Contents

Quick overview

Provident’s Scheme of Arrangement is now in the final stages.

The Scheme was proposed because Provident could not afford to carry on paying full refunds to customers winning affordability complaints. The Financial Ombudsman was upholding 75% of complaints against Provident.

The FCA, Provident’s regulator, said it did not approve of the Scheme. But as Provident has stopped providing doorstep loans, the FCA did not object to the Scheme in court.

It started officially on 5 August 2021 after it was approved in court. The deadline for claims was the end of February 2022.

Provident has assessed claims and informed customers of their decision. The large majority of appeals have been held.

Provident is making payments to bank accounts or sending cheques:

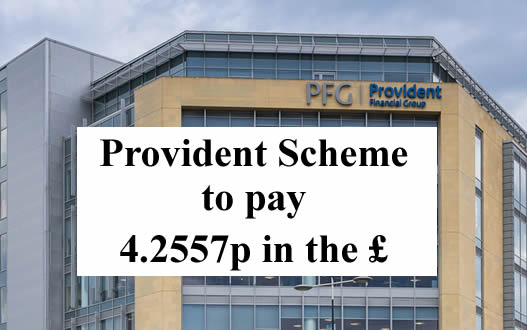

- it is paying 4.2557p in the £;

- so if your redress was £1,000, you will receive about £42;

- a final letter will be uploaded to your portal account setting out the payment;

- the first bank payments will be arriving in accounts on Tuesday 5 July.

Here is confirmation from one reader (see the comments below for others):

FUNDS PENDING!!!

Hi all, I’m new to this to thread but just thought I would give an update.

I have a Monzo account, it is showing my Bacs credit as going into my account on Monday, for most people with standard accounts this means you will be be paid Tuesday

I can also confirm it is 4.2557% as stated.

Glad it’s eventually been sorted.

But no-one should assume they will get their payment next week.

They may be going out in batches. And in any mass payment, some of them fail. Do not plan your July finances on the assumption that you will get paid early in the month.

Which loans were covered by the Scheme?

More than 4 million people were given a loan by Provident that comes under the Scheme.

These loans were given between 6 April 2007 and 17 December 2020.

The loans came from four different brands:

- Provident – often called “doorstep loans” or “home credit”;

- Satsuma payday loans;

- Greenwood – another doorstep loan brand that hasn’t been used since 2014;

- Glo – a very small guarantor loan brand.

If you have an affordability complaint about Vanquis or Moneybarn, these complaints are NOT included in the Scheme. You can still make a normal affordability complaint and get a full refund.

The definition of “unaffordable”

A loan is only “affordable” if you could repay it on time and still be able to pay your other debts, bills and living expenses.

You may have paid the loan on time, but it may still have been unaffordable.

If paying Provident left you so short of money you had to borrow more or you got behind with bills then it was “unaffordable”.

If you had several loans without a break between them, then Provident should have realised you were trapped in a cycle of borrowing and that these expensive loans were not affordable. Even a single loan can be unaffordable if it is large.

Provident pays out on old uncashed cheques

In 2018-20 Provident frequently made very poor offers to people that complained, sending a cheque. They frequently used to offer to refund just a few loans, often not the largest or the most recent. For example, in one case with a large number of loans, Provident upheld a loan for £1,000 but decided the next loan for £2,500 was affordable.

Many thousands of people didn’t cash these and instead sent their complaint to the Ombudsman, where they often got ten times as much! who had made affordability complaints.

When the Scheme was announced, people tried to cash the cheques but some cheques were too old to be bankable. Until now Provident has refused to send out a new cheque. In February 2022, at last Provident relented and refunded this money and people can also make a claim to the Scheme for the extra they should have had.

How much will you be paid?

The next stage is for Provident to divide up the £50 million in the Scheme between the people who have had their complaints upheld.

Customers who made a claim have been told which loans have been upheld and what the total redress for these loans is. You will be paid a percentage of this redress number, not all of it.

When the Scheme was voted on, many people thought they were being told that the payout would be 10%, or 10p in the £. I said at the time that that looked unlikely and it could only have been based on an unusually low number of people making a claim.

For several months Provident quoted a range, saying:

Based on the claims that we have received to date, we estimate that the pence in the pound rate of compensation to be paid to each customer will be between 4-6p.

Now it is known that Provident will only be paying 4.2557p in the £.

A final letter will be added to your portal account setting out what you will be paid.

Credit records will be cleaned

In other schemes and Administrations, some people say getting rid of a default was the most important result for them. Not the small cash refund!

For upheld loans, any defaults or missed payments will be removed from your credit record.

This clean up will be done at the end, when they can do everyone’s together. This is very annoying if you want to make a mortgage application, but there is nothing you can do to speed it up.

If your credit record is not cleaned in this process, there will probably be no-one to complain to about this. But there is process for resolving this sort of problem, see Correct credit records by “suppressing” them if the lender has disappeared.

Current loans

Loans that were sold to a debt collector

If your loan was sold to a debt collector, Provident is trying to get this settled. This seems to be taking some time, for example with Lowell saying they haven’t been given the right information from Provident. Several people are complaining about these in the comments below.

Loans that hadn’t been sold were written off in December 2021

In December Provident announced that it was no longer collecting any payments for existing loans:

There is nothing you need to do. You can stop making payments on your outstanding loans owed to PPC and if your payments are taken by the Continuous Payment Authority (CPA), we will stop these for you. Any payments made after 31st December 2021 will be paid back to you.

If you’re in arrears or didn’t pay your loan within the time we agreed when you got your loan, we’ll update your file with our Credit Reference Agency to show the balance as zero and partially settled.

Your credit record is being changed to show that the loan is partially settled or partially satisfied.

If you are a Provident or Satsuma customer, you should have been told about this by email or letter.

That is a pathetic payout

Provident is a successful company with the profitable Vanquis and Moneybarn brands which are still in business. It is a disgrace that the regulator has allowed them to structure their business in a way that has permitted Provident to abandon all its doorstep lending customers and not pay them their proper redress.

If you are feeling mad that Provident has got away with paying you so little, this is the time to look at whether you can make other affordability complaints, not just for loans but for other types of credit.

I have a separate page for each sort, as they need slightly different template letters to complain:

- refunds for large loans, including Moneybarn and other car finance;

- refunds from catalogues and credit cards such as Vanquis;

- refunds from overdrafts.

Evie says

My brother just got this response on his portal.

Good Morning,

Thank you for your message and please accept our apologies for the error. I have escalated the issue and we will be reassessing this to ensure the correct compensation is applied to your claim and will be in touch via the portal as soon as possible.

Kind regards

He stated the loan details are correct and his but compensation already received was our dad. Surely they can’t now say the loans they deemed unaffordable are now affordable to avoid payment him out a redress amount. We will wait and see what they come back with.

Tim says

So I received an outcome yesterday.

Two loans both upheld as unaffordable, £300 and £600.

With compensation of between £40-£50.

Now my complaint is, looking through this forum.

It appears there was an agreement/option to vote for.

Well I’m pretty sure I never knew of anything to vote for, I was simply contacted as someone who had previously had a provident loan, and I could claim compensation.

So I did.

As the compensation claims being offered is that low it’s hardly worth pursuing. Is there any scope for appealing for more or is this something that’s not gonna happen?

Sara (Debt Camel) says

It’s not going to happen. Sorry, it was approved in the vote, although you aren’t The only personq who was unaware of the voting.

Johnny E says

It is good to see they are sticking to their response timeline. Haven’t received my news yet but a few years ago I got some money back and had to wait a lot longer than the original timeline given by that particular company.

Has anyone who has spoken to them asked what % of people they have responded to so far or what the final date is for this stage of the process ie when the final people should have been contacted by?

Sara (Debt Camel) says

Has anyone who has spoken to them asked what % of people they have responded to so far or what the final date is for this stage of the process ie when the final people should have been contacted by?

the customer services staff you talk to will just not know this information.

Geraint says

Just managed to get onto the compensation page, they have said only 2 of my 7 loans were unaffordable! It says i can appeal the decision, do i just need to message them and say i want to appeal or is there anything specific i need to do?

Sara (Debt Camel) says

do you have the details of your loans? If not, you first need to ask for these. You want to know the loan amount, the date borrowed & repaid and the interest paid.

So if it turns out they upheld loans 2 and 4 and these were small, you can say its unreasonable to to uphold the later larger ones.

How long ago were these loans?

Geraint says

I do have them written down somewhere but i have asked them for all these details anyway, they range from £100-£500 they have upheld loans that were £300 and £450! They span between 2017/18 and 2020.

Sara (Debt Camel) says

ok, when you have them come back here with the details?

As they are so recent, it can help an appeal if you can get a current copy of your credit record and also your bank statements for this period.

Gloria says

Getting between £73 and £110. Better than nothing I suppose.

William Berry says

I have 8 loans all running into one another. Deducting the final payments off the next loan and they upheld only 2 of them is that correct.

Sara (Debt Camel) says

how large were the loans?

William says

300. 500 600 800 600 800 800 1300

500 1300 was upheld

Sara (Debt Camel) says

Then if there were no big breaks between the loans, I think you should suggest that this makes no sense and your position was clearly getting worse. Suggest that all the loans after the £500 should be upheld,.

How long ago were these loans?

William says

Between 2010-2016

Debs says

I’ve just had a email to log in , when I finally got in I’ve had 5 out of 8 upheld my gross claim value is £2206.52 to which I will get between £88.26 to £133.39 .

Sara (Debt Camel) says

5 out of 8 is probably reasonable unless you think they have not upheld the largest loan for some reason.

Char says

Hi I havnt yet heard anything? Are people receiving via email or letters? Thankyou

Julie G says

I had my email this afternoon.

Jen B says

I hand an email today sayi g my claim is upheld

Amanda says

I still haven’t heard from them yet eather

Ben says

I got my email today, they have listed 11 loans between 300 and 650 and have upheld 9 of them.

Interestingly they rejected loan 9 and 10 from when I was in a worse financial position and had multiple CCJ’s on my record.

Seems a bit dodgy as one of them is the only one I still owed money on of 400.

I’ve appealed the decision as there’s no way it was affordable, I was in such a bad position financially while taking these loans out.

They said the final payout will be between 86 and 116 which is fine but I just want the other 2 loans accepting as well.

Joanna says

Hi, I’ve just received the email to say that out of 8 loans they are upholding only 1, however this is a different loan from one that they originally said was unaffordable and I received the interested back, now they are saying it was affordable. These loans were all over a continuous 6 year period. Would you say I should appeal on the grounds that they have contradicted previously upheld loans to what they are now saying? My financial situation over the 6 years remained the same. Tia

Sara (Debt Camel) says

Were these loans continuois, with little or no breaks between one finishing and taking the next one?

COuld you list the loans in date order:

eg 200,400,300,300, 500,600,450

Joanna says

Hi Sara, these are the loans and dates.

500 (Nov 2012),

600 (jun 2013),

1200.(Jan 2014) (upheld this time),

300 (may 2015),

800 (July 2015),

500 (dec 2015) (upheld last time),

500 (apr 2016),

500 (mar 2017)

Joanna says

I’ve be put an appeal in as I think the fact they have contradicted themselves is a concern

Christina says

I had contact today, the long and short of it – Your claim for compensation in the Provident Scheme of Arrangement has been upheld. This is calculated as £1419.56 x 4 to 6 pence in the pound = £56.78 to £85.17. Should I accept? Is this as good as it gets?

Sara (Debt Camel) says

how many loans did you have and how many have been upheld as unaffordable?

Steven D says

Both Satsuma loans upheld, £66-£99 estimated. Better than a kick up the a***

Sarah B says

Hi

I had one loan and it defaulted with months of late payments registered on my credit file. Does anyone know when this will be removed and how much potentially the score may increase by, just ball park, I’ve read somewhere that the initial hot on your credit file is 350 points 😮

Sara (Debt Camel) says

How large was this loan? Have you heard if your claim has been upheld?

When did you first miss a payment and what date was the default added to your credit record?

What is the rest of your credit record like – do other debts show missed payments? defaults? using a lot of your credit card?

David says

I called them yesterday to ask the same thing, they’re anticipating defaults/missed payment markers to be deleted around the end of June-ish I was told. I’ll believe it when I see it but that’s what I was told.

Chris w says

Hi

I have had a reply from provident they have upheld a few of my loans however they are saying as of 27th of August 2021 I still owed them a large amount of money the thing is all loans where paid off in 2017 and I have not taken any loans out with them since

Thank you

Sara (Debt Camel) says

A few people have had a similar problem. GO back to them and say that you don’t owe them anything, repaying everything in 2017.

Chris w says

Thank you for the reply Sara I have just been through some paperwork I had and all the loans they say I have a outstanding balance on are the ones I had in 2009 when I went bankrupt they are showing on the statement I had that they are all paid up so not sure what to do

Sara (Debt Camel) says

ah.

Legally those loans no longer exist as your liability was extinguished in bankruptcy.

However what provident has done is what lenders normally do in this sort of situation eg for PPI refunds. they subtract the money that was cleared by insolvency.

Chris w says

The rotters as the percentage they are going to pay is so small I’m not that bothered with my £70-£100 they are offering I can put the heating on for half a hour

Many thanks for your help Sara all the best

Chris wharton says

Hi I appealed against their decision telling them far as I was concerned I owed them nothing got a email back saying they agree with their original decision and my claim has gone to a adjudicator I will let you know what the outcome is

Melanie says

870, 250, 500 900 1000, 450,500 ,850, 300 in that order and they only upheld, the first and the 450, it makes no sense at all.

Sara (Debt Camel) says

Unless there were some very big gaps between the loans AND your income went up sometimes a lot, as you say that makes no sense.

how long ago were these loans?

Melanie says

They have not told me dates but I have requested it. I didn’t have a pay rise either. I have appealed but just don’t understand how they are making the decision

Sara (Debt Camel) says

nor do I …

Lozza C says

I have just had my outcome. All bar 1 upheld redress £2400 I should expect to receive £94-£139 by July 1st. Considering I didn’t owe them any money and the redress should have been £2400 it’s pretty disappointing. There’s nothing to appeal it’s too much hassle for the 1 that wasn’t uphelp proportionally to the payout. Seems to be most people have a balance so they use that to clear off the balance

Marc says

“Seems to be most people have a balance so they use that to clear off the balance” If you mean most people ‘on this blog’ then this could be correct I guess. But there’s thousands and thousands of claims and only a small number of people actively chatting on here.

I think that a lot of people probably knew roughly what to expect as the outcome from the scheme and will accept it when it arrives and/or they just voted for the scheme at which point a standard claim was submitted for them in which case whatever happens, happens.

Generally speaking the majority of what you read is the bad stuff, but that’s because generally speaking no one would be looking for this site if they were ok with how everything was going. It’s like, no one rings a customer services number and thanks them for the great service. They only call if they need something or have a problem.

£94-£139 is a pretty good amount going by what’s posted so far, I think you’re the highest (on this blog) so far. You’d have got a lot less if they didn’t do the scheme and they just went bust.

Sara (Debt Camel) says

I think that a lot of people probably knew roughly what to expect as the outcome from the scheme

I don’t agree. I think most people will be pretty horrified at what they get.

You’d have got a lot less if they didn’t do the scheme and they just went bust.

And she would have got a LOT more if the FCA had done a decent job of regulating Provident – stopped the mis-selling, made Provident hold sufficient capital to pay compensation in full, provided a back up scheme for redress for lenders that go under etc

Customers have every right to be aggrieved here, mis-sold very expensive loans with a regulator tha5 didn’t act, and now seeing the directors and shareholders laughing all the way to the bank.

Lozza C says

Yes sorry I mean people that I’ve read comments from on this thread seem to be having balances wiped but no redress sent to them.

It is disappointing especially as I originally asked the FOS to look into this as irresponsible lending a good few years ago and my claim was rejected by both Provident & the FOS found in their favour. I only submitted my details last year when I was emailed to say I might be entitled to a claim. I found the outcome at the time pretty outrageous as I both defaulted on a couple of these loans and the final one of these loans resulted in a CCJ.

Mark says

Thank you very much for articulating this. I’ve read some deeply unfair comments that have performed some very bizarre mental gymnastics to place the blame on us, the customers.

Elspeth says

I still haven’t heard anything about my claim can you tell me when I should here

Sara (Debt Camel) says

Lots of people haven’t, they are dealing with claims in batches

Edward love says

Haven’t heard anything yet had loans with provident and satsuma

TB says

Family member heard today. 2 loans with satsuma £500 each both upheld. Expecting redress of around £30-£40!

Interesting she didn’t have bad credit but both upheld

Emma says

I’ve had my last night. 9 out 17 upheld. Valued at just over £5000 however I did receive almost £3000 from them a couple of years ago so £2000 outstanding. Expected to get £88-133. I wasn’t expecting them to relook at my claim given my previous payment so I’m ok with that.

Evie says

So my brother just received his up to date claim, they removed incorrect compensation from calculations and kept the 4 out of 7 loans upheld so he will get between £328-£493.

He’s happy to accept that. Just waiting now to see when I’ll find out about mines.

Chaz says

Provident have agreed that my loans were unaffordable.

I am unhappy with the settlement amount offered.

Is it worth appealing this or will this not make a difference to the amount they will pay?

Many thanks!

Sara (Debt Camel) says

You can’t appeal the percentage they will pay out.

You can appeal if you think more loans should have been decided to be affordable.

Marc says

“The total estimated amount of money you may receive as compensation is between £138.61 and £207.92.”

There was no exceptions to any of the loans I had, they upheld all 15. My initial 2 loans were taken out when I was already in financial trouble and almost every single loan taken out after that was for more than the previous one and they were used to pay off the previous loans.

Better than I expected. I had a similar claim with Sunny a while back, then they went bust and I only received about £20 out of the thousands that I was owed. So I’m quite chuffed to be in the £100’s this time around.

Sara (Debt Camel) says

I have seen three people get over £30,000 from the Ombudsman. Which would be reduced to £1000-1200 in the scheme.

At the moment Provident seems to upholding a lot fewer loans than the Ombudsman would, as well as paying out at a low percentage.

Marc says

Blimey! That’s a whole other level of debt isn’t it, I can’t imagine what’s like to have so much debt that you would be due a redress from one company for £30k. I thought I had it bad with around £10 in loans and redress of around £3.5k (before the scheme calculation).

Sara (Debt Camel) says

Some people had borrowed continuously from Provident for 20 years and were upset to find they could only go back to 2007…

Evie says

My dad got just under £9000 from ombudsman and my mum around £12000. My brothers got his redress letter max of £490 if 6% for over £8000 today and I’m still waiting to hear my loan plus the 8% interest was approx £25000. Me and my brothers were unfortunately too late our claims where with ombudsman before scheme started. I’m still waiting to hear about my mines. Seems like a lot more people have been hearing over last few days so hope I’m soon. I sent a lot of evidence with my claim so I’m hoping I get something back.

KENNY says

Were YOUR Mum and Dad in the Sheme of Arrangement when they received their compensation when the Ombudsman dealt with their claim.

Thanks

Kenny

Sara (Debt Camel) says

no, the Ombudsman only looked at cases before the Scheme was started. So her mum and dad got proper refunds.

Evie says

No they weren’t, they got there compensation back in 2020 before scheme was introduced.

Jason says

Hi just to inform people that provident have placed the amounts that people will receive in your portal, they are paying 3 to 4 pence in the pound that they owe you.

I will be gating between 234 and 340 depending on what percentage they have agreed to pay out.

Nichola says

Not everyone, they must be doing it in batches. I’m still waiting for my outcome.

Jason says

Found my payment in my spam box,. Please check

Starshine says

Unfortunately mine was rejected even though I had several loans at any one time over a 5/6 year period , I’ve sent the complaints through and think I have 11 days to wait for an answer, it seems like they’ve upheld half and rejected half , will see what happens next !

Emma says

I received my decision today, 3 out of 7 loans upheld as unaffordable. 2 of the largest loans were considered as unaffordable, and one of those was a defaulted account. I have appealed as one of the ones they considered affordable was still quite large and in similar financial circumstances. I thought it worth going back to them on this one.

For me the best bit will be getting the default removed from my credit report rather than any recompense.

Debbie says

I have just been on the portal and had a message saying that out of 14 loans 13 were unafordable. The total estimated amount of money you may receive as compensation is between £200.37 and £300.59.

So it doesn’t sound definite?

I don’t know whether to appeal or not.

Sara (Debt Camel) says

You can only appeal the number of loans that were unaffordable. If they saud 13 were unaffordable and only one wasn’t, that may well be reasonable.

You cannot appeal the pathetically low payout you will get – that is why Provident set up this Scheme so it could get away with paying people very little for their mis-sold loans.

Paul says

Just got my redress letter on the portal.. apparently, they accepted a proportion of my loans, £5,103 was unaffordable, so at 4p-6p in the pound, I should receive between £204 and £306 when it’s paid out. Better than nothing I guess.. don’t owe them anything either, so they have to pay me out… which is good. Just added bank details for BACS… awaiting payment in due course!

Gaz says

Hi Sara. Thanks for all the help information you give for this. I got a list of my loans before the vote and the total was over £20,000. Today i had a reply saying they have upheld just under £5000 so works out at £200 – £300. when I made the claim I didn’t have much evidence of struggling but one thing I do have that I didn’t send them is an IVA completion certificate which I was in for 6 years. if i appeal and send them this would it help or would I be at risk of them sending the money to the iva company. The IVA finished 2 years ago . Thanks

Sara (Debt Camel) says

have they said that some loans are outstanding when you don’t think they are?

were any provident loans included in the IVA?

Gaz says

There was one loan outstanding from when they started the scheme. In Decemeber they said I no longer need to pay this. I had paid back more than I borrowed on this but not all the interest.

None on the loans were on the IVA. Provident never knew about the IVA and I borrowed a number of times during the 6 years. A number of loans I had in the 6 years have not been upheld, but if I was in an IVA then they should be counted as unaffordable. I’m unsure though it I let them know this in an appeal whether the money will go towards the IVA.

Sara (Debt Camel) says

“I’m unsure though it I let them know this in an appeal whether the money will go towards the IVA.”

That is hard to tell,

Lisa says

I have had my email telling me to log in to my account. I have been awarded something but cannot download the documents advising me the amount. I press it but nothing happens. Can you suggest anything?

Thank you.

Annilou says

My phone won’t open pdf files so had to turn the laptop on .. depends on type of phone I suppose :)

Alyson says

I’ve just heard off provident they are upholding my redress. They have agreed that 9 out of 17 were unaffordable, my estimated amount back is between £129.42 and £194.13, what I should of received was £3235.42 (obviously would of been a lot more through the fos). Ive accepted the offer as I was expecting less, just the wait to July now to see what actually gets given.

Paul says

Just had my redress !

Wow good and bad is all I can say 18 from 19 loans upheld as unaffordable for a total of over £8000 but they say I have outstanding loans of £3000 to which I do not.

So my total was £5000 to which il get 4%-6% back

In one way I’m happy to get a redress of between £200-£300 but feel slightly unimpressed as when they sent out our letters to say about the scheme all the illustrations were on a 10% so feel slightly misled but I suppose a little is better than zero

Sara (Debt Camel) says

These alleged outstanding loans – go back and ask which loans these are. Several people have been told this who say they do not owe any more more money.

getting another 3000 added would get you more than £100 more…

Kayla says

My claim has been upheld. Turns out I had 11 loans, 6 of them has been classed as unaffordable. Strangly they aint in an order like the first 5 affordable its random. Outcome says possibly between 100 and 150 compensation from what would of been 2600 odd. Its between 4p and 6p to the pound. Thought I would let you all know

Sara (Debt Camel) says

do you feel the decision is fair? is it the larger one that have been upheld? or is it just random?

Kayla says

They’ve not added dates. So I’m unsure its fair or not maybe fair if it’s long dates between i think its terrible they havent added the dates however they are on my credit file. But its not enough information. It’s very random iv had a 200 one upheld but a 600 one not and vise versa. Iv just noticed it says i have an outstanding balance on 2 provident loans and a satsuma loan which I do not on the provident loans however the satsuma loan says outstanding balance of 73 pound but I actually owed them before interest 150. Very odd all I can think off with the 2 provident loans that they’ve classed as affordable, its a case of early settlement maybe deduction of unpaid interest??

I haven’t the strength to argue it im saving that for amigo

Sara (Debt Camel) says

It’s pretty easy to send them an email asking for the dates of the loans and then if it still looks random say you want to appeal as the loans selected don’t make sense.

Marie says

I’ve just received my outcome and out of 18 loans they said 9 where unaffordable. The total amount of compensation I should have had is £2996.68 but I will receive between £119.88 to £179.81.

I am fairly disappointed with this but looks like I have been offered more then most and reading the comments on here there is no point in appealing this offer

Sara (Debt Camel) says

the 9 that were not affordable – were they all smaller?

If they weren’t, then appeal – a lot of people have had very odd results, there may be something wrong with what they are doing. But they will on;t look at cases where people appeal.

Marie says

Most that they have upheld are for between 250.00 to 500.00 however there are few that haven’t been upheld where I had 2 loans running together for example – 5.6.2010 £200.00 paid 16.11.10 then 10.7.2010 £300.00 paid 28.6.11 then 12.11.2010 £300.00

Sara (Debt Camel) says

Well it’s up to you. You could email them to say you would like to appeal as all the later loans were unaffordable,.

Emma C says

I have had my redress on 17 loans,I’m sure I have had a lot more than that but got married in 2015 so my name changed so I’m not sure if they have used my maiden name too,I did email them before putting my claim in telling them this and was told that it would all be on one account but doesnt seem enough loans to me,I have emailed them asking for list of loans and what name they were in.

They have upheld 13 of my loans which is good my redress £5680 and I’m expected £227-340 but I’m definitely sure I had a lot more loans.

Sara (Debt Camel) says

Quite right to ask for the list of loans and dates. If there aren’t any before 2015, you can see what has gone wrong!

TB says

Just received email.

23 loans in total, 8 found to be affordable completely sporadic some affordable others not no pattern or logic to it.

Estimated gross redress £5000 amount to received £200-£300 absolute joke!

HR says

Hi Sara,

I hope this is useful. I got an email today from Provident. I’d used Satsuma consecutively for months out of desperation over an 18 month period. I guess it’s depends on your earnings and what was borrowed and for how long and interest over paid but significantly the 9 out of 14 claims upheld are for larger loan amounts.

Until all claims are sorted they can’t guarantee the amount but say that we’ll hear the outcome by the end of July with payment in the second half of the year.

I’m happy with anything I get back to be honest having luckily got out of debt since and repaired my credit rating. Never again.

Thanks for all your help and others on this site.

For info:

● The total estimated amount of money you may receive as compensation is between £179.48 and £269.22.

david d says

Have received e-mail today , my re-dress payment they say is between £178 / £288 and will received after all claims have be finalised expected to be before July 1st

Tink85 says

I have just heard my outcome…. 7 out of 11 loans upheld. Estimated compensation amount £231 – £347. I will be appealing though as the most important thing for me is having my credit file cleared. They have upheld my first three loans ever with them as unaffordable my middle three and my last one. There is one loan in between the last one and the three that was not upheld which was taken out on 2/6/17. My last one was take out on the 25/07/17, the one before which was upheld was taken out on the 26/11/16 and I was still paying when I took out the one they haven’t upheld. I cleared these loans last April as I was in a payment plan so late markers are still showing in my account up until then.

mark b says

hi i got my email today 10 loans 10 upheld comensation is £258.00 to £378 im happy with that its better than a kick in the ass

Manxcat says

Hi Mark

I got my email yesterday, my original claim to provident got rejected, I then went to the FOS, submitted all the info they requested, things went quiet….. that was when they were going to go to court etc , but it hadn’t been made public at that point. Eventually got an email from the FOS saying that they were no longer dealing with Provident cases and I was to go back to Provident.

They have upheld my claim this time….. a few loans got rejected, but like you I am happy with the outcome, should have been £5140, looking to get £206 – £306, would have preferred the original amount, but hey ho, much better than a kick. I really didn’t expect anything.

Mandy says

I recieved my results today over half my loans were rejected at the time of these loans i was actually on a dmp should i appeal

Sara (Debt Camel) says

How many loans did you have? Did they uphold the larger one? or the later ones? or is it random?

Mandy says

Had 19 upheld 5 . 2 were larger 700 and 1000 the other 3 were smaller 2 of the declined ones were larger but for the majority i was on a.dmp with stepchange which my provident loans were never part of as that was my only source of credit after a relationship breakdown but onv i did not disclose thos to the agent

Sara (Debt Camel) says

Then i suggest you appeal asking for the other loans to be included especially the larger ones.

With these cases it it the length of time and the number of loans that should have told provident you were in financial trouble and stopped lending. A lender should have made checks, not relied on what you told your agent.

Becca says

I’ve received my upheld loans amounts today from provident I also feel its a low amount should have had £5000 will get £230-£330

I never owed all mine were paid off. What I don’t get is if you still owe say a grand that gets wiped yet the compensation people are receiving is a lot less than what they are writing off

Sara (Debt Camel) says

That is the way this works. In an administration that is what happens, so the Scheme offers the same.

Babs says

Just received my email, 5 loans upheld out of 15. Loans upheld are sporadic and can’t seen any logic to them. Compensation should be £5179 so getting back between £207 and £310. I was in a DMP during all those loans and I know more than 5 ran into each other, not sure whether to appeal or not!

Sara (Debt Camel) says

you arent the only person to have said the loans upheld are at random. Getting another 5 upheld could be a couple of hundred more pounds…

Babs says

I have sent my appeal in giving details on my DMP and defaults I had. See what they say!

Rik says

“Your claim for compensation in the Provident Scheme of Arrangement has been upheld.

Good news! We have written off all loan amounts you have owed to us. Even though your upheld claim

won’t cover all your outstanding balance, we have written this off. You do not owe us any money.

Every loan I got was paid off in full and my next comment is a copy of what provident sent me so doesnt make sense

Rik Bevin says

These were sent by Provident which prooves there;s nothing I owe yet they have upheld loand but say they are writing off what I owe!!!

Original Loan Value Status ✓ = unaffordable ✗ = affordable Gross Claim Value Outstanding balance

£300.00 ✓ £395.91 £0.00

£500.00 ✗ £0.00 £0.00

£300.00 ✗ £0.00 £0.00

£1500.00 ✗ £0.00 £0.00

£650.00 ✓ £869.01 £0.00

£1000.00 ✓ £1336.94 £0.00

£950.00 ✗ £0.00 £0.00

£650.00 ✗ £0.00 £0.00

£1200.00 ✗ £0.00 £0.00

£1100.00 ✓ £2167.81 £0.00

Carl says

They are saying the same with me but only showing four loans in six years which I had a lot more than that I have appealed and asked for a copy of my loans on four occasions they said they would send the information but I am still waiting they said we will pay off what you owe but I owed nothing I asked them to send me a copy of any correspondence they sent me to sayi owed money still nothing because they didn’t I believe they are saying this to a lot of people I have no idea what we can do about this maybe Sara can tell us ?

Kirsten says

I haven’t heard anything yet, should I have? I’ve checked the portal nothing on there either. 😕

Evie says

I’m still waiting to hear too. They did say on their website they aim for everyone to hear by the end of the first week in April but who knows if they will stick to that.

Bigmac says

Im struggling to comprehend the 5% (average) payout given that we know that Provident set aside £50m for the compo. My simple maths would mean that the true cost of compo would be around £1billion!! And this doesn’t include the 8% interest.

Are there really that many unaffordable loans given by this company?

Sara (Debt Camel) says

yes. Mis-selling on a MASSIVE scale for decades

(But your £50m ==> £1billion calculation DOES take account of 8% interest I think)

Bigmac says

There’s no mention of interest in the calcs done by provident. My £50m to £1bn calculation was simply based on the likely payout being around 5% ….I.e. £50m is 5% of £1bn.

Although, I’m guessing payouts to people who paid off the loans is somewhat skewed by the amounts owing being wiped in full?

Sara (Debt Camel) says

It may be that the 8% is included in the redress they are calculating for each loan.

the amount written off was not large, it won’t make much of a difference to the payouts.

Lilly says

I have had my email today. 7 loans upheld out of 12. At first it looks a bit random as to what’s been upheld and what hasn’t.

Luckily I still have my payment books and the way the loans are listed on the offer is what’s random! They aren’t in order so I’ve matched up all the loan numbers in the payment book and 4 out of the 5 rejected ones are where I paid in full, the first loans I had. After that I was in the spiral of taking out further loans to pay off the previous one. There is no more than a 3 month gap between any of the rejected loans and my income was the same throughout.

The other rejected one is is one that was settled by ESB (where a new loan was taken to wipe the previous one out) so that makes no sense.

It looks to me like one of the criteria they using as being affordable is if you actually paid it off and on time, which I did with the first 4 loans. It doesn’t mean I wasn’t in financial trouble though or that they were affordable. I will be appealing as there’s nothing to lose by doing so.

Sara (Debt Camel) says

did the size of the loans tend to increase?

Lilly says

Yes they did

Sara (Debt Camel) says

Then this is a point to make in your appeal – your situation was getting worse and that was largely because of these loans

Lilly says

Yes they did, or some were the same. My first loan was £100 creeping up to £750 for my final loan. This was between 2008 and 2011.

Luckily I received a redundancy payment in 2011 and paid the last one off and never went near them again.

Annette says

I received a email I’m looking at a refund between 239 – 339 they are paying £4-£6 per £100 not sure whether to appeal considering the amount of interest I paid them over a few years or just take what’s offered

Sara (Debt Camel) says

You can’t appeal the percentage they will pay out.

You can appeal if you think more loans should have been decided to be affordable.

Sara (Debt Camel) says

how many loans did you have and how many have they decided were unaffordable?

Claire says

My husband and I both put our claims in last year.

My husband had a reply on 01/03/2022 stating that his claim hadn’t been upheld.

I’m hoping that no news is good news in my case.

I’m unsure how Provident is letting people know, if it’s sorted alphabetically I’m in for a long wait!!

Debbie says

I don’t think it is as my surname begins with a y and I was contacted yesterday

Chris says

Hi , I received a letter through the provident portal today advising me that 4 of the 5 loans had been upheld. All my loans were back to back just before 1 finished I had another start my own fault but the 4 upheld loans total £3,250 in interest so I’ve been told to expect £130 – £195 , it’s taken me a few lean years to get myself together. The 50 million compensation pot is nothing compared to how much money provident etc made but £130 is better than a poke in the eye with a sharp stick but only just !

Aksmith says

I have had my email today only 1 out of 13 loans upheld. What do I do to appeal the others?

Sara (Debt Camel) says

first ask for the loan details – amounts borrowed, date borrowed, date repaid, interest paid. Unless you know that, you can’t point out why they seem to have got this wrong!

Hayley B says

My husband has received his SOA upheld message, and you’re entirely correct Sara, having the further information is pivotal to understanding the position. Without dates etc (and the agreement numbers which they DO provide being in a jumbled up order), how are claimants supposed to make an informed decision whether to appeal or not!

The cynic in me would suggest it’s either a deliberate attempt to cause confusion (and acceptance of redress) or they’re missing a trick which could avoid unnecessary appeals. Particularly overlapping dates of loan taken out and loans repaid would hit one of their own qualifying criteria. As would all loans listed in date order if they increased in amount over time.

Redress amounts seem to be increasing as the days go by, so I’ll continue to wait for my outcome message 🤞🏻

Paula says

Anyone else still waiting? There seems to be lots getting messages,

Jennifer Done says

I have not had a reply yet

Evie says

I’m sitting waiting. Hopefully we hear soon.

Char says

Hi emailed them and they replied saying they havnt reached a decision on my claim yet they will be in touch by end of April if not before so maybe there is just a delay with processing claims

Rick says

Hi all I’m bit confused

I’ve had a reply back they basically say 3 out of 10

Upheld.

And these were for the lowest loans

That’s got to be a mistake

Also are they working out loans what I took out

Or what’s got to be paid back total.

Sara (Debt Camel) says

Ask for the details of all of your loans – amount borrowed, interest paid, date take, date repaid.

You need this to point out just how wrong their decision is.

Stephen says

I had a email and got a offer yesterday. Don’t know when it will be paid tho

Sara (Debt Camel) says

possibly July, depends when all the claims and appeals have been resoloved

Mandy says

Ok thanks for yoir help

Tink85 says

Appeal gone in… how their algorithm works is baffling. My first ever loan unaffordable but some others not 🤷🏼♀️

For loan number ending 014 – the amount of this loan value had increased and loan number ending 007 was still being paid.

Loan number ending 324 – loan number 007 had just finished and 014 was still being paid. 007 has been deemed as unaffordable which shows I was not in a position for anymore loans to be affordable.

Loan ending – 168 I was still paying loan 848 had just finished 999, loan 999 has been deemed unaffordable so it shows I should have had no further loans.

Loan 893 – I was still paying loan numbers 168 and 169. Your policy at the time was only two loans could be taken out at the same time however this was my third loan. Loan 168 had late payments which shows I was not managing my finances. Loan 169 was unaffordable which shows I should never have been given loan 893. The large amount of this loan and the amount of previous loans I had meant this loan should have had proper checks run which would have showed it was unaffordable.

All of the above loan numbers should be upheld as they were clearly unaffordable and made my financial situation worse. Had proper checks been run this would have been clear, as I had defaults on other accounts at in 2015 and payment arrangements for other loans in 2016 and 2017.

Sara (Debt Camel) says

there are some VERY weird decisions – I think there may be some errors in their algorithm

Simone says

Hi received a message today in my portal.

They have upheld most my loans expect 2, stating comp is between £170-£240.

No dates are shown on my statement and it all looks confusing.

Not really happy about the amount of compensation but as we voted into a scheme we was not really sure about, I am thinking if it was better to have took them to court privately.

I hope people starting hear some good news and credit scores improve. But apart from that provident have wasted my time caused me stress and left never wanting to use a doorstep lender or any lender for that !!

Jade says

Anyone here put in a claim who had their loan sold on and still waiting for a response?

I had mine sold on to Vanquis Fresh Start who coincidently messaged last week to say the Fresh Start branch were closing and my loan will be written off. This is now reflecting on my credit file as of today but the default it accrued still remains. Anyone in a similar position?

Ally G says

I’ve not heard anything yet from provident;I’m just glad I’ve kept all paperwork from the 5loans I was last paying off to them still from 2009/2011 as shows interest; I ended up DMP as just got too much a week to pay ; 5 at one time I was paying ; they even gave me 2on the same day to pay another;this is not including the loans I had the yrs they starting from 2007, I’ve had too many to count as got stuck in that cycle from the mid 90’s what started with a £50 loan to paying 1000’s over 18yr period with them. what got me into a borrow cycle to pay one off with another or loan from another doorstep company.

Happy to say though after coming across this site only last year I’m Debt free don’t owe a penny to any these charlatans or anyone; after questioning most on my DMP or requesting CCA with some. I got £10k of debt with diff lenders to £0 because they said too old they would now close the accounts with £0 balance. Debt free great credit score at last , so anything off this vile company will be a bonus .

I’m just happy to be debt free after 10yrs of paying companies like them who don’t care at end when gets too much ,who prayed on the vulnerable,making out doing you a favour when it’s all about interest and getting money each week from you in their pockets !

Mrs Sandra Williams says

Hi I was with them for over 23 years still haven’t heard anything

Carl says

Hi Sara I have asked provident to send me a copy of all my loans four times now they have recognised my appeal and what I’m asking for I also asked before I appealed but they have still not sent them they said I had four or five loans over six years which is not true and said they would clear the dept on the account I never owed them a penny an have never had a letter or anything from them to say I owed them which I also asked them to send me a copy of any correspondence they sent me to say I owed money which they also haven’t sent me any proof I feel they are ignoring me and don’t know what else I can do ?

Carl says

Hi Sara I was wondering are they supposed to pay the 8% a year is it like the payday loan ones only I see nothing about this on my refund?

ent number

Brand

Original Loan Value

Status

✓ = unaffordable ✗ = affordable

Gross Claim Value

Outstanding balance

Net Claim Value*

Totals

£455.30

£499.00

£Nil

Detailed breakdown of your loan(s):

15025340

Home Credit

£350.00

✓

£0.00

£68.00

13829998

Home Credit

£1000.00

✓

£72.41

£0.00

13307725

Home Credit

£300.00

✓

£382.90

£0.00

15352789

Home Credit

£600.00

✓

£0.00

£431.00

Totals

£455.30

£499.00

£Nil

Previous compensation paid

£N/A

Net Claim Value after deducting previous compensation

£Nil

Estimated compensation

£Nil to £Nil

Sara (Debt Camel) says

The 8% may be included in the Gross Claim Value number?

do you agree you owe the balances shown?

Carl says

Has far as I know I didn’t owe a penny I had a brain hemorrhage in 2012 and was in hospital for four months and left disabled the manager of the Warrington branch told me the dept was squashed I have never received correspondence from them saying I owe anything and there has never been anything on my credit file I have asked for loan details from 2007 to 2012 because I know fora fact I had more loans than that I have also asked them to show any proof I owed this money and any letters they must have sent if I owed money

Sara (Debt Camel) says

in this situation they may well treat the amount they wrote off as a balance that you still owe I am afraid.