Have you had big overdraft problems for a long period?

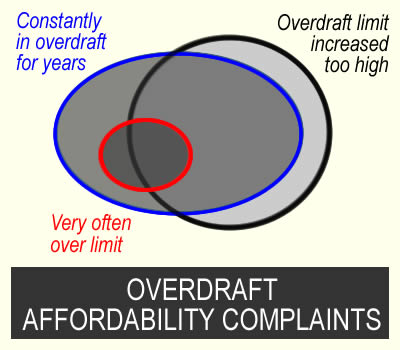

You can make an affordability complaint and ask for a refund of overdraft charges if:

- your overdraft limit was set too high at the start or increased to a level you are unable to clear; or

- your overdraft usage showed you were in long-term financial distress. For example, being in the overdraft all the time, or using an unauthorised overdraft a lot

- your overdraft was originally a student account with no charges, but now interest is being added and you are in the account all or almost all of every month.

This article shows how to make an affordability complaint to your bank, with a free template letter to use. If the bank doesn’t make a you a good offer, it is free to take your case to the Ombudsman.

These complaints do not hurt your credit record. And

Contents

Overdraft affordability complaints

Overdrafts are supposed to be for short-term borrowing

Overdrafts are intended to be used for short-term problems, not as long-term borrowing. A bank should review a customer’s repayment record and overdraft limit and if there are signs of financial difficulty, offer help.

One sign of financial difficulty is hardcore borrowing for a long period. The Lending Code defined hardcore borrowings as “the position where a customer’s current account overdraft remains persistently overdrawn for more than a month without returning to credit during that period”.

Some Ombudsman decisions

All cases are very individual. But these examples give you an indication of what the Ombudsman thinks is important.

In this NatWest decision, the Ombudsman decided:

NatWest did have an obligation to monitor Miss K’s use of her overdraft facility.

Any fair and reasonable monitoring of Miss K’s overdraft facility would have resulted in NatWest being aware Miss K was in financial difficulty … by October 2014 at the absolute latest. So NatWest ought to have exercised forbearance from this point onwards.

In this Santander case, the bank didn’t notice hardcore borrowing:

By this point, Miss C was hardcore borrowing. In other, words she hadn’t seen or maintained a credit balance for an extended period of time. Santander’s own literature suggests that overdrafts are for unforeseen emergency borrowing not prolonged day-to-day expenditure. So I think that Miss C’s overdraft usage should have prompted Santander to have realised that Miss C wasn’t using her overdraft as intended and shouldn’t have continued offering it on the same terms.

Decide which reasons apply to your overdraft complaint

In the overdraft all, or almost all, of the month for a long while

This is the most common reason for winning a complaint

Overdrafts are meant to be used when you have a short term problem. Using the overdraft a lot for a few months is fine. Or for a few days at the end of a month before you are paid.

Banks should review your overdraft annually. This is in most overdraft terms and conditions. And even if it isn’t, the Ombudsman says this is good industry practice.

So at one of these reviews, your bank should have seen if you were in difficulty with the overdraft. For example if you are in the overdraft for all (or almost all) of the month for a prolonged period. Or if you were often exceeding your arranged overdraft limit.

I would say over 18 months or 2 years is prolonged borrowing, not short term.

The bank set your limit too high

This may have been from the start when you were first given an overdraft. Or the initial low limit may have been fine, then the bank increased it to a level which it was impossible for you to repay.

If the bank saw signs of financial difficulty, it should not have increased your credit limit, even if you asked for it. And it should have considered offering your help instead (the regulator’s word is forbearance), for example by stopping charges.

But what is too high?

This depends on your income and expenses. An overdraft of £2,000 for someone whose income is £1,800 a month is a lot – but if you earn £5,000 a month, then a £2,000 overdraft may be reasonable.

Other points that help a complaint

You won’t win an affordability complaint by saying the charges were too high.

Instead, you say the bank should have known they were unaffordable for you because of all the financial problems it could see on your statements and your credit record.

Here is a checklist, do any apply to you?

- often having direct debits or standing orders not being paid;

- a lot of gambling showing on your statements;

- significantly increasing other debts with the same bank (you may also be able to complain about those loans or credit card);

- being recently rejected for a loan or a credit card by the bank;

- significantly increasing debts with other lenders showing on your credit record;

- a worsening credit record – maxed out credit cards, new missed payments, payment arrangements, defaults etc;

- using payday loans;

- mortgage arrears;

- a reduction in the income going into your account.

Free student overdrafts

You can only win a complaint about these after the bank has started charging you interest

Making your complaint

What you need at the start

You don’t need to know the dates your limit was increased before complaining, my template asks for them.

You don’t need to send statements to the bank with your complaint – the bank already has them!

You can’t go back and see exactly what your credit score was in say 2021 when the bank increased your limit. But your current credit record shows what was happening back six years, so download your credit report now and keep it. The sooner you get the report, the further back it goes. I suggest you get your free TransUnion statutory credit report.

Send a complaint by email

I don’t recommend phoning to start off a complaint. It’s too complicated and you will be talking to someone that doesn’t specialise in these complaints.

I think email is the simplest way to make these complaints. Here is my list of bank email addresses for complaints.

An alternative is to send a long message in the app. But if this means using a chat facility, it’s not usually a good idea, as you are again talking to someone who doesn’t understand what you are saying and tries to tell you what help is available with your overdraft – when all you want is to have your complaint considered.

A template you can adapt

In the template below, I’ve invented some examples and dates so you can see how a complaint email could read. The bits in italics should be changed or deleted to tell your story. Delete dates if you don’t know them. If a sentence doesn’t sound relevant, delete it.

I am making an affordability complaint about the overdraft on my current account number 98765432.

Your identity details (these are needed if you complain by email, not if you use secure message):

My name is xxxxx xxxxxxxx. My date of birth is dd/mm/yy. The email address I use/used for this account was myaddress@whatever.com.

Your home address (if you know the bank has your current address, ignore this):

My current address is xxxxxxxxxxxxxxxxxxxx. Please do not send any letters to older addresses you may have on your records.

If your overdraft was originally a student overdraft with no interest include this, otherwise delete it:

My account started as a student overdraft and no fees were charged. I am complaining about the period after, when you started to charge fees.

START BY SAYING they should have noticed your financial difficulty

Overdrafts are meant for short-term borrowing but you could see I was unable to clear the balance in a sustainable way. I was using the account for long term borrowing as I could not get out of this. The fees and charges you were adding were making my position worse.

I am complaining that [every year since [20xx] OR for many years] you have failed to notice my difficulty during the annual reviews of my overdraft. You should have offered forbearance eg by stopping interest and charges being added.

By 2017 I had been in my overdraft constantly for many months, not getting back into the black even when I was paid. This “hardcore borrowing” is a clear sign of financial difficulty. My income was only £1,850 a month – after I had paid bills, there was no way I could hope to clear an overdraft of £3500 in a reasonable length of time.

OR

By 2021, although my salary took my account briefly into credit, within a few days, I was back in the overdraft.

include any other points that show you were in difficulty

You should have seen that I was in financial difficulty because you rejected my loan application in 2021.

You should have noticed that the income going into my account decreased from 2020.

From 2020-22 there was a lot of gambling showing on my account.

In 2022 and 2023 there were a lot of rejected direct debits on my account.

… or anything else!

Say if the initial limit was too high or it was increased too high

You should never have given me an account with such a large overdraft. When I applied, you should have checked my credit record and income and seen I had recently missed payments to a credit card and had taken several payday loans.

OR

You should not have increased my overdraft limit. When you increased the limit, you should have seen that my debts to other lenders on my credit record had increased a lot

OR (for accounts that had been student accounts)

You should have seen after [2020] when you started charging interest that the limit was too high to be repayable on my income.

In your reply to this complaint, please tell me when any limit increases were and how much the limit went up.

END BY asking for a refund of charges and interest:

I would like you to refund all the interest and charges that were added to my account from 2016 when you increased my overdraft limit.

OR

I would like you to refund all the interest and charges that were added to my account from 2021 when you should have realised that my finances had got worse to the point that I was no longer able to clear the overdraft.

Please remove any late payment and default markers from my credit records.

Points to note

Student overdrafts

You won’t win a complaint about a student overdraft saying you were a student and it was unaffordable at that point.

But when the bank has started charging interest, it should start doing reviews and check if you are in difficulty. So from then on, you can win affordability complaints.

You can complain if the account is still being used or if it is closed

These complaints can be made if:

- you are still using the account or you have stopped using it and are paying it off;

- the account has been closed;

- the bank defaulted it and sold it to a debt collector (here you still complain to the bank, not the debt collector). If the debt collector has gone to court and got a CCJ, add a sentence to the template saying you want the CCJ removed as part of the settlement of your complaint.

But if you have had an IVA or bankruptcy after these problems, or if you are still in a DRO, then you shouldn’t complain – ask in the comments below for details.

Old accounts

Banks may say FOS won’t look at an old complaint, but this isn’t right. FOS will often look at a complaint if it has been open in the last six years. How far back FOS will go seems rather random, but it should be possible to go back at least 6 years.

Open and recently closed accounts aren’t a problem – the bank will still have your statements.

If your complaint is about an account that was closed more than 6 years ago, it’s going to be very hard to win.

Packaged bank accounts

These affordability complaints are not about the fees on packaged bank accounts. MSE has a page about packaged bank account charge complaints.

Personal accounts, not business accounts

The complaints covered here relate to personal accounts. For business accounts, talk to Business Debtline about your options.

The Bank replies

They want to phone me!

People are often scared if they get this message. But it may be good news! You can just ignore it or say you would like a reply in writing.

If you decide to take the call, it helps to be prepared:

- have a pen and paper handy so you can write down anything

- if they say they are partially upholding the complaint, ask them the date they are refunding the fees from, and how much. And say you would like to see this in writing before you decide whether to accept it.

- if they ask you questions that sound complicated or worrying, ask them to put the questions in writing as you find the phone difficult

- when they say they are rejecting the complaint, ask for this in writing, as you will be going to the Ombudsman.

Rejection/poor offer – go to the Ombudsman , it’s free

Banks reject many good complaints, hoping you will give up. So don’t! You know if the overdraft has caused you a lot of problems.

You can’t go straight to the Financial Ombudsman (FOS), you have to wait for the bank to reply, or for them to have not replied within 8 weeks.

Here are some things banks may say to try to put you off:

- you could have declined the increase to your overdraft limit – FOS probably won’t think that is a good reason

- you never let the bank know you were in difficulty – FOS probably won’t think that is a good reason

- your salary was enough to return you to credit each month – this is misleading if bills meant you soon went into the overdraft;

- FOS will not look into things that happened more than 6 years ago – if your account was still open in the last 6 years FOS may well look at it.

And the bank may offer to refund fees for the last 15 months say, even though your problems have been large for many years. Think twice about accepting a low offer – you won’t put this offer at risk by going to the Ombudsman.

If you are offered a refund for the last 6 years but not any further back, have a think if this is a good enough offer. It is unpredictable whether the ombudsman will be prepared to go back further than 6 years.

If you aren’t sure, post in the comments below.

To send the case to FOS, complete this online form:

- you can use what you put in your complaint to the bank;

- if the bank rejected your complaint or made a low offer, say why you think this is unfair;

- use normal English, not legal terms.

You don’t need to send your bank statements – the bank will send those to FOS. And you don’t need the policy documents for your bank account, the lender will supply those to FOS if they are needed.

Do these complaints work?

Yes! From 2024, some banks are making more offers directly.

A Guardian article featured a case where someone used the template letter here. Barclays denied it had done anything but made an £8,000 “goodwill” payment to the customer.

And if your bank rejects your case, people are winning cases at the ombudsman. FOS is a friendly service although it isn’t speedy. It isn’t faster to use a solicitor or a claims firm,

The comments below this article are from other people who have made this sort of complaint. That is a good place to ask for help if you aren’t sure what to do.

Refunds from unaffordable loans

Thomas says

Hi Sara – £600 awarded by Natwest out of goodwill. But bank charges and interest going back 6 years was £6,300 and they have rejected this. Any particular wording I should use in the complaint to the Ombudsman? Thanks for all your help.

Sara (Debt Camel) says

Use the Ombudsman’s online form (https://help.financial-ombudsman.org.uk/help) as that asks for a lot of little things they need to set up the complaint in their system cirrectly, like your date of birth and whether this is a joint account.

Use some of the language from your complaint to Natwest. Point out Natwest should have seen the gambling on your bank statements and your very heavy overdraft usage.

Say this has affected you by keeping you trapped in the overdraft continuously for many years.

Ask for a refund of the bank charges going back to xxxx – pick a date at which you feel your situation got extremely bad.

Helen says

I sent my natwest overdraft complaint to the ombudsman I have had a reply today to say it is being looked into. They have stated the below

will be looking further into the checks completed by NatWest Bank prior to accepting your overdraft application and any limit increases. I will consider whether these were reasonable and proportionate in the circumstances of your complaint. I will assess the final response letter issued and whether this is a fair outcome in the circumstances of your complaint.

Should I also say that I’ve hardly been out of it in the last few years? And racked lots of charges up sone unpaid dds etc?

Sara (Debt Camel) says

yes. And also say that you understand it is good practice for a bank to revioew overdrafts annually and you do not believe that Natwest made proper checks there.

Helen says

So I did say this after I got this response from

The adjudicator . I have reiterated that the bank failed to make other checks so do you think it’s worth responding?

can confirm that having assessed all of the available evidence, I was unable to confirm that NatWest Bank had offered you this overdraft irresponsibly.

I appreciate that you may have started to utilise PayDay Loans. However, we would only look at the account activity, and existing credit commitments etc at the point of the overdraft being applied to the account.

Considering all of the checks carried out by NatWest Bank at that time, there was no evidence that this would be unaffordable to you.

I appreciate that this is frustrating as your financial situation could have changed since then. However, at the time that the overdraft was applied/increased there was no evidence to suggest that this was unaffordable to you.

Sara (Debt Camel) says

I suggest you respond that you have read https://www.financial-ombudsman.org.uk/decision/DRN5869499.pdf which says:

“Taking all of this into account, I find that NatWest didn’t act fairly and reasonably towards Miss K. It continued to provide and charge Miss K for her overdraft facility when her account usage (and what she more likely than not said in October 2014) ought reasonably to have shown she was having difficulty meeting her commitments and her debt had become unsustainable in circumstances where she was experiencing financial difficulty.”

and you consider exactly the same arguments apply to your case – that Natwest should have seen from your continuos very heavy overdraft usage and the payday loans that the overdraft had become unsustainable for you.

Ask for this to go to an Ombudsman if the adjudicator does not change their mind.

Helen says

Thank you I’ve replied to that effect. Do they normally relook at it after making a decision ? I just feel that they have missed the point a bit.

Sara (Debt Camel) says

They can decide to look again.

Helen says

So the adjudicator won’t relook at it so I have asked for it to be passed to the ombudsman to make final decision. Do you think it’s worth doing that?

Sara (Debt Camel) says

definitely!

Helen says

So you think I should point anything else out to the ombudsman such as I had direct debits returned including some loan payments as well as several

Pay day loans being taken out over

The last few years?

Sara (Debt Camel) says

yes point out all those things.

Jax says

Hey, is one adjudicator usually signed to a specific bank? I’m getting the same(ish) response to my NatWest overdraft claims. I’ve submitted a lot of claims and a few of them are out of time with the six year rule but the adjudicator has been suitably persuaded that I fall under the three year rule as I only found out about affordability claims last year. My overdrafts with NatWest were taken out in 2002 and 2016 and settled respectively in 2008 and 2016, but the 3 year principal should still apply- especially since the last overdraft was paid off by getting a loan with NatWest. How can I be reasonably aware if I didn’t know that I had recourse to complain?! The adjudicator keeps making ref to the fact that since 2009 I made unsuccessful applications for bank loans with NatWest (being successful in 2016) so I should have been aware of their lending rationale, but I’ve counter argued that just because they may have made a responsible decision those times doesn’t mean the 2016 one was correct. I’m gonna take it to ombudsman but reading about the response to NatWest overdraft decisions, I can’t help thinking the same person must be adjudicating for all of NatWest overdraft claims- and I therefore don’t think they are doing a good job.

Sara (Debt Camel) says

Not normally.

The point about loans being rejected isn’t very good. A bank may reject a loan because it is considering the amount of risk it wants to take – a lot of banks were offering less credit in 2009-12. Unless you were told a loan application was rejected as you would not be able to afford it ( which is unlikely) the rejection may well have had nothing to do with affordability.

Helen says

So after I sent my credit report and back statement over the investigator agreed to look again but then came back with the below response:. I then went back and said I thought they had an obligation to review the overdraft every year but he won’t budge if

I am unable to agree that NatWest Bank have acted unfairly in the circumstances of your complaint – or, that they acted irresponsibly by offering you this overdraft and any of the limit increases.

I appreciate the point that you have raised in relation to the payday loans that you took.

However, upon reviewing the credit report, it’s clear that these were taken from 2019 onwards.

The last overdraft increase applied to your account was on 2 December 2009.

There has been some time since this and therefore these payday loans would not be relevant to be considered as part of this investigation.

I can also see from the credit report that you opened several mail order accounts from around 2017 onwards.

Once again, these would not be relevant as these were not in place prior to your overdraft being set up or any of the limit increases.

I have reviewed the existing credit agreements that you held prior to the overdraft and last increase in December 2009.

Having reviewed these, I am unable to agree that this overdraft was unaffordable to you.

I have seen no evidence to suggest that by approving your application and raising the overdraft limit, that this was unaffordable .

Sara (Debt Camel) says

Go back to the adjudicator and say that what happened after 2009 is also relevant to your complaint as Natwest has failed to review your overdraft annually despite your persistent and long term heavy usage. Ask him to be clear why he is not taking this into account.

This sounds like it will have to go to an Ombudsman but it’s good to get a clear answer from the adjudicator on this point first.

Helen says

Thank you for your response. Is it very often the ombudsman disagrees with the investigator?

Sara (Debt Camel) says

It happens! Well worth pushing this. Even if you only get 6 years refunded, that is better than nothing/

Helen says

So the investigator came back withthis.

As I have confirmed previously, with irresponsible and unaffordable lending complaints, we look at the checks carried out at the point of application and any limit increases.

I appreciate your feelings on this and the further information you have supplied. However, my view remains the same.

Your emails will all be reviewed by the ombudsman and considered as part of their final decision. I will next be in touch in the coming weeks when I have a further update for you.

Helen says

What do you think to this Sara

Sara (Debt Camel) says

I think you are right to ask for this to be looked at by an Ombudsman.

James says

Only a few days left before NatWest have to accept/decline/ask for more time to respond to my adjudicators decision.

If it does get passed to an Ombudsman because they don’t come back to the adjudicator or whatever, is that then another long wait in a pile of cases or does that all happen pretty quickly?

Thanks

Sara (Debt Camel) says

It’s typically 2-3 months. Can be less or more.

Sometimes a lender pops up after a few weeks and says they accept the offer.

James says

Ahhhh annoying. Assumed it was the adjudicator which was the long wait. Oh well, fingers crossed.

Is there any benefit to the bank accepting adjudicators ruling rather than just going to full ombudsman?

Thanks

Sara (Debt Camel) says

yes, only Ombudsman decisions are actually published on the FOS decision site (the consumer’s name is anonymised so you would be Mr J).

James says

Blimey, if that’s the only incentive to not going all the way to ombudsman then not sure why they ever accept the adjudicators decision.

Sara (Debt Camel) says

oh it also takes up more of their time. And the 8% added interest gets bigger. And it will REALLY annoy the Ombudsman if they do this a lot: the lender will be called in for a chat, if there is a real reason, the Ombudsman will work with the lender show why they are making the decisions they do, if necessary the Ombudsman will go to the trouble of a key decision on a typical case (these can be 20+ pages long), and the FCA will be informed.

Ann says

Hi I recently emailed in an affordability complaint, re my overdraft with Lloyds, around 10 days ago. I wasn’t sure whether you get any confirmation from them to say it’s been received etc so was going to leave it a while longer then check with them but late afternoon today, I had a text message from somebody at Lloyds saying they would like to speak to me about my complaint and would be phoning me but not to worry if I missed the call as they would try again. I’m really worrying about talking to her on the phone in case I say the wrong thing, I’m on medication which makes me forgetful etc but would it go against me if I don’t talk to them?

Thank you so much for all the advice and hard work you put in helping us all out x

Sara (Debt Camel) says

I suggest you answer The call but just ask them to reply in writing as the phone makes you anxious and you are on medication that makes your forgetful.

Mary says

Hi Sara

I got an email from a FOS investigator, I replied answering their questions and now they’ve replied saying they can’t help as they believe I’ve brought my complaint to them out of time.

OD was approved and increased a few times in 2015, I was not working nor did I have any benefits going into the account. I was also in the midst of a gambling addiction (no longer a problem). I applied for a loan to clear the OD when I started working in 2019ish and it was declined.

My last OD increase was June 2015. I’m still in the overdraft. I explained to them that I only became aware of banks irresponsible lending complaints this year like many people tbf.

I’m not sure what to do now.

Sara (Debt Camel) says

Which bank is this?

The account is still open? How many days of the month, roughly, are you in the overdraft?

Mary says

RBS. Account is open. Everyday the OD is maxed out and has been for years.

Sara (Debt Camel) says

“I was also in the midst of a gambling addiction “

Did you mention that as a reason why you did not complaint earlier?

“I applied for a loan to clear the OD when I started working in 2019ish and it was declined.”

Did the adjudicator’s decision specifically mention this, saying you should have complained at that time?

To be clear, you should definitely ask for this to be looked at by an Ombudsman. It is just a question of any specific points it is worth making.

Mary says

Yes, I told them about the gambling and that I had no income.

Yes, they specifically mentioned that. They said ‘You ought to have been aware at this point that the overdraft was unaffordable to you and that The Royal Bank of Scotland may have done something wrong’

Sara (Debt Camel) says

So I suggest you go back to the adjudicator and make the following points:

For many years until I stopped being a problem gambler [9 months ago, in early 2020, whatever] it was impossible for me to think rationally about my money. Back in 2015 I was not working and had no income going into the bank account, I relied on the overdraft and at the same time I hoped that I would be able to clear it with a big win, which of course never happened. But every month for years was trying to get through to the next month. I didn’t blame RBS for this, I thought it was entirely my fault. Also I had no idea that RBS should have checked the overdraft increases were affordable so how could I have complained about something I did not realise was wrong?

I think you should take into account that a problem gambler is in a vulnerable position and not expect that they can just stop gambling or be able to risk the overdraft which at the time I saw as my lifeline.

I applied for a loan when I was working to try to bring down the cost of the overdraft. That doesn’t mean at that point that I thought the overdraft was “unaffordable” – at that point I still had not heard of that concept. I just though the loan would be cheaper. When it was declined I just thought I had to work harder to get myself out of the mess I was in. At that point I still had no idea that RBS was at fault for increasing the overdraft limit to an unsustainable level.

As soon as I found out [in month/year, earlier this year, whatever] what an affordability complain was I realised that RBS was partly to blame for my financial difficulties over the years. They should never have increased my limit because of the gambling and they should not have allowed me to carry on being in the overdraft every day of the month for many years with no way of getting out of it as the overdraft was larger then my income.

So I think I have complained within 3 years of knowing that I had a cause to complain so FOS should look at my complaint right back to 2015.

But even if FOS deicide you cant do that, you should still be able to go back 6 years. Because RBS should have reviewed by overdraft annually and for the the last 6 years (and before that too) they failed to do this as any check would have shown that I was in massive financial difficulty and the overdraft charges every month have made that worse.

CM says

I have a similar complaint with rbs for a 1500 overdraft I have been in for 18 years. RBS refused to look into the complaint due to the 6 year/3 year rule. About 2 months ago I complained to the ombudsman and received this response.

“I am writing about your complaint with RBS. I’m sorry that things still haven’t yet been resolved.

However, the Ombudsman are still working through the clarification from the Supreme Court about consumer credit agreements. They know customers have been waiting a while and as soon as I can I’ll let you know what I think.

In the meantime, I will continue to update you around every 30 days. You don’t need to do anything further at this stage. ”

Can you please advise me what this means and is this likely to be a lengthy process?

Sara (Debt Camel) says

FOS is looking at whether it should change the way it makes the decision on whether to go back further than 6 years. If it does, it will be generally good news for affordability complaints.

So far as I can tell, FOS has issued some key decisions on this and is waiting to see if the lenders decide to dispute any by going to court.

Mark says

Dear Sara

In March this year Lloyds Bank promptly agreed an o/d affordability complaint and refunded charges that went back 6 years to March 2017. I do understand there is a regulatory 6 years (but this is voluntary isn’t it, not written in stone that would prevent them going back further?).

The o/d was first approved in March 2005 and in their letter agreeing my complaint Lloyds stated they should not have granted the overdraft when I “first applied in 2017”. I didn’t first apply for o/d in 2017…it was 2005. Lloyds have just seamlessly continued this o/d arrangement without any reviews.

I had referred matter of charges 2005 -2016 to FOS, sending copy of Lloyds “agree complaint” letter but didn’t point out this “typo”saying 2017 instead of 2005 as I hadn’t noticed it. The FOS response is I should have known it was unaffordable and have had 3 years to know this ( I dunno which 3 years they are talking about) and Lloyds have refused the complaint as prior 6 years limit. FOS did ask when/how I knew I could complain I referred to this website in December 2022

If Lloyds readily settled 6 years, surely Lloyds having said they shouldn’t have given me the o/d when I first applied (as said it was 2005 not as they mentioned 2017) they are culpable.

I have referred it back to adjudicator who will presumably refer it to Ombudsman.

Sara (Debt Camel) says

Well the typo is an unusual feature… but normally typos don’t help you a great deal.

The points you need to make to the Ombudsman are:

– you only found out that Lloyds had a duty to check affordability in Dec 2022 and you complained promptly after that (the reference to 3 years is the time limit you have to make a complaint about a problem that is older than 6 years)

– before then, you thought your overdraft charges were your fault for borrowing too much and you did not think Lloyds was partially at fault as you were unaware that they had done anything wrong.

Go back to the adjudicator and ask for those points to be passed into the Ombudsman. Do this now – don’t wait to be asked by the Ombudsman as the Ombudsman will assume that you have made all the arguments you want considered to the adjudicator and may not ask you anything.

Mark says

Dear Sara

I had previously pointed out this re the 3 months, to the adjudicator in a separate email but still received what appears to be a generic type response (seeing those same on here). I also noticed the adjudicator doesn’t acknowledge receipt of emails. Thought this would be auto response at least. Do they really look into these things?? Let’s see what happens.

Thank you

Sara (Debt Camel) says

I assume you meant 3 years not months.

Set out the points you want to make to the Ombudsman now in full. Send tgem to the adjudicator and ask for them to be passed to the Ombudsman

Mark says

Hi Sara

I did emhasise the points you highlighted…regretably without a successful outcome. Out of time is the Ombudsman decision and not knowing is not an excuse, FOS points out!

Here is part of FOS response

“…I (Ombudsman) can still look into complaints made outside the time limits if I’m satisfied the failure to

comply with them was due to exceptional circumstances. Mr H has told us that he didn’t

complain earlier because he didn’t know he could make a complaint about unaffordable

lending.

In coming to my decision I have to be fair to both Mr H and Lloyds and what I have to decide

is whether I think the circumstances outlined by Mr H would’ve prevented him from referring

his complaint in time had he chosen to do so. I’m afraid that not knowing he could complain

is not considered an exceptional circumstance. “

james says

If a bank is to accept the ruling of an adjudicator, or the full ombudsman decision, how long do they then have/does it normally take them to implement the remedy? Thanks

Sara (Debt Camel) says

A month. Realistically if a debt has to be bought back from a debt collector this may take longer. As will correcting a credit record.

Siobhan says

I’ve had this from the adjudicator today. I take it I’ll have to leave it?

NatWest have raised an objection to our service reviewing your complaint as they believe it’s been raised out of time. Under our rules, we can’t consider a complaint if the complainant refers it to the Financial Ombudsman Service:

2) More than:

(a) Six years after the event complained of, or (if later)

(b) Three years from the date on which the complainant became aware (or ought reasonably to have become aware) that he/she had cause for complaint.

You were given an overdraft in November 2015. As there’s no evidence to suggest that you complained to NatWest before 2 June 2023, I’m satisfied more than six years has passed since the event complained of.

I’ve then gone on to consider when you would’ve been reasonably aware, you had cause to complain.

You’ve said you started struggling financially between 2016 and 2019 and entered into a debt management plan in January 2020. I think you ought to have been aware that there was an issue in January 2020 (at the latest) and that NatWest’s decision to give you an overdraft may have contributed to this issue – so I’m also satisfied more than three years has passed from the time you ought to have been aware you had cause to complain.

Sara (Debt Camel) says

I suggest you go back and make four points.

1) you have complained within 3 years of becoming aware that you had a cause to complain

2) in 2016-19 you were in financial difficulty but you felt that was your problem for having borrowed too much – it never occurred to you that NatWest was partly at fault for not having checked the overdraft was affordable as you had no idea that such a rule existed

3) StepChange (or whoever your DMP was with) gave you debt advice in 2020 but they never mentioned that you had a possible reason to make affordability complaints. You don’t think it’s reasonable for someone with no knowledge about debt rules to be aware of something that an expert such as StepChange did not mention.

4) you now understand that a bank should review the affordability of an overdraft every year. In which case you are complaining about their decisions in every year after 2015 – and the last 6 decisions therefore fall withing the “6 year rule” part of what FOS can consider.

Siobhan says

Thank you so much

Siobhan McMurdo says

This is the latest from the adjudicator, doesn’t make sense to me. I have to submit a new complaint?

Siobhan says

Sorry I didn’t copy the email 🤦🏼♀️

Thank you for your email.

As your complaint was about the initial lending in November 2015, it’s been raised out of time for the reasons already explained.

If you’d like us to look into the reviews completed in the last six years, you’d need to raise a new complaint with NatWest first and give them a chance to investigate.

If you still disagree, please let me know and I can refer it to an Ombudsman who will decide whether it’s a complaint we can look at. Please note, the Ombudsman will making the decision solely based on the initial lending also.

So I basically have to say the same thing as my

Original complaint but change the date? This is ridiculous.

I’m probably going to leave it, so much hassle

Sara (Debt Camel) says

Well that is a ridiculous argument.

When you sent in your complaint, did you include any references to theb problems this has caused you

eg “Overdrafts are meant for short-term borrowing but that was not what I was using the account for. The fees and charges you were adding were making my position worse.”

how many days of the month you were in your overdraft

how it was impossible for you to clear it

gambling on the account

rejected direct debits

use of unauthorised overdraft

anything else that happened after 2016???

This may be a hassle but you could get a significant amount of money back for a refund for just 6 years.

Siobhan says

Hi Sara

I explained about the fees and how I was always borrowing and always at my overdraft limit and even going over that. Mentioned I was in a dmp. Had payday loans, credit cards maxed out and that NatWest had already agreed that in 2016 they could see I was always in my overdraft and that I clearly having issues.

I’ll send another complaint to NatWest today.

Sara (Debt Camel) says

First I suggest you reply to the adjudicator that this wastes your time, Natwest’s time and FOS’s time.

Can you ask the adjudicator why they don’t just invite NatWest to reconsider your complaint for the last 6 years?

And say in any case you want this decision to go to the Ombudsman as you have complained within 3 years of finding out that you had a cause to complain.

You can also send Natwest another complaint, I have now rejigged the template in the article above.

Linda says

Hi, I’ve been following this for a while, I made a complaint to NatWest, which got rejected. Persistently in the overdraft from 2008-2016 maxing a £3.4k overdraft. There were other factors CCJ etc at the time one of which was a NatWest credit card, arrears on other things too. So I forwarded this to FOS and stated that I had only recently found out about this and prior to that had seen it completely as my issue and not that the bank should have completed annual reviews.

I’ve had a response from FOS today agreeing with NatWest. Is there anything more I can say here or is it not worth it? Any help appreciated.

“NatWest have raised an objection to our service

2) More than:

(a) Six years after the event complained of, or (if later)

(b) Three years from the date on which the complainant became aware (or ought reasonably to have become aware) that he/she had cause for complaint.

More than six years have passed since the overdraft charges applied between 2008 and 4 June 2017. As there’s no evidence to suggest that you complained to NatWest before 5 June 2023, I’m satisfied the complaint about these charges has been raised out of time.

I’ve then gone on to consider when you would’ve been reasonably aware, you had cause to complain.

Our rules do allow us to set aside the time limits if the delay was due to exceptional circumstances. These circumstances would need to have prevented you from carrying out day to day activities.”

Sara (Debt Camel) says

It is definitely worth asking the adjudicator to look again and for this case to go to an Ombudsman if the adjudicator doesn’t change their mind.

How did you clear the overdraft in 2017?

james says

Just to updated…

As I mentioned before Adjudicator ruled in my favour, will total about £22k refund. However, Natwest have asked for more time (an extra week) to respond due to case load.

Maybe I’m overthinking it again, but that suggests to me they may not agree and ask it to go to the full ombudsman. Anyone been in a similar position with Natwest asking for more time? If so, did they appeal/disagree with adjudicator?

Thanks

Sam says

Hi,

I sent in an overdraft complaint to Barclays and won. They refunded the fees and charges for the last 6 years and closed off my overdraft. I understand they could not go back further but I had basically been in my overdraft since 2000 so i sent this to the FOS. They have come back today to say that they are unable to look further into this as I raised a complaint in May 2015 via a claims management company which was unsuccessful. I don’t ever remember doing this, so I am after some advice.

Do I push this back to the Ombudsmen?

If I did already complain, why did Barclays not say anything previously?

I don’t want to seem pushy as the Ombudsmen as looking at other complaints for me and I don’t want to annoy them but I really do not remember ever already putting a complaint in.

Regards

Sara (Debt Camel) says

Did they say this was an affordability complaint? May 15 would have been surprisingly early for one via a claims company… could it have been a PPI refund?

Sam says

Thank you for getting back to me. The FOS sent me the final response that Barclays apparently sent to me back in 2015 and it says that the complaint was about being unhappy with the bank charges and daily overdraft fees. It does not say anything about affordability. It also says that they have been unable to give the claims management company permission to deal with this for me!

Should I ask Barclays which company this was?

It wont have been a PPI claim as I’ve never had a loan with Barclays. I vaguely remember something about package fees that I have never used, but I’m sure this was done by me and not a claims company.

Thanks again.

Sara (Debt Camel) says

Do you recall complaining to Barclays about overdraft fees and charges in 2015 directly, not through a claims company?

Sam says

Hi,

Definitely didn’t complain directly, genuinely didn’t think I could.

Thanks

Sara (Debt Camel) says

Then it’s important that you go back to the Ombudsman and say you that you did not make any complaint to Barclays in 2015 and you certainly never used a claims company and they may have mixed you up with someone else.

Sam says

Hi Sara,

Me again!! So I went back to FOS and said that I did not complain back in 2015 and they must have mistaken me for someone else.

They emailed back today with a copy of Barclays file on the complaint. The company that I apparently used was called Bank Charge Recovery Ltd. The file says that there is a signed and dated letter of authority to act on my behalf. The FOS said that if I can provide clarification or information that supports my stance then they will review it. The problem I have now is that Bank Charge Recovery Ltd have dissolved in 2017 so I am unable to review any paperwork they may have or speak to anyone about this.

What do you suggest I do next?

On a side note, the file they have on the complaint says that the so called complaint in 2015 is about rescission of unfair bank charges. My complaint with Barclays now is an affordability complaint so is this different?

Thanks

Sara (Debt Camel) says

I suggest you reply that you have never heard of this company and you have checked companies house and it was dissolved in 2017 so you are not sure how you can produce any information to prove a negative. Ask if you can be shown the signed letter of authority that Barclays have on file.

Sam says

Hi,

I have emailed back the above points and she has already replied saying she has asked Barclays for the letter of authority and will let me know once they reply but she then said this.

However, I should make it clear that it’s unlikely this will change things. Because the information I have supports that a complaint was raised and, as a minimum, Barclays’ final response was sent to your address in 2015.

Surely if Barclays can’t produce the letter then that surely helps my claim?

She has already sent the final response that they claim was sent back in 2015. I did point out that there is no document in my online banking. There is a section where all documents they have sent me (unpaid direct debits, charges etc) that dates back to 2013 but there is no final response document saved in there!

Thank you so much for the help.

Sara (Debt Camel) says

yes, Barclays should be able to produce the letter of authority AND the final response.

Sam says

Hi Sara,

So the FOS has got back to me this morning saying this:

Barclays have informed me that a signed letter of authority wasn’t received from Bank Charge Recovery (BCR), and this is the reason the response was sent directly to you. Barclays sent the attached update letter to BCR instead.

Barclays has also provided evidence of a complaint received in 2014 regarding a packaged bank account. BCR was the representative on this complaint and a signed letter of authority was included. I’ve attached both the complaint summary and the letter of authority Barclays received.

Both complaints include information specific to you such as your full name, address and account details. So I’m satisfied these complaints were raised by you or on your behalf. Furthermore, I’m satisfied Barclays final response was sent to your address in May 2015 and, at the very latest, this would have given rise to reasonable awareness, starting the three year time limit.

I trust I’ve explained the reasons why events prior to 14 May 2017. However, if you don’t accept what I’ve said, you can ask an ombudsman to look at this again and make a decision on our service’s remit here. They’ll review the information we have on file – including what I’ve shared with you.

Am I fighting a loosing battle?

I thought with the complaint being an affordability complaint, it might be treated separately.

What do you think?

Thanks

Sara (Debt Camel) says

So does the signature on the packaged bank account look like yours?

Yes you can go back and argue that complaints about packaged bank accounts and bank charge recovery has nothing to do with an affordability complaint. And the responses from Barclays did not mention the issue off affordability so as you were unaware that a bank had to check for affordability at that point, making those complaints did not alert you to the possibility. And the claims company did not suggest you should complain about affordability.

Sam says

Hi Sara,

It does match yes, it was a long time ago and it is quite possible I did do it but I was pretty desperate back then, I would have signed anything if someone said there was a chance of getting some money back!!

I responded to FOS saying that the overdraft charges and packaged bank accounts are nothing to do with this complaint and they have responded with this

———————————–

I believe I made it clear in my email that the Letter of Authority related to a separate, earlier complaint from 2014. In your email dated 8 September 2023, you said you’d never heard of Bank Charge Recovery Ltd. So the signed Letter of Authority, where you gave Bank Charge Recovery Ltd authority to act on your behalf was mainly to provide some background context for you.

In any event, as I’ve previously explained, I’m satisfied Bank Charge Recovery Ltd raised a complaint about the overdraft charges to Barclays on your behalf in May 2015. I’m also satisfied Barclays wrote directly to you the same month in response to this complaint, telling you why it didn’t think the charges were unfair. As this letter gave you six months to refer your complaint to our service, charges applied before 11 May 2015 are outside our six month time limit.

You continued to be charged for your overdraft. But, given that you’d previously raised a complaint – and received a response on overdraft charges – I don’t think it can be argued that you weren’t reasonably aware you could complain about this issue. This means that charges applied between 12 May 2015 and 13 May 2017 are outside our six and three year time limits.

I trust I’ve clearly explained our rules – and why we can’t help with all the charges you’ve complained about. My outcome is unlikely to change so, if you remain unhappy, you can ask for an ombudsman to make a decision. As I’ve previously explained, the ombudsman will have access to all the information I’ve looked at – including the information we have on previous complaints to Barclays.

———————–

Am I fighting a losing battle?

Sara (Debt Camel) says

Possibly. And you have had all interest and cahregs for the last 6 years refunded, which is good.

But you can ask for this to go to an Ombudsman and say as none of the communications from Barclays in 2015 mentioned “afffordability” and as at that point you had never heard of an affordability complaint and was unaware that a bank should have checked your overdraft was affordable annually, you don’t see how you have been expected to make a complaint asbout that at the time, or to take a complaint you didnt not know you had the right to make to the Ombudsman.

Steve says

Sara,

Thank you so much for your help with this website. I’ve received an email back from HSBC today bullet pointed to the following:

– Gesture of goodwill refunding £1224.64 (credited to my account overnight) of all interest and charges on my Bank Account back to October 2018 when the facility was first approved (This is the figure they have stated in their email)

– As it was a goodwill gesture they wouldn’t be required to pay the 8% interest

– Reduced my overdraft down in half for me

I have responded back asking for a statement showing all charges and interest for the period in question to confirm. Does this need referring onto Ombudsman or have i now gone as far as can go? Thanks!

Sara (Debt Camel) says

Has this cleared your overdraft, or nearly?

If the details they send confirm that the interest & charges do add up to 1224, then there is no need to send this to the ombudsman, this is a “full refund”. Banks do normally get these numbers right, but if you thought it would be more, it’s good to check up.

Will you now be able to manage with the lower overdraft limit?

Steve says

Hi Sara,

Yes i’d managed to get myself out of the overdraft some time ago, it was only that i came across this page did i decide to chance it and send off the template letter so i’m able to manage without it being the level it is at!

Awaiting a response now from the bank to confirm all of the payments but it looks correct after the refund came through

Louise073 says

Hi can I ask what email address you sent it too please.Thankyou.

Adam Abu Nab says

Hi Steve, congrats, can you tell me who / what address you emailed? I have the same bank. Thanks!

Geraldine says

I have a 4k o/d with Barclays bank on an account. It was originally around 1k. I increased it in December 2018 in the midst of a mental breakdown which led to a surge in gambling addiction. They agreed to increase my o/d several times in the same month despite multiple transactions on gambling sites. At the time I was earning around 1700 per month. I now earn 2k per month and have been paying approximately £120 in interest monthly, always maxing the overdraft every month. I applied for and was granted a Barclays loan within six months of the o/d increase as well as holding a Barclaycard which was also maxed out until I got a loan to pay it and some other credit cards off. I have since had two other loans to consolidate debts but they essentially move around because of gambling. I am getting therapy for the addiction now but am obviously in a dire situation financially. I live with family so have no major bills like rent or utilities in my name. I believe they have lent to me irresponsibly (and of course realise that I have been irresponsible but feel my mental health has been a major factor). Do you think I have a case to complain and will they close my account if my complaint is upheld?

I am worried because I haven’t told anybody about my situation and feel that closing my account will raise questions with family members.

Sara (Debt Camel) says

This sounds like a strong complaint about the Barclay overdraft – it is not responsible to increase an overdraft where there is a lot of recent gambling showing, and certainly not to a level that is over what your salary is in a month.

If Barclays rejects this, send it straight to the ombudsman.

The refund may well clear the overdraft, in which case Barclays may remove the overdraft but aren’t likely to close the account.

It also sounds like a good complaint about the loan Barclays gave you – see https://debtcamel.co.uk/refunds-large-high-cost-loans for a template. Change that to say that Barclays should have seen the gambling and high overdraft usage and your maxed out credit card.

James says

I can help a little here.

Had a maxed out overdraft with NatWest for 6 years. Adjudicator ruled that I had all the info required about the increase in limit so wouldn’t uphold my complaint on that basis. However NatWest should’ve seen I was using my account in a bad way and with a hell of a lot of gambling transactions and so after 6 months should’ve stepped in.

Also had two loans from NatWest granted after that. Adjudicator ruled they shouldn’t have given them to me as should’ve seen state of other account and don’t more checks etc.

In short mine sounds very similar to yours (albeit mine unfortunately is more extreme numbers), NatWest said they’d done nothing wrong, two seperate adjudicators upheld my complaint tho (one for each issue). So def send to FOS if Barclays say no.

Also worth noting I sent my complaint, the response, bank statements and my credit file to FOS when raising and have had initial decisions inside 2 months in both instances. Put the effort in and seemingly it’s not as long a process as some people experience. Good luck (I’m still waiting to hear if NatWest accept the decisions)

Lauren says

Hello,

I have been in my Lloyds overdraft since January 2019. I opened my overdraft at around 1.3k which was later increased to 1.5k. I have been in my overdraft everyday for the past 5 years!

I wanted to ask if I stand a chance in being refunded fees as I do have several of retail/klarna purchases on my bank statements. Also, if I was offered support from the bank, would this affect my credit file? As in would this affect my credit score?

Thank you :)

Sara (Debt Camel) says

This sounds like a good complaint to me.

If I was offered support from the bank, would this affect my credit file? As in would this affect my credit score?

no.

(And even if it did, how else you you propose to clear this overdraft?)

Sahil says

Hi sara received email from fos what would be the best reply thanks when tsb offered me overdraft i had other credit cards and overdraft as well

What prompted you to get in touch with TSB to log your complaint in the first place?

– Why didn’t you log your complaint earlier than this date?

– When did you realise that something had gone wrong with the account and you had suffered a loss because of this? Please provide ballpark dates at the very least.

– When did your finances deteriorate as a result of being given the credit? Please provide ballpark dates at the very least.

Sara (Debt Camel) says

Can you give a summary of this overdraft, when opened, when limit was changed, is account still open, roughly how many days a month are/were you in The overdraft?

And do you have any other borrowing from TSB during this period – loans, credit cards…

Sahil says

Hi dear sara thanks for the reply

Account was opened in 2014 and the overdraft limit was £100 but with time increased to £3000 which i cleared in 2021 with a loan from same bank tsb account is still open and i am still paying the loan payments

That i had in use £5000 halifax overdraft halifax credit card aqua credit card and 2 barclays debit cards

I never come out of the credit always pying the overdraft fee and never had help from the bank

Sara (Debt Camel) says

oh were many of the limit increases more than 6 years before you complained? That’s ok, it just changes how you reply.

I never come out of the credit always pying the overdraft fee

so in 2017 say you were in your TSB overdraft for every single day of the month?

did the same apply to your Halifax overdraft – have you also complained about this? When was the Halifax account opened?

Sahil says

Yeah the 3000 limit was increased online time to time without any checks

Yes i was in overdraft for every single day and its same for the halifax and other credit cards

Yes i complained to halifax they paid for upto six years and the claim is with FOS for halifax as well

Sara (Debt Camel) says

Some replies could be as follows- but make sure they are EXACTLY right for your case and how you felt. Thats what matters.

“What prompted you to get in touch with TSB to log your complaint in the first place?”

I have made affordability complaints to TSB and the Halifax [this year?] after I found out that a bank should have checked every year to make sure that an overdraft is affordable. I found this out from a friend/relative who told me/by seeing an article in the Guardian/Sun about these complaints/ by seeing about them on Instagram/Facebook/other social media, by …. whatever happened to you. As soon as I heard this, I realised that the fact that I have been in my TSB overdraft every day of the month for many years means they were unaffordable so I made a complaint.

“Why didn’t you log your complaint earlier than this date?”

Before then I didn’t associate my money problems with by bank’s decision to give me an overdraft. I thought I had just borrowed to much. I didn’t realise that the bank was partly to blame by not reviewing my overdraft annually and seeing that it was impossible for me to reduce my usage as it was too big.

“When did you realise that something had gone wrong with the account and you had suffered a loss because of this? Please provide ballpark dates at the very least.”

I always knew I was paying overdraft fees and that they were expensive but i thiought that was just normal. I took a loan from TSB to clear the account in 2021 to try to reduce the charges – I am still paying that loan off. But in 2021 I didn’t realise that anything had gone wrong with TSB’s bank account administration, or I would have complained at that point. I still thought it was my problem to find a way out of the overdraft as the fees were very high.

“When did your finances deteriorate as a result of being given the credit?”

My finances have been difficult for years. I know you are just looking at this TSB account, but I was juggling money and payments between two bank accounts and I also had increasing credit card debt and I didn’t tend to think of them separately. The initial £100 overdaft from TSB was ok, but they kept increasing it and i foolishly though this would make it easier to manage my money. Instead the high monthly charges have made it more difficult.

Sahil says

Thank you very much for your response sara i will definitely update you the outcome

And believe me what you wrote it was exactly my situation once again thanks allot

Sahil says

Hi dear sara today received reply for adjudicator and said the complainis more than 6 years old he said if want to contact with onbdusman i can what would be your suggestion please thank

From what I’ve seen, you applied for an overdraft with TSB in July 2014 and your last limit increase was to £3,000 in December 2014. There were no further limit increases after this.

TSB does not agree to the service investigating your complaint about credit given to you more than six years before you complained. TSB doesn’t object to us looking into the credit given to you in the last six years before you complained. So my investigation focuses on whether we are able to look into the credit given to you more than six years before you complained

Sara (Debt Camel) says

so your option is to say you are happy for the adjudicator to look at only the last 6 years. OR to ask for this to go to an Ombudsman.

Sahil says

Yes i asked to check forthe last 6 years

This was the reply

By June 2018, you’d been in your overdraft for six months without achieving a positive balance. As a result you incurred overdraft charges/interest. For this reason, you would’ve reasonably been aware that the overdraft was unsustainable by July 2018 at the latest. So TSB caused you loss as it continued to provide an overdraft facility that was higher than your income keeping you in debt. As such, I think that you knew enough, by July 2018, to decide whether the overdraft facility TSB continued to provide contributed to your inability to achieve a positive balance given your level of income.

As this is the case, I think you’ve complained about credit provided more than six years before you complained too late. I haven’t seen anything to make me think that you’ve referred your complaint late as a result of exceptional circumstances. I understand that this will be disappointing but I’m sorry that I don’t currently think we can look at your overdraft from more than six years before you complained. I can only look into your overdraft from 16 June 2017 onward.

Sara (Debt Camel) says

So you now have to choose:

EITHER

you tell the adjudicator you are happy to give up on the claim for more than 6 years ago and ask the adjudicator continue with your claim for the last six years only

OR

you tell the adjudicator that you want an Ombudsman to look again at the decision because you want your claim considered going back more than 6 years. If the Ombudsman agrees with the adjudicator that FOS cant look at this, then the adjudicator will then look at the last 6 years only.

sahil says

yeah i already said the adjuciator to look for 6 years

on the reply top adjudicator said i was in struggling in 2018 what do you think do i have chance to get the refund

and i spoke to her now as well and she said bank should have remove the overdraft they shouldnt renew it she just need 3 bank statment from the bank and she will reply me within 1 month

i beleive i will get refund from 2017 what do you think?

Sara (Debt Camel) says

that sounds promising

Sahil says

Hi dear

Received refund from tsb today from nov 2018

But overdraft was given in 2014

Please need your guidance as the complaint was resolved till 2018

And I complained to get refund from 2014 but I wasn’t explain well by the case handler that if I accept to get refund from last 6 years I wouldn’t be able to back 2014

As i have new information to add on the same complaint and i said email to case handler i would like to add new information but after one week she gave her decision with out taking the new information even i called her the day she made a decision that i have new information to add but she was very very rude she didn’t listen to me at all

Now what should i do should i complaint to the bank or FOS service again with new information ?

Or if the case is already handled by case handler stage I cannot complain again ?

I know shouldn’t have accepted from the case handler for upto 6 years and gone to obdusman but it clearly wasn’t explained by the handler

So please if you can comment would be very kind of you thank you

Sara (Debt Camel) says

I am sorry but you should have sorted this out in September and said then you weanted the case to go to an ombudsman.. I hope the refund from Nov 2018 is a good one.

Sahil says

Thank you for the quick reply dear sara

Means now I cannot complain to no one even with new information 😢😢

Not even obdusman?

More than £3k from 2014 to 218

Sara (Debt Camel) says

it isn’t a question of new information. You were asked in September if you wanted the adjuicator to look at just the last 6 years or for an ombudsman to decide if they could go back further. You said just the last 6 years.

EP says

Hi Sara

Do you think it’s worth me putting in a claim. I have been in constant use of my £4000 overdraft for the last 10 years, never being in the black even after being paid. My average take home pay is 1500 per month. Whilst being overdrawn to this extent, the bank provided me with 2 credit cards and a total of 6 loans. Whilst being offered this credit there were hundreds of gambling transactions on my account. This has left me in a perpetual cycle of debt.

Sara (Debt Camel) says

Do you still have a gambling problem?

EP says

I’m seeking help for that so my gambling transactions have been minimal the last few months, however the damage has been done from before.

Sara (Debt Camel) says

That’s good, otherwise some nice refunds and all the money will be gone in a couple of months…

I think you should immediately complain about the overdraft. In this mention the gambling showing on the account and that they have failed to review your overdraft usage each year. And mention your increasing other debts including debt to the same bank.

Also put in separate complaints about the loans from your bank (https://debtcamel.co.uk/refunds-large-high-cost-loans/) and the credit cards (https://debtcamel.co.uk/refunds-catalogue-credit-card/) In each of these say that the bank should have seen the very high constat overdraft and the gambling transactions on the account.

EP says

Thanks Sara. I will keep this page updated.

Natalie says

Hi Sara,

The adjudicator hasn’t found in my favour for a RBS overdraft. I’ve been in my OD since 2018 it was never used as my account.

The adjudicator has said;

I understand that you’re unhappy with RBS charges for using your overdraft and you believe they should seen that your were struggling financially however having looked at how this particular account was used I can see that RBS ought to have known you were experiencing financial difficulty.

I say this because as you have said this was not your main account, the only transactions coming in and out of the account was money you were transferring in and money you were transferring out. I appreciate your account showed no credit balance between 3 December 2018 – February 2021 however during that time you made sure to remain within your overdraft limit, it was not a main account with essential bills going unpaid, there was no unarranged overdraft fees, returned direct debits or unpaid transaction fees, there was the three gambling transactions on 3 Dec 2018 but nothing through the rest of the history on this account that would have been considered as problematic or alerted The Royal Bank of Scotland to the fact that you were struggling with gambling.

Sara (Debt Camel) says

how much were your transferring in and out each month? Was it just money to cover the overdraft fees?

who was your main account with? did you have any other credit from RBS or Natwest?

Natalie says

Yes it was just enough to cover the fees. Sometimes I would make a payment of a couple of hundred but then I’d transfer it back out again as I was gambling.

I had a NatWest account that was also in overdraft, although the NatWest wasn’t my main account either. I did use the NatWest account for gambling.

The adjudicator said in relation to that;

The Roya Bank of Scotland would not be cross referencing data for other accounts you held with NatWest, although they are part of the RBS group but still separate financial entities in banking terms.

My main account was Lloyds.

I did have a 20k loan with RBS but that came later in 2021 and I have put a separate complaint in about that, it is with a different adjudicator.

The loan cleared the overdraft for a while but I had soon transferred it and used most of for gambling and paying off other credit.

I no longer gamble.

Thanks

Sara (Debt Camel) says

“it was just enough to cover the fees. Sometimes I would make a payment of a couple of hundred but then I’d transfer it back out again as I was gambling.”

In that case you can argue that overdrafts are meant for short term problems, and RBS should have seen that your overdraft was being used heavilty and consistently for many years, and most months the only credits to the account were to cover the overdraft fees. Occaisionally you paid a bit more but later that month the overdraft was again maxed out.

I think this is a good reason to go back to the adjudicator and ask them to look again, and for the case to go to an Ombudsamn if they don’t change their mind.

“I had a NatWest account that was also in overdraft, although the NatWest wasn’t my main account either. I did use the NatWest account for gambling.”

Have you made a complaint about that?

Natalie says

Yes and that one was agreed by a different adjudicator.

They said for the NatWest there was significant gambling and NatWest should’ve stepped in November 2019.

Thank you I’ll go back to the adjudicator

MARC says

Hello many thanks for your help. I put in a claim with the financial ombudsman roughly end of April for my overdraft, They have found in my favour I have agreed to the Ombudsman decision today. They have told the bank i have agreed so basically all put to bed. Just wondering how long roughly will it take for the bank to transfer me the money? Thanks again for this website

Sara (Debt Camel) says

Is this a decision from an adjudicator? If it is, first the bank has to accept the decision.

MARC says

Everybody My self and the bank have agreed today with the adjudicator outcome. Refund for 2 years fees. Just wondering on average how long before the money hits my account. thanks

Sara (Debt Camel) says

It should be in the next 4 weeks, but banks are usually much faster than this. If you name the bank, other people may say what their experience was.

MARC says

LLoyds. Everything was agreed today. I agreed with the adjudicators decision and lloyds offered me a settlement which i am happy with.

The adjudicator called me and told me she would leave it with lloyds now has everyone involved has agreed to her outcome

Amber says

Took Lloyds 2 weeks and the overdraft money was refunded to me.

Rachel says

Hi Sara, We’ve exchanged several emails about our overdraft. It was taken out in 2003 (10K), reduced to 5K in 2009. Our initial claim was rejected by Natwest and I’ve now had an email from the person assigned to investigate the claim at the FOS:. They have said:

The rules say we can’t look at a complaint if it was made more than:

Six years after the event complained of; or if later

Three years from when the customer was aware, or ought reasonably to have been aware, of cause for complaint.

Before I can even consider the merits of the case and in particular the irresponsible lending or this overdraft, I must ensure that we review the jurisdiction first, and your complaint about irresponsible lending may not be something I can investigate due to them time thats passed. You initially took the overdraft out in 2003. This was reduced in 2009. There has been no more increases on the overdraft since you applied in 2003. This would mean you would have needed to bring your complaint to us by 2009 for us to be able to consider this inside of the six year rule.

I have asked NatWest if they consent to us investigating this part of your complaint however, I’ve not yet had a response. Once I do I can then look at what needs to happen next.

Could you offer any advice about this? How was I suppose to claim for something I didn’t know was wrong?

Sara (Debt Camel) says

Can you go back and say:

I appreciate that going back more than 6 years requires us to have complained within 3 years of finding out we have a cause to complain – that is what we have done.

But our complaint is not just about the the limit set in 2003 and 2009. It is also about NatWest’s continued failure to review our joint overdraft.

I have read https://www.financial-ombudsman.org.uk/files/290226/DRN5869499.pdf which says

“NatWest did have an obligation to monitor Miss K’s use of her overdraft facility.

Any fair and reasonable monitoring of Miss K’s overdraft facility would have resulted in NatWest being aware Miss K was in financial difficulty … by October 2014 at the absolute latest. So NatWest ought to have exercised forbearance from this point onwards.”

NatWest never made these checks on our account, not even when they were well aware that my husband suffered ill health in 2021. So the 6 year part of your rules should mean that you can always look at the failure of Natwest to do this in 2017-23, even if you decide you can’t look back further than 2017.

Rachel says

Thank you so much. Seems unfair that they will only go back 6 years – when most people don’t even know it is something they can complain about until they saw your article! I really appreciate your help.

Rachel says

Hi Sara, – had a reply from the Natwest:

You are correct in that NatWest should be able to consider the overdraft charges for six years prior to you complaining, however at this stage this is not what I’m trying to understand. I need to first rule on the six and three rule regarding the earlier overdraft and increases and whether I think they should be considered under with the entire complaint at hand.

NatWest haven’t yet responded regarding thier consent on this part, but in the case they don’t consent can I please ask you provide your comments on the below questions ahead of time:

When did you first become aware you had cause for complaint (rough month and year)? And why?

Why did you only bring this complaint to the NatWest/our service now? Why didn’t you raise a complaint with NatWest before now?

When did you first realise that you was struggling financially? If you was first struggling to manage the overdraft, why didn’t you think that NatWest had done anything wrong?

When did you feel that NatWest to blame for these concerns?

If we do consider it out, we’ll also need to ask if there is any exceptional circumstances which prevented you from again complaining during this time, can I please ask you to let me know if any exceptional circumstances stopped you from bringing this complaint earlier? An example of when this may apply is when a customer has been otherwise incapacitated and not in a position to contact the business about the issues they have.

Sara (Debt Camel) says

At least they have agreed they can go back at least 6 years.

Here are some points other people have made, make sure what you say is exactly right for your case, add in in any dates or other points.

When did you first become aware you had cause for complaint (rough month and year)? And why?