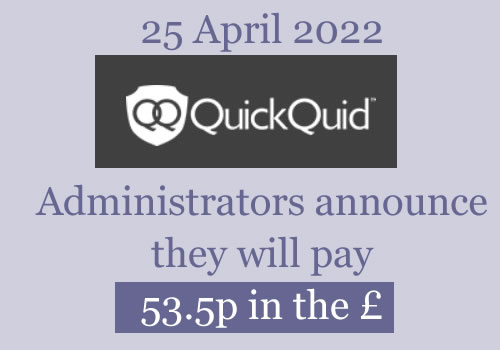

Payments – UPDATE – 25 April 2022

Administrators have started sending emails to everyone with an upheld claim telling them what they will be paid.

“The Joint Administrators are now in a position to declare a first and final dividend of 53.5p in the £”

The average claim value is c £1,700. Someone with that claim value will get a payout of about £910.

The payout details are given in the email:

- This will be paid over the next two weeks.

- If the administrators couldn’t validate your banking details, it will be sent by cheque. I don’t know how the administrators will “validate” your details.

- If you used a claims company, the money will be paid to them.

- Most people are not having any deduction for tax paid to HMRC, so there is no need to reclaim anything.

Credit records

The administrators may decide to :

– remove any negative marks on your credit record

– delete all loans that were upheld

– delete all your loans.

I don’t know what they have chosen to do – if people can check and report in the comments when they see a change, that would be great.

How much your credit score will change will depend on whether there were any negative marks. If you want to get a mortgage, you would like as many payday loans gone as possible, even if they were repaid on time and not hurting your credit score.

In a few months when the administrators no longer talk to the CRAs you can ask for any remaining loans to be “suppressed” so other lenders can’t see them. See https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do that now.

QuickQuid went into administration in October 2019

CashEuroNet (CEU), which owns the QuickQuid, Pounds To Pocket and On Stride brands, stopped giving loans and went into administration on 25 October 2019.

I will be talking about QuickQuid (QQ) rather than CashEuroNet as it is the more familiar name. Everything here also applies to loans from Cashruronet’s other brands, Pounds To Pocket and On Stride.

Grant Thornton were appointed as Administrators. They set up a page about Redress Complaints – this is their term for people who have asked for a refund because they were given unaffordable loans.

Background to the QuickQuid Administration

QuickQuid was one of the “Big Three” payday lenders in Britain, starting out in 2007.

After Wonga and the Money Shop Group had all stopped lending and gone bust over the last fifteen months, QuickQuid was left as the largest UK payday lender.

QuickQuid had well over a million customers. When it went into administration there were c. 500,000 customers with outstanding loans.

Many of these customers had prolonged borrowing from QQ. They either rolling loans over or repaid one loan but were left so short of money that they had to borrow again.

These customers have good reasons to win an affordability complaint and get a refund of the interest they paid.

Affordability complaints started on a small scale in 2015 and increased in the next few years.

In 2018, complaints going to the Financial Ombudsman (FOS) jumped with the involvement of Claims Companies and QuickQuid became the most complained about firm to FOS, excluding PPI complaints.

For a long time QQ refused to refund interest on any loans taken more than 6 years before or where the loans were given in 2015 or afterwards. This resulted in a huge backlog of claims at the Financial Ombudsman, where QQ had made very poor offers to customers and then rejected an adjudicator decision.

In late July 2019, QQ agreed to accept several thousand FOS complaints it had previously rejected.

By accepting the FOS decisions on loans over 6 years, long chains of borrowing, and loans taken after 2015, the scale of QQ’s likely future liability for refunds will have become clear to the company.

After failing to persuade the FCA that a Scheme of Arrangement was appropriate, Enova, CEU’s large and profitable US parent, decided to close the UK business, blaming the UK regulatory environment.

How could the regulators let this happen?

This is an excellent question… Stella Creasy, MP called for an inquiry into the FCA over Wonga and QuickQuid.

What has happened in the administration

Customers with a valid claim for a refund are “unsecured creditors”. This includes:

- any refunds that were in progress after an amount was agreed or a Final Decision from a FOS Ombudsman (FOS);

- complaints that were underway at QQ or FOS when QQ went under;

- any new complaints sent to the Administrators.

All complaints at FOS legally had to stop and were been passed back to the Administrators. It isn’t possible to send any new complaints to FOS.

It is now too late to submit a Claim for unaffordable lending. The last date was 14 February 2021.

The administrators have given the following statistics about claims:

- 169,000 customers made claims for unaffordable lending;

- 78,000 claims were upheld by the administrators;

- the upheld claims had a total value of £136million, so an average of about £1,700 per claim.

Still owe a balance on a QuickQuid or On Stride loan?

More than 300,000 of the current loans were sold to Lantern in summer 2021. You should have been informed if your loan was sold.

The administrators have now stopped collecting any money from the remaining unsold loans.

This page is kept updated

The comments below this article are a good place to ask any questions. And you may be able to see where someone else has already found out the answer.

Amy says

Payments from who ???

Oliver says

Where on the website. Can’t find it anywhere in the FAQ.

Also not received email yet.

Does it mention about when they are making the over payment refunds?

Sara (Debt Camel) says

I think Tina is referring to the Money Shop, not QuickQuid.

Tina Mulcahy says

Yes money from money shop payments being made from this month

David G says

Hi. I’ve only just came about this post, and to be honest it’s all sickening what we will all receive. 1st and foremost though is that I hope we are all out of this payday loan circle, its vicious and careless. Anyway my post is this, probably back in 2019 sometime before they went into liquidation, I received an email stating that out of my 26 loans I took out with them, only 7 was being upheld. For this I received a payment of just over £1.4k, but the other 19 loans I worked it out that they would of owed me just shy of 5k (just over 6k in total) my question is why was only these selected few upheld? And now going forward (because I received emails) I will get the further what they owe me, but this will only be at a guess 5p to the pound. Why didnt these get sorted too with the other loans that got upheld. Makes your blood boil really

Lisa Smith says

David G this is what happened to me and its absolutely disgusting that they denied the other loans at the time and now during the redress will cover every loan but at 4p/£

David G says

I’m guessing a lot of people were in the same boat. They knew they was going under, so just offered people a small percentage of what they owed to them and just simply said the others weren’t being upheld, of course they are, but now like you say at 4p to the pound

Mike says

Hi Sara,

Just wondering why the figures are. Initially I was declined when I put a claim in and carried on paying. I did go through an appeal and today the accepted and also sent me the figures. I know we will only get a small percentage but it was all about my credit file really.

Anyways there’s 2 figures, just wondering what the overpayment is? Is this the amount I paid while waiting for a decision? Still be liable to the admin percentage payout?

Accepted claim value: £243.64

Refund for overpayment on Casheuronet loan: £400

Sorry if it’s a daft question

Mike

Sara (Debt Camel) says

Is this the amount I paid while waiting for a decision?

does the £400 look like the amount you have paid to a loan since the administration started?

Mike says

Hi Sara,

I think so yeah, I’ve paid £50 a month for some time now. So could well be. It was defaulted from like 2 years ago, but last summer I started trying to clean all me debt and stopped burying my head.

This is the last one apart from the amigo one and I’m debt free and credit history clear from these loans! £18,000 in debt to 0 is just crazy in 10 months! Thank you again.

Sara (Debt Camel) says

If this was money you paid during the administration this will be returned in full, not reduced to 4% (or whatever figure eventually emerges)

Mike says

Ah ok, if it is then awesome. Once the acceptance of the appeal came in on Wednesday I cancelled the payment plan. Then this came this morning followed another email saying the account was cleared etc.

Like I say it’s more about the credit file for me. The dream of owning a house is a step closer 😊

Jo says

So I stupidly got a company to act on my behalf to make a claim against QQ. After a long time the FOS upheld my claim and was due a payment of around £2000, with 25% going to the company acting for me. Anyway the FOS made their judgement 2 weeks before QQ went bust so I never received a payment. I told the company acting for me about this and they said that was ok not to worry as I owed them nothing. Today I receive a letter from them saying if I don’t pay the 25% within 30 days they’re taking me to court. Now I have lots of evidence as I keep everything . Just wondering if this has happened to anyone else recently.

Sara (Debt Camel) says

which claims company was this?

Jo says

Allegiance finance

Sara (Debt Camel) says

That may be an error – they are not normally one of the difficult claims companies. I suggest you email them a complaint, saying what has happened.

chris says

Hi I have had real trouble with Allegiant Finance. I left a bad rating on TrustPilot saying exactly what they had done which was poor. They then lodged a complaint with TP arguing that my review was libellous. However, I was able to prove to TP everything I had said so the review was reinstated. I hope you clear this up.

Jo says

I have to say, I found them dreadful. From them sending an initial complaint to QQ to referring to the FOS, it took them 14 weeks, 6 weeks longer than needed. I honestly believe if they’d made the complaint to the FOS at the 8 week point, as they should have, then I’d have most likely received the money I was owed. I’ve kept every email sent and received, along with all of the chats, which clearly show the delays. I’ve found their communication to be very slow. I’m very tempered to see if I have grounds to take legal action against AF, as I believe their delays cost me dearly.

Jo says

Thank you, I will email them. I’ll let you know the outcome. I really appreciate your advice.

Matt says

Hi Sara

I have been looking for some advice, I paid just under £700 of my final loan on the 29th of October. Does that mean I am likely to get this back as they were all ready in administration. As this is what happened with the money shop . Any advice would be helpful.

Thanks

Sara (Debt Camel) says

Have the administrators decided that loan was unaffordable?

Matt says

Hi Sara

Yes they have come back and said a couple of weeks ago . That both my loans were unaffordable, but I paid one loan just but administration and the second loan after going in to administration.

Thanks

Matt

Sara (Debt Camel) says

Then I think you should get back all the payments you have made since administration started in full.

lee says

hi i put in a claim early last year got a couple of emails back say my claim had been upheld but nothing since.?

thanks

lee j

Southers says

“You will be told which loans (if any) have been upheld the total value of your redress.

This is NOT the amount you will receive. You will only get a small percentage of that… That percentage won’t be known until all claims have been assessed – my guess is this will be in May-July 2021”

Matthew Pople says

Is there email address for the joint administration to contact to lodge a complaint regarding redress of payment to a customer and creditors?

Gemma says

Hi im so stuck with quickquid.

I belive they irresponsibly lent to me, I have back to back loans I was a single mum I couldnt afford it. I have spoken with them and request they reduce the debt a si can’t pay the £700 outstanding. They won’t reduce the overall sum. I have spoken with fca, financial ombudsman, stepchange, citizens advice noone knows how to help me.

My credit score is severely impacted as its been a missed payment every month since 2013.

What can I do?

Sara (Debt Camel) says

Have you paid them anything since 2013?

did you make a claim to the administrators?

Gemma says

No I haven’t paid them anything

it was too late unfortunately to make a claim.

Sara (Debt Camel) says

then this debt may well be statute barred. Yiou could talk to National Debtline on 0808 808 4000 to confirm this.

If it is statute barred, you can tell QuickQuid you will not be paying it and also ask them to add a default back in 2013 to your credit record as it is inaccurate and against GDRP to be recording a missed payments each month – that will mean the debt just drops off your credit record.

Adrian says

So new twist , my outstanding balance with Quickquid for a loan found irresponsible has disappeared from my credit file.

Anyone heard any further updates as to what has happened with outstanding balances?

Matt says

Hey Adrian

Which credit reference agency has it been removed from?

Thanks

Adrian says

I use Credit Karma to check so believe it’s TransUnion. Aboustley no sign of it now not even in my closed accounts.

Rachel Opray says

I’ve had an loan from 2013 added! I’ve tried to get them to remove it but they’re saying to wait. I can understand this for my 2 other QQ loans but to suddenly add an old one is so frustrating

Tony says

Hi, Ive received an email informing me that my claim has been accepted fully,

I have a default on one of the accounts, and read that it will take a number of months for my credit file to be updated, I have also asked for a more specific time frame however in an email they said,

‘Unfortunately at this time, we do not have a more specific time frame. We ask that you be patient with us in respect of your payment and credit amendment, we anticipate all amendments will be completed once all claims have been assessed, and all assets have been sold or realised.

I was wondering if you had a rough idea when this would be, as it’s impacting my ability to obtain new credit, or if there is any way I could get the default removed sooner.

Kind regards

Southers says

From correspondence received today:

It was anticipated that a final dividend would be paid before 12 September 2021 in accordance with

the notice of intended dividend, issued on 15 July 2020. However, in order to allow further time to maximise asset realisations for the benefit of the Company’s creditors it is likely the Joint Administrators will make an application to Court to seek a short extension to the notice of intended dividend.

The total value of claims received is not yet known. However, since the total crystalised claims received and assessed as accepted significantly exceeds the money available to be shared out, any distribution to unsecured creditors will be significantly smaller than the accepted claim amount.

Timbouk says

Looks like the Quickquid redress will be delayed. According to the lasted report they need more time to hopefully raise more funds to pay the redress.

john says

administrators looking for extension from courts, covid 19 latest excuse , recieved progress report in email yesterday

looks like its going to be a long time before a payout if they get the extension

Neil says

Hi Sara,

I spoke to you on this thread before, I am trying to secure a mortgage and having a few problems. I got a hold of a more comprehensive credit file there and it looks to me like Lending Stream have a bunch of loans that are showing up as being ‘adverse’ which were loans they refunded me for after an Ombudsman investigation. I’m wondering what I should do now? Do Lending Stream still exist? If so I suppose I should be talking to them to get those removed. Appreciate any guidance, thanks.

Sara (Debt Camel) says

yes they do – ask them to remove the negative marks.

Lou says

I missed the deadline to claim for pounds to pocket, I assume there’s nothing I can do? Just suck it up? Thank you for any advice

Sara (Debt Camel) says

do you still owe a current balance?

Emma says

Hi Sara

This article is really helpful, thank you. Wondering if you have an opinion/suggestion for our situation relating to OnStride.

We have noticed an account for OnStride on my partner’s credit file after checking all three agencies via CheckMyFile. (It’s one of three loans that have appeared on his file that he has never been in receipt of or applied for and we’re trying to get to the bottom of whether this is a mis-match or fraud).

This particular loan was apparently opened in 2010! He has absolutely no knowledge of it and it was for £400. Oddly it’s still showing as ‘open’ within the loans section and from June 2015 until January 2016 they continuously logged ‘1 missed payment’ against him. In February this updated to ‘unknown status’ and then from March 2016 to the current month they have continuously logged ‘Arrangement to Pay’ against him. This makes no sense because we’ve never have correspondence about the debt let alone agreed some kind of payment plan.

Are we entitled to write to them and request a CCA given what is happening? If we can’t get anywhere/get it removed is it worth asking they log it as a default from the date they applied the ‘Arrangement to Pay’ status in 2016 so it drops off next year? (Even though we’re quite certain it has nothing to do with him but not sure the options we have with them).

It is only being reported to TransUnion.

Thanks in advance

Sara (Debt Camel) says

Has he ever taken payday loans from a lender called Pounds 2 Pocket

Emma says

Hi Sara, thanks for replying.

No he hasn’t ever had a loan from them or others affiliated with those businesses (I think there are a few from what I can tell and they are in administration?)

Sara (Debt Camel) says

ok then he should phone the CashEuroNet Customer Support Team at 0800 016 3250 and say this debt is not his and he wants it deleted from his credit record.

Even if it was his, it would be statute barred by now and should have had a default added and dropped off his record long ago. But it seems easier to keep things simple by pointing out the loan is not is.

Emma says

Thanks, Sara. We were unsure whether to call or write a letter/email in case there are challenges and we need a trail?

In addition to the OnStride record, we saw he has another open with United Kash (DCA) relating to an account from 2011. The weirdest thing is that it’s being paid each month (aside from a few misses). The payments certainly aren’t coming from my partner so it feels like there’s been some kind of mis-match with his file or identity fraud. We’re not sure if the United Kash account is linked to the OnStride one.

There is another open account with Everyday Loans that’s not being paid. He’s never been in receipt of this money, has never spoken with them – on looking it seems they make you go into a branch to finalise a loan and he’s certainly never done that. Before this one was apparently opened, there’s a record he had another from them the year prior (which payments were made to but not from him).

Would it better to write to/email all of these companies so we have a trail of confirming he is not the borrower? Are we better going straight to the creditor where we can see they have sold the debt to a DCA?

Thank you again for your help.

Sara (Debt Camel) says

This sounds like someone else’s details have been linked to his credit record. I suggest he contacts United Kash and ask what this debt is that is showing on his credit record as he is not making any payments to it so it must belong to someone else. It is possible that if that one gets resolved it may sort out the other two…

but I still suggest he talks to Onstride – phone or email, it doesn’t matter. And he should also ask Everyday loans to remove the record from his credit file as he never took that loan.

Ian says

Quick question. Any idea roughly what the “small percentage” of the total repayable is likely to be?

My total is around £5500 but wondering what the actual redress is likely to look like… 30%? 3%?

Cheryl says

Sunny have just paid out, they went bust just before QQ & it was 3.21% that folk got back

Amy says

Had my Sunny payout this morning , £12.46 wow what and utter disappointment

Joon says

Just wondering is anyone else still waiting for their claim result? I submitted in august and I’m still waiting

Jonnic says

Think there’s several still waiting including me (if I recall there is something like 20k people with outstanding results from the latest report). My case was supposedly delayed due to responses from 3rd Parties. I have managed to speak with them (although still not resolved) – maybe try calling even if it just confirms that your claim is still in progress?

Joon says

Yeah I called all the third parties and got all the relevant information for them and they told me they still have to do it themselves. Waiting game still I suppose

John says

I still am waiting as waiting on 3rd parties.

Charlotte says

I’m the same. They are still dealing with 3rd parties. I rang and they asked that I speak to the 3rd parties for them. They didn’t give me specifics of what I go they wanted etc. so I haven’t bothered

Sarah says

Anyone had any update to this?

John says

Nothing in a while I have called and emailed several times to be told they are waiting on 3rd parties, I know this will have gone to DCA and I think maybe paid off I can’t recall as I was in a right mess back then, they asked me for details of the 3rd party, I assume they should know who it was sold too .

Gemma Storey says

Anyone have any idea when we will get our payouts?

Oliver says

September 14th at the very earliest. They are going to the courts for an extension

John says

Looking at the report they posted online (never emailed) latslest update is that (if I read it correctly) they have got the information from 3rd party debt collectors and are going through these.

An extension has been applied for and they have no estimation on what the p in £ Will be.

Martin Cox says

I’m not waiting on compensation but I am due a refund on an overpayment made (£715) pre appeal on my original decision. I’ve been told it will be September before I see that money. But surely it should be returned immediately as its nothing to do with compensation… Its a joke how this administration has gone.

Hector says

I’m in the same situation. I agree it’s an absolute joke. The administrators are trying to maximize their profits frankly they are no better than the company they’re liquidating.

Claire says

Hi

I have several quick quid loans from 2018. I’m too late to put a claim through but I’m hoping I can get them removed from my credit report. How would I go about this?

Thank you

Sara (Debt Camel) says

You need to wait 6-12 months until the administrators have stopped talking to the credit reference agencies, at that point you can contact the CRAs and ask them to “suppress” the loans, see https://debtcamel.co.uk/correct-credit-records-lender-administration/.

But it is too soon to do this now, if you try the CRAs will ask QuickQuid who replay that they haven’t decided the loans are unaffordable.

Dave says

To anyone it may help, I had to reissue bank details to get my payout, and enquired about progress and received the below response:

Dear

Customer ID:

Ticket: 379457

Thank you for contacting CashEuroNet UK, LLC. At this time we are working to review and issue the remaining claim assessments and we are expecting these to be issued by 25/06/2021. Please monitor your emails, we will provide you with an update as soon as possible.

If you have additional queries, please don’t hesitate to ask.

Yours sincerely,

Kirsten

For and on behalf of CashEuroNet UK, LLC

The Joint Administrators

hugo r says

I have not been communicated with after i have out in my claim for pounds to pocket. I borrowed £2000 off them even with other debts, costing me over £4000 in repayments. I am highly unlikely to get anything due to me defaulting on the last two payments. I then paid the debt collector off. I have not had anything from casheuronet except a measly £50 for my wage day advance loans!!!

Sara (Debt Camel) says

I have not had anything from casheuronet except a measly £50 for my wage day advance loans!!!

Wqageday advance was a different lender – nothing to do with Casheuronet

Ryan says

Hi,

I made my claim in January but have yet to receive a response other than the generic “thank you for submitting your claim” email.

Has anyone else been waiting this long to even get a decision?

I have emailed them to chase it but seems like they should have at least made a decision by now.

Oliver says

Should be 120 days from submission for a response. I would call them and chase

Pat Smith says

I replied to that email the other day and they sent the decision letter through again. Apparently they had sent it months ago, but I never received it. It was a rejection but as I hadn’t received it the first time, they allowed me more time to appeal. I sent my appeal stuff through about an hour later and the same day I was told 2 had been overturned and thus accepted (the majority of the money). Respond to that email ASAP asking whether you have a decision yet! Hope this is of some help.

Catherine says

I received mine today – claim value over £5k but expect to see only pennies, so frustrating!

Richard says

Hi,

Does anyone know if the outstanding loans are going to be sold on or if they are going to accept reduced offers?

Thanks,

Richard

Sara (Debt Camel) says

The administrators are still hoping to sell the loans.

Richard says

Thanks. If they do sell will the credit agreement be passed on too or will the debt become unenforceable because it’s usually kept with the original creditor?

Sara (Debt Camel) says

I don’t know – in this situation the CCA agreement may be provided with the sold loan.

James says

Hi Sara, I had a poundstopocket loan and only made 1 payment then stopped. It was unaffordable and i had a gambling problem, my claim was rejected but i think my appeal had been accepted. It said this “Based on said evidence which reflects your income and expenditure at the time of funding, the Joint Administrators have accepted your appeal.” This was April and they said they would be in touch but still nothing yet. What will the outcome be? Will i just have to pay my loan amount with no interest and will it be off my credit file? In my appeal i asked for interest removed, off my credit file and an affordable monthly payment to clear it.

Thanks

Sara (Debt Camel) says

Will i just have to pay my loan amount with no interest and will it be off my credit file?

That sounds likely. And you will be able to make an affordable repayment.

Hannah says

Hi Sara

I paid over £750 after they went into administration to clear my two outstanding loans . My claim was rejected I appealed back in December and haven’t heard anything yet . If my appeal is rejected will I not received the money I paid after they went into administration. And if I am able to get it back do you know what time line we are looking at .

Thanks

Sara (Debt Camel) says

If your claim is accepted, your money will be refunded in full. They seem to. Be. Working slowly through these appeals, the good news is some are being won.

Hannah says

Hi

Thanks for the reply, what happens if I lose the appeal . Will they still refund the £750 that I paid after they went in to administration.

Thanks

Hannah

Sara (Debt Camel) says

no – if you lose the appeal then that money was required to settle your loans. It is only due back to you if the money was not owed because you won the appeal.

Hannah says

Thanks Sara for that information

Hannah

Tom says

I had a Quickquid loan and paid it off after a default, I know it’s too late to claim but is there a way I can complain to have the default removed or is it too late for me to do anything?

Sara (Debt Camel) says

It is too late to make a claim. If you wait 6-12 months you will be able to ask the credit reference agencies to “suppress” the default because the administrators will have stopped talking to the CRAs. But it is too soon to do this now. See https://debtcamel.co.uk/correct-credit-records-lender-administration/

Laura says

Made a claim last year…this is the latest response:

Thank you for contacting CashEuroNet UK, LLC. I truly apologise for the timeframe it is taking to provide your assessment decision. We were recently notified by the Joint Administration approval is still needed by the FCA to provide our customers with a decision on their claim. Once in receipt of the approval, all decisions will be communicated by email. Please continue to monitor your emails for future updates.

A daley says

I had several QQ loans during 2010-2014

I still have an outstanding balance, I never receive any correspondence from them in regards to any redress claims.

Is there anything I can do now, I am aware the claim date has passed.

Sara (Debt Camel) says

Have you made any payments to them since 2014?

A.D says

I have never been asked for a payment , was in a debt management until 2017 then I came out of that.

Sara (Debt Camel) says

was this loan included in your debt management?

A.D says

It was included and I was told by the debt management company that it had been cleared.

Sara (Debt Camel) says

Then at this point there is nothing you can do to get a refund.

Are all the debts off your credit record?

Jo says

Anyone had any updates? I’m still waiting for mine but last week I had a letter to say one of my balances had been cleared. I owed approx £600 held my arc and £300 held by Pra, one is quickquid one is pounds to pocket. I contacted CashEuroNet for an update but they said they don’t have one for me yet. Strange altogether. I’m chalking it up as a win though as it was the £600 one that was cleared 🙂

Lea says

No update mines another case sold to a third party.

The last I contacted them they told me

##Thank you for your email and your continued patience.

As you will be aware from previous correspondence, our review of your claim identified that you had a loan that was sold to a third party prior to the administration. In order for the Joint Administrators to assess your claim, they were required to obtain up to date loan information from the third party. Unfortunately, the exercise took significantly longer than anticipated to gather and process the information.

We apologise for this delay. The Administrators are now in the process of finalising the assessments for customers with one or more loans that were sold to a debt purchaser. Whilst we are unable to provide you with a date of when you will receive your assessment, please be assured that it is a priority of the administrators.

Please note that the delay will not have any affect on your timings in respect of your ability to appeal.

Yours sincerely,

For and on behalf of CashEuroNet UK, LLC

The Joint Administrators##

They are really dragging their feet.

Lorraine says

Asked for an update today, I’ve had my QQ complaint upheld and am waiting for a redress payment, see reply below, they’re buying time with this court delay, I’ll continue to wait.

As detailed in the Joint Administrators’ latest progress report, the timing of the dividend is not yet known. It was anticipated that a final dividend would be paid in September 2021 in accordance with the notice of intended dividend. However, in order to allow further time to maximise asset realisations for the benefit of the Company’s creditors it is likely the Joint Administrators will make an application to Court to seek a short extension to the notice of intended dividend.

The total value of claims received is not yet known. However, since the total crystalised claims received and assessed as accepted significantly exceeds the money available to be shared out, any distribution to unsecured creditors will be significantly smaller than the accepted claim amount.

All creditors will be continued to be updated, and will be informed as soon as the dividend is ready to be processed.

M says

Sarah, Can I ask how are they legally allowed to hang onto overpayments if they have nothing to do with the compensation claims? Considering it’s a full refund and won’t be counted towards the final payouts on those with compensation claims.

Sara (Debt Camel) says

it’s a question of how you can get them to pay these out now…

Administrators have to try to do everything “on the cheap” – handling a lot of refunds individually would cost more. There are still people who have not had a decision on their claim – it may be they are waiting for all those to be completed then planning a batch run to everyone.

Chris Wright says

Hi

I received an email in February 2021 from the administrator saying my account had been cleared (£731) and I was due a redress in May2021 of £96. I still haven’t received the £96 and I do not hold much hope of getting it.. But it was quite a surprise that they cleared my outstanding balance.

Sara (Debt Camel) says

It sounds like the £96 is a refund of payments you made since QQ went into administration. These should be returned in full, they are just being slow :(

Nicola says

Hi, I got caught up in a long cycle of using various lenders 2015/19 (rolling loans) with Onstride being the last, my finances hit a wall early 20 so I decided to offer a reduced amount expecting my claim to be upheld & details erased from my file but it was rejected Nov 20. I’ve only just appealed due to personal circumstances and they have rejected it due to the time lapse. I’ve seen the suppression details in another post but thinking of complaining to the IPA as I know if it went to FO it would be upheld. I’ve had 2 successful claims with several in process. It’s been a journey but I’ve learnt my lesson!

Money Nerd suggests complaining to Walter Rivera @ Grant Thornton

04/19 1500 which I rolled to 3500 on 07/19 after using Satsuma in the process . . .

My file is in good shape apart from Onstride which is reporting 1 month late every month.

Any other suggestions? I want to remortgage later this year if possible.

Thanks for your insights, I love this community.

Nicola

Sara (Debt Camel) says

who is Walter Rivera?

what were the personal circumstances that delayed your appeal?

Nicola says

My Dad had a bowel cancer Op Feb 20, I also broke my ankle that month (he’s now recovered but it was his 3rd different cancer in 6 years so shook us to the core)

The article is dated 18 May 21 and refers to Walter Rivera c/o GT @enova.com (my mistake stating GT)

I can’t find anything else online

Sara (Debt Camel) says

That Money Nerd article is useless. The person writing it clearly has no idea what happens in an administration. Walter Rivera works for the US parent company – they have put Onstride into administration and will ignore any complaints about it.

If you complain to the IPA about Grant Thornton GT will just say you are outside the time limit to appeal.

Yes, you may well have won at the Ombudsman but that route is no longer open.

You will be able to get this record suppressed from your credit file at some point, but that is not yet as the administrators are still talking to the CRAs. I suggest you come back in 6 months time and see if this has changed then.

Nicola says

Not great but thanks for the clarity. I don’t want to waste time emailing the wrong people.

Lastly, is it worth making an offer to settle to the administrators?

2nd loan 3500

Paid 1686.15

Redress 1st loan 492.08

Balance 1321.77

Make an offer or wait out 6 months as suggested above?

Sara (Debt Camel) says

These aren’t really alternatives. I think the administrators are trying to sell the loan book, which is causing some of the delay.

What sort of offer did you have in mind?

James says

I take,it, it will be next year before the adminstraters start making payments to everybody.?

Sara (Debt Camel) says

The last update says that the administrators had intended to make payments before 12 September but they are now seeking a short extension.

Nicola says

50%

660.27

Plus request details are deleted from my file

I don’t really want an AR to pay for several years

Sara (Debt Camel) says

Well they will be unlikely to be offered 50% by a debt purchaser, so they would be better off taking that.

However they may simply not be looking at individual cases at all. Administrations are run as cheaply as possible.

Jo says

Spoke to them today.

Now looking at November for payouts apparently.

Jo f says

I haven’t even had a response about my claim yet, I’ll be surprised at a November payout lol

Bonnie says

I have a copy of my Transunion credit file from June 28, 2021 where there are no Quickquid loans showing and just checked again today (July 17) and Quickquid loans are reporting on my Transunion file.

Has anyone had loans added on? Any advice on what to do!

Limmers says

I would email transunion and raise a dispute include both copies of credit report and explain you have no knowledge of the issues. Hopefully they just delete it as they know Qq are in administration xx

Rachel says

Yes, I had an old loan added. I emailed QQ customer service to complain and after some back and forth they removed it.

Fran says

I had a loan with QQ 2015 not made payment only just seen it on my credit score what do I need to do in regards to it thanks

Sara (Debt Camel) says

I’m sorry but it is now too late to make a claim for affordability.

Have you never been contacted about this debt?

The debt may be sold to a debt collector – the administrators are trying to sell some of the open loans.

At some point the debt may become statute barred if you took the loan in 2015.

How does it show on your credit record, as defaulted? If yes, what is the default date? If no, is it showing as in arrears?

Because this is all uncertain and if you contact The administrators this will acknowledge the debt and stop it becoming statute barred (unless it already is) then I suggest you wait and see what happens if you are not being asked to pay.

At sone point it will be possible to get your credit record cleaned up if the debt is not sold.

Jack says

Hi Sara for you and everyone.

I emailed quickquid / casheuro net for update.

Got this reply thought share.

Thank you for your email and your continued patience.

As you will be aware from previous correspondence, our review of your claim identified that you had a loan that was sold to a third party prior to the administration.

In order for the Joint Administrators to assess your claim, they were required to obtain up to date loan information from the third party. Unfortunately, the exercise took significantly longer than anticipated due to the issues incurred whilst gathering and processing the information. In addition, ensuring that the remediation offered by the Joint Administrators was fair and in line with regulatory guidance.

We are pleased to confirm that these issues have been resolved and the assessments are being finalised, ready to send. You should receive your claim assessment email by 31 August 2021.

Please be assured that the delay in the assessment will not have any effect on your timings in respect of your ability to appeal.

If you have any questions or require any further information, please contact the QuickQuid Customer Support team on 0800 056 1515 or support@quickquid.co.uk or the On Stride Customer Support team on 0800 210 0923 or customersupport@onstride.co.uk, as applicable to your loan. The Customer Support team are here to help Monday to Friday 8am-4:30pm. They are closed on weekends and Bank Holidays.

Khia says

Brilliant thanks for sharing

Jack says

No worries,. Apparently it’s anyone who’s had a quick quid loan that was sent to Lantern debt was known as mmf. It was lantern that caused all the delays passing information on. And that everyone should be getting emails before 31st August 2021 with outcomes details.

Jo f says

I think they just say these things when we call up. My two loans are with pra and arc Europe and I haven’t heard a peep from them in regards to my claim

Char says

I have just got my email tonight stating that claim has been accepted and the accepted value – obviously won’t get that total but the emails appear to be going out now re: claim value – so now it’s just the wait in payments

Jo f says

Thanks for sharing that. It really does seem to be going on for ages so it’s nice to have a potential date x

GRAHAM R says

Just had an email from Casheuronet confirming total accepted loan value. No percentage given though. At least its something.

Sarah says

Hi all.

Finally just now received my claim decision! 10:09pm 9/8/21! I submitted my claim in august 2020!! Despite various emails to them over the last year I finally heard back!

Joanna Takla says

Just received my claim accepted email with amount calculated so hopefully payments will be wighin a few months?? but of course the actual payout will be significantly smaller. Any idea what that could look like?? With Wonga was 4.3p in the £1…

Sam says

Just received email regarding my claim but can not make head or tale of it , can anyone explain thanks

Total interest and fees on loans £632.00 1

Total compensatory interest £353.43 2

Accepted claim value £985.43 3

I know it’s going to be very little but can someone just explain the above thank you

Sara (Debt Camel) says

The interest and charges on the loan(s) they have decided are unaffordable added up to 632. To this is added compensatory interest at 8% per year which comes to 353.

So the total redress they have calculated for you is the sum of those two numbers – £985

You won’t get paid that amount though – you will only get paid a percentage of it. That % has not yet been announced.

jamesLee says

The bottom value but around 3p-4p in the pound

so about £30

Michael says

Probably a stupid question, but I’ve been confused by this whole process! If my claim is rejected and my appeal is also rejected, will my loan, which defaulted in 2018, just remain on my credit file for 6 years as normal?

Thanks!

Sara (Debt Camel) says

yes.

Ryan says

I’ve just received an email from CashEuroNet to say that my claim has (finally) been accepted. My loan was also sold to a third party which is what caused the delay.

The total interest and fees accepted is: £1575

Total compensatory interest is: £712

Accepted claim value is: £2,288

I understand that I will probably only receive a very small percentage of this fee, but I want to ask about the debt that was sold to a third party.

I have been paying said third party £20 a month since 2018 (a total of over £700 by now) as part of a repayment plan.

1. Am I able to reclaim the £700+ paid to the third party?

2. Can I also stop paying the third party any further money now that CashEuroNet has accepted my claim?

Any advice would be much appreciated.

Sara (Debt Camel) says

How much do you still owe the debt collector? Who is it?

Ryan says

There is still just over £700 remaining debt to the 3rd party. Originally there was around £1500.

They are called Moriarty Law.

Debbie says

I’m in the same position but I stopped paying Lantern in March this year after 7 years of paying them. There’s about £300 left on my loan that was sold to them. I’d like to think we’d get some of our money back.

My email came through overnight and my total redress is £3585, though I know I won’t get that.

Nicola says

Received an email tonight saying my claim has been accepted. Says my claim is £603 but know I’ll be lucky to get anything back 🙃

jamesLee says

Just got my email too…. thank god this is close to ending!

going off the other payouts from pay day loans we are looking at about 3-4p right?

So my 780 accepted claim value is looking at about a £27 payout!

Dangerous to assume but also important to set the right expectations huh!

Sara (Debt Camel) says

We don’t know what the % payout will be. What happened in other administrations isn’t really relevant at all.

But it’s good to keep your expectations low.

chris says

Received my email this evening. Total redress £11,446.76. I had got my ruling finally from the FOS…1 month before QQ went bust. Obviously, words fail me at this time.

Linda whelan says

Just recieved email this evening,saying my claim has been accepted. Nearly £5000 I know it won’t be anywhere near this amount I’ll get back. But just happy with anything at this point. And also closure on the last of my claims

Catherine says

Hello – I’ve finally received my email today confirming my claim has been upheld totalling over £5k claim value (am aware I will see nothing near that amount in reality).

I had several loans from Quick Quid and for the most recent one the debt was sold to a third party as I could not pay it (I actually can’t recall who at the moment but will contact Cash Euro Net for the details).

I am now in an IVA which is due to end Jan 2023. Since QQ have upheld my claims can this debt be removed from the IVA to lower the value (it’s a considerable amount – £1500) or am I obliged to continue making payments to the third party through the IVA even though the loans were found to have been unaffordable for me?

Ashley Clark says

I owe lantern £367. I have paid them £444 my redress is £459. Do I still need to pay them?

Ashley Clark says

Sorry the whole debt was £772 and it gave me a CCJ will that be wiped as well?

Sara (Debt Camel) says

At the momwent it isn’t clear if the redress from the administrators will be used to offset the debt owed to a debt collector. I hope it will be but this isn’t confirmed until the administrators tell people what will happen.

It is VERY unlikely the CCJ will be removed. I haven’t heard of that happening in an administration.

You may however be able to apply to the court for the CCJ to be “set aside”. This costs £255 but if you are on benefits or a low income this could be free. Or it may be possible to get the debt collector to it being done “by consent” which would be £100.

I suggest you wait at the moment and see what is happening to the debts, then think about the CCJ afterwards.

EDIT set aside application costs rose to £275 in October 2021

Ashley Clark says

Just got this message from Moriarty Law

Our client is still awaiting a response from the account originator and as such, the account remains on hold,

As far as I understand the redress would only be for any interest and charges on the account the original loan amount portion would have still been outstanding so normally speaking the County Court Judgement would remain although we would seek instructions from the administrators in regards to what they want us to do regarding any County Court Judgements that have been entered so will get back to you once we have further information to provide. 👍

Alanna says

I woke up to an email this morning:

Guide

Total interest and fees on loans £1,834.02 1

Total compensatory interest £1,370.08 2

Accepted claim value £3,204.10 3

Would be nice to get the £3k but going by previous claims with other companies, it will likely be around £3!

Jo q says

Hi Sara

Can you advise, I’ve had a claim accepted of £1300. Obviously this will be more like the usual .04p to the pound on payout but do they clear existing debts out of that amount before payout as other companies have?

Cheers

Sara (Debt Camel) says

existing debts to QQ – yes definitely.

but a debt that has been sold to a debt collector? We don’t know as the adminsitrators haven’t said.

Can you go back to the administrators and ask if your redress can be set off against the balance you owe to xxxxx debt collector?

Steve says

I received a ‘partially accepted’ email in November last year. Am I to assume that it’s just a waiting game now as not received anything since