In a Debt Relief Order (DRO):

In a Debt Relief Order (DRO):

- you don’t have to make any monthly payments at all;

- your creditors can’t ask you to pay them, take you to court or send bailiffs;

- at the end of a year, the debts in your DRO are wiped out.

If you meet the DRO criteria, it is often your best debt option, unless you expect your situation to improve a lot very soon.

DROs were introduced in 2008. In the first ten years, a quarter of a million DROs were set up. In 2023, DRO numbers increased with the costs of living crisis – now more than 2,500 people a month choose a DRO.

This article looks at the important things you need to know about DROs:

- are you are likely to meet the DRO criteria;

- is this is the best option for your financial problems;

- what can happen during a DRO and after it ends.

Contents

Are you eligible for a DRO?

The main criteria

Unlike most of the other debt solutions, you have to be able to meet all of the rules to get a DRO, there isn’t any “wriggle room”. The most important ones are:

- your total debts have to be under £50,000 You can’t decide to leave a debt out to get under this limit;

- you can’t own a house or have a mortgage. This applies even if you only own part of the house, you don’t live in it, the property is in another country, you can’t sell it, or it has negative equity;

- the second-hand value of your assets must be less than £2,000. That doesn’t sound much, but ordinary household objects and clothes etc are not counted at all. There is also an additional allowance for a car, see below. The second-hand value is what you could sell it for, eg on eBay. Few people have a problem with this £2,000 limit;

- you can’t own a car or motorbike worth more than £4,000 You may be able to have a car on finance – read Can I have a car on finance in a DRO for details;

- you must have less than £75 a month spare income after paying all your normal bills and expenses. See below for more about this.

- you can’t have had a DRO within the last 6 years.

The £75 “spare income” test

The hardest rule for most people to understand is that you can’t have a DRO if you have “more than £75 a month spare income“:

- this is the amount of money you have left over after paying your bills and other everyday expenses;

- it doesn’t take into account the payments you are currently making to your debts, because those payments stop in a DRO.

The level of spare income will be assessed by the debt advisor who sets up your DRO. You aren’t expected to live on a very tight budget. You can have some money for Xmas, replacing household goods, kids costs etc

I have come across people who have had an IVA payment of over £150 proposed who would have been easily “under £75” on the DRO criteria.

You don’t need to worry that disability benefits such as DLA or PIP will mean that you have too large an income for a DRO. When you have a disability-related benefit, you are allowed to offset that income with a line called “adult disability expenses.”

Some people who have been struggling with debt repayments find the expenditure allowances surprisingly generous. This may be the first time in a long while that you have any money to spend on clothes.

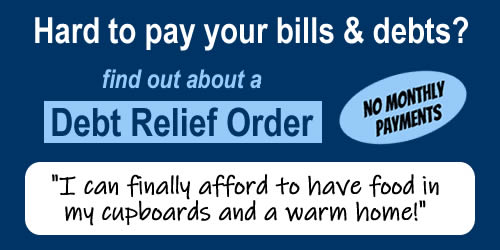

The quote in the picture at the top of this article from a reader sums this up:

“I can finally afford to have food in my cupboards and a warm home.”

Other technical criteria

Apart from these main rules, some other reasons could stop you from getting a DRO. These are much less common – your DRO adviser will check if any are a problem for you.

A few debts can’t be included

A DRO will clear most kinds of debt, not just money you have borrowed such as credit cards, but also council tax and energy arrears, tax debts and benefit overpayments.

Three that cannot be included in a DRO are:

- student debts;

- magistrate’s court fines, including TV license fines (but fixed penalty charges such as parking fines and the London Congestion Charge can be included); and

- debts incurred through fraud.

See this National Debtline factsheet for a complete list of debts that are included and excluded.

The DRO total debt limit is only for included debts – so if you have a large student loan debt that is ignored in checking if you are under the limit.

What about my partner?

You won’t be refused a DRO because you live with someone who has assets or a good income.

If you and your partner both have debts and want a DRO then you each have to apply for one – there isn’t any such thing as a joint DRO.

If you have a DRO and your partner doesn’t, then they will become fully responsible for any previously joint debts that you had together. This applies to things like council tax arrears and a joint bank loan.

What happens during the year a DRO takes?

“The DRO year”

In a DRO, your debts are cleared after a “moratorium period” of 12 months.

During this year your creditors are not allowed to ask you to pay the debt or take you to court.

No monthly payments during the DRO year

A DRO is designed for people with little or no spare income, so you don’t have to make any monthly payments.

From 6 April 2024, the £90 fee to set up a DRO has been scrapped.

This is a major advantage over an IVA, where you have to make payments for five or six years usually. And over a DMP, which could last a long time if you can only make low payments.

If something changes during the year

Once a DRO has been set up, you will find the DRO very low-key. No one from the Insolvency Service checks what you spend money on or asks for your bank statements,

But if you have a change of circumstances during the year (pay rise? inherit money?) you have to inform the Insolvency Service.

If you no longer meet the DRO criteria, your DRO may be cancelled. This is pretty rare, because often if your income goes up, your benefits are reduced.

Some detailed articles:

- what happens to my DRO if my pay increases or I get a lump sum of money?

- inheriting money in a DRO

- do not take money out of your pension during the DRO year

- how a DRO affects refund claims – it’s best not to try to make affordability or other refund claims while you are in a DRO. Wait until the year has ended and then think about them.

A DRO harms your credit score

A DRO is a form of insolvency and has the same bad effect on your credit rating as bankruptcy or an IVA. See how does insolvency affect my credit record? for details.

The DRO marker stays on your credit record for 6 years.

A DRO won’t affect the credit score of anyone else in your house unless you have joint financial products, such as a joint bank account.

At the end of the DRO year

At the end of the DRO year, there is no check that you still meet the requirements. Your DRO simply ends and your debts are written off, see What happens at the end of a DRO?

After the DRO year has ended, you can start to “repair” your credit record. It only gets better slowly until the DRO and the debts in the DRO drop off your credit record.

Who does a DRO suit?

A DRO is frequently the best option with a low income or where much of your income comes from benefits.

This includes:

- where you have caring responsibilities;

- pensioners;

- people with long-term health conditions;

- when you have high childcare costs.

When you only have a short-term money problem, a DRO is unlikely to be your best option. It gets rid of your debts after a year, but it will have a very bad effect on your credit file for six years from when it begins. This downside is well worth it if you have a larger debt problem, but not for a short-term difficulty. Here look at a temporary token payment plan.

If you qualify for a DRO, it is always a better option than an IVA. In a DRO you don’t have to make any monthly repayments and it is very rare for a DRO to fail, but more than a third of IVAs fail, leaving you back with your debts.

DROs affect your credit record for 6 years in the same way that IVAs and bankruptcy do. This can make it harder or impossible to take out new credit at a reasonable interest rate and harder to get a new private tenancy – but if you have large debt problems you may well have a poor credit record anyway.

It is unusual for a DRO to cause any problems with your employment – talk to your adviser if you are worried about this.

How to set up a DRO

Who to talk to

Contact Citizens Advice. They can also help if you have problems with priority debts such as rent arrears.

If you would prefer to do this on the phone, contact National Debtline. Or Business Debtline if you are self-employed.

After the debt adviser decides that you are eligible for a DRO they will talk you through the details. You are often sent an application pack to complete.

Setting up your application

Your adviser does all the necessary checks before submitting your application. This can take two or three months sometimes. Your adviser may set up a Breathing Space for you during this time so you don’t get hassle from creditors.

I’ve looked at some common questions about DRO applications here: DRO application FAQs. But talk to your adviser about anything you are uncertain about or would like confirmed.

This includes:

- anything you have on Hire Purchase or any unusual debts ;

- if you are owed money by someone. Or you expect to get money in the next year, possibly from benefits backdating;

- what happens to bills such as council tax and utilities if you have a partner.

It’s important that all your debts are listed on a DRO as you cannot add another one later. Let your adviser know if you are worried you may owe council tax for previous year, owe HMRC and tax credits ocerpayment, oew the DWP any benefit overpayments, may have parking tickets you haven’t kept track of.

Approving your application

As the adviser makes all the detailed checks, the process of approval is very fast once your application is submitted to the Insolvency Service:

- there is no court hearing;

- no-one visits your house;

- DRO applications are usually approved within 2 working days of being submitted;

- more than 98% of DRO applications are approved.

When your DRO application is approved, the Official Receiver send you a letter called the Debtor’s Notice. Keep this letter safe even when your DRO has finished – it is a simple proof that a debt has been included in your DRO.

gaynor says

Hi Sara,

I am in the process of doing my budget for my creditors and it’s looking likely that a DRO is the option I will be taking.

I would like to know if I am able to renew my phone contract with EE before I go down this route. My 24 month contract ends in 2 months time, so ideally I would like to renew it or upgrade now before I apply for the DRO.

Any advice would be greatly appreciated thank you.

Sara (Debt Camel) says

Your DRO adviser will go through the details with you. But in most cases:

– if you aren’t in arrears with the phone contract, the debt itself isn’t included in your DRO

– your adviser will assess if the payments are necessary for you, in which case the repayments can be counted as part of your expenses.

Can you just switch to a cheap SIM only contract? It may be best to talk to a debt adviser now about a DRO and this.

Alex says

Hello Sara. Me and mypartner has debts, she 12k and me 18K. We are on universal credit and have 2 kids. We thinking about DRO, but we have a car worth 4k but I am registred keeper. Can my partner apply for DRO at least? And second question if she has bank account but no debt in bank,bank will close her account or not?

Sara (Debt Camel) says

Car – probably.

If you have any joint debts here then if she gets a DRO they became your sole debt.

Are you making payments to your debts at the moment?

Check the value of you car every 6 months – at some point it will be under 2k!

Alex says

1)So if we living together but car is registred on myself its counted as only my car. So she can apply for DRO?

2)her bank will close her current account if she will be on DRO or not If she do not owe any money for bank?

3) As I understand she can apply but me not because of car value?

We do not have any joint debts and we are on DMP with stepchange separetly. My debts is mine,her is her. Can you please answer on my questions to fully understand everything in our case. Thanks

Sara (Debt Camel) says

How much are you paying to the DMP each month? How much is she paying?

Alex says

I pay 176 and she pay 129 per months,but we pay that much because limit ourself as much as possible. My annual review will be in september,her in October.We have joint universal credit and we getting 100-300 each month depends on wages. Because I get paid weekly and once in 3 months I have 5 salaries so we get paid from UC 100£ in this months. She work part time and doing 20 hours per week. Youngest doughter 1 year old

Sara (Debt Camel) says

I think she needs to talk to someone about a DRO. I suggest she talks to National Debtline on 0808 808 4000. They can talk about the car – which probably will not be an issue for a DRO for her – but also how much spare income she has a month.

And you too should consider why you are stretching to pay so much and whether your DMP payments should not be reduced.

J says

Hello,

my I’m currently having issues with my CC which i have maxed out and have now gone over the limit twice due to interest charges.

this is 6.5k.

I also have a loan, which admittedly is an ok interest rate, but still have just under 5k to pay in the next 4 years at £122p/m. this would be more managable on its own, but with the CC and about 1.2k on a paypal credit account owned and being constantly in my overdraft of £600 i am struggling. i’ve been looking after my kids for the last 2 years while my wife works.. so this has dragged me into debt quicker.

ive recently started a zero hour contract job for times im not looking after kids, but due to earn about 600 this month which will help with minimum payments but little else.

the bank (HSBC) has let me increase my overdraft on debit card in last month and also my CC was raised by 1k about a year ago.. it probably wasnt in such a mess back then but my income wasnt great..

we recently moved into a house my wife bought. i am not on the mortgage, i have very little in the way of possesions and i dont drive. we have a joint account that we dont really use but it in its overdraft at the moment due to an emergency payment i had to make.. im worried this might affect my wifes credit score? i can only assume mine is beyond repair at the moment anyway.

i cant remember the last time that i was out of my overdraft or out of debt. is a DRO the best option for me?

thanks

Sara (Debt Camel) says

how large is the overdraft on the joint account?

your wife’s house – was this bought with any money from you – eg from a previous house you both owned?

j says

no, I’ve had no financial input in the House whatsoever.

the overdraft limit is 200.. think overdraft is 170.

however just rereading and think I’ll have more than 75 left after outgoings with this job with this month’s wage, but it is zero hour so hard to say that is true every month.

also regarding the £2000 of assets.. i doubt i have this amount but how is it assessed?

S ank says

Hi Sara, I have a question but cannot work out how to post one, just how to click reply? Can you advise how I submit my own question please? Thank you

Sara (Debt Camel) says

Go down to the “Leave a Reply” large box at the bottom of the comments

Sara (Debt Camel) says

A DRO will affect her credit score – the best thing is to get the overdraft cleared, then you get a new account with no overdraft and the old account is closed. Overtime the link between you on the old account will matter less.

I think you should talk to National Debtline on 0808 808 4000 about a DRO – it may not be right for you but it would help if you could rule this in or out as an option.

if a DRO isn’r rught, you can look at payments arrangements or a debt management plan to get the interest stopped.

You may also be able win affordability complaints about some of the debts. See https://debtcamel.co.uk/tag/refunds/ which has articles about these. But these can be slow and should not stop you taking action now to get a debt solution.

J says

Thank you Sara, I will give them a call and find the best option.

We set the joint account up a few years ago but didnt use it in the end.. we have been sticking to our own accounts (for obvious reasons!) but i recently had to use it (or more specifically it’s overdraft) as I had nothing left in my debit or credit cards.

so I think even just closing the account and not setting a new one would be a better option to stop the link between us.

I’m so used to considering my overdraft as ‘my money’ that I guess that RE: the DRO, that once I do get paid this month it will cover my bank accounts overdraft, but I probably wont have over £75 of credit left..

I will call stephange as suggested and work on clearing the joint account overdraft.

thanks, J

Alex says

Thanks Sara for advide. Do bank will close her account if she not owe money to bank after DRO? What do you think?

Sara (Debt Camel) says

i think YOU TWO need to close the account and asap. Regardless of a DRO.

Alex says

Sorry,but how to get wages if current accounts will be closed? If to open new current account what is the difference between old and new?

Sara (Debt Camel) says

You need to get the overdraft cleared and the joint account closed. So you both then use separate bank accounts.

Otherwise any credit problems you have will harm her credit rating. Whether this is a DRO or payment arrangement or missed payments.

L says

Hi. I got my DRO in June 2023.

I have let all of my creditors know that I have my DRO. How long does it take from the DRO being granted, for all my accounts to be closed and no longer show on my credit reports?

Ps, I’m not bothered about them being on my credit record, I’d just like to know how long the accounts take to be closed after the debt is written off with the DRO

Sara (Debt Camel) says

The debts should be marked as defaulted on the date of your DRO. They should be marked as closed after your DRO finishes in a year. The debts will no longer show 6 years after the start date of your DRO.

See https://debtcamel.co.uk/repair-credit-record-dro/ for details.

Stacey says

Hi, im wondering if you can help. I have £7000 of debt all bar one have defaulted. £3000 of this is with a debt collector. I private rent with my partner and don’t have any assets. Would a DRO be better for me as I have recently had a baby so currently not working. My partner works fulltime both have seperate bank accounts and the debts are only in my name.

Hope you can help

Sara (Debt Camel) says

A DRO is a real possibility for you unless you expect your situation to improve significantly in the next year or two. Talk to National Debtline on 0808 808 4000 about the pros and cons.

But if you expect you may need to move and get a new private tenancy, then a DRO on your credit record makes things harder and you may need a guarantor.

If you decide it’s not for you, the other alternative is probably making token payments to all your debts (including the one you are still paying noirmally) until things do improve.

Andrew says

Hi there

Can a debt owed to a current or former employer for overpayment of salary be included in a DRO?

Thanks

Andy

Sara (Debt Camel) says

so far as I know, yes. Talk to National Debtline on 0808 808 4000 about this and your full situation.

Jane says

Hi there.

I’m considering a DRO as I have unsecured debts of about £23k and I can’t afford the repayments and have defaulted on a few of them. My worry though is that a lot of the advice says that DROs are suitable for people on a low income. I take home £2,400 a month but I live in an expensive part of the country (rent is £1650) so I would meet the criteria of less than £75 a month leftover. Would my salary prevent me from being eligible do you think? Even if I meet all of the criteria on the list?

Thanks

Sara (Debt Camel) says

There is no salary check in a DRO – it depends on the amount you have left over after paying bills and essential living costs. Talk to National Debtline on 0808 808 4000 or contact your local Citizens Advice.

Emma says

That’s great. Thank you.

Jane Power says

When you say there is no salary check, do you mean they dont check how much you earn? Do they check your expenditure? ie if i put £50 for food costs, but for a few weeks on the run i some how managed to spend less on food, would that be an issue? Thanks

Sara (Debt Camel) says

Some points.

1) there is no salary test for eligibility in a DRO. Someone on 30k a year may be eligible if they have high expenses eg rent, children. Another person on 20k a year may not be eligible if they re single, no kids, low rent.

2) the adviser setting up your DRO will want to know what you earn. They have to complete income and expenditure details. You will normally be asked for bank statements as a check on what you are spending.

3) BUT you may be spending “too little” on food or clothes or heating before your DRO because you don’t have enough money as you are paying too much too your debts. Explain this to your adviser who will make sure the numbers that go in are sensible numbers for you to live on long term.

4) during a DRO there are no on going checks on your income or what you spend money on. None at all. If you want to live on porridge and baked beans and spend the rest of your food budget on handbags or cut flowers no one will know or care.

5) You do have to tell the Insolvency Service about getting extra income – but often that is swallowed up by prices having gone up.

Judy says

I’m at the final stage of a DRO application. It is being reviewed. For the last six months, I have been helping people (mainly from a religious community) therapeutically voluntarily. I am on benefits. I do it over the Internet.

I want to extend my possibilities to serve by working with groups. The training costs about $9000. It would take exactly one year to complete. Members encourage and wish to support my further training. Some have benefited in life-changing ways.

There has been talk about fundraising since I have no money or means. They have been inspired by doing so by social media like GoFundMe! How about the gift of education? What if they raised enough for a deposit and I pay monthly? What if they paid monthly for the course or training? What if they technically took me on as an official volunteer (currently I do it independently), and offered me the training? Would any of these be against my pending DRO? Is there anything you can suggest that might make it possible for me to take the opportunity to advance in preparation for a better future while under the DRO?

Sara (Debt Camel) says

Personally I would be very suspicious of any training like this that you have to pay for or raise money for.

You need to talk to your DRO adviser about what you would have to declare to the Official Receiver in a DRO. This may be best left until afterwards.

Lily says

Hi.

I have been asked to step up into an acting position for my job. For a maximum of 3 months. It is certain that I will not be needed in post for longer than this.

With the step up it means my wages will go up.

Do I need to declare this to the insolvency agency? As it is only for a short term?

Thanjs

Sara (Debt Camel) says

I suggest you talk to the adviser that set up your DRO.

If you get Any benefits, remember they will be reduced for this period.

Chris says

I’m mulling over the possibility of a DRO. I currently have a joint DMP for debts totalling 22k which won’t be fully paid off until 2029. I’ve had several missed payments and I’m struggling this month too. I have a few concerns though:

1: One of my debts is with Amigo and I’m worried about them going after my guarantor. I’m still waiting for a decision on an affordability complaint so this would no longer be a problem if my complaint is upheld (right?). I understand they’re going into liquidation soon so is this something I should be worried about?

2: My partner and I rent privately and we have 2 children. We recently had to move due to our previous landlord selling the house and it was difficult enough finding somewhere to move to. If we found ourselves having to move again within the next 6 years, would the DRO make this impossible or just a lot more difficult?

3: There’s no nice way to say this but my partner’s grandfather is in the later stage of his life and if anything were to happen she would receive an inheritance and have 25% ownership of his house. Not saying anything will happen in the next year but still needs to be considered.

4: Are priority debts included if you’re already paying arrears via an arrangement (previous year’s council tax bill, for example)? How about mobile phone contracts? My partner and I are both currently in payment plans to pay off some arrears alongside our usual monthly amount.

Sara (Debt Camel) says

I currently have a joint DMP for debts totalling 22k which won’t be fully paid off until 2029. I’ve had several missed payments and I’m struggling this month too.

Then unless you immediately go for a DRO, I think you should ask for your DMP payment to be reduced.

I am not sure if you are saying that you would both go for a DRO or just you. If just you, you need to work out what debts your partner would be left paying in a DMP – their debts plus joint debts.

1. if your claim is upheld, then your guarantor should be released. (We haven’t actually seen any decisions on these cases with an open loan yet, so until we do I can’t be 100% sure about this. But say 98% sure.) Liquidation is irrelevant. If there is a remaining balance after your loan has been upheld OR after it has been rejected, the balance will be sold to a debt collector.

2. A DRO makes it harder to rent privately but not totally impossible. You may have no options that make it easy to rent privately.

3. If your partner inherits anything, this will have no affect at all on a DRO that you are in. (It would affect a DRO that they are in – their DRO would be very likely to be cancelled.)

4. priority debts are included whether or not you have an arrangement to repay. As are mobile contracts with arrears. But last years council tax bill would have been a joint liability with your partner. So unless they also have a DRO, they will still owe the debt.

I think you should talk through your situation with a debt adviser. Who is your DMP with?

Caroline says

Hi, I’m hoping to get a DRO but I have a ‘debt’ for a very expensive coaching programme I signed up for in the US. I signed a contract with this coach and have since realised I was groomed/manipulated into signing up for it, the programme has been harmful to me- and I’ve left it. I have a large outstanding amount of money I haven’t paid (they let me do the programme and delay starting the payment plan – all dodgy I know now). This debt takes me over the DRO limit.

Ive emailed them several times to ask if they will release me from the contract or pursue me for payment. I haven’t received any replies to these emails and they haven’t chased me for any missed payments for 2 months.

my debt management company say unless I get confirmation they have released me from the contract they can’t put me forward for a DRO. It feels like this coach is ignoring my emails deliberately as a power thing, and I’m not sure she’s going to give me a response.

I’m feeling really frustrated that I may have to go into bankruptcy rather than a DRO because this coach won’t respond to me. I’d also like to check if I’ve emailed multiple times with no response and not been chased for payment this could be sufficient to discount the debt for the DRO. I understand what my debt management company are saying but would like a second opinion I guess. Do you have any further suggestions in this situation please?

Thanks for your amazing website it’s incredibly helpful!

Sara (Debt Camel) says

How much is this American debt?

How much are you over the 30k limit with it?

Lucy says

Hi Sara,

I’m considering a DRO as I currently have debts totaling at around £11,500 and struggling to make the minimum payments.

I am self-employed (sole trader) and work part-time hours due to having a young child. My monthly income is minimal because of this and we claim UC to ‘top up’ my income and cover childcare cost/bills. My husband works full time and covers the rest of our bills. However, we have a joint bank account, so what I wanted to ask was:

1) – How would I break down or show how much money I am leftover with after our bills are covered, if we only use one bank account and my husband’s wages covers 90% of this?

2) – As we have a joint bank account and have done for several years, is it best to remove my husband from the joint account and set up his own individual account, to prevent him from being negatively impacted by my DRO? We have no joint debts. If so, do you have to wait a certain period of time before applying for a DRO once he has been removed from the joint account to prevent him from being affected?

3) – The car I drive daily is registered in my husband’s name and I am just a named driver, as he purchased this via a bank loan. It currently values at around £6500. If I did decide to go down the DRO route, would I have to include this as an asset if it is registered in my husband’s name?

Thank you :)

Sara (Debt Camel) says

1) the adviser who sets up your DRO will sort all this out. I suggest you talk to Business Debtline about a DRO as they specialise in the self employed – see https://www.businessdebtline.org/

2) yes get his named removed now. Even if you don’t go for a DRO, you will probably need payments arrangements so it’s best to not have any joint accounts. No need to delay starting to get a DRO – that isn’t an instant process, it often takes a couple of months.

3) No, you don’t own it, it isn’t your asset.

Mandy says

Hi Sara,

I stumbled across your website a few weeks ago, I’ve been an avid reader and follower. I was hopin you can give me some advice on an issue that isn’t me, but my niece and I’m not sure she is getting the best advice.

She has recently received a CCJ from a previous landlord for what he claimed to be damage to the property she vacated. The CCJ was against her and her ex-husband (they left the property when they split) She wasn’t on the tenancy, her husband was.

The CCJ was made after neither of them defended it and it is approimately £5.5k in total.

Last week Bailiffs turned up but she was out. She called National Debt Helpline and since then I believe she was advised to speak to Citizens Advice. They have told her to enter into an IVA, having read on here about the pitfalls of entering into one, I am not sure this is the right course of action for her. She has no assets of any sort, her car is worth £1,500 maximum and her property is rented, she has two children of 9 and 12 (not her ex-husbands) she is currently on benefits, would a DRO be possible/more applicable in her case?

My initial thought was to get her to call StepChange? Any advice you could give would be massively appreciated, she is understandebly in an absolute state. She has no other debt at all, just this CCJ.

Thanks in advance for any advice you can offer.

Sara (Debt Camel) says

No that doesn’t sound right at all. An IVA sounds entirely unsuitable…

“National Debt Helpline” sounds a lot like the well respected charity National Debtline – but it is the sort of name often used by commercial firms trying to pretend to be National Debtline whose main aim is to sell people on IVAs.

Or she may have spoken to the real National Debtline who may have signposted her to Citizens Advice either for help with the bailiffs or for a DRO or both.

There are also fake firms trying to pretend to be Citizens Advice…

I suggest she calls the Citizens Advice debt helpline: 0800 240 4420. She should say what has happened and that a friend has said that an IVA is unsuitable and she may need a DRO instead.

let me know what happens?

Mandy says

Thanks Sara

That was my thought exactly, I’m going to call her this evening, I just wanted someone with real knowledge to confirm my thoughts. I’ll update you on the outcome.

Jane says

I have a lot of debt and hoping to get a DRO. I have just finished paying off rent arrears that I had been taken to court for. Would this be classed as giving a debt priority and stop me getting a DRO

Thanks, Joanna

Sara (Debt Camel) says

No it won’t. Priority debts like rent arrears are never counted as a “preference”.

See https://debtcamel.co.uk/debt-options/dro/ for an overview and https://www.nationaldebtline.org/ answers a lot of common questions.

Talk to National Debtline on 0808 808 4000 or go to your local Citizens Advice to check your eligibility and get a DRO set up.

Lily says

Hi. I obtained a DRO on 30th June 2023.

I have been made aware of an essential living fund, which is available in my area, which can be applied for to help with the cost of groceries, energy bills and other things such as household furniture.

The money isn’t paid directly to a bank account, and is put into a pre paid card. If successful, applicants must show receipts for proof they have used the funding appropriately. If I was to access support from this fund, would it impact my eligibility for my DRO?

Thanks

Sara (Debt Camel) says

How much money could this be? It would be a one off, or regular each month?

Lily says

It would be a one off, and no more than £400 for the groceries. The furniture is gifted

Sara (Debt Camel) says

I don’t think that will be an issue. Talk to the adviser who set up your DRO to be sure.

Jane says

I was about to get help with a DRO and my circumstances have changed. Ive read a tight budget isnt expected on a DRO, but what would be a reasonable amount in their eyes for food and clothing for one person? I havent bought clothes for years, and i often live on toast. Ive got a new job, I will have to eat properly now i will be working full time and I will need to buy new clothes, so im panicking!

One of my debts is with my bank, would it be better to open a new account now for my wages or would that be frozen or closed too? How do they expect you to get your wages if accounts are closed down?

Sorry, apart from the obvious things, what can be included in the budget, ie can my prescription charges be included, I dont really socialise but is there any wriggle room for “leisure”. I dont want to say not to every works “do” !!

Thank you

Sara (Debt Camel) says

prescription charges – definitely. Also things like haircuts, dentists. a reasonable amount for gifts, and yes leisure.

I suggest you have a look at this budget sheet from National Debtline which may prompt you for some other lines you should include https://tools.nationaldebtline.org/yourbudget/ and then talk to National Debtline on 0808 808 4000. they will say if they think any amounts look too high. And talk you through what to do about a bank account.

Gillian says

Hi we are talking to citizens advice about a DRO. We have credit card debt of around 9,000 and as our flat was repossessed and sold we also have a shortfall debt of 20,500. We have a car on HP which is worth about 4,500, my husband needs this for work and as I cannot carry shopping due to arthritis he drives me to the shops. Should we sell the car, or hand it back but then we would be better off by 153.00 a month. I’m so upset by all of this, don’t know which way to turn.

Sara (Debt Camel) says

when does the car HP end?

how long ago was the house repossession?

you are now renting – private or social?

can I ask how old you and your husband are?

Gillian says

The car has 20 months left. The house was repossessed (handed back) in June, sold in December. We had interest only, no way of paying the mortgage off, no equity and a short lease. I am 63,husband 61. We rent privately.

Sara (Debt Camel) says

Well if you need the car, you should not hand it back.

If Citizens Advice say you can not have a DRO because of the car, then you could consider making token payment offers of £1 a month to the credit card and repossession arrears.

Then in a few years time, possibly when your husband retires, you could write asking the lenders to write off your debts . – they are more likely to consider that after they have been receiving token payments for several years.

Tilly says

I had a DRO approved in Oct 2023. I am self employed so went through business debtline. I had a bounce back loan as a sole trader. I’ve been chased up for payment and have spoken to someone who has advised it’s on hold until April. But in his communication he implied I am still liable and that there will be some next steps. He said something about the DRO team liaising with the bank. I am waiting to hear from someone else at the bank to explain this better, but this has left me utterly perplexed. I don’t know if he just wasn’t understanding a DRO, or if there’s a genuine question over whether the BBL is included. It was on my application, which was accepted. Is there a possibility that the bank can refuse to wipe this debt at the end of the DRO? I am now feeling super stressed, and as far as I’m aware I shouldn’t even be in conversation with creditors about the debt. Any advice appreciated.

Thank you.

Sara (Debt Camel) says

That doesn’t sound very likely to me, but Business Debtline are the experts on bounce back loans so I think you should ask them

Safina says

Hi Sarah,

I am mom of 3 lives with my partner. I only work partime but me and my partner don’t share any account but he helps me out with stuff. I have a unsecured loan and credit card debit of around £19k. I am making the minimum payments but they are getting out of hand. Due to my health I cannot do full time and only managing part time on which I can barely survive a month. I have read your blog about DRO and was seeking advice from that will this be a good option ? If it is what is the best way to go forward. Also with DRO will my all bank account will be closed ? Please if you can guide me i will much appreciate it.

Sara (Debt Camel) says

If you are eligible for a DRO is usually a very good option for you – the main exception being where you expect some big improvement in your situation in the next year or two.

I suggest you talk to National Debtline on 0808 808 4000 about your options.

Safina says

Thank you Sarah. One more thing when it says you should not have saving of £2000. I have credit card limit that is not use which is around £2000. Will this be classed as saving ?

Sara (Debt Camel) says

no!

Esther says

Hi Sara, I currently have a Step Change DMP with 5 x credit cards amounting to approx 15k. I have been sent notice of default for all of them and they have been been switched to debt collectors. On my part time salary, and the low rate of payment it’s going to take me about 30 years to pay them off which is really depressing and my mental health is suffering greatly.

The National debt line are recommending a DRO but I am scared of the negative impact this will have on my credit rating.

Or do you think as my credit rating is already impacted so it won’t make any difference, and will be the same with or without a DRO? or will the DRO be even worse? Thank you for your help.

Sara (Debt Camel) says

how long has the DMP been running? How much are you paying a month?

Are you renting? privately or social housing? do you own a car or have one on car finance?

Rylee says

Hi. I have a DRO, and I recently have been made aware I am entitled to universal credit. I am going to make a claim. Should I be successful this would be a change of circumstances, and I would need to let the DRO agency know. Will they need to see copies of bank statements again? And is there anything else they would need to see proof of. Thanks

Sara (Debt Camel) says

Tell the debt adviser that set up your DRO and ask if it will make a difference. They may be able to help you supply a new income and expenditure statement. Don’t forget council tax, water, broadband, mobiles etc may all be going up in April…

Claire says

Will gambling affect being approved for a dro?

I have £18k worth of mainly credit card debts.

I’m self employed low income, last month was the worst for my business, I only made £400 profit.

My essential bills come to £1100 a month (not including credit card debts)

I have been gambling the money I have away for years thinking it will magically solve everything and then my partner has had to help me cover my half of the essential bills when he can. I’m just wondering if it’s worth applying for a dro if my bank statements show excessive gambling?

Sara (Debt Camel) says

Gambling won’t stop you getting a DRO, but you do need to get help to stop the gambling. And you need advice about your business. I suggest you phone Business Debtline on 0800 197 6026 – they can talk about your business and you own debts.

L says

Hello, I can’t afford to continue on this route I am presently on. I qualify from what I’ve been told as I owe less then £30,000. Due to being on UC- LCWAWRA as well as pip, I was told that they don’t count the pip as an income towards your monthly expenses so that would cut my ‘earnings’ in half meaning i have to pay way more than I get in.

My main wowe and worry is that 3/4 months ago I had to take out a 8k loan for ‘debt consolidation’ with my bank but it just got washed on my high expenses. I am due to make its first payment next month and I don’t have the funds and I’m stressed that this loan due to being recently taken out (‘Nov) will make me not get approved!!! Any advice? :(

Sara (Debt Camel) says

I think you should talk to National Debtline on 0808 808 4000 who will go through all the DRO eligibility criteria with you and also help you look at whether you have any other options.

James says

Hi,

My DRO has recently been approved for two overdrafts and two credit cards.

I have a normal current account with Barclays which I have never owed money to same with my chase account. Will I lose these accounts seeing how they are normal current accounts or will it be fine? I got told you need to have a basic account I was reading but I assume that would only mean if I wanted to open a new account?

Thanks

Sara (Debt Camel) says

Some banks will close your account. Your DRO adviser may know what Barclays and Chase do

F says

Hello

Asking for advice my cousin earns after tax 20,000

He has 5000 in credit card debt what would be the best solution for him forgetting rid of this outstanding debt?

I have told him to write to the credit card companies because he does have very difficulties and a bad credit rating but they’re still allowed him to borrow on other cards

Many thanks

Sara (Debt Camel) says

I think he should talk to a Debt adviser about his options. Phone National Debtline on 0808 808 4000. It isn’t really possible for me to guess what his options are. You have posted on a page about a debt relief order – if he is left a DRO then that would be the simplest and quickes way to get him a clean start.

AT says

Hi there,

I have come to the conclusion that a DRO would be the best option for my circumstances and I meet the eligibility regarding level of debt and spare monthly income, assets, etc. I have been paying the majority of my creditors through a DMP but needed to take out a couple of additional credit cards following the breakdown of my marriage last year and having to start from scratch with new furniture, appliances, etc. These have now been added to my DMP but I have been advised that I would not be approved for a DRO due to the additional credit card providers getting treated preferentially during the period before they were added to the plan (in terms of me paying off more each month than my creditors on the DMP were receiving). Is this a legitimate reason for them not to approve the DRO application please? Thank you in advance.

Sara (Debt Camel) says

When did you take out the new cards?

Which debt advice service did you speak to?

S says

Hi Sara! I hope you’re well.

I have £10,000 in credit card debts, 3.5k in a BNPL catalogue, and around £10k in personal loans. I’ve been off work for the last 6 months with Depression and continue to be treated but have gone back to work recently., earning around £1700 a month after tax. I meet the majority of the criteria for a DRO except my car is worth around £6k and I have camera equipment work around £3k. Ideally I would keep both (the car for work, camera because it’s a hobby) but was wondering what is best to do in order to meet the DRO criteria – should I sell them and put the money towards the debts (will that then allow me to apply for a DRO?)

Many thanks!

Sara (Debt Camel) says

Do you not need the car?

Is 3k what you could get by selling the camera?

Are you making normal payments to the debts?

S says

Thanks for the swift reply!

Yes I need the car to get to my workplace (20 miles away with early starts before public transport begins).

Yes the cameras would fetch around £2800/3000.

I’m meeting all my payments as standard (minimum payment on cards, and meeting my loan obligations) I’ve not missed any payments on anything yet but I’ve had to start borrowing money from friends and family and can’t keep doing it because I’ll not be able to pay them back soon.

Sara (Debt Camel) says

So you could potentially sell the car and buy one under 4k?

i think you need to talk urgently to a debt adviser about your options – you may have other choices that a DRO but carrying on making minimum payments by borrowing from friends and family is not an option.

Talk to StepChange now – a debt management plan may stablise your situation. And they can talk about a DRO too. Use their online tool,and then phone them up to discuss the results: https://www.stepchange.org/how-we-help/debt-advice.aspx

S says

Ok, thanks for the help, I’ll follow your advice

J says

Hi Sara

I’ve managed to get myself in a lot of debt. i currently have 3 loans with a total balance of £18,151 along with 7 credit cards at 7.5k balance with interest added monthly.

I’ve moved back home and i’m about to start a new job on 30k a year. I feel like I could possible pay this all off in 2 years but it literally leaves me with ZERO every month for 2 years.

I’m constantly stressing about money, life and this new job i’m going into and don’t know what to do.

do you think i should just suck it up and put my head down to pay everything off or recommend and IVA or bankruptcy even? at 38 years old with no house, I just don’t know where to turn or how long it maybe before i can pay this all off along with then saving for another 2 years for a deposit somewhere

Sara (Debt Camel) says

it literally leaves me with ZERO every month for 2 years

is that zero money for anything except debt repayments?

or zero after covering your transport, lining costs and some rent to your parents?

Do you have a car? On finance?

J says

So I have worked out on 30k per year, I will have everything paid off in 20minths time.

However either will be left with ZERO everymonth. I won’t have any money to go out, for a takeaway, new clothes, holidays, birthdays etc. I will literally have 2p in my bank every month.

My car is bought outright and worth £1,200.

My wage will cover my food for the month, mo ey for living at home for my parents, Petrol for work and the gym.

Part of me thinks that going bankrupt and just getting it all cleared might make more sense, as I will be able to save some money from there.

I know my credit file will be ruined for 6 years and I will struggle to even get a mortgage in my lifetime now.

I already have defaults on my credit file which come off in May2025.

Mentally I’m just at rock bottom and I ca not see a light at the end of the tunnel.

Sara (Debt Camel) says

are all the debts defaulted? any sold to debt collectors?

J says

Hi Sara

No none of them are at the moment. i’m still up to date on all of them

Sara (Debt Camel) says

ok so leaving yourself with nothing for 2 years isn’t sensible. Why not set a budget that allows you some money for clothes, gfts, etc which takes 2.5 or 3 years to clear the debts?

If you go bankrupt now, you would have to make payments for the next three years, as you will clearly have some surplus income after paying your essential expenses including clothes, gfts etc. there seems no point in doing this if you can just clear the debts in 3 years anyway and not have insolvency on your credit record.

Same with an IVA but even worse – there you would be paying for possibly 5 years and are likely to pay much more than the amount of your debts as IVA fees are high.

J says

Hi Sara

There is literally nothing left from my wage. I have put it below for you to look at. it would be like this for 20 months. so would agree this would still be the best decision rather than Bankrupt or DRO? i suppose i would have a clean credit file. But its the thought of not being able to spend any other money. This new job does have some bonus involved. However i was going to use that to possible save up to get my own place in 24 months time.

Pay £2,042

food £125

Phone £50

Petrol £30

Gym £22

Sky £112

118118 – Loan £358

reevo £288

finio £303

zopa £50

fluid £131

tesco £100

Zable £150

credit spring £195

elfin £128

balance £0.00

Sara (Debt Camel) says

A DRO is not possible – you have to much spare income after paying the essentail bills and living expenses but no debts.

do you own a car?

are the repayments to the debts the minimum payments? more than the minimums? less than the minimums?

J says

right ok,

118118, reevo, credit spring and finio are all loans.

zopa, zable, fluid, tesco and elfin are all credit cards.

Son no DRO, would you recommend bankruptcy or just sucking it up for 20months and paying everything off on time.

by the way. total debt is £21,500 with interest over the 20 months it will be a total of £30,000 that i would have paid back

Sara (Debt Camel) says

I think you should either repay the cards more slowly (which costs more in interest) or look at a debt management plan with Stepchange for all your debts, which will get interest frozen.

Bankruptcy is not a sensible option where – you would be paying for three years. You can clear the debt in 3 years without insolvency.

Talk to StepChange if you aren’t sure about what to do. do not under any circumstances agree to an IVA.

Also you can look at affordability complaints against all of your debts – the fact they will be affordable when you are living at home is irrelevant – some of these lenders have lent you way too much money. See https://debtcamel.co.uk/tag/refunds/

Jack says

Hi Sara. If I owe property abroad and property value is less that 2000£ it is not possible to apply for Dro? How official receiver can find out about it?

Sara (Debt Camel) says

It doesn’t matter what the property value is. Lying on an application form is an offence and I don’t recommend it.

Talk to a good debt adviser about bankruptcy – in theory you would lose the property in bankruptcy, but if its very low value and abaroad, the official receiver may not be keen on the idea.

Sarah says

Hi Sara my DRO ended May 2023 however I’ve still been getting letters from Barclays partner finance for a loan I had that was included in the DRO.

I’ve checked my credit file and they are still reporting each month that I’m in arrears.

I’ve written to them but they keep saying that they don’t recognise my account.

Have you any advice should I go to the Ombudsman? Thanks Sarah

Sara (Debt Camel) says

what details about the account have they asked for?

LB says

Hi, I’ve just been made aware that I may be entitled to claim universal credit (UC) Childcare element. The UC claims are taking up to 5 weeks to be approved. My DRO ends in 3 weeks. Will I need to let the official receiver know I am making a claim? As if I do get approved I will not receive any payments until after my DRO has ended. Thanks

Sara (Debt Camel) says

you don’t need to tell the OR about changes to your income that happen after your DRO year has ended

LB says

Thanks for your response. So I won’t even need to tell the OR I am making the application either?

Thanks again

Sara (Debt Camel) says

No – for a start you don’t know how much you will get or if it will be successful!

RG says

Hi Sara, My dro ended 4 weeks ago- I went through a messy divorce a few years back and my life is now on the up- – I know this might sound a silly question i am just still scared of everything I went through to get the dro and constantly question myself but I want to revert back to my maiden is this ok to do now.

Sara (Debt Camel) says

Changing your name now won’t make any difference to your DRO.

clive says

Hi Sara,

I have some debts that i’m struggling to pay, totaling £15k, these are all personal debts. Firstly I would like to know if I could apply for a DRO, as I’m self employed and a director of my own ltd company. Would it effect my company? My vehicle is in my name but is an asset on the company accounts, would I need to declare it, as it’s over the 4k allowance. Many thanks

Sara (Debt Camel) says

You need specialist debt advice – contact Business Debtline, they specialise in advice for the self employed and people with small limited companies. https://businessdebtline.org/

Eliza says

Hi, I’m the sole earner in the household and am responsible for 2 adults. Both adults are not working due to 1 due to bereavement – not eligible to claim benefits, and the other old age and language barrier – no of pension age yet.

As I’ve picked up all the financial responsibilities in the house, do put the spending for 3 adults or just myself?

For e.g the food shop for the whole month for 2 adults is £450, we cant afford to eat out and this includes toiletries.

Thanks

Sara (Debt Camel) says

are you related to these two adults?

Eliza says

Yes, I’m the daughter and sister for both of them.

Sara (Debt Camel) says

Then I think you should put in the spending for all of them and explain to the DRO adviser why.

Safina says

Hi Sara,

I have got my DRO approved recently. I have been notified by creditor that my account has been closed which is fine as it was mentioned on the DRO. However, one bank which is Halifax keep adding interest to the overdraft that is mentioned in DRO. and I have been told any debt which is not mentioned in DRO I have to pay. Do you think that should I contact Halifax and other creditors that I have became insolvent via DRO? Please advise.

Sara (Debt Camel) says

If any lender or debt collector asks you to pay, tell them about the DRO.

Bank overdrafts are the only sort of debt where “not paying” can go unnoticed, because they just debit your account. But it’s very very unusual for a bank not to notice your DRO and immediately close the account with the overdraft…

Have you switched your banking to a different bank?

Safina says

Yes I have switched to other bank account. Halifax has overdraft debt and NatWest has credit card and load amount. NatWest has put a restriction on my account but Halifax’s has not. Should I tell Halifax about it ?

Thanks

Sara (Debt Camel) says

Yes I would tell them.

Gail says

In the year after a DRO how much is “too much” disposable income and needs declaring to the Insolvency Service? A friend is 4 months into their DRO and has been offered a few extra shift at work. He also knows that his car needs around £400 work on it. Is it reasonable to work extra shifts to save the £400 to afford fixing his car, or would this need to be declared? It seems wise to save to pay for this rather than not be able to afford the £400 cost (as he only has £75/m DI) then have to borrow to pay for it? Thanks

Sara (Debt Camel) says

do you know what his DI showed as on the DRO application?

Gail says

About £50, thanks

Sara (Debt Camel) says

ok so I suggest he talks to the adviser that set up his DRO. If these shifts are only temporary, then this may not be a problem, but he needs advice on whether to tell the Insolvency Service about this.

Sam says

Hi Sara. Curently half way through my DRO. I was aware that I can’t borrow more than £500 during the DRO without informing a potential lender.

I still have my ebay & PayPal accounts and needed some critical parts for my car since it failed its Mot being such an old car (which is already aproved in the initial £2000 threashold from last year). And without it I can’t get to work since it’s mostly a rural area that I live in.

Was curious of the total and the option to pay in 3 appeared (wasn’t there before) and I knew paypal does this individually as in they know your financial situation as in, aware that I have a DRO. At least my logic at that time. Proceeded to apply and got accepted. Unfortunatly it was for £540 in the end because of individual shipping for each part, which is above the threshold. Shall I contact PayPal personally to let them know I have a DRO to be sure?

Thank you,

Sam

Sara (Debt Camel) says

Could you just pay £40 off?

But yes, you should tell them.

Sam says

Thank you. Will do.

Sara (Debt Camel) says

how long ago were these applications for credit?

Hannah says

Hi,

Please advise if I’m suitable for a DRO. My income and expenditure meets the criteria. I also have debts under the 50k threshold- approx £40k.

However, I’m really worried because I lied in my loan applications. None of my applications were checked for earnings as this was fabricated due to an addiction to day trading which began when I tried to pay off my autistic son’s debt.

How thoroughly will they check my loan application, in particular my income at the time of applying?

Also, I know I did something wrong by lying about my income but equally I feel that the lenders lent to me irresponsibly as they didn’t check my income accurately for loans that were all over 10k, the biggest was 25k .

Sara (Debt Camel) says

How recent were these applications? Have you closed the trading accounts? Are you making payments at the moment?

Hannah says

Yes I have stopped trading, got rid of my credit cards and moved my money to accounts without overdrafts.

I’m no longer making payments, one debt has been written off, one has just defaulted and one is on hold until February next year.

Sara (Debt Camel) says

how did you ask for the write off? have you asked other lenders?

over what period were all the loan applications?

Hannah says

I wrote to each of the three creditors to request a write off explaining my situation and using a template from citizens advice as a rough guide. I sent a summary of my budget plus supporting letter from my GP plus latest doctors or hospital letters to demonstrate my ill health and my sons’ issues.

Quoting my circumstances as:

I’m under incredible amount of stress, I have 2 very changing autistic children plusi have historic anxiety issues requiring medication. One of my autistic sons is completely dependant on me for care, the other is high functioning, however he has developed a gambling addiction and has racked up his own ( relatively small) debt. In order to pay off his debts I began to trade and this spiralled into an addiction which led me to seek the loans and whilst it was my intention to pay them all off with my trading income – this was very possible to begin with until I lost all funds.

I then suffered a stroke so my GP write again to emphasise the need to remain stress free for my stroke recovery and upcoming heart surgery as I was discovered to have a hole in my heart

The loan applications are very recent with her oldest being 2 years

none of my applications were checked for accuracy thoroughly enough otherwise I would have failed to secure the loans as my actual income is only my carers allowance and child benefit for my daughter.

To date, one creditor has agreed to the write off, one has said I’ve only just been defaulted and they will get back to me within 30 days re a write off decision . Tesco have not entertained it at all but have put my loan on some sort of hold until February next year.

Sara (Debt Camel) says

So you have roughly 4 options:

1) a DRO

The Insolvency Service only makes very basic checks on a DRO application. The checks in practice are made by the debt adviser submitting the application.

It is not the Insolvency Service’s job to decide if a debt is fraudulent – fraudulent debts can been listed in a DRO and will not stop a DRO being approved, but the creditor could still pursue you for them at the end of the DRO, which would make the DRO pointless (see the gov.uk page for creditors https://www.gov.uk/guidance/guidance-for-creditors-listed-in-a-debt-relief-order-dro#money-back)

That is unusual. I can’t say it never happens but it is very rare for “consumer debts” such as loans from authorised lenders.

More common would be for someone to get a Debt Relief Restriction Order (DRRO), see this article about BROs which also applies to DRROs. https://debtcamel.co.uk/bankruptcy-restriction-order-bro/. You need to ask yourself if you would actually care about this.

You could talk to a DRO adviser and see what they think. I am also assuming you do meet all the DRO criteria. Yiou haven’t mentioned your housing nor whether you own a car worth over 4k etc – you need a DRO adviser to go through all of these..

2) bankruptcy

Bankruptcy is pretty much like a DRO here. Fraudulent debts aren’t written off. You may get a BRO.

But one difference is you make the application yourself. If you find DRO advisers won’t put your application forward, you don’t have that problem with bankruptcy.

The other difference is that there is a fee of £680 in bankruptcy.

If you feel you might prefer bankruptcy I strongly urge you to talk to a good debt adviser about DRO, bankruptcy and the differences. No one should ever go bankrupt without getting proper debt advice, which means talking to a debt adviser, not just filling out income & expenses and have some program suggest bankruptcy.

3) continue to push for write offs

One debt is on hold until February – is it possible that they may reconsider the write off then?

The other debt – you could offer them £1 a month and then ask again in a year for a write off, pointing out that your situation is unchanged. At that point you could think about going to the Financial Ombudsman saying there is no prospect of you ever being able to clear this debt

4) make affordability complaints

If you win an affordability complaint, interest is removed but you still have to repay the amount your borrowed. If that would take forever, then affordability complaints don’t really help you here.

———————————————

One possibility that exists as a theoretical possibility with all of these options is a lender deciding to add a Cifas marker to your account to say you committed application fraud. This isn’t the same as taking you to court but would make it much more difficult to gain more credit or even operate a bank account.

———————————————

I suggest you talk to an adviser about a DRO or continuing with write off requests, and any other options. Your local Citizebns Advice would be good, or phone National Debtline on 0808 808 4000.

Hannah says

Thank you so much for such a comprehensive answer! I don’t own a car, I am a named driver in my son’s Motability vehicle. My husband pens the house and I don’t pay bills so I’m assuming I don’t have beneficial interest.

I will go for waiting to see if I can get another writeoff and then pursue the DRO. Re: the misinformation about my income on my loan application, I’m assuming my creditors feel equally as guilty since they lent huge amounts of money without proper checks on their part to a somewhat vulnerable person. I’m guessing they will not bother with that angle…?

But it is what it is and I have to weight up my options within a tangled mess that I got myself into.

Thank you once again, I feel lighter and assured that I can do this!

Sara (Debt Camel) says

I’m assuming my creditors feel equally as guilty

They may not have thought much about it. Asking for write offs is a check about your situation now and how likely it is to improve.

Hannah says

True. I’m just a number. However, my point is that they are also culpable and they know it

Sara (Debt Camel) says

Well they are to blame. But whether they “realise” this, I have no idea. And even if they do, how will it help you?

Hannah says

I suppose and maybe naively that it will deter them from pursuing any complaint against me for misinformation

Sara (Debt Camel) says

That is not something I am sure you should rely on – but please talk to an adviser as I have said.

Tommy says

Hi Sara,

I was made redundant 6mths ago and in a DMP with 32k debt. Stuggling to find work again despite 1,000s of applications.

Does a DRO prevent you from applying for jobs as a Marketing Manager of a limited company? I noticed the DRO restrictions mention not being allowed to be involved in the promotion of a Limited company…

Thanks,

Tommy

Sara (Debt Camel) says

That language comes from the Company Directors Disqualification Act (https://www.legislation.gov.uk/ukpga/1986/46/section/11). So far as I know, it is intended to bar people from directing the operation of a company itself. I do not think it is intended to stop anyone acting as a middle manager promoting the company’s products. If you talk to National Debtline on 0808 808 4000 they will be able to confirm this.

Kierra says

Hello Sara. I had a DRO issued back in January 2020, which was discharged in January 2021. I was doing well for a few years and have ended up in a pickle. I am in contact with StepChange and Payplan who are looking at suitable options to manage my current debt. Current debt is about £20k and my monthly surplus is about £80.

Stepchange are advising a DMP and then a DRO if payments are no longer affordable.

Payplan are recommending a IVA for 5 years.

1. Given that I have already had a DRO in the past 6 years, when is the earliest I would be eligible is it January 2026 or January 2027?

2. Is an IVA better than a DMP?

Thanks

Sara (Debt Camel) says

January 2026

With only £80 surplus you only have to be worse off by £5 a month to qualify for a DRO. I think StepChange are right and in this situation it would be mad to apply for an IVA which could well run into problems very soon.

Adri says

Hi Sara.

How I can switch from IVA to DRO, at the moment I’m doing monthly payment £125 to my IVA. I have done some research myself, and I feel that better option for me is to change to DRO. How I can do the change? My IVA started on May 2024.

Thank you

Sara (Debt Camel) says

how large are your monthly IVA payments? Are they affordable?

Billy bob says

Hi, I’ve 45k on cards and step change recommended a DRO, I’ve never budgeted properly and the step change budget was an eye opener.

I’m worried my bank statements don’t show the real picture as I use my credit cards when I’m out of money, , for example my total grocery spend doesn’t show up in my bank statements as I often use credit.

I’m scared to death of a DRO being refused because I’ve no way of paying off 45k by any other means.

Somehow I’ve not missed any credit card payments, again this comes from my bank account, I’m frightened this will be classed as over the £75 surplus even though I heavily rely on credit.

So confusing.

Sara (Debt Camel) says

This always feels confusing as you have been making the card payments and then been left so short you have to use the cards again.

So no, you bank statements don’t show the full picture, but what actually matters for a DRO is what your income and expenditure will look like when you aren’t paying the debts…

Stepchange wouldn’t have recommended a DRO if they didn’t think you will have less than £75 a month left over after paying bills, everyday living expenses and put a bit by for things like gifts, car costs, dentist etc

Are all your debts cards and loans and overdrafts? Or do you also have arrears on bills, parking tickets etc?

Billy bob says

Just cards, no assets, rubbish car.

Although I have a phone handset on contract.

Sara (Debt Camel) says

This sounds like a good DRO if you are under the spare £75 a month test.

I suggest you talk to Money Wellness about a DRO.

If they say on looking at your numbers in detail that you are not eligible, I think you should go back to StepChange and talk about a DMP. Don’t opt for a DMP or an IVA with MW.

NB you are getting close to the 50k DRO limit. Don’t put off doing this or you debts may escalate to you are no longer eligible

Billy bob says

Thanks for your help, two of my CC debts are with my own bank (joint account) what should I do before committing to a DRO.

I have another(unused) account with another bank.

Sara (Debt Camel) says

Move over your income and any direct debits and standing orders for household bills to the other account.

Your DRO adviser should talk you through this is you ask.

Billy Bob says

Hi, whilst I continue to faff around switching bank accounts (doing it manually) I have again this month made all my CCard payments, now I’m short for fuel and will need to use credit for it.

I can’t bring myself to miss payments, will this go against me for the DRO.??

Sara (Debt Camel) says

No but you have to stop! Now! you are creating a lot more problems for yourself. What does your DRO adviser say?

Billy bob says

Hi, I was accepted for a DRO a month ago, I’ve had no acknowledgment from any creditor, is this normal? So far I’ve just had missed payment letters.

Is it my responsibility to inform them of my DRO number.??

I’m already on the official register.

Sara (Debt Camel) says

No you don’t have to tell the creditors. This will probably sort itself out in another month or two. If you still get letters after that, tell the creditors about the DRO.

Arjun raj says

Hi i have a debt of 25k. I came as a student in uk and took loan of 16k for doing business and it got messed up and my partner cheated me. Also i have credit bills of 9k . Can i apply for DRO? I have no assets . I have lost job where the last salary amount was credited this month. Please help me on this.

Sara (Debt Camel) says

Presumably you are looking for another job?

Your business – was this closed down properly with all tax being sorted? I suggest you talk to Business Debtline about this – they cover business and person debts for the self employed and small limited companies. See https://www.businessdebtline.org/

Vicentin says

I have a debt of 24 k

Sara (Debt Camel) says

Is that just one debt or your total debts? Are you unable to pay much towards this debt?

Kayla says

Hello. I had awful debt back in 2020 and was in touch with Step Change. A DRO was granted July 2020 and discharged July 2021.

Since this time I have had credit cards and loans all of which I was managing perfectly fine.

However, earlier this year my long term abusive situation came to an end and since then I’ve been scrambling to get some stability for me and my kids. I literally had to start from scratch we barely had the clothes on our backs.

Despite reaching out to services for support, I didn’t get any help and fell into debt trying to better my situation. I literally went from only have £3k debt to now £14k.

This debt is a combination of 10’credit cards, 2 loans and 4 payday loans.

Took my head out of the sand and contacted Payplan and am now on a DMP.

Initially they wanted to go the DRO route as my income left over was less than £75, but of course I already had a DRO in the last 4 years.

The DMP is due to end 2049!

Payplan are wanting me to continue the DMP and then apply for a DRO in July 2026.

I honestly can’t pay back this amount any earlier and still trying to get some of the balances reduced.

Just wanted some advice around whether the course of action Payplan are suggesting is correct or is there anything else that others can advise?

Sara (Debt Camel) says

how much are you paying to the DMP each month?

Can you list the debts in your DMP?

Kayla says

Hi

I pay £55 a month.

Please see debts below…I have multiple debts with the same creditor.

118 118 Money £148.0

118 118 Money (loan) £1,600

118 118 Money (loan) £1,500

118 118 Money £1,200

APFin Ltd £500

Capital One (Europe) Plc £1,155

Capital One (Europe) Plc £190

Jaja Finance £1,300

Lendable Ltd £700

Onmo Ltd £570

Quidie limited (Fernovo) £200

Tick Tock Loans £300

Vanquis Bank Ltd £480

Western Circle £500

Zopa Recoveries £2,200

Zopa Recoveries £1,250

Sara (Debt Camel) says

is the £55 a month really affordable or leaving you short each month?

do you have any arrears on bills?

what benefits are you getting?

Kayla says

I only receive child benefit.

I do think the £55 is affordable.

A lot of this debt was incurred in the past 12 months. I had to get myself and my children out of unsafe situation. The council and children’s services wouldn’t help (I made a complaint which was upheld), so I ended up having to borrow money and put myself in this situation even though I worked so hard after the first DRO.

At least 9 of the above debts were opened since Jan 2024.

I don’t have any arrears because part of getting to a safe place was to clear those arrears…which I couldn’t clear without borrowing the money from elsewhere.

Do you think a DMP is the right way to go? Payplan are pushing for a DRO but that won’t happen until 2026…is that a good option or should I continue with the DMP?

Sara (Debt Camel) says

so Payplan are right that you can’t have second DRO until 2026. There is no need to make any decision on that until you get to that point.

if you can only pay £55 a month at the moment, your options now are either to carry on with the £55 a month DMP and think again in mid 2026, or to say you only want to pay 31 a month at the moment and save up each month towards bankruptcy fees, which are currently £680.

A DMP sounds likely to be better.

But you can improve this a lot by making affordability complaints against all of your lenders, even the small payday loans and including all the lenders who have lent to you more than once. Winning any will reduce the balances and may get you some cash back. these lenders have lent you an astonishing amount of money over a short period while you still had a DRO on your credit record. I would send any rejections or poor offers to the Ombudsman.

I have templates you can use – different ones for loans and credit cards, see https://debtcamel.co.uk/tag/refunds/

Kayla says

Thank you so much this is really helpful. I know a lot of this is self inflicted but even now looking at my debts I was surprised how much I was allowed to borrow in less than 12 months.

Will definitely look at those templates and put complaints in.

Payplan have advised similar. They actually advised against a bankruptcy and IVA. I’ll continue paying and then revisit my options in 2026.

I’ve made a start to tackling the issue so feel less anxious.

Stephen says

Hi Sara, Merry Christmas! I hope you can help.

In November 2020, I invested my savings and took out a British Business Bank loan to start a franchise. When the pandemic hit, my income disappeared overnight, and I couldn’t access any financial support except Universal Credit. To stay afloat, I took out a Bounce Back Loan, but the business ultimately failed, leaving me with poor health, a ruined credit score, and £25K in business-related debt as a sole trader. Before this, I had an excellent credit rating and always saved for a rainy day.