Contents

Quick overview

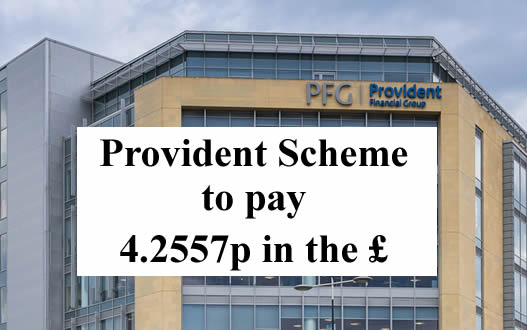

Provident’s Scheme of Arrangement is now in the final stages.

The Scheme was proposed because Provident could not afford to carry on paying full refunds to customers winning affordability complaints. The Financial Ombudsman was upholding 75% of complaints against Provident.

The FCA, Provident’s regulator, said it did not approve of the Scheme. But as Provident has stopped providing doorstep loans, the FCA did not object to the Scheme in court.

It started officially on 5 August 2021 after it was approved in court. The deadline for claims was the end of February 2022.

Provident has assessed claims and informed customers of their decision. The large majority of appeals have been held.

Provident is making payments to bank accounts or sending cheques:

- it is paying 4.2557p in the £;

- so if your redress was £1,000, you will receive about £42;

- a final letter will be uploaded to your portal account setting out the payment;

- the first bank payments will be arriving in accounts on Tuesday 5 July.

Here is confirmation from one reader (see the comments below for others):

FUNDS PENDING!!!

Hi all, I’m new to this to thread but just thought I would give an update.

I have a Monzo account, it is showing my Bacs credit as going into my account on Monday, for most people with standard accounts this means you will be be paid Tuesday

I can also confirm it is 4.2557% as stated.

Glad it’s eventually been sorted.

But no-one should assume they will get their payment next week.

They may be going out in batches. And in any mass payment, some of them fail. Do not plan your July finances on the assumption that you will get paid early in the month.

Which loans were covered by the Scheme?

More than 4 million people were given a loan by Provident that comes under the Scheme.

These loans were given between 6 April 2007 and 17 December 2020.

The loans came from four different brands:

- Provident – often called “doorstep loans” or “home credit”;

- Satsuma payday loans;

- Greenwood – another doorstep loan brand that hasn’t been used since 2014;

- Glo – a very small guarantor loan brand.

If you have an affordability complaint about Vanquis or Moneybarn, these complaints are NOT included in the Scheme. You can still make a normal affordability complaint and get a full refund.

The definition of “unaffordable”

A loan is only “affordable” if you could repay it on time and still be able to pay your other debts, bills and living expenses.

You may have paid the loan on time, but it may still have been unaffordable.

If paying Provident left you so short of money you had to borrow more or you got behind with bills then it was “unaffordable”.

If you had several loans without a break between them, then Provident should have realised you were trapped in a cycle of borrowing and that these expensive loans were not affordable. Even a single loan can be unaffordable if it is large.

Provident pays out on old uncashed cheques

In 2018-20 Provident frequently made very poor offers to people that complained, sending a cheque. They frequently used to offer to refund just a few loans, often not the largest or the most recent. For example, in one case with a large number of loans, Provident upheld a loan for £1,000 but decided the next loan for £2,500 was affordable.

Many thousands of people didn’t cash these and instead sent their complaint to the Ombudsman, where they often got ten times as much! who had made affordability complaints.

When the Scheme was announced, people tried to cash the cheques but some cheques were too old to be bankable. Until now Provident has refused to send out a new cheque. In February 2022, at last Provident relented and refunded this money and people can also make a claim to the Scheme for the extra they should have had.

How much will you be paid?

The next stage is for Provident to divide up the £50 million in the Scheme between the people who have had their complaints upheld.

Customers who made a claim have been told which loans have been upheld and what the total redress for these loans is. You will be paid a percentage of this redress number, not all of it.

When the Scheme was voted on, many people thought they were being told that the payout would be 10%, or 10p in the £. I said at the time that that looked unlikely and it could only have been based on an unusually low number of people making a claim.

For several months Provident quoted a range, saying:

Based on the claims that we have received to date, we estimate that the pence in the pound rate of compensation to be paid to each customer will be between 4-6p.

Now it is known that Provident will only be paying 4.2557p in the £.

A final letter will be added to your portal account setting out what you will be paid.

Credit records will be cleaned

In other schemes and Administrations, some people say getting rid of a default was the most important result for them. Not the small cash refund!

For upheld loans, any defaults or missed payments will be removed from your credit record.

This clean up will be done at the end, when they can do everyone’s together. This is very annoying if you want to make a mortgage application, but there is nothing you can do to speed it up.

If your credit record is not cleaned in this process, there will probably be no-one to complain to about this. But there is process for resolving this sort of problem, see Correct credit records by “suppressing” them if the lender has disappeared.

Current loans

Loans that were sold to a debt collector

If your loan was sold to a debt collector, Provident is trying to get this settled. This seems to be taking some time, for example with Lowell saying they haven’t been given the right information from Provident. Several people are complaining about these in the comments below.

Loans that hadn’t been sold were written off in December 2021

In December Provident announced that it was no longer collecting any payments for existing loans:

There is nothing you need to do. You can stop making payments on your outstanding loans owed to PPC and if your payments are taken by the Continuous Payment Authority (CPA), we will stop these for you. Any payments made after 31st December 2021 will be paid back to you.

If you’re in arrears or didn’t pay your loan within the time we agreed when you got your loan, we’ll update your file with our Credit Reference Agency to show the balance as zero and partially settled.

Your credit record is being changed to show that the loan is partially settled or partially satisfied.

If you are a Provident or Satsuma customer, you should have been told about this by email or letter.

That is a pathetic payout

Provident is a successful company with the profitable Vanquis and Moneybarn brands which are still in business. It is a disgrace that the regulator has allowed them to structure their business in a way that has permitted Provident to abandon all its doorstep lending customers and not pay them their proper redress.

If you are feeling mad that Provident has got away with paying you so little, this is the time to look at whether you can make other affordability complaints, not just for loans but for other types of credit.

I have a separate page for each sort, as they need slightly different template letters to complain:

- refunds for large loans, including Moneybarn and other car finance;

- refunds from catalogues and credit cards such as Vanquis;

- refunds from overdrafts.

Christine Weatherburn Kizzyo says

No I didn’t, I will contact Lowell again and advise them I will be again contacting the financial ombudsmen thank you Sara.

Christine Weatherburn Kizzyo says

Hi Sara,

have finally had a reply off Lowell after hounding them for weeks!! they have confirmed the high court has now agreed for the ccj to be set aside ( I not yet had this in writing) but Lowell said this is now in the hands of the court to remove it from my credit report & can’t give me a time scale so maybe next year I’m hoping, what a farce this has been!!

Dean says

I been waiting for payment t hard a txt from you deliver payment in to my bank account natwest

Sara (Debt Camel) says

Are you trying to contact Provident? This is an independent blog with news, not a part of Provident.

Katie says

Hi, I’m in the process of sorting out my mums debts as she’s considered vulnerable with a long term illness. I’ve been in contact with Lowell to have outstanding debts wiped on the grounds of vulnerability, however they’re not budging on the last one which is Vanquis, from a Provident loan she took out in 2013 (she’s been paying it for years and last payment was October this year so I can’t claim statute barred) she still has just under £500 remaining. My question is, if Lowell purchased the debt, is there any way we can get it scrapped? I know a lot of Provident ones were wiped but it seems unfair that that the ones that were sold off still have to be paid. Thanks ☺️

Sara (Debt Camel) says

it is a shame she didnt make a claim to the Provident Scheme.

Has Lowell agreed to wipe some debts?

Can you say how old your mum is? And what her health problems are? Is she renting? Private or social?

Katie says

Hi Sara, thanks for your reply.

She / I knew nothing about the scheme to be honest. Plus she has a habit of ignoring any letters that are sent, due to her mental health at the time, hence why I’m picking up the pieces now. Lowell wiped the other one she had because it was statute barred. She’s 57 now and suffers terribly from Crohns – her symptoms flair up when she’s stressed and I’ve explained to Lowell’s how this (small) debt is affecting her health. She’s worried it will escalate to court but hasn’t got the means to be able to pay it just yet. And yes, she rents from the council.

Thanks Sara 😊

Sara (Debt Camel) says

apart from this old debt, does she have any other debts? any arrears on bills?

does she own a car?

Katie says

I think she could possibly be behind on her council tax, however I did also get this sorted for her last year; I had it passed from Jacobs enforcement back to the council and they set up a payment plan. I’m not sure if this has finished now though. She hasn’t paid her water bill in over 20 years but I think they’ve given up on that now!

And nope, she doesn’t have a car either. She has no other credit and no credit cards etc.

Sara (Debt Camel) says

So one option is for her t9 offer a £1 a m8nth to Lowell and then repeat the write off request in a year.

Another option if for her to talk to her local Citizens advice about a debt relief order. Which is overkill for ne £500 debt but it could actually clear the accumulated water debts and any council tax arrears.

Sue says

I have received a letter from Lowell Solicitors this morning advising the CCJ in reference to a Provident Loan has been set aside. The CCJ dropped of my credit file in April this year, so not sure why thay have set this aside as it is over 6 years old. There is still a balance outstanding on the loan & I’m worried they will sell this balance to another Company for further recovery. For info, this loan was deemed as irresponsible lending by the administrators & payments have been made to Lowell until April this year. They then closed my account & took no more payments by direct debit.