Have you had big overdraft problems for a long period?

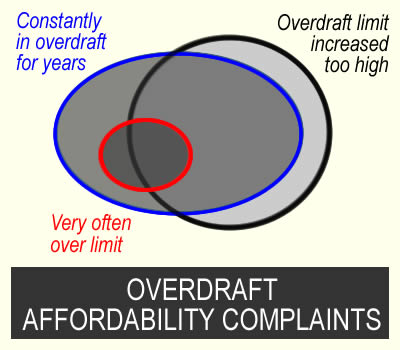

You can make an affordability complaint and ask for a refund of overdraft charges if:

- your overdraft limit was set too high at the start or increased to a level you are unable to clear; or

- your overdraft usage showed you were in long-term financial distress. For example, being in the overdraft all the time, or using an unauthorised overdraft a lot

- your overdraft was originally a student account with no charges, but now interest is being added and you are in the account all or almost all of every month.

This article shows how to make an affordability complaint to your bank, with a free template letter to use. If the bank doesn’t make a you a good offer, it is free to take your case to the Ombudsman.

These complaints do not hurt your credit record. And

Contents

Overdraft affordability complaints

Overdrafts are supposed to be for short-term borrowing

Overdrafts are intended to be used for short-term problems, not as long-term borrowing. A bank should review a customer’s repayment record and overdraft limit and if there are signs of financial difficulty, offer help.

One sign of financial difficulty is hardcore borrowing for a long period. The Lending Code defined hardcore borrowings as “the position where a customer’s current account overdraft remains persistently overdrawn for more than a month without returning to credit during that period”.

Some Ombudsman decisions

All cases are very individual. But these examples give you an indication of what the Ombudsman thinks is important.

In this NatWest decision, the Ombudsman decided:

NatWest did have an obligation to monitor Miss K’s use of her overdraft facility.

Any fair and reasonable monitoring of Miss K’s overdraft facility would have resulted in NatWest being aware Miss K was in financial difficulty … by October 2014 at the absolute latest. So NatWest ought to have exercised forbearance from this point onwards.

In this Santander case, the bank didn’t notice hardcore borrowing:

By this point, Miss C was hardcore borrowing. In other, words she hadn’t seen or maintained a credit balance for an extended period of time. Santander’s own literature suggests that overdrafts are for unforeseen emergency borrowing not prolonged day-to-day expenditure. So I think that Miss C’s overdraft usage should have prompted Santander to have realised that Miss C wasn’t using her overdraft as intended and shouldn’t have continued offering it on the same terms.

Decide which reasons apply to your overdraft complaint

In the overdraft all, or almost all, of the month for a long while

This is the most common reason for winning a complaint

Overdrafts are meant to be used when you have a short term problem. Using the overdraft a lot for a few months is fine. Or for a few days at the end of a month before you are paid.

Banks should review your overdraft annually. This is in most overdraft terms and conditions. And even if it isn’t, the Ombudsman says this is good industry practice.

So at one of these reviews, your bank should have seen if you were in difficulty with the overdraft. For example if you are in the overdraft for all (or almost all) of the month for a prolonged period. Or if you were often exceeding your arranged overdraft limit.

I would say over 18 months or 2 years is prolonged borrowing, not short term.

The bank set your limit too high

This may have been from the start when you were first given an overdraft. Or the initial low limit may have been fine, then the bank increased it to a level which it was impossible for you to repay.

If the bank saw signs of financial difficulty, it should not have increased your credit limit, even if you asked for it. And it should have considered offering your help instead (the regulator’s word is forbearance), for example by stopping charges.

But what is too high?

This depends on your income and expenses. An overdraft of £2,000 for someone whose income is £1,800 a month is a lot – but if you earn £5,000 a month, then a £2,000 overdraft may be reasonable.

Other points that help a complaint

You won’t win an affordability complaint by saying the charges were too high.

Instead, you say the bank should have known they were unaffordable for you because of all the financial problems it could see on your statements and your credit record.

Here is a checklist, do any apply to you?

- often having direct debits or standing orders not being paid;

- a lot of gambling showing on your statements;

- significantly increasing other debts with the same bank (you may also be able to complain about those loans or credit card);

- being recently rejected for a loan or a credit card by the bank;

- significantly increasing debts with other lenders showing on your credit record;

- a worsening credit record – maxed out credit cards, new missed payments, payment arrangements, defaults etc;

- using payday loans;

- mortgage arrears;

- a reduction in the income going into your account.

Free student overdrafts

You can only win a complaint about these after the bank has started charging you interest

Making your complaint

What you need at the start

You don’t need to know the dates your limit was increased before complaining, my template asks for them.

You don’t need to send statements to the bank with your complaint – the bank already has them!

You can’t go back and see exactly what your credit score was in say 2021 when the bank increased your limit. But your current credit record shows what was happening back six years, so download your credit report now and keep it. The sooner you get the report, the further back it goes. I suggest you get your free TransUnion statutory credit report.

Send a complaint by email

I don’t recommend phoning to start off a complaint. It’s too complicated and you will be talking to someone that doesn’t specialise in these complaints.

I think email is the simplest way to make these complaints. Here is my list of bank email addresses for complaints.

An alternative is to send a long message in the app. But if this means using a chat facility, it’s not usually a good idea, as you are again talking to someone who doesn’t understand what you are saying and tries to tell you what help is available with your overdraft – when all you want is to have your complaint considered.

A template you can adapt

In the template below, I’ve invented some examples and dates so you can see how a complaint email could read. The bits in italics should be changed or deleted to tell your story. Delete dates if you don’t know them. If a sentence doesn’t sound relevant, delete it.

I am making an affordability complaint about the overdraft on my current account number 98765432.

Your identity details (these are needed if you complain by email, not if you use secure message):

My name is xxxxx xxxxxxxx. My date of birth is dd/mm/yy. The email address I use/used for this account was myaddress@whatever.com.

Your home address (if you know the bank has your current address, ignore this):

My current address is xxxxxxxxxxxxxxxxxxxx. Please do not send any letters to older addresses you may have on your records.

If your overdraft was originally a student overdraft with no interest include this, otherwise delete it:

My account started as a student overdraft and no fees were charged. I am complaining about the period after, when you started to charge fees.

START BY SAYING they should have noticed your financial difficulty

Overdrafts are meant for short-term borrowing but you could see I was unable to clear the balance in a sustainable way. I was using the account for long term borrowing as I could not get out of this. The fees and charges you were adding were making my position worse.

I am complaining that [every year since [20xx] OR for many years] you have failed to notice my difficulty during the annual reviews of my overdraft. You should have offered forbearance eg by stopping interest and charges being added.

By 2017 I had been in my overdraft constantly for many months, not getting back into the black even when I was paid. This “hardcore borrowing” is a clear sign of financial difficulty. My income was only £1,850 a month – after I had paid bills, there was no way I could hope to clear an overdraft of £3500 in a reasonable length of time.

OR

By 2021, although my salary took my account briefly into credit, within a few days, I was back in the overdraft.

include any other points that show you were in difficulty

You should have seen that I was in financial difficulty because you rejected my loan application in 2021.

You should have noticed that the income going into my account decreased from 2020.

From 2020-22 there was a lot of gambling showing on my account.

In 2022 and 2023 there were a lot of rejected direct debits on my account.

… or anything else!

Say if the initial limit was too high or it was increased too high

You should never have given me an account with such a large overdraft. When I applied, you should have checked my credit record and income and seen I had recently missed payments to a credit card and had taken several payday loans.

OR

You should not have increased my overdraft limit. When you increased the limit, you should have seen that my debts to other lenders on my credit record had increased a lot

OR (for accounts that had been student accounts)

You should have seen after [2020] when you started charging interest that the limit was too high to be repayable on my income.

In your reply to this complaint, please tell me when any limit increases were and how much the limit went up.

END BY asking for a refund of charges and interest:

I would like you to refund all the interest and charges that were added to my account from 2016 when you increased my overdraft limit.

OR

I would like you to refund all the interest and charges that were added to my account from 2021 when you should have realised that my finances had got worse to the point that I was no longer able to clear the overdraft.

Please remove any late payment and default markers from my credit records.

Points to note

Student overdrafts

You won’t win a complaint about a student overdraft saying you were a student and it was unaffordable at that point.

But when the bank has started charging interest, it should start doing reviews and check if you are in difficulty. So from then on, you can win affordability complaints.

You can complain if the account is still being used or if it is closed

These complaints can be made if:

- you are still using the account or you have stopped using it and are paying it off;

- the account has been closed;

- the bank defaulted it and sold it to a debt collector (here you still complain to the bank, not the debt collector). If the debt collector has gone to court and got a CCJ, add a sentence to the template saying you want the CCJ removed as part of the settlement of your complaint.

But if you have had an IVA or bankruptcy after these problems, or if you are still in a DRO, then you shouldn’t complain – ask in the comments below for details.

Old accounts

Banks may say FOS won’t look at an old complaint, but this isn’t right. FOS will often look at a complaint if it has been open in the last six years. How far back FOS will go seems rather random, but it should be possible to go back at least 6 years.

Open and recently closed accounts aren’t a problem – the bank will still have your statements.

If your complaint is about an account that was closed more than 6 years ago, it’s going to be very hard to win.

Packaged bank accounts

These affordability complaints are not about the fees on packaged bank accounts. MSE has a page about packaged bank account charge complaints.

Personal accounts, not business accounts

The complaints covered here relate to personal accounts. For business accounts, talk to Business Debtline about your options.

The Bank replies

They want to phone me!

People are often scared if they get this message. But it may be good news! You can just ignore it or say you would like a reply in writing.

If you decide to take the call, it helps to be prepared:

- have a pen and paper handy so you can write down anything

- if they say they are partially upholding the complaint, ask them the date they are refunding the fees from, and how much. And say you would like to see this in writing before you decide whether to accept it.

- if they ask you questions that sound complicated or worrying, ask them to put the questions in writing as you find the phone difficult

- when they say they are rejecting the complaint, ask for this in writing, as you will be going to the Ombudsman.

Rejection/poor offer – go to the Ombudsman , it’s free

Banks reject many good complaints, hoping you will give up. So don’t! You know if the overdraft has caused you a lot of problems.

You can’t go straight to the Financial Ombudsman (FOS), you have to wait for the bank to reply, or for them to have not replied within 8 weeks.

Here are some things banks may say to try to put you off:

- you could have declined the increase to your overdraft limit – FOS probably won’t think that is a good reason

- you never let the bank know you were in difficulty – FOS probably won’t think that is a good reason

- your salary was enough to return you to credit each month – this is misleading if bills meant you soon went into the overdraft;

- FOS will not look into things that happened more than 6 years ago – if your account was still open in the last 6 years FOS may well look at it.

And the bank may offer to refund fees for the last 15 months say, even though your problems have been large for many years. Think twice about accepting a low offer – you won’t put this offer at risk by going to the Ombudsman.

If you are offered a refund for the last 6 years but not any further back, have a think if this is a good enough offer. It is unpredictable whether the ombudsman will be prepared to go back further than 6 years.

If you aren’t sure, post in the comments below.

To send the case to FOS, complete this online form:

- you can use what you put in your complaint to the bank;

- if the bank rejected your complaint or made a low offer, say why you think this is unfair;

- use normal English, not legal terms.

You don’t need to send your bank statements – the bank will send those to FOS. And you don’t need the policy documents for your bank account, the lender will supply those to FOS if they are needed.

Do these complaints work?

Yes! From 2024, some banks are making more offers directly.

A Guardian article featured a case where someone used the template letter here. Barclays denied it had done anything but made an £8,000 “goodwill” payment to the customer.

And if your bank rejects your case, people are winning cases at the ombudsman. FOS is a friendly service although it isn’t speedy. It isn’t faster to use a solicitor or a claims firm,

The comments below this article are from other people who have made this sort of complaint. That is a good place to ask for help if you aren’t sure what to do.

Refunds from unaffordable loans

Sara F says

Hi Sara, I sent my complaint to NatWest on the 14/05/23 I have received emails acknowledging that the complaint was received and that they are looking into it. Last week I received an email again saying it’s taking longer than they thought but will get in touch. I sent an email to say that if they don’t contact me by the end of day today I will send to the FO, but I also decided to call them on Friday, after waiting 2hrs for them to answer they advised that they are still looking into it and that it’s not been 8 weeks… I was confused because for me 8weeks would be this Sunday. Then the lady explained that only working days count and that I was on day 39 so had to wait until day 56 to be able to then send this to the FO. Is this correct? I wasn’t aware of this and was very shocked. Can anyone share they experience with NatWest? How long did it take them to answer. They haven’t said no to the complaint but I have only received what looks like general emails to say they are still looking into it. Thanks

Sara

Sara (Debt Camel) says

That’s nonsense. 8 weeks is 8 weeks, not 56 working days.

I would wait three days as it only passed the 8 week point yesterday. Then send to FOS. And include in the complaint to FOS that Natwest has not informed you at the 8 week point of your right to go to the Ombudsman and on the phone they told you this Was 56 working days.

frida says

Hi Sara – just wanted to say thanks for this incredible site and the advice so far. I sent my affordability complaint in early May after reading the Guardian article. I got an immediate reply from my bank HSBC turning me down and as per your advice I referred to the ombudsman, It took about 8 weeks but the caseworker has found in my favour and given HSBC 2 weeks to respond to his offer (refunding charges and either payment plan to clear overdraft or 8% if refund leads to overpayment)

hopefully they agree with the caseworker decision. i wanted to ask how likely it is that they will take the overdraft facility away completely. i do not intend to ever get into this situation again (financial situation has improved significantly) but I also know sometimes dipping into an O/D is unavoidable. would i be able to change accounts and get a new interest free overdraft or will this decision be on my file and prevent any other banks giving me the option?

Sara (Debt Camel) says

Fingers crossed HSBC accepts the decision.

Do you expect the refund to clear the current balance?

Frida says

From my estimations it should clear about 75-85% (the caseworker said they looked at 2019 onwards as prior to this I had been using the overdraft responsibly) I can probably clear the remaining balance in 2-3 months.

Sara (Debt Camel) says

ok then I suggest you should go back to your caseworker and say you would like to be able to keep an overdraft of £500 for emergencies after you have cleared the balance – ask if that is possible.

jonathan says

Well i had a reply from the caseworker at the fos saying that they could not help as it was too long ago and that i should of known. I have until the 20th to say whether i accept his decision. Another case handler is looking into the resolve loan that they gave me to clear the cancelled o/d but as yet not had a decision. Do you think i should wait until the 20th to reply in case the other case handler decides in my favour? Or should i reply now stating again that i have only just recently found out that i could complain? Many thanks jon

Sara (Debt Camel) says

how long ago was this? have they asked you why you did not complain before?

jonathan heard says

The actual bank account was closed in march 2014 but the overdraft was from 2001 until it was shut. The resolve loan was started from around april 2014. The case handler stated that they can look at a late complaint under exceptional circumstances and if they were responsible for this. I have said that i was only recently aware of being able to complain so obv this isnt good enough. A few years ago i tried to get copies of old statements but couldnt remember my account number and went into a branch to ask where they said they wouldnt have it anymore, but in december i was sent statements dating back to 2001.

Sara (Debt Camel) says

under exceptional circumstances

that rarely works for something so long ago. Unless you were in prison o hospital for most of the time.

and if they were responsible for this

I guess they asked you when you because aware that the bank was partially responsible for your problem? Some wording like that?

The point to make in reply is that although you knew you were in financial difficulty at the time, you assumed it was your problem because you had borrowed too much and couldn’t get back out of the overdraft. Say you were unaware that the bank had a regulatory duty to check annually that your overdraft was affordable, so you thought it was your own fault and had no idea that the bank was partially responsible, so you did not know you had a reason to complain.

Add that you do have all the bank statements for this period, so you can show the overdraft was unaffordable.

jonathan heard says

Hi i have replied to the audjuicator saying that i dont accept his decision and have outlined the points you raised above, as they gave me a deadline of the 20th july to respond so back to the waiting game! Its funny that the resolve loan which was assigned to another audjudicator within a few days of the overdraft complaint being assigned and as yet still had no decision. will keep you updated on both complaints

jonathan heard says

Hi i used the reasons you gave above and it came back still with a no and also by an ombudsman. Basically saying i should of realised years ago!!! Anyway the resolve loan complaint which i made along with the overdraft complaint was handed to an aujudiactor about a week after the overdraft was handed to an aujudicator and i still have had no response regarding this! will keep you updated

Janet says

Hi Sara,

I have just had a rejection from an adjudicator regarding my RBS OD.

They’ve said it wasn’t my main account and RBS wouldn’t have know i was a gambler.

They’ve said I used the account and ensured the over draft was cleared. – I’ve had this since 2018 and it may have been clear for a month or two but majority of the months it’s been in the full overdraft, is this not something that they need to take account?

He’s also said “you never went over your overdraft limit” but that’s not true, every month when RBS charges interest I go over the arranged limit.

I’m feeling really disheartened. His decision does seemed rush. He didn’t introduce himself like most others have done and it was sent through at 1am.

Does the fact that RBS and NatWest both gave me a £1000 overdraft on the same date make a difference?

I didn’t use either as my own bank but the NatWest had multiple gambling and the RBS only a little. I would use both of them to transfer between accounts

Sara (Debt Camel) says

Which was your main bank?

What about your non overdraft debts, did they increase during this period?

Janet says

My main bank was Lloyds, I would just transfer money in and out. But I only managed to not of the overdraft a couple of times within the last 5 years without then going back into it. I’d say at least 8 months a year in the full OD’s.

During my time with RBS they also gave me a £20,000 loan despite me being in my OD for the majority of the time.

I did raise it the OD and Loan on the same complaint by the adjudicator hasn’t mentioned the a once, not sure what’s happened there? I have asked for clarification.

Should I mention that NatWest and RBS are the same?

I also had 5 credit searches on my credit report before I opened both accounts, he hasn’t mentioned this. Is that worth mentioning?

Sara (Debt Camel) says

have you also made a complaint about the Natwest overdraft?

Janet says

Yes but it hasn’t been allocated.

Sara (Debt Camel) says

Then definitely go back and say you should not have been given two overdrafts on the same day by Natwest and RBS as they are part of the same bank. And that when reviewing your RBS overdraft they should have noticed there was some gambling and also that there was a lot on the Natwest account.

Also make the point that the fees took you over the overdraft limit every month.

Ask for this to go to an Ombudsman if he doesn’t change his mind.

Anna says

Hi Sarah. Just wanted to say a massive thanks for this site and your help. I made an affordability complaint to Santander on 12th April. I chased it up once a week. I took at least 5 weeks for someone at Santander to have it assigned. The case was then assigned to a case handler but she was waiting weeks for info from other departments. I don’t quite believe that was the case as the response was 3 months to the day! I had sent it to the FOS who had requested the files from Santander about 2 weeks ago.

Yesterday I finally got a response. Joint overdraft £4500. The paid all interest and charges from 12th April 2017 plus the 8% = £5134.72. OD paid off and £634.81 surplus for us. The account is going to revert to basic account (no overdraft facility) but that’s the whole point. So thank you 😊

I have £500 one on my own account but the are refusing this saying I use the overdraft as it should be. I’m in it every month so I don’t get that I think I will await the letter and then see about sending that to the FOS do you think that’s worth it? Also my husbands single account OD £2300 they are offering £300 towards it. Again, awaiting the letter behind their reasoning. (Will come back for advice when they arrive

Sara (Debt Camel) says

good result on that joint account!

Rachel says

Hi Sara,

Natwest has rejected my claim about a joint overdraft of £5K. They say that there is ‘nothing to suggest the bank has failed to make adequate assessments’. Actually we had a £10k overdraft from 2003. We reduced this overdraft in 2011 to £5k. In 2013, we applied for an increase to 6.5k which was declined. Natwest says that there was no reason to doubt the affordability of repayment at the time of application. They also say that unarranged overdraft charges from 2008 only totalled £521. They say they communicate on a regular basis including Monthy ‘pre-advice’ of interest and charges and annual summary of interest and charges. Notice of Variation was issued to all customers across January and February 2020. I also registered for text alerts from 2015. They say they sent out regular repeat usage letters and that I have not contacted them in response to these letters. Do you think this is worth perusing with the FOS? Your help and advice would be really appreciated.

Thank you

Rachel says

This is the section from the letter:

Notice of Variation was issued to all customers across January and February 2020. This was specifically issued to advise of the changes to charges and interest rates which confirmed

‘overdrafts are recommended for short-term borrowing only. If you find yourself using your overdraft most of the time, there could be other ways to manage your finances. If you have concerns about how these changes could affect you, a financial health check can be arranged in any of our branches to review your finances and the suitability of your banking products’ It

also highlighted free independent advice from debt charities and a freephone number’ This was recommunicated again to all customers later in 2020 as the changes were deferred tosupport customers during the Pandemic.

Sara (Debt Camel) says

That is a generic letter sent when they changed interest rates. It does not absolve NatWest of responsibility for assessing if the overdraft is affordable for you.

The Ombudsman can always go back 6 years. And can choose to go back further if they decide you have only recently found out you had a cause to complain in the last 3 years.

How many days a month are you in Your overdraft and how long has this been going on?

Markh says

Hi Sara

At the beginning this year Lloyds refunded my overdraft affordability complaint within a matter of days,. This was for six years, going back to January 2017. This being the maximum period the bank can settle. My situation stretches back since 2005 a further 12 years, which Lloyds said I should refer to the FOS for this further period. I did so, and FOS are indicating (not yet adjudicated) that 6&3 could apply, meaning they cannot consider matters beyond six years. This doesn’t seem right, especially as Lloyds settled the original six years almost immediately and advised me to refer to FOS. Seems a bit contradictory, Lloyds would obviously know whether the previous years are “claimable”! Any advice you can give me would be so appreciated.

Sara (Debt Camel) says

Lloyds could have gone back further than 6 years if they had wanted. They had to tell you you had the right to go to the Ombudsman. I don’t think they were saying you would win.

The point to make to the adjudicator is that although you knew Your overdraft was too large you thought That was your fault for borrowing too much and that because you did not know the bank should have checked affordability each year, you had no idea that Lloyds was partly responsible for this so you had no cause to complain.

MarkH says

Thank you Sara. I avidly read your comments on this website, and had the impression that 6 years period was the legal limit that banks would “voluntarily” refund any charges. You infer that this is NOT the case and they could indeed have gone back further. I certainly didn’t get the feeling they were being anything other than sincere and were not simply dismissing me.

The FOS informed me they would make a decision (possibly in coming week) but were taking into account 6&3 years. So why puzzled why they would they be indicating there is possibly a 6 year time limit? Perhaps should wait for the FOS decision but my circumstances the 6 years prior 2017, were no different to the last 6 year period. Thanks Sara so much for your time.

Sara (Debt Camel) says

FOS has rules it has to work to. It can look at any problems in the last 6 years.

And it can go back further, a lot further, if you have become ware you had a cause to complain in the last three years

Rachel says

We use the overdraft constantly – never out of it.

Overdraft of 10K agreed in 2003.

Overdraft was reduced to £5k in 2011.

Application to increase overdraft to 6.5K in 2013 was declined.

They have said, ‘We sent out regular repeat usage letters to our customers where we see that debt is persistent and customers are not regularly coming out of their overdrafts. Naturally the frequency of these letters is governed by your actual account usage however I can see we most recently sent you these contacts in:

– June 2023,

– April 2023

– December 2022

– October 2022

– June 2022

– May 2022

– April 2022

– January 2022

– February 2021

– November 2020

– August 2020

– July 2020

– June 2020

Sara (Debt Camel) says

Send this to the Ombudsman. If they thought your overdraft was not affordable, they should have acted eg by offering to freeze the interest and charges, not written you vague warning letters.

jed says

As expected Natwest have rejected my request stating it was my decision to utilize the overdraft offered to me and it was given to me with the satisfactory checks made so to the ombudsman it is! Probably a silly question but i want my complaint to be as strong as possible, what sort of documentation should i be attaching to my form?

Sara (Debt Camel) says

How many days in the month are you in your overdraft? How long has this been going on for?

Did you have a lot of other debt and were the payments to this going out of the NatWest account?

Jed says

on and off for the last few years, and probably haven’t left it in the last year either, I actually had a £6000 loan and a £6500 credit card balance from them that are paid for out of the overdraft every month. How do I provide documents for this though, won’t the statements NatWest provide them evidence it all?

Sara (Debt Camel) says

So what matters here is if you are in your overdraft for all or almost all of the month. An overdraft used on and off for the last few days of a month is what an overdraft is meant for.

I suggest you go back a few years and look at your bank statements and work out how many days a month you were in the overdraft. And see how this has got worst.

Also how the payments to other debts increased.

NatWest will supply the bank statements. But this is your point, that NatWest should have seen all these problems from you bank statements.

You may also have a good claim about the credit card and loan.

Jed says

I have had a look out of curiosity and have been pretty surprised, ive probably spent 30 of the last 36 months in between 2k and 7.5k in debt to the overdraft, including consistent gambling deposits for a few grand a month, as well as Natwest loaning me £7500 whilst i was £6000 into my overdraft and only on a 2k wage, so barely taking me out of it, subsequently ending up back into it the next month.. should i be explaining all of this in intricate detail? or simply stating and allowing the ombudsman to investigate themselves? Thankyou for all of the help by the way, its really appreciated.

Sara (Debt Camel) says

I think for the overdraft complaint you should expand on that a bit. Perhaps twice as long? But not thousands of words.

Also make a complaint now about that loan!

David says

Hi I’ve just started using a debt management company. Will I still be able to get anything back? I had a big overdraft for about 6 years

Sara (Debt Camel) says

You are in a DMP? Or an IVA?

David says

DMP my overdraft was a big reason I had to use one. Had loan and credit cards as well

Sara (Debt Camel) says

Being in a DMP is a great time to make affordability complaints, about your overdraft or other debts in your DMP, or any settled debts for example debts that you consolidated into a loan now in your DMP.

If you have a complaint upheld, it will reduce the balance I owed and so speed up your DMP.

The complaints won’t harm your DMP and you are now in a safe financial space where if you get a poor offer ( these are common, including from banks) you just send it straight to the Ombudsman.

Thomas says

Hi Sara, thank you so much. I had an overdraft with Natwest since 2002 (1000 limit) and this then increased circa 2007 to 3000 and then by 2012 to 5300. My wage was between 1500 and 3000. I have never been out of the overdraft and in 2019 Natwest gave me a loan in 2019 for 20,000. I also had credit card debt of 12k and 8k with 2 other lenders. I used the 20k to clear these 2 credit card debts. Was still in my overdraft and never in a credit balance for at least 20 years. I then applied for and received another loan from Natwest for 12k and got given this in 2022 and then cleared the overdraft. I have complained to Natwest 3 weeks ago after coming across your site… stating hardcore borrowing and an affordabillity overdraft complaint. I also had repeated consistent gambling of thousands of pounds each month for around 6 years until I stopped. They replied to me today to say they will get back to me in 5 weeks… should I also contact them to look at why they gave me a further 33k in loans when I had been at the limit of my overdrafts for 20 years plus… from going back to the statements online (only back to 2016 were available) I paid 6,100 in overdraft charges and interest. No idea how much I paid in interest and overdraft/unpaid transaction fees from 2002 to 2016 but it must be at least 5k. I will let you know when I get a response.. but interested to see if you think I have a claim that they should not have let me borrow more through the 2 loans Thanks

Sara (Debt Camel) says

Yes I suggest you submit a Separate complaint about the 2 loans. See template here https://debtcamel.co.uk/refunds-large-high-cost-loans/

As part of that complaint, say it should have been clear from you very high overdraft usage (about which you made a complaint on dd/mm/23) that these loans would be unaffordable. If the gambling was going on at that time, also mention that.

Thomas says

Hi Sara, thank you again for your advice. I raised a complaint based on your template re the unaffordable loans and Natwest have replied saying as I have complained about this already they have added this information to my existing complaint about the overdraft. I have replied to say no they are completely separate complaints and need to be treated differently as Natwest replied this week saying they need another 5 weeks to investigate (which would be right on the 8 weeks). I have not had a response as yet.

Thomas says

Hi had letter back from Natwest. Given me £150 compensation -took a week longer to get back to me as the investigator was ill and sent me the wrong persons letter about their outcome. They have given me £300 back in bank charges and £150 in bank interest. basically have said all the checks on the overdraft increases were applied and the 2 loans the checks were done correctly fully credit scored and income assessed. Also pointed out that onus is on the customer to reach out to them and they did send me letters – monthly pre advice of interest and charges, annual summary of the same, notice of variation in Feb 2020. Also said they sent out 7 regular repeat usage letters over 3 years and I did not contact them and whilst they “suggest o/d facilities are for short term use, how customers us them and their frequency will be varied. Said the gambling was below the threshold for a decline of the O/D as fell within the banks guidelines within the time of the loan applications. (gambling totalled £10k plus in 2018 and 2019). Is it worth now going to the ombudsman and are there any terms/words you would use and can you point me to the template letter please. Thank you so much for all your help. Happy with the £600. Also glad to say I am out of the overdraft and no longer gambling. I still think the loans and charges/interest should not have been given to me if someone had looked at the accounts as I was in my overdraft for over 20 years and never had a credit balance. Thanks!

Sara (Debt Camel) says

Also glad to say I am out of the overdraft and no longer gambling.

That is very good news

I was in my overdraft for over 20 years and never had a credit balance.

Then send this to the Ombudsman – you have nothing to lose! even if they only give you a refund for 6 years it will be more than Natwest have given you.

Helen says

I have been in my overdraft to the max every month up to 1600 pounds in the last few years very rarely getting out of it st all. I made a complaint to natwest which got rejected. I sent it to the ombudsman. I lost one complaint due to being time bared do you think overdrafts are the same?

Sara (Debt Camel) says

The Ombudsman can always go back 6 years.

Helen says

Do you know how long overdraft queries are currently taking with the ombudsman service at the moment? Mine has been there 5 months.

Sara (Debt Camel) says

Which bank? Are you asking for refunds for over 6 years ago?

Helen says

So it’s Natwest I haven’t asked for a refund over 6 years although I’ve had an overdraft for more years than that

Sara (Debt Camel) says

You could phone up and ask why this is taking so long

hannah says

Hi Sara,

I made a complaint to financial ombudsmen regarding my HSBC overdraft charges and HSBC have accept ombudsmen’s recommendation that they pay back all charges from 2019 onwards. On 19th June i received an email from financial ombudsmen saying HSBC have 4 weeks to get in touch with me regarding the refund. I have heard nothing from HSBC and we are now passed 4 weeks. I have contacted them on numerous occasions and they are unable to provide me with any information. They have just said the case is still open and ongoing. What am I to do moving forward and why is this taking so long? Can you give me any advice?

Thanks for your help

Sara (Debt Camel) says

Tell your adjudicator at FOS about this delay.

Hannah says

I have told them and they said they are chasing it up as HSBC has missed 28 day deadline. Do you know if this is normal for HSBC? What happens if they miss the deadline? Its now been 7 weeks. Thanks for your help

Sara (Debt Camel) says

this is very annoying but it will get sorted. This is not normal for HSBC.

At least with HSBC there is no danger that they are going to go bust!

James says

Response from Natwest (took the full 8 weeks). Maxed out £25k overdraft for about 6 years.

Crux of it was…

Satisfied they made the right call letting me have the overdraft. “The above applications were accepted with no internal policy warnings being triggered – this means that the overdraft applications did not require any manual checks.” This is despite numerous gambling transactions and payday loans.

In terms of hardcore borrowing. Seems to be rejected because there were some credits large enough to clear the balance (from gambling transactions) and because they tried to contact me a handful of times to discuss it (with no success). Finally they state that lots of communications included info on what to do if struggling.

Shambles really. Hard to explain fully without pasting the full reply. Will go straight to FOS. Anyone know current lead times?

Thanks

CC says

Overdraft complaints are taking a lot longer than loans. I submitted an overdraft complaint 8 weeks ago and haven’t heard anything. However I have two loans that I submitted just 6 weeks ago and they have both been picked up.

james says

Thanks for this – sounds like it will be an extra happy or sad Christmas then!! Haha

Please do update on the timelines you experience as and when it progresses.

Seems odd that some people further back in this thread seemed to get assigned pretty quickly. Wonder if certain circumstances push you up the queue.

Sara (Debt Camel) says

Some things slow you down – if you are trying to go back further than 6 years.

No it’s because there is a pre-stage while FOS decided if it can look at the case. Until you get through this, an

Adjudicator will not be assigned.

Nick says

I think it’s around 4 months to be picked up by an adjudicator mine has been with FOS for 2 months now. Keep an eye out for my final decision when I post it because TSB said the same thing about the large gambling transaction income to me

James says

How long did it take you to get a case number etc? I got an auto response, but not been given a reference number or anything.

Please do post your progress (including when your case gets picked up, then when there’s a decision etc). Would really appreciate it.

Thanks

Chloe says

It should take no longer than 10 days to receive a reference number from the FOS.

Gemma says

Natwest have rejected my complaint rgarding an overdraft in place since 2012 and have paid £50 into my account as a gesture of goodwill! They said that I would have been receiving statements with the charges and interest clearly detailed so I was aware of the existence of these charges since day one of having the overdraft. What should I do now?

Sara (Debt Camel) says

Send this to the Ombudsman. What can always go back 6 years nd can sometimes go back further.

The fact that NatWest sent you statements is irrelevant – they still had. regulatory duty to check the overdraft was affordable for you.

Gemma says

They also said because the overdraft was in place since 2012 that I am outside of the 6 years to complain. This overdraft is still in use today so I’m confused by their response

Sara (Debt Camel) says

They are hoping you will give up. Even if the Ombudsman decides they cannot go back more than six years, you can still get an overdraft refund for the last six years as the bank should have reviewed the overdraft every year. So they got it wrong for the lest 5 or 6 times!

Jean jibson says

I have had a response from Halifax today regarding my overdraft of £1500 I’ve been in constantly for over a decade I’ve been paid £1491 plus £50 for inconvenience and they took my overdraft away I’ve spoken to bank they say they are only upholding my complaint from 2018/2021 as they say I was sent a letter and it was upto me to tell them I was struggling when I then asked is this a generated letter sent out to all overdraft users she said yes so I then asked why 2018 and she said we can only go bk 6 years so I said that would be 2017 then she agreed and is checking why shall I go to ombudsman ?

Sara (Debt Camel) says

Yes I think so.

A) the Ombudsman may go back further then 6 years

B) this generic letter is not a reason for them stopping a refund. they should have assessed if the account was unaffordable and if it was (and as they are refunding you it sounds like it!) then they should have contacted you and said this and offered to stop charges.

Jean says

Hi Sara I’ve just spoke to the advisor assigned to my case she says 11 June 2018 is furthest she can go back as the year before that it was an automatic renewal and not manual she then said that from 2021/2023 they sent 2 letters out regarding my overdraft and that’s why they can’t refund those 2 years she also said that an ombudsman can’t go back further than 6 years they are governed by the fcs and they work on same principle to say I’m confused is putting it mildly can you help please

Sara (Debt Camel) says

I have never come across the Ombudsman making any distinction between automatic renewal and a manual renewal.

They are choosing not not refund after they sent out those letters. The Ombudsman may not agree the letters were important and may think the refund should continue after them.

They are choosing not to go back beyond 6 years. They are wrong that the Ombudsman cannot go back further.

The DISP rules for the Ombudsman say:

“The Ombudsman cannot consider a complaint if the complainant refers it to the Financial Ombudsman Service:

(1) more than six months after the date on which the respondent sent the complainant its final response, redress determination or summary resolution communication; or

(2) more than:

(a) six years after the event complained of; or (if later)

(b) three years from the date on which the complainant became aware (or ought reasonably to have become aware) that he had cause for complaint”

So the Ombudsman can decided that it can go back further than 6 years if you have complained within 3 years of finding out you had a reason to complain.

Basically they are not right and they are hoping to put you off going to FOS. I suggest you don’t waste any more time but send this to the Ombudsman who may well take different decisions.

You are not risking the offer you already have by going to FOS.

CM says

I had a very similar outcome from the Halifax. Pleased that my overdraft has been cleared but I also want them to go back at least 6 years so I have gone to the ombudsman. Good luck.

Kim says

Hi I heard from my case handler today after referring to fos in January and my complaint goes back way back past the 6yrs. He’s asked me more questions which Iv answered straight away so il await the outcome. Thank you Sara for all your help

Jae says

I made a claim in the last week and have already been declined by Natwest. Was a student account opened in 2008 and I argued that years after I continue to live in my overdraft, have had a number of payday loans over the years, the highly charges years ago for overdraft fees and it is clear I could not afford the charges and the have never offered resolutions to this. I used the template provided on this site. They have said I can go to the omnibus. Which I will do and update.

The reply was basically that they do not monitor individual accounts.

Sara (Debt Camel) says

Perhaps they don’t – but the Ombudsman typically says that it is best practice that they should.

Jae says

Hi Sarah

I have been given a response from the omnibus man agreeing that the 6 year rule prevents them from going back any further in years and therefore they are not considering my complaint from 2013/14 to Narwest as I am reporting out of timescales. Even with my updating that in the last 6 years I have continued to be in hardship, living in my overdraft, payday loans and going over my overdraft.

There is nothing other than I didn’t know I could complain and other than being in financial hardship there is no additional vulnerabilities.

I have until 15/10/2023 to respond if I disagree, I feel I haves already pointed out the obvious do you suggest anything else at this stage?

Thank you in advance.

Jae

Sara (Debt Camel) says

Has the Ombudsman asked you when you realised Natwest were partly to blame for your overdraft problems? Or whose you fault you thought the problems were?

Jae says

Hi Sara

Yes they asked about when I realised NatWest may be to blame, Even though I had already explained that I only realised when I saw the guardian news article and was made aware of NatWest Role.

[deleted reference to the FOS investigator]

Jae.

Sara (Debt Camel) says

have they agreed that they can look at the last 6 years?

Jae says

They have said they are not considering the last 6 years as the issues started before that time and they feel I had enough time to complain about it.

Sara (Debt Camel) says

is this a decision from an investigator/adjudicator or a Final Decsion from an Ombudsman?

Natasha says

Just to say my account with NatWest was the same a student account originally open in 2004 NatWest rejected it but the ombudsman service found in my favour so it’s definitely worth pushing forward with.

Sara (Debt Camel) says

ok, I suggest you go back and say that you have read https://www.financial-ombudsman.org.uk/files/290226/DRN5869499.pdf and you think the approach taken by FOS in that case and set out in detail should also apply to yours here, and you would like an explantion of what is different in your case.

Add that even if FOS decides it cannot go back more than 6 year – although that previous decisions suggests that he can in your sort of situation – it should still be possible for FOS to consider the most recent 6 years of charges as Natwest has failed to monitor and check that your overdraft was affordable on at least an annual basis. So in each of the past 6 years NatWest has failed to make these checks, you are complaining about each of these failures and they are all within the 6 year rule.

Ask for this to go to an Ombudsman if the Adjudicator does not change their mind.

Janet says

Hi Sara,

The adjudicator has rejected my complaint about an OD. I was given until 26th July to submit my representations. I submitted them the very next day after the rejection (13th July) however have not had an acknowledgement. I emailed again Thursday to ask for an acknowledgement or update and nothing back still. Do I need to be worried?

I want to make sure my representations are received and passed to an ombudsman but total radio silence from the adjudicator.

any suggestions on what to do next?

When I call their number it just rings out too.

Sara (Debt Camel) says

It’s unusual but you have clearly replied in time and followed it up, so you should be fine.

Adam says

Hi Sara, thank you for providing this resource, I have multiple complaints in for debts which stretch back to 2011 submitted within the past week. I understand the ones over 6 years are likely to be rejected and I will have to take them to the ombudsman.

I just have question regarding the policy of reviewing post the 6 year period, their website states:

“Unless you made your complaint within 3 years of becoming aware (or when you should reasonably have become aware) that you had cause to complain.”

What does this mean in practice? I legitimately did not know was able to complain about this until recently and had mental problems with gambling at the time (albeit not formally diagnosed).

From your perspective what circumstances could they argue I should have “reasonably became aware”? I have never sought any help or advise for my finances until now and if my partner had not seen one of your posts on social media I would not have any idea I could do so.

Thanks

Adam

Sara (Debt Camel) says

It is a lot simpler if you wait until you get the replies from the lenders as they will give you a clue as to the line they may take at the Ombudsman and then see what the Ombudsman asks. It is better to reply to specific points rather than for me to try to list the variations and permutations that can happen.

John B says

Hi Sara,

Got a quick decision from Lloyd’s today. They have upheld the complaint and awarded me £1,300, I think I’m owed a lot more, but I have a 2k overdraft. They say I have to have the overdraft taken away so I’m left with a £700 bill to pay them.

This doesn’t seem fair at all.

What would you suggest?

Thanks

John B

Sara (Debt Camel) says

What period did this £1,300 relate to?

Do you think it should have started sooner? or ended later? or both?

Lloyds often halts a refund when it says it send you a generic letter about your overdraft in 2021/22. This is not a good reason, the letter did not inform you that your overdraft was unaffordable.

As you think you should get more, you should probably send the case to the ombudsman immediately.

They have to allow you to repay the overdraft remaining with an arrangement.

John B says

Since 2018, I definitely have been charged more as some charges were around £3 a time and I have counted near to a thousand separate charges for various amounts.

She has said I will get a final decision letter that will explain it will, shall I wait or shall I go to the Ombudsman straight away?

Sara (Debt Camel) says

I think you should wait and see what the letter says.

Teresa H says

Hi Sara

I recently put an affordability complaint to Nat West for my Overdraft of £6550 which I have had for over 10 years.

They have rejected my complaint as I can now see that I mistakenly put the claim date from July 2019 instead of July 2021. I did clear my OD from time to time between July 2019 to April 21, which they commented on as to one of the reasons for rejection.

However, since July 2021 I have used my overdraft constantly due to having 2 emergency Hip Replacements in the summer of 2021 and being diagnosed with Anxiety , Depression and PTSD. This has greatly affected my income and clearly my focus! ( by putting in incorrect dates!!!)

Since December 2021 I have also had Credit Cards that are on payment plans and my credit score has been affected.

Could I go back to Nat West and ask them to reconsider my complaint from the correct date of July 2021??

I feel so annoyed with myself for such a stupid error but feel I should try again before going to the Ombudsman

Thank you in advance for any help that you can give.

Teresa

Sara (Debt Camel) says

I am not sure that will make any difference as NatWest could have said “we will uphold your complaint from Jul21” or Jul22 or any other date. If they have rejected it completely I think this will have to go to the Ombudsman and there isn’t much point in trying to get Natwest to look at it again.

Because your overdraft problems are so recent, you should assume that you will get a larger refund. Overdrafts are meant to be used when you have problems. It isn’t until you have been using the overdraft heavily for a prolonged period, eg over a year, that a refund is likely.

Can I ask if you are buying or renting?

How large are all your total debts? Including this overdraft? It may be a good idea to look at a debt management plan, where all your debts are included. There interest should be frozen and you make one affordable payment a month. Talk to StepChange about the details of this: https://www.stepchange.org/how-we-help/debt-management-plan.aspx. Your complaints still carry on in a DMP and winning any will really speed it up.

Hermes says

Sara,

I can’t thank you enough for inspiring me to have a go at this. I’ve just come off the phone with Halifax and they’ve agreed to pay a refund of £7000 dating all the way back to 2015. You don’t understand how much this is going to help me. You are an angel. Thanks so much for putting this article together, i followed it word for word and it worked. keep up the amazing work.

Sara (Debt Camel) says

wow. They went back more than 6 years? That’s really unusual, normally these older cases have to go to the Ombudsman.

Angela says

Can I make an overdraft or credit card affordability complaint if I included this debt in a Protected Trust Deed (Scotland)?

Sara (Debt Camel) says

I am not a Scottish expert – I suggest you ask in the comments on this blog https://www.advicescotland.com/home/protected-trust-deed/

Mark says

Eight weeks has passed since I made a complaint to santander about my overdraft ive had since 1994. Just received a letter from them saying they need more time to complete their review .They have also included that I can now send my complaint to the FOS but they said whatever I do ,they will continue to investigate.

Sara (Debt Camel) says

Send it to the Ombudsman now. This gets you into the queue sooner if their offer isn’t good.

Betty says

If the adjudicator rejects and you ask for an ombudsman decision does the bank get informed?

Sara (Debt Camel) says

yes – is this a problem?

Betty says

No, I’m just wondering if perhaps if sometimes this makes a bank want to settle so they don’t run the risk of a decision against them being published?

Sara (Debt Camel) says

It’s correct that Ombudsman decisions are published – the customer is anonymised so you would be Ms B. And sometimes a lender prefers not to have that done and so accepts an adjudicator decision.

I’m not sure this is relevant when you disagree with ab adjudicator decision though.

Sara f says

Hi Sara, I have just received my email from NatWest to say they don’t agree with my complaint and offered me a £70 credit on my credit card. Can you please help me where shall I send this next? Do you have a template? Thanks

Sara (Debt Camel) says

This is an overdraft complaint? I’m checking because this comment is on a page about overdrafts but you said NatWest had offered a credit on your credit card. Perhaps this is because the bank account has been closed?

Sara f says

Hi Sara I made the complaint about the overdraft and it was their decision to credit my credit card account. No the bank account is still open.

Sara (Debt Camel) says

Towards the bottom of the article above there is a section saying how to send a case to FOS.

There is no template letter. The FOS online forms asks you a lot of questions so they can set the case up in their system – things like your date of birth and whether this is a joint complaint.

Dawn says

Hi Sara

Could you please advise if I have a case. Checking my NatWest records from at least 2016 I have maxed out my overdraft each month (normally just a few days after being paid). I was taking payday loads at least 2 or 3 a month to cover costs. Since 2020 no wages are paid in to this account and I only pay in money to cover the interest. This is around £50 a month. Since 2016 I have never cleared my overdraft once and still to this day owe £1950 on a overdraft that has no money being paid into the account.

Sara (Debt Camel) says

this sounds like a good case. Make those points in your complaint.

Send this to the Ombudsman unless NatWest make you a reasonable offer.

Liz says

Hi

I’ve had a case worker allocated by the ombudsman and they’ve asked.

Would you confirm when you became aware that the business lent to you irresponsibly and how you became aware of this? This isn’t when you became aware you could complain, but when you were aware that the business did something wrong?

I didn’t realise irresponsible lending was a thing until I read the guardian article and realised I could complain. I don’t know how to respond to this and don’t want to say the wrong thing!

Sara (Debt Camel) says

When did the overdraft start to be a problem?

is the account still open?

did the response from the bank (who is it?) mention any particular reasons why the bank thinks you should have complained earlier?

Liz says

It’s NatWest and the account was originally a student one back in 2005. I’m not complaining about the original overdraft application but instead that it became a problem 10 years ago. I changed jobs and have not been out of the overdraft since. Largely just put in enough money to pay the OD fee.

The response from the bank concentrated on the fact it was originally a student acct and that they hadn’t done anything irresponsible it setting up the OD and that it recent years they have written to me re the constant usage, but these were always generic letters.

Sara (Debt Camel) says

A previous comment say you were just complaining about the last 6 years – is that correct?

Liz says

Oh you’re right sorry, I used the date 2017 in my initial complaint to NatWest. I’ll go back to the FOS with that date but I wasn’t aware at that time that it was classed as irresponsible lending and have only just been aware since May this year that I could complain. Is that a fair comment in response to their question?

Sara (Debt Camel) says

OK then I suggest you reply that you have only complained to NatWest about the last 6 years because you were under the impression that was as far back as you could go. And that as a bank should have checked on the overdraft affordability annually, you are asking for a refund for that period.

Say that you had never heard of irresponsible lending until you read the Guardian article on it in May this year and that until that point you were unaware that NatWest had done anything wrong and you thought your overdraft was your fault for having used it so much.

Natalie says

Hello Sara,

I recently sent my complaint into nationwide re my £2500 overdraft. They’ve taken approx 3 weeks to come back to me and called me today to conclude that they disagree with my irresponsible lending complaint because they can see that I have been making retail purchases and had a holiday recently therefore have concluded I have been spending on luxury items ? I have had an overdraft of at least £500 for as long as I can remember (at least 10 years) and this increased significantly from £1500 to £2500 in September 2019 at which time I was earning approx £1400 pcm, my rent alone was £700… every single month I max out the £2500 limit often going over and I am never out of my overdraft even when I get paid. I had to bite my tongue on the phone as was slightly offended that they had dismissed my crippling financial difficulties which they have quite obviously made worse for me, due to seeing something as small as retail spending, which was likely to be essential work clothing in all honesty! No goodwill was offered nor any other advice other than rejection. Do you think I should pursue a FOS complaint?

Thank you

Sara (Debt Camel) says

yes I think this should go to the Ombudsman.

Do you have other debts as well?

Natalie says

Thanks Sara,

Yes, lots, which Nationwide would also be able to see as this is my only bank account where all these debts have payments come from.

I must add, In order to pay for my recent holiday, I have been selling personal belongings at boot sales every Sunday leading up to it to raise money to afford it!

Sara (Debt Camel) says

do you think you can win any affordability complaints about them too? Any credit cards that increased your limit when you had only been making minimum payments? Any loans where you have only managed to make the repayments by using your overdraft?

Natalie says

Most definitely, I have sent complaints to capital one and Barclaycard so far. I do also have a complaint with the FOS currently for shop direct/very. I have a Tesco bank loan (had a payment arrangement with them for arrears which I have only just caught up on) which is paid from the overdraft in question, as well as a maxed out credit card with nationwide ( £3000 ) which gets paid from my overdraft every month too? I haven’t yet sent a complaint in about this nationwide credit card yet but do you think I should whilst this is all going on? Thank you

Sara (Debt Camel) says

When did you get the nationwide credit card and did they ever increase the limit?

Natalie says

I think I got the credit card in around 2017 and I cannot remember if it’s ever been increased or has only ever been £3000. It’s certainly been £3000 for at least 2 years. I will try and obtain this information though.

Sara (Debt Camel) says

I would just send in the complaint – the credit card template https://debtcamel.co.uk/refunds-catalogue-credit-card/ asks for this information as part of the complaunt.

Natalie V says

I’ve had a complaint for my overdraft sat with the ombudsman since February. It’s not a complicated one and the overdraft was provided in 2018, so Worthing the last 6 years. It’s not been allocated to an adjudicator and when I called the FOS they said it’s in a queue and that’s pretty much it.

The wait for overdrafts appears to be a lot longer than credit cards or other issues at the moment.

Natasha Y says

I think there is some randomness or factor we don’t know involved. I sent a complaint about an overdraft and one about a credit card at the start of February my overdraft complaint was dealt with a couple months ago (NatWest) but have been told no one is yet assigned to my credit card complaint (Barclaycard) and they’ll be in touch in another two months. So I’m not sure how they decide to allocate adjudicators but I’m not convinced it’s as simple as x number work on these complaints and x do these or that they are done in order.

Jon says

Hi Sara,

I’ve had a NatWest account since 2003 (which was a student account that became an interest paying overdraft of £2000 after I left university).

The account has been negative for almost the entire time I’ve had it, and when unarranged overdraft fees were allowed I was maxing those out every month.

I have a long term health condition (psychosis) and have been out of work for long periods, however I always managed to keep the account from default due to loans from family during this period. I have defaulted on other loans (payday loans) and credit cards – although these have now dropped off my credit file being more than 6 years ago. I do still have a CCJ that is due to drop off my credit file in September.

I have now been working for the last 2 years constantly. I have a gambling problem and the vast majority of the money going out of the account has been related to this (both previously while out of work and in the last two years). I’m now seeking treatment for that also.

I asked NatWest to refund at least 6 years of interest and charges as they should have seen from the use that it was unaffordable and not being used as intended, and picked up on my CCJ etc (please see next comment)

Jon says

I am worried that due to my complaint NatWest will remove the overdraft immediately due to my misuse of it, and my funds, being that they were used mostly for gambling. Even though for all current debt I have kept up on all (except two missed payments on a loan last summer, which I then settled fully).

On the same day I made the complaint I also put in an overdraft reduction plan of £30 a month – which I have had a response saying it’s been accepted (although it will be regularly reviewed to see if it’s “right” for me).

I spoke about my health condition in the email and the gambling issue has been evident in my account for basically the entire time I’ve had it. But I’m really quite worried. After looking at my complaint, my statement that the overdraft is unaffordable, my health condition and gambling issue, could they demand the entire overdraft back immediately, or remove it and say I need to pay more towards clearing it? (In some sense for my own good to stop me using it). I have to make repayments to family and my other debts and I can’t afford to pay more than I already am.

Sara (Debt Camel) says

It’s very rare that a bank closes and account when they get a complaint.

How large is your balance at the moment?

Are you currently in work or getting benefits?

Jon says

Currently I’m £1970 overdrawn. I’m currently in work and my wages are £1780 a month, so it would get completely eaten up. Do you think that I have a case to get the interest and fees back?

Sara (Debt Camel) says

how long has this been going on for? If it has been a prologed period, this sounds like a good claim.

If it’s a just a couple of months as your income has been reduced or your rent has shot up, then probably not.

Jon says

Thanks Sara.

It’s been going on in a similar way for more than 10 years, almost constantly in the overdraft so hopefully I have a case then.

I got a reply from NatWest, a few days after I complained to give me a case number, also saying they are sorry I think they let me down and they promise to do everything they can to put it right. But I think this is just a standard acknowledgement template so I don’t think it means they will offer anything.

Then I emailed a psychiatric report as further evidence to add to my case file, and got a reply within 30 minutes, apologising for any inconvenience my “concern” had caused me and saying my email had been forwarded on, which wasn’t a template from the look of it.

I think maybe I’m clutching at straws but I’m hoping the quick response time for the second means something.

Anna says

Hi Sara,

I sent case to ombudsman and have been assigned case worker. He is looking into cause for going back more then 6 years and I have also brought up the end of refund date being 2021 with the generic letter sent (Lloyds). He is asking few questions and one is puzzling mw”when did I first realise I was in financial trouble? ”

What is the right answer here? I mean I have known for years that my finances were bad, payday loans, credit cards, (all btw, thanks to you claimed back on charges and refunded) but I always thought one day I will crawl out. So what can I answer to that question?

Thanks

Sara (Debt Camel) says

I think you should say what happened. For many people it would be something like this: that you knew your finances were bad and you were having to juggle a lot, but you kept borrowing to try to get into a bit better position and to reduce the interest you were paying, hoping that if you got a payrise you would be able to crawl out of the problem and just repay debts, not borrow again. Because your overdraft was just there and the charges were taken automatically rather you having to pay them each month, the other debts seemed more of a problem as if you missed one your credit score would get worse. You didn’t see there was anyway of getting out of the overdraft, so you just accepted that you were living in it, as at that time you had no idea that a bank should have reviewed whether the overdraft was affordable, so you thought it was your own fault for spending too much when you were younger.

Sally says

I submitted a claim about an overdraft and a loan provided by NatWest.

The adjudicator has said a different team will look at the loan and has given me a reference number.

Do that loan complaint only now going into the loan queue? Or will they see it was submitted 4 months ago with the overdraft complaint?

Sara (Debt Camel) says

it should be treated as having been submitted 4 months ago

Rich says

Hi Sara.

Just a quick question. The Halifax have upheld my complaint for my £2700 OD. They have gone back six years straight away and want to pay me £6k+. But I’ve had this OD for around 12 years. I have a feeling they are just going to pay it and remove my overdraft. Which I’m fine with as I want it gone.

What I’m not fine with is the 6 years.

So my question is. Can I still send it to the FOS for the remaining years of Halifax just pay me out for the 6 years they have upheld? Will the ombudsman still look at the years prior?

Thanks. Must say the page is a god send thank you so much.

Rich

Sara (Debt Camel) says

When they responded to you, did they ask you to accept this offer to refund 6 years?

If you aren’t sure, go back and read the letter and email carefully.

(Banks don’t normally, they usually just say this is what we are going to do and you have the right to go to the Ombudsman.)

Rich says

I’ve only spoke to them on the phone as of now. They have told me other the phone that they upheld complaint. But the way she was speaking, I got the impression that they would refund and the money would be in my account with the OD paid off and gone before I even receive the letter. Made it sound it would be that quick. I did keep repeating to her that I will read and go through the final response letter when received and request a pdf copy to email. But till got the impression that they would refund the 6 years regardless. If this was to happen. Would I still be able to go to the ombudsman for the remaining years. Thanks in advance.

Sara (Debt Camel) says

If they do this without asking you if you accept this as a settlement, then yes, you can go to the ombudsman. Wait until the letter arrives though as you will want to attache a copy of that to the FOS complaint.

Rich says

Thanks for reply. I will do this 100%. Just wanted to make sure my thinking was correct.

If they do this. At least I’ll get the 6 years now and OD gone. Anything after if the ombudsman side. Will be a bonus.

Thanks again

J schofield says

Hi. Just a quick post to Thank you for the info and advise on your site. I have had a £1900 overdraft with Halifax for several years and living in it constantly. After reading your advise I sent a letter of complaint 14 days ago and today received a letter stating they agreed with my complaint and refunding me £4347 in charges . I can’t believe how easy this was and again thank you.

Kay says

I’ve had an overdraft with Monzo since I set up an account with them 3 years ago. when I signed up to the account it instantly offered me an overdraft of £1000 and I was stupid/desperate enough to accept it.

Since then I have stayed firmly in that overdraft (usually within £10-£20 of the limit) and don’t use it as my main account so only paying in enough money each month to cover the fees, I cleared the overdraft once when I got a loan from another company but had used it all again the following month. I’ve had gambling problems and would transfer money in sometimes to use for gambling, then blocked gambling transactions from the account but found that paying through PayPal meant I could circumvent this even though it still lists the gambling site’s name along with paypal on the majority of each transaction.

Would it be worth complaining about this to see if I could get a refund of charges? Not because of the gambling but because I’ve only ever been out of the overdraft once since opening the account?

Sara (Debt Camel) says

what were your finances like when you opened the Monzo account?

Chloe says

Hi Sara,

I put in a complaint about my NatWest overdraft, I said it never should’ve been issued.

The adjudicator has emailed me their findings saying NatWest should’ve known I was in trouble in Dec 2019 and stopped charging interest.

They have asked NatWest to respond.

The overdraft was actually issued in July 2018 and they adjudicator hasn’t addressed the opening of the account.

Should I go back to the adjudicator now and ask them why the initial account overdraft issuing has been addressed? Or wait to see if NatWest respond?

Many thanks

Sara (Debt Camel) says

Go back and ask the adjudicator now. This is a question you aren’t actually rejecting the de ion at this stage.

How much interest did you pay on it before Dec 19?

Chloe says

The account was opened for a year and half with the overdraft so i estimate around 500.

It had been maxed out and used for gambling since day 1 too.

Thank you the response.

Sara (Debt Camel) says

Ok but the question is, could the bank have expected this would happen when they gave you the overdraft?

Chloe says

Response received as…

The initial overdraft lending there was no concerns. National Westminster Bank Plc couldn’t have seen how the account was managed, so when the overdraft was initially granted, there were no concerns.

However, despite this, as per my findings, National Westminster Bank Plc had to monitor the account, and its usage, and step in when they could see there was a problem.

…

Can I ask for it to go to an ombudsman? Or a better question, is it worth it? My argument would be…

Natwest gave me £1250 overdraft and a RBS overdraft of £1250 on the same day despite the fact that…

My credit report shows I had 10k debt

My credit report shows I was using near enough 95% of all my credit cards

I had a Santander overdraft of 1k which was constantly at its max and had been for over a year

I had a pay day loan shown on credit report of 1450 with quickquid, that was taken out 1 month before the OD was applied

I had opened a capital 1 credit card in March (so 5 months before) this was already at its limit if £200

I appreciate your advice

Sara (Debt Camel) says

Is it worth it?– that was why I asked you how much you actually paid in charges over the extra period. It’s up to you if you think it’s worth disputing this for £500 extra refund.