Have you had big overdraft problems for a long period?

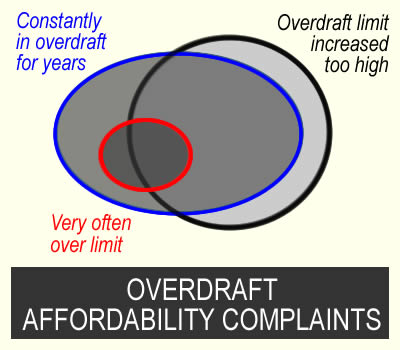

You can make an affordability complaint and ask for a refund of overdraft charges if:

- your overdraft limit was set too high at the start or increased to a level you are unable to clear; or

- your overdraft usage showed you were in long-term financial distress. For example, being in the overdraft all the time, or using an unauthorised overdraft a lot

- your overdraft was originally a student account with no charges, but now interest is being added and you are in the account all or almost all of every month.

This article shows how to make an affordability complaint to your bank, with a free template letter to use. If the bank doesn’t make a you a good offer, it is free to take your case to the Ombudsman.

These complaints do not hurt your credit record. And

Contents

Overdraft affordability complaints

Overdrafts are supposed to be for short-term borrowing

Overdrafts are intended to be used for short-term problems, not as long-term borrowing. A bank should review a customer’s repayment record and overdraft limit and if there are signs of financial difficulty, offer help.

One sign of financial difficulty is hardcore borrowing for a long period. The Lending Code defined hardcore borrowings as “the position where a customer’s current account overdraft remains persistently overdrawn for more than a month without returning to credit during that period”.

Some Ombudsman decisions

All cases are very individual. But these examples give you an indication of what the Ombudsman thinks is important.

In this NatWest decision, the Ombudsman decided:

NatWest did have an obligation to monitor Miss K’s use of her overdraft facility.

Any fair and reasonable monitoring of Miss K’s overdraft facility would have resulted in NatWest being aware Miss K was in financial difficulty … by October 2014 at the absolute latest. So NatWest ought to have exercised forbearance from this point onwards.

In this Santander case, the bank didn’t notice hardcore borrowing:

By this point, Miss C was hardcore borrowing. In other, words she hadn’t seen or maintained a credit balance for an extended period of time. Santander’s own literature suggests that overdrafts are for unforeseen emergency borrowing not prolonged day-to-day expenditure. So I think that Miss C’s overdraft usage should have prompted Santander to have realised that Miss C wasn’t using her overdraft as intended and shouldn’t have continued offering it on the same terms.

Decide which reasons apply to your overdraft complaint

In the overdraft all, or almost all, of the month for a long while

This is the most common reason for winning a complaint

Overdrafts are meant to be used when you have a short term problem. Using the overdraft a lot for a few months is fine. Or for a few days at the end of a month before you are paid.

Banks should review your overdraft annually. This is in most overdraft terms and conditions. And even if it isn’t, the Ombudsman says this is good industry practice.

So at one of these reviews, your bank should have seen if you were in difficulty with the overdraft. For example if you are in the overdraft for all (or almost all) of the month for a prolonged period. Or if you were often exceeding your arranged overdraft limit.

I would say over 18 months or 2 years is prolonged borrowing, not short term.

The bank set your limit too high

This may have been from the start when you were first given an overdraft. Or the initial low limit may have been fine, then the bank increased it to a level which it was impossible for you to repay.

If the bank saw signs of financial difficulty, it should not have increased your credit limit, even if you asked for it. And it should have considered offering your help instead (the regulator’s word is forbearance), for example by stopping charges.

But what is too high?

This depends on your income and expenses. An overdraft of £2,000 for someone whose income is £1,800 a month is a lot – but if you earn £5,000 a month, then a £2,000 overdraft may be reasonable.

Other points that help a complaint

You won’t win an affordability complaint by saying the charges were too high.

Instead, you say the bank should have known they were unaffordable for you because of all the financial problems it could see on your statements and your credit record.

Here is a checklist, do any apply to you?

- often having direct debits or standing orders not being paid;

- a lot of gambling showing on your statements;

- significantly increasing other debts with the same bank (you may also be able to complain about those loans or credit card);

- being recently rejected for a loan or a credit card by the bank;

- significantly increasing debts with other lenders showing on your credit record;

- a worsening credit record – maxed out credit cards, new missed payments, payment arrangements, defaults etc;

- using payday loans;

- mortgage arrears;

- a reduction in the income going into your account.

Free student overdrafts

You can only win a complaint about these after the bank has started charging you interest

Making your complaint

What you need at the start

You don’t need to know the dates your limit was increased before complaining, my template asks for them.

You don’t need to send statements to the bank with your complaint – the bank already has them!

You can’t go back and see exactly what your credit score was in say 2021 when the bank increased your limit. But your current credit record shows what was happening back six years, so download your credit report now and keep it. The sooner you get the report, the further back it goes. I suggest you get your free TransUnion statutory credit report.

Send a complaint by email

I don’t recommend phoning to start off a complaint. It’s too complicated and you will be talking to someone that doesn’t specialise in these complaints.

I think email is the simplest way to make these complaints. Here is my list of bank email addresses for complaints.

An alternative is to send a long message in the app. But if this means using a chat facility, it’s not usually a good idea, as you are again talking to someone who doesn’t understand what you are saying and tries to tell you what help is available with your overdraft – when all you want is to have your complaint considered.

A template you can adapt

In the template below, I’ve invented some examples and dates so you can see how a complaint email could read. The bits in italics should be changed or deleted to tell your story. Delete dates if you don’t know them. If a sentence doesn’t sound relevant, delete it.

I am making an affordability complaint about the overdraft on my current account number 98765432.

Your identity details (these are needed if you complain by email, not if you use secure message):

My name is xxxxx xxxxxxxx. My date of birth is dd/mm/yy. The email address I use/used for this account was myaddress@whatever.com.

Your home address (if you know the bank has your current address, ignore this):

My current address is xxxxxxxxxxxxxxxxxxxx. Please do not send any letters to older addresses you may have on your records.

If your overdraft was originally a student overdraft with no interest include this, otherwise delete it:

My account started as a student overdraft and no fees were charged. I am complaining about the period after, when you started to charge fees.

START BY SAYING they should have noticed your financial difficulty

Overdrafts are meant for short-term borrowing but you could see I was unable to clear the balance in a sustainable way. I was using the account for long term borrowing as I could not get out of this. The fees and charges you were adding were making my position worse.

I am complaining that [every year since [20xx] OR for many years] you have failed to notice my difficulty during the annual reviews of my overdraft. You should have offered forbearance eg by stopping interest and charges being added.

By 2017 I had been in my overdraft constantly for many months, not getting back into the black even when I was paid. This “hardcore borrowing” is a clear sign of financial difficulty. My income was only £1,850 a month – after I had paid bills, there was no way I could hope to clear an overdraft of £3500 in a reasonable length of time.

OR

By 2021, although my salary took my account briefly into credit, within a few days, I was back in the overdraft.

include any other points that show you were in difficulty

You should have seen that I was in financial difficulty because you rejected my loan application in 2021.

You should have noticed that the income going into my account decreased from 2020.

From 2020-22 there was a lot of gambling showing on my account.

In 2022 and 2023 there were a lot of rejected direct debits on my account.

… or anything else!

Say if the initial limit was too high or it was increased too high

You should never have given me an account with such a large overdraft. When I applied, you should have checked my credit record and income and seen I had recently missed payments to a credit card and had taken several payday loans.

OR

You should not have increased my overdraft limit. When you increased the limit, you should have seen that my debts to other lenders on my credit record had increased a lot

OR (for accounts that had been student accounts)

You should have seen after [2020] when you started charging interest that the limit was too high to be repayable on my income.

In your reply to this complaint, please tell me when any limit increases were and how much the limit went up.

END BY asking for a refund of charges and interest:

I would like you to refund all the interest and charges that were added to my account from 2016 when you increased my overdraft limit.

OR

I would like you to refund all the interest and charges that were added to my account from 2021 when you should have realised that my finances had got worse to the point that I was no longer able to clear the overdraft.

Please remove any late payment and default markers from my credit records.

Points to note

Student overdrafts

You won’t win a complaint about a student overdraft saying you were a student and it was unaffordable at that point.

But when the bank has started charging interest, it should start doing reviews and check if you are in difficulty. So from then on, you can win affordability complaints.

You can complain if the account is still being used or if it is closed

These complaints can be made if:

- you are still using the account or you have stopped using it and are paying it off;

- the account has been closed;

- the bank defaulted it and sold it to a debt collector (here you still complain to the bank, not the debt collector). If the debt collector has gone to court and got a CCJ, add a sentence to the template saying you want the CCJ removed as part of the settlement of your complaint.

But if you have had an IVA or bankruptcy after these problems, or if you are still in a DRO, then you shouldn’t complain – ask in the comments below for details.

Old accounts

Banks may say FOS won’t look at an old complaint, but this isn’t right. FOS will often look at a complaint if it has been open in the last six years. How far back FOS will go seems rather random, but it should be possible to go back at least 6 years.

Open and recently closed accounts aren’t a problem – the bank will still have your statements.

If your complaint is about an account that was closed more than 6 years ago, it’s going to be very hard to win.

Packaged bank accounts

These affordability complaints are not about the fees on packaged bank accounts. MSE has a page about packaged bank account charge complaints.

Personal accounts, not business accounts

The complaints covered here relate to personal accounts. For business accounts, talk to Business Debtline about your options.

The Bank replies

They want to phone me!

People are often scared if they get this message. But it may be good news! You can just ignore it or say you would like a reply in writing.

If you decide to take the call, it helps to be prepared:

- have a pen and paper handy so you can write down anything

- if they say they are partially upholding the complaint, ask them the date they are refunding the fees from, and how much. And say you would like to see this in writing before you decide whether to accept it.

- if they ask you questions that sound complicated or worrying, ask them to put the questions in writing as you find the phone difficult

- when they say they are rejecting the complaint, ask for this in writing, as you will be going to the Ombudsman.

Rejection/poor offer – go to the Ombudsman , it’s free

Banks reject many good complaints, hoping you will give up. So don’t! You know if the overdraft has caused you a lot of problems.

You can’t go straight to the Financial Ombudsman (FOS), you have to wait for the bank to reply, or for them to have not replied within 8 weeks.

Here are some things banks may say to try to put you off:

- you could have declined the increase to your overdraft limit – FOS probably won’t think that is a good reason

- you never let the bank know you were in difficulty – FOS probably won’t think that is a good reason

- your salary was enough to return you to credit each month – this is misleading if bills meant you soon went into the overdraft;

- FOS will not look into things that happened more than 6 years ago – if your account was still open in the last 6 years FOS may well look at it.

And the bank may offer to refund fees for the last 15 months say, even though your problems have been large for many years. Think twice about accepting a low offer – you won’t put this offer at risk by going to the Ombudsman.

If you are offered a refund for the last 6 years but not any further back, have a think if this is a good enough offer. It is unpredictable whether the ombudsman will be prepared to go back further than 6 years.

If you aren’t sure, post in the comments below.

To send the case to FOS, complete this online form:

- you can use what you put in your complaint to the bank;

- if the bank rejected your complaint or made a low offer, say why you think this is unfair;

- use normal English, not legal terms.

You don’t need to send your bank statements – the bank will send those to FOS. And you don’t need the policy documents for your bank account, the lender will supply those to FOS if they are needed.

Do these complaints work?

Yes! From 2024, some banks are making more offers directly.

A Guardian article featured a case where someone used the template letter here. Barclays denied it had done anything but made an £8,000 “goodwill” payment to the customer.

And if your bank rejects your case, people are winning cases at the ombudsman. FOS is a friendly service although it isn’t speedy. It isn’t faster to use a solicitor or a claims firm,

The comments below this article are from other people who have made this sort of complaint. That is a good place to ask for help if you aren’t sure what to do.

Refunds from unaffordable loans

Mark says

Hi Sara

Good news!!

Further to my previous post, I submitted a complaint to Lloyds Bank saying they should have reviewed my overdraft position, instead of letting it just run and run year in, year out, and therefore seen that it was unaffordable for me. Today (amazingly just 5 days after complaint) they agreed unreservedly with my complaint, apologised and refunded me all charges/interest for last 6 years, some £1600. Apparently they (banks) unable go back further than 6 years unless instructed by Financial Ombudsman (FOS). They themselves emphasised that I still have the right to take up matter with FOS.

Frankly, I am shocked at the speed they agreed and settled.

Thank you Sara for your guidance on this site.

Mark says

Hi Sara

Regarding my successful speedily resolved complaint against Lloyds in which they went back six years, do you think it would be worthwhile to refer this further to the FOS with regards to the previous period 2005 – 2016 in which I was basically same situation as the now resolved x6 years 2017 – 2023. Lloyds letter which boldly states “We Accept Your Complaint” does also mention that I have the right to refer my complaint (whole period) to FOS.

I was never out of my o/d position during the entire period save a few days here and there perhaps. During that period Lloyds gave me a personal loan of £3000 which I was unable to pay in entirety and they since sold balance on to a major debt collector company of which I am paying ridiculously low £2/month. Whole thing adds to fact I couldn’t afford overdraft as well as loan.

Many thanks

Sara (Debt Camel) says

did you also complain about the loan?

Miss B says

Just thought I’d drop a note here as my OD claim is a little different to others on here and thought it might encourage others to pursue a claim. I set up an account with Santander in 2010. Their deal at time was to mirror what I had with HSBC so copied over my £500 OD. This has never increased but until 2020 as soon as I was paid and my bills went out I was in the OD. Santander have never allowed me to increase it or have any other credit with them. Up until 2017 they also allowed me to go over my overdraft often by double and then charged me for the pleasure. From 2015 I started getting bigger charges and fell into a gambling/pay day loan cycle until the end of 2018. I put a composing in to Santander Dayi g they should have realised my situation was worsening and didn’t attempt to help and shouldn’t have allowed me to go over my overdraft which meant I was receiving bigger charges. Santander turned down within a few days. Off to the FOS and nearly a year later they have agreed with me and today said Santander need to pay back all interest and charges from Feb 2015. The charges alone for this period are over £2000 my overdraft is still £500. Santander have until the 8th to reply. I will update their response – but my point is you don’t have to have lots of increases or high OD amounts to be successful – hopefully this will encourage others to complain when they live in their OD on smaller amounts of bank credit.

Sara (Debt Camel) says

Thanks – fingers crossed Santander accepts this decision.

Miss B says

Keeping everything crossed. It looks like most people are getting offers from Santander whilst waiting on FOS decision so I may still be in with a fight ahead of me but hopefully not. Not entirely sure if they are prompt at responding either.

Miss B says

Santander have agreed.

Although made a strange comment stating the refund will clear my overdraft which I knew. They would therefore remove the facility, fine I knew this would be the case. But then said if that would be a problem I should call them. Almost like they are suggesting I could keep it. Which I absolutely don’t want to do – it just seemed an odd comment to make and a bit counter productive – is that normal. I’ve politely declined.

Sara (Debt Camel) says

This is common at the moment. I think it’s because the regulator doesn’t want to see lenders remove a line of credit someone may be relying on, not as a marketing ploy.

Of course most people once they are out of the overdraft trap don’t want to be able to slip back into it.

Steven W says

When did they agree? I spoke to them yesterday and was told overdraft refunds are currently all being placed on hold whilst they review the policy. They said we should have an answer in the next few weeks before my 8 weeks is up.

Miss B says

Sara – aaah I guess that makes sense I just thought it a bit odd. But all good news none the less.

Steven – I complained the beginning of 2022. I was turned down by Santander within a week and then went straight to the FOS. An adjudicator picked up my case in June 2022 and made a final decision to agree with me last month. They gave Santander two weeks to respond to their decision to which they agreed after about 3 weeks. My complaint is much further along than yours with FOS involvement so it’ll be different to what is happening with yours. Good luck though most people seem to be winning these.

Kim says

Hi Sara, I was turned down by Halifax a second time so I’m looking to foward complaint to ombudsman. But I forgot on 5th April 2019 I filed for insolvency as my family advised due to my mental health at the time but I wasn’t in it longer than a couple of months as I just didn’t know what I was doing then. So is my complaint going to be differant from others?

Sara (Debt Camel) says

what form of insolvency? bankruptcy, IVA, Debt relief order, or was it a debt management plan?

You can’t usually be in a form of insolvency for just a couple of months. Who helped you set this up?

Kim says

It was an IVA and the reason it stopped was once I started to get myself straight hardly anything I was paying was goin to my creditors

Sara (Debt Camel) says

so did the IVA fail? or was it settled?

Kim says

I’m guessing it failed as I told them I wasn’t happy with it and no more payments were made

Sara (Debt Camel) says

who was the IVA firm? Have you checked the Insolvency register to see if your name is still on it? See https://www.insolvencydirect.bis.gov.uk/eiir/

Kim says

I don’t remember name of company I would have to find paperwork but just using the link you gave me no I’m not on the register

Sara (Debt Camel) says

Then I think you should carry on with this complaint. It isn’t clear to me what happened. Worst case a refund is taken by your IVA firm, but that may not happen so worth a try?

L Taylor says

Hello Sara,

I wanted to give an update to the above case.

Yesterday Barclays called me to refund me 6 years for chargers, totally just over £8k. I’ll give more detail, and also the template I used to write to them.

Complaint put in on January 15th via the chat functions on the app (I had a letter drafted that I had to then type in on my phone – but worth it as the complain reaches them quickly versus by post!)

Was told to expect response by 30th Jan – this came and went – I called that day and they said it would be now by the 19th Feb

1st Feb – received a call from my case handed to say she had reviewed and in light of my circumstance they would refund 6 years totalling just over 6 years.I had asked for £9k in refunds… so was happy with this!

I do have charges dating back beyond this, so probably could have taken up with the FOS for historical charges, but I’m the interest of time I was also happy with this.

L Taylor says

It has meant that I’ve been able to pay high interest debts down, leaving me with the two overdrafts still (now at 6.5k currently 0% interest and a payment plan in place)

Additionally, I would like to add I have spoken with Barclays financial assistance at the back end of last year, and they did freeze the interest on my overdrafts and we have since put a plan in place that should allow me to pay down the balance as a 0% loan, that they don’t credit check for, but budget planner etc is required.

(Part 2) My main point is call Barclays and explain your situation! Speak to financial assistance and be persistent. I have spent hours on the phone, but worth it. However, at no point was I offered refund or anything for charges, so if it wasn’t for this website and community I would still be struggling with double the debt at least! Thank you!

L Taylor says

Sorry so many typos! I meant I was refunded 8k from the 6 years of charges!

Sara (Debt Camel) says

it was a very good result for you. What a relief!

cyrilv says

So… the case handler at the FOS got in touch today – and it looks like she has come up with the goods. About £1350 compo from Halifax (minus the £297 that has already been paid to me) plus an extra £150 by way of goodwill and for the trouble caused. Needless to say I’ll be snapping their arms off for that one, can’t see any reason as to where there’ll be any more to come via the Ombudsman.

All I now need to know is what happens next; the adjudicator has been informed that I’ve said yes to her offer and it appears that Halifax have up to 16th Feb to agree to my acceptance. Surely they won’t withdraw it now. How long before this ~£1200 hits my account?

Anyway, looks like a decent win here. Many thanks to Sara and everyone.

Sara (Debt Camel) says

If Halifax says No it can take another few months as it goes to an Ombudsman.

Bank seem to be are accepting most adjudicator decisions at the moment so fingers crossed.

cyrilv says

Halifax have said yes; according to the adjudicator this is what Halifax have agreed to offer at this stage, and it looks good to me so I’m accepting. Hope they don’t backtrack after all this!

Sara (Debt Camel) says

I have never heard of a bank changing its mind after accepting a decision.

cyrilv says

All sounding good then! What’s the time scale between the bank’s acceptance of my decision and the money landing in my account? I’ve heard 28 days.

Sara (Debt Camel) says

They should deal with it in that time. It may be a lot quicker.

But you cannot be 100% sure this money will arrive within 28 days – even though it is rare for a bank to go over, don’t make a promise to do something and then be unable to keep it.

Chris says

I’m wondering if you complain to your current bank about the overdraft that you have had for years, will they then remove the overdraft completely from your account after the complaint?

Sara (Debt Camel) says

See https://debtcamel.co.uk/affordability-complaint-credit-record-faqs/

Saz says

Hi,

FOS sent Halifax a letter mentioning what they found and supporting my claim and that I should be paid back any interest from dec 2017 they had up until today (3 Feb) to response to see if they had any evidence to show that I shouldn’t be paid , what’s they likeliness of Halifax coming back and objecting? ..on the letter to Halifax it didn’t say how much I would be paid. Are people just figuring it out how much they are getting or they getting told? Just wondering what the next steps will be. assuming I will hearing something today

Saz says

Hi,

I’ve just got this, has any one else had this

Halifax hasn’t responded to my assessment sent on 20 January 2023. I have sent a follow up chaser this morning asking it to respond by 10 February 2023.

If I don’t receive a response by this date, I will prepare the case to be reviewed by an ombudsman for a final decision.

If you have any questions, please get in touch.

Sara (Debt Camel) says

it isnt uncommon for a lender to not reply in time. The adjudicator is giving them more time as if they do accept this will be quicker than this having to go to an Ombudsman.

Saz says

Just had the below sent. Is it common for Halifax still not to come back and now it’s gone to an ombudsman.

An ombudsman will review this complaint

Because Halifax didn’t reply, an ombudsman will review the complaint and make a decision.

Can Halifax in the meantime come back and accept the decision? Also how long does it usually take with ombudsman

Thanks

Sara (Debt Camel) says

It isn’t common.

Yes Halifax may come back and accept.

if they don’t, then 1-6 months usually – overdraft complaints normally seem to be at the quicker end of this range.

Saz says

So Halifax have come back with a counter offer do I accept it?

Halifax has made an offer to settle your complaint – but its offer isn’t in line with the recommendations we set out in our letter of 20 January 2023.

They are offering me 1 year back worth of interest. When I work it out I think I’m around 500/600 down do I let it go to an ombudsman?

Sara (Debt Camel) says

You said the adjudicator proposed a refund from Dec 17. Would this really only be £5-600 less than the offer of 1 year refund?

Do you know what charges you paid in 2018,2019, 2020, 2021? 2022

Saz says

In 2019 I reduced my overdraft (bonus from work) From 2500 to 2000 and kept digging away it when I got money I wasn’t expecting But then was stuck at 1500 overdraft for ages butI finally paid off when I got payday payout last year. So they are saying I was only result in money trouble 17-18 xx

Saz says

So I’ve worked out I’ll be around 600 less then I thought due to Covid etc when they stopped putting chargers on overdrafts etc.

Sara (Debt Camel) says

do you have the amounts you paid in charges for the different years?

Saz says

Sorry for the delayed response so chargers are as followed

Dec17-18 = 1247.47

Dec 18-19 = 1182.12

Dec 19-20 = 471

Dec 20-21 = 204

After speaking to my case worker at FOS I’ve decided to decline Halifax offer after checking all my statements Halifax was basically saying the reason why they are only giving me 12month back (17-18) as if they would have put me on payment plan etc this is what they would have done.

My only worry was if I declined the offer I had the risk of not getting anything!

They offered me 1700 after 8% was added.

Just wondering as anyone else had offers like this before it taking the next step to ombudsman. Is it likely they will come back and agree to what the FOS have said or will it go to ombudsman?

Thanks for all your help

Sara (Debt Camel) says

on those numbers it looks as though you were in quite a bit of trouble in 18-19 as well!

I am sorry I don’t think I have seen many cases in this situation, where an adjudicator has made a decision and then the lender has offered less – I don’t know if Halifax will now have a rethink or ask for it to go to an Ombudsman.

I think the chance of you getting nothing is about zero – the worst case would be an Ombudsman saying they think Halifax’s offer was a fair one.

Saz says

Hi Sara,

I just wanted to give you an update on this. so I got the ombudsman’s provisionally decision yesterday (it’s only been 2 weeks if that) they have given me a provisionally decision because its different to what the adjudicator said. They upheld my complaint and said Halifax have to refund from 2016 and not 2017 which the adjudicator originally said. so it should be an additional £855 in total, I should be getting just under £4000 but then there is the 8% on top of that ( not sure how to work it out if im honest). Halifax have up to the 4th April to either provide more evidence or accept the complaint. Hoping this will come to close soon it will have been a year in April since I started my complaint.

Will halifax contact me with a breakdown of cost or will they go to the ombudsman with it?

Thank you so much Sara, If I get this payment I will become debt free and weight will be lifted.

xx

Sara (Debt Camel) says

Normally the lender tells you what they are refunding not FOS. They should say how much 8% interest there is and how much tax has been deducted from the 8% part.

Saz says

UPDATE: Halifax has agreed to the Ombusdman decison. yeah :-).

how long usually is it before i hear from the bank the break down of what they will be giving me and when it will hit my account.

Thanks

Kim says

Morning, can I ask what the differance is between an adjudicator and ombudsman please?

Sara (Debt Camel) says

the Financial Ombuds is a two stage system.

First your case is considered by an adjusiducator, sometimes called an investigator. They make a decision – if it is accepted by both parties, you and the bank, that’s it. 90% of cases are settled like this.

But if either party doesn’t accept the adjudicator decision, the case goes to be looked by a more senior person at FOS with the title of “Ombudsman”. These Ombudsman decisions are also the only ones published, the customer is anonymosed so you would be Ms H. At Ombudsman decision is legally binding on the bank – they will pay up.

Steven W says

Has anyone heard from Santander recently? I was called a week ago to say all overdraft complaints are with another team to check over, before finalising the refund and now the 0800 number I called before / and was called on last Tuesday does not work.

Lynn says

I sent an affordability complaint 3 weeks ago to Halifax using the email address given on here. Is it normal not to receive an acknowledgement of the e-mail? Thanks for your help

Sara (Debt Camel) says

I think you should phone up and ask them to confirm they have your complaint.

Lynn says

I will do thanks

Peter says

A little update from my complaint with Lloyd’s about my overdraft and loan. I had 3 missed calls this morning and I received notification about incoming payments. They have transferred about £2000 in my account, cleared the overdraft (£700) and returned interest on my CC account from January, but still stands at £1200. I haven’t received any e-mails or letters though. Should I give them a ring back and ask for it? I’m curious why £2000, I had my CC for about 6 years and I have paid interest on it over £120 in the last 6 months alone.

Sara (Debt Camel) says

So you complained about an overdaft and a loan? Did you also complain about the credit card?

But they have cleared your overdraft and changed your credit card balance?

I think you need to ask for details in writing of what they have decided to refund. As it may well be you should send the rest of your complaint to the Finacial Ombudsman.

Peter says

Sorry, my bad about the loan. I complained about my overdraft and credit card. All they did, was sent me a letter that my complaint will be investigated, which was sent like 2 weeks ago and today, I had 3 missed calls with a message to call them back and discuss my complaint. But like I said, I checked my bank account and they have transferred 3 payments, 1×1800, 1×130 and 1×30 without any discussion. Not sure why 3 separate payments. But now, my overdraft is gone (£700), but my credit card account still is at £1200 and when I check into that, I see they have returned the interest from January, but that’s it.

Haven’t gone through my overdraft fees yet, but if do calculations like £20 (it’s definetly more) a month over 6 years, it ends up with almost £1500. And I assume credit card interest might be around the same number.

Sara (Debt Camel) says

Ok I think you need to wait for the decision letter. If nothing comes in a week, phone them up and ask where it is.

PS was there a loan that you didn’t complain about?

Peter says

OK, thanks.

I included in my complaint that they refused to give me a any loans, due to my credit score and history, but didn’t have problem increasing my overdraft and giving me a credit card.

I went through my CC interest and it’s about £1250 over 6 years. I might be wrong, but I believe refund should be bigger than £2000.

Don’t they also have to add that 8% on top of that?

Sara (Debt Camel) says

That is a good point to make.

They only have to add on 8% from the point your account should have returned to credit if they hadn’t added on the interest that they shouldn’t have.

Peter says

I see. I will wait for the letter and will post an update as soon I hear from them. I’m quite happy they haven’t refused to my complaint and have noticed there was something wrong.

Peter says

Received the letter today from Lloyds about my refunds. They agree they should’ve seen my account earlier but they are not agreeing with the credit card, since when I was offered it, CRA information looked good and there were not any red flags. They refunded the overdraft interest and tax for last 6 years and added £100 in cheque on top of it. Not sure what to do now, should I accept it or go to ombudsman?

Sara (Debt Camel) says

when was the credit card offered? and did they ever increase the limit on it?

Peter says

They never increased the limit, but I got it when I had several payday loans, ongoing HSBC loan and constantly around 800-900 in overdraft.

They were saying, because I made minimum or a bit over minimum payments every month, my account was in good hands.

Sara (Debt Camel) says

when was the credit card account opened?

Peter says

In August, 2017. Still opened, originally it was 1250, they decreased to 1200 in 2018 I think.

I tried to reduce it, but it didn’t let me do it. Only to increase it which I never did.

Sara (Debt Camel) says

So its your decision about whether the refund on the overdraft feels like a fair settlement of your whole complaint.

The card was opened in the last 6 years, so there would be no problem in getting FOS to look at at.

The argument would be that 1250 was too high a limit as they could see your heavy overdraft use and the payday loans. and the large HSBC loan.

N says

Hi,

I emailed NatWest today with an affordability complaint. I’ve never been charged for being in my overdraft as my account is a student account although I have been constantly in it since I’ve had it. I’m only 18 and my limit is at £2,000. I’ve asked them to bring me back to black, how likely is this to happen?

Sara (Debt Camel) says

It isn’t at all likely. The compensation for unaffordable debt is a refund of interest, which you haven’t paid…

If a few years after uni you are still trapped in your overdraft and have been paying fees at that point you may be able to win a complaint and get the interest refunded.

Julia says

This sounds very interesting. Over the years my husband and I have had lots of stress with money. Barclays kept sending us letters about taking out loans with them. We were desperate to get out of overdraft and away from credit cards, so took them up on it. In the end after nearly separating we decided to take out a larger mortgage to pay off all the debts, which has added years more. Hoping we can do a successful complaint, as looking back was a very dark, stressful time. Despite it should having being the best time to enjoy our young family.

Sara (Debt Camel) says

So you had an overdraft with Barclays for a long while, and then a loan, did you also have a credit card?

Julia says

Yep, credit cards too kept switching to interest free so been with most lenders over the years. Will keep you posted on the outcome!

Julia says

Yes, that’s right credit cards about 3. It was a very difficult time. We extended our mortgage in the end, which seemed mentally easier to take but obviously far from ideal! Thankfully in a better place, now children are older we both work full time. But looking back it was awful!

Sara (Debt Camel) says

Sorry I meant did you have a Barclaycard?

Julia says

Sorry Sara, yes we did, thanks

Sara (Debt Camel) says

In that case I think you should do a combined complaint – because if Barclays had stepped back and thought about all the information it knew about you, it would have realised that a lot of this credit was unaffordable.

Start with the overdraft template in the article above. But say at the begining you are asking for a refund on interest on the overdraft, loan and credit card. Then add a paragraph in on the credit card (read https://debtcamel.co.uk/refunds-catalogue-credit-card/ for ideas) and the loan (read https://debtcamel.co.uk/refunds-large-high-cost-loans/ for ideas). And also point out you had two other credit cards which Barclays should have seen from your credit records and the fact you were making payments to them from your bank account.

Julia says

Thanks Sara for your help with this. Barclays called yesterday and spoke to my husband. They made him feel silly, and said because the overdraft has “only” been £5k, since 2017 we weren’t in it for a few years as end of 2017 we took out a separate mortgage of £40k to pay off the loans, overdraft, credit card. Barclays in the 6 years say they “only” added £500 to make it £5500 for “emergency lending”. They says they could only go back 6 years and we have no case.

Do you think it’s worth pushing? Thank you so much. Julia

Sara (Debt Camel) says

I think you should send the case to the Ombudsman. Be clear you are complaining about the loan which they should have known from your ovderaft you could not afford. Also about the overdraft and about the Barclaycard. Point out you were ony able to get out of the debts to Barclays by remortgaging.

Kim says

Hi my complaint with Halifax is now with ombudsman but the update from them is there busy and can take upto 4 months for my complaint to be given to a case handler so still a while to wait

John says

Hi Sara

I have constantly been in my Halifax overdraft of £1000 since 2012, (yes 11 year) 90% of that time, a week after payday having no funds left because of increased payday lending etc. Off the top of my head I don’t remember Halifax increasing my overdraft but my question is should they have noticed month on month I had a decreased disposable income and that my outgoings were out weighing my incomings and If so does my criteria warrant starting a claim against Halifax? Many thanks again.

Sara (Debt Camel) says

I think Halifax should have noticed your financial problems from your overdraft usage. And also seen the payday loans – another red flag that you were in difficulty.

Send them a complaint! They may only offer you a refund for the last 6 years – if they do it’s up to you whether to accept that or take the case to the Ombudsman who sometimes decides that they can go back further than 6 years.

John says

Thanks Sara appreciate your advice

Denise says

Over draft charges

Sara (Debt Camel) says

Do you have a question? Have you read the article above these comments?

Jack says

Just wondering if anyone has put complaint in with Lloyds Bank on there online site. Just I did last Monday ( now 7days+) not heard anything back to say got it / looking at it etc.

Anyone know how long they take to just notified received.

Peter says

They didn’t reply to me either, I sent an email and received automatic reply and that was it. Couple weeks later I got missing calls and it was sorted (sort of).

Jack says

Thanks Peter now been 2weeks nothing. No email or letter. The website says will reply within 3-5 days. I’ll email as well now I think.

Peter says

Try maybe sending complaint through the email? I sent it on 9th of January and they called me 8th of February and refunded my OD the same day. But it looks waiting time takes roughly a month at least.

cyrilv says

And the payment hit my account last night, three days after the adjudicator informed Halifax I accepted their offer. Everything I stated above was there along with an extra £258. I can only assume that that was 2 1/2 years’ interest at 8% simple, which would tally with the original total.

So – that’s me debt free at last. Never thought I’d wipe out the £12k or so total over the years, but I’ve done it. And you’ve been so helpful on this journey!

Kim says

Hi, can I ask how long you waited for a case handler please? As Iv been told upto 4 months and my complaint is also with Halifax

cyrilv says

Hi Kim,

the whole process took me around six months. Heard nothing from August until the end of January other than two pro-forma letters about a backlog – and then the adjudicator got in touch and got to work fast. Once the (very fair) decision was accepted by Halifax they took three days to pay.

Lynn says

Complained to halifax on the 18th Jan, just off the phone to them, agree with my complaint and refunding me £3353 (this is from my overdraft, going back to 2017) should be in my account today. Cant thank you enough Sara, without your website I would never have know about affordability complaints! Thanks again

Sara (Debt Camel) says

Excellent. Have a great weekend!

Lynn says

Thank you I absolutely will :)

David says

I complained to HSBC about 6 months ago and they rejected my claim. I went to the Ombudsman and the judicator has agreed with me and told HSBC that they must refund my charges over 6 years, include 8 % interest and compensate me. My charges over that period were £11,858. HSBC had until the 16th to appeal and respond to the judicator but so far haven’t. Hopefully I’ll have some news next week and will update you all. I used the template on here from the start and constantly checked into the site to see how everyone else was getting on with their claims and this is the reason why I’m at the stage where I am. Thank you all for your input and keep fighting for what is rightfully yours. If you think that there’s anything you’ve done that may help others then make sure you leave a comment as your input will definitely help someone on here.

Sara (Debt Camel) says

fingers crossed they accept this decision!

George says

Hi Sara,

My case is probably a little different in that I had already received my refund from Lloyds bank back in August of last year for irresponsible lending.

It was initially rejected by Lloyds but after taking the complaint to FOS they said that I was entitled to all overdraft fees dating back to 2017.

The bank sent me a letter of my refund and stated that I would not be entitled to borrow from Lloyds for at least 12 months.

I originally had an overdraft or £4700 and then agreed to pay instalments and got it to about £2400 until my refund hit which covered the rest.

When the refund took place and they said I could not borrow, the bank put my overdraft back up to £4700. I am now back within the overdraft and the bank apologised for their error but are now proceeding charging me daily overdraft fees again. Admittedly, I would have liked to have avoided re-entering the overdraft but times are difficult and it should have not been accessible in the first place.

I have re-raised with the bank last year and did not hear back within 8 weeks. After calling again today, they apologised again and said they have a new complaints system and have now opened yet another complaint for which I may not hear back for another 8 weeks (all the while I will receive daily OD charges).

Do you have any advice for this? Should I open another complaint immediately with FOS?

Thank you

George

Sara (Debt Camel) says

How many days of the month are you currently in your overdraft? What is the maximum it gets up to?

what is the rest of your financial situation like – do you have credit cards and loans that you are repaying normally? or have payment arrangements for?

George says

The maximum is £4700. I am approximately £4000 into the overdraft and am unlikely to be able to be out of it within the near future. Therefore, I will be in it everyday of the month.

I have 2 existing loans, one of which the final instalment is due next month. The other has about 18 months remaining at £400 per month. No credit cards.

Sara (Debt Camel) says

What is your income each month?

The loan that finishes next month, what are the repayments on that?

What were the interest rates on these 2 loans?

And are you behind with any bills?

George says

My income each month is £2500.

The loan that I have 18 months remaining is for £8000 at 19% APR.

The other loan has one more payment of £350 which will be paid off mid-March.

I am not behind with bills and am fairly confident that this will remain the case.

I have spoken to the bank again and they said they won’t offer me any repayment plan (even though the overdraft was provided in error) whilst I have a complaint open with them.

Sara (Debt Camel) says

who is the loan from that is finishing? the interest rate?

who is the 19% loan from?

have you considered affordability complaints against the loan lenders/

you seem to have taken the decision to carry on paying these two large loans by using the overdraft which you knew should not have been there.

I have no idea what the Ombudsman would say in this case. But first you need to wait and see what lloyds say.

I suggest you should stop using this lloyds account completely and switch to another bank whioch does not have an overdraft. Then you can start paying £350 extra a month into the lloyds accoun to start clearing the overdraft debt.

George says

The loan that is finishing is with Savvy. It is only finishing because I am paying it off in full by the way instead of continuing over a long period with high interest rates.

The loan for £8000 was from Vanquis. Yes, perhaps a good idea for me to put an affordability complaint in against these.

The overdraft facility should not have been there but it is also an error from the bank as to why it is. I am going to proceed with the Lloyds complaint and also pursue with a complaint to the FOS as my original complaint was not answered within the 8 week period. Lloyds have now opened a new one because they have a new complaints system but that should not have impacted the set response timeframe.

I have a Halifax account I can use but would like to see what the outcome is first of all with Lloyds and see whether they would be willing to take any responsibility for their error. If interest is to incurred, I can contact the FOS again to make a complaint against an overdraft that not only could I not afford, I never requested for it to be there in the first place.

Sara (Debt Camel) says

It is clear that Lloyds complaint handling has made this worse. I would be interested to know how this complaint goes.

Halifax is part of the same banking group. I think you should switch to using a different bank. Whatever happens it seems likely that that will be a remaining overdraft to llods to be paid off.

Use the template here https://debtcamel.co.uk/refunds-large-high-cost-loans/ for claims against Savvy and Vanquis. In them you should have pointed out that the large lloyds overdraft at the time should have been an indication you were in difficulty.

George says

I also don’t hold out much hope that Lloyds will pay off any of the overdraft, however some form of accountability would be nice. I will keep updated on this when I receive a response.

Thank you for the template.

Great work you do here and have a good weekend.

Sasha says

Hi Sara do you have a contact email for nationwide overdraft complaints please

Sara (Debt Camel) says

there is an email address on this page, which is linked to in the article above: https://debtcamel.co.uk/email-addresses-banks-credit-cards/

Tom says

Hi. Anyone up to date on the Tsb complaint? I wonder how long they take to answer

GMR says

I had a bank account with HSBC for many years. I was in a bad way financially & was always in an unauthorised over draft & being charged bank charges every day/month. Finally I decided to break the cycle. Open up a new account & the overdraft that was owed was sold to a debt collector. This still shows on my credit score but the 6 years is almost finished so I hope it will clear. I submitted a complaint 2 weeks ago & missed a call from a HSBC escalated complaints member today. I am not holding much hope because of the time scale. Account closed in 2016. I am assuming this is just to say that I will not be eligible for a refund. Any thoughts ?

Sara (Debt Camel) says

I too would expect HSBC to reject this because of the age of the complaint. The Ombudsman can look at older cases if you have only recently found out you can complain. So you can send this to FOS – but do you have much evidence about this? The longer ago it was, the less evidence there may be.

Chloe says

Santander overdraft complaint went in 16/02 received a call a week later that the policy on overdrafts is being being reviewed and that may slow down the process.

I submitted a loan complaint same time, they’ve stated it will be looked at and should be dealt with quicker. Just in case anyone wants to know re current time lines.

Steven W says

Hi Chloe I spoke to Santander this afternoon. They tell me its still under review but the review team have now requested all the overdraft fee’s for all the open cases including mine…. the lady then said figures since the overdraft was last increased (this was Jan 2020) so I said “eerrm no I am looking at 6 years since Jan 2017 and not just since the last time it was increased! She said “oh right yes ok”

So just over 1 more week and my 8 weeks is up then it goes to FOS and I made this clear to Santander. Not sure why they are dragging their heels.

Chloe says

any luck on this one? I just called Santander, they said my complaint is waiting for a review from another internal team… whatever that means. They have another 3 weeks to reply before i send to the FOS.

TT says

I send an overdraft complaint to LLoyds in the first couple of days this month and just received a message that they have send a letter to me with a solution. Missed a Call and called them back, the lady had left for the day but spoke to a colleague who read the letter to me. Apparently they will refund partially around £800 from the period 2019 up to beginning 2022. However they wont refund the last 12 months, which were almost entirely in overdraft, those fees add up to almost another £800, with the reason that they have emailed me about budgeting (couldn’t find any particular email) and that was the point for me to have taken action with them get in touch and find a solution? Further they will Remove my remaining overdraft £2.5k at the end of March and refund me £800 on the same date. However the outstanding amount will be owed as Unarranged overdraft and is due immediately, that’s -£1.9k and this will be reported as immediate debt. I will receive my wages a few days later and will be immediately in problems again, that doesn’t seem fair, or is it? Hope you have some great advise like always!

Sara (Debt Camel) says

I think you should send this case to the Ombudsman. That does not sound like a good reason not to refund the last year. If they thought you were in difficulty they should have stopped charging you…

if they had refunded the interest up to now, they should have allowed you to make an arrangement to repay the rest of the overdraft.

You may want to consider getting a new bank account! Perhaps one of the new challenger banks, without an overdraft? Starling, Chase, Monzo…

TT says

They had send several in-app emails (which I missed), didnt receive on my email or posted – saying that ive been in overdraft and should consider changing the amount so the fees will be lower. First one came at the end of Jan, and then a couple throughout the year.

Waiting for the letter to arrive and then to have a call with the complaints manager, probably next week. Do you think they will still negotiate when I push back?

If not they will action this refund and removal of overdraft, in that case I can still send to ombudsman for the last year eventho i have received partial solution?

Sara (Debt Camel) says

should consider changing the amount so the fees will be lower.

How much is your income a month?

Do you think they will still negotiate when I push back?

I am not optimistic

If not they will action this refund and removal of overdraft, in that case I can still send to ombudsman for the last year eventho i have received partial solution?

I don’t know, I dont remember seeing a case quite like this.

TT says

In 2022 this was £2.5k. The complaint was for that period 2018-2022 predominantly.

Since the end of its 2022 (dec) £3.3k and therefore I am happy with still keeping some of the overdraft. But it was merely so at the time it was irresponsible and have been up till now deep in overdraft the entire month as it barely covered my salary.

As you said, shouldnt they have contacted me via phone or post to highlight their concerns which had been going on for years. Instead of sending in app message that seemed generic and wasnt opened?

Also seemed odd that they only refund at the end of next month, instead of doing this directly?

Sara (Debt Camel) says

so for 2022, which they havent refunded, your income much the same as your overdraft. In this case, for them to suggest you can budget your wasy out of this while they still add fees each month, was just wrong. Another point to make to the Ombudsman.

I would giver them a week to reply and no more, then sand the case to FOS.

anon says

Hi Sara,

I’m so happy I came across your Instagram and your website. I’m not sure if I can claim but here i go. I have an account with natwest and I have an overdraft of £2000. I mainly pay my bills into this account but for the past 10 years I have always been into my overdraft. And at times i go over which is disheartening. I did call them 2 years ago to see how I could repay it but the telephone conversation did not amount to anything and I’m still in my over draft. I get charged around £50 – £60 pounds in interest every month and my monthly salary is £1883. I’m on the last 3 months of my maternity leave with no income but i always try to scrape to find money to pay off the bills plus the interest. I have looked at your template but I’m still trying to see how I can word the letter so I can highlight the chargers. Thank you for your time. Any thoughts?

Sara (Debt Camel) says

First my apologies that your name is missing! This was caused by a database glitch – I managed to retrieve your comment but not your name…

This sounds like a good complaint to me. (UNLESS you told them 2 years ago that you were making a complaint. It doesnt sound as though you did.)

I think you should change the template to say you have been in your overdraft for 10 year. And that your salary is less than your overdraft limit so it seems impossible for you to pay off.

Tom says

Hi I was hoping for some advice please and also my story might help others.

I took out an overdraft with Halifax on 9th April 2020 for £250. I was constantly overdrawn then on the 17th April 2020 I managed to increase my overdraft to £1000 and again I was constantly overdrawn. I made an affordability complaint in 2022. I informed them I suffer from mental health problems and I wasn’t fully aware what I was doing when I took out the loan and also that my credit rating wasn’t good and they should have noticed this. For the higher overdraft I also informed them I was constantly overdrawn and they shouldn’t have given me a higher overdraft. I requested if they could please wipe off the £1000 overdraft and refund me all interest paid. There response was they found nothing wrong with giving me the first overdraft but found the second one was there fault. In total they deducted £595 from the £1000 overdraft….

Tom says

They also informed me they would wipe out the remaining debt if I provided more medical evidence as what I provided wasn’t sufficient which I felt was discrimination. I then decided to send in further medical evidence to have the remaining debt wiped and in a phone call chasing up the letter they informed me in my decision letter that I was misinformed by them and for this they would award me £20. They also refunded me a further £100 that went to reducing the remaining overdraft but I did manage to pocket some of that myself. They said everyone is entitled to this £100 in charges back once a year. My account is on hold for 30 days until I come to the decision to wipe off the debt and the account gets closed or pay it off myself and keep the account open. I was hoping that they would just wipe off the £1000 overdraft and refund me all interest paid? I seen on the financial ombudsman website that you can be financially awarded for stress and misinformation etc but then I checked UK Trust pilot website which is all 1* reviews saying things like your wasting your time with the ombudsman, there corrupt and in the pocket of the banks which makes complete sense! Does anyone have any suggestions what I should do please. Thanks.

Sara (Debt Camel) says

“I took out an overdraft with Halifax on 9th April 2020 for £250. I was constantly overdrawn then on the 17th April 2020 I managed to increase my overdraft to £1000”

is it right that that was the same month? or is one of the dates wrong?

“I wasn’t fully aware what I was doing when I took out the loan “

I assume that should have said overdraft.

” they deducted £595 from the £1000 overdraft”

have you added up how much interest you were charged on the overdraft from the point they increased your limit?

Faye says

Hello, just after a little advice , I’ve been in the overdraft constantly since around 2009 (£1100) like I’m in the whole overdraft every month, never really out of it, I get paid weekly so obviously when wages go in the overdraft usage decreases but once I’ve paid bills that same day I’m right back to using the whole overdraft again. In 2019 they gave me a loan of £5000, even though I was still £1000+ into my overdraft. Is it worth complaining about the unaffordable loan too (at the same time as the overdraft) or do I do these separately?

I had and still have credit cards from other lenders that I pay using this account and debt payments that appear on bank statements, I also have gambling transactions on my statements too.

I’m with NatWest overdraft and loan. Credit cards are with capital one

Sara (Debt Camel) says

how long have there been gambling transactions on your statement? how much are these – there is a lot of difference between a couple of trips to the bingo a month and a problem gambling habit… do you want to stop gambling?

how much are your weekly wages?

credit cards from other lenders – did any of these increase your credit limit when you were only making minimum payments?

Faye says

Hey,

Gambling in 2007 ish was anything from £80 per month to around £200 per month , still gambling transactions now but there are less, as I had set up a safe play of no more than £20 a week. Sometimes I don’t gamble as I’m already getting help on this.

My weekly wages were around £300 per week in 2016 but I’m doing lots of overtime to try and pay exsisting debts off and keep up with bills so my weekly wages are around £400 to £535 weekly with all the overtime. My partner has her wages paid into my bank too. I’ve had a few failed direct debits but my children do send money to my bank to try and cover these.

Yes aqua increased my credit card limit from £900 to £1600 a couple of years ago, whilst only paying the minimum I’ve also had two repayment holidays with them as I couldn’t keep up repayments .

Sara (Debt Camel) says

So this sounds like a good overdraft affordability complaint. Make the points that your bank should have seen the gambling, and that your wages were low compared to your overdraft. and that you have had direct debits that had to be covered by money from family – all of these points suggest that your bank should have realised the overaft fwas too high and offered to help eg by stopping adding overdraft charges.

This also means they should not have given you a 5k loan… you could add this into the overdraft complaint, but for some people this gets complicated if the bank makes an offer on one and rejects the other one. With very inter-tangled complaints (eg the bank gave you several loans and increased your overdraft limit or credit card limit) I think it’s worth putting them all together , but yours can be made as two seperate complaints easily.

Use the template in the article above for the overdraft and the template in this other article https://debtcamel.co.uk/refunds-large-high-cost-loans/ for the loan. Add a sentence into the loan complaint saying that the bank should not have given you the loan as it was clear from your heavy overdraft usage that you would struggle to repay it.

Let us know what happens to both of these complaints!

Faye says

Hey just an update.

I made 2 seperate complaints to NatWest 1 for the overdraft 1 for the loan, they came back within 2 weeks about the overdraft complaint and rejected it, so sent it straight off to the ombudsman… they have sided that it was unaffordable and NatWest have now agreed to pay interest &charges from March 2017… this landed in my bank this morning … overdraft paid off yay.

The loan complaint they haven’t even replied to, I chased them up after 3 weeks from the same email thread as the loan complaint and said they would look into it. 8 weeks still nothing so that’s now with the ombudsman. I’ll keep updating as I hear more, thank you for your help. Can’t remember the last time I didn’t have this overdraft hanging over my head.

Kirsty says

Hello,

I’ve had an overdraft since 2008 which was increased in 2014, since having the account I have literally lived in it and have only ever been in credit for a matter of days when I got paid.

The bank was originally Yorkshire Bank however they were taken over a couple of years ago by Virgin.

How likely is it my complaint will be accepted by Virgin as they didn’t originally give me the overdraft? If they do accept it, do you think it’s likely they would backdate to 2008 or am I correct in thinking they only consider the last 6 years?

Thanks for any help and advice!

Sara (Debt Camel) says

Virgin didn’t just buy some debts, they bought the whole bank so they are liable for Yorkshire’s poor lending decisions. If they reject your complaint saying they aren’t, then send this straight to the Ombudsman.

It’s unlikely they will backdate to 2008. They may offer 6 years. Or back to some other date that may or may not make sense… the Ombudsman may take a different view and say they should have gone back further.

If you get an offer and you aren’t sure what to do, come back here?

Kirsty says

Hello,

Thanks for your help above!

I received a call from Virgin today, they said they were looking into my complaint and wanted to clarify the reason for extending my overdraft in 2014. They said I had requested an extension because I was going on holiday. I said this could have been the case, it was almost ten years ago, however an overdraft should be for short term emergency use and I’ve been in it for almost 14 years and it hasn’t been monitored. Also, if they look back at the transactions before my increase, they will have seen I was using payday loans at the time.

They advised they will respond by letter in due course. I’m keeping everything crossed however I’m not feeling too hopeful!

Sara (Debt Camel) says

ok, straight to the Ombudsman if they reject it or make a poor offer – come back here and check if you aren’t sure!

Kirsty says

Hello,

As I thought, I have received a letter from Virgin to say they will not uphold my complaint as they did the correct checks and I could afford the increase in overdraft.

They haven’t acknowledged my complaint about being in my overdraft for 14 years and considering it irresponsible lending, or that around the time of increasing my overdraft they would have been able to see payday loans on my account.

I have raised a claim with FO and they have asked for a copy of the response from Virgin which I have sent.

How likely is it that FO award when the bank has refused the claim?

I’m worried because I asked for the overdraft to be increased the FO will dismiss my claim. Thanks for any advise!

Sara (Debt Camel) says

“How likely is it that FO award when the bank has refused the claim?”

It sounds like a good claim to me.

“I’m worried because I asked for the overdraft to be increased the FO will dismiss my claim.”

That isn’t relevant – the bank still needs to check that it is affordable even if you ask for the increase.

Luke Mc says

Hi Sarah, just wanted to say thanks for your help – I made a complaint to my bank about an overdraft that they shouldn’t have let me extend – this in time led to me having to default on the overdraft in 2021 (with covid etc) – I made a complaint and they took some responsibility and agreed to backdate it 3 years to 2018 which is great news. This will now end next year, will this automatically improve my credit rating by it being backdated? Or will credit score only improve once default is 6 years passed? I have paid the debt off already, I just read that each year that passes the default is slightly less harmful – thanks again!

Sara (Debt Camel) says

can you say some more about this – did you make an affordability complaint? Why did they pick 2018 as the date for a default?

Luke m says

Yes it was an affordability complaint with Lloyds – I think they said they could see I was having financial problems in 2018 so that’s why they backdated it to then. Will this help my credit rating seeing as now I’m effectively 4/5 years into it? I know credit score goes up once it’s removed

Sara (Debt Camel) says

I think you should send the complaint to the Ombudsman and ask for a refund of charges from 2018 and for the default to be removed.

Luke says

I forgot to mention they also refunded £1400 – so very happy with that. Regarding my question about how it will help my credit – will it improve now that it only has 18 months until default is removed?

Sara (Debt Camel) says

Ah!

The effect of a default decreases as it gets over 4 years, see https://debtcamel.co.uk/credit-score-change/. How much your score changes in practice depends how many other problems there are – if there are a lot then reducing or removing one may not make a big difference.

John S says

Complaints gone in last week for Santander, Lloyds, RBS and NatWest overdrafts. I’ve only received automated replies, strangely enough Lloyds came back and said they couldn’t find my account but after sending them my postcode again I haven’t heard anything back. Waiting game it is then.

Thank you Sara for all the information and templates. This site is really amazing.

John S says

Just an updated on the Lloyds O/D. I received a text message today to say they would be sending a letter out and also be giving me a call. That makes it around 10 days since I made the initial complaint. The lady said she agreed they shouldn’t have given me the overdraft and would refund interest only from when it first received an increase (twice in the same day) she said that the once the refund was received it would go towards clearing the balance and I would then have 35 days to clear the remaining balance other wise it will then be reported as an un arranged overdraft and start to affect my credit file. She also said I would be able to speak to the financial assistance team at Lloyd’s who may be able to set up a payment plan and stop that from happening.

All in all a pretty painless process with Lloyds and I’m £1200 better off. Thank you!

Sara (Debt Camel) says

will you be able to clear that balance? They should allow you to set up a repayment plan without this affecting your credit record.

denise says

I’m with Halifax but I m still paying for overdraft fee of 17 pound a month am I entitled to them fees back

Sara (Debt Camel) says

This depends how much of a problem your overdraft is for you. Roughly how many days of the month are you overdrawn?

Denise says

I was married when this overdraft was out but I’m single now so it’s becoming a problem I don’t use this account much now

Sara (Debt Camel) says

Is the account now in your name only? How many days of the month are you overdrawn?

Gill says

Hi thank you for this group, it’s giving me hope. I submitted an affordability complaint with Santander regarding overdraft. The over draft was increased from £500 to £3000 within a year. I sent complaint on Friday via email and then via the app. Got a very quick reply saying they are not upholding my complaint.

I have a gambling habit which I am now finally get support with to stop. I had a debt management plan in place when the overdraft was increased in 2018/19

Do you think it’s worth a send to the FOS?

This is part of the response

I regret you have been aggrieved enough to complain.

We discussed all of this further by confirming that each time a customer’s overdraft is increased, the customer’s credit file is checked to ensure that we are responsible lenders.

If the overdraft was not affordable at the time, then we would not have increased it.

I would also politely like to point out that just because a customer is given the overdraft facility, they are not duty bound to use it.

Within my discussion with the Financial Assist Team, we have considered that your position, in terms of the overdraft being unaffordable, would not have been discovered just recently.

Finally, there has to be some responsibility on the customer. Once again, the overdraft may be in place but there is no obligation to spend this.

Sara (Debt Camel) says

yes send that straight to the Ombudsman!

Gill says

Thank you, I think I have a very strong chance.

Santander chat said I had had an email response, I didn’t! Also said they called and left a voicemail, they didn’t! They basically said I didn’t have to use the overdraft, difficult to do that as I have been at the limit of £3000 since they approved that amount. My salary was £1440 so each time I got paid and paid bills (including dmp payment) I was back at limit.

I will keep you updated of any progress

Thank you again for your help

Gill says

Not sure what this means but will keep you updated

Update. Santander sent message in the app chat

After getting a not upholding message

From Santander

apologies, your complaint has been escalated, I am currently still investigating and will get back to you with my resolution shortly.

Then

Thank you for that, I have sent your details to the project team who review these decisions retrospectively, I will get back to you with their findings in a few days.

NW says

I’ve had an overdraft with Santander since around 2016 initially 1k. I also had a 10k loan with them taken out at the end of 2015 which I paid off over 3 years but did miss a few payments. In 2018 once the loan was paid they upped my overdraft from 1k to 2k. I’ve pretty much been in my overdraft since the initial 1k borrowing. They would have seen I also had payday loans and gambling transactions on my account (not many in the 3 months leading up to the loan, but a lot in 2015 and 2016 before the overdraft and loan were given) Also lots of money In and Out from friends and family lending me money. Do you think I should complain? I’ve stopped gambling a little while ago now but picking up the pieces from all the interest i ran up over the years has left me in a vicious cycle. The only evidence I have of unaffordability will be all my bank statements, Santander has provided me with statements from 2013 till now so it’s all there but I don’t have any credit reports or anything, it’s also outside the 6 year window.

Sara (Debt Camel) says

what was your overdraft usage like in 2018, 2020?

NW says

Pretty much always in my overdraft till present. I was always using payday loans too or loans from family. It’s littered all over my bank statements. There may be a quiet month here and there but on the whole a complete mess year on year.

Sara (Debt Camel) says

Then I think you should complain.

MH says

Hi Sara,

I complained to Halifax when they increased my OD from £1000 to £1900. I have been in and out of it for years (probably back to 2016 (mainly in it more than out of it!) They replied very quickly saying they would call me. To be fair to the lady, she was very sympathetic and apologied that they should never increased it looking at my history on my account. She agreed to go back and refunded me 6 years worth of charges totalling £1140. She did however say that the OD would have to be removed which suits me. Thank you SO much for this page!

Steven W says

8 weeks is up and no news from Santander. Apparently my case is still under review. The case handler called me this morning and she doesn’t think I will get 6 years fee’s back so I said no worries it is with FOS now so will leave it with them. Constant £1000 overdraft for 12 years, increased twice in 2020 and 2021 and now £2000 o/d. Gambling, DMP, payday loans and other debts all being paid in that overdraft.

Chloe says

Good luck. I have a similar case but only at the start of my journey with Santander. I won’t hold out much hope to them settling in the 8 weeks then!

Steven W says

At the beginning 8 weeks ago it sounded quite hopeful.. Santander were basically agreeing to look into refunding all fee’s for 6 years….then we suddenly hit a brick wall and all cases were put under further review… I expect they had too many cases and most were being upheld by the FOS so they have retreated and gone away to think up an explanation to help them wriggle out of any responsibility… That was what I gauged from the lady on the phone this morning and the last couple of calls from Santander… Rather than offer refunds they are probably going to offer us some action plan / pay plan to get out of it… but that is just my hunch and NOT fact. Something they know they should have done a few years ago rather than allow these overdrafts to drift and drift…

To be honest I am happier this is now with the FOS after weeks of deliberating from Santander. They are definitely working on a way to wriggle out of these cases.

Ask for fee’s to be put on hold while the account / overdraft is under review, they agreed to this for me.

Neil says

Hi Sara,