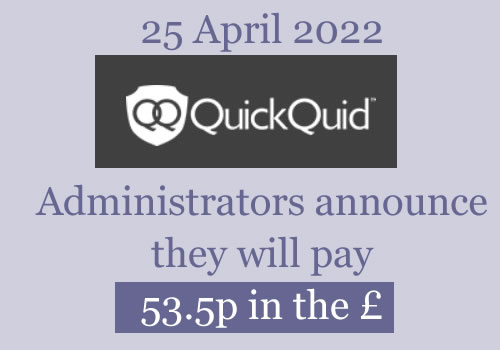

Payments – UPDATE – 25 April 2022

Administrators have started sending emails to everyone with an upheld claim telling them what they will be paid.

“The Joint Administrators are now in a position to declare a first and final dividend of 53.5p in the £”

The average claim value is c £1,700. Someone with that claim value will get a payout of about £910.

The payout details are given in the email:

- This will be paid over the next two weeks.

- If the administrators couldn’t validate your banking details, it will be sent by cheque. I don’t know how the administrators will “validate” your details.

- If you used a claims company, the money will be paid to them.

- Most people are not having any deduction for tax paid to HMRC, so there is no need to reclaim anything.

Credit records

The administrators may decide to :

– remove any negative marks on your credit record

– delete all loans that were upheld

– delete all your loans.

I don’t know what they have chosen to do – if people can check and report in the comments when they see a change, that would be great.

How much your credit score will change will depend on whether there were any negative marks. If you want to get a mortgage, you would like as many payday loans gone as possible, even if they were repaid on time and not hurting your credit score.

In a few months when the administrators no longer talk to the CRAs you can ask for any remaining loans to be “suppressed” so other lenders can’t see them. See https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do that now.

QuickQuid went into administration in October 2019

CashEuroNet (CEU), which owns the QuickQuid, Pounds To Pocket and On Stride brands, stopped giving loans and went into administration on 25 October 2019.

I will be talking about QuickQuid (QQ) rather than CashEuroNet as it is the more familiar name. Everything here also applies to loans from Cashruronet’s other brands, Pounds To Pocket and On Stride.

Grant Thornton were appointed as Administrators. They set up a page about Redress Complaints – this is their term for people who have asked for a refund because they were given unaffordable loans.

Background to the QuickQuid Administration

QuickQuid was one of the “Big Three” payday lenders in Britain, starting out in 2007.

After Wonga and the Money Shop Group had all stopped lending and gone bust over the last fifteen months, QuickQuid was left as the largest UK payday lender.

QuickQuid had well over a million customers. When it went into administration there were c. 500,000 customers with outstanding loans.

Many of these customers had prolonged borrowing from QQ. They either rolling loans over or repaid one loan but were left so short of money that they had to borrow again.

These customers have good reasons to win an affordability complaint and get a refund of the interest they paid.

Affordability complaints started on a small scale in 2015 and increased in the next few years.

In 2018, complaints going to the Financial Ombudsman (FOS) jumped with the involvement of Claims Companies and QuickQuid became the most complained about firm to FOS, excluding PPI complaints.

For a long time QQ refused to refund interest on any loans taken more than 6 years before or where the loans were given in 2015 or afterwards. This resulted in a huge backlog of claims at the Financial Ombudsman, where QQ had made very poor offers to customers and then rejected an adjudicator decision.

In late July 2019, QQ agreed to accept several thousand FOS complaints it had previously rejected.

By accepting the FOS decisions on loans over 6 years, long chains of borrowing, and loans taken after 2015, the scale of QQ’s likely future liability for refunds will have become clear to the company.

After failing to persuade the FCA that a Scheme of Arrangement was appropriate, Enova, CEU’s large and profitable US parent, decided to close the UK business, blaming the UK regulatory environment.

How could the regulators let this happen?

This is an excellent question… Stella Creasy, MP called for an inquiry into the FCA over Wonga and QuickQuid.

What has happened in the administration

Customers with a valid claim for a refund are “unsecured creditors”. This includes:

- any refunds that were in progress after an amount was agreed or a Final Decision from a FOS Ombudsman (FOS);

- complaints that were underway at QQ or FOS when QQ went under;

- any new complaints sent to the Administrators.

All complaints at FOS legally had to stop and were been passed back to the Administrators. It isn’t possible to send any new complaints to FOS.

It is now too late to submit a Claim for unaffordable lending. The last date was 14 February 2021.

The administrators have given the following statistics about claims:

- 169,000 customers made claims for unaffordable lending;

- 78,000 claims were upheld by the administrators;

- the upheld claims had a total value of £136million, so an average of about £1,700 per claim.

Still owe a balance on a QuickQuid or On Stride loan?

More than 300,000 of the current loans were sold to Lantern in summer 2021. You should have been informed if your loan was sold.

The administrators have now stopped collecting any money from the remaining unsold loans.

This page is no longer updated

Comments have been turned off. If you have a query, please post it on the Refunds from loans page.

Shaan says

I was suppose to have my refund 2 week after 21/12/21 but all I keep getting is its been escalated but its getting really annoying

Kel says

Have you checked the bank details they hold for you?

Ashley says

I presume if its anything like mine there was an error with the calculation of the overpayment and they haven’t got round to it yet because of the volume they need to reassess.

Kel says

Did you get an email to say there was an issue with your overpayment calculation?

Ashley says

Yep I did

I refer to your assessment outcome email dated 2/8/2021.

Following an internal review, we have found that there was a system error

with the calculation of your “Refund for overpayment on CashEuroNet UK,

LLC loan”.

We have now reviewed your assessment in detail and amended the “Refund

for overpayment on CashEuroNet UK, LLC loan” to reflect the correct

value of any overpayments made to your loan once set off of your redress

accepted claim value has been applied. The date from which set off applies

for the purposes of assessing your claim was 15 July 2020. Therefore any

money that you paid into your open loan after that date which resulted in an

overpayment will be refunded to you.

We will shortly be sending you a revised assessment outcome which will

detail your revised refund amount. The assessment will be with you within 7

days of this email.

Hadn’t heard anything since so I gave them a bell and it was escalated similar to the above comment and was told due to the volumes its taking abit more time, understandable at this point

Kel says

Ah right, I’ve checked my emails and haven’t had anything since feb last year so I’m guessing my overpayment value was correct. My claim was initially rejected in Dec 20, I appealed and recieved my accepted claim in feb 21.

Robert James says

Are you saying they’ve already overpaid a swathe of people? That’ll mean less in the redress, hopes rapidly fading….

Sara (Debt Camel) says

NO>

They haven’t overpaid people, some people have overpaid the loans… that is what is being returned to them. There aren’t many of these people, there is no need to worry.

Ian H says

And it’s allowed for in the admin report

mark says

i think people are hoping for 30% TO 50% return.i think there is more chance of it to be 10% if your lucky. my total of loan that has been accepted is 8.500

Sara (Debt Camel) says

People are hoping for 30-50% because that is what the administrators have said.

there is no reason to think that it is likely to be 10%

If you want to be very pessimistic, fine, but please don’t suggest that “10% if you are lucky” is likely unless you have the numbers to back this up.

Timbouk says

If anything I am encouraged with the administrators quoting the 30p-50p in the pound figure.

As far as I know they didn’t have to include that line in the latest update report. They are unlikely to have quoted that figure if they didn’t think it was realistically achievable. Based on Wonga I was expecting a lot less.

Sara (Debt Camel) says

exactly.

Robert James says

The financial numbers indicate between 30 % to 50 % payout, the 20% variance is due to the HMRC corporate tax settlement which is yet to be confirmed.

I personally believe it will be nearer 50% , perhaps more.

Lara James says

I’m just wondering; if a loan was sold off to Lantern, would they get paid out directly from my redress by casheuronet or do I just keep paying them as normal?

Sara (Debt Camel) says

was this loan sold during the administration?

Lara James says

No, it was before administration.

Sara (Debt Camel) says

how much has QQ assessed the redress due at? And did they decide the last, sold loan was unaffordable?

how much do you owe to Lantern?

Lara James says

The redress has be valued at £2880, I know I’ll get alot less. Just one loan was sold to Lantern and this was deemed unaffordable by QQ. I still owe around £260 to Lantern.

Sara (Debt Camel) says

Well you should get 800-1400 – so that would be enough to clear the Lantern debt. But you can ask QQ what will happen to the Lantern debt. And you have a good case to tell Lantern to remove the default from the record when you settle it.

Robert says

I wouldn’t be paying Lantern anything if QQ deemed it as unaffordable then they should not have sold that debt on to Lantern and I would be very clear if you have the documentation to prove that they deemed it as such then I would forward that to Lantern and tell them the debt is uncollectable and if they persist then you will go to the Financial Ombudsman and I would request they write off the debt. The whole purpose of the redress is not to pay other creditors for QQ failings. Esp as they buy the debt at a massively reduced cost. As you know the redress is to go some way in making up for the failures of these businesses to follow the process and practices when lending money. Not to pay another Debt Collector for a debt that should never have been given in the first place if it was unaffordable.

Lara James says

Robert, thank you! Your advice is brilliant :-) I’m going to send Lantern an email this morning showing that QQ deemed the loan as unaffordable, request that they remove the default and cease taking payments from me.

Thanks! Hopefully I’ll get somewhere with them! I just hope QQ don’t deduct the balance from my redress and send it directly to Lantern!

Sara (Debt Camel) says

It doesn’t look that brilliant to me.

You could try this, but I think you should first ask the QQ administrators what they intend to do.

I have looked at a similar situation in this article: https://debtcamel.co.uk/no-set-off-scheme-administration-debt-sold/ – but I am suggesting there that someone can ask for set off, not for the balance to be wiped. And here where you are being paid a lot more than the Lantern balance, set off would mean that you use the money to clear the debt.

I would put aside the money from QQ when you get it to clear this debt if you do not win this argument… otherwise you may end up with a CCJ.

Deb says

I have the same situation. My account has been on hold with Lantern for over a year and they haven’t bothered me at all in that time. My loan sold to them was unaffordable. I’m waiting till I get my money then I’ll ring them to work out what I need to do. I owe them £320 of a £1000 debt

Rachel says

I had an email a while back to say my claim is £5399.52. If it’s 30-50p to the pound I am very much looking forward to the payout! Fingers crossed they email everyone soon with expected payout figures 🤞🏻

Scott Mather says

Dragging feet on this now . Was worried by the 20p disparity. Gave them leeway to swallow some up .

sharon says

i got an email to say my claim was £2128 i rang them last night to see if there was an update people have waited to long now for these claims.

getting beyond a joke.

Andrew says

Hopefully it will be nearer the 50% , I’d happily settle for around 40% which is my guess.

Al says

Fingers crossed, mine about 3200 and I would be MORE than happy even with the 30% !!!

Paul says

I can personally see this getting delayed again or at least payments will be very slow if the overpayment repayment process is anything to go by based on a comparatively low number of people they had to pay. I wouldn’t bank on getting paid in March or even April.

Surely the HMRC tax query should be a straightforward yes or no for an outfit like Grant Thornton. Sounds like they are buying time still dealing with individual cases and making a good few £ for themselves. Over a year since the claim portal closed.

Out of interest how much did you borrow to get that much in interest/compensation back. Some crazy amounts people are due back. Hope you get a good result.

Sara (Debt Camel) says

It isn’t a “tax query” – they require confirmation from HMRC that no corporate tax is owed before the company can be liquidated. They can be 99.99% sure of the tax situation but they still need that HMRC confirmation.

Patrik says

Most of these liquidations end up in the single digits, so I was very surprised when they indicated 30-50%. That said, I don’t think they would put a range down if they didn’t think it would end up in that range. I had an email back from them about the timing and by March means end of March is when payments are intended to be made. Obviously there is an outside chance it may delay a couple of weeks, but I do think they intend to keep the timing they have set out this time. In order to win this kind of business, they need to show that they can close out cases as well as delivering an amicable result between all creditors.

Suzanne says

Morning all, I’ve just received a copy of my free Experian Statutory credit report and can see that both QQ loans have now been removed from my file, so the process does seem to be ticking along.

Jak says

I haven’t heard anything since the email on 9th august 2021 stating my claim amounts. Hopefully this will be resolved in March as it’s been over 2 yrs since I received the original email

MR says

I check this thread to see if there are any updates. I cannot believe how many people just want to put their negative views on here; What are you achieving by doing that? Other than causing people to be more anxious. 30% at the least is a great result – there is absolutely no reason to think that we will not receive at least that much. As for exactly when we will receive it – We’ll just have to wait and see. An update is not far away. Be grateful we are getting something that’s not in the very small percentage range. There is absolutely no need for negativity.

mr mark brooks says

hi i got a email saying, my claim has been excepted for £8.543.52 dose this in clued the 8% interest

Sara (Debt Camel) says

are there no details in the email?

Jak says

Yes it should do as it’s calculated with the 8% on it mine has it included

mr mark brooks says

hi sara yes about the loans which have been excepted.no details of interest

Sara (Debt Camel) says

Does it list the interest paid on those loans? Does that add up to £8.543.52?

mr mark brooks says

hi no details

Sara (Debt Camel) says

Then I think you need to ask QQ to clarify this. I could guess, but there isn’t any point.

Sara says

Can you make a complaint about irresponsible lending to a credit union?

Sara (Debt Camel) says

yes – the rules for CUs are slightly different but you can argue that it was not fair to give you an unaffordable loan.

Diane says

Hi, I would like to say that I agree with the comment about negative views.

I understand people have been dealt with in different ways, but the thing that

I find strange is that we all!!!!! borrowed money from these firms, for whatever

reasons we went to them. They didn’t come to us. The Liquidators have a process

to work through and yes it has taken a while but it does seem like it is nearly over.

I have been awarded £3,300 for my claim. It has been hard for me but will be

quite glad of 30p or anything that I get as I thought I’d get nothing. Have been emailed

and informed that any monies coming back to me should be paid by the end of March,

If it takes longer then so be it.

Mark says

They did come to us. They phoned and pestered me many times to take out loans.

Noel mxxready says

Last loan with them in 2014 they made loads of phone calls and letters inviting me to take out more loans which I threw in the bi. What about the lovely rt ads inviting u to take them out ad well. Great to c them removed as soon as they went bust

Jak says

Hi

That’s interesting I’ve not heard anything since the 8th august last year when they advised of my claim amount which had been accepted I suppose they are working through all of the claims and just to be patient

Robert James says

Hopefully, if all is going to schedule, we should get an email confirming the percentage pay-out next week or the week after.

This then gives them 4 weeks to have the pay-outs completed by end of March.

Jak says

That’s good news

Thanks for the update

Sara (Debt Camel) says

were you replying to Robert? That “timetable” is what he is hoping for… I wouldn’t rely on it. It isn’t an update from the administrators.

Robert James says

The administrators say we will be paid by end of March. The pay-out emails normally come 2 to 4 weeks before. Simple logical deduction that we will get pay-out emails within the next 1 to 3 weeks.

Unless you foresee the goal posts moving again.

Sara (Debt Camel) says

The administrators say we will be paid by end of March.

It may mean they have just started to make payments by then.

The pay-out emails normally come 2 to 4 weeks before.

That is a complete guess on your part.

Robert James says

I call it a common courtesy to tell the recipients of a payment 2 to 4 weeks before pay-out.

If they cannot do that, why are these administrators in this business?

Sara (Debt Camel) says

what you would LIKE to happen isn’t relevant here. There is no point in arguing about this.

And most people would rather be told today and paid tomorrow than told today and have to wait a few weeks.

Robert James says

Well, the administration end date is 14th March and I don’t think a court will allow a further extension.

So I assume the payouts will follow soon, the no reason for money to be held by the parent company.

Sara (Debt Camel) says

I don’t think a court will allow a further extension.

Why?

I assume you are not an expert in adminstration?

I have no reason to think an extension is needed but if say the administrators don’t have the tax clearance they need I can’t think why the court would reject a request for an extension.

Robert James says

If they don’t have the tax clearance, why don’t the y pay the minimum say 30% to us now, and we get the other 0 to 20% when clearance comes through.

I am not rich like the administrators are and I require some of that money.

Sara (Debt Camel) says

Payments will be made at some point. Hopefully by the end of March.

But NO-ONE should assume that will happen. Do not make any financial plans on that basis.

And it is just pointless you telling people what you think the timetable will be as though it is set in stone.

Sorry, but I saw way too many people reading and discussing what the administrators words meant about timing and payments in the Wonga and many of them were very disappointed.

Don’t let this happen to you.

Chris says

Robert – I solidly believe you should stay away from your speculation which risks making people anxious or giving false expectations. Sarah does fantastic work at keeping us up to date with official announcements which is what we need. Let her get on with it.

The only other relevant info here would be when someone has actually receives a payment or a notification of intent to pay. And they’ll be able to prove it…

Jason says

Hi Sara,

I am a support worker and a client of mine is waiting on a payout like everyone else on here. Rightly so, you have said not to make any plans on 30%-50% payout until it is in the bank and this is what I have been telling my client, however, as this was told back in November (?), he has mentally prepared himself for at least 30% which would be a potentially life changing amount for him. As it has now been months since that announcement and payouts are imminent, if the payout is substantially less than 30% this could have severe consequences on his mental health (As damage would have been limited had he been warned say a month after that announcement that it would be less).

I know nothing can ever be set in stone until it happens and they were quoted as ‘may’ pay 30-50% but if it WERE to be anything less, would he have grounds to file a complaint against them due to the distress it will have caused by really, leading him on?

I know this type of thing would not just impact my client but also many others on this forum.

Many thanks,

Jason

Sara (Debt Camel) says

I doubt it.

But I have no reason to think 30-50% is not still the likely range. It is after all very broad!

Jason says

Thanks Sara

Danny carmody says

hi Sara, in the email and call l got, we will get the % email feb/march and redress payouts end of march, admin/QQ have never given any dates, just months, its now a waiting game, so can every one stop say it should be this week, next week, just wait like we have been told, hope this is of help, Sara you have been so good running this site for all of us well done

Andrew says

I happy with any amount at any time , why can’t people just be patient .The payouts will start when the start and people will get what the get .

Gary says

All just wait till end of March. We all made a mistake taking these loans and are all in financial trouble. Don’t count on this money and think of it as a bonus.

Mark says

Don’t forget this company was the reason you got in to difficulties in the first place. They pestered you with phone calls and then sent letters through the post offering discounts if you had so many loans. If I remember right it was bronze, Silver then gold membership to get the most discount off your loan. The more you took out the better the discount. They prayed on the needy…I look back and think I was an idiot to fall in to the trap of getting many loans out…but we are not the idiots….They are! Whether it’s 30p or 50p in the £…I’m glad that them and other companies like them have gone. If one world could describe them then its EVIL

Noel mccready says

Agree with everything u say there

Mari says

Help!! Has anyone else out there asked for redress payment to be made into a foreign bank account? I moved abroad a few years ago and closed my uk account. I asked for payment to be made to my bank here in Portugal and quickquid said that was ok. Now I receive an emails saying if I don’t have a UK account then I will be paid by cheque. Foreign banks won’t accept cheques. My redress amount was £9,700 so 30% of that is quite a substantial amount!

Sara (Debt Camel) says

Send in a complaint saying that a cheque is not satisfactory, they have to pay you by bank transfer.

Mari says

Hi Sara. I send a reply email saying I needed payment by bank transfer but received another email saying that wasn’t possible. I’m so worried they’ll just not bother to send it. I received a redress payment last year from Paydayuk into my foreign account so I can’t understand why QQ are saying it’s impossible.

I will do as you say though and escalate it as a complaint. Thank you

Mari says

Does anyone have the name and email address of the CEO or Managing Director of these administrators? I’m getting absolutely nowhere with emailing them re paying into my foreign bank account.

The only option they’re willing to discuss is a) payment into a UK account in my name, oe B) a cheque to my foreign address

I don’t have a UK account, they won’t allow payment to my daughters UK account and foreign banks won’t accept UK cheques.

I’m getting desperate now

Sara (Debt Camel) says

This is nonsense. Foreign creditors have always been able to make a claim in an administration.

Have you complained directly to the administrators eg email Chris.M.Laverty@uk.gt.com ?

paul says

Yes it’s David Dunckley, his secretary got the pleasure of me over Wonga.

mailto:david.dunckley@uk.gt.com

Or call tel: (0)2077283037

Mari says

No I hadn’t Sara, but I’ve just sent an email to him now. Hopefully he’ll be able to sort something out.

I received a redress payment from PayDay UK last year to my foreign account with no problems at all so I can’t understand their insistence that it can’t be done!

Thank you

Mari says

Hi Sara

They’re still refusing to sent payment to a foreign account, even though I complained to Chris laverty

Just received an email today saying I must be paid by cheque

I’m at just about at breaking point now

Any other suggestions?

Sara (Debt Camel) says

yes, this is absurd. Send a complaint about Chris Laverty through the Insolvency Service to her professional body: https://www.gov.uk/complain-about-insolvency-practitioner. the details you need are here: https://www.insolvencydirect.bis.gov.uk/fip1/Home/IP/9121

Adam says

Hi

I have not had any information or email from them yet about any amount. Should I contact them or wait a little while longer? When I go to the link from the email sent saying it would be around 120 days or just says the portal is closed. Thanks in advance

Ed says

You’re by no means alone there! I’ve emailed and phoned several times now… they simply won’t tell me what my redress is, nor will they send me an email, however they have told me that my claim had been upheld! All very odd… given we’re only talking a few weeks from a further update I’m just going to leave it till then – hopefully we’ll all be put in the picture at that time.

Noelmccready says

Just wondered if all the overpaymens have been paid yet. If not surely they have to be sorted before the redress is sorted.

Sara (Debt Camel) says

not really – they are two separate payment steams. But obviously I hope they have all been soted.

Kel says

I’m still waiting for my overpayment refund, still getting the same response ‘delay due to volume of payments’. Getting slightly annoying now !

Jane Y says

Same here its so frustrating! Mine is £70!

Jak says

I have just spoken to them and was told they are waiting for the administrators to tell them the final % we will get back and payments should be processed by the end of March

Gemma says

I’m so bored of waiting now!

Mark says

Thanks for the update Jak, the wording here is interesting that they are now waiting for the administrators to tell them the final %, I’m wondering if this suggests that the HMRC step has now been completed

Sara (Debt Camel) says

you are trying to read too much into a remark from customer services.

Melanie says

Hi

I emailed them yesterday about the overpayments, as I was told it would be within 4 weeks and that was 4 weeks ago, still nothing just that they are working through them 🤷🏻♀️

Frustrating as mine is about £350

Kel says

I did the same thing too, still not heard anything back.

Gemma says

If the over payments are so so far overdue, I really can’t see refunds being given by end of March. I pretty sure they’ll drag their feet on those too!

Sara (Debt Camel) says

overpayments are a manual exeercise. I have no idea why they are taking so long but it may not have any effect on the main refunds.

Mark says

I’ve been told today by the company that I went through to claim for miss-selling of payday loans that Grant Thornton have until October 2022 to pay out any redress. Fingers crossed its not true.

Jim says

The administration can last until October, but the redress payments must be made by end March

Mark says

I did mention that I had heard that the payments were to be paid in March and the reply I was told is that there is no legal obligation for Grant Thornton to make payments of redress in March. So it basically sounded like as long as the redress payments are made by October then there is no problem. Or if it went back to court an extention could be granted.

Sara (Debt Camel) says

Extensions can always be granted.

But at the moment there is no reason to think that payments won’t start being made in March.

Trebor says

I had to call them today to update my bank details.

Very friendly Claudia, got my details updated and stressed that the emails confirming final percentage and payout amounts will be due out within the coming weeks and payments will be made no later than the end of March.

No indication of any delays.

I’m made up at the prospect of 30-50%.

Especially given the Wonga redress of just over 4%.

Bob says

I should probs phone them also to make sure they hold the correct bank details for me as its been so long, whats the number to phone? cheers

Trebor says

0800 016 3250 was the number I was given in response to an email I had sent them.

Really quick, efficient and friendly call, took less than five minutes, worth it for the peace of mind, knowing they have the correct details.

Sabrina says

Had this as a reply from them today!

Dear Sabrina

Customer ID:

Ticket:

Thank you for contacting CashEuroNet UK, LLC. In response to your recent query, per the progress report sent to customers payments will start going out prior to the end of March 2022. It could be sooner but should again be no later than the end of March.

Updates will be provided as they become available and will be forwarded to all creditors. We appreciate your patience.

Yours sincerely,

Claudia

For and on behalf of CashEuroNet UK, LLC

The Joint Administrators

Claudia C

USHA says

I didn’t get any emails about the amount of my claim, though I know I do have an accepted claim. I hope I’m not the only one?

Al says

I didn’t either I had to email them and they sent me a pdf attachment within 24 hours

Claims@casheuronetuk.co.uk

Jak says

I didn’t either just that it would be significantly reduced I rang yesterday and was told between 30-50%

Micky says

What is the chance of the payout actually being higher than 50%?

Sara (Debt Camel) says

No one knows. I would be surprised.

Don Crater says

Estimations between 30-50%. We’re all hoping it’s toward the higher figure; and considering the Wonga %ge there is understandable nervousness

Zero point in speculation

Zero point in anything other that waiting it out

Ian H says

If you run through the reports and figures virtually nil. If the Enovo SLA is negotiated to zero then maybe but that’s unlikely. On reasonable assumptions of fees and balances I have said around 35 – 45 per cent looks favourable. But that is on assumptions and not definite. As Sara has said all along there is no reason to suppose it won’t be in line with the administrators estimates but until it arrives or is announced do not assume anything and anything above 30 is a bonus. More than 50 and hats will be eaten.

Jak says

When I spoke to them last week they said potential 30-50%

John says

Hi has there been any update as to when we should be getting an updste from them?

Paul says

Well… Its March 2022 – let’s see what lady luck brings us. My debt didn’t go to Lantern but was sat with PRA. Whatever redress I get, as and when I get it, I hope its not used to furnish the debt which has been dormant for years. My redress says £2800… Obviously hoping for 30-50% as alluded to but not counting my chickens. The dormant debt is £1299. I’m fearful of getting 30-50% and that furnishing the debt and I see nothing. Time will tell. Good luck everyone and thank you to Sara (Debt Camel) for the updates and insight. Its appreciated

Cheryl Slater says

Does anyone know which email addresses work to contact them on? The ones mentioned in this article are not full email addresses. The one I was using before claims@casheuronetuk.co.uk is now being returned undelivered

Robert says

Cheryl, I received a reply from claims@casheuronetuk.co.uk 08/02/2022 and casheuronetuk@uk.gt.com 10/02/20022. Best of luck!

Further:

If you require specific information relating to your claim (such as your credit file) or need to update your bank details for payment, please contact the QuickQuid Customer Support team on 0800 056 1515 or support@quickquid.co.uk or the On Stride Customer Support team on 0800 210 0923 or customersupport@onstride.co.uk, as applicable to your loan.

Lloyd says

Next update supposed to be late April/May

Danny carmody says

john any time now, as they told me or end of march, so just a waiting game now, all the best,

Kayleigh says

It’s March! Good luck everyone, hope we all get our payments swiftly or at least an update soon 🤞🏽🤞🏽🤞🏽

SK says

I don’t want to raise any false hopes or speculate about the percentage of the payout etc. but below is an extract from Enova’s annual report regarding CashEuroNet…

“The administration of our subsidiary, CashEuroNet, through which we conducted our U.K. business, could have an adverse impact on our liquidity and financial position.

Effective October 25, 2019, in accordance with the provisions of the U.K. Insolvency Act and pursuant to approval by the board of directors of CashEuroNet, insolvency practitioners from Grant Thornton UK LLP were appointed as administrators in respect of our subsidiary, CashEuroNet. Claims related to the management and financial support of CashEuroNet prior to the administration may be asserted, which could result in additional expense to us. We are currently providing certain administrative, technical and other services, and incur other exit costs and expenses related to CashEuroNet during its administration. While we do not believe there will be claims or costs beyond the initial anticipated charge of $74.5 million, we cannot provide complete assurance we will not experience significant additional claims or costs related to the administration of CashEuroNet and its prior business conducted in the U.K.”

Sara (Debt Camel) says

I don’t think that has any relevance at all to the percentage or timing of payout.

Chris says

Will we get the money in our bank end of March or will they tell us how much we’re getting end of March?

Sara (Debt Camel) says

that is unclear. It is also possible that some people will have been paid by the end of March and some won’t, as the payments are very likely to be made in batches.

Kelly says

Hi,

I have looked on the claims portal and I filled it all in but I didn’t see anywhere to put my bank details. Could someone help please. My claim has all been submitted but can’t remember putting my bank details on it. I no longer have my old bank account that they have. Will they most likely contact people to check? Thanks x

PJ says

I emailed them to check which bank account they had on file. They would have some bank account detail from when you were using them, so there should be something on file I would think.

If not, it’s possible you will instead be getting a cheque, although then you would need to make sure they have the correct address details.

Kim says

No bank details had to be updated by 14th March 2021. You may have to contact them and see if they can change it now but it may be too late.

Calum says

Hi Kelly,

Ring them. I just double-checked mine for peace of mind. 0800 016 3250.

Hope this helps

Gill Owen says

Tried sending Email today for update ….but was not delivered due to address not found …has anybody else had this problem … as the email I used …was the same as other correspondence I’ve had with them

Joanna says

Yes, I tried to email too, but got an undelivered message. This concerns me.

Jak says

Hi

I tried emailing last year no response but I did manage to speak to someone over the phone a couple of weeks ago

ROBERT says

Johanna, I read your post & emailed 30 minutes ago, and a reply from Claudia within the hour.

Try once more I advise. claims@casheuronetuk.co.uk

Dear Robert

Customer ID: *********

Ticket: UKCMP-*******

Thank you for contacting CashEuroNet UK, LLC. Thank you for confirming your email address, the communications are going via email to k***************

Thank you for making us aware of the email address, which remains active and live. We are aware of this issue and it is being investigated. We apologise for the inconvenience caused.

Should you have any further questions or concerns, please do not hesitate to contact us.

Yours sincerely,

Claudia

For and on behalf of CashEuroNet UK, LLC

The Joint Administrators

Joanna says

Thanks so much for the update!

Jack says

Hi Everyone, I have a claim in against QuickQuid which was accepted but I got my accepted claim value all the way back in November 2020! Haven’t heard anything since the Grant Thornton update in May 2021, do you think I will receive my payment this month like everyone else? Im so confused by it all

Sharon says

The CashEUronet UK website has gone. I tried to look today but it is not there. Can anyone else still get access to this?

Sasha says

I can still see the website