On 10 May 2021, Provident Financial Group (PFG) announced that it was closing its home credit operation, also known as doorstep lending. Doorstep lending has been at the heart of Provident's business for most of its 140-year history. Agents would visit customers at home, giving loans and collecting weekly repayments. Now Provident says: In light of the changing industry and regulatory … [Read more...]

How does a payment arrangement work & is one right for you?

A typical payment arrangement is an agreement to repay a credit card, catalogue or loan in affordable monthly amounts. This is also called an arrangement to pay. You can ask a lender for an arrangement to pay, or a debt collector. The key points are: an arrangement is needed if you can't afford the normal debt repayments; do not offer more than you can afford; ask the lender or … [Read more...]

Provident’s Scheme to cut refunds – background & voting

UPDATE This article gives the background to the Provident Scheme to massively reduce the refunds it is paying, the scheme proposal and the voting arrangements. On 4 August 2021 the Scheme was approved in court. See Provident Scheme – claim a refund for details of the scheme claims and payouts. In March 2021 Provident Financial Group (PFG) proposed a Scheme of Arrangement to reduce the … [Read more...]

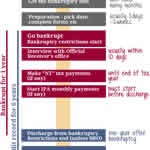

Bankruptcy timeline – what happens & when?

This bankruptcy timeline shows WHAT is likely to happen and WHEN if you go bankrupt in England, Wales or Northern Ireland. Some of the times are fixed - the bankruptcy marker is definitely going to drop off your credit file after six years. Others are less definite, but the indications in the timeline here should be right for a large majority of the people who go bankrupt. Take the decision … [Read more...]

No set off in a Scheme/Administration when debt had been sold?

In 2021, the Instant Cash Loans (ICL) Scheme Arrangement, Money Shop, Payday UK and Payday Express customers whose debts were sold to PRAC Financial (PRAC) have not been given set-off between their ICL redress and the loan they still owe. The same situation could occur with other Schemes of Arrangement and other debt collectors. In 2022, it seems to have happened to some Provident loans that … [Read more...]

Barclaycard – more big cuts to credit limits in 2021

In April 2021, Barclaycard is cutting a lot of customers' credit limits. Some of the reductions are dramatic. Here is what one Debt Camel reader said: Today I received a letter from Barclaycard informing me my credit limit is being reduced from £5,000 to £250 in 1 months time. My balance is zero and has been for several months. Not very happy about this as it’s there for emergencies etc and … [Read more...]

Doorstep lending – a template letter to ask for a refund

UPDATE: The Morses Scheme has failed. See Morses - what is happening to loans and refunds UPDATE: in March 2022, Loans At Home went into administration. There is no money to pay any refunds. Any remaining loans have been written off and you should not make any payments to them. UPDATE: The Provident Scheme has now closed and it is too late to make any Provident complaints.Doorstep lending - … [Read more...]

How much will my credit score change if … ?

How much will my credit rating go up or down? That is a very common question. But it's often tricky to answer! This article has some guideline numbers from Experian that may help. These are only indications - your credit score may not go up or down by this much. They assume nothing else has changed on your record. They also apply to single issues. If you have two defaults already, getting … [Read more...]

Will my bankruptcy application be refused?

"Can I go bankrupt?" is a very common question. People worry that their bankruptcy application will be rejected because their debts aren't large enough. Or the Official Receiver will say they should repay the money they owe. Or that they don't meet the legal criteria. Or they have just borrowed some money. But less than 1% of bankruptcy applications are rejected by the Insolvency Service, … [Read more...]

Amigo’s 1st Scheme – key points to think about

This article relates to Amigo’s first Scheme, which was rejected in May 2021. See Amigo's second Scheme for the latest news. On 25 January 2021 Amigo announced that it is proceeding with the next stage of its proposed Scheme of Arrangement and published the formal Practice Statement Letter (PSL) that describes the Scheme for the customers affected. I have updated this article with some … [Read more...]

No calls or letters about a debt for years?

If its been several years since you stopped paying a debt and you haven't had any phone calls or letters for a long while, you may be hoping your debt has "got lost". Perhaps the debt collector has forgotten about it... Mr H has a typical situation: I stopped paying a loan at the start of 2016 when I lost my job. I have a Default on my credit file for June 2017. The bank sold it to a debt … [Read more...]

Payday lenders – email addresses for complaints

If you want to get a refund for "unaffordable" payday loans, the first step is to complain to the lender. Often it's simple as the lender has a Complaints section on their website, but some have been taken over or the website isn't there anymore, so here is a list of their email addresses. For all these emails put AFFORDABILITY COMPLAINT as the subject of the email. If you haven't already … [Read more...]

Amigo first Scheme – my estimated numbers don’t look good

This article relates to Amigo’s first Scheme, which was rejected in May 2021. See Amigo’s second Scheme for articles on the second Scheme. When Amigo announced it was seeking a Scheme of Arrangement on 21 December 2020, I said there were very few details and asked some questions. On 25 January more information about the Scheme was given. But there weren't any of the useful numbers I … [Read more...]

Amigo seeks refuge from refunds in a Scheme (December 2020)

UPDATES In May 2021 the court rejected the Amigo Scheme accepting the arguments of the FCA that it was not the fairest that could be proposed to customers. See Court rejects Amigo Scheme of Arrangement for details. In December 2021 Amigo published the proposals for its Second Scheme. See Amigo's new Scheme for the latest news. Amigo announced on 21 December 2020 that it is seeking … [Read more...]

I’m in a DMP – can I get a mortgage?

A reader asked about applying for a mortgage when she is in a Debt Management Plan (DMP): "I have been in a DMP for 8 years and still have 6 to go as I still owe £16,000. With hindsight, I should have gone bankrupt! My parents will give us a 20% deposit in 2021, but they don't know about my debts so I can't use their money to end the DMP. Will I be able to get a mortgage?" This case highlights … [Read more...]

- « Previous Page

- 1

- …

- 6

- 7

- 8

- 9

- 10

- …

- 14

- Next Page »