Contents

Quick overview

Provident’s Scheme of Arrangement is now in the final stages.

The Scheme was proposed because Provident could not afford to carry on paying full refunds to customers winning affordability complaints. The Financial Ombudsman was upholding 75% of complaints against Provident.

The FCA, Provident’s regulator, said it did not approve of the Scheme. But as Provident has stopped providing doorstep loans, the FCA did not object to the Scheme in court.

It started officially on 5 August 2021 after it was approved in court. The deadline for claims was the end of February 2022.

Provident has assessed claims and informed customers of their decision. The large majority of appeals have been held.

Provident is making payments to bank accounts or sending cheques:

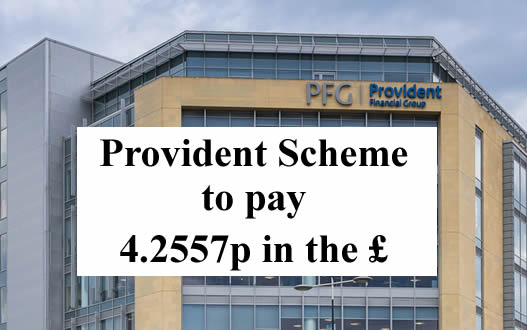

- it is paying 4.2557p in the £;

- so if your redress was £1,000, you will receive about £42;

- a final letter will be uploaded to your portal account setting out the payment;

- the first bank payments will be arriving in accounts on Tuesday 5 July.

Here is confirmation from one reader (see the comments below for others):

FUNDS PENDING!!!

Hi all, I’m new to this to thread but just thought I would give an update.

I have a Monzo account, it is showing my Bacs credit as going into my account on Monday, for most people with standard accounts this means you will be be paid Tuesday

I can also confirm it is 4.2557% as stated.

Glad it’s eventually been sorted.

But no-one should assume they will get their payment next week.

They may be going out in batches. And in any mass payment, some of them fail. Do not plan your July finances on the assumption that you will get paid early in the month.

Which loans were covered by the Scheme?

More than 4 million people were given a loan by Provident that comes under the Scheme.

These loans were given between 6 April 2007 and 17 December 2020.

The loans came from four different brands:

- Provident – often called “doorstep loans” or “home credit”;

- Satsuma payday loans;

- Greenwood – another doorstep loan brand that hasn’t been used since 2014;

- Glo – a very small guarantor loan brand.

If you have an affordability complaint about Vanquis or Moneybarn, these complaints are NOT included in the Scheme. You can still make a normal affordability complaint and get a full refund.

The definition of “unaffordable”

A loan is only “affordable” if you could repay it on time and still be able to pay your other debts, bills and living expenses.

You may have paid the loan on time, but it may still have been unaffordable.

If paying Provident left you so short of money you had to borrow more or you got behind with bills then it was “unaffordable”.

If you had several loans without a break between them, then Provident should have realised you were trapped in a cycle of borrowing and that these expensive loans were not affordable. Even a single loan can be unaffordable if it is large.

Provident pays out on old uncashed cheques

In 2018-20 Provident frequently made very poor offers to people that complained, sending a cheque. They frequently used to offer to refund just a few loans, often not the largest or the most recent. For example, in one case with a large number of loans, Provident upheld a loan for £1,000 but decided the next loan for £2,500 was affordable.

Many thousands of people didn’t cash these and instead sent their complaint to the Ombudsman, where they often got ten times as much! who had made affordability complaints.

When the Scheme was announced, people tried to cash the cheques but some cheques were too old to be bankable. Until now Provident has refused to send out a new cheque. In February 2022, at last Provident relented and refunded this money and people can also make a claim to the Scheme for the extra they should have had.

How much will you be paid?

The next stage is for Provident to divide up the £50 million in the Scheme between the people who have had their complaints upheld.

Customers who made a claim have been told which loans have been upheld and what the total redress for these loans is. You will be paid a percentage of this redress number, not all of it.

When the Scheme was voted on, many people thought they were being told that the payout would be 10%, or 10p in the £. I said at the time that that looked unlikely and it could only have been based on an unusually low number of people making a claim.

For several months Provident quoted a range, saying:

Based on the claims that we have received to date, we estimate that the pence in the pound rate of compensation to be paid to each customer will be between 4-6p.

Now it is known that Provident will only be paying 4.2557p in the £.

A final letter will be added to your portal account setting out what you will be paid.

Credit records will be cleaned

In other schemes and Administrations, some people say getting rid of a default was the most important result for them. Not the small cash refund!

For upheld loans, any defaults or missed payments will be removed from your credit record.

This clean up will be done at the end, when they can do everyone’s together. This is very annoying if you want to make a mortgage application, but there is nothing you can do to speed it up.

If your credit record is not cleaned in this process, there will probably be no-one to complain to about this. But there is process for resolving this sort of problem, see Correct credit records by “suppressing” them if the lender has disappeared.

Current loans

Loans that were sold to a debt collector

If your loan was sold to a debt collector, Provident is trying to get this settled. This seems to be taking some time, for example with Lowell saying they haven’t been given the right information from Provident. Several people are complaining about these in the comments below.

Loans that hadn’t been sold were written off in December 2021

In December Provident announced that it was no longer collecting any payments for existing loans:

There is nothing you need to do. You can stop making payments on your outstanding loans owed to PPC and if your payments are taken by the Continuous Payment Authority (CPA), we will stop these for you. Any payments made after 31st December 2021 will be paid back to you.

If you’re in arrears or didn’t pay your loan within the time we agreed when you got your loan, we’ll update your file with our Credit Reference Agency to show the balance as zero and partially settled.

Your credit record is being changed to show that the loan is partially settled or partially satisfied.

If you are a Provident or Satsuma customer, you should have been told about this by email or letter.

That is a pathetic payout

Provident is a successful company with the profitable Vanquis and Moneybarn brands which are still in business. It is a disgrace that the regulator has allowed them to structure their business in a way that has permitted Provident to abandon all its doorstep lending customers and not pay them their proper redress.

If you are feeling mad that Provident has got away with paying you so little, this is the time to look at whether you can make other affordability complaints, not just for loans but for other types of credit.

I have a separate page for each sort, as they need slightly different template letters to complain:

- refunds for large loans, including Moneybarn and other car finance;

- refunds from catalogues and credit cards such as Vanquis;

- refunds from overdrafts.

Sarah Louise Tansley says

Morning!

I submitted my appeal on 3rd March and received an email on 16th March saying it had been sent to the adjudicator who has 60 days to reply to me so I am hoping to receive a reply before 18th May. They haven’t really been overly consistent with so called deadlines so I’m not expecting to hear anything within the time to be honest!

Milly says

Hi, I received a letter via the portal, confirming that my claim is upheld they say 6 loans

I believe between April 2007 and December 2020 I had more loans than the 6 listed from Provident and Greenwoods

Home Credit £1300.00 ✓

Home Credit £300.00 ✗

Home Credit £2255.00 ✓

Home Credit £383.56 ✓

Home Credit £400.00 ✗

Home £1000.00 ✗

The total estimated amount of money you may receive as compensation is between £71.82 and £107.72.

How is this fair ?

I have appealed and asked numerous times for each loan details the dates taken and repaid and the interest paid on each. I keep getting the same message back but each time worded a bit differently each one has the same details of the 6 loans above with no date and interest added details

I cannot see the outcome of the appeal being any different how can they get away with it

I was in such a bad position financially while taking each one of these loans out, I only took each loan out of desperation and did struggle with each one to keep up the repayments

Sara (Debt Camel) says

You can’t appeal about the low % you will be paid – that is the same for everyone. That was the purpose of the Scheme, so Provident doesn’t have to pay people very much.

But you can appeal if you think other loans were also unaffordable. eg that £1000 loan…

Milly says

Thank you Sara

Yes do understand all payments are low for everyone, But i am sure i had more loans in that period and would of thougth that the £1000 one would of been considered as unaffordable

Sara (Debt Camel) says

Then i suggest you ask provident to give you the details of your loans, including date taken, date repaid, amount of interest paid, and weekly payment. Say you want to appeal but need these.

When you see the details, it may be clear that some loans are missing. And you will be able to make a better argument that as they have decided that X loan was unaffordable, then Y loans, taken straight afterwards say, was also unaffordable.

Milly says

Thanks Sara

I have now asked 3 times the same thing but they just reply the same thing why can they not give me the answers

1. Every loan i had between 2007 to 2020 From Provident and Greenwood

2. Dates when each loan was taken out

3. Date each one was repaid

4. Interest i paid on each loan

5. Weekly payments i made

** There same reply each time ** Thank you for contacting us about the Provident Scheme of Arrangement.

We have assessed all loans which were taken from Provident, Satsuma, glo or Greenwoods between 6 April 2007 and 17 December 2020.

We have reviewed your Scheme Claim against the Scheme claim rules as set out in the Scheme Explanatory Statement.

If you wish to dispute the outcome of your claim, you can submit an appeal via the Claims Portal within 30 days of the date of your outcome letter. Alternatively, please confirm the reason/s you disagree with our decision via phone or email and we will log the appeal for you.

Whilst you are able to raise an appeal, some parts of the scheme cannot be successfully disputed:

I do think each loan was unaffordable to me at the time but understand they will not pay out on every loan but think they should pay out on the £1000 one but they will not send me the dates and details so i cannot argue that the loans was overlapping and things like that

Sue worsley says

Hi I have had an email of provident asking for my bank details I have sent reply s heard nothing was given 3different phone numbers all not taking calls how are we surpost to get any further with our claims

Maria Murphy says

Don’t give anyone your bank details. As far as I know they’re paying out by cheque only so they won’t need bank details, I’m moving house shortly and asked if I could give them my bank number and they told me that they couldn’t as ALL redress will be by cheque, also no one will be getting paid until July at the earliest.

It sounds a bit fishy to me

Kim says

It’s your choice if you want bank transfer or cheque, I had to check with them as my surname changed and they said that’s fine as long as my bank details matched it will still be transferred

Wendy says

There paying bank they have asked for details on the portal and sending cheques to those who don’t provide bank

Sarah says

No they pay the overpayment by cheque and any compensation will be paid in the bank

Jenny says

I spoke to provident and they said there paying the Redress straight in to the bank only overpayment is a cheque.

Sue worsley says

Hi Sara would it be possible to send me the link for Morse’s to claim back of them please

Kim says

Thank you I didn’t know I could do this so have used your template and put in a complaint to them as well as had many loans over many years also with them

Julie says

I totally agree, in the first instance I feel it’s wrong that they just list the loan amounts and no other details I.e dates taken out and interest paid, then expect you to email them for these details, my appeal has gone to the adjudicator as they say they have looked at it and the outcome remains the same, it will be interesting to know if anyones appeal has been upheld

Milly says

Julie it is so true, How are you supposed to appeal without theses details I do not know

Like was my loans overlapping

did i struggle to make the weekly payments

Was i late in paying off the loans

Without theses details i cannot make them see the loans was unaffordable and was given to me when i was struggling to pay back the original loans

Milly says

I have asked them numerous times for a break down of loans they have finally replied as you can see all the loans overlap how can they say that it was affordable lending, My compensation is between £71.82 and £107.72 here is the breakdown

1. 237609964

Week-200949 £383.56 Cash Loan 07/12/2009 (Start date)

Week-201209 05/03/2012 End Date

2. 404810423

Week-200849 Balance £704 – £400 Cash Loan 09/12/2008 (start date)

Week-200949 paid £383.56 in full to renew to get another loan 07/12/2009 (end date)

3. 408916710

Week-200948 £2,255 Cash Loan 01/12/2009 (start date)

Week-201544 02/11/2015 (end date)

4. 886721053

Week- 200826 £1,000 Cash loan Balance £1,680 01/07/2008 (start date)

Week- 200948 £1,270 paid in full to renew to get another loan 01/12/2009 (end date)

5. 966264384

Week- 200731 £1,300 Cash loan Balance £2,145 06/08/2007 (start date)

Week- 200948 £985 paid in full to renew to get another loan 01/12/2009 (end date)

6. 1024477113

Week-201234 £300 Cash Loan Balance £528 28/08/2012 (start date)

Week- 201336 £130 Paid 10/09/2013 (end date)

Between Greenwood and Provident I know i had a lot more loans but they cannot find them and without my account book I can never prove that, I have put in a appeal to say all my loans was unaffordable but i do not expect to win the appeal

May says

Hi Sara

Do you have any idea when credit files will be wiped and defaults removed?

Sara (Debt Camel) says

in a few months. Not until everyone’s complaints have been decided and appealed probably.

Adam says

Hello I still not heard a thing is it worth a call or do you think I will just get what seems the standard response? We are busy lots of claims etc.

Teresa says

I still haven’t heard anything

Louise Whitehouse says

My loan was bought by lowell so will I have to still pay all of this back or will provident buy it back

Sara (Debt Camel) says

have provident decided this loan is unaffordable?

Louise Whitehouse says

Yes and I am going to get some compensation

Louise Whitehouse says

Lowell bought my loan from provident and also my vanquis bank credit card will they get in touch with me do you think

Zoe says

Sara Provident have accessed my loans we’re unaffordable but Lowell said I am still liable for them as they bought them from provident

Neomi says

I’m the same. Provident said unaffordable On my redress letter it said that my debt had been sold on but as of august 2021 any outstanding balance is written off. However yesterday Lowell sent me a letter offering me a 70% discount on the same loan if I paid it all back before a certain day. I contacted them they said they weren’t writing the debt off like provident told me (and in the provident letter it does say debt purchaser have confirm r debt is written off) and they asked me to email a copy of my redress letter from provident to them.

J Scott says

I’m the same I have had a upheld case redress of 18 of the 19 loans I had. However lowell who bought my last loans that I just could not repay (£6350) now £4790 after my repaymant plan, they have said they haven’t been told and they have now asked for proof twice of the provident redress letter. However the redress letter doesn’t state the dates of the loans, and one had a balance that was written off, which further confused me, as the loans up to the lowell take overs were settled with other loans etc, so Im not sure where they got that from, neither the less it is Nil so I’m not too worried the lowell debts though I am, as if I get the 4-6p that doesn’t give me anywhere near the lowell balance so how is that a redress, if the loan I was given was unaffordable and I shouldn’t of had it then surely they should be told they can’t take more than the settlement of 4-6p for a final settlement offer, or provident should call it back from lowell its adjust and unfair otherwise surely?

Zoe says

Neomi they said exactly the same to me to send in a letter but it wouldn’t matter as they know owe the debt

Zoe says

Hi Sara could you give some advice on whether those who loans were sold on by provident to Lowell will still have to pay the money back even though provident said they were unaffordable my loans were sold in 2015 and I have been paying them back to Lowell since then I contacted loan and they have said coz they bought the debt of provident I’m still liable to pay ? Really don’t understand why I have been offered compensation between £130-198 but won’t know exactly how much till all claims are sorted but if it’s not written off with Lowell I will have to still pay back over £2000 with them which is confusing I haven’t accepted the offer as I don’t see the point as I still have to pay the debt Lowell are asking for a copy of the letter but stress it won’t change and I still have to pay the outstanding balance

Sara (Debt Camel) says

I am trying to find out the answer to this.

Zoe says

Thank you Sara I’ve spoke to lowell today about this and there saying to send a copy of the letter regarding it being written off and they will look in to it but still saying it’s still owed as there from 2015 not recently like last 2 years I’ve said there they were unaffordable as it states in the letter all 3 of them and there the ones lowell have told the man what is the point of me accepting the compensation when I will still have the loan to pay back really don’t get it .

J scott says

I received the following from Lowell from my email regarding the 4790 I owe of the over £6k they got from provident which was all unaffordable but seems enforceable by Lowell -absolutely fuming some mere top offer if it’s 6p of £550

Thanks for your email.

Responding to your query

Please be advised that Lowell are a debt purchasing company who act independently from Provident, as such they no longer hold ownership over the account. Whilst you may have been contacted by Provident, their decision to write off any accounts solely effects any live accounts held by themselves at the end of 2021, unfortunately your account is not one of those effected. As your former Provident account was sold to Lowell on 26/06/2015, it is not included in Providents’ recent decision.

Whilst we understand that Provident have upheld your claim, confirmed numbers or data have yet to be shared with ourselves and payments from Provident are not yet expected until July and any reductions or compensations can not be actioned at this time.

As such, the outstanding balance remains valid and owed at this time.

With this in mind, please confirm how you would like to proceed?

Next Steps

I’ve put your account on hold for 14 days to allow time for you to get back to us. If we don’t hear from you in that time, contact will resume.

If you have any queries regarding this, or if we can be of any further assistance, please don’t hesitate to get

Emma says

Has anyone received their cheque?

Sarah says

No today is my 10days not including weekends and the bank hols.. be good to see if anyone had it yet.

Katy says

Hi I just thought it let people know I received my cheque in the post today. This was for payments I’d made since 27th august 2021, not the redress amount. Its arrived 14 days after I got the redress outcome

Richard says

I received my overpayment refund cheque this morning as well.

Laura says

Yes I got mine in the post this morning

Steve says

I recived my cheque for £160 this morning it was posted out on the 29th.

David says

Got my £225 cheque for overpayment today

Emma says

That’s good to hear that some are starting to receive them

Kes says

Hi, did you receive any correspondence about this cheque for overpayment at all? Or did it just show up so to speak.

Emma says

I received it through the post Saturday morning didn’t hear anything apart from the first email it wad mentioned on with the overall out come :)

Shirl says

Got mine too. Wish it was more.

Marc says

You know it’s only for the ‘over payments’ you’ve made since last year though, right? So they are just returning money you didn’t need to pay at this stage. If you’re claim has been successful you’ll be due to receive your claim redress at a later date – this is the one you wish was higher.

Sarah says

Yea i know its for the overpayment since 27th august.. but mine was for £1061.10 and ill get my redress which is between 300-548 in july shame really it not for the full 9 grand but it better than nothing..

Sarah says

I got my cheque too

Sandra says

Received cheque this morning for over payment

Sam says

Overpayment cheque received today

Daniel says

Yes I received mine today ☺

Kim Webb says

I still haven’t heard anything. Anyone else ? Should I call them ? I check the portal every day.

Diane says

I messaged days ago and they replied today to confirm they’ve not even reviewed mine yet, and it’ll now be sometime in May.

Hope you hear soon, good luck 🤞.

Teresa says

I still ain’t heard anything either, I kept calling them no one answered after an hour so cut them of

George davis says

Pure robbers & they know it

Debbie says

I recieved the email to login to the portal to read the redress but i cant get the letter to download and open ive tried alsorts. Anyone else had this problem?

SHELLEY COOPER says

Are you trying to view it on your phone?i I had the same problem i went to the libery to use a computer think it can only be viewed by windows

Richard says

Try a different device to open it on between whatever you have eg. Smartphone, laptop, desktop, and tablet.

emma daniels says

received my out come as follows 8 out of 16 loans agreed as unaffordable

Your estimated Total Compensation Value is: £427.93 to £641.89.

This is calculated as £10698.21 x 4 to 6 pence in the pound = £427.93 to £641.89

This is the total amount of money we estimate that we owe you in compensation after taking everything

into account. This is only an indicative figure at this stage. We will notify you when all claims have been

agreed and we are able to process all compensation payments. We expect this to be in the second half of

2022.

Agreement

number

Brand Original

Loan Value

St

Denise says

Good morning.

I received an email yesterday asking me to log in to the portal. I have the ID number but for the life of me, couldn’t remember my password, so I selected an option to retrieve it via email. It wouldn’t work. I’ve tried every which way to get it to work…and failed, miserably.

Has anyone else had issues with the portal and logging in etc?

Vince says

Yes Denise. I’m the same. Can’t get past entering ID number and requesting password renew. Keeps coming up with something has been entered wrong. A friend of mine tried ringing the 0800 number but gave up after waiting an hour and ten minutes for someone to answer

DL says

Yes!

I had a decision on my account which I have appealed but I am also representing my father who died last year. All relevant documentation sent in but for the life of me I can’t access the portal even though I’m executor and all my details are now linked to his account. After my decision I emailed, heard nothing and tried ringing. When I rang they just said a decision hadn’t been made on my fathers account and the portal is rubbish and doesn’t work!

I’ve since had a response to my email this morning saying,

‘Your claim is still under review and we expect all outcomes to be issued by the first couple of weeks of May.’

No mention of the portal even though I also stated I couldn’t access it on behalf of my fathers estate as I also couldn’t remember the password I had set and it won’t let me reset.

Kathy says

I made my original complaint to Provident in November 2020 to be told they aim to deal within 5 days then 28 days then 56 days,still hadn’t heard anything after 56 days then was notified about soa in 2021,how is it fair that they purposely dragged my complaint out after the 56 days in order to pay less?

Sara (Debt Camel) says

it isn’t fair. Provident has treated you and its other customers appallingly in order to save money.

Matt Zieler says

I filled out the information online and now provident are saying that there is no record of it? I believe they are taking advantage of me because I autistic! They now state that the deadline has passed? I received the email in June 2021 and I claimed by filling in my details online. I am determined to get what I am owed, is there any way I can make them pay?

Sara (Debt Camel) says

what date did you make a claim?

Emma says

Shocked to find my cheque was in the post this morning nice little surprise !

Joanna says

Anyone submitted their appeal and heard back yet? If so did it go in your favour? They have until 11 June to respond to my appeal.

Sara (Debt Camel) says

One person so far has won his appeal. He was one of the very early ones.

Joanna says

Ah ok, interested to see if many more win, fingers crossed

Zoe says

Hi Sara would I be in a position to appeal even though my debt was sold on to lowell in 2015 by provident my claim it said in my letter the debt was sold on and wrote off last year aug 2021 but that’s not true I’ve been paying it’s since 2015 I’ve been awarded compensation and there asking for bank details but I would rather appeal as I think the decision is unfair as I still have to pay the debt owing to lowell

Joanne says

Hi , had my case upheld and submitted bank details for a bacs transfer that was on the 5th April… just wondered has anyone else prompted for this ? And has anyone had theirs via bank transfer yet ? Just sent them as message on the portal .. as can’t get through on the phone many thanks

Sara (Debt Camel) says

no one will be paid until all complaints and appeals have been decided. Not for a couple of months yeat.

Joanne says

Many thanks, I read by the end of June of not before.. was curious

Malek says

Does anyone know if Provident’s entries, good or bad will be removed from our credit files if upheld?

Couldn’t see anything in the letter. This is all I am worried about..

Dominic says

I received this reply today on this matter:

We will automatically remove any adverse credit history on your credit file where a valid claim has been upheld. I can confirm that this will be done at the end of the scheme which will be June / July

Glenn says

Haven’t heard anything back yet

Paula says

I haven’t heard anything yet but my son has when will I hear something about what’s goin off

Teresa says

Same ere I haven’t heard anything, nd calling them is a joke sitting on hold waiting for them to answer

Paula says

I phoned this morning and answer machine came on then went bloody dead

Beth says

I got my redress , all together provident / greenwood I had 83 ( yes 83) loans from 2007 till 2020.. 81 where upheld as unaffordable I got myself into a terrible mess renewing loans to pay of previous ones , I did manage to clear them but was a struggle and I done without things for years , my total would have been over £53k my compensation payment will be between £2100 and £3200 more than I expected but still a pittance of the 53k it should have been

Denise says

Good afternoon,

I have just come off the phone with “Provident” After a 45 minute wait I managed to talk to a lady about my bank details etc. She told me that any monies owing to collection agencies would be paid to them and anything remaining would go to ourselves. She also indicated that payments would be made in the first week of July.

I hope that this information helps?

A walker says

I never managed to get in to the portal will I still get a refund on any money i paid after the date given

Sara (Debt Camel) says

the problem is if you don’t know what Provident have upheld or not, how do you know whether you should appeal?

Suzie says

Hi I’ve not heard any think. Do you heard about the cheque or are they just sending them out be you heard any think. Mine say no statement to see at moment

Gavin says

I was looking through my form about the redress claim I see a lot of inconsistencies and unsure exactly how they’re working out these payments but I have a 20 loans deemed as unaffordable but seeing my claim value for similar loans fluctuate a little like for the 3 loans of £1000 I have net values of £1,460.10, £1,775.40 and £1,695.36 and I would have thought that same amounts for same agreements would be the same value right?

Sara (Debt Camel) says

1) were the loans all the same length and interest rate?

2) were any of the loans refu=inanced early – that will reduce the interest paid

3) 8% interest is being added on so if (1) and (2) are identical, there will still be more 8% interest added for an older loan than a more recent one

Gavin says

Thank you for the information and yes they were for the same length and interest rate and some I got to repay other loans I had with them so it’s kinda hazy to me which were which but it definitely clears up the fluctuations as the forms are very basic and don’t mention dates in which loans were handed over or paid off or what interest was payed over what period of time so I couldn’t really look into it more myself which is a big problem on my end as I have no clue how it’s worked out fully on their end since provident have been giving the most basic of information to all within the scheme I guess

Sara (Debt Camel) says

how many loans did they decide were affordable?

Gavin says

Out of 26 loans 6 were affordable and 20 were unaffordable

Sara (Debt Camel) says

ok, well unless the 6 were large, they may be a fair decision.

Gavin says

Thank you for the insight given today you actually helped me understand a bit more

Paula says

Hi Sara my appeal as from this morning has been sent to the adjudication, I asked for the dates of my loans when I first appealed as I’m more than sure I had more than the 13 between provident and greenwood’s, but they never gave me that info? Will the adjudicator be able to see it all?

WO says

I had a letter saying all my loans were mis sold and I should be due compensation totalling £11,612.70, but my estimated compensation is between £464.51 to £696.76. I am devastated as I had also complained well before Provident went into this SOA, and it was not upheld at that time. I then tried to escalate complaint via Resolver and basically Provident strung it out to avoid paying me.

My question is this… can my balance owed to Moneybarn or Vanquis be written off instead, when they are both owned by Provident…why should they not be liable

Sara (Debt Camel) says

can my balance owed to Moneybarn or Vanquis be written off instead,

No.

Legally these are separate limited companies, which is why Provident is getting away with this.

Ethically it stinks.

But do you have possible affordability complaints against Vanquis – did they increase your credit limit too high? See https://debtcamel.co.uk/refunds-catalogue-credit-card/

Or against Moneybarn? See https://debtcamel.co.uk/refunds-large-high-cost-loans/

leslie says

hi my name is leslie X address now is XXXXXXXXXXX i h in inave received an email to say i am due a claim i have tried i n vain to log on to the portal 4915-2315-ba8E

Sara (Debt Camel) says

Hi Leslie, I am afraid this site has no connection with provident. You have to keep emailing and phoning them to get this sorted.

Ian R says

Hi folks post just delivered cheque and letter detailing all loans etc-good luck 🍀

Emma says

Yes received mine Saturday morning 🙂

Char says

Brilliant Ian hopefully mine and others cheques will start coming through our letter boxes soon

Kelly says

That’s really good Ian. Hopefully people will still receiving the payments.

mark brooks says

hi can you tell me was it the provident you got refund.mark

Annie says

Just had email my appeal on 27 April has not been upheld will now go to adjudicator and I will hear from them within 60 days Said 30 for appeal but took less

Debbi says

I’ve appealed against the decision to only uphold 2 of my 11 loans including 3 close together which all went to step change and they only allowed the middle loan for £500 not the two for £1,000 and £1,500 either side

I’ve heard back today that they have looked at it and still don’t think they were unaffordable and have now sent it to the Adjudicator has anyone else been referred and had any success ?

Sara (Debt Camel) says

one of the very early decisions has had his appeal upheld. That is the only one who has said they have had a final decision.

Greg Meechan says

My Satsuma loan balance was written off having been passed to collections company (cannot remember which one).

This loan was judged to have been unaffordable, why, if written off is the balance being deducted from the gross claim value?

Greg

Sara (Debt Camel) says

Because the write-off of, say £460, effectively is giving you £460 worth of your refund.

Lorna says

Received email to supply bank details, not able to log on with scheme id, not able to reset password, no answer from phone and no response to email, how can i find out further information?

Denise says

Hello there,

I was in the same boat. I rang them…and after a 45 minute wait, I was able to give my bank details etc. And got a confirmation email as well.

I would try them….persevere with the wait time until you get through…

I do wish you luck :)

Geraint says

Hi all just had this email as i was unhappy about what loans they deemed unaffordable! Anyone else had a similar email?

Thank you for raising your appeal with us, we have now had the opportunity to review this but our decision remains unchanged.

Under the Scheme your claim will be a Disputed Scheme Claim and will now be referred to the Adjudicator for an independent review to take place. Once the Adjudicator receives your appeal they will have up to 60 days to review the information and determine an outcome. If any further information is required from you we will be in touch.

In the meantime no further action is required from you.

Regards,

Provident SPV Limited

Sara (Debt Camel) says

yes a lot of these appeals are now being passed on.

Richard says

I had the same message as they said two loans had money outstanding and was deducted from the total

£320 and another for £8. These loans were actually written off in 2009 when I made myself bankrupt. I sent them a copy of the Bankruptcy Certificate at the time, and also when making this claim as evidence that I can’t deal with debt. Typical Provident shenanigans, it’s only a few quid more than what they stated to me but I might as well appeal.

Sara (Debt Camel) says

this is an appeal you won’t win. I am afraid when refunds are given it is usual to deduct money owing that has been written off in an insolvency. It is routing with PPi refunds.

Annie says

Got e mail my appeal on 27 April was not upheld Off to tribunal now and answer within 60 days Said 30 for appeal and was quicker

Sp says

I appealed on the 27/5 – They have today referred my case to the adjudicator. Although I stressed the loans were unaffordable and they kept on increasing my loans. I also made it clear to them, that I could not see an affordability credit check on my files.

Nic says

Hi Sara, I borrowed 3 loans from provident dating back to 2007. I raised a complaint for irresponsible lending and it had been upheld.m via the scheme. They accepted liability for all 3 and they therefore should never have been sold to me. They sold one of these debts to Lowell on 2015 and iv been paying £15 each month since 2018. Iv still got an outstanding balance of £1024 and iv paid them in excess of £510. I spoke with Lowell on 04.02.22 and they confirmed that if my claim was upheld I would receive a refund of fees which I have paid. I have since received my FRL from provident confirming the outcome and this was forwarded to Lowell. They have told me I still owe them the debt and I’m liable to keep on paying it and they won’t refund the fees even though I was told different in feb 22. Therefore I am still paying for a loan which I should never have been given to me. Furthermore, I didn’t sign any documents when taking out these loans as they were given as home credit. This means I didn’t give any consent for them to sell my loan to anyone as I was never given and terms and conditions. Can you advise me what I need to do I order to get Lowell to refund the fees and write off the remainder of the debt? Thanks.

Sara (Debt Camel) says

I am trying to find out what is happening to these Lowell debts.

gillian says

Hi guys, has anyone waited over the 30 days for appeal outcome.

Paula m says

Mine was at 5 may the 10th passed to adjudicator , I have put a m in my name as there is another Paula on here

Gary Boyd says

I dont understand how some people has already been paid by cheque when the scheme isn’t closed yet.anyone clear this up thanks.

Sara (Debt Camel) says

The cheque repayments are NOT for their share of the refund of interest paid on unaffordbale loans – that will have to wait until annl claims and appeals have been decided.

The cheques are where someone has made an overpayment to a loan – this is being refunded in full. So the amount is already known and it can be paid now.

Gary Boyd says

Ah ok ,thank you. I assume because of the amount of people appealing it will take longer to get sorted.thanks

IAN R says

Further to my earlier note I see from the letter that came with my cheque that they upheld a my loans were unaffordable-they were all between £200-£300-so I’m pleased to get some back when it’s sorted in july-Hope you all succeed-👍

Sarah Louise Tansley says

I appealed and it was submitted to adjudicator on 16th March – I’m wondering if that’s why I haven’t heard about or received correspondence about overpayment since August 2021. Hoping to hear something within the next week as that will be 60 days since it was submitted 🤞🏻

Steven says

Mine has gone over 60 days, I sent them a question on the portal and got this response:

“We can confirm your claim is currently wit the scheme adjudicator and they will be in the process of providing you with the outcome of your claim.

Please be patient as your outcome statement should be in the process of being sent out to you and should be provided to you shortly. ”

I submitted my appeal on the 8th of March so its been 64 days now and still no response!

Sarah Louise Tansley says

Ah right! I’m not surprised at all that they’ve gone over the time specified! I’ll definitely keep an eye on my emails! Hope you hear something soon!

OK says

Am I right in thinking no compensation will be paid until all appeals have been held and all adjudicator outcomes decided? Considering there are people who have still not had original outcome that may want to appeal and subsequently it go to an adjudicator, we could be looking as much as 3 months or more before payments are made?

Sara (Debt Camel) says

I think July is the earliest possible date. I don’t know how many appeals are being made.

Tracey says

In July 2019 I made a complaint against Provident for Unfair Lending on 6 Loans, on which all 6 I was turned down, stupidly I didn’t appeal the decision. I then submitted the claims on the claim portal and they have upheld that all of the loans were unaffordable, how can this be fair ??

Sara (Debt Camel) says

It isn’t fair. It stinks.

Provident rejected a lot of good complaints in 2019. It is a shame you believed them and didn’t go to the ombudsman. or you would probably have been paid in full before this Scheme started.

Paula m says

I had done mine through resolver 2 years ago all deemed affordable, now 7 are unaffordable but I’m appealing the rest ,

Julie says

Hi Sara

I have had a letter and it states that my debt purchaser has agreed to write off the balance. (Lowell) does this mean I can stop making payments to them?

Thanks

Sara (Debt Camel) says

yes… but you might want to check this with Lowell first.

Zoe says

Hi Sara have you had any luck finding out where those who has their debts with lowell are still liable and have to pay even though my letter said the debt was written off last year I have till 31 st may to decide what to do

Sara (Debt Camel) says

what is this 31st of May date?

Zoe says

Hi Sara the 31st may is when I have to decide if I accept the offer of compensation or log a appeal but I don’t know whether there is anything I can do as lowell say I still owe the debt as they bought it from provident in 2015 and if that’s the case if I accept the offer between £130/£198 I will still have £2600 to pay it’s shocking really

Sara (Debt Camel) says

well I hope this is cleared up before then!

Zoe says

Hi Julie is the letter the one with the offer of compensation ? Did lowell buy the debt or was they collecting it on behalf of provident coz I’ve been told by lowell they bought my debt off provident so I owe them and still have to pay the debt

Julie says

Hi Zoe yes the letter is the one with compensation offer. I think Lowell bought the debt but the letter states debt purchaser has agreed to write off loans so just presumed it was cleared.

Manxcat says

Hi

I read somewhere that provident are paying 8% interest…. is this right?

If so, would that be on top of the figure they have quoted me or is it included?

They have estimated that I should receive anything from £206 to £308.

Thanks in advance.

Sara (Debt Camel) says

In is included in that figure

Julie says

Hi

Well I’m not very happy I keep getting emails telling me to log into my portal and give my bank details , I’ve tried lists of time and it says wrong password so I have requested a new password abs it won’t do it I have emailed 4 times and no reply and I have rang twice and been on constant hold , what a right fiasco it is , still mooned been in touch with me so I don’t know what they have offered or how o will get it paid .

Kelly says

Have you tried using your scheme id to create a new account? I was sure I’d already set up an account but when my password didn’t work and it wouldn’t let me reset I tried a new account and that let me in. I think everyone is assuming they already had an account from signing up to the scheme but actually they need to register again.

Diane says

Still waiting to hear if they’ve upheld or not, they did email back a week ago to say they’ve not reviewed mine as yet, I assume lots are still waiting to hear? However most of mine was before 2007 which they do not take into account, and I didn’t have as many after 2007, so even if upheld I imagine it will just be a few pounds in my case.

A waiting game lol.

Lucy says

I contacted Lowell and they told me that they won’t delete anyone’s account untill provi give them a full list if accounts. They put me on a refuse to pay which apparently does not affect my credit score.

They said they won’t return any funds even though I sent them the letter. Until they have recieved instructions from provi.

Provi say just keep waving the letter under their nose but it’s not that simple they won’t budge in my opinion Lowell are trying to make excuses not to delete people’s accounts.

Sara (Debt Camel) says

this is frustrating but it sounds like a miscommunication between Provident and Lowell which will get resolved – I hope soon.

Zoe says

Hi Lucy was your debt sold to lowell if so when I’ve contacted lowell who have had mine since 2015 and they say it’s owe to them as they bought it yet the 3 loans have been upheld as unaffordable

Sara (Debt Camel) says

I think this will be sorted out betwen Provident and Lowell over the next few weeks. I know it’s stressful but it should get reolved.

Lowell were the debt collector who bought many Money Shop loans and they were all sorted out properly, so I expect these will be too in the end.

Zoe says

Hi Sara thank you for that information so if I agree with the decision on the 3 loans that are down as being unaffordable and accept the offer of compensation. And then just wait for provident to sort it out with lowell I’ve just spoke to lowell and there asking for the letter to be sent email to them to see but basically there is nothing they can do till they hear from provident regarding loans they bought .

sevgin says

i get email for bank details but i cant login,all my login details is correct

Ashley says

Just saw an update on the scheme website

Loans sold to Debt Purchasers will have their balances reduced

Our Debt Purchasers have agreed to reduce loan balances for customers with an upheld claim against the Scheme of Arrangement, in the same way Provident has. Where appropriate, the Debt Purchasers including Lowell, Cabot, PRA, Vanquis Bank, Arvato, Grove and Moorcroft will also refund any over payments. We will advise our Debt Purchasers regarding the outcome of your claim during May 2022, so please allow them some time to amend the balance of your account.

Upheld Claim payments

Payments for upheld claims will be paid into bank accounts in July 2022. Cheques will also be posted out during July 2022. The quickest way to get your claim money is by adding your bank account details to your Portal account. You can set up or log into your account here.

Lucy says

Hey Zoe

Yes it mine was passed to Lowell but I’m on a DMP with stepchange so stepchange have already zerod my account but just waiting Lowell and Provu to talk I emailed my letter to Lowell. You can ask Lowell to put you on a refuse to pay if your letter states it will be void.

Mines been passed to adjucator because the loan amounts did not match original statement.

I read Ashley’s message I believe we just wait for External Debt collectors to sort this.

Zoe says

Hi Lucy thanks for the reply I pay £1 a month off mine so I’ve left it in place for now I did notice the balances were different like yours so I’m goner appeal yes defo will wait for more info .

Ashlee says

Hi mine also was sold to lowell and they’re saying that they won’t write it off regardless and the letter off provident means jack. I called their bluff and phoned ombudsman who said that it should be written off as my rights were the same with lowell as with provident themselves. I’ve a complaint in with lowell over it as their “agent” reduced me to tears arguing and belittling me and if no success I’ll be taking it to ombudsman so let’s hope its sorted before then. My sister has been told the same but she’s not as stubborn as me so is just waiting it out

J scott says

Hi Ashlee, be really curious to know how you get on as my loans were upheld as unaffordable but Lowell said they purchased the debt and therefore own it so refused to zero, nil or close it as they say it’s owed to them and the provident letter doesn’t affect my Lowell account .

Sara (Debt Camel) says

i think this will be sorted in the next few weeks – when Provident tell Lowell which accounts are affected.

J Scott says

I’m hoping so, if not I will have to repay the rest of my outstanding balance to lowell for loans that were marked unaffordable.

Zoe says

Hi Sara I’ve put a appeal in to have my loan balances checked as they don’t match with what’s on the claims with provident just wanted to ask do I still need to put my bank details on the portal if I’m doing a appeal or do I wait to see the outcome and then just let them send a cheque out for whatever I’m owed compensation

Sara (Debt Camel) says

Does it say that you are accepting their offer by putting your bank details in?

Zoe says

Hi Sara it just says the bank account you want your compensation paying in to as it’s the quickest way or they just send a cheque which I don’t mind either is fine just don’t want to put my details and then they say I accepted the offer even though I appealed against it so thinking just let them send a cheque .

Lucy says

Hey Zoe and Sara

Re: Update

I have emailed my original statement to Provi. I sent them a message through portal aswell saying Lowell refuse to void account and that it is unfair on us having to wait even longer for a decision. They have asked me to call them to which i am about to do.

Let you know how I get on.

Zoe says

Hi Lucy How did you get on what did provident say ? Hope it’s good news ? I have appealed against my claim only coz the balance lowell have is £2680.50 which is totally different on the claims with provident so I’ve emailed the statement from Lowell to provident to support my appeal so have to wait and see

Chris Clipstone says

I find your comments very helpful

Julie says

Hi

So, got a email stating debt purchaser had agreed to write off loan. (Lowell)

Then today got email off Lowell stating that this only applies to current provident loans so as my was purchased by them in 2015 I still have to make the agreed payments to them. How unfair is this !!!!