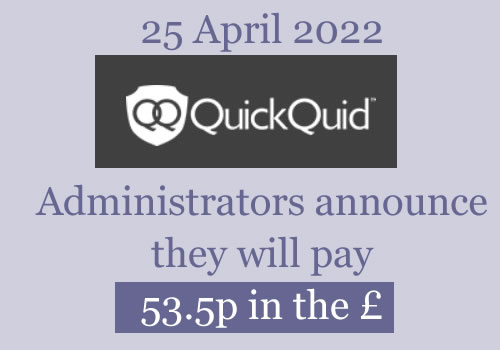

Payments – UPDATE – 25 April 2022

Administrators have started sending emails to everyone with an upheld claim telling them what they will be paid.

“The Joint Administrators are now in a position to declare a first and final dividend of 53.5p in the £”

The average claim value is c £1,700. Someone with that claim value will get a payout of about £910.

The payout details are given in the email:

- This will be paid over the next two weeks.

- If the administrators couldn’t validate your banking details, it will be sent by cheque. I don’t know how the administrators will “validate” your details.

- If you used a claims company, the money will be paid to them.

- Most people are not having any deduction for tax paid to HMRC, so there is no need to reclaim anything.

Credit records

The administrators may decide to :

– remove any negative marks on your credit record

– delete all loans that were upheld

– delete all your loans.

I don’t know what they have chosen to do – if people can check and report in the comments when they see a change, that would be great.

How much your credit score will change will depend on whether there were any negative marks. If you want to get a mortgage, you would like as many payday loans gone as possible, even if they were repaid on time and not hurting your credit score.

In a few months when the administrators no longer talk to the CRAs you can ask for any remaining loans to be “suppressed” so other lenders can’t see them. See https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do that now.

QuickQuid went into administration in October 2019

CashEuroNet (CEU), which owns the QuickQuid, Pounds To Pocket and On Stride brands, stopped giving loans and went into administration on 25 October 2019.

I will be talking about QuickQuid (QQ) rather than CashEuroNet as it is the more familiar name. Everything here also applies to loans from Cashruronet’s other brands, Pounds To Pocket and On Stride.

Grant Thornton were appointed as Administrators. They set up a page about Redress Complaints – this is their term for people who have asked for a refund because they were given unaffordable loans.

Background to the QuickQuid Administration

QuickQuid was one of the “Big Three” payday lenders in Britain, starting out in 2007.

After Wonga and the Money Shop Group had all stopped lending and gone bust over the last fifteen months, QuickQuid was left as the largest UK payday lender.

QuickQuid had well over a million customers. When it went into administration there were c. 500,000 customers with outstanding loans.

Many of these customers had prolonged borrowing from QQ. They either rolling loans over or repaid one loan but were left so short of money that they had to borrow again.

These customers have good reasons to win an affordability complaint and get a refund of the interest they paid.

Affordability complaints started on a small scale in 2015 and increased in the next few years.

In 2018, complaints going to the Financial Ombudsman (FOS) jumped with the involvement of Claims Companies and QuickQuid became the most complained about firm to FOS, excluding PPI complaints.

For a long time QQ refused to refund interest on any loans taken more than 6 years before or where the loans were given in 2015 or afterwards. This resulted in a huge backlog of claims at the Financial Ombudsman, where QQ had made very poor offers to customers and then rejected an adjudicator decision.

In late July 2019, QQ agreed to accept several thousand FOS complaints it had previously rejected.

By accepting the FOS decisions on loans over 6 years, long chains of borrowing, and loans taken after 2015, the scale of QQ’s likely future liability for refunds will have become clear to the company.

After failing to persuade the FCA that a Scheme of Arrangement was appropriate, Enova, CEU’s large and profitable US parent, decided to close the UK business, blaming the UK regulatory environment.

How could the regulators let this happen?

This is an excellent question… Stella Creasy, MP called for an inquiry into the FCA over Wonga and QuickQuid.

What has happened in the administration

Customers with a valid claim for a refund are “unsecured creditors”. This includes:

- any refunds that were in progress after an amount was agreed or a Final Decision from a FOS Ombudsman (FOS);

- complaints that were underway at QQ or FOS when QQ went under;

- any new complaints sent to the Administrators.

All complaints at FOS legally had to stop and were been passed back to the Administrators. It isn’t possible to send any new complaints to FOS.

It is now too late to submit a Claim for unaffordable lending. The last date was 14 February 2021.

The administrators have given the following statistics about claims:

- 169,000 customers made claims for unaffordable lending;

- 78,000 claims were upheld by the administrators;

- the upheld claims had a total value of £136million, so an average of about £1,700 per claim.

Still owe a balance on a QuickQuid or On Stride loan?

More than 300,000 of the current loans were sold to Lantern in summer 2021. You should have been informed if your loan was sold.

The administrators have now stopped collecting any money from the remaining unsold loans.

This page is no longer updated

Comments have been turned off. If you have a query, please post it on the Refunds from loans page.

Robizm says

I received the emails but I did not even make a claim. I only had one loan and got into difficulties. They rang me in work so often chasing payments that I was making and even carried on calling me at work after the loan was finished with an automated message. Horrible company.

I am not expecting redress and I am assuming I am on the list for my complaint about the phone calls etc.

Elizabeth Frost says

I had many loans with QQ somewhere between 2007 – 2011, I don’t have exact dates but at the time I lived at the same address as I do now. January 2019 I put in a claim through resolver and In March I received an update from QQ saying that they do not hold any records for me and that I’ve never held a loan with them. I’ve just tried to make a claim through the claims page on here and apparently they cannot find an account with the info I provided, what is my next move?

Any help would be greatly appreciated.

Sara (Debt Camel) says

do you have any evidence of these loans? bank statements? emails? was there ever a response to your Jan 19 claim through Resolver? did you ask for a list of your loans at that time?

Sam Gravener says

Hi,

I had loans with QQ from 2013 which were unaffordable.

I put in a claim, and have just had a really confusing email back.

The title said my claim had been accepted fully, but then the first line said it had been rejected. It also went on to say that a full breakdown of my loans was attached to the bottom of the email – it wasn’t.

I’m really confused. I have emailed them back to clarify what’s going on but do you have any advice?

I can’t access records of my loans online but remember that I had several loans one after another before defaulting on them late in 2013.

Thank you!

Graeme says

Read the previous comments. It seems that this email may have gone out in error.

Sam Gravener says

Thanks! Yes I skipped to comment and then read them after. Glad it’s an error and will wait to see what happens.

Rosie says

I had this email last night and I’ve the exact same one again now. Has anyone else?

Danielle says

Yeah, I’ve just had it again! Youd think they’d learn the first time

Siân says

I’ve had the same one again – it’s quite comical now if they keep getting it wrong!

Zoe says

Yes I’ve just had another

Kay says

Yes, I had it again, this time from support@email.quickquid.co.uk – I am guessing they are having problems with their Mail merge – a similar thing has happened with other companies before – they are probably using a system to send emails and these extra emails people are receiving is them thinking they have fixed it – or the test is going out in error 🙂

Adrian says

Yup just received another one lol

Emma says

Yep just got another too!

Sara (Debt Camel) says

Do they say the same as the previous ones?

Kay says

Exactly the same!

Kayleigh Wells says

I had a few QQ loans about 9/10years ago, always paid them off. Moved to new address 8years ago debt free & I also go this email. I defo owe them nothing.

Pamela says

I’ve had an email today..Dear valued customer..saying my claim was rejected

..I didn’t put in a claim…then it says to continue to pay my loan….my loan was paid back about 10yrs ago 🤔…what should I do ?

Karen says

I’ve had exactly the same email this evening!….

GW says

Looks like they haven’t managed to stop the emails coming out. I had two, the same as everyone else, that have only just come through this evening at 19.00.

TG says

I have received 2 strange emails tonight from QuikQuid, one stating I still have an outstanding loan which I have not had for over 2 years! also with the same title, I phoned them and was told a batch of emails have been sent in error! A hour later another emails stating my claim had been accepted and a list of loans was attached, then further on the email stating I would receive no redress, also no list of loans was attached!

This is worrying if they cant get this correct how on earth can the process redress claims….. maybe we should be claiming against the administrators for worry and mis-information!

Lucy says

I don’t know what I’d do without this site. I’ve received these emails at 19.18 and 19.27 tonight. I read them and worried but came straight to read the comments on here.

I feel relieved now and will wait to see what other emails we all receive.

Thank you for this site Sara it’s been such a help to me for a while now and thank you everyone for posting as it reassured me straight away as soon as I realised others had received the same emails.

Shorif Uddin says

Just got the two emails at 7pm today,

Very strange

Natasha says

I received two emails from QQ this evening between 7 and 8pm, the first stating my claim has been accepted, but then in the email it states it has been rejected and to continue paying my loan, and the second email the same except no mention of paying a loan.

I haven’t had a loan from them in 5 years, and paid them all off? I don’t understand what is happening.

Graeme says

So just received this:

Dear Graeme,

You may have received one or more unexpected emails from us on 5 November 2020 relating to the assessment of a claim submitted. The email(s) were sent in error due to a technical issue during some routine email testing. We apologise for any confusion or concern.

Please ignore the email(s) as they do NOT represent your official claim assessment outcome.

We wish to reassure you that we are actively working on finalising your claim assessment, and as previously stated, your official assessment outcome will be issued within 120 days of your claim submission.

Please be aware, if you have not received a “we’ve received your claim” acknowledgement email from us, your claim cannot be considered for assessment at this time. This is because we have not been able to verify your identity, as the bank details you have entered could not be validated. To resolve this issue and complete your claim submission, please contact the Customer Support team on 0800 0163 250 to verify your details. Please do so as soon as possible; your claim cannot be progressed until we have received and validated that information.

Again, we apologise for any confusion or concern this may have caused.

Yours sincerely

The Customer Support Team

For and on behalf of CashEuroNet UK, LLC (in Administration)

Graeme says

Worth noting, these emails are being sent to my old email address, despite having given (and my confirmation of my claim email being sent to) my current, up to date email address.

Sara (Debt Camel) says

go back to them and double check that they do have your new email.

Graeme says

Logging into the claims portal shows that it’s my up to date one they should be contacting.

I’ll contact them on Monday to reaffirm that it’s that one they should be using.

Robert Evabs says

Received the following email just now

You may have received one or more unexpected emails from us on 5 November 2020 relating to the assessment of a claim submitted. The email(s) were sent in error due to a technical issue during some routine email testing. We apologise for any confusion or concern.

Please ignore the email(s) as they do NOT represent your official claim assessment outcome.

We wish to reassure you that we are actively working on finalising your claim assessment, and as previously stated, your official assessment outcome will be issued within 120 days of your claim submission.

Shivs says

I have just received an email apologising for the error sending out their previous emails.

PC says

For anyone who received the 2 misleading emails I just received this.

————

You may have received one or more unexpected emails from us on 5 November 2020 relating to the assessment of a claim submitted. The email(s) were sent in error due to a technical issue during some routine email testing. We apologise for any confusion or concern.

Please ignore the email(s) as they do NOT represent your official claim assessment outcome.

We wish to reassure you that we are actively working on finalising your claim assessment, and as previously stated, your official assessment outcome will be issued within 120 days of your claim submission.

Please be aware, if you have not received a “we’ve received your claim” acknowledgement email from us, your claim cannot be considered for assessment at this time. This is because we have not been able to verify your identity, as the bank details you have entered could not be validated. To resolve this issue and complete your claim submission, please contact the Customer Support team on 0800 0163 250 to verify your details. Please do so as soon as possible; your claim cannot be progressed until we have received and validated that information.

Again, we apologise for any confusion or concern this may have caused.

Yours sincerely

The Customer Support Team

For and on behalf of CashEuroNet UK, LLC (in Administration)

PC says

You may have received one or more unexpected emails from us on 5 November 2020 relating to the assessment of a claim submitted. The email(s) were sent in error due to a technical issue during some routine email testing. We apologise for any confusion or concern.

Please ignore the email(s) as they do NOT represent your official claim assessment outcome.

We wish to reassure you that we are actively working on finalising your claim assessment, and as previously stated, your official assessment outcome will be issued within 120 days of your claim submission.

Please be aware, if you have not received a “we’ve received your claim” acknowledgement email from us, your claim cannot be considered for assessment at this time. This is because we have not been able to verify your identity, as the bank details you have entered could not be validated. To resolve this issue and complete your claim submission, please contact the Customer Support team on 0800 0163 250 to verify your details. Please do so as soon as possible; your claim cannot be progressed until we have received and validated that information.

Again, we apologise for any confusion or concern this may have caused.

Yours sincerely

The Customer Support Team

For and on behalf of CashEuroNet UK, LLC (in Administration)

K W says

I have now received an email apologising saying these emails were sent out in error and do not represent the final outcome of my assessment. Will receive the outcome within 120 days of my claim (I claimed 1st week of Sept)

Chrissie says

I have had this one from casheuronet tonight, using my name.

You may have received one or more unexpected emails from us on 5 November 2020 relating to the assessment of a claim submitted. The email(s) were sent in error due to a technical issue during some routine email testing. We apologise for any confusion or concern.

Please ignore the email(s) as they do NOT represent your official claim assessment outcome.

ROBERT says

Dear Robert,

You may have received one or more unexpected emails from us on 5 November 2020 relating to the assessment of a claim submitted. The email(s) were sent in error due to a technical issue during some routine email testing. We apologise for any confusion or concern.

Please ignore the email(s) as they do NOT represent your official claim assessment outcome.

We wish to reassure you that we are actively working on finalising your claim assessment, and as previously stated, your official assessment outcome will be issued within 120 days of your claim submission.

Please be aware, if you have not received a “we’ve received your claim” acknowledgement email from us, your claim cannot be considered for assessment at this time. This is because we have not been able to verify your identity, as the bank details you have entered could not be validated. To resolve this issue and complete your claim submission, please contact the Customer Support team on 0800 0163 250 to verify your details. Please do so as soon as possible; your claim cannot be progressed until we have received and validated that information.

Again, we apologise for any confusion or concern this may have caused.

Yours sincerely

The Customer Support Team

For and on behalf of CashEuroNet UK, LLC (in Administration)

Sara (Debt Camel) says

oh boy. Well at least that is cleared up.

chris says

Just got another email following the 2 emails this morning saying that the first two emails have been sent in error. So, I think there has been some sort of glitch with this and people should ignore the 2-email approach if it comes to them.

John says

They’ve now sent an apology email tonight. I think it’s disgraceful that thousands of people worried about their historic debts on their credit file, like me who had one loan paid off years ago for a very small sum, have threatening emails saying we owe them money. Especially after entering, voluntarily our details for redress. Disgusting breach of our data.

Siobhan says

I also received the emails this evening and yesterday evening. I haven’t made any claims and paid quick quid back in full a long time ago.

Chantal Smith says

I haven’t yet received an apology email.

JL says

These clowns are as bad as uk govs handling of covid

I wonder if the FCA are aware of these emails being sent out !

Bruno says

I have also received the strange email 4 times over the past few days. I then received an email this morning apologising for the mistaken email. They said they are still goong through my case now and that I have to just sit tight for now.

Chantal Smith says

This company is an absolute nightmare. Can’t they just do it right. So we all got the false emails about our claims being rejected. This morning I have woken up to an apology email and it now says that I haven’t raised a claim yet???. What is wrong with them? Has anyone else had this? I have a claim reference email and it says my claim has been submitted???

Sara (Debt Camel) says

They aren’t having a good week, are they…

Kyleigh Goodband says

I have had exactly the same email stating I have yet to make a claim, I have made a claim and had the email confirmation of my claim 🤔 I emailed them back to say this so will wait for another confirmation email, I have about 7 now!

KB says

I recieved an apology email regarding the error with the automated emails going out but never actually recieved the original email. I have a current loan with on stride … I’ve tried to log in to their website to view my loan but it’s not working now and coming up with an error… is anybody else having this issue?

Rebecca says

Yes same getting an error message as soon as try to sign in

KB says

I wonder if it’s an a genuine issue with logging in or if they don’t want people logging in to check their balance etc. Just seems strange after that email went out in error

Adam says

I received the email twice and upon contacting them have been told my claim is no longer active even though I registered on the portal I’m being told it isn’t possible to to re activate the claim, so it has passed to a manager to try and resolve. Wondered if anyone’s else’s claim had been cancelled

Sara (Debt Camel) says

Have you had the “apology” email?

Adam says

No I only got 2 emails, saying the claim had been rejected

Sara (Debt Camel) says

ok, try to get get an update on Monday and let me know if no progress?

Adam says

Will do, the agent I spoke to had assured me he would send me a confirmation email of the conversation, as he told me not to call back and they would contact me but as I suspected he didn’t so I will be calling them monday.

Graeme says

Hmm, it seems the lunacy continues. After seeing a few more comments here I thought I’d log in to the claims portal to see what’s what, and it’s just telling me they don’t recognise my details now. I’ve fired off an email to claims@casheuronet.co.uk to ask for an update on what’s going on.

Kayleigh W says

I’m filling out my claim form now from link off apology email. It’s asking for my bank account details! Is it safe to fill this in

Sara (Debt Camel) says

If it is on the QQ claims portal page – link in the article above – then yes, this is safe.

Lloyd says

You have been told the emails have been sent in error, so please stop messaging casheuronet, this will only slow down the process

Graeme says

There’s more to it than that with me. I understand that the emails were sent in error, but they were also sent to the wrong email address and I can no longer log in to the portal to check my details.

Sian says

Anyone else having issues logging in to their onstride account?

Adam says

To update, upon speaking with them today I have been told due to the fact I rejected their final in the final response letter and sent it to the fca/ fos I am not eligible at this to to submit a claim. Which I find very strange. I wonder how many other people this will effect, as it did allow me to submit a claim to the portal when it opened and would be unaware the claim wasn’t active if I hadn’t spoken to them. The have said they will look into it but I’m not holding out much hope.

Sara (Debt Camel) says

This sounds like nonsense. Please let me know if this isn’t resolved.

Chantal Smith says

It sounds like a they are trying their best of getting out of paying as many claims as they can or who you spoke to doesn’t understand the system and is telling you something that is false. Hopefully they will pay up. I have submitted a claim, got confirmation it has been received and then the apology email I received says I don’t have an active claim? I am unable to log in to any of the accounts or portal to check this since it doesn’t recognise my details. They appear to definitely be having lots of technical problems as well as sending out the incorrect information. Let’s hope what they have told you definitely isn’t correct. Fingers crossed.

Graeme says

I doubt it. It doesn’t matter how many people’s claims they approve, the pot for payouts is a fixed sum set aside for it. It’s no skin off the administrators’ noses whether or not they approve it.

Chantal Smith says

But the less claims they have to payout surely the better?

Sara (Debt Camel) says

why?

Siobhan says

I’d imagine she means because the pot of money to pay out for claims isn’t bottomless. For example £100 will give 100 people a £1 each. But if only 5 people claimed they would get £20 each?

I don’t know if that’s how it works. Just a guess of what Chantal means?

Sara (Debt Camel) says

That’s true, but my question is why do the administrators care? They won’t make any more money either way.

Shorif says

Any idea how much is in the pot to payout

Sara (Debt Camel) says

I don’t think there have been any further updates after this in mid May:

https://admin.turnkeyinsolvencyservices.biz/Viewer/pdfViewer.aspx?sid=ven4fkeyayl3gu0vbi2haqbs&did=0ecc5659-87e7-4db1-8bc1-5c3d62b4d642

Shorif Uddin says

Alot to read but judging for what I did see there is a few millions in the pot?

Jack Turner says

I accepted an offer and was just waiting for the money to go in to my account before they went in to administration.

Now these clowns are saying that they are assessing my claim !!

Surely I am a creditor for the £4K they were due to pay me ?

SK says

I would hope the FCA keep a close eye on these assessment outcomes by the administrators where the FOS already ruled in customers’ favour… But now I am not surprised by anything these companies (and their still blooming parent companies) can get away with before and even after being in administration…

Chantal Smith says

Less claims to process so less work for them to do.

Sara (Debt Camel) says

But they get paid for the hours they spend… And most of it is just computerised anyway, no human intervention.

Graeme says

That’s down to their IT framework, not man power, and seeing as they dealt with the Wonga administration too, it should realistically be pretty much set up already.

Chantal Smith says

Oh I see. Ok. Thanks for explaining that Graeme.

Mr and Mrs C says

We have tried to log onto the claims portal but it would not let submit the details. We have called QQ helpline and were told that since our claim was agreed through FOS for 9k just before they went into administration, they have now escalated to a manger to see if it needs to be submitted again. She has no idea how long it would take. I suspect we have to just keep ringing to see if we are in the big pot or not?

Adam says

Seems I’m not the only one then, hopefully we will be hearing from them soon.

Martin says

It’s an absolute disgrace how long this has went on and went the same way as how Wonga loans was handled. Its a joke that it looks like they are going to take the full 120 days to get back to people who potentially due a refund. I’m getting constant calls from Onstride looking to settle my balance despite myself stating to them on numerous occasions that I will not be settling my balance until I receive the email stating whether or not I’m due a refund. What is the point of paying off a balance when potentially if found in my favour I could offset all or part of the balance if its accepted I was lent to unaffordably… The company staff seem to have no idea to this by constantly giving out misinformation. Its about time Grant Thornton pulled their finger out regards this. In total since these companies have went into administration I have been done out of over 6k in compensation and have received peanuts instead… Yes I can accept responsibility for borrowing off payday lenders but when banks turn you down it forces people into no other option than to borrow from payday loans.. Also the fact there is zero protection from the FCA for consumers when it comes to payday lenders is extremely frustrating. How many people have committed suicide to mounting debts and have experienced severe mental problems due to the incompetents and reckless lending from these companies.. Then compound the misery by sending misleading emails last week.. Its a shambles

Alexxx says

I submitted my claim on 6th august and still waiting for final decision(it is 100 days gone, so 20 days left) . I have outstanding loan and pay my instalments because do not want damage my credit history. I hope if my claim will be accepted I will get refund back like ICL have done now . Is it any info about this? Overall i think they will already have outcomes of claims, they simply waiting last day, because people still have active loans and pay like me to avoid default on report(((

Phil says

i have tried to log into the claims portal but it doesn’t recognise my details. My email address and bank have changed since I made the claim and needed to update them.

I rang the helpline to be told that my claim had been closed and was unable to be reopened !!

My complaint was upheld by an adjudicator at the FOS with a potential redress of £9k but QQ went into administration before replying to the FOS so assumed that my case would be passed to the administrator.

This is a shambles, i assume i need to try to contact Grant Thorton now?

Sara (Debt Camel) says

You can tell the helpline that you want to make a complaint about this as you have to be allowed to make a claim in the administration. Or you can contactthe administrators at Grant Thornton.

Sara lou says

Hi ive had an email with an update but the link won’t open has anyone had the same?

Sara lou

Sam Gravener says

Yeah I have. Basically the error means we don’t have permission to open it.

Sam Gravener says

Ah just tried again and it opens now.

Jim says

yes, I’ve had the email with the administrator’s update. I was able to open it and read it.

Can’t copy and paste though.

Not much in the way of good news. The claims portal is still open until Feb 2021 – so they’re unable to update on the level of claims or possible redress.

Before administration, the company (Casheuronet) had 147 employees (130 of them based in Chicago). Since the administrators have come in, 74 staff have been retained (66 in USA).

The statement of payments made during the period of administration (basically the last year) shows that staff costs of £4.7m have been paid in the last year.

The administrator’s fee to date is just over £3m.

Other payments to other creditors/suppliers in the last year amount to a further £7m – I don’t think the administrators fee is in that. One payment of more than £3m is described as Enova SLA costs – Google didn’t really help!!

It seems that Enova is/was their parent company, I think.

Interesting that a company in administration can still make payments to their parent company (not in administration).

The administrators estimate at least another year is needed at a cost of a further £3m!!

SK says

Yes, Enova IS their parent company and as you pointed out taking away lot of cash still! Call it whatever you like but to me it is legal daylight robbery!

This was David Fisher’s (CEO of Enova) statement when CashEuroNet went (pushed?) into administration:

“Over the past several months, we worked with our U.K. regulator to agree upon a sustainable solution to the elevated complaints to the U.K. Financial Ombudsman, which would enable us to continue providing access to credit for hardworking Britons,” said Fisher. “While we are disappointed that we could not ultimately find a path forward, the decision to exit the U.K. market is the right one for Enova and our shareholders. Looking ahead, we believe that our diversified product offerings provide meaningful growth as we allocate our resources where we see the greatest opportunities.”

Oh, and Nick Drew (CashEuroNet’s managing director) is still proudly listed on Enova’s website (under Company tab in Meet Our Leaders section)…

Jim says

Sorry Sara …..more from me

So, to date 108,000 claims on the portal (didn’t I read that Sunny had more than 500,000 potential redress claims)

And it appears there is currently around £60m of cash/assets available (this is a moving number due to assets being realised/loans being collected and other costs being made – not least that additional £3m to the administrators comes out of this).

But, let’s say the number of claims gets up to 150,000 – and let’s assume there is no-one else to pay other than “redress clients” – that would work out as £400 per client. But, there are a lot of assumptions in that calculation!!

Michael says

Hi Jim, any indication of when they’ll be in a position to make payments to creditors?

Jim says

The portal is open until Feb. They’re requesting an additional 12 months to wrap up their work on administration. Based on that, maybe sometime between march 2021-Oct 2021. That’s only guesswork though

N says

I wouldn’t hold your breath for any redress claim. There will be nothing left in the pot, there is c£79m in creditors and this doesn’t include any redress claims, the administrators are charging almost £3m for their services. They owe the tax man. The American parent company reckon they are owed £71m too. I’d just forget about it and move on with your lives, I am.

David Lacoste says

I agree with this, all i’m looking forward to is record on my credit file being finally removed. But as mentioned above they are dragging things out as much as possible to milk more money. The fact they are asking for an additional 12 months after already 12 months to wrap things up I think is a disgrace and shouldn’t be accepted.

Chrissy Frost says

Me too. I’m just waiting for the claims assessment email so the loans can be removed from my credit file. Anything after that is a bonus.

Danni says

Hi Sara,

I wrote to you previously for advise as I was told by CashEuroNet (after calling the helpline number 0800 016 3250) that I’m unable to make a claim through the portal as I previously accepted a refund for one small loan. At the time they didn’t take my loans going back past the 6 year’s into consideration. I contacted them again by phone requesting that the allow me to put in a claim. I then requested a direct response from the administrators. This was 3 months ago.

On the 17th October I emailed casheuronetuk@uk.gt.com with my request, and haven’t received a response. Today I emailed claims@mail.casheuronetuk.co.uk with the same request.

I just went to the CashEuroNet website and viewed the following: “You are able to submit a claim for all loans not considered as part of a previously accepted and redressed affordability complaint which was assessed by CashEuroNet prior to the Administration.

You cannot be redressed twice for the same loan. If you previously received a redress payment and/or waiver from CashEuroNet, then the historic loans that were redressed at the time will not be considered again.”

Please correct me if I’m wrong, but does this not contradict the advice they’re giving me, and other’s? Or am I reading it wrong?

Do you have any updates on how to escalate these request?

Thank you

Danni

Sara (Debt Camel) says

I think that isn’t necessarily incompatible. They could argue they had “considered” all your loans before so won’t do this again.

This is not the approach the same administrator took with Wonga. You could email Chris Laverty – details here https://www.insolvencydirect.bis.gov.uk/fip1/Home/IP/9121 – and ask.

Danni says

Thank you. I will try that route.

Kind regards

Danni

luke12345 says

I submitted a mis-sold application on the portal on 7th September, it says that i should receive an update in 30 days, which which make it overdue.

As it’s been over 2 months – Is this to be expected it would take more than 30? or could i have missed the email?

Thanks,

Sianyy says

Just received my emai from cash euro net all 5 of my loans have been rejected. Disappointed to say the least!

Shorif Uddin says

What day did u complete the online form?

Sianyy says

5th august 4 loans with P2P and one with OnStride all rejected. I have appealed though as it’s not clear on “ Subject to the type of loan borrowed from CashEuroNet UK, LLC, if you were a repeat borrower of CashEuroNet UK, LLC loans for a significant number of loans or period of time (without a break from CashEuroNet UK, LLC of at least 6 months) your claim for all loans beyond the threshold have been accepted.” took 3 of the 5 loans out within 6months of one another all large loans!

Alexxx says

Hello, I received my outcome today. have a question about refund for overpayment section. does it mean as they will transfer money shortly like ICL done? because i had active loan and paid them money. there is nothing mentioned about this payment due date. Any information about REFUND FOR OVERPAYMENT will be welcome

Guide

Total interest and fees on loans £845.53 1

Total compensatory interest £36.34 2

Less set off £1,045.02 3

Revised interest and fees on loans £0.00

Revised compensatory interest £0.00

Accepted claim value £0.00 4

Compensatory interest settled by way of set off £36.34 5

Remaining loan balance potentially due to CashEuroNet UK, LLC £0.00 6

Refund for overpayment on CashEuroNet UK, LLC loan £473.81

Sara (Debt Camel) says

rather a complicated way to set things out, but yes, it looks as though they are refunding you £473. No idea when though…

Sarah Morris says

I have received an email stating my accepted claim is £5800. Am I right in presuming I will not get anything near this?

Graeme says

Yes, you are. It depends how much successful claimants there are and how much money is allocated to pay them. The Wonga administration saw a payout of 4.3%, so I’d say it’ll probably be around that here, too.

Gary says

Wonga paid out 4.3% so it may be similar to that amount.

Hector says

I have received my claim outcome today too. Am also owed an overpayment refund. Looks like the balance at time of submission of the claim is the one taken into account before being set off against claim value. Later payments will be refunded. No word on when the overpayment will be refunded but I have written to them to ask.

Alexxx says

Thanks. As soon as you find out something, please write here.

Hector says

Here is the reply that I received regarding the overpayment:

“In regards to your overpayment query, the refund for overpayment will be paid within seven months after 14th of February 2021. If the refund for overpayment gets paid sooner, we will advise you via email. Please make sure your banking details are updated correctly to make sure you receive the refund and the redress.“

It’s not great news but I guess it’s good that we are getting some back as overpayments as opposed to pennies on the pound.

Chantal Smith says

I haven’t yet received my outcome and I put it in in August. Should I be concerned yet?

Rosie says

I’ve not received any email about my claim nd I put mine in on the 8th of August.

J says

I found an email from Quickquid saying my claim is valid, never even knew I’d submitted one so presume they’re just emailing old customers? Regardless, looking at the numbers it looks like the vast majority is just going to their parent company anyway which makes me wonder… If the parent company can claim £71m then shouldn’t peoples claims be valid against the parent company who should in practical terms have paid more attention to what their subsidiary companies were doing?

I know it’s very simplistic but I don’t know any better lol, but it seems completely immoral to me that they could have a hand in ruining a lot of peoples lives and then saying ‘yoinks’ before tossing whatever they have over the fence to hide it lol.

At the very least, you’d expect the parent company to be repaid on the same terms as everyone else… Either way, it’s something back which I never even considered although back in the day I was probably handing them perhaps £450 per month in interest and charges over about a 4 year period… What’s that? £30k including interest at 8%?

Honestly, I’m just glad to be shot of them!

Shorif Uddin says

I got a email from cash euro stating all my loans are being redressed but over 10 loans are missing, the whole of 2016.

Who shall I contact.

Sara (Debt Camel) says

phone the CashEuroNet Customer Support Team at 0800 016 3250.

Shorif Uddin says

I just did, she wasn’t really hopeful. She first told me to appeal Nd I told her in the email it states I should contact customer support.

Then she says she will escalate it to management. Do you think I should email the appeal them?

Sara (Debt Camel) says

I think you should send in an appeal if you haven’t had a response in a week. Make a note so you don’t forget!

Jim says

I’d hate to sound greedy, but the more appeals they get add to the cost for the administration and also add to the time delay of bringing this to an end and maybe getting some sort of redress. I do understand about people wanting to clean up their credit record but if the decision is “ok we find that 5 out of 9 of your loans were unaffordable” who can you appeal to if you don’t like the decision. FOS are out of the game. If the administration comes back and sticks with their decision, then so be it. Best wishes to everyone

Rebecca says

I’ve just had my outcome through and they’ve missed out a large chunk of my loans too. Please let me know if you get anywhere with the support team

mark thixton says

Hi,

I have a CCJ given to me by Quickquid for £752 in 2016 I settled it the year after is it possible to have this removed from my credit report if the loan was sold to me without thought if i could afford it?.

Thanks

Mark

Sara (Debt Camel) says

have you sent QQ a claim and has it been upheld for this loan?

Mark Thixton says

Hi Yes I’ve sent a claim in and had an email response saying it’s now under investigation.

Sara (Debt Camel) says

ok, who was the claimant for the CCJ, had it been sold to a debt collector?

mark thixton says

I think it was under pounds to pocket it hadnt been sold to a debt collector.

Sara (Debt Camel) says

oh! I was not expecting you to say that.

OK in this case wait for the decision from the administrators. If this includes the debt that there was a CCJ on, there is an option for you to apply to have the CCJ set aside with a consent order from the administrators. National Debtline can advise on this, but there is no point in thinking about it now until it is clear that the debt has been admitted as unaffordable.

Shorif Uddin says

Hi Sara, I have a problem got a reply back, they stated that I made a complaint in 2016 but I never received any sort of payment from them. In total I had 18 loans from them and only 10 are being refunded. Below is the reply I got from them. What shall I do?

Many thanks

Thank you for contacting Quick Quid. It is our highest priority to resolve any client issues as soon as possible.

After further review, our records indicate you had a previous irresponsible lending claim including loans from 2016. You cannot be redressed twice for the same loans.

If you previously received a redress payment and/or waiver from CashEuroNet, then the historic loans that were redressed at the time will not be considered again. Your current redress includes base loans from 2017 until now, which covers the loans taken out after the previous irresponsible lending claim.

Sara (Debt Camel) says

is it correct you made a complaint and it wasn’t upheld?

Shorif Uddin says

They tried to refund me 50 pounds and I rejected it

We take seriously our responsibility to treat customers fairly and to that point we uphold your complaint as it relates to affordability but do not uphold your complaint as it relates to dependency. As such, we would like to offer to waive £44.25 which equates to the interest charged on loans 2613090, 2769515, 2901456.

Sara (Debt Camel) says

but you didn’t go to FOS? did it say you had the right to do that?

Shorif Uddin says

I was stupid and didn’t, as I was suffering depression after my dad passed away.

Sara (Debt Camel) says

OK, well I am not sure this is going to go anywhere. It sounds as though the earlier ones are pretty small anyway, as as you are only going to get tiny amount of the assessed refund, is it worth bothering to appeal this?

Jin says

I agree Sara. And to comment on something you wrote earlier on this thread Sara….I thought when I read the administrators report that the suggest was any appeals or disagreements with the automated decisions would lead to manual interventions which would both increase costs (someone employed by the administrators or them themselves needing to deal with these) and also delay the process. The administrators have also stated that all loans will be cleared from credit records even those not found to be unaffordable (by this automated check)

Sara (Debt Camel) says

Any customer is entitled to have their redress claim assessed fairly. If someone doesn’t think theirs has been, then they can appeal.

I was pointing out that if the redress amount would be small, then when a small percentage is paid out, this may not be worthwhile.

I am not very interested in your argument that people shouldn’t appeal because it will cost the administrators money to consider the appeals. For someone whose claim has not be fairly considered that is irrelevant.

Appeals will not delay the process. And even if they did, this is not relevant to an individual who thinks their claim has not been properly assessed. Some delays are baked in because the portal does not close until February 14 and after that legally time has to be allowed for appeals. But as yet there are some important issues (sale of the loan book, treatment of debts sold prior to administration) that are unresolved.

The administrators have also stated that all loans will be cleared from credit records even those not found to be unaffordable (by this automated check)

where has this been stated?

Jim says

Ok Sara, in response:

Firstly, I apologise if I came across as abrupt in suggesting that people shouldn’t appeal – all I was trying to suggest was that if the decision has been made by the alogorithm then why do we/people think that an appeal will come up with a different decision. Clearly, if an obvious error has been made (e.g. there are missing loans from your record, or if your loans appear to fulfill the criteria they set out for the unaffordable lending algorithm) then by all means appeal – but in agreement with your sentiment – if the outcome is likely to be so minor (e.g. small loan amounts or interest paid) – then it doesn’t seem worthwhile.

Absolutely, I understand the portal doesn’t close until Feb and if that means that claims put in now can be assessed now – then there would be no further time delay- but there would be an additional cost to the administration.

In terms of the “all loans cleared from records” – sorry, it appears I slightly misread their email – In the “Loan breakdown” of the email, it stated “please note you may see a loan showing £0.00 in the interest and fees column…..etc……our records show you paid no interest – therefore no compensation is due to you …..we will still remove all record of this loan from your credit file as part of your accepted redress claim” – sorry I sped-read the email – so you’re right if a loan is not deemed to be “unaffordable” then that would not be wiped.

Sianyy says

Hi Sara,

Thoughts on me appealing these loans:

Loan ID

Start Date

Loan Amount

Paid Interest And Fees

Accepted/Rejected

2017GB788758663

2017-05-10

£2,600.00

£2,018.13

Rejected

11563716

2017-01-31

£950.00

£337.42

Rejected

11990775

2017-05-31

£950.00

£609.95

Rejected

All taken in the same year within 6 months of each other. There was 2 other loans taken in 2015 and 2016 which were rejected but I’m not fussed about.

There email doesn’t specificy how many loans they class as significant or repeat but states taken at least 6months without a break. Just want to know if it’s worth it? Thanks

Sara (Debt Camel) says

Those are very large loans, so worth appealing about.

I do not know how the administrators will handle the appeals – if they intend to just do a quick check you didn’t qualify using their algorithm you may not get anywhere, if anyone actually things about your claim you may. But worth a try when the amounts are large.

Lloyd says

Just got my notification that 1 of my 8 loans has been successful in redress. £1100. However it says you will receive far less than this. What do we think this is or what do we think the % will be ?

Marie says

Hi can anyone tell me how I update my bank details please it says to do it on the portal but that just asks for details to submit a claim or if anyone has a phone number to call thanks

Robert says

Hi, Marie the Portal looks like you are submitting for the first time your claim. However, just follow the process and the Portal will eventually recognise you. From there on you SHOULD be able to make your adjustments. Good luck!

Marie Darling says

Thanks I’ll try again regards Marie

Tracy says

I have received an email this morning stating that my outstanding balance has been paid off in full (around £284)! I stopped repayments just before the Administration, as I was awaiting on payment of the agreed settlement figure of around £3.5k and therefore have not made any further payments until the redress is sorted. I presume maybe that they are settling those figures:

“Thank you for your recent payment to QuickQuid. Your account is now considered paid in full*. You may continue to receive mailed notices from QuickQuid about your balance over the next several days. Please disregard these as they were sent before your final payment was received.

You can access your cost of borrowing statement by logging into your account

Tracy says

PS: Received a second email upholding my claim…. all the correct figures (same as agreed with FOS), slightly more interest. Nothing to be done now until the portal closes in February and they assess the pot!