UPDATE

in April 2021, Barclaycard has made another set of cuts to customers’ credit limits.

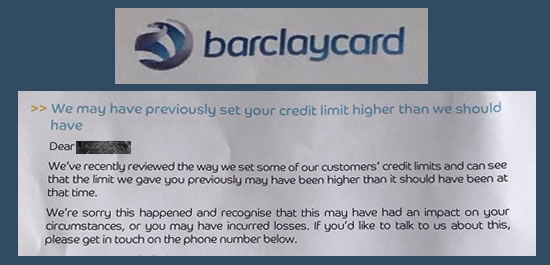

In July 2020 Barclaycard sent out letters to some customers saying their credit limit may have been set too high.

They say:

We’ve recently reviewed the way we set some of our customers’ credit limits and can see that the limit we gave you previously may have been higher than it should have been at that time.

We are sorry this happened and recognise that this may have had an impact on your circumstances, or you may have incurred losses.

Some people aren’t being offered a refund, many are being offered £75. But if you go back and explain why the high limit caused you problems you may be able to get more.

MoneySavingExpert has been told that Barclaycard is paying out an average refund of £230 to customers for these errors. If that is the average, some people will get a lot more!

How much is “too high”?

You may have been pleased when Barclaycard increased your credit limit. But a large limit isn’t good if you then struggle to make the minimum payments.

And only paying the minimum amounts traps you in credit card debt for a long while.

If you have had letters before from Barclaycard warning about “persistent credit card debt“, that is another sign your balance may be too high.

The Financial Conduct Authority (FCA) who regulates banks and credit cards, says that a lender should check a higher credit limit is “affordable” before they increase it.

By affordable, they mean that you could afford the repayments without having to borrow more money or get behind with bills. And also that you will be able to afford to pay more than the minimum sometimes so you aren’t trapped in debt.

Should you phone them?

Barclaycard suggests you phone them on 0333 202 7490 if you would like to talk to them about this. That number is genuine, this isn’t any sort of scam.

If you are happy with your card and don’t feel that making the minimum payments has been difficult, you don’t have to do this.

But if paying your Barclaycard has become very hard as the limit is too high and the balance never seems to drop, you can call them and ask them to help you.

Think what to say & what to ask for

It’s good to start by saying that you have had this letter and you agree the credit limit was too high for you.

It can help to say what has actually happened to you. Here are some typical problems other people have had:

“Paying the credit card bill sometimes leaves me so short of money I have to put my food shopping on a credit card.”

“I didn’t want to miss a Barclaycard payment so sometimes I haven’t been able to pay my council tax.”

“I keep worrying every month about how I can juggle money to make the Barclaycard payment.”

“My debt never seems to go down and I can’t afford to pay more.”

You can also say that Barclaycard should have known you would have difficulty:

“If you had looked at my credit record you would have seen I had a lot of other debt and this was increasing”

“My credit record would have shown missed payments and defaults to other debts”

“I had only been paying the minimums for ages before you increased my limit – that should have warned you I wouldn’t be able to manage a higher limit.”

“I don’t know why you increased my limit when you could see there was a lot of gambling on my card.”

You can then ask them to put right the problem they have caused. For example;

- give you a refund of the interest you have been charged after they increased the limit.

- agree to freeze interest so your payments start clearing the debt much faster, but say this shouldn’t show as a payment arrangement on your credit record as it is Barclaycard’s fault the balance is too high.

“My lender hasn’t written to me”

You don’t have to wait until the credit card admits they got your limit wrong – you can send an affordability complaint in yourself.

Read How to complain a credit card limit was too high. That has a template letter you can use – it’s easy so you don’t need to use a claims company.

You can use the same approach to argue a catalogue, store card or overdraft limit was increased to it was unaffordable,

Comments on this article are now closed.

Please leave a comment on the more recent article:

Barclaycard – more big cuts to credit limits in 2021

Mary says

I am trying to pay down my credit cards of £12k I have 3 one has a £600 balance. I have £850 in my santander account covering my over draft- should I take this and pay off the credit card?

Barclays who I owe £8k wrote to me and said under new rules they set my limit too high but will not reduce it at the moment. I am worried -should I be though? Will I get any refund from them and if I ask will they close my account down or any other negative impact? Thanks

Sara (Debt Camel) says

So what Barclays wrote is

“We may have previously set your credit limits higher then we should”

and they went on to say:

“We are sorry this has happened and recognise that this may have had an impact on your circumstances or you may have incurred losses. If you’d like to talk to us about this, please get in touch on the phone number below.”

If you read https://debtcamel.co.uk/refunds-catalogue-credit-card/ that looks at how people can complain if they think a lender raised their credit card limit to a level that was “unaffordable” for them.

With this letter, Barclaycard seems to saying that this is what it did to you. Do you remember when they last increased your credit limit? At that point were you only making minimum payments and have you bee struggling since with other debts accumulating partly because of the problems of paying the Barclaycard debit?

Mary says

Hi Sara,

Thank you for the reply I just found it. I have been trying to pay off my credit cards since 2018. I have taken out a loan in August 2018 and put it half on the card and rest on other debts to pay less interest ect-also opened other cards recently to do balance transfer but due to a lot of bad luck and financing two funerals (last one my sisters July 19 ) I am back to square one. I can not remember with all that’s been going on when I had the increases as it’s been a rough 2 years and the card is 20 years old. I have no clue about increases but have often paid minimum especially in the last 12 months. As I do not have a clear picture of repayments-increases etc do you recommend I ask for statements as can only see the last 12 months and 5 of them have been in lockdown before I discuss it with them. In short I am struggling- my other sister recently gave me £600 to give to the cards but with 11k owing still struggling but a little less of course.

Sara (Debt Camel) says

That sounds a difficult situation. Can i ask if you are renting or do you own a house? Do you havea complete list of your debts – the loans as well as credit cards?

Mary says

The loan is now 3400

Barclays 7500

credit card 2 is 2900

One more 1000

Very-500

I am renting-was about to buy in 2018 when these were all half paid off.

Sara (Debt Camel) says

I think you should talk to a debt adviser about your options. I suggest you phone National Debtline on 0808 808 4000

Jane says

my wife has a credit card with Barclaycard and never received any correspondence. I was convinced it set to high,so raised a complaint which they denied liability. i appealed the the Financial Ombudsman and the claim was successful.

all the best

Paul says

I’ve received an interesting letter from Barclaycard out of the blue this week in which they state:

“We’ve recently reviewed the way we set some of our customers credit limits and can see that the limit we gave you previously may have been higher than it should have been at that time”

“We’re sorry this happened and recognise that this may have had an impact on your circumstances, or you may have incurred losses. If you’d like to talk to us about this, please get in touch on the phone number below”

They go on to say they’ve reviewed my current limit and feel that it is still right for me at this time.

To me, that says they’ve already admitted wrong doing so in my mind, if I complained, I can’t see any other outcome than a positive one for me.

My question is, would you ring them to talk about this or would it be better to submit something in their online portal instead? I’ve also received a text message asking me to give them a call about it.

Sara (Debt Camel) says

I suggest you phone them BUT FIRST think what you want to say…

– do you agree the limit was raised to a level that was unaffordable?

– should Barclaycard have known you would find this difficult as you had only been making the minimum payments beforehand? If they had looked at your credit record would have seen you had a lot of other debt?

– have you since then been struggling because of the higher minimum payments? Have you got more debt? Behind with any important bills?

Things you can ask for…

1) you can ask for a refund of the interest you have been charged after they increased the limit.

2) you can ask them to agree to freeze interest so your payments start clearing the debt much faster, but ask for this to not show as a payment arrangement on your credit record as it is Barclaycard’s fault the balance is so high.

Fred says

I had this same letter. So I made a complaint which they rejected. They sort of ignored all the points I made. After making a bit of a fuss they refunded me £400 as a gesture of goodwill.

I took it the offer. I perhaps should have take it further

Brian says

Hi. My 12k Barclaycard limit is now with a 3rd party and reducing interest free at 70bpermonth. Currently 9k. Would I still be eligible to make an affordability case. I have had the limitcsteadily increased several years ago and it has been add that high level unused for about 4 years just reducing interest free. I was heavily commited elsewhere.

Sara (Debt Camel) says

I think that’s worth a complaint, ending up defaulting so the debt was sold is a clue it ended up being unaffordable! See https://debtcamel.co.uk/refunds-catalogue-credit-card/

James says

Curious about this. My wife didn’t work, she was caring for her elderly grandmother and getting £250 approx per month in benefits and suffering depression. Barclaycard (an initial account) increased her limit to £13,000 over several years and she got into difficulties, her depression didn’t allow her to open up to me until it was too late . The debt was eventually passed to collection and still being paid interest free today at almost £200 per month, she still owes approx £6000.

So no letter from them as the debt is moved on but any chance of them or FCA hearing a case do you think? A credit limit of £13k for someone with an income of £2500 benefits never seemed right to me.

Sara (Debt Camel) says

I think that is well worth a complaint. Use the link above and send it to the Financial Ombudsman if Barclaycard say No.

James says

Thanks Sara, I tried Barclaycard back in 2017, they said not their fault. Excerpt of my letter:

“In January 2013 you have increased what was a manageable limit of £2500 to £4900, then

again to £7900 in September 2013, again to £11,100 in May 2014 and then to £12000

where is currently stands.

You should never have increased my credit limit in 2013. At that time I was not working

after giving up my job to act as carer for my elderly Grandmother getting a government

income of just over £200 per month.

With the exception of a lump sum payment of £6940 from other borrowings of in early

2015 I have only made minimum payments on this credit card for a long number of years,

and within 10 months of making the £6940 payment I was back at my limit.

These signs of always being at my limit and making minimum payments should have

shown you that I could not repay my balance within a reasonable length of time, so you

should not have let me borrow more which you done by taking my credit limit from £2500

to £12000 in 24 months without once checking if my income could support this.

I then went to FCA, they found in favour of Barclaycard. I just looked out my original correspondence with them. Barclaycard refunded £50 for not responding to my letters in 8 weeks and a £12 late payment fee and FCA said this was fair and my wife chose to utilise the credit at her disposal. She made minimum payments always and there was no indication the limit was too high.

Sara (Debt Camel) says

I presume you went to the Financial Ombudsman (FOS) not the FCA.

I am sorry you lost that complaint, it may be that the same complaint now would be won, very annoying for you. But now I think they will reject because your complaint has already been dealt with.

James says

Hi Sara, just providing an update, we tried again to Barclaycard after their admission of setting limits too high, after the usual weeks of back and forth we received a letter from them 2 weeks ago.

“I have carefully taken your concerns into consideration and fully reviewed your account again. Unfortunately, as we have already reviewed this matter under a previous complain in 2017 our decision remains the same.

As the decision remains the same we have no further comments to make on your credit limit increases

I’m sorry to hear about the difficult time you must have face, I can only imagine how hard it has been for you.”

I guess it was worth trying, but honestly like you, I didn’t expect anything else from Barclaycard, and I doubt the CS Associate who responded can ever actually imagine how difficult it has been for my wife. I doubt it’s worth trying FOS again, anyway, we’ll keep paying it away to the PRA Group we have just under £5000 of the debt remaining.

Sara (Debt Camel) says

Do you know when the account was originally opened?

James says

Hi Sara, yes it was opened in January 2001 with a limit of £1000 through to £2500 until January 2013 then all the increases as stated above.

Sara (Debt Camel) says

In that case I suggest you read https://debtcamel.co.uk/ask-cca-agreement-for-debt/ and see if the debt collector can produce the CCA agreement.

Robert Garrett says

I’ve been trying to get BarclayCard to increase my Platinum limit for years, as it is the lowest limit card I have but the easiest to pay down. Barclays doesn’t want to raise limits on their cards either, even for those of us that can aford paying off monthly.

Susie says

Can you complain if you have not had an increase? I opened my card at 6k and that’s how it has stayed after I consolidated my debt. I was late with a payment and although it didn’t effect my credit score the card went from 0% to a high rate of interest. I have never had increases but I’m persistently in debt. Could I ask for a interest freeze?

Sara (Debt Camel) says

You can complain that the original limit was too high. See https://debtcamel.co.uk/refunds-catalogue-credit-card/. These complaints tend to be harder to win than complaints saying your limit was raised too high when you were already only making minimum payments, but if you know the amount was unmanageable, for you, it’s worth a try.

Nathan Hewer- says

once you have sent back the letter with the £75 goodwill refund?- say posted back in prepaid envelope on the Monday morning. Could it be processed that same week e.g 3/5working days?

Sara (Debt Camel) says

Your letter contained a goodwill offer of £75?

I think before you accept it you should Read the article above and think if you should also ask for more help, eg for interest to be frozen.

Gary says

Yer Halifax kept increasing my credit card s was paying bills an doing an so on didn’t realise how much till I sat back an looked how much it was costing 1 card went to 16ooo outher 10000 was disabled my income was around 1200 a month so at this time in dept for 26ooo then things changed for me the kids grow up left home I was down around 500 a month I got a loan at Halifax to pay cards of was advised to cut cards up 4 months down line sent new cards with same limits guess wot wife stared a speand daughter getting married and I in it up to my neck again

Sara (Debt Camel) says

how long ago was this loan?

How large is remaining loan? How much do you now owe on the cards?

Are these your only debts or do you have others? Are you buying or renting?

TRI says

Hi Sara I sent lending stream an affordability complaint on the 16th June regards 4 outstanding loans and 8 previous loans. A month later I received a subjext access request. Today I have recieved breach letters for all 4 outstanding loans threatening further action if not paid by the 21st of aug (totaling 1500).

Should I be worried about the lack of a final response and receiving these letters instead or go ahead wait the full 8 week the approach the FOS?

On a side note still awaiting final responses from Mrlender/Mymoneypartner/loans2go

Thanks in advance for any help/feedback.

Matt G says

Had a Barclaycard account a few years back. The limit went from £1500 to 14k in 23 month without asking. Mostly minimum payments. Never cleared the

balance. 95% gambling transactions. Never once asked my income or outgoings…

Barclaycard upheld my complaint in May so sent it to the FOS but it’s in a massive backlog at the minute.

Sara (Debt Camel) says

Those were enormous credit limit increases!

Barclaycard upheld my complaint

I assume you mean rejected it? Quite right to ask the Ombudsman to look at that case. In your case the argument is mainly to do with the amount of gambling – and possibly whether your credit record would have shown other debts increasing.

People with a lot smaller numbers may have a good chance of winning a complaint if they always made minimum payments.

Matt G says

Sorry, yes Barclaycard rejected it

Thanks to your article I feel a lot more confident about this complaint

Many thanks

Justin says

Hi Sara

I have recieved one re a closed a/c way back in 2014 and can see they put my limit up (or allowed me to do so) from £1,500 to £2,500 a month after first using the card, and then to £3,000 just some four months later (from a old saved PDF copy of my credit file from 2018). From memory I don’t think this was specific balance transfer card. I have rejected their first contact standard £70 distress and inconvenience payment having spoken to them on the phone so will pursue as necessary.

My question is that since then I have a newer and still current card and was given a far higher limit of £5,500 later in 2014 from the outset but same earnings as before, Is it worth pursuing this as a matter with them as well? As if they are willingly questioning the limit of £3000 given on the prior account then won’t they be doing the same for a higher limit on a further acocunt or is it to do with the fact that limits were increased without proportionate affordability checks on original account? This was a specific balance transfer card with a very low or 0% rate for some 12 or 18 months, so I guess they might use this as a defence for this challenge? Secondly is the whole point of balance transfer cards mean that you are borrowing more in theory to pay off debts as there is no mandatory rule here that the old credit card account you have transferred from must be closed (does this not fit in with borrowing more to make things affordable?).

Sara (Debt Camel) says

I have a newer and still current card and was given a far higher limit of £5,500 later in 2014 from the outset but same earnings as before, Is it worth pursuing this as a matter with them as well?

I think so, yes.

Secondly is the whole point of balance transfer cards mean that you are borrowing more in theory to pay off debts as there is no mandatory rule here that the old credit card account you have transferred from must be closed (does this not fit in with borrowing more to make things affordable?).

I’m not sure what point you are trying to make here? I suggest keeping a complaint simple.

Mairead says

Just wondering if anyone’s had a resolution on this so far? Have received a letter myself and any refunded interest/freeze of future interest would be so helpful, I’ve been struggling at my limit for ages and received a persistent debt letter on it. Would be helpful to understand what others have experienced! Thanks

Sara (Debt Camel) says

These letters are all pretty recent so it may take a whole for people to get results from going back and asking for help.

But don’t delay talking to Barclaycard about this. You know the key points to make – you are a pensioner, have been struggling to pay more than the minimum as the amount is so high, you have been worried by the “persistent debt” letters, and you would like them to help.

Gemma says

Hi. I’ve just received this letter, phoned the number on the letter, after making sure it wasn’t a scam, writhing 2 minutes I was offered £50 but has to be paid into my bank account so he needed all my bank account details! Soon put the phone down!!

Justin Sandy says

Barclaycard generally will offer to pay straight into a bank, they do make these offers over the phone. As long as the letter is received by post this is genuine. The letter should have been from the Customer Portfolio Team at Barclays/Barclaycard.

Katy O says

I made an affordability complaint with Barclaycard at the end of last year. They sent me a response (apparently – I never received it) essentially saying get lost we didn’t do anything wrong. They have now sent a letter as above. They have offered £75 by way of apology but claim that because the issue was “resolved” it isn’t a problem. Pointed out the difference between what they were saying last year and what they are saying now and are having to go through the complaints procedure again. looking forward to hearing positive stories on people being able to get this resolved!!

Angela says

Hi Katy, same problem here, over the years they increased my limit to £14,600 without my permission. Received the letter from them and i am in persistent debt. They wrote to me saying i would here from them within 2 weeks,,,,which i didnt, raised a further second complaint 3 months later and told the first complaint was resolved as they sent me a letter (which i never received!) offering £70 apology! Unacceptable, i will dispute this and fight for my rights, these companies rely on lower and working class to access the money they offer then they increase the interest (APR) along with the credit limit because they know you will use it, absolute day light robbery! Yes we spent it, yes they prayed on us, now we are struggling to pay the interest alone because they are taking more in interest than the actual payment.

Jimmy James says

Hi,

I have two Barclaycards, I have a £12k and £11k Limits, (I have two as Barclaycard brought Morgan Stanley cards years ago..)

I have just had two letters this morning saying my credit limit has reduced £7200 and £7300. I owe about 4500 and 5200 on them.

I also have two Amex’s cards, they did the same and they were so strode and basically gave me £200 left on my cards, – I had 12000k limits and £5200 on them – Yes I did have balance’s, this was last month. I did call Amex and they said they would keep the limits if I could pay them all off – daft, I even said to the guy – really mate – Could you do that? he went away and spoke to his manager and they said sorry, nothing we can do..

I have always paid my bills instantly when it comes through the postbox, and my credit score is 521 on Experian, We do have a lot of debt I earn well but have some historical debts due to house improvements and etc.

I guess data and these companies can check you out electronically? as I can check on myself with the credit agencies…

My question is that in a nut shell they are reducing there risk even though I pay well over the minimum payments per month?

Is this a new thing that card companies are reducing risk as they are at risk them selves? and spy on you as you have other accounts? and they can check your credit record with out you even knowing…

In a year or two the debs will go down for sure.

Any advise or comments?

Sara (Debt Camel) says

Do you care if they have reduced your credit limits? It sounds as though you have a lot of debt already.

Is this a new thing that card companies are reducing risk as they are at risk themselves?

Lenders always could do this but it was uncommon. I think Covid-19 has meant lenders want to reduce their risk in some areas.

and spy on you as you have other accounts? and they can check your credit record without you even knowing…

You give a lender the right to check your credit record when you apply for credit.

Jimmy James says

Ok, thanks for your response all noted.

David says

I have two Barclaycard accounts. One had a credit limit of £3000 and the other £2500. I have made several Balance Transfers from these accounts that have always been settled properly. In 3/20, I made £2000 of Balance Transfers from the second account whilst I used the other for minor purchases. I set a minimum payment of £50 for the BT account, an amount above the minimum payment. I always paid the other balance in full when due. My strategy with the BT account was to pay off the remaining balance when the “interest free” period ended.

In July, my BT account credit limit as reduced from £2500 to £1950 without notice. Also in July , the other account credit limit was reduced from £3000 to £300 without notice. As these two credit limit reductions were made without prior notification to two perfectly managed accounts, I regard Barclaycard to be acting as irresponsible card issuers and lenders.

I would welcome comments on my view on Barclays behaviour, especially with regard to the structure of potential complaints to the regulator.

Thank you for your interest in this matter.

Sara (Debt Camel) says

So Barclaycard was reducing the amount of unused credit you had at the time?

David says

Good Morning,

Yes, that is the case. I have managed all my financial affairs with Barclays, and others, impeccably. When I use a Balance Transfer arrangement, I set the Direct Debit to be more than the minimum payment. Then I would not use the account for general purchases. As the interest free period is due to end, I would wind down the outstanding balance to avoid interest charges.

Whilst Barclays may make business decisions that we do not like, we should be informed before these decisions take effect. That is the basis of my position.

Sara (Debt Camel) says

OK, can you explain how you think you have been disadvantaged by thus decision? Had you built A definite plan around this credit being available? Had you turned down other credit because you had this, which has now been withdrawn? Would you have done something differentLy if you had known they were going to do this!

I am looking for possible arguments you could make.

David says

Hello Again,

My complaint is about the lack of notice, rather than the reductions themselves. However, I do find a reduction of 90% from £3000 to £300 as particularly insulting.

I have various other credit cards that I can use as required. As I explained in my earlier email(s), I wind down Balance Transfer(s) as the interest free period(s) come to an end.

I have reviewed my repayment history of the Barclaycards with them. Barclays acknowledge that my repayment pattern has been impeccable. I have an outstanding query asking about my actual versus theoretical repayments since the inception of the accounts in 6/13 and 2/14. I have examined my Karma credit report this morning to verify those dates. Interestingly, Barclaycard have reported the old credit limits to Karma, which under the circumstances I consider to be misrepresentation.

Overall, my case seems the opposite of others that I read on your blog. Whilst I can understand limiting potential loss in dubious circumstances, why risk offending a customer with perfect behaviour?

What are your thoughts?

Sara (Debt Camel) says

My thoughts are that I completely understand why you are peeved/insulted but I doubt you have a reason to complain unless you can evidence that you had made immediate plans around this being available. A lender is entitled to withdraw an offer of credit.

It seems likely that Barclaycard are just generally cutting back on their exposure in this area. If you only use them for 0% deals, they make no money from you. Agreed the risk looks very low going by your history, but they may decide they want to reduce it further by decreasing the limits.

I suggest you close the £300 limit card. It won’t do your credit score any good at all with such a low limit.

Barclaycard probably only update the credit reference agencies once a month.

Overall it is sensible to assume that 0% deals are going to get much harder to get, especially in size. I suggest you should set about overpaying them by more as you cannot rely on being able to refinance them in future.

David says

Thank you for your thoughts. I shall act accordingly.

viva says

an affordability complaint if it is happen on 2010 if it is possible to complain, now I am lost so much money , one credit card to other credit cards

paid , balance transfer to another credit cards , then all credit cards are full . all game is end. then arrange DAP.

If this sitivation can I go to complain if possible, still credit companys demand money. I paid part settlement by family and friends supports.

Sara (Debt Camel) says

Hi viva,

2010 is a long while ago. You seem to have a lot of debt problems including your mortgage. I think you should talk to a debt adviser about your options.

Jason says

Also received a letter from Barlaycard this morning. I have 3 cards with them. A Hilton Honors card with a £9000 limit which is my everyday spending card and collecting Hilton points. Typically paid in full or running at no more than £1200. My second card is a Platinum Visa with a limit of £6500 and a balance of zero, the third is also a Platinum Visa with a limit of £5000. Neither the second nor third cards have been used for over 2 years.

My letter was on the 3rd account with £5000 limit, they have dropped that to £2000 stating “We regularly review the credit limits we offer customer to make sure they only have the limit that they use. This means we can support all our customers in these uncertain times” It goes on to say “We’ve based your new limit on how much you’ve been using your card and we’ve set it at an amount higher than any balance you’ve had in the last year. This means you should still be able to keep using your card in the same way”

It doesn’t bother me as I don’t use it, I’ll expect a similar letter for the second card, and possibly even my main card which I use every week. I see this as perfectly fair from companies offering credit, situations do change over time, and in the current times I’m sure they’re trying to minimise risk and looking at my cards I have probably way too much available credit close to £20,000 in the current climate regardless of salary and job security.

Jason says

Update from my September posting. Got a second letter 16th January from Barclaycard for the other account with the £6500 limit and zero balance. They reduced the limit from £6500 to £250

Called them up today and just told them to close the account, at which point the adviser asked if I wanted to appeal the decision, I just said No, it’s fine just close the account t. As I admittedly said above, I probably had too much credit with Barclaycard, but now £11k versus £20k

Sara (Debt Camel) says

closing that account is good – a £250 limit is pointless and doesnt help your credit score.

Jason says

Next update from Barclaycard, after they reduced my £6500 ( with zero balance ) to £250 I simply closed the account, the other account that went from £5000 to £2000 is still there with zero balance

Next up they’re now onto my Hilton Honors card, letter last week to decrease the £9000 limit to £7600, this one has about £900 on it just now

So Sept 2020 £20K available -> Feb 2021 £9.6k available.

Ray Smith says

Hi All, I have also received a letter, had a credit card with BC between 2011-2017, over this time I also had quite a serious gambling addiction and accumulated large payday load debts this led to minimum payments only over the majority of the BC term. The main question is this outwith the terms or should I still speak to Barclaycard as per the letter

Sara (Debt Camel) says

did BC increase your credit limit during this period?

Ray Smith says

From memory, I think they did however my credit report only goes back till 2014 so I can’t check for definate and the no longer have the account.

Sara (Debt Camel) says

would your BC card have shown a lot of gambling transactions?

Waa Barclays your current account?

Do you think anyone looking at your credit report would have seen that you were accumulating a lot more debt over this period?

Ray smith says

Hi Sara, apologies as I was trying to get a more detailed credit account which show my balance was increased from on 09/2015 in the middle of credit card transactions when I was adding to gambling account via through barclaycard. I have also looked at credit report and for one lender (wonga) it showed I had approximately 20-25 loans each year for 2014,2015 and 2016 each totalling about 5k a year, 15k in total

Sara (Debt Camel) says

OK so that sounds like a good argument that they should have seen you were in difficulty and not increased your credit limit.

I suggest you phone them up and say this. Say you would like a refund of the interest you paid back to …. the problem here is what to say – would you think 2014 is fair?

If they reject this, you can out in a formal complaint, see https://debtcamel.co.uk/refunds-catalogue-credit-card/. But with one of these letters, it seems worth just phoning and explaining your situation first.

Jason Dela Cruz says

Hi Sara,

Setting this page up is very helpful, my situation is slightly different, I received the exact letter after i’ve paid off my cc (i got a loan!) it was a stressful time…i asked multiple times to cancel it but they refused, they kept saying that my interest will go down eventually so I stayed until i just gave up and paid it off 3 months ago and I literally just received the letter last Friday

Always been at 9k limit

What I can i do to get something back?

Sara (Debt Camel) says

ok, so your argument is

1) they gave you a credit limit that was much too high – which they seem to have agreed by sending you this letter

2) you asked them for help many times and they said there was nothing they could do

3) you think they should have offered to stpop charging interest untile you balance had dropped to a more manageable amount, – say 3k?

4) so you sould like them to refund all the interest charged to your account since the balance first went over 3k, and for this not to harm your credit record as this was Barclaycard’s fault in the first place.

I suggest you first try this by phone and then send in a formal written complaint if you don’t get a good response.

S says

I was put into great difficulty with my barclaycard as I was desperate, like others it was like they gave me a lifeline each time they increased my limit. I’m not good at all on the phone, a bag of nerves and forget everything I want to say! Is there a way I can contact them online/ email with my response to this letter please? Thanks

Sara (Debt Camel) says

Do you know how much they increased your credit limit and over how long a period? This doesn’t have to be exact, just a feel for it?

Do you still have the account open? Are you making the normal payments?

S says

Hi, they increased it over the years but the last limit increase was from £14000 to £18700 in 2016. We were only paying minimum payments, withdrawing cash from the card to get by, paid other debts with the card, and a few years previous (quite a few now so may not count!) I had complained that they had set my limit too high and I couldn’t afford to pay. They then agreed to an interest freeze for 6 months but then the account carried on with minimum payments, a few late payments. Also during this time, I had taken out other cards and consolidation loans which surely would have shown up on a credit score if they had done better checks? I ended up paying it off once my partner and I split and sold the house.(Mainly due to money issues!!)

Sara (Debt Camel) says

So if you had previously complained the limit was too high, then you have a strong case for saying they should not have increased it again.

After the 6 month interest freeze, did they check to see if you could go back to paying interest? Roughyly when was this?

When was the account closed?

Shaun says

Hello all,

I just received my letter yesterday. Unfortunately for me I had already submitted a claim to the FOS but they felt Barclaycard were not irresponsible – shocker.

I have been paying off my credit card via DMP with StepChange and have 18 more payments (£3,000 debt outstanding) left to make.

Is anyone in the same situation as me and have had any success complaining about this letter? Any little in compensation would be a great help. Appreciate any advice as unsure how to word my complaint.

DANIEL POWELL says

Hi,

Has anybody received payment yet? If so how long did it take for the refund to be paid into their accounts

Many Thanks

Dan

sam says

I am not sure if i have received a payment like this, a payment of £75 has appeared in my account from BBPLC creditfocus, i did have a barclaycard for £7500 that they admitted i shouldent of had, i had to go to stephange to help with it then barclays sold the debt, this was around a year and a half ago, is this related to this ? also does that mean barclays have scrapped the debt i owe?

Sara (Debt Camel) says

That does sound like it might have been one of the “we set your limit too high” payments.

i did have a barclaycard for £7500 that they admitted i shouldent of had

when did this happen? Can you say more about this?

Pete says

Hi,

I’ve been reading through these comments many have had similar problems. I’ve had a Barclaycard since 2012. The initial limit was £1000 and it was later upgraded to platinum increasing the to £3000.

They then upped the limit to £8000 before increasing it to £12.300. In all the time I have held that card, I have had a gambling problem. Thankfully this is now over. I always made the minimum payment before instantly borrowing the money back. I can’t get all the data just, however, the vast majority of transactions were gambling. At my worst, I have taken loans to clear the balance before maxing out the card again pretty much straight away. Around 18 months ago, Barclaycard classed me as in persistent debt. I’ve since managed to pay enough for that to no longer apply. My current balance is £10,250.

From the annual statements back to 2016, the following totals are shocking:

Total transactions: £59,475.97

Total payments: £65,886.88

Total interest: £11,702.37

Total fees: £1,650.94

Without seeing this forum first, I made a complaint a few days ago including by chance much of your suggested wording. Almost instantly they have credited my Barclays current account with £75 and have said they will write to me. What can I expect?

Given the figures above, do you think it’s too much to hope for them to close my account and call it quits? I’ve read other stories in other sections of the site that are encouraging in this respect.

Sara (Debt Camel) says

I don’t know what they are likely to say, I haven’t seen enough responses yet to have a good feel. Could You come back and say?

But if they don’t offer you a very substantial interest refund, you should put in a formal complaint and send it to the Ombudsman.

Pete says

I haven’t had a letter as promised just yet but I did phone them the other day. I was told my complaint had been escalated to another team. Weirdly, the £75 that appeared in my account seemed to do so way too quickly to be as a result of my initial email and the last I spoke to had no knowledge of it being connected to my complaint. I suspect I have contacted them at the precise moment they were about to contact me. Regardless, I’ll keep you posted. :)

Pete says

I’ve now received a full reply to the above complaint in a lengthy letter. They have bullet pointed a summary of my complaint (pretty much as above,) and have upheld it. They have offered £75 and a sincere apology.

However, they then go on to say that they don’t think they were irresponsible which contradicts them upholding my complaint.

The letter says if I’m not happy with the result I should contact the Financial Ombudsman. Is that the case, or should it be the Financial Conduct Authority?

Based on my original complaint Sara, and the upholding it, do you think I would have a good case?

Sara (Debt Camel) says

It is the Financial Ombudsman (FOS) not the FCA.

I said earlier

“If they don’t offer you a very substantial interest refund, you should put in a formal complaint and send it to the Ombudsman.”

and I still think that is correct. Anapolgy and £75 doesn’t seem good enough to me, but obviously it’s your decision.

Jacqueline says

Hi, I had the letter a whike ago saying they were reducing my limit from £11,700 to £11,300. I have heard nothing since and never been in touch with them myself, but today I have had a radam credit of £75.00 paid in to my personal account which I was not informed about from them, can I expect something else with my actual card its maxed out? Or do I neec to follow this up myself? Does anyone know

Sara (Debt Camel) says

Have you only been making minimum payments for quite a while?

Jacqueline says

Yes, also had covid payment break.

I am now paying the minimum payment but still tight.

Sara (Debt Camel) says

Right , so this looks like one of the small payments Barclaycard are making to Some people where they think they raised their credit limit too high – see the article above – but you haven’t had had a letter saying that.

You can Complain that they raised your limit too high, which is why you have Only been able to make minimum payments.. Say they did not properly check you could afford the higher limit. Ask for a refund of the interest you have paid. This is an “affordability complaint”.

This article looks at making an affordability complaint about credit limits: https://debtcamel.co.uk/refunds-catalogue-credit-card/.

Also read https://debtcamel.co.uk/credit-card-pay-more/ which looks at the problem of “persistent credit card debt” – you may have had letters from Barclaycard about this – if you have, this is something to mention in your complaint as it is more proof that you have been struggling for a while.

Matt says

My case against Barclaycard has finally been picked up by an adjudicator…

£1500-£15k credit limit increases in 18 months.

Always maxed out and littered with gambling transactions.

I will let you know what why this goes

David Barrett says

I have been told that I am due a substantial amount of refund from Barclaycard related to the letters mentioned above. The letter was dated late July, I received it early Sept. Barclaycard sold the debt to a DP 5 years ago and the letter has stated that they have credited the DP held account for the amount, this happened early Aug before I was aware of any of this. My question is if Barclaycard has sold the debt, received compensation for it, agreed that they have wronged me how can it be correct that they pay my compensation to a third party rather than to me direct?

Sara (Debt Camel) says

Have you been making payments to the debt collector?

David Barrett says

up until 5 months ago when COVID hit

Sara (Debt Camel) says

Ok, well Barclaycard are entitled to use the refund to reduce the outstanding balance – but you need to know what the refund was – if it was larger then the balance the rest should come to yoh. Barclaycard should tell you what they have done.

Ray Smith says

Hi with regards to my previous post, barclaycard got back to me and advised that my complaint wasn’t upheld. The reason being that I have never missed a payment (the vast majority minimum) and my card showed usage in spain so I must have had money to holiday. My credit report shows over 100 payday loans over this time and I was basically borrowing from Peter to pay Paul. My BC is also riddled with betting transactions. Can I request complete copies of my statements as my account is now closed

Sara (Debt Camel) says

You can send Barclaycard a Subject Access Request asking for details of what you spent etc

But I am not sure you need that in order to send in a formal complaint?

Celia Delphi says

£75 credited. Followed your advice. Credit double without requesting and of course used whilst payday loans and other credit cards were on the go. Although I paid above minimum I was revolving debt cycle for some time before I could get out. Thanks Sara

sarah says

Hi Sara

My grandmother has had a barclaycard for many years it use to be around 15k the put it down to 5k over a period of time. Shes 83 on the high rate disabilities cant leave the house i am her registered carer. Around 2 months ago while tidying her house i found loads of threatening letters from barclaycard due to many missed payments. She was so traumatized by this she was hiding it from me. For the last round 4 years shes only been paying the interest as she couldn’t afford to pay anymore off its still over the limit now and they have defaulted her account. could i put in a irresponsible lending for this ? nobody even looked into her account to see why shes fallen so behind they just kept adding interest over and over again, shes paid 1000s in the last 4 years on just interest. Is it worth trying to get the debt wiped off and compensation ??? thanks

Sara (Debt Camel) says

Has she been spending on the card or is it just over the limit because of The interest being added?

Do you mind saying what her disabilities are?

Is this her only problem debt?

Is she renting or does she own her house?

sarah says

Hi Sara

Nope not used the card in years, as shes 83 she has many shes got COPD, Glocuma in both eyes, diverticulitis her breathing is the worst she cant leave the house anymore. yes its her only debt at the moment, she rents her house.

Sara (Debt Camel) says

I think given her age, extensive health problems and the fact she has no assets, the best approach may simply be to as Barclaycard to write off the debt.

See https://debtcamel.co.uk/debt-options/less-common/write-off/ which looks at asking for a write off. You could write the letter for her and she could sign it? Things to mention include:

– you are helping her with the letter because of her sight problems

– her age and health problems. It will help if she could get a letter from her doctor listing her problems.

– that her only Income is benefits – list them

– that she is largely housebound, she doesn’t have any savings or a car and rents her house,

– that she has been ignoring the letters because she has been very worried about them and didn’t want to show you them.

– that she can only afford to pay a token £1 a month to the debt and that this will never change.

Say you cannot understand why a pensioner living on disability benefits was ever given such a high credit rating. Ask for her debts to be written off as there is no prospect of her ever repaying even 10% of the balance. Ask for her case to be considered by the vulnerability team and for all future communications to come from them as she has become increasingly upset by the threatening tone of the letters.

Good luck. If they say No, just arrange to set up a £1 a month standing order to them and ask for interest to be frozen.

sarah says

Thats great Sara

I will give this a go and update you. Fingers crossed. Thats all we want is for it to be written off.

I will keep you updated x

Tanya Bee says

I saw that some other people had had this text message and wondered if anyone had actually received the letter it talks about? I am assuming the message itself is genuine.

“We’ve sent you an important letter regarding a payment we would like to make to you in relation to your account. You’ll find further details in the letter. Should you have any questions, we’re here to help. We’ve provided a dedicated telephone number for you to reach us on in the letter. Your Barclaycard Team”

I received that message on the 17th of September and no letter has appeared yet. I’m wondering what is going to happen, my account is currently in default and they suspended repayments temporarily due to my circumstances. I am due to discuss resuming them in November I believe, but have had no contact from Barclaycard since last year other than this message.

Thanks in advance if anyone does have any insight into what might be going on, if anything.

Pete says

This will be genuine and it seems you’re further along in the process than I am. On 18th September, I received a similarly worded text saying that they had made a payment to my account and details would be explained in the letter they’ve sent me. They also mentioned a dedicated number which would appear in the letter. That text arrived 2 days after the payment of £75 was made into my account. The actual letter only arrived yesterday but weirdly was dated 26th August.

I suspect you’re at the stage where they are going to make you an offer of compensation of some sorts but if their communications with you are typical of other’s experiences then it’s possible that it’ll happen all out of sync. Try not to worry. This is genuine albeit very haphazard.

sarah clancy says

Hi Sara

Barclaycard have refused to write of my grandmothers card and said they have not acted irresponsible and still want her to pay the card off. Do you think i have a chance if i take this ti the ombusman ?

Thank you

Sarah

Sara (Debt Camel) says

did you supply any medical evidence? did the reply come from the vulnerable customer team (or something like that – the name may be different)?

sarah clancy says

No just a lady called [CH]. I sent in the letter to say i could speak on my Nan’s behalf they are saying they haven’t received that also so cant talk to me. They haven’t asked for a single thing from us just still keep sending horrible threatening letters.

Sara (Debt Camel) says

The letter you sent in asking to speak for your nan. Was it signed by your nan?

sarah clancy says

Yes it was signed by her.

It was sent as normal post from work i franked it. I wish i had scanned it now.

Sara (Debt Camel) says

OK, two options:

Can you phone Barclaycard up from your nan’s house? So she can get through security and give authorisation to talk to you?

If not, you need to get a new copy of this letter i am afraid. Then phone Barclaycard up and ask if you can email this in. Or if they want it posted, get them to tell you the correct address and who it should be marked for the attention of.

It is well worth persevering with this as it sounds as though no one from the vulnerablity team has even looked at the request.

sarah clancy says

Ok thank you Sara i will get straight on to this much appreciated.

Thank you

Sarah

Liam says

Hi Sara,

I’ve just received a letter stating my limit was too high, and they want to pay £75.

The card was put in to an insolvency and had a balance of 10k. It was sold to a debt collection agency now and Barclays consider the account closed.

At the time I had a gambling problem and held other loans and credit cards that were maxed out and was paying just the minimum payments on, in the end all the debt just collapsed and I ended up insolvent (but luckily this was the catalyst for treatment)

The Barclaycard was only used for 1 payment of 10k and taken out when all other credit card debts (first direct, 2x MBNA, vanquis, Aqua, capital one) were maxed and being met with minimum payments.

Is it worth asking for the interest back or should I just post back the letter and be glad if the £75?

Sara (Debt Camel) says

what sort of insolvency?

Liam says

It was a IVA through Payplan

I’m currently still in it, but maybe able to offer a full and final as I’ve been offered a job abroad (but currently with the covid situation it’s been delayed). I don’t know if that makes any difference but thought I’d let you know. :-)

Sara (Debt Camel) says

OK, so as you are still in the IVA, any refund may well be claimed by your IVA firm. I doubt they would care about £75, but it may simply not be worth trying to make a complaint and get more, only for it to not be paid to you.

Liam says

Yeah, That’s what I thought,

Would I have to give it them if they accepted my full and final? Would it be worth the complaint after?

Sara (Debt Camel) says

Some IVA firms still claim the money after a final settlement, I don’t know if Payplan will.

And I don’t have any feel for how straing your case against Barclaycard is, or how much you might get back.

And it’s possible any refund may not be paid at all but may be used by Barclaycard to offset the debt the debt that was owed to them.

Sorry a large amount of unknowns here.

William says

I also received an unexpected 300 GBP refund 2 months ago. I have filed an unaffordability complaint afterwards and 2 days ago a friendly lady called me to inform me they didn’t uphold my complaint, but they can offer me an additional 75 GBP. I really got the feeling they tried to put me off with that 75GBP. So I have politely refused this and told her that I will refer this to the Ombudsman and asked for a breakdown of that refunded 300GBP.

She told me it might take a long time to check this. Fine with me. The 300gbp was a nice gesture, but it doesn’t make any sense. I have paid almost 3000GBP interest over a 2000 GBP credit card in the last 4 years. That breakdown of the refund, might prove their own wrong-doing.

If not, then at least somebody has to go the extra mile over this, which will cost them more as this 75GBP. Or maybe they reconsider my complaint.

To be continued…..

Mik says

I raised a complaint which has been rejected. As a result they have closed my account and marked it as delinquent saying I have advised of financial difficulty and unaffordability, which I haven’t. I stated that was the case at the time they increased my credit limit. Can they do this? What are my next steps?

Sara (Debt Camel) says

Phone them up and complain!

but how affordable is your balance? Are you paying more than the minimum to it?

Martyn says

I received this letter this morning and I find it quite insulting to apologose for setting it to high, I’m in great debt and have 10 cards that I’m juggling. I phoned back in May to ask them to freeze interest which they totally refused. The guy on the phone there was just nothing from him, they have reduced my limits through the course of the year to my account balance so I had to pay every month or the interest would have taken me over the limits, I relied on one of them cards as my everyday card (travel to work etc) and basically he said I need to speak to customer services for any other reason but this letter. I understand hes doing his job but what a pointless piece of waste paper to be sent out to people that are already stressing and struggling to budget each month. Hes logged a complaint for me but don’t suppose anything will come of it

Sara (Debt Camel) says

can I ask what the rest of your finances are like at the moment? they sound very tight?

Martyn says

Hi Sara, yes they are very tight. I stress myself monthly on how to get by, but it’s just one of them things I guess. Trouble is I don’t want to ruin my credit report so try my best where I can. I’m 20k in debt, when I was doing 50 hour weeks I was OK, but now back on lockdown and had to agree to reduced hours I’m yet to see what holds for me!

Sara (Debt Camel) says

I think you should talk to StepChange about a debt management plan. That is a MOUNTAIN of debt and with interest being added you are running just to try stand still.

Yes a DMP will affect your credit record, but it will also give you your life back, you will clear the debt years sooner and then begin to repair your credit record…. https://www.stepchange.org/how-we-help/debt-management-plan.aspx

Sarah says

Has anyone had a response? I called Barclaycard this afternoon and the complaint lodger told me my complaint would not be upheld as I have been making minimum payments. I said to him that does he even know how I made the min payment or what struggles I went through and he said I’m just telling you facts. Also, what’s the point of ringing barclaycard up to tell them about financial difficulties as they will make an arrangement that will only impact your credit file. The guy wasn’t overly phased eventhough he could hear I was in tears.

Sara (Debt Camel) says

That sounds like a very unsympathetic phone call :(

I suggest you read this article which looks at making an affordability complaint about credit cards: https://debtcamel.co.uk/refunds-catalogue-credit-card/ and think about sending one Barclaycard. That looks at how to put together a comaplint, what to say.

Where it says “ay that they should not have increased your credit limit:” you can add a sentence saying they wrote to you on dd/mm/yy to say they agreed they set your credit limit too high.

And I would also put at the end that you feel your telephone conversation with someone from customers service on dd/m/yy was very upsetting and you don’t think the agent really listened to what you were saying, despite you being in tears, so you would like some compensation for this as well.

To encourage you that people can get good refunds from these complaints, see this comment left today who has just wone a case against Barclaycard when he took it to the Ombudsman: https://debtcamel.co.uk/refunds-catalogue-credit-card/comment-page-18/#comment-396780

Sarah says

So a quick update. I have a complaints person ring me up with a decision telling me my compliant was being upheld and closed on the the way my account was managed. At this I point I stopped her and said that my understanding from the initial complaint taker was I’d receive a call about the complaint which I didn’t think it was a decision instead the next call would be a further discussion call. I told her I don’t accept the decision on the premise the investigation hasn’t been telly investigated. I’ve been asked to ring customer services again! Compliant remains open but I can see the outcome already.

Sara (Debt Camel) says

telling me my compliant was being upheld

I guess you meant to say it was being rejected.

How long ago did you send in the complaint?

Sarah says

I sent the complaint in around the 20th of November. I checked my credit file and at the time I received increases in jan 2016 and jan 2017 I have £21k of unsecured debt. I looked at my credit file last night.

The complaints handler told me as I’d been meeting minimum payments there was no issue with my account

Sara (Debt Camel) says

I think you have to assume Barclaycard will not change there mind so when they confirm this the case will have to go to the Finacial Ombudsman. The Ombudsman is good but can be slow… if you are struggling at the moment, you need to look at options such as a payment arrangement or a debt management plan that will ley you relax while your complaint goes through.

Sarah says

Hello

So I had my decision delivered that my complaint will not be upheld. They told me that they didn’t know anything about my financial struggles and as I was meeting min payments, everything was in order. I informed the agent that all roads lead to an impact on credit file so what’s the point of calling. I have mortgage renewal coming up and due to now falling into persistent debt I’m being impacted.

He wasn’t phased. I told him that £21-£24k debt is pretty high. The admission of liability shows barclaycard are at fault but he said that they have worked with the FCA and almost pre judged the outcome

Sara (Debt Camel) says

Have you sent this to the Ombudsman yet?

Banks have been told by the FCA what letters they have to send and when about “persistent debt” – this does NOT mean that this is all they have to do about making sure credit is affordable.

Martyn Wyatt says

I have received a letter back from my complaint and they have offered me £75 for the inconvenience but says I’m not entolited to money back for anything else, despite having 3 cards with what was a total credit limit of over 17k just under my salary (before my hour drop this month) I’m a little dubious on my next steps

Sara (Debt Camel) says

I suggest you read https://debtcamel.co.uk/refunds-catalogue-credit-card/ and send in an affordability complaint.

Did you get an email in the last two weeks from Barclaycard entitled “Changes to your T&Cs” ? You may not have read it, it didn’t sound very interesting…

But if you did, did it say they are going to increase your minimum payments in January? I would be interested to know what the numbers are for the £2500 example they quoated you.

Martyn Wyatt says

I did read it yeah, my two cards with a balance of just over 2k each the minimum will increase to £9₩ something a month, its around 50 to 60 at the moment.

Sara (Debt Camel) says

ouch. As I said previously to you, I think a debt management plan might be a good option for you to look at. These new much higher minimums reinforce this.

But I think the higher minimums also reinforces an affordabilty complaint!

That link for credit card affordability complaints doesn’t have a simple template letter as people’s cases can be very different. Instead it has a “build your own” approach with a pick and mix list of things to say. You should add a sentence to that list saying the Barclaycard said on dd/mm/yy that they agreed they had increased your credit record too high. And another sentence saying Barclays have now decided to increase the minimum payments to the cards from January 2021, and you were already struggling badly with them and this has meant they are completely unaffordable and you are going to have to go into a debt management plan because of it.

You can say a lot more if you want – that is the bare minimum to set out your case.

NB you don’t have to choose between an affordability complaint and a DMP. A DMP will give you a safe breathing space while an affordability complaint goes though.

David says

Sara, I have just recieved one of these letters from barclays. My problem is that I owe barclays £7000 from my credit card. Two yesrs ago I was two weeks away from my dro ending when a benefit back payment cancelled my dro. I expected Barclays to chase me for the money but nothing happened and I’m hesitant to contact barclays as this will restart the debt clock. Am I doing the right thing by not contacting them?

Sara (Debt Camel) says

Can I ask what your current debt situation is like? How large were the debts in your DRO? Have you repaid any of them? Been contacted by any of them?

David says

My total DRO debts were about £12000. I was contacted by a debt collection agency on behalf of one of my credit card companies who offered me a good deal to clear that debt. However since paying off one debt would mean I would have to pay off the larger debts I ignored their two letters. That was almost two years ago and even though my credit card debts debts show on my credit file. None of the credit card companies have tried to collect for almost two years. My strategy is if things got nasty then I would tell my debtors that I would seek bankruptcy. This would not pose a problem as I am on long term sickness benefits due to chronic illness.

Sara (Debt Camel) says

When people have a DRO ended like this, I usually encourage them to go bankrupt immediately and get it over with, at the point where they have cash for the bankruptcy fee.

But your plan is ok, if you don’t mind the uncertainty. Given that, I can’t see any point in poking a sleeping lion to accept this small offer.

If you are later contacted by debt collectors, before reaching for the bankruptcy button, read https://debtcamel.co.uk/ask-cca-agreement-for-debt/ as that will some times mean a debt is unedforceable and doesn’t have to be paid.

Al says

I agreed to the £75 payment over a week ago, Friday 11th but no sign of payment yet, how long have others waited for this please?

Thanks

Ed says

This is the first I’ve heard of any letter of this type being sent out (and I read anything that they send me)! I’ve had a Barclaycard for 20 years during which time the credit limit and balance reached £15000 around 2010 which contributed to a cycle of consolidations and payday loans to service it. The balance is still around £6500 which is slowly being chipped away at. Worth sending an email?

Sara (Debt Camel) says

I was never sure how Barclaycard decided to send these letters too.

As you haven’t had one, I suggest you read https://debtcamel.co.uk/refunds-catalogue-credit-card/ and think about whether you want to make a complaint. It may not be easy to win as it was so long ago, but you know how much difficulty that size limit caused you and if it was a lot, have a go!

Ed says

Hi Sara

Just to add, I received the 36 month letter yesterday, I’ve been offered what sounds like being the standard options of repayment for up to four years. I’m fairly willing to take the offer, however I’m pretty miffed that the repayment APR will still be around 23%, only a couple of percentage points below the rate on my card.

Whilst I’m fully conscious that the amount to be repaid is on me, it truly feels like Barclaycard, in doing what they are duty bound to do under the FCA scheme, are doing their level best to squeeze every last pound out of me given the thousands upon thousands in interest I’ve already paid them.

Also, given what I am hearing that other people seem to be having significant chunks of their debt written off, I’m starting to feel like I should stand my ground a bit with this and it’s also making me more minded to make an affordability complaint.

One last thing… I’m aware that the FCA now have a 100% cap on interest on pay day loans that effectively means that a £100 PL loan will never cost more than £200 to repay. I’m pretty sure that over the years I have paid, and am continuing to pay, well over double my balance in interest. Does this FCA rule not apply to all types of debt rather than just very short term debt?

Thanks again for your help Sara :)

Sara (Debt Camel) says

The 100% cap only applies to payday loans :(

John Smith says

Hi, how far does this go back? I remember back into 2015 I paid all my debt off £6k, tried to cancel my credit card there and then but the Barclay person on the phone said you have to go to another department for this and they didn’t have the phone number (trying to fib me off). Anyone way I managed to use all my credit (gambling at the time) and my limit was increased as well. Would I have a case to get money back, they would have known what my money was being spent on at the time if they seen the transactions.

Sara (Debt Camel) says

2015 isn’t a problem.

Read https://debtcamel.co.uk/refunds-catalogue-credit-card/ and send them an affordability complaint.

Lauren says

Hi,

I just phoned Barclaycard today about this, requesting that the payment plan I’m about to enter into does not show on my credit file (as per advice above) and I was essentially told that this is impossible. They said that they freeze the interest on payment plans anyway, but that they are required to report the plan to the credit reference agencies. Is this correct? Has anyone been successful at getting Barclaycard to do this? Just wondering how far I should try to push this when I phone back to confirm my payment plan in the next few days!

Sara (Debt Camel) says

They do now always freeze interest on payment plans. If you need one, you should confirm that you want one. Don’t let concerns about your credit record lead you to a bad choice here.

But then I suggest you send them a written complaint – their I suggest you send them a secure message https://www.barclaycard.co.uk/personal/customer/register-online-account – saying you have had to have a payment arrangement set up and have been told this will affect your credit record. Say that the main reason for your difficulty is that Barclaycard have increased your credit limit to high, so you think it is unreasonable for this to harm your credit record. Ask for this to be corrected and say if it isn’t you will be sending your complaint to the Financial Ombudsman and also asking for a refund of the interest you have already been charged because of the too high limit.

Alison Sabine says

I rang up barclaycard up on 11th December after receiving a complain reply offering me £75 which I decided in the circumstances to accept as even though I had a large ish balance over £2000, it was mainly interest free and when I did start getting interest and was struggling to pay they stopped the interest. So I accepted it and by this week still hadn’t received the refund so rang them to be told the complaint had been closed and error in not issuing my refund but they are going to reopen and I should hear within 5 working days. Has anyone else had this? What now?!

backinbusiness says

Morning all. I received two of these letters but didn’t reply at the time. (Had bigger fish to fry). I’d also received persistent debt letters so have sent them this for each card:-

“Good afternoon. You recently sent me a letter highlighting that you’d set my credit limit too high. At the time I was embroiled in divorce proceedings and did not reply. Although I am no longer in financial difficulties, for a period I was, as evidenced by your “Persistent Debt” letters some years ago.

I therefore wish to claim a rebate / refund for fees incurred during this period plus 8% interest.

I look forward to hearing from you.”

I’ll let you know their response.

BiB

backinbusiness says

Well that was quick – received a response by 1:30pm offering a refund of £225.

I could press for more, however I’m not in difficulties now and it’s more than the £75 each goodwill gesture I’d anticipated.

Not bad for an email that took about 30 seconds to compose.

Go do it!

BiB x

Michael says

Hi,

We had two Barclaycards going back around 10 years. They are both at a zero balance now thanks to a bank loan. Between 2012 and 2016 the credit limits were raised quite a numbers of times, eventually with a combined limit of £27k. I did write a couple of paragraphs to give some background on the ins and outs of this but it was apparently too long to post here, but basically we got completely trapped with seemingly no way out of the spiraling interest charges. We were self-employed at the time and options were very limited for us.

Anyway if possible I just wanted to cut to a quick question if anyone is able to help… as we had two cards would we have to makes two separate claims or a combined claim?

Sara (Debt Camel) says

You say “we” had two Barclaycards.

Do you mean one of you had one and one had the other? That would mean two separate claims.

Or did one of you have both accounts and your partner was an additional card holder on both acoounts> That would be one claim from the account holder about both accounts – the other card holder is not part of this claim.

Michael says

Hi Sara, thanks for replying. It is the latter as both cards were in my name and my wife was an additional card holder. At the beginning of 2013 the combined credit limit was £13,860. By June 2016 Barclaycard had upped the limits several times to a combined £27,360. Throughout this time I was self-employed (we ran a small business together since 2004) and my income was low, I had another card with approx £5k owing, plus a joint 10k personal bank loan (4 year term, 2013-2017). I never missed a payment and always paid more than the minimum each month (not sure if that will go against me?) but it was very rare for the balance to reduce each month.

By 2017 I realised this just could not carry on and contacted them for the first time. They suspended interest for 12 months, but this took lots of calls and lots of pleading and was not easy. During that time they reduced the min payment on one card from £100+ to £25+, hardly an encouragement to pay off the balance. As a long term plan to pay off I asked if they could reduce the int rate – they refused saying the only option was an IVA and then when the interest suspension came to an end they actually increased the int rate.

Sara (Debt Camel) says

OK so these debts are yours, not joint.

I think it would be worth putting in an affordability complaint, see https://debtcamel.co.uk/refunds-catalogue-credit-card/. But I also think you need some good debt advice on your full situation as that is a very large debt. I suggest you talk to National Debtline on 0808 808 4000 about your options and tell them you are considering an affordability complaint.

Michael says

Thanks, Sara. It’s a long story but I ended up getting a second job to help my chances of getting a bank loan to pay it off. After 6+ months of employment I was able to get said loan (though not at a very competitive rate) which cleared both Barclaycards to zero. We ended up closing our business last year but both remain in full employment and have 4.5 years left and the loan/debt will be gone, along with that crushing feeling of desperation each time the latest credit card statement arrives. I still have both cards now which are almost never used and Barclaycard still haven’t reduced the credit limits (despite sending a letter saying they would!)

Michael says

Hi Sara, I am now getting all my figures together so that I can put in a claim. I have a quick question if possible… I have calculated household expenses during the period in question – mortgage, household bills, food & clothes, joint personal unsecured loan – technically these are all joint costs for our household (my wife & I) so should I be halving them when I include details on my claim? I have of course listed separately my total credit card debt (all in my name).

Sara (Debt Camel) says

are you trying to show the card payments were unaffordable?

Michael says

Yes, I’m trying to demonstrate my income and outgoings at the time, showing that repayments were unaffordable. While this claim will be for my personal credit card debt, the monthly household expenditure as shown on bank statements etc. will be joint.

Sara (Debt Camel) says

One option is to keep it simple and just send them your bank statements. And if your other debts were increasing during this time, point out they could see that from your credit record. Keep complicated calculations for later if it has to go to the Ombudsman.

Martyn says

I got this back from a complaint email regarding responsible lending as I declined their £75 offer.

Inbox

Make a complaint

2conversation(s)

Reference:

Thank you for your e-mail.

As your complaint has been escalated to our Customer Relationship Unit, a member of the team will contact you in due course. The Customer Relationship Unit have up to 56 days to deal with a complaint under guidelines issued to us by the Financial Conduct Authority.

In the meantime, I would like to take this opportunity to apologise for the delay and the inconvenience caused to you.

If you would like to contact our Customer Relationship Unit you can reach the team on 0800 056 3336 (from abroad +44 1452 828020) (open 08:00-20:00 Monday-Friday).

Kind Regards,

Piyush Panwar

Customer Service Advisor

Barclaycard Customer Services

Mik says

Barclaycard are refusing to remove the delinquent status from my credit file despite admitting irresponsible lending. Can I take them to the financial ombudsman over it?

Sara (Debt Camel) says

Have they offered a refund/balance reduction?

Mik says

Yes they refunded interest, over limit charges and late payment charges but no further balance reduction and no correction to my credit file.

Sara (Debt Camel) says

Have you already sent them a formal complaint and they have replied saying you have the right to go to the Financial Ombudsman about this?

Mik says

No, I didn’t send a formal complaint. They insisted the refund and I asked them to reflect the issue on my credit file. They said they didn’t think they needed to do that.

Sara (Debt Camel) says

then send them a “proper” complaint saying they have agreed your limit was set too high and offered redress for this. Which you are happy to accept.

But their error in raising your credit limit has also badly affected your credit record, which will affect the cost of other credit and things like mobiles or insurance you can get. So it is only fair that they remove the default which would not have occurred if they had not raised your credit limit too high.

Then send the complaint to the ombudsman if Barclaycard reject it.