Four million people in Britain have a credit card specifically aimed at people with a bad credit rating. These cards have interest rates of 30-70%. A standard interest rate on a normal credit card is about 20-28%.

Brands include Vanquis, Capital One, Aqua, Ocean, Marbles, Zable and 118. Some normal credit card lenders like Barclaycard have a specific bad credit product available. They are all much the same – except for the interest rate…

They may be called bad credit cards, sub-prime credit cards, credit-builder cards or second-chance cards. Different names, same thing.

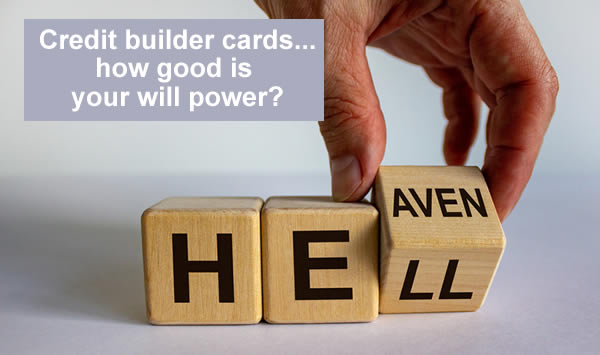

Whether they work well for you depends on your situation and how you use the card:

- will you end up in heaven with a better credit score?

- or in hell with expensive, mounting debt leading to more defaults?

Contents

Do they really improve your credit score?

How to maximise your credit score gain

Use a credit card well and your credit score goes up. To get the biggest boost to your score:

- Don’t take a credit builder card with a tiny limit of £200 or less. These are much less good for your credit score than £250 or more.

- Use the card once a month for something that is less than a quarter of your credit limit, such as a tank of petrol.

- Set the card to repay the full balance every month by direct debit.

- Know when the direct debit is collected and make sure there is the money in your account for it.

- Most lenders let you change the date, just after you are paid is often best.

This is the best way to maximise your credit score – using the card, but never too much and never running a balance.

When the card is repaid in full every month, you never pay interest on normal purchases, so the high interest rate doesn’t matter. (The exception is if you take cash out on the card. Then you have to pay interest right from the day you withdraw the money.)

There is no need to buy lots of things, just one purchase a month is fine. Leave the card at home after you have used it and don’t add it to your online shopping accounts – avoid temptation!

There is a myth that you need to pay interest to improve your credit score – this just isn’t true.

How much will your credit score improve?

This depends on why your score is bad. Three cases:

- You may have a “thin credit record” with little showing. Perhaps you have recently moved to the UK, never had much credit or all your old problems have dropped off after six years.

Here a credit builder card can make a big difference, not immediately but after a few months. See How much will my credit score change if… for details. - You have defaults or missed payments. Here it take time for your score to improve a lot. This new card won’t make a big improvement right away. As your problems get older, new good marks on your credit record will help your score increase.

- Your other credit cards are maxed out. Here getting a new credit card with a small limit will make very little improvement AND if you don’t clear the balance it can even make your utilisation worse.

Don’t get two cards. It will take longer before you see any gain at all and you won’t see twice as much gain.

These cards can be dangerous

If you don’t pay off the balance in full you end up with expensive debt.

Only paying the minimums means it can take 15 or 20 years to clear a credit card balance. That £25 pair of shoes can cost you £50 or even £75.

And if you have to borrow more to make the repayments, you fall into a spiral of ever-increasing debt, leading to defaults and disaster for your credit rating. The opposite of what you wanted.

Here is what one Debt Camel reader said about his card:

“it’s a card that puts you more and more in debt rather than builds your credit rating”.

These problems are very common. The regulator found that 25% of these credit builder card accounts had serious arrears after only a year.

So … should you get a credit builder card?

It helps to be clear about why you want the card.

And be honest with yourself about how tricky your current situation is.

Are your finances getting worse?

If they are, then this is your problem, not your credit score.

Get a credit builder card when you are struggling and it’s very likely you will just run up more debt and as it’s expensive, it will make your situation and your credit score worse.

Instead you need to talk to a debt adviser, see The Better Alternatives below.

Only to repair your credit record?

For people in an improving situation, feeling confident they are in control of their money, it comes down to willpower.

It sounds as though the reader who asked the question is in a pretty good place at the moment. She is working her way out of her previous difficulties. She is saving every month in LOQBOX .

So she probably isn’t going to max out the card immediately because she is in trouble. But will she be able to stick to the rules to maximise her credit score and never pay interest?

If she is confident she can, then yes, get the card now.

Or will she be tempted to put her Xmas spending on the card? Or use it for a bargain she has just seen in a sale?

Some people are overly optimistic that they will be able to say No to this sort of temptation… Even though they know that in the past they have had problems.

If this sounds like you, you can make your life less stressful in future by not getting the card in the first place. The reader’s credit record will carry on improving over time even without it!

As a safety net – just in case?

Don’t do it.

To have a high interest card that you will use if things get difficult is setting yourself up to fail. Because when you use the card and can’t repay it in full, each month gets harder, not easier.

You need the extra credit

Don’t do it.

Most people get one of these cards knowing they will use it to borrow. Sometimes it is for one specific thing, often it is general pressure with bills and other debts. Any credit score improvement will be a nice, but the real reason is card is wanted is to use the extra credit.

This is too often a disaster because of the large amount of interest that is added.

The lenders will often increase your credit limit. But that short term relief gets you deeper into debt. As two StepChange clients said:

“The credit card company just keeps feeding the rope to you for you to hang yourself”.

“I would have been better off going to a food bank or borrowing money from family”

The better alternatives

Let’s be clear, you aren’t being offered a “second chance” because the lender is feeling kind.

They know you will be tempted to use that shiny new credit card. And they hope you will find it hard to pay it all off because then they will make a lot of money out of you.

Two better alternatives for credit building are:

- LOQBOX – that is a risk-free way to improve your credit score if you can make monthly savings

- Experian’s Boost facility. That has the big plus that it can’t harm your credit score or get you into more debt.

A better alternative safety net is to put some money aside in savings.

A better alternative if you are in a difficult situation now is to talk to a debt adviser. Phone StepChange on 0800 138 1111. They can talk about your options and explain the pros and cons of each so you can decide.

Michael F Aspinall says

I would steer clear of cards from capitol one,as the big credit reference agency’s like Equifax,its algorithm is set up to recognise cards like capitol,vanquish as bad credit cards and alters your score accordingly,( without warning You) as the algorithm also recognises the likes of Lowells as a debt collection lawyers,if they search your credit file it remains on your file for two years!! Always remember credit agency are not your mates it’s geared up for the benefit of banks because there’s a hell of a lot more profit in misery!!

Good luck

Sara (Debt Camel) says

Equifax,its algorithm is set up to recognise cards like capitol,vanquish as bad credit cards and alters your score accordingly,( without warning You)

I doubt that is true. What you are seeing is some combination of the fact any news card harms your score fir a few months AND the fact that mist people applying fir one are in a difficult position so there score may already be declining as other debts increase.

as the algorithm also recognises the likes of Lowells as a debt collection lawyers, if they search your credit file it remains on your file for two years!!

Searches like that don’t harm your score and aren’t visible to other lenders.

Always remember credit agency are not your mates it’s geared up for the benefit of banks because there’s a hell of a lot more profit in misery!!

But that’s spot on!

G says

You can’t use credit cards for gambling anymore,that was stopped recently.

Sara (Debt Camel) says

That’s true! I had forgotten that.

John says

Came here via a “Will a credit card improve my credit score” enquiry in an internet search.

Fantastic, clear wording on the site. No jargon, or long and convoluted reams of information. Told me exactly what I wanted to know in clear and concise terms. I have just got one of these cards for the sole and specific aim of improving my credit score – which has been lower than average (yet stable) for quite some time now. I was intending to ‘wash’ a couple of hundred pounds every month on items like food shopping, that would otherwise come out of my current account – through the credit card, and then pay the balance in full every month – which I have already set up by DD. I notice you recommend only using the card once a month though? I might have used it a dozen times a month (small amounts) and then paid it all off.

Would this activity be harmful to my account/credit score? They gave me a much bigger credit limit than I wanted or needed, and total money spent would likely be less than a third of the limit every month.

I’m no fool, and smiled when I read the statement about helping people on the card literature. I know full well they aren’t my friends, and also know that if everyone used the cards as I will, they wouldn’t be in business, as they make all their money on the high interest. I don’t ‘need’ the card, and will not be viewing it as ‘extra money’. It’s purely because I have been led to believe my credit score will improve.

Sara (Debt Camel) says

It doesn’t matter if you use it for several small purchases. It can just be easy to lose track of them, which is why I tend to say just use it once then leave it at home!

Nicola says

Some advice please? I am trying to improve my terrible score, 340 on experian (4/5 year old defaults and CCJ’S totalling about £3000) and am wondering if it is worth making arrangements to pay these off, or will it start them all from the beginning again if I make a payment plan? They are all with Lowell for phone contracts and I don’t want them to start chasing me again and take a full 6 more years. The 2 CCJ’S are for £780 and £320

Weatherman says

Hi Nicola

There are two different things to think about here.

One is when these debts will drop off your credit record. That’ll be six years after the default or CCJ, and has nothing to do with whether you make arrangements to repay them. Making arrangements to repay them might also help your credit record a bit while they’re still on there – and reduces the risk of Lowell applying for a CCJ against any of your defaults.

The other is when they become statute barred. Your defaults will become statute barred if six years pass from the point the creditor could go to court (usually when the default notice was sent), but this 6-year period will reset if you make a payment or write to acknowledge the debt. Once they’re statute barred, your creditor can’t get a CCJ against the debt, so you don’t need to make payments.

Your CCJs never become statute barred, but after six years your creditors will need the permission of the court to take enforcement action. If you get a letter about that, call National Debtline.

But also bear in mind e.g. mortgage lenders might ask you about any debts you owe, and you have to tell them, even if they’re not on your credit report and/or are statute barred.

(second comment coming in a sec!)

Weatherman says

I get what you mean about Lowell, because they own all your debts: if you contact them about one, they might think “Ah, maybe it’s worth chasing her for the others too!”. But don’t forget the statute-bar time period would only reset for the debt you make a payment for.

So there’s no hard and fast rule here – hopefully this helps you work out what’s right for you.

Nicola Newland says

Ah thank you so much, but I am still a little confused. What I was worried about is that my file says default date 11/07/2016, balance 780, and just a red D for that month and blank payment history since, so if I start to pay it off will that still stay on my file past the 6 years ( 11/07/2022) if I am still paying it? Or will the default disappear and a new payment plan show? Sorry, I’m a bit dim with this kind of stuff. TIA. Nicky.

Weatherman says

Hi Nicky

No problem at all!

Whether or not you start to repay this debt, the default won’t do anything different than it’s going to anyway – it’ll stay on your file until 11/07/2022, then drop off. There then won’t be anything about this debt on your credit record.

Rosie Whitman says

This and ‘How much will my credit score change if…’ are brilliant articles – thank you!

Last I checked, I had a high credit score, but don’t have much of a credit history as I pay everything outright. However, I want to buy a house by the end of the year, so this is a good way for me to build that history, as I’m very disciplined and hate being in debt.

A few questions though:

– You mentioned using the card for small amounts such as fuel, yet I’ve seen ‘minimum credit limits’ ranging from £150-300. What do these minimum limits mean in practice? If they’re what I think they are, then I’m guessing you cannot spend below that amount?

– To what extent will applying/borrowing from these companies (high interest, credit building cards) negatively affect my credit score versus using the card to build credit and thus improving the score? For example, applying will knock 50 points off, but repaying on time within given limits, will increase the points by 90.

Thank you in advance!!

Sara (Debt Camel) says

I’ve seen ‘minimum credit limits’ ranging from £150-300.

I’m not sure where you are seeing those, but it sounds as tough they are the minimum credit limit someone would be offered. Nothing to do with the amount you need To spend together a good mark on your credit record. I suggest you spend under 30% of that amount each month and repay in full.

But really you want a balance over £250 as very low limit loses 40 applying will knock 50 points off, but repaying on time within given limits, will increase the points by 90.

applying will knock 50 points off, but repaying on time within given limits, will increase the points by 90.

The lose from applying is only temporary, it goes after 6 months. So apply sooner rather than later!

You don’t need more than 1 of these cards. Good luck!

Steven says

Great article. Many thanks for the good work. I recently got a credit card to boost my score as I’ve had nothing on it for 5 years. I maxed it out and am paying it off in big chunks before the 0% runs out.

Stupidly tried to get a car on lease whilst this card was maxed and was declined. If I cleared the card today, and then saw this reflected in the credit reports, then how long would you think to reapply for a lease car? I will have that decline on my credit report now so I have to leave it 3 months atleast? There is nothing else on my report and I can afford to pay it fully off now no issue.

In a situation where I can’t get credit cos I’ve got no credit history (due to bad credit 6 years ago which thankfully is sorted now fallen off). Maybe I’ll be fine once this card is back to zero and just messed up here applying too early.

Sara (Debt Camel) says

how recently did you get the card? what is the limit and what is the balance now?

is there anything else on your credit record at all? I assume you have checked your credit records with all three credit reference agencies?

Steven says

Got card in Jan, maxed out to £1500 in March. Just paid £500 off it today but could clear it if I needed to. Plan was to clear it over next 3 months and then leave at zero.

On my report (checked all) are some pay day loans from 5.5 years ago that are paid up (missed payment on one, but was paid up). Then another small credit card with a balance which I cleared today, and a small phone bill which I only took out in Jan (last phone was fri years ago and is on my report as paid up no issue).

I’m guessing I’m daft to have applied for car finance yesterday when I planned on paying these cards today. But do I even think about applying again in the next 3 months, or wait as unlikely? I’m in no rush for a new car but saw an offer and went for it as student loan now paid off which the monthly extra money from that would have paid for it.

Apologies for extra info. Appreciate the advice.

Sara (Debt Camel) says

the payday loan with a missed payment – who was the lender?

You generally need a VERY good credit score for leasing.

Steven says

MyJar. Missed payment in Feb and March 2016. Paid and closed in April 2016.

Before the credit card my score was Good with Credit Karma and Excellent with Experian. Now Fair and Good. Hopefully when paid off they will both be excellent

I guess I need to get my name on more things to start building up a history again. I earn well and am saving towards a house in a couple years. Would have thought my earnings and spare income alone would be enough to get a car lease. Though ofcourse a credit report doesn’t show that.

Thanks again

Sara (Debt Camel) says

Myjar is in administration. I suggest you send them a complaint to generalcomplaints@myjar.com saying the loan was unaffordable. It is highly unlikely you would get any significant refund, but if they uphold your complaint the missed payments should be removed from your record.

“Plan was to clear it over next 3 months and then leave at zero.”

Sounds like a good plan to me. But when it is at zero, use it once a month for something small like a tank of petrol and set up the card to be repaid in full every month. That will maximise the benefit to your credit score.

Steven says

Awesome. Will do. Thanks so much. Keep up the good work, we all appreciate it so much.

Kg says

I think one thing that people fail to mention is that if you are struggling to have self control on reusing cards where you are paying minimum or smaller amounts, is that you can ask them to close the card but the balance remains and you just pay it down as normal I.e. minimum or fixed payments. This way your balance will go down and you’ll feel better that it isn’t rebounding.

I have done this and it doesn’t affect your file or anything like that. You still accrue interest but atleast you don’t use it unnecessarily.

Nigel says

I’m looking to get mortgage this year or next year, one way to improve my credit rating is to get a credit card, however they will do a hard credit check so is it worTh it

Sara (Debt Camel) says

how much debt do you currently have?

is there anything wrong with your credit rating or does it just not have much on it?

Nigel says

6k debt – atm paying off 500 a month of it.

It has a lot on it, I was in a mess before, tahts behind me now so I’m just building it up at the momment it’s poor, a defult just got removed as added in error, so went from very poor to poor moved up 222, no it should go up preeti fast,

Sara (Debt Camel) says

Paying off debt does not improve your credit score, with the exception of a non-defaulted credit card where you are reducing your credit utilisation.

How many defaults do you have remaining? What are the default dates that are showing on your credit record – these may not be the debts you think you actually missed payments to the debts.

How many debts have missing/late payments/payment arrangements? How long ago did those problems start?

The debt where you got the default removed – did that go back to being in arrears? or to not having any problems at all?

Nigel says

I have 0 defaults

Late payments only 1 or 2 over 6 months ago.

Sara (Debt Camel) says

and do you have a current credit card which has no late payments or other problems on it?

Your score seems unusually low if you have no defaults and only a coup[le of lat payment markers, what other problems are there?

Nigel says

I had late payments before but that’s over 6 months and incorrect defaults messed things up and took over 6 months to remove due to so many errors,

I use to have a credit card I think 1 miss payments now closed.

No other problems really just taking time to build up, due to past problems,

Sara (Debt Camel) says

Well… as I said, in general repaying debt does NOT improve your credit score. Of course it is still a good idea as you won’t be able to get a mortgage until all the debt problems have been resolved and the easiest way to show that is to settle the debts.

A rough rule of thumb is you need to settle all the debts with previous problems at least a year before a mortgage application.

Getting a credit builder card adds new good marks to your credit record if you use it properly, as the above article suggests. But it doesn’t remove any of the harm from the previous problems on your credit record.

A hard search is no big issue if you get given a card… but I suggest you go through https://www.moneysavingexpert.com/credit-cards/bad-credit-credit-cards/ which does soft searches and only apply to one where it looks VERY likely you will get it. If none of them look very likely, carry on repaying debt and wait 6 months and look again.

Jamie says

I recently got a level card to try to improve my credit score. I have just found out that I am being charged interest from the date of my purchases. I thought this was illegal?

Sara (Debt Camel) says

That sounds unusual. I will have a look at this.

Sara (Debt Camel) says

I have had a look at this card and it certainly is unusual in the way it charges interest on purchases but it isn’t illeagl. See https://debtcamel.co.uk/level-credit-card-avoid/ which I have just written on this.

Mike says

Iv used one the problem being credit reference agency who down mark you because your using a credit building card you can’t win

Sara (Debt Camel) says

what makes you say CRAs don’t like credit builder cards?

Mike says

Because iv actually seen I reduction in a credit score because of use of credit building cards I suppose you just confirm to CRA that you may have had past issues another issue with equifax a debt company Cobalt did a soft search of my CRA file for address confirmation- I have no debt issues-it was a soft search but never the less they dropped the score 100 points and in bold type states Debt company search ! These CRA are for the benefits of banks poor score higher interest rates – massive profits in debt and misery

Thanks

Bob says

Great article! I was discharged from bankruptcy over 2 years ago, and I used Loqbox for the first 2 years and I have 2 ‘bad’ credit cards with a total of just short of £5k available credit. I haven’t missed a payment on any account since the day I was made bankrupt (over 3 years ago) and I clear the balance by DD every month on the cards. I never spend more than 20% of each card’s credit limit each month either. I am a company director and earn a reasonable salary. My credit score on each ref agency, however, simply won’t rise, and I still can’t get my bank (NatWest) to give me a ‘standard’ current account – I have to remain with a foundation account. I basically owe no money to anyone, and I earn a good salary, and yet I can’t get a ‘normal’ bank account and can’t even get a debit or credit card that allows me to ‘pay at pump’ for my fuel! What more can I do, or do I simply have to wait out the full 6 years before the bankruptcy goes from my file?

Sara (Debt Camel) says

Going back to a “normal” bank account with the same high street lender is always hard.

Have you looked at getting an account with Monzo or Starling?

Bob says

I haven’t because:

– I have my son’s savings account and my savings account all on the NatWest app

– I didn’t want a new ‘application’ to negatively impact on my score still further

– I thought that because I have held an account with NatWest for years, it’s seen as ‘good’ on my rating (it comes up as a good impact according to Totally Money) and so again, didn’t want to lose that

Do you think that the factors above are minimal or short lived, or are those points ‘real’?

Sara (Debt Camel) says

You don’t have to close the Natwest account, just apply for a new one. The effect of a new application is small and short lived – unless you are planning more applications soon I wouldn’t worry about it.

Bob says

Thanks for that. I’ll give it a go :)

Andy says

Hi Sara

In 2020 I started using credit-building credit cards as a way of improving my credit scores. Because no single lender was willing to give me very much credit, I got several cards as a way of ensuring my overall credit utilisation remained low. I use the cards for small purchases on a rotation basis and clear the balance as soon as the transaction becomes visible in my account. My scores have risen to either ‘fair’ or ‘good’. However, it reached the point early this year where I had eight credit cards, which was becoming unmanageable. As some of my providers were making large increases to my credit limit, I opted to close the two cards that had the smallest limits. These two cards had three years and two years of on-time payments respectively. I understand these payments will disappear from my report once the CRAs receive notification that they are closed. Will the absence of these on-time payments cause my credit scores to go down, bearing in mind that as well as four credit cards that have been open for 0.5-2 years I also have two credit cards which have been open for over seven years, all with a complete history of on-time payments? When I had eight credit cards my combined limit was £11,050 and I now have six credit cards with a combined limit of £12,850. I would really appreciate your input on this as I have learned so much from your website.

Many thanks!

Andy

Sara (Debt Camel) says

clear the balance as soon as the transaction becomes visible in my account.

Do you mean when the statement arrives? or do you check your account before that and clear it earlier?

So you have a zero balance on all of the cards every month?

Andy says

I don’t wait for the statement to arrive. It usually takes a couple of days for a credit card transaction to clear and become repayable but as soon as it does I repay the amount owed. Because I have multiple cards which I’m using all the time I clear the balances as soon as possible to keep track of spending. I was a bit unsure about doing this at first but my understanding is that when a credit card provider reports to a CRA they tell them how much has been debited from and credited to your account in the preceding month. The CRA will see that I’m borrowing money and paying it all back. I’m just not borrowing it for very long! The fact that I’m repaying it before it becomes due seems to be irrelevant to them. So yes my balances usually stay at £0 despite me using the cards frequently. Sometimes due to cashflow it isn’t possible to repay the amount immediately in which case I leave it sitting in my account until I get paid. But I never leave it there long enough to pay any interest because after all I am using the credit cards to build a positive credit history not because I need the credit.

In the past credit card companies have agreed to lend me money when I couldn’t really afford to repay it which is unethical so this is my opportunity to use them for my purposes.

I must stress that I am still learning about credit scores so please correct me if any of the foregoing is wrong.

Sara (Debt Camel) says

ok so you are making your life very complicated and possibly not getting the best use of the credit cards to boost your score.

See https://debtcamel.co.uk/im-using-my-credit-card-but-my-report-says-im-not/.

When you use the card it is better not to pay it off until it appears on the statement. Many people find setting up the car to be repaid in full by direct debit is the easiest.

It is better for your credit score to repay in full so you never pay interest.

And you don’t need that number of cards at all – your credit record can be perfect with just one card. You could drop the number of cards down to 4 – close any that had problems, no matter how long ago. Then you could just use 2 cards one month and then the other two the month after. Much easier to keep track of.

Andy says

One of the main reasons I kept several credit cards going was that both Credit Karma and ClearScore notified me that managing multiple credit products well is good for my score. I agree that eight was definitely excessive and perhaps six is too. So I will review this and perhaps drop down to four.

As far as it being overcomplicated goes, I really don’t mind it: it takes just five minutes of my time each day.

The summary of your credit report that you see on apps like Credit Karma is deceptive in that it is missing important information. When you look at your full report it doesn’t just include details of your balance at the time of reporting, it also includes the amount you have repaid since the last report. So there is information there that goes beyond the status of your account at the time of reporting. It is for this reason that I don’t see the point in waiting for my statement to come before I repay. The ‘statement balance’ on my full report might usually be £0, but the ‘payment amount’ is always a positive number. As a result I have never had a notification that I’m not using my credit cards. Because I am using them, and the CRAs can see that. It is the full credit report itself, and not the summary Credit Karma provides, that is important and is used to calculate your credit score.

I think what I’ll do is try your suggestions for six months and see whether they have a positive impact on my score.

Many thanks

Andy

David says

I have one deafult in my name registered 19/5/20 and all settled. Haven’t missed a missed payment for 3 years but had quite lot before then. Am paying off all my credit cards 4 in total 2 are now closed and score is at top of poor on experian. Will it keep improving whie paying off all cards limit on cards now £2800 with using £2500 of it up, plan leave one open for one transaction a month. What are chances getting a mortage in the next year. Would paid all cards by June

Sara (Debt Camel) says

When was the default settled?

What % deposit will you have?

David says

The default was settled October 2020. Hoping for 15-20% on joint application with someone with no credit issues

Sara (Debt Camel) says

“Will it keep improving whie paying off all cards limit on cards now £2800 with using £2500 of it up”

yes because at the moment your credit utilisation is very high. As you repay the debt it will drop.

Did either of these accounts have missed payments in the past?

David says

There was one missed payment 3 years ago on them

Sara (Debt Camel) says

ok that was a pretty long time ago.

if there was an account without a missed payment I would say keep that one and close the other. As it is, closing one is probably a good idea.

The sooner you can clear the cards the better. You may be able to get a mortgage now, but the longer after they are cleared the better your situation looks. I suggest you talk to a mortgage broker about timing this.

Sofiane says

I have a question, I am getting advice from Business Dept Line preparing to enter a dro.

My question is can I keep an existing credit card for up to £500 with the bank been aware of my intention to enter a dro? I have declared 4 credit cards totalling 19k.

I currently owe £680 on this credit card but dro advisor requested to add it as debt.

The trouble is it already affected business ( sole trader) trading part time.

I had stopped using it for 3 weeks relaying on what i earn at weekends. Merely £200. The card helped keep my business aflotI and since 3 weeks now i quickly run out of cash,. As a result I’m being unable to pay my stall rent for this coming weekend. I ended with just £5 in my bank account.

I’m terrified as iit looks like going for a dro will hurt me more than making me debt free.,I’m penniless.since adhering to the advisor request.

Lastly, I read that I can choose what debts I choose to add.

This credit card had initially £5000 credit limit. I reduced to 700 and planing to bring it down to £500 as soon as possible. As using it to pay my stall rent will stop having to use the cash that I normally keep to pay my card statements.

Please advise accordingly.

Many thanks

Sara (Debt Camel) says

All debts have to be listed in a DRO.

In the DRO you will no longer have to make payments to this or any other debt. So the £200 you were planning to use to reduce the limit and the other payments to your debts will then be money that can help pay your stall rent.

Have you also stopped making payments to your debts?

If you need to use the card to keep your business afloat, is it genuinely profitable? Business Debtline can help you look at this.

Sofiane says

Hi Sara,

Thank you for your swift reply.

I initially was paying my stall rent on a monthly basis variable payments as management tend to reduce rent Accordingly in this times of crisis. Between 380 up to 500. As a first year sole trade it kept me going, paid my rent and bills on time. Up until last weekend switched to weekly payment..

Last weekend I paid a manageable 135 in rent for the weekend. I used 200 to pay a difference in my home rent that was in areas for 30 days only… I paid my rent always on time for my home for the past 7 yesrs.

This business at weekend helped me to carry on due to being made redundant during covid woking for 6 years for the same employer.. Considering the businesses foot fall being very low since crisis begin, I managed to keep all my debters happy.

The card will only be used for food and and stall rent ,earnings will go towards paying my house rent.

Lastly,

I suffer from anxiety, panic attacks and depression.

I spoke to all my debtors yesterday, all agreed to hold actions for 30 days.

Thank you

Sofiane

Sara (Debt Camel) says

how much have you been paying to your debtors a month, including this card?

Sofiane says

Tesco bank recently upped it tofrom 60 to £90 called then froze interests for 60 days.

Lloyd’s, around 50 – mbna, 42 variable – Aqua 34

Amazon business Amex £418

But they owe me 250 from while barclays suffered an outage and didn’t post in June 22.

Nationwide owe 680 for my last month bill they offered a pay plan to help stop interest

Stall rent 380.

Household and food 300

My initial balance was 5000 cleared it in full back in January 23. Then tmreduced it to 700

Sara (Debt Camel) says

So a DRO will remove the regular payments to the debts. That sound like £200 a month ish including the Nationwide normal payments? That alone will pay for half the stall rent.

But I can’t tell if this business is profiatble or what the cash flow problems will be.

You cannot choose to leave a credit card or overdraft or any other debt out of a DRO. I suggest you talk to Business Debtline agin about your worries about how you will manage the cash flow for your business during the DRO period.

Anthony says

I am trying to get a “bad credit” card or a credit builder card following my bankruptcy in 2020 that was discharged in October 2021. Over the last 2 and a bit years my score has slowly crept up to its current level of 472 with Clearscore (Equifax) and 563 with Credit Karma (Trans Union).

On Clearscore I do not have any credit card offers, not even bad credit ones, however with Credit Karma I was told I have a 100% chance of being accepted for a Zable credit card. I applied but was declined, although they did say that no hard search has been performed. Obviously, the 100% chance does not mean 100% chance!

I am on the electoral roll and have no accounts in arrears, no hard searches. I have just finished a 12 month Loqbox Save with no missed payments. This should be marked as settled in the next few weeks. I am using the Loqbox Spend product with no missed payments.

My question is, what more must I do to be eligible for one of these credit builder cards?

Sara (Debt Camel) says

Have you checked that all the debts in your bankruptcy are now showing as defaulted on or before the start date of your bankruptcy? And as satisfied or partially satisfied with a balance of zero owing?

And have you checked your Experian credit record using MSE’s Credit Club?

Anthony says

Looking at my Experian report, I can see that some of the debts that were defaulted on as far back as 2017 do show a balance of zero but do not have a partially settled mark against them. Is this a problem?

I believe that some of these accounts were later sold on to debt collection companies that may have marked the account as partially settled.

Sara (Debt Camel) says

That’s not a problem.

Anthony says

Thanks for your quick reply!

I have just checked my score on MSE Credit Club. I wasn’t aware of it before, I just assumed Experian didn’t have a similar thing to Clearscore or Credit Karma, so thanks! My score is 598.

It says: N/A chance of getting a top bad-credit credit card

All of my accounts do show defaulted on or before the bankruptcy date, but Vanquis refuses to mark that debt as satisfied or partially satisfied. All others are marked as settled or partially settled.

It’s confusing as I would have thought I am the kind of customer these cards are aimed at, but it seems I don’t meet eligibility criteria and I’m wondering why and what I can do.

Sara (Debt Camel) says

Ah it is the Vanquis that is the problem. You need to stop applying for these cards and make a complaint to Vanquis and then send that to the Ombudsman. See https://debtcamel.co.uk/credit-file-after-bankruptcy/

Anthony says

My mistake. Vanquis is showing on Clearscore as in default whereas all other debts are not. I have contacted Vanquis and they insist they have completed the required actions. On Experian there are a number of accounts in the defaulted accounts section with some of them not marked as partially settled, but here Vanquis is showing as partially settled.

Can you clarify what the correct course of action is? Do I need to contact. Clearscore to get Equifax to reflect the same partially settled status as Experian, and do I need to get the debts in the defaulted section on Experian marked as partially settled?

I appreciated your help with this!

Sara (Debt Camel) says

If what you are seeing on the reports is confusing because the data may be different and different terminology seems to be used, it’s often easier to look at the three Statutory Credit Reports. See https://debtcamel.co.uk/best-way-to-check-credit-score/ for links to them.

This article https://debtcamel.co.uk/credit-file-after-bankruptcy/ explains what should have happend when you went bankrupt and when you were discharged. If this hasn’t happened for some debts, this may well explain why you are being rejected for credit builder cards. Make the complaints as that article suggests.