Contents

Quick overview

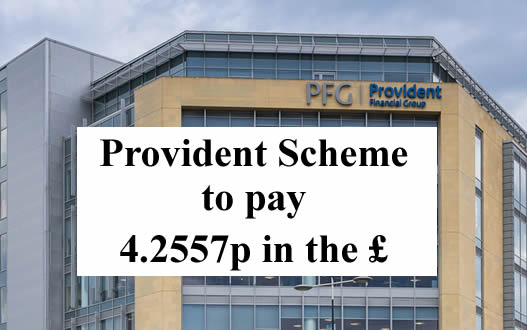

Provident’s Scheme of Arrangement is now in the final stages.

The Scheme was proposed because Provident could not afford to carry on paying full refunds to customers winning affordability complaints. The Financial Ombudsman was upholding 75% of complaints against Provident.

The FCA, Provident’s regulator, said it did not approve of the Scheme. But as Provident has stopped providing doorstep loans, the FCA did not object to the Scheme in court.

It started officially on 5 August 2021 after it was approved in court. The deadline for claims was the end of February 2022.

Provident has assessed claims and informed customers of their decision. The large majority of appeals have been held.

Provident is making payments to bank accounts or sending cheques:

- it is paying 4.2557p in the £;

- so if your redress was £1,000, you will receive about £42;

- a final letter will be uploaded to your portal account setting out the payment;

- the first bank payments will be arriving in accounts on Tuesday 5 July.

Here is confirmation from one reader (see the comments below for others):

FUNDS PENDING!!!

Hi all, I’m new to this to thread but just thought I would give an update.

I have a Monzo account, it is showing my Bacs credit as going into my account on Monday, for most people with standard accounts this means you will be be paid Tuesday

I can also confirm it is 4.2557% as stated.

Glad it’s eventually been sorted.

But no-one should assume they will get their payment next week.

They may be going out in batches. And in any mass payment, some of them fail. Do not plan your July finances on the assumption that you will get paid early in the month.

Which loans were covered by the Scheme?

More than 4 million people were given a loan by Provident that comes under the Scheme.

These loans were given between 6 April 2007 and 17 December 2020.

The loans came from four different brands:

- Provident – often called “doorstep loans” or “home credit”;

- Satsuma payday loans;

- Greenwood – another doorstep loan brand that hasn’t been used since 2014;

- Glo – a very small guarantor loan brand.

If you have an affordability complaint about Vanquis or Moneybarn, these complaints are NOT included in the Scheme. You can still make a normal affordability complaint and get a full refund.

The definition of “unaffordable”

A loan is only “affordable” if you could repay it on time and still be able to pay your other debts, bills and living expenses.

You may have paid the loan on time, but it may still have been unaffordable.

If paying Provident left you so short of money you had to borrow more or you got behind with bills then it was “unaffordable”.

If you had several loans without a break between them, then Provident should have realised you were trapped in a cycle of borrowing and that these expensive loans were not affordable. Even a single loan can be unaffordable if it is large.

Provident pays out on old uncashed cheques

In 2018-20 Provident frequently made very poor offers to people that complained, sending a cheque. They frequently used to offer to refund just a few loans, often not the largest or the most recent. For example, in one case with a large number of loans, Provident upheld a loan for £1,000 but decided the next loan for £2,500 was affordable.

Many thousands of people didn’t cash these and instead sent their complaint to the Ombudsman, where they often got ten times as much! who had made affordability complaints.

When the Scheme was announced, people tried to cash the cheques but some cheques were too old to be bankable. Until now Provident has refused to send out a new cheque. In February 2022, at last Provident relented and refunded this money and people can also make a claim to the Scheme for the extra they should have had.

How much will you be paid?

The next stage is for Provident to divide up the £50 million in the Scheme between the people who have had their complaints upheld.

Customers who made a claim have been told which loans have been upheld and what the total redress for these loans is. You will be paid a percentage of this redress number, not all of it.

When the Scheme was voted on, many people thought they were being told that the payout would be 10%, or 10p in the £. I said at the time that that looked unlikely and it could only have been based on an unusually low number of people making a claim.

For several months Provident quoted a range, saying:

Based on the claims that we have received to date, we estimate that the pence in the pound rate of compensation to be paid to each customer will be between 4-6p.

Now it is known that Provident will only be paying 4.2557p in the £.

A final letter will be added to your portal account setting out what you will be paid.

Credit records will be cleaned

In other schemes and Administrations, some people say getting rid of a default was the most important result for them. Not the small cash refund!

For upheld loans, any defaults or missed payments will be removed from your credit record.

This clean up will be done at the end, when they can do everyone’s together. This is very annoying if you want to make a mortgage application, but there is nothing you can do to speed it up.

If your credit record is not cleaned in this process, there will probably be no-one to complain to about this. But there is process for resolving this sort of problem, see Correct credit records by “suppressing” them if the lender has disappeared.

Current loans

Loans that were sold to a debt collector

If your loan was sold to a debt collector, Provident is trying to get this settled. This seems to be taking some time, for example with Lowell saying they haven’t been given the right information from Provident. Several people are complaining about these in the comments below.

Loans that hadn’t been sold were written off in December 2021

In December Provident announced that it was no longer collecting any payments for existing loans:

There is nothing you need to do. You can stop making payments on your outstanding loans owed to PPC and if your payments are taken by the Continuous Payment Authority (CPA), we will stop these for you. Any payments made after 31st December 2021 will be paid back to you.

If you’re in arrears or didn’t pay your loan within the time we agreed when you got your loan, we’ll update your file with our Credit Reference Agency to show the balance as zero and partially settled.

Your credit record is being changed to show that the loan is partially settled or partially satisfied.

If you are a Provident or Satsuma customer, you should have been told about this by email or letter.

That is a pathetic payout

Provident is a successful company with the profitable Vanquis and Moneybarn brands which are still in business. It is a disgrace that the regulator has allowed them to structure their business in a way that has permitted Provident to abandon all its doorstep lending customers and not pay them their proper redress.

If you are feeling mad that Provident has got away with paying you so little, this is the time to look at whether you can make other affordability complaints, not just for loans but for other types of credit.

I have a separate page for each sort, as they need slightly different template letters to complain:

- refunds for large loans, including Moneybarn and other car finance;

- refunds from catalogues and credit cards such as Vanquis;

- refunds from overdrafts.

Robert Gawley says

I’m from Northern Ireland to. Contacted them last week. Gave my scheme number and details.. they got back to me saying your scheme number doesn’t work yet it was them that gave it to me. They issued me with a knew one, also they said it it ok to use this email to Contact you…this is the same email I’ve used dealing with them for years. Why bein so stupid? So went in to check the portal and guess what they refused me….in FEBRUARY!! I was raging no one had emailed me about this and the 30 day period had passed to appeal. Bunch of charlatans.

Sara (Debt Camel) says

In this situation you can ask to be able to still make an appeal.

Paula says

Gosh that’s not good!! Did they not send you a email? You should check your spam , I check the portal every day still nothing , hope you can maybe appeal? Hopefully Sara can advise you

Robert Gawley says

No email from them checked spam. I’ll be honest I don’t check the portal everyday but one of the emails they sent me away back in October 21 Sets out the time frame of the claims and it says we will contact you around March or April to let you know if your claim was a success. This is why I checked it myself last week..then found out it was settled in February without them letting me know. Probably so I couldn’t appeal. Just think the whole process is a joke to be honest.

Linz says

Hi Sara, you mentioned catalogue earlier. Can people appeal on those. Thanks

Sara (Debt Camel) says

Yes! people are winning a lot of complaints against Very, Next, JD Williams etc. They often increased people’s credit limits stupidly high.

See https://debtcamel.co.uk/refunds-catalogue-credit-card/. And don’t be surprised if the lender rejects your complaint, send it straight to the ombudsman.

Marie says

Hi, I put in a complaint with Provident a few years ago but it wasn’t upheld.

I didn’t escalate it to the Ombudsman but put in a complaint via the Scheme Portal.

I keep logging in but they haven’t given me a decision yet, it just says claim submitted.

Will my past complaint final response prevent me getting redress through the scheme?

Sara (Debt Camel) says

no, they should ignore that and look again from scratch

Marie says

Thanks Sara :)

Wendyb says

Has anyone in northern Ireland heard anything yet?

Thanks

Sara (Debt Camel) says

most people that have heard and ghot a good or bad response don’t continue to check these comments every day. So far as I know, where you live isn’t relevant to when your case is decided.

Paula says

No not me either I’m in (NI)

Robert Gawley says

I’m in Northern Ireland they settled my claim back in February and I hadn’t a clue about it. It wasn’t upheld meaning I couldn’t appeal as the 30 days notice had passed..It felt slightly sneaky and under handed how they did it.

Sharon Bevan says

I email provident every few days as i’m not set up on the Portal, for an update and always get the same generic answer but worded differently. According to provident End of April, today but i know they move the goal post and now it will be in May. It’s the waiting i hate it. I don’t have a clue how they determine claims as mine has been with them for 16mths, just missing out on the bigger payout, my claim aas with the FOS.

Susan says

The latest update on their website states first week in May, so I think everyone should hear by the end of next week.

Paul says

Am I right in thinking payments will be in July ?

This payment is for a lot, lot less than my QuickQuid redress so I can afford to be more relaxed about this one.

Sara (Debt Camel) says

possibly July – you cannot rely on this money being there until it arrives.

Dorabelle says

Hi how far do they go back with loans

Sara (Debt Camel) says

April 2007 – but some of their records don’t sem to be good.

Dorabelle says

ok thanks sara I have had many loans before 2007 according to there records I had 4 after then 1,300.00 700 500, 300 was the 0ne they saying was unfordable so I want be getting much back

Sara (Debt Camel) says

if you had a lot before 2007, put in an appeal and say you understand the earlier loans can’t be refunded, but they should be taken into account when establishing a pattern of unaffordable lending and so you think all 4 loans should be refunded.

Dorabelle says

Thanks Sara for your reply

Dorabelle says

Hi sarah just had email saying saying they have looked again and there decision remains same and passing on to Adjusticator 😏

Harsukh says

I was owed over 12k and offered £780 as compensation via the scheme I don’t feel this is right as the suffering I had been going through on those years was so bad my health had deteriated due to high level of stress.

Sara (Debt Camel) says

Ethically it isn’t right, totally unfair. But Provident have got away with this by getting the Scheme approved. There isn’t a way you can challenge the pathetically small percentage you are being paid.

Teresa says

Still haven’t heard anything

Marie says

Me neither

Hitch says

Me too, haven’t heard anything 😕

Teresa says

Called them today and all they said was end of April, said to them will call u on Tuesday then

Jackie c says

I cot an email yesterday but can’t seem to get Livy in so don’t know what’s happening can find a phone number to get through to them

SA says

I have seen so many examples of people who are rightfully owed redress getting practically nothing back because a company has either entered a Scheme of Arrangement or have gone into administration. It seems like a huge get-out clause and increasingly companies appear to be getting away with it.

Regulators should be doing more to ensure there is a back-up plan, so that companies are forced to have a protected pot of cash that puts borrowers higher up the chain when it comes to redress claims.

If a loan has been deemed to be genuinely unaffordable or lending practices are proven to be in question, then people should receive what they are owed in full – not a tiny percentage.

Imagine if people regularly turned around to loan companies and said ‘actually, I am only going to pay you back a tiny percentage of the interest I’m meant to and it might take me a year before I pay’?

I get that there is an argument about borrowing from these companies in the first place but for some, it’s may be the only available option in what can be a desperate situation, particularly with a poor credit rating.

And if a company is unable to pay valid redress claims in full, it should not be allowed to continue to trade or set up another similar company (not necessarily the case here but there are others out there who are basically holding redress customers over a barrel to ensure they can keep trading while still paying a minimal amount in redress).

Sara (Debt Camel) says

I agree.

And this is absolutely the case with Provident which made very poor offers to complaints hoping people would accept them and now continues with its profitable Vanquis and Moneybarn businesses. Legal but disgusting behaviour. The regulator should change the rules so it’s impossible and also provide a back up scheme for when a form fails so customers still get full redress. Like it did for PPI firms, everyone was refunded in full even if the firm went under.

Dawn says

I claimed a few years ago and got it refused by provident, I didn’t realise I could claim again…I suppose its to late to join this scheme.

Sara (Debt Camel) says

Yes I am afraid it is :(

Terry Elliott says

We have a claim for about 6k that went to the ombudsman prior to the scheme being approved, what happens with that.

Sara (Debt Camel) says

Did you make a claim to the Scheme?

Terry Elliott says

We went through allegiant a claims company.

Sara (Debt Camel) says

Then I hope Allegiant will have enterewd a claim for you.

You need to ask Provident if you have a claim entered.

However much it is upheld for, you will only get about 5% of that amount back. So 6k would be about about £300

Terry Ellioty says

They seem to be saying that claims referred to the FOS before the announcement of the application for the scheme on 15th march are different. I’ve emailed them for clarification and will post the reply when I get one.

Dianne says

Has anyone received any money that was overpaid ? My emailed stated the 350.00 l had paid after the arrangement was accepted would follow . Nothing yet but hopefully it comes soon !!! My actual redress is in July.

Sam says

No, they told me 10 working days which has now passed but nothing.

Helen says

Ive been offered 730-1098 as my upheld claim is 18k how is this fair? I’ve been stuck in a circle of debt had to get loans or phone contracts ect to cover my provident fees, they owe me 18k and can get away with paying me pennies yet I still have to pay debt collectors and their fees for the loans I got to pay provident :(

Sara (Debt Camel) says

It isn’t fair. Provident has set up this Scheme so it can get away with paying you very little and let its shareholders carryon making big profits.

Blame the FCA for ineffective regulation and letting Provident get away with it. And never have anything to do with Provident’s other brands – Vanquis, Moneybarn and the new expensive loan brand they have just set up, Sunflower.

But who are your other loans with… you may be able to make complaints to them and get paid in full…

Julie says

Hi Sara my redress email does not show the dates of when I took out my loans and the gaps between each loan, how can we appeal effectively if we don’t have all the details regarding the loans we took out? I have appealed the ones they claimed were affordable but I cannot tell what dates these were for I just know with my satsuma loan of 500 I took it out whilst struggling to maintain payments with a 800 provident loan which they are saying were both affordable

Sara (Debt Camel) says

You need to tell Provident you want To appeal but need to know the details of the loans – the dates taken and repaid and the interest paid on each.

Julie says

Thank you Sara, I will contact them, but it might be too late as I completed a small section that they provided to state why you want to appeal, it’s a shame they didn’t provide these details to us in the first instance

Sara (Debt Camel) says

Go back and say you want to add more information to your appeal but in order to do this you need the details of the loans, so they need to to send you them.

Paula says

I still have heard nothing on the portal do I need to contact them?

Johanne Huggins says

Neither have i

Hitch says

Same here, Paula 😕

Teresa says

Same ere not heard anything

Kevin says

Give them an email. I hadn’t heard anything, sent a polite email regarding this and I had a reply next day detailing what I was to receive back.

IAN R says

Sara I know July is supposed to be when we get compo but I just wonder what’s happened the over payment cheque/transfer-it says in the email that was it was enclosed ? whatever that means-it’s now eleven days since email arrived-so much for the ten days that was mentioned

Daniel Eccles says

It has to be 10 working days so I would imagine they should be arriving anytime this week but remember weekends and Bank Holiday Mondays don’t count

IAN R says

Yes I know about working days & bank hols but bank transfers go within 2 hours I wait for somebody to say they received there payment – put it straight on el/ga when it comes – 🙃 – ever hopeful /keep ringing them fellow brits-

Teresa says

Just spoke to o them they said we should all hear by the end of the week if we don’t got call them Monday

Pami says

Didnt get an email but logged in as i do everyday..today i found my claim had been accepted

Will receive between £232 and £348.

Marie says

I have received my redress email today. Every loan upheld at a total compensation value of £10,139, This means I will get a measley £608 at the most!

Anyway the debt was sold to Lowell and I have been making monthly payments to them to pay off the debt.

In my email from Provident it says:

Your account had been sold to a debt purchaser who have confirmed that any outstanding balance as at 27th August 2021, has been written off in full.

Does this mean I will get all my payments back that I have made since 27th August 2021?

I have been paying approx £50 a month.

I rang Lowell and they said Provident haven’t been in touch with them yet!

Thanks

Sara (Debt Camel) says

the amount you have paid to Lowell should have been taken into account when calculating the redress…

You are going to need the details for each loan to be sure what has happened here.

Marie says

Thanks Sara.

I will look into it and in the mean time put in an indemnity claim for payments made to Lowell from 27th August 2021.

Neomi says

I got this also but today I’ve received a letter from Lowell for a provident account offering me a 70% discount if I pay the outstanding balance in full

Gemma says

Just had an email through the portal. They upheld £4k of my loans and will be paying me back around £150…. geez! Pittance really

Sara (Debt Camel) says

yes. Pathetic.

Ss says

Will any ccjs held as a part of provident debt also be written off?

Sara (Debt Camel) says

I hope so but at the moment this isn’t clear.

Wendy says

What happens to the 8% added on does that not apply with the scheme

Sara (Debt Camel) says

so far as I know, it has been included in the redress total you have been quoted.

Wendy says

Thank you… I originally complained in 2017 took it to f. O they said 5 loans out of lots upheld I got 900 back did the scheme not thinking anything if it and all my loans have been up held.. Gutted as if the f. O would of thought so I’d of got 28000 instead I’m getting between 1100 and 1650…but it’s better than nothing I suppose

OK says

Got my outcome today. Estimated compensation is between £630-950. Total loans of £15,748. 16 out of 19 loans deemed as unaffordable. My debt was sold to Lowell and I paid them back near £1300. The loan that was sold to them was deemed unaffordable. Would I have a claim to get that money back or is that included in my compensation? I finished paying lowell in February 2021.

Sara (Debt Camel) says

you need to ask Provident this.

Wendyb says

Got my outcome today, between 680.00-1021.68 more than I expected my miles, happy enough,19 out of 26 affordable crazy but happy.july 1st payment should be with me,from northern Ireland

Paula says

So I got my statement in the portal as follows : 600,1000,650, 450 deemed unaffordable

750, 300, 500, 200, 1000, 150, 300, 300, 400 all deemed as affordable, my balance was 1,245.55 on because of this the unaffordable is not greater so I received nil…. I have put an appeal in , angry is not the word

Mark says

Received my redress today. Firstly, they incorrectly have stated that I had an outstanding balance of £1273.95 which I can prove is baloney with the data request I asked for from themselves! It categorically shows each payment I made to provident up until I had a zero balance.

So the total claim value has been calculated as £1325.40, the net claim value £51.45 and my total expected compensation…

£2.06 to £3.09.

I am absolutely livid. Out of 11 loans, 3 have been deemed unaffordable. They took thousands from me.

Debbi says

I didn’t get an email but logged in and the notification is there. 11 loans and only upheld 2.

One that was upheld for £500 and is loan 9 of 11, yet I had a two loans a for £1,500 each, one a month before and the other 3 days after the £500 one, I was paying all 3 at once and all 3 went to Cabot. Still part of a DMP

One of the loans upheld £500 is part of my DMP, . It says ‘your account has been sold to a debt purchaser who have confirmed that any outstanding balance as of 27th August 2921 has been written off in full’ I have logged into Cabot and the balance is still the same and I’m paying the same amount to step change.

I had submitted an appeal. I paid each loan off with a new loan, had other payments day loans and cataloged but it says not upheld as loans not used to refinance a previous loan and did not have loans with other providers at the time.

Paula says

I was the same all my loans rolled into one another with no breaks, how they can pick some affordable and unaffordable beggars belief

Lilly says

I’ve had a letter from Norton Rose Fulbright LLP today, the independent adjudicator asking me to provide evidence of the medical condition that impacted on my ability to manage my finances. Nowhere in my appeal did I say that I had any such medical condition. Nor did I say I had any vulnerabilities which is also referenced in the letter.

Has anyone else who appealed had this letter? I just wondered if it’s something generic they are sending out or if it’s just a mistake?

Sara (Debt Camel) says

I suggest you reply that they seem to have mixed you up with a different case as you had no medical condition.

Lilly says

Thanks Sarah I have. I have asked them to check that they are assessing my appeal on the information I actually provided.

I was just wondering if the medical/vulnerability issues are about the only way anyone will manage a successful appeal. The information they are asking for is quite stringent given the passage of time. I doubt anyone is going to bother asking a medical professional for a historic view on their mental capacity 10 or so years ago for such a paltry sum of money. They also asked for a written professional opinion on how long the difficulties/vulnerabilities were deemed to last at the time they were diagnosed. That is an utter piece of string question and in my opinion designed to put people off pursuing an appeal.

I’m quite annoyed by it actually and although I didn’t claim any such difficulties, I imagine it’s distressing for those that have and who may still be experiencing those difficulties.

Sara (Debt Camel) says

Yes I heard they were making providing medical evidence sound Very Difficult.

But that isn’t th3 onl6 grounds you can appeal on. You should be able to argue that some other loans were unaffordable. And any evidence you can Provide on that will help, not medical.

Lilly says

I have provided quite a bit on unaffordability given I still have my payment books and could string together the loan numbers they gave up in mixed up format, and also information on quite a history of pre 2007 loans going back to 2001.

Thanks

Lisa Marley says

I had my email today and will only receive between £8.40 and £12.59!!

It does say we can appeal, would this make much difference?

Sara (Debt Camel) says

how many loans did you have and how many have they upheld? Does it look as though there are large loans they haven’t upheld?

sandra says

got my redress through today finally…. had 42 loans and all held unaffordable..would have been worth 22000 but I will get back around 1300 …more than I as expecting

Gemma says

I have had an email that says £nil x nil but that my claim has been upheld.

Does this mean I won’t be getting any compensation

Sara (Debt Camel) says

did it say how loans you had and how many were uphedl? Did you have a balance on a loan which has been cleared?

Jan says

I had 5 loans only one is marked as unaffordable and my “payment” will be between £2.90 and £3.60 it’s a joke they asked my to send back details I’m not going to even respond!

Sara (Debt Camel) says

were the other 4 loans larger?

David says

The FOS found that my complaints were ruled against me. Provident then re checked in there scheming . Over £16000 of all the loans were found to be unaffordable. This in theory the FOS cost me the best part of £15,000 because it was before the Provident and FOS collaboration. I wish there was a way I could take up a legal case against the FOS

Sara (Debt Camel) says

That is very surprising. Was your Ombudsman decision from an adjudicator or a final decision from an Ombudsman?

David says

It was the ombudsman I believe . Provident dismissed them as affordable apart from the lowest loan of £200 , i know I waited nearly 5 months before I got decision from FOS

Sara (Debt Camel) says

that sounds too quick for a final Ombudsman decision. It may be you should have rejected the adjudicator decision and asked for an Ombudsman decision.

Annie says

Same happened with me Provident never upheld and FOS agreed with them Now I have been told nearly 10000 in loans upheld and that’s only half them I had Doesn’t add up at all affordable before now unnafordable

Alfred says

I received a letter via the portal today, confirming that my claim is upheld and my estimated compensation amount.

My debt was sold to Lowell and its managed by Overdales solicitors, I have been continuing to pay since the alleged August 2021 write off date.

Spoke with Overdales, who said they will put the payments on hold and speak with Lowell.

Not content with that I spoke with Lowell myself this evening, who were quite dismissive as I have a CCJ for this loan it is litigated for and cannot be written off. They said I need to contact Provident….. not happy at all.

The CCJ will drop off my credit file in August anyway due to the 6 year rule, but Lowell will still be expecting me to pay the final £200!?

Any advice gratefully received.

Sara (Debt Camel) says

Send Lowell a complaint if they won’t agree to write off the rest.

Julie says

My account has been passed to Lowell group and was paying this through a debt management plan with step change I have received an e mail today and it states my account has been written off and I owe nothing. Does this mean I can remove this from my debt management plan?

Sara (Debt Camel) says

yes

LOU says

Hi Sara I have received letter via portal that upholds all loans and they have made an offer – however my balance was sold to PRA group and they entered a CCJ against me – in my letter from provident it says the debt is wiped and the company they sold it too confirm it was wiped from August 2021 – yet I’ve still been paying it, still shows I have a balance and certainly is not wiped from my credit file – what can I (if anything) do please do you know ?

Sara (Debt Camel) says

how long ago was the CCJ?

what is your current financial situation like? (This may sound irrelevant but it’s not.)

LOU says

I’m a little bit better financially but not a significant

Improvement – the CCj was entered in 2018

Sara (Debt Camel) says

if you have made payments since August and PRA confirms the debt should have been wiped then, they should refund those payments.

You can ask PRA to “set aside” to the CCJ. If they refuse, you can ask them to consent so you can apply to have the CCJ set aside – but this will cost you some money unless you are on a low income. Talk to National Debtline on 0808 808 4000 about how to apply for a CCJ to be set aside by consent and whether you would have to pay any fee.

The CCJ will drop off in 2024 if you do nothing.

LOU says

Yes I think the issue is in my letter from provident it says it’s been wiped but PRA say they no nothing about it so therefore I am still liable ? Seems rather unfair that I potentially would have to pay to have it set aside when legally it was deemed as an unfordable (and therefore should never have been lent) loan ?

Sara (Debt Camel) says

Send PRA a complaint enclosing that letter from Provident.

LOU says

Ok will do will keep you posted ! Thankyou

Adreva says

Recieved an email this evening with the following

Please update your bank details on the Portal by 13th May 2022 to secure your payment method, we expect to commence payments in June.

Dorabelle says

Hi I have too and I am appealing mine

SDJ says

Hi everyone,

Received my outcome today all loans upheld even though i defaulted years ago due to my mental health problems,

Hope everyone hears soon, so glad this is another chapter over with.

Kevin Mcintosh says

I have been offered between 536 – 846 for loans totalling 13k.

I have accepted and submitted my bank details. Any idea how soon I will receive bank transfer?.

Sara (Debt Camel) says

Possibly July. But don’t rely on the money being there by any particular date – it’s not safe.

Nicholas Haynes says

Do you mean provident could renege on their offers?

Sara (Debt Camel) says

no, but the timescale for paying is not definite. And even when it is, things can go wrong with payments and it may take a few more weeks for some people.

Faye says

Hi Sara hope you can help, received a email from provident upholding 2 loans rejected 3 also I owed a balance which was sent to a debt collector who in turn ccj me this is what provident say.

Your claim has been upheld however the value of your claim is less than the balance of your account.

● Your account is owned by a debt purchaser, who has agreed to reduce your balance by the value of your claim which is £Nil.

I’m confused do I still owe the debt collector

Sara (Debt Camel) says

do you think the other three loans were also unaffordable?

was the loan that was sold one of the ones provident agreed were unaffordable?

Faye says

Hi Sara, a snippet of the letter

● Your claim has been upheld however the value of your claim is less than the balance of your account.

● Your account is owned by a debt purchaser, who has agreed to reduce your balance by the value of your claim which is£Nil

Your estimated Total Compensation Value is: £Nil to £Nil.

This is calculated as £Nil x 4 to 6 pence in the pound = £Nil to £Nil

This is the total amount of money we estimate that we owe you in compensation after taking everything into account. This is only an indicative figure at this stage. We will notify you when all claims have been agreed and we are able to process all compensation payments. We expect this to be in the second half of 2022.

Agreement number

Brand

Original Loan Value

Status

✓ = unaffordable ✗ = affordable

Gross Claim Value

Outstanding balance

Net Claim Value*

Totals

£419.80

£523.90

£Nil

Detailed breakdown of your loan(s):

741750099

Home Credit

£500.00

✗

£0.00

£0.00

726923081

Home Credit

£1000.00

✓

£0.00

£518.50 outstanding

704416534

Home Credit

£300.00

✓

£419.80

£0.00

212712908

Home Credit

£500.00

✗

£0.00

£0.00

1093466472

Home Credit

£200.00

✗

£0.00

£5.40 outstanding

Totals

£419.80 gross value claim claim

£523.90 outstanding

£Nil

Previous compensation paid

£N/A

Net Claim Value after deducting previous compensation

So I think the ccj £1000 has been deemed unaffordable

Sorry hope this is making more sense to you than me😀

Sara (Debt Camel) says

sorry but pasting that in strips off all the formatting so I can’t make much sense of it. It looks as though only one loan was upheld? are you sure that is the one where there is a CCJ?

how much did you pay to [provident for this loan? How much have you since paid to the debt collector?

Faye says

Hi really sorry Sara☹️I’m not much good at computers, two loans have ticks one for a £1000 with £500 outstanding and one for £300 no outstanding balance on that one, 2 for £500 each and one for £200 rejected, I haven’t heard from the debt collector for years only realised recently I was ccj in 2018 from someone after looking into found it was provident

Sara (Debt Camel) says

It’s not your fault, it’s the way these comments work.

I suggest you ask Provident for all the information relating to all the debts – – that should say what you paid to each debt.

Joanna says

Hiya I have received my outcome all my loans have been upheld and receiveing compensation but it was sold to Lowell provident told me all debts will be cleared including them I have spoken to Lowell but they are telling me I still have to pay Lowell

Sara (Debt Camel) says

Tell Provident this. And send Lowell a complaint with the Provident decision attached.

Joanna says

Okey thank you

Joanna says

Spoken with Lowell payments still have to be made to Lowell as they sold the loan to them there mangers are talking to provident for Mis leading customers

Sara (Debt Camel) says

I’ll try to find out what should be happening. This may take some time.

Jackie c says

Can’t log in to porthole got Emil yesterday so don’t know what’s happening to my claim .don’t know how to phone about it

Lucy says

Hi Sara

I recieved my online letter and like others my loan was sold to Lowell im on a DMP with Step change.

As Provy said they have been in contact with Lowell and written off the oustanding balance I called today and LOWELL say they have know clue about this that thia has not been written off and i still make payments. I spoke to Step Change they too say they have no clue about this either.

They said you should have stopped making payments from Aud 2021 then.

I have now emailed Provy to ask what the hell is going on and also asked them to confirm with either Step Change or Lowell that the debt is written off.

Lucy says

To Sara

Forgot to ask

How do I get the money back that I have been paying since 27th Aug 2021. These have not been taken into account and step change think that I dont get this back either. What do I do?

Sara (Debt Camel) says

Ask Provident to explain what has happened. I can’t guess what is going on here!

Marie says

I contacted Provident about mine and they said I will get them back after the scheme ends. However I did a Direct Debit Indemnity with my bank for every payment made since 27th August 2021. They asked for a screen shot of my email from Provident and within 15 mins all the payments were in my bank account :) £320!

Marie says

These were payments to Lowell by the way

Timbo says

Anyone got an overpayment cheque yet ?

Daniel says

So after holding for 1 hour and 22 minutes I finally got to speak to someone about the fact that it has now been 12 days since my email, I told them I spoke to someone last week who told me I would receive the cheque within 10 working days, she told me that there had been a delay due to the bank holiday and the cheques were being sent out this week so should receive by the end of this week or beginning of next week

Dominic says

Hi all, perhaps a bit of hope for those who were not upheld and then appealed.

I have received a letter in the post from Norton Rose Fullbright acting as the independent adjudicator for the scheme – and they have upheld the claim, overturning the original decision.

My claim is small and I know the dividend will be insignificant but I have a plethora of missed payments so I am now hoping that these should eventually be removed.

Sara (Debt Camel) says

this is very good news – you are the first person that has reported winning an appeal.

Kelly McCandless says

Breaks my heart to see some of the figures people will be receiving. My complaint was at ombudsman and at final stages. I was a week away from final decision to be told 3 days later they had to stop as provident was going to court. I got my redress letter yesterday 14 out of 20 upheld. Had it not been in scheme my redress would have been £19,000 I will get between £770 to £1158. Out of the 6 they said we’re affordable were my last 3 which were £1,000 £1000 and £1300 Two were taken out within a week of each other and used to pay of last loans. I don’t know if it is worth appealing for a measly amount. I am in a far better place thanks to Sara and this site but so many more will still be in a spiral and provident just continues under different names. The ombudsman has to put its hands up for its part in this fiasco, leaving people upto 8 months before even assigning it to anyone. I waiting 12 months for an adjudicator, who then left and I was put in another 6 month queue. Basically robbed me of 18k.

Sara (Debt Camel) says

I think it’s worth appealing for those last large loans to be included. It may only be another £50-£100 but it’s money you should get.

Caroline says

Hi I received my decision and only 1 was upheld but I received nothing. What is the point of upholding a claim but giving nothing back? Provident wrongly claimed I still owed them Money which is not the case as that was paid off 6 years ago and I have not had a loan since. The relentless texts and letters asking me to take out another loan was beyond a joke even though they again knew I was no longer working.

I appealed and asked where to submit evidence and received no reply. It has now gone to the adjudicator. I was only working part time with a mortgage, then became seriously unwell and had to leave my job. In the decision it says that none of the interest on the loans was higher than the loan itself and that’s how they make their decision????? I thought the whole point was the fact the interest was so incredible high. If I took longer to pay a loan I would of paid more interest, I have a letter when I first went into sick pay from provident which gave me longer to pay it off which would incur more interest. . I was so glad to pay it off. I had loans prior to 2007, but did not include those in my appeal. They have upheld the smallest loan which is just ironic. I do have lots of evidence to back up my claim so we will see what happens. Good luck to everyone..

Joseph Ianson says

Hi sarah..iv been been payin lowell solicotors since 2012 at 2 pounds a month.the loan was sold on by provy..my question is do i still have to this as the provy are not trading now. Thanks joe

Sara (Debt Camel) says

Did you make a claim to the Provident Scheme?

How much is left – and do you have any other problem debts?

Joseph Ianson says

Yes gettin between 150 to 250 compo.yes have outstandin balance of 2000 with lowell

Sara (Debt Camel) says

was the debt sold to Lowell listed by Provident as being upheld or rejecyed? or wasn’t it there at all?

Joseph Ianson says

Yes the debt was sold to lowell soliceters

Sara (Debt Camel) says

No I am asking if provident upheld this debt as being unaffordable in your claim? or rejected it? or does it not appear in the lst of debts at all?

Carla says

Has anyone received there cheque yet ?

Daniel says

I rang them today and they told me due to the Bank Holiday, there had been a delay sending the cheques out, they said they were being sent out this week

Teresa says

Rang them again today on hold for nearly an hour, had to cut them of, still haven’t heard anything

John Durrell says

I’ve had my “appeal” sent off for independent review. I have repeatedly requested for the info regarding my previous loans etc. I’ve just had a reply via the portal, provident saying they cannot give me this information until the independent review has come back

Sara (Debt Camel) says

that is ridiculous. How can you provide evidence if they haven’t given you the dates?

John Durrell says

I have rang them again and are now saying because of the large volume of requests they think the earliest they can send this is the end of the month but my appeal should of had a response by then I said it seems they’re deliberately trying to hinder my appeal

Sharon Bevan says

Has anyone appealed? If so have you had a reply? And how long did you have to wait until you had a decision?

Sara (Debt Camel) says

the first report of a win came yesterday – see Dominic’s comment a few above this one.

Dominic says

My appeal was referred to the scheme adjudicator on 1st March and an in-writing response was received yesterday, dated 3rd May. So basically the entire 60 days for me.

The portal hasn’t updated yet though, last note is “Your appeal has been submitted”.

Nicky says

Hi all

Regarding the 8% it states this will be added to each loan for every year after they were finished so a loan that finished in 2012 there would be 8 years of 8% interest added this is what it states on their scheme website, I have worked mine out and both amounts are at 4% and 6% so I’m assuming this cannot include the 8% maybe this will be added once a theclaims are finalised we shall see.

Sara (Debt Camel) says

no this will not change. If you think the calculations are wrong you should appeal them now.

Wendy says

It states that the 8% has been added on to each gross amount already

Kat says

Hi – has anyone mamaged to speak to them?! I cannot access the portal and ive sent 6 emails and no response.