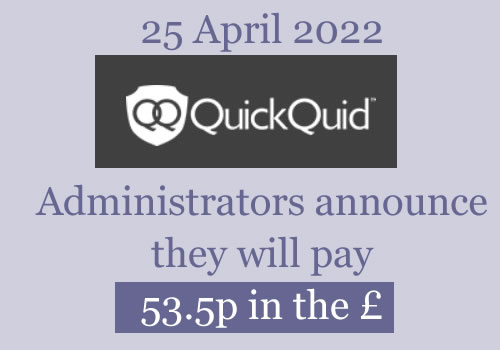

Payments – UPDATE – 25 April 2022

Administrators have started sending emails to everyone with an upheld claim telling them what they will be paid.

“The Joint Administrators are now in a position to declare a first and final dividend of 53.5p in the £”

The average claim value is c £1,700. Someone with that claim value will get a payout of about £910.

The payout details are given in the email:

- This will be paid over the next two weeks.

- If the administrators couldn’t validate your banking details, it will be sent by cheque. I don’t know how the administrators will “validate” your details.

- If you used a claims company, the money will be paid to them.

- Most people are not having any deduction for tax paid to HMRC, so there is no need to reclaim anything.

Credit records

The administrators may decide to :

– remove any negative marks on your credit record

– delete all loans that were upheld

– delete all your loans.

I don’t know what they have chosen to do – if people can check and report in the comments when they see a change, that would be great.

How much your credit score will change will depend on whether there were any negative marks. If you want to get a mortgage, you would like as many payday loans gone as possible, even if they were repaid on time and not hurting your credit score.

In a few months when the administrators no longer talk to the CRAs you can ask for any remaining loans to be “suppressed” so other lenders can’t see them. See https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do that now.

QuickQuid went into administration in October 2019

CashEuroNet (CEU), which owns the QuickQuid, Pounds To Pocket and On Stride brands, stopped giving loans and went into administration on 25 October 2019.

I will be talking about QuickQuid (QQ) rather than CashEuroNet as it is the more familiar name. Everything here also applies to loans from Cashruronet’s other brands, Pounds To Pocket and On Stride.

Grant Thornton were appointed as Administrators. They set up a page about Redress Complaints – this is their term for people who have asked for a refund because they were given unaffordable loans.

Background to the QuickQuid Administration

QuickQuid was one of the “Big Three” payday lenders in Britain, starting out in 2007.

After Wonga and the Money Shop Group had all stopped lending and gone bust over the last fifteen months, QuickQuid was left as the largest UK payday lender.

QuickQuid had well over a million customers. When it went into administration there were c. 500,000 customers with outstanding loans.

Many of these customers had prolonged borrowing from QQ. They either rolling loans over or repaid one loan but were left so short of money that they had to borrow again.

These customers have good reasons to win an affordability complaint and get a refund of the interest they paid.

Affordability complaints started on a small scale in 2015 and increased in the next few years.

In 2018, complaints going to the Financial Ombudsman (FOS) jumped with the involvement of Claims Companies and QuickQuid became the most complained about firm to FOS, excluding PPI complaints.

For a long time QQ refused to refund interest on any loans taken more than 6 years before or where the loans were given in 2015 or afterwards. This resulted in a huge backlog of claims at the Financial Ombudsman, where QQ had made very poor offers to customers and then rejected an adjudicator decision.

In late July 2019, QQ agreed to accept several thousand FOS complaints it had previously rejected.

By accepting the FOS decisions on loans over 6 years, long chains of borrowing, and loans taken after 2015, the scale of QQ’s likely future liability for refunds will have become clear to the company.

After failing to persuade the FCA that a Scheme of Arrangement was appropriate, Enova, CEU’s large and profitable US parent, decided to close the UK business, blaming the UK regulatory environment.

How could the regulators let this happen?

This is an excellent question… Stella Creasy, MP called for an inquiry into the FCA over Wonga and QuickQuid.

What has happened in the administration

Customers with a valid claim for a refund are “unsecured creditors”. This includes:

- any refunds that were in progress after an amount was agreed or a Final Decision from a FOS Ombudsman (FOS);

- complaints that were underway at QQ or FOS when QQ went under;

- any new complaints sent to the Administrators.

All complaints at FOS legally had to stop and were been passed back to the Administrators. It isn’t possible to send any new complaints to FOS.

It is now too late to submit a Claim for unaffordable lending. The last date was 14 February 2021.

The administrators have given the following statistics about claims:

- 169,000 customers made claims for unaffordable lending;

- 78,000 claims were upheld by the administrators;

- the upheld claims had a total value of £136million, so an average of about £1,700 per claim.

Still owe a balance on a QuickQuid or On Stride loan?

More than 300,000 of the current loans were sold to Lantern in summer 2021. You should have been informed if your loan was sold.

The administrators have now stopped collecting any money from the remaining unsold loans.

This page is kept updated

The comments below this article are a good place to ask any questions. And you may be able to see where someone else has already found out the answer.

Lauar says

Hi

Can you just clarify when you say the money we should receive back from QQ will be significantly smaller than what we would have got should they have not gone into administration, if we were due thousands, will it still be thousands or will it be hundreds? Just wondering what happened to Wonga customers if it is the same administrators?

Many thanks

Len says

It’ll be more like 10% if you’re lucky

Sara (Debt Camel) says

It is a fair bet the Administrators will take the same approach with QQ that they took with Wonga. But the amount of money to distribute could be a lot more or a lot less. No one has any idea.

I think you should base any plans on getting much back, then you won’t be disappointed.

Paul says

hi all , love reading all your comments. i had a complaint with piggy bank and it was upheld while i still owed them for my existing loan. because i had an existing loan piggy bank cleared my balance and i still now have a redress complaint for the remaining redress. the amount i still owed them was well more than what i would have received from the 5%/10% when finally issued. anyway my question is i still owe a large amount to on stride as a was offered another loan shortly after then went into admin. do you feel it is worth stop making the payments as the possible redress i get will clear most of the loan and you then get a better amount back than what you would get once the company is sold and assets given to us. i know this runs a risk a damaging my credit file but if the loans are removed anyway its more beneficial. hope this makes sense.

Sara (Debt Camel) says

Did you have previous loans from Onstride or QQ?

Paul says

yes i have had countless loans from qq, p2p but only 2 from on stride

Chantal says

Hi I had loans with Quick Quid and Pounds to Pocket but I’m not sure where I stand and wondered if it’s worth persuing. I spoke to someone in Quick Quid just before they went in to administration as they believed that I owed them a little bit more than the redress amount so they wrote the difference off. I was in an IVA for 6 years and both their loans were part of this plan and they would have received funds from the IP each month but they were telling me they never received anything and to contact their insolvency team with all the details and the proof and they would look in to it and resolve as they should have had enough left without writing the remaining balance off of 106 pounds and there should have been some for me to be refunded as technically they have had more out of me than they were entitled to. I have heard nothing from them in response to these emails and I wondered if there was anything I can do about it or is it one of those cases that I’ve now just got to drop?

Sara (Debt Camel) says

So QQ calculated a redress amount but said you owed them more. But you are saying you didn’t because they aren’t taking account of payments they received from your IVA, so you should be owed some redress – is that your argument?

Chantal Smith says

Hi Sara, yes that is correct.

Sara (Debt Camel) says

I think this doesn’t really sound worth it – even if you win the argument (which onbvuously you should!) you will only get back a percentage of the extra, which could be small

Unless they are saying you owe them something because they never recognised the IVA. That would be worth arguing about.

Chantal says

I think they were saying that they never had any payments from me during my IVA period but I proved that they did, well my IP sent me the proof and I forwarded it on to them. But I’ve heard nothing since? It wouldn’t have been much anyway. They may have received about 400 quid in the 6 years but looking at the redress amount and the balance it looks like they never took in to account my payments from my IP?

paula says

Hi. I am with Onstride, who have tried ringing me 3 times today, Do i pay them now or wait to find out, if they have gone in to administration i am unsure what to do. Thanks for any replies.

Sara (Debt Camel) says

Did you have loans with Onstride or QQ before this last one?

Jenny Williams says

Hi – I wonder if anyone can give me some advice.

I sent an affordability complaint through to QuickQuid last week, not actually expecting a reply as they are now in administration. I received a reply including the following:

***

‘Complaint – to help us reach a fair complaint outcome in a timely manner (and where appropriate provide an offer of compensation), please provide us with the following information as soon as possible:

· Bank statements (at the point/s you took out your loan/s with us)

· Payslips (at the point/s you took out your loan/s with us)

· Any additional information relating to your financial circumstances (at the point you took out your loan/s with us)

· What is the date of your first loan?

· How long did it take you to realise that QuickQuid might have been responsible for any financial difficulty you faced?

This information will enable us to complete a full investigation into your complaint.’

***

As you can see, they are asking for quite a lot of information which it will be difficult and time-consuming for me to track down at this point. Am I better off waiting now for the Administrators to open a claims portal (similar to what happened with Wonga)? And will the fact I’ve already contacted QuickQuid directly invalidate any claim I make via the portal when it does open?

Thanks for this site, it is very helpful!

Sara (Debt Camel) says

I don’t think anyone will read your bank statements if you send them! I suggest you reply saying you would like your complaint to be decided by the automated ajudication tool the administrators are proposing to use.

Jenny says

Thanks Sara, I suspected that was the case and have done as you suggest. Just a case of wait and see now.

Anthony says

Hi Sara.

I received the same email that Jenny got, from QQ and I emailed them what you suggested to Jenny.

I got a loan with On stride 1500 plus a top up of 1000, I still pay every month but I thought to stop pay until I get answer from them.

Charlie says

Hi.

I registered a complaint with quickquid about 3 months ago (before they went into administration) and I recieved an email back saying that I was not due any refund but I am sure I should be as I have pending claims with wonga and I definitely struggled to pay back the loans.

I’ve been meaning to go to the financial ombudsman or whoever it is but I have no idea of what to do from this point.

How can I move forward with trying to put in a claim?

Any help would be much appreciated!

Thanks in advance

Charlie

Sara (Debt Camel) says

Do you still owe them money?

Charlie says

No I dont owe anything.

Sara (Debt Camel) says

You can no longer go to FOS.

I suggest you wait until the new Claims Page had been up in a ciouple of months probably and then out a Claim in there.

rennes99 says

Hi Sara

I contributed several months ago to this thread and wonder where I stand now with my claim, as it falls into a sort of “purgatory” position I think….

The FOS upheld my complaint, and asked QQ to give me redress on all but the first 3 of my loans (36 in total.)

Shortly before they collapsed, QQ responded to the FOS and agreed with their findings, and that they would refund the interest etc on these. It’s there in writing. They never got round to actually confirming a figure however – the FOS merely said QQ agree and will contact me directly with confirmed offer.

However, since QQ closed their doors and disappeared, the FOS have emailed to say they now must pass my complaint back to the administrators.

When the claim portal goes live, I wonder how I should approach my claim – its not a new one, and the particular loans to be refunded had already been agreed by QQ, although a monetary figure was never given (a delaying tactic I expect.)

I winder where my claim would sit? In all honesty the refund amount is of little concern to me now, the CRA info which I was very close to having removed last year was more important!!

Many thanks

Sara (Debt Camel) says

I think you will have to wait and see. It may be a claim is automatically entered for you. Or you may need to put a claim in, which will be easy.

rennes99 says

I wonder if, once the claim portal is live, I could contact them directly and explain this, and request (if it is automatically entered) that the CRA info is updated quickly rather than wait a year/18 months, as an individual request? Possible or barking up the wrong tree?

I was so close to an unblemished Credit Report! :(

Sara (Debt Camel) says

Well you can ask. But they don’t have to agree and all “extra” things they take on take time and reduce the amount in the final pot for refunds. So they may not be keen.

rennes99 says

OK – i’ll wait for the announcement of how they intend to proceed :)

Thanks for your help as always

Jodie says

Hi Sara

Could you give me some advise please? I have taken a lot of quick quid loans out and I still owe them now I haven’t paid them now in a while has it’s unaffordable for me they have double what I took out They keep ringing me on over seas number spoke to them which they said they would waver £50 off the interest in all total the loan now stands at £1300.

I don’t know what to do with it.

Sara (Debt Camel) says

I suggest you send them a complaint by emailing complaint@onstride.co.uk and say you had a lot of loans from them that were unaffordable and you would like your complaint to be decided by the automated adjudication tool the administrators are proposing to use.

And when you have done that, respond to any contacts asking you to repay the balance by saying that you will not be making any further payments to your current loan with them until they have assessed your complaint as you have been told you will have the right of set-off between redress for unaffordable lending and the balance owed.

Mary says

Hi 👋 I took a loan out with stride in 2019 but unfortunately I struggled to pay back the money ,resulting using my everyday bill money to pay back the loan.Would it be possible for me to claim a refund?

Sara (Debt Camel) says

yes you will be able to put in a claim, but it’s hard to win a single loan case unless the loan was very large in relation to your wages.

Ian Jones says

Hi,

I Lodged a complaint about Quick Quid through Paydayrefunds.co.uk back in 2018. I believe that this company is no more! I had back and forth communication with QQ via the above. I had sent my details many times, however QQ said they could not find me on their system. I had even given them my account ID number. My loan history was no longer on my account homepage. On 11th April 2019 I apparently had a final decision back from QQ stating I had not had more than 5 loans. Yesterday, I decided to log onto my QQ page and saw I could download my data due to GDPR. I found a history of 20 contracts of loans. I spoke to QQ today and they said that 5 loans were fixed and the other contracts were flexi loans. They said the case is closed as I didn’t appeal their decision within the 6 months and now, as I have previously complained I cannot make another complaint.

Any advise would be gratefully received.

IJ

Sara (Debt Camel) says

When did you last contact them about this? Have they sent you a copy of the response they sent to the claims company?

Ian Jones says

I last contacted them before this contact around April 2019. I had given all the information that I had or could gather through emails and bank records but I had no information regarding the loans until I got the information from their website this week.

Whilst on the phone, they said they had sent the information to the third party however I have no email about their detailed findings except for I had less than 5 loans.

To top it all off, I had £28.88 debited from my bank account yesterday from a company called fixitcrowd who I have no email authorisation to debit my account. I’ve never even heard of them.

The whole claims scenario seems to be an utter mess and mine field

Sara (Debt Camel) says

Using a claims company can really mess you up sometimes.

I suggest you send QQ an email with COMPLAINT ABOUT INACCURATE INFORMATION as the title. Say you and your claims company were given inaccurate information that you only had 5 loans from them but now you have discovered from …. that actually you had …. On that basis you want them to agree to accept a new claim from you as you only discontinued the old one because there seemed no point in progressing it without any evidence about the other loans.

re fixitcrowd – tell your bank you have never heard of them and this was not authorised and that you want the money refunded by the bank.

Sara (Debt Camel) says

It may also be that you can simply add a Claim on the claims portal page under development. The administrators may not care that you did not pursue your previous claim. But that won’t be known for certain for a few months.

Jan says

Just reading review about that company and it looks like it’s a scam

Their website look like it’s a posh bank account , but Monzo can do the same free of charge.

Chrissie says

I had a complaint in with pounds to pocket, only submitted 4 months ago. Should I wait for the portal to go up to proceed?

Sara (Debt Camel) says

Have you had a reply to your complaint? If not, then you aren’t likely to get one soon (or at all) but it is very likely your complaint will be automatically submitted to the portal. Check back in a few months that this is what is happening.

Christine Sisson says

I had the standard reply here end of October and nothing since

I refer to previous communications and the purpose of this email is to assure you that the investigation of your complaint is still ongoing. I would like to thank you for your patience and confirm we will contact you as soon as possible, and at latest within eight weeks of the date we received your complaint.

If you need to contact us in the meantime, please do not hesitate to do so on the details below.

Emma says

Hi I’m wondering if the portal for quick quid has gone up yet as I’ve already made a claim with wonga and said I Had quick quid but I’ve not heard anything back yet can someone help me please

Sara (Debt Camel) says

no, the administrators said it’s unlikely to be up before April.

David says

Hi..I have had contact from Lantern Debt Recovery saying that they bought my debt from QQ and also from Mr.Lender. I am making affordability complaints to both. Will this get the debt recovery people off my back until I have had answers?…..David

Sara (Debt Camel) says

Have you told Lantern about the affordability complaints?

David says

Hi Sara…I have only just had notification from Lantern that they own these debts. They in turn seem to have inherited at least one of them from Motormile Finance. Should I inform Lantern straight away? Thanks…David

Sara (Debt Camel) says

Lantern is the new name for Motormile Finance. Just a name change, same firm. Yes notify them that you have affordabilty complaints in with the lenders.

Daniel James says

HI Sara,

I had a FOS final decision and offer of settlement just over 2,500. The company went into administration before this was paid.

Is there any update what I am likely to receive if anything? Would the administrators accept a lower settlement now?

Thanks

Sara (Debt Camel) says

You now have a claim in the administration for 2500. That will be paid out when the administrators know how much money there is to divide between the unsecured creditors. That won’t be for 9 month or more. The administrators won’t listen to an offer to settle now I am afraid.

Anthony says

Hi Sara.

I received the same email that Jenny got, from QQ and I emailed them what you suggested to Jenny.

I got a loan with On stride 1500 plus a top up of 1000, I still pay every month but I thought to stop pay until I get answer from them.

What do you think I need to do? Shall I pay or not the payment due.

SAD says

Hello!

So I had a loan with QuickQuid, one of 4 loans I took out back to back (including my partner taking one out with on stride to be able to keep up with repayments) which sent me into financial didficulty.

Around about the same time QQ went into administration, I sent them an email to basically explain I couldn’t keep up with the repayments at all, with just over 700 owing on my account.

If I sent through the template, would they be likely to cancel the interest payments on what I owe? Or what would be the likely outcome? Thanks for your help ☺️

Sara (Debt Camel) says

With 4 loans, having the interest removed from the last one may be the result of a claim. With 3 (because one was taken by your partner, not you) it’s less likely but possible if the loans were large.

Have you been paying them anything? Do you have other problem debts?

Emma says

If QQ is in administration, can they still give refunds for other complaints? I am not sure if this is an affordability complaint, or just they didn’t do what they said. I went into hardship and followed all their instructions. They said if I did this all interest would be frozen. I then noticed they continued to charge a daily interest. When I queried this they said it was not put in hardship because the arrangement was not made within 30 days, however I gave them everything they needed within 6 days, it just took that long for them to sort out. When I said this they wrote off the remainder of the loan but said there would be no compensation. The interest they charged during the hardship period was alot more than the remainder of the loan so is this really compensation? Just wondering if I should follow up on it if they are in administration, or just leave it.

Sara (Debt Camel) says

You can put in a Claim when the administrators set up the portal in a couple of months. All refunds for any reason now have to go through the administrators and you will only get a % back.

SAD says

I have 4 in my name and one in my partners.

My partners claim has some left to be paid back which is still having interest out on to it

My quick quid claim is also in arrears, I also have other problem debts at the same time!

Thank you

Sara (Debt Camel) says

I suggest you talk to StepChange about a debt management plan to try to get your finances into better shape: https://www.stepchange.org/how-we-help/debt-management-plan.aspx

Alex says

Hi Sarah I had a lot of loans with Quickquid and did complain but they were not upheld. For Personal reasons I’ve missed the deadline in sending my complain to the FOS as 6months and 2 weeks has passed. I now understand they are in administration – l have emailed the administrators and received no reply yet. Is there anything else l can do?

Sara (Debt Camel) says

The administrators are pretty likely to accept a Claim. Check back in a few months when the Claims Page is live.

Ian McIntosh says

Hi – as I understand, if a loan is subject to an affordability claim any interest should be refunded/void. I understand that interest paid up to the appointment of the administrators will just be paid as a Claim, but are they still going to collect interest after they are appointed, even though it’s supposed to be refunded? Surely that interest should be treated differently as its collected by the administrators and not the company before the administrators were appointed?

Sara (Debt Camel) says

Your loan agreement remains as before and legally you still owe the agreed repayments.

But you may also have a Claim for unaffordable lending, especially if you had borrowed several times before this last loan (had you?).

If you have a claim which is upheld this should be “set off” against what you owe QQ.

Derek says

HI. My son had a loan from quick quid using our address back in decenber 2018 for 250 pounds, he doesnt live with us and is what they call sofa surfing, homeless, trying to get on a council list, how would they have thought it a good idea to lend in the first place, weve just found out today by opening a letter, any advice would be good

Sara (Debt Camel) says

if it was just 1 loan, he is unlikely to win a claim, sorry.

Sam says

Is it likely QQ will be even worse than the Wonga settlement? I’m not familiar with their financial situation (obviously it’s not good!)

I am also pursuing a claim with MyJar, they asked me to provide them back statements and payslips at the time of my loans today. Should I have to do this?

Sara (Debt Camel) says

We will have to see some numbers. If this low settlement puts a lot of people of claiming from QQ, the ones who do claim may do rather well!

Sam says

Thanks Sara. Sorry to pester you but can you elaborate on whether I should have to provide MyJar with bank statements and payslips in regards to my claim?

SK says

QQ’s parent company Enova International doing rather well! Disgusting!!!

Enova Reports Fourth Quarter and Full Year 2019 Results

http://ir.enova.com/2020-01-29-Enova-Reports-Fourth-Quarter-and-Full-Year-2019-Results-1

Suzanne says

HELP PLEASE – I have an Onstride loan and still paying. Just checked and I have had 14 loans/top ups since 2011. I have obviously been going from loan to loan – should I still pay the existing one? What should I say/email to complain?

Skivvy says

This is my email to lending stream. What do you think my chances are?

I was given unaffordable loans On Stride. I would like to claim a refund of the interest I paid.

My On Stride loan is still active and I am still paying. I however can not afford to do so. I would like to come to a payment arrangement with you as continuing to pay the high instalments is making me have no money. I can manage £50 per month.

It is to be noted that I had an active Amigo loan at the time I took out this additional loan Had you checked you would have seen it was a loan of £10,000 this was a guarantor loan. The payment is almost £400 per month.

I am making an affordability complaint. This loan was and still is unaffordable for me and they would have realised this if they had checked properly before giving me the loan(s).

I request that you write off this loan as it was unaffordable and I have already paid back the amount I borrowed minus the extortionate interest.

You would have seen from my credit record that I had recently missed payments/had defaults issued against me. I constantly live in my overdraft and exceed any agreed overdraft.

My outgoings of my bank account always exceeded my wage and I was only able to balance this by taking out more loans. I was in an unbreakable cycle.

I look forward to hearing from you.

Sara (Debt Camel) says

Lending Stream or Onstride?

Skivvy says

It was lending stream.

I also have onstride and an amigo loan. I have applied to all.

Dave says

Hi Sara,

I was due to make a P2P payment on my existing loan with them yesterday but they haven’t taken any money from my account and I can’t even log in to see what’s going on. I have £600 outstanding with them and have never missed a payment but they have just stopped taking the money. Have you had any other reports of this from P2P or the sister QQ? After Wonga suckering me out of £5K I’m certainly not going to go out of my way to pay P2P and spend hours trying to make a payment over the phone. Their website says you should continue to repay as normal

Alex says

Update from administrators 31/01/2020

All outstanding loans remain subject to the terms agreed with CashEuroNet, QuickQuid, On Stride Financial and Pounds to Pocket and customers should continue to make payments in the usual way. Those customers with complaints should continue to approach the company in administration. These complaints will then be assessed and if valid dealt with as unsecured creditors of the administration estate.

for example I pay my onstride loan and need to pay more 11 month, but I raised complain about irresponsible lending, actually I need to pay 4 month more and I will pay back everything what I borrowed if loan was unaffordable(except interests) if current creditors have rights to set-off balance, what the point to pay instalments until you will not receive final response about your complain? they want that you pay loan, and later when you will pay off your loan ,you will be unsecure creditor instead rights of set-off balance. how this is working? they should answer ASAP for customers with active loans with irresponsible lending complaints, to allow them set-off balances. Am I right? do not understand this moment

Sara (Debt Camel) says

You are right. every pound you pay them now, may mean you only get back a small amount of that £ if you win your redress claim.

If you are sure you have a good claim, it’s best to refuse to pay any more.

Alex says

it was my first loan with them(1400£ for 16 months) I am not sure how good is my claim and I do not want damage my credit score, because they will put my loan in late payment and later default it. At the moment I borrowed I had 5 loans on payment arrangement, one account with late payment and 4 credit cards with a high balances. I really need advice what actions I can take in this case??? Administrators should know about peoples rights of set off and why they nothing mentioned about it. what I can do in this case?

Sara (Debt Camel) says

So I am afraid you have a difficult decision. I can’t guess how likely you are to win a redress complaint. One loan cases are harder, but that is a big one.

Can you actually afford the repayments without borrowing again from someone else?

Alex says

I think so, but I will loose 1100£ of interests if I will pay! is it will be sense to contact onstride and tell this everything? or useless?

Tracy says

I made a complaint to QQ in August 2019, was finally told in October to expect a final outcome in 2 weeks and then guess what they went into Administration and I’ve heard nothing since. I am furious with myself I did not claim with Wonga, Quick Quid and many others years earlier as I’ve lost out on thousands, My Wonga claim came in at £1511 and I’m getting £65 which is disgusting and no doubt I’ll be kicked in the teeth with QQ as well seeing as it’s the same people dealing with their payouts as Wonga. I’m sure Grant Thornton is laughing all the way to the bank while we just keep checking ours for the pittance we’re owed.

Laura says

Hi Tracy

Same thing happened to me, I was expecting a few thousand from them and know I probably won’t receive anything now. How long did Grant Thornton take to get in contact with you with regards to your Wonga claim?

Tracy says

Hi Laura, sorry to hear you lost out as well, I received my email asking for bank details back in October which I supplied and got a confirmation on the 19th of October that, was the last I heard from them till I got my email stating I was getting 4.3p in the pound on the 30th of January, Gutted.

Sarah payne says

I also made a claim to QQ in September 2019 and had an email in October saying they would give me a decision in 2 weeks, hey presto nothing! I am now waiting for the portal which will probably payout a measley 4.3% like Wonga did, absolutely disgraceful. 6 months of waiting for £110 from and they still haven’t paid it. Don’t hold up much hope from this one either!

Grant says

Update from administrators website 31/01/2020, looks like some time from closing claims window and development of online submission portal

Chris says

Useful to know that claims which have been assessed and partly decided on by the FOS will just be handed over to the Administrators so no need to make a further claim from scratch.

Sara (Debt Camel) says

I think we have to wait until the Claims Portal is published before we know that for sure.

Nick says

I’ve sent an email to quickquid regarding the refund process. I did however have a different email address back then and can’t get access to it. Should this matter? Also, should I receive an email back whether I’m entitled to anything?

Berny66 says

Hi Sara

I started an unaffordability claim with QQ and P2P on 31 August 2019. Since then I have been contacted by a recovery company called Lantern. I wrote and explained that due to QQ going into aministration (and their sister companies) I was waiting to hear what will happen next from the administrators. I also sent them the email I had received from QQ and P2P from my Resolver account. They have now put my accont on hold unitl 14th March 2020 but said that after their investigation, they do not find QQ or P2P liable for the unaffordability claim and so they (Lantern) cannot uphold my complaint. I do owe £1925.97 which I was given a CCJ for because I was out of the country and never received emails informing me that this was going to court. Due to a divorce, I was caught in the trap of paying loans and then taking out bigger ones just to live. I’m not sure what to do with regards to Lantern. Any advice would be much appreciated. Regards, Berny

Sara (Debt Camel) says

How many loans did you have from QQ and PTP before this last one now with Lantern?

What is the rest of your financial situation like – do you have other CCJs or debts you have been trying to ignore?

Chris says

Received a letter from a debt collector chasing my remaining debt with QQ (amount still to pay £265 approx). Have sent back the letter I got from the Adjudicator last July stating that refund of interest on loans 7-31 (value approx £12000) should be made. I hope that will be the end of it. Payplanplus has now reallocated repayments now in the DMP so there is no extra money to continue paying QQ.

Berny66 says

Hi Sara

Thanks for getting back to me. I had other loans with QQ and P2P for over a year (I think somewhere in the region of about £12000, possible more but I can’t access the QQ site to see my history.) However, I moved overseas because I was very down about my financial situation and just ignored it. I am now in a debt plan with some remaining debt, again accrued during my marriage, which I can manage but I’m not sure why Lantern have not upheld my complaint and are still trying to recover the remaining balance left over from P2P. I have just received the administrators email this morning saying that they have accepted my claim for ‘unaffordable lending’ and will let me know in due course what my claim will be worth when they are at that stage. Can Lantern keep chasing me for this debt or should I just send them the administrators email I have just received? Again, thank you for your help with this matter.

Sara (Debt Camel) says

So the administrators have accepted your claim, but they haven’t yet decided which claims are valid. This is going to take many months. At that point you have a strong case to ask Lantern to look again as the administrators have decided the last loan was unaffordable. So the question now is how best to get through to that point.

Who is your DMP with? Can I ask how large the debts in it are and at what rate you are paying them back?

Berny66 says

Hi Sara

I have forwarded the administrator’s email to Lantern and asked them to please wait until I am updated by the administrators, so I’ll see what they say. I am not in a debt plan as such but just with the debt recovery companies. I have about £8000 debt (3 companies) and am paying £150 a month which I can manage as I have just started a new job and really want to be rid of the stress that always goes hand in hand with debt! Like other posters on here, I just thought it would be better to wait to see what my redress would be and hope that P2P/QQ will use any refund to reduce/cancel the amount I still owe. Thanks for your help. :)

Berny66 says

Is the above the best thing to do or do you think I should start paying Lantern in order to satisfy the CCJ that P2P registered against me back in April? As I have said, I was out of the country so never even knew they were taking me to court even though they had my email but never wrote to say this was going to happen? Thanks again for your help with this.

Cyndy says

Sara I have a quick quid complaint with Resolver before they went into administration. Resolver is now asking me to close my case. Should I close it and then put a new complaint via the portal when it opens. Confused 😒

Jo says

Hi Sara, I have emailed QuickQuid and their administrators 6 times now since October for redress complaint for quick quid and pounds to pocket but I’ve not had any acknowledgement or response. Is this normal? I’m concerned they’re ignoring my complaint. What do I need to do please?

Sara (Debt Camel) says

Nothing much is going to happen until they put their new claims portal live. In April possibly.

Jo says

Does that mean I’ll need to use the portal or will they keep a record of what I’ve already sent them?

Sara (Debt Camel) says

Until it is up and running and they have explained things, that isn’t known.

simon says

I have an existing loan with QQ which was passed to ARC ( Europe ) ltd for collection in august 2019. I am in a DMP and they are making payments to ARC. I had an affordability complaint with FOS at time of QQ administration , should I continue to pay ARC ?

Sara (Debt Camel) says

how many loans had you had from QQ before the last defaulted one? How large was the last loan? And what is the current balance in your DMP?

Colin says

My situation with QQ is this – I put my complaint in 2018, it was knocked back and I forwarded to the Ombudsman, the Adjudicator sided with me but advised on 03/09/2019 that QQ had rejected his findings, he said that he’d asked them if they wished the matter be passed to the Ombudsman however they went into Administration before it was resolved.

My question is, will this have been passed to the Administrators to deal with? Is it worth me checking with them to see if its been received?

Sara (Debt Camel) says

I think the case will have been passed to the administrators.

I think they will automatically set up a Claim for you.

But I suggest you come back in April when the new claims page should be live. At that point there may be something definite, you can’t rely on me guessing!

Colin says

Cheers Sara

Scott says

I was absolutely gutted when i heard QQ went into administration, i had taken my complaint to the Obudsman some 5 months earlier and QQ finally agreed to over £6k in refund. One week later they go into administration and i will now get a small fraction of that :-(

Laura says

Exactly the same happened to me and I will expecting the same amount back as you, made me so angry!!

Len says

Yep, 5p in the £…..so prob no more than £300. Same happened with me and Wonga. £1500, ended up getting £49 :(

Sara (Debt Camel) says

There is no indication that will be the final payout. oddly if a lot of people are put off because it seems so little, then those who do complain may get more!

Luke Brooks says

I had an FOS final decision of £3600. Gutted. Will probs get £300 if lucky. What do you think Sara??

Sara (Debt Camel) says

I don’t have any information.

Disgruntled debtor says

Hi, great info thanks for taking the time to write about the debacle.

I have an outstanding balance with qq from July 2013. I’ve never paid on or acknowledged it. I still get a statement each year from them. They state that it isn’t a demand. Can I get this removed from my credit file so you think? It would now be statue barred from what I understand. Thanks

Sara (Debt Camel) says

Does it have a default date on it?

E JAY says

I emailed quickquid with a complaint and received nothing back, emailed again and nothing. I have heard there is a portal in place to complain but where is this?

Sara (Debt Camel) says

It’s not live yet. Come back and look again in a month.

pc says

I had the same issue, if you give their team a call they can let you know if they have recieved the complaint, no news on the portal as of yet.

Dd says

Out of the blue I’ve had an email saying ive defaulted on my quick quid loan, it’s from 2013! They are demanding £675. Anyone else

Sara (Debt Camel) says

Do you agree there was a last loan you did not repay? had you borrowed a lot from them before that?

Dd says

Yes I had quite a few back then and yes I do owe them i think

Sara (Debt Camel) says

ok so you have two possible ways forward.

You could talk to National Debtline (0808 808 4000) about whether you can argue that this debt is “statute barred”.

Or you could send the administrators a complaint about all your loans from QQ, saying you think they were unaffordable and say you won’t make any payments to this outstanding debt until the administrators have assessed your claim as you will have the right of set-off if the administrators owe you money for the unaffordable lending and you owe them money for the last loan.

Alex says

Hello. I had complain against onstride regarding irresponsible lending 2 -3 month ago. I still have open loan with them and 9 instalments left. now I noticed that my loan was removed from transunion and Experian credit reference agencies, but I did not receive any email about it. my payment scheduled instalments are the same ,so ro reduced payments offered how it should be if complain upheld. how to understand this? my complain upheld or not, or they now remove all loans and it is not related to complain. Any body have the same situation, Did you hear Sara something about it?

Sara (Debt Camel) says

how many loans did you have before this one?

how much left to pay?

Alex says

had one loan and this loan is removed. it was 1400 for 16month, 9 instalments left to pay. if they removed my loan from CRAs so my complain upheld or they remove by mistake? as I said no any more info given to me(on email or calls). for first 7 instalments I paid around 1100 of interests, so it I have rights of set off balance I need to pay only 300£ more and loan should be closed. As I heard until portal opens, they will not make decision about irresponsible lending,so why they remove my loan from my files? I had 5 loans an arrangement to pay , one more late payment and 4 credit cards with a high balances when I opened account with them. I sent them my creditcarma report as a proof. what you think why they removed my file?

chinne menahaya says

Hi

Trying to help my girlfriend with her debts. She has a default with quid quid and a default date. Is there anything she can do to 1. claim money back 2. remove the default

regards

Sara (Debt Camel) says

how many loans did she have from them before the defaulted loan?

chinne menahaya says

Hi Sara

She just had this one

Thanks

Sara (Debt Camel) says

how large was the loan?

chinne menakaya says

Hi,

It was 337

regards

Sara (Debt Camel) says

In that case she is pretty unlikely o win an affordability complaint to the administrators and so they are unlikely to remove the default.

Tst says

If this was marked on her Credit Karma report (Transunion) I would dispute it.

I raised a dispute against a missed payment status 2 on a quickquid loan for a similar amount. I wrote sentence or two in the explanation box stating that I had issues submitting the payment due to a technical fault with their payment system, I also noted I had spoke to an advisor who stated it wouldnt be listed as a late payment and mine was removed in 3 days. If it’s a similar story to this you may be in with a chance, if not I reckon it is still worth a try it cant hurt.

Good luck

Alex says

lender must offer you payment freeze if you asking about it or it is their decision , they can say no, we do not want give you a payment holiday?

Sara (Debt Camel) says

This is what the FCA who regulates lenders says:

“Due to the coronavirus (Covid-19) pandemic, the FCA expects lenders to provide appropriate forbearance to consumers who are experiencing, or expect to experience, difficulty in keeping up with repayments. The FCA’s rules on forbearance state that firms should allow the customer reasonable time and opportunity to repay.”

Have you asked a lender and been told No? Or are you just worried that is what they will say?

Alex says

I am just worried that is what they will say. I do not trust onstride. I once asked them about 1 month holiday before payment due date, they agreed about it and anyway registred missing payment and add status late payment to my acc. eventually I had to pay in one month double payment and in that case they removed late payment. I am up to date now. I am really worry about my score that after one more agreement to freeze payments for some time,they put my acc in late payment again. Their staff are horrible and not supportive at all. they will report to CRA’s that I was not in touch and it is simple missed payment , even you were contacted with them. they lying too much and their purpose to damage as many credit histories as possible

Sara (Debt Camel) says

ah Onstride – they are currently in administration.

But that quote I just gave from the FCA was actually taken from a notice it put out about BrightHouse entering administration – https://www.fca.org.uk/news/news-stories/caversham-finance-limited-brighthouse-enters-administration . And the next sentence in that notice said:

” This is applicable even when a firm is in administration.”.

So they should agree to you having a payment holiday. Ask them. If they say no, send them a copy of that FCA notice and ask them again – you want this in writing so an email will do.

I hope they will be reasonable. If they aren’t, then you still need to cancel the payment if you can’t afford it. You can argue later that it is unreasonable for your credit score to be affected – I think you will win that argument. But the most important thing is that you are not short of money at this difficult time.

AND on a separate point, was this the first loan you had from Onstride? Had you ever borrowed from QuickQuid? You may have a good “affordability complaint” to the administrators. Read https://debtcamel.co.uk/payday-loan-refunds/ which looks at what an affordability complaint is. If you think you have a good complaint, then send one to the administrators.

David Lacoste says

Do you think the current situation will cause delay in getting this issue settled?

Is there any way to find out how much longer they are going to take?

Thanks

Sara (Debt Camel) says

I hope not because it is going to take a long while yet. The portal for people to put claims in isn’t yet live, then that will have to be open for quite a few months, then the administrators have to assess all claims and allow time for people to appeal…

Tom Whelan says

Hi there, do you know if the customers have been contacted yet and whether the online portal has been set up?

I had numerous rollover loans and would have thought that this was done irresponsibly.

Many thanks

Sara (Debt Camel) says

not that I have heard.

Neil says

So I’ve looked at my credit report with Trans union and it states I have Default dating back from Oct 14 and I’ve paid nothing towards it, as I didn’t know. pounds to pocket have subsequently gone into administration, where do I stand as the default will fall off regardless in October this year.

Sara (Debt Camel) says

did you have other loans from pounds to pocket or QuickQuid?

Sara (Debt Camel) says

You may be chased at some point by the administrators or by a debt collector if the loans has been sold. I am surprised the adminsitrators haven’t already contacted you about this, quite a few people have been contacted about old unpaid loans.

You could try to ignore the loans and hope that doesn’t happen.

Or you could put in an affordability complaint when the administrators set up the portal, which should be soon. Then if you win that, a refund will be set off against the remaining balance.

Neil says

Yeah but they are all settled.

Bobby says

Has everyone received some sort of communication with QQ? My case was with ombudsman and then they went bust, but I haven’t heard a thing from anyone. My case was with them for almost a year

Louise says

Nothing from QQ.

I was told I would receive over £3000, then they went into administration six weeks later and was informed my awarded sum will reduce dramatically. This was done by a claims company who I’ve heard nothing from since.

As regards QQ I’ve heard absolutely nothing. This was several months ago even though I was told my meagre payout would be with me in early February.

Sara (Debt Camel) says

Your claims company should not have said that. QQ haven’t yesterday started asking people to put in claims, it will be many months before you get your small payout.

Thomas says

Hi Sara,

I took out a 1500 loan with OnStride last year which I couldn’t afford, but I was desperate. I lowered my expenses but was honest with my low income at the time and was accepted.

Jan 4th this year, I submitted an affordability complaint to OnStride. Near end of March more than 8 weeks passed and I had received no reply from them. At the start of April when Covid hit, I asked for a payment holiday for a few months like all other creditors have given me during this period – However, despite me never once missing a payment, they wanted me to put a full DMP in place to give lower payments during the Covid issues, refusing the payment holiday. On the basis that I still can afford to pay and don’t want my credit rating lowered because of this virus, I refused this and have had to keep paying. I also asked them in the email what’s happened with my affordability complaint, as I submitted it at the start of January and it’s now middle of April without any response regarding it from them and was simply fobbed off I felt with them stating that the time frame can be longer than the standard 8 weeks because OnStride is in admin and not giving any more details than that. Therefore, I am uncertain of how I should proceed with this issue and am hoping you can advice me. Is it time to go to the financial ombudsman?

Thanks,

Thomas.

Sara (Debt Camel) says

Ask again for a payment break – new rules have come in this week. A lender HAS to give you a one month break with no interest being added. this applies even though they are in administration.

You can no longer send onstride cases to the Ombudsman – you have to wait for the administrators to decide your complaint. That is likely to be at 2-12 months.

So you have to decide whether to carry on with the normal payments after the 1 month break.

If you pay less or nothing now to onstride after the 1 month break then your credit rating will be affected. These negative marks will be removed if you later win your complaint.

If you repay the loan now, and you win the complaint you are likely to only get back a small amount of the interest you have paid – for Wonga this was less than 5%.

So ou will be much better off if you don’t pay them anything more now and you win the complaint- in that case the interest is removed and you only have to repay what you borrowed.

But of course if you don’t pay now and you don’t win the complaint, you will still have to pay it all and may get a negative mark on your credit record.

People that owed Wonga money at the end were offered a chance to setttle this for just 20% AND have they credit record cleaned. BUT this may not aoppy with Onstride.

Sorry, there is a lot here that is uncertain. I think you should focus first on your overall finances… .How have your finances been affected by Coronavirus and will they be back to “normal” in a couple of months? Will you be able to pay all your other creditors when the 3 month payment breaks end?

If your finances are going to be in a mess anyway, then trying to protect your credit record is probably pointless.

And if you can’t rep[y without borrowing again elsewhere, you should not do this. First because it just prolongs the payday loan cycle of interest paying and reborrowing. Second because you may find it much harder to borrow in future.

Sarah says

Hi I won my case against pounds to pocket in November via the ombudsman. I was due to be paid and they held out and then went into administration.

I’m wondering if there is any more information on things?

Thanks Sarah

DM says

Hi Sarah, I have an outstanding complaint with quick quid I raised in Nov with no response. I have noticed today on my credit report I have a default for onstride in relation to pounds to pocket for £1k which I am embarrassed to say had forgotten about the payment arrangement for £16 a month I set up. Question is will the administrator look at all loans for cash Euronet as part of QQ complaint and should I wait for outcome or contact pounds to pocket with a new IRL request and start making payments again? I can now afford to make higher payments than the £16 (prob £50-75 a month) but am more concerned with the defaults on my credit file. Looks as though I had one loan with P2P in 2013 and one in 2019

Sara (Debt Camel) says

Is the default the first or the second P2P loan?

The administrators haven’t said yet how they intend to calculate redress across the different products. I hope it will be a single calculation. I really hope it will just be a single claim even if the calculations are done separately.

Starting to pay more now will not improve your credit record. The only way that defaUlt will hi are either if you win the affordability claim OR if the administrators later do what they did with Wonga and offer people the cg SNC day to settle at 20% Of the balance and have the default removed.

Paying more now will also reduce the amount of compensation you get from your affordability complaints. It’s better not to pay and to have the balance written off by your compensation than to pay the balance and then only get paid say 5% of the compensation.

Also if you gave any other debts you are paying interest on (credit card? Overdraft?) clear these first as no interest will be being added to this old P2P debt.

DM says

Thanks Sarah, default was on the second loan. Just to clarify on your comment with regards to Wonga, did the administrators accept 20% of the remaining balance and remove negative info from credit files?

Sara (Debt Camel) says

yes – but the administrators only offered it right at the end of the administration, after more than a year. They won’t take this if you offer it now!

And they may not do this with QQ/P2P. They decided they couldn’t sell the loan book with wonga so they didn’t have any other options is my guess. I don’t know what shape the QQ/P2P loan book is in, it is less high profile than Wonga which will make it easier to sell but in these coronavirus times they may only get peanuts from it.

Frank says

Hi Sara, there is an update from the administrators on the QQ website today. Not much info thought

Sara (Debt Camel) says

Thanks