Contents

Quick overview

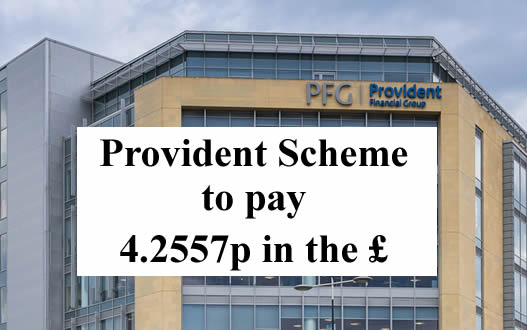

Provident’s Scheme of Arrangement is now in the final stages.

The Scheme was proposed because Provident could not afford to carry on paying full refunds to customers winning affordability complaints. The Financial Ombudsman was upholding 75% of complaints against Provident.

The FCA, Provident’s regulator, said it did not approve of the Scheme. But as Provident has stopped providing doorstep loans, the FCA did not object to the Scheme in court.

It started officially on 5 August 2021 after it was approved in court. The deadline for claims was the end of February 2022.

Provident has assessed claims and informed customers of their decision. The large majority of appeals have been held.

Provident is making payments to bank accounts or sending cheques:

- it is paying 4.2557p in the £;

- so if your redress was £1,000, you will receive about £42;

- a final letter will be uploaded to your portal account setting out the payment;

- the first bank payments will be arriving in accounts on Tuesday 5 July.

Here is confirmation from one reader (see the comments below for others):

FUNDS PENDING!!!

Hi all, I’m new to this to thread but just thought I would give an update.

I have a Monzo account, it is showing my Bacs credit as going into my account on Monday, for most people with standard accounts this means you will be be paid Tuesday

I can also confirm it is 4.2557% as stated.

Glad it’s eventually been sorted.

But no-one should assume they will get their payment next week.

They may be going out in batches. And in any mass payment, some of them fail. Do not plan your July finances on the assumption that you will get paid early in the month.

Which loans were covered by the Scheme?

More than 4 million people were given a loan by Provident that comes under the Scheme.

These loans were given between 6 April 2007 and 17 December 2020.

The loans came from four different brands:

- Provident – often called “doorstep loans” or “home credit”;

- Satsuma payday loans;

- Greenwood – another doorstep loan brand that hasn’t been used since 2014;

- Glo – a very small guarantor loan brand.

If you have an affordability complaint about Vanquis or Moneybarn, these complaints are NOT included in the Scheme. You can still make a normal affordability complaint and get a full refund.

The definition of “unaffordable”

A loan is only “affordable” if you could repay it on time and still be able to pay your other debts, bills and living expenses.

You may have paid the loan on time, but it may still have been unaffordable.

If paying Provident left you so short of money you had to borrow more or you got behind with bills then it was “unaffordable”.

If you had several loans without a break between them, then Provident should have realised you were trapped in a cycle of borrowing and that these expensive loans were not affordable. Even a single loan can be unaffordable if it is large.

Provident pays out on old uncashed cheques

In 2018-20 Provident frequently made very poor offers to people that complained, sending a cheque. They frequently used to offer to refund just a few loans, often not the largest or the most recent. For example, in one case with a large number of loans, Provident upheld a loan for £1,000 but decided the next loan for £2,500 was affordable.

Many thousands of people didn’t cash these and instead sent their complaint to the Ombudsman, where they often got ten times as much! who had made affordability complaints.

When the Scheme was announced, people tried to cash the cheques but some cheques were too old to be bankable. Until now Provident has refused to send out a new cheque. In February 2022, at last Provident relented and refunded this money and people can also make a claim to the Scheme for the extra they should have had.

How much will you be paid?

The next stage is for Provident to divide up the £50 million in the Scheme between the people who have had their complaints upheld.

Customers who made a claim have been told which loans have been upheld and what the total redress for these loans is. You will be paid a percentage of this redress number, not all of it.

When the Scheme was voted on, many people thought they were being told that the payout would be 10%, or 10p in the £. I said at the time that that looked unlikely and it could only have been based on an unusually low number of people making a claim.

For several months Provident quoted a range, saying:

Based on the claims that we have received to date, we estimate that the pence in the pound rate of compensation to be paid to each customer will be between 4-6p.

Now it is known that Provident will only be paying 4.2557p in the £.

A final letter will be added to your portal account setting out what you will be paid.

Credit records will be cleaned

In other schemes and Administrations, some people say getting rid of a default was the most important result for them. Not the small cash refund!

For upheld loans, any defaults or missed payments will be removed from your credit record.

This clean up will be done at the end, when they can do everyone’s together. This is very annoying if you want to make a mortgage application, but there is nothing you can do to speed it up.

If your credit record is not cleaned in this process, there will probably be no-one to complain to about this. But there is process for resolving this sort of problem, see Correct credit records by “suppressing” them if the lender has disappeared.

Current loans

Loans that were sold to a debt collector

If your loan was sold to a debt collector, Provident is trying to get this settled. This seems to be taking some time, for example with Lowell saying they haven’t been given the right information from Provident. Several people are complaining about these in the comments below.

Loans that hadn’t been sold were written off in December 2021

In December Provident announced that it was no longer collecting any payments for existing loans:

There is nothing you need to do. You can stop making payments on your outstanding loans owed to PPC and if your payments are taken by the Continuous Payment Authority (CPA), we will stop these for you. Any payments made after 31st December 2021 will be paid back to you.

If you’re in arrears or didn’t pay your loan within the time we agreed when you got your loan, we’ll update your file with our Credit Reference Agency to show the balance as zero and partially settled.

Your credit record is being changed to show that the loan is partially settled or partially satisfied.

If you are a Provident or Satsuma customer, you should have been told about this by email or letter.

That is a pathetic payout

Provident is a successful company with the profitable Vanquis and Moneybarn brands which are still in business. It is a disgrace that the regulator has allowed them to structure their business in a way that has permitted Provident to abandon all its doorstep lending customers and not pay them their proper redress.

If you are feeling mad that Provident has got away with paying you so little, this is the time to look at whether you can make other affordability complaints, not just for loans but for other types of credit.

I have a separate page for each sort, as they need slightly different template letters to complain:

- refunds for large loans, including Moneybarn and other car finance;

- refunds from catalogues and credit cards such as Vanquis;

- refunds from overdrafts.

Vicky says

One month after taking out my loan with Satsuma I had to add it unto my DMP and therefore it was finally paid off via pay plan. Do you think because of this I have little hope of any compensation. It was for 1500

Sara (Debt Camel) says

That is a very large loan. When was it taken out?

Vicky says

Sarah it was taken out in 2017

Sara (Debt Camel) says

ok then you need to take a copy of your credit record now – download it and keep it safe.

And also set about getting your bank statements for the 3 months before you took the loan as these will show it was unaffordable.

Do this now, so you have them ready if they come back and reject your complaint.

Vicky says

Thank you, will sort that now

Sarah Louise Tansley says

The same thing happened to me Vicky. The initial loan was £1000 and they added £900 interest charges. They were not helpful when I told them my circumstances and my partner became ill and soon after taking it out, I had to add it to my existing StepChange DMP. They did write it off in December and have rejected me any compensation as part of the scheme and I’m not holding out much hope but I have appealed against that as I thought why not, as they didn’t do thorough checks and put me in a worse financial state!

Stephen Harrison says

I could not repay my loans and Provident sold them to Cabot Financial I am still paying them back at £15 a month and it will take years to free myself from debt. This company has caused so much hardship.

Sara (Debt Camel) says

do you have other problem debts as well?

Stephen Harrison says

Yes, Amigo Loans and Vanquis apart from Provident. Vanquis is with the Ombudsman. The others still waiting.

Sara (Debt Camel) says

ok well voting will begin soon – possibly tomorrow – on Amigo’s new Scheme.

How much did you borrow for this Amigo loan, how much have you repaid so far?

Stephen Harrison says

10500 owe 4000 I have had to borrow money from my ex wife to make the repayments.

Sara (Debt Camel) says

ok so you have more than repaid what you borrowed?

Borrowing from your ex – urgh what a conversation to have.

Do you think the loan was unaffordable for you right from the start?

Stephen Harrison says

I had to take out two loans because I could not afford to repay the first one.

Sara (Debt Camel) says

So if you had two top ups from Amigo that is usually a sign the loans were unaffordable and you may well have a good complaint.

But it may be late this year/early next year before you know if it is upheld – that is a long while to keep making payments if they are unaffordable, especially with bills and prices going up.

As you have paid more than you have borrowed, if you want you can ask Amigo for Equitable set off. It will let you pause paying Amigo until your complaint is settled and during this time they won’t ask your guarantor to pay. It harms your credit record but if you eventually win your complaint the negative marks will be removed.

Kirsty Law says

Hi Sara

I haven’t heard anything from the scheme yet, I actually knew nothing about it until the wrote to me, I will admit I threw about 3 letters away when they first came as I seen provident on the letter and it just went into the bin, it was only after the 4th in aug/sep that I actually read it and then went on to fill out the claim form online,

I haven’t had a loan with them for about 5-6 years as I changed to loans at home as my agent was going to work for them and the rates where better ( loans at home have now gone into liquidation as my agent msg me to let me know)

I know I had loads of loans threw provident, normally one every year for 400-500 from about 2003, Iv no records on bank statements as I paid by cash every week when my agent came to my door, there was weeks I would fall behind but it’s so hard to fall behind when somebody is knocking on your door,

Can I call provident and ask how many loans Iv had? Will they tell me or as Iv read above they won’t tell people? I don’t get how they will work out the % of interest either,

Thanks 😊

Sara (Debt Camel) says

I suggest you wait until you have had the decision from Provident then if they have rejected it, or only upheld a couple of loans, you can ask them for a list of your loans and appeal.

The steps in working out what you get are:

1) work out which loans should not have been given as they are decided to be unaffordable

2) add up all the interest you paid on those unaffordable loans and add 8% statutory interest on – this is called your redress amount – it is the amount you would have been paid before the Scheme if the ombudsman had decided your complaint.

3) add up every customers redress amounts to give a Total Redress

4) divide the Total Money Available by the Total Redress – this gives the percentage everyone will be paid. so it the total Money avaiable is £50 million and tTotal Redress is £800 million, everyone would be paid 50/800 = 6.25% of their redress.

Kirsty Law says

So does that mean that I will get the interest I paid back plus the 8%? So confusing, if I’m completely honest none of them where affordable but I was a single parent and I took them out for Xmas, my daughter who’s 24 couldn’t belive when I told her how much I paid,

Like Iv said loans at home have now gone into liquidation and i will carry on paying that threw direct debit as I don’t want to have it go on my credit file as default, seems as if a lot of loans with high apr are going bust at the moment

Sara (Debt Camel) says

Interest paid plus 8% on any loans provident decides are unaffordable. BUT then you will only get small percentage of this calculated amount back.

If you have been borrowing from LAH for 5 years you probably have a strong complaint against them to – see https://debtcamel.co.uk/refund-doorstep-loans/ for a complaint template you can send them now.

Can you afford these repayments? With energy bills and everything else going up so much?

If you stop paying it would harm your credit record – but it must be poor anyway or you would not have to borrow from this sort of high-cost lender. If you win a complaint in administration all negative marks would be removed from your credit record.

The risk is that you pay them a few hundred pounds more over the next few months, then have the complaint upheld and only get back a small amount of what you have paid… not an easy decision, but if you can’t really afford the repayments, then don’t get behind with bills or borrow elsewhere to stretch to pay LAH.

Kirsty Law says

Thank you Sara

I will just wait like everybody else, it was them who wrote to me so I’m guessing they have all my loans I took out on file, I will think about LAH, i guess I never missed many payments as I always knew I would need another once that one was paid off, it’s a vicious cycle

Sara (Debt Camel) says

they would have written to you if they only had 1 lon on file…. but waiting is best now.

You don’t have to miss a payment to win an affordability complaint. Continuous borrowing is enough – make a complaint now!

Sid says

hi, I wanted to ask whether this 8% interest is included in the 50mil pounds pot or is it going to be paid separately which can actually make a good payment at the end. I’ve had a loans with Provident constantly from 07 to 2014. Borrowed 10 000 and paid 9 500 interest. Sid

Sara (Debt Camel) says

it’s included in the 50m pot. There is no extra money to pay the 8% s from

Sid says

alright, many thanks for your quick reply Sara.

Stephen Harrison says

Thank you, I won’t do anything that harms my credit rating.

Joy Brightley says

Sara please I like to know if my claim got on on time can you check for me

Sara (Debt Camel) says

No. Sorry you need to ask Provident.

John Durrell says

Claim got rejected. I appealed and asked for info regarding the loans i had with provident. Got a stock answer, no mention of providingme the info I asked for to make a proper appeal

“Thank you for raising your appeal with us, we have now had the opportunity to review this but our decision remains unchanged.

Under the Scheme your claim will be a Disputed Scheme Claim and will now be referred to the Adjudicator for an independent review to take place. Once the Adjudicator receives your appeal they will have up to 60 days to review the information and determine an outcome. If any further information is required from you we will be in touch.

In the meantime no further action is required from you.

Regards,

Provident SPV Limited”

Sara (Debt Camel) says

Phone Provident up and ask for a list of your loans – say may you want to provide extra evidence but can’t until you have the list.

John Durrell says

Thank you sara I will

IAN S says

The thing is if provident are sending out rejection letters/emails first-then no news is good news-and I just wonder how many people will get anything other than £5-£50 poor performance by fca on this matter-basically blackmail by provident saying they would go into liquid if scheme not accepted-?

Stephen Harrison says

Amigo and Provident I voted for Bankruptcy, they deserve that and the administrators will be inundated with claims.

Sara (Debt Camel) says

You have just voted against both Amigo new schemes

Diane says

How do we get notified the outcome please? Email, mobile text message or letter? Tried to log on to the portal to check for updates but despite putting in all the correct info it stated invalid. Àny ideas please? Thank you.

Sara (Debt Camel) says

I think people have been told by email.

I don’t know why you can’t login – I think you need to phone Provident and ask.

Diane says

Thank you Sara,

No email as yet from them about any updates of the claims.

I’ll try again tomorrow, and if still having issues logging onto the portal I’ll call them.

Thank you for your fast reply.

Des says

Hi Diane,

The same thing has happened to me. The system won’t recognise my details. Very suspect….

Julie says

Hello Sara

I have not yet heard anything from provident I had several loans going back 2017 to date, the three loans that were active were on payment plans for £10 per week

It would be nice to have some sort of redress but I am just glad they have closed the active accounts and on my credit file three of the loans read settled but my satsuma loan reads satisfied why is this different and if my claim is upheld will these then be removed from the credit file or still show under closed accounts

Stephen Harrison says

My Multiple Loans go back to 2007. My current debt is being handled by Cabot Financial, which I am paying back at £15 a month. Still have 1300 pounds to repay. I provided bank accounts that show at the time of the first loan I had zero income and 69 pence in my bank account. Provident still don’t reply or think I have a valid claim? Why?

Sara (Debt Camel) says

have they rejected your claim?

Ashley S says

Hi

Hoping someone can help.

I had 10-12 loans with Provident and they would agree to keep giving more and using some of the money for the new loan to pay the rest of the last one.

In hindsight it was my fault but I was in a bad place and am glad that my situation has improved some what.

Of the loans I had,the last 2 I couldn’t manage when I was pregnant / get Stat Mat pay so I defaulted and they were passed to a debt management company, totalling around £3500.

I have contacted the company (Moorcroft) and they said the debt was passed back to Provident and they no longer own it.

Anyone in this situation.

What happens if there is a outstanding balance on dated loans? Will I get any redress if eligible.

Also,they are still appearing as default on my credit file – will these get removed?

Thanks in advance

Sara (Debt Camel) says

I think Provident has probably already written off the balance on the last two loans that were returned to December. Has this happened?

You can still get a refund on the earlier loans – with 10-12, I would hope you would get refunds on at least the last 6, possibly more.

And the defaults should be removed on the last two loans if they are decided to be unaffordable.

Diane says

My hubby had his email from provident last night but he’s having problems logging in now too,

Scheme ID:

Why are we writing to you?

We are getting in touch to let you know there is a secure message waiting for you in the Claims Portal.

What do you need to do?

Log in to the portal and read your new secure message. This message contains an important update about your claim.

Useful links

Claims Portal log in link:

Are provident phone lines open on weekends does anyone know please? That’s both of us now having issues, it’s frustrating.

Thank you.

Sara (Debt Camel) says

I am sorry but you have to phone them up and say this. I don’t know if the phones are open at the weekend, if no answer, do it on Monday.

Diane says

Thanks Sara,

We’ll try Monday now, hubby will ring as soon as he’s home from work, we feel it’s going to be a rejection going by most of the posts so far.

I’ll update as soon as we know.

I’m still awaiting on mine but I never put in for mine until after my hubby’s.

Cheers.

Sara (Debt Camel) says

if it is a rejection, insist on being sent a list of the loans.

Stephen Harrison says

They did and now my Solicitor is having it reviewed. My claim against Vanquis is with the FOS. Provident are nothing but Crooks.

Sara (Debt Camel) says

You should ask your solicitor what he thinks your options are. It isn’t clear to me that there is ANYTHING that a solicitor can help with. So don’t throw good money after bad by paying someone that can’t help/

Mrs ea darch says

Just heard from provident, surprise surprise, claim not upheld. Why are provident dealing with the claims and not a impartial company?

Sara (Debt Camel) says

Because customers voted to approve the Scheme Provident put forward.

Did you borrow from them a lot?

Julie says

Hi

Is this the final week when we will all have some news one way or another if our claims have been upheld or refused?

Sara (Debt Camel) says

no, there is no deadline here.

Dawn says

Hi,When will we hear something do you think it will be April or may because I think they are doing the one that are not upheld first,do you know how many people put a claim in? Thanks

Sara (Debt Camel) says

I can’t make a guess at the timescales. No money will get paid out for a very long time as they have to have decided everyone’s claims, including appeals, first.

Diane says

I posted the other day that my hubby had an email from SOA to say important message in the portal, the email came through gone 11pm Friday night, wasn’t expecting a late email, not at that time of the night from them but he tried getting on there but it kept saying invalid code etc, anyway he’s morning shift this week so tried ringing after 2pm to explain. He couldn’t get through to them, it’s automated and he waited in the queue system then it just went on and on, after a while it clicked off.

Anyone else having issues please? Cheers

Debbie says

Everyone just be very careful that emails you get are totally genuine as I have heard that fraudsters are sending out links that will mess up your phone. Never access the portal through a suspicious link. Always type in entire address. Sorry for rant but I have been a victim myself and had to factory reset my mobile.

Paula says

I have had these loans out for years and greenwood, it was always paying one off with the next loans money, it got so bad I just couldn’t afford it and defaulted . I haven’t heard anything bad yet I keep an eye on the portal

Joe says

No email yet from Provident but their website states we should receive the claim outcome by 1st of April

Sara (Debt Camel) says

It says

“All letters and emails are expected to be delivered by the 1st week of April.”

Although that isn’t clear, it does not say the 1st of April.

It may mean by the end of the 1st week in April.

Mark says

Do we think everyone who filed the claims form months ago will get some kind of compensation even as little as £100 for example?

Sara (Debt Camel) says

No.

Provident say they may be paying out 5-6%. If that’s right, people would have to have enough loans upheld that they should get £2,000 refund.

That’s certainly possible with Provident. I have seen many people who borrowed from provident for year who get more then £10,000, some more than £20,000 and a few more than £30,000.

But not everyone will get that.

And at the moment it looks as though Provident is rejecting some good claims. Some Provident dont seem to have the list of the loans right! Some they say money is wed when it isnt. And some decisions just sound wrong – a £2000 Satsuma payday loan is VERY VERY likely to have been unaffordable.

So if people get a rejection or a poor offer, they will have to appeal or they will get little or nothing.

kenneth mcpherson says

Like to know who decides which soa PROVIDENT loans WERE OR WERE NOT AFFORDABLE IN THE SCHEME OF ARRANGEMENT.. WHO DECIDES WHICH LOANS will get reimbursed compensattion ???

Does the court decide ..because if provident decides they could easily say no one can claim .. has to be someone accountable to say which loans can be claimed on..???

I have made claim also emailed the Financial Ombudsman regarding same.. THANKS..

Sara (Debt Camel) says

Provident decides. You can no longer go to the Ombudsman – not for anything that happens in a Scheme.

There is an appeal mechanism with the Provident scheme and I encourage everyone to use it. If Provident hasn’t sent you a list of your loans with the rejection or poor decision to not uphold enough loans, the first thing is to ask Provident for a list of the loans.

Leanne C says

I’ve left several messages on the portal and getting nowhere

Leanne C says

Just had this message, I’m sure they are dragging it out so my appeal isn’t successful

Can you please provide the additional information for your appeal by the 31 March 2022. Please note the information has been requested for you.

Many thanks

Sara (Debt Camel) says

Reply that until you know the loans and the dates you don’t seem how you can know what other information to provide.

Leanne C says

I’ve left messages on the portal and made 4 calls to them all asking for my loan dates, amounts and interest for each and they aren’t providing me with what I need so I can appeal their decision

Sara (Debt Camel) says

yes and say you may be able to provide extra evidence but you need the dates of the loans in order to do this.

Leanne C says

I’ve tried loads like I said but not getting anywhere.

Each person i spoke to on phone said they’d sort it and they haven’t

I’ve only got to 30th to appeal

Sara (Debt Camel) says

Then send it in now and make the point that you have several times been told you will be sent details of the loans but this has not happened.

Musarat says

I wrote an email to them and it took a week or so and I had to enter details into a link I was sent. After a further 2 weeks I was able to access all my loans from provident and satsuma. My interest has totalled over £10000 for 11 loans and still have not heard if I have been successful yet so am hoping to hear soon. They said in March and April all decisions will be sent out. Will wait until last week of April if I have not received anything will contact them again. Emails seem to work better than messaging and phone calls

Diane says

Ok, we managed to get onto my hubby’s portal account, due to him having an email last Friday from provident SOA to say there’s an important message for him, as like everyone else at the moment, not upheld due to the same list of reasons that everyone else have received.

Anyway he have messaged SOA to request the loan list as they must have them on the system to have sent him a letter in the first place, also stated have been previously upheld on other loans taken out from having others elsewhere so it makes no sense.

Hopefully they’ll comply soon so hubby can take it further.

It was sent to SOA because he tried sending to the claim link dept that was on the letter but the link didn’t work.

Anyway, I’ve not heard anything on mine yet so it will be interesting to see what the outcome will be there.

Diane says

I understand you can complain about provident on the resolver website too if they don’t comply which we will be doing if they fail. Google in resolver, provident is actually listed on there. Easy to use. It should get them moving. I’ve succeeded this way if any issues with any company. Free too so don’t worry, and I only used them before because Martin Lewis from money saving expert listed it.

Sara (Debt Camel) says

No, you cannot use Resolver for anything to do with a Scheme.

Diane says

Arh I see, I seen provident listed but not the actual scheme, my confusion there then sorry. X

Kelly says

Hi can you check plz to see if I have a claim with yous

With provident I had 4 loans with them. A guy called Stephen was collecting monies every Friday.

Sara (Debt Camel) says

I am sorry but you need to ask Provident this.

This page just gives information about the provident Scheme, I am not part of Provident.

I have deleted your name and address details.

Tim says

I notice on the front page of the claims portal they have listed key dates such as the claims submission deadline being 5pm 28th Feb. They then list H1 2022 – payments made and scheme terminated.

Any idea what H1 2022 refers to? 1st half of 2022?

Dave says

This confused me also as I read on here that payments may not be paid until 2023 which seems more realistic going by previous schemes for Wonga etc which went on forever!

Sara (Debt Camel) says

Schemes should not “go on forever” – although the Money Shop’s seemed to, there were extra complicating factors there.

Julie says

Hi, yes I read somewhere in their website that by the end of this month everyone who had made a claim will be told if upheld or not, I hope they stick to their deadlines

Sara (Debt Camel) says

So far I don’t think they have told anyone whose claim has been upheld.

Dave says

Sorry Sara did not mean to cause offence.

So is H1 2022 correct or more likely 2023 as written on this site?

Thank you

Sara (Debt Camel) says

oh I think 2022 now. When Provident wrote off all the current loans they were still owed, this sppeded things up by several months as they no longer have to to try to sell the remaining loans to a debt collector.

H1 – well it’s possible. I hope so. But a lot depends on how many appeals they get.

Diane says

For anyone having problems getting hold of SOA for copies of loan lists and any information you require, my husband have been sent these details here,

Informationrequests@provident.co.uk

Sara (Debt Camel) says

Thanks for sharing this

Chris Ratley says

Can anybody tell me?

Once logging into the Provident Claim Portal, I click the Redress Outcome Page in Menu.

It reads:

Claim Redress outcome

You don’t have any statements to view at the moment

Should it have any details or do I have to wait until after April 1st.

Diane says

Hi Chris,

Once they’ve reviewed they’ll send you an email to let you know there’s a message in your portal. So once they do you should see any redress statements. Good luck 🤞.

Chris says

Thank you for the reply

Chris says

Can anybody tell me?

Once logging into the Provident Claim Portal, I click the Redress Outcome Page in Menu.

It reads:

Claim Redress outcome

You don’t have any statements to view at the moment

Should it have any details or do I have to wait until after April 1st.

Rik Bevin says

Once they have had a look at your claim, they will post the decision in your inbox. Im not sure where you get the date of April 1st as they emailed me and said it could take 3 months for them to get through them all but good luck :)

Jax says

The timeline on their website says everyone should know the outcome by the first week in April.

Chris says

Sorry I did put 1st April, it is the first week of April we should here outcome as written on provident website.

Stephen Harrison says

Dis allowed even though they sold the debt to Cabot and I still owe 1300 pounds, just another waste of time they are now allowing anything under the scheme.

Sara (Debt Camel) says

have you made an apeal?

Stephen Harrison says

Yes [claims firm] appealed on my behalf today on the grounds that I did not have an income spent the money on food and the fact that the debt was sold to Cabot Financial proving overwhelmingly that the loans were unaffordable. Provident still will not budge though the scheme is corrupt.

Emma says

Can’t log in to my portal account surprisingly!!

Reading these comments it sounds like nobody is being upheld and we have all been conned!!

Is there anything that can be done about this?

Sara (Debt Camel) says

They seem to only be telling the rejections at the start. That doesn’t mean they are planning only rejecting most people.

Stephen Harrison says

They will reject every claim. What you gonna do, Nothing, that’s what, we have all been stitched up.

Joanne says

Hi I submitted a claim last year through a claims company but unfortunately I was to late as it was when they decided they couldn’t afford to uphold any more claims resulting in them doing this scheme. I tried to access the portal to look at my claim but I could not get on it so I rang provident directly & got through to someone straight away & he explained everyone would get a response by first week in April. I have evidence though as I have my books with loan numbers & account number on so I’m keeping everything crossed .

Carl says

I have received information from provident upholding my claim however they say it doesn’t cover what I owe but they aren’t squashing the dept anyway they only showed me four loans with no dates next to them I know I had lots more even between 2007 to December 2012 which I then had a brain hemorrhage / stroke and was in hospital for four months came out in April 2013 the collector had stopped coming to our house and I received a phone call from the manager saying the dept had been squashed four loans is a joke had far more than that and they only gave me money back on two of them loans even though I know they was all unaffordable

Sara (Debt Camel) says

Go back and say you had a lot more loans.

Carl says

Yes I have appealed thanks Sara I had provident for 30 years unfortunately gambling payday loans ect .

Vh says

Letter in prob portal says claim upheld but says I had £300 owed which I don’t as all paid off in 2017 befure I moved only listed one loan anni had about six !

Also says two satisumas removed owe nothing but already new that however both these on letter are incorrect amounts

What a mess

Complete further disagreement form in portal an requesting a list of all loans

Absolute shambles really

Lorena Cussens says

Is anyone having any success? I had around 8 loans dating back to 2007/8 up to 2017/18 with their doorstep company and satsuma. I’m yet to get a reply to my claim but it seems everyone’s being rejected

MP says

Soooooo today, I received an email from Provident.

The first of part of it is as follows. Basically, they have upheld my claim but not given me a penny because they have deducted it from what I owe them. As far as I was aware, I had paid everything off

Your claim for compensation in the Provident Scheme of Arrangement has been upheld.

Good news! We have written off all loan amounts you have owed to us. Even though your upheld claim

won’t cover all your outstanding balance, we have written this off. You do not owe us any money.

What else do you need to know?

● A Scheme of Arrangement was implemented on 27

th August 2021. This is to assess and pay

compensation claims against Provident Personal Credit Limited (which traded under the brand

names Provident, Glo and Satsuma) and Greenwood Personal Credit Limited (“Greenwoods”) for

not carrying out the right checks to see if your loan(s) were affordable or not, between 6 April

2007 and 17 December 2020.

● This statement is an update on your claim for compensation.

What have we done to review your claim?

● We have looked at all the claims made using the scheme claim rules. These rules look at factors

which could affect your ability to afford the loans.

● The claim rules are set out in the Explanatory Statement. You can find a link to the statement at

the end of this statement.

Sara (Debt Camel) says

Did they say how many loans you had, which were upheld and which had a balance owing that has been written off?

MP says

They upheld on 1 of 4 Satsuma loans and any redress was taken off the balance owed on my Provident loan which they have already written off and closed as zero balance.

Naughty very naughty.

Sara (Debt Camel) says

how large were the 4 satsuma loans? List them in order…

Carl says

I got exactly the same message they are ripping people off i have never received a letter saying I owe money and I have never moved house I was told by the manager my dept was clear

Vh says

Same email as me

Rip off

I owed nought an was four years ago so how come no one chased the denting I owed it

Sounds like they say this to everyone

Plus the content of the

Hey good news !!! We have upheld your claim part as though they doinvv us a favour

Jaz says

Hi

Sara

I has a letter from Satsuma last 15th December 2021, they mentioned if you’ve an outstanding balance, we’ll be cleaning it and there are no more payments to make, As you’re in arrears or didn’t pay you loan within the time agreed when you got your file with our Credit Reference Agency to show balance as Zero and partially settled, is there anything I can do for not to show on my credit partially settled , and how to go by doing this, thanks again Sara for the help you given us.

Sara (Debt Camel) says

did you make a claim to the Provident/Satsuma Scheme?

Jaz says

Hi Sara

No I just received a letter saying that I would not need to make any more payments, and cuz iv not made much payments it would show partially settled

Sara (Debt Camel) says

Then that is a shame because if you had made a claim to the Scheme and had it upheld, then teh negative mark would be removed. It is now too late to make a claim.

I wouldnt worry too much about it. Partial settlement doesnt affect your credit score and many lenders wont care about it.

Stephen Harrison says

Not heard of anyone who has been recompensed, every claim rejected on reddit.

Leanne C says

Hi Sara,

They’ve finally provided me with the information I asked for several times:

Further to your appeal, please see the information requested below.

Agreement 407763630 – Issued 28/04/2009 – Loan Amount £100.00 – Interest Charges £55.00 – Total Amount Payable £155.00

Agreement 128014048 – Issued 15/09/2009 – Loan Amount £200.00 – Interest Charges £110.00 – Total Amount Payable £310.00

Agreement 1127786826 – Issued 27/01/2017 – Loan Amount £200.00 – Interest Charges £112.00 – Total Amount Payable £312.00

Please ensure any additional information you wish to add to your appeal, is done so before the 31 March 2022.

Sara (Debt Camel) says

does that look right to you? 3 loans?

Leanne C says

Nope, I’m sure I had a load more than 3

Sara (Debt Camel) says

then go back and say this. 2 loans in 2009 and one in 2017? Give details of when else you were borrowing – was it a different agent? different address? different name or email?

Do any other loans show on your credit record still?

Leanne Casey says

Just looked, can only go back to 2019

Sara (Debt Camel) says

so the loan from 2017 isnt showing on your credit record?

have you moved or changed name?

Leanne C says

Nothing before 2019 is showing.

Lived in this house since 2004 and my names never changed since birth

Sara (Debt Camel) says

so the 2017 loan isnt showing? what credit report are you looking at

Leanne C says

Have access to Equifax on trial but only goes back to 2019

Sara (Debt Camel) says

are you saying that you can only see reports from 2019? or that there are no details of any credit before 2019?

a 2019 report will have details of settled loans going back to 2013 – are there any provident loans in there?

Ashley says

I am yet to hear back,I know I had an outstanding balance and know they will try to use that to not pay any compensation.

From my credit file (the loans now show as settled as of Jan 2022) I can see I had around 9, some of them were running together.

As frustrating as the Wonga / Moneyshop schemes were at least they were transparent some what. They listed all the loans,the interest, and then gave an amount.

I feel there’s no transparency here, Is there any independent company / organisation monitoring how fairly they are making decisions on claims?

Ceri Ann says

Ashley I was wondering the exact same thing. Surely someone is overseeing that these complaints are being dealt with in a fair way. I am still waiting about the outcome of my £2000 loan which I paid off with a dmp. The full interest was added on. This is an impossible company to work with but I have my credit file and proof of unaffordability ready to send if my complaint is not withheld

Leanne C says

Just looked and only Provident showing is:

21/1/17 – £51 x 7 months

Also got 2 x Mr Lender

09/06/16

04/03/16

2 CCJs from around same time

6/1/17

5/7/17

Sara (Debt Camel) says

So that is the 2017 loan that Provident have on their records.

Are you sure you had other provident loans from 2013 to 2017? Did your agent change? Do you have any records of these loans?

Leanne C says

I def had loans before 2017 I’m sure of it, but no proof.

Guess I’ll just have to write this one off and accept it

Marc says

I think it’s fair to say that if you’ve submitted a claim through scheme and you only had a low number of very small loans like £100 or £200. Then realistically it’s not going to make much difference in terms of the value of any redress you might receive if you’re claim is upheld v’s your claim being rejected.

I can’t imagine you’d ever be successful in receiving any redress for ‘all’ of your loans, they will always count the first one or two as ok for example and then look beyond that for unaffordability patterns of behaviour.

The total redress on such low level loans would be so small that by the time they work out the scheme’s pay-out percentage you’d be down to a couple of £ if you’re lucky. I just wonder if it’s worth the fight for some of the people I’ve read comments from on here. Have you really thought about what you might get out of it in the end? If you only borrowed a few hundred quid then I’m sorry to say but even if you’re lucky enough to be successful with your claim, you’re probably fighting for the value of a couple of Mars Bars.

Sara (Debt Camel) says

I don’t think you have any idea how much small amounts of money matter to people at the moment. Plus winning a complaint can mean your credit record is cleaned – that is often more valuable than a bit of money back.

Marc says

That’s a fair point, getting your credit file cleaned up is a pretty big deal, so it’s worth doing for that I suppose.

Alf says

Interestingly the Provident scheme advised me on Friday last week that they will NOT be amending credit records/removing defaults for upheld loans. I had two small loans, both defaulted in 2018, both accepted as unaffordable last week by the scheme.

Sara (Debt Camel) says

really? That is very surprising, did they say why not?

Sara (Debt Camel) says

you may be able to get the credit reference agencies to suppress the records anyway, but it’s going to be much simpler if Provident do this for everyone.

Alf says

No justification provided, just a no. I’m going to write into them to clarify, the response came via the secure messaging function on the portal so I’m wondering if it could be an error. It’s difficult to understand how they can stand behind a default if they are now admitting unaffordable lending.

Marc says

I had 7 £1000 loans with Satsuma over a 2 to 3 year period. In some cases they were paid back in full as per the contract so the full amount of interest was paid to Satsuma. In some cases I consolidated and paid them off early so I didn’t go the full term. In some cases I was allowed to have 2 separate £1000 loans running at the same time. When ever one was paid off, I took another within 1 or 2 months because I was in a cycle of debt.

That’s what un-affordability looks like for me and that doesn’t include any of the other lenders I was using at the same time. If I was successful my redress would potentially be in the £1000’s. Of which I expect to actually receive less than £100 if I’m lucky enough.

Ceri Ann says

Marc I think you definitely deserve to win your unaffordability complaint. Looks like this company just kept breaking the law. Let’s hope some of us receive good news very soon

Evie says

That’s similar to me Marc I had 16 loans in total with provident 6 prior to 2007 then 10 between 2007 and 2010, all loans were £1000,£1500 or £2000 always had 3 or 4 running at same time. All paid off then just took another. Staggering amount I paid interest looking back now and how on earth I was allowed to get a £1000 loan one month then two month later £2000 then two month later another £2000. I’m not expecting much in terms of redress, maybe take my wee ones out for the day if I’m lucky.

Marc says

Evie, that’s incredible! It’s the multiple loans that frustrates me the most I think. That ability to buy yourself out of the financial baggage with even more financial baggage.

I made a claim against Sunny (before they disappeared) and Lending Stream for the same reasons and was successful on both.

I truly hope you end up with something back in your bank account.

Evie says

Well hears hoping we find out soon as their website says their aiming for everyone to find out next week. My complaint was with the ombudsman’s, unfortunately not looked at in time before the scheme was introduced but I’m glad I’ve got all my loans details so when I hear back about my decision with the scheme I can cross check it with information I have already.

Nicky says

Hi guys

I’m the same as Evie I had 16 loans between 2009 and 2o20 I paid them all off eventually sometimes £10 a month was constantly badgered to take out new loans.

Terrible cycle of debt I haven’t heard nothing ss yet so fingers crossed.

Sarah says

Hi,

I’ve had my redress letter but there’s no mention of my glo loan. Has anyone else had this problem? Are they assessing these loans separately?

Thanks

Sara (Debt Camel) says

Have they given you a list of your other loans?

No one else has mentioned this – glo was a VERY small lender. They shouldn’t be doing this seperately. Contact them and ask about the glo loan.

Sarah says

Hi Sara,

Yes they’ve listed my other loans. I’ve sent a message through the portal

mrsbutla says

I’ve heard back . I was successful . £1400. BUT they are keeping it to pay off a loan that was still outstanding . It wasn’t a loan . A Provident collector came to my home and told me they’d bought a debt and were turning into a loan which I was made to sign . No money was paid to me and no explanation of the original debtor . In a panic I signed . I paid for many many months then I think around 2014 /2016 I wrote and asked for further information on the debt and that until they could explain who I originally owed the money too I would make no further payments. I never ever heard back nor did they ever chase or write requesting payment again . This debt (if it really is a debt!) would now be statute barred – meaning it’s pass the legal time in years to demand it and therefore they have no right to try and take the money they owe me to pay what they say is still outstanding . The letter even said – Good news you no longer owe this money . Well mate – I never did . I’ve appealed and they’ve opened an appeal . I’ll take to the FOS as I can see them wriggling out of this. No way did they have the right to turn catalogue debt into a loan ! We shall see . I’m not letting this go.

Sara (Debt Camel) says

Was this a loan with Vanquis Fresh Start?

Unfortunately no complaints about a Scheme can be taken to the Ombudsman 😥

Nicola Butler says

I’m not complaining about the scheme. You can complain about the decisionx

Sara (Debt Camel) says

not to the Ombudsman you can’t.

Nicola Butler says

So really Sara they can say what they want to us and we have to accept it . I’m actually repaying Lowell as well so I’m wondering if the debt Provident bought was resold . I’ll have to contact Lowell and find out if it’s the amount Provident are trying to offset my compensation.

Sara (Debt Camel) says

I think Provident may be buying back the debt from Lowell and settling it. ALL the payments you have made to Lowell should be taken into account.

Sara (Debt Camel) says

Also you can appeal if you think Provident have not got this right. Perhaps some loans are missing. perhaps you think more loans were unaffordable and Provident should have known this. Perhaps your payments to Lowell have not all been taken into account.

The appeal doesn’t go to the Ombudsman, but if will be looked at. I have seen people win a lot of appeals in administrations. I hope the same applies in this Scheme.

Jim says

So letter in portal. Only had one loan which I defaulted on as was in financial crisis. Appeal upheld. Loan amount owing reduced and balance written off. Their words “I owe them nothing” I’m delighted. Is it too much to hope this will be removed from my credit file also?

Sara (Debt Camel) says

It should be. Tell them you want this to happen

Jim says

Thanks Sara.

Keep up the brilliant work!

Jim says

So I wrote to them as you suggested asking for my credit history to be updated.

This was the reply.

“Where a valid claim is upheld through the Scheme, we will look to reflect the outcome on a person’s credit file once the claims process is complete for all customers. At this stage of the process we anticipate that any required amendments to credit files will be made post April 2022”

Can I assume they will remove the unaffordable loan at some point from my credit file (it’s my last default and I’d love to get rid of it )

Sara (Debt Camel) says

If the loan that they have upheld is the one that has defaulted on your credit record, then that should be removed.

So they haven’t said they won’t do this, just they will do them all in one batch at some point.

Jim says

Thanks Sara!

Will report back once it happens so others know.

Rambo says

I’ve not heard anything yet so I’m taking it has no news is good news

Sara (Debt Camel) says

No news is no news. It is unsafe to take it any other way.

Evie says

Has anyone had their claim upheld yet and receiving any payment? Have we any idea of percentage per pound anyone has received if they have been successful?

Sara (Debt Camel) says

They won’t decide the % payout until EVERYONE has had their claim assessed AND all appeals have been heard. Months away.

Evie says

So just now are they just going to notify you off the amount upheld without the amount you will receive then? If they won’t know appeals to later on? But later will find out what percent of that your actually get?

I’m just going by their website said everyone should get letter or email regarding their claim by first week in April.

Sara (Debt Camel) says

Yes, you will be told these loans have been upheld, these haven’t, and the assessed redress is £x.

At that point you can appeal the decision.

They cant decide what the payout percentage is until they know what everyone’s £x add up to, after all the appeals have been held.

Evie says

Thanks Sara that’s what I thought as I thought how on earth could they tell you what you would get if it’s likely a high number of claims will be appealed.

Lana says

I thought I seen somewhere that payments were to be in the first half of 2022. Maybe I seen it wrong but very frustrating if it’s months away Sara.

Sara (Debt Camel) says

Well June is the first half of 2022 and we are in March so it’s also months away.

My suggestion is everyone stops trying to be sure about the timing of the payout as it can’t be done. The money will come when it comes. I have seen hundreds, perhaps thousands, of people tie themselves in mental knots trying to interpret remarks by administrators or people running a Scheme or customers services to prove that a payout is imminent.

Evie says

I was more wondering just if anyone had it upheld and will actually going to get a payment from them as everyone so far I’ve if it been upheld but getting zero as owed a balance. So like today someone had £1400 upheld but will go to balance so I take it £1400 is actual amount they paid in interest and not % of their overall interest.

Sara (Debt Camel) says

yes, that £1400 is what they would have received from Provident before this Scheme started.

Marc says

Evie,

I think I understand what you’re trying to say. It seems that everyone that has been told they’ve been successful are people that are also then being told that the they still won’t be receiving any cash in the bank for ‘some reason’.

I still haven’t heard of a successful claim that ‘will’ result in someone receiving actual cash in the bank when it’s all said and done in the months to come.

No matter if they are successful or unsuccessful they’ve all been ‘zero cash being paid out to the customer’ so far.

Evie says

Yes Marc that I was meaning. It’s got me wondering now if they agreed to wipe balances in December and now saying you’ve been successful we’ve wiped your balance do those amount that we’re already written off now come out scheme pot so Provident again will be the only ones really benefiting from this scheme. If that makes sense.

Nicola Butler says

I had an email to say to log in to the portal as there was an update on my claim.

Kelly says

Hi Sara,

Provident have upheld my complaint and are saying this will be used to clear my outstanding balance however I have no balance with them as my debt was sold to Lowell which has now been paid, surely they can’t just keep that money? Any advice would be greatly appreciated. Thank you 😊

Sara (Debt Camel) says

Go back to them and explain this.

Sarah says

Hi everyone ,

No response yet from provident re: my claim , I checked my credit record and it states delinquent balance £748 on my exhausting loan -Is this the amount the would take off redress if i was successful or would it be full amount £2134

Sara (Debt Camel) says

probably £748 – but credit records aren’t always a reliable source of what the balance owed is.

Sarah says

Thanks that’s great – definitely didn’t owe them £2134 I think that’s what my balance was when I took my last loan

OK says

I had 23 loans going back to 2007 up until 2011. Taking out loans to pay other loans. My debt got sold to Lowell and ended up owing them nearly £3,000. I finished paying it off in Feb 2021, thankfully. Had over £12,000 just in interest across all loans. Was in a bad place at the time and never any checks done. Often given advice by the agent to take out another loan. I had a complaint with Ombudsman which was shelved due to this scheme. Hoping for positive outcome, but heard nothing yet. I did a freedom of information request and got all details of all loans and repayments made, prior to submitting claim through the scheme and uploaded evidence, along with proof Lowell debt had been paid off in full. I think 23 loans across 4 years shows enough it was irresponsible lending. Let’s see what happens!

Jo says

The amount I borrowed is very similar to you although my provident went to my IVA which I finished in 2020 . I also put in a complaint but was to late due to scheme but tbh I don’t think we will get much if it is upheld . Maybe £100 if we are lucky 😣

Sara (Debt Camel) says

Sorry to tell you but it is pretty likely that any refund will be paid to your IVA, even though it has finished.

J says

I had other refunds that never went to my IVA . Just have to wait & see I’m not expecting anything really, I was just happy to put an end to it by doing my IVA for 6 years 😊

Marc says

WOW! I thought I had it bad. I feel for you. I hope you get everything you deserve.

Me says

Spoke to provident today, as I’ve heard nothing, got straight through & asked why they are cutting it a bit fine when they are supposed to be letting everyone know by the 1st April. They told me that me claim hasn’t been assessed yet & they should hopefully let know everyone know by the end of April, I said can you update your website please then at least people will know what’s going on.

Lozzy says

It said by first week in April not the 1st of.

Katie S says

Hi, got my Email to say my claim has been upheld however they have said due to my claim being less than my outstanding balance, they are just going to write off my remaining balance. My outstanding balance was… £1.37. So the upheld claim must have been worth less than £1.37 if I am reading that correctly.

Sara (Debt Camel) says

did they say how many loans you had and which had been upheld? If not, go back and ask for this information.

Katie S says

They did, I only had 3 and 1 was upheld. The one which was upheld was for £800

Sara (Debt Camel) says

Did they say which loan you owed money for and how much?

And did they say what the interest paid on the upheld loan was? Because this doesn’t sound right.

Katie S says

Hi, I have gone back to ask which loan the outstanding balance was on. They are saying no interest has been paid. I don’t actually remember if I paid any of them off early to confirm whether I paid interest or not.

Sara (Debt Camel) says

You could ask for details of the dates loans were taken out and the dates repaid.

Marc says

I’m just going through all of my bank transactions at the moment and making sure I’m aware of everything I borrowed and also paid back. For Satsuma, I took more loans than I could originally remember. Just goes to show you the state of mind I was in at the time. I previously I thought I had about 7 or 8 loans. Between 2017 and 2020 I actually took 15 loans. Curiously I have transactions showing that I borrowed £7900 but I have payments to Satsuma totalling around £9850. My loans were always paid on time or in some cases paid early when consolidating. So how have I paid more in interest than I borrowed? I know their interest was high, but I don’t think the contractual interest was ever more than the loan it’s self.

I could be missing a deposit from them in my bank transactions.

Can I ask, has anyone ever had a credit deposit from Satsuma under any other name than “Satsuma” on their bank statements? On my Lloyds account they show as “Satsuma Loans” but has anyone ever noticed any other names when using Satsuma?

Thanks in advance

Sara (Debt Camel) says

Curiously I have transactions showing that I borrowed £7900 but I have payments to Satsuma totalling around £9850

That suggests that you paid 9850-7900=£1950 in interest.

Marc says

Doh! I got that completely wrong didn’t I. I think I might be missing some payment transactions then. I’ll keep looking. Thank you for checking my calculations Sara

Sharon brombley says

Has any one had a phone call from a company couldn’t quite hear them as I was on a bus but claiming that I’m due over 3 thousand back and asked me to get a pen and paper so they could tell me how to get it, I ended the call as sure it was a scam

Sara (Debt Camel) says

sounds like a scam to me.

Sharon brombley says

Thank you I thought it was