Some people will give you advice that helps them more than it helps you. Other people just aren’t very good at helping…

Here is a serious run through of people to avoid, with some rather less serious illustrations:

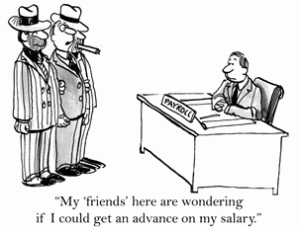

Loan sharks

A loan shark is someone who lends you money on a commercial basis but who is not regulated.

They may not look sinister, they can be someone well known in your community, the school playground or your housing estate for helping people out who are short of money to pay a bill.

But their interest rates can be very high and you may be put under a lot of pressure to repay faster than you are able. If you have already borrowed from one, talk to Stop Loan Sharks in complete confidence about what you can do.

In Britain, all legal lenders have to be authorised by the Financial Conduct Authority. You can check the FCA for a list of non-authorised firms you are warned not to use, but if you are sufficiently dubious to do that, then honestly you shouldn’t be thinking of borrowing from that person!

Nad credit loans

They have very high rates of interest as well, but they aren’t illegal :(

Payday Loan companies often don’t do proper checks to see if borrowers are able to repay loans. When you can’t repay it, you often have to borrow again. And Again. And Again.

So what might seem a high but just about acceptable cost for a short-term emergency all too frequently then spirals into an out of control problem.

The jaws of a piranha fish

They aren’t so much sharks as piranhas. One bite is unlikely to kill you financially but they keep coming back for more. If you have been badly bitten by them, read Can you claim a payday loan refund? as you may be able to get a refund of interest.

If you have a poor credit rating, you may feel these are your only options to borrow, but they usually make your situation much worse.

Before taking out this sort of bad credit loan, get some help to look at your whole financial situation.

Look at Not enough to live on, which has emergency budgeting ideas and contact a recommended debt help organisation.

Your friendly bank manager

He’s not your friend! His three aims are to meet his sales targets, maximise the profits and minimise the risk for his bank.

Helping you through a difficult patch doesn’t feature high up on his list, even if you have been a customer of the bank for all your adult life.

If you can’t make the monthly payments to the bank, be very wary of talking to your bank manager until you have opened a current account with a bank you don’t owe any money to and arranged for your income to be paid into it. Otherwise, your bank manager may just help himself to your next pay cheque to pay off your loan or credit card.

A firm that phones you or advertises on Facebook

The message on your phone says “A little know government solution that will wipe out 80% of your debts”. How kind of him to call!

Guess what, he is hoping to sell you an IVA, because he will make a lot of money out of it. He is probably going to pass your details to anIVA firm – he will get paid c£800 for this.

These callers will not give you good advice and they won’t explain the advantages of other routes that won’t make them as much money. Responsible debt advice providers don’t cold-call people and they don’t advertise in newspapers or on television.

If you end up choosing an IVA, your Insolvency Practitioner is going to make money from it, probably £3,500 or more – fair enough, he is providing a service. But get the advice and make the initial decision with the help of a body that isn’t going to make a profit from you.

Schemes offering to help you get money out of your pension

Money tied up in your pension could solve your debt crisis – but unless you are 55 you need to accept that your money is tied up and should be left there. Clever wheezes, often promoted by spam texts, are of dubious legality and should be avoided. As a spokesperson for the life insurer Phoenix, says:

“Many unscrupulous businesses offer customers the opportunity to unlock their pension, in exchange for cash, before they reach 55; often without making them aware of the fees they are charging for this service. The fees can be as high as 30%, in addition to the 55% tax charge they will incur for extracting money from their pot early. Even worse, some of these schemes are set up to commit fraud, and when customers come to draw their pensions in a few years, there may be nothing left”.

Your mate at work with a new car

Nice isn’t it? Their holiday in the spring sounded brilliant too…

Nice isn’t it? Their holiday in the spring sounded brilliant too…

So why can’t you afford it if he is earning much the same as you?

Who knows – he could have won the lottery, or have a trust fund, or a partner with generous parents. Or he could have mortgage arrears and be in an even greater debt mess than you are!

If he seems savvy about ISAs, comparing insurance providers and interested in pensions, then he might be good with money and a good person to chat to about debts. But most young people with a family who are good with money don’t buy new cars – that is a warning signal, not a badge of financial competence.

So where should you go?

Check out my list of Good Places to go for Debt Help.

There will be one or more that can help whatever your situation, whether you live in Scotland, are self-employed, have a tax problem, are suffering from depression, need to know what to do with a court form or want advice on the most suitable debt solution.