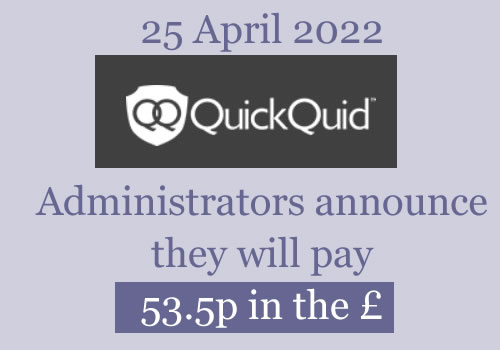

Payments – UPDATE – 25 April 2022

Administrators have started sending emails to everyone with an upheld claim telling them what they will be paid.

“The Joint Administrators are now in a position to declare a first and final dividend of 53.5p in the £”

The average claim value is c £1,700. Someone with that claim value will get a payout of about £910.

The payout details are given in the email:

- This will be paid over the next two weeks.

- If the administrators couldn’t validate your banking details, it will be sent by cheque. I don’t know how the administrators will “validate” your details.

- If you used a claims company, the money will be paid to them.

- Most people are not having any deduction for tax paid to HMRC, so there is no need to reclaim anything.

Credit records

The administrators may decide to :

– remove any negative marks on your credit record

– delete all loans that were upheld

– delete all your loans.

I don’t know what they have chosen to do – if people can check and report in the comments when they see a change, that would be great.

How much your credit score will change will depend on whether there were any negative marks. If you want to get a mortgage, you would like as many payday loans gone as possible, even if they were repaid on time and not hurting your credit score.

In a few months when the administrators no longer talk to the CRAs you can ask for any remaining loans to be “suppressed” so other lenders can’t see them. See https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do that now.

QuickQuid went into administration in October 2019

CashEuroNet (CEU), which owns the QuickQuid, Pounds To Pocket and On Stride brands, stopped giving loans and went into administration on 25 October 2019.

I will be talking about QuickQuid (QQ) rather than CashEuroNet as it is the more familiar name. Everything here also applies to loans from Cashruronet’s other brands, Pounds To Pocket and On Stride.

Grant Thornton were appointed as Administrators. They set up a page about Redress Complaints – this is their term for people who have asked for a refund because they were given unaffordable loans.

Background to the QuickQuid Administration

QuickQuid was one of the “Big Three” payday lenders in Britain, starting out in 2007.

After Wonga and the Money Shop Group had all stopped lending and gone bust over the last fifteen months, QuickQuid was left as the largest UK payday lender.

QuickQuid had well over a million customers. When it went into administration there were c. 500,000 customers with outstanding loans.

Many of these customers had prolonged borrowing from QQ. They either rolling loans over or repaid one loan but were left so short of money that they had to borrow again.

These customers have good reasons to win an affordability complaint and get a refund of the interest they paid.

Affordability complaints started on a small scale in 2015 and increased in the next few years.

In 2018, complaints going to the Financial Ombudsman (FOS) jumped with the involvement of Claims Companies and QuickQuid became the most complained about firm to FOS, excluding PPI complaints.

For a long time QQ refused to refund interest on any loans taken more than 6 years before or where the loans were given in 2015 or afterwards. This resulted in a huge backlog of claims at the Financial Ombudsman, where QQ had made very poor offers to customers and then rejected an adjudicator decision.

In late July 2019, QQ agreed to accept several thousand FOS complaints it had previously rejected.

By accepting the FOS decisions on loans over 6 years, long chains of borrowing, and loans taken after 2015, the scale of QQ’s likely future liability for refunds will have become clear to the company.

After failing to persuade the FCA that a Scheme of Arrangement was appropriate, Enova, CEU’s large and profitable US parent, decided to close the UK business, blaming the UK regulatory environment.

How could the regulators let this happen?

This is an excellent question… Stella Creasy, MP called for an inquiry into the FCA over Wonga and QuickQuid.

What has happened in the administration

Customers with a valid claim for a refund are “unsecured creditors”. This includes:

- any refunds that were in progress after an amount was agreed or a Final Decision from a FOS Ombudsman (FOS);

- complaints that were underway at QQ or FOS when QQ went under;

- any new complaints sent to the Administrators.

All complaints at FOS legally had to stop and were been passed back to the Administrators. It isn’t possible to send any new complaints to FOS.

It is now too late to submit a Claim for unaffordable lending. The last date was 14 February 2021.

The administrators have given the following statistics about claims:

- 169,000 customers made claims for unaffordable lending;

- 78,000 claims were upheld by the administrators;

- the upheld claims had a total value of £136million, so an average of about £1,700 per claim.

Still owe a balance on a QuickQuid or On Stride loan?

More than 300,000 of the current loans were sold to Lantern in summer 2021. You should have been informed if your loan was sold.

The administrators have now stopped collecting any money from the remaining unsold loans.

This page is no longer updated

Comments have been turned off. If you have a query, please post it on the Refunds from loans page.

Ian H says

This has no impact on the administration. It simply notes there may be claims against the parent which need to be provided for in the accounts. Most interesting if I have read it correctly and I am no expert on US accounting practice it seems Enova has provided for the SLA as a charge which, typically, means a charge to them not income.

SK says

That’s correct, they swallowed $74.5 million loss but then they charged $9.7 million for the SLA… This is also in that report:

“The Company recorded a one-time after-tax charge of $74.5 million, including one-time cash charges of $52.2 million, as a result of placing the UK businesses into administration. During the year ended December 31, 2020, the Company recorded an impairment charge of $0.4 million ($0.3 million net of taxes) to write down a receivable on certain expenses incurred by the Company prior to administration that were deemed non-reimbursable by the Administrators.

The Company entered into a service agreement with the Administrators under which the Company provides certain administrative, technical and other services in exchange for compensation by the Administrators. The agreement is scheduled to expire April 8, 2022 but with options to extend the term for three-month periods. During the years ended December 31, 2021, 2020 and 2019, the Company recorded $2.8 million, $5.0 million and $1.9 million, respectively, in revenue related to these services. As of December 31, 2021 and 2020, the Administrators owed the Company $0.5 million and $0.9 million, respectively, related to services provided.”

Lara James says

Really! By the 22nd! That’s great news! I haven’t read any of the reports so wouldn’t have known. Thanks for that :-)

Micky says

Are you sure this is correct? I don’t think it means they have to receive the funds by this date.

Danny carmody says

just an update, when waiting for redress email this month, please check your spam box, as it may end up there, hope this is of help to all waiting,

Mark says

Cheers Danny. Thanks for the heads up.

James says

This is the email I received today

Thank you for contacting CashEuroNet UK, LLC

In regards to your query, the Joint Administrators anticipate that payment details and payouts will be made by the end of March. Whilst there remain a number of material matters to conclude in relation to the Administration, the Joint Administrators anticipate there to be a dividend to unsecured creditors in the range of 30p to 50p in the £. The exact payout amounts are still to be determined and yet to be released. Please continue to monitor your email.

Updates will be provided as they become available and will be forwarded to all creditors. We appreciate your patience.

Yours sincerely,

For and on behalf of CashEuroNet UK, LLC

The Joint

Kizzy says

Hi, I got this email today (1/3/22) after I asked Quick Quid for an update on redress payments.

Thank you for contacting CashEuroNet UK, LLC.

In regards to your query, at this time our Joint Administrators have advised that payment details and payouts will be made by the end of March. The exact payout amounts are still to be determined.

Updates will be provided as they become available and will be forwarded to all creditors. We appreciate your patience.

Yours sincerely,

Pam

For and on behalf of CashEuroNet UK, LLC

The Joint Administrators

I hope this is helpful for others waiting for their payment

Danny carmody says

this email from QQ, & admin is what been sent out over the last 5 weeks, l got the same email reply weeks ago, so we just have to wait till the new update is sent out, at the end of march, l was a phone call, saying we would get a email redress statement which will show what we will get paid out, l would say end of march payout,

Kizzy says

It seems to be a fairly bog standard response. I agree it will probably be late in the month when payments are released but at least it will finally be done with. It’s the number of extensions and lack of communication that’s been frustrating. I suppose it’s worth the wait if it means a larger percentage payout.

Chris says

As a result of the Joint Administrators’ recent court application, the Joint Administrators have until March 2022 to make a distribution.

K says

They must be ready to make payouts as it looks like they’ve shut down the website now.

Mark S says

Hi K, which website are you referring to? Both quickquid and casheuronet websites seem to be working as they previously have when I have accessed them.

K says

Apologies, you are right – I think it had briefly gone down (or perhaps issues my end). Website is still up and running

Lara James says

Maybe that was just a blip as I can still access the website.

Nick says

Is everyone twitching like me waiting for an update! I hope it’s good news for everyone concerned 🤞🏻🤞🏻🤞🏻

Matt says

Hi All

I’m eagerly awaiting news and I do hope the 30-50% dividend estimate is accurate.

I have an accepted claim value of £14310.49 so I would be happy with even 30% of that

From reviewing the last progress report – looking at the cash/assets against liabilities – it seems like there would be almost 50% dividend available but again, that depends on what additional expenses have arisen since then and if there were any further assets to be realised. Either way, we are now in March so not long to wait…

Niall says

Has anyone else had their claim accepted but stopped receiving update emails? Last email I received was nearly a year ago despite having confirmed/updated my details through the portal.

Jak says

Yes I heard nothing since august last year so I called them last week and made sure my details were correct and asked when I was likely to expect the payment the lady said by the end of March everything should be settled. Hope this helps

Danny carmody says

Hi sara & all, just had this email sent to me 30mins ago from Casheuronet.uk.llc, it reads The joint Admin, anticipate the payments details will be made by the end of march, the exact pay out amounts are still to be determined and yet to be released, please monitor you email, yours sincerely kristi w, you can share this, so looks like we need to all wait till we all get the redress email,

Adam says

Any noticed the language being used? There is nothing guaranteed here, so far I have read that they “anticipate’” the payment will be made, that it “should” be made and that it will be “hopefully” made before the end of March.

Paul says

Anticipate though… they are a disgrace if they can only anticipate what they are going to do within the next 29 days.. If they don’t know the amounts now, I’m sorry but there is no hope of receiving a penny in March, they clearly have no plan in place and don’t have the man power or technology to get this completely smoothly and as quickly as possible. This was proven when they completely messed up the Wonga administration. How Grant Thornton are still running a successful business is beyond me.

Mark says

I can’t see it been paid this month then Danny. It still sounds like there is lots to do. April at the earliest I’d say. Great work though mate and thanks for keeping us updated.

Tim says

Way too much negative speculation, and it’s not helping anyone, especially those already anxious to get what they are owed.

Danny carmody says

hi, was thinking the same, the email that we are waiting for will turn up in the last week in march, and the pay out in april, thats what i think, as the email i had today, said they still have % redress amount worked out,

Gary says

There is absolutely no reason to not believe them, we all want the money but we will get what we get when we get it.

They said by the end of March, we are two days in. Start being concerned by the 15th by all means but for now just relax

ROBERT says

‘I am sure Sara has a link for this. Email today sent out to all those that registered with an update on your claim with Provident & their associated companies. Mine was Satsuma.’

Hi ROBERT,

Claim Portal – Secure Message Received

Scheme ID:

Why are we writing to you?

We are getting in touch to let you know there is a secure message waiting for you in the Claims Portal.

What do you need to do?

Log in to the portal and read your new secure message. This message contains an important update about your claim.

Useful links

Claims Portal login link:

Regards,

Provident SPV Limited

Sara (Debt Camel) says

This is about Provident and Satsuma. not quickquid. Wrong page.

Ben says

Hi Sara,

Can you please remove my details from debt camel? I cannot deal with the speculation of people and theories coming up about when this will be paid. I have moved emails into Junk but it still comes into my inbox and flags up.

Thank you. You have provided a very valuable service and this is a great page but I can’t deal with the negativity and speculation any more.

Sara (Debt Camel) says

you can unsubscribe at the bottom of any email.

Mike_T says

I emailed them last week to try and get a copy of my claim assessment. This was the reply they sent me

Thank you for contacting CashEuroNet UK, LLC. In regards to your query, the Joint Administrators have provided an update to inform you that, due to delays in obtaining HMRC clearance (the clearance application was submitted in October 2021), we have had to apply to court to extend the date for the payment of the dividend by 6 months from 14 March 2022, the previous deadline set by the court for the payment of the dividend. The administrators require the HMRC tax clearance in order to calculate the dividend payable on all admitted creditor claims.

We have now received the clearance we require and are working to declare the dividend and make the payment as soon as possible. We now expect to pay the dividend to all creditors by 30 April 2022. We appreciate your patience.

In reference to the claim assessment, a copy was requested to be resend to you. While I’m unable to provide a time frame for this to be received, I can assure you that we will get this out to you as soon as we can.

Robert says

Well, at least they got Tax Clearance. I suspected there would be a delay in the tax clearance due to ‘working from home’ , possible strike action, etc.

Now the tax people are out of the way, anytime between now 30th April , I expect. This has put a spanner in my debt clearance plan for March 31st, but if you cannot trust a responsible corporation, who can you trust?

sharon says

i have not even received an email at all yet, they are defo dragging this out

Sara (Debt Camel) says

Many people have, some haven’t. But there is no reason to think what most people have been told isn’t right.

Scott Mather says

Me neither , had nothing since may last year

Tony says

You and me both

Tara says

How many more times are they going to delay payments and make people wait this has gone on far to long now another month rediculas

K says

Man that is so annoying if that is the case. They just need to get their stuff in order. This has been going on for years already.

Steve says

Spoke to ‘sunny’ at casheuronet this morning and she stated that there has been an extension made until 30th April 2022 due to hmrc tax clearance issue. Sunny said this had been agreed by courts and an update was coming.

In her words ”you should receive your payments before this date”, but when I asked about further extensions she didn’t seem to confident in her voice that it couldn’t happen.

Sorry to be sending this out 😔

Kyleigh Goodband says

Yet in the comment above they say they’ve had the tax clearance! This is getting beyond a joke now 😡

Holly says

Got a message to say it’s being extended again -let’s just assume it’s not coming then when it does it will be a nice surprise :)

Sean says

Are they taking the P or what. Notification saying it’s been extended AGAIN.

If it was the other way around they would demand it now. Asap.

And charge us.

It better be at the higher rate. I’ve already got the debts they sold chasing me for the money. Well they can have it when this lot cough up.

Louise says

Thats an extension granted iv just had email

Catherine says

Hi I just received the below email, but don’t know how to access the document but assuming the same thing uts been extended again.

Document Alerts

You have registered to receive document updates for case C30202122.

The following document has been added

Document Notice to creditors – Extension of deadline to pay dividend created on 03/03/2022 10:15:27

This is an automated email, please do not respond to this email as it does not get monitored.

ann stanley says

Me too ,

The following document has been added

Document Notice to creditors – Extension of deadline to pay dividend created on 03/03/2022 10:15:27

Andy says

Reading that letter the issue appears to be HMRC dragging their feet hence they had no choice but to apply for an extension. The way it reads is that even though the extension is for 6 months they still aim to have every payment made by April 30th as they do now have that tax clearance all be it arrived after they made the extension application. I wouldn’t be surprised to see some of those claims being paid fairly soon, its just unfortunate its not all going to be wrapped up by April 30th. I cant imagine its in their interest to drag this on as it just means more calls and emails from creditors. Annoying but at least we know now. What I’d really like to see is the final %.

David Woods says

Does anyone have the details of the website we are supposed to log in to to see these letters as u can’t locate it in pat emails. My have just deleted thinking it’s junk, even tho it is haha.

Richard says

I got the email with grantthornton.co.uk/portal login details on the 21/05/2021

‘Please find below the credentials to access the Grant Thornton UK LLP Insolvency Act Portal:’

Claire Briggs says

I emailed them for an update and got this reply similar to others

Dear Claire,

Thank you for your email.

The Joint Administrators have released an update to inform you that due to delays in obtaining HMRC tax clearance we have had to apply to court to extend the date for the payment of the dividend by six (6) months from 14 March 2022, the previous deadline set by the court for the payment of the dividend. The Joint Administrators require tax clearance from HMRC in order to calculate the dividend payable on all admitted creditor claims.

We have now received tax clearance from HMRC and will declare the dividend and make the payment to all unsecured creditors as soon as possible. We anticipate making payment of dividends to all creditors by 30 April 2022.

If you require specific information relating to your claim, please contact the QuickQuid Customer Support team on 0800 056 1515 or support@quickquid.co.uk or the On Stride Customer Support team on 0800 210 0923 or customersupport@onstride.co.uk, as applicable to your loan.

Kind regards,

Octavia

chrissy says

“We have now received tax clearance from HMRC and will declare the dividend and make the payment

to all unsecured creditors as soon as possible. We anticipate making payment of dividends to all

creditors by 30 April 2022”.

Danny carmody says

hi all have the same short email, saying extended, thats all l got, no more details,

paul says

Where is this information?

Melissa says

So basically we can forget receiving any funds for about two months? Or is there still a good chance we are on course for a March payment?

Sara (Debt Camel) says

No one should plan for the funds being paid in March. Or even April. Even when the payments start, they will be in batches, you will not be able to find out what batch you are in and some payments go missing and have to be retried.

Jane Y says

I’m still waiting for my overpayment amount to be refunded let alone the redress amount. Its d9 frustrating!

Ian H says

As others have said wooah easy there guys. HMRC was always a challenge – see the previous update – HMRC don’t give clearance till they give clearance and GT had to make an assessment of things so that they didn’t miss the previous deadline of, if I recall, 22 March to declare a dividends. I know it’s frustrating but administration is a nightmarish process especially in last two years. This has been ongoing for 2 years 4 months that’s actually not that bad given the complexities of things. GT haven’t said it will only be in 30 April but before then. I think around the 25th if this month we will see the dividend declared and then payments running from there. If I recall there were three Wonga emails. 10 Jan 2020 they sent an update saying they would communicate by end of January on amount, this happened on 29 January and then a final wind down email in April 2020. So if that is a precedent I would expect it to start on around mid/late march with the update, announcement late March or early April and payments over about 3 weeks from there.

I am not saying that is definite but based on similar administrations that seems likely. So please

1 stop blaming GT they are actually doing what the law requires and are doing it pretty well

2 focus on three weeks time when you can all be relieved to see things moving definitively

3 stop saying, even in jest, it won’t happen till 2024 or whenever. It’s close now so let’s just sit tight and wait.

paul says

That’s your opinion and that’s fine. But you’re wrong GT did not handle the Wonga administration in a timely or professional, they are also being investigated as there is a conflict of interest with that administration.

If you think just because they are using loopholes in law because they can’t wind up a administration in a timely manner then that’s fair enough. But almost 3 years to manage an administration is ludicrous

Carol says

Paul – try listening for a change – you might learn something. There are processes to complete before moving on to the next stage. Sara has stated many times to everyone that no timing is guaranteed and not to expect or make plans until the money is in your account. Believe it or not she does know what she is talking about which unfortunately it seems you do not.

Danny carmody says

well said Ian

Joanna says

I received this today, after emailing them for an update…

Thank you for contacting CashEuroNet UK, LLC. In regards to your query, the Joint Administrators have provided an update to inform you that, due to delays in obtaining HMRC clearance (the clearance application was submitted in October 2021), we have had to apply to court to extend the date for the payment of the dividend by 6 months from 14 March 2022, the previous deadline set by the court for the payment of the dividend. The administrators require the HMRC tax clearance in order to calculate the dividend payable on all admitted creditor claims.

We have now received the clearance we require and are working to declare the dividend and make the payment as soon as possible. We now expect to pay the dividend to all creditors by 30 April 2022. We appreciate your patience.

Lorraine says

They’re not great at keeping people informed, any information I’ve had has been through this useful site and that information has mostly come from responses to emails people have sent to CEN UK.

The payout is much better than previous payouts so hopefully we’ll all have received notifications and payments by end of April 2022, it’s all in front of us.

Jo says

Can anyone please advise where this letter is to be able to read it please?

Lolly says

It’s on their insolvency portal. I found the link and login details by searching ‘quickquid’ in my email inbox

Rob says

If Grant Thorton received your claim, you should have received an email around May 2021 – search for “Update from the Joint Administrators” in your email inbox. In that are specific login details for https://www.grantthornton.co.uk/portal/ – latest update is in there.

Jim says

I assume today’s news is correct, even though it’s coming unofficially from CashEuroNet rather than Grant Thornton. Maybe GT are waiting for the dividend percentage before they post an official update.

Anyway, it’s good news, the end is in sight and ~40% is massively better than I was expecting 6 months ago.

Tina M says

There has been no confirmation of exact percentage as of yet only that it should be between 30-50% so don’t know where you get a figure of 40%

So you shouldn’t be stating this as many people are relying on this money and this is not a true figure as of yet

Jim says

Yes, my post mentioned ~40, which means about 40. I agree nobody should rely on these payments, even the 30% “minimum “ until the dividend is declared and the payment received.

Sara (Debt Camel) says

So another update:

– they got an extension from the court

– after the court extension they now have the tax clearance from HMRC

– they will be calculating the %, letting people know

– they expect to pay everyone by the end of April.

I suggest people sit back and wait for new of the % that will be paid and then to be paid. There is nothing you can do to speed this up.

I am deleting comments which say you will be lucky to get 10% in 2024, or that these delays are deliberate so the administrators make more money, or that they are making a fortune in interest etc etc.

Jim says

Out of interest, where are you getting this information from? I see the comments on this site, but most of us have not had email updates and there is no official update from the Joint Administrators.

Sara (Debt Camel) says

There is no reason to think what most people have been told isn’t right.

Adam says

You also said you didn’t see any reason for them to ask for an extension this time around?

Sara (Debt Camel) says

And I said if an extension was needed the court would give it. And that people should not assume they would be paid by the end of March.

I am not sure what you are hoping to achieve here?

Ben says

Hi all just have a update ive spoken to cash euro net about obtaining copy of email regarding claim tgere has been a extension until end of april we wont hear anything this month however the repayments will be signifitly smaller which we all know and we have have to extend paynents furher not the news we wanted but its a clear update hope it helps

Steven says

Sorry for being thick if they say by 30th april why do they need a 6 month extension?

Sara (Debt Camel) says

Because it takes time to liquidate a company after the payments have been made. eg Wonga was dissolved in December 2020 after the vast majority of payments had been made by the end of March.

Ian H says

Because administration doesn’t end with dividends. The blurby bit in the letter has a date for dividends and the overall administration must end in six months.

Ryan says

Just received this today

The Joint Administrators have provided an update to inform you that, due to delays in obtaining HMRC clearance (the clearance application was submitted in October 2021), we have had to apply to court to extend the date for the payment of the dividend by 6 months from 14 March 2022, the previous deadline set by the court for the payment of the dividend. The administrators require the HMRC tax clearance in order to calculate the dividend payable on all admitted creditor claims.

We have now received the clearance we require and are working to declare the dividend and make the payment as soon as possible. We now expect to pay the dividend to all creditors by the 30 April 2022

Updates will be provided as they become available and will be forwarded to all creditors. We appreciate your patience.

Yours sincerely,

For and on behalf of CashEuroNet UK, LLC

The Joint Administrators

Kristi W

James says

The last update said they HAVE to pay by the end of March, so how can they get an extension and why do they need one? This started in October 2019

Sara (Debt Camel) says

They asked the court for an extension as at that time HMRC had not responded.

I have no idea why some people here thought a court would not agree to a further extension in this sort of situation.

James says

What sort of situation is it? I only ask because it says in the November update, that the HAVE UNTIL March 2022 to pay a dividend! It uses those words, so I assumed they couldn’t drag it out any longer.

Sara (Debt Camel) says

a situation where HMRC had not provided the clearance the administrators need to pay out.

Paul says

Should I be concerned I’ve not had the email/letter yet (checked my Spam) or these coming out in batches?

Brian says

Hi Paul I just rang them up & they sent email straight to me there & then

james says

i had to email them to get a reply, got 2 different update emails within an hour or 2, this was the reply 5 minutes ago

Dear xxxxxxxxxxx,

Customer # xxxxxxx

Thank you for contacting CashEuroNet UK, LLC.

In regards to your query, the Joint Administrators have provided an update to inform you that, due to delays in obtaining HMRC clearance (the clearance application was submitted in October 2021), we have had to apply to court to extend the date for the payment of the dividend by 6 months from 14 March 2022, the previous deadline set by the court for the payment of the dividend. The administrators require the HMRC tax clearance in order to calculate the dividend payable on all admitted creditor claims.

We have now received the clearance we require and are working to declare the dividend and make the payment as soon as possible. We now expect to pay the dividend to all creditors by 30 April 2022.

Updates will be provided as they become available and will be forwarded to all creditors. We appreciate your patience.

Yours sincerely,

Pam

For and on behalf of CashEuroNet UK, LLC

The Joint Administrators

Susan says

Did you register for updates? Check the portal and add your email address for updates. https://turnkeyinsolvencyservices.biz/gt-login.html

Sarah says

Hi sara,

Hi all,

I went through the wonga experience so I’m very open minded, not expectant, won’t set myself up for the disappointment, I’ve been more relaxed with this one and learned not to count your chickens so to speak!

Im a bit anxious though as some seem to be receiving updates and others not, I’ve had an email back in August 2021 stating they’ve accepted my loans were unaffordable and given the amount, which I know won’t be what we receive, but that’s the only correspondence I’ve had off them. It just strikes me as strange how they’re not emailing all the people who they’ve accepted had unaffordable loans to keep everyone updated. Surely emailing all although I know it’s a large amount would save people hearing things via word of mouth and then getting in touch with them?! Maybe I’m just over thinking it.

Anyway good luck everyone. Let’s all hang in there a little longer we’ve come this far and soon it’ll all be behind us!

Ian H says

I agree although at £526 an hour I am not sure emails would be great value!!! I say with tongue firmly in cheek

neil says

Hi Sarah, I’m the exact same, last email was accepted claim amount. I rang them and they assured me my name was still in the system and I was getting redress. It is odd but hopefully it works out easily. If not worst case we’ll have to chase them a bit.

Chris says

Good news is we have a more specific date. No announcement made that it will be less than the 30-50% suggested and the end is in sight. Happy days

James says

Actually beginning to agree with some of the comments on here now, where I didn’t at first! Does seem that they keep having to ‘ask for extensions’, so very possible it will happen again at the end of April…you’d think if its taken this long, the payout should be decent, but I’m even dubious about that now…

Sara (Debt Camel) says

That seems unlikely now as they have the HMRC tax clearance. It’s not impossible but there is no reason to think it is going to happen.

James says

October 2019 they applied for it, I’ve been told in an email, how could that take so long??

Is there no one we, as a group, can appeal to?

Sara (Debt Camel) says

no.

Sorry but I am just being practical here. I know it’s annoying but there is nothing you can do.

Kyleigh Goodband says

What I don’t understand and this is probably just me being thick but if all they were waiting on was the tax clearance to pay us by the end of this month and they now have that, why is it going to take another month to get it? 🤔

Sara (Debt Camel) says

There is nothing unusual going on here. Administrations don’t move fast.

Jak says

I spoke to them this afternoon and asked

1They applied for an extension but the clearance came the day after, so why do they need to delay it as they should have had everything in place ready – she couldn’t answer me

2. I asked if this is not sorted by April what is stopping them from applying for a further extension- again she couldn’t answer

3 I asked why I was not receiving emails at all- this she said was that they were sent in batches

4 I asked if they are delaying it does the interest become higher -no

5. I asked if the % had changed – still looking between 30-50%

Hope this helps

Paul Mc says

At last someone at HMRC has pushed a button and made a decision. Consumers put to the bottom of the pile. I did suggest previously I wasn’t expecting anything even by April going by the overpayment process comments.

Bit more pain to come inevitably for some unlucky folk that fall through the payment process but it’s a bonus to get anything back anytime. Here’s to 50% (hopefully!). Thanks for the update.

Stefan Reeves says

I’m starting to worries a little now not sure if anyone here can help me out. i did the claim via the quick quid claims portal got accepted for around £2,000. i messaged quick quid the over month saying i was still accepted. but i have not heard a word and email or nothing from grant thornton. i have no access to there log in system or anything . im starting to worries people receiving these emails about an extension that i have missed something via grant thornton which means i am going to lose out. if this is the case this isnt fair as i have clearly applied via quickquid claims portal got accepted and i have heard nothing from grant thornton. did anybody else do it through the claims portal recieving an email from grant thornton etc.. im confussed.

Jim says

I think you are in the majority. Most of the unsecured creditors, including me, have heard nothing.

The exceptions are people who have sent in a specific query about their claim, or a small minority who registered to receive updates.

Finally, tonight, Grant Thornton have posted the latest update on the Administration website.

If you have an accepted claim you should be fine. You should have a claim reference number if you need to chase them, but hopefully this won’t be necessary.

John says

What i don’t understand is that they have the clearance now so surely they can let people know what the percentage will be as they must have been working on it and not just left it until having the clearance

Mark says

This is down to the inept HMRC..

Delighted that I’ll be paid by the end of April

Mark says

I appreciate money is a very emotive subject but we all need to wait now and just be grateful that we aren’t Ukrainian. I shall be donating some of my redress to help those poor people and I’ll be grateful for any money that I receive. At the end of the day I am to blame for taking out the loans with Pounds to Pockets. Yes, the interest they changed was extortionate and they should’ve completed more stringent financial checks but I would have been in dire financial difficulties without their loans.

Paul says

I agree. I made some bad decisions but fortunately we live in a country where unfair practices are challenged. Yes I shouldn’t have been given continuous extensions but because I was I have an accepted redress of £2800 give or take a few pounds. To get 30-50% of this back will be a welcome bonus. I’ve tried for 18 months not to count or rely on it… But must admit I did think it was coming in March 2022 and it still may but I think the email that some have had today (I haven’t – I’ve asked for a copy) confirms in 4-6 weeks this SHOULD be resolved. Let’s hope everyone gets the best possible outcome they can. At the end of the day through stupidity and desperation I took these loans however governing bodies have successfully highlight bad practice so thanks to them I should get something back and I’m very grateful. Try to stay positive folks

Mark says

Don’t forget this is a company like others that put people in dire straits. They didn’t respect anybody. Massive fees for taking out loans and made people missearble. If they were a company that helped people then why would they be shut down. They are criminals! People say oh ok if we 30% – 50 % I’m happy. Why should we be happy with that return? Disgusting if you ask me.

Paul says

Can’t vouch for your personal circumstances but no-one held a gun to my head. I made some bad decisions and unscrupulous companies rubbed their hands with glee. Getting some redress will be suitable compensation. I’d love 100 % but I’ll take what I get and chalk it up as experience. I’ll not make the same mistakes again. Very grateful for sites like this where others have helped point people in the right direction to get something back. These companies are businesses, the business of making money at our expense. I didn’t do my due diligence and it seems neither did they. No real winners in this. Everyone will have a different story and/or experience. Mine is a painful one but I made mistakes too

Niall says

Well said, we all made choices in this case it was a poor one dictated by circumstances.

Sasha says

For those of us that don’t receive the emails, they have updated the news section of their website:

Mr and Mrs C says

Thank you for that, we have received no further emails since May 2021 when we received notice to say that our claim has been accepted. Praying we dont fall some loophole where we are forgotten!

Vh says

Hi

Just sent email

Worrying as reply says Dear Peter cox !! That’s not me

My claim was agreed two days before administration so gutted at the time as u can imagine

Didn’t register on portal as didn’t know had to as heard nothing just assumed lost my refund

I emailed two months ago to ask if I’m on there an chrck bank just had a reply cancel confirm bank number but no info on email

I’m assuming all ok as agreed an they have bank info correct

I’m due about a grand so very concerned an they now don’t answer phone an respond in wrong name !!!

Robert says

Don’t worry too much about wrong name. I got an email from quickquid branch of emails (why different ones, I don’t know) with correct sort code but wrong account number. I verified by phone my bank and they had the right details anyway.

If you are concerned, a quick phone will verify your details.

Regards

Rob

Robert Gough says

Well surprise surprise a delay ! I’ve emailed the administrator to ask the exact dates they got clearance and HMRC a freedom of information request to ensure that the dates match: I do not believe them one bit and I made it clear to Chris laverty that unlike Sara’s comment – you can complain about an administrator and the process of in the .gov website . If they got the clearance the day after then all they need is 1 day extra . I also asked if this means they will now be extending the wind up by another 6 months and then charging another 6 months of fees

Sara (Debt Camel) says

a freedom of information request to HMRC about someone else’s tax affairs (person or company) will be rejected.

You can complain about the conduct of an administrator via the insolvency Service gateway portal. Or you can sue them. As a matter of practicality, this will get you nowhere when you are complaining about a one month delay. And one which was reasonably caused by HMRC.

USHA DABYCHARUN says

Yeh, why is that? As in why do som receive and some don’t. I don’t and was wondering if there was a problem somewhere.

Sara (Debt Camel) says

a) they go out in batches

b) some emails sent in batches never seem to arrive, lost in cyber space

c) are you registered with the portal to get updates?

James says

How do I subscribe to email alerts?

Robert says

Hi, I am a bit worried that I may not have done something right. I had my Claims accepted email from ‘claims@mail.casheuronetuk.co.uk’ last August.

But I understand we are not getting updates because we haven’t registered with GT’ s portal. I looked at this and it says put in code from letter, etc. I’ve had no letter or message to register with GT portal.

I’ve checked my bank details with Quickquid claims email and that’s fine

Will, this effect any updates regarding the percentage and the actual getting paid? This is a bit worrying to me now, as I may’ve been ‘shafted’ by the not having appropriate information emailed to me.

Sara (Debt Camel) says

so far as I can tell, this just means you don’t get routine updates that go to everyone. You should still get any messages that ralate to your own redress.

Robert says

That’s okay, thanks.

I’ll just sit tight and await my redress. Hopefully soon….

Mark says

As far as I remember the portal was just to make sure they had your latest bank details that they can pay the redress in to.

ROBERT says

Hi, similar to others my last update was 21 May 2021 without any prompting or to CLICK a box, requesting further. This was from claims@mail.casheuronetuk.co.uk

HOWEVER, IF YOU FOLLOW THE LINK BELOW:

Please find below the credentials to access the Grant Thornton UK LLP Insolvency Act Portal:

If you are a creditor, employee, or shareholder on one of the insolvency cases published here, you will have received a letter from the Grant Thornton UK LLP insolvency practitioner providing you with a login name and password.

Web address: grantthornton.co.uk/portal

Login: C30202122

Password: THIS WOULD HAVE BEEN ON THE EMAIL YOU RECEIVED 21/05/21 or thereafter.

FURTHER, AT THE BOTTOM OF THE PAGE IT STATES: Document Alerts

Register your email address to be notified of any future document uploads, meetings or decisions

GOOD LUCK!

Danny carmody says

hi got it works fine, thank you

Ciaran says

Are they still anticipating to pay 30-50%

Sara (Debt Camel) says

They haven’t suggested there is any change to that.

Lea M says

This was super helpful , to find the email after the credentials . Thank you for that Robert

Steve says

Now that the tax clearances have gone through, should we be expecting an announcement regarding the payout percentage this week? Personally I’m not bothered if we have to wait until April to get the money, I just want to know how much so that I can at least plan stuff! Getting inpatient now

Sara (Debt Camel) says

No. Well it may happen but there is no point in getting your hopes up.

Danny carmody says

Hi Sara, i think the uk tax end 5th april, so we should see the % redress statement amount any time from the 6th april, it should have been all worked by them, hope l got this right,

Sara (Debt Camel) says

I am not sure why the end of the tax year is relevant.

Marie says

Hi guys, for those that haven’t received the latest email, check your spam folder.

Their previous emails have come straight into my inbox but this one didn’t for some reason :)

Hope this helps.

Finger’s crossed for 50%!!!

eh says

Hi Sara

i emailed casheuronet yesterday, as I could not find my orginal email they sent about how much I had a valid claim for, I remember it being over 11,000. i received an email back saying that my claim amount is now 7,700 and i would receive just a percentage of this. why has my original claim amount dropped? as i think this is unfair

Sara (Debt Camel) says

Unless you have your original email, it is hard to say.

PJ says

A possibility could be that 11,000 was the total claim and the 7,700 was the partially accepted claim. It’s purely speculation on my part though.

ROBERT says

Hi Eh, depending on when you submitted your claim, mine was 6 August 2020 and received the assessment, in November 2020 from support@email.quickquid.co.uk. Do a search of your INBOX for this address.

From: “QuickQuid”

To:

Sent: Tuesday, 24 Nov, 20 At 01:02

Subject: Your claim has been assessed and partially accepted.

James says

Would just like to say, Well done Sara, you’ve had to deal with a lot on here.. 👍😎

Gemma says

I’ve not received an email regarding the further extension. I’ve checked both spam and inbox.

What does this email say regarding payout date now?

I’m getting concerned that this, once again, is going to drag for another 6 months!

Can anyone shed some light?

Thanks 😊

Sara (Debt Camel) says

The article above has been updated for this.

Mark says

Now there is clearance from HMRC does this mean we pay 20% tax on our redress?

Sara (Debt Camel) says

I think the HMRC clearance related to the company’s corp[orate tax, nothing to do with deducting tax on the 8% part of the payments.

Mark says

Ok thank you Sara.

Chris says

We are nearly there now! It’s disappointing it’s unlikely to be this month however I can’t see any further delay past April but not making any plans till I receive the dividend email! I have been getting all my info from this site so thanks Sara great work as always. It’s a result that it looks to be at least 30% as I haven’t seen anything from them that suggests otherwise. So I’m just patiently (will a bit impatiently) waiting now although it does appear all the hurdles like HMRC etc have been cleared.

Graeme says

I actually reckon, there’ll probably still be some going out this month. The delay on HMRC clearance meant they couldn’t start as early, but they’ve got it now so there’s no real reason they can’t start moving full steam ahead if that’s all they were waiting on. That said, we don’t know which batch of payments we’ll be part of, so it’s definitely still beat to be patient and not to anticipate a quick payout.

Sara (Debt Camel) says

there is no particular reason to think this will happen.

Matt says

Hi

I had a claim via the ombudsman which they accepted and was waiting to be paid out until they went bust.

I’ve haven’t had any email updates like everyone else.

I’m worried now I won’t get paid out as I haven’t been up to speed on this and binned an email I shouldn’t have…

Ian Brasy says

Matt, I was in the same position having had claim accepted. I then followed this up with a further claim to the liquidators. I fear that if you didn’t you will have lost out. I hope not but claims have been closed for a long time now. Got to be worth an email to them though.

Curtis says

I haven’t received an email since I got my claim amount, so didn’t know about this update. Can I assume I should receive this update soon and just wait or should I be chasing this anywhere!?

Thanks

K says

I was also in the same position, Ombudsman had upheld my claim and given them 7 days to pay, it was 2 days before the deadline when they announced theyd gone bust. Was absolutely devastated, and as described above, i put in a second claim to the assessment portal.

I hope you get this sorted, as your claim had been accepted by the ombudsman you should be treat as an unsecured creditor in the administration i believe

Mark G says

I had a claim also via the ombudsman. I received an email in November 2020 from the administrators saying the claim of £14k had been accepted and to make sure in the portal that my bank details etc were correct. I’ve had no emails since but have no reason to believe that my claim has changed at all so I’m fully expecting a payout at the same time as everybody else with an accepted claim.

Carl S says

I was the same, emailed them in November was told my claim was partial upheld but they didn’t have a claim value available for me emailed and called for about 6 weeks before I finally received the claim value email, just contact them to ask.

PK says

Hi all, just a bit confused as to why only some people received an email with this most recent update. If I got an email from them last may and one again in august with my claim value, why do I need to log in to the portal thing to register for updates?

When it comes to them actually paying out are there going to be any more things I should have registered for previously that will prevent them from being able to transfer me the money? Sorry if I am not entirely trusting of the process but this last “lack of” update has my spidey-senses tingling

i do want to say thank you to this page as it has been an invaluable source of info.

thank you

Scott says

Hi Everyone,

The following email was sent 21/05/21 to the people that I am assisting.

The Joint Administrators of CashEuroNet UK, LLC (in Administration) (which traded at traded at Casheuronetuk.co.uk, Quickquid.co.uk, Onstride.co.uk and Poundstopocket.co.uk) have released their Progress Report for the period 25 October 2020 to 24 April 2021. Blah blah

Moving forward, our team at Grant Thornton will continue to upload reports to creditors onto the firm’s creditors information portal for viewing and downloading which can be accessed at grantthornton.co.uk/portal. In accordance with rule 1.50 the Insolvency (England and Wales) Rules 2016, all future notifications and reports will be uploaded to the portal only and you will not receive a physical copy in the post.

This is with the exception of the following documents for which hard copies will still be issued in the post:

a a document for which personal delivery is required;

b a document which is not delivered generally

c a notice under rule 14.29 of intention to declare a dividend

This email states that they will no longer contact each person to provide an update as these will be posted online to the portal. They also provided log in details to access the portal and you could then register for update alerts to be emailed to you. Some on here have done this and that is why they are receiving emails and the majority haven’t.

Scott

Scott says

The email that they then received for an update was

You have registered to receive document updates for case C30202122.

The following document has been added

Document Notice to creditors – Extension of deadline to pay dividend created on 03/03/2022 10:15:27

This is an automated email, please do not respond to this email as it does not get monitored

You then needed to log in and read the full update as it wasn’t fully explained in any email direct to a person. (Unless someone had actually emailed the administrators for an update round about 3/3/22

Sara (Debt Camel) says

thanks for clarifying this.