Mrs E asked:

I have a catalogue debt of about £2000 from 2014. I was paying through a debt management company until March 2016 when I stopped. They are going to court for a CCJ. I don’t know how to fill in the form with my expenses or which debts I should include.

Mrs E’s questions are about completing the N9A Admission form that was included with the Claim Form she has received.

This is the form to use if you agree you owe some or all of the amount claimed but you can’t pay it all and want to make monthly payments.

It lets you propose an amount to pay each month towards the CCJ and it asks for details of your circumstances, including income, expenditure and other debts which will explain why you are offering that amount.

This isn’t an easy form to complete – this article looks at the common questions people ask about this form.

Contents

When NOT to complete this form

Don’t complete this form if you are defending the claim, see What to do if you get a Claim form for more details. If you lose the case you will still be able to get monthly payments agreed at that point

If you can pay the whole amount straight away and manage without having to borrow more money, that is usually better than offering monthly payments. If you repay a CCJ in full within one month it gets deleted from your credit records. But monthly payments will mean the CCJ will stay on your credit record for 6 years. So if you can afford the whole amount it’s better to pay it and protect your credit score.

This is the wrong form if you already have a CCJ and want to get your monthly payment reduces – see what to do when you get a CCJ.

FAQs about completing the N9A form

Looking at this example of a completed form may be helpful.

The first page of the form is easy. It asks for the number and ages of your children and whether you have other dependents. This helps to assess whether the amount you are putting down on expenses is reasonable for your family size.

Does all the money in my bank account count as savings?

If you expect to spend all the money in your account by the time you next get paid, that isn’t savings.

Unless your savings are more than one and a half times your monthly income, the Court Official ignores them in deciding how much you should pay towards the CCJ.

If you have a joint account, only put down your half of the savings.

I have mental health or physical problems, is my disability money income I have to include?

Yes. The income section has a line “other benefits” and you put ESA/DLA/PIP/AA in there.

This makes your income look high!

But you also need to include the extra costs you get because of your disabilities. One approach is to put a line called “Disability costs” in the Expenses section under “Other Expenses” which is equal to any PIP or DLA that you receive.

Must I list my tax credits and child benefit as that money is for my children?

There is an income line, labelled “Child benefit(s)”, you should put any Child Benefit and Child Tax Credit in there.

In the “Expenses” section you will include all your child-related costs: food, clothes, school costs etc. By doing this you are showing you are using the money and it isn’t available to be paid to your creditors.

Do I have to include my partner’s income?

No – your partner is not liable for paying your debts (NB I am assuming this isn’t a joint debt.)

But if your partner has an income, they should be contributing to the household costs:

- if you pay the bills and do the shopping and your partner gives you £600 a month towards it, then that can go in the “Others living in my house give me” line – which is also where you would put any money your adult children are paying or money from a lodger;

- if you split the bills, then you should only put the part you are paying in the Expenses section. Many couples adopt the “I’ll pay the rent and you pay the council tax and other bills” approach, but on this form it’s probably better for you to put down half of all the expenses, rather than 100% of some and nothing of the others.

What about things which aren’t listed as expenses?

Anything to do with car costs (road tax, insurance, servicing, new tyres etc) goes under Travelling costs.

Toiletries and all other household consumables, from loo rolls to light bulbs, go into Housekeeping costs.

You can also add extra lines in the Other section for example:

clothes; other bills (including insurance, telephone, mobile and broadband); emergencies; birthdays/xmas; child care costs; disability costs. You can add a covering letter to explain any of these or go into more details.

Will they check up on these figures?

This is information you are supplying to the Court – you should make it as accurate as possible.

You don’t have to supply payslips and evidence with this form.

But if a creditor thinks you are concealing something you may have to attend a court hearing after the CCJ has been granted, bringing in documents and answer questions under oath about your finances. This is unusual but can happen.

I’m worried some of my expenses are too high

Perhaps they are… but many people worry about this when their expenses are completely reasonable… You aren’t expected to live on baked beans on toast and never buy your children any clothes.

If you talk you expenses through with a debt adviser (see Getting Some Help at the bottom of this article) they will be able to say if what you are putting down is likely to be acceptable. And they may also remind you of something that you have forgotten to include.

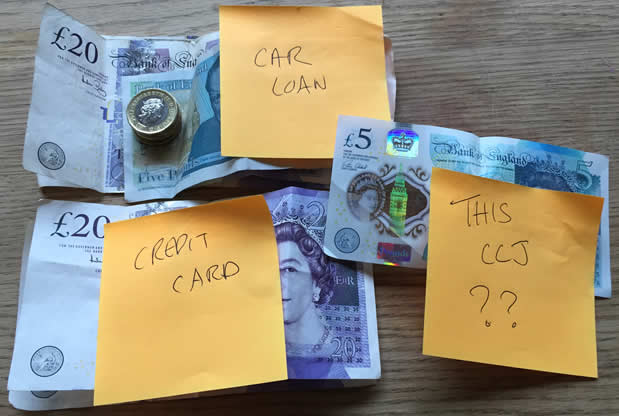

How much should I offer? And what about my other debts?

If you have arrangements in place to repay priority debts such as rent arrears and council tax, put these amounts in. If you have priority debts but haven’t yet agreed repayments you need to do this as soon as possible as it will reduce the money you can pay to this CCJ.

If you have too many debts for the space in the Credit Debts section you can enclose a separate sheet.

If you are in a debt management plan (DMP), it is normal to offer the same amount to the CCJ that is currently being paid to that debt in the DMP.

If you aren’t in a DMP, look at the amount of Disposable Income you have. This is the amount of income you have left each month after paying your essential expenses (rent, council tax, utilities, food, transport, clothes etc) and priority debts. This Disposable Income is then the amount of money you have to divide between all your other debts.

It should be divided between your other loans, credit cards and catalogues and this debt you are getting a CCJ for so that the biggest debts get the largest amount. This is called “pro-rata” and creditors accept that it is fair.

Have a go at completing National Debtline’s My Budget:

- this is good at sorting out a monthly budget when some of your income or expenses are weekly, fortnightly, quarterly or annual;

- it does all the pro-rata calculations for you and suggests how much you should be paying to each debt.

If you are still making full payments to some other debts, the My Budget app will say what these have to be reduced to. You might want to carry on paying another loan or catalogue in full and just offer a low amount to the CCJ debt. But the CCJ creditor and the court will not think it is fair.

If this seems confusing or impossible, talk to National Debtline about your options, see below.

What do I do if I can’t afford to pay anything?

You should always make some offer, even if it is just £5 a month. If you think this is impossible you must get debt advice about what to do.

If you ignore the court forms because you can’t offer any money, you will still get a CCJ and they will expect you to pay it all immediately.

I have some other debts I haven’t been paying anything to, should I include these?

It is best to list them all and also start making payments to the other debts.

These may not feel like urgent problems at the moment, but what happens if they contact you and threaten a CCJ? If you offer all your spare money to this CCJ, what will you do when the next Claim Form arrives?

Getting some help

Many people find this form tricky. If you are in a DMP, talk to your DMP company – they already know a lot about your budget and can advise.

If you aren’t, call National Debtline – they can help you work out your Income & Expenditure so you know what to put in which lines on the form.

They can also help look at your whole debt situation and what a sensible monthly offer would be not just to this CCJ but to your other debts.

They can also advise on if your situation is more complicated, for example:

- you have priority debts that need to be sorted first;

- you know your income is going to change – perhaps because you have applied for benefits but they haven’t yet started to be paid;

- you have other problem debts that creditors are pushing you to repay;

- the income & expenditure section shows you have no spare income at all.

Sam Nurse says

Also important to take care when recording bank account balances that are in credit at the time but fluctuate by stating ‘revolving credit’ to prevent the court or the creditor from assuming an inaccurate, better off financial position. For example, at a certain time in the month, a bank account may be £2000 in credit but a week later may have a debit balance. It is important to clarify.

Also, if a nil payment is offered or a deficit budget is presented, court staff may determine a judgment in default which means the whole amount is payable immediately rather that an instalment plan. If in doubt, always seek free debt advice from an expert.

Sara (Debt Camel) says

Good points, Sam. If you already have a debt adviser, for example if you are in a DMP, talk to them. Otherwise National Debtline are easy to get through to on the phone – 0808 808 4000.

Julie says

I had a credit card given and my benefits were suspended by the time it all came back I had spent all the money and see the court letters and couldn’t deal with them a ccj was given then I had a form which I ignored now it has been passed to bailiffs my outgoings and incoming are so tight I had several surgeries only spine so can’t walk without help I get ESA and a mobility for PIP but I don’t know where to start I get so sick with worry I don’t open curtains or answer door or phone I also suffer with depression & anxiety after a bad fall I just feel lost. Sorry if this is wrong section.

Sara (Debt Camel) says

Hi Julie, Sorry if this is a scary question, but do you have any idea how big your debts are, just roughly? And are you buying or renting?

David says

Hi I am awaiting a ccj income/expenditure form with a debt owing of just under £1000 and was hoping that I could pay around £100 a month, would the court be likely to agree with this figure each month or demand I pay the full lot?

Sara (Debt Camel) says

It’s not a question of “oh that will repay the debt in under a year so it’s OK”, what matters is what your income & expenditure forms says. If that shows £100, that will usually be approved. If you aren’t sure what to put on the form, National Debtline 0808 808 4000 can talk it through with you.

David Gritton says

Thanks Sarah I thought it might after working my income and expenditure out I think I could go for £150 a month at a push.

Sara (Debt Camel) says

Don’t push it too far! Seriously, it’s better to have agreed a sustainable amount than one which you may need to return to court to vary later if you can’t manage. If you agree £100 and have £50 spare at the end of the month, put it in a savongs account as an ermergency fund in case something goes wrong in the following month.

David Gritton says

Thanks for the help, I’ve just been really worrying as I don’t have the money to pay the full amount if they ask for it and I’m really hoping they accept the monthly amount

Trevor hurst says

I had a letter from courts saying thay have issued a warrant to seize goods if I don’t pay in full I,am on benefits and live in rented house can I ring courts up and try and sort repayment plan before bailiffs come out thanks

Sara (Debt Camel) says

Hi I suggest you talk urgently to National Debtline 0808 808 4000 about this debt and your full financial situation. They can advise what your options are and what you could offer to a repayment plan.

Roy says

Dear people,

I wonder if somebody could help with my question which is: i have an outstanding ccj which is just over 4 yrs old it is for £16000 pounds and with a bank, i was a garantor to my business overdraft.. i have had no contact with the bank since or over the debt..maybe because i moved house some time ago. My question is do you think they would except an offer to settle…i would not offer the full amount but was thinking to offer half the ammount if they would except, but to except as full payment to the debt and issue a satisfied certificate so i could have entered on my credit file, satisfied.

Im wanting to get a morgage within 12 months once ive saved a deposit or since i have not heard anything from the bank since the time of the ccj would i just be opening a can of worms…and just approuch a company that will lend me the morgage ? By the time ive saved the deposit the ccj could be 5 yrs old.

Kind Regards.

Sara (Debt Camel) says

They may accept a partial settlement but are likely to either want to know where the money is coming from or ask for an income & expenditure sheet to see what you can afford to pay them. They are highly unlikely to agree to mark the CCJ as satisfied.

Kayleigh says

I have had a ccj put against me recently and I am trying to work with them and I have offered them £100 a month which I feel is what I have to spare each month, but because I have £234 after everything is paid they are saying the want that not the £100 I have tried to explain I am a single mother with three children and do not have any savings so the extra £134 a month comes I handy for birthdays, party’s the children go to etc but the don’t seem to want to budge I feel like I am been pushed in to corner to agree to a payment I don’t feel I can meet every month

Sara (Debt Camel) says

I suggest you talk to National Debtline 0808 808 4000 – they will help you draw up an income and expenditure statement you can send to the firm.

Kayleigh says

I have already done this with the from and I am left with 256 once everything is paid out for the month, they said they take £20 off that incase of emergency and then I am left with £236 which they expect me to give to them, however I do not think this is right as I would be left with £20 to live on for the rest of the month, I couldn’t take my children any where or send them

To a party etc, I have offered them £100 a month which i think is reasonable

Sara (Debt Camel) says

This is why I am suggesting you talk things through with a debt adviser. It may be that some of the amounts you have down for expenses are too low and should be increased.

Jane says

Hi, I have a CCJ for a credit card in for £4600 which is being dealt with Bluestone Credit Management. In July 2015 I made an arrangement to pay £50 per month and have made this payment regularly every month since. Ive checked my credit report recently and and not one payment has been registered on my report so the debt is still showing as £4600. Is this correct or should my payments be shown on my report?

Sara (Debt Camel) says

You can ask the creditor to give you a statement of your account which should show your payments are being recorded. The balance on CCJs isn’t usually updated, and it wouldn’t make any difference to your credit score if it was.

Jane says

Ok, many thanks.

Steve Johnson says

My partner and I have both been issued with seperate ccjs for the same debt.

Do we have to fill in both forms?

Sara (Debt Camel) says

Have the CCJs been issued? Or do you just have Claim Forms at the moment?

Luke Cardwell says

Hi, A few years ago I had “a bad year” as a result I have ended up with 3 CCj’s totalling a little over £2,000.00 These are all listed on my credit file. Possibly unusually? I have never heard from either of the 3 creditors, historically 3 years, 1 year and 6 months old dated judgements.

My question, If I contacted the companies and offered them 50% of the total outstanding as final and full settlement? would they hold there stomachs and roar with laughter? or could they decide to accept? I am on universal credit with about -£150.00 per month and have been left a £1,000.00 from a departed good friend GRHS, or, should i let sleeping dogs lay and have a party?

Sara (Debt Camel) says

are these your only three debts? are you behind with any bills? UC – are you out of work? is that likely to change? are your renting or buying, if renting, privately or social/

Jane James says

Hi Sara, I ended up with a CCJ on a large debt (circa 11k) around 9 years ago. I was in a lot of financial difficulty and only stated I could afford a token amount of £1 per month, which the court accepted. The creditor took me back to court within a few months to ask for redetermination but the court ruled that I should continue to pay at £1 per month. I’ve never missed a payment since. Around 4 years ago the management of the debt was taken over by collection company, who now write every year requiring an updated financial statement. I haven’t supplied this as the amount to be paid has been determined by court and is affordable. Can they take me back to court again if I continue to pay the token amount?

I would like to be able to make them a FFO at some point if funds become available but I aren’t sure how much to offer if that did happen. Are they likely to accept a FFO if they have a CCJ?

Sara (Debt Camel) says

Yes the creditor can go back to court again, see https://debtcamel.co.uk/debt-collector-income-expenditure/

Yes it is possible to offer a F&F to a CCJ. How much and whether it will be accepted depends completely on your situation, there is NO rule that says after 10 years they will probably accept 40% or anything like.

Aaron says

Hello,

I’m entering in to a DMP and I’ve got a (irrational?) fear of CCJs, is it possible that a court would make me pay in full, regardless of the fact I have no savings, living in rental, and about 400 a month disposable, of which 385 is going towards the DMP. Presumably in this situation I would offer what the DMP is paying this creditor and hope it goes well? But could they just reject that offer and instead of offering an alternative monthly payment, just say I need to pay in full regardless? Would a court be that brutal?

Sara (Debt Camel) says

It’s irrational. Why would a creditor go to court for a CCJ when you are paying as much as you can through a DMP? What would they gain from it?

If you had a house with equity some lenders such guarantor lenders will go for a CCJ to try to get a charge over your house – but you haven’t.

So being taken to court is unlikely. If you are, you can just offer what the DMP is paying. Courts aren’t brutal, they look at the evidence – the article above describes how to complete the court form which shows what you can afford.

Honestly this doesn’t happen very often. there are hundreds of thousands of people in DMPs and it wouldn’t be working for them if they kept getting CCJs. It’s not impossible, but if it does happen the court will accept a sensible payment.

See https://debtcamel.co.uk/worried-dmp/ for some other worries about starting a DMP you may have.

Laura says

Hi, my partner has a claim form from the court for a credit card debt that has just come through. When filling in the income and expenditure form to offer a monthly amount does he put in the full amount of universal credit or just his portion as it is a joint claim for benefits. Also does a CCJ still get applied if monthly repayments are set up or are you only excluded from getting one if you settle in full? Thank you

Sara (Debt Camel) says

Are you working?

If he offers monthly repayments he will still get a CCJ.

David says

Hi quick question if you pay a payment of monthly do you avoid ccj being shown on your record

Sara (Debt Camel) says

No. The only way to avoid the CCJ being shown is to pay it in full in the first 30 days.

David says

Would you be able to help with a situation I’m in

Sara (Debt Camel) says

Do you have a court case in progress?

I can’t give advice on a court case, but if you say a couple of sentences, nothing long, I will suggest where to get help.

David says

Had an accident hit a parked car I took full responsibility for the accident told and went through my insurance got a county court letter through saying I’d owned £8000 for there hire car and storage and recovery of car through the third party but thought my insurance had everything covered

Sara (Debt Camel) says

What does your insurance company say?

David says

I rang them this morning and explained and they said there were aware there was a third party claim going through they said these letters are sent out to scare you and speed up the process but do you think I should get legal advice anyway

Sara (Debt Camel) says

Good – I think your insurance company probably has this covered. BUT it’s not a good idea to ignore court papers. I suggest you talk to National Debtline on 0808 808 4000 about what you should do.

David says

Hi just a quick why do you suggest to call the national debt line

Sara (Debt Camel) says

because you have to decide whether to ignore the court papers – not normally a good idea!

H says

If ccj papers are not sent back in time can the creditor/creditors solicitor ask the court to make a judgement by default and if so do the courts decide how much monthly I pay back or do the creditors suggest an amount .any advice would be lovely thanks

Sara (Debt Camel) says

can the creditor/creditors solicitor ask the court to make a judgement by default

They don’t have to ask – a judgment by default will be automatically issued

do the courts decide how much monthly I pay back or do the creditors suggest an amount

It would normally be for the full amount.

So if you get a judgment by default, to pay the full amount, read the Mr Green – agrees he owes the money but can’t pay it all at once section in https://debtcamel.co.uk/help-ccj/ for how to ask for a monthly amount to be set.

jaz says

Hi Sara, I had a court letter to pay for a company that scammed me in 2018, it was an online company that trains you to do an online course to get your HGV license, the company is called New wave driving school. I did not take any lessons or done any test with them, there got a finance company to pay for 0% finance for the course I was supposed to do, and further, they then added an extra course for me to do, a class 1 license which I never asked for and added an extra cost for that course, I phoned them up and told them about this, and they’ve denied it, and said I asked for it, but they still go behind my back and made that finance with the finance company and charged me for a course that I didn’t ask for, later I received tex of them that I can cancel the course if I wasnt not happy and will refund any money I had made to them, so I phoned them up and there said this tex was sent by mistake, I said I dont want to continue with your services, I triead many times to contact them and ther avoided me when I mentioned my name and sometimes put the phone down on me, and other times saying they will phone me back, but there did not get back to me, so I cancelled the payments with my bank, and now I have received a court letter saying I have to pay this ounstanding balance to the finance company. Is there anything I can do?

Sara (Debt Camel) says

If you have received court papers, I suggest you talk to National Debtline on 0808 808 4000 for help.

Nadia says

I’m due in court very soon In connection with a family dispute where I could potentially leave court with a ccj for 25k plus costs (fast track)

If the worst happens and the judge doesn’t see through the lies of the other party, can the other party decline to accept instalments? I do have other debts which I am chipping away at the moment (no missed payments)

I’m not bothered about taking a ccj if it comes to that, I have my mortgage and dont plan to move. Not enough equity to cover worst case scenario though.

I am very worried that the other party will not be receptive to instalments and will petition me for bankruptcy, leaving us homeless

Weatherman says

Hi Nadia

Can you explain a bit more about the situation? What debts would be included in the CCJ?

You can apply to repay a CCJ in instalments. Prepare an income and expenditure statement (a budget, basically) that shows what you can afford. The other party will first be asked if they agree to this, but if they don’t, the court will look at your circumstances and decide. There’s more information about that here: https://www.nationaldebtline.org/fact-sheet-library/varying-a-ccj-ew/

Whether you can pay the other party’s costs in instalments is, as I understand it, at the discretion of the court. It very much depends on the circumstances, so it may be worth speaking to a solicitor about this.

Sara (Debt Camel) says

Commercial creditors tend not to apply for bankruptcy in this sort of situation if you are making a reasonable repayment offer. If your house has to be sold in bankruptcy the Official Receiver’s fees, taken first before any distribution to creditors will ofter be in five figures. So it is not a good way of getting paid unless you have a LOT more equity than the total of all your debts, not just the one from the creditor making you bankrupt. And the person making you bankrupt has to pay over £1000 in fees.

Unfortunately some private individuals may not realise this or may simply want to cause trouble for you.

You may need to be prepared to pay a lot less to your other debts so you can pay more to this CCJ – if you get one of course.

Can I suggest you talk to National Debtline about your situation and what you should considering offering. Phone them on 0808 808 4000.

Dan says

My wife received a CCJ Claim last week out of the blue. She thought the debt was statute-barred but checking statements, she last paid July 2016. It defaulted Oct 2015.

She doesn’t recall receiving previous correspondence from the company, or a Letter Before Claim. Calling them last night, they claimed they had sent the LBC in Jan 2020. She tried to request the CCA but the advisor said they couldn’t do this as it had already “gone legal”.

The advisor did take a DSAR from her and referred her to their specialist team due to her struggles with anxiety & depression – something she takes medication for.

What was confusing is that he implied that the specialist team had the power to review and withdraw legal action, but insisted that she had to respond to the claim.

Speaking to Step Change today, they thought it was strange to leave it over a year between the LBC and the claim letter, and they advised her to speak to FOS (strange as she’d need to complain to the company first before they’d get involved).

It’s getting a bit confusing as she doesn’t seem to have the option of ensuring the CCA, etc. is in order before the claim continues. She wouldn’t want to agree or disagree with it without knowing this, so she’s under pressure to pick a side.

Can they really wait that long after sending the LBC? Should she be complaining to the company for denying the CCA? Is there any way that she can avoid responding to the claim letter beyond the 14 days?

Sara (Debt Camel) says

Unfortunately, now they have started a claim, she has to file a defence or she is VERY VERY likely to get a CCJ “in default” as she did not defend it. It is possible the firm could withdraw the claim, but this hardly ever happens and unless they tell her in writing (not on the phone) that they will do this she should assume that they won’t.

Can I suggest she talks to National Debtline on 0808 808 4000 about what she should say? They can also explain how to ask for extra time and how to request a CCA – this can and should be done know – ignore the creditor’s attempt to put you off by saying it is too late.

The Legal Beagle forum is another good place to get help with a court claim: https://legalbeagles.info/forums/forum/legal-forums/court-claims-and-issues

She needs help fast on this! Arguing about whether they should have waited so long after the Letter Before Action is not going to help her.

Michelle says

Hi hubby just received ccj forms for financial statement. We are really struggling atm as son is at university and is struggling too. I’m on pip and husband is my cater. Can we add any contributions we give our son to help him out? Atm we’re helping him paying his phone, an openpay debt and his credit card.

We’re in a housing association house if that makes any difference Thanks

Sara (Debt Camel) says

Can you say how large the debt on the CCJ claim is? Who is the creditor and what sort of debt was it?

Does your husband have other debts? Do you?

Michelle says

It’s just over £3k there’s another about £1k they’re not contacting us about in joint names ( they’re both overdrafts from previous bank who was constantly adding charges so grew exponentially plus hubby had stopped work to look after me and son -who’s autistic and a few other things but lost his dla and I don’t think he’d get it again with newer rules ) and he’s already paying £28 a month to an already sorted ccj all Lloyd’s/tsb

£1k energy areas and £50 rent arrears they’re both being paid off with overpayments – energy is mine rent is both

Sara (Debt Camel) says

I think that sounds a very difficult situation for you. The amounts of money aren’t enormous, but they can still look impossible to pay in a reasonable length of time.

I think you should both talk to National Debtline on 0808 808 4000 about your options. It may be that a Debt Relief Order would be a good option for your husband.

And if your son’s DLA ended at 16, it may be he would qualify for PIP – your local Citizens Advice can help with this.

James says

Hi Sara,

As a general rule is it fair to assume that if a debt collecting agency sends a CCJ claim form for a debt that the debt is enforceable?

Eventually the debt agency agreed to accept my offered monthly payments some years ago based on the industry I work as mentioned I would need a Tomlin order

I’m just wondering as I’m about to ask for all CCA records for all accounts and would be interesting based on the question above and if they did have the original agreement.

Thanks

Sara (Debt Camel) says

As a general rule is it fair to assume that if a debt collecting agency sends a CCJ claim form for a debt that the debt is enforceable?

no! It may be statute barred. The creditor may be unable to produce a CCA agreement (if that is relevant). There may be other reasons to challenge the debt as well.

The fact a creditor was threatening a CCJ means they were trying to push you into paying. Not that they would win a claim if you defended one. Of course the debt may have been enforceable, but you should not assume it is.

So if they never started the claim but you made a payment arrangement, then why not ask for a CCA? Assuming a CCA agreement is relvant for that debt?

Emmanuel says

I have just put in an application to set aside a default judgment order.My reasons are am still engaged with the creditor and was out looking for advice at the citizens advice and become ill at some point,so did not get the chance to put in a defense response on receipt of claim form.It appears that is a debt company who is the Claimant.And has been writing to me several letters before claiming that it owes the debt I owe from my creditor. I had always ignored their letters,main reason being I have got any aggrement with them..And also not taken out a credit card from them… What should I do now.I have also not received any validation letter from the debt company.

Sara (Debt Camel) says

I suggest you talk to National Debtline about your set aside application. You can phone them on 0808 808 4000,

Emmanuel says

Had to do the application on chatting to the national Debt line first.

My concerns now are about the debt company who claims to the Claimant saying that I owe them xx amount monies when I have not taken out any credit card or done any monetary business with.Is a prove letter good to ask at this stage?if yes what about CCA aggrement?

Sara (Debt Camel) says

who got the CCJ – the original lender or the debt collector?

Emmanuel says

Default Judgment for debt collector

Sara (Debt Camel) says

and on what grounds have you applied for a set aside?

You cannot ask for the CCA agreement when there is a CCJ in place. And a prove it letter will not be likely to get you anywhere either.

Emmanuel says

The grounds are just clear fact I am still engaged with the lender who is to the main creditor.Also on receipt of the claim form I never had to the chance to put in a defence response,mainly because I went out to CAB near me to seek advice,but appointment was delayed in a queue session and also feel ill same time looking for appointment but appointment did not come on time . appointment was too late that Default judgment letter then arrived.

Sara (Debt Camel) says

I think you need to talk to National Debtline about that.

Emmanuel says

Ok,I will speak to the national Debt line

sean says

Hi Sara

I am defending a CCJ credit card debt (disputing the amount of interest added by the DCA) so my income expenditure sheet is being sent to the court.

I have a large amount of other defaulted credit card debt none of which is at the LBA stage yet and intend to enter a DMP in the near future.

But I’m wondering what I should be putting down as repayments on these debts when I haven’t actually started repaying any of them yet?

Sara (Debt Camel) says

Why not just talk to StepChange now – what are you waiting for? The longer you delay, the more likely you are to have court costs added.

Also consider affordability complaints, see https://debtcamel.co.uk/refunds-catalogue-credit-card/. They may be able to speed up a DMP.