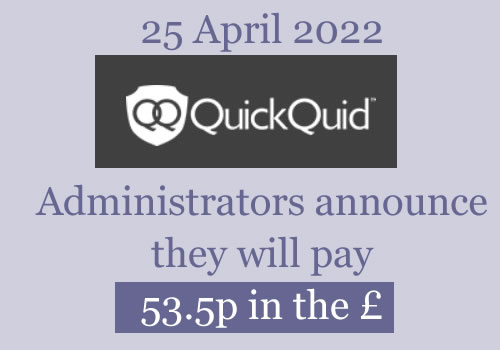

Payments – UPDATE – 25 April 2022

Administrators have started sending emails to everyone with an upheld claim telling them what they will be paid.

“The Joint Administrators are now in a position to declare a first and final dividend of 53.5p in the £”

The average claim value is c £1,700. Someone with that claim value will get a payout of about £910.

The payout details are given in the email:

- This will be paid over the next two weeks.

- If the administrators couldn’t validate your banking details, it will be sent by cheque. I don’t know how the administrators will “validate” your details.

- If you used a claims company, the money will be paid to them.

- Most people are not having any deduction for tax paid to HMRC, so there is no need to reclaim anything.

Credit records

The administrators may decide to :

– remove any negative marks on your credit record

– delete all loans that were upheld

– delete all your loans.

I don’t know what they have chosen to do – if people can check and report in the comments when they see a change, that would be great.

How much your credit score will change will depend on whether there were any negative marks. If you want to get a mortgage, you would like as many payday loans gone as possible, even if they were repaid on time and not hurting your credit score.

In a few months when the administrators no longer talk to the CRAs you can ask for any remaining loans to be “suppressed” so other lenders can’t see them. See https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do that now.

QuickQuid went into administration in October 2019

CashEuroNet (CEU), which owns the QuickQuid, Pounds To Pocket and On Stride brands, stopped giving loans and went into administration on 25 October 2019.

I will be talking about QuickQuid (QQ) rather than CashEuroNet as it is the more familiar name. Everything here also applies to loans from Cashruronet’s other brands, Pounds To Pocket and On Stride.

Grant Thornton were appointed as Administrators. They set up a page about Redress Complaints – this is their term for people who have asked for a refund because they were given unaffordable loans.

Background to the QuickQuid Administration

QuickQuid was one of the “Big Three” payday lenders in Britain, starting out in 2007.

After Wonga and the Money Shop Group had all stopped lending and gone bust over the last fifteen months, QuickQuid was left as the largest UK payday lender.

QuickQuid had well over a million customers. When it went into administration there were c. 500,000 customers with outstanding loans.

Many of these customers had prolonged borrowing from QQ. They either rolling loans over or repaid one loan but were left so short of money that they had to borrow again.

These customers have good reasons to win an affordability complaint and get a refund of the interest they paid.

Affordability complaints started on a small scale in 2015 and increased in the next few years.

In 2018, complaints going to the Financial Ombudsman (FOS) jumped with the involvement of Claims Companies and QuickQuid became the most complained about firm to FOS, excluding PPI complaints.

For a long time QQ refused to refund interest on any loans taken more than 6 years before or where the loans were given in 2015 or afterwards. This resulted in a huge backlog of claims at the Financial Ombudsman, where QQ had made very poor offers to customers and then rejected an adjudicator decision.

In late July 2019, QQ agreed to accept several thousand FOS complaints it had previously rejected.

By accepting the FOS decisions on loans over 6 years, long chains of borrowing, and loans taken after 2015, the scale of QQ’s likely future liability for refunds will have become clear to the company.

After failing to persuade the FCA that a Scheme of Arrangement was appropriate, Enova, CEU’s large and profitable US parent, decided to close the UK business, blaming the UK regulatory environment.

How could the regulators let this happen?

This is an excellent question… Stella Creasy, MP called for an inquiry into the FCA over Wonga and QuickQuid.

What has happened in the administration

Customers with a valid claim for a refund are “unsecured creditors”. This includes:

- any refunds that were in progress after an amount was agreed or a Final Decision from a FOS Ombudsman (FOS);

- complaints that were underway at QQ or FOS when QQ went under;

- any new complaints sent to the Administrators.

All complaints at FOS legally had to stop and were been passed back to the Administrators. It isn’t possible to send any new complaints to FOS.

It is now too late to submit a Claim for unaffordable lending. The last date was 14 February 2021.

The administrators have given the following statistics about claims:

- 169,000 customers made claims for unaffordable lending;

- 78,000 claims were upheld by the administrators;

- the upheld claims had a total value of £136million, so an average of about £1,700 per claim.

Still owe a balance on a QuickQuid or On Stride loan?

More than 300,000 of the current loans were sold to Lantern in summer 2021. You should have been informed if your loan was sold.

The administrators have now stopped collecting any money from the remaining unsold loans.

This page is kept updated

The comments below this article are a good place to ask any questions. And you may be able to see where someone else has already found out the answer.

Tom says

Hi,

Looking for advice,

I took out 13 loans with Quick Quid in 2018 (all debts paid in full/satisfied) in complete ignorance of the effects they are now having on my credit report and mortgage application.

I missed the deadline to make a claim but to be honest I just want to clear them from my record if possible!

Has anyone been successful in this process and/or can give advise on the best way to go about this?

Thanks in advance,

Tom

Sara (Debt Camel) says

There isn’t much you can do at the moment. It’s too late to make a claim to the administrators. If you wait 6-12 months the administrators will have stopped responding to queries from the credit Reference Agencies and at that point you can get the CRAs to “suppress” these loans, see https://debtcamel.co.uk/correct-credit-records-lender-administration/. But it is too early to do this now – if you try, the CRAs will ask the administrators who reply they have not assessed these loans as being unaffordable.

Matt says

Hi Sara

I won an affordability complaint yesterday after having to send in my bank statements on appeal. I paid £400 to quick quid on the 30th October five days after they went into administration. Can I ask who has got this money ? and am I likely to get it back as I did with the money shop and if they do pay out am I likely to get it all back or just a small percentage.

Thanks

Sara (Debt Camel) says

You should get all if that money back.

Leon says

Hi I have received the following email saying my outstanding loan remains unpaid

“ As a result of the wind down, CashEuroNet UK LLC will be unable to receive any payments after the 23rd of August 2021.

We confirm the Joint Administrators are prepared to accept £106.36, being 25% of your outstanding loan balance, as full and final settlement, provided payment is received by the 23rd of August 2021. Should you accept this offer we would then be able to reflect this on your credit file within 45 days of receipt and prior to ceasing operations.

To repay your outstanding loan balance, please call QuickQuid 0808 234 4561 or On Stride Financial at 0800 210 0925. ”

I have checked all three credit reference agencies and there are no outstanding QQ loans at all?

My question is, should I pay? Could my credit file still be affected?

Many thanks

Sara (Debt Camel) says

Do you agree there is a remaining balance of about ££425.

Is this an old defaulted loan? When was the default?

When did you last make a payment to this debt?

Did you make an affordability claim?

Leon says

I made an affordability claim for an old loan, that wasn’t defaulted. Yes I agree that the outstanding balance was around £425, and I probably last made a token payment around 6 months ago.

There is nothing on my credit report (from all 3 agencies” about an outstanding balance though, all the QQ loans are shown as settled.

It’s pretty confusing!!

It’s been “partially upheld” but doesn’t seem to go in to much detail…. The claim result is:

Guide

Total interest and fees on loans £691.20 1

Total compensatory interest £183.36 2

Less set off £974.56 3

Revised interest and fees on loans £0.00

Revised compensatory interest £0.00

Accepted claim value £0.00 4

Compensatory interest settled by way of set off £183.36 5

Remaining loan balance potentially due to CashEuroNet UK, LLC £425.44 6

Refund for overpayment on CashEuroNet UK, LLC loan £0.00

Im so confused!!!!

Sara (Debt Camel) says

ok so using the numbers on each line:

(1) is the interest and charges being r3efuded on the loans they have decided are unaffordable – there should also be a list of those loans? did you think that was an acceptable result, if not did you appeal it?

(2) is the 8% extra interest added to (1)

(3) is the total they are setting off against the debt you owe them. It should be the total of (1) and (2) but they come to £874.56 which is £100 less than the number they give in (3). I have NO idea why.

(4) is just saying they are using all your claim to reduce your balance so you won’t get any cash.

(5) doesn’t matter

(6) says that after they have used your compensation to reduce the laon balance you still owe them £425.44. That suggests that the loan balance before was £1300. Or perhaps £1400, hard to tell because of that odd £100.

But you thought you owed them about £450? not £1300? Can you check up on that?

Leon says

So it does seem to make reference to a £1400 loan AND a £1500, im struggling to see how the £1500 isn’t updated?

08 £100.00 £30.40 Rejected

9567998 2015-06-15 £200.00 £48.00 Rejected

10750128 2016-06-07 £225.00 £88.20 Rejected

11060504 2016-09-01 £700.00 £527.20 Accepted

12827204 2018-01-12 £1,500.00 £144.00 Accepted

12923071 2018-02-06 £125.00 £33.20 Rejected

13148602 2018-04-05 £700.00 £437.00 Rejected

13796431 2018-09-07 £1,400.00 £20.00 Accepted

Sara (Debt Camel) says

when were you sent this decision?

they have “accepted” both the 1500 and the 1400 loan

The numbers at the end are – so £20 on the last £1400 loan. They add up to the £691.20 whioch is the interest being refunded.

Can you work out from bank statements what you have actually paid to that last loan?

Adrian E says

Had the same issue message and issue with Wonga ( they really need to give more then a months notice for these offers)

Both Wonga and Quickquid were loans found to be unaffordable

Didn’t pay Wonga and nothing showing on my credit file , unable to pay Quickquid due to the short notive and I assume it’ll be the same.

I’m guessing the Loan book hasn’t been sold and that although legally the debt will still exist after the closedown no one will legally own it.

Sara (Debt Camel) says

Wonga were unable to sell their loan book. The QuickQuid administrators are still trying to sell theirs (so far as I know) but as they are likely to get less than 25p in the £ for the debts, they would prefer to settle at that amount.

They cannot practically give more than 30 days notice – this is a quick “last minute offer” before they decide what debts to sell and before they work out the “p in the £” compensation that they will be paying. There is no time to let the money come in slowly, they need to close the finances down.

If the debt is no longer on your credit record as the default was over 6 years ago OR the debt has been deleted as the loan is not affordable, then this debt should not reappear.

If any debts remain with QQ when the administration has ended – ie they have not been sold – then you can ask the CRAs to suppress the credit records – but it is too early to do that at the moment.

Bottom line – we don’t know if the debt will be sold. If it is, you may prefer to have settled it at 25% now. If it isn’t, you would do better by ignoring the offer.

Richard says

I think QQ have now sold the loan book at least in part. Last week mine was sold to Lantern UK. I’m guessing the ones that haven’t been sold are the ones that will be written off if not paid directly.

Leon says

That’s the gamble….. There is no mention of any outstanding QQ loans on my credit report(s)

Is it worth contacting the administrator to ask? Or is that just putting my head up over the parapet!

Sara (Debt Camel) says

Ask what? they aren’t going to say they won’t sell your loan!

Matt says

Hi Sara

I asked CashEuroNet for a response about paying out for claims made after the administration started and this was there response

Please note that, as the case is an administration, Insolvency set off (and potential refunds due to customers) only apply after the date that the notice of intention to distribute was circulated to all creditors (15 July 2020).

Does this mean that only payments made after 15 July 2020 that were unaffordable will get a refund but those that paid between the 25th of October and the 19th July won’t .

Sara (Debt Camel) says

I will make some enquiries.

Matt says

Thanks Sara for looking at this issue.

Matt says

Hi Sara

Hope your well

Just had this email this evening. Really disappointed . Just seems another way for the administration to keep more money for there business.

Following on from our previous communication, we note that the final payments for your loan was on 28 October 2019 which was before the notice of intention to distribute was circulated to all creditors (15 July 2020)

As explained previously, as the case is an administration, Insolvency set off (and potential refunds due to customers) only apply after the date that the notice of intention to distribute was circulated.

Sara (Debt Camel) says

Apparently, there is a “crystallising date” in an administration and money paid after that is refunded.

ICL was a Scheme and not an administration so the rules are different.

Debbie says

Has anyone received an email today saying:

Document Casheuronet LLC – creditors let re extension created on 17/08/2021 14:42:08

Jim says

Just received an email with a new document alert for the insolvency portal, but don’t have the link to the insolvency portal. Does anyone have the link or the document to which this refers

Document Casheuronet LLC – creditors let re extension created on 17/08/2021 14:42:08

Cheers

Richard says

Dear Sirs

CashEuroNet UK, LLC – In Administration

In the High Court of Justice, Business and Property Courts of England & Wales

No. 007155 of 2019

Pursuant to rule 3.54(5) of the Insolvency (England and Wales) Rules 2016, I write to notify you that on

12 August 2021 the court ordered that the Joint Administrators’ term of office be extended in accordance

with paragraph 76(2)(a) of Schedule B1 to the Insolvency Act 1986 for a period of 12 months giving a

revised date for the automatic termination of the administration of 24 October 2022.

The reasons for seeking the extension, as given in the application to Court, are as follows:

To allow further time in order to pursue a sale of the loan book in order to maximise asset realisation

for the benefit of the estate

To conclude the Redress Claim process, including issuing assessment outcomes to customers with

one or more sold loans and

Finalising all appeals

Should you require any further information or explanations, please email casheuronetuk@uk.gt.com.

Yours faithfully

for and on behalf of CashEuroNet UK, LLC

Chris M Laverty

Joint Administrator

The affairs, business and property of CashEuroNet UK, LLC are being managed by Chris Laverty,

Trevor O’Sullivan and Andrew Charters appointed as joint administrators on 25 October 2019.

Chris says

Heres what they say in the latest update …

Dear Sirs

CashEuroNet UK, LLC – In Administration

In the High Court of Justice, Business and Property Courts of England & Wales

No. 007155 of 2019

Pursuant to rule 3.54(5) of the Insolvency (England and Wales) Rules 2016, I write to notify you that on

12 August 2021 the court ordered that the Joint Administrators’ term of office be extended in accordance

with paragraph 76(2)(a) of Schedule B1 to the Insolvency Act 1986 for a period of 12 months giving a

revised date for the automatic termination of the administration of 24 October 2022.

The reasons for seeking the extension, as given in the application to Court, are as follows:

To allow further time in order to pursue a sale of the loan book in order to maximise asset realisation

for the benefit of the estate

To conclude the Redress Claim process, including issuing assessment outcomes to customers with

one or more sold loans and

Finalising all appeals

Should you require any further information or explanations, please email casheuronetuk@uk.gt.com.

Yours faithfully

for and on behalf of CashEuroNet UK, LLC

Chris says

So they have an extension to Oct 2022!

Lisa Smith says

This is getting ridiculous now.

Oliver says

Disgraceful. That’s 3 years since the administration started. Wonga. Sunny etc did not need this much time. I’m sure they had loans sold to third parties. Sunny paid my £9 within 10 months of the administration. No appeal or extra info needed. They are really stretching this out.

SK says

People, please do make a complaint to the FCA

My complaint has been rejected by the FCA and one of the reasons was this: “Consumer credit activities such as lending are unlikely to give rise to financial losses to consumers either often or of significant amounts.” This is ridiculous!!! Numerous PDL companies went bust or entered a scheme within a couple of years and individuals are losing thousands of pounds by not being paid full redress!

Needless to say I have forwarded my complaint to the The Financial Regulators Complaints Commissioner…

Deb says

Hi Sara

I’ve had my redress claim come through by email it’s £3855 although I know I will only get a small amount of this, my last loan I took with QQ was sold to Lantern quite a few years ago. I stopped paying them in Feb this year after seeing one of your replies. This loan has been deemed unaffordable by QQ but has an outstanding balance of £335 with lantern , the total was £950. My question is do I need to pay the balance to Lantern ?

Thanks

Sara (Debt Camel) says

You can ask the administrators about this. And ask Lantern about this.

By the way the administrators are being unhelpful about explaining what will happen, my guess is they will not be using the calculated refunds to set off against the balance you owe Lantern. But you do not know that for sure until you ask.

What is the rest of your finacial situation like?

Deb says

Thanks for the info. I’ve been lucky enough to clear all my debts with debt collectors over the last few years and only have this one left. It just seems unjust that we have to pay a debt collection agency the full amount when they have probably brought the debt for pennies anyway and the loans were unaffordable.

Sara (Debt Camel) says

indeed. Read https://debtcamel.co.uk/no-set-off-scheme-administration-debt-sold/.

You should first ask Lantern about set off. If they say No, then you have the option of

EITHER accepting this

OR putting in a complaint as that article suggests and sending it to FOS if they don’t settle (there is no track record of how these case will be decided at FOS, so far the debt collectors have agreed reasonable compromises)

OR saying you are prepared to offer them the amount you get back from QQ in full and final settlement of the debt and if they will not accept that you will be making a complaint and taking this to the Ombudsman.

Ryan says

I wrote to Lantern about this and they replied:

“So far, we have had no contact from the Administrators or our client regarding any balance amendments.”

When I wrote to CEN about what they will be doing I received a boilerplate email about not knowing when payments will be made.

So I phoned them up but got a very vague answer saying they won’t be doing anything other than making the payments.

I’m not 100% sure the person knew what I was talking about though *shrug*

Sara (Debt Camel) says

See my reply to Deb today.

Ryan says

Thanks, Sara.

You’ve been a great help.

Shuffler says

I have had my claim for redress rejected. I had 3 loans with Poundstopocket from 2011-2013 rather than QuickQuid. I’ve appealed and sent a copy of my credit report from the time the first loan was approved which shows numerous late payments, defaults (totalling £60k) and ccjs. They are refusing to consider my appeal without bank statements covering the period of the loans which I don’t have. I would have to pay £10 a statement to get copies which would cost me more than I’m likely to get back if successful. They’ve not commented at all on the credit report I sent. Any advice on how I get them to look at my appeal without bank statements or am I fighting a losing battle?

Sara (Debt Camel) says

How large were each of the loans, in order? How much interest did you pay on them?

Shuffler says

Dec 11, £750. Apr 12, £500. Feb13, £1150 which I still owe some of. Total interest was about £1170.

Sara (Debt Camel) says

the last debt -are you making payments to it? has it been sold to a debt collector? how much do you still owe?

what is the rest of your financial situation like?

Shuffler says

Yes, it’s been dealt with by Lantern. £425 left, paying off £5 per month. Financial situation still not good, that’s why I ‘m paying so little to this and other lenders.

sean says

recieved email back today after complaining about extension they have replied all payments including redress will be paid as soon as possible , all payments have to be made by march 2022 hope this helps

Oliver says

2.5 years after the start of the administration. Absolute joke vs other payday lenders that went to the wall. Those too had loans sold to third parties but managed to make redress payments within a year.

Natalie says

To The Creditors

17th August 2021

CashEuroNet UK, LLC – In Administration

In the High Court of Justice, Business and Property Courts of England & Wales No. 007155 of 2019

Pursuant to rule 3.54(5) of the Insolvency (England and Wales) Rules 2016, I write to notify you that on 12 August 2021 the court ordered that the Joint Administrators’ term of office be extended in accordance with paragraph 76(2)(a) of Schedule B1 to the Insolvency Act 1986 for a period of 12 months giving a revised date for the automatic termination of the administration of 24 October 2022.

The reasons for seeking the extension, as given in the application to Court, are as follows:

To allow further time in order to pursue a sale of the loan book in order to maximise asset realisation for the benefit of the estate

To conclude the Redress Claim process, including issuing assessment outcomes to customers with one or more sold loans and

Finalising all appeals

Should you require any further information or explanations, please email casheuronetuk@uk.gt.com.

Yours faithfully

for and on behalf of CashEuroNet UK, LLC

Chris M Laverty

Joint Administrator

Sara (Debt Camel) says

This does NOT mean the payout will be that long delayed. After the payout it takes a long while to liquidate the company.

Natalie says

It’s dragging so much, I have overpaid and asked several times when those funds should be returned to me as they aren’t part of the claim and they just fob me off. Frustrating. It may not take them that long but I’ll bet it’ll be reason enough to delay it as long as they can!

Sara (Debt Camel) says

It seems they are only refunding in full payments made after the decision to issue a dividend on 15 July, see https://debtcamel.co.uk/quickquid-casheuronet-administration/comment-page-11/#comment-440459. Payments made before then will only get a small % back

Natalie says

Sorry I’ve only just seen the thread with the same info I posted (older comments don’t seem to load for me)? I mean payments I made to QQ through Stepchange after the date in July 2020. I should receive those back in full shouldn’t I?

Sara (Debt Camel) says

I hope so. Based on that email to the other reader, yes.

Older comments – there should be a blue button that says “Older Comments” below all the comments you can see on a page.

14k Owed says

So im wondering how much the auditors are making from this. The actual people who are loosing out are loosing out due to the company handling this taking millions.

I think maybe its time we put in a request to find out how much they have taking and join together to take them to court to actually get our money back rather than them sitting back laughing with their profits.

Sara (Debt Camel) says

The fees are detailed in the administration updates

14k Owed says

When final % is known I think we need to put in request to find out what % would have been prior to delay 1 and then prior to delay 2. If final % is lower after delays then seriously this needs to be addressed

Sara (Debt Camel) says

I don’t think you would ever find out those figures as they haven’t been calculated. I am not unsympathetic, just being practical here.

Neil says

Haven’t had the email yet which would be worrying. But then it’s hardly been consistent. I was really hoping to get the credit file in shape but by the time this is all done and dusted the loans will be well on their way to dropping off anyway. Expecting around the wonga 5p on the pound based on nothing more than the feeling that the folks who have least get done over the most, as is tradition.

Denise says

Good morning,

I just spoke to a lady at CashEuroNet and she informed me that the extension could take the possibility of a pay out into March of 2022.

I believe that it is conceivable that any final figures may change within that time period and that the revised ones will be updated and sent out nearer the time. Apparently they didn’t foresee the actual amount of claims being made or appeals about decisions already made.

I know that this isn’t great news for many but I do feel that if it is out of our hands, then we have to go with the flow.

Ler’s see what the next seven months brings…

Thank you for reading.

Lex says

I spoke to an advisor at CashEuroNet today and the informed me payouts would start mid September up until March 2022 but who knows if this will actually be the case.

Mr and Mrs C says

I spoke to an advisor who assured me that my 9k payout would be in the bank that day, within 2 hours they had gone into administration and we will be lucky to get £90. I don’t think they know any more than we do.

Martin says

This is getting quite frustrating now.. Updates are few and far between and no one seems to have any clue as to what’s going on once contacted. I don’t normally mind but I am due an overpayment refund and its desperately needed. No percentage is to be deducted for overpayments. Yet they seem to be hanging onto this for absolutely no reason at all. Surely by settling all overpayment made that would be at least part of the battle and several claims would be then closed. Joke of an administration

Caz says

Hi wondering if I could get some advice I hav a qq default on my credit file dated jan 2017 ther is a balance still owing I’ve not made a payment since default was added & clear score have advised me lantern debt recovery will be added to my cf in my Oct report however I havnt had any correspondence from lantern so my question is do I have to admit I own this debt & ultimately pay it if I hear from them ?

Thanks in advance

Sara (Debt Camel) says

did you make a complaint to the QQ administrators?

Caz says

No I was too late & missed deadline

Sara (Debt Camel) says

Then it is going to be hard to challenge the debts. It is usually easy for a debt collector to produce a CCA agreement for these debts. It isn’t close to being statute barred.

Do you have a lot of other problems debts, some of which you may be paying, others ignoring?

Caz says

I can pay it but havnt had any correspondence from them as yet it’s also showing on my credit karma aswell as the quick quid account 2 accounts for same debt I’m going to raise a dispute to get qq 1 removed

Sara (Debt Camel) says

does the QQ show as closed?

Caz says

No still currently opened I wasn’t able to raise a dispute online with TransUnion for some strange reason & have had to email them with this information hopefully get a response soon should I can’tact lantern to pay the debt seems they,be been roporting since august yet I’ve had no correspondence from them I’m worried incase they do apply to a court for a ccj before contacting me which I most definitely don’t want.

Sara (Debt Camel) says

Well it should show as closed.

Lantern would rather you pay than they take you to court. They may accept a partial settlement offer – worth thinking about.

Caz says

Thank you so much for your help I’m going to contact lantern & see if they,l accept a lesser amount .

B says

I just wanted to update for anyone potentially waiting to suppress their QuickQuid records off their credit file that QuickQuid are still responding to complaints, therefore it is still too early to request suppression. I recently emailed to test and they were still returning email queries on credit referencing queries.

Ben says

Hi

Has anyone had the payout email details yet, which they said would come in September.

The last I spoke to an Advisor was that an email will be sent in September and hopefully then a payout will be ready?

Oliver says

Just spoke to customer services. The deadline for 3rd party sold loans was 31st August for a decision. Customers have 21 days to log an appeal. CashEuroNet then have up to 8 weeks to provide a response.

So if the last appeal was 21st September + 8 weeks you looking at December before all appeals are finished at the earliest

Payments will not be made until all appeals are resolved and closed.

Jordan Noone says

Hi Sara,

I have received a letter from Lantern regarding a debt I owed to QQ, to be honest I completely forgot about it for years and it’s around £900. I haven’t received any correspondence about this loan for literally years. I can afford to pay in full, they’ve added a default to me account this month, is it worth asking them to remove this before repaying in full? Thanks

Sara (Debt Camel) says

How old is the debt?

Jordan says

Just over 2 years, I am struggling to find exact dates as it won’t allow me to log in on the onstride website

Sara (Debt Camel) says

That seems very recent for. a debt you have forgotten about?

You can ask Lantern to remove the default but it’s unlikely they will. However it should be back date to when you hadn’t paid the debt for 6 months – this is definitely worth asking for as it means the debt will drop off your credit record sooner.

Jordan says

At the time I had numerous payday loans and credit cards, all have now been paid off which has been a long process but this obviously just got lost within them all, and the fact I had no letters or emails from them just compounded that. Due to QQ claims now not being taken, I feel I would’ve had a very good chance of unaffordability, what next steps could I take? Thanks

Sara (Debt Camel) says

I am sorry but this is too late. You can offer Lantern a partial settlement, that is the only option you have.

USHA DABYCHARUN says

Hello ,

So, any idea on when Quickquid plan to repay us?

Rob says

When the lawyers have drained off 99 % of available cash, lol.

On a more serious note, anytime between now (as it’s mid-September) and March 3022 , sorry typo March 2022.

sumbal taheed says

Hi everyone,

Think this question was just asked previously, not entirely clear still.

Do we know when Onstride Financial are looking to make the actual payment to the majority of us?

Thanks very much

Sumbal

Oliver says

I spoke to customer services and the mid September is inaccurate.

21st September is the last date for appeals from the 3rd party loans which ended 31st August. 21 days to appeal.

CashEuroNet then have up to 8 weeks to decide on an appeal

Realistically it won’t be until December at the earliest for any cash out

Owed 14k says

Personally once payments are made I am going to request total values of what they had that could have been repaid in Sep 2021 (which was stated as payment dates) and then what is total value that is paid when they finally do. I want to be clear that as a business they have not used the extension to make profits themselves at our loss.

If it turns out they could have made a higher payment in Sep but delaying meant a lower payment due to costs then I will sue them.

Lmaddi says

I was in a short term payment plan, my payment wasn’t taken this month so I emailed and was advised my loan has been written off and closed.

Does this mean it has been sold?

Sara (Debt Camel) says

It doesn’t sound like it! The administrators are usually clear when the loan has been sold. I suggest you ask them to be sure.

Leanne m says

Thank you, I got the following reply

In regards to your query, our records indicate that your account was not sold to a third-party agency. The remaining balance for Installment Loan: was written off due to On Stride Financial currently in the process of winding down its operations

I’m surprised but if it is true I’m certainly not complaining

Sara (Debt Camel) says

I’m not surprised. This happened with a LOT of Wonga loans.

Is the loan marked as defaulted on your credit record?

Leanne m says

No it’s not, it’s down as dequilant, although in a payment arrangement they kept marking it as a missed payment. Every month showing as missed on my report

They were not the easiest people to deal with

Sara (Debt Camel) says

Ok, well if you wait 6-12 months you should be able to get the record “suppressed” so that no one else can see this, as you can argue that a default date should have been added, the record is incorrect but the admin is have stopped responding to the credit reference agencies. At the moment it is too soon to do this as the administrate still answering queries from the CRAs.

Jack says

I was able to get Experian to completely delete it from my credit record.

Dean says

Any idea of what dividend we should expect( apologies if this has been answered previously)?

Thank you

Sara (Debt Camel) says

Keep you expectations low is my suggestion.

cat says

hi, i was wondering if i can get some help understanding what is happening i took a quickquid in 2014 and defalted in 2015 i havent noticed anything on my credit score until this month and ive now got a default for both quickquid and lantern at the same amount and same dates could someone explain or maybe point me in the write direction on what to do i am new to all this but ive been trying to work so hard to clear my debts one at a time but now i got too 800 pound defaults for the samething???

Sara (Debt Camel) says

Did you make a claim to the administrators for unaffordable lending?

Is the default date 2015 on yiur credit records?

When did you last make a payment to this?

How large are your other remaining debts and any arrears on bills?

cat says

no i didnt i wasnt even aware i had too or got any emails or anything in regards to this

yes it is

i havent made a payment as it hasnt should up on my credit report until yesterday and i was about 18 when i did it and totally forgot about it

all maybe 500 at the momment as ive been paying 2 big onces off and close to finishing paying them

ive tried to get it off my report so ive only got the lantern one and not the quickquid as they are both default but ive had no luck :/

Sara (Debt Camel) says

ok so any records with a default date will drop off your credit records after 6 years. So if this was in 2015, they should both be dropping off this year sometime.

It is normal to get two defaults when a debt is sold to a debt collector. The debt from the original creditor should be marked as closed and then it isnt counted for your credit score.

if it isnt marked as closed, this is wrong. You can as QQ to correct this, but as it will dropping off sometime this year (what is the exact default date?) you may feel this isnt worth the hassle.

Lantern will probably accept a settlement offer from you that is less than the full amount if you have any spare money to do this.

Wayne says

Hi,

I submitted a claim via the portal and received confirmation of from CashEuroNet that they were Acceptting irresponsible lending for 10 of 14 loans I took back in May. This equates to a payout of over £1100 but I have yet to receive any payout. Can you confirm will payment will be made by CashEuroNet.

Regards

Wayne

Sara (Debt Camel) says

No date has yet been set. But you – and everyone else – will on;y be receiving a small percentage of that total number you were told.

Noel says

They have assessed my redress at 13 grand think I will be lucky to get 3 percent of that had loans with wageday Advance. Got a letter from them they were in admin with same crowd as Quick Quid they offered me the sum of 157 pounds which I accepted. I never even put in a claim. This came out of the blue. Thought if this crowd was in admin Qiick Quid could go the same way and it did. My last loan was 2014 but they tortured me for 4 years looking me to take out more loans. Think the Wonga payout was 3 per cent so not expecting any more than that.

Rob says

What is a small percentage in reality 10%, 20 %, or a measly insulting 2%.

Sara (Debt Camel) says

Probably less than 10%, keep your expectations low.

Gary Armstrong says

Had an email from a director at grant Thornton apologising for the delay in payments but she stated that the post NOID payments will be issued in November as previously advised, hopefully this will be carried out but I wouldn’t hold my breath on it

Tracey Bennett says

Apologies if sounding stupid, but was does Post Noid mean?

Robert says

‘post NOID payments’, not sure what NOID stands for and does it apply to me. I am owed £5143 .. say 10’ish percent of that gives around £500. Will this be paid in November.

Sara (Debt Camel) says

NOID stands for Notice Of Intended Dividend.

In this context, post NOID payments are payments someone made towards an outstanding balance after the administrators had announced that a dividend would be paid – these will be refunded in full. They are NOT the payments to all unsecured creditors.

Keep your expectations low I suggest – less than 10%.

Steve says

Hi Sara,

I wonder if you can help.

I had many payday loans from both Quick Quid and Satsuma (often at the same time).

I got in financial trouble and ended up with lots of late payments on the loans and also defaulting on my credit card as I tried to pay the loans as a priority.

Is there anyway now that the loans are being identified as unaffordable that I could possibly apply to get the default removed from my credit file for the credit card?

Thanks for your time and advice

Steve

Sara (Debt Camel) says

No. Not unless you win an affordability case against the credit card. Did the credit card increase your limit too high?

Robert says

Any indications or rumblings when a pay-out will be made. I personally feel the administrators should give a monthly email update even if it is nothing– I call it good manners. I feel the administrators should no longer be paid from August , as they seem to have mis-managed the administration. They’ll get a move on then.

David says

Robert

I totally agree with your comment, the whole thing has been a shambles.

Has anyone heard anything at all regarding payments?

Gary Armstrong says

Had an email saying post noid payments will be made in November and the redress payment they have until March 2022 , going by them so far I wouldn’t hold my breath and I agree the whole thing is a shambles especially when we are going to get pittance back

Bonnie says

Hello, does anyone know if Quickquid are still responding to the CRAs?

Sara (Debt Camel) says

My guess is yes. It isn’t clear they have even decided all the claims yet.

Joanne hare says

Any idea on when payouts will be made

Had an email confirmation to say claim has been accepted and the amounts which obviously will be a lot lower but still be nice to get something ..they are taking ages. Received email beginning of August

Joanne

Gavin says

Potentially March from what I have read.

Keisha Palmer says

Hi, can I still make a claim for Quickquid? I was unaware they went in administration until two days ago. I just saw the email in my junk from Eurocash which said to ignore email. Many thanks

Sara (Debt Camel) says

No sorry, the deadline for claims was in February.

Graham says

Any news on payouts yet have heard nothing for months

SK says

No, Enova the parent company and the administrators are still siphoning off the last remaining pennies…

Tm says

Surely the money should come from Enova and we should get back all we are owed??

Sara (Debt Camel) says

the UK payday lender was set up as limited company. Legally it does not have to be supported by its US parent.

James says

I had a claim that was rejected but the appeal accepted to have interest removed, payments made more affordable and off my credit file but still haven’t heard anything else since April, except Lantern have taken over and I’ve set a low payment plan with them. Will this affect my appeal? Thanks

Sara (Debt Camel) says

It shouldn’t afffect you appeal – that depends on the decision about affordability at the time the loan was taken out.

Gem says

Any idea when the payouts will be made?

I thought it was September but that has been and gone already!

It is getting somewhat ridiculous now!

Sara (Debt Camel) says

There will be a new 6-monthly update in November. I don’t think they have yet sold the loan book, or more people may have reported being told their loans have been sold.

Noel Brown says

We just have to wait unfortunately. Even best case scenario we’re going to get a pittance while still others (administrators) are profiting, the government don’t care (they allowed in the first place)

Is there enough of us willing to join together to try and fight in the legal system?

Is utterly immoral companies are allowed to profit from others low points and the administrators are picking the carcass clean. Far from happy

Jane says

Have just received an email from Casheuronet.

Following an internal review, we have found that there was a system error with the calculation of your “Refund for overpayment on CashEuroNet UK, LLC loan”.

We have now reviewed your assessment in detail and amended the “Refund for overpayment on CashEuroNet UK, LLC loan” to reflect the correct value of any overpayments made to your loan once set off of your redress accepted claim value has been applied. The date from which set off applies for the purposes of assessing your claim was 15 July 2020. Therefore any money that you paid into your open loan after that date which resulted in an overpayment will be refunded to you.

We will shortly be sending you a revised assessment outcome which will detail your revised refund amount. The assessment will be with you within 7 days of this email.

What an absolute joke! So its been reassessed but have to wait 7 dayd for the ourcome! Has anyone else had this.

Danny carmody says

still waiting for a date on refunds, what a joke for all of us

Robert James Aldridge says

I’m also waiting for a refund on bank charges from Santander. The adjudicator to the ombudsman , stated Santander were happy to refund half of charges and I accepted. It is now been three weeks and I’ve heard nothing, seen no money and I can’t contact the necessary department. These corporations need taking down a peg or two. We should follow the American example and pursue class action lawsuits which would cost them dear. That’ll teach them to not bully the little people to whom the money means a lot.

Noel mccready says

Wageday advance paid out to me did not even have to submit a claim just accept what they were offering thought if they were in different Quick Quid might go the same way so there u go

Connie says

I had a loan from onstride, I had an email back in February but wasn’t very clear. The title said it had been fully accepted then body of the email said both loans rejected in full.

I haven’t heard a thing from administrators or Lantern. Didn’t want to chase this up incase! I’m in a DMP with stepchange which they haven’t taken any payment since August.

Has anyone else had similar? Should I contact in stride to get an update or best to leave?

Louise says

Hi, I had two loans with QuickQuid which I put in an unaffordable lending claim for. Both claims were accepted and last month the information was removed from my credit file. Both loans had defaulted in 2016 and 2017, the defaults were removed last month by QuickQuid. However today Lantern have added two new entries to my credit file showing a missed payment from September this year and have added the default information of the loans. I have had no correspondence from

Them prior to this. I have contacted lantern and am awaiting a reply but am I right that as my claims were both successful all negative information related to the QuickQuid loans (the defaults) should no longer be reported on my file , I’m also unhappy about the late payment marker from Lantern as I have had no communication from them prior to today or opportunity to pay.

Sara (Debt Camel) says

yes if QuickQuid have removed the negative information, so should Lantern. Tell them this and send them a formal complaint if they refuse.

Louise says

Thank you!

James says

Did you get an email saying they had removed it or did you just notice they had? They said it would be removed from mine also and i see a lantern account open but no on stride im wondering had it been removed for me

Richard says

Isn’t is the case that Lantern have a responsibility still to report accurate information? For example I had a successful claim through the FOS against a loan with Lending stream. They were told to remove all previous negative information but can now report the future status e.g. that I was in an arrangement or that it could be marked as defaulted again. Once it was paid off though then they would have to remove the entire entry.

I did argue this multiple times as I could basically be defaulted twice my for the same debt but the answer was that they had to be able to report the status even if found unaffordable.

Sara (Debt Camel) says

did you take your complaint to FOS?

Richard says

Yep, I took it all the way to a FO to make a final decision as it was my view that either the information should be removed or that the original default should remain. It obviously looks worse to have more recent negative information than a default that was about 3 years old.

All loans were found to be unaffordable (even the first) but the two that had a remaining balance would continue to be reported. This is what the FO said:

“Our adjudicator also said any adverse information about the

loans should be removed from Mr ** credit file but the outstanding loans themselves did not

have to be removed until they had been repaid. ” …

“Lending Stream has said that it will remove any adverse information about the lending from

Mr ** credit file but would continue to report information about the outstanding loans – that

a repayment plan was in place or subsequent missed repayments as examples. Lending

Stream has an obligation to accurately report Mr **’s outstanding debt to the credit reference

agencies. So, this part of the compensation isn’t unreasonable.”

I then had about 10 more calls with an adjudicator who queried exactly what this meant with the FO. It was confirmed that it meant while negative information would be removed they would then be able to report negative information again including a default.

Sara (Debt Camel) says

that sounds… weird and not right.

William says

My situation is that I can now afford to pay my loan off in full. It is £1202. However, Lantern doesn’t have any record of my account, and I have no idea how to pay off the outstanding debt. No clue.

Sara (Debt Camel) says

When do you think the loan was passed to Lantern?

Mark says

This is never ending. Do we know when the redress will be paid ?

Robert James says

I understand that there will be an official email update this month ( November) from the administrators . Is this correct? Hopefully, there will a percentage quote on how much of the claim we will be getting, if they don’t know that by now–there’s problems.

Robert Liddell says

Yes report due this month most others usually in 3rd week of month so I think we may see this about 22/12/21 and hopefully a dividend declared and payments start!

Susan says

Well interesting thread.

It will remain to be seen if anyone will actually be reimbursed.

I have certainly not been given any updates.

Neil says

I also haven’t heard anything since they accepted my claim. The money is unimportant now as it will be buttons, was hoping to fix the credit file but time and good behaviour will take care of this before the administrators get their act together. The parent company should be prohibited from conducting business in the UK as a deterrent to other companies who would make out like bandits while everything is going well then disappear when the bills start coming in.

Sara (Debt Camel) says

Pretty sure Enova won’t touch the UK with a barge pole. Ever.

SK says

Looks like Enova are getting complaints in the USA as well… This is from their latest quaterly report:

CFPB Civil Investigative Demand

The Company has received a Civil Investigative Demand (“CID”) from the Consumer Financial Protection

Bureau (“CFPB”) concerning certain loan processing issues. Enova has been cooperating fully with the CFPB by

providing data and information in response to the CID. Enova anticipates being able to expeditiously complete

the investigation as several of the issues were self-disclosed and the Company has provided, and will continue

to provide, restitution to customers who may have been negatively impacted.

“Enova has led the industry in providing innovative products that help consumers and small businesses and we

are committed to putting customers first and complying with regulatory requirements,” said Sean Rahilly,

General Counsel & Chief Compliance Officer at Enova International. “We have devoted significant efforts to

continually improving our technology and processes, as well as ongoing enhancements to our systems and

controls to prevent negative customer experiences. Working with our regulatory authorities like the CFPB is a

critical part of the process of providing financial services and we look forward to completing the

investigation.”

Susan says

I heard that this mess is somehow connected to US, interesting everything in UK is governed, ruled and taken over by America.

Does that mean we are all now Americans :)

Seriously, it is as you said the principle of it all.

Sara (Debt Camel) says

no, really this is a UK mess. Nothing to do with US regulation.

Noel mccready says

If it is the same as Wonga allow 2 or 3 percent of what they owe u think its the same administrators does all of them

Susan says

Thank you for contacting CashEuroNet UK, LLC

As was explained in the Joint Administrators’ most recent progress report, the Joint Administrations intended to apply to court seeking an extension to the Administration. The Joint Administrators needed more time to complete the sale of a segment of the loan book. As a result of the sale, more funds will be available to distribute to creditors (including redress creditors).

he Joint Administrators applied to the Court on 12 August 2021 and it made the following orders:-

1. The Joint Administrators’ term of office be extended for a period of 12 months giving a revised date for the automatic termination of the administration of 24 October 2022; and

2. The Joint Administrators will make any distributions and declare any dividends in respect of such distributions within thirteen months of the Last Date for Proving.

As a result of the above point 2, the Joint Administrators have until March 2022 to pay a dividend to the unsecured creditors (including redress creditors).

Whilst the Joint Administrators have been granted the above extensions, they are continuing to ensure that they can make a distribution as soon as possible.

Please note no further action is required by unsecured creditors as a result of the extensions and the Joint Administrators will continue to update creditors on the progress of the case in their progress reports.

Yours sincerely,

For and on behalf of CashEuroNet UK, LLC

paul smith says

this has gone on long enough delay after delay utterly unacceptable

Noel mccready says

Looks like March 2022 before we hear anything they are always one step ahead of us