Have you had big overdraft problems for a long period?

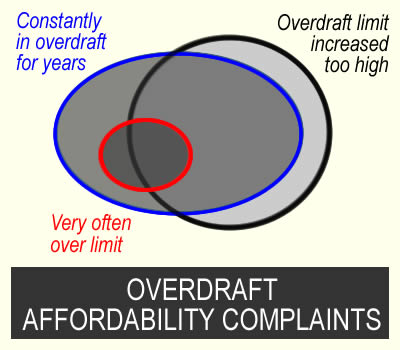

You can make an affordability complaint and ask for a refund of overdraft charges if:

- your overdraft limit was set too high at the start or increased to a level you are unable to clear; or

- your overdraft usage showed you were in long-term financial distress. For example, being in the overdraft all the time, or using an unauthorised overdraft a lot

- your overdraft was originally a student account with no charges, but now interest is being added and you are in the account all or almost all of every month.

This article shows how to make an affordability complaint to your bank, with a free template letter to use. If the bank doesn’t make a you a good offer, it is free to take your case to the Ombudsman.

These complaints do not hurt your credit record. And

Contents

Overdraft affordability complaints

Overdrafts are supposed to be for short-term borrowing

Overdrafts are intended to be used for short-term problems, not as long-term borrowing. A bank should review a customer’s repayment record and overdraft limit and if there are signs of financial difficulty, offer help.

One sign of financial difficulty is hardcore borrowing for a long period. The Lending Code defined hardcore borrowings as “the position where a customer’s current account overdraft remains persistently overdrawn for more than a month without returning to credit during that period”.

Some Ombudsman decisions

All cases are very individual. But these examples give you an indication of what the Ombudsman thinks is important.

In this NatWest decision, the Ombudsman decided:

NatWest did have an obligation to monitor Miss K’s use of her overdraft facility.

Any fair and reasonable monitoring of Miss K’s overdraft facility would have resulted in NatWest being aware Miss K was in financial difficulty … by October 2014 at the absolute latest. So NatWest ought to have exercised forbearance from this point onwards.

In this Santander case, the bank didn’t notice hardcore borrowing:

By this point, Miss C was hardcore borrowing. In other, words she hadn’t seen or maintained a credit balance for an extended period of time. Santander’s own literature suggests that overdrafts are for unforeseen emergency borrowing not prolonged day-to-day expenditure. So I think that Miss C’s overdraft usage should have prompted Santander to have realised that Miss C wasn’t using her overdraft as intended and shouldn’t have continued offering it on the same terms.

Decide which reasons apply to your overdraft complaint

In the overdraft all, or almost all, of the month for a long while

This is the most common reason for winning a complaint

Overdrafts are meant to be used when you have a short term problem. Using the overdraft a lot for a few months is fine. Or for a few days at the end of a month before you are paid.

Banks should review your overdraft annually. This is in most overdraft terms and conditions. And even if it isn’t, the Ombudsman says this is good industry practice.

So at one of these reviews, your bank should have seen if you were in difficulty with the overdraft. For example if you are in the overdraft for all (or almost all) of the month for a prolonged period. Or if you were often exceeding your arranged overdraft limit.

I would say over 18 months or 2 years is prolonged borrowing, not short term.

The bank set your limit too high

This may have been from the start when you were first given an overdraft. Or the initial low limit may have been fine, then the bank increased it to a level which it was impossible for you to repay.

If the bank saw signs of financial difficulty, it should not have increased your credit limit, even if you asked for it. And it should have considered offering your help instead (the regulator’s word is forbearance), for example by stopping charges.

But what is too high?

This depends on your income and expenses. An overdraft of £2,000 for someone whose income is £1,800 a month is a lot – but if you earn £5,000 a month, then a £2,000 overdraft may be reasonable.

Other points that help a complaint

You won’t win an affordability complaint by saying the charges were too high.

Instead, you say the bank should have known they were unaffordable for you because of all the financial problems it could see on your statements and your credit record.

Here is a checklist, do any apply to you?

- often having direct debits or standing orders not being paid;

- a lot of gambling showing on your statements;

- significantly increasing other debts with the same bank (you may also be able to complain about those loans or credit card);

- being recently rejected for a loan or a credit card by the bank;

- significantly increasing debts with other lenders showing on your credit record;

- a worsening credit record – maxed out credit cards, new missed payments, payment arrangements, defaults etc;

- using payday loans;

- mortgage arrears;

- a reduction in the income going into your account.

Free student overdrafts

You can only win a complaint about these after the bank has started charging you interest

Making your complaint

What you need at the start

You don’t need to know the dates your limit was increased before complaining, my template asks for them.

You don’t need to send statements to the bank with your complaint – the bank already has them!

You can’t go back and see exactly what your credit score was in say 2021 when the bank increased your limit. But your current credit record shows what was happening back six years, so download your credit report now and keep it. The sooner you get the report, the further back it goes. I suggest you get your free TransUnion statutory credit report.

Send a complaint by email

I don’t recommend phoning to start off a complaint. It’s too complicated and you will be talking to someone that doesn’t specialise in these complaints.

I think email is the simplest way to make these complaints. Here is my list of bank email addresses for complaints.

An alternative is to send a long message in the app. But if this means using a chat facility, it’s not usually a good idea, as you are again talking to someone who doesn’t understand what you are saying and tries to tell you what help is available with your overdraft – when all you want is to have your complaint considered.

A template you can adapt

In the template below, I’ve invented some examples and dates so you can see how a complaint email could read. The bits in italics should be changed or deleted to tell your story. Delete dates if you don’t know them. If a sentence doesn’t sound relevant, delete it.

I am making an affordability complaint about the overdraft on my current account number 98765432.

Your identity details (these are needed if you complain by email, not if you use secure message):

My name is xxxxx xxxxxxxx. My date of birth is dd/mm/yy. The email address I use/used for this account was myaddress@whatever.com.

Your home address (if you know the bank has your current address, ignore this):

My current address is xxxxxxxxxxxxxxxxxxxx. Please do not send any letters to older addresses you may have on your records.

If your overdraft was originally a student overdraft with no interest include this, otherwise delete it:

My account started as a student overdraft and no fees were charged. I am complaining about the period after, when you started to charge fees.

START BY SAYING they should have noticed your financial difficulty

Overdrafts are meant for short-term borrowing but you could see I was unable to clear the balance in a sustainable way. I was using the account for long term borrowing as I could not get out of this. The fees and charges you were adding were making my position worse.

I am complaining that [every year since [20xx] OR for many years] you have failed to notice my difficulty during the annual reviews of my overdraft. You should have offered forbearance eg by stopping interest and charges being added.

By 2017 I had been in my overdraft constantly for many months, not getting back into the black even when I was paid. This “hardcore borrowing” is a clear sign of financial difficulty. My income was only £1,850 a month – after I had paid bills, there was no way I could hope to clear an overdraft of £3500 in a reasonable length of time.

OR

By 2021, although my salary took my account briefly into credit, within a few days, I was back in the overdraft.

include any other points that show you were in difficulty

You should have seen that I was in financial difficulty because you rejected my loan application in 2021.

You should have noticed that the income going into my account decreased from 2020.

From 2020-22 there was a lot of gambling showing on my account.

In 2022 and 2023 there were a lot of rejected direct debits on my account.

… or anything else!

Say if the initial limit was too high or it was increased too high

You should never have given me an account with such a large overdraft. When I applied, you should have checked my credit record and income and seen I had recently missed payments to a credit card and had taken several payday loans.

OR

You should not have increased my overdraft limit. When you increased the limit, you should have seen that my debts to other lenders on my credit record had increased a lot

OR (for accounts that had been student accounts)

You should have seen after [2020] when you started charging interest that the limit was too high to be repayable on my income.

In your reply to this complaint, please tell me when any limit increases were and how much the limit went up.

END BY asking for a refund of charges and interest:

I would like you to refund all the interest and charges that were added to my account from 2016 when you increased my overdraft limit.

OR

I would like you to refund all the interest and charges that were added to my account from 2021 when you should have realised that my finances had got worse to the point that I was no longer able to clear the overdraft.

Please remove any late payment and default markers from my credit records.

Points to note

Student overdrafts

You won’t win a complaint about a student overdraft saying you were a student and it was unaffordable at that point.

But when the bank has started charging interest, it should start doing reviews and check if you are in difficulty. So from then on, you can win affordability complaints.

You can complain if the account is still being used or if it is closed

These complaints can be made if:

- you are still using the account or you have stopped using it and are paying it off;

- the account has been closed;

- the bank defaulted it and sold it to a debt collector (here you still complain to the bank, not the debt collector). If the debt collector has gone to court and got a CCJ, add a sentence to the template saying you want the CCJ removed as part of the settlement of your complaint.

But if you have had an IVA or bankruptcy after these problems, or if you are still in a DRO, then you shouldn’t complain – ask in the comments below for details.

Old accounts

Banks may say FOS won’t look at an old complaint, but this isn’t right. FOS will often look at a complaint if it has been open in the last six years. How far back FOS will go seems rather random, but it should be possible to go back at least 6 years.

Open and recently closed accounts aren’t a problem – the bank will still have your statements.

If your complaint is about an account that was closed more than 6 years ago, it’s going to be very hard to win.

Packaged bank accounts

These affordability complaints are not about the fees on packaged bank accounts. MSE has a page about packaged bank account charge complaints.

Personal accounts, not business accounts

The complaints covered here relate to personal accounts. For business accounts, talk to Business Debtline about your options.

The Bank replies

They want to phone me!

People are often scared if they get this message. But it may be good news! You can just ignore it or say you would like a reply in writing.

If you decide to take the call, it helps to be prepared:

- have a pen and paper handy so you can write down anything

- if they say they are partially upholding the complaint, ask them the date they are refunding the fees from, and how much. And say you would like to see this in writing before you decide whether to accept it.

- if they ask you questions that sound complicated or worrying, ask them to put the questions in writing as you find the phone difficult

- when they say they are rejecting the complaint, ask for this in writing, as you will be going to the Ombudsman.

Rejection/poor offer – go to the Ombudsman , it’s free

Banks reject many good complaints, hoping you will give up. So don’t! You know if the overdraft has caused you a lot of problems.

You can’t go straight to the Financial Ombudsman (FOS), you have to wait for the bank to reply, or for them to have not replied within 8 weeks.

Here are some things banks may say to try to put you off:

- you could have declined the increase to your overdraft limit – FOS probably won’t think that is a good reason

- you never let the bank know you were in difficulty – FOS probably won’t think that is a good reason

- your salary was enough to return you to credit each month – this is misleading if bills meant you soon went into the overdraft;

- FOS will not look into things that happened more than 6 years ago – if your account was still open in the last 6 years FOS may well look at it.

And the bank may offer to refund fees for the last 15 months say, even though your problems have been large for many years. Think twice about accepting a low offer – you won’t put this offer at risk by going to the Ombudsman.

If you are offered a refund for the last 6 years but not any further back, have a think if this is a good enough offer. It is unpredictable whether the ombudsman will be prepared to go back further than 6 years.

If you aren’t sure, post in the comments below.

To send the case to FOS, complete this online form:

- you can use what you put in your complaint to the bank;

- if the bank rejected your complaint or made a low offer, say why you think this is unfair;

- use normal English, not legal terms.

You don’t need to send your bank statements – the bank will send those to FOS. And you don’t need the policy documents for your bank account, the lender will supply those to FOS if they are needed.

Do these complaints work?

Yes! From 2024, some banks are making more offers directly.

A Guardian article featured a case where someone used the template letter here. Barclays denied it had done anything but made an £8,000 “goodwill” payment to the customer.

And if your bank rejects your case, people are winning cases at the ombudsman. FOS is a friendly service although it isn’t speedy. It isn’t faster to use a solicitor or a claims firm,

The comments below this article are from other people who have made this sort of complaint. That is a good place to ask for help if you aren’t sure what to do.

Refunds from unaffordable loans

Emma j says

Halifax have contacted me so I put a complaint in for £3000 for my over draft going back 6 years even though Iv had it for 15 years thy said they can only go back 6 years

They have agreed to my complaint and offered me £6000 and out of this they will take away my over draft. So that leaves me with £3000 to pay off other debts.

They have stopped my daily fees also till I get the money in mid Feb. Would you say this is a win! Iv been waiting since May 2025

Sara (Debt Camel) says

Well it helps you out of the current mess.

In theory the ombudsman could decide to go back further, but the vast majority of cases only get a refund for 6 years, so taking this as win may be the most practical thing to do.

Emma j says

Brilliant I will do then thank you so so much I’m

Going into 2026 debt free

Anne says

I used the HSBC email address in your list. Should I at least get an immediate automated reply to say it’s been received, or is it just a case of waiting for an actual person to confirm receipt and that it’s being dealt with? Do you know how long this should take if it’s not an automated response?

Sara (Debt Camel) says

If you haven’t had a response in the next four weeks, phone them up and ask what is the progress on your complaint

Cara says

Hi Sara,

I sent my complaint about my Natwest overdraft to the FOS. A case owner contacted me before Christmas to uphold the complaint and wrote to Natwest. The case owner has now stopped working on my case (possibly off sick, I’m not sure). A new case owner has been assigned. Is it usual that a case owner changes the decision of a previous case owner in this way? They asked me about payments into my account which I told them were payments for work my husband carried out for friends who used my bank account in error. These payments were then moved to my husbands account. The case owner has included these payments in figures for my income. They said I had disposable income of £1,500 even though at the time my wages were less than that without any bills going out etc. Can they assign my partners income to me even though we don’t share our finances in this way? My husband was self employed also so no account was taken of the payments not being his actual wages – tax, NI, materials etc had to be taken out of the money. I have written back to the FOS to say I do not accept the decision. My overdraft was £3,600.

Sara (Debt Camel) says

This sounds a decision that should be challenged

Cara says

Thank you. I have sent a message to the case owner advising i do not agree with their decision and letting her know my husbands income was his not mine. Hopefully the decision will be changed

EmJ says

Thank you so much for your template it helped me write an email to Halifax because I have had my £3000 overdraft now for over 15 years. I complained May 2025 so it has took a long time and to be honest I thought it would be too good to be true but fast forward to now I have had a phone call and they are giving me £6000 so with this I can wipe my overdraft off. Pay off my credit card and pay off a small store card I have! They could only go back 6 years which is fine. I won’t have much left after paying things off but what ever is left will go towards a family holiday this year. I honestly can’t thank

You enough x

David says

Hi i submitted a complaint to Lloyds in May 2025. I have just called them today for an update and they have said there is currently no update and it has not been allocated to case manager. Any advice on what i should do next would be appreciated, they have said they are still in the data gathering stage

Sara (Debt Camel) says

They aren’t data gathering, your complaint is just sitting in a pile somewhere.

Send this to the Ombudsman now, using the FOS online form linked to in the article above. This sort of extreme delay is unreasonable

Hollie says

Hi,

I completed an affordability complaint on my Lloyd overdraft.

I sent this in may 2025, I rang every four weeks there about to chase the progress. Jan 2026 now and still no-one allocated as a case manager or any progress.

Can I challenge this or is this standard, from what I’ve read people do seem to be getting responses much quicker but I know it may vary from bank to bank.

I haven’t taken it to FOB yet, as ideally wanted to wait to see what lloyds said first.

Any suggestions? Should I just take it to FOB or is it worth waiting.

Sara (Debt Camel) says

Send this to the Ombudsman now. This sort of extreme delay is unreasonable