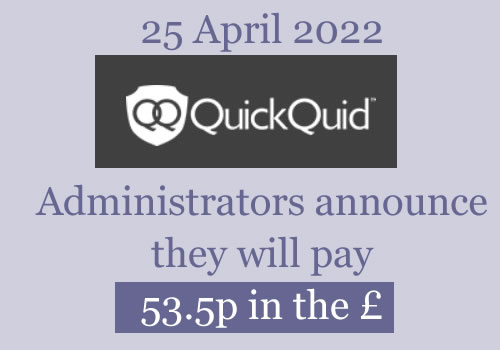

Payments – UPDATE – 25 April 2022

Administrators have started sending emails to everyone with an upheld claim telling them what they will be paid.

“The Joint Administrators are now in a position to declare a first and final dividend of 53.5p in the £”

The average claim value is c £1,700. Someone with that claim value will get a payout of about £910.

The payout details are given in the email:

- This will be paid over the next two weeks.

- If the administrators couldn’t validate your banking details, it will be sent by cheque. I don’t know how the administrators will “validate” your details.

- If you used a claims company, the money will be paid to them.

- Most people are not having any deduction for tax paid to HMRC, so there is no need to reclaim anything.

Credit records

The administrators may decide to :

– remove any negative marks on your credit record

– delete all loans that were upheld

– delete all your loans.

I don’t know what they have chosen to do – if people can check and report in the comments when they see a change, that would be great.

How much your credit score will change will depend on whether there were any negative marks. If you want to get a mortgage, you would like as many payday loans gone as possible, even if they were repaid on time and not hurting your credit score.

In a few months when the administrators no longer talk to the CRAs you can ask for any remaining loans to be “suppressed” so other lenders can’t see them. See https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do that now.

QuickQuid went into administration in October 2019

CashEuroNet (CEU), which owns the QuickQuid, Pounds To Pocket and On Stride brands, stopped giving loans and went into administration on 25 October 2019.

I will be talking about QuickQuid (QQ) rather than CashEuroNet as it is the more familiar name. Everything here also applies to loans from Cashruronet’s other brands, Pounds To Pocket and On Stride.

Grant Thornton were appointed as Administrators. They set up a page about Redress Complaints – this is their term for people who have asked for a refund because they were given unaffordable loans.

Background to the QuickQuid Administration

QuickQuid was one of the “Big Three” payday lenders in Britain, starting out in 2007.

After Wonga and the Money Shop Group had all stopped lending and gone bust over the last fifteen months, QuickQuid was left as the largest UK payday lender.

QuickQuid had well over a million customers. When it went into administration there were c. 500,000 customers with outstanding loans.

Many of these customers had prolonged borrowing from QQ. They either rolling loans over or repaid one loan but were left so short of money that they had to borrow again.

These customers have good reasons to win an affordability complaint and get a refund of the interest they paid.

Affordability complaints started on a small scale in 2015 and increased in the next few years.

In 2018, complaints going to the Financial Ombudsman (FOS) jumped with the involvement of Claims Companies and QuickQuid became the most complained about firm to FOS, excluding PPI complaints.

For a long time QQ refused to refund interest on any loans taken more than 6 years before or where the loans were given in 2015 or afterwards. This resulted in a huge backlog of claims at the Financial Ombudsman, where QQ had made very poor offers to customers and then rejected an adjudicator decision.

In late July 2019, QQ agreed to accept several thousand FOS complaints it had previously rejected.

By accepting the FOS decisions on loans over 6 years, long chains of borrowing, and loans taken after 2015, the scale of QQ’s likely future liability for refunds will have become clear to the company.

After failing to persuade the FCA that a Scheme of Arrangement was appropriate, Enova, CEU’s large and profitable US parent, decided to close the UK business, blaming the UK regulatory environment.

How could the regulators let this happen?

This is an excellent question… Stella Creasy, MP called for an inquiry into the FCA over Wonga and QuickQuid.

What has happened in the administration

Customers with a valid claim for a refund are “unsecured creditors”. This includes:

- any refunds that were in progress after an amount was agreed or a Final Decision from a FOS Ombudsman (FOS);

- complaints that were underway at QQ or FOS when QQ went under;

- any new complaints sent to the Administrators.

All complaints at FOS legally had to stop and were been passed back to the Administrators. It isn’t possible to send any new complaints to FOS.

It is now too late to submit a Claim for unaffordable lending. The last date was 14 February 2021.

The administrators have given the following statistics about claims:

- 169,000 customers made claims for unaffordable lending;

- 78,000 claims were upheld by the administrators;

- the upheld claims had a total value of £136million, so an average of about £1,700 per claim.

Still owe a balance on a QuickQuid or On Stride loan?

More than 300,000 of the current loans were sold to Lantern in summer 2021. You should have been informed if your loan was sold.

The administrators have now stopped collecting any money from the remaining unsold loans.

This page is kept updated

The comments below this article are a good place to ask any questions. And you may be able to see where someone else has already found out the answer.

David Lacoste says

So the administrators fees are 3.4 million quid. Not bad.

Chris says

Yeah agreed. It’s good to see they’re not trying to rip us off and take all the money. Like you, I was worried they’d be taking way more too.

This does leave a good amount left for us to hopefully get a reasonable return, but who knows!

Neil says

I wonder how much it will cost to continue employing the administrator for another 12 months.

David Lacoste says

The 3.4 million is the total cost, they aye about a third of the way through that.

Tony says

Let’s hope it’s more then wonga

Daniel Brown says

I didn’t receive any contact but when I checked my credit score it had dropped 200+ points yesterday for an account in June 2018 which was settled in Aug 2018 with no contact what so ever to say it was defaulted.

J says

I had the same from a debt back in 2011, they put a default on my credit score. I’ve asked them to show me evidence that I took out a loan, so they sent me a made up statement on blank paper which means nothing. I’ve been asking them for further evidence ie loan agreement or proof of correspondence from me but to no avail. All I get back from them is ‘sorry you have been a victim of fraud, please contact the office to arrange a monthly repayment’. Bloody idiots.

chrisc says

I see the administrators are asking for an 18 month extension to the 12 months limit I really think this should be contested as now with the benefit of hindsight they had an extension to the wonga administration which in real terms realized very little in the way of extra funds for creditors yet generated them an additional 1.5 million pounds of income and even after their own agreed date to pay people came and went they handled their business with a complete lack of empathy or any consideration to peoples real world problems.

Sara (Debt Camel) says

There are some legal matters they are taking counsel’s opinion on before they can launch the portal. That then needs to stay open for 6 months. Then time assess claims and resolve appeals.

There isn’t any chance this can be completed in a year.

SK says

In an ideal world there would not be any administration process as Enova – who was (still is?) behind CashEuroNet UK and still operating making huge profits! – should cough up all the costs. CashEuroNet UK were using Enova’s “unique technology, analytics and customer service capabilities that let us rapidly evaluate new data sources to offer consumers and small businesses the right amount of credit or financing when and how they want it”

And just a reminder what David Fisher, CEO of Enova said about “pushing” CashEuroNet into administration: “Over the past several months, we worked with our U.K. regulator to agree upon a sustainable solution to the elevated complaints to the U.K. Financial Ombudsman, which would enable us to continue providing access to credit for hardworking Britons,” said Fisher. “While we are disappointed that we could not ultimately find a path forward, the decision to exit the U.K. market is the right one for Enova and our shareholders. Looking ahead, we believe that our diversified product offerings provide meaningful growth as we allocate our resources where we see the greatest opportunities.”

Again, I am going to point all these out to the administrators but will not be holding my breath…

Sara (Debt Camel) says

I am going to point all these out to the administrators but will not be holding my breath…

good idea not to hold your breath as the administrators will ignore this. The fact that the US parent could repay everyone is not relevant to the administration as there is no legal obligation on Enova to do this.

Samantha says

Hi I’ve had an email from Euronet and began completing my details in the claim portal until they requested my bank details. Is it right that this information is requested at this point in the process?

Kathryn Underdown says

I am also wary of doing this if anyone could advise please. Surely the verification of our accounts was secured by personal details entered before they requested bank details?

Rachel says

Hello, I did the same. I don’t know if I should give the bank details, can anyone confirm this is legit – thanks

Hannah says

Hi has anyone done the claim, I’m also like you and stopped when asked for bank details. Thanks

Sara (Debt Camel) says

The reason they ask for bank details is probably that the Wonga administration – which had gone pretty well if slow – went badly wrong at the end when a large number of customer turned out to have changed bank accounts. Which was, of course, predictable as so many people abandoned bank accounts in 2012-4 as the only way of escaping from some payday lenders. But which the administrators had not expected and not geared up to handling.

So that maybe why they may be asking upfront what your bank account is, to avoid those problems.

Julie Wisdom says

I’ve had the same and at stopped at bank details. Not sure what I do

Danny says

Nothing can come out without your CVV number and your long card number.

Linda says

Hi i logged on to my qq account and saw i owe a debt from 2011 745.00 didnt even know i owed anything.! Said has been passed to debt collectors ive not heard anything. Do i contact them? I have never recieved a letter or anything what should i do

Sara (Debt Camel) says

had you borrowed a lot from them before this loan?

Linda says

Hi sarah yes i did. I was knee deep in debt borrowing from peter to pay paul. They never ever turned me down. Im now paying my debts off its taken a long while. But its getting better monthly. I have paid off all of my payday loans or thought i had. I have been back on the site just now and in 2011 there is a note that says my debt has been passed to a collection agent and to call a number but on checking the number is qq. If i owe it i will try and pay it back but just need advice on the best way to do it. As it was a few years ago now

Leonie Johnson says

Please don’t pay anything this debt is now statue barred, look it up

Sara (Debt Camel) says

Well the debt MAY be statute barred… I won’t give advice on this here as I don’t know the details of the case, which is why I always suggest people should talk about their specific situation to National Debtline on 0808 808 4000.

But it’s important to also say that IF the debt is statute barred, then there is no problem in sending a claim for unaffordable lending to the adminsitrators. Once a debt is statute barred it can never become “unbarred”.

Linda Whelan says

Oh wow didnt realise that thank you!!

Ash says

Hi. I had quite a few loans with QQ back in the day and was eventually threatened with court action by a debt management company, so I entered in to a payment plan which I am still making payments to to to this day.

If QQ agree to refund some of my interest payments and remove the debt from my credit report am I allowed to claim back any money I have paid to the debt management company as well? Thanks

Sara (Debt Camel) says

It’s not clear what the administrators will do about this sort of situation.

When the claims portal opens, I suggest you put in your claim and see how things go.

Rob says

How much longer is this going to drag out.

David Lacoste says

A long, long and prolly even longer time…

Scott says

At least another 18 months, and dont expect a good outcome, probably 5p in the pound owed.

Emily says

Hey Sara/all,

Onstride defaulted 3 months to the minute after I started missing payments with them, despite several calls with them telling them I was in financial difficulty, attempting to set repayment plans, being told that I would be sent letter from the court etc.

I still have £400 left on this debt which I can clear straight away, but I am loath to do so if I will be offered to have the default removed and only pay 20% of the debt in the future?

It was only 1 loan I had with onstride, but it was the last loan in a string of extreme lending which I quickly started to miss payments with. I dont think the administrators will go into that much detail with their automated tool though so I suspect I will not win the affordability complaint.

I just want the default to be removed, do you think they will accept an offer of removing the default if I pay the balance in full straight away and withdraw my complaint?

Thanks

Emily

Sara (Debt Camel) says

do you think they will accept an offer of removing the default if I pay the balance in full straight away and withdraw my complaint?

Sorry no idea.

Richard says

Hi Sara

I have read through your articles regarding default payments and my head is currently spinning.

I am looking to move and wanting a mortgage. We got knocked back for one so I decided to open an Experian account. Within the report I found I had defaulted on a payday loan (quick quid) which I took out in 2013. I also opened a Trans Union account and found on there a default for another loan (pounds to pocket) both these loans say they are currently in default by £1250 and £1085 even though both were paid off in full through a debt management program with Step Change.

I did make a successful claim for being mis-sold the loans and received the interest back but the default markers were not removed and as mentioned the loans are still open on my credit report.

I have emailed and called onstride numerous times they have told me the default marker is correct and that the resolution team are dealing with it.

Any help and advice would be very very much appreciated.

Thanks

Richard

Sara (Debt Camel) says

I did make a successful claim for being mis-sold the loans and received the interest back

was this directly with the lender or visa FOS?

if it was directly with the lender, did you have an email saying they would remove the default?

Richard says

Foolishly it was through a third party claims company. I did not receive any information stating that that the default would be removed. I was completely unaware I even had a default on my file.

Since my previous comment I have had a reply from Onstride stating that they are sending correct up to date information to Experian and TransUnion so I now need to take it up with those companies.

Thanks Richard

Chantal Smith says

Hi, I have the same issue with Lending Stream. The default marker was to be removed but Experian still have it logged. I have tried so many times to contact Lending Stream and Experian and not getting anywhere. I decided to go to the financial ombudsman and they did nothing about it either as far as I am aware. I also wanted to move home and get a new mortgage and this was holding me back. All I can suggest is you get Experian to log some information on your file for you as the companies are gone in to administration I don’t think they can any longer make any edits to your file.

Natalie says

Hello, Please can I ask if anyone received the same email as me that states the company CashEuroNet UK, LLC have made an application to the Court under the Insolvency Act 1986 and the Insolvency Rules 2016 for permission to make such initial and further distributions, as appropriate, to the unsecured creditors of the Company. Today is the last day to write in about this email and I am wondering how many of you may have done this. The email also states you can apply to attend the court hearing about this matter? Is anyone interested in doing this?

Thanks for reading Natalie

Sara (Debt Camel) says

The administrators are asking for more time to sort things out. It is a routine application to the court, you don’t need to do anything.

Franc says

I want to make a claim for miss sold loans by QQ? Please where is the portal to make a claim?

Sara (Debt Camel) says

It isn’t yet live. You can wait or send a complaint in now, see If you haven’t yet put a complaint in in the article above.

A says

Hi,

I made a complaint to quickquid and I know they’re in administration but I only want the negative marks removed but I haven’t heard a single thing and it was last year I made the complaint, is this normal Because there in admin? X

H says

Very normal, The administrators will contact you in due course. I’m guessing early 2021.

Pc says

There has been an update sent out today. Claims need to be submitted before feb 14th 2021 and the Administrators will make a payment to creditors with accepted claims within seven months of 14 February 2021 (i.e. by 14 September 2021).

So I don’t anticipate it being too much longer to hear and most probably early 2021

Ruby says

I am trying to email QuickQuid about an affordability compalint. But i keep receiving an email straight away saying it cannot be delivered to the email given. Please does anyone have the correct email. Tia

Sara (Debt Camel) says

which email have you tried?

Ruby says

complaint@quickquid.co.uk

Which was linked at the top of the page.

David Lacoste says

So as per the email today the Joint Administrators have applied and been granted an extra year for administration beginning at the end of the current period ending 24 October 2020. So they now have till 24 October 2021 for further admin tasks, this won’t even be the end of the full process.

I think this is a total disgrace, how can they be allowed to draw this out as long I don’t know. They have had more than enough time and resources.

Nikki says

Hi I had a quick quid loan back in 2016. It was only one loan of around 1000 but I soon went into a DRO. It is worth claiming?

Sara (Debt Camel) says

if the loan was included in your DRO then it’s likely you didn’t actually pay any interest… so unless you think you did, it would be pointless to claim.

Lynsey says

Hi sara I successfully had an affordability complaint against quick quid via the ombudsman early September 2019, agreed to redress and correct credit reference files. To cut a long story short never received payment in the timescale and subsequently went into administration. I’ve accepted i won’t see the money, my issue is with the default that still hasn’t been removed from my credit file. Then today received an email about the extended dates to October 2021 I’ve tried without sucess to get this corrected with credit reference agencies and quick quid. Seems very unfair as I’m trying to get a mortgage Is there anything else I can do?

Sara (Debt Camel) says

Unfortunately not. Administrations are a very slow process :(

chris c says

I see the claims portal they said in their statement “would be live by the end of July at the latest” isn’t live. Looks like they have learned nothing from their Wonga exploits, whats a deadline to them? they say the portal should be open for 6 months but all claims need to be received by the 14th February 2021, I am not a mathematical genius like the administrators but that leaves them about 14 days to pull their finger out doesnt it??

Delina says

Claim portal is now up

Sarah says

Hi Sara. Luckily I received my Sunny repayment earlier in the year, all thanks to you and this site.

I have just received an email from CashEuroNet asking me to confirm my details in relation to my claims against Pounds to Pocket and QuickQuid. Am I likely to receive any payout at all from these firms?

Sara (Debt Camel) says

Briefly:

– the administrators expect to distribute money

– if you still owe them money DEFINITELY make a claim as the amount you owe could be reduced or cleared

– if you don’t owe any money I expect you will only get a small payout, but for many people this is worth doing to get the loans removed from your credit record

– of course if lots of people don’t bother, thinking the amount may be small, there will be more for each of the people who do claim.

– as it’s easy to claim why not do it if you think the loans were unaffordable?

Sarah says

Thanks Sara. I’ve applied but I was wondering if my claim would take into account both QuickQuid AND Pounds to Pocket, or just the latter? I didn’t use PTP anywhere near as much as QQ.

Sara (Debt Camel) says

it should be both.

Mel says

I had two payments remaining in March & April and I changed pay dates. I rang OnStride on 6/3 and agreed two DDs for 31/3 and 30/4 to settle the loan. They added an extra £10 in interest as my loan would be settled 8 days later than original. They emailed confirming the DD, but stating £560 was being taken on 31/3 and a further £168 then would remain. I emailed back querying this, as the two payments agreed and amount owing was only £507 in total, spread over two payments. They replied, sorry we were mistaken and your DDs are set up for £253.50 each. Today I was checking my credit file report and saw my credit score had dropped by 200 points since last week. Onstride was showing as not settled & with a default with £624 owed. I logged into my banking to look at statements and Onstride never took DDs. I rang the bank and they’ve said the Onstride DD was setup, but they never claimed against it. I immediately logged onto Onstride and paid the agreed £507 for the missing two payments as I was unaware they’d been missed.

I rang them and all they did was demand an extra £169 of interest they were insisting was now due and said they had no idea why the DD wasn’t collected and it was probably HSBCs fault. I’ve emailed complaints demanding the default and interest is removed, since they never took agreed direct debit, nor did they inform me of the default.

Were they supposed to do this in writing?

Sara (Debt Camel) says

What a shambles.

Unfortunately a lender doesn’t legally have to notify you in writing of a default. Technically you have defaulted as the amounts weren’t paid…

But any reasonable firm would first have told you in March that you had missed a payment. You could then have had an argument about the DD, you would probably have won and even if you hadn’t the worst would have been one late payment marker not a default.

The problem now is how to get customer services to actually listen to you and do the right thing. I suggest persevering and phoning them up a LOT. After a month of that, you could put in a complaint to the administrators.

ALSO think if you have a claim for unaffordable lending. Win that and all negative marks will be removed after about a year or so.

Mel says

Probably wouldn’t have a claim. It was my second loan. First one with P2P was about £1500 with interest (£800 borrowed) and I kept to payments and only had one payment left when I reborrowed in this second loan. However I wasn’t working when I took the second loan and both times I was under a mental health order. I had no debt at all five years ago having cleared student loan, and had savings towards a house deposit. Then was a victim of a major crime that took years of legal delays to get to court and my mental health plummeted, costs of therapy stacked up and then victims compensation never paid out on a technicality. Now in a mess. Trying to sort it out. On stride were informed of my mental health status and that everything must be in writing through my advocate, but they just ignored it all, even though I met my end of the bargain by not missing payments until they stuffed up and never took them. I’m kicking myself I didn’t check my bank statements, but with covid and being really busy at work to keep my mind focused, I didn’t see it. Since my bank has confirmed all the details about the DD set up and no attempts taken, surely OnStride breached their contractual obligations they set out in their direct debit confirmation?

Sara (Debt Camel) says

definitely worth a claim. It takes little effort and costs nothing. When loans are large you can win at FOS with just 1 or 2 loans. The administrators should be applying similar rules to assessing claims.

” surely OnStride breached their contractual obligations they set out in their direct debit confirmation”

can you copy out what you think they are in breach of?

Even if they are in breach, you cannot take legal action against a company in administration and the Ombudsman will not look at the case. So you are down to being a pest with customer services and later putting in a complaint to the administrators.

Mel says

Sara,

I mentioned I’d gone online and paid them the missing payments using their Pay Online. But it’s showing under Repayments the dates and the payment, but then in the column ‘Missed’ and interest has gone up again by another 3 days. No one is answering their helpline number and HSBC say no amount is pending on my Visa debit card. So I did a payment for £2 yesterday, also now shows up on their repayments as £2, then ‘Missed’. Bank confirms that £2 wasn’t taken either. Interest increased by another 50p when I logged in five minutes later. This is ridiculous, my credit rating is plumetting and interest going up and I’ve been trying to give them the balance since March!

Sara (Debt Camel) says

Try the helpline tomorrow, not the weekend.

Mel says

An update, I’ve tried phoning them 4 times today. First call was answered with ‘are you going to pay the full amount of £x right now?’ and when I said no, they hung up. Next three attempts, as soon as you put date of birth, they hang up.

I’ve now logged it all with the Financial Conduct Authority who have taken full details and who also looked at recent complaints on TrustPilot with people saying same thing about payments not being taken. They are going to raise it with the administrators.

Another £5 of interest has been added since yesterday.

Thoroughly recommend the FCA – they were really good.

Teresa Parker says

I have had an email today asking to confirm my details for my claim by administrators. At the end they said they were not able to verify my information and gave a number to call. Has anyone else had this? I am slightly worried it could be a scam.

Thanks

Chris says

Yes this happened to me. They provide a phone number which is genuine. I have used it. When they went through my details, they knew about former addresses and phone numbers without me prompting them. So, use the number they give on the site.

Joe says

Be careful here guys; I also used the online claims form for Quick Quid, they were not able to verify me using my new details so I called the number.

I had to update my new address and bank account details and later in the evening, received an email informing me that my direct debit instruction (wtf) had been set up using my new bank details (wrong amount owed and date of first collection was showing as two years ago). Now my debt with Quick Quid is being paid through a DMP and to a debt company who they sold my debt to, so QQ are no longer receiving payments directly?

I checked my banking app, and see that Quick Quid suddenly appeared on my Direct Debit list (I hit cancel as fast as I could). What’s worse, they’d arranged to take a payment out today but nothing came out? Called the QQ support line, they could not see the email they sent me that they had set DD up nor did they see one had even been set up? This was two seperate colleagues on two seperate calls confirming this.

Called my bank, confirmed the DD had been cancelled by me but they claim the DD was “keyed” by me and that’s what was showing their end – so in effect, I apparently set it up myself? At no point did I instruct, agree or decide with QQ that they could start taking DD payments from me?

Anybody got any advice/has it happened to anyone else after updating bank details for the claim?

scott says

Why when making a claim am I asked for my bank details?

Any help appreciated

Chrissie says

To match it to the bank you used when taking out the loan I imagine to confirm your identity

Joe says

I’d agree it may be to match it to the bank you used to take the loan and possibly so they have correct details of where to pay any refunds?

Just be careful, as I explained on my post above that because I had to update them to my new bank details, this gave them the opportunity to set up a DD instruction (not agreed to by me, as I am paying through a debt collector) and even went as far as scheduling a payment to be taken on the very same day it was set up – I cancelled and no payment was taken but just check on these things.

Antony says

Claims portal is useless, doesn’t recognise me even with my loan ID and I currently still owe them £2500 and am still paying it!

Sara (Debt Camel) says

How many loans did you have from them before the current one?

Antony says

I had 7 with pounds to pocket, and loads with quick quid, the current one was £3750, I am paying them £130 a month through a DMP which will be paid off in 18 months, I am worried I will be left with nothing by the time the administration finishes, when they could have written off my current loan

Sara (Debt Camel) says

Who is your DMP with? You could ask them to remove the current balance saying you expect more back through the right of set off.

Also contact customer support (0800 056 1515 and/or support@quickquid.co.uk) and be persistent that the Portal will not accept your claim.

Neil says

Same for me, portal doesn’t recognise my details.

Sarah says

not heard from QQ since January when I called and emailed to make an unaffordablility complaint, So I decided to call them yesterday, the man was very rude, he asked my name atleast 6 times and in the end I spelled it phonetically, SARAH, S for sugar I said, he replied F for fugar, Then as I’d given my first and last name in the same sentence in response to him asking my name, he wrote them both under first name, when I corrected him he said well why did you tell me your name was (first and last name) in the same sentence. For my D.O.B 27th of the month I said, 77th he replied, and also said “well you should just pay your debt then” the list goes On believe me there’s a lot more. Near the end of the call with QQ I tell him I’m calling to see my claim status he informs me that a complaint made via phone is not an official complaint (Also I have a copy of the email I sent to them back in January stating I wish to make a formal Unaffordability complaint so I actually did a complaint via telephone and email in which they responded To say they will look into it) more to follow…

Sarah says

Part 2: QQ worker tells me that complaints must be made through the portal, they have not taken into account the verbal complaint I made over the phone back in January or the email complaint I made also in January to which they responded that they will look into it, They really should tell their customers that they need to go on the portal to put in a complaint, please print this Sara as I’ve waited since January for a decision from them only to find they’re not even looking into my claim as it’s not via the portal

Andrew C says

Hello Sara,

I was unable to make a claim through the portal because I had previously made a complaint (in 2019). My 2019 complaint was ‘not upheld’. Despite feeling that I had been fobbed off, I did not bother to progress my complaint to the ombudsman.

Do you think I should try to get them to accept a claim, or should I just forget about it and write it off?

Thank you

Sara (Debt Camel) says

I think you should ask them to accept a Claim and if they refuse, explain why. They took Claims from Wonga customers in this situation.

Kyleigh Goodband says

Tried to make a claim through the portal but wouldn’t accept it and gave me a number to ring ( I believe because my address has changed they had to update whilst speaking to me ) got through to a very nice lady it was very quick and all has now been submitted. Dont be put off if your asked to call, it’s very quick and simple. Fingers crossed for some money coming my way no matter how small 😁

SK says

Received the below email last night from ‘foscomplaints@enovahelp.zendesk.com’ email address, I guess this is a reply to my email sent in October 2019 (just before they went into administration) chasing them for a response to the FOS Adjudicator who upheld my complaint and awarded about £8000+ redress…

Better late then never…

Aug 20, 2020, 2:22 PM CDT

Dear XY,

Customer ID: XXXXXXX

Ticket: XXXXX

Thank you for contacting CashEutoNet UK, LLC. We do apologize for the delay. Your new claim has been submitted successfully. You will receive your complaint decision within the next 120 days. If your complaint is upheld, payment details will be available after the claims window is closed so that we can accurately determine your offer details as per administration protocols.

Mo says

Hello

If I had an ongoing claim going through the FOS but then Quick Quid went into administration do I have to make a claim via the portal or should they have my details?

Sara (Debt Camel) says

I think you are OK, but why not try sending in a complaint through the portal? It takes little time – better safe than sorry.

kerry says

Why do i need to provide bank details when they are fully aware of who i am, having emailed me. Has anybody else had DD set up on their acc’s after providing these details.

thanks

Sara (Debt Camel) says

A DD cannot be set up without your approval.

Joe says

Correct, but QQ DID set up a DD after I updated my bank details with them actually withhout my approval, so they are doing this to people. People really need to keep an eye out and be made aware of this by checking in their DD section of their online banking after updating bank details as part of their claim.

Joe says

They did this to me – set up a DD without my approval. Luckily, I cancelled it but jus be careful.

I found out as they sent out a DD confirmation after giving them my new bank details, checked my online banking and the DD was there – I cancelled it and called bank to confirm cancellation.

Dave says

I finished paying of my debt to QQ via StepChange this month, still a bit to go to clear everything, but there light at the end of the tunnel.

I got my complaint rejected by QQ a few years ago, but have submitted again this time… I know that I have only myself to blame for taking out loan after loan after loan, but in the end there was no way I could afford the repayments, and the companies should have given me a reality check, rather than keep lending, and they need to held to account.

Good luck to everyone submitting a claim, and if you are struggling, then please get help, one phone call to Stepchange saved my life.

Jo says

Just a quick query. I won my affordability claim but never received the payment as they went into administrstion. Do I need to make a claim on the portal?

Sara (Debt Camel) says

Probably not, but why not try sending in a complaint through the portal? It takes little time – better safe than sorry.

sara says

Hi im struggling to submit my claim its says doesn’t recognise my details is anyone else struggling

Thanks Sara

Chantal Smith says

Hi yes I had the same issue and I have just left it as I don’t know what else to do. 😞

Jason says

Yeah, I am unable to submit my claim via the portal too.

D says

I rcd another email today asking me to submit a claim however had already completed. Original mail said 30 days response is that likely?

Alan says

Hi folks

i had some loans through QUICKQuid, and ive now heard from the administrators that my complaints for redress have all been upheld. Im getting letters from PRA Group demanding payment for a debt they bought from QuickQuid.

Bearing in mind the fact that the administrators have upheld my claims for my QQ loans, do i have to pay PRA group?

Sara (Debt Camel) says

Ask the administrators what they will be doing about this.

George says

Hi Sarah, I have a relatively straightforward question (I hope), I have a claim in via the portal. I took 1 QQ loan for £200 about two years ago. While I don’t really expect anything back (a few pennies), how do they (the administrators) gauge that this loan was affordable or unaffordable to me in deciding my case? It was a one off, of a relatively small amount after all.

Sara (Debt Camel) says

The administrators haven’t published the details of their assessment criteria but it’s likely they will have attempted to reach the same conclusions as FOS might have, but only looking at their internal records eg your past lending from QQ.

On that basis you are VERY unlikely to win a claim for 1 small loan.

Natalie says

Hi Sara,

I submitted a claim back in August which has been recognised, but recently I’ve been getting calls from a number which I’ve traced back to quid quid with an American voice which others have registered as harassing. Should I be answering this call and is it in regards to my claim?

Danni says

Hi Sara,

I wrote in sometime at the end of last year to query whether or not I would be able to submit another complaint so my loans dating back further than six year’s could now be taken into considetation. I previously accepted a poor offer January 2019, that didn’t take into consideration loans dating back six years which was the bulk of my loans. They only upheld one loan out of many. I emailed Quickquid three times since the end of last year when they went into administration and I haven’t received an acknowledgement or a response.

Have you heard anything further regarding cases like this? I’m aware you can’t be redressed for the same loan twice, which is not what I want. I simply would like all the other loans they unfairly refused to consider, to now be considered as it says they are now considering them.

Thank you in advance.

Sara (Debt Camel) says

Have you tried putting your details into the Portal ?

Danni says

Hi Sara,

It didn’t recognise my details. I callled the number to speak to someone, and they were not very helpful at all.

Thanks

Sara (Debt Camel) says

In your situation, the Wonga administrators would have accepted a Claim. I suggest you call them again and say you want to put in a Claim and ask how to do this as the portal will not accept it. The administrators cannot refuse to accept a Claim – they may reject it but they can’t stop you from putting one in.

Danni says

Hi Sara,

Are you suggesting I call back the quickquid number, or contact the administrators directly? When I called the number on the portal page it went through to the quickquid people, and they were being unhelpful and they didn’t even give me the option to put in a claim to see if it will be rejected or upheld.

Kind regards

Sara (Debt Camel) says

I suggest you try the quickquid number again – if you don’t get anywhere say you would like a response from the administrators.

Patrick T says

Hi

I had a claim that was with the FOS and was awaiting payout from QQ before they went into administration.

The online portal doesn’t work for me so I called their customer helpline. I left the UK in 2017 and they are saying because I’m not a UK resident they can’t process this- but it has never been an issue with any of the other lenders who have refunded me nor the FOS.

I have asked them why they are stating this but have got nowhere. Any suggestions?

Sara (Debt Camel) says

Ask them again. You are an unsecured creditor of the firm, the fact you live abroad is not relevant, the administrators have to let you submit a claim, ask them how to do this.

Patrick T says

Thanks Sara

Just tried again and got this response:

Please be advised that in order to submit a claim you would need to be a UK resident as well as have a UK bank account. If you no longer hold this information you will be unable to submit the claim as advised previously.Unfortunately, there is no way to move forward with a claim if you no longer reside in the UK.

Any further advice?

Sara (Debt Camel) says

It is hard to say anything polite about that – it is complete rubbish.

That response – is it in writing or is it what they said on the phone?

Patrick T says

What they said by email. The lady I spoke to by phone a couple of weeks back was useless also.

I still have a UK bank account and agree that my residency status is irrelevant.

Do you know in the administration who I could maybe escalate to?

Thanks in advance

Sara (Debt Camel) says

Yes – send a complaint to Chris Laverty – details https://www.insolvencydirect.bis.gov.uk/fip1/Home/IP/9121

Say you are a redress creditor of Cash Euronet and QuickQuid customer service have been told you (see the email which you can attach) it is not possible to submit a Claim from outside the UK. Ask why this is as it appears contrary to normal administration practice.

Kelly says

I have a loan with on stride. I ended up on a debt management plan with StepChange. Last September I was able to clear some of my debts and start repaying my creditors. All of my creditors dealt with me, no issues. On stride refused to set up a direct debit as they said it they hadn’t recieved any correspondence from StepChange. StepChange said they had sent a letter and wouldn’t contact on stride further. So for over a year I’ve sent 20+ emails, which were either ignored or I was told they wouldn’t set up a DD. I then spoke to a collections advisor who told me he would set up a direct debit however the interest that was frozen had now been loaded back onto my loan. I borrowed 3.5k, I’ve paid 2.8k and now I owe 4.3k!!! Can they do this? I’ve actively tried to repay them and loading back my interest seems like an absolute kick in the teeth. I’ve submitted a claim. Last person I spoke to was arguing with me and said ‘we are a loan company, what do you expect?’

Sara (Debt Camel) says

That was a very large loan. If you feel the monthly repayments were too large to be affordable, I suggest you submit a Claim using the portal. If you win. interest is removed from the debt so you would not have to pay any more and the default would be removed from your credit record.

Kelly says

I have submitted a claim. I hadn’t intended to but the fact they refused to set up a DD for the past year and then have the nerve to put all of the interest they was apparently froze whilst I was StepChange back onto the loan is unbelievable. I even said I was happy to pay interest from present date until the balance is cleared. If I hadn’t of contacted them repeatedly my account would still have been on hold and wouldn’t have recieved any notices of default. The man I last spoke to said it wasn’t me calling that eventually took my account off hold, it was that they hadn’t recieved a payment from StepChange in over a year

Andy says

Has anyone had their assessment yet? The website says 30 days, email confirming the claim said 120, so I’m guessing it’ll be between the 2! 🙂

D says

Its 120 days, I rang them up to clarify.

Chantal Smith says

My claim said up to 120 days to be assessed. Jist got to wait now.

Alexxx says

they are deliberately dragging out the time in order to take more from those who still have active credit, like mine.

Kel says

Looks like they are selling to a debt management company who are convientley located in the same building as the administators. I’ve had an alert on my credit report. Not received any correspondence. This is just a way to pay less to the people who have active credit

Adrian Evana says

Same story as others, unable to register via the claims portal. Question is do I need to my complaint against Quickuquid was awaiting an ombudsman decision when QQ went into administration. I believe I don’t but does anyone have any information when my claim would be assessed?

Craig says

I currently have a large loan outstanding with QQ which was defaulted. It appears on my Experian Credit report. I have a DMP which was set in Jan 2019 but for some reason I either didn’t add it to my DMP. I am now looking to get a mortgage with a specialist lender a condition is paying off all PDLs on Experian. I have put a claim through the portal. My question is should I just pay the total amount with QQ which I can now do and wait for any result of the claim in 2021 as a bonus (I do feel I was missold) or do I connect QQ and try and negotiate a smaller settlement figure and pay that off.?

Sara (Debt Camel) says

QQ are unlikely to be prepared to negotiate. If you clear the debt, you are likely to only get a very small percentage back from QQ.

Shell says

Hi Sarah

My credit file shows I defaulted on a qq payday advance March 2010. I hadn’t seen them on my credit file up until dec 2019. Looking through spam emails they have been sending me random statements from around 2015. I haven’t had any communication with them or made a payment. In 2019 I emailed them telling them that they shouldn’t be reporting to credit reference agencies anymore and made a complaint to them regard their irresponsible lending.. I never heard anything back and have since (aug) submitting a claim for compensation.. they have now emailed me stating that in doing so I’ve acknowledged my the debt.. does this type of communication reset the clocks of my debt? Are qq able to refer to collection agency and they take the debt to court if I do not pay or admit liability?

Sorry for the long post.. I do appreciate your knowledge

Kind regards

Shell

Sara (Debt Camel) says

Making an affordability complaint does reset the clock, but if the debt was already statute barred at that point it can never be “unbarred”.

Also the debt is showing on your credit record because QQ have failed to add a default date back in 2010.

I suggest you tell QQ this and that you await their decision On your complaint.

Shell says

Thanks Sarah,

Since 2010 I haven’t spoken nor responded to any emails sent.. so would that make it status barred? If they sold the debt would I then be at risk of a judgement? Should I just cut my losses and pay them?

Thanks again

Sara (Debt Camel) says

How many loans did you have from them?

Pb says

Hi,

I have an outstanding loan with QQ from 5years ago. The account was never placed into default and still states outstanding for the amount of £675.

I have made a claim for this under the joint administrators but I am wondering what my best option should be. Should I clear the balance as it was never a defaulted account or should I wait to see if it will be cleared with the claim. I cant remember how many loans I had with them so I have also request a list of all loans.

Any advice would help

Sara (Debt Camel) says

Did you definitely have several from them?

Pb says

I can’t be 100% sure. I had a lot of payday loans , taking them to pay others. I cleared all my defaulted ones over the past years and they are due to drop off next year. This is why I requested my loan history. If the account is still an active loan would it be better to clear the balance if I have no others with them.

Sara (Debt Camel) says

a default should have been added. It is wrong that it hasn’t.

I suggest waiting until you see how the claim is assessed as if it is upheld, the balance will be reduced or even written off and the debt will very probably be deleted from your credit record.

Pb says

I was able to to get the loan history and it was only 1 with this lender for £400, with accrued interest to £675. As the account is still active and stating late payments only and not default on experian. If I were to clear and close this, would it update my credit report as a settled account that was never in default.

My main concern is my credit score and want to be able to rectify it as soon as possible. I am not concerned so much on and compensation.

Sara (Debt Camel) says

“If I were to clear and close this, would it update my credit report as a settled account that was never in default.”

yes. But the late payments will still show for 6 years from when the date is settled.

your credit score will not increase if this debt is repaid. See https://debtcamel.co.uk/defaulted-account-credit-score/.

But other lenders may be more likely to lend to you once the debt is settled.

With only 1 loan it is pretty unlikely you will have your Claim upheld.

BUT you should know what happened to outstanding Wonga loans… the admionsitrators (who are the same administrators dealing with QuickQuid) were unable to find a debt collector who would buy the outstanding loans for a proce the administrators thought was reasonable. Instead the adminstrators offered all the people still owing money the chance to setle their debt for 25% of its value and in return they agreed to delete the debt from the credit record.

I don’t know how likely this is to happen with QQ. If it does, it would save you money but more importantly it would mean that your credit record is cleaned up.

Lisa Perry says

Hi

I have an old outstanding loan to pay off but I can’t find the QQ bank details. No one answers the phone or replies to my emails at support@quickquid.

We are looking to get a mortgage and this will affect my credit score.

Help please ?

Thank you

L

Sara (Debt Camel) says

Was this your first loan from QQ? When was it taken out? Have you had any other payday loans in the last two years?

Peter says

Hi I was at the stage of the FOS telling quick quid that they needed to uphold around 28 loans ranging from £100 to £900 and th Fos told me that quick quid had agreed to this and then 2 weeks later they go into administration. As my complaint was already with the FOS does this mean I will be contacted in the future by the administrator in terms of any redress and I know not to get my Hope’s up. I could have been looking at over 5k but this will not happen now, I guess I will be lucky to even get the initial offer quick quid made me of £1300 .

Sara (Debt Camel) says

You should be logged. As having a complaint. But if you have received nothing from the administrators then I suggest you ask them if you need to put a claim in.

Mr and Mrs C says

Hi -is the portal now up for the administrators? We had compensation of 9k when they went under and we have been waiting almost year for further news but nothing has arrived.

Sara (Debt Camel) says

yes – address in article above

Mr and Mrs C says

Thanks, its not accepting the details, nothing has changed. Will email quick quid to see if they can help register the claim

Sara (Debt Camel) says

you may not need to send in a claim if it was already assessed but it’s good to make sure of that!

Mr and Mrs C says

Thanks, it was already agreed via the FOS. Have emailed Grant Thornton and also QQ to see if they can be of any help

Helen says

Hi. I put in an affordability complaint prior to Quickquid going into administration. I received notification of receipt but heard nothing since. I re logged the claim via the portal. I’m expecting nothing back but I’m desparate for this to disappear from my credit record. This is the only black mark left to drop off and is still sitting there as they never defaulted the debt when they should have despite sending them several requests to do so over the past few years. Just hoping my complaint is upheld so this thing can finally be removed! (I had 18 loans from them over as many months.) If it is not, is there any way of pursuing getting a default added and backdated with the administrators so it will drop off my credit file imminently instead of in another few years?

Sara (Debt Camel) says

With 18 loans I would be surprised if the last loan that defaulted is not upheld as being unaffordable and deleted from your credit record.

This may not be for many months though. There is nothing you can do to speed this up.

C says

Morning all

I’ve had a look through and can’t find anything, but other PDL’s going in to administration have allowed those who’ve already made a successful claim, still put in a claim for those loans not successful. I’ve done this with wagedayadvance, Sunny, payday express, pduk and money shop.

When calling to quickquid yesterday as the site wouldn’t let me register, they said I’m not able to due to a successful claim on those under the 6y age level. Is this true.

Sara (Debt Camel) says

This seems a strange stance for them to take as they are the same administrators as for Wonga, when they allowed people to make a second claim.

Go back and say you have a legal right to put in a claim to the administrators and ask how you should do this. They may reject your Claim but they have to allow you to make one.

rennes99 says

You’ve mentioned before that there is nothing that can be done to speed up the Credit File update process – this is really seriously affecting me currently.

Last year the FOS found in my favour that all my loans (from the third loan to loan 23!!!) were unaffordable. Before QQ went into administration, they agreed with the findings, and I have it in writing that they agree to refund all that interest (which amounted to quite a few thousand) and that they will remove all entries from my Credit File for those loans.

A few weeks later, just before my refund was due and just before the credit file was due to be updated, they went under.

After initial dismay, i’ve accepted that i wont see that money, infact very very little of it. I really don’t even care about the pence in the pound I may be owed now. Only the credit file……..

I have managed to move earth and heaven to clean up the rest of my Credit File, and these may multiple loans are the only negative influence on it, and massively so given the number of loans and negative markers on them as I struggled to repay.

What can I do regarding Credit File entries, which were agreed to be removed a year ago before the Administration, on loans 3-23, which are preventing me getting a mortage a year later

In the last year i’ve worked so so hard and sacrificed so much to save a deposit, not taken any debt whatsoever and now am in a position to buy my first home. But because of these markers, which were due to be removed a year ago, i cant get a mortgage! I’m trying to arrange one before the Stamp Duty holiday ends, but QQ are saying 120 days + to review my Claim and then update the credit file.

I’ve been emailing them back and forth for days now, all departments, stating very clearly I am happy to not submit a claim, and waive my compenstation which they already agreed was due, if they would just simply remove the entries that they already agreed they would. And i’m being met with a “Computer says no” wall of nothing apart from “Please submit a claim using the portal.”

So not only are they still, a year later since going under, preventing me from moving on with my life, denied me the refund I was due, stopping me buying my first home, they are going to cost me another 6-12 months in dead money rent, another year of my life and likely several thousand in stamp duty when they finally remove the information an a year or whatever it will be.

I’m completely beholden to them over something they already agreed to do!!!!

I really don’t know what to do anymore

Sara (Debt Camel) says

I understand your frustration but I don’t know how you can speed this up.

rennes99 says

nor do I :( I’ll try loop in Grant Thornton to my emails and see where that gets me…. as i’m literally offering to remove myself as a creditor if they just do what they said they’d do before, its a no brainer surely.

Biggest mistake of my life getting involved with Payday loans, and years after the last one it’s still ruining it

Mel says

There is a Grant Thornton email. I managed to get my issue sorted and the default removed plus all the interest and missed payments on file. I’d been trying to pay off my loan since March this year – Onstride hadn’t taken the payments and instead put me in default. I was able to prove to Grant Thornton my bank balance, no DD taken etc and they investigated and found Onstride had taken the card details wrong despite it being a direct debit and therefore neither the DD or card payments were being made. Loan is now cleared and credit ref agency reflects that and have told me the default should disappear too in next 45 days.

rennes99 says

Hi Mel

Thats great to hear…. good result!! :)

Have you got the email you can share? I’ll have to try that route!

Alexxx says

Hello. Is anyone got claim outcome ? I have put my claim on portal on 6th of August, so 60 days gone already. what they waiting for? for last day?(claim should be assessed in 120 days)

Chantal Smith says

They say it can take up to 120 days to assess your claim as they will be working on a very high number of claims and will need to assess each one individually and fairly. You may hear sooner but they have covered themselves by saying it could take up to this long.

Linda Rowan says

Hi I am really concerned I heard nothing about QQ, pounds to pocket, NDR going into administration should we not have been notified and being able to contact the administrator for information on moving forward.

We have moved from our previous property were I originally opened the QQ account and unfortunately I don’t know what my previous telephone numbers were.

How do I place a claim for a loan I could not afford and am still struggling to pay off.

Please would you be able to help.

Thank you

Sara (Debt Camel) says

Have you tried to put in a Claim on the portal?

Peter says

I also had a claim with QQ and mine went as far as the FOS and was expected by QQ for them to go into administration 2 weeks later. I was looking at a redress of nearly 6k and i know I will be lucky to get a fraction of that now. As long as your complaint is registered with them and all your details they hold are correct we’ll just need to be patient and it will be resolved when its resolved. I’ve waited over a year already #patienceisavirtue