When you have a complaint about a loan, credit card, mortgage, pension or insurance and you can’t get it settled with the company, send the complaint to the Financial Ombudsman Service (FOS).

Your complaint will be investigated by one of our case handlers, who will try to understand what happened and if the business did anything wrong. Your case handler will let you know the outcome based on what they think is fair and reasonable. If either you or the business disagree with this, you can ask for a final decision from an ombudsman.

This article looks at this in more detail, so you feel prepared. All types of cases go through the same general processes.

Don’t worry about the number of points – most people will be unaware of many of them! But they are here in case they crop up in your case.

Contents

Before it goes to the ombudsman

FOS will only look at a case after you have complained to the company and the company has had the chance to try to resolve your complaint.

You can send a case to FOS as soon as you have a Final Response from the company to your complaint. If you haven’t had a response after 8 weeks you can send the complaint to FOS without waiting any longer.

(The exception here is complaints about payment services such as Open Banking, where a complaint can go to FOS after only 15 days. The company will tell you if this 15 day limit applies to your complaint.)

After a Final Response from a company you have to take your case to FOS within 6 months. After 6 months it would only be considered in exceptional circumstances eg if you had been seriously ill.

You can send the complaint to FOS online, on the phone or by completing a form and posting it. Completeing their online form is MUCH the easiest way to do this:

- you can attach the Final Response from the company (if you have one) and other documents that you want FOS to look at;

- it is often convenient to use the complaint you sent to the lender as the starting point and add a summary if it is long.

This is an easy procedure. You don’t need to use legal language or mention laws the company has broken. Just say what happened and why you feel you haven’t been fairly treated by the company. Ombudsman statistics show that using a Claims Management Company doesn’t make it more likely you will win your case.

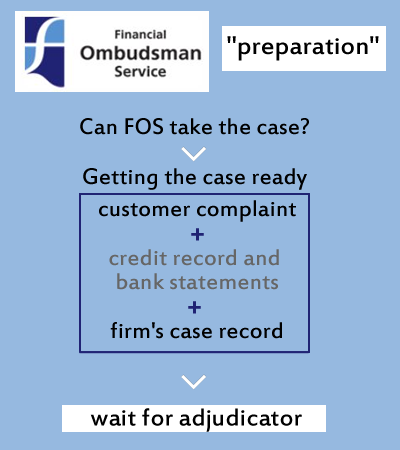

FOS – case preparation

First FOS checks it can consider the case. This is usually easy but:

- FOS only looks at some sorts of “financial” complaints. You can’t complaint to FOS about your water bill, tax or something the DWP has done;

- if the company isn’t based in Britain, FOS may not be able to look at the complaint even if it is a subject they cover;

- some or all of your complaint may be outside the time limits FOS has. But lenders often say your case is too old and FOS then decides it can look at it!

Then FOS asks the company for their record of your case. FOS may also ask you for more information – for example you will usually be asked for a current credit report and bank statements for affordability complaints.

When FOS has all these, your case is ready to be looked at. How long until your case is allocated to an adjudicator depends on the type of case it is, but 2-4 months is common.

FOS – investigator/adjudicator level

Adjudicators, sometimes called investigators or case handlers, are the first level decision makers at FOS. The job of the adjudicator is to look at your complaint and what the company says about it and to then consider if the company has done something wrong. And if it has, to say what should be done to put this right.

Some adjudicators seem more friendly than others. Here is what one person said:

I had to re send some [bank staements] of mine but my adjudicator has been in touch with me via phone call and email . He is wonderful and has explained everything of what he is doing. He said he hopes to have a decision within 2 weeks

Others get straight down to work and only send you questions. But it doesn’t seem to make any difference to the decision you get in the end!

Sometimes the adjudicator will decide they have all the details they need and make a decision quickly. Today, while I was writing this, a reader left a comment saying;

The adjudicator (once it had been assigned to him) got back to me within 1 day with the decision!

That is unusually speedy. It will normally take a few days or weeks if the case is long or if the adjudicator asks you or the firm about something and has to wait for the reply.

The adjudicator writes a preliminary decision, asking you or the company to explain if you disagree with it or if there is any more information you would like taken into account.

Don’t give up if the decision isn’t what you were hoping for. Read it carefully and reply saying why you disagree – adjudicators do change their minds at this point! It is easier and quicker to go back and make points here than to ask for the case to go to an ombudsman.

This can go on for while with you and the company making new points and the decision changing to take account of them.

Then the adjudicator issues their decision. If both you and the company accept it, that is the end of the case. This happens in 90% of cases.

Some complaints go to the second level

If you or the company disagrees with the adjudicator, the case will go to be looked at by an ombudsman, see below.

The adjudicator’s decision always says that ombudsman is likely to agree with the adjudicator. It doesn’t mean your case is particularly strong (if you won) or weak (if you lost).

If you don’t like the decision, try to read it through and think if it was a fair decision. If you don’t think the adjudicator understood your case or something important was missed, it is worth going to the next stage.

If you disagree with the adjudicator’s decision, reply saying why in as much detail as you can. Ask for your comments to be passed to the ombudsman that will look at the case. This may be the last chance you get to explain your position.

If you were happy to accept the adjudicator’s decision as a reasonable compromise but the company disagrees, tell the adjudicator if you want the ombudsman to consider improving the decision. For example if the adjudicator said you should have an overdraft refund from September 2022, you could explain why you think this should be from earlier.

FOS – ombudsman level

An ombudsman is a senior decision-maker at FOS. You normally keep the same adjudicator through this second stage and still communicate with them, not directly with the ombudsman.

The ombudsman looks at your complaint from scratch – this isn’t a quick check to see if the adjudicator missed something. But it often goes through very quickly because by now the case is normally well organised with a clear timeline of what happened when.

If the ombudsman decides to change what the adjudicator said, a provisional decision will be issued. Once again you and the company have a chance to comment on it.

In many cases the ombudsman agrees with the adjudicator’s decision. Then a Final Decision will be issued straight away because you and the company have already had the chance to comment on it. That’s why you need to get any points you want the ombudsman to consider to your adjudicator before an ombudsman picks up the case.

A Final Decision from an ombudsman is legally binding on the company. There are no more appeals they can make and they can’t go to court.

In the VERY rare event that the company ignores it, first talk to your adjudicator. See Won your Financial Ombudsman case but worried you won’t be paid? which looks at this.

Ombudsman decisions are published here, but your name and details are not given.

David Cunliffe says

Hi iam in the process of complaining through the ombudsman and they need my bank statements but i am paper less and was wondering if there is any way to get them online to send im with TSB thanks in advance

Sara (Debt Camel) says

You can normally download digital statements and send those.

Keith says

That sounds about right for the useless Ombudsman.

Ash says

Hi,

You do not need to use to Ombustman if you think they are useless. They do a great job and 90% of people agree. Anyone with any kind of brain knows they are busy.

Please feel free to never use them again.

Jessie rowe says

I have had dealings with the FOS over the last two years and have found the Adjudicators to be really great and very thorough.

I managed to claim back over 10k to date and I have one case boiling with Provident but this is proving to be a headache as Provident are being very pedantic!

GM says

How is the FOS in regards to communication?

I’ve sent a complaint about Vanquis and they wrote me asking for more details, which I did via email. it’s been a month now and when I ask again via email for any progress, I don’t get any reply!

Sara (Debt Camel) says

What is probably happening is that your case is the Case Preparation stage as I called it in the article above – you have sent your information, they also need Vanquis’s case file before it can be looked at by an adjudicator. If you phone them up they will explain what is happening.

Naro says

Hi Sara

FOS have ask for my bank statements and credit file. Should I send it to them by email or by post. Would they accept it if I send it by email?Because if I send it by post its going to be a lot of papers.

Thanks

Sara (Debt Camel) says

Email should be fine.

Naro says

Hi sara,

They asked for my bank statement from May 2011. I have online banking but could not access my bank statement that far. If I go to any branch of my bank (Natwest) will they be able to print it out for me?

Thanks

Sara (Debt Camel) says

Possibly, it is well worth a try

Naro says

Hi

I just want to ask, how will I receive the FOS final outcome of my case. Will I receive email, postal mail or phone call? Because I have my case sent to them more than 6 months ago and they might have sent me a postal mail.

Thanks

Sara (Debt Camel) says

If you used their online form, you were asked how they should communicate with you.

Jan says

I have been wanting to apply to the Financial Ombudsman Service for years and Kensington Mortgage Company responded to my complaint in writing stating I was not an eligible complainant to the FOS and The Financial Conduct Authority would not allow them to investigate my complaints about hidden, unfair and excessive charges. On one day alone back in 2013 Kensington Mortgage Company charged the account £17,612. In one year 2013-14 the total charges added to the account was over £40,000. I could not afford to pay hidden and unknown charges indefinitely.

In 2019 it was confirmed that I was an eligible complainant to the FOS under FCA rules and had been all along and my concerns should have been addressed back in 2014. Both myself and the Court were misinformed. It turns out the FOS had written to Kensington Mortgage Company prior to the Court hearings informing my Complaints were with them, going to be investigated, I was eligible to complain and most importantly to please hold off on any eviction or repossession proceedings. Of course KMC forgot to tell the Judge that bit, even though he asked. It is the FOS who decides whether or not someone is eligible to complain. I lost everything my home, much of my belongings and my home was sold at a massive undervalue leaving me with nothing.

mark sutherland says

Do I get extra redress if complaint was passed from adjudicator to ombisdman

Sara (Debt Camel) says

No – except as it takes longer the 8% simple interest added will be a bit more.

Kala Harvey says

Hi both me and company agreed with adjudicator decision. Can any one tell me if company has 28 working days to pay or 28 days. Acceptance paperwork was signed digitally on 25/9/19 and trying to work out deadline date thanks

Sara (Debt Camel) says

28 calendar days not working days. But some firms go over it … who is the firm? Don’t make big decisions contingent on the money arriving by 28 days even though in almost all cases it does.

Kim Brown says

I have a case with the ombudsman against a car finance company the adjudicator upheld my complaint and the finance company rejected the decision. I was told it was going to an ombudsman for a final decision and was in the que to be allocated this was in june 2019 and I’m still waiting for this to be allocated to a ombudsman. How long realistically should I wait for this to be allocated and what is the likelihood of the ombudsman not agreeing with the adjudicator decision thanks

Sara (Debt Camel) says

I suggest you should be phoning up every month and asking about progress. In 90% of cases, the ombudsman agrees with the adjudicator – I haven’t sen enough car finance cases to say anything more specific.

GRMN says

What are my options if the ombudsman’s final decision is certainly wrong?

Sara (Debt Camel) says

A final decision is legally binding on the firm, not on the consumer. So you have the right to take legal action in court against the firm. I suggest you take professional advice from a solicitor, a local Law Centre or Citizens Advice before starting this.

Paul says

Adjudicator is agreeing with me and has given the business 14 days to respond. What happens next? What happens if they don’t respond? This was 5 days ago and not heard anything yet….

Sara (Debt Camel) says

if they agree, the business has to do what the adjuidcator said.

If they disagree the complaint goes to an Ombudsman for a Final Decision.

If they don’t reply they are often given a few more weeks but ultimately this is treated as a rejection and it goes to an Ombudsman.

If this is a payday loan refund case, post on https://debtcamel.co.uk/payday-loan-refunds/ for more details.

Tracey says

Back last year I opened a case regarding ppi refund, I ended up making a complaint and asking to be put in touch with management. I explained that I have suffered from mental health issues since I was 15 due to abuse and I didn’t know that I should have told the adjudicator this. He explained that this was understandable and it was then counted as ‘exceptional circumstances’ regarding the time taken to complain and I ended up receiving a ppi refund. Now, here’s the problem….. I am complaining about irresponsible lending on a store card, there were no affordability checks done and they increased my credit limit from £850 to £6000 which interest was £100 per month. I was a compulsive spender, an issue I had to over compensate being abused by my mother. I had eleven other cards at the same time, which obviously appeared on my credit score….. (to be continued)

Tracey says

(cont.) Due to the fact I did not know I could complain about this, I only found out last year, time scale is a problem. They could only look into it if there were exceptional circumstances why I didn’t complain earlier. I sent the adjudicator evidence of credit limit increases, wage slips confirming I was on low income, other card bills (which were high), I also sent a letter my therapist wrote to them explaining my mental health problems from the age of 15 years old. The adjudicator has basically called me a liar regarding my mental health and has also said mental health is NOT an exceptional circumstance. And yet in the previous year it was counted as an exceptional circumstance. I explained this to her and she would not answer it at all. But basically told me to in lay mans terms to ‘shut up’. I want to take this further as I think mental health is not covered enough regarding complaints within the FOS, does anyone know how I can take this further?

Sara (Debt Camel) says

That should not have happened. You can phone up the Ombudsman on 0800 023 4567 and say you want to speak to a manager as you are upset about how your adjudicator has treated you and dismissed your mental health problems.

Tracey says

I’ve asked to be put in touch with the manager, just waiting to see if she does it or not.

Tracey says

Had a reply from adjudicator regarding being passed on to management. She said my complaints are ‘I am unhappy with ombudsman decision and the fact I couldn’t talk to him about my case’. This is not the case at all, I want to complain about the lack of understanding mental health problems and her treatment regarding this. Where upon she asked me what other things was I going to complain about. I thought this was highly inappropriate considering I want to complain about her treatment of my case. So I am now awaiting a reply from a manager.

Kimberley says

Hi , I have had a complaint going since last March about Lending Steam. It’s been a very long drawn out process. In summary the complaint was about a draw down loan with them. I had lots of pay day loans with different companies but could not afford to pay them . I was borrowing money from each to pay the other. My mistake was complaining to the ombudsman at different times about different lenders when in hindsight I should of complained about them all at the same time. Anyway the adjudicator has said it’s not unaffordable lending as I only took one loan With them and therefore they would not have had to scrutinise my finances. I don’t agree with this though as I have showed all the evidence that at the times I was unable to pay the loan and had seven pay day loans. Is it worth going to the ombudsman?

Alex says

Hi Kimberly, it is worthy indeed

Alex says

We will see, when I have talked to the adjudicator she seemed in a different world and keep saying that it is not a requirement for a lender to do in depth checks.

Very strange

Craig says

I feel that it is very unfair once a final decision has been accepted by a loan company for them to be able to take 28 days to pay out. It should be very similar time frames to the time it would take their company to pay out an agreed loan surely? Also want to say how grateful I am to the FOS for continuing their work from home. These are indeed difficult times and I currently have 2 o going complaints that I have received updates on since the ‘lockdown’.

Sara (Debt Camel) says

Well realistically a lender will need a couple of days to calculate the repayments and authorise them. And it may need a couple more days if payments are still being made.

If the debt has been sold it may take quite a bit longer to work out. But I can’t see why 95% of payments can’t be made within 7-10 days.

George says

If a Financial company offers a settlement and you feel it should be more, and the Fos disagrees can the business retract their offer?

Or would it be best to accept the settlement then take it to the Fos if the company has confirmed its without predujice?

Sara (Debt Camel) says

Are you talking in theory?

if you have an offer it would be simpler to talk about that…

George says

I have an offer of 20k, I feel it should be 40k. The company disagrees.

They’ve stated 20k is in settlement of the claim.

So I don’t think I can accept AND also go to the FOS, however if I do and the FOS don’t agree can the company reduce their offer later?

Sara (Debt Camel) says

what sort of claim is this? Have they said it is a goodwill offer, or have they accepted liability and you just think their calculations are wrong?

George says

Home insurance claim (there’s no other page on the site so asked it here)

Its a complex claim, just curious whether a company can offer X then retract it.

Sara (Debt Camel) says

I’m sorry but I don’t have any useful experience of that. The cases I know best are composed of complaints about a series of loans, say 10. I the lender agrees 3 were missold but not the other 7, then if the case goes to the Ombudsman, the Ombudsman normally doesn’t look at the 3 both sides agreed were mis-sold so there is no risk in going…

But I don’t know if you can safely assume that with your case.

You could go to your local Citizens Advice and ask someone to look at it for you? They won’t be insurance experts, but a fresh pair of eyes?