If you receive a Claim Form from a County Court through the post you need to respond rapidly.

Ignoring court papers is a bad idea, even if you think the debt is too old or you are worried you can’t pay the money.

- If you agree you owe the money you will get a County Court Judgment (CCJ) but if you complete the Claim Form papers properly you will be able to make monthly payments and won’t get visits from bailiffs.

- If you don’t agree you owe the money, you need to defend the Claim.

Contents

Check this really is a court form

Some debt collectors send letters designed to make you think you are being taken to court when you aren’t! If you get one of these, read Threats of CCJs and bailiffs – are debt collectors bluffing?

If you get a letter headed something like Letter Before Claim or Letter Before Action, a court case has not yet been started. But don’t ignore this – it is much easier to dispute a debt at this stage than fight a court case in a month or two. So read this: How to reply to a Letter before Claim.

A real N1 Court Form may be on white paper or on blue and white paper. It will have something like this at the top:

There should be a court name, a court stamp and a claim number.

If you aren’t sure, you can phone the court to check or phone National Debtline on 0808 808 4000 and ask them.

In the same pack, you also get other blank forms: N1 – Claim form; N9 – Response pack; N9A – Admission (specified amount); N9B – Defence and counterclaim.

Check you are named as the Defendant on the form. If your name is slightly wrong (a typo? your maiden name?) you should treat this as though it is correctly addressed to you.

But if it’s obviously meant for someone else, read this about debt letters for other people coming to your house.

Don’t panic!

This article looks at your options. for what to do, now you know the form is real.

But first, don’t panic! Some worries you may have:

- you can’t be sent to prison for not paying the utility bills, loans, credit cards and other debts that lead to this type of court action.

- if the court decides you owe the money, you will get a County Court Judgment (CCJ) – this isn’t a criminal conviction.

- if you get a CCJ, you can get an affordable monthly payment agreed. You won’t have to pay it all at once if you can’t afford to.

- you won’t get bailiffs coming round to your house unless you try to ignore these papers and then ignore the CCJ.

If the court is the Civil National Business Centre in Northampton, you will not have to go to Northampton. If there has to be a court hearing, you can ask for this to be in your local County Court.

Reasons to dispute the debt – READ THIS

You may not know that you have a reason you can defend this case and not get a CCJ. So read this even if you know you owe the money.

It’s not your debt!

Often you know immediately which debt the form is referring to.

But sometimes a debt may have been assigned to someone else – this is legal jargon for selling your debt. The new owner of the debt is entitled to sue you for the money – you don’t have to have agreed to the debt being sold.

If you don’t recognise the debt at all, call up the claimant and ask about it.

If you are called Jane Baker, the debt may belong to a different Jane Baker. Or this could be identity theft – someone pretended to be you.

You may feel nervous about being pressurised to agree to something, but make it clear you just want to know more details of the debt, then end the call when you get them.

After talking to the creditor, if you still don’t think the debt is yours, you must reply to the Claim, see How to dispute the Debt below.

If you ignore the Claim because the debt isn’t yours, you will get a CCJ automatically because you didn’t repond to the forms.

The only exception here is if you have convinced the creditor that the debt isn’t yours. Here you want the creditor to tell you in writing that they are going to stop the court case and withdraw the Claim. If they say this on the phone, that’s not good enough, ask them to put it in writing.

If you aren’t sure what to do, telephone National Debtline on 0808 808 4000.

You recognise the debt – but is the amount right?

The debt may have been yours, but the amount may be wrong:

- perhaps you paid some money recently which hasn’t been taken into account;

- you may have already paid the debt off – possibly several years ago, possibly to a different debt collector;

- you may have had a partial settlement, also called a full and final settlement, accepted.

- the amount may be right, but there is some reason why the claimant owes you money. This means that you have a counterclaim against the claimant, which can be decided by the court at the same time as the claim against you.

Other reasons to defend the case and not get a CCJ

It’s not just whether you owe this money, what is important here is if the creditor can win the case.

There is a lot of legal protection for consumers, especially for old debts.

Here are some reasons you may be able to defend the case:

- for credit cards (including store cards and catalogues) and loans (including HP and payday loans) the creditor has to be able to produce a copy of the written agreement for the debt. See National Debtline’s Getting information about a debt for details. That tells you how to ask for this information and you should do this asap, BUT ALSO reply to the Claim within the short time limit, see How to dispute the debt below for details;

- the money was for some goods or services where there was something wrong and it’s not right that you should pay;

- you have gone bankrupt and the debt should have been wiped out by that, or the debt was included in a DRO or an IVA;

- the debt is statute-barred so the claimant can’t go to court about it because it is so old, see Questions about Statute-Barred Debt for more information;

How to dispute the debt

What to put on a defence form

If you don’t recognise the debt or you don’t agree you owe the money or you have a counterclaim, or you have some other possible defence you must complete the Defence Form (N9B) and say why you are disputing the debt.

The words you use matter here. Although it may be possible to add other reasons later in your defence, it is simpler to try to list all the possible reasons you have now. Don’t just put what you think is your “best reason”, if there are several reasons to defend the case, list them all.

National Debtline has a good factsheet on Disputing a debt. Read that, but unless you are very confident, I suggest that you call National Debtline on 0808 808 4000 and ask for help. You can also post about your case on the Legal Beagles forum.

Reply within the tight time limit

You need to send the Defence Form back within 14 days. Send the paper form to the court, and send it recorded delivery and keep a copy. Or, if the claim was made using an online service, you can respond online.

If you would like more time to sort this out you should complete and send back the Acknowledgement of Service form ( N9CPC) within the 14 days. You then have 28 days from when you received the forms to return the Defence Form.

It is essential you put in your defence within the given time. If you don’t reply in time you get a CCJ “in default” – because the rules assume that if you don’t reply you are agreeing you owe the money.

So don’t assume you will win the case because the debt isn’t yours or it’s very old. If you don’t reply in time, using the court forms and defend the case, there will never be a court case and no judge will even look at it – you are going to get a CCJ.

And things won’t wait if you have talked to the creditor on the phone or written to them… For example you may have asked the creditor for the CCA agreement and they haven’t replied. You still have to use the forms to reply in time to the court and defend the case.

What to do if you agree you should pay the money

If you can pay it all now – you won’t get a CCJ on your credit record

If you can pay the full amount, then you should complete the Admission Form (N9A) but you don’t need to give details about your income and expenses. You should fill in:

- the box that says How much of the claim do you admit

- Section 1 Personal details

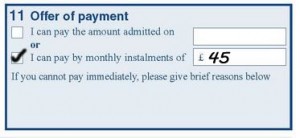

- the box that says Section 11 Offer of Payment

- Section 12 Declaration – sign and date this

You should send the paper form back to the Address for sending documents on the N1 Claim form. Send this recorded delivery and keep a copy of what you send.

If you do this, you will not get a CCJ on your credit record.

NB This is not a reason to pay up and keep quiet if you have good grounds for disputing the debt. If you defend the case and lose, you still have the option of paying the money in full within a month and the CCJ will then be removed from your record.

Offer to pay in monthly installments

Here you need to complete the Admission Form (N9A):

- the box that says How much of the claim do you admit,

- Section 1 Personal details

- Section 2,3,4,5 about your family and financial situation

- Section 6,7,8,9,10 about your income, expenditure and other debts (make sure that all your incomes and expenses are quoted as per month so that you can add them up)

- the box that says Section 11 Offer of Payment

- Section 12 Declaration – sign and date this.

For more information see How much should I offer to a CCJ? and talk to National Debtline if you are unsure what to offer or what what to put on the form.

It is common for courts to accept your offer of payment, especially if you have taken advice about how much to offer and how to complete the form.

If the creditor accepts your offer, you will get a notice that you have a CCJ and should make the monthly payment that you have proposed.

If the creditor refuses your offer, it gets sent to the court to determine how much you should pay. This is usually done without a hearing. Talk to National Debtline if you are uncertain what is happening or what you should do, or if a repayment is set that you can’t afford.

Do you have other debts?

If you have been avoiding tackling a larger debt situation, getting these court papers is a warning that you need a rethink.

Try to list all your debts and have a first stab at doing a budget, then ring National Debtline on 0808 808 4000. They can help with what to put on the court forms. But just as importantly, they can talk about your bigger debt picture and what your options are.

What happens next if I do get a CCJ?

I’ve done another article on this, see link below. For now the important thing is to complete and return the forms correctly, as this will minimise your problems later on.

TTRover says

Hi,

I have received a Court Judgement by default for a resident car parking ticket on 15/Feb/2018. I have now paid in full on 26/Feb/2018, is there a formal letter template that I can use to send to Gladsotnes to confirm that I have paid and request them to issue notice of cancellation as I have paid within 1 month of the claim.

Thanks

Sara (Debt Camel) says

No, this should happen automatically. The CCJ isn’t actually cancelled, it is just removed from the register.

Nigel says

Hi I have received a county court papers via a DCA (PRA), stating I owe over £15k from an old HSBC loan back in Sept 2003. The claim form says i defaulted in Sept 2006 & PRA we’re assigned the dept in Sept 2007.

PRA have said they have received a payment of £512.50 upto 10/1/12. This is a lie.

The date on the court issue is 22/3/18, which even with this made up lie puts it outside the statute barred of 6 months.

PRA have dogged me for a decade with letters and phone calls at all hours of the day and night.

I suspect this is them chancing their arm, but I have already registered a defensive online, claiming this is statute barred, saying their claim of a payment is a lie & asking them to prove it… I believe now I wait to see if I have to go to my local court to defend?

Court costs have been added in excess of £770, yes I understand clerical work needs to be done, but I’m assuming when I win my defence I will not have to pay any court fees??

Many thanks.

Sara (Debt Camel) says

Have they produced a CCA agreement for the debt?

If you win you pay nothing.

Nigel says

Hi Sara, thanks for the speedy response,

No they have not produced a CCA, nor have I ever asked for one as I “know” this is statute barred…

Sara (Debt Camel) says

it’s always best to have as many defences as possible!

Nigel says

Having filed my defence using MCOL, it’s taken less than a week for the court to get back to me saying that; the claim against you is now discontinued.

Just shows that the DCA were chancing their arm that I wouldn’t defend it, they know it’s SB, and to make up a lie that I’d made a random out of the blue payment, shows what underhanded tactics these companies will employ to try and pressurise you.

Sara (Debt Camel) says

Excellent news!

Kelly Warren says

Hi, we’ve received a judgement for claimant for Northampton, it doesn’t have the crest at the top of the page, it does have a crown and the county court stamp halfway down. There is no form worn it to fill in so I’m thinking it may be the last step before they issue the ccj. I haven’t disputed this previously because it comes from a parking fine at a hotel. They have a 15 min drop off policy, I was actually picking up my daughter who worked there, she was on her Induction which ran over so I was waiting over 40 minutes. When the original fine came, she took it into work and was assured they would contact parking eye to cancel it as per there usual

Agreement with staff. We had a 2nd fine but again my daughter was assured but the hotel it was being dealt with and we didn’t need to pay. So we are shocked to receive the court notice. My daughter no longer works at the hotel and they are now saying the manager dealing with it had also left so can no longer help us!! I’m now left with a fine that’s increased to £197, £97 of which are apparently costs added on aswel as an increase to the original fine. Is it worth now appealing? Or cutting our losses and paying it. Didn’t do it within the 14 days as the hotel advised they would sort it and have only backtracked on this today. Your advice would e much appreciated.

Sara (Debt Camel) says

A “Judgement for Claimant” letter means that there has already been a court case and you have lost, presumably because you didn’t enter a defence.

If you are saying that you never received a Claim Form, then you have grounds for applying for a set-aside and then either paying the fine or defending it in court. The problem is that unless you are on a low income, it will cost you £255 so it would be cheaper to pay the CCJ. If you pay it within 30 days it will disappear from your credit records.

See https://debtcamel.co.uk/help-ccj/ which looks at all your options.

kelly warren says

Thanks for your advice, we literally had the 2 letters about the original fine and then this court letter, no claim or response pack was received. Parking eye say they sent 4 letters before this but we absolutely did not receive these. But don’t know how we could prove this so we’re going to have to pay. The letter was issued 17-04-18 so am I right on thinking if we pay it in full, the ccj will be removed from the register?

Sara (Debt Camel) says

Yes it will be.

Frankie says

I have received ccj papers from moriarty law on behalf of the loan store ltd. I had numerous payday loans in 2012 very young and stupid at the time and probably did use them, yet there is nothing on my credit file. I have 14 days to file my defence? Who do i put an affordability complaint in to? moriarty, loan store or mmf. Also who do I ask for a copy of the credit agreement? Moriarty law sent a copy of the debt purchased but no credit agreement, and finally the FCA now have a Warning on their website about the loan store ltd not being regulated, will this help in my defence?

Sara (Debt Camel) says

First you have 28 days not 14 if you complete the acknowledgement of Service form in the pack https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/688717/n9-eng.pdf

The Loan Store in 2012 I think was a brand of Cheque Centre (according to https://assets.publishing.service.gov.uk/media/5329df7bed915d0e5d00032b/140131_companies_background_working_paper.pdf) – this is not the firm the FCA is warning about.

Assuming that is right, it isn’t good news for you as Cheque Centre is in administration. You need to phone the Finanical Ombudsman and ask what your options are for making a complaint against them.

Did Moriarty or MMF send you a Letter Before Claim? See https://debtcamel.co.uk/letter-before-claim-ccj/

A request for the CCA agreement should be sent to MMF and copied to Moriarty. More details and template letter here, don’t forget to enclose £1 https://www.nationaldebtline.org/EW/factsheets/Pages/getting-information/credit-agreement-advice.aspx

Good places for help and advice on defending a court case are:

National Debtline

Legal Beagles forum https://legalbeagles.info/forums/forum/legal-forums/court-claims-and-issues

You may also want to put in affordability complaints to other payday lenders you have used – to get any money back and to forestall other court action. If you repaid all the loans from a lender there is no downside to doing this. If you still owe the last defaulted loan and it is close to the 6 year point when the debt may be statute barred, it is a hard decision to make about whether to put in a complaint or not.

Michelle Cameron says

I received a Court Form dated 7 June received 8 June. In Northampton. Without it being stamped and signed. I made an appointment with citizens advice bureau. Who phoned the courts up to see if real or Fake. Yes it is real but the courts were baffled as to why this hasn’t been stamped as it has been issued. So left it as that. Took citizens advice bureau advice and sent it back with stamp and signed then I will fill it in and sign it myself as itrequests your signature, as then it will be Legal.

Sent it back recorded delivery signed for with proof as sent back on the 13th day which they would received on the 14 day deadline.

Now am just waiting for it to come back, it’s a waiting game now.

Janet says

My husband received a ccj from a notorious no win no fee accident claim solicitors referring to an accident last Dec 17 where he scuffed a rear side bumper the woman was perfectly fine now claiming alsorts injuries! We strongly dispute the claim as she’s lying about being rear hit. We’ve never had a letter of claim or anything else. we’ve sent the pack to our insurance company. Any thoughts or advice pls?

Sara (Debt Camel) says

Have you just found out about this? Have you moved, so the Claim Form went to a previous address?

Clare says

Hi Sara, thanks very much for this article.

I’ve had an email from “Asset Collections & Investigations” that says unless I repay an old payday loan debt from 2014, they will start CCJ proceedings.

I do intend to pay this as they have been calling / emailing for around 6 months now and I have had enough. I wanted to check though, should I worry that they are threatening CCJ action or should I just pay it? I’ve not received any court letter etc but I am just unsure.

Thanks in advance.

Sara (Debt Camel) says

So you haven’t had a Claim Form, but have they sent you a letter Before Action/Claim? Read https://debtcamel.co.uk/letter-before-claim-ccj/ which describes what this letter looks like – the cover letter doesn’t have a set format, but it has to include certain attachments, including a Reply Form.

This old payday loan – who was the lender? Had you borrowed from them before? If you had, you may want to make an affordability complaint to the lender (not to Asset Collections) and ask Asset Collections to put a hold on any enforcement action until your complaint has been resolved. If you win a complaint like this, interest is removed from the outstanding balance. See https://debtcamel.co.uk/payday-loan-refunds/

Ryhan says

I am in desperate need of help as I have been wrongly issued a county court claim form and then judgement.

My debt was with Zopa and then went to Cabot and then Mortimer Clarke Solicitors. They asked me to send an income & expenditure form within 14 days of their letter which I did but they actually issued the court claim on a date within that time frame so the.cost went from £665 to £795. I disputed this with them and they didn’t respond to my emails except to say to fill in the county claim form and make my offer through them! And now I have just received a judgement for £835 which needs to be paid within a month or I’ll be totally screwed for the next 6 years!

I’ve spoken to Stepchange just now and they said to speak to Civil Legal Advice and I’ve also rang National Debtline but everyone is now closed until Tuesday. If anyone here could help in the meantime it would be very much appreciated!

Sara (Debt Camel) says

If you didn’t file a defence to the court Claim in time, then they may be little you can do now to get the judgment removed. I think talking to National debtline on Tuesday would be a good idea.

You have a few payday loan complaints in progress, have any of them been settled?

How much do you owe to all lenders except the payday lenders? You have mentioned a defaulted credit card, this Zopa loan, what else?

Ryhan says

Hi,

Yes QQ paid me £3600 after I had advice from this site so my outstanding £2000 debt was wiped out and I received £1600 in January 2019. It was a good result and one I never reported back on here which I should have. Safety Net Credit also refunded me interest and deleted negative info from my credit record. My affordability complaint with Wonga also remains until January 2020 as recently announced.

I have a case with the FOS for MyJar as they were absolutely disgusting to deal with and denied having made the majority of the loans and even after sending them my bank statements showing the loans they did not change their decision. I chased that up today via email as I have not heard back for about 3 months since it was lodged. Lending Stream rejected my complaint as my loans were all paid back on time apparently even though I repeatedly borrowed.

I owe £3600 to Capital One which I haven’t started making any payments towards yet since defaulting about a year ago and all the rest are payday loans which remain with Satsuma, Sunny, Uncle Buck., Wizzcash and WDA. I have payment plans in place for 2 of them but not the others as there are just too many to afford at once. These were taken out in more recent years when I didnt have a history of repeated borrowing so I didn’t lodge affordability complaints with them and they were all 1 time loans.

Sara (Debt Camel) says

What has WDA offered you for the outstanding balance?

And has the debt been sold to a debt collector? It is odd if you haven’t had an email from them when you had made a complaint – check your spam folders. Read https://debtcamel.co.uk/wageday-advance-wda-administration-sale-morses-club/

Ryha says

£105 but haven’t heard from them for a long time now. I only recently found out they went bust.

I’m not sure but have had no correspondence from them for many months and I didnt make a complaint against them as it was just the 1 loan. I’m more worried about the fact Mortimer Clark have issued me with cc claim when I sent them back the i&e form within their time frame.

Sara (Debt Camel) says

Well they don’t have to accept an offer you make. It’s not clear there were any grounds to defend the CCJ, but do talk to National Debtline about this.

Sara (Debt Camel) says

that is a lot of creditors. I suggest you get a debt management plan set up to cover them all, including the ones you have payment arrangements with. Talk to StepChange about this, see https://www.stepchange.org/how-we-help/debt-management-plan.aspx

This won’t harm your affordability complaints. But it makes it MUCH less likely that another creditor will go for a CCJ. If the Zopa debt had been in a DMP they probably wouldn’t have gone to court.

Your approach of setting up a couple of payment arrangements “because it’s all you can afford” isn’t treating the other creditors fairly. And it’s not working very well.

John smith says

Hello i recieved a parking charge notice for £100 parking outside my own house, but i hadent parked inside of there sign boards so in my eyes its the public highway, and i was jot going to entertain such a rediculous fine so i ignored it for 2 years and recieved a letter from the dcbl saying to pay them £160, i never got the letter in time so i got another one saying i failed to pay them and they have instructed the private parking crooks to take legal action, with intimidating “as seen on channel 5” logos stamped all over it, is this just another bluff from a group leaches trying to take good hard working peoples money?

Kind regards

Sara (Debt Camel) says

I suggest you talk to National Debtline on 0808 808 4000. Or you could go to your local Citizens Advice.

You should ignore the “advice” that crops up all over the internet saying that letters about private parking problems are just bluffing – people can and do get CCJs if they ignore problems,

Matthew says

Hi I have received a courts claim form and a letter from dca saying I might be able to avoid the ccj if get in touch with them and fill in the i&e form and a box for settlement offer and monthly offer.

I owe £14000 from £5000 loan. However when ringing them few days ago they said because I’m not working only way to not get ccj I’d pay full balance of over 3 months which I obviously can’t do.

I have offered a full and final settlement offer of £4000 and filled in my i&e and emailed them It I’m currently unemployed. Do I have any chance? Has it gone too far with the courts for them to accept a f&f offer now? Thank you

Sara (Debt Camel) says

“I owe £14000 from £5000 loan” that sounds like an expensive loan… who was the original creditor? how old is this debt?

do you have other debts that you haven’t been paying? do you know what they add up to?

If you are unemployed, where would you get 4k from to settle this?

Matthew says

Original creditor was bamboo loans now with lantern. The debt is only 1 year old. I was working at the time but my credit still wasn’t great my total other debt is about 20k between 12creditors ranging from 5k credit card 3k credit card 5k overdraft the rest payday loans. A family member is offering to pay the 4K I only need to wait another year then I get quite a bit of money so can pay them all off but really want to avoid a ccj at all costs I haven’t paid anything towards these debts for 1 year and most of them have gone to dca

Sara (Debt Camel) says

Ah. You can’t ignore debts or you may end up with CCJs. I suggest you think about making token payments of £1 a month to your other debts.

Your F&F offer may well have been accepted if you had made it earlier. But if it isn’t now and you get a CCJ, get some debt advice about bankruptcy and whether that would work better for you.

Matthew says

Can I offer a defence to the claim form for interest been high even though I signed and accepted it at the time?

Sara (Debt Camel) says

This is complicated. Your best option may be to put in an affordability complaint to Bamboo asap and try to get the Lantern court case stayed until there is a decision on your complaint. Talk to National Debtline on 0808 808 4000 about how you could do this, or go to your local Citizens Advice.

Kuba says

Sarah, I have received a Claim Form which I believe to be real. Now I have 3 questions and I would appreciate any and all help.

Basically my ex used my very account and maxed it out. I moved out and had no idea this has happened. The debt is £461.05 and its been defaulted in August last year. I spoke to a friend that works for the police and he said I’m fully liable as I’m responsible for my own account.

1. Can I settle this out of court for a full and final with Lowells and ask them to drop the court case?

2. If they agree do I still have to return the court documents?

3. If I can’t and I have to pay in instalments do I still get a CCJ on my credit file?

Sara (Debt Camel) says

If it’s in your name, yes you are liable. You can report your ex for fraud to the police, but that can be hard to prove.

Yes you can offer a settlement, but having started a court case Lowell may not be prepared to accept a low one. this would have been better done earlier.

When did you open the account? When was a payment last made to it?

Stuart Alford says

Hi after some advice – I had a letter from Moriarty law stating they are looking at obtaining a CCJ – I’ve issues a defense on moneyclaim online today I received a letter saying they are still going ahead – it was an old internet bill I disputed the bill with supplier as I wasn’t getting speed advertised – will the court wrote to me with a date ? As im informed Moriarty law don’t have the deed of assignment as it was bought in bulk

Sara (Debt Camel) says

I can’t help you with a court case in progress. phone National Debtline on 0808 808 4000 or post on the legal beagles forum https://legalbeagles.info/forums/forum/legal-forums/court-claims-and-issues. Good luck!

Nicole says

Hi I was just wondering what your outcome was as I’m currently in this situation myself

Sara (Debt Camel) says

That is an old query and it’s unlikely you will get a reply.

What sort of debt was this? How old? Do you have a reason to dispute it?

Tori says

Hi I received a county court claim for £ 285 for a payday loan which I failed to pay as I had an accident and couldn’t work . I only had one loan therefore cant claim unaffordability. The particulars of the claim state the that 260 outstanding and 25 court fees – BUT i paid £74 to the loan and the default notice issued in April stated I owed £194 . Am I right that the particulars of claim are wrong and I can defend on the fact the amount is wrong . Also they did not send a letter before action

I am not disputing I owe the money , I am disputing the amount. Thankfully I am now in a position to pay but don’t want to pay any more than I have to !

Sara (Debt Camel) says

Hi Tori, can I suggest you talk to National Debtline on 0808 0808 4000 about this. Or post on Legal Beagles Forum https://legalbeagles.info/forums/forum/legal-forums/court-claims-and-issues. Or both…

Tori says

Thanks for your help

David says

Hi Sara. I have a question about court/ legal fees. If I recieve a court claim form for an old small credit card debt and offer the full amount so I don’t get a ccj, will I also have to pay court/ other fees on top of the debt as well? And/ or be chased afterwards for legal costs by the creditors solicitors?

I’m planning on asking for CCA first if I get a letter before claim but considering options.

Sara (Debt Camel) says

As you know, if the creditor intends to go to court for a CCJ, they should first send you a letter before action/claim. See https://debtcamel.co.uk/letter-before-claim-ccj/. You should view that as your last opportunity to make a settlement offer without the cout fees being incurred.

Do they have your current address? Do you think the debt is close to being statute barred?

David says

Thank you for your reply. Yes they do. No as I have been making £1 token payments for about 10 years until recently. I would pay it off as its a low amount but I have other defaulted accounts from that time that are larger and worried flood gates will open as I have never replied only made token payments. I want to find out if any are enforceable now so I can move on and not have possible ccjs hanging over me for the next 10+ years.

Can they start a court claim before they get the CCA themselves?.. or do they need to show the court the CCA before they can apply for a ccj against me? As I’m aware they use tricks/ grey areas to get their way.

Also at the letter before claim stage do you think a 40% settlement other would close the account or just pay it in full.

Sara (Debt Camel) says

So there is no chance of the debt becoming statute barred. Wht don’t you ask for the CCA agreement now? Not wait until you get a letter before claim?

Once you have asked for this – use the correct words and enclose £1, see https://debtcamel.co.uk/ask-cca-agreement-for-debt/ they should not start court action until they have produced it. I would do that and leave worrying about what % to offer as a settlement until you see if they can find the CCA.

Kate Glinsman says

Hi, I recived a CCJ from an electrician who worked on my home. He is asking for £15000 for a job he didn’t even finish. Do I need to put in a total defence with all text messages and witness statements? How do I properly defend myself?

Sara (Debt Camel) says

You need help with this. There are strict timescales to respond with a defence and you need to get that first defence as good as possible, not planning to mention a lot of extra points later on.

Places to get help with this:

– your local Citizens Advice

– National Debtline on 0808 808 4000

– the Legal Beagles forum https://legalbeagles.info/forums/forum/legal-forums/court-claims-and-issues

Neeko says

Hi Guys,

I need some help, i have received letter from County court business centre regarding debt which i owed about 10 years ago. My debt was sold to Capquaest in 201i-2012. I was defaulted 2009 and haven’t made payments toward any of my debt since 2013.

Do i stand any chance of defending it?

Thanks

Sara (Debt Camel) says

I assume you ignored the Letter Before Claim/Action that you received – that is a pity as it is much easier to challenge a debt at that point. Now you have to defend a court case.

It is possible you can defend this on the ground that it is statute-barred – that may depend on when in 2013 you last made a payment. Do you know the answer to this?

Depending on the type of debt, you may also be able to ask capquest to produce the CCA agreement for the debt and the debt is unenforceable if you can’t.

The article above looks at what to do and reasons to defend the claim. And as that says, phone National Debtline for any advice.

Neeko says

Thanks Very much for the comments, the last payments that I made was around June 2013 and it wasn’t made direct to Capquest it was through a company and that company is gone bust about 4 years ago.

I only ignore letters because i thought is gone passed the limitations period.

I have responded the claim form defending all the claims I have also requested CCA and CPR 31,14 request to the court.

Am I on right track.

Thanks

Neeko

Sara (Debt Camel) says

I only ignore letters because I thought is gone passed the limitations period. well this is what happens if you do that… next time, reply to the Letter before claim!

I have no idea what you put in your defence. The wording matters. Please talk to National Debtline about it or post on the legal Beagles forum. I don’t give advice on how to word defences or what to put on court forms.

Natalie says

Could really do with some help please

So in February of this year I recieved a court judgement for an old catalogue account I had back in 2011 that lowell had filed for, I have been paying off this debt since…but I have just learnt about the statue barred information (which I wasnt aware of at the time or I would have disputed it when I got the letter) so in theory that debt should have been statue barred when lowell applied for the court order is there anything I can do about it now?? Thanks

Sara (Debt Camel) says

No, sorry there isn’t.

Michelle says

Hi,

I have been chased by Lowell for 2 debts that were with the same catalogue. I was about to put in an affordability complaint (2 accounts in my name, with MULTIPLE buy now pay a year later deals on, which I anticipated paying off in time but didn’t and the interest built up to uncontrollable amounts) with the original company Very. However I received a court claim form this morning, and now not sure what to do.

Sara (Debt Camel) says

How large is the debt alleged on the Claim form? What are the rest of your finances like?

Michelle says

Thanks for your reply – one for £1800 and the other £1600 – both from very, lowell bought both these debts, however they also added another catalogue debt onto the claim form from a different company for £215 plus costs so total amount on form was around £4000, Lowell have also bought approx £3000 other other defaulted debts I have. I have initiated an affordability complaint and informed the court in the defence of this fact. Lowell waited for around 2 months to send me the CCA I requested, then 9 days later they started the court claim…(also put this in the defence)I had to admit the £214 claim- so looks like another ccj, I am currently unemployed with 3 children and have been rejected for every job now for 2 years…I already received a ccj in july that was set at £1 a month thankfully but would like to avoid more. Not sure what type of arrangement would be best for me as my ex bought me a car that is worth around £4500 so not all debt solutions are appropriate…because of stress and other issues I avoided dealing with all this defaulted debt and am now thinking maybe I should just make £1 token payments to keep them off my back and away from more ccjs…

Sara (Debt Camel) says

I think you should talk to National debtline on 0808 808 4000 about this Calim, your defence, how much you should offer and your full financial situation and what your debt options are.

JMA says

What if I have requested a copy of my CCA and offered a settlement if they are able to provide it, they have not sent it? Do I deny thr whole debt or part of it?

Sara (Debt Camel) says

Have you been sent a Claim Form?

when did you ask for the CCA?

Andy H says

Hi Sara,

I received a Letter of Claim for one of my two debts that have ended up with Drydenfairfax/Arrow Global. The LOC is for the smaller one. I have been making ‘token’ payments (2 x £15) for a few years now. Can they really take me to court if I’ve been making payments? I’ve paid nearly £1800 off the original debt according to the statements received (17 years and counting!)

I’m self employed and don’t have a fixed income so regular monthly payments are a struggle sometimes. I find it really difficult to complete Inc/Exp forms that they are asking for. Any advice welcome!

Sara (Debt Camel) says

Can they really take me to court if I’ve been making payments?

Yes they can. My guess is you have ignored a few letters from them in the last few months, including a Letter Before Claim/Action. If you had completed the forms with that letter, you might not now be getting a CCJ :(

What sort of debt was this? And what sort of debt is the other one with Arrow?

Andy H says

Thanks Sara, guess I’ll just have to get on completing their forms

As both debts are ages old and been passed from pillar to post at least 5 times over the years, would it be worth asking for the original credit agreement or are we past that as I’ve been paying for so long?

Smaller debt is a credit card, bigger one was a personal loan with my old bank. My employer went bust whilst I was in hospital, struggled with health then just finding another job after that, hence self employed now for so long.

Andrew says

I have returned my N9B defence and counterclaim and have received a Notice of allocation to Small Claims Track instructing me to return a bundle by 21st Nov. Is it ok to update my defence document if i’ve already filed the N9B defence form? Also I’ve now decided not to counterclaim as I do not have time. How do I tell the court?

Sara (Debt Camel) says

I don’t give advice on court cases in progress.

You can talk to National Debtline on 0808 808 4000. Or post on the Legal Beagles forum, see https://legalbeagles.info/forums/forum/legal-forums/court-claims-and-issues. Or both!

Oladipupo says

Hello house, please can anyone kindly advice me as to how I can defend myself against a £1200 original debt Vodafone claimed I owed them but this has now turned to £1457 by now and I received the letter from County Court Business Centre that it is owed to Lowell, charged included.

Below is the content of the letter.

1. The Defendant entered into an agreement with Vodafone under account reference 7017666857 (‘the Agreement’).

2. The Defendant failed to maintain the required payments and the services was terminated.

3. The Agreement was later assigned to the Claimant on 30/08/2018 and notice given to the Defendant.

4. Despite repeated request for payment, the sum of £1210.19 remains due and outstanding.

And the Claimants claims

A. The said sum of £1210.19

B. Interest pursuant to s69 County Courts Act 1984 at the rate of 8% per annum from the date of assignment to the date of issue, accruing at a daily rate of £0.265, but limited to one year, being £96.82

C. Costs

The Claimant believes that the facts stated in this claim form are true and I am duly authorised by the claimant to sign this statement

Signed Simon Plunkett

( Claimant’s Legal Representative )

Please guys help me out on this one, I don’t want to go into this new year feeling this way, cause it will be a major setback again.

Sara (Debt Camel) says

You say Vodafone claim your owe this, is it wrong? Or are you just hoping there is some defence you don’t know about? When did you default?

Do you have other problem debts as well, or are you paying everything else at the nifmal rate?

Oladipupo says

Good morning, thanks for the reply. Yes I actually owe Vodafone but it’s meant to be for the sim only that they would have continued to charge me for, the problem started when the phone didn’t get delivered and I started getting charged for it anyway. I can’t remember paying from January 2017 but I can’t be specific. Also with regard to the question about my intentions, I am hoping I can form some kind of defence please.

About other debts, I also have a capital one & vanquis default that I am aware of and the capital one is also with Lowell. The only thing left with me is my business account over draft which is what I have been trying to use to get back on track but this Lowell County Court claim is definitely going to ruin it for me again. I struggled with work for getting disqualified and it’s really been a hard past 2 years for me, I am only hoping the next year will be better but this letter is making me loose the little hope. Please help in anyway I can, I still haven’t replied to the claim form.

Sara (Debt Camel) says

So it sounds as though you agree you owe some money but not all of it. You can admit part of the debt and challenge the rest.

I can’t help with a court case and what to put on your defence. Good place for help are National Debtline on 0808 808 4000 and the Legal Beagles forum: https://legalbeagles.info/forums/forum/legal-forums/court-claims-and-issues

But three things to do right away:

1) acknowledge service of the form within the 14 days – this gives you another 14 days to decide what to put in the defence. details of how to do this are on the forms or talk to national Debtline and they will explain.

2) send a Subject Access Request to Vodafone asking for copies of all your personal information including recordings of any calls with customer services about the problems with non-delivery. This may provide evidence for your defence. See https://www.vodafone.co.uk/gdpr-sars-form/

3) think about what the debt should be if you agree you owe for the SIM. Other people such as National Debtline will need you to tell them this.

If you defend a case all the way through arbitration to a hearing at your local county court it will take many months. If you can put aside some money each month during this time, then could you have enough to pay the CCJ if you eventually get one? If you can pay a CCJ within 30 days, it will disappear from your credit record. If you just cross your fingers and hope you win, then by the time you get the CCJ it may be impossible to pay it within the month.

Lastly for anyone else reading this, it is a great pity you did not dispute the debt with Lowell before they sent court papers. that would have been much easier!

Oladipupo says

Thanks for the reply once again, I understand you want me to agree to some sort of payment for the sim, but won’t that mean I have agreed to the CCJ? I read about some people’s case where they defend their case totally and ask for proof of agreement from Lowell solicitor etc, then they also offer the Claimant some sort of mediation so as to offer to pay certain amount to settle out of court, don’t you think I stand a chance with that? Please tell me also if I disagree to this claims totally, do I need to state why in the first reply or I can bring up my reasons when it’s time to defend later

Sara (Debt Camel) says

I am not saying you don’t have a defence. I have suggested who you should talk to about that.

I am just saying what to kick off right now before you get your defence in.

Your defence should cover all reasons you may want to use. Although it can sometimes be amended later it is MUCH simpler to get the best defence you can in at the start.

Oladipupo says

Ok, I started filling the online form for my defence and, I am struggling to know what exactly I should put down or is it how I should put it.

Do I state that I Mr ….. ……. will like to make the Court aware that I am disputing all the claims put forward by the Claimant because of the following reasons.

I Mr …. ….. do not owe Vodafone that amount proposed by the Claimant.

I also disagree with the claimant that Vodafone transferred a debt to the claimant to claim on behalf of the Vodafone

I also want to make the court aware that I did not at any point receive any letter from neither Vodafone nor the Claimant about this debts before before being transferred to the court

I will like the court to know that I intend to defend the claim made against me as I don’t have any sort of agreement with Lowell solicitors.

I know I may have typed rubbish and it’s the main reason I want help from anyone who have put in a defence recently for a similar case.

I want to also find out if it is at this stage that I should request the copy of the credit agreement from the Claimant, and also if now is the time to ask the claimant for mediation so as to see if we can come to an agreement. Thanks and I will appreciate every information that may be useful for at the moment.

Sara (Debt Camel) says

Please contact National Debtline or post on the Legal Beageles forum. Or both. I don’t give advice on a court case in progress. And no one else here will either.

Dramalama says

I received a ccj letter and disputed the claim, Sent the information back in time. I have now received a letter stating they had not received anything from me so say I owe the money. I sent the letter recorded delivery so I have the date time and who signed for the letter. Where would I stand with this?

Sara (Debt Camel) says

When you say “a ccj letter” do you mean a Claim Form? who did you send the information back to?

If you aren’t sure, talk to National Debtline on 0808 808 4000 urgently

MK says

I have question and need advice please.

I have had CCJ issued to me in 2015. It was for 6 courier deliveries which went unpaid to courier and amount payable was £436

Actually my cousin use to get some items from Aliespress and sell them online. For the sake getting the deliveries he always put his name and my name on the address label so that either one of us at home accept the deliveries.

I didn’t realise that he did not pay the couriers and I ended up my name on the CCJ as well only because I accepted may be 1/2 deliveries.

When I got this CCJ, I did not bother and stupidly ignored this. Now when want to go for credit and I cannot get because of this amount unpaid and CCJ.

Could you please advise me how to get round this problem as my cousin has moved out from my place and I am stuck with my name along with his name on the CCJ.

It is going to be 5 years now and I do not have the paperwork of this as well and want to get rid of this.

Looking forward for your kind response.

Sara (Debt Camel) says

I’m sorry but I don’t think there is anything you can do now having ignored the CCJ at the time. You should have disputed the debts before the CCJ and sent a defence to the Claim when the court form arrived.

Dan Went says

Dear Sara

I received a claim form from Northampton County court and the claimant is Lowell asking for the money which I owned to Halifax and British Telecomunication. I called Halifax and British Tele , they got no record of me. If I challenge Lowell in court and I lost, can I still pay full amount they asked for and the CCJ won’t be on my record. I do know I had an account with Halifax . Thanks

Sara (Debt Camel) says

Yes you don’t have the CCJ permanently on your record if you lose the case but pay within 30 days.

Talk to National Debtline on 0808 800 4000 or post on Legal Beagles forum about how to defend a court claim.

Charlotte says

Hi I’m looking for a bit of advice please

My partner received a claim form yesterday for a debt with Lowell consisting of a Capital One and Vodafone debt. He has a token payment plan set up with Stepchange the Capital One debt is on this but he hasn’t got the Vodafone debt on it. He doesn’t dispute this but my partner is in prison until end of March and therefore unable to sort it. Do you think if I ring Lowell and explain the situation they would put this on hold or would they go ahead? Any advice is appreciated

Sara (Debt Camel) says

I’m sorry but as a court case is in progress, I suggest you talk to National Debtline on 0808 808 4000 about this tomorrow.

Ulla says

I just received a claim form. if I pay it partially will I get CCJ? if I pay partially will I get CCJ?

Sara (Debt Camel) says

Yes you will :(

I suggest you talk to National debtline on 0808 808 4000 about this claim, your other debts and what your options are.

Syed says

I got 2 CCJ last year that showing on my credit report on my name from old address that I moved from there almost 2 year to go just I seen now what can I do how I pay & removed ccj from my name & credit history really I am in stress I can’t open any account I can’t get anything

Sara (Debt Camel) says

I suggest you phone National Debtline on 0808 808 4000 and ask if you have a case to have these a CCJs “set aside”.

Banjie says

I have received a letter of claim from Northampton for a CCJ, dated 3rd march.

Just wanted some rapid advice about the following as I only have about a week and something left:

1) Do I have time to send a CCA request and how should it be addressed, to the creditor, the solicitor hired by the creditor, or the court? in an informal way or just defending the claim? What other documents should I ask for at this stage?

I am afraid that it takes weeks to receive them, so can the claim be stopped in the meantime and how?

2) Could I still try a negotiation and how , again informally contacting the creditor, the solicitor defending their claim or through a defence with the paper courts?

3) Does it look bad if I ask for the CCA, when i actually know that the debit is mine? Or is it my right to do so?

A quick response would be so much appreciated, given the short time left before the CCJ is issued.

Sara (Debt Camel) says

It is a shame you did not ask for the CCA when you were sent a Letter Before Action.

1) talk to National Debtline on 0808 808 4000. Or post on the Legal Beagles forum https://legalbeagles.info/forums/forum/legal-forums/court-claims-and-issues. Or both.

2) yes, but you also need to submit a defence to the Claim as many creditors will refuse to negotiate at this stage.

3) it is your right to ask for the document.

Banjie says

I actually contacted National debtline and they were not very helpful, assuming that I should have a serious reason to file a defence and that it would incur further costs for me, and I have very little chances to take it further. The guy inquired insistently about why I should ask for a CCA.

They actually tried to discourage me instead. To be honest it sounded like they were very much in favour of the creditor, sounding a bit fake.

Sara (Debt Camel) says

that sounds unusual. Did you call that number or did you google for it, as there are a number of firms that try to look a lot like National Debtline on google.

try posting on the Legal Beagles forum. I do not give advice about court cases in progress.

Paul says

Hi, The driver received a claim form via the County Court Business Centre in Northampton with regards to a parking fine over 3 years ago. The driver was given advice to ignore which now seems to have been unwise. The parking fine was due to a time at work on a private business park off of public roads. The driver had nowhere to park one day as it was busy so parked where they thought would be fine to do so. Unfortunately the driver got a ticket, but other colleagues stated they always bin the fine and letters, plus the driver noted the parking sign was lying on the floor. However since February 2017 just recently in the last month, the business park has decided to appoint a new parking enforcement company and all signs have been replaced, which means the driver is unable to provide photographic evidence for the defence. The driver has decided anyway to complete the AOS and choose to fully defend, which has been completed today. The driver will take a look into the defence examples and prepare one to submit, not sure how much chance they have but considering the fine was £60 and with additional charges plus interest they are now charging £274 this seems fraudulent to me but I expect is standard practice.

Is there anything else the driver should be aware of, could they be ordered by a court to pay more than the total if they rule in favour of the claimant? It hasn’t come at a great time due to COVID-19 and loss of earnings, plus the same car the driver has to make a final payment on in October.

Thanks.

Sara (Debt Camel) says

I suggest you post on Legal Beagles about this: https://legalbeagles.info/forums/forum/legal-forums/court-claims-and-issues

Paul says

Thanks for the response. I have posted on the Legal Beagles forum this morning as suggested.

Sandy says

Hi, I was using a credit card in UK around 2015. Then I left to home country and lost the credit card. Then called the bank from overseas and asked to block, but they were not able to verify my identity through my bank account and I didnt know the card number. They asked me to visit in person with an ID proof. I didnt return to the UK since then due to personal issues. I was away from the UK 5+ years. I do not know what was happened during this time since I do not have anyone to communicate if any letters at the address where I lived. I never got any payment follow ups on email or phone.

Outstanding was around £650 at the time I lost the card. The card limit was £1000, So I assume the maximum utilisation in case of any misuse of my lost card also shouldn’t exceed £1000. I was ready to pay while blocking the card, But it didn’t happen due to the verification failure.

Will this impact my living conditions in the UK? What are the options for not effected by this in the future?

Thanks in advance.

Sara (Debt Camel) says

Are you planning on returning to the UK?

Rich says

Hi,

I recently moved back to live in England & now have a fixed address have received 2 letters claiming I owe money. One for around £600 and the other for £2,600 who have now sent me a claim pack – which if i don’t respond to I will get a ccj against me. This is an old student loan that’s been sold to this company. I’m trying to find information if i can push back at all? Should I make them show me proof of why I owe this ie. The Student loan account number it relates to,do I call or write to them? I’d just like to be prepared before I speak to them so any advice would be really appreciated. Thanks.

Sara (Debt Camel) says

So you received 1 letter saying you owed £600 and now a Court Claim saying you owed £2600?

How old were these student debts? when did you last make a payment or validly defer them?

Leonidas says

I just received Claim form from county business centre. I own this money but Im unable to work. Im a cancer patient, lost my half face, eye and no good vision from my healthy eye. I live on benefits but its enough to pay my house bills. Can you help me how to defend this?

Sara (Debt Camel) says

I am very sorry to hear that. Can you say who the creditor is and are they aware of your health problems?

EC says

Hello can anyone help? My husband received a County Court Claim form from Hoist for a credit card debt. This was the first he had heard of Hoist or the debt. He has had mental health the issues for years and got into a small amount of debt back in 2012 when he lost his job so doesn’t recognise whether this debt is even his or not as no documents or letters have even been sent.

I acknowledged the claim and sent Prove it! Letters to Hoist and to their solicitors and although they acknowledged the letter and said they would send us the information, they never did and the deadline for filing a defence was looming so we logged a defence stating they hadn’t followed protocol by issuing a Letters of Claim and also had not responded to the Prove it! Letters we sent.

Then a couple of week ago we received a letter from Hoist saying that they had decided to proceed with the claim and we would receive a directions questionnaire from the court. The directions questionnaire has come and we have completed it but my question is this:

How are they able to take my husband to court and proceed with this claim when they have failed to even prove he owes the debt or that they have the legal right to collect it? How can you possibly take someone to court for breaching a contract that you haven’t even proved exists?

Sara (Debt Camel) says

Unfortunately, a lender does not have to prove you owe a debt before starting a Claim.

A great place to get help and support with this court case is the Legal Beagles forum: https://legalbeagles.info/forums/forum/legal-forums/court-claims-and-issues

EC says

Hi Sara,

I have looked on there a few times and can’t find any examples like this one where creditors have proceeded to claim without proving the debt? Please can you help with regards to what this means? Surely they can’t expect someone to pay for a debt they haven’t proved is their debt?

Sara (Debt Camel) says

They don’t have to prove you owe the debt – you can dispute this in court.

If you had told the debt collectors before they started the Claim that the debt was disputed, legally they could still start the Claim but you could complain that they were in breach of the FCA’s rules. You should have been sent a Letter Before Action/Claim. If you had returned the reply form saying you disputed the debt and asked for a copy of the CCA agreemnt they should not have started the court case before they had supplied the documentation.

BUT now the case is underway, much the simplest thing is for you to defend it.

I know you have logged a defence – you need advice on what to do next, with this DQ, filing witness statements etc

I cannot help with this, you need specific advice on your individual case. Please talk to National Debtline on 0808 808 4000 – they are now open after the Xmas break. Or post on the legal Beagles forum https://legalbeagles.info/forums/forum/legal-forums/court-claims-and-issues. Or do both.

C says

Hi we moved house back in july, and I received a parking ticket when I went to the gym. The actual parking ticket i bought blew on the floor so wasn’t visble. Anyway the notice that was left on the car had no serial number no details or anything just a card that said something about data protection and my vehicle details may have been recorded. I contacted the parking company to say I was no longer living at the address registered to the car and recieved an automated reaponse completely unhelpful. I have just managed to get some post today from the old property had a letter saying letter before claim dated 15/10 for a debt of £185 i went to the web address on the letter and have just paid it in full. I have just opened another letter and its a county court claim form dated 4/12. Obviously I have just paid it in full online not realising I had this letter. Im worried im going to get a CCJ now as we are going to be buying our first home in april. If I have paod online in full through the parking company website will they update the courts so it goes no further do you know? Sorry for the long message. Thanks in advance.

Sara (Debt Camel) says

You did not respond to the N1 Court Claim within 14 days so it is likely you will get a CCJ. But if this is paid in full within a calendar month the CCJ will be removed from your record. You have already paid part of it – you will now have to only pay the court fees – but you need to phone up to confirm this – with a mortgage application coming up you don’t want to get this wrong.

C says

The payment i made direct to the parking company included the fees for court in the outstanding balance the fees matched those stated on the court letter? Not really sure what to do next.

Sara (Debt Camel) says

ah ok, I thought you had just paid the ticket. You need tot alk to the company (or the solicitors if you have the details for them) on Monday. You may have got a CCJ or it may be too late to stop it, but if you do get a CCJ and you have paid it in full within a calendar month from the date of the judgment then it should not appear on your credit report.

C says

Ah ok well, the date of the court letter is 4th december but there isn’t an actual court date on it. It says respond within 14 days which would take me to the 18th of December. If the CCJ hasn’t been issued and yet and iv now made full payment does it stop it going any further?

Sara (Debt Camel) says

Yes but the point is it doesn’t matter if it has gone further as a if there had been a judgment you have already paid that so it should not appear on your credit record.

C says

Ah ok well, the date of the court letter is 4th december but there isn’t an actual court summons date on it. It says respond within 14 days which would take me to the 18th of December. If the CCJ hasn’t been issued and yet which im hoping as its been christmas, covid and iv now made full payment does it stop it going any further? Theres no solicitor details on the paperwork. Just says if i agree then make payment to the company on the front, excel parking.

Sara (Debt Camel) says

Phone them upon Monday.

C says

Ok thankyou, just panicking. Parking companies shouldn’t be allowed to get away with things like this. Thanks for your help. Happy new year.

Richard says

Hi There

Just received a County Court Claim Form in relation to debt that PRA Group took over from a Barclays credit card debt. Approx £7,000

Last spoke to them (PRA Group) 1/12/2020 and they said they’d call back end of Jan 2021 which they didn’t . Each time I spoke to them I told them had just enough money to pay living costs. Any advice on what to do next ? Someone said something about Unlawful Debt (ie. Magna Carter article 61 Common Law) and should be able to not pay. Advice on this also please

Kind regards Richard

Weatherman says

Hi Richard

You need to get debt advice about this. This is the first step towards getting a County Court Judgement (CCJ) against you. Call National Debtline on 0808 808 4000 – their advice is free. They can help you deal with the immediate problem (the CCJ) and also help you work out a strategy for your debts overall. They know their stuff!

Someone who *doesn’t* know their stuff is whoever told you about Magna Carta letting you avoid paying. It’s completely untrue. There have been similar claims about Magna Carta and COVID regulations – they are also nonsense! See this: https://fullfact.org/online/did-she-die-in-vain/

peggy says

I agree with the comments but i want to remove my name off court record

how do I get this done

Weatherman says

Hi peggy

Can you explain a bit more? If you agree that the CCJ was correctly issued, then your name stays on the Register for six years. You can’t change that.

Daniel says

Hello,

I have received a judgement in my old address from county court for the claimant that I should pay a debt (parking fine).

When the acclaimed contravention initially happened, I received a parking ticket from the private parking, I tried to appeal it, but I was redirected to a another site. That site was requesting me to pay for the appeal that will be sent on my behalf to the private parking company. At that point, I became suspicious of the site demanding payment to make an appeal. I could not go ahead with the appeal.

I moved out of the address few weeks later. I think, other correspondences were sent to that my old address of which I did not receive them, and this include the county court judgement against me. I was only called upon few day ago by the landlord who handed over bunch of letters to me. What can I do about this judgment since I did not receive any letter before this judgment??

Sara (Debt Camel) says

How long ago was the judgment?

Ian says

Hi Sara,

Our dog was operated on in 2019 and we though we were insured. The insurers didn’t pay out so we incurred a debt of £4,800 which increased to £5,900 when solicitors involved.

I have multiple credit and loan debts totalling £20k plus for which I have had payment plans in place for since 2013 and I’m up to date on the payments.

I sent a budget form to the vet’s solicitors saying what I could pay each month bearing in mind my other unsecured creditors but they refused this (I have been paying it anyway on the advice of nationaldebtline.

More recently around March 11th they had asked for 50% of the balance in full and final settlement which I was not in a position to pay.

I had no correspondence from them in a while but I’d come into a bit of money so I contacted them saying I could now pay 50% of the balance. I was away with work at the time. They emailed me back to say that they had issued court proceedings! I was baffled as there had been no notice. They said they had sent a 14 day notice letter but I definitely didn’t receive it. The claim is now for £7,200! Should I defend it and say they had agreed to 50% of the balance and that they issued without warning?

Many thanks

Sara (Debt Camel) says

So you have had a claim form?

Ian says

Yes. Service date was April 12th

Sara (Debt Camel) says

Can I ask if you are buying or renting?

Ian says

I have a mortgaged house with my wife

Ian says

I’ve now filed the acknowledgment of service which gives me until 10th May to file a partial defence (I.e. for the original bill amount). Is it worth defending it or should I just accept the claim as I know that I could incur further charges by defending the claim. In essence I’m asking what are my chances of succeeding in proving that they were willing to accept 50% of the balance and that I didn’t receive their 14 day letter?

Many thanks

Sara (Debt Camel) says

Will you be able to pay the bill in full?

Ian says

I can pay it on a 0% credit card as my credit score has been repaired after 6 years. But do i not have a chance of arguing that proceedings have been issued prematurely as I didn’t receive a 14 day letter?

david says

Hi there,

Thanks for this website, today I received an email from tm legal acting on behalf of lending stream of a debt for 345 (the email now says the balance as 445) saying they have submitted a county court claim, I never received a letter before claim as this must have gone to an old address, today I have updated my contact details with TM legal, they said I now need to contact the court to get them to post the ccc to my new address, my issue is that I have already set up a payment plan with them of £5 pounds per month but it has failed on each occasion and I made the payment on their website manually to start off with, i am assuming it failed because they had the incorrect address, I have also looked at my emails and I made an affordability complaint with Lending stream on 21/09/2018 they responded with a data request but did not send me a further response to my affordability complaint, they just kept selling the debt on, sorry if that makes no sense its all a bit stressful, my question is what do I do now please?

Sara (Debt Camel) says

ok so this is two completely separate problems.

my issue is that I have already set up a payment plan with them of £5 pounds per month but it has failed on each occasion and I made the payment on their website manually to start off with, i am assuming it failed because they had the incorrect address,

How what period was this? did you ask them why the payment plan was not set up? what did they say?

You should talk to National Debtline on 0808 808 4000 about what your options are now about this court claim.

I made an affordability complaint with Lending stream on 21/09/2018 they responded with a data request but did not send me a further response to my affordability complaint

You need to ask LS why they did not respond to this. If they did not respond you should now ask for a response. But if they did respond then this is too late to do anything as you should have sent the case to the Ombudsman within 6 months.

What is the rest of your financial situation like? What other problem debts do you have? Do you have other debts you are not paying that you have been trying to ignore? Are you behind with any important bills?

David says

Thanks for your response and for your questions.

How what period was this? It was set up on their website in April 2021. The first payment failed I received an email and made payment on their website.

did you ask them why the payment plan was not set up? what did they say? I called them today and they said they couldn’t see why it failed but because it has failed they have now proceeded with the court claim. I will call the debt line tomorrow.

What is the rest of your financial situation like?

Up to date on current commitments, all priority bills. Family of 4 going from month to month not been able to clear these debts from 3+ years ago.

What other problem debts do you have?

PROVIDENT FINANCIAL – satsuma £1382 (voted no)

Lending stream – debt assigned to TM Legal £350

Original Lender : PDL FINANCE LIMITED T/A MR Lender £549

CASHEURONETUK £349

LOWELL PORTFOLIO I LTD – capital one £301

Vodafone £571

Halifax PRA GROUP (UK) Limited £4.5k

Npower – Westcott £1.9k

Npower – Westcott £904

Southeast water – lcs £360

Total £13.7k

Do you have other debts you are not paying that you have been trying to ignore? I’ve just not been able to pay these past debts off. Are you behind with any important bills? Up to date current bills

Thank you

Sara (Debt Camel) says

It’s a shame you did not ask why the May and June payments weren’t made. But legally they could have gone to court for a CCJ even if you had been making payments.

Oh that’s a lot of problem debt. you need to ask National Debtline about the whole of your financial situation, not just the court claim. Even if you manage to avoid a CCJ in this case (which may not be possible) one of the others will soon pop up demanding to be paid. You need to look at a debt management plan for all of the debts Ora form of insolvency.

Glen says

Hi, I’ve been sent a claim form from county court business centre for the sum of £850, regarding ppl music license. I do owe them money but not that much as the pub was closed a lot through COVID lockdown. Does this mean I automatically have a ccj against me ? I can pay the money if it means not getting a ccj or is it to late. I don’t want a bad credit report as I need good credit for the business. Can you tell me my options. Thank you. Kind Regards Glenn.

Sara (Debt Camel) says

You don’t yet have a CCJ if you have just been sent a Claim form.

But if you do not submit a defence within the tight timescales allowed, you will get a CCJ “in default”.

If you think the amount is wrong you may be able to submit a defence on form N9B. I suggest you talk to Business Debtline about this urgently tomorrow https://www.businessdebtline.org/.

If you defend a claim like this and lose the case, if you pay within a month the CCJ will be removed from your credit record. So you don’t have to worry that you should pay it all now, even if you think the amount is wrong, as you can’t risk getting a CCJ.

Emma says

Hi Sara

I’m hoping you can advise.

I had a claim form come through the post from Cabot, I acknowledged service, and then defended the claim as I had previously asked them for proof i owe the debt (I have no idea what its for). Anyway this was early 2021. I have heard nothing since March 2021 in regards to this and no CCJ has been entered against me. It sits in the money claim portal as last action was my defence. Its still on my credit file though. I don’t recall having any more communication from them since my defence. Is there any way i can have this removed from my credit file?

Sara (Debt Camel) says

I suggest you send Cabot a formal complaint by emailing complaints@cabotfinancial.com

Say that you do not recognise the debt (give its details). If you have never borrowed or had an account with that lender/firm, say this. Say they did not respond to you saying this in [month year] and have issued you with a claim form which you have defended a year ago.

Say you want the debt removed from your credit record and the claim discontinued.

Zoe says

Hello,

As if things weren’t bad enough. Now this!

In 2019 I asked Capquest to provide a CCA for a Halifax card. They replied finally 3 months later acknowledging my request and apologising for the delay. I still have this letter. Then a month later they sent through what they claimed was the CCA. There were many things wrong with it. Wrong credit amount, the signature was dated a year after the agreement was taken out and the rubber stamp but just with a date no company name. You can see lines where it has been scanned or photocopied and pieced together from various documents.

I spoke to the National Dent Helpline who said I needed to challenge this as it’s not considered an acceptable CCA. Arrow said they would refer back to Halifax and I heard nothing more from them over 2 years.

Then last September I received a letter from Drysdenfairfax threatening court action. This was a month before the default came off. I contacted the NDH again who sent me some templates to request a further data request asking for what additional information they had to pursue this as the CCA was still outstanding. They ignored this request and yesterday court papers arrived. It’s not yet a CCJ but what can I do to stop this. Presumably Arrow can’t enforce if the CCA is still outstanding from 2019 and they haven’t contacted me once in this time. I can’t get a CCJ but really don’t know what to do.

Sara (Debt Camel) says

I assume you spoke to National Debtline? There are other firms that have similar names but they just try sell you an IVA so I guess you have spoken to The Real Thing.

What you need to do now first thing is submit a defence to the claim. The timescales are tight for this. It is not something I give general guidance on, you need specific advice. I suggest you talk to National Debtline again. And also post on the Legal Beagles court forum: https://legalbeagles.info/forums/forum/legal-forums/court-claims-and-issues

After that you can also consider sending Arrow a complaint saying they should not have started a court case in this situation. But that can wait, the defence is the important thing.

One other thing – how large is the claim for?

Zoe says

thank you!!

Its for £1267. I’ve always disputed this debt. In 2014 I was chased by debt collecting agencies for credit I’d not taken out from an address up north. We believe it may have been someone who lived below us, a lot of post went missing during their stay. All got overturned but unable to get anywhere with Halifax as they had my old address.

The ‘CCA’ has been pieced together from applications I made to Halifax in recent years not 2008. The card they claim I applied for didn’t come out until 2011. The signature they included is dated a totally different year than 2008. Is this not fraudulent? It’s hard to find out exactly what is and isn’t an acceptable CCA.

Are Arrow allowed to leave it 2 years without making any contact about this debt? I’ve had nothing until they wrote saying it was passed to their solicitors who incidentally are owned by Arrow.

I’m torn between just giving them the money and making them go away or defending.