If you receive a Claim Form from a County Court through the post you need to respond rapidly.

Ignoring court papers is a bad idea, even if you think the debt is too old or you are worried you can’t pay the money.

- If you agree you owe the money you will get a County Court Judgment (CCJ) but if you complete the Claim Form papers properly you will be able to make monthly payments and won’t get visits from bailiffs.

- If you don’t agree you owe the money, you need to defend the Claim.

Contents

Check this really is a court form

Some debt collectors send letters designed to make you think you are being taken to court when you aren’t! If you get one of these, read Threats of CCJs and bailiffs – are debt collectors bluffing?

If you get a letter headed something like Letter Before Claim or Letter Before Action, a court case has not yet been started. But don’t ignore this – it is much easier to dispute a debt at this stage than fight a court case in a month or two. So read this: How to reply to a Letter before Claim.

A real N1 Court Form may be on white paper or on blue and white paper. It will have something like this at the top:

There should be a court name, a court stamp and a claim number.

If you aren’t sure, you can phone the court to check or phone National Debtline on 0808 808 4000 and ask them.

In the same pack, you also get other blank forms: N1 – Claim form; N9 – Response pack; N9A – Admission (specified amount); N9B – Defence and counterclaim.

Check you are named as the Defendant on the form. If your name is slightly wrong (a typo? your maiden name?) you should treat this as though it is correctly addressed to you.

But if it’s obviously meant for someone else, read this about debt letters for other people coming to your house.

Don’t panic!

This article looks at your options. for what to do, now you know the form is real.

But first, don’t panic! Some worries you may have:

- you can’t be sent to prison for not paying the utility bills, loans, credit cards and other debts that lead to this type of court action.

- if the court decides you owe the money, you will get a County Court Judgment (CCJ) – this isn’t a criminal conviction.

- if you get a CCJ, you can get an affordable monthly payment agreed. You won’t have to pay it all at once if you can’t afford to.

- you won’t get bailiffs coming round to your house unless you try to ignore these papers and then ignore the CCJ.

If the court is the Civil National Business Centre in Northampton, you will not have to go to Northampton. If there has to be a court hearing, you can ask for this to be in your local County Court.

Reasons to dispute the debt – READ THIS

You may not know that you have a reason you can defend this case and not get a CCJ. So read this even if you know you owe the money.

It’s not your debt!

Often you know immediately which debt the form is referring to.

But sometimes a debt may have been assigned to someone else – this is legal jargon for selling your debt. The new owner of the debt is entitled to sue you for the money – you don’t have to have agreed to the debt being sold.

If you don’t recognise the debt at all, call up the claimant and ask about it.

If you are called Jane Baker, the debt may belong to a different Jane Baker. Or this could be identity theft – someone pretended to be you.

You may feel nervous about being pressurised to agree to something, but make it clear you just want to know more details of the debt, then end the call when you get them.

After talking to the creditor, if you still don’t think the debt is yours, you must reply to the Claim, see How to dispute the Debt below.

If you ignore the Claim because the debt isn’t yours, you will get a CCJ automatically because you didn’t repond to the forms.

The only exception here is if you have convinced the creditor that the debt isn’t yours. Here you want the creditor to tell you in writing that they are going to stop the court case and withdraw the Claim. If they say this on the phone, that’s not good enough, ask them to put it in writing.

If you aren’t sure what to do, telephone National Debtline on 0808 808 4000.

You recognise the debt – but is the amount right?

The debt may have been yours, but the amount may be wrong:

- perhaps you paid some money recently which hasn’t been taken into account;

- you may have already paid the debt off – possibly several years ago, possibly to a different debt collector;

- you may have had a partial settlement, also called a full and final settlement, accepted.

- the amount may be right, but there is some reason why the claimant owes you money. This means that you have a counterclaim against the claimant, which can be decided by the court at the same time as the claim against you.

Other reasons to defend the case and not get a CCJ

It’s not just whether you owe this money, what is important here is if the creditor can win the case.

There is a lot of legal protection for consumers, especially for old debts.

Here are some reasons you may be able to defend the case:

- for credit cards (including store cards and catalogues) and loans (including HP and payday loans) the creditor has to be able to produce a copy of the written agreement for the debt. See National Debtline’s Getting information about a debt for details. That tells you how to ask for this information and you should do this asap, BUT ALSO reply to the Claim within the short time limit, see How to dispute the debt below for details;

- the money was for some goods or services where there was something wrong and it’s not right that you should pay;

- you have gone bankrupt and the debt should have been wiped out by that, or the debt was included in a DRO or an IVA;

- the debt is statute-barred so the claimant can’t go to court about it because it is so old, see Questions about Statute-Barred Debt for more information;

How to dispute the debt

What to put on a defence form

If you don’t recognise the debt or you don’t agree you owe the money or you have a counterclaim, or you have some other possible defence you must complete the Defence Form (N9B) and say why you are disputing the debt.

The words you use matter here. Although it may be possible to add other reasons later in your defence, it is simpler to try to list all the possible reasons you have now. Don’t just put what you think is your “best reason”, if there are several reasons to defend the case, list them all.

National Debtline has a good factsheet on Disputing a debt. Read that, but unless you are very confident, I suggest that you call National Debtline on 0808 808 4000 and ask for help. You can also post about your case on the Legal Beagles forum.

Reply within the tight time limit

You need to send the Defence Form back within 14 days. Send the paper form to the court, and send it recorded delivery and keep a copy. Or, if the claim was made using an online service, you can respond online.

If you would like more time to sort this out you should complete and send back the Acknowledgement of Service form ( N9CPC) within the 14 days. You then have 28 days from when you received the forms to return the Defence Form.

It is essential you put in your defence within the given time. If you don’t reply in time you get a CCJ “in default” – because the rules assume that if you don’t reply you are agreeing you owe the money.

So don’t assume you will win the case because the debt isn’t yours or it’s very old. If you don’t reply in time, using the court forms and defend the case, there will never be a court case and no judge will even look at it – you are going to get a CCJ.

And things won’t wait if you have talked to the creditor on the phone or written to them… For example you may have asked the creditor for the CCA agreement and they haven’t replied. You still have to use the forms to reply in time to the court and defend the case.

What to do if you agree you should pay the money

If you can pay it all now – you won’t get a CCJ on your credit record

If you can pay the full amount, then you should complete the Admission Form (N9A) but you don’t need to give details about your income and expenses. You should fill in:

- the box that says How much of the claim do you admit

- Section 1 Personal details

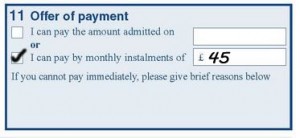

- the box that says Section 11 Offer of Payment

- Section 12 Declaration – sign and date this

You should send the paper form back to the Address for sending documents on the N1 Claim form. Send this recorded delivery and keep a copy of what you send.

If you do this, you will not get a CCJ on your credit record.

NB This is not a reason to pay up and keep quiet if you have good grounds for disputing the debt. If you defend the case and lose, you still have the option of paying the money in full within a month and the CCJ will then be removed from your record.

Offer to pay in monthly installments

Here you need to complete the Admission Form (N9A):

- the box that says How much of the claim do you admit,

- Section 1 Personal details

- Section 2,3,4,5 about your family and financial situation

- Section 6,7,8,9,10 about your income, expenditure and other debts (make sure that all your incomes and expenses are quoted as per month so that you can add them up)

- the box that says Section 11 Offer of Payment

- Section 12 Declaration – sign and date this.

For more information see How much should I offer to a CCJ? and talk to National Debtline if you are unsure what to offer or what what to put on the form.

It is common for courts to accept your offer of payment, especially if you have taken advice about how much to offer and how to complete the form.

If the creditor accepts your offer, you will get a notice that you have a CCJ and should make the monthly payment that you have proposed.

If the creditor refuses your offer, it gets sent to the court to determine how much you should pay. This is usually done without a hearing. Talk to National Debtline if you are uncertain what is happening or what you should do, or if a repayment is set that you can’t afford.

Do you have other debts?

If you have been avoiding tackling a larger debt situation, getting these court papers is a warning that you need a rethink.

Try to list all your debts and have a first stab at doing a budget, then ring National Debtline on 0808 808 4000. They can help with what to put on the court forms. But just as importantly, they can talk about your bigger debt picture and what your options are.

What happens next if I do get a CCJ?

I’ve done another article on this, see link below. For now the important thing is to complete and return the forms correctly, as this will minimise your problems later on.

NT says

I received a claim form even I had a DMP with equivo of £1/month. I’m expecting this thing to happen so need a few advise from the group

1. The amount I need to pay increased because of the court & legal fee. If the ccj was successful do I need to pay the court & legal fee in full or they could be waived due to affordability?

2. How do I send the claim form because there was no return envelope?

3. Do we have a thread, forum or contact number helpline for me to understand how to fill up the claim form?

4. Can someone advise me do I need to send more docs before the ccj or judgement would be finalized after I admit the full amount?

//tksnota

Sara (Debt Camel) says

How much do the debts in your DMP add up to? Are you making token payments to them all? Is anything in your situation going to improve soon?

Are you buying or renting?

NT says

I have close to 90k of unsecured debts. Only hasn’t defaulted and paying token on all of them.

I will not be able to pay the debt and ready to accept ccjs.

I’m also expecting restrictions on my property but will deal with later because I have a couple of decades to sell the property

//tksnota

Sara (Debt Camel) says

So the article above says what to do in replying to the court. It has links to National Debtline and Legal Beagles who can advise. You need advice on when interest can be added after judgment.

Also have you looked at affordability complaints again5 the debts? See https://debtcamel.co.uk/tag/refunds/, they may reduce the balances and prevent some CCJs and restrictions.

NT says

I will look into the affordability article

Do you mean the cost and legal fees stipulated on the claim form might increase when a judgement was finalized?

Sara (Debt Camel) says

No, I mean whether interest may be added after judgment. Its unusual but it sounds as though you have Large debts so talk to National Debtline

NT says

I need guidance to whom I need to send the claim form. Is it the claimant address or the address for sending the doc? Both addresses are different

My confusion originates from that admission doc because it is written send the complete form to the claimant address.

Sara (Debt Camel) says

see https://nationaldebtline.org/get-information/guides/replying-to-a-county-court-claim-ew/ and if in any doubt talk to National Debtline

Duke says

Hi there, I have received a Court Claim for an unpaid Thames Water bill. The company trying to recover the debt is JC International Acquisition LLC who bought the debt from Thames Water and BW Legal is trying to recover the debt from me. BW Legal sent me a Water bill dated March 2019 as a proof (so I think the debt is statute barred) but they said the default notice is different so for them the debt is not statute barred . Moreover, at that time I was renting a room all bills included and I wasn’t responsible for paying any bills. Just trying to figure out if my defence is strong enough to win the case. Any good advice? In the meantime I did the acknowledgement of service and got an extra 14 days to produce my defence. Can I submit the N9B module with my separate defence sheet by email or should I post it or use the online portal moneyclaim.gov.uk ? Looking forward for your precious advice

Sara (Debt Camel) says

I suggest you talk urgently to National Debtline on 0808 808 4000.