Contents

Quick overview

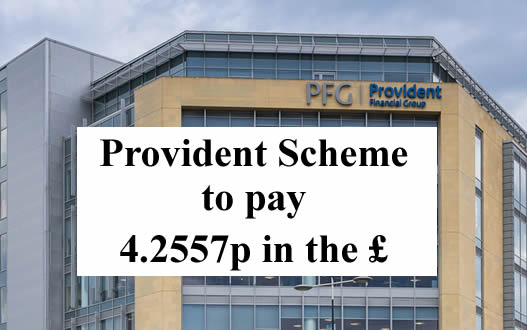

Provident’s Scheme of Arrangement is now in the final stages.

The Scheme was proposed because Provident could not afford to carry on paying full refunds to customers winning affordability complaints. The Financial Ombudsman was upholding 75% of complaints against Provident.

The FCA, Provident’s regulator, said it did not approve of the Scheme. But as Provident has stopped providing doorstep loans, the FCA did not object to the Scheme in court.

It started officially on 5 August 2021 after it was approved in court. The deadline for claims was the end of February 2022.

Provident has assessed claims and informed customers of their decision. The large majority of appeals have been held.

Provident is making payments to bank accounts or sending cheques:

- it is paying 4.2557p in the £;

- so if your redress was £1,000, you will receive about £42;

- a final letter will be uploaded to your portal account setting out the payment;

- the first bank payments will be arriving in accounts on Tuesday 5 July.

Here is confirmation from one reader (see the comments below for others):

FUNDS PENDING!!!

Hi all, I’m new to this to thread but just thought I would give an update.

I have a Monzo account, it is showing my Bacs credit as going into my account on Monday, for most people with standard accounts this means you will be be paid Tuesday

I can also confirm it is 4.2557% as stated.

Glad it’s eventually been sorted.

But no-one should assume they will get their payment next week.

They may be going out in batches. And in any mass payment, some of them fail. Do not plan your July finances on the assumption that you will get paid early in the month.

Which loans were covered by the Scheme?

More than 4 million people were given a loan by Provident that comes under the Scheme.

These loans were given between 6 April 2007 and 17 December 2020.

The loans came from four different brands:

- Provident – often called “doorstep loans” or “home credit”;

- Satsuma payday loans;

- Greenwood – another doorstep loan brand that hasn’t been used since 2014;

- Glo – a very small guarantor loan brand.

If you have an affordability complaint about Vanquis or Moneybarn, these complaints are NOT included in the Scheme. You can still make a normal affordability complaint and get a full refund.

The definition of “unaffordable”

A loan is only “affordable” if you could repay it on time and still be able to pay your other debts, bills and living expenses.

You may have paid the loan on time, but it may still have been unaffordable.

If paying Provident left you so short of money you had to borrow more or you got behind with bills then it was “unaffordable”.

If you had several loans without a break between them, then Provident should have realised you were trapped in a cycle of borrowing and that these expensive loans were not affordable. Even a single loan can be unaffordable if it is large.

Provident pays out on old uncashed cheques

In 2018-20 Provident frequently made very poor offers to people that complained, sending a cheque. They frequently used to offer to refund just a few loans, often not the largest or the most recent. For example, in one case with a large number of loans, Provident upheld a loan for £1,000 but decided the next loan for £2,500 was affordable.

Many thousands of people didn’t cash these and instead sent their complaint to the Ombudsman, where they often got ten times as much! who had made affordability complaints.

When the Scheme was announced, people tried to cash the cheques but some cheques were too old to be bankable. Until now Provident has refused to send out a new cheque. In February 2022, at last Provident relented and refunded this money and people can also make a claim to the Scheme for the extra they should have had.

How much will you be paid?

The next stage is for Provident to divide up the £50 million in the Scheme between the people who have had their complaints upheld.

Customers who made a claim have been told which loans have been upheld and what the total redress for these loans is. You will be paid a percentage of this redress number, not all of it.

When the Scheme was voted on, many people thought they were being told that the payout would be 10%, or 10p in the £. I said at the time that that looked unlikely and it could only have been based on an unusually low number of people making a claim.

For several months Provident quoted a range, saying:

Based on the claims that we have received to date, we estimate that the pence in the pound rate of compensation to be paid to each customer will be between 4-6p.

Now it is known that Provident will only be paying 4.2557p in the £.

A final letter will be added to your portal account setting out what you will be paid.

Credit records will be cleaned

In other schemes and Administrations, some people say getting rid of a default was the most important result for them. Not the small cash refund!

For upheld loans, any defaults or missed payments will be removed from your credit record.

This clean up will be done at the end, when they can do everyone’s together. This is very annoying if you want to make a mortgage application, but there is nothing you can do to speed it up.

If your credit record is not cleaned in this process, there will probably be no-one to complain to about this. But there is process for resolving this sort of problem, see Correct credit records by “suppressing” them if the lender has disappeared.

Current loans

Loans that were sold to a debt collector

If your loan was sold to a debt collector, Provident is trying to get this settled. This seems to be taking some time, for example with Lowell saying they haven’t been given the right information from Provident. Several people are complaining about these in the comments below.

Loans that hadn’t been sold were written off in December 2021

In December Provident announced that it was no longer collecting any payments for existing loans:

There is nothing you need to do. You can stop making payments on your outstanding loans owed to PPC and if your payments are taken by the Continuous Payment Authority (CPA), we will stop these for you. Any payments made after 31st December 2021 will be paid back to you.

If you’re in arrears or didn’t pay your loan within the time we agreed when you got your loan, we’ll update your file with our Credit Reference Agency to show the balance as zero and partially settled.

Your credit record is being changed to show that the loan is partially settled or partially satisfied.

If you are a Provident or Satsuma customer, you should have been told about this by email or letter.

That is a pathetic payout

Provident is a successful company with the profitable Vanquis and Moneybarn brands which are still in business. It is a disgrace that the regulator has allowed them to structure their business in a way that has permitted Provident to abandon all its doorstep lending customers and not pay them their proper redress.

If you are feeling mad that Provident has got away with paying you so little, this is the time to look at whether you can make other affordability complaints, not just for loans but for other types of credit.

I have a separate page for each sort, as they need slightly different template letters to complain:

- refunds for large loans, including Moneybarn and other car finance;

- refunds from catalogues and credit cards such as Vanquis;

- refunds from overdrafts.

Pawel says

Hi,

I have received letter saying that I will received between £17.25 and

£25.87. The loans are below, does this seems right?

Agreement

number

Brand Original

Loan Value

Status

✓ = unaffordable

✗ = affordable

Gross Claim

Value

Outstanding

balance

Net Claim Value*

Totals £431.14 £0.00 £431.14

Detailed breakdown of your loan(s):

800002402706 Satsuma £650.00 ✗ £0.00 £0.00

800001382272 Satsuma £200.00 ✗ £0.00 £0.00

900002640292 Satsuma £250.00 ✗ £0.00 £0.00

800002173355 Satsuma £400.00 ✗ £0.00 £0.00

900002777795 Satsuma £500.00 ✗ £0.00 £0.00

800001906198 Satsuma £600.00 ✗ £0.00 £0.00

800001294541 Satsuma £100.00 ✗ £0.00 £0.00

800001014088 Satsuma £300.00 ✗ £0.00 £0.00

800001540847 Satsuma £400.00 ✗ £0.00 £0.00

800002982670 Satsuma £1200.00 ✓ £431.14 £0.00

Totals £431.14 £0.00 £431.14

Previous

compensation

paid

£0.00

Net Claim

Value after

deducting

previous

compensation

£431.14

Estimated

compensation

£17.25 to £25.87

Sara (Debt Camel) says

Over how long a period were this loans? Were there any major gaps between them or were you pretty much constantly in debt to Satsuma?

Lisa says

Hi all

I asked for dates of the loans, which were sent to me. I then left a message asking why some were not classed as unaffordable when they were all loans that paid off the loan before. I also told them a brief outline of my personal circumstances at the time. I never mentioned that I was going to appeal but

I received a message back saying they have put in an appeal on my behalf. I then received an email saying it has been handed to the adjudicator. 60 days wait for the outcome…..is it normal in these situations to have them appeal on your behalf?

Lisa

Sara (Debt Camel) says

yes this is the way the Scheme works.

Lisa says

Great thanks. I thought you’d have to initiate the appeal yourself.

Gord says

Hi Sara it will be interesting to see the outcome of these independent adjudicators as reading here they are not upholding cases I was on my 3rd appeal loans previously upheld on an outcome then rejected the next week I originally had 4 out of 5 loans upheld appealed as I had a lot more done an dsar which came back with not all my loans on it I wanted to cross check every loan loans that were on previous compensation letter not even on dsar also on the last apeal I went in April to 5 loans to 26 loans then to 33 on compensation letters I’ve now contacted the ceo of nortonfull bright the adjudicator and I went through every point that was wrong and also stated that I borrowed continuously from 1990 until the scheme dates and as I was continually borrowing for 17 year many loans overlapping loans paying of loans so I feel that from 2007-2020 I was relying on these loans and missing priority bills so therefore ALL borrowing in the dates of the scheme were unaffordable also loans on compensation letters were not even on dsar also a loan amount of £2685 when you could only borrow £2500 from provident that was the maximum and this agreement isn’t even on the dsar also most of the loans of £2500 have redress plus the 8% the compensation on these were £5000 plus but one of the £2500 loans had a clear balance and only £111 compensation I put all above points to adjudicator

Lyn says

Anyone else received a email saying they have relooked at your claim and said your now allowed an higher amount, my original redress was between 218 and 338 and now its 256 and 385 but I didn’t ask them to review my claim. I’m not complaining but it just seems odd

Tink85 says

Yes, but my amount has gone down. I have an appeal in with them though which I’m awaiting the outcome of.

Emma says

I have too. Not complaining!

Mandy says

I had a claim before the scheme of arrangement was voted on and they upheld only 5 of my loans and did pay me compensation of £5900 that was very welcomed at the time like you I have now had an email saying all my loans over the years ard now upheld and my compensation should have been wait for it !!!!! £46000 omg I couldn’t believe it but due to the scheme of arrangement and my previous amount awarded I will get another payment of about £1600. They have been very crafty paying out certains loans only, now they only have to pay a smaller amount on all the loans they should have upheld

Lucy says

Hey Zoe

I was ages on the phone just to be told Provident want confirmation email from Lowell to explain why they wont discard peoples accounts.

(eyes roll yawn yawn) so I thought i’ll put in a direct complaint with Lowell don’t want to jinks it mind but i’ll let you know what i wrote and what they say admitidly i did threaten them legal action and stated i had good grounds to aswell …. i mean its something their all too familiar with doing to us from the start…. so i will let you know the outcome.

Zoe says

Hi Lucy good luck I seem to be getting nowhere at the moment still saying same thing so I’m goner wait to hear from my appeal and go from the did get a email from provident saying they sold my debt to lowell and I need to still pay them it’s shocking !!!!

Zoe says

Hi Lucy my email was from soa ( scheme of arrangement) .

Debs says

After having another email yesterday saying I had a secure massage in my portal to find that I had more loans added a d one that I owe £307. Which i didn’t as i paid all my loans off in full .

Just been on phone with them they have told me I’m getting two lots of compensation as they have looked at my claim again I have asked for them to look into this amount what they think I owe , which I know I don’t owe them always paid them off ,

Lisa says

I had an email yesterday evening to read a secure message on the portal but unable to login. I’ve reset my password several times but still not working.

I wondered if anyone else had this issue or if lots of people have logged on ok roughly what the message is if it’s more generic to everyone instead of personal.

Marc says

The only time I had an issue was with a password reset. I found that if I resent my password and tried to log in straight away again it didn’t work. Eventually I cleared the cookies out of my browser for the claims portal and rest my password, then I left it a few hours and tried again and it was fine. So I don’t know if it was a delay with the password reset or clearing the cookies, but one or both worked ok for me.

Gord says

Yes I cannot get messages in the portal and each time waited hours on phone to get through if you email them they will send you copy of message by email a few days later I’m now on my 3rd appeal

John Morgan says

Same here passed of over the whole thing

Adam says

Is anyone still waiting to hear back from Provident on the actual claim in the first place I have heard nothing where it seems others have had first stage and appeals etc but I have not had a thing I check the check portal daily and it has not changed at all?

Marc says

Log into the Portal and have a look

If you can’t see anything in there or you can’t get into the portal, then speak to them.

Teresa says

I still haven’t heard anything

Marc says

Log into the Portal and have a look

If you can’t see anything in there or you can’t get into the portal, then speak to them.

Diane says

Same here, unable to log into the portal yet again, tried ringing, left emails.

The last time I heard they said I’ll hear early weeks of May the latest. We are almost in June, and I’m a carer for my adult autistic son, I have chronic kidney disease, high blood pressure, and don’t have time to keep ringing all the time.

I live in South Wales, so wonder if they’re working on area by area?

Sara (Debt Camel) says

They are NOT working area by area. I am not publishing any replies from people saying where they live.

Lucy says

Zoe

Can I ask if Provi originally said in a letter your debt with Lowell had been wiped are they now saying that you carry on paying Lowell?

The only reason I ask is because Stepchange told me that all debts sold to debtors were Void from December 2021.

If this is the case email Provident and state that you want that debt written off completely explain due to the fact it was unaffordable hence why it was passed to Lowell and you struggle to pay it off aswell as the fact that we are all in a living crisis and your still struggling to pay for that debt.

Or get in contact with either National Debtline, Citizen Advice or StepChange.

Zoe says

Hi Lucy my email is from soa when they did the offer of compensation they say loans would be written off but then there’s a part that says doesn’t include those sold to lowell mine were from 2015 which is stupid as mine has been assessed as unaffordable and I’m due compensation but the figures owing don’t match what are on my claim so I’ve asked for a appeal but if there unaffordable how can they expect me to pay them if there in the soa really don’t understand it shouldn’t matter who bought them off provident it’s still a debt but want to pay compensation between £130/£198 but I still have to pay the debt off I’ve emailed soa and they replied as the debt was sold to lowell I still have to pay it .

Zoe says

Hi Lucy what’s the email address you have for provident could you please give it me to email them and see what they say . Thank you . Also when we’re your loans from ?

Zoe says

It did say there were written off and I queried it with lowell and they said didn’t matter as the loans were before they went bust and they bought the debt the loans I had are defo in the claim I’ve checked the details with lowell but there having none of it said it doesn’t matter and I owe them which I pay a £1 amth and have done for the last 2 years or so .

Lucy says

Sara

What do you make of this I still don’t really get it because they did say 8 % didn’t they?

In regards to your compensation figures; We expect to pay compensation at a rate of between 4-6 pence in the pound.

The estimated pence in the pound compensation rate is calculated by dividing £50m (the total Scheme compensation pot) by the total value of valid claims for unaffordable loans submitted by all of our customers. The current estimate of the total value of valid claims is between £833m and £1250m, so the pence in the pound compensation rate has been estimated as £50m ÷ £833m to £1250m = 4p to 6p pence in the pound.

Sara (Debt Camel) says

Provident is calculating the total refund you should have got if there was no scheme. This is based on a refund of the interest you paid plus 8% statutory interest.

The total amounts come to between £833m and £1250m for all customers who have made a claim. A final figure won’t be known until all claims and appeals have been decided.

But Provident only has £50m to pay out. So that will be divided between the customers with upheld claims. who will be paid a proportion of their toal refund. This is expected to be between 4p and 6p in the £.

Gord says

Hi I’m getting nowhere with scheme had to report what was going on to FCA I received a scheme I’d I then received an email with compensation I was getting £3-4 compensation but I had more than 5 loans so I appealed them I found out I had 2 scheme id’s because they had my date of birth a year out so I waited on second scheme out come which came on 11/5/22 and it’s compensation was £966-1450 but still didn’t have all my loans on it so appealed again yesterday I received new compensation letter with all my loans which I have had to appeal again as some of the loans that were upheld on 11/5/22 were not upheld now do they know what they are doing also a strange loan on it saying I borrowed £2685 and I owe them £2470 which ir wrong as I know the most you could borrow from them is £2500 so I don’t know where they got that from totally stressed with all this

Marc says

The 8% is interest being paid to you for every year your redress has been due to you. So if they decided your redress was £100 and that was for a loan from 2 years ago, your total redress amount will be £100 + £8 + £8 = £116. << This represents the total redress figure on your letter. The 8% is already included, you don't need to worry about it.

Because we are in a scheme where you will only receive your share of a £50m pot available to cover 'all' redresses being paid out, they are telling you that you will actually receive between £4 & £6 per every £100 of your redress. For a total redress of £116 you will actually receive in your bank between £4.64 & £6.96

So in your case your total redress figure on your letter will be approximately £20,800. This already includes the 8% you mentioned. If Provident are paying £6 out of every £100 (6%) so you'll receive (£20800 / 100 * 6) = £1248

John Durrell says

My appeal went for an external review the response should of been before 15/0522 (60 days after the review)

Still nothing. Any advice?

Marc says

Log into the Portal and have a look

Lucy says

Zoe

You don’t need to contact provi though you need to complain to Lowell.

My loan was sold to lowell in 2018 I had two debts with lowell one for provi and one for another company (nothing to do with provi)

Basically I have been advised that: if the loan was written off from 27th August from Provi then by Law regardless of wether the loan was sold you should not make any payments to Lowell. If no agreement has been signed to give Lowell permission to take over the contract the contract terms are still with Provi, that an agreement was not signed to act on Lowells terms I have grounds to seek legal action if they still refuse to close/void account within 8 weeks after my complaint has been submitted. They told me that it is classed as a criminal offence for any debt collector to be chasing money for a loan that no longer exists monies paid should be refunded or transfered to another debt. If you are experiencing hardship I/you should state in the email that you want these actions to begin with imediate affect. Enclose a copy of Providents letter. I was also explained that Debt collectors pick up debts via i think they call it a phishing poole/list I requested that the monies paid on that account once its voided is transfered to my other small debt which would then be paid off as well. I mean its a long shot but you can email your complaint to Lowell I wish you all luck be back in contact with you when i get a response.

Zoe says

Lowell said they bought the debt from provident so they own it I’m goner ring citizens advice speak to them then contact lowell after I’ve spoke to them because something is not right here with this especially if it’s suppose to be wrote off thank you Lucy good luck speak soon .

Marc says

Try using https://www.resolver.co.uk/ to keep all your complaints/claims in one place. It allows you keep all communications and attachments in once place so if you need the evidence later, it’s all there. Lowell’s should respond directly on Resolver, most financial institutes recognize it.

Sara (Debt Camel) says

I wouldn’t. This situation with Provident isn’t a standard complaint.

Maria says

I use resolver to keep all my details and am able to download my file case to my phone. It’s free and easy to use, can I ask you why you wouldn’t suggest it?

I’ve found it extremely helpful.

Sara (Debt Camel) says

I have no problem with people using Resolved for complaints where the lender is not in administration or a Scheme.

Their system is built around set points including telling people to go to an Ombudsman. That is no longer possible in a Scheme. And in administrations and Schemes, Claims have to be submitted on the lender’s website page. An email from resolver may well be disregarded.

Kat says

Hi Lucy, did you get a response from this?

Nicky says

Hi Sara

So am I right in thinking although they have offered me 915 – 1329 in compensation I may not get any of these amounts depending on how many claims are successful?. And it could considerably less.

Sara (Debt Camel) says

Provident should have a very good estimate of the likely range so I would hope you will be paid an amount within that range

Gord says

Hi Sara provident don’t know what they are doing I’m on my 3rd appeal which is not due back till 23/7/22 but they are telling people they will get there payments on 1/7/22 how can they pay people and not all decisions have been sorted so how can they decide what people are getting when it all hasn’t been sorted reported this to FCA they first sent out only decisions on 5 of my loans I sent it to appeal then got a decision back on 12/5/22 upheld 26 loans but still not all of my loans so that went to appeal got another compensation offer on 18/5/22 which had 33 loans on it but some of the larger loans were now not upheld so had to appeal again now to wait 60 days for this appeal totally fed up now

Marc says

Just for information for everyone. I see comments about what seems to be a random list of loans on redress letters with no dates and no idea of the order in which the loans where taken.

This won’t answer all of your questions, but I have found that writing down the loan list “But in ascending order according to the Agreement Numbers” that will at least put your loans in the order they were taken. Personally I just put it in a spreadsheet but writing them down in order is just as good.

Because most of my loans where with Satsuma, by ordering the list by Agreement Number it sheds a whole new light on their rationale behind upholding some loans and not others. I went from a list that had ‘not upheld’ randomly placed in the list every 2 or 3 loans.

By ordering, I clearly see that they have not upheld the first few loans I took and then they’ve upheld everything else, indeed, it’s not random at all. So this might clear up the confusion for some people if you give it a try. Basically, higher Agreement Numbers means the loan was taken more recently than a lower Agreement Numbers.

Marie says

So I got this from Lowell with regards to my loan that was sold to them, but has since been deemed as unaffordable:

Please be advised that Lowell are a debt purchasing company who act independently from Provident, as such Provident no longer hold ownership over the account. Whilst you may have been contacted by Provident, their decision to write off any accounts solely effects any live accounts held by themselves at the end of 2021, unfortunately your account is not one of those effected. As your former Provident account was sold to Lowell on 31/10/2015, it is not included in Providents recent decision.

However, whilst we understand that Provident have upheld your claim, confirmed numbers or data have yet to be shared with ourselves and payments from Provident are not yet expected until a later date. As such any reductions or compensations can not be actioned at this time.

As such, the outstanding balance remains valid and owed at this time.

The account is now without a plan in place. Please can you advise how you wish to proceed with the account?

So I sent this to Lowell in reply:

Good evening,

The debt that you bought form Provident was from a loan that should not have been given and has been deemed as unaffordable by Provident, therefore it no longer exists.

If you chase me for the debt, or I gain a negative impact on my credit file, I will be in touch with my solicitor.

I will also be sending your email to the financial ombudsman.

J scott says

I have also had this from them. Extracts of the main outline anyway , “The account we hold relates to 2 loans totalling £6.390.00. The current balance is £4,790.00. I am unable to provide the loan agreement numbers.

Please note that any accounts that Provident have advised customers to have been ‘written off’ will solely affect any live accounts held by Provident at the end of 2021, this is because Provident are closing their doorstep lending business. As your Provident account was sold to Lowell on 26/06/2015, it is not included in Providents’ recent decision.” And

“As such, the outstanding balance of your Provident loan that Lowell hold, remains valid and owing at this time”

I asked Lowell for my agreement numbers as I have had a redress and it showed provident cancelling (nil) a loan they apparently still had but the last 2 loans I had with provident were sold to Lowell. I didn’t have any others so was trying to track why Lowell are asking for money on 2 loans if provident had only sent 1 or if something else was going on, I still can’t see how an unaffordable loan that was given can still be chased by anyone if you ask me, seems unethical to carry on chasing an upheld redress loan, as it was missold to begin with and if it hadn’t been it wouldn’t exist .provident should do the decent thing and request these upheld loans back from the providers and nil them ,rather then let them carry on being paid they were paid for these defaulted accounts still.

Marie says

I have it in writing from Provident that Lowell had agreed to write off the balance from August 31st 2021.

I claimed back my monthly direct debit payments to Lowell from that date, via my bank as a Direct Debit Indemnity, after showing them the email, and those payments were back in my bank the same day.

They are getting nothing more from me.

Adreva says

Marie ,

I’m afraid its not quite that simple, as the loan is owed by Lowell and they’ve paid Provident for it so its not legally Providents loan anymore to write off. It still exists.

“Confirmed numbers or data have yet to be shared with ourselves and payments from Provident are not yet expected until a later date”

This seems to suggest and is what should happen is that Provident will contact and pay Lowell’s for the loan.

There’s alot of variables with this and no-one knows what’s going to happen with loans like this yet.

Best to ask Lowell’s to pause the account until the provident scheme is sorted and take it from there.

What a mess and good luck

Marie says

Hi Andreva,

What you have said does make sense as surely Provident should be settling this debt, as Lowell bought the debt in good faith.

I will message them and ask them to pause the account until the scheme is sorted.

Many thanks :)

John Morgan says

Hi ask them to show you the contract that you signed with lowel,no contract no payment, you never employed lowel for anything

Sara (Debt Camel) says

This is irrelevant – a lender is entitled to sell your loan without asking you to agree.

Julie says

Hi Sara

Why did provident send email saying debt purchaser has agreed to write off loans and now Lowell saying loans are not being written off?

Is there still a chance some loans sold to Lowell will at least be reduced if not written off?

Sara (Debt Camel) says

I think there is some mis-communication going on.

Zoe says

Hi Sara I keep getting emails to login in portal and register my bank details for the compensation to be paid in to but I’ve asked for a appeal due to the loans not matching what’s owing etc etc Ben though there upheld as being unaffordable so do I still need to put details down even though I’ve appealed as I don’t agree with the decision.

Sara (Debt Camel) says

Yes they still need your bank details.

Zoe chai says

Ok thank you Sara will add them now .

Annie says

Received a letter today saying payments on upheld claim being paid from 1 July

Catherine Molloy (kate) says

I was with Provident for years I made the claim against them. It seemed to be going OK anything they ask for ì sent, was told Provident had excepted i was one of the miss -sold loan.

Then about 6mnths later they emailed to say I had missed the deadline and wouldn’t be recieving anything..

Sara (Debt Camel) says

When did you make the claim?

Kerry says

Hi Sarah

I had a complaint in with provident before the scheme was introduced. I was one of the lucky ones and after speaking to the manager we came to an agreement on a amount of repayment. I accepted and received my payment. I have just had a letter stating that my claim is being accepted within the scheme and I would get a amount from that too in July time. I am confused as I have no log in details etc and just received a letter by post. Should I contact them to advise them or ? I mean the amount I received is lower than what I should of received however it was huge compared to what I am being offered by the scheme.

Thank you

Sara (Debt Camel) says

If you are now being offered money, then I think this is EXTRA above what you were originally given. They probably made you a poor offer before and now you are being paid a small percentage of the extra you should have had.

Diane says

I’m still waiting to hear anything at all, approx three weeks ago was told I should hear anytime in early May and still waiting.

So unaware if my claim is upheld or not.

Trying to get through is a nightmare. I care for my adult autistic son and I have Kidney disease alongside high blood pressure, so stress is not good for me. I’ve emailed a few times since to request an update and nothing. Still having issues in signing in to the portal too.

Anyone else still waiting on the first stage, to hear if upheld or not?

Cheers.

Teresa says

I still haven’t heard anything keep getting told will hear soon that was weeks ago

Adam says

Hello can someone let me know the number for Provident claims please I have heard nothing at all from them I check the portal and email daily but nothing there.

Dawn says

I’m still awaiting a decision I did my claim through allegiant I think they are purposely delaying the claims

Marc says

Do you mean Allegiant clicked on the Claim Button in the Claims Portal on your behalf after the Provident Scheme of Arrangement started?

Or did you have some sort of claim running with Allegiant before the Scheme of Arrangement started?

Jayne smith says

They can not be involved now and shouldn’t be charging you the 25% fee, I made sure I got it in writing as they couldn’t appeal for me.

Kim says

I messaged provident yesterday as people are posting all differant things they’ve been told and it’s just confusing me. Iv just received a reply and they’ve said all claims should start being processed by July 1st so here’s hoping. They didn’t state what happens to the ones that are waiting on appeals though

Michelle says

I’ve not heard a thing since I put my claim in. When it first opened. So I’ve not even heard if mine was accepted. I used them for about 10 years I was forever in a circle of debt with them. Do I need to contact anyone ?

Sara (Debt Camel) says

Have you logged into the portal and looked?

Michelle says

Yes many times.

Marc says

But what do you actually see when you log into the Portal?

In the ‘Claim’ tab on the left side, Is it telling you that you have a Redress Claim Submitted for example?

In the ‘Redress’ tab on the left side, is it telling you that your awaiting a redress outcome? Or something else?

Daniel says

Provident have provided the details of my loans – Only 2 out of 13 are deemed ‘unaffordable’ Some loans also show an excess of 100% charges added to the amount borrowed eg 2 loans show £1500 borrowed, charges £1800 Total £3300 (only 1 of these was deemed unaffordable) whereas others are closer to what I would expect eg £500 borrowed, charges £300 total £800 & £500 borrowed, charges £325 Total £825 (why the difference in charges?) Again, only 1 was deemed unaffordable. I am considering appealing the affordability based on the information provided but they say I will need to provide proof of an error – I am running out of time to request any further information – Should I bother? Do the figures look right to anyone else? (Loans post 2016 were most likely sold to the likes of Lowell & have since been paid up).

Sara (Debt Camel) says

Were there an6 big gaps between repaying one loan and taking th3 next? Can you list The loan sizes in date order? Eg 400,300,500,600,80,400 etc

Daniel says

Issued/ Value/ TAP/ Charges/ Rate/ Paid up

*10/02/2014 1,500.00 3,300.00 1,800.00 (no date)

18/11/2013 387.32 704.78 317.46 29/07/2013

08/02/2013 900.00 1,638.00 738.00 31.50 30/07/2013

10/12/2012 388.32 706.71 318.39 13.59 10/12/2013

*19/10/2012 500.00 800.00 300.00 25.00 12/02/2013

07/11/2008 700.00 1,484.00 784.00 14.00 29/12/2011

22/03/2008 1,000.00 1,680.00 680.00 30.00 26/01/2010

10/11/2007 200.00 270.00 70.00 10.00 22/03/2008

02/06/2007 500.00 825.00 325.00 15.00 22/03/2008

04/11/2006 200.00 250.00 50.00 10.00 02/06/2007

10/12/2005 100.00 125.00 25.00 5.00 03/03/2007

24/09/2005 400.00 660.00 260.00 12.00 15/12/2007

*= demed unaffordable

Daniel says

looks like I’ll have to accept their decision although I can’t see any real logic in it :(

Sara (Debt Camel) says

It does look random.

I suggest you appeal and say all the loans from 22/03/2008 1,000.00 (including that one) were clearly unffordable.

Marc says

18/11/2013 387.32 704.78 317.46 29/07/2013

This one was paid off before it was issued.

Greg says

“The total estimated amount of money you may receive as compensation is between £24.56 and

£36.84.”

The above is from the statement on the portal when I log in.

Also told that as account sold to debt purchaser they would be in touch and refund any payments made after scheme opened.

I have today received a cheque from Provident for £3?

Marc says

If it was a cheque then it’s just a refund for any over payments you’ve made on any loans that they closed off and wiped out. It’s not the compensation that you mentioned from your redress letter, that will be paid into your bank account July ’22 onwards.

Kelly says

I received my decision today wat does it mean when they say my claim was on uphold I’m really confused can anyone help

Sara (Debt Camel) says

Can you copy and paste in what it said?

Sarah Louise Tansley says

Had an email today to look at the portal and surprise surprise (not) they have not upheld my appeal! Honestly! I knew that would be the outcome. Trying to pay out as little as possible. Am I right in thinking that I should be paid back any payments I made to them from August 2021?

Catherine says

Is this the appeal to provident or after they’ve sent it to the adjudicator? I’m awaking my appeal decision that been sent to the adjudicator.

Sarah Louise Tansley says

Hi,

Yes it’s the one sent to the adjudicator!

Annie says

I’m waiting on reply from adjudicator as well I don’t know how they intend paying out in July when these have t been done yet

Gord says

I know I’ve appealed mine 3 times as loans previously upheld now not upheld and mines just gone to adjudicator so how can they start paying people on 1st July I was under the impression that once they had all outcomes of claims they could work out the percentage you are getting as they only have 50million so how can they start paying people until this is all sorted I’ve reported the way this scheme is working things out maybe a lot more should do it they are a despicable company

DL says

I’ve still yet to hear about my deceased father’s claim but with mine it has gone to the adjudicator who then contacted me to ask for evidence on my medical information I declared. Just waiting for my GP to do a short note to answer what they want as despite having stacks of medical evidence, they have been quite specific in their questions. They were quick to contact me. Mine if upheld will be for pennies compared to some people and I did debate on just leaving it but then thought they are the ones who have treated people badly not us.

Annie says

DL What date did yours go to adjudicator on I don’t really have evidence I just can’t work out how they uphold small loans but then say large ones are affordable even though half paid back to pay remainder of previous loan

DL says

It went in the 3rd May and I heard from the adjudicator 17th May asking for the evidence.

Whether I will get the medical evidence in on time I don’t know as my GP has been off sick all week.

Might leave a message in the portal as they had obviously read it to read about my medical issues which i am surprised about considering the way they have been with other people

Annie says

Mines went in April and not heard anything back as yet

Annie says

Sorry it was 10 May mine went to adjudicator a week after yours

Marc says

It’s worth noting that the Adjudicator is a court appointed 3rd party that is not part of Provident or affiliated to them in any way.

Not everyone is working against you, I’m just saying. When you spoke to Provident in portal it probably prompted them to send it to the Adjudicator who is not Provident.

Initial appeals go back to Provident, Appeals to the adjudicator go to a legal practice who act as an ‘impartial mediator’ basically. The impartial 3rd party is trying to do you a favour by asking for evidence. If they’re asking for evidence it’s their way of saying that your case is weak or maybe weakened with out any further evidence so it’s worth following up if you can. For a legal practice, ‘official documents are golden’, a letter from your GP describing your issues is one example of an ‘official document’ and it leaves very little debate over the nature of your medical concerns and possible symptoms.

If there’s a delay in getting the evidence for the adjudicator, you should tell the adjudicator. They are solicitor, they won’t put it on hold for ever if you don’t let them know what’s going on with your GP.

Good luck!

DL says

I don’t think they are against me, I think Provident have treated people appallingly bad. Tbh i was not going to bother because compared to others mine is small and my GP practice has enough of a job trying to keep me alive. My medical evidence reads like war and peace and interestingly the adjudicator’s questions are very specific of a secondary to my medical condition that nearly killed me and they want to know how that impacted me around that particular timeframe which you won’t get in ur standard medical notes. But you make a good point, I will contact them direct just to say the medical evidence may be a few days late than requested due to my GP being off sick.

Will be interesting to see what happens!

Marc says

My GP charges me £25 every 5 years for detailing my medical history for the purpose of renewing my Shotgun license. So I hope your doctor doesn’t charge you more than the amount of redress you would ultimately receive if you were successful.

DL says

I am very lucky, im under a spinal unit where every letter sent to the GP i get a copy of as part of their normal procedure so broad info i have for the adjudicator.The very specific questions involved a different hospital in a specific timeframe which i have provided the dates to my GP for him to find quickly. Fortunately he doesnt charge me for any letters. If u are a genuine patient with chronic conditions he always goes the extra mile. Ive provided him with a copy of the adjudicator questions. Once up on the system it should only take him two minutes to answer. Im curious to see what happens now.

Still no news on my deceased father’s claim. Provident just say it hasnt been looked at yet.

Maria says

Hi All, I read somewhere that by accepting compensation from the provident scheme could put you on a list of some sort which could then affect future credit application? I am about to apply for a mortgage and don’t want to jeopardise the application? Any advice would be appreciated

Sara (Debt Camel) says

This sort of black list doesn’t exist. If it did, it would be illegal.

Have you made a claim to the Provident Scheme?

Do the Provident loans still show on your credit record?

DL says

I’ve just found out that my deceased father’s claim has been fully upheld between 1400-2100 and they are hoping to pay out the end of June. I only found out by chance, I never received the email decision so didn’t have a clue and couldn’t access the portal. So anyone that hasn’t heard I would follow it up. I rang and held on today. They said they had sent out an email to me 29th May about my father’s claim but I never received it. Because of portal issues they took my bank account and sort code over the phone ready for pay out. They said they plan to start paying out the end of June

Rose says

Hi, Sara,

I only had three loans, for £400, £300 and £400, across 2 years (and paid the earlier loan off with the later one each time). They’ve rejected my claim – I presume because, though I was on benefits at the time, and had a terrible credit record, there weren’t enough loans/not high enough to meet the tiers they use to judge: I did actually have two CCJs, and plenty of defaults, but I don’t have my credit report from the time (I borrowed from them in 2008/9). They’ve sent me their final decision, but I assume I can’t send it to the FOS as their letter says that the FOS won’t consider this as it’s a Scheme etc – and, whilst I’ve got some emails etc that would show my financial situation, I don’t have anything else? Is that right?

Thanks so much for your advice, as always.

Sara (Debt Camel) says

“They’ve sent me their final decision”

do you mean you have appealed and this is the result of the appeal?

Rose says

Yes – originally, they rejected my application as they said I did not provide the evidence they’d asked for (I’d mentioned over the ‘phone that I was on benefits and disabled at the time of taking out the loans): they reopened it to take that evidence, and then came back with a letter saying it was now rejected on the tier basis.

Sara (Debt Camel) says

You can reply that you would like the case to go to the independent adjudicator.

realistically i think you would only be likely to have the last loan upheld, so the redress would not be much money.

sandra says

hi Sara…. just wondering ..my award says from 2007 to 2020 but what happens to the other loans before 2007?

thabks

Sara (Debt Camel) says

the Provident Scheme only covers loans from April 2007 which is when the law changed to allow these affordability complaints.

Sabrina says

I received a letter from them saying what I should be getting on 4ty april 22. I put in the appeal straight away on the same day to which on the 12th April they said would be going to the scheme adjudicator and would take 60 days. I’ve still not heard back from them in regards to it .. I know I technically have until 12th June however has anyone actually heard back from the scheme adjudicator well before the 60 days as I think they are cutting it fine considering they are expecting to start paying out in July ‘22.

Alfred says

Is there any update on closed Provident accounts now owned by Lowell / Overdales?

I sent Provident a message about it a couple of weeks ago and this was their response:

” I have queried this for you and been advised that you should speak to debt purchaser about this as the information regarding balance write off will be sent to them in the next week. We have been advised that the debt purchaser will arrange any refunds of payments made since 27th August 2021. We are paying the balance amount as it was to the debt purchaser on 27th August 2021 meaning any over payments are owed by the debt purchaser not Provident.:

Lowell / Overdales are still being completely unhelpful, in fact they are threatening enforcement action as I have stopped repayments.

Can they do that? CCJ was granted August 2016.

Christine says

Hi I’m having exactly the same problem with lowell solicitors, all they keep telling me is they are a debt purchaser not collector so different?????? and have had NO information from provident regarding account write offs ect… and if I cancel my payment plan could end up with bailiffs at my door!! Unfortunately the provident portal has gone quiet and they are not answering my messages!!

Diane says

My last update at the end of May.

Thank you for contacting us about the Provident Scheme of Arrangement.

We have not made a decision on your claim as of yet.

We expect to be back in touch with the outcome of your claim in the next few weeks and we appreciate your patience regarding this matter.

Kind regards,

Customer Service Advisor

IAN R says

I’m just interested how they going to divide the £50 million they have set aside for the scheme.my guess they have made some calculations of how many Will appealing-once the figures known they can start to pay out-keeping the just under £50 million then can make slight adjustments by making a small second payment to use the total amount available -what do you think Sara ?

Sara (Debt Camel) says

The Money Shop ended up making a small second payment. Amigo is planning on doing this. I don’t know if provident will.

Babs says

I put an appeal in on 6th April and it was sent to adjudicators, haven’t received a reply yet. Any idea how long it should take?

adele says

Hi – I put in an appeal on 12 April – I messaged them on the scheme website portal to ask if there were any updates this morning and received a really quick reply to say that my appeal had not been upheld and their decision remained unchanged and that a letter was on its way to me stating this information. I would just message them on the scheme page and ask for an update.

Lynn says

Anyone any ideas of they will actually pay out by july?

Sabrina says

Personally I think it’s doubtful as I’m still waiting to hear back from the adjudicator about my appeal which I done in April … according to them the adjudicator is behind on the appeals 🙄.

Joanne says

Last message I had 3 weeks ago said it would … so will wait and see

Joanne says

Mine didn’t as I agreed to the offer they said so I the dark

Gord says

Contact the adjudicator yourself nortonrosefulbright.com I did as I was sick of provident mistakes I put my cases to them and after waiting on 2 previous appeals and dsar which did not have half of my loans on I was sick of provident mucking me about they replied and asked some questions and I replied they stated they would get back to me within 14 days I also asked provident why they could pay out a percentage when not all claims were decided and the advisors said I don’t know how they can do that what a joke of a company also reported all this to FCA as they are looking to fine them for there behaviour the more people report them the better it is

Sabrina says

How do you know that they are the adjudicator they are using ??

Gord says

I googled it and when they replied they confirmed they are the adjudicator

Marc says

All of the scheme information is on the scheme website.

Adjudicator is named in this document. Page 43

Ashley says

I just called Provident as my bank details had been submitted on the portal but I couldn’t see them,was asking for them again so wanted to double check.

The advisor was adamant that payment will be received BY July 1st 2022. I had to ask a few times,will they start in July but she seemed to think they will be paid by July 1st. I find that hard to believe seeing as many people are still waiting.

Let’s see what happens over the next few weeks.

So far I have only been given a rough estimate. Still no idea what the actual payment will be.

Kim says

I never received any notifications a scheme was even taking place. I never had a letter. An email or a message which I have from other companies stating we could even apply to apart of the scheme. Should we have been told this was happening as we did have numerous loans through provident but not one single word of any scheme of arrangement

Christine says

Hi I had loans with provident which ended up being sent to Lowell which at the time I stupidly ignored this ended up in then obtaining a ccj which I currently have a payment plan in place.

I recently won my affordability case and was informed by provident by the claim portal they had contacted the debt purchaser who had agreed to write off my debt from august last year, and refund any payments made however lowell will not expect this and say they are a debt buyer not collector so refuse to close the account and remove ccj as they have had NO confirmation about this and if I stop my payments will be left with no option but to use bailiffs!!! I’m at my wits end as the £35 a month would come in very handy at the moment!!

Zoe says

Hi Christine Phone lowell and see if you can reduce your payment while you wait for a decision on whether the debts will be written off . I pay mine at £1 amth I’m waiting to hear about a decision on my appeal as the balances on the provident loans with lowell don’t match what’s on the scheme paperwork so the offer that’s been made to me is under what it should be and if the debts was to get written off I want to make sure everything is correct. Lowell haven’t been helpful at all , all they keep saying is they bought the debts so I owe them I gave up with trying to explain what we have been told but they don’t want to listen hopefully this will be all sorted out soon and the debts will be written off .

Christine says

Hi Zoe thanks for that will try to reduce my payment with them but they so unhelpful with this situation, they make me feel like I’m making it up as I go along!! how did you find your original provident account number that was sold to lowell as none of the reference numbers I have on the provident portal correspond with the one lowell has on record.

Zoe says

Hi Christine I know what you mean that’s why I have gave up with lowell as they just don’t wanna accept it should be written off !!! I looked what numbers the scheme had for the loans then rang lowell and asked them what the numbers were and mine matched so just go with the account number that’s on the portal with provident as that’s what they should be under with lowell if there not ask why either way appeal against it if you think anything is wrong and let them look in to it because they should also provident should have your details on system still send them a email asking for your account details and confirm what loan / loans were sold to lowell

Christine says

Hi Zoe contacted lowell this evening who said they only have a customer number from provident and there personal reference number, and none of these Match anything I have on the portal, there no where near, contacted provident by phone who said it’s the agreement number I need as that’s whats what was sold but there now unable to give me this as there systems are now limited as the scheme is now closed and have no access to this information so I’ve now sent an email to see if I get any joy that way fingers crossed!

Zoe says

Don’t put your account on hold with lowell just tell them you want to pay a £ 1 a month tried to get me to put mine on hold but I said no just leave it as I’m still paying while this gets sorted hopefully they will buy the loan back off lowell as mine were upheld as unaffordable

Zoe says

Hi Christine lowell can give you the reference numbers for the loans they bought from provident and you can double check them but sounds like you need to appeal against it if things ain’t matching then at least they can look in to it for you so it’s not stressing you out like it does that’s why I appealed once I get a decision I will update on here . Good luck think we all need it 🤔

Tink85 says

My claim has not been upheld by the adjudicator, as they say it does not meet any of the tiers. My claim does meet the criteria as I had recent defaults and less than 3 months between loans? Is there anything o can do about this?

Sara (Debt Camel) says

Not at this point. This is why these Schemes are unfair – there is no proper external appeal.

Annie says

I received e mail today and payments are July I am also waiting on adjudicator but looks like payments will be made and maybe a top up later

Babs says

Got a reply from the adjudicator today, no surprise they haven’t changed the original decision. Just need to wait on payment now!

Catherine says

Surprise surprise the adjudicator has upheld Provident’s decision to only uphold one of my 13 loans. It’s absolutely disgusting that they’ve got away with this scheme and we can’t do anything more about it.

William says

Just had email from adjudicator and my appeal has NOT been upheld

Joanna says

Got my email today too, not upheld by adjudicator, apparently no additional evidence, even though they previously upheld on and this time the didn’t on the same loan, contradicting their process.

Any ideas on when we find out how much we will get based on the original upheld case, and when?

J payne says

Well it seems no appeals have been upheld by the adjudicator..What a surprise NOT!!

I sent an email 2 days ago about not hearing anything about my appeal, had an email today to log in to portal to view message,site down for maintenance AGAIN…finally got on to be disappointed with the message.

Absolutely criminal how they’ve got away with this!!

Julie says

Yes I had exact same experience, appeal not upheld by adjudicator just a waste of time appealing, they will always agree with the first decision, not long now at least we will get the small payout they deem fit to give us in July

Sara (Debt Camel) says

some people have won appeals – it sounds as though they have just sent out a whole batch of rejections together.

Catherine says

A kick in the teeth that it also says you can send it to the FOA if you’re not happy with their decision but because of the scheme won’t be looked at by the FOA. It’s a joke.

Annie says

When did they go to adjudicator Mine went 10 May and not heard as yet

adele says

12 April – I messaged them on portal and they told me that my appeal had not been upheld.