in persistent debt and concurrent loans was one of their criteria..I also had several other loans with different organisations at that time.I am really only looking for the last loan to be upheld as unaffordable as it was defaulted. I paid £409 back of the £500 I borrowed on that loan and they are chasing for another £590. I have emailed to point out the error in their calculations but unsure what will happen now as they don’t seem terribly competent.

I did have to provide my bank details for the possible claim so concerned they may try to withdraw money so reiterated they have no right or expectation of continuous authority on my bank account. Maybe a bit paranoid!

Sara (Debt Camel) says

If they don’t respond to your email, then make sure you put in an Appeal within the time they stated.

Ask your bank if there is a CPA to QQ – if there is, cancel it with the back. Better paranoid than sorry!

Dave L says

Another rejection today by onstride once again going against their own policy, an £800 loan against £2300 is clearly more than 30% of my income. I had misgivings when I heard that Grant Thornton and particularly Chris Laverty were involved in this administration abc from my experience so far it would appear that I was right

Sara (Debt Camel) says

Are they looking at whether the repayment is more than a third of your income? rather than the loan amount?

There were actually very few people grumbling about the Wonga assessments – it feels to me as those the assessment for these larger loans in particular are less fair.

Dave L says

I just checked the email again, it states loan value as a percentage of income. I have no idea what’s going on but am struggling to believe to that Grant Thornton can actually be this incompetent.

Sara (Debt Camel) says

have you put in a formal appeal or just queried it?

Dave L says

Formal appeal on this rejection and the one with QuickQuid as well, I also copied in Grant Thornton

Jim says

Dave…their criteria doesn’t seem to state over what period “income” is….I.e. not necessarily monthly income. I feel it would be fair to assume it would be the length of the loan…..I.e. repaid over 6 months, then what is 6 months income for you?

Dave L says

Weird thing is when I phoned CashEuroNet earlier they said it was monthly income so we’ll have to see I guess

ClaireR says

I’ve had my redress email this morning partially upholding on 4 out of 6 loans.

I had my complaint with the FOS who had agreed they should refund 3 out of 6 loans, I was due to be paid the week they went into administration.

I’m considering this a victory as one extra loan will be removed from my credit file.

I’m happy to say I have moved on from the awful payday loan trap part of my life, I would liken it to an addiction, a quick easy fix that you can’t see the long term harm at the time.

Dave R says

Claire you’re so right about the addiction thing. Congrats on breaking the cycle – I managed to as well and it feels great.

I’m on about day 70 of waiting for an update from QQ, I don’t expect to hear anything back before end of Jan! Did you wait the full 120 days before you heard anything?

ClaireR says

Hi, I submitted my claim on 3rd September. So that’s less than 120 days.

Steven says

Just had an email back from quick quid administrator saying claim has been fully accepted. My accepted claim value £1500. Less set off £480. Accepted claim value £1020. Will now just have to wait and see what the final dividend will be.

K W says

I got my redress email and it says my claim has been assessed and fully accepted.

Total interest and fees on loans – £3,716.11

Total compensatory interest – £2,479.61

Accepted claim value – £6,195.72

Will just have to wait and see how much i actually get. Dont anticipate it being more than £200

N says

Submitted my claim 6th September, got email today with claim agreed for £15,869 I’m gutted, the bunch of crooks! :(

Sam says

I’m confused? That’s a huge amount?

Sara (Debt Camel) says

N is probably astonished they paid so much interest and upset they will only get a small amount of the compensation back.

N says

That’s right, I’m owed nearly £16k yet I’ll be lucky to see £700-£800 if even that. It’s terrible these companies get away with it. Just shut shop and that’s their responsibility gone. Their American parent company should have to pay everyone every penny owed, not claim they are owed £71 million it’s criminal and immoral IMHO

Christine says

I still have not heard anything after putting in claim on 5th August, should I be worried?

K J says

May be worth checking out chasing with them? I submitted my claim in the 1st week of September. I would have assumed they are working to date order

Dave R says

Have you double checked your inbox and junk/spam folders for emails from QQ or Casheuro ? I’m sure you have but worth a look if you haven’t :-). Otherwise you’re way out of the 120 day period so I would definitely try and find out what’s going on,

Chantal Smith says

Some of the responsibility has to lay with individual too for asking to borrow money knowing they can’t afford the repayments. I think the revolving credit is the fault of the lender though and also rollovers. But it is not all down to the fault of the lender. All these companies had so many complaints against them which obviously prooves they were irresponsible and its caused them all to shut down as they have to pay too much back.

The problem you have now is where can people go that need to borrow money but can’t get high Street lenders or good rates because they have a poor credit rating.

J says

Maybe they’ll look at other options like finding out how to break the cycle and get out of debt? I know it’s different for everyone, but it’s common for some people to look to blame the victims in situations like this.

If someone has little or no money then how realistic is it that lending someone hundreds or thousands of £’s is responsible lending? I remember when I was at my lowest point and borrowing from a dozen lenders, none of whom performed any checks but happily loaned to me on the proviso that I could pay charges to get me through to the next month and then increasing my credit limit because I could afford the charges but not the loan repayment?

There are now companies out there who offer an alternative, you can borrow £300 and repay £350 over 6 months for example and not charge extra if you can’t make a payment one month… I’ve not had to borrow from a company like this for a while, but there are alternatives and no £30 to borrow £100 for a month in not reasonable.

David says

Hi.

These were my details:

10751012 2016-06-07 £400.00 £392.60 Rejected

11695866 2017-03-14 £700.00 £700.00 Accepted

13291044 2018-05-13 £100.00 £44.60 Rejected

13538810 2018-07-13 £100.00 £41.60 Rejected

13790581 2018-09-06 £100.00 £42.80 Rejected

Does this mean i’ll get £700 in compensation or will it be a much lower amount.

Thanks

N says

I believe Wonga customers got 4.3p in every pound so you are looking at about £28 could be more but likely to be less to be honest.

Mr and Mrs C says

Can someone confirm the email address the administrator emails are coming from? We have still received nothing, we couldnt log the claim on the portal, and when we called QQ we were told since the amount of 9k had been agreed through FOS we were already in the claim, but have since heard nothing. Have a terrible feeling we are about to get stiffed again!

ROBERT says

Hi Mr & Mrs C,

support@email.quickquid.co.uk

Have an ID number if you have access to it, or failing that ring them.

Phil says

Is anyone else having a problem with QQ rejecting a claim which had been upheld by an FOS adjudicator prior them going into administation?

I was unable to access the claims portal and when i spoke to helpline they said my claim had already been settled which is untrue.

Having got nowhere with the helpline I wrote to the administator and last week I received an email from QQ saying my claim had already been settled,

in the last week i have provided them with the adjudicators letter and a complaint I made to the FOS over the length of time they had taken to look at my complaint so they could see that it hadn’t been closed.

I thought that all claims that were at the FOS would be transferred to the administrator, my potential redress recommended by the FOS was approx £8k and i know i will only receive a token amount back but it appears that QQ are still trying to weasel their way out of claims.

I had similar complaints against Payday UK / Express and had no trouble registering my claims which were both upheld by the Money Shop its just seems to be QQ that are being awkward.

Sara (Debt Camel) says

they do seem to making this rather more difficult than other administrations have… be persistent!

Phil says

Hi Sara

i am trying but I am not getting anywhere with QQ, they are just stonewalling me now saying the my case is closed

They have lied that the FOS found against me and are refusing to reopen it

Can I complain to the administrator?

Sara (Debt Camel) says

yes you can, email Christine Laverty – details here https://www.insolvencydirect.bis.gov.uk/fip1/Home/IP/9121

BUT an adjuidcator decision was not a Final Decision from FOS. If you had a Final Decision from an ombudsman, I would expect QQ to accept it. This may be why you think they are lying to you but they are actually saying you don’t have a final decision.

Of course, an adjudicator decision is still some evidence that the lending was unaffordable though.

Phil says

Thanks Sara

I have emailed her and attached correspondence from FOS and QQ, hopefully someone will review it.

Pete says

They rejected all mine was taking them one after the other to get higher limits and also taking loans from avant at the same time by the time they approved the last loan I was around 20k in debt have appealed but don’t know if they will agree

. 2016GB937674937 2016-05-16 £2,000.00 £749.70 Rejected

2015GB690275818 2015-12-30 £3,800.00 £463.90 Rejected

2015GB087487036 2015-11-25 £3,700.00 £34.65 Rejected

2015GB088425613 2015-10-12 £2,200.00 £106.07 Rejected

10003547 2015-10-08 £300.00 £4.59 Rejected

Antony says

Reading through the comments on here I am so glad I have managed to turn my finances around, thanks to Payplan and my DPM I only have one year left and I am debt free, all them payday loans I used to worry about and use one to pay another a thing of the past, good riddance to the crooks, they owe me £3500 but resigned to not getting anything, just glad to see light at the end of a very long tunnel now

Rebecca says

I was surprised when my assessment came back that all my loans with QuickQuid had been omitted . The claim assessment had only looked at my 2 loans with onstride. I’ve called today and been told that I need to submit a separate claim for my QuickQuid loans does this sound right? I’m concerned as I still have an outstanding balance with onstride so if my claim for my QuickQuid loans is accepted would they offset this against my onstride account? It appears I have two different customer Id references so not sure how they would work this

Rebecca says

My original plan until I spoke to them today was to appeal the original claim assessment advising the quick quid loans had been ignored. It seems submitting a new claim for the quick quid loans is going to delay things as this may take up to 120 days for a new claim to be looked into

Sara (Debt Camel) says

Was this borrowing at the same time? Or was there a big gap between the QQ loans and the Onstride loans? What was the result of the Onstride complaint?

Rebecca says

There was a gap of over 6 years. The onstride complaint was unfortunately rejected. A £4K loan but this was less than 30% of my income at the time so doesn’t seem to meet any of their criteria for being unaffordable

Sara (Debt Camel) says

Ok then I suggest you go back to customer services and say yoh are happy to put in a new claim for the QQ loans but you want an assurance that any refund will be offset against the Onstride balance remaining.

Rebecca says

Thank you I will do

CMcK says

Hi,

I’ve had an email today from casheuronet inviting me to put in a claim.

I did have QQ loans in (I think) 2011-2013. I was a student, I was using payday loans to pay off payday loans. It was a house of cards that inevitably toppled.

I did default on about £700, and it was on my credit report and I was being chased for it. I think I last engaged with them in 2014.

The chasing stopped years ago. It came off my report. And to be honest I’ve just buried it.

I think I have a case for them being miss sold, but at the same time I’m wondering if there’s any point in me chasing this up as I might owe them more than my compensation would be, so really I’d just be poking a dormant debt that is far older than 6 years old so could probably just ignore until it goes away.

Would there be any benefit to addressing it?

Thanks in advance

Sara (Debt Camel) says

did you have a lot of loans from them before the default?

the problem with ignoring this is now they have dug this old debt up, will they sell it on to a debt collector and you then have to try to argue that it is too old and statute barred? I don’t know. they may just give up on it.

Ian says

Hi – just wondering if you can help please. Quick quid have partially upheld my claim however looking at the table they provided they have rejected quite an amount of loans despite me being in 2 clear long burrowing chains and one of their assessment being ‘if you were a repeat burrower for a significant number of loans or period of time (without a break of at least 6 months) your claim for all loans beyond the number or period of time threshold have been accepted.

Here are my 2 chains and their assessment-

Chain 1 – 22 loans taken between March 2012 to October 2013. 16 out of 22 loans were rejected! No break of at least 6 months

Chain 2 – 20 loans taken between April 2015 and December 2016. 11 out of 20 loans rejected. No break of at least 6 months.

The acceptances and rejections are all very random. Does this seem like an error to you or have I misunderstood something?

I think I will appeal. Thank you – any comments much appreciated

Sara (Debt Camel) says

It does sound odd. I suggest you appeal.

Nichola says

Hi, I have a claim in with cash euro net and I am in a debt management plan. I have just acquired a loan to clear my debt plan, however I still have at least 2 debts in my plan from quick quid and pounds to pocket. I have received an email today an update from Cash Euro Net saying that my loans were sold on before they went into administration and so they have contacted the company they were sold to and they need more time to assess my claim. My question is really if I use my loan to clear my debt plan could I be shooting myself in the foot, if there is a chance the debts from QQ etc that were sold get wiped? I had claims in with the Money Shop for other loans and they have just been wiped. Thanks for your help.

Sara (Debt Camel) says

why on earth would you take a loan to clear a debt management plan? That is usually a disastrous move. It is not going to improve your credit rating if that is what you are hoping for?

nichola says

It will pay it off quicker and I will pay less per month. I thought it would look better to have a loan rather than a debt plan on my credit rating? Thank you.

Sara (Debt Camel) says

How can you pay less a month and pay it off quicker? That doesn’t make sense.

Is the interest not frozen in your DMP? Who is the DMP with? Who is the new lender and what is the interest rate?

This is not going to look better on your credit record.

nichola says

The monthly interest on the loan is less than my monthly management fee. I am with Fresh Start for my DMP, the loan would be with the Halifax. I can still change my mind on the loan, I have 14 days. Thank you.

Sara (Debt Camel) says

ah you are paying a fee. You can switch your DMP to StepChange – no fees! See https://www.stepchange.org/debt-info/free-debt-management-plans.aspx. There is NO difference between a free DMP and one you are charged for, except the free one will end quicker as all your money goes to repay your debts.

Sara (Debt Camel) says

so to answer your question – ” if I use my loan to clear my debt plan could I be shooting myself in the foot, if there is a chance the debts from QQ etc that were sold get wiped?”

yes this is possible. It isnt clear what the administrators will do here, but there is some chance you will get a much better result if you don’t clear these debts.

Michael says

I have received a similar email regarding my pounds to pocket loan being sold to lantern. Does this mean as the loan was sold it is less likely I will receive a payment for it being missold? I would ideally just like the loan and subsequent default removed from my records entirely if at all possible.

Shannon says

I would like to no the same information on this one

nichola says

Thank you very much for your help Sara, I appreciate it.

Andrew says

Hi Sara, thanks for the website and great help you give to everyone on here.

I’ve had a rejection letter come through, stating that I did not meet the criteria.

I have sent in an appeal as I took out 1 loan for 4k in March 2017, which was unaffordable for me, I was earning 1,825 and had 1,350 in credit commitments before this loan. As I owed circa 40-50k at this point. This took me upto 1,500 a month and the debt spiral continued to get out of control.

However they are saying I need to provide bank statements – I have no access to these because the account I had the money paid into has been sold to Link Financial. What do you suggest at this point? I can show my credit report listing all of these credit commitments?

21 days is not a long time to pull all this information together and I’m really stressed by it as clearly we cannot go the FoS who would of likely found in my favour like my other creditors..

Thanks in advance,

A

Sara (Debt Camel) says

You just go back to the old bank and ask for the bank statement. This is a recent loan, it shouldn’t be difficult.

BUT what happened to this loan? Have you repaid it? If not, how much do you owe? And how much do you owe on your other debts? can you say how much you owe at the moment? are you buying or renting?

Andrew says

Thanks Sara for your help.

They are not willing to extend my appeal period which makes this really difficult.

I have not made a payment for this loan for over 2 years as they did not respond to my affordability complaint in 2018 and have never chased it. I owe £4k, with interest removed i owe £1k.

I owe £40k at this time, I am renting and managing a DMP of £650 a month

Thanks in advance

A

Sara (Debt Camel) says

So I repeat, these old bank statements should not take long to access.

Are all your debts, including this Link one, included in your DMP?

How are you finding the DMP payments?

Andrew says

Hi Sara,

I will go to my ex bank tomorrow to get them hopefully they will be able to provide rapidly.

Erm tight but manage-able. Hoping to put this all behind me in the coming years.

Thanks for help

A

Andrew says

Sorry I should of added all but Amigo Loans, as they have had an adjucator decision and they have sided with me

and they need to agree my payment offer

Thanks

A

Adreva says

Claim Submitted Sept 12th

Response Received Today

I still owe quickquid £500 ish for a loan that’s going to be removed from my credit report.

What’s the best way forward…

Sara (Debt Camel) says

sorry has the Claim been rejected? or upheld but the amoount to be refunded is less than the balance owed?

Adreva says

Its been accepted and after the offsets the outstanding balance is £500 ish.

With Wonga balances were offered to be paid off at 20% of the balance outstanding prior to the end.

I actually didn’t get the offer and the loan was taken off my credit report and I assume has ceased to exist when Wonga was legally gone.

Sorry Sara think I’ve answered my own question basically wait and see.

Thank you

Sara (Debt Camel) says

You are right that is what happened with Wonga. technically the loan still exists but there is no-one who owns it any more so it may as well not.

This may happen here too unless the administrators manage to find someone to buy the loan book from them. My guess is they were offered so little for the Wonga book that they decided they would be better off if only some of the borrowers accepted a 20% settlement offer than taking a lot less for all the outstanding loans.

Adrian says

Thanks Sara certainly something to bear in mind.

Pete says

Hi I appealed the descion and have had a email from casheuronet to say the administration team now uphold my complaint and be in touch below are the loans I had the last one for £2000 is sitting with a balance of £3560

My understanding is this will have to be reduced to the original loans amount and all payments previously made to loans offset against the balance plus 8% which should potentially see this debt completely cleared

Am waiting for a revised email from the administrator to clarify it all

2016GB937674937 2016-05-16 £2,000.00 £749.70 Rejected

2015GB690275818 2015-12-30 £3,800.00 interest £463.90 Rejected

2015GB087487036 2015-11-25 £3,700.00 interest £34.65 Rejected

2015GB088425613 2015-10-12 £2,200.00 Interest £106.07 Rejected

10003547 2015-10-08 £300.00 interest £4.59

Sianyyy says

Hey, how long did it take for you to get a response regarding your appeal?

Thanks

Sian

Pete says

Got a email from casheuronet on the 18th saying appeal accepted and I’d receive a revised assessment email however I’m still waiting on this

Hannah says

Hi Sara

Not sure if you have answered this question previously. I had 4 loans with quick quid that have been rejected after an appeal . I only took these loans out between 2018 – 2019 but i missed a lot of payments while on maternity leave . I am back working now , with one default from capital one to fall off in May 2022. I am wondering what happens on your credit file when this business goes into liquidation. Will the loans stay on for another six years from the start date or is there any legal way to have these removed.

Thank you and have a great Christmas for all the work you do .

Hannah

Sara (Debt Camel) says

is there a default date on the credit records?

Hannah says

Hey Sara

No default date just a lot of late payments on all four of the loans . I was just wondering as I heard that high street mortgage advisor don’t like payday loans . I have another 18 month until my final default falls off with cap one . I know it a while but just wondering where I stand with quick quid having to remove data as they will be liquidated.

Thanks

Hannah

Sara (Debt Camel) says

They don’t have to remove the data.

They may sell the loan book to a debt collector. If they don’t, they may offer you a F&F settlement – this is what happened with Wonga, if people paid the offer, the debts were removed from their credit record.

But you will have to wait and see what they do.

Antony says

Got a decision today, had £2300 left to pay which has been wiped off thankfully, nice result just before Xmas, reduces my DMP, will be paid off by next Xmas now, left with £900 after but not expecting any of that, just glad to clear my current loan, don’t get how they decide to refuse half the loans though, not bothered about appealing

Dave R says

Finally have my quickquid decision and they are partially upholding my complaint and accepting it for 3/4 loans. The one they rejected was my first payday loan many years ago which is no longer on my record anyway.

Not fussed about the redress amount – have accepted that will be tiny. My main concern is that with the last loan they added a default which shouldn’t be there – does anybody know how long they are taking to update credit files? Is there anyway I can request that they action the removal of the default immediately?

Sara (Debt Camel) says

My guess (ie I do not know if this is right) is that they will do credit record updates in a batch after all claims are determined. ie mid next year. I don’t think they are employing staff to deal with requests to handle an individual case earlier.

Paul says

Hi Sara,

I know you will say there is no way to tell but I have an accepted claim value of £2445 which is rather a lot of money, and quite frankly 4% is pitiful which seems to be the number being banded about. Do you have a gut feeling about what may be paid? Also do we know when this will likely be paid out? Seems to be taking an incredible amount of time in what is not a difficult exercise as far as I can see. Thanks!

Sara (Debt Camel) says

There is no point in me guessing here. People can still submit claims for another couple of months. The administrators haven’t yet sorted out what to do with debts that were sold to debt collectors.

Pandy says

Apologies if this has already been covered but the administrator’s most recent progress was published earlier this month:

https://find-and-update.company-information.service.gov.uk/company/FC032279/filing-history

Echoing what Sara states above, I think it is critical that anyone with an outstanding claim with the F.O.S. should now submit a claim through the portal too. It could become rather problematic if you do not.

Sianyyyy says

Put both my appeals in to CashEuroNet on 25/11 advised would receive response within 21days and no reply. Have chased several times. Has anyone else had a reply regarding their appeal? Thanks

Shorif Uddin says

Still waiting on my reply been over 21 days

Chantal Marie Smith says

Still waiting for my reply and mine has been over 35 days. I have chased it today.

Siobhan B says

Can anyone help me understand the email I received from cash euro net. Thank you

The Joint Administrators have assessed your claim and can confirm that it has been partially accepted.

Guide

Total interest and fees on loans £331.00 1

Total compensatory interest £64.43 2

Less set off £395.43 3

Revised interest and fees on loans £0.00

Revised compensatory interest £0.00

Accepted claim value £0.00 4

Compensatory interest settled by way of set off £64.43 5

Remaining loan balance potentially due to CashEuroNet UK, LLC £329.57 6

Loan ID Start Date Loan Amount Paid Interest And Fees Accepted/Rejected

7094377 2013-06-03 £150.00 £638.43 Rejected

9878444 2015-09-08 £150.00 £45.60 Rejected

11552916 2017-01-29 £150.00 £36.00 Rejected

12127579 2017-07-07 £400.00 £35.20 Rejected

12707859 2017-12-13 £500.00 £174.80 Accepted

12893616 2018-01-30 £725.00 £156.20 Accepted

Does this mean I still owe them money? Do I pay? The loans that were accepted defaulted, will that be removed off my credit?

Sara (Debt Camel) says

So they are saying you had 6 loans and they have upheld the last two only – which looks like a pretty normal decisions as the first 4 weren’t large and there were gaps after loans 1 and 2.

The refund on interest on loan 5 and removing the interest from loan 6 have reduced the balance you owe to £329.57.

They should either remove the default or remove the whole credit record.

Your options are

1) repay that amount

2) make an affordable monthly payment arrangement

3) do nothing and get hassled.

If you don’t clear the debt than at some point the administrators will either sell the remaining debts to a debt collector or offer everyone a full & final settlement offer. For Wonga everyone was offered to settle at 20%, but this doesn’t mean that will happen for QQ.

KelE says

Like everyone who received the mass email from QQ on 5th Nov 2020, I decided to call them to find out if these was correct and I was informed the email was sent in error, an additional email would be sent to notify all applicants.

I have not received my “official” claim email, on 05/12/2020, I’ve sent an additional email to QQ to ascertain when I’ll likely hear from them about my claim, as I understand there is an appeal deadline, again no response….I called the number I’d previously called 0800 0163 250 and was redirected to Dollars Direct…..is there anything further that I can do or do I wait for them to contact me?

My complaint about QQ and P2P was with FOS when casheuronet went into administration so my complaint was sent with others.

I’ve followed all the steps and now feel I have know other avenue to obtain a final decision.

Is there anything further you can suggest Sara???

Please note QQ had only held up one loan before I went to FOS despite having all the evidence of irresponsible borrowing which showed I had continually loaned between the two companies (and other payday loan companies during the same period but fir additional years pre and post QQ and P2P) for over three years, every 30 days from QQ and approx every 6 months from P2P!

Chantal Smith says

Has anyone else appealed the decision and just getting the same scripted answer back over and over again? I appealed as two loans were disregarded in my claim and they just keep the replying with the following answer even though I’ve asked for a proper answer and appealed too.

Any advice or assistance from anyone would be greatly appreciated.

Thank you for contacting CashEuroNet UK, LLC

Your claim / loan(s) were assessed against a number of different affordability criteria held on CashEuroNet’s systems. The assessment tool will consider (but not limited to) the following:

The customer’s loan value as a proportion of their reported income;

The total time in loan, or number of loans to identify repeat borrowing without a significant break; and

Additional affordability factors, e.g. payments in arrears of customer hardship.

In your assessment email, we provided sufficient information for you to understand how your claim has been calculated.

Please note that any loans that have been previously compensated will not be re-assessed by the Joint Administrators.

Yours sincerely

Sara (Debt Camel) says

How much did you pay in interest on these other two loans?

Chantal Smith says

Hi Sara, this is the breakdown

Loan ID Start Date Loan Amount Paid Interest And Fees Accepted/Rejected

1907128 2011-01-31 £450.00 £103.94 Rejected

2165828 2011-04-04 £1,000.00 £309.76 Rejected

5315178 2012-09-25 £300.00 £75.00 Accepted

5505800 2012-10-24 £

Kind regards Chantal

Chantal Smith says

Hi Sara,

I paid £103.94, £309.76, £75 and £0.

The first two have been rejected and the second two which are the lowest two have been accepted?

Sam Phoebe Gravener says

It’s been more than 120 days since I submitted my claim and I haven’t heard anything… anyone else?

Pete says

I’ve had the following through after appeal but doesn’t seem right to me outstanding loan current balance is £3358. 94 loan was originally £2000 but doesn’t seem like they have removed the interest from this

2016GB937674937 2016-05-16 £2,000.00 £749.70 Accepted

2015GB690275818 2015-12-30 £3,800.00 £463.90 Accepted

2015GB087487036 2015-11-25 £3,700.00 £34.65 Accepted

2015GB088425613 2015-10-12 £2,200.00 £106.07 Accepted

10003547 2015-10-08 £300.00 £4.59 Accepted

Total interest and fees on loans £1,358.91

Total compensatory interest £431.62

Less set off £3,494.49

Revised interest and fees on loans £0.00

Revised compensatory interest £0.00

Accepted claim value £0.00

Compensatory interest settled by way of set off £431.62 5

Remaining loan balance potentially due to CashEuroNet UK, LLC £2,200.03

Refund for overpayment on CashEuroNet UK, LLC loan £0.00

Sara (Debt Camel) says

Is only the last loan outstanding?

Pete says

Yes only the last one outstanding

Sara (Debt Camel) says

What was the balance before this redress?

Pete says

Original loan £2000 current Balance is £3558. 94 before redress

Sara (Debt Camel) says

ok, so you need to go back to QQ and say that this line

2016GB937674937 2016-05-16 £2,000.00 £749.70 Accepted

is wrong, as they have added £1558.94 in interest and charges. Ask them to correct that and rework the redress calculations.

Pete says

Thank you that’s what I thought I made it Current loan balance £3558.94

which is

£2000 loan

£1558.94 interest on balance

Surely the table should be

£3558.94.

-£1558.94 interest

-£1358.91 paid in fees and interest

-£431. 62 statutory interest

Balance remaining £209.64

It’s a slow battle but thanks for all your help I’ll let you know when I get a response

Ben Rivers says

Hi Sara, I just got a call from Quickquid. They are asking me to send a 1 month bank statement transactions included. Is this a normal request as I did not have to do this for the Wonga clam. Also. Why would they be asking for this?

Thanks

Ben

Sara (Debt Camel) says

HAve they told you what the settlement amount is? Have you appealed it?