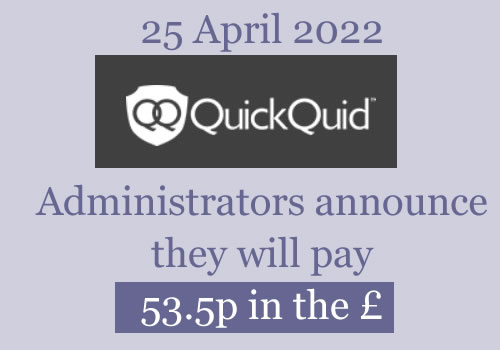

Payments – UPDATE – 25 April 2022

Administrators have started sending emails to everyone with an upheld claim telling them what they will be paid.

“The Joint Administrators are now in a position to declare a first and final dividend of 53.5p in the £”

The average claim value is c £1,700. Someone with that claim value will get a payout of about £910.

The payout details are given in the email:

- This will be paid over the next two weeks.

- If the administrators couldn’t validate your banking details, it will be sent by cheque. I don’t know how the administrators will “validate” your details.

- If you used a claims company, the money will be paid to them.

- Most people are not having any deduction for tax paid to HMRC, so there is no need to reclaim anything.

Credit records

The administrators may decide to :

– remove any negative marks on your credit record

– delete all loans that were upheld

– delete all your loans.

I don’t know what they have chosen to do – if people can check and report in the comments when they see a change, that would be great.

How much your credit score will change will depend on whether there were any negative marks. If you want to get a mortgage, you would like as many payday loans gone as possible, even if they were repaid on time and not hurting your credit score.

In a few months when the administrators no longer talk to the CRAs you can ask for any remaining loans to be “suppressed” so other lenders can’t see them. See https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do that now.

QuickQuid went into administration in October 2019

CashEuroNet (CEU), which owns the QuickQuid, Pounds To Pocket and On Stride brands, stopped giving loans and went into administration on 25 October 2019.

I will be talking about QuickQuid (QQ) rather than CashEuroNet as it is the more familiar name. Everything here also applies to loans from Cashruronet’s other brands, Pounds To Pocket and On Stride.

Grant Thornton were appointed as Administrators. They set up a page about Redress Complaints – this is their term for people who have asked for a refund because they were given unaffordable loans.

Background to the QuickQuid Administration

QuickQuid was one of the “Big Three” payday lenders in Britain, starting out in 2007.

After Wonga and the Money Shop Group had all stopped lending and gone bust over the last fifteen months, QuickQuid was left as the largest UK payday lender.

QuickQuid had well over a million customers. When it went into administration there were c. 500,000 customers with outstanding loans.

Many of these customers had prolonged borrowing from QQ. They either rolling loans over or repaid one loan but were left so short of money that they had to borrow again.

These customers have good reasons to win an affordability complaint and get a refund of the interest they paid.

Affordability complaints started on a small scale in 2015 and increased in the next few years.

In 2018, complaints going to the Financial Ombudsman (FOS) jumped with the involvement of Claims Companies and QuickQuid became the most complained about firm to FOS, excluding PPI complaints.

For a long time QQ refused to refund interest on any loans taken more than 6 years before or where the loans were given in 2015 or afterwards. This resulted in a huge backlog of claims at the Financial Ombudsman, where QQ had made very poor offers to customers and then rejected an adjudicator decision.

In late July 2019, QQ agreed to accept several thousand FOS complaints it had previously rejected.

By accepting the FOS decisions on loans over 6 years, long chains of borrowing, and loans taken after 2015, the scale of QQ’s likely future liability for refunds will have become clear to the company.

After failing to persuade the FCA that a Scheme of Arrangement was appropriate, Enova, CEU’s large and profitable US parent, decided to close the UK business, blaming the UK regulatory environment.

How could the regulators let this happen?

This is an excellent question… Stella Creasy, MP called for an inquiry into the FCA over Wonga and QuickQuid.

What has happened in the administration

Customers with a valid claim for a refund are “unsecured creditors”. This includes:

- any refunds that were in progress after an amount was agreed or a Final Decision from a FOS Ombudsman (FOS);

- complaints that were underway at QQ or FOS when QQ went under;

- any new complaints sent to the Administrators.

All complaints at FOS legally had to stop and were been passed back to the Administrators. It isn’t possible to send any new complaints to FOS.

It is now too late to submit a Claim for unaffordable lending. The last date was 14 February 2021.

The administrators have given the following statistics about claims:

- 169,000 customers made claims for unaffordable lending;

- 78,000 claims were upheld by the administrators;

- the upheld claims had a total value of £136million, so an average of about £1,700 per claim.

Still owe a balance on a QuickQuid or On Stride loan?

More than 300,000 of the current loans were sold to Lantern in summer 2021. You should have been informed if your loan was sold.

The administrators have now stopped collecting any money from the remaining unsold loans.

This page is kept updated

The comments below this article are a good place to ask any questions. And you may be able to see where someone else has already found out the answer.

Mike says

Hi Sara

This might already be an answered question but, the issues with QQ At the moment, is it the same as their other side with Pounds 2 Pocket?

P2P agreed with the adjudicators findings just recently but never sent the actual settlement figure back in the reply to the adjudicator. When I chased the adj they mentioned they were waiting for the settlement figure as this was not included. It looks very much like this was done intentionally due to QQ/P2P current issues I guess..? Not holding out much luck now of course..

Thanks Mike

Sara (Debt Camel) says

yes, they are two brands owned by the same company which is now in administration.

Vi says

If QQ goes to administration and I have late payments with them. Is late payment going to be cleared from credit file if money were lent irresponsibly? Or late payments going to stay on the credit file?

Sara (Debt Camel) says

“Is late payment going to be cleared from credit file if money were lent irresponsibly?”

yes.

AC says

Ok now QQ is on the brink of collapse & the advice is for customers owing them to continue paying what they owe

What happens to customers QQ is owing?

This is so unfair!

Sara (Debt Camel) says

My advice is more nuanced than that… it depends if you have a good claim for a refund or if you will have difficulty repaying… See the article above

Paul says

With QQ now set to close down, would it be possible to try & claim more money back even after receiving refunds ?, even with their other brand Onstride ?

Sara (Debt Camel) says

CashEuroNet that is set to close owns the QQ and On Stride brands. If you have had a refund for QQ, it may well be that you will be able to make a claim about On Stride to the Administrators, but you will have to wait until the Administrators publish details about the Claim process to be sure.

Iain123 says

Enova, the parent company of QQ, increased 11% on the USA stock market today. All that money they’re saving in the UK will be boosting profits back home.

Rel says

I’m absolutely heartbroken and angry. I was trapped in a cycle of debt with QQ and Wonga for years, and only recently this year managed to drag myself out of it….. I have to take some responsibility for getting involved with them in the first place, but their lending has been categorically defined as mis-sold and unaffordable.

All the interest I’ve paid over the years (£13k with just QQ and Wonga alone… just in interest!!!!!) has meant I’ve been held back. And they can now just disappear into the sunset even after agreeing that their loans were mis sold and agreed that they owe us a refund.

There simply has to be some sort of intervention here to help us from higher up?! I know there is no actual cover from FSCS, and no ACTUAL current course now they are in administration…. but this simply has to go beyond that to a matter of morality and justice?!

It’s not enough to say “bad luck, you were shafted, so sorry, oh well.” There simply has to be some help now from higher up for the poorest people who are owed money. Especially after Wonga etc…. us people getting low pence in the pound is just absolutely unacceptable. To many, this was a justified and rightly owed lifeline to a solution to a problem QQ largely created.

How can this be escalated? While obviously not as serious, it smacks of the same greed as the BHS pension scandal

Kw says

I quite agree. Ive got a case being looked at by Ombudsman with Uncle Buck. Are they likely to go under too? Seems an easy way out for these sharks to ditch their liabilities

SK says

Contact your local MP. I definitely will.

Anthony Jr says

I currently have an agreement with QQ to repay 40/month and interest is frozen. They call this a ´hardship’ plan and it gets reviewed every six months. So far it has been reviewed three times in a 20 month period.

My credit record shows that monthly payments are over six months late, this is the mark that goes on every month. I find this harsh but they have claimed in the past that I’m outside the contractual agreement, despite being up to date on my ‘hardship plan’. Fine. At least it’s not a default.

So how will the administration affect me? I don’t want them to register a full default against my credit record, yet how will the plan be reviewed if they are no longer around? The payment plan is due to last another 20 months or so, at which point I would expect that the administrators would have fully wound up the company and it wouldn’t make sense for me to be paying a defunct company any monies at that point? It’s a tricky one.

Sara (Debt Camel) says

Did you have any previous loans with QuickQuid or Pounds To Pocket?

Anthony Jr says

Hi Sara

I did have one or two smaller loans prior to this one. If I complain and stop making payments towards this repayment plan I do worry about the impact to my credit score, what can you suggest?

Thanks

Hector

Elle says

Could not agree more. I had my complaints in with wonga and quick quid but the time they have been sat with fos has meant I have now missed out on getting back what should have been thousands. I am heartbroken. I thought this was a way out of this nightmare these company’s got me in in the first place. Yes I too played a part but they exploited us! This can’t be allowed to happen! They accept they should never have leant us the loans yet we will receive next to nothing back. How is that right! If we owe them the money we still have to pay it back!!!

Elaine says

The amount of time sitting with the FOS is a disgrace. I was lucky this time round but only just and missed out with WDA and Wonga

Rel says

It’s not right. At all. Yet currently the only response to that given (and all that can be given at the moment) is along the lines of “yes you are right, it’s not acceptable, but legally there is nothing you can do.”

Quite simply, there NEEDS to be something legally that can be done put in place, where there is a parent company in operation somewhere who can cover such redress, as a condition of allowing administration proceedings. The government needs to help. Multiple £1000’s owed, legally binded by Ombudsmen, to individuals who need it the most, must be paid somehow

Reuben says

FOS decided to focus on their restructure instead of looking at cases. That’s why they haven’t been able to deal with our cases. It is so unfair and whoever decided that their restructure was more important should pay the compensation then self or be sacked. It’s selfish and arrogant behaviour. They are just as much to blame as the these loan sharks as they let them get away with it.

Ljc says

I agree and feel so much for you – I had the same with The Money Shop it was thousands and I was devastated

Matthew says

Dear Rel/All,

I’m so sorry to hear of your plight. As has been commented on previously I think contacting your MP is the best option both short and long-term.

I would add that 38 Degrees, social activism charity could also be an option in gaining wider publicity and support by creating a petition. 38 Degrees is people led, so it up to you to create the campaign and hopefully people see the petition and sign this on the site. There may already have a petition, but I’d argue that a fresh campaign based on recent events may gather momentum to put pressure on MPs to highlight the cause in parliament. I’m not sure of the rules on this site ( what She is comfortable with). But social media, support from 38 Degrees Team will help spread the word, issue and hopefully gather press attention etc.

Press and media coverage is important to raise awareness of these appalling organisations.

Sincerely, Matthew

Sara (Debt Camel) says

I have seen people try to use petitions before with very little success, see https://debtcamel.co.uk/smi-loan-help-mortgage/comment-page-1/#comment-244142 for an example.

Basically they will only work if people are prepared to put a lot of effort into social media publicising them. That means people using their Facebook, Twitter, Whats App accounts to tell their friends about the issue and ask them to sign and share it.

How many people will actually be prepared to do talk in public about their payday loan problems? I’m not criticising people who don’t want to, I completely understand. But social activism won’t work if people want to be anonymous.

Jo says

I’m devistated. I accepted a settlement figure through the FOS on 8th October, and it was with the FOS with their service for almost two years. Clearly I won’t get this money now. Thankfully I managed to get out of the cycle of payday loans a while ago, so can do nothing but put this down to my bad luck. Surely though, the FOS have to be held accountable also though. How can it be right that they sit on complaints for years in some cases. Had they dealt swiftly with mine (and others) claims, then we wouldn’t be in this position now. And how come money was put aside for PPI and not mis-sold payday loans. It’s just unfair I think.

M says

I will no longer be reading these threads. QQ going into administration was the end of my payday loan complaint journey. Nothing will be done and holding out any hope of government intervention is a waste of energy. Need to move on now. Thinking about our redress that is never coming will make you Ill, leave it go. Thank you Sara for helping and enabling Vulnerable people to fight back to these scumbags!

Yvonne says

You me both..

Hayley Preston says

I agreed my settlement figure and a day before the administration announcement quick quo’s emailed me to say I will get my money within 28 days! The day before! It’s disgusting! I don’t know how a company that has this volume of complaints can say ‘we owe quite a lot of money (even though we spent it all on tv adverts over the years) and then just go bump when it comes to the crunch! There has to be something that can be done here! This happening should not be allowed!!!

Lauren says

I am very happy for the people that got paid out before this happened but can you stop sharing it as for people who have no no chance of getting paid just makes it worse.

Thanks

Rel says

People who were mis-sold loans and paid interest they never should have had to pay, straight into the pockets of the parent company, should NOT be treated as “unsecured creditors.”

We never invested in the company, supplied them with goods/services or took a risk…. we were mis-sold to through greed and malpractice and had to pay interest to them that we should not have been made to, and should be treated as a priority alongside/just after employees who need to be paid their wages.

Sara (Debt Camel) says

Unfortunately, a lot of consumers lose out when a firm goes under. For example, anyone holding a Gift Card or who has paid for an item that has not been delivered or is faulty.

Rel says

Hi Sara.

You’re quite right of course. But surely their purchase of a gift card to use your example is an example of payment made in anticipation of goods received at a later date and that is the risk you take (similar to the Thomas Cook collapse.)

We were mis-sold and wrongly charged interest on a product we should not have been sold – as a result of mal practice much like PPI!

I know the details of the FSCS veiw between PPI and lending… but there in lies the problem and it is not enough to say “those are the facts” so to speak…. those facts should be changed and the parent company should be held to account!

P.s Sare please continue your excellent work on these matters…. you have been of immense help to many :)

Deb says

I received an email at 00.12am this morning stating QQ we’re sorry but they needed two more weeks to look into my case of complaint and that I could sent it to the FOS if I wanted too !! No chance of that now so I’m going to sit and wait. It’s sucks big style BUT hopefully sometime in the future I might just get a small return of redress. Here’s to hoping, wishing and praying !!

Andrew says

Well I’ve put a claim in for the interest refunds, see what happens. I’m not holding my breath. :)

chris says

Hi Sara, I’m a little confused. I received an email from my adjudicator on 24/10/19 @12:34 to state quick now agree with her findings for compensation for £7800 and will contact me. I then noticed on 25/10/19 that they have put themselves into liquidation. does this mean I will still receive my payment as they would have know about the administration the day previous where they agreed with findings? Or will this now mean I loose everything? – I would never have known about complaining if it were not for you and this blog. thank you so much.

Sara (Debt Camel) says

No, sorry, you are now an unsecured creditor.

You have a Claim for £7800, but you are probably only going get a small percentage of that after a year or so. Very bad timing for you.

I assume you don’t owe QQ any money?

Chrid says

No I do not owe them any money but would have used this cash to become debt free. Very bad timing indeed. I did see further up on this page that the parent company are paying 58mil to leave the market. Dp you think this be used along with there sold assets to pay people?

Sara (Debt Camel) says

I don’t know. It may be this is just form of accountancy-speak and the parent company is just writing off debt it is owed, rather than actually increasing the cash available to pay refunds. At the moment the safe thing is for you to have low expectations I am afraid.

Louise says

Sara

I was told on 16/09/19 that QQ agreed I was mis sold the loan and they have agreed that they owe me £3489. Did I miss the deadline too?

Sara (Debt Camel) says

If you haven’t already been paid, then Yes. The first thing administrators usually do is put a stop to any more payments.

Louise says

Thankyou for your quick response Sara

Elakndb says

Nope sorry you won’t get this, you will be put into the pot with everyone else who’s an unsecured creditor and will probably get a few pence in the pound of this amount in a couple of years time

L says

I feel so sick reading these posts

Heartbreaking

Myles says

Hopefully the fact that the FOS don’t have to deal with QQ now will mean that complaints about other companies will start moving through quicker. I have another case in against Sunny at the minute so I’m hoping they don’t go under too as I’ve now missed out on QQ and wonga.

Matthew says

Dear Myles,

I think, call it gut instinct, Brexit, or just cautionary adage. That perhaps the message in their industry might be, the well is dry in this form of business, let’s get out of the market in the UK. Whether long-term, there may be a redress is unknown.

I too feel sick and so desperately sad. These businesses are a model of “vulture capitalism”. Comes from 2008 crash in America, my reference Michael Moore’s “Capitalism is not a love story”. Heartbreaking each one of your stories, of losing out.

I’m in a hole too but it does get better. Sara, unknowingly has been a life saver to me and so many others here. This example is how one person can make an incredible difference with one website, skills and dedication.

I’m not sure of Sara’s future intentions of the site, but I would like to suggest that with trust/grant funding. This or another site like this could continue inspired work educating, raising awareness and helping people to exercise informed action.

There is so much faith and optimism in the site, as well as the horrid.

Thanks Sara

Are small claim courts useful in any of these situations Sara? Just triggered by a comment Jo made earlier

Sara (Debt Camel) says

Are small claim courts useful in any of these situations Sara?

No. You can’t start court action against a firm that is in administration.

Jo says

You know I’ve been thinking about this all day and given that the FOS had my complaint with QQ for almost 2 years, I think I might make a complaint against their service and hold them liable for the money I was due to receive

SK says

Been thinking about the same!

SK says

Also thinking about a way to somehow hold Enova liable and make them pay before they leave the “regulated” UK market. I know it’s a long shot but…

Andy S says

I’d suggest you make a copy of your complaint that you then also send to your MP. FOS as a public body has timescales it should abide by, it has clearly failed to maintain these and there maybe compensation from a complaint due to the fact that there lack of service has led to direct financial loss.

Also check which branch of the civil service setup they are and send the complaint to the minister who runs this is assuming that MP and your own arn’t one and the same.

Reuben says

FOS are supposed to give an answer within 90 days of receiving everything. They spectacularly failed to do that here. They should have to answer for this. What is the treasury select committee doing about this? Nicky Morgan got her cabinet promotion so probably couldn’t care less about the shambles at FOS anymore. Disgusting!!!

Matthew says

Perhaps in response to this a FOI (Freedom of information) request could be sent to companies, FOS, Civil Service.

It may garner information? About performance and other specific requests.

Investigative journalist may do this or find this of interest.

Sara (Debt Camel) says

FOS says:

“If things are more complex, it will take longer. It will also take longer if you or the business don’t agree with what we say, and want an ombudsman to make a formal, final decision. Generally, though, we can resolve most complaints within three months of a case handler getting in touch with you.”

that is not the same as saying “FOS are supposed to give an answer within 90 days of receiving everything”. QQ was objecting every step of the way.

Mr and mrs c says

I am going to make a complaint to the fos. It will go no where but I need to get it off my chest. Our case was with fos 14 months before being picked up by an adjudicator, case was dealt with and agreed within 15 days of that. We accepted 12th September and have been waiting for payout ever since. I feel like the light at the end of our tunnel has gone now, we were so close to getting back on our feet financially with that 9k we have now lost out on

Sara (Debt Camel) says

I know this is not going to feel like a satisfactory answer, but if FOS had pushed more cases through to Final Decsions faster, without trying to get QQ to accept the way complaints were being decided, then the company would simply have gone bust a lot earlier.

jo says

I suspect that would most probably have been the case, but we will never know for certain. It’s a real bummer after i waited for two years, to have been offered (and agreed ) a settlement three weeks ago. however, i have been out of the payday loan cycle for several years now, after lots of hard work on my part, so not desperately in need of this money, unlike others, who i feel so sad for. That being said, i will knock on every door in an attempt to resolve this, even if i am fighting a loosing battle.

Sara (Debt Camel) says

Bummer indeed.

Rel says

One more for Sara on a slightly different note…. QQ had already agreed with FOS that my loans were refundable back to 2013 (after the first 3.)

Whilst a refund is now not going to happen, what about the removal of the record of these loans from my Credit record? Had QQ continued trading, I think these would have been removed in the near future (which is very important to me as I am looking at mortgages in 6 months or so… QQ and Wonga are the only bad history I have left.)

Now they are in administration, am I going to have to wait over a year thus scuppering applications for me in the new year?

Wonga administrators seek to pay the pence in the pound and remove the negative information by Jan 2020…. A year and a half after they closed down. Is a similar wait now on the cards to get this removed?!!

Now that I’m resigned to a miniscule amount of redress, the CRA info is almost more important!!

Sara (Debt Camel) says

I think you will have to wait a while to get an answer from the Administrators on this.

I hope the QQ administration may be quicker than Wonga. First because there are no foreign business to be sold / wound up. Second because the Administrators were feeling their way with the Wonga administration, and a lot of the decisions they will have considered in detail then can, I hope, simply be replicated here eg whether loans over 6 years should be considered. But much under a year would be surprising.

Whether there are any factors that would make the QQ administration more complex than Wonga may show up when the Administrators publich their proposals in a month or two.

H says

QQ Rejected my claim end of Sept, i submitted to FOS same day, i doubt i complaint has even been opened at FOS yet, will they automatically forward my complaint onto the administrators or will i have to make a complaint again?

Cheers

Sara (Debt Camel) says

In other administrations FOS has informed people whose case is being returned to the administrators.

But if you aren’t sure what has happened to your complaint, when the administrators publish their Claim page, the safe thing is to try to input a Claim. This will be very easy!

simon ditchfield says

My QQ Loan was recently sold to ARC Europe Ltd even though I had complained directly to QQ about affordability and had informed them prior to the debt being sold that that loan and historic ones were being looked at by the FOS. I wonder if current QQ customers will suddenly find themselves in a similar situation with loans having been sold prior to administration.

Sara (Debt Camel) says

Have you told Arc you are disputing the debt with QQ?

simon says

Yes, I have told them. I am in a DMP and ARC are being paid monthly.

Tansy says

For those of us who are still paying off a loan with On Stride, I realise we still have to pay and am fine with this, but will our credit reports still be updated as normal or will the accounts be allowed to show up with a ‘U’ or something that casts doubt on us as borrowers, do you know? I only just took out a small loan with On stride that isn’t paid off until next July.

Sara (Debt Camel) says

I expect your credit record to be updated as normal. If this turns out not to be possible, the debt is likely to be simply deleted from the record. Your credit record is not going to get harmed because of this.

Dave says

DS ,

I am in the same boat, I set up a payment plan monthly and never missed a single payment thought it was all ok then checked my Experian credit score and it shows I’ve missed payments for 6 years which is incorrect and has killed me for getting finance, I paid the loan in full when I realised what it was showing last week, Now I don’t know who to contact so they can change my credit score and make it correct. As credit Experian told me QQ are the only ones who can change this information . Gutted really am

Sara (Debt Camel) says

I am sorry you took that step last week without getting any advice.

Now you have paid the debt, it will be marked as closed on your record and will continue to be there for another six years.

Instead you should have asked QQ to add a default date that was 6 years ago and the debt would have dropped off your files. You can ask now, but I don’t know how long it will take to get this resolved now they are in administration. It may take a very long time.

You should also put in a claim for unaffordable lending, see article above for how to do this. If you win this the debt will be deleted from your record.

But now you have repaid the debt, you will only get a very small amount of money back from the calculated compensation. It would probably have been better NOT to have settled the debt.

B says

The dirty tactics used by the likes of Quick Quid and Wonga to get out of refunding customers is a disgrace, the government need to do more and stop allowing these vermin to ‘play’ a very broken system. With such high profits for it’s owners, for quick quid to claim ‘liquidation’ is outrageous. Cash Euronet should be fined.

I’m so terribly sorry for anyone who won’t get a penny from these leeches. The financial Ombudsman also needs to do more, they cannot keep allowing these lenders to carry out delaying tactics otherwise what’s the point.

Lending stream will be next, Watch this space! And if the FOS ought to be prioritising all of the complaints against this company before millions more are screwed over for. 2nd time

Sara (Debt Camel) says

Fining CashEuroNet would reduce the money available for refunds… not a great idea.

Turtle says

I agree re concerns of the remaining lenders doing the same thing. Why sit around waiting for the UK arm of the business to start hemorrhaging money through refunds when they can stick it in administration and save themselves a lot of money?

I have a strong Lending stream complaint in the FOS queue. There is a balance so the loan is still active on my credit report. I would pay this off now in order to get this off my credit report (as an active loan) on the basis it’s with the FOS and I may be due a redress down the line but now I have to take into account if they do dump themselves into administration, I may only get a percentage refund so it’s not in my interest to pay off the loan early. Ridiculous.

Stacey says

It’s weird fos takes so long to do things with qq and yet I received an email from my adjudicator yesterday, Sunday in light of everything. Dont get me wrong she’s always responded but the process needs to be looked at.

Gary says

I have claims in against QQ, but have an outstanding loan with Onstride, due to the fact these are the same company I have decided not to pay my Onstride loan as I now will receive very little from QQ,

fred says

I had already a complaint in the FOS queue.

Will I have to submit another one through their scheme? not that there is any point at this stage.

Sara (Debt Camel) says

Probably not, but this won’t be known for certain until the Administrators publish details.

steve nolan says

i was listening to Martin Lewis on radio 4’s money box on sat 26th he said that we might be able to take our fight for redress to the usa , because enova international who owned casheuronetuk weren’t in financial trouble and were a going concern and have made 35 million available to the administrators Grant Thornton to wind the company down and this money should of been made available for redress to us the complainants . quick quid have fleeced the uk market and taken money and don’t want to abide by the decision to tighten the regulations in the uk regarding payday loans so i’m looking for advice about going forward with class action against enova international .

Iain123 says

Nice one. Keep an eye on the news and here, pass on information you come across.

Val H says

Hope that we can all take this to Enova they should not be able to just walk away.

They are wealthy enough to pay the compensation. We all need to keep any news posted on here about this.

Alex says

Can anyone help, I am trying to understand the difference between QQ and The Money shop administrations. With The Money Shop if you had an offer you could still accept and get paid. All the talk here about QQ is that money will not get paid, even if an offer has been made.

Sara (Debt Camel) says

Hi Alex, it is confusing. QQ has entered an administration which is a form of company insolvency, so the insolvency rules apply. The Money Shop has sought permission from its creditors and the court to put in place a Scheme of Arrangement, which handles its liabilities in a different way.

Colin Brown says

I have complained to the FOS about the FOS over not being quick enough. The bottom line is if they had been quicker then I would have been paid out, imagine if someone sent a compliant to me in my job and I took a year to even deal with it that just wouldn’t happen.

What really annoys me is that some people had there complaint picked up and sorted within 2 months and mine took a year so there were people that complained 6 months after I did and got paid out, they cherry pick the cases to get their numbers down, how can they do this, I cannot just ignore complaints in my job there is a queue.

They are too soft with these crooks and they give them too long, the excuses they give to delay paying knowing they are going bust is just total fraud.

JA says

We’re lucky to even have a free service like the FOS.

Mr and Mrs C says

I have done the same, it will go no where but I want them to know that the 14 month wait to be assigned to an adjudicator is not acceptable, lessons need to be learned from this fiasco!

Colin Brown says

Hi Mr & Mrs C,

It is the cherry picking of cases that annoys me and the people who were on here on thurs/fri saying they had just been paid, that does not help people that have lost their money.

How far down the line were you with your complaint?

Mr and Mrs C says

Hi Colin, we accepted the offer from QQ on 12.09.19, waited over the year to get an adjudicator and once we were assigned one, it was resolved in 6 weeks, I just cant help but think if we had been assigned one sooner we could have been paid out. Have been stiffed twice by QQ, first with the initial interest charges of course and now with the 9k that was offered and never paid.

Colin Brown says

ah that’s terrible! QQ were just in the process of offering me the money.

I am just figuring out what we could do on mass.

I have contacted the administrators and also emailed their parent co.

Jacob says

I made a complaint last week when the news broke. Received a call back today and was on the phone over half an hour to a lady explaining my dissatisfaction with their service. She is going to investigate my complaint further and was very apologetic but kept coming out with excuses. I am absolutely livid that I complained over 2 years ago and did not get a resolution from the FOS. I am not going to let this lie. It’s amazing how i got a call back a within a few days when I’ve complained about them but they couldn’t deal with my QQ complaint in 27 months. Rightly or wrongly this complaint has taken over a big chunk of my life over the last 2 years and emotionally I’m drained by it all and all for nothing.

Colin Brown says

Hi Jacob,

The honest answer is they pussy foot around the companies responses, they should be harder with them, when they make excuses like “our system is down” or “we have the wrong bank details – even though they have been given them 3 times it is just pathetic, the timeframes they give the companies to come up with excuses is too long, then they give them extensions.

I am so angry they cherry pick the cases, how many people will have been paid before you..

Matt says

I received an acknowledgement from the FOS in August 2018 upon receipt of my case files against quick quid.

I sent an email in November 2018 asking for an update.

I got this;

Thank you for your email

We currently have not received a reply from cash euronet in response to our request for their file on your case.

What were the FOS doing for 3 months?

It beggars belief…

Em says

Are we definitely not getting our refund – was past the 28 day mark :(

Em says

Hi All,

I had one loan from On Stride late last year that I quickly fell behind on as (surprise surprise) it was unaffordable. I put in a complaint with the FOS and tried to contact On Stride to set up an affordable payment plan, they were incredibly rude, aggressive and not helpful at all. The call ended up with me in tears hanging up as I didn’t know what to do. Two months later they put a default against the loan. This was after having missed around 3 or 4 payments. As It was only 1 loan I doubt I’ll win a case through any online portal, I was hoping to be able to demonstrate to the FOS that I had enough adverse lending on my credit file at the end of last year (2 large high interest loans that were marked as late payments, 3 credit cards running at 99% usage, a £1500 overdraft I was permanently in and a multitude of payday lending +1 default from Wonga) the loan was £500 over 6 months and my take home was around £2000 a month.

The only thing I really want is for the default to be taken off and to start an affordable repayment plan. Do you think this is still possible? Do you think I could reason with the administrators? I feel like the default they filed was done so with little warning and much too hastily, but I have no idea the regulation around this?

Any help/Guidance appreciated!

Thanks

Em

ClaireR says

Not sure if this has been asked already,

But the redress confirmation email was from Enova, stating

“Thank you for your email and confirming your banking details for the refund portion of the settlement. Please allow us time to action the redress. We will then contact you directly in a separate correspondence with the closing details to the settlement. ”

If Enova are still trading would the redress come from them?

Clutching at straws, but all the emails confirming the bank details etc are all with Enova email addresses

Mr and Mrs C says

I was thinking the same, all our emails are from Enova also.

Mr and Mrs C says

In fact the original offer is from Enova too

Colin Brown says

It makes it even more frustrating that they will not pay even though the payment details came from Enova which we cannot claim from – “erm isn’t Enova the same company as Enova”

ClaireR says

Hmmmm wonder where this leaves us legally?

Sara (Debt Camel) says

So far as I know, your legal claim for redress for an unaffordable loan was against the lender, CashEuroNet. i don’t think the fact CEN outsourced much of its complaints and payment handling to its US parent changes that.

Kw says

We wont get anything Enovo or QQ all the same company. I think we need to conceede we have been dealt a low blow here…

I am so upset as I had also given my bank details 1 week before the news broke…

Jo says

Well after waiting almost 2 years for the FOS to look at my complaint, I’ve now made a formal complaint to the FOS, about the service they provide, or lack of it. I’m sure I’ll get no joy from the FOS, but it’s a process I need to go through in order to escalate my complaint to the independent assessor. I’ll let you know how I get on.

Sarah Morris says

I am gobsmacked, I even received an email from the Financial Ombudsman Officer today relating to my complaint he had been dealing with, even sending him a screen shot from ‘The mirror’ to which he never acknowledged regarding Quickquid going under!

On the 22nd October FO Offficer forwarded me the following:

I can confirm that the lender has finally provided me with a response to the adjudication:

We would like to advise that in order to amicably resolve this complaint we are willing to refund interest and charges paid on loans 4 to 12 as outlined in your assessment. In addition, we will amend the consumer’s credit file and remove the loans associated with the credit file. Please note a breakdown as well details with the next steps will be provided in a separate email to the customer.

I have sent him an email this evening as I am disgusted by the way he has handled this, even by emailing me today like nothing has happened!

Ross says

I was recently paid out just before the announcement and QQ was instructed to remove adverse information from my credit. Will this still happen and when is this likely to happen? Cheers. R

Sara (Debt Camel) says

It will still happen but I don’t know what the timescale is likely to be.

Lloyd says

I’m so gutted, my 28 days to get a refund was due yesterday!!! Had won a my case against Pounds to Pocket through an adjudicator and had submitted my bank details.

Also, I had been paying a debt collector and was told this money would be added to the initial decision.

Waited for nearly two years for this decision only to fall on the last hurdle!

John says

Hi Sara,

I currently have an OnStride loan which isn’t due to be paid off until 2021. My circumstances have changed recently however and I was actually just about to pay off the outstanding balance (c£3.5k) this week until I saw the news of administration.

I just wanted some guidance in terms of what to do next, should I continue to make the monthly payments and see how the situation develops? Is there a chance my loan would be written off and I wouldn’t have to pay the remainder?

Thanks,

John

Sara (Debt Camel) says

The Wonga administrators have now, after 13 months, made an offer to Wonga customers with an outstanding loan that they can settle it for 25% of the balance.

BUT there is no guarantee this will happen in the QQ administration, what the “offer” might be or when it may happen.

In the meanwhile, you are paying interest that you wouldn’t if you asked for a settlement figure now on your loan. I can’t tell how much off you would get for an early settlement, it may be less than you would hope, but I suggest you should ask QQ customer services now what the figure to settle the loan is so that you know that piece of information.

John says

Thanks Sara, I know of the settlement figure for my loan. Should I expect them to negotiate in any way on that figure given the administration?

I’ve spoken to customer services but they basically said the figure was that and that’s it.

Thanks,

John

Sgtflanders says

The Guardian are looking for stories on how this has affected people, may be some good publicity and an opportunity to get a journalist involved?

https://www.theguardian.com/money/2019/oct/28/quickquid-customers-how-have-been-affected-by-its-collapse

You can stay anonymous too.

SK says

Let the fun begin!

Chris says

Thank you. I have added my story.

Mr and Mrs C says

added ours too

Clive says

I had a claim rejected by QQ about 4 months ago, I did not go to the FOS. Am I able to re-apply and could it be assessed differently especially if they are using an automated tool ?

Sara (Debt Camel) says

Yes you will be able to reapply. Yes it will be assessed differently, so this is going to be worth a try!

Jo says

Does any have an email address for complaints at the fos?

Mr and Mrs C says

Their website says to complain to your adjudicator first, I have done that on Monday but had nothing back as yet. Will give to the end of the week for an acknowledgement and try another approach.

Jo says

That’s interesting because when I rang yesterday to complain, I was told a manager would ring within 48 hours, which I was really surprised to hear if I’m honest.

T says

It’s a disgrace they are allowed to do this and we get peanuts.

My advice to anyone who has a claim with FO delayed due to the 6 year rule. If you have any loans after this date then to let the FO look at the more recent loans before any other lenders go bust as it will most likely happen.

Sara (Debt Camel) says

Most lenders have given in and aren’t disputing the 6 year rule any more.

Jay says

Most lenders aren’t disputing, because most lenders won’t be paying.

Most payday lenders will be out of business by the year end.

Martin says

https://uk.finance.yahoo.com/news/fca-lacked-common-sense-giving-193606417.html

SK says

https://www.theguardian.com/money/2019/oct/30/director-of-quickquid-owner-kept-watchdog-role-as-lender-hit-rocks

Damon Gibbons, the director of the Centre for Responsible Credit thinktank, said: “QuickQuid have been playing fast and loose with the rules for a number of years. It’s shameful that it has gone into administration leaving hard-up customers without compensation while its parent company in the US is profitable and a former director of the company is sitting on an influential FCA committee.”

Herve says

I just want to cry… My 28 days also are due and I was waiting on this money to pay off my debts.

I just want to badly to get out of this payday loan trap! I really need help, I might be homeless and lose everything because of that.

What can I do? What can we do? This is so unfair!

Can someone help?

Sara (Debt Camel) says

I can’t help you get this money back from QQ.

But can you summarise your other debts at the moment? And your income? Then I can suggest who to talk to about getting help with your debts.

Herve says

I have in total £1600 on payday Loan with 4 different lenders.

My priority would be to finish with the payday loans, they are taking on my energy.

I’m stuck also with barclays credit card on about 6k in total (but this can be dealt on a different way that the payday loan)

Because my job reduced my hours I’m now having only £1350 per month and I’m trying to find an other job.

Everything started to fall when I started to borrow then I lost my job, and this job that I have now reduced my hours since June (thank you brexit).

Sara (Debt Camel) says

So who are the payday lenders you currently owe money to? HAd you had several loans from each of those lenders?

Herve says

I’m with Lending Stream, Satsuma, Sunny loan and Ferratum. Just since a few months because I had family issues to deal with on top of my job issue. I will say around 3-4 months.

The loans were always small amount like 100/200/300 maximum but it’s like that you stay stuck on their system.

Sara (Debt Camel) says

Ok then you probably aren’t going to win an affordability complaint against those lenders. I suggest you should talk to StepChange about a Debt Management Plan, to include not just the payday loans but also the huge Barclaycard debt and any overdraft you have – see https://www.stepchange.org/how-we-help/debt-management-plan.aspx. This will let you make one affordable payment a month to StepChange – which can be increased later if you find more work. The lenders are asked to freeze interest and in your case they are very likely to do this.

Herve says

Many thanks; I will call them tomorrow!

Can’t wait to get back on track and enjoy life again.

Hannah says

Hi Sara

Can I ask about credit scores , regarding payday loan companies that go into administration . I have two accounts with quick quid that have late payments showing, however I complain to the ombudsman on the 23rd of October but reading your report then the ombudsman can’t look at these . All the loans I had were unaffordable. But who do I know take this up with .

Thanks

Sara (Debt Camel) says

You will be able to make a Claim to the administrators. As you had an existing case at the Ombudsman, it may well be that you have a Claim automatically sent in by the Administrators. The administrators will asses this claim and any loans that are determined to be unaffordable will have the credit record problems deleted.

Rachel says

hi – I had a claim through [a claims company] and was confirmed on 18th October this claim was successful and I would receive my refund within 28 days, does this mean I will no longer be receiving my refund?

thanks

Sara (Debt Camel) says

You are now an unsecured creditor and you will get paid a small proportion of this when the Administration concludes – possibly in about a year.

Mr and Mrs C says

We have received a response back from the FOS re complaint about their service:-

I can confirm that I have forwarded your complaint to be investigated.

I would also like to apologise for these unfortunate circumstances and how this has affected you.

I will no longer be involved in this part of your complaint and you will be updated once this has been allocated

Suspect another 14 month wait whilst they look at their own shortcomings.

MR says

I hate the fact that a large and still profitable company can do this. Could we complain to Enova.

Enova is a company that specialises in online lending.

Quarterly findings by Enova state – ‘Enova through its trusted brands, uses it’s proprietary technology, analytics, to quickly evaluate, underwrite, and fund loans. Their website states. Enova brands a powered by: ENOVA DECISIONS ™ – I’m guessing here but I think that means that when we accessed QQ online etc you would be approved a loan in seconds and then funds transferred in minutes. We are using an online Enova decision platform. So when Casheuronet agreed ‘that it irresponsibly lent to customers, isn’t it the Enova technology responsible for approving the loans and then Casheuronet simply provide funds?

I’m guessing we probably can’t complain and this may even be stupid, but it’s been bugging me that a company can enter the UK market, make people’s lives a misery and then leave.

Sarah H says

My case was upheld by the financial Ombudsman with cashnurnet pounds to pocket and figures were agreed on 24th September 2019

CashEuroNet were given until 23rd October to get in touch to make payment. They emailed asking for bank details on the 10th October and i haven’t heard back from them. The Ombudsman contacted me on 24th October to ask if had been paid. Then this happened. The Ombudsman emailed me on 24th saying that they had contacted them and given them two weeks to reply and they were continuing to work with them as normal until they hear different. I still haven’t heard anything back thanks Sarah H

SK says

I made a complaint to the FCA based on the following statement on thier website under “About us – Protecting consumers” section:

“We work to protect consumers in a wide range of ways. We act to ensure firms have their customers at the heart of how they do business, give them appropriate products and services, and put their protection above the firms’ own profits or income.”

Enova and CashEuroNet are tecnically the same company walking away with a huge profit and they do not even try to hide it!!!

I also received a courtesy call and email from the FOS (from a Casework Team Manager precisely) on the 28th October stating that they are working closely with the administrators and my complaint is not forgotten. I replied in a long email unleashing a huge complaint about how they – and the FCA – managed to let CashEuroNet to get away with dirty delaying tactics etc. and how soft they are with other companies – i.e. Satsuma not responding to adjudicators and Lending Stream’s delaying tactics…

I have not heard from the FOS since…

I really hope these complaints will make a difference, at least in the future.

SV says

Hi,

I made a case using Resolver on the 30th Sept this year, as I’ve had many unaffordable payday loans from QQ.

And on Weds 30th Oct I got an email saying this:

“ I refer to previous communications and the purpose of this email is to assure you that the investigation of your complaint is still ongoing. I would like to thank you for your patience and confirm we will contact you as soon as possible, and at latest within eight weeks of the date we received your complaint.

If you need to contact us in the meantime, please do not hesitate to do so on the details below ”.

Does this mean that I will hear back from them within the eight weeks or not?

Please advise!.

I don’t understand why they can’t pay back the claims people had made before they went in to Administration?!

And any claims made after waits a year or whatever and gets a shared percentage just like the Wonga claims.

Sara (Debt Camel) says

Does this mean that I will hear back from them within the eight weeks or not?

That is very unlikely, this is probably just an automated email.

I don’t understand why they can’t pay back the claims people had made before they went into Administration?!

because legally anyone wanted a refunding is a potential unsecured creditor. And the Administrators have to treat all unsecured creditors in the same manner. you will all get paid the same percentage at the end of the Administration. That is the law, it’s not the Administrators deciding to do this, they have no option.

SV says

Thanks for advising Sara!

What do you think I and many others should do now with claims/cases that are just sat in progress?

Is there another way? Or do we need to wait to see if Quick Quid will be in touch then?

Also I have had some unaffordable loans with high interest using MyJar, Is it worth putting a claim through?.

Many thanks

And Well done for all your effort and hard work that you do Sara!

Sara (Debt Camel) says

I don’t think you can do anything at the moment. The administrators need to come up with thewir proposals for how to handle the administration.

It is definitely worth putting in complaints to any other padyad lenders you used several times. Don’t delay!

Trevor says

This is a bigger debacle than Brexit!

Like many here, I was very close to a satisfactory resolution with QQ. Now it seems they have cut and run. My adjudicator put together a very thorough report into my claim, but that’s been a waste of time. What is the point of a FOS when they can’t bring about a resolution for customers?

Alison says

Good afternoon. I’m hoping someone will be able to advise me. My son borrowed £200 a couple of months ago from QQ and now owes £360 but has lost his job and a payment of £100 is due soon. What’s his best course of action?

Sara (Debt Camel) says

was this his first loan from them? what is the rest of his credit record like? does he have other problem debts as well?

Alison says

Yes it was his first loans but he took it out to pay for his SafetyNet loan. He also has an Amigo loan which I am guarantor for

Sara (Debt Camel) says

ok as it’s his first loan and it isn’t huge, he is pretty unlikely to win a Claim for unaffordable lending. For payday loans , the first few loans don’t normally get refunded unless they are very big.

So he can’t rely on this coming to his rescue. It sounds as though he can’t pay it as he has lost his job. I hope he has claimed Universal Credit? He could offer QQ a token £1 a month until he finds another job.

BUT he should consider putting in a complaint about unaffordable lending to SafetyNet credit – template letter here: https://debtcamel.co.uk/payday-loan-refunds/. Lots of these complaints are being won as SNC could see his bank statements so they had no excuse for lending hims so much…

AND he can also make an affordability complaint about the Amigo loan. If he wins that, interest is removed and you will be released as the guarantor. There is a different letter for this, see https://debtcamel.co.uk/how-to-complain-guarantor-loan/.

Joseph says

Hi Sara, I remember seeing that some people were approached to submit a claim after Wonga went bust even when they had successfully won their complaints at FOS, do you think this might happen with QQ?

Sara (Debt Camel) says

Yes it may happen. It’s not likely to work though unless you had decided to drop the over 6 year loans so the FIS decision was just on a few loans.

Same if you accepted a decision direct by QQ and never went to FOS, if that was a poor decision – and a LOT of QQs early “goodwill” offers werE very poor – you may be able to make a new Claim to have your case reconsidered,

Elizabeth Newton says

Thanks goodness I went through the legal system when I did.

Court presented them with papers, 24 hours later I got my cash.

Feel sorry for those who were owed thousands, waited and now won’t get a bean.

Terrible state of affairs.

Sara (Debt Camel) says

Well done!!!

Most people had an adjudicator decision, so there was no option for them to go to court.

Sarah says

QQ accepted my claim and had 28 days from 2nd October 2019 to pay my redress. 28 days ended on 30th October, 5 days after they announce they have gone into administration.

Livid, upset, frustrated are just a few feelings going through my head right now.

Enova only emailed me the week before the administration announcement to confirm my bank details. Enova definitely need to be held accountable for this absolute mess that has been left.

Rel says

Sara

What do you recommend is the best course of action to take now, for claims that were with the FOS where QQ had already agreed to their findings and that redress was agreed to be due on these loans, but hasn’t been paid ?

I see a “portal” will be set up for claims but I don’t this this would apply in this situation as the “claim” part was concluded.

Many thanks

Sara (Debt Camel) says

There is nothing you can do at the moment.

When the Administrators set up their portal, they will say which Claims will automatically be included – I expect yours will be but this is not definite yet.

When the Administrators assess your Claim it is likely they will set it to the HIGHER of the amount they calculate and any amount that was previously agreed, eg your FOS awarded refund. So you can’t lose out by this.

But of course you will only get paid a small percentage of this in the end.

M says

Would have been nice to have received an e-mail from my adjudicator to say I am officially screwed and the agreed redress is no more. Last e-mail I received was to say he was aware of the news and will get back to me.

Sara (Debt Camel) says

FOS will be waiting to be contacted by the administrators.

You will be told officially by FOS when the complaint is returned to the administrators.

A lot of what I have put in the article above is because having seen the Wonga & Wageday Advance administrations I have a very good idea of what is going to happen.

M says

Thank you Sara.

Mr and Mrs C says

We have put a complaint into the FOS regarding the amount of time taken to start working on our case. It took 14 months for them to pick up our case and now we have lost out to the tune of 9k which was accepted in September and QQ kept stalling the payment, FOS just told us to wait and that we would receive our money. I would urge everyone in this situation to complain to the FOS.

ClaireR says

Did you complain via their website, or just by email?

Thanks

Mr and Mrs C says

By email, they have got back in touch with us and said they are looking at the case and expect to respond by 15.11.19. I don’t expect we will get anywhere with them, but I don’t think the way they have dealt with the case loads is fair to us consumers and a lot of people have lost out financially now.

ClaireR says

Thank you,

I will do the same, mine is only £1900 but it would have

cleared all my existing loans which is really frustrating.

Louise says

Do you have the email address for FOS please.

Mr and Mrs C says

I just emailed my adjudicator and ask him to refer to their manager, I also copied in complaint.info@financial-ombudsman.org.uk

SK says

You can write to your local MP, too, highlighting the fact that Enova are walking away with a huge profit and a smile on their faces from this leaving thousands missing out on their rightful compensation. The goverment should step in and stop this happening. I think it’s worth a shot but not holding my breath though!

Mr and Mrs c says

Could anyone pen a template of what to say to an MP? Do we just ask them to look at what happened? Sorry to appear clueless I don’t really know what to say

S says

You have to let it go, you are just wasting your time and effort now. They can’t touch Enova as the agreement was with CashEuroNet who are a separate legal entity and this company is now in liquidation. Insolvency Act now applies so they can’t favour any unsecured creditor, they have to treat us all equally. I’ve lost £3000 and I’m devastated but it’s the law and there isn’t anything we can do about it!

Sara (Debt Camel) says

I am all for campaigning to get the laws and regulations changed, but this seems pointless at the moment. Wait until after the election and then write to your new MP.

I will be writing a “lessons from QQ’s demise” article in a few weeks. That may help with what to say.

Gemma says

Hi. I’m hoping you can help. Just before the company went into administration, I had accepted their offer (via the adjudicator) for redress on the loans that had been agreed as “unaffordable” and as part of my offer, it had been agreed that my final loan (which still had a small outstanding balance) should never have been offered, and the redress was also going to pay off this balance. I have today received an annual statement for this loan, and the balance hasn’t been reduced. It is still showing that I owe them for this. What happens in this case? I have sent the correspondance on to my adjudicator but wondered if anybody on here could advise. Thanks

Sara (Debt Camel) says

What I expect to happen is:

– you will be able to submit a Claim to the administrators – indeed the administrators may arrange for this to happen automatically for people in your position

– this will be valued at the HIGHER of what the administrators calculate and what you had agreed through FOS

– this amount will be used to offset the balance still owed and any negative mark will be removed from your credit record. This is n’t going to happen fast…

– you will get a small percentage the remaining redress paid out to you at some point

If you are currently making any payments to this balance eg in a debt management plan, you should stop this now.

Gemma says

Thankyou Sarah :)