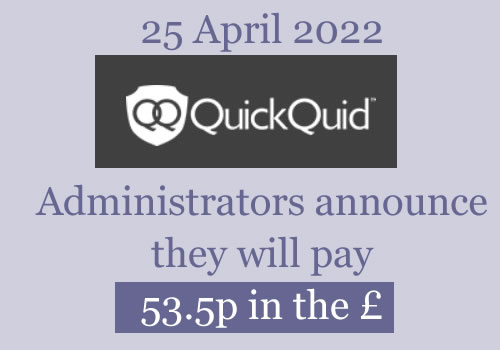

Payments – UPDATE – 25 April 2022

Administrators have started sending emails to everyone with an upheld claim telling them what they will be paid.

“The Joint Administrators are now in a position to declare a first and final dividend of 53.5p in the £”

The average claim value is c £1,700. Someone with that claim value will get a payout of about £910.

The payout details are given in the email:

- This will be paid over the next two weeks.

- If the administrators couldn’t validate your banking details, it will be sent by cheque. I don’t know how the administrators will “validate” your details.

- If you used a claims company, the money will be paid to them.

- Most people are not having any deduction for tax paid to HMRC, so there is no need to reclaim anything.

Credit records

The administrators may decide to :

– remove any negative marks on your credit record

– delete all loans that were upheld

– delete all your loans.

I don’t know what they have chosen to do – if people can check and report in the comments when they see a change, that would be great.

How much your credit score will change will depend on whether there were any negative marks. If you want to get a mortgage, you would like as many payday loans gone as possible, even if they were repaid on time and not hurting your credit score.

In a few months when the administrators no longer talk to the CRAs you can ask for any remaining loans to be “suppressed” so other lenders can’t see them. See https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do that now.

QuickQuid went into administration in October 2019

CashEuroNet (CEU), which owns the QuickQuid, Pounds To Pocket and On Stride brands, stopped giving loans and went into administration on 25 October 2019.

I will be talking about QuickQuid (QQ) rather than CashEuroNet as it is the more familiar name. Everything here also applies to loans from Cashruronet’s other brands, Pounds To Pocket and On Stride.

Grant Thornton were appointed as Administrators. They set up a page about Redress Complaints – this is their term for people who have asked for a refund because they were given unaffordable loans.

Background to the QuickQuid Administration

QuickQuid was one of the “Big Three” payday lenders in Britain, starting out in 2007.

After Wonga and the Money Shop Group had all stopped lending and gone bust over the last fifteen months, QuickQuid was left as the largest UK payday lender.

QuickQuid had well over a million customers. When it went into administration there were c. 500,000 customers with outstanding loans.

Many of these customers had prolonged borrowing from QQ. They either rolling loans over or repaid one loan but were left so short of money that they had to borrow again.

These customers have good reasons to win an affordability complaint and get a refund of the interest they paid.

Affordability complaints started on a small scale in 2015 and increased in the next few years.

In 2018, complaints going to the Financial Ombudsman (FOS) jumped with the involvement of Claims Companies and QuickQuid became the most complained about firm to FOS, excluding PPI complaints.

For a long time QQ refused to refund interest on any loans taken more than 6 years before or where the loans were given in 2015 or afterwards. This resulted in a huge backlog of claims at the Financial Ombudsman, where QQ had made very poor offers to customers and then rejected an adjudicator decision.

In late July 2019, QQ agreed to accept several thousand FOS complaints it had previously rejected.

By accepting the FOS decisions on loans over 6 years, long chains of borrowing, and loans taken after 2015, the scale of QQ’s likely future liability for refunds will have become clear to the company.

After failing to persuade the FCA that a Scheme of Arrangement was appropriate, Enova, CEU’s large and profitable US parent, decided to close the UK business, blaming the UK regulatory environment.

How could the regulators let this happen?

This is an excellent question… Stella Creasy, MP called for an inquiry into the FCA over Wonga and QuickQuid.

What has happened in the administration

Customers with a valid claim for a refund are “unsecured creditors”. This includes:

- any refunds that were in progress after an amount was agreed or a Final Decision from a FOS Ombudsman (FOS);

- complaints that were underway at QQ or FOS when QQ went under;

- any new complaints sent to the Administrators.

All complaints at FOS legally had to stop and were been passed back to the Administrators. It isn’t possible to send any new complaints to FOS.

It is now too late to submit a Claim for unaffordable lending. The last date was 14 February 2021.

The administrators have given the following statistics about claims:

- 169,000 customers made claims for unaffordable lending;

- 78,000 claims were upheld by the administrators;

- the upheld claims had a total value of £136million, so an average of about £1,700 per claim.

Still owe a balance on a QuickQuid or On Stride loan?

More than 300,000 of the current loans were sold to Lantern in summer 2021. You should have been informed if your loan was sold.

The administrators have now stopped collecting any money from the remaining unsold loans.

This page is kept updated

The comments below this article are a good place to ask any questions. And you may be able to see where someone else has already found out the answer.

Eric says

“There have been other customers who also provided details for a closed bank account, but the account was overdrawn and therefore the bank retained the funds from the dividend payment. Please be aware that if you are in a similar position to this we will not be able to recall the funds.”

That is the message I got from casheuronetuk@uk.gt.com a few minutes ago. I am done with CASHEURONET and just chalk it down to bad luck and move onto Myjar.

Ben says

If it’s any consolation, if you had changed your bank details then it would have been ignored. Someone posted on here that they had a payment of £6,234 sent to an old bank account even though they had updated their bank details, the bank withheld £1384 before returning the rest as the account was overdrawn. So the person lost £1384 due to Grant Thornton’s error. The Joint Administrators have made a real mess of this.

Matt Lenton says

Called both phone numbers I had on my email form QQ dated 25 April and neither bare now working. Still not received my cheque after 2 months. I move in 10 days. Who can I contact?

Matt Lenton says

I emailed and had this response. Not sure why my bank wouldnt take the payment..

Dear Matthew

Thank you for your email

We have investigated your payment and found that it was attempted but failed as the bank details were invalid, the payment bounced or the address held on file was incorrect.

The Joint Administrators intend to make a further payment to customers whose payment failed. However, the timing of the next payment is dependent on when you are able to provide us with valid up-to-date bank or address details so that we can process the payment.

What do I need to do?

In order for us to update your bank details, please respond to this email to upload a copy of the information requested below. Once received, we will be able to amend your details and update you by email once we have done so.

a copy or picture of your bank statement or bank card that needs to reflect the following:

Your full name and surname

The account number and sort code

Please note: If you send a picture of your current bank card as proof, the 16-digit card number must be completely covered in the picture provided.

AND

We need proof of your identity, from a copy or picture of either of the following:

your driving licence

your passport

Matt Lenton says

Not happy about sending my details again after they have already verified my back details..

Ben says

I refused to do this as I had already verified my bank details and I’m not willing to send my personal ID documents willy-nilly when it’s unclear who will have access, how long they will be stored etc. They sent me a cheque instead.

Lesley says

I had to do mine again but I got a bacs transfer within the week. Keep the faith

Kay says

I had a email from the dividend team saying my bank details have been updated last Friday and will be on the next payment run within 14 days. I’m not holding my breath. I’m hoping it’s the last time I have to contact them because I am thinking about just giving up on it at this point

Wasim says

Thank God I found this page, been emailing quickquid for a while for a payment update for no reply. Just emailed ceudividend@uk.gt.com after finding it here

Sasha W says

I have finally received my funds today. I commented a while ago about how they couldn’t find my claim. I received a response to the complaint I sent on the 9th of June confirming my amount due and asking me to send back ID and confirmation of my bank details. I wasn’t happy about doing it as I had received a refund of over payment in December with no problems.

I replied the same day with what was requested. I received an auto response advising it will take 14 days. I didn’t receive any other communication. The money arrived in my account today as a bank transfer.

Kayleigh says

I have received my refund today at 1.40pm.

Thank the lord!!

k says

Thank Sara !!!

Jo says

I’ve just received the redress payment into my account this afternoon. I was promised numerous times over many weeks, but finally its there now. If you’ve had a payment agreed then just hang on, it can’t be much longer! Good luck everyone & thanks to Sara for setting up this amazing group page for support & guidance, its been invaluable.

Ron says

I’ve also finally had my redress paid today after submitting details and documents last Wednesday for the second time. It may seem like nothings happening but hang in there and eventually you’ll get it one way or another.

Wasim says

So they sent the payment end of April to a account I closed August 2021, only found that out after finally getting a reply via email. CashEuroNet told me to liaise with my previous bank to get my money back, have spoken to my previous bank who said seeing as the accounts there is no money in my name on the system. I wasn’t overdrawn just closed that account cos it wasn’t needed. What do I do next?

Sara (Debt Camel) says

Get the bank to put it in writing that there is no money in the account.

And double check that CEN had the correct bank account number, not just the reight last 4 digits

Waz says

Thanks Sara this website and your advice have been very helpful, have now updated my bank details with them and awaiting payment on the next run.

ETIGO says

Is it too early to ask for credit reporting to be supressed now?

Sara (Debt Camel) says

I would leave it another month or two.

AN says

It really is shocking that people still not had redress paid … am thankful I was in the first batch !!

Sara .. I remember something you put about claiming against unaffordable car finance .. payments are crippling me

Can you please refresh my memory about if there’s anything I can do ?

Sara (Debt Camel) says

yes! see https://debtcamel.co.uk/unaffordable-car-finance/ which is important to read if you still have the finance.

How much did you borrow and how much have you paid so far? This affects what the decision in your case may be.

Then this page https://debtcamel.co.uk/refunds-large-high-cost-loans/ has the template letter to make these complaints.

AN says

This is great info .. thanks .. I borrowed 10,000 over 5 years and are 20 months down the line … worse still , the car is a wreck with numerous faults .. I can’t afford to fix it and pay the monthly amount

Sara (Debt Camel) says

in that case you need to complaint about the quality of the car as well as the affordability. Ask for a refund of the repairs you have had to pay for so far.

But only 20 months in, if you win the affordability complaint the likely redress is that you would have to hand back the car and be refunded some of the money you have already paid and any deposit at the start. Plus any money the Ombudsman awards for the cost of repairs.

This may not be what you would ideally want – on the other hand this doesn’t sound like a car you rerally want to keep… and if you cant afford to repair it and make the monthly payments, what option do you have except for Vouluntarily terminating the agreement, handing back the car and making an affordability complaint to wipe out the remaining balance and get some refund? Hvae you read that link on car affordability complaint options?

AN says

You are totally right , it’s not a car I want to keep !!

I would settle for returning and some of the money back to start again on a different path .

I read the links and it seems to me that they were much more concerned with high commission rather than my situation.

Sara (Debt Camel) says

“I would settle for returning and some of the money back to start again on a different path ”

If you win the complaint, that will be the end result.

But these complaints take time and during that time you have to keep paying for a car which is unaffordable and cannot afford to repair… it is likely to be more sensible to VT the car now (see https://debtcamel.co.uk/vt-end-car-finance-early/) and make an affordability complaint at the same time.

This leave you without a car, but if you cant afford it and cant drive it, is that much of a loss?

Commission is an interesting subject. I am hearing that more complaints are being made about this but so far I have not seen any being at the Ombudsman.

AN says

All terrific advice …. I have put in an affordability claim , have requested help with repairs .. and after reading the attached .. am definitely going to VT the car . I will have a little to pay , am at about 40% of payments but it seems to be in their interest to agree a repayment schedule. They can not say I haven’t taken reasonable care of car as I have had it serviced twice before actually due at the garage where bought .

Will keep you informed, finding your help invaluable

Sara (Debt Camel) says

take photographs of the car before you VT it. Good luck

Laura Davies says

I haven’t received my payment

Waz says

I’d suggest you send a email to ceudividend@uk.gt.com for a update. I sent a email myself and within 7 days I received payment

Jane Guvenir says

I submitted a claim in August 2020 and had completely forgotten about but seen the comments and found email confirmation of my submission. I have not had any further response nor redress so unclear what I should do now. Any advice? I submitted the claim after receiving an email invite me to submit a claim through the portal in in July 2020.

Sara (Debt Camel) says

I am sorry but you should have chased this up a long time ago. You can email ceudividend@uk.gt.com but it may be too late to do anything.

Jane Guvenir says

Thank you I have sent a mail to that address today. Unfortunately I had an accident in September 2020 and have had ongoing health issues which is probably why I forgot all about it however the email following my claim does say that they would respond with an outcome which I have never had.

Jo says

I had exactly this same thing, I submitted through the portal in August 2020 & never heard again thereafter. I had already been given a ‘final settlement offer’ by QQ but a matter of weeks later they went into admin so I never received this higher payout & had to follow the same reclaim route through the portal. As long as you have the submission reference to prove you followed the claim procedure then just email them to chase it up. It took me sending the administrators lots of evidence of my original claim award & the portal claim ref, but I eventually got just over £1200 back a few weeks ago. Good luck.

Jane Guvenir says

Thank you I have mailed them and will see what response I get.

Morri says

Im still being chased for mine, it seemed to get passed from lantern recently to a company called moriarty law, like withing the last month or two this happened, and im being threatened with court action has anyone else had this or have some advice, because I can barely afford to feed myself at the moment never mind them and the law firms additional fees

Sara (Debt Camel) says

This was a QQ debt? Did you make a claim to the administrators?

What is the rest of your financial situation like – do you have other debts you can’t pay? Are you behind on any bills?

IP says

hi,

i had a loan a few times from CashEuroNet UK who went into administration, i still have a debt which was sold to lantern

i used resolver to contact the FO and they directed me to the administrators as they tell me they dont get involved once the company is in administration.

the administrators direct me to the debt collector on their website, so i sent the email below:

***********

Hi,

I’ve been directed to get in touch with yourselves by Grant Thornton regarding the mis-sold load which was sold to yourselves by the administrators of CashEuroNet UK, which also ran QuickQuid and OnStride.

I’ve attached the case file via Resolver including a response from the Financial Ombudsman.

It seems I’m too late to submit a claim via the administrators website so I’ve been asked to get in touch with Lantern to request the debt be written off and removed from my credit file.

Thanks

*********

after reading the article above on this website, im wondering if you could advise me if im doing the right thing or not and what options i have.

even if i cant get any refunds, id still want them to remove the adverse entry in my credit file, is that possible?

Thanks

Sara (Debt Camel) says

Well it’s theoretically possible – Lantern could decide to do anything if they want.

But as they have no information about your application for this loan or its affordability, they may well decline.

IP says

Thanks for your reply

Do you know what other options I have in terms of who to contact and what to tell them?

I mean if I’ve missed a ‘deadline to claim’ and the FO are asking me to send the administrators a letter to question irresponsible lending/affordability of loans and they in turn are telling me to speak to the company they sold the debt to, do I refuse to pay the debt collection agency?

I don’t even mind them not refunding anything, I’d just be happy with the entry on my credit file gone and the debt written off

Any pointers, links etc would be greatly appreciated

Thanks

Sara (Debt Camel) says

There aren’t any other options relating to the affordability of the loan that I am aware of.

If you can afford it now, you could offer Lantern an amount to settle the debt.

Michael says

I see a lot of safety net credit reclaims and was wondering if anyone has the link to the templates still? Btw thanks to you guys for keeping me sane and updated when was waiting for my quick quid redress.

Ryan Abram says

Hi Michael,

Where do you see those claims?

Thanks Ryan

Sara (Debt Camel) says

in the comments on these boards?

See https://debtcamel.co.uk/payday-loan-refunds/ for a template letter to use and a lot of comments below that article.

SafetyNet credit is one of the easiest lender to win a complaint against as they could see your bank statements.

Michael says

Cheers Sara I owe you one :)

Sara (Debt Camel) says

good luck!

Michael says

Seen it all plastered on Facebook and the internet as well

Donald says

Hi folks,

I forgot about this qq redress. They stated my bank details were not right and advised I would receive a cheque. Months later and heard nothing and no cheque has appeared.

I did follow up but emails to Casheuronet have gone unanswered.

Anyone else know what I can do? I really could do with the money just now 😢

Sara (Debt Camel) says

contact the QuickQuid Customer Support team on 0800 056 1515 or support@quickquid.co.uk

Donald says

Thank you so much for this amazing page and for helping everyone! Turns out my redress of £900 was paid into an old bank acc back in April. Despite them telling me I would receive a cheque.

I am not able to currently work and this website has helped me to literally put food on the table.

Thank you so much Sara, it is amazing what you are doing for people. All the very bets to you!

Sara (Debt Camel) says

wow, glad that was located for you!

Tracey says

Hi Sara do you know what happens to the left over funds from the payout scheme once everyone has been paid? Thanks

Sara (Debt Camel) says

When the company is dissolved (which hasn’t yet happened) remaining funds that have not been paid out because bank transfers failed or cheques were not cashed at transferred to a department of the Insolvency Service when people can ask for payment.

Idiot who used QQ says

FYI.

Information on CRA suppressed as no response from Data Supplier-QuickQuid.

Sara (Debt Camel) says

thanks for the info!

Gary says

Received my redress when payouts were first made and was wondering when my default and other loans should drop off credit file ?? Any ideas on how I go about looking into this ?

TIA

Idiot who used QQ says

Raise a dispute with TransUnion, an individual dispute for each entry. QQ are not responding to CRA requests so the information gets suppressed. It still exists but cannot be seen by lenders or you.

TransUnion are the only CRA carrying QQ records.

Mehdi says

Hi Sara,

I’ve had no correspondence or redress from this, even though i have a valid claim. What should i do?

Sara (Debt Camel) says

What evidence do you have that you submitted a claim? This is VERY late to be querying this, the money was distributed 6 months ago.

Mehdi says

I appreciate that it is late but since the claim form was submitted, the administrators were sending out progress reports and nothing in any emails thereafter one received Jan 2021 suggested that the claims are going to be paid out. I have an email thanking me for submitting my claim, alongside a customer ID.

Surely the administrators should have contacted everyone, rather than solely rely on people contacting them?

From previous posts above, perhaps a payment didn’t go through due to bank account information. There’s no telephone number to speak with them about this?

Sara (Debt Camel) says

did the Jan 21 email suggest you claim had been upheld?

Mehdi says

Nope, it was just a Joint administrators progress report. I’ve had no email to say whether the claim has or has not been successful. Very much like one of the comments above from Jane Guvenir, heard nothing from them.

Sara (Debt Camel) says

you will have been sent an email saying if your claim was upheld or not. But it may have gone into spam.

If it was rejected, it is now too late to appeal that decision.

Have you contacted the QuickQuid Customer Support team on 0800 056 1515 and at support@quickquid.co.uk ?

Mehdi says

If it went into Junk, that’ll be a problem as my Junk folder purges to delete every 6 months. In between your replies, i have emailed casheuronetuk@uk.gt.com & ceudividend@uk.gt.com asking for information/update.

I’ve tried calling 0800 056 1515 but it goes to an automated message saying “we are close for the holidays”.

I will email support@quickquid.co.uk now to see what happens.

Idiot who used Quick Quid says

If you scroll back over the many (many) messages you will encounter a selection of different emails and telephone numbers. This will take up your time, but may be your only option. The other alternative is to contact Grant Thornton directly. If you cannot evidence a successful claim, and cannot demonstrate that you are entitled to redress then the outcome is pretty bleak. Grant Thornton did not expect claimants to contact them as several of the messages in this incredibly long thread demonstrate. I fear you have delayed too long.

Brian Beckett says

Hi I was originally contacted by the administrator stating my account was identified as one that fell into the criteria of affordability, I was told not to enter into any repayment plans until a decision had been made. This was at the start when they went into administration, my debt had been should to a debt recovery company who contacted me to say due to information received they would no longer be pursuing the outstanding debt. Shortly afterwards I was contacted by another debt collection agency saying they had purchased the debt from the previous company, and I now owed them an amount double my original debt I replied to them and explained however they have pursued me, the one time I spoke to a member of staff they said they didn’t care and the money had to be paid as they had purchased the debt, I have since tried contacting the administrator but have had no response what it anything should I do

Sara (Debt Camel) says

So you made a claim to the scheme? Did you get that claim decided?

Andrew says

Hi Sara, I’m hoping for a little advice. I’ve been chasing information regarding a claim. I received an email today stating that my payment had been paid to a CMC ‘Last minute refund Ltd’ which I apparently gave them permission in September to be authorised on my behalf. I hadn’t, also had never heard of this company before and after doing a little research that the company began the winding up process in Sept 21. I have asked for authorisation proof and proof of transaction, to which I haven’t had a response yet. But not sure what to do next. Thank you

Sara (Debt Camel) says

well you have done the right thing so far. How long since you asked for this?

Andrew says

To be fair, it’s was only this afternoon but the situation just doesn’t feel right. The response I was given says i gave authorisation in September(I didn’t), which I assume would be Sept 21 as payments were made Apr 22, but ‘last minute refund Ltd’ entered into their winding up order Sept 21. I wasn’t sure if I should register the issue with an authority straight away.

Sara (Debt Camel) says

if the administrators have paid the wrong person, you should not have to try to get this money back.

Mehdi says

I fear this also, i have tried contacting them on all the number and email addresses found in this thread, 2 emails directly to GT no avail. At a minimum i’d expect GT to reply to my emails with any correspondence that should have been received when everyone else’s above was, i’ll try and call them direct tomorrow to see if they’re able to give me an update!

Do we know when the company is going to dissolve, i only ask as i hope they’re not delaying their response to me by waiting for this to happen.

Ben says

Hi Sara,

I can’t find a thread on it but have Piggy Bank redress been paid out yet? If so, what were the payouts as I haven’t seen any email communication but I just emailed them and it said the winding up had been finalised.

Thanks

Sheri says

Hello!

I have only just got on board with this! I realised I had a quick quid loan in which I am now being chased for by a solicitor, it is over 7 years!

Is there anything I can do? Realised I probably missed the opportunity!

Sara (Debt Camel) says

yes, too late to make a claim.

But when did you last make a payment to this debt? does it still show on your credit record?

B says

Hello I can confirm that they are no longer reporting to CRAs and I have successfully got the record suppressed!

They waited 4 weeks and no response

taruk says

Hi there, could you tell me how i go about getting my default suppressed? kond regards

Karen says

I am still paying into Quick Quid. I knew nothing about this. I have emailed ceudividend@uk.gt.com to ask for information and guidance. Another company is 247Moneybox. I owe less than £150 and they have today, reported a default notice against my credit file. I feel this is unfair for a small amount owed, this will affect credit file for 6 years.

Sara (Debt Camel) says

you are still paying QuickQuid? or a debt collector the debt was sold to?

When did you first miss payments to 247?

karen says

I think I am paying someone like ACI or ARC think they brought the debt from Quick Quid.

As for 247 I cannot remember the last payment made. I have tried to call them on the number they provided and it says the number is not recognised. I have tried to email the address they provided and it is returned as not able to send.

Sara (Debt Camel) says

I am sorry but it is too late to make a complaint about QQ. The fact they are in liquidation doesn’t affect the debts that have been bought by a debt collector.

247 – roughly when would you have borrowed this? And is it likely to be correct that you defaulted on it?

Kay says

Hi Sara,

Onstride accepted my appeal in full on the 26/04/21 and said I would receive another email with the revised amount owed (this was never sent) then my debt was sold to Lantern in July 2021.

I have been going back and forth with Lantern since then with them freezing my account and looking into this until they finally opened up a formal complaint and they have now sent me a final response that Onstride did not make them aware so I still owe them the whole balance. I cannot get a reply from Onstride, tried all the emails in this forum and Matthew Drinkwater, they sent a standard email on the 27/10 that of 24 October 2022, the Administration of CashEuroNet UK, LLC has closed and the Joint Administrators have ceased to act.

I have sent this to the Ombudsman yesterday as Onstride accepted that the loan was unaffordable but never the next steps. Obviously it’s too late for new claims and I’m not expecting a refund, but there is still a balance to be paid to Lantern but neither of them are letting me know what it is.

Have you seen anyone else with this issue?

Thanks

Sara (Debt Camel) says

Sending this to the Ombudsman as a complaint against Lantern may be all you can do.

Kay says

Hi Sara,

The Ombudsman replied that they are no longer able to consider complaints as Onstride are in administration and to make a complaint to the administrators and the organisation on the government website. Onstride accepted that it was unaffordable but sold the whole thing to Lantern so now I might still have to pay £1000 (interest that should’ve been wiped) and the default will stay on my credit file. I know it’s a hard one but do you have any advice at all at what to do next?

Sara (Debt Camel) says

Is this a decision from an adjudicator? Or a second level decision from an Ombudsman?

Kay says

Hi Sara,

I don’t think it even got that far, I submitted the complaint online and this was the first email I had back saying “we’re no longer able to consider complaints about Casheuronet UK LLC t/a Onstride as the business went into administration in 2019. In these cases, once a business enters administration, we’re required to stop considering complaints about that business and it becomes the responsibility of the administrators to consider all complaints going forward.”

It just says customer help at the bottom of the email.

TG1 says

Hi Sara, what happens to the money left over following all the claims payments? Can those awarded redress payments make a claim on this fir further redress and what would be the process? Many thanks

Sara (Debt Camel) says

There is no money left over.

Ian Taylor says

Hi Wondering if you can help please? I had both a Quick Quid and lending stream account. I have only found out in the last day or so about both companies offering redress.

I had moved house in 2020 and I had no idea about this so assume I had letters possibly? I certainly had no emails to say this has happened. My issue is, is that I am paying through a DCA (lantern) who then forwarded it onto solicitors to collect.

Where so I stand with this? Surely I should not be paying out to a company who bought a debt for something that no longer exists?

Sara (Debt Camel) says

QQ debts did not cease to exist when they went into administration. But it is now too late to make an affordability complaint about them.

You can still make an affordability complaint about Lending Stream, see https://debtcamel.co.uk/payday-loan-refunds/.

Did you have other problem debts? You can make affordability complaints for a wide variety, see https://debtcamel.co.uk/tag/refunds/

Sue says

Quick Quid loans which were paid off 4 and 5 years ago and part of my claim are still showing on my trans union credit report – is this correct?

Sara (Debt Camel) says

Your claim was upheld? Then they shouldn’t be – see https://debtcamel.co.uk/correct-credit-records-lender-administration/ for what to do.

Jason says

Hi Sara,

I have just seen that Quickquid ‘re-launched’ in November 2023…. How does this work? As they went into administration and we all got paid a percentage of the redress. If someone new has taken on Quickquid (using their name, logo, everything etc) then isn’t that effectively buying them out therefore we should’ve been entitled to the full redress?

Sorry if there is a simple explanation, I am just very curious.

Sara (Debt Camel) says

The administrators will have sold the brand name, not the company, the new Quickquid has no liability for what the old one did

Jason says

OK thank you Sara for clarifying. On the new website it says that Quick Loans are the ‘new owners’ so it was that wording that got me wondering.

Stephen says

Hi Sarah,

Just a quick on regarding Onstride Loans which my claim was upheld and all negative information removed from my credit file. After the refund it left a small balance of a few hundred pounds which was sold to Lantern. How does this work as it’s no longer showing on my credit file but they are chasing this amount?

Sara (Debt Camel) says

you still owe this money. I suggest you make a payment arrangement with them

Stephen says

Thanks Sarah, but it’s not on my credit file and was an unaffordable loan, what can they do if I don’t pay as it’s been removed off my file now?

Sara (Debt Camel) says

Well in theory they could take you to court for a CCJ.

Stephen says

Ah ok, I’m not sure what to do then as it’s £400 I could do without paying really, because there is no default date I’m not sure when it will become unenforceable or (drop off) my credit file even tho it’s not on there already.

Sara (Debt Camel) says

What other debts do you have? Are you making normal payments to all of them? Any arrears on bills?

Stephen says

I’m on a stepchange DMP and everything is going fine at the moment, it’s just this debt and some old ones that have re emerged since some debt went to debt collectors in the DMP, I have a lot more emails chasing debts that are over 6 years old

Sara (Debt Camel) says

Ask StepChange to add this into your DMP.

how much are you paying the DMP a month?

Stephen says

Paying £250 a month, surely it would be better to wait until the 6 year rule when they can’t chase it anymore, not sure on what date that would be from tho?

Sara (Debt Camel) says

The date you made a claim to the QQ administrators possibly. But Lantern may not want to wait that long… adding it to your DMP is the simple option, up to you.

Stephen says

Thank you, I just think if they can’t default it then they can’t CCJ it as it’s not on my credit file?

Sara (Debt Camel) says

Getting a CCJ has nothing to do with what shows on your credit record. Lots of people get CCJs for parking tickets that never appear on your credit record.

Stephen says

Can you get a CCJ for a loan that was deemed unaffordable and shouldn’t have been given? All negative information was to be removed so a CCJ is negative and can’t be put in my file surely?

Sara (Debt Camel) says

You still own the balance of the loan after interest was removed. This is not legally unenforceable in court. Will Lantern take you to court? I don’t know.

Joe says

Can’t believe this is still going for some! I never put the claims in on my loans as I thought it may acknowledge the debt and the big one is now statute barred with an unpaid balance of £3600 and off my credit report.

William Ponton says

Hi, wondering if you can help.

I had an old quick quid debt that was statue barred, I had PRA group hassling me on the phone, now when I spoke to one of the csa on the phone they told me the last payment was made in 2016.

Now they sent me a letter saying that quick quid had made payments to my account so its not statute barred.

How has quick quid made payments to them?

I certainly haven’t made any payments.

Sara (Debt Camel) says

Did you make a complaint to the administrators about affordability/misselling?

William Ponton says

Hi Sara, no I didn’t know about the affordability/misselling until they contacted me and I found out that they had gone into administration.

Sara (Debt Camel) says

Go back and argue that this is an “non-payment transaction” which the FCA identified in 2023 as a problem where debt collectors were incorrectly treating them as re-setting the limitation period. See https://www.fca.org.uk/publication/correspondence/consumer-duty-portfolio-letter-dpca.pdf

Let me know what happens here.

Will ponton says

It’s been a while since I heard anything, but I had a call today.

Going round in circles, I referred the non payment transaction and was told “we don’t do that” and that apparently I need to prove I didn’t make payments.

I asked where the payments had came from to quick quid who were then paying pra group, they told me my bank account 😂😂😂

What next?

Sara (Debt Camel) says

Ask for the date of the payment so you can get your bank statement that month and prove you never made this payment

Joe says

Hi William,

Did you apply for the payout over mis selling?

If so that acknowledged the debt so it doesn’t matter that you didnt pay since 2016

William Ponton says

Hi Joe

No I didn’t know about the miss selling until I researched it recently after receiving a letter from PRA group.

Scott says

I was contacted by what appeared to be administrators and told to set up an account and go through the processes of putting my claims forward for mis-selling. I then got another email stating that they had mainly rejected all the claims but I was due something back – but never received it and how no clue how to contact anyone as all the emails bounce back…can anyone help please?

Sara (Debt Camel) says

How old is that email? What exactly did it say about what you would get?

Scott says

Thanks for the reply, This was started back in 2020…I had contact with QQ, who rejected my claims on the loans I had.

Then my following contact was with casheuronetuk, and the The last Email was dated 29/09/2021

Would it be easier if I emailed it to someone?

Sara (Debt Camel) says

No, just copy in the but here that says what you will Be paid.

J says

Hi can anyone give me some advice about Oodle finance? I’m paying back more in interest than my car is worth!

Sara (Debt Camel) says

Read https://debtcamel.co.uk/unaffordable-car-finance/ and any further questions there please!