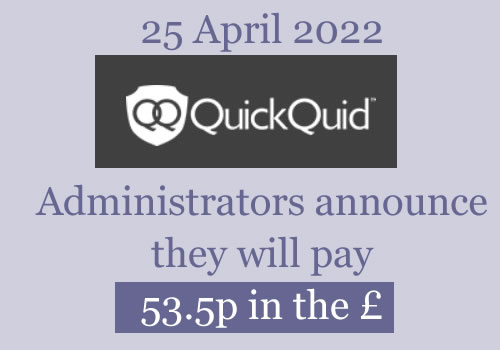

Payments – UPDATE – 25 April 2022

Administrators have started sending emails to everyone with an upheld claim telling them what they will be paid.

“The Joint Administrators are now in a position to declare a first and final dividend of 53.5p in the £”

The average claim value is c £1,700. Someone with that claim value will get a payout of about £910.

The payout details are given in the email:

- This will be paid over the next two weeks.

- If the administrators couldn’t validate your banking details, it will be sent by cheque. I don’t know how the administrators will “validate” your details.

- If you used a claims company, the money will be paid to them.

- Most people are not having any deduction for tax paid to HMRC, so there is no need to reclaim anything.

Credit records

The administrators may decide to :

– remove any negative marks on your credit record

– delete all loans that were upheld

– delete all your loans.

I don’t know what they have chosen to do – if people can check and report in the comments when they see a change, that would be great.

How much your credit score will change will depend on whether there were any negative marks. If you want to get a mortgage, you would like as many payday loans gone as possible, even if they were repaid on time and not hurting your credit score.

In a few months when the administrators no longer talk to the CRAs you can ask for any remaining loans to be “suppressed” so other lenders can’t see them. See https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do that now.

QuickQuid went into administration in October 2019

CashEuroNet (CEU), which owns the QuickQuid, Pounds To Pocket and On Stride brands, stopped giving loans and went into administration on 25 October 2019.

I will be talking about QuickQuid (QQ) rather than CashEuroNet as it is the more familiar name. Everything here also applies to loans from Cashruronet’s other brands, Pounds To Pocket and On Stride.

Grant Thornton were appointed as Administrators. They set up a page about Redress Complaints – this is their term for people who have asked for a refund because they were given unaffordable loans.

Background to the QuickQuid Administration

QuickQuid was one of the “Big Three” payday lenders in Britain, starting out in 2007.

After Wonga and the Money Shop Group had all stopped lending and gone bust over the last fifteen months, QuickQuid was left as the largest UK payday lender.

QuickQuid had well over a million customers. When it went into administration there were c. 500,000 customers with outstanding loans.

Many of these customers had prolonged borrowing from QQ. They either rolling loans over or repaid one loan but were left so short of money that they had to borrow again.

These customers have good reasons to win an affordability complaint and get a refund of the interest they paid.

Affordability complaints started on a small scale in 2015 and increased in the next few years.

In 2018, complaints going to the Financial Ombudsman (FOS) jumped with the involvement of Claims Companies and QuickQuid became the most complained about firm to FOS, excluding PPI complaints.

For a long time QQ refused to refund interest on any loans taken more than 6 years before or where the loans were given in 2015 or afterwards. This resulted in a huge backlog of claims at the Financial Ombudsman, where QQ had made very poor offers to customers and then rejected an adjudicator decision.

In late July 2019, QQ agreed to accept several thousand FOS complaints it had previously rejected.

By accepting the FOS decisions on loans over 6 years, long chains of borrowing, and loans taken after 2015, the scale of QQ’s likely future liability for refunds will have become clear to the company.

After failing to persuade the FCA that a Scheme of Arrangement was appropriate, Enova, CEU’s large and profitable US parent, decided to close the UK business, blaming the UK regulatory environment.

How could the regulators let this happen?

This is an excellent question… Stella Creasy, MP called for an inquiry into the FCA over Wonga and QuickQuid.

What has happened in the administration

Customers with a valid claim for a refund are “unsecured creditors”. This includes:

- any refunds that were in progress after an amount was agreed or a Final Decision from a FOS Ombudsman (FOS);

- complaints that were underway at QQ or FOS when QQ went under;

- any new complaints sent to the Administrators.

All complaints at FOS legally had to stop and were been passed back to the Administrators. It isn’t possible to send any new complaints to FOS.

It is now too late to submit a Claim for unaffordable lending. The last date was 14 February 2021.

The administrators have given the following statistics about claims:

- 169,000 customers made claims for unaffordable lending;

- 78,000 claims were upheld by the administrators;

- the upheld claims had a total value of £136million, so an average of about £1,700 per claim.

Still owe a balance on a QuickQuid or On Stride loan?

More than 300,000 of the current loans were sold to Lantern in summer 2021. You should have been informed if your loan was sold.

The administrators have now stopped collecting any money from the remaining unsold loans.

This page is kept updated

The comments below this article are a good place to ask any questions. And you may be able to see where someone else has already found out the answer.

Liam says

Just a query someone may have the answer to ….

The figure which was quoted for redress, does this include the statutory 8% interest or does that get added on to the amount ie Redress £1234 + 8% or is the redress figure THE figure.

Think my loans went back as far as 2010 – is the 8% calculated from loan date to Oct 2019 when the administrators were called in ??? Asking for a friend of course ;)

Sara (Debt Camel) says

I think if you look back at your email it said how much was a refund and how much was 8% added interest. At a guess the 8% runs up to some date which is the same for everyone.

Jim says

Why is the QuickQuid administration taking so long?

A comparison with Wonga, also administered by Grant Thornton, is interesting. Wonga was a larger company with 401k successful redress claimants after the bankruptcy, compared to 78k for QuickQuid.

So QuickQuid should have been quicker. It was smaller, and Grant Thornton will have benefited from the recent experience of dealing with a complex PayDay loan company bankruptcy.

However; time from entering into Administration to declaration of the dividend: Wonga 74 weeks, QuickQuid 126 weeks so far (dividend still not declared).

One difference between Wonga and QuickQuid. In Wonga’s case there was very little money to pay the claimants and the Administrators, so that provided a practical limitation on how long the Administration could last. With QuickQuid there is much less limitation.

Wonga managed to pay 90% of their redress claimants within 4 weeks of declaring the dividend, so there is still hope that most of us will be paid before the end of April.

Sara (Debt Camel) says

Let me list some differences.

1) the pandemic. Seriously, the administration started in Oct 209. The first few months are just investigating the scale of the problem, then the administration gets going but lockdown hits. You may think looking back it wasn’t that big a deal – for every firm of auditors it was huge. They weren’t set up to work from home.

2) Wonga was a simple payday lender with one product. It’s pretty easy to produce a decision engine for deciding when multiple short term loans tipped over into being unaffordable. QuickQuid also has Pounds To Pocket/Onstride and larger loans are much harder. There have been a lot more appeals and a lot of them have been won.

3) a US parent that was still going and claiming it was owed money – makes a significant difference to payouts and the time involved to get it resolved.

4) QuickQuid had sold many more loans than Wonga – more complications for the QQ administrators

5) They gave up on selling the Wonga book as too old and too toxic – but have persisted and secured more money by selling the QuickQuid book but it has taken time.

Adam Jackson says

Hi

Could anybody please advise me if there are any time restraints on complaining about irresponsible lending to companies that are still active such as aqua credit card and vanquis.

I had accounts with these sorts of companies years ago and was just wondering whether it was worth making a complaint. At the time I had multiple pay day loans and other credit just to try to stay afloat, the companies just kept increasing my limits without me even asking and I stupidly continued to use the available credit, just don’t want to waste my time if after a certain period of time you lose the right to make a complaint.

Thanks in advance

Sara (Debt Camel) says

The problem you are complaining about has to be after April 2007 – that was when there was a change to the Consumer Credit Act that all these complaints are based on.

If the limit increases were more than 6 years ago, it’s likely that the lender will reject your complaint saying it is too old. They may say that the Ombudsman won’t look at it. But that is the Ombudsman’s decision to make, and if you explain that you have only found about affordability complaints about credit cards recently – within the last 3 years – and until then you didn’t realise a credit card lender should have checked the limit was affordable, then the Ombudsman is likely to decide they can look into your complaint.

How long ago were your problems?

paul says

Have a read and make your own mind up and Grant Thornton’s affairs over the past few years

https://www.google.co.uk/amp/s/www.goingconcern.com/grant-thornton-let-off-the-hook-big-time-by-uks-audit-cops/amp/

https://www.google.co.uk/amp/s/www.cityam.com/grant-thornton-caught-up-in-conflict-of-interest-accusations-over-greensill-capital-appointment/%3famp=1

https://www.thetimes.co.uk/article/audit-giant-grant-thornton-accused-of-conflict-over-role-in-sanjeev-guptas-takeovers-fgn527ksj

https://www.thetimes.co.uk/article/conflict-inquiry-into-grant-thornton-and-wonga-reopens-wzlnjp7rz

Danny carmody says

hi Paul, on the good side we are still going to get some redress, we all will get this some time this month, QQ has taken longer that it should but we hope to get % 30% to 50%, when QQ closed, they just pulled out of uk, so the loan book could be sold on, which has helpped us get to the level of % redress even at 30% is good for all of us,, better than wonga at 2%, just think 2 days before they pulled out of the uk, l was due my redress, so lost a big repayment of redress, so now happy on what l hope to get, all the best

jacqui says

Hi,

In all of 247MB updates (Section 1.4) it states:

Customers that were either not entitled to Redress, or those who were not satisfied with the Redress amount calculated by the Joint Administrators, were given the opportunity (through the customer portal) to challenge the basis of the Joint Administrators’ decision.

We have never been told what are claim assessment is worth

How could we challenge when they have never actually told anyone which loans have been upheld and which loans weren’t?

I have asked for a breakdown several times but just told to go onto the portal or log into my account

When I do it says claim has been accepted – but there is no breakdown

Why are 247MB not following their own rules?

Aaron says

We have been told… well I have anyway, just awaiting the redress payment amount confirmation which is due between now and I’m assuming 3 weeks time as they plan to make payments by the end of April.

Don’t rely on this though as anything can change, just be patient.

Robert says

Hi,

It’s a bit academic now as payments are allegedly being made this month.

I don’t know what you can do? Though, I don’t think a lot of people will appreciate any more delays caused by an investigation?

mark says

I got a payment today re moneybox 247….

Never at any point was told the amount or the 9 pence in the pound.

I really should not have got this payment as moneybox247 had already given

me £500 when i complained a couple of years ago.

ill keep the money though!!

Sara (Debt Camel) says

it may well be that the £500 was a poor offer and the money you have got today is for the extra you should have had then.

MARK says

Could be, but pure speculation as ive received no correspondence from the administrator..

btw, there are a few Mark’s on this thread.

im more than happy with the quick quid admin….ie the 30 to 50p in the £…the wait is nearly over..

Dan says

I’ve also had a payment from 247 moneybox today, but no notification on how it has been calculated. Hopefully that will follow soon 🙂

Claire says

I got a payment from Moneybox today. I don’t even remember claiming , £12.77

Mark says

If Grant Thornton are to be investigated…can this delay the redress that is due to be paid out this month from quick quid/pounds to pocket? It just seems to be one thing after another at the minute. Also can we claim against Grant Thornton for miss-selling the Miss-selling?

Sara (Debt Camel) says

No it won’t.

And no you can’t.

This is the problem with people raising all these points about how unfair everything is. There is nothing you can do do about the length of time this is taking – and as you are set to get a result which appears surprisingly good compared to most high cost lender administrations, it isn’t even clear that you have lost out by the process being slow. Would you have preferred to have had 5% after 18 months…

Mark says

I would rather have between 30%-50%. I guess with a lot of rumours doing the rounds it does begin to play on your mind a bit. Thanks for the swift reply. I guess I will just sit and wait, And enjoy a pint when it arrives.

Patrik says

Yes, I got the 247MB payment as well, but no information on the % redress etc. I guess there will be information about this at a later date. Looks like the % was fairly small (in the single digits).

Luke says

Hi, I haven’t posted on this site before but have kept an eye on it for QuickQuid, Money Shop and Wonga and it has proven to be invaluable so I’d just like to say thanks to Sara for taking the time and effort to keep it going. It’s much appreciated. I have sympathy for those who are a little anxious around when we will hear definitive information as I have felt a little like that as well. Hopefully, all will be resolved soon. However, in the interim, thanks again to Sara – it’s helped me a great deal..

Alan G says

Wanted to wish everyone good luck for April and hopefully we’ll start to hear some news this week! Thanks to Sara as without this website and help as I wouldn’t have known where to start to sort my debt mess out and get redress, for me this is my last Payday loan claim but all the best to everyone with this and future claims.

Sara, I’d like to make a donation to a debt support charity, previously I think you’ve mentioned a couple you support and recommend and would be grateful if you’d remind me.

Sara (Debt Camel) says

A small donation to your local Citizens Advice would be great. Or a local food bank.

Kelvin Smithyman says

Hi Sara, thanks for all the great information on this very helpful site. Hopefully we may get some news this week. Over the years QQ have caused me personally a lot of heartache, stress and anxiety. Just a question- from announcing a dividend to coughing up – how long do you forecast !

Sara (Debt Camel) says

between 1 and 30 days. I have no way of making an accurate guess.

Kelvin Smithyman says

Hi Sara. I thought you had inside knowledge!!!!!

Sara (Debt Camel) says

I have seen enough of these administrations go through to know what may happen, what is very unlikely to happen, and to know what I do not know…

KarenH says

Hi,

I am awaiting my fourth redress payment thanks to Sara & this invaluable site. Amazing support & couldn’t have done it otherwise.

I’ll also make a donation to our local food bank.

David says

247 moneybox has started paying out redress at 9.35% I got my pay this morning.

Lukasz says

I had loans with them and never got notified i can make a claim…wonderful.

Mark S says

I also received my 247 moneybox redress payment this morning, I didn’t receive any updates from them on the percentage or when the payment was due to be made, just money deposited today

Lukasz says

Hello Sara,

Do you have any information relating to myjar.com administration process. It’s been long time since they went in to administration and so far, absolutely no communication from them. I looked at their website and it’s looks like they don’t have claim portal set up either.

Sara (Debt Camel) says

Best place to ask is the comments under the Payday loan page where there will be more people in the same situation as you: https://debtcamel.co.uk/payday-loan-refunds/>

If you haven’t yet made a complaint, I suggest you send a very short email to myjar@harrisons.uk.com with CLAIM as the subject.

Helen says

If your entitled to redress from myjar you will be notified by the end of April by email, payment due by the end of May.

Sara, I too would like to thank you for all your help and updates, much appreciated.

Lukasz says

Thank you for reply.

Nicki says

I haven’t received an email from Cash EN since May last year (the standard update). Previous emails received from QQ re claim being fully accepted in 2020. I’m only up to date on what’s happening thanks to this page. Should I be concerned I’ve heard nothing directly?

K says

Wouldn’t worry too much Nicki; i haven’t received much communication either but when i rang them up they definitely had the correct email on file (they sent an email to confirm, which turned up fine).

If you’re really concerned I would just give them a ring and double check the details are right – especially the bank details!

Nicki says

Yeah good idea thank you! I suppose the fact that I never heard ANYTHING from 247 Moneybox had just got me thinking. Completely missed out on that one and I have no idea why :-(

Andy Turner says

If you look through your emails you should have one with details on logging into the grant Thornton portal. Once you set that up you can then see all the latest information, plus set up an alert if things change. It’s a bit clunky but at least you can get the information direct from them then.

Nicki says

Yeah I did that last year, just hadn’t received anything since!

L says

Can’t believe I had so many loans with so many people and missed the date with them all. I had many QQ loans around 2011/2012. For being on your site a lot, I’ve only just seen this. Is there anyway to get in touch with administrators about this? I didn’t even get contacted to vote. Thanks, Sara.

L says

Not all – many of them.

Sara (Debt Camel) says

I’m sorry but the deadline for making a claim was more than a year ago. There is nothing you can do now.

Colin Brown says

Dear All.

I was told by the administrator that because my complaint was upheld by the ombudsman prior to QQ going bust I don’t have to do anything they will automatically pay it.

How to I check what I’ve been paid?

Do I need to do anything?

Vh says

Cant believe still no update on QQ

Mine is £9540 so hopefully a nice percentage an not a shock

Considering how many they need to pay they will be inundated by end April with calls if wrong or other queries

Maybe the six month extension meant that claims will be late too an they haven’t updated their page

Let’s hope we get this over soon

My last one an biggest

Thanks Sarah your a star

Robert James says

I emailed someone important in the Grant Thornton company last week demanding to know when we are guaranteed to get paid and if not, why? I got a ‘person on annual leave till Monday 4th April’ message. Seems like all the important staff whom make the decisions are off on holiday at this crucial stage, no wonder it’s taking so long.

Also, I would recommend watching your bank accounts, if you’re not already, as with other recent administrations you may just get a payment without notification. Emails cost money, I believe.

Ian Williams says

Hopefully payment will be made soon.Robert could you let us all know if you hear off Grant Thornton when guaranteed payment will be.

Thanks

Ian

Sara (Debt Camel) says

There is no way they will tell someone asking. It will be announced to everyone at the same time.

I am sorry but everyone neds to sit back and wait. Do not plan on the money being in your account at any particular date. In any large set of batch payments, some just fail and have to be retried later.

Robert James says

Got a reply from the email I sent to Grant Thornton, but back through CashEuronet They seem quite certain in saying we will be notified before payment before 30th April. It goes as below.

Thank you for your email.

Regarding the payment date, the dividend payment is anticipated to be made by 30 April 2022. I can confirm that you will receive a notification prior to payment to inform you of this.

We appreciate your continued patience.

Lukasz says

Six month extension was due to no clearance from tax man…but they got it in the end so no extension will take place

Stressed says

They are currently using the extension though aren’t they? Or we would have been paid in March?

Sara (Debt Camel) says

extensions are routine in administrations. There may be several. That does not mean there will be another one here.

Robert James says

Had an email notification from Provident , important Information. But I will have to wait till I get home as I need my password to log on to the Provident portal. This applies to a series of Satsuma loans I had, lovely jubbly. Hope it’s some money from a future redress, they are talking about 10%

H says

I received mine also yesterday, they are paying between 4 – 6p in the pound.

Robert James says

Just look in my portal, I changed my password. It states I’ll get £16 to £25. Oh well, that’ll pay for pint when I get my Quickquid redress.

H says

I wasn’t expecting anything tbh, i had a successful claim against Satsuma a few month before they went into the scheme, just signed up because i had a email and thought i had nothing to lose. The loan that had originally rejected by Satsuma is being refunded just a shame its only 4-6p in the £. Its definitely made me appreciate the hard work the administrators have put in on the quickquid one. :)

Graham says

Spoke to some American woman yesterday with regards to QQ

I was informed that my claim had been accepted, but, they could not tell me how much the original claim was for.

I got told that i had been sent an e-mail stating the amount ans that i would be getting a percentage of this. I done evr recall receiving an e-mail, I have checked through my mail boxes and spam folders, nothing. Anyone know roughly when these were sent out ?

TBH, i had completely forgot about this until i read it on this site, lol.

I had 20+ loans off these sharks over the years, but, i dont have a clue as to how much for.

Could be getting £10 or I could be getting £1000. Could be a bag of chips or it could be wipe my remaining CC bill.

Lukasz says

I lost my emails by accident, but i have emailed qq in uk and they sent me all “paper” work with all details. Just contact qq on email and tell write to them you lost all emails.

Sasha says

I got the email in December 2020 from the email address claims@mail.casheuronetuk.co.uk

Hope this helps

Mark says

I received mine on 19th December 2020. But I guess they could have been set out over a few days…

Sara (Debt Camel) says

they were sent out over weeks or months, not just a few days.

Graeme says

Yeah, the portal didn’t close til Feb 2021, and people were already receiving decisions by then, so it could have been any time.

Paul says

I had my redress claim email on 25/11/2020.. from Quickquid (support@email.quickquid.co.uk).. detailing my accepted claim amount.

Sara says

My email was from QQ 25/11/2020 regarding amount for upheld refund, they received my application 20/08/2020 if it helps.

EH says

I didn’t receive my accepted claim email until 09/08/21 and my claim Was submitted in Aug 20.

J says

I’ve had an email to say that everyone will be paid by 30/04

J says

So has the amount now changed from 30p-50p to 6p-9p?

Thanks

Sara (Debt Camel) says

No, the comments about 6-9p are in relation to the Provident Scheme. The QQa administrators are still saying 30-50p

Paul Langford says

How are they making 30 and 50 p

Sara (Debt Camel) says

because that is the amount of assets that the QQ administrators have to distribute

Stan says

My gut feel is that with Easter upon us , it only leaves 16 working days to have all done by 30th of April, I am not hopeful at all to get it by end of April , especially since no email notifications at all yet.

Timbo says

Hi

They have been fairly good in keeping everyone up to date and the last update in early March sounded like they were pretty confident of getting everyone paid out by 30th April. In my head for some reason I think we will get the email before Easter and then payments from just after Easter until the end of the month.

Robert James says

Oh well, will have to borrow some money to tide me over the Easter Hols. Though , a certain other loan company has agreed to write of my debt , but they’ve already sold it on and say it’ll take 6-8 weeks to buyback, in the meantime i continue paying them, which I haven’t yet. So I suggested pay me the money and then it’s my responsibility to pay the company they sold the debt to, and their part in my business is over .

I can borrow out of that payment over Easter, that’s if they go for it. I had a nickname Del once, for my many dodgy dealings.

Sara (Debt Camel) says

why would you continue to make a payment to a debt the lender is writing off? Every payment you make now complicates things…

And you do not want to sort things out with the debt purchaser yourself – let the original lender do it as they also have to tell the debt purchaser to correct your credit record.

mark says

They will send out the pence in the £ figure with money in the bank account quickly thereafter i would have thought

to minimise enquires , i would have thought..

Mark says

I’ve just come off the phone to them and they said that there has been no release of the percentage payout as of yet so they could not let me know what it will be. I did ask if its likely to be anytime soon and again the lady couldn’t say. She says im in the dark as much as you are…. It seems like it’s on a go slow to me.

Sara (Debt Camel) says

It isn’t on go slow, but the customer services staff will be told when you are told.

Liz says

I don’t really understand why there is so much discussion on this. The Administrators have been clear on next steps – processing dividends by 30 April

2022. In my experience the payment is processed and you receive a notification by email to inform you that the transaction is complete (subject to bank processing times). The cash is often there already so check your bank account when you receive the email.

Mark says

If its like wonga then the cash was in my bank 1 week after the redress email.

Robert James says

There is much concern because the money is six months overdue with constant delays & excuses. (Legal Jardon, etc)

So, we need that money rather more now , and a lack of faith in the administration which has festered due to inadequate communication. Not to mention the previous history of the administrating firm which I will leave yourself to google.

I personally, have made promises based on the 30th April and could prove costly if fatal for me.

Sara (Debt Camel) says

It isn’t overdue. Extensions are a routine part of administrations, most have them and several are common.

The administrators have been more communicative then most. Legal jargon Is their natural language.

I hope you get your money by 30 April but it was foolish to make promises on the basis you would get it by then as I have been saying for months.

Robert James says

So, 3 years possibly ongoing till 4 years for an payday administration is the norm? Sorry I didn’t, I thought was a lot shorter, but obviously I must have slipped universes, this one’s a lot slower.

Sara (Debt Camel) says

See my comment here about why it has taken longer then Wonga https://debtcamel.co.uk/quickquid-casheuronet-administration/comment-page-20/#comment-476797

Graeme says

Slower but significantly more transparent with what looks to be a significantly better outcome than previous administrations. You are aware of a little thing called coronavirus, right? Lockdown affected everybody, administrators included.

Lisa Smith says

We have been told over and over not to rely on it

There have been so may delays and changes there is no way to guarantee anything

I hope it all works out for you

massive sad face says

Hi Liz,

The discussion is happening because a few thousand people have had a carrot dangled in front of their face for about 2 and a half years.

I had my claim with QQ accepted before they announced the admin. I complained to QQ first. They offered me around £500. I rejected that and went to the FOS. FOS ruled they were in the wrong and the amount of the claim ended up being around £4500.

if i remember correctly it cost QQ about £500 each time a case went to the FOS. So their logical way of dealing with complaints was to offer the customer the £500 in the hope they would accept and go away.

I was told at the start of October 2019 they would make a payment to me within 28 days. 14 days later they went into administration.

No payment was sent.

It’s now 25 days to go until GT and QQ glide past the promised pay date and still no word on the actual percentage that’ll be paid out.

Yes i know HMRC held it up.

If they told people and amount/percentage then people could ease off and relax little…ok we just have to wait for the cash…ok that’s fine.

But currently it’s all hushed tones and whispers which leads people to suspect the worst.

Sara (Debt Camel) says

It isn’t hushed tones and whispers. The administrators here have been a lot clearer by giving a range for the payout than administrators usually are. Normally you get told nothing until jus before it is about to be paid.

I know people are impatient but there is no sign that anything is wrong and fretting doesn’t speed things in.

MASSIVE SAD FACE says

Hi Sara,

I love you BTW. You’re a legend. This websites ace and you help people in a big way. So thanks.

Wonga and money shop both came out with percentage ranges during the admin did they not? And then eventually it was announced “oh actually it’s only 1%”. Or 3% or something.

The hushed tones an whispers – to clarify – I meant that’s what it feels like as a creditor waiting for the percentage to be confirmed. I dont mean Grant Thorton are whispering…they just aint talking much at all.

All in the game tho right?

Sara (Debt Camel) says

Wonga didn’t.

the Money Shop wasn’t an administration, it was a Scheme of Arrangement which is quite different.

Grant Thornton have been as communicative as administrators normally are – and giving the 30-50p range more helpful than average.

Ceeeee says

I say this with 100% good intentions. There are lots of comments on this (now massive) thread repeating the same questions and voicing the same doubts. Please note the following are facts:

1. Grant Thornton applied for an extension whilst awaiting tax clearance, but this can now be DISREGARDED as tax clearance has been granted.

2. Therefore, they are now ANTICIPATING making payments to all claimants by 30th April 2022. The key word is anticipated, so while I would not plan on it being by then, it will most likely be before then or very shortly after – there are no other reasons for delays other than the logistics of transferring the cash.

3. There is no reason to doubt that this will happen, and it is confirmed that we will get 30-50%.

4. Calling and emailing them in the meantime will achieve absolutely nothing, except perhaps cause yourself more stress or unnecessary doubts. Also, I would not want to be their customer service staff right now – none of this is their fault.

5. Sara and others have taken time to explain all of the above numerous times, but some responses have caused people further worry and stress.

Please therefore be patient, put it aside for now, and wait for any updates. I desperately need money myself but know there is nothing to be gained by worrying about it right now.

Ps, thanks Sara for your guidance, input and patience.

Mark says

A great post. Why people are still phoning hoping to be told something different to what we already know is beyond me. Please just chill and what will be will be.

Liz says

I totally agree with you! Sarah you have done an excellent and very patient job. I understand the frustration but you should not be relying on definite pay outs by 30 April. I think the process and the information provided has been very clear. I was approached by the administrators to submit a claim and TBH forgot about it. Anything I receive will be appreciated.

Paul says

I phoned QQ helpline last week – just to double-check my bank account was correct.. which it was, so no issue. She did say we would be paid by 30th, and to monitor e-mails… so I am taking that as the deadline. If it creeps a little, I will not mind too much.. to be getting (potentially) 30p per pound back, makes it worth the wait!! Best things come to those who wait.

Tina M says

I too rang quickquid today to confirm they had all my correct details and spoke to a nice American woman although couldn’t confirm percentage did say had all clearances and they are on track to have payments paid out by 30th April just keep an eye on emails

Noe mccready says

Rang today like u to ensure they had my details no problem and 3 weeks to go have a nice day everyone

Adam says

In no way is it “confirmed” that it will be between 30% and 50%. They have said it may be this.

blokefromhull says

Sara – Thanks so much for all of your invaluable expertise and help during this process.

Given the unwillingness of people on this thread to actually read and understand information rather than jumping to silly conclusions which have nothing to do with the information we have, and that cause more panic for others, is it not prudent to disable further comments on this topic until further updates are received from the administrators? I’m sure you’ll know as much as anyone else when they release another update or further information.

I can’t express my gratitude for the help you give myself and others here, and I can imagine you’d be getting frustrated with the aforementioned.

Sara (Debt Camel) says

I do understand why people are anxious. I don’t want to disable comments.

Ross says

With regards to 247 moneybox, I tried emailing the administrators and the email bounced, I just want to know what my dividend return is. I’ve had two separate payments from them on two consecutive days and still don’t have a clue what I’m actually due.

Sara (Debt Camel) says

I suggest you email 247dividend@harrisons.uk.com and ask what is happening.

Awsan says

I received £2.36 from them without any email. Was sent from Active Securities

Jamie says

Hi Sara – slightly different slant to the on going quick quid scenario . I have today Received a letter regarding provident (satsuma) loan repayments and it’s 4-6p in the £. With a large number of the higher values of my loans not been upheld .

Is this worth appealing / cab I at this stage. ?

Thanks

Sara (Debt Camel) says

yes it is. Do you have the details of the loans? How long ago were they?

TH says

Hi Sara i know this is not relevant to payday loans but my mom died at the end of last year, the council are chasing me for outstanding care fees but my mom left nothing, they had already taken the house and all her savings, I had poa but she made her own decisions around her spending as she did not lose capacity. the council are now asking me to pay 13K but its not my debt, they are really worrying me and threatening that they will send bailiffs. i have told them time and time again my mom has nothing left and they are saying I must pay. i have never signed anything or have anything joint with my mom so why are they pushing me and worrying me

Sara (Debt Camel) says

What a horrible thing to have deal with at a difficult time.

I don’t know why they are saying this but it doesn’t sound right. I suggest you talk to your local Citizens Advice. If you can’t get an appointment with them quickly, try National Debtline (0808 808 4000) instead.

Claire Briggs says

Hello, firstly I’m so sorry to hear about the loss off your mum, I used to work in finance for a care home. Did you sign the contract as her poa or sign a guarantor that if mum couldn’t pay you would? If mum had no funds or assets then she would have been entitled to funding from the local authority savings have to be less than 23,250 for part funding and less than around the £14k mark for full. It may be worth calling adult social care and explaining what’s happening and see if they can help. If they took the house and her savings then it doesn’t sound like any kind of financial support was granted also mum would have been entitled to a personal allowance per week of £25 not a lot but it was still an entitlement. I hope you manage to get this sorted out good luck x

TH says

I didn’t sign anything with the care home me or my mom never agreed for her to go in the one they just put her there, she was charged top up fees to by the date hime and these were not discussed when she got down to the threshold of just over 22k the council was behind in their paperwork and it did not go to panel until she had about £300 left, I always had to pay for her personal items like clothes shampoo haircuts etc out of my own money as she had nothing left

Char says

This thread has been amazing and the whole page. I stumbled across it while wonga were undergoing administration and it’s thanks to this page I was able to make a claim in time. I have also now got claims in with a couple other people and some of my others I have had upheld and had payouts on – none of which I was expecting so it has all been a valuable bonus. JD Williams are now looking into my complaints on 3 separate catalogue accounts I had with them that they increased my limit on well above what I had declared as affordable. I’m totally responsible for using it but if I can the CCJs removed I will take it as a win. We are all here because we made some bad decisions along the way. I took it as valuable learning experience and now have nothing on credit apart from my car which I have nearly now cleared. So thanks Sara for this amazing site – by far the best thing on the internet for advice.

I do have a question – my old Lloyds current account which I have now closed I incurred over the years substantial bank charges for bounced DDs and unauthorised overdraft (sometimes incurring a charge for a few pence overdraft of £30) I managed to get about £60 back one month but is there any way to get any of the charges back? We are likely talking hundreds of pounds in charges some of which were incurred as a result of other charges and caused financial problems which were part of how I ended up in the payday loan cycle in the first place?

Sara (Debt Camel) says

Thanks!

Did you have an authorised overdraft that you were exceeding? How long ago were these problems?

Char says

No the account was a basic one with no overdraft facility so I should of been able to go overdrawn in the first place as the account wasn’t supposed to allow this (not even a £10 buffer). I closed the account about a year ago and moved over to Monzo as it just worked a lot better for me. The charges were incurred over about a 6-10 year period before that date (I hadn’t had any for a while when I closed the account, but as the account is now closed I can’t access the old letter copies etc. to see exactly when they started / stopped)

Sara (Debt Camel) says

I think this is worth complaining about. So far as I know, a bank should not have been able to make these charges on a basic bank account.

Lolly says

Hi

I have just had a refund of £830 from Lloyds this week on the basis of them allowing unaffordable increases on my overdraft. Unfortunately they will only look at the last 6 years and say an ombudsman won’t look any further back. I used the template letter from this site and just tweaked it to reflect my circumstances. It took about 2 1/2 weeks before I got a call and the money was transferred within minutes. I had also had a very small amount refunded a couple of years ago from Lloyds but this didn’t stop me from being able to claim. If it wasn’t for this site, I would never have known about or received this much needed money… so big thanks to Sarah.

I still plan to send my claim onto the ombudsman in the hope Lloyds we’re trying to fob me off on the years prior as the fees they were taking from me were particularly high then, dating back to 2013. Nothing ventured nothing gained. Good Luck.

Char says

Thanks for this

Aaron says

Abit off topic but I was given a refund a few years ago from hsbc as they hadn’t sent out text messages in regards to going into unarranged overdraft. I was in and out of an unarranged overdraft with them for quite a while and placed even further into an overdraft due to there charges, sometimes £80 per month. Where do I stand? Have I got any chance?

Sara (Debt Camel) says

did you also have an arranged overdraft? did this go on for a long while?

Aaron says

No I didn’t have any overdraft at all, I would say if went of for a few years

Sara (Debt Camel) says

did you ask for an overdraft that was rejected?

Aaron says

No, nothing at all

Sara (Debt Camel) says

ok, well this isn’t a standard affordability complaint, but you could complain that the extra charges they added on caused you to be in the unauthorised overdraft for longer, generating even more charges. Say this wasn’t an odd problem but carried on for a long while and you don’t think they treated you fairly 9use that phrase) by continuing to add changes that made your situation worse. Ask for a refund of the charges.

I would expect them to reject this, but send the complaint to the ombudsman and let them make the decision.

Chris says

Hiya Sara, I wonder if you can help.. I have a arranged overdraft with natwest, but have gone overdrawn a few times and have been charged quite abit of fees, is there anything I can do to try and get some of the fees paid back?

Thanks

Sara (Debt Camel) says

Read https://debtcamel.co.uk/get-refund-overdraft/ which looks at affordability complaints about overdrafts.

Sue says

I complained to RBS a month ago about RBS not noticing that I was in Financial Difficulty over many years & despite this, they constantly increased my overdraft. I received a full & final response yesterday to say this was, in their opinion, not the case but RBS awarded me £100 as a goodwill gesture instead.!!! Thanks to Sara for helping with providing templates to put the complaint in.

Sara (Debt Camel) says

I suggest you send this straight to the Ombudsman – see https://debtcamel.co.uk/get-refund-overdraft/ which explains how to do this – it’s easy.

Chris says

OK great thankyou… I also had a loan with a lender called Mini credit? Do we know what’s happened to them? Is it worth trying to get anything back? Cheers

Sara (Debt Camel) says

long gone I am afraid

J says

Hi,

I’ve had a few creditors come back after writing affordability complaints saying I signed and agreed to the agreements- is it worth going back to them or just going straight to the FO?

Thanks

Sara (Debt Camel) says

ha! Straight to the FOS – they must think you will just give up.

T hook says

Any way of getting out of paying claims company I stupidly used when quick quid payment finally comes through??!!!

Sara (Debt Camel) says

no

Martin says

I used [a claims firm] I think, they emailed saying they would drop my case because of the little redress I would likely receive.

Can they change their mind now it’s 30/50p ?

Sara (Debt Camel) says

I don’t know. It may depend on the exact words they used.

Patiently waiting says

I used a claims firm years ago. Quick quid claimed I had just one loan (I didn’t) and so they were dropping the case.

Now that casheuronet have contacted me to start this process I’m just hoping the useless claims company don’t crawl out of the woodwork to try and get a share.

Sean says

It can happen, I used a claim firm (never again) I never saw a penny. My redress was used against a previous debt to the bank in fact 6 months later ended up in debt to the claim firm by £800. Now waiting for the qq claim to come through so I can pay off previous claim to claim firm. But already looking like I won’t get enough now.

Danny carmody says

just in case you get from QQ the full redress in your account, please pay the 3rd party there share, as they will go to court to get there share, and it will cost more than any redress you will get paid, have seen the claim company to this, it takes them just 5min on line to do this, hope QQ pay there share for you, best of luck,

J says

Thanks Sara

Sara (Debt Camel) says

yes lots of FOS cases won against Moneybarn and Everyday Loans.

Parker says

Hi Sarah

I have an old avant credot loan which I originally took out at £4000 which I needed for family personal circumstances which I will not go in to to secure this deposit on a flat only to yet have to move again due to Family Mental Health issues in 2017. Avant Credit Ltd are no longer there but another company has taken this debt on of which it has now exceeded to just over £6000 of which I have made an agreement of paying £30 per month which will take a long long time to clear do I have any rights of getting this reduced? They did try to give me the opportunity to pay £4000 to clear the debt of which I can ill afford as still paying off some other old loans. Would this be worth me going to the Financial Ombudsman and see if I have a claim on this company

Sara (Debt Camel) says

You can still make a complaint to Avant even though they are no longer lending.

How much have you paid to this so far?

How large are your other debts, do you have any priority debts (rent, council tax, utilities?)

Andy says

Hi Sarah is there a claims portal for myjar?

Sara (Debt Camel) says

no, send an email asap to myjar@harrisons.uk.com with CLAIM as the subject. No need to go into details, just say your loans were unaffordable and you would like a refund of interest paid.

Bruce says

I got an email saying my claim is accepted and told me the amount from cash Euronet. I have since received no more emails does this mean my claim has been scrapped

EH says

I don’t think so, I’ve not had much communication from them either. Think you had to subscribe for updates, which I didn’t know about or do . I since emailed them to double check bank details and I got a reply confirming them, so I think all will be ok.

paul roffey says

Bruce,

I am in exactly the same position as yourself.

Genuinely I have no idea either.

Saralou says

I’m in the same position. Had an email to say claim accepted. Confirmed banking details with them. Then nothing else.

I emailed last week to double check they were in possession of my correct details and they confirmed they were. So I think you’ll be ok. They probably just don’t have the time or resources for follow up emails and updates at this time.

Fingers crossed we all hear soon.

Nic 51 says

Sorry to ask on this thread but am I too late to claim against Mr Lender for loans from 2011 through to 2014? I already have my statement from them but didn’t do anything with it

Thanks

Sara (Debt Camel) says

Not too late!

I already have my statement from them but didn’t do anything with it

Did you ask for this? or did they just send it to you?

Nic 51 says

Hi Sara

I asked for in 2017 but didn’t know what to do with it, to be honest inforgot all about it but had in the a folder in my mailbox and came across it last night. Is there a template you could suggest

Thanks

Sara (Debt Camel) says

try this https://debtcamel.co.uk/payday-loan-refunds/

Jak says

I’ve just logged it with them , couldn’t remember dates so just put in long dates from and to. I used the information provided by Sara on what to say on the email I’m in the process now of getting the information from them, so they are still accepting claims

Sara (Debt Camel) says

Mr Lender is very much still in business.

J says

Hi,

Just had a response from 118 basically saying they won’t uphold my complaint, despite the fact that I struggled to repay the first loan with then and ended up taking out a loan with everyday to pay 118 off then a further loan from 118. Amy tips of how to go back to them? Thank you

Sara (Debt Camel) says

Just send it straight to the Ombudsman. See https://debtcamel.co.uk/refunds-large-high-cost-loans/ which explains what to do. 118 won’t normally negotiate and you would probably just be wasting your time.

Chris says

I know off topic… Just a quick one I’m trying to get a loan to consolidate my debts.. My credit score isn’t the best.. Is there any advice who would be able to lend to someone with a poor credit score? Thankyou

Chris

Sara (Debt Camel) says

How about a completely flexible consolidation loan at 0% interest aimed at people with bad credit? If you situation improves you can pay more, if it gets worse you can pay less.

This is a debt management plan … talk to StepChange about it: https://www.stepchange.org/how-we-help/debt-management-plan.aspx

Commercial consolidation loans for people with bad credit are at very expensive interest rates and often turn out to be unaffordable. Do yourself a big favour and talk to StepChange who will explain how a DMP works.

Andy says

Best thing I ever did was go to StepChange, and it was actually thanks to Barclays (who I owed £££££) for putting me on to them. I went from never sleeping and fearing the phone every time it rung to paying off over £45k in debt (and 0 interest on that) over 5 years, and finally being debt free and now starting to rebuild my finances. I can’t recommend Step Change enough.

Paul says

Just wanted to say thank you for the use of your claim template.

I sent it to Lending Stream last week and have been offered and accepted a very decent refund of loans up to 10 years old! Well done Debt Camel and to be fair, well done Lending Stream.

Scott says

Hi Paul, this has caused me to to review a previous complaint to Lending stream.

Sara, one for you possibly, I had 30 loaned from LS between 2010-2017 in and amongst many loans from all the others that have been discussed above. (Am 1 of the many awaiting the casheuronet payout.)

I had sent them a mail in the past questioning whether they had done their affordability checks sufficiently. Although I had managed to pay them all back on time and some earlier than others it’s would’ve been clear that I was using other to do so. I received a mail from them stating the above and that they felt they were in the right. I wrong assumed I would get nowhere and took it no further. Do I still have the ability to question this?

Sara (Debt Camel) says

No. You should have gone to the Ombudsman within 6 months. I am sorry, 30 loans was almost certainly a very strong case.

Scott says

So the initial complaint was done via a 3rd party and I was clearly ill advised. Is it worth submitting a personal complaint and taking it down the ombudsmen route regardless.

Sara (Debt Camel) says

No. But you may have a good complaint against the useless claims company if they advised you not to proceed.

Paul says

Hi

Go back to them. I was surprised when I saw I had 22 loans! They agreed that they probably shouldn’t have done 15 of them. I was amazed the amount the agreed to refund and all done within 10 days! Get back to them and keep trying

matt says

seeing lending stream on here reminded me i had a few loans with them so sent a email a about 7 days ago to them with your template letter, had a reply yesterday offering me 1000s back ( guess i had more loans than i thought). acepted it and money paid in seconds to my account. Thanks to all here and this great site, also well done to lending stream that was so efficent and quick for a process like this.

Ryan says

I had a rejected claim against Lending Stream so I passed it over to the Financial Ombundsman just over 2 weeks ago but they haven’t even acknowledged my complaint yet. Is this normal? Thanks

Sara (Debt Camel) says

how did you send the complaint to FOS?

Ryan says

I sent the complaint through the Financial Ombundsman website. I’m guessing it’s just taking longer due to the amount of claims going in at the moment.

Sara (Debt Camel) says

and you haven’t had any acknowledgment that it was registered? That is unusual. I suggest you phone up and check they have it.

Danny carmody says

hi Ryan, just to let you know, with QQ i sent my details to the Financial Ombundsman, i had an email 6 weeks later to say they would look at my claim, then 4 months later they looked in to it, and it went my way, so in your case this can take months, not weeks, hope this is of help,

Ryan says

OK then thanks for the reply. Seems like I could be waiting a while then!

Victoria says

Hi Sara, slightly off topic, but is it possible to claim against a clearer secured loan? We borrowed a secured loan from 1st stop, on a high interest, whilst already struggling in a cycle of payday loans and missed payments. It has now been cleared, but we paid an extortionate amount. Thanks for all your help

Sara (Debt Camel) says

You can try, expect this to have to go to the Ombudsman. Only a few people have mentioned this and I don’t recall any results. Use the template here https://debtcamel.co.uk/refunds-large-high-cost-loans/.

Karl says

Has anyone heard anything about casheuronet? Starting to get nervous that it’s not going to be paid out in April

Sara (Debt Camel) says

lots of people are understandably nervous, but there a=isnt any reason to think the payout won’t be between 30p and 50p, nor that it won’t be announced soon and payments start by the end of the month.

But NO-ONE should assume they will get a payout by the end of the month. Don’t make promises based on this. It isn’t safe.

Karl says

Absolutely Sara.

Thanks for all your info.

I’m a bit desperate for this payout. I just want to see the announcement so I can sleep again!!

Robert James says

I apologise for bringing everyone down with regards to the QuickQuid payouts by referring to it’s timescale. But I am a bit anxious and excited about being significantly richer soon, hard to sleep at night sometimes. A bit like christmas eve when I was younger – up at three o’clock in morning. Not long now…

Enough said, before I put my foot in it again. And I would like to thank Sara for being understanding and informative.

Susan says

I think we are all in the same boat I keep checking here for news to. Just also want to thank Sara for the page I recently used one of your templates and got £2700 back from Mr Lender

Kudos says

Hi, understandable. However last conversation with QQ, yesterday, was told that payments are scheduled to be made by 30th, however there are no indication of % to £ yet and they can also take advantage of the 6months extension granted last month

So dont think too much / anticipate payout end of April, you will only end up being disappointed

It will come in its own time

Good luck

Rav says

I had a loan with quickquid which i paid/settled 2016 which went to FOS and was deemed miss sold, i was then issued a refund in 2019. Quickquid however edited the settlement date for this loan on my credit file to reflect a 2019 settlement date rather than the actual 2016.

I have disputed this with trasunion and failed.

raise with quickquick directly and failed due to administration.

Any idea who i should contact to have this error corrected? It will remain on my file till 2026 at this rate and i will struggle to get a mortgage.

Cheers

Sara (Debt Camel) says

If you wait another 4-6 months, you will be able to ask TransUnion to “suppress” this record as it is an error but at that point the administrators will no longer be replying to the Credi Reference agencies. See https://debtcamel.co.uk/correct-credit-records-lender-administration/

Jason says

Your Christmas analogy is a good one…However, the emails will be sent soon, with payments quite quickly thereafter.

I am at a loss as to why folk are saying that the payout wont be between 30 and 50p in the £ and that there will be a

major delay…

it is just not a reasonable assumption to make, without any basis in logic.

Tim says

Agree Jason, I would think if there was any reason why payments would not happen in April they would have said by now. The update in March was pretty straightforward.

Regarding the percentage as far as know they didn’t have to give a range so once again it would seem promising it will be between 30p -50p.

By quoting that amount it has been a positive move for me as I was expecting about 4% max. With a redress of just under £10k it should hopefully be worth the wait.

james says

the assumtions come from the fact its taken 3 years to this point, some of us have unfortunatly been waiting since we put in fos complaints, i myself are one of those who was promised payment before they went into admin in 2019….they also have under 90 million to split for 135 million in refunds, redress, there own payments and any other payments that would need to be finalised, they dropped the ball last month literally days before the pay out date saying they needed another 6 month extention…which they was granted…as sara has said multiple times DO NOT expect the payment to be made my the end of the month as it is not guarenteed

Emma says

Hi, I was just wondering with the tax that QQ could hold back would that be 20% of the final redress amount of the 8% interest? :)

Sara (Debt Camel) says

On the 8% interest. But tax deductions may well not happen.

Robert James says

Just a query on method of payment into bank by QuickQuid, when the redress comes.

Will it be BACS, fast transfer, or direct bank transfer as they have sort code and account number only, or something else?

Sara (Debt Camel) says

At a guess, BACS

charwin says

Robert James is my hero

Graham says

Well after apparently missing the original E-Mail stating my full redress amount, and after several phone calls to find this out, I, today, received an E-Mail stating that my FULL redress should be £3088 !!!!!!!!!!, Obviously I am only going to get a percentage of that, but, even at 30%, It’s still £925 !!! Considering I had forgotten all about my complaint against QQ, until checking on here for something completely different the other day, I am quite happy, nice surprise.

Paul C says

Sounds promising.

Mine is £2798.74 and would be most welcome at £839 – £1399 potentially depending on the projected 30-50% but not counting my chickens. Whatever will happen we’ll all find out within a few weeks.

My original redress email was late 2020 and then a follow up early 2021. This has gone on for a long time but fingers crossed the patience will be worth it for all of us

Em says

I have a QQ upheld claim but I still owe money to Onstride who sold my debt to Lantern. Will the claim redress pay off that balance first? Thank you!

Sara (Debt Camel) says

probably not, but you need to ask the administrators this. Was the debt that was sold one of the ones the administrators decided was unaffordable?

Em says

No it doesn’t seem to appear on the list even as rejected.

Sara (Debt Camel) says

You need to contact the administrators and ask why the Onstride loan is not on there. I suppose it may have been under a seperate account number. It is a pity you have left this very late.

Ricky Fisher says

First week of April has passed, has anyone received a payment?

Sara (Debt Camel) says

no. The first step will be to tell everyone what % they will be paid. Just look at the comments here – you will be able to spot when this has happened!

Nikki says

Hello I didn’t know about lodging a claim I was never contacted by anybody and have accidentally stumbled across this just recently.

Obviously too late to claim but I have an outstanding balance that was sold to lantern. They are still chasing the money.

Those that claimed and it was accepted are having outstanding debts wiped, is there a way to get mine wipes without the claim?

Have emailed lantern but I doubt I’ll get a response very soon from them.

Thank you!

Sara (Debt Camel) says

what are the rest of your finances like? How old is the debt that has been sold? How large? How much did you borrow and how much have you paid to it?

Nikki says

£1500 sold about 3 years ago to lantern.

I can’t remember how much I originally borrowed

Sara (Debt Camel) says

can you look back at your emails? see from your bank statements? do you know when you last made a payments to this – could it have been more than 6 years ago? Sometimes QQ waited for a very long time before selling loans.

is this your only problem debt? are you up to date on all your important bills and current debts?

This all affects what your options are and what you can say to Lantern.

Nikki says

I have the loan agreement number still I contacted grant Thornton who have said I need to contact lantern which I have done but I doubt I’m going to get a reply.

It was taken out in 2017 originally. Sold to in stride and then on to lantern. Last payment was in 2017.

Up to date on everything else.

If they are wiping the debt of those with a claim surely they should be wiping all the debts?

J says

Nikki, I am in a similar situation. QQ have advised they will write to Lantern and ask for the debt to be written off

Nikki says

Thank you my debt is with pounds to pocket and they are no longer contactable. Cash Euro net have said to contact lantern so not sure where to go now nobody is contactable 😩

J says

Couldn’t say- all I can tell you is what I have been told about mine in particular.

Do you have a redress claim against QQ?

I had 11/12 claims upheld the 12th being unpaid and now with Lantern, according to an email I have from QQ will be written off once the payouts have been made which QQ have also confirmed will be done by 30/04. QQ will get in contact with Lantern direct- apparently I don’t need to do anything.

Lantern are quite good at replying and I have sent a copy of that email to them

John says

Hi Sara,

I want to ask you , am I still able to claim for irresponsible lending even after over 6 years ago ? Many thanks

Sara (Debt Camel) says

yes, who is the lender?

John says

It was a car finance, company called MOTONOVO.

Sara (Debt Camel) says

OK, was the loan over 6 years ago? when was it repaid?

John says

Account was settled March 2016. 6 years and a month ago. Thanks

Sara (Debt Camel) says

so yes you can make a complaint.

Expect Motonovo to reject it as being over 6 years old. You can still send this to the Ombudsman to make a decision on – the Ombudsman can look at cases where someone is complaining about something that is over 6 years old if they have only found out within the last three years that they can make a complaint.

But there may not be much evidence to support your complaint unless you have (or can get) your bank statements from the time you applied for the finance? Download a copy of your current credit record – that may have a bit of information form that log ago. Do this now, don’t wait to be asked for it in a few months time when more information may have dropped off.

john says

Hi Sara,

many thanks for your help. i actually have complained to the motonovo finance and they responded below,

“As a result of you having submitted your complaint outside the regulatory time frame that we have to consider the complaint within, I will be rejecting the complaint without considering the merits of it.

I would also note that we will not be providing escalations rights to the Financial Ombudsman Service; and do not provide the Financial Ombudsman Service authorisation to review this matter, given the above rationale.”

i have also sent the complaint to the FOS, do i have any grounds? cheers

Sara (Debt Camel) says

i told you they would say that!

FOS will look at older cases. Have you got your bank statements?

John says

I m afraid , that bank account defaulted 3 years ago. And I have no access to that account anymore.

Sara (Debt Camel) says

you can still get bank statements in that situation but it takes time, so set about getting them right away. Ideally you want 3 months before and three monbths after the date the car finance started.