Contents

Quick overview

Provident’s Scheme of Arrangement is now in the final stages.

The Scheme was proposed because Provident could not afford to carry on paying full refunds to customers winning affordability complaints. The Financial Ombudsman was upholding 75% of complaints against Provident.

The FCA, Provident’s regulator, said it did not approve of the Scheme. But as Provident has stopped providing doorstep loans, the FCA did not object to the Scheme in court.

It started officially on 5 August 2021 after it was approved in court. The deadline for claims was the end of February 2022.

Provident has assessed claims and informed customers of their decision. The large majority of appeals have been held.

Provident is making payments to bank accounts or sending cheques:

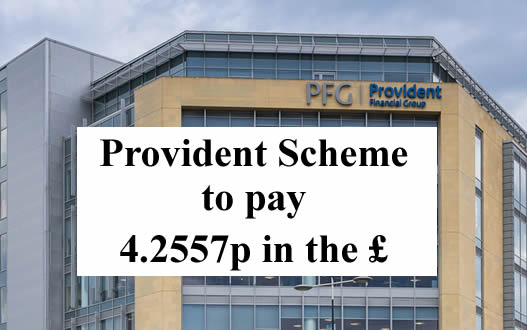

- it is paying 4.2557p in the £;

- so if your redress was £1,000, you will receive about £42;

- a final letter will be uploaded to your portal account setting out the payment;

- the first bank payments will be arriving in accounts on Tuesday 5 July.

Here is confirmation from one reader (see the comments below for others):

FUNDS PENDING!!!

Hi all, I’m new to this to thread but just thought I would give an update.

I have a Monzo account, it is showing my Bacs credit as going into my account on Monday, for most people with standard accounts this means you will be be paid Tuesday

I can also confirm it is 4.2557% as stated.

Glad it’s eventually been sorted.

But no-one should assume they will get their payment next week.

They may be going out in batches. And in any mass payment, some of them fail. Do not plan your July finances on the assumption that you will get paid early in the month.

Which loans were covered by the Scheme?

More than 4 million people were given a loan by Provident that comes under the Scheme.

These loans were given between 6 April 2007 and 17 December 2020.

The loans came from four different brands:

- Provident – often called “doorstep loans” or “home credit”;

- Satsuma payday loans;

- Greenwood – another doorstep loan brand that hasn’t been used since 2014;

- Glo – a very small guarantor loan brand.

If you have an affordability complaint about Vanquis or Moneybarn, these complaints are NOT included in the Scheme. You can still make a normal affordability complaint and get a full refund.

The definition of “unaffordable”

A loan is only “affordable” if you could repay it on time and still be able to pay your other debts, bills and living expenses.

You may have paid the loan on time, but it may still have been unaffordable.

If paying Provident left you so short of money you had to borrow more or you got behind with bills then it was “unaffordable”.

If you had several loans without a break between them, then Provident should have realised you were trapped in a cycle of borrowing and that these expensive loans were not affordable. Even a single loan can be unaffordable if it is large.

Provident pays out on old uncashed cheques

In 2018-20 Provident frequently made very poor offers to people that complained, sending a cheque. They frequently used to offer to refund just a few loans, often not the largest or the most recent. For example, in one case with a large number of loans, Provident upheld a loan for £1,000 but decided the next loan for £2,500 was affordable.

Many thousands of people didn’t cash these and instead sent their complaint to the Ombudsman, where they often got ten times as much! who had made affordability complaints.

When the Scheme was announced, people tried to cash the cheques but some cheques were too old to be bankable. Until now Provident has refused to send out a new cheque. In February 2022, at last Provident relented and refunded this money and people can also make a claim to the Scheme for the extra they should have had.

How much will you be paid?

The next stage is for Provident to divide up the £50 million in the Scheme between the people who have had their complaints upheld.

Customers who made a claim have been told which loans have been upheld and what the total redress for these loans is. You will be paid a percentage of this redress number, not all of it.

When the Scheme was voted on, many people thought they were being told that the payout would be 10%, or 10p in the £. I said at the time that that looked unlikely and it could only have been based on an unusually low number of people making a claim.

For several months Provident quoted a range, saying:

Based on the claims that we have received to date, we estimate that the pence in the pound rate of compensation to be paid to each customer will be between 4-6p.

Now it is known that Provident will only be paying 4.2557p in the £.

A final letter will be added to your portal account setting out what you will be paid.

Credit records will be cleaned

In other schemes and Administrations, some people say getting rid of a default was the most important result for them. Not the small cash refund!

For upheld loans, any defaults or missed payments will be removed from your credit record.

This clean up will be done at the end, when they can do everyone’s together. This is very annoying if you want to make a mortgage application, but there is nothing you can do to speed it up.

If your credit record is not cleaned in this process, there will probably be no-one to complain to about this. But there is process for resolving this sort of problem, see Correct credit records by “suppressing” them if the lender has disappeared.

Current loans

Loans that were sold to a debt collector

If your loan was sold to a debt collector, Provident is trying to get this settled. This seems to be taking some time, for example with Lowell saying they haven’t been given the right information from Provident. Several people are complaining about these in the comments below.

Loans that hadn’t been sold were written off in December 2021

In December Provident announced that it was no longer collecting any payments for existing loans:

There is nothing you need to do. You can stop making payments on your outstanding loans owed to PPC and if your payments are taken by the Continuous Payment Authority (CPA), we will stop these for you. Any payments made after 31st December 2021 will be paid back to you.

If you’re in arrears or didn’t pay your loan within the time we agreed when you got your loan, we’ll update your file with our Credit Reference Agency to show the balance as zero and partially settled.

Your credit record is being changed to show that the loan is partially settled or partially satisfied.

If you are a Provident or Satsuma customer, you should have been told about this by email or letter.

That is a pathetic payout

Provident is a successful company with the profitable Vanquis and Moneybarn brands which are still in business. It is a disgrace that the regulator has allowed them to structure their business in a way that has permitted Provident to abandon all its doorstep lending customers and not pay them their proper redress.

If you are feeling mad that Provident has got away with paying you so little, this is the time to look at whether you can make other affordability complaints, not just for loans but for other types of credit.

I have a separate page for each sort, as they need slightly different template letters to complain:

- refunds for large loans, including Moneybarn and other car finance;

- refunds from catalogues and credit cards such as Vanquis;

- refunds from overdrafts.

Kelly says

Can anyone tell me the Scheme number so that I can make a claim please. I got a letter today with no scheme number on. Thank you

Sara (Debt Camel) says

Was this saying your remaining balance had been written off?

The Scheme ID you need to make a claim is specific to you, no-one here knows it. You need to phone Provident on 0800 056 8936 and ask them.

Mich says

I raised a dispute with my credit agency for provident to back date my credit file to 2017, which is when the default started.

MP says

Quick question.

If you had different accounts with Provident, for example, one with Sunny one with Provident do you have to make a claim for each one or does one claim cover all?

Thanks

Sara (Debt Camel) says

Sunny wasn’t a Provident brand – did you mean Satsuma?

MP says

Sorry, yes meant Satsuma

Sara (Debt Camel) says

One claim should cover them all. But if you think Provident may have had different email addresses or home addresses for the different lending then you need to make sure that both accounts are treated as a single one for this assessment. Were you sent info about the Scheme with two different scheme numbers on it?

kirsty jane says

Hi i havent received an email to say i can apply but have received an email to say debts being wiped as of the 31st? Does this mean im eligble to apply?

Sara (Debt Camel) says

Anyone who has borrowed from Provident or Satsuma can apply to the Scheme.

How many loans did you have from them? were they large?

The article above tells you to phone provident if you do not know your Scheme Id number as you need that to make a claim.

kirsty jane says

I managed to find scheme id and apply, thank you. I think ive had 3 one was at an old adress tho so do I need to do this one seperate? largest one was £800

Jason gore says

My debt got pass on to cap quest recovery do I need to pay

Sara (Debt Camel) says

did Capquest buy the debt? Or were they collecting on behalf of provident?

Have you made a claim to the Provident Scheme?

Jason Gore says

Not sure thing it got pass on

Sara (Debt Camel) says

Ask Capquest then

Hevs1969 says

Sara, are you aware that Provident have sent out letters (received today), stating that as of 31 Dec 2021 it is folding, and these letters state that have outstanding balances have been wiped out? I have one such letter right here! Good job I ceased making payments at the same time I lodged a claim, otherwise that would’ve been 100% monthly payments made to only received a fraction back if the claim was/is successful.

julie says

Hi All,

Just received this in my inbox

Hi Julie,

Important update about your loan

We’ve some important information about your loan(s). If you’ve an outstanding balance, we’ll be clearing it and there are no more payments to make. This is because we’ve made the decision to close Provident Personal Credit, whcih includes Satsuma, on 31st December 2021.

julie says

Over the years, we’ve been proud to help people who needed a loan, but the tough economic situation resulted in Satsuma stopping lending last year and now we’re closing altogether.

There is nothing you need to do, other than not make any more payments. If your payments are taken by Continuous Payment Authority (CPA), we’ve stopped these for you. If you pay another way, you can now stop making payments. Any payments made after 31st December 2021 will be refunded to you.

As you’re in arrears or didn’t pay your loan within the time we agreed when you got your loan, we’ll update your file with our Credit Reference Agency to show the balance as zero and partially settled.

julie says

Provident SPV Limited Scheme of Arrangement

If you make a valid claim in the Provident SPV Limited Scheme of Arrangement (the Scheme), the amount of your claim will be reduced by your outstanding debt.

If your outstanding balance is less than the amount of your valid Scheme claim, you’ll receive a payment on the difference between the two amounts. If your outstanding balance is more than your valid Scheme claim, you won’t receive a Scheme payment but the remainder of your outstanding balance will be cancelled.

There are more details on this and examples at the bottom of this email.

Sarah Louise Tansley says

Morning.

I just received an email from satsuma saying that my outstanding loan will be completely wiped and to make no more payments. Result!

Adreva says

Same email , really pleased apart from the fact Satsuma have now registered a default in Sept 2021, Four years after I last made a payment.

Phoned today and said to wait for 6-8 weeks for the credit record to update. Useless customer service it’s not the status that worries me it’s the new default that will last until 2027.

Sara (Debt Camel) says

Have you made a claim to the Scheme? If that is won, all negative information will be removed – which is better than having the default date changed to being older.

You may find it hard to get Provident to pay any attention to you saying the default date is wrong as they are concentrating on the Scheme. In a year or so you can probably get the whole record “suppressed” from your credit record, see https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do this at the moment.

MP says

Providentpersonalcredit.com has also been updated to reflect the same message on their website.

Sarah Louise Tansley says

Sara, do you know why I can’t see or find the satsuma loan on my credit file? I was paying it off through StepChange along with a Santander credit card which is on my credit file.

Sara (Debt Camel) says

what credit report are you looking at?

Sarah Louise Tansley says

I’ve looked on the credit score one and Experian and it isn’t on either of them.

Sara (Debt Camel) says

Credit score is ClearScore? That reports on Equifax data.

Have a look at Credit Karma – that reports on TransUnion data which can be different from Experian abd Equifax data.

Sarah Louise Tansley says

Thanks for the info. I’ve just registered on credit Karma and you’re right, it’s on there. The status says delinquent. Do you know what that means?

Sara (Debt Camel) says

it means they say you have missed some payments or are in a payment arranagement but they didn’t add a default.

Have you made a claim to the Scheme? See the article above for how to do this. If you win a claim in the Scheme, then all defaults and missed payments etc are removed, so do this now!

Kayla says

Just seen satsuma and provident are stopping all payments if u still owe money on the 31st Dec and clearing balance to zero and updating credit files to zero and settled. Which is fantastic for some. Just wondering will this mean they will correct any defaults reported?

Sara (Debt Camel) says

No – but if people win a claim to the Scheme then the defaults and any missed payments for the unaffordable loans will be removed… so make a claim now if you haven’t already done this!

nats daley says

As usual thank you Sara I did’nt even know there was a scheme so good job I check your page :-)

I have a £20 payment outstanding with Satsuma I don’t bank on getting anything but just wanted to say A BIG THANK YOU for keeping us all in the loop.

Step says

Hi Sara,

I defaulted on a satsuma loan back in 2019 ans I think it was passed to moorcroft, I’ve received a letter to satsuma today stating that current loans cleared etc, but mine isn’t a current and Is still with moorcroft for collection. Would mine be wiped too or am I still expected to pay moorcroft? I have put in a claim on the system.

Im confused 😕

Thanks

Sara (Debt Camel) says

Moorcroft are collecting on behalf of Satsuma, Satsuma still owns the debt. If you check your TransUnion credit record you will see the loan is there under Satsuma/provident name.

This balance is being wiped and you don’t have to may Moorcroft anymore. If you phone Moorcroft they should confirm this – come back here if they don’t!

Val says

Hi

Genuine Letter received in post an email today Satsuma written off both my loans £210 and £1300 nothing to pay an credit file to bd updated

All I did was fill in on line portal

No evidence required

Waited the past year for portal to close but even before it has had this today

Well pleased

Says if there is money over after it’s paid off I’ll get a percentage

Pennies I expect

But such a releif to get this

So if u haven’t claimed in portal do it ! Cos it looks like they are wiping balanced before their portal even closed

Sara (Debt Camel) says

Everyone with a remaining balance is having it wiped, whether they have made a claim or not.

You may only get “pennies” if your claim is upheld now the balance has already been cleared but they will also clear the negative marks from your credit record, which will be good!

So anyone who hasn’t made a claim should do this right away. There is NO downside.

Lorraine says

Hi

I was a provident customer for yrs

When and how long to get refunded plz

Sara (Debt Camel) says

have you made a claim to the Scheme?

Charlie says

I had an email yesterday from Satsuma saying any outstanding balances will now be cleared by the 31st December and you don’t need to make any more payments. They will put down on your credit score it’s at zero however will state it as partially settled because we haven’t cleared the loan in time. Which I don’t see as fair.

It goes on to say about this provident scheme claim which I am confused about. It says’

If you make a valid claim in the Scheme, the amount of your valid claim will be reduced by the relevant debt outstanding under your loan(s) which we’re clearing. This means that a dividend paid to you in the Scheme will be based on the amount of your valid claim left after that reduction, if any. If your outstanding debt does not eliminate your valid Scheme claim in full, you’ll receive a dividend on that part of your valid Scheme claim still remaining after the reduction. If your outstanding debt does eliminate your valid Scheme claim in full, you’ll receive no payment in the Scheme but the remainder of your outstanding debt will be cancelled.

It does say, please note: you don’t need to make anymore payments

There is more information on this in the email, but Its just too long to put it all in the comments. The question is, will my debts still be cleared and if I’ve made a claim before and what I receive is less that my balance will it still be cleared ?

Thank you

Sara (Debt Camel) says

Everyone who still owes Provident/Satsuma (it’s the same company, two different brands) money is getting this message. Your balance is being wiped. If they are taking payments by CPA, they will stop taking them. If you are paying them, you should stop.

If your claim is assessed as being less than the balance, the balance will remain cleared, you just won’t get any cash refund.

If your claim is assessed to be more than the amount they have cleared, then they take off the amount they have cleared and you will be paid a proportion of the remaining amount in cash.

There is NO downside to making a claim, you can’t lose.

And if you win, not only may you get some cash refund but any negative marks on your credit record will be removed.

I suggest you send in a claim this weekend if you haven’t already done this!

Nick says

Hi I had 2 satsuma accounts and am in a DMP with Step Change. I’ve had the emails from provident to say stop making payments. The amounts to be written off on 2 loans is £5 and approx £1700. I haven’t made any claims as I didn’t have too many loans with them. When I check credit file, the smaller loan just shows as open with a £5 balance, the other shows as delinquent and approx £1700. I don’t plan to make a claim as it will be less than the amounts still owed but wondering what will happen to the status of this £5 loan – I don’t want another default. Any suggestions please Sara.

Sara (Debt Camel) says

You can still have a claim upheld if there were only a couple of loans if the amounts were large. £1700 is definitely a large loan!

And they gave you a second loan before the previous one was paid off.

Satsuma defaults – they didn’t add them to many people’s accounts for no good reason – it looks like an error. some people are finding that a default is being added now when the payments were missed years ago.

Making a claim isn’t causing these defaults to be added – often someone only finds out about the Scheme when they have a default added and start hunting round the web to find out why.

I suggest you make a claim – if it is upheld the missed payment or arrangement to pay or default markers will all be removed.

Nick says

Thanks for the advice, I will follow up and claim

C says

Does this include loans that were passed to 3rd party collectors?

I know in the past after a successful claim they pulled the back with a different company but unsure how it works with this

Sara (Debt Camel) says

This applies where Provident/Satsuma were using a debt collector to collect a loan on their behalf – this was usually done by Moorcroft.

It does NOT apply to loans that have been sold to a debt collector – at the moment they are not being wiped.

But for those loans you can make a claim in the Scheme and those loans will be considered.

C says

Thanks for the response.

It was moorcroft I think. How would I know if it was just bejng collected by them or was actually sold to them?

Sara (Debt Camel) says

have a look at your Credit Karma report – under whose name is the loan? If it is still provident/satsuma, the loan has not been sold.

C says

I’ve checked and they both still day Provident, so I assume they will be cleared?

Sara (Debt Camel) says

yes they should. Have you had the email or letter from Provident? You can ask Moorcroft to confirm this.

C says

The letter I’ve got is from satsuma, and they still send a yearly payment statement thing which shows the payments that I pay to moorcroft.

L says

Hi just to add my experience, I stopped paying satsuma earlier this year when I lodged a claim so they transferred the loan to moorcroft. I contacted moorcroft by email to tell them I had raised a claim against satsuma for unaffordable lending and it was therefore in dispute and could they transfer it back to Satsuma,. They did this with no questions asked and sent me a letter to confirm they had sent it back.

Hope this helps .

Denise says

I hope that I am allowed to post this?

I just noticed it on my news feed.

https://www.thesun.co.uk/money/17093539/payday-loan-doorstep-lending-debts-written-off-satsuma-provident/

If it’s old news, apologies.

Seasons greetings to you all…

Stephanie says

Hi Sara

My provident loan was sold onto Lowell, will my debt be wiped like other people are saying or will it not be as it was sold to Lowell ? Payments are made to them monthly through my DMP with step change. Hope you can help.

Sara (Debt Camel) says

No it won’t be wiped by the recent announcement.

How many loans from Provident did you have? Have you made A claim to the Scheme?

Stephanie says

I had 2 loans with provident, ive put a claim in under the scheme. Think they will be accepted. It’s a shame it was sold on and not being wiped though.

Sarah Greenwood says

Hi Sara

Can you confirm a few things for me not specific to Provident but to any of the payday lenders who have recently stopped trading. If someone has a debt with the original creditor in some cases the remaining balances are being wiped off and this occurs without making any claims for unaffordable lending at all but by making a claim the customer may get some compensation?

So what happens when the debt has been passed or sold onto a third party debt collection agency?

Does the balance still get wiped without the customer doing anything?

Does the customer need to make an affordability claim?

Does it depend on whether the debt has been sold or whether the debt collection agency is acting on behalf of the original creditor and how would the customer find this information out.

Sorry for all the questions

Sara (Debt Camel) says

Sorry but the answers are lender-specific.

Can you repost on the payday loan page https://debtcamel.co.uk/payday-loan-refunds/ and say who the lenders are and for each of them if your debts were sold or just being collected for the original lender.

Lauren says

Why are the Lowell debts not being wiped I have a repayment with Lowell sold to them by provident so I have to keep paying it then , are every other company being wiped except Lowell then

Sara (Debt Camel) says

Only the debts that Provident still owns are being wiped. Any sold to debt collectors such as Lowell are not.

Provident is wiping the debts it owns because they are now too much hassle to collect for the small amounts it is getting. It is a cost-cutting exercise that dramatically simplifies its operations that are winding down prior to closure.

Provident isn’t in control of the debts that were sold and they don’t require any effort from it. It can’t wipe them without it taking a lot of time and costing a lot, so it isn’t doing this.

It may feel unfair to you but this is being done for Provident’s benefit, not customers.

Have you put in a complaint to the Scheme? this will cover debts that were sold to Provident.

Paul says

Are people getting a redress under the SOA yet or will all of this be done after the end of

February? I put in my claim on the first day and have still not heard anything.

Sara (Debt Camel) says

I don’t think anyone has heard yet about whether their claim has been upheld… and that is only the first stage.

First people will be told what the decision on their claim is – which loans are upheld and which aren’t. Then they can appeal this decision. the first decision is probably just automated. So if you don’t think this is right – or you realise that you had more loans than are being accounted for – people should definitely appeal.

Only when everyone has been told and all the appeals are heard will there be a calculation of how much will be paid out.

Kate says

Hi Sara

In relation to the complaints and redress. Can customers do this if a DRO has cleared the debts already? They may have made some payments in the past but the DRO has effectively already cleared the balance – can they still submit a complaint? Also if a debt has been sold on is it still worth a complaint based on this debt no longer being enforceable as the debt no longer technically exists?

Thanks Kate

Kate

Sara (Debt Camel) says

From your address, you work in the advice sector so I will give a broader than usual response. This applies to all affordability complaints, not just the Provident Scheme.

1) if you complain to a lender where the last debt was cleared in a DRO then all the loans will be assessed for a refund. The refund will then be reduced by the amount that was written off in the DRO. So this is worth doing if the client had a lot of debts as the client may still get some cash back.

(You could argue that this set off against a debt cleared in a DRO should not happen as the debt no longer legally exists, and I would agree with you. But that is not the view the Ombudsman takes and this set off is standard practice, happening to thousands of PPI cases.)

2) if the DRO is still in progress you can complain, but if the redress may be over £2000 the DRO would be revoked.

3) all refunds for debts prior to bankruptcy go to the OR so these are not worth pursuing. In an IVA the refund will go to the IVA, and for completed IVAs the IVA firm will often (but not always) claim it.

4) if a debt has been sold on is it still worth a complaint based on this debt no longer being enforceable as the debt no longer technically exists? er good luck arguing that non-enforceability in court (unless there is a specific reason such as statute barring or inability to produce the CCA agreement). You can and should make complaints about debts that have been sold on. And if there is a CCJ from the debt collector, ask for the lender to arrange for it to be set aside.

Raerose says

Hi there, has anyone completed their claim and added the default evidence? I have tried to do this but it only allows me to enter a year, with no option to add text and write the companies name. Then I click ‘add default’ but there is no button to upload evidence/documents, so essentially all I can do is add a year and select add default.. this cant be right surely.

Raerose says

I may have answered my own question! In the end I added it to the section where it says medical history and just renamed it! All submitted now

Peter says

Hi. Me and my wife have got many loans from provident and Greenwood and satsuma. I think around 20 in total. That is since 2006 till 2020. Amounts were different but the largest I think was around £1000 or £1200 each and smallest £200 each. We moved houses a few times but I have submitted only 1 claim for each of us. Would this be enough. I have however sent an email today with all the previous addresses. Should I do anything else.

Sara (Debt Camel) says

did your email mention that you have had Greenwood, provident and Satsuma accounts?

Peter says

Hi. Thanks for the email.

No I haven’t yet. Only sent them my old addresses.

Sara (Debt Camel) says

then I suggest you send them another email explaining all your different accounts and address and asking for assurance that all the accounts will be considered together in your claim.

Irma says

Hi. Thanks again. I was just speaking with them. Been also advised that mu I’d scheme will cover all loans without need of supplying all other information.

Thank you

Nick says

Hi.

Does anybody know how long its going to take for the provident loans to be removed from your credit report.

Linda Fullbrook says

How do I make a claim there is no link to click on to download and forms?

Sara (Debt Camel) says

See the How to send claim to the Scheme section in the article above. this has to be done through their Scheme portal, so you have to start by setting up an account.

Stephen says

Total scam company scam scheme of arrangement, medical evidence bar is set so high no one can conform to it.

Sara (Debt Camel) says

would you like to explain some more?

Stephen Harrison says

I couldn’t pay and they sold the debt to Cabot Financial I am paying 15 a month and I still owe thousands. What can I do sick of these companies.

Sara (Debt Camel) says

make a claim to the Scheme as the article above says.

Apart from this debt, do you have other problem debts? Are you behind with any bills?

Jack says

Hi there,

Thanks for this information it is so helpful. i have submitted a claim via Provident as i had numerous loans (approximately 13) with Satsuma from 2016 -2019 and am awaiting feedback. These loans totalled to a few thousand over the years and were definitely unaffordable so hopefully i should receive some sort of refund payments. What i’m more concerned about is my Credit File. All payments were on time and never late, and all accounts were settled. Will it be difficult to remove these accounts from my credit file? And should i submit a separate email of complaint to Provident or CRA’s asking them to remove the information from my Credit file whilst my claim submission is being reviewed in the Portal or wait for that to be settled first?

Thanks

Jack

Sara (Debt Camel) says

They won’t remove anything until your claim has been resolved.

In a years time they will have given up talking to the credit reference agencies and at that point you will be able to get any remaining loans “suppressed” but it is too early to do this now.

J says

Ok thanks and noted, much appreciated

Lynne says

Just heard I’m getting £58.64 out of a possible £9K 😫

Annie says

Oh have the emails started to come through Lynne

Sara (Debt Camel) says

no, I think Lynne is reporting on a very small second payment from the Money Shop Scheme, nothing to do with Provident.

Lynne says

Yes sorry having checked again the email is from the money shop/instant cash loans. I think I provident is sunny/satsuma and there’s a few months to go yet?

Ro says

I’ve just been offered £6.20 from a £950 calculation!!!

Sara (Debt Camel) says

This for the Money Ship / ICL scheme – not Provident. It is the second much small payout from ICL. thsi is NOT an indication of the paypouts people may get from provident.

In March people who complained about QuickQuid are likely to get between 30% of 50% back – what happens with other lenders may be dreadful or great but it is no indication of what Provident borrowers may get.

Scott says

I’m getting pestered off vanquish bank fresh start over provident loans amount owing .

Should this not be wiped off now.

Sara (Debt Camel) says

you were given a loan by Vanquis to clear a debt owed to Provident? What interest rate was this loan? How long ago was it? And are the monthly payments affordable?

How many loans did you have from Provident before this one?

what is the rest of your finacial situation at the moment? Do you have other problem debts? Are you behind with any bills?

Scott says

No they must have sold/passed it to vanquis fresh start ..I had lots of provident loans from 5 years or more ago.

Looking at provident site it says payments should cease. Do I make the payments

Sara (Debt Camel) says

do you know when this happened? this is showing on your credit record as defaulted?

What are the rest of your finances like?

Stephen says

I am in the process of taking action against Vanquis, Provident and Amigo, they are all shady. Unfair lending and profiteering. I complained about the way that the provident agent was clothed but it fell on deaf ears, she flirted was overly friendly and suggestive whilst her cleavage almost in its entirety was on display. I am also not suing another well-known brand for a data breach. Never give up, they will never apologise or admit that they have done wrong. Our courts should never have allowed Provident or Amigo to arbitrate their own behaviour however the UK is now a rogue state.

Sara (Debt Camel) says

I suggest you talk to National Debtline on 0808 808 4000 about your options

Jack says

Is anyone else having trouble logging into the portal?

I enter my Scheme ID and password. It then takes me to a page asking me to change/update my password.

It then says my existing password does not meet the criteria for a new password change (lol).

So I can’t actually login in now.

Sara (Debt Camel) says

phone up and ask what is happening.

Tracy says

If provident cleared all your debt like they done to me will I still get compensation from the scheme or not

Sara (Debt Camel) says

It depends how big your refund is. If the refund should have been £1000 and they have wiped £400 of debt, they will reduce the refund to £600. It’s a fair way of doing this.

Cath says

When will they update the credit files to show a settled balance? I know they wont temove the loans until at least June but just wondering when the balance will show as satisfied and £0?

Sara (Debt Camel) says

Some time in the next 6-12 months is my guess.

Matt says

My credit karma file updated today with it removed and marked as settled.

Zoe says

Hello, my creditkarma file was updated today. It shows paid and settled and the account has been closed.

Martyn says

Same here – Creditkarma have updated Provident acct as settled, moved to ‘Closed’ folder, with Zero balance, and my credit rating has gone up by 40+ points!

Zoe says

Mine too, although noted they added a missed payment for December. Hopefully that will get adjusted at a later date

Nicola says

I had several loans with provident over the years amounting to to a huge part of my debt. I got an IVA set up in May 2017 to which these provident debts are included. Are no more payments being made to provident? Should I contact my IVA as they are probably still paying them. I moved house a year ago so provident would of sent any correspondence to my old address. I have put in a claim to provident yesterday when I saw that people are making claims.

Sara (Debt Camel) says

No more payments are being made to Provident. You can tell your IVA firm, but Provident should have notified them.

if you get a payout from the scheme claim I am afraid it may well be paid to your IVA, not to you.

Margaret says

Hi I had doorstep loans with provident greenwood’s and shopacheck who are now morse I still have an outstanding loan of 500 hundred pounds and its on my credit records as a default but CAB contacted all my creditors and they accepted a pound a month but they never came to collect this was 7 +years ago I rang morse and they refused to do anything . Any help would be appreciated

Sara (Debt Camel) says

Is this £500 owed to Provident? Or Morses?

Tim says

I notice you have to put a claim in before the end of February. As the company is not in administration ( unless this about to happen) does anyone have any idea how long it will take to hear about our claims?

Sara (Debt Camel) says

3-6 months at a guess. Then there will be an appeals process. Unlikely to be any payouts for 6-9 months at least.

Terri says

I couldn’t afford to pay the monthly payments so I ended up getting in new debt as I was leaving myself short so I lent money off my mum to pay the outstanding balance I left my self so shirt with no gas or electric ,

Sara (Debt Camel) says

have you made a claim to the scheme?

Sara (Debt Camel) says

You need To make a claim t9 the Scheme urgently. The article above says what to do. In a few weeks it will be too late so do it now.

Audrey says

You have put the wrong name on the letter you sent me……

Sara (Debt Camel) says

Hi Audrey, you need to contact Provident about this. See the article above which tells you how.

Chris Sykes says

I noticed that yesterday my outstanding Satsuma Loan disappeared off my credit file, anyone else seen this ??, will this have any impact on my credit score when it next updates ?, I’m using credit karma.

Sara (Debt Camel) says

Were there any negative marks on the record – late/missed payments or a default?

Adreva says

Chris it was removed from mine but my score went down as they added a default then closed the loan.

The default was 4 years after id last made a payment grrrr

Sara (Debt Camel) says

Have you made a claim to the Scheme.

Fazza says

Hi Sara

It seems provident has marked my file as paid and closed however the account history is still showing missed payments for the last few years I didn’t pay this account. I was disputing it and had a complaint in for unaffordable lending before it went to the scheme. Do you think its worth pestering them to remove all the negative information from their entry and if it will have an effect ? It will be about 4-5 years of missed payment markers

Sara (Debt Camel) says

have you made a claim to the Scheme?

Fazza says

Yes I have

Sara (Debt Camel) says

well if it is upheld, they should remove the missed payment markers. I doubt you will get anywhere by hassling them now, they will just say it will all be sorted in the Scheme.

Alan B says

Hello,

I complained to Provident and the FSO on behalf of my Mother due to her being in a care home.

She received a settlement in November 2020 which we though was the end of it.

My Mother passed away in June 2021 and today I have received and email from Provident addressed to her saying that they have a uncashed Cheque in her name.

Could you advise on what my next step should be, as the money would go whatever it is towards a headstone for her, if it could still be claimed.

Thank you.

Sara (Debt Camel) says

I hope they will pay this in full if it was agreed before the Scheme was set up, but you need to talk to Prpvident and explain the situation and say who a new cheque should be issued to.

Julie Gardner says

Hi I have been a customer of provident and greenwoods for many years from 2007 to 2017 (greenwoods till about 2013) many many loans at the same time and my husband had provident since 2014 again both of us having loans at the same time. My question, will I if entitled get back from the greenwoods loans all paid up, do I need to tell them I had greenwoods? They are aware I’ve moved but would I need to provide previous address?

Sara (Debt Camel) says

As the article above says, I think you should contact them and make sure that they know you had greenwoods and provident accounts and that you have moved – you want all the loans from both accountsa and both addresses assessed as a single account.

Julie Gardner says

Hi, I emailed them with addresses, and stated I wanted it all dealt with as 1 account, I also included the claim number, will they respond to my email or just take the information?

Sara (Debt Camel) says

have you submitted a claim on their form using the claim number?

Julie Gardner says

Yes I have, I included the details in the email.

Think I’ll give Them a call tomorrow, I understand they’ll be inundated but I’m getting nervous and don’t want to miss the deadline.

Geraldine says

I have been trying for weeks to contact Provident to obtain a Scheme number. I am being cut off or asked to try again later. Have the lines closed?

Does say the scheme is open until 28 February so should not be.

Sara (Debt Camel) says

This should not be happening. Is anyone else having this problem?

I suggest you email soa@provident.co.uk and explain you need a scheme number but can’t get through on the phone.

Stephen Harrison says

Yes, they point blank refused to give me my Scheme ID, denied un-affordability, even though I had no income and relied on charity, The debt was eventually sold to Cabot Financial.

Sara (Debt Camel) says

This was on the phone?

Stephen Harrison says

Yes, eventually I had my Solicitor phone them for the scheme ID number. I am going for Amigo, Provident, and Vanquis.

Sara (Debt Camel) says

For anyone else reading this, a solicitor will not be able to get more from Amigo or Provident Schemes than you can by making a claim.

And for Vanquis you can make a complaint yourself and send it to the Ombudsman – a solicitor adds nothing to this process exact for their high fees.

I have deleted the last sentence about something that is not relevant.

Mike_T says

I’ve received a decision today on my claim and it says my claim as not been upheld. I have decided to dispute this decision based on Provident are the only company to reject claims on all loans with them. I wasn’t expecting much anyway as i still owed satsuma before they ceased trading.

I was surprised I got a decision before the deadline for new claims closed though.

Sara (Debt Camel) says

This is the first decision I have heard of. How many loans from Satsuma did you have? How large were they? Were there any gaps between the loans?

Mike_T says

I honestly can’t remember (I don’t know where I could find this out as I’ve changed banks when I entered a DMP), I do know I was rolling loans over and also getting loans from other companies to pay these and vice versa. I think I owed satsuma around £800 when they ceased taking payments. I’ve also been in a debt management plan for the past 2 years.

Sara (Debt Camel) says

Provident did not give a list of your loans when they declined the claim?

I think you need to go bank and get your old bank statements – you can do this from accounts – one that was closed 2 years ago won’t be a problem.

They will give the evidence to show the Satsuma loans were unaffordable.

Jan says

Can anyone help me I have got a ccj with provident and a company called Lowell solicitors are chasing the debt and threading me with bailiffs do I still have to pay this I am scared to contact the company and will this ccj be taken off my credit file

Sara (Debt Camel) says

Did Lowell go to court for the CCJ or Provident?

Was this your first loan from Provident?

Lucy says

Hi Sara

I am having difficulty trying to get past the medical documentation that provident require. They are asking for letters from my GP surgery

that are

A) Old letters (we’re talking 2015)

B) letters sent electronically

C) I have recently changed GP Surgery

I provided as much information as I could yet provident were not satisfied and said my electronic letters need to be date stamped.

I feel the documentation evidence is practically impossible to get through. I contacted them they said my evidence was not good enough and gave me a list of stuff I need to provide wich is impossble for me to do and they deleted my evidence that I provided off my claim. I explained everything to them.

What should I do?

Sara (Debt Camel) says

how many loans did you have from them over what period?

Lucy says

Yes so I had 16 loans between 2008 to date

Some small and then large ones towards the end except my last loan was sold to Lowell i pay it off through stepchange.

Sara (Debt Camel) says

Have they decided your claim and are you appealing it?

Because with 16 loans I would expeect them to give you a refund on the later larger one without any medical evidence.

Lucy says

Sara

No decision has been made yet the claim is still there the medical eveidance they wanted was because the loan in 2014 It being one of the largest I couldn’t pay at the time because I had knee surgery following an accident. I lost my job because my employer would not have been able to pay the 2 years sickness that it took for me to recover. I told provident at the time that this was a problem for me and they reduced my payments except after a few months the the provident rep did not come round to collect and i never heard from them again until Lowell threatened me with legal action in 2018

I just wonderd what to do the status on my claim is sitting at waiting redress outcome

Sara (Debt Camel) says

ok, well you need to go back to your old GP Surgery to try to get the evidence. This can be done and if this loan is a lot of money it’s worth trying to fo this.

Lucy says

Thank you Sara I will try

Richard says

I have had many loans for many years. I submitted a 4 Yr d GP Letter used for my ESA reassessment whichstates I have had many issues sincce 1990, a recent letter from GP with the same info but updated (note some GP Surgeries may charge £30, you can also request your full medical records from your hospital for £50 which may be worth paying) and I also submitted a FACE Assessment from a mental health social worker in order to obtain funding to pay for a P.A. to help with my physical and mental health care. Provident Scheme have read these but have not made an decision as yet.

Stephen says

My full medical history and reports were not enough for Amigo they wanted a doctor to clearly state that the medical conditions made me unable to take out the loan. These people are nothing but Crimianls.

Sarah says

I got my claim rejected. I will be disputing this. I had 2 loans from them in quick succession, about 3 months apart but I ended up with a default on my 2nd one. I had a history of Payday loans, small amounts but a lot of them at the same time and accepting me to have these clearly did not help me! I would’ve had a terribel credit rating and the last one they gave to me I had another one with a different company at the same time, which also defaultEd! I’m not very happy. I managed to get all my others taken off my credit record last year even by another company who told me they couldn’t remove it from my credit record! Any advice? Thanks

Sara (Debt Camel) says

how large were the loans?

Sarah says

small amounts £200 – but I had a few of them in quick succession not just with this company.

Sara (Debt Camel) says

did you borrow repeatedly from Provident ? Ignore the other lenders here.

If you were only taking small loans and there were breaks between your Provident loans of more than a two or three weeks, then you will find this a hard claim to win.

Sarah says

fair enough I’m still going to try. I managed to win with others last year for similar circumstances with others! Will let you know if any positive outcome

one of their claim rules state:

You did not have loans with other loan providers at the same time;

I did so I will appealing on this basis.

Sara (Debt Camel) says

Good luck – I would be interested to know the result.

Mary Hannon says

Is it true that Provident do not have to honour claims from Ireland?

Sara (Debt Camel) says

The affordability claims discussed here are based on UK rules. I don’t whether you can make any claims in Ireland, sorry.