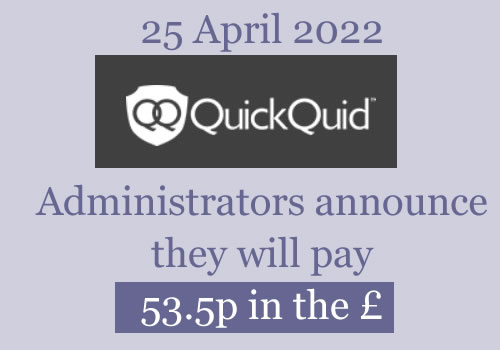

Payments – UPDATE – 25 April 2022

Administrators have started sending emails to everyone with an upheld claim telling them what they will be paid.

“The Joint Administrators are now in a position to declare a first and final dividend of 53.5p in the £”

The average claim value is c £1,700. Someone with that claim value will get a payout of about £910.

The payout details are given in the email:

- This will be paid over the next two weeks.

- If the administrators couldn’t validate your banking details, it will be sent by cheque. I don’t know how the administrators will “validate” your details.

- If you used a claims company, the money will be paid to them.

- Most people are not having any deduction for tax paid to HMRC, so there is no need to reclaim anything.

Credit records

The administrators may decide to :

– remove any negative marks on your credit record

– delete all loans that were upheld

– delete all your loans.

I don’t know what they have chosen to do – if people can check and report in the comments when they see a change, that would be great.

How much your credit score will change will depend on whether there were any negative marks. If you want to get a mortgage, you would like as many payday loans gone as possible, even if they were repaid on time and not hurting your credit score.

In a few months when the administrators no longer talk to the CRAs you can ask for any remaining loans to be “suppressed” so other lenders can’t see them. See https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do that now.

QuickQuid went into administration in October 2019

CashEuroNet (CEU), which owns the QuickQuid, Pounds To Pocket and On Stride brands, stopped giving loans and went into administration on 25 October 2019.

I will be talking about QuickQuid (QQ) rather than CashEuroNet as it is the more familiar name. Everything here also applies to loans from Cashruronet’s other brands, Pounds To Pocket and On Stride.

Grant Thornton were appointed as Administrators. They set up a page about Redress Complaints – this is their term for people who have asked for a refund because they were given unaffordable loans.

Background to the QuickQuid Administration

QuickQuid was one of the “Big Three” payday lenders in Britain, starting out in 2007.

After Wonga and the Money Shop Group had all stopped lending and gone bust over the last fifteen months, QuickQuid was left as the largest UK payday lender.

QuickQuid had well over a million customers. When it went into administration there were c. 500,000 customers with outstanding loans.

Many of these customers had prolonged borrowing from QQ. They either rolling loans over or repaid one loan but were left so short of money that they had to borrow again.

These customers have good reasons to win an affordability complaint and get a refund of the interest they paid.

Affordability complaints started on a small scale in 2015 and increased in the next few years.

In 2018, complaints going to the Financial Ombudsman (FOS) jumped with the involvement of Claims Companies and QuickQuid became the most complained about firm to FOS, excluding PPI complaints.

For a long time QQ refused to refund interest on any loans taken more than 6 years before or where the loans were given in 2015 or afterwards. This resulted in a huge backlog of claims at the Financial Ombudsman, where QQ had made very poor offers to customers and then rejected an adjudicator decision.

In late July 2019, QQ agreed to accept several thousand FOS complaints it had previously rejected.

By accepting the FOS decisions on loans over 6 years, long chains of borrowing, and loans taken after 2015, the scale of QQ’s likely future liability for refunds will have become clear to the company.

After failing to persuade the FCA that a Scheme of Arrangement was appropriate, Enova, CEU’s large and profitable US parent, decided to close the UK business, blaming the UK regulatory environment.

How could the regulators let this happen?

This is an excellent question… Stella Creasy, MP called for an inquiry into the FCA over Wonga and QuickQuid.

What has happened in the administration

Customers with a valid claim for a refund are “unsecured creditors”. This includes:

- any refunds that were in progress after an amount was agreed or a Final Decision from a FOS Ombudsman (FOS);

- complaints that were underway at QQ or FOS when QQ went under;

- any new complaints sent to the Administrators.

All complaints at FOS legally had to stop and were been passed back to the Administrators. It isn’t possible to send any new complaints to FOS.

It is now too late to submit a Claim for unaffordable lending. The last date was 14 February 2021.

The administrators have given the following statistics about claims:

- 169,000 customers made claims for unaffordable lending;

- 78,000 claims were upheld by the administrators;

- the upheld claims had a total value of £136million, so an average of about £1,700 per claim.

Still owe a balance on a QuickQuid or On Stride loan?

More than 300,000 of the current loans were sold to Lantern in summer 2021. You should have been informed if your loan was sold.

The administrators have now stopped collecting any money from the remaining unsold loans.

This page is kept updated

The comments below this article are a good place to ask any questions. And you may be able to see where someone else has already found out the answer.

Adam says

Another week gone, it’s two and a half years down the line and after at least two extensions they still haven’t said the percentage to be paid out or when that will be. Only had “anticipates, expects etc..,” They expected the money to be paid this month but that won’t happen. Please do not rely on this money next month.

Graeme says

Sara’s advice right from the get go has quite right been to never rely on this money, be that an anticipated percentage or a projected payment date. I’m not sure what you’re attempting to achieve by putting a more negative spin on that advice.

Timbouk says

Why I agree you should not rely on the money to be paid in April I do not get the negativity of your post. Yes it hasn’t be paid in March but there is only a small one month extension to this. Also as far as I am aware they were under no obligation to say they hoped payout would be between 30p-50p in the pound. Admittedly if it’s now under 30p I will be disappointed but this seems much higher than redress payments from companies such as Wonga. Hopefully in a months time we should know the percentage and have either received our redress or waiting for it to be paid.

J says

Hi can you still claim from Sunny?

Does. Anyone know if or how you can get a full list of everyone you borrowed from?

Credit report only shows last 6 years.

Thanks

Sara (Debt Camel) says

No, Sunny has passed the stage of being able to claim.

there is no way to get a complete list of everyone you borrowed fro, Your old emails or bank statements may help.

Robert James says

I’ve put a claim in on the Provident / Satsuma administration. I checked my old emails and I did manage a claim before deadline in February. I wasn’t sure because getting the password to work was a pain. Do you have an idea of what the timescale will on that administration, perhaps next year for payout?

Sara (Debt Camel) says

See the Provident page https://debtcamel.co.uk/provident-scheme-claim-refund/

Robert James says

Hi,

I see the value £135 million banded around on this forum. Is this the correct amount available to creditors? If so, when divided by 78,000 accepted claims this gives the anticipated average value of £1700 per claim. Some more, some will be less depending on your claim.

james says

no the amount available was under 90 million at the last update and there was 136 million owed in claims alone not including over payments, what the company owed and what fees the administors will take ….they are still to remove any fees and overpayments from that amount so will be less than 50%.

james says

so for every 1700 owed they will pay a maximum of 850 IF they do not take the 20% tax from the 8% interest

Robert James says

I believe from posts above there’ll no tax on the 8 % interest.

Sara (Debt Camel) says

This is not known at the moment.

Robert James says

Hooray! I’ve found my Grant Thornton portal password & login details. It was under an old unused email address which I switched the account from because it was unreliable. Now, today Windows mail decided to download over 1000 thousand emails from the old account and there it was at the bottom.

I’ve now registered my new email with the site, so should get instant updates rather than through the grapevine.

Another interesting point is there were emails for two previous administrations that showed I get my pittance of a payout with 18 months of applying for them.

Don’t know why this one is going on 3 years. Imagine the fees!? A fixed term/price contract would’ve achieved quicker results.

Dan says

Didn’t know there was such a thing. How did you log on? I have looked at it and clicked “forgotten password” but it’s not even sending me a link to be able to log on.

Robert James says

CashEuro@claims , should’ve sent an email on 21st May, 2021 with the GT portal login & password. When logged on you can register your email for updates.

Danny carmody says

hi Dan, l think you only had a short time, to log on the this email site, you could ask sara for some help on this, or just wait, hope this will all end very soon,

Robert James says

Oh well, GT have got six weeks to wrap this up and pay everyone, so I’m hoping for some news this week?!

james says

they have 6 months from the 14th march to finish paying us and finalise the administration…they have only advised that we would be paid by the 30th and this is not a court ordered date. as sara advised do not make any plans on the money arriving by these dates as it is not guaranteed

Danny carmody says

the bet thing to do now, wait for that email with that % and the amount we will get, we all will get one each, this will be the next update that we are waiting for, this should been any time now hope the first week in april,, then the payments by end of april, the payments will be in block payments, so you watch this site and you will see when it will all kick off, but if you dont get the main email, check your bin file as it may go there, best of luck

J says

Hi does anyone have a link for the provident claims thanks

Sara (Debt Camel) says

if you haven’t already made a claim to Provident, it is now too late.

See https://debtcamel.co.uk/provident-scheme-claim-refund/

J says

Hi I do already have a claim but can’t log in to their portal

Thanks

dm says

Am gutted am not getting anything this month and like many am on the long road of trying to fix a decade of being trapped in the payday loan cycle with 16 + lenders (all started with a £250 loan from payday Uk) . However at least GT a) looked at loans beyond the six years b) the statutory interest calculation I never would of received as savings interest as had no money and savings rates for the last ten years has been less than 0.5% and c) 5-7 % would have been my original expected outcome based on other administrations so if (and I hope) we get 30% and more hopefully don’t have to take an additional 20% deduction for tax cannot say this would be an unfair outcome in comparison to other payday lenders but only wished I had taken the advice from Sara / other sites and got help sooner. Then addressed my circumstances rather than burying my head in the sand looking for short term fixes to get my life back on track. Thankfully through this website have managed to claw back redress to offset against other debts but more importantly get many thousands cleared from outstanding balances and negative marks / defaults removed. Thanks Sara x

Emma Crideford says

Like everyone on here still waiting for an update on when the payment will be made but thankfully not replying on the money coming in anytime soon. If it comes in April that will be a bonus. Does anyone know if you can still claim against Swift Sterling as I’ve put in a complaint and not heard anything? Thanks

Sara (Debt Camel) says

No. if your loans were before December 2015, they were from a Malta-based lender and it is now too late to make claims in Malta about these old loans. Swift Sterling loans from 2016 onwards these loans were from a UK lender where it is too late to make a claim in administration.

Lindsey says

Is it to late to get a redress from sunny loans. I had payday loans from 2016.

Sara (Debt Camel) says

yes.

But if any still remain on your credit record, you can get them removed, see https://debtcamel.co.uk/correct-credit-records-lender-administration/

Carlo says

Hi sara.my question isnt concerning QQ but safetynet.i recently had a affordability complaint rejected as i had done one in 2020 which i couldnt remember doing. Is it possible to bring my case to the ombudsman if i think they are wrong? I have a spreadsheet of my loan history with them showing borrowing interest and frequency. I can show you if u think i have a chance..

Kind regards

Carlo

Sara (Debt Camel) says

DO you think you did complain before?

After that complaint was rejected, have you continued to borrow from them?

Carlo says

Yes i do think i have complained but i will double check. Sorry to bombard you with questions but i also have another loan with Myjar which totals nearly £4000. I understand that they are going into administration so should i even start paying them some money back? Tbh i havent paid them a penny and its been over 3 years and was wondering could i poss get compensation from them also?

I also had a loan with Satsuma of £900 which they have written off because they had gone bust also. Could i alao get a refund even though they wrote off my balance?

Thanks again Sara

Sara (Debt Camel) says

Myjar – you can still make a complaint but be quick – send complaints to myjar@harrisons.uk.com with CLAIM as the subject. The aim here isnt to get any money back (you haven’t paid any interest by the sound of it so there is nothing to refund) but to reduce the amount you owe…

Satsuma – the deadline for making a claim was the end of february.

Al says

Thanks for this Sara, I didn’t even know they had gone under. I sent your template and received this back,

Good Afternoon,

Thankyou for contacting us.

We can confirm your email has now been passed onto our dedicated complaints team.

They will investigate your complaint and account further.

Please kindly note that this can take up to 8 weeks.

Chris C says

Just received this today after checking my bank details. Not sure if it’s an error, but clearly states end of March?

At this time our Joint Administrators anticipate that payment details and payouts will be made by the end of March. The exact payout amounts are yet to be released. Please continue to monitor your email.

Updates will be provided as they become available and will be forwarded to all creditors. We appreciate your patience.

Yours sincerely,

For and on behalf of CashEuroNet UK, LLC

The Joint Administrators

Sara (Debt Camel) says

looks like an error!

Chris C says

I thought so to Sara. Have replied asking for clarification

Chris C says

Just to confirm that the March commitment email was sent to me in error and they resent the generic email saying end of April again.

paul says

More evidence they don’t know what they re doing I got this

Hi Paul,

The Joint Administrators are aiming to make the dividend payment by end of April.

Whilst there remain a number of material matters to conclude in relation to the Administration, the Joint Administrators anticipate there to be a dividend to unsecured creditors in the range of 30p to 50p in the £.

“For example, if your accepted claim was for £100 you can expect to receive between £30 to £50 as your dividend payment.”

That’s three different answers to three different people in one day lol

So is it the HMRC or a number of ‘material matters’ ??

Mark says

They have told everyone the exact same thing.

30 to 50p in the £, paid by the end of April.

Julie says

This is what I received yesterday after Thank you for contacting CashEuroNet UK, LLC.

In regards to your query, the Joint Administrators have provided an update to inform you that, due to delays in obtaining HMRC clearance (the clearance application was submitted in October 2021), we have had to apply to court to extend the date for the payment of the dividend by 6 months from 14 March 2022, the previous deadline set by the court for the payment of the dividend. The administrators require the HMRC tax clearance in order to calculate the dividend payable on all admitted creditor claims.

We have now received the clearance we require and are working to declare the dividend and make the payment as soon as possible. We now expect to pay the dividend to all creditors by 30 April 2022.

Updates will be provided as they become available and will be forwarded to all creditors. We appreciate your patience.

Yours sincerely,

Pam

For and on behalf of CashEuroNet UK, LLC

The Joint Administrators

james says

theyve been sending that one out since the 3rd of march, no updates since then when we was told they had been granted 6 more months to finalise paying everyone and finish up the administration

Sara (Debt Camel) says

There is no sign that this will happen.

Kizzy says

I got this reply this afternoon.

Thank you for contacting CashEuroNet UK, LLC.

In regards to your query, at this time we do not have an exact amount or date as to when payments will be made. We now expect to pay the dividend to all creditors by 30 April 2022.

Updates will be provided as they become available and will be forwarded to all creditors. Updates will include all information regarding your payment such as tax information. We appreciate your patience.

Yours sincerely,

Pam

For and on behalf of CashEuroNet UK, LLC

The Joint Administrators

Mark says

I would suggest patience, as whether we get paid in April, May or June there’s nothing we can do about it. Trying to second guess and decipher wording in emails from the administrators is pointless tbh. Whenever we end up getting paid we’re on the home straight now so see that as a positive and thank your lucky stars that you don’t live in a country being mercilessly bombed by a tyrant.

ClaireR says

Very well said.

It’s not just all of us that will be glad when it’s over, I’m sure Sara can’t wait too and will stop having to reply to the same comments over and over again.

Patience.

Dom says

Spot on that mark.

USHA DABYCHARUN says

Very true! It’s the weight of the wait for me. Can’t wait to get paid (anything is a bonus for me at this point) but can’t wait till it’s all over!!

Mark says

I’d say that all these companies were/are tyrants. I’m not sure I follow that comment. They played on many peoples difficulties.

Graeme says

I follow that comment fine, they’re saying there’s worse thing happening in the world than us having to wait one more month for a payout, or are you totally unaware of what’s happening in Ukraine right now?

Noel mccready says

Totally agree with u.Patience its money I wasn’t expecting. No point in harassing administrators for another 5 weeks at least. We will be told what payout we will be getting soon.

mark brooks says

well said, Noel

Dan says

Hi all. I can’t get into my Grant Thornton portal. Quickquid have emailed me the log on details for it but still fails. Also not received ANY contact since my claim was accepted (apart from replies to emails).

Could I just ask for anyone to reply to this with news if/when they get any more emails or information.

Thank you

Sara (Debt Camel) says

just pop back to this page every few days.

Tom says

Unreal Sara – made a claim to Piggy Bank through your templates for loans I took out 8 years ago in 2014 – 2017. 750 quid paid as redress within 5 days of the initial email. Thank you for the template! I have done the same with Vanquis. Makes waiting for the QuickQuid PayOut a lot more bearable.

Sophie says

Well done , the greedy little pigs won’t play ball with me at all even though I had several loans , can’t get anywhere with lending stream either , even though I had several with them often 3 or 4 together! Like everyone waiting on QQ payout and then draw a line under the whole sorry mess

Sara (Debt Camel) says

Send the rejected complaints straight to the Financial Ombudsman! Just because other people have got ok refunds directly doesn’t mean the lender was right to reject yours.

Sophie says

Thanks Sarah il give them a go

Aeron says

Hi Sara, are piggy bank not in administration? Is there any update on the redress claims do you know? Just that i have an accepted claim and have been waiting years but Tom mentions above he has put in a claim and had a payment. Thanks

Graham says

Wow, well done. Can I ask when you submitted your affordability complaint? I did last February, which they accepted for all 12 loans but I’ve yet to receive payment. Presumed everyone was waiting for redress payments until administration had finished.

JJ says

What do you mean paid?? Are you just one of the unsecured creditors or have you actually reaceived money 😀

Mark S says

Hi Tom, when did you make the Piggy Bank claim? Piggy Bank is currently in administration and all successful claims are now classed as creditors similar to Quickquid

Sara (Debt Camel) says

If you would like something positive to do think about whether you can make any other affordability complaints!

After I posted this, people have reported getting refunds from Lending Stream, Safetynet Credit and Piggy Bank! And complaints going in to Vanquis, car finance, and bank overdrafts.

I have template letters for different sorts of borrowing, it’s not just payday loans any more…

– SafetyNet Credit, Drafty – the payday loan template works well for these complaints which are often easy to win as the lender could see your bank account! https://debtcamel.co.uk/payday-loan-refunds/

– credit card or catalogue limit raised too high when you were only making minimum payments? See https://debtcamel.co.uk/refunds-catalogue-credit-card/

– have you been in your overdraft for all or almost all of the month for years? See https://debtcamel.co.uk/get-refund-overdraft/

– large loans and car finance: https://debtcamel.co.uk/refunds-large-high-cost-loans/

Chris says

Hi S

Yes was car finance with Blackhorse, and I made the complaint about 3 months before the end of the contract. A bit of advice in advance, Blackhorse are the uncooperative company I have ever dealt with, it took me months to get a reply and writing to them I found was the way by record deliveries..Personally I would make the complaint as soon as you can.

Regards

Chris

Noel mccready says

Black Horse denied I existed but I used a claims company to check. Which cost me 2000 as they are allowed to charge 30 per cent of ure claim. Did not want to do this but Black Horse fecked me about.claims company had my PPI money 8 grand within a few weeks but ad I said I had to pay them 2grand for doing so.

Sara (Debt Camel) says

There is NO reason to use a claims company for affordability complaints.

Noel mccready says

Know regarding but when u don’t exist there was no other option anyhow ppi dead and gone and I see black horse haven’t dhanged

Robert James says

Hi,

Any further updates on the ‘material matters’ that’s holding up the Quickquid redress payments?

It’s getting a bit late now, with barely 5 weeks to do the emails followed by payments in batches.

We were told once tax clearance is granted there should be an open road.

james says

they have been granted 6 months from the 14th march to finalise paying everyone and finish winding down the administration. the 30th of april is only a suggested date and as sara has advised do not make any plans on the money arriving by the dates given

Mark says

After reading a comment about likely loans on Saturday I sent them a short email, got a reply on Monday morning £630 refund within 10days and credit file updated.

Thanks to whoever made the comment.

Alan says

I submitted a claim on Monday and got a reply stating that the investigation had been opened, so fingers crossed!

Kelly says

Hi, I have done the same. Can I check with you, did you get your response via email or did they write to you?

Kay says

Likely loans responded to my claim by email the next day to say they would investigate. Within 7 days they accepted the claim and within 10 days of my original email the refund was in my bank so very quick response.

Kay says

The correct email for Likely Loan complaints is complaints@oakbrookfinance.co.uk. check you sent it to the right place

Mark says

Hi my claim was accepted within 48hrs, payout due was £630 to be paid within 10 days.

4 days later I received another email saying they had made a mistake and the payout will be £1277.

2 line email well worth it.

eddie says

Hi Mark,

what were you complaining about? Ill do the same

Graham says

Crikey, some positive news about Likely Loans. Well done.

I claimed about four loans with them, all of which taken out at times when I had multiple payday loans. They rejected my claims and even suggested they found no evidence of payday loans on my file during their investigation. They were there in plain sight. Wrote to FOS last June. Was advised at Christmas the FOS upheld my complaint, confusingly since it’s gone back and forth. Still being asked to supply bank statements etc now.

Anyone any idea how long the process is likely to take with the FOS? Or what length of time Likely Loans have to respond should the FOS uphold my complaint? (again?!)

Bruce says

I’ve not received an email since 21/05/2021. Why is that?

james says

you will have had to register for updates within the portal to receive the update emails….although they are only the same as what is posted on there gt administration page such as the 6 month updates…these emails do not affect the outcome of your claim so dont be worried about not receiving them

Danny carmody says

hi Bruce, if your talking about QQ, admin Grant thorinton had a portal open last year for email updates, this is now closed, you will get your own email from QQ next month showing the % and your own redress amount that you will get by end of next month hope this is of help

Robert James says

Is that the portal where you register for emails update? I registered last week after finding the login & password hidden away in my emails.

So if they’ve just closed it, that’s a good sign. They must be preparing for bombarding our bank accounts with copious amounts of cash.

paul says

Haha love the positive thinking….

It’s the dangling of the carrot they’ve done now almost 12months that’s irritating.

And the worst thing about any administrators is there is nothing or nobody they answer too. These are worse than the lenders if you ask me, preying on companies etc that have to liquidate and make millions out of it.

Chris Lavertys ‘bonus’ at the end of it will be the biggest payment

Robert James says

I would have thought there was an overseer independent of the administrators checking that they are doing everything as quickly as efficiently as possible with no back room dealings. £90 million in the pot is a lot of money to go to us ‘plebs’ , which I get the feeling is how they see us.

I think the judge should’ve asked why they weren’t prepared for a tax clearance delay, etc and issued a penalty clause to encourage them to pay up. A good penalty clause would’ve been that they get no fees after a certain date, they’ve had enough money already. Possibly even a refund of fees.

Sara (Debt Camel) says

There is no overseer of administrators. The judge does not look at these things.

Sarah says

Hi whilst also waiting on QQ thank you for all the helpful info. Ive had vanquis and aqua cards should I write to them I feel cheeky as I applied to them my children are disabled so I cant work as im their carer, but I paid minimum payments for years but never late or missed?

Sara (Debt Camel) says

did they increase your credit limit during this time?

Ssrah says

Yes several times.

Sara (Debt Camel) says

then that is worth a complaint: https://debtcamel.co.uk/refunds-catalogue-credit-card/. Dont be surprised if they reject the complaint – send it straight to the Ombudsman, it’s easy as that article explains.

Sarah says

Fab thank you so much

jacqui says

Hi can I just ask – is anyone else waiting on a 247 money box redress claim – my claim has been accepted and their latest update says they have gone in to liquidation and payments should now go ahead in March? is that still correct

Also I’ve never actually been told my claim amount has anyone else? just got told claim was accepted

Sara (Debt Camel) says

Best place to ask is the main payday loan page: https://debtcamel.co.uk/payday-loan-refunds/

Paul says

Yes, I am waiting too.

As I undertsand it, they have made an appeal for creditors to register a claim by March 30th ( this is not people who had loans with them I think – these claims are already in the system – it is other businesses/individuals they owe money to ) and then they will will dish out a few pennies to everyone in April.

I am not expecting much at all from 247MB. If I am lucky enough to buy a takeaway maybe.

On a brighter note I fell out with SafetyNet Credit a while back as they refused to re-open my account due to “my previous borrowing patterns with them”. That made me think that they were almost admitting that they shouldn’t have lent to me previously and in a fit of rage at being declined I registered a claim against them. Within weeks I had a £10K refund. So alls well that ends well with that one.

Lea says

Do they stop looking into claims after a certain time frame

Sara (Debt Camel) says

who, QuickQuid?

Lea says

Sorry no Vanquis

Sara (Debt Camel) says

Vanquid will normally reject a complaint if the limit increase was over 6 years ago. Actually they often reject good ones in the last 6 years. Just send your complaint to the ombudsman.

See Tim’s question here and my reply: https://debtcamel.co.uk/refunds-catalogue-credit-card/comment-page-31/#comment-475666

It’s best to ask more questions about Vanquis on that page as they are more likely to be answered by people who are making claims against Vanquis.

J says

Hi, also off topic but does anyone have any experience and successfully won their Affordability complaints? I have had two lenders come back saying my complaint wasn’t upheld as they did their credit checks and that was their final response.

Many thanks

Sara (Debt Camel) says

who are the lenders and cab you say something about each complaint? Some reject most complaints, however good. So you may just need to send it to the ombudsman.

Jo says

I had 2 companies say that and when it went to the FOS they admitted fault and did not perform any checks. Go all the way with the complaint, all they can say again is no but it’s worth the chance of them upholding. Good luck to you xox

Robert Gough says

Hello, I won a massive one against Moneybarn for unaffordable Car Finance for £14,000. They also used the we did credit check and asked for Bank Statements excuse, however the Ombudsman awarded in my favour and a full refund of the £14,000 as they may have checked my credit rating and bank statements but they only used that data to validate my Income, They never actually looked at the content. The Ombudsman said you could see returned fees and unexpected unauthorised overdraft fees on the statements which shows I was clearly not managing my finances well. Plus my most recent default was just a couple of months before the agreement. Its deffo worth using this argument, Just cause the ask for copies doesn’t mean that actually looked at the detail

Darren says

Hi Sara

Many , many thanks for all your advice here; i used your template recently for a message to Moneyboat, whom i have no outstanding debt to. They put a default against me for only £240 two years ago despite my agreeing to pay the amount o/s in full in a process of mediation to rule out a ccj they tried to place on me for it.

They’ve come back within 3 days with a “final offer” of a refund of interest over £400 but no recognition of my request (as per your template) to remedy my credit file. For me, it is the default more than anything else i object to! Is it correct/fair of me to expect them to put that right and i should go back with that, or do i at least accept the compensatory amount? Thanks in advance.

Sara (Debt Camel) says

Say you will accept the offer if the default is removed, otherwise you are sending the complaint to the ombudsman.

Emma Crideford says

Hi, do you know if you can claim from Catalgue companies such as Very for constantly putting your credit limit up before checking with you? Thanks

Sara (Debt Camel) says

yes you can – read https://debtcamel.co.uk/refunds-catalogue-credit-card/ and use the template letter in that link. Any further questions are best asked on that page.

Sue says

My claim with Quick Quid was partially upheld for £4,360 I know I won’t get that but 30p – 50p will still give me something back. I just wondered what amount others claims were?

Daniel says

Mine a few quid short of 7000

Hazel says

Mines was £10800 so fingers crossed

James says

Mines, and I’m rather ashamed to admit, is £23.5k

Mark says

Mines £4.5k. You shouldn’t be ashamed mate. None of us should be.

Lisa Smith says

Mine is around £7.5k

Michael says

Mine was around £1,800 so if at current we go for 30% – 50% that’s a good 1/3 if not 1/2 still good for me though

N says

Mine was £16k so getting 30-50p in every £ is great news, was only expecting about £800 back originally! I’m not believing or relying on it until it’s sat in my bank though!

Slowpoke says

Mine was partially accepted for an accepted claim value of £4,553

VH says

Mine is £4,444. Hoping for some news in the next week or so *crosses fingers*

Phil says

Mine is around £9,700

Jamie says

I have no idea what mines is as they sent it in an attachment / link to Zendesk which says ‘help centre closed’

Despite numerous emails and calls they still won’t tell me the value of my claim. All i know is that i have one and that it has been accepted.

Robert James says

Oh well, with all those high payouts the percentage is going to drop significantly, not enough money in the pot. Mine is only £5230, which is same as someone will get with 30 % of £17K. There may ending up being a sliding decreasing scale on percentages as they go higher, so people lower on scale get a better payout. Remember the phrase’ material matters’!!!??? On the other hand the high rollers may be outweighed by loads of vastly smaller values, hopefully to balance things out.

I think the administrators should have kept their mouths shut about percentages till they’ve actually got confirmation. A lot a hopes will probably be shattered with an associated cost society to clear up the mess and a further strain on overstretched services.

Sara (Debt Camel) says

There may ending up being a sliding decreasing scale on percentages as they go higher, so people lower on scale get a better payout.

No this will never happen.

All unsecured creditors will get the same % payout.

Robert James says

So this may reduce percentages to 10 % if these high rollers are significant. So someone at the bottom will probably get sod-all of sod-all, whilst someone at the top would be laughing. A microcosm of the capitalist world. A sliding scale would be fairer and more democratic, rather similar to a fairer taxation system.

Sara (Debt Camel) says

No this is totally wrong. The administrators knew what all the claims added up to when they estimated the payout at 30-50p.

Of course many of the people who post on here are expecting large amounts – they are the ones who are most looking forward to getting the money. That doesn’t mean they are typical of all the claims.

And someone “at the bottom” is there because they were lucky and didn’t get drawn too deeply into the payday loan trap. That doesn’t mean they need to repayment more than someone who is owed a lot of redress.

AN says

So if the administrator knows what the claim values total is , and know the total pot of money collected..why aren’t they informing people of the percentage redress and starting payouts ?

It was previously said that 90 million would not make much interest with another month delay .. but this is on top of the previous 6 month delay … so where is all the interest accrued actually going ?

With savers interest rates increasing … it makes business sense for them to take the full 6 months delay and cream off a tidy sum .

After all , there is no one scrutinising them !!

Sara (Debt Camel) says

Because they may know pretty closely what the total values are but both have to be EXACT before they can finalise this payment.

With savers interest rates increasing … it makes business sense for them to take the full 6 months delay and cream off a tidy sum .

They get little or no interest on this sort of account and any interest is treated as increasing the pot to be distributed.

The administrators make NO money from interest by delaying thisng. I will delete any further comments on this subject.

Richard says

Stop bringing people down Robert, your speculating isn’t helpful and has no basis in fact or knowledge of the system. This page run by Sarah is a great help to many people caught by the cycle of debt and are now optimistic about getting a redress. The administrators would have done at least the rough calculations to announce 30-50p there’s no sliding scale.

CS says

This comment makes zero sense, I don’t see how giving someone owed a smaller amount a higher percentage is fair? Surely that’s unfair on the person owed the larger amount? As for the comment about the “high rollers” making the percentage lower, (which has not once been indicated to be happening). This would also mean that they too get a lower percentage not just the people with lower claims values so why would they be laughing about it?

Graeme says

The size of the pot is the size of the pot. All claims were sorted out before the estimated figure was given of 30-50%, individual claims are not the source of any fluctuation in that figure – there are other creditors and administration costs to factor, but there is no reason to doubt the percentage we’ve been given as yet.

J says

Hi to those that have been successful in their Affordability claims to other lenders; would anyone be willing to share a copy of their complaint letter/ email they wrote to help others like myself please?

Not having much success!

Sara (Debt Camel) says

What sort of debts?

The template letters on my pages work fine, there is generally no “magic phrase” that will guarantee a lender accepts your complaint. But if they reject it (or make a poor offer0 just send it straight to the Financial Ombudsman! Many lenders often reject very good complaints, writing a rejection that might look impressive but is actually irrelevant or wrong or misses the point…

Paul says

With the flurry of comments about claims is there any new info ?

Sara (Debt Camel) says

No

J says

Hi Sara, they are made up of a few payday loans.

Safety net just don’t seem to respond. And I had cards with Capital one, ocean and vanquish

Thanks

Sara (Debt Camel) says

how long ago did you email Safetynet Credit?

Cards – if the increased your credit limit to an unmanageable level when you were only making minimum payments, read https://debtcamel.co.uk/refunds-catalogue-credit-card/ which has a template for these complaints.

ROBERT says

complaints@safetynetmail.co.uk is the email I used successfully last year.

Daniel says

Has anybody had a successful complaint against Lending Stream?

If yes, can I ask how long it took.

Thank you

Sara (Debt Camel) says

it’s pretty quick now – and they do make OK offers if you have borrowed quite a few times from them.

Deb says

I wish they had with me! They refused my claim even though I had numerous loans with them and other payday lenders so I sent it to the FOC who also said there was no grounds for a redress. They were my biggest loans I took out and I got a CCJ. I always remember this company as the one that got away with it :(

Sara (Debt Camel) says

you lost a FOS complaint against Lending Stream? That’s unusual. Did you take it to the second Ombudsman level?

Deb says

No I didn’t know there was a second level and this was about two years ago now, I just thought thst my claim was over

Sara (Debt Camel) says

that is a shame, you would have been told you could ask for an ombudsman to look at it. But it is now too late.

Rosy says

Hello All,

I was wondering if anyone can help how do I make an unaffordable claim against very & littlewoods it’s dating back nearly 10 years ago would I be able to make a claim?

Does anyone have the the details as to where to send the claim

For both very & littlewoods.

Thank you

Sara (Debt Camel) says

See https://debtcamel.co.uk/refunds-catalogue-credit-card/ which looks at these claims and ask any questions below that page.

RC says

Sara,

When desperate some years ago, I submitted unaffordable lending complaint to them. The offered me £100. Naively I accepted, but I borrowed from them twice as much as QQ and my QQ redress claims is over 8k, so assume lending stream would have been higher. As I accepted the terrible £100 offer, am I prevented from going back to them?

Sara (Debt Camel) says

yes. Sorry but those are the rules.

Sarah S says

Did you get an email from them some time later apologising for them not advising that you could escalate to the Ombudsman?

I did exactly the same as you and I had 53 loans in total with them over 18 months.

When they sent me an email to say that they did not include the ombudsman information I rang and said does that mean I can now send to the ombudsman even though I accepted the paltry offer and they said NO because 6 months had passed. I wish I had have tried now because if they had have included this information I would have escalated it, but at the time didn’t have a clue about the FOS and just thought that was that .

Sara (Debt Camel) says

That isn’t right. If they did not inform you you had the right to go to the Ombudsman you can go.

Patrick says

Sara I made a complaint against lending stream a few years ago when complaints for irresponsible lending wasn’t popular and they upheld my complaint and I just accepted it, now knowing the way things have changed regarding to irresponsible lending is there anything I can do, can you make a second complaint?

Sara (Debt Camel) says

sorry no, you should have gone to the Ombudsman then.

Unless you borrowed from them again after the first complaint?

Dave K says

Hi. I made a complaint a few weeks ago and it took just over a week to get sorted from complaint to payment.

William says

Yes. My redress was settled within 7 days of me sending the letter. Was very quick. No hassle. Sent the letter they upheld and money was in my account within 2hrs of md accepting the redress

J says

I have been told that 11/12 of my redress complaints with QQ have been upheld- how do I find out, or can I find out how much I borrowed?

I have one unpaid that is with lantern- does anyone know what will happen to this one?

Thanks

paul says

‘Please be assured that the Joint Administrators are aiming to make the dividend payment to all creditors by the end of next month. In order to make the payment we have to ensure that the position with regards to asset realisations and future costs is crystallised. Obtaining tax clearance from HMRC has been a material factor in this.

As detailed in our most recent Progress Report, the expected dividend range is between 30p to 50p in the £. All creditors will be updated before the payment is made.’

Tim says

Is this an update from the portal?

Daniel says

I wish I could get onto the portal. Never got details of it

Na says

Is it too late to make claims against places like satsuma and safety net? If not, how do we do this

Sara (Debt Camel) says

Satsuma too late – the Provident claims process closed in February.

Safetynet credit – you can still make claims, they aren’t in administration and they can be one of the easiest lenders to win a claim against as they could see your bank account so they know when you were in trouble… Use the template here https://debtcamel.co.uk/payday-loan-refunds/ and if they make you an offer which is too low, ask in the comment on that page, as they often make poor offers or reject good claims – they are losing a LOT of cases at the Ombudsman.

Any other high cost lenders? Has a credit card or catalogue increased your limit too high? Are you permanently in your overdraft?

N says

Thankyou. Yep always in overdraft. I have ko other debts. This was silly young me haha

Sara (Debt Camel) says

then read https://debtcamel.co.uk/get-refund-overdraft/ and think if you may be able to make an affordabilty complaint about your overdraft

N says

Do i just use the complaint email sara? Not sure what to wrote lol x

Sara (Debt Camel) says

to complain about

– SNC use template here https://debtcamel.co.uk/payday-loan-refunds/

– overdraft use template here https://debtcamel.co.uk/get-refund-overdraft/

Craig says

I have a claim upheld for £2000 with a mixture of QQ and pound2pockets but at the high end I will expect £1000 and £600 at the lowest.

Has anyone received their money yet or will these all be done in one batch when the administrators decide?

We have been waiting so long, I know it is only one month to go but you would think they would give us a confirmed payout date, a note to say by the end of April is I suppose the best they can do. It is almost like the resent the fact they need to pay us back.

Sara (Debt Camel) says

no one has been paid or been told what they will be paid.

What will happen is:

1) first everyone will be told the % they will be paid

2) then people will then be paid in batches. This will be at random, not based on your name, size of claim, when you made it, your bank, favourite colour or anything else. You won’t be told which batch you are in.

Craig says

Thanks for the info Sara! I will keep an eye on their emails.

Gavin says

Realistically, when can we expect to be told the percentage, and what will be the timeframe approximately between that and first payment rollout?

Sara (Debt Camel) says

there really isn’t much point in me guessing.

Danny carmody says

details of % and what you will get, is due any time next month and up to the 31st, it just a waiting game now, just keep looking for the main email, we should all get this at the same time,, or just check Sara site here and you will see lots of messages when it starts,

An says

Be gutted if they say payout will be 31st April :))

Sara (Debt Camel) says

you should not rely on the money arriving at any point. Even when payments start, some go wrong and have to be rescheduled for later.

Tracey says

There’s only 30 days in April so hoping for an email with % value anyday from 1st April

Nick says

Sara I have used Safetynet for a long time and they have recently migrated me to Tappily with a lower interest rate and I currently have an account in use with them. Should I still go ahead and claim to safetynet do you think?

Sara (Debt Camel) says

Yes. you should be able to get a refund for the time with Safetynet. Hopefully that may clear your account so you don’t have to use Tappily either – also expensive!

J says

Hi,

I was just wondering how the 30p-50p per pound will be determined?

Thanks

Sara (Debt Camel) says

They add up the total money to be distributed. Then they divide that by the total of all the redress amounts that should be paid.

eg if the total money they have is 800 and the total amount to be distributed is 2000, the percentage everyone gets is 40%

Steph says

Hi, just wanted to reiterate the thanks to whoever added a comment on this thread about likely loans – I sent an email last week (copied what they said they wrote so only a couple of lines!) and got an email to say it was being investigated & today they offered a refund of £970 which I have accepted! They advise it will be within me within 10 days!

Thank you!

Mark says

Do you have an email address for them? I’ve used the one on here and I’ve never had response.

Kay says

Send your email to complaints@oakbrookfinance.co.uk

Very quick response. Good luck

Antony Parker says

Hi Steph

What was it that you wrote?

I had a 4k loan with them and I’m going through the process of complaining to a lot of my previous lenders.

Thanks in advance

Sara (Debt Camel) says

She probably used the template here for complaints about large loans: https://debtcamel.co.uk/refunds-large-high-cost-loans/

Are there any other types of debt you want to complain about?

Steph says

Hi Antony,

I just kept it short (think I copied what the original poster on here said!) and said:

‘Dear sir/madam,

I am making a review of my past finances and wish to make an affordability complaint about a loan I took out with yourselves when I was in extreme debt & using loans/credit cards just to support my everyday living costs. Would you please let me know how to start this process and send any forms I need to complete?’

And that’s it!

Big thanks to Sara too – I have followed this site for a couple of years now & it’s brilliant for guidance/news!

Craig says

Has anyone been able to make a successful claim against 118 118 Money?

Sara (Debt Camel) says

Lots of people!

See the template on this page https://debtcamel.co.uk/refunds-large-high-cost-loans/ and the comments below that article are the best place to ask questions about 118.

Craig says

Thanks Sara :)

Robert James says

My complaint to Loans2GO is now being officially under investigation. Perhaps my written ‘The Guv’nor’ diplomacy worked or perhaps Loans2Go have had a lot of complaints and fear the rug being pulled from under them. You never know I may get a surprise in the bank in 2 weeks

Hazel says

I took my complaint to ombudsman after loans to go rejected my complaint and won , money was in my account after one week

dawn wright says

I have just been going through the lenders I used that haven’t gone bust and sending some emails (all my complaints with the lenders that have gone bust have all been upheld) – I had loans with Mr Lender and have now emailed them but going through my old emails I realised I raised this with them back in 2019 and they said they were investigating and then received nothing further – would my complaint now have timed out

TIA

Sara (Debt Camel) says

if they never sent you a final response, then that is there fault and they now need to do this.

If they did send you a final response and you didn’t take it to the Ombudsman, this is now too late.

dawn wright says

thank you for your reply Sara – luckily I didnt get a final response just that they were investigating

dawn wright says

the plot thickens – Mr Lender has now advised they sent me a letter via post in 2019 declining my complaint and have emailed me a copy but I find this a bit strange as other lenders have always contacted me via email – does anyone else have any experience with Mr Lender and did they send letters out.

I am sure I did not receive any letter from them as I cant remember getting any letter from any payday letter on any query – was always done via email but how would I prove this

TIA

Sara (Debt Camel) says

Yes they sometimes sent letters. I suggest you reply you never received it and ask why you were not informed by email as that was the way you made your complaint.

dawn wright says

Hi – have already done that and asked them if they sent any further/follow up emails – thank you for all your advise – from what I have read Lending stream decline most of their complaints – so will try and take it to the ombudsman

Richard says

Hi,

I have seen recent posts regarding myJar, went into DMP because of them and not very responsive at the time to the DMP administrators. However, that was all +6 years ago. Do I have a valid claim as I was paying loans in full and then agreeing a new loan within days of settling the original loan? My debit card payment probably took longer to process than the new loan agreement…

Sara (Debt Camel) says

yes but you need to make a claim rapidly to the administrators. Send a very brief complaint to myjar@harrisons.uk.com with CLAIM as the subject.

Ben Morgan says

Evening has anyone had a affordability complaint against 118 money whilst waiting I’ve tried other lendings lendingstream point blank said no myjar are currently looking at every loan taken out and will contact me if successful however 118 money I took out a loan for 2.5k they asked me for if I wanted more so I went for 3k they agreed without any hesitation at the current time I had 30k in loans and finance etc which I’ve explained just wondered of anyone else has done the same and got anything back thanks

Sara (Debt Camel) says

how many loans did you have from Lending Stream?

lots of people win complaints against 118 but many have to go to the Ombudsman as 118 rejects them. This isnt a fast process but you have nothing to lose and could get a large amount back! Use the template here: https://debtcamel.co.uk/refunds-large-high-cost-loans/

Melissa says

Hey. I’ve had this response today from them, if it helps anyone then great:

Thank you for contacting CashEuroNet UK, LLC.

The Joint Administrators expect to pay the dividend to all creditors by the 30 April 2022. The exact payout amounts are yet to be released. We do apologise, we do not have an exact time frame of when you will receive this notification however, it should be soon.

Please continue to monitor your email.

Tony Wilson says

Have just called as i could not remember what my original settlement was for they confirmed payment should be by end of April but could not say for how much

dawn wright says

have just received the following from Mr Lender

We can confirm, we would not be required to send you an email to inform you that we have issued our final response via postal service. Our final response was issued to the address details which you confirmed.

In regard to escalating your complaint to the Financial Ombudsman Service (FOS), although you are within your rights to escalate your complaint we will inform the FOS that they do not have our permission to look into this.

does the ombudsman require the lenders permission to look into any complaints?

My original complain was via email and their response saying they were looking into it was via email also

Sara (Debt Camel) says

FOS will decide if they can look at this. Make the point that you complained by email, Mr Lender acknowledged it by email and they did NOT say the final response would be by post so you weren’t aware it had been sent out but not delivered.

Michael says

Its now 1st April 2022 and still no news of final dividend for Quik Quid administration despite promises we would at least be notified by now.

Should we start to be concerned and is there any redress available against Grant Thornton to all of us creditors for what must be the longest administration ever.

When will we be notified yet alone paid

Sara (Debt Camel) says

Should we start to be concerned

No

is there any redress available against Grant Thornton to all of us creditors for what must be the longest administration ever

No

When will we be notified yet alone paid

they still expect to pay by the end of the month so people should be notified in the next 3 weeks at a guess

sharon says

Hi Sara

have there been any further updates yet, we were told we would know the payouts in march we are no on the 1st of April & still nothing with all house hold bills going up the money needs to be with us sooner rather than later.

Sara (Debt Camel) says

no news. If you come on here and look at the comments you will see when people start to hear anything.

Ryan says

Anyone else feeling apprehensive about getting our refunds by the 30th April? Especially seeing as the payments will be in stages and staggered due to so many refunds. I find it a bit bad that there have been no updates whatsoever. We still don’t even know the percentage yet! I appreciate people are going to say be patient but for people like myself who put a claim in years ago before they even went into administration, my patience is wearing thin. I just want to know how much I’m at least getting! The delay was supposedly due to not getting the necessary tax clearance which came through a day after they applied for an extension. Surely then the process should helave been delayed by 1 day and not a whole month and probably longer. Sorry for the rant but like so many, I could really do with the refund I’m owed.

Sara (Debt Camel) says

It’s natural to be apprehensive. But there is no particular reason to think this is not going to meet the latest deadline. Any worrying about it doesn’t really help.

Noel mccready says

I’m waiting too think we won’t hear anything until yhr new tax year starts. Just wonder will we be responsible for sorting out what tax we owe which will be due from the 8 per cent interest. Know from past PPI cases it was left to us at the start. People did not pay up and then the firms ducted the tax and sent it to the tax people themselves.

Sara (Debt Camel) says

The new tax year has NOTHING to do with when you will be told. What possible difference could it make?

I don’t yet know what they are going to do about tax deductions.

Tracey says

Received this after my email query today:

I write in response to your emails to Chris Laverty and David Dunckley below.

I confirm that the Joint Administrators are still on track to make payment of the dividend by the end of April. The dividend is estimated to be in the range of 30p – 50p in the £ (i.e. between 30% to 50% of your accepted redress claim). All customers will receive confirmation of the exact amount they will receive prior to payment.

Kind regards

Alasdair

J says

Hi does anyone know how to find out what loans you took out with QQ

Sara (Debt Camel) says

They should have told you in the response to your claim which loans were upheld and which weren’t.

If you haven’t made a claim, it is now too late to do this.

J says

I didn’t say I hadn’t made a claim. I know my claims have been up held. I was curious to know if like others there is a portal where you can see what was originally borrowed

Sara (Debt Camel) says

No, but that should all have been in the email you were sent.

James says

Is there a way to check redress amount? I’m sure I put all my details forward before Feb 2021 but I’ve not had any emails from anyone about anything but I’m quite sure I had a redress email, which I can no longer find. Is there somewhere to log in and check details/ bank details etc?

Many thanks

J says

I’ve had to chase them and can’t not see an email. Would it be from cash euro net or QQ themselves? Thanks

James says

I’m in the same boat as J… Almost impossible to find any info

Danny carmody says

hi j and james QQ customer support team, phone no 08000561515 mon to friday times 9am to 4pm hope this of of help, you may need your case no/ref ,no also the last address your had the loan at, all the best

J says

James, I logged in to the Grant Thornton portal where is advised us to contact Quickquid direct or on stride